Research Article: 2019 Vol: 18 Issue: 3

Formation of Risk Mitigating Strategies for the Implementation of Projects of Energy Saving Technologies

Tetiana Hilorme, Oles Honchar Dnipro National University

Oksana Zamazii, Khmelnytskyi National University

Olena Judina, Dnipro University of the Humanities

Rita Korolenko, Kryvyi Rih National University

Yulia Melnikova, National Technical University “Dnipro Polytechnic”

Abstract

The risks of implementation of projects of energy saving technologies are grouped (technical, financial, procedural) and appropriate mitigating strategies for the purpose of improving of socioeconomic efficiency are proposed. A model for overall risk estimating of energy saving projects was proposed based on the model of audit risk by R. Dodge. The proposed author's model for assessing investment risks allows optimizing the allocation of investment project resources by forming the optimal ratio of investment characteristics taking into account the impact of risk management measures and instruments. This allows us to identify reserves of financial resources of the project, provides a determination of the necessary and sufficient funds for the implementation of risk management measures and increases the reasonableness of the decisions made. The article has developed an investment strategy based on the recommendations of an investment energy audit.

Keywords

Energy Saving, Risk, Project, Strategy, Investment Energy Audit, Qualimetric Assessment.

JEL Classifications

M5, Q2.

Introduction

Management decisions, which are accepted at the initial stages of the energy saving projects implementation, influence significantly the duration and cost of project implementation, the cost of postponed decisions and, accordingly, the economic efficiency. The reliability of investment project is determined by the internal organization operation (production schemes, marketing calculations of sales volume and possible demand for products, forecasted debit and credit indebtedness, etc.), on which the project calculations are based. Such organization of the project takes into account certain risks since before the development of input data in terms of their authenticity. Project realization can be affected by the impact of various risks, most of which endangers not only the realization of a particular project, but even the operation of the enterprise at all.

Literature Review

There is a hypothesis that, under conditions of the objective existence of risk and the financial, moral and other losses associated with it, there is a need of formation in a certain mechanism that would allow as well as possible (on the goals basis) to take into account the risk, accepting and executing relevant managerial decisions.

Karabegovi? & Dole?ek (2017) proposed a tactical (short-term) estimating model of investment in energy saving technologies in consideration of external risk factors (political, economic, demographic, international trade, etc.). Kumar et al. (2017) through studies of the mechanism of risks leveling of energy saving projects, pay special attention to the mechanism of information awareness of consumers in regard to energy saving. Li & Tao (2017) proposes to divide the system for estimation the effectiveness of energy saving projects, to allocate independent hierarchical subsystems based on the method of hierarchy analysis by Saaty (1992). Herewith, the author defines 4 levels of criteria for choosing the optimal communication mean of project developing in order with the aim of risk reduction: the first is consumer type; the secondeconomic indicators of consumer opportunities; the third-apprehensible promotional means; the fourth-tools that provide a direct impact on the consumer. The founder of the Analytic hierarchy method Saaty (1992) while forming the strategy of the future energy system, which is a reverse process, develops five hierarchical levels: focus, desirable scenarios, problems, actors, politicians.

From the standpoint of eventology, subjective observations and the mathematical apparatus of the theory of random events make it possible to identify the general statistical regularities of the distribution of a probability set in various, including management systems (Sun & Hong, 2017). The existing practice of using the methodology of eventology to provide the numerical value of procedural risks, self-diagnosis of the strategic potential of an enterprise in the process of monitoring the investment risks of implementing energy saving projects and its corresponding correction (Wu et al., 2017; Gupta et al., 2017).

Methodology

While introducing energy saving technologies an enterprise faces risks associated with the implementation regime. There is a connection between the risk mitigating strategy and its management methods, since each strategy has its own set of implementation tools. Thus, the avoidance risk strategy will be significantly different from the retention risk strategy with regard to management methods. While developing a risk leveling model in realization of energy saving technology projects, the risk estimating methodology for risk is used according to socioeconomic content (Tetiana et al., 2018a; Tetiana et al., 2018b; Koev et al., 2019).

The quantitative and qualitative methods are used for the market analysis (Liang, 2017; Marinakis et al., 2017). A qualitative risk analysis involves identification of the sources and causes of the risk of processes and work, identification of areas and types of risk, identification of the practical benefits and possible negative consequences that may arise in the process of implementation of projects (work, processes) that contain risk. Most scientists, who are involved with risk assessment, state that qualitative analysis is the most complicated stage of general risk analysis.

A qualitative risk assessment is a process of identification and determination of the risks that require rapid response. Such an assessment of risks determines the degree of importance of risk and chooses a response. The availability of accompanying information helps to prioritize risk of different categories. A qualitative risk assessment is an assessment of the conditions for the occurrence of risks and their impact on the object by standard methods and means. The main task of a qualitative assessment is to identify possible types of risks, as well as factors that influence the level of risk in the implementation of a particular type of activity. At this stage, it is important to identify all possible circumstances and a detailed description of all possible risks.

Building a model of risk assessment in the introduction of energy-saving technologies we used qualimetric assessment (Tetiana et al., 2019), which involves structuring the object of study (the object as a whole is the first level of generality), its division into constituent parts (second level), which in turn are divided into parts (third level), etc. A qualimetric assessment of the risk determination is carried out in the following stages: the formation of a hierarchical system, usually determined by a diagram or table; assessment by experts of establishing the significance of indicators: a combination of quantitative and qualitative assessments according to certain rules into an overall assessment of the object.

Results and Discussion

Thereby, we are of the opinion that it is possible to divide risks into three groups: technical, financial, procedural. Table 1 presents risk groups for implementation of Projects for Energy-saving Technologies (PET) and mitigating strategies.

| Table 1: Risks Of Implementation Of Projects Of Energy-Saving Technologies (Pet) And Mitigating Strategies | ||

| Risk groups | Elements of risk group | Mitigating strategies |

|---|---|---|

| Technical Risks (?R) | ?R1: equipment running efficiency, life duration, warranties | quality of specifications, procedure for electing an energy service company, contract terms |

| ?R2: technical experience | Internal personnel training, hiring a qualified external consultant | |

| ?R3: audit quality, accuracy | technical aptitudes and the auditor`s assessment, audit quality improving measures | |

| ?R4: manufacturing/installation of products | qualification of a seller or subcontractor | |

| ?R5: Operation and Maintenance (O&M) | personnel qualification improvement, training in particular | |

| ?R6: sustainability of savings | O&M quality, administrative management | |

| ?R7: verification of savings (approach, tools) | necessity of measurement changing, guarantee or desired accuracy | |

| Financial Risks (FR) |

FR1: project savings are not realized | external counseling |

| FR2: fixed payments | monthly fluctuations in savings | |

| FR3: cost of postponed decisions | selection of another implementation way | |

| FR4: post-contract savings | engineering support, O&M quality | |

| FR5: no tax benefits | selection of another investment strategy | |

| Procedural Risks (PR) |

PR1: poor quality of equipment selection procedures | qualitative internal or external consulting experience |

| PR2: problems in enterprise management | qualitative contract formulation | |

| PR3: project selection in critical situation | comprehensive contract formulation | |

| PR4: operation and service; quality personnel training | personnel development strategy | |

| Overall risk (?ET) |  |

|

Technical risks can be managed through the analysis of variables (level estimation) and the implementation of appropriate strategies to mitigate this risk, but under conditions of attracting internal resources and/or external support. In almost all cases (for example, direct buying) there is the highest risk level for the consumer at the lowest considering the overall cost. Factors of financial risk are of paramount importance while estimating the most cost-effective modes of energy efficiency measures financing. The risks, associated with energy efficiency financing modes are always large and varied. Procedural risks are related with the qualification level of personnel at all hierarchical levels: managers (while making managerial decisions regarding the implementation of energy saving technologies projects and mitigating strategies), professionals (while choosing theoretical and methodological approaches to forming a mechanism and providing qualitative practical recommendations for its implementation, quality counseling at all stages of the lifecycle of the mechanism), specialists (formation of a quality database, implementation) and workers (while production/installation).

The maximum risk in determining the energy efficiency of energy-saving projects arises at the stage of forecasting the costs dynamics for the implementation of these projects and comparing energy efficiency savings. For business entities, the net financial benefits of a project are an indicator of the hidden costs presence, but do not consider the outcome of the provision of the service and warranted savings.

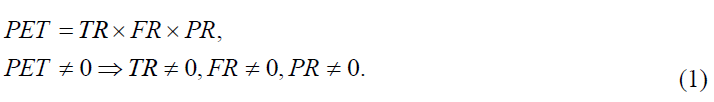

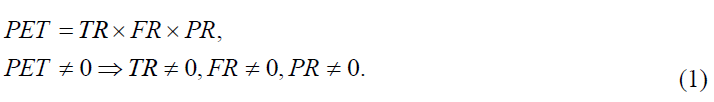

The second hypothesis of our study is an opportunity to calculate the overall risk while implementing energy-saving projects with the help of the audit risk model (https://cplusglobal.wordpress.com/2014/04/15/audit-risk-model/). Risks elements are estimated from 0 to 10 points according to each criterion and entered into the assessment form (usually spreadsheet) for each of the main criteria. These points are then summed up. Total amount of points for each main criterion is multiplied by the coefficient of “weight”, which reflects the relative importance of each criterion. After that, the overall risk of implementation a mechanism for marketing development of energy-saving technologies (RIM) is determined. It is proposed to define it according to the analytical formula:

Where, ?ET is the general risk of implementation a mechanism for marketing development of energy-saving technologies; ?R-Technical Risks, FR-Financial Risks, PRProcedural Risks.

At the last stage, the leveling of energy-saving projects risks is the formation of a scientifically substantiated significance scale of the overall risk (herewith this two ways are possible: constructing the matrix of the relationship between the risk components (groups) scales: “low”, “medium” and “high” or value in percentage). The end of the project validity or the transition to a more advanced level is determined by the value of this scale. For example, if the overall risk of introducing this mechanism falls into the elimination plane-it is necessary to end the project, in the plane of efforts intensification-transition to a more progressive level.

What is more, while organizing of investment energy audit, it is necessary not only to carry out an ecological and economic analysis of the proposed measures to increase energy efficiency, but also to conduct a socioeconomic analysis. Energy saving is a key factor for corporate social responsibility. First of all, it is connected with the socioeconomic feasibility of introducing energy-saving measures-the socioeconomic effect for business: improving of public opinion, capitalization through goodwill growth, positive image, increasing loyalty to existing personal as well as potential, etc. (Tetiana et al., 2018).

The results of our study are confirmed by the following studies. Marinakis et al. (2017) while forecasting new financing horizons of energy efficiency projects taking into account the concept risk, consider the peculiarities of the formation of global changes in the innovative energy saving technologies market under the influence of the creation of information interactive support with the use of Internet technologies.

Conclusion

The risk and its level will be determined by the phase of implementation of the energysaving project, which has time limits; is stipulated due to the fact that situation while developing, changes the risk level by increasing or decreasing it under the influence of new, additional risk factors; this, in its turn, may weaken the managerial influence, or make it unnecessary. With the help of the developed risk assessment model, at each stage of the project, we determine the level of risk and involve appropriate methods to mitigate it and control, with the aim of promoting the project reliability. Judging from the above mentioned such stages as risk assessment and management cannot be consistent, and when involved, should be considered in parallel. The author provides recommendations for creating a development strategy to mitigate the impact of the procedural risk group.

After determining the overall risk of introducing energy-saving technology projects, it is necessary to conduct an internal control test, which will reveal the list of identified errors and irregularities in the investment audit and determine the materiality criteria for calculating the identified risks. The determination of the materiality of information is determined by the professional judgment of the expert carrying out this calculation. But in order to avoid the bias of professional judgment, it is recommended to introduce the internal standard of the enterprise, which reflects the criteria of materiality. In this case, the criterion of materiality can be qualitative and quantitative. A qualitative criterion allows determining the importance of information, selecting the most important facts for verification. A quantitative criterion for the allocation of material information is the numerical value of a particular indicator, starting from which it becomes important to be checked. This “threshold” may simply be a specific amount or part of a generalized quantitative measure. In the first case, this is an absolute measure of materiality, in the second-a relative one.

An application of the proposed author's model is possible not only to determine the reliability of a specific project on energy-saving technologies, but also to assess the reliability of the company's investment activity. In addition, the calculated risk values allow us to compare projects using cluster analysis. According to the results of this analysis, priority investment directions were established, which are relevant information for decision-making by top management of enterprises and other alpha stakeholders.

Prospects for further research is the matrix building of the company's development strategy taking into account risk and profitability taking into account compositional analysis, the formation of the Alpha Panel of investment portfolio stakeholders and so on.

The developed strategy model of leveling risks in the implementation of energy-saving projects is implemented in the study of the use of solar energy, heat pump, heat of soil and air (including ventilation), which are being developed at the Scientific Research Institute of Energy at the Oles Honchar Dnipro National University (Dnipro city, Ukraine).

Recommendations

Based on our studies, we can provide the following recommendations for reducing risks in the implementation of energy saving technology projects. The general strategy for mitigating technical risks is the qualitative conduction of energy audit, first of all, an Investment Graded Audit (IGA), considering the implementation risks (assessment of the management compliance level, professional skills and abilities of staff to provide high-quality Operation and Maintenance (O&M)). In order to mitigate the factors of financial risk is the development of investment strategy, taking into account the recommendations of the investment audit, appropriate verification and control. In order to mitigate the impact of the procedural risk group, it is recommended to create a personnel development strategy, especially the designation of economic feasibility of external consulting, subcontracting, and outsourcing (when the effect of personnel investments into personnel professional development of the enterprise is minimal).

References

- Gupta, P., Anand, S., & Gupta, H. (2017). Developing a roadmap to overcome barriers to energy efficiency in buildings using best worst method.Sustainable Cities and Society,31, 244-259.

- Karabegovi?, I., & Dole?ek, V. (2017). Development and implementation of renewable energy sources in the world and European Union.Contemporary Materials,2(6), 130-148.

- Koev, S.R., Moroz, I., Mushynska, N., Kovin’ko, O., & Kovalchuk, S. (2019). Features of building a managerial career based on entrepreneurship education. Journal of Entrepreneurship Education, 22(1S).

- Kumar, A., Sah, B., Singh, A.R., Deng, Y., He, X., Kumar, P., & Bansal, R.C. (2017). A review of multi criteria decision making (MCDM) towards sustainable renewable energy development.Renewable and Sustainable Energy Reviews,69, 596-609.

- Li, M.J., & Tao, W.Q. (2017). Review of methodologies and polices for evaluation of energy efficiency in high energy-consuming industry.Applied Energy,187, 203-215.

- Liang, X. (2017). Emerging power quality challenges due to integration of renewable energy sources.IEEE Transactions on Industry Applications,53(2), 855-866.

- Marinakis, V., Doukas, H., Xidonas, P., & Zopounidis, C. (2017). Multicriteria decision support in local energy planning: an evaluation of alternative scenarios for the sustainable energy action plan.Omega,69, 1-16.

- Saaty, T.L. (1992). The Hierarchon: A dictionary of hierarchies. Pittsburgh, Pennsylvania: RWS Publications.

- Sun, K., & Hong, T. (2017). A framework for quantifying the impact of occupant behavior on energy savings of energy conservation measures.Energy and Buildings,146, 383-396.

- Tetiana, H., Chorna M., Karpenko L., Milyavskiy M., & Drobyazko S. (2018). Innovative model of enterprises personnel incentives evaluation. Academy of Strategic Management Journal, 17(3).

- Tetiana, H., Karpenko, L., Fedoruk, O., Shevchenko, I., & Drobyazko, S. (2018a). Innovative methods of performance evaluation of energy efficiency project. Academy of Strategic Management Journal, 17(2), 112-110.

- Tetiana, H., Nazarenko, I., Okulicz-Kozaryn, W., Getman, O., & Drobyazko, S. (2018b). Innovative model of economic behavior of agents in the sphere of energy conservation. Academy of Entrepreneurship Journal, 24(3).

- Tetiana, H., Shurpenkova, R., Kundrya-Vysotska, O., Sarakhman, O., & Lyzunova, O. (2019). Model of energy saving forecasting in entrepreneurship. Journal of Entrepreneurship Education, 22(1S), 2019.

- Wu, Y., Li, L., Xu, R., Chen, K., Hu, Y., & Lin, X. (2017). Risk assessment in straw-based power generation public-private partnership projects in China: A fuzzy synthetic evaluation analysis.Journal of Cleaner Production,161, 977-990.