Research Article: 2022 Vol: 28 Issue: 6S

Foreign portfolio investment and monetary policy: A disaggregated analysis in Nigeria

Nurettin Can, Vistula University & Nile University of Nigeria

Nurlan Atabaev, American University of Central Asia

Yusuf Adamu, Central Bank of Nigeria & Nile University of Nigeria

Talant Asan Uulu, American University of Central Asia

Sanar Muhyaddin, Wrexham Glynd?r University

Citation Information: Can, N., Atabaev, N., Adamu, Y., Uulu, T.A., & Muhyaddin, S. (2022). Foreign portfolio investment and monetary policy: A disaggregated analysis In Nigeria. Academy of Entrepreneurship Journal, 28(S6), 1-17.

Abstract

The study used Toda-Yamamoto causality framework, an augmented vector autoregressive model, to examine the response of foreign portfolio investment to monetary policy decisions in Nigeria. The results indicated no causality running from any of the monetary policy tools to aggregate foreign portfolio investment. However, a unidirectional causality was found running from the total foreign portfolio investment to the policy rate and cash reserve ratio. This suggests that monetary policy is reactive, as developments in the foreign portfolio markets influence it. The results also showed that each key component response to specific monetary policy instruments with varying levels of magnitudes.

Keywords

Monetary Policy, TodaYamamoto, Foreign Portfolio Investment, Nigeria, CBN

JEL Classification Numbers: C51, E52, E58

Introduction

Foreign Portfolio Investment (FPI) is an investment in the financial assets of a foreign economy, such as equities, bonds, and money market instruments available on an exchange. This form of investment does not offer direct ownership of the company's assets to the investor and is normally easier to liquidate. FPI is usually seen less favourably than Foreign Direct Investment (FDI) since it could be disposed off quickly. International financial management has made it possible for domestic economies to have an idea and get interested in investing in international debt securities to raise capital and augment their financing shortfalls. Economies, particularly, developing ones, face a shortage of foreign exchange to finance trade and investment (Can, 2003). They face this problem, more, because of the small-open nature of their economy associated with weak and not easily convertible currency. As a result, their domestic decisions cannot influence the development of the international market. One way of financing the shortfalls of foreign exchange is through capital flows. These flows can either be FDI or FPI. The Inflow from FDI is more reliable and serves as a major driver of economic activity. On the flip side, foreign portfolio investment is volatile and easily reversible and could alter the persistence of monetary policy shocks on its flows (Demirbas et al., 2022). Understanding the transmission and magnitude of flows could provide the monetary authority with a clue to review policy towards stabilising the economy. The foreign portfolio inflows are influenced by several factors, crucial amongst all, is the interest rate in the attracting economy. Monetary policy resolutions via the changes in interest rates have variant implications for investment. When the rate of interest rate is high in an economy it attracts foreign portfolio investors especially those practicing the theory of return chasing. However, this, may also suggest expensive borrowing capable of dampening domestic investment.

The Central Bank of Nigeria has for a long time maintained its anchor rate, at a higher level including in periods of downturn experienced during 2016 to attract foreign portfolio investment. Some schools of thought are, however, against the idea of focusing policy to attract foreign portfolios at the expense of competitiveness hence recommends capital controls. They justified capital controls as a way of preventing inflows of hot money which they think could excessively increase the value of the home currency, hence undermine competitiveness and reduce vulnerability to sudden changes in the financial market. In other words, once an economy liberalises and allows inflow of capital, issues of macroeconomic stability become of paramount importance, given that foreign portfolio flows may be volatile and easily reversible, thereby impacting macroeconomic stability. The fact that hot money is easily reversible is a concern for monetary policy management. The new normal, however, has been to remove capital controls and allow for free capital mobility as a way of integrating with the rest of the world. Integration of financial markets removes covered interest differentials across countries, but not exchange-rate variability (Frankel, 1992). Given the scenario painted above, it is imperative to examine some of the issues to guide policy.

Despite its role in the provision of money for investment and the deepening of domestic capital markets, huge and abrupt inflows of helicopter money could lead to undesirable macroeconomic consequences. The volatile nature and unpredictability of foreign portfolios certainly have an influence on prices and hence on monetary policy management. Besides, if the absorptive capacity of the recipient country does not keep pace with the growth in capital flows, it could result in distortions in the domestic economy. Moreso, aggregate foreign portfolio investment could disguise the true responses of inflows to monetary policy. This is because the major components of the foreign portfolio investment may have different capital intensities that would generate different responsiveness from monetary policy decisions. However, most studies in the literature have generally centered on the aggregate level of portfolio investment in studying its relationship with monetary policy. To this end, this study is undertaken to address the weakness associated with aggregation by using the disaggregation approach for a better understanding of the dynamics of FPI and its major components.

The broad objective of the paper, therefore, is to examine if key monetary policy instruments of the CBN influences the decision of portfolio investors in Nigeria. Specifically, the study examines the response of aggregate FPI to monetary policy decisions, investigate the nexus between monetary policy and equity component of the FPI, assess the impact of monetary policy on the bond component of the FPI, and evaluate the response of the money market instrument component of the FPI to monetary policy shocks.

Literature Review

There is a wide range of literature on investment in foreign portfolios to developing countries with both specific and global economic characteristics. The characteristics of each country relate to progress, economic risks and prospects for return to the market; while the global characteristics affect the accessibility of foreign capital and relate to worldwide financial conditions such as interest rates, markets, environment and risks (Can & Tursunbadalov, 2019). The literature also addresses a number of monetary policy tools that can stimulate investment. Monetary policy was statistically proven to have a positive impact on portfolio investment (Karaman & Can, 2014). For example, Conover et al., (2005) argued that monetary policy influenced the choice between aggressive or defensive equity portfolios. The paper also found that the Fed's easing favours cyclical stocks with tightening in favor of defensive stocks. Ammera et al., (2018) examined the impact of interest rates on portfolio investments on the basis of panel regression of annual data from 2003-2016 and found that low interest rates led to massive foreign investments into the United States. Rubin (2018) studied the Fed's policy forecast and portfolio flows to emerging markets during a simple recession and found that the monetary policy component primarily has implications for portfolio flows in emerging markets. A change in market expectations for future U.S. monetary policy may lead to greater inflows in the emerging market portfolio, while higher expectations for interest rates reduce these flows. Conover et al., (2005) scrutinized the connection between U.S. monetary policy and global asset yields and found that U.S. monetary policy had a strong correlation with defence yields. U.S. stock yields were higher and volatility less steadily as Fed pursues loose monetary policy. Fratzscher, Savorovsky & Straub (2009) studied the impact of monetary policy on portfolio investments in the United States using quarterly data between 1974 and 2007 using the SVAR method and found that monetary policy has a significant impact on capital flows and trade balance.

Flageollet & Bahaji (2016) examined the impact of monetary policy on the joint movement of capital and bond yields and their implications for the allocation of risk-based assets. The system switch model, which controls the economic effects of monetary policy, was used to find that risk-based portfolio strategies were ineffective in the low correlation system of inflation shocks. Fanelli (2017) examined the affiliation amongst monetary policy, capital controls, and international cases, and found that an increase in insurance considerations could lead to an increase in local currency positions and lower volatility in excess yield on securities in the local currency, rather than an increase. Carvalho & Fidora (2015) also found that increasing foreign holdings in eurozone bonds is linked to a long-term interest rate cut in the eurozone.

The literature did not focus solely on the response of portfolio flows to the monetary policy shock, which constitutes a material change in the interest rate. Other strands spotted at the connection in the opposite direction. For example, Carvalho & Fidora (2015) examined whether foreign purchases of eurozone bonds since the euro launch and the global financial crisis had a significant impact on long-term interest rates in the eurozone. To examine issues of internal authenticity, they followed Bandholz, Clostermann & Seitz (2009); Beltran et al., (2013) and used the parsimonious Vector Error Correction Model (VECM) to assess the impact of foreign holdings on long-term interest rates in the eurozone. The results showed that the increase in foreign holdings of eurozone bonds from the first quarter of 2000 to mid-2006 led to a decline of 1.55 percentage points in the long-term interest rates of the eurozone. These results are consistent with the results of other studies on the impact of foreign bond purchases on long-term U.S. interest rates such as Warnock, Warnock (2009); Bertaut et al., (2012).

In Nigeria, Ayodele, Afolabi & Okoye (2017) assessed the impact of interest on portfolio investments using co-integration technique and the error correction model with annual data covering the period 1985 to 2014 and found that the prime lending rate significantly affects portfolio investment. Golit, Adamu & Belonwu (2018) examined whether CBN's monetary policy rate was a signaling tool for investors in foreign portfolios, using the Structural Vector Autoregressive Model (SVAR) and found that changes in the MPR had an impact on the behavior of investments in foreign portfolios in Nigeria. Siddiqui & Aumeboonsuke (2014) also discussed the relationship between FDI and interest rates within 5 Asian countries, and found that interest rates had a negative relationship with FDI in those countries. Wakasa, Hashimiye & Nazarb (2015) examined the affiliation between macroeconomic factors and the volatility in FDI investments in South Asian countries and found a significant link between macroeconomic factors and the volatility in investments in foreign portfolios. The most recent study that worked on this relationship was that of Jelilov, Celik & Adamu (2020), which scrutinized responses of foreign portfolio investments to CBN monetary policy decisions. Toda-Yamamoto Causality model and Generalized Impulse Response Function was used in the study and found that changes in monetary policy position can only affect the conduct of investments in foreign portfolios with a lag of 6 months with marginal effect. The study resolved that monetary policy is only a tool for guiding portfolio investors in Nigeria since it affects investments in foreign portfolios through Treasury bill rates instead of through the MPR and Monetary Reserve Ratio (CRR).

The comprehensive review of the aforementioned literature revealed that most of the studies on monetary policy and capital flow in general or investment in foreign portfolios in particular were based on the overall portfolio. If not assembled, it is both monetary policy and stock or and bonds. The uniqueness of this study is its attempt to consider the association with a detailed approach, as well as to study all three main components of investments in foreign portfolios in one study. The two studies that directly examined the response of foreign portfolio investments to monetary policy in Nigeria are Golit, Adamu & Belonwu (2018); Jelilov, Celik & Adamu (2020). A review of these studies found that the first studies were at an overall level and did not take into account the characteristics of the variables’ data creation process, while the second believed that the characteristic of the estimated variables was also in the overall external portfolio. The results of these studies should be carefully interpreted due to the procedures used. For example, how stock portfolios might respond to monetary policy might not be how the bond portfolio or money markets respond. If response to monetary policy by these variables were in the same direction, the degree of the response to the monetary policy shock will be different. That's the main gap this paper is trying to bridge.

Data and Empirical Strategy

Data

The paper employed monthly series from January 2007 to March 2020. The aggregate vector autoregressive model is specified with Foreign Portfolio Investment (FPI), Monetary Policy Rate (MPR), Cash Reserve Ratio (CCR), Inter-Bank Interest Rates (IBR), nominal Exchange Rate (EXR), Consumer Prices (CPI), and the Nigerian Treasury Bill Rate (TBR). The domestic interest rates are captured by the Treasury bill rate and interbank call rate. The consumer price is represented by the Consumer Price Index. The disaggregated model replaced only the total foreign portfolio investments in the aggregate model with the 3 components for three separate models. These components are Equity (EQT), Bond (BON), and Money Market Instrument (MMI). All the data are sourced from the CBN Statistical Bulletin.

Technique for Data Analysis

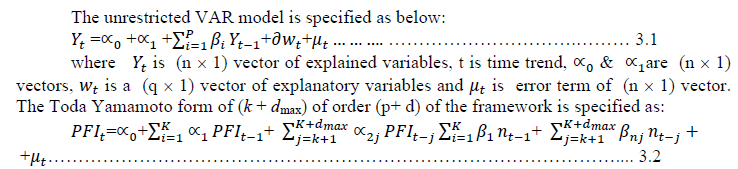

The principal technique adopted is the Todayamamoto (TY) non-causality framework to determine the response of foreign portfolio investments and its core components to monetary policy decisions. As a starting point of estimation of the TY method, the maximum order of integration (dmax) was established which was I (1) followed by the determination of the optimal lag length (k) of the unrestricted model which was 2 having pass the stability and LM test. However, the money market instrument model indicated a suitable optimal lag length of 8 with which the model was estimated. After that, the unrestricted models were adjusted in line with the obtained unit root and lag length selection results and re-estimated. EViews 11 is the econometric software adopted for the estimations. Having ascertained the presence of cointegration in the model, the last step was to confirm if monetary policy decisions Granger Cause total foreign portfolio and its components.

The TY technique is an argumented Vector autocorrelation model that operates under the VAR framework and has proven to be a powerful and reliable tool for the examination of time series with numerous variables. The multivariate model is an improvement to the univariate autoregressive model and has remained suitable for assessing the attributes of financial and economic time series and for prediction. Distinct from the simultaneous equation representations in which other variables are handled as dependent and some as independent or independent plus lagged dependent. In the VAR framework, all the series are treated as endogenous, and hence, no a priori difference between dependent and independent variables. This attribute would aid in addressing the bi-casual findings of the association between monetary policy and FPI observed in the literature.

Model Specification

Estimation Results

Descriptive Statistics

The distribution of the series is based on 154 observations thereby given an ample horizon for estimation. The series indicated a non-negative mean for all the variables with monetary policy rate recording a mean value of 11.12 per cent and a standard deviation (SD) of 2.64 per cent. The cash reserve ratio indicated a mean value of 12.53 per cent with a SD of 9.32 per cent. The TBR showed a mean of 9.20 per cent with a SD of 3.50 per cent. The nominal exchange rate showed a mean value of 195.89 and a SD of 70.61, the interbank call rate has a mean of 12.01 per cent and a SD of 8.22 per cent, while the headline consumer price index has a mean of 161.02 per cent and a SD of 68.13 per cent. The total foreign portfolio investment showed a mean value of N4.21 billion and a SD of 2.3 per cent, while the equity, bond, and money market instruments components of the foreign portfolio indicated means and SDs of N7.52 billion and 7.49 per cent, N1.28 billion and 2.3 per cent, and N6.27 billion and 1.37 per cent, respectively. All the variables are normally distributed as shown by the Jarque-Bera statistics. The entire variables are positively skewed except for the monetary policy rate and the TBR. The aggregate foreign portfolio investment recorded the highest positive skewness of 4.56 while the cash reserve ratio had the lowest positive skewness of 0.12. Similarly, all the series recorded positive Kurtosis (table 16 appendix 1).

Stationarity Test and Lag Length Selection

As reported briefly under 3.3.1, the unit root test for the variables employed in the study indicated that at 5 per cent significance level, only total foreign portfolio investment was stationary at levels, while the rest were stationary at first difference. This decision was arrived at by the consistent findings from both the Augmented Dickey Fully and Philips Perron test (table 1 appendix 1).

Trend and Graphical Analysis

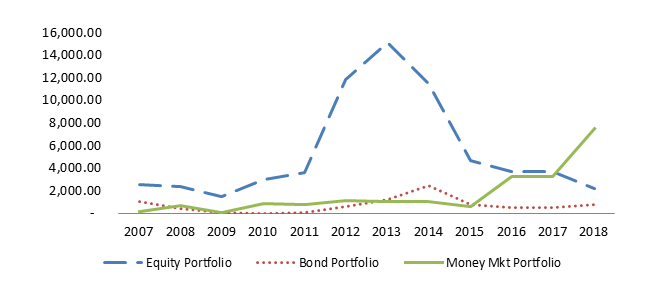

Foreign Portfolio Investments and its Components

The economy of Nigeria has over the years been associated with dwindling capital flows. However, in recent years the trend has been on an upwards trajectory. This expansion was due, largely, to the underdeveloped nature of the financial system of the economy. The literature has also established that a less developed financial system tends to offer greater opportunities for investors to leverage. This is because the interest rate is likely to be high in less developed financial markets thereby providing higher returns for portfolio investors. The trend of portfolio investment and its components for the periods of the study indicated a dominance of equity component of foreign portfolio investments into the country and a lower flow of the bonds component.

Source: CBN

The equity component of FPI sustained the increasing movement until 2008 before declining. This decreasing trend during the period may be attributable to the global financial crisis that happened at that time. Inflows from the equity component deteriorated to about 1.4 billion US dollars in 2009 from 2.5 billion US dollars recorded in 2007. However, this was accompanied by a swift pick up until 2013 when it plummeted. The dwindling pattern became persistent for some time before improving to about 15.1 billion US dollars in the year 2013 before declining again due to the US Federal Reserve policy on monetary policy normalisation, and the risks associated with the Nigerian general elections in 2015.

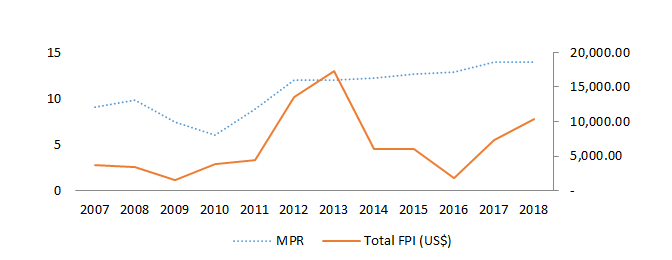

Aggregate FPI and MPR

From 2007 up till 2014, the monetary policy rate seems to be driving the aggregate FPI, but the pattern became not regular subsequently as the route of inflow exhibited that despite the rise in the policy rate, flows between 2014 and 2016 declined. This may suggest that the policy rate might not be the core apparatus investors consider when deciding either to invest or not.

Source: CBN

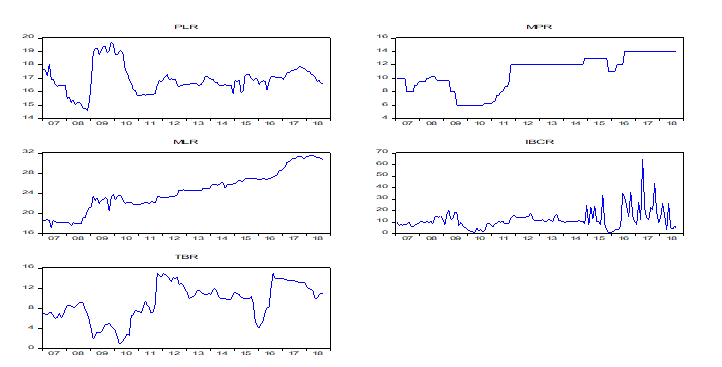

Monetary Policy Rate and other Short-Term Interest Rates

Figure 3 below showed that, on average, all the rates are moving in the same direction indicating that the policy rate may influence the movement in key short-term rates in the market. Nevertheless, volatility in drifts varies amongst the short-term rates.

Source: Author using Central Bank of Nigeria Data

Results

Results of Aggregate Model

TY Granger Non-Causality: The TodaYamamoto vector autoregressive granger causality result for the aggregate model (table 3 appendix 1) indicated that the of non-causality for all the monetary policy variables to foreign portfolio investment was accepted. This suggests that the selected instruments of monetary policy options i.e MPR, IBR, TBR, EIBR, and CCR do not have a significant impact on FPI. Nevertheless, a unidirectional causality from FPI to the MPR was found. The result implies monetary policy is reactive, as developments in the foreign portfolio markets influence it. The conclusion from the finding is that FPI in the country does not respond to monetary policy, rather, it is the monetary policy that responds to foreign portfolio investment. Therefore, the decision to tweak the monetary policy rate to influence portfolio investment may not be plausible in Nigeria.

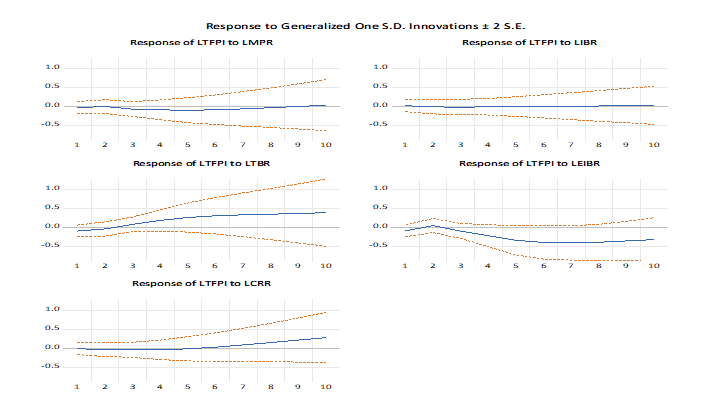

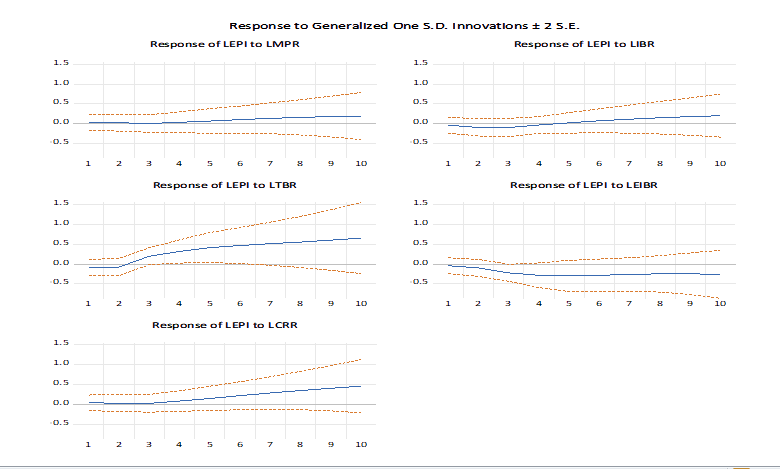

Impulse Response Function of the Aggregate Model: The results of the Generalised Impulse Function (figure 4), revealed an insignificant response of foreign portfolio investment given the impulse of MPR. This finding corroborates the TY granger non-causality results as the response was on average, not only marginal but against apriori. The foreign portfolio investment responded negatively to CRR up till the sixth month suggesting that a surge in the CRR decreases foreign portfolio investment. This finding is also counterintuitive because an increase in CRR reduces the liquidity position of banks and consequently increases the interest rate and a higher interest rate supposed to results in high FPI. Similarly, FPI responded negatively to exchange rate depreciation throughout the forecast horizon. Moreover, the impulse from IBR was positive, though also marginal from the first month up till the end of the forecast horizon.

The TB rate innovation did not affect the FPI immediately. However, it turned positive from the third month throughout the forecast horizon with an average of 0.3 per cent. Interbank call rate responded in the same direction with the TBR rate as FPI reacted to its shock in the first month immediately and continued until about the second and a half months before it bowed negatively in the third month but continued in the positive trajectory throughout the forecast horizon.

The conclusion from the above findings is that an increase in the MPR does not lead to FPI, and even in the second, ninth, and tenth month that it was positive, the response was small for the CBN to hinge its decision to keep a higher rate. Therefore, it could be inferred that investors monitor the movements in the TBR and interbank rate rather than MPR and CCR in deciding whether to invest in FPI or not. This implies that the policy rate is a signalling tool via TBR and interbank rate.

Variance Decomposition (VD) of Aggregate Model: The VD showed that innovations to FPI constituted 100 per cent of the variation in itself in the first month and 43.0 per cent by the tenth month. The variation of MPR by about 0.024 per cent explains the deviation in the FPI in second month. This trend continued, on an average of 0.7 per cent through the period of forecast and reached 0.67 per cent by the tenth month. This is inline with the impulse response function finding. CRR displayed an analogous influence with the policy rate by explaining the variation in FPI with about 0.1 per cent on average before reaching 2.7 per cent in the tenth month. About 15 per cent of the variation in FPI on average was explained by the TBR which is also in tandem with the result from the Todayamamoto and the generalized impulse response function. From the second month, the exchange rate wielded a significant impact of about 0.9 per cent before hopping after to 16 per cent in the tenth month. The result is what is expected as depreciation in the exchange rate result in high foreign investment. The CPI explained the variation with an average of 8 per cent, while the interbank call rate was the least impacting (table 5 appendix 1).

Discussion of Results of Sub-Component (Disaggregated Models)

Granger Non-Causality (Equity Portfolio and Monetary Policy): The TY result for the equity portfolio model showed that the of non-causality for all but TBR to FPI is to be accepted. This means that FPI is uninfluenced by the selected instruments of monetary policy besides the TBR. The result indicated that the equity component of the foreign portfolio investment response majorly to the Treasury bill rate. In other words, if monetary policy wants to influence the dynamics of equity in the capital market, it should adopt policy measures that could alter the Treasury bill rate rather than MPR, exchange rate; cash reserve ratio, or interbank call rate. This is understandable because equity investment is a longer-term venture. This has also confirmed the neutrality of monetary policy in the long term.

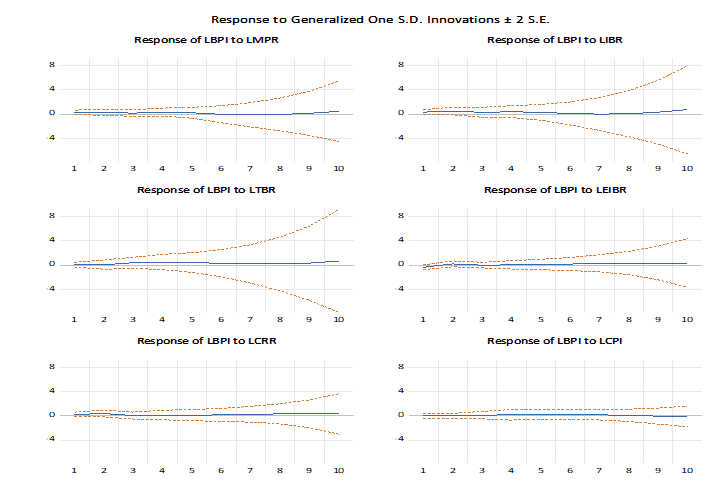

Impulse Response Function of Equity Portfolio and Monetary Policy: Given a one standard deviation innovation, the monetary policy rate affects the outcome of equity portfolios contemporaneously, though, marginally (Figure 5). It maintains the positive response throughout the forecast horizon on an average of 0.02 per cent. Further analysis indicated that, besides MPR, CRR, IBR, and TBR also exerted a positive response to innovations on average. As expected, the TBR impact more on the equity portfolio with an average impact of 0.55 per cent. Moreover, the exchange rate innovation to FPI was contemporaneous and negative, exerting impact of 0.3 per cent on FPI. The conclusion from the finding is that an increase in the anchor rate would attract equity portfolio investment to Nigeria slightly. This also applies to the other monetary policy tools but exchange rate. The conclusion from this finding is that monetary policy decisions affect the composition of equity foreign portfolio investment in Nigeria. But to exact high impact, the treasury channel should be explored more.

Variance Decomposition (VD) of Equity Portfolio and Monetary Policy

The VD analyses revealed that a shock to equity FPI constituted 100 per cent of the variation in itself in the first month and 33.8 per cent by the 10th month. The variation of MPR by about 0.02 per cent explains the deviation in the equity FPI in the second month. This trend persisted with 0.2 per cent through the forecast period and reached 2.6 per cent by the 10th period. This result is in tandem with the impulse response function outcome. CRR and CPI displayed a comparable influence with the policy rate by explaining the variation in equity FPI with about 3.0 per cent on average. About 20 per cent of the variation in equity FPI on average was explained by the TBR which is also in tandem with the result from the Todayamamoto and the generalized impulse response function. From the second month, the exchange rate exerted a significant impact of about 2.2 per cent before springing to 16 per cent in the tenth month (table 8 appendix 1).

Sub-Component (Disaggregated Models-Bond) Results

Granger Non-Causality (Bond Portfolio and Monetary Policy): The Bond component of the foreign portfolio investment showed that the of non-causality from the policy rate, TBR, EIBR, and CRR to Bond portfolio investment was not rejected. However, the of non-causality from the interbank call, rate was rejected. This implies that only the interbank rate exerts influence on the Bond component of FPI. Likewise, unidirectional causation running from the Bond portfolio to MPR and CRR was obtained, meaning that the decision of bondholders influences the setting of the MPR and the CRR but not the other way around. This may be so, because bonds are a longer-term investment, thereby, rendering monetary policy reactive. The conclusion from the findings is that Bond portfolio investment in Nigeria does not respond to and monetary policy. So, any decision by the CBN to raise interest or change the CRR to attract bond foreign portfolio investment would not affect the bondholders directly. The only way is through the interbank call rate indirectly since the MPR has proven to granger cause the IBCR (table 9 appendix 1).

Impulse Response Function of Bond FPI and Monetary Policy: The Generalized Impulse Response Function (GIRF) in the case of Bond (figure 6) revealed that given a one standard deviation innovation the impulse from MPR, CRR, TBR, IBR, and inflation affected the Bond foreign portfolio investment positively and contemporaneously. Furthermore, from the first month up to the 6th, innovations from MPR influenced the behaviour of investor's contemporaneously with an average of about 0.2 per cent. It only turned negative in the seventh and eighth months but revert to a positive trend in the ninth and tenth months. The interbank call rate also exerted a positive impulse from the first month to the entire forecast horizon with an average of 0.4 per cent. The TBR and CRR innovations, on other hand, affected the bond FPI immediately with a positive value of 0.4 and 0.3 per cent, respectively, throughout the forecast horizon. However, the bond portfolio reacted negatively and contemporaneously to the exchange rate shock. It turned positive in the second month then negative again in the third month before it maintained a positive reaction throughout the forecast horizon. This suggests that monetary policy could attract bond FPI, though marginally. The finding is also consistent with the interbank call rate influence on bonds from the causality.

Variance Decomposition (VD) of Bond Portfolio and Monetary Policy

The VD analysis of Bond foreign Portfolio investment showed that innovations to bond FPI constituted 100 per cent of the variation in itself in the beginning month, dropped to 87 per cent in the second month before reaching 50 per cent by the 10th period. The 2nd period indicated that deviations in bond FPI are explained by 1.92 per cent variation in MPR. An average of 6 per cent deviations in the bond FPI was accounted for by the policy rate shock through the forecast horizon. This result corroborates the outcome of the impulse response function. Also, Treasury bill rate revealed an analogous influence as it explained variation in bond FPI by 7 per cent and settle at 9.9 per cent by the last period. The difference in bond FPI was explained by 11 per cent on average deviations in interbank call rate. The CPI, CRR, and exchange rate exerted impact from the second period at 2, 3, and 5 per cent, respectively (table 11 appendix 1).

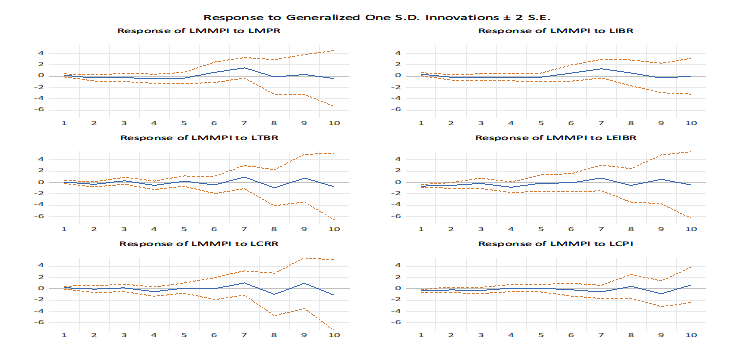

Results of Money Market Instruments Foreign Portfolio Investment (MMI)

Granger Non-Causality (MMI and Monetary Policy): TY Granger Causality for the money market instruments portfolio investment indicated that the of non-causality from the exchange rate and treasury bill rate to money market instrument was not accepted. The finding suggests that these two instruments of monetary policy are effective in influencing money market instruments of FPI. Moreover, the Central Bank appears to be most effective in influencing the money market instruments than the equity and bond components. This is because of the finding of bidirectional causation from TBR, inflation, and exchange rate to money market instrument and a unidirectional relationship from money market instrument to the MPR and CRR. This proposes that policy options using MPR and CCR are reactive but proactive through the exchange rate, inflation, and treasury bill rate. The conclusion from the findings exhibited that money market instruments respond to TBR, exchange rate, and inflation directly. However, decisions of money market instruments holders are key to determining the MPR and CRR. Therefore, if the CBN wants to influence the holdings of money market instruments, it should adopt the exchange rate and Treasury bill channel because they exerted significant influence on the MMI (table 12 appendix 1).

Impulse Response Function of the Money Market Instruments Portfolio and Monetary Policy: The Generalized Impulse Response Function (GIRF) for Money Market Instruments (MMI) revealed that a one standard deviation innovation the impulse from the anchor rate, CCR, TBR, and interbank call rate affected the money market instruments positively and contemporaneously. Innovations from MPR turned negative from the second to the fifth month with an average of about 0.2 per cent. It only turned positive in the sixth and seventh month but revert to a negative trend in the eighth and tenth month. The GIRF revealed a mixed association between CRR and MMI. The innovation from CRR exerts a negative influence on MMI in the second, fourth, eighth, and tenth months, while the rest of the periods in the forecast horizon saw MMI reacting positively to CRR shock. The interbank exchange rate impacted negatively on MMI throughout but the month of July and September. The inflation impulse affected the MMI immediately, but negatively. It maintained the negative impact to the third month before turning positive in the fourth, fifth and thereafter eighth and tenth months with an average impact of 0.2 per cent (figure 7).

Variance Decomposition (VD) of Money Market Instruments Portfolio (MMI) and Monetary Policy

The VD analysis of Money Market Instruments FPI showed that innovations to MMI- FPI constituted 100 per cent of the variation in itself in the beginning month but dropped to 50 per cent by the 10th period. The 2nd period indicated that deviations in Money Market Instruments FPI are explained by 6 per cent variation in MPR. It jumped to 40 per cent in the seventh month before dropping to 24 per cent by 10th period. The result corroborates the outcome from the IRF. Also, CRR revealed an analogous influence with MPR by explaining variation in money market instruments FPI with 8 per cent and settled at 14 per cent by the last period. The variation in the MMI foreign portfolio investment was explained by about 20 per cent on average deviations in the Treasury bill rate. The CPI and exchange rate wielded an impact of 3, and 5 per cent, respectively (table 14 appendix 1).

Policy Implications

The study found that the anchor rate is an indicative tool for the aggregate foreign portfolio investors since it does not affect FPI directly. The results also showed that each key component response to monetary policy instruments with varying levels of magnitudes. This development might imply that the general monetary policy decisions could not be effective in influencing foreign investors’ decisions. The conclusion also showed that money market instruments are the most sensitive component to monetary policy decisions in Nigeria. This is plausible because investments in it are short-medium term while that of bond and equity operates in the market with a longer tenure of maturity. The TBR is the core rate that influences the behaviour of portfolio investors with equity and money market instruments holdings in Nigeria. For the Bonds holding, the interbank call rate is the dominant influencer of its holding. Most of the responses of foreign portfolio investments and components were marginal, indicating that the effectiveness of monetary policy is possible even if the monetary authority decides to reduce policy rate as no significant capital flight could be lost. Since the general finding is that different components respond differently to monetary policy decisions and different decision tools, the study recommends component-specific policy prescription.

Summary, Conclusion and Recommendations

Summary of Findings

The response of foreign portfolio investment to monetary policy decisions was examined from two perspectives.

First, the response of the aggregate portfolio investment to monetary policy. The results indicated no causality running from any of the monetary policy tools to aggregate FPI. Nevertheless, a unidirectional causality was found running from the total FPI to the MPR and CRR. This suggests that monetary policy is reactive, as developments in the foreign portfolio markets influence it. In other words, total foreign portfolio investment in Nigeria does not respond to monetary policy, rather, it is the monetary policy that responds to total foreign portfolio investment. Therefore, the decision to tweak the monetary policy rate to influence portfolio investment may not be plausible in Nigeria.

Second, the responses of key components of foreign portfolio investment were examined. The results showed that each key component response to specific monetary policy instruments with varying levels of magnitudes. This development might imply that the general monetary policy decision could not be effective in influencing foreign investors’ decisions. The finding also showed that the money market instruments in the most sensitive component to monetary policy decisions in Nigeria. This is plausible because investments in money market instruments are short-medium term while that of bond and equity operates in the market with a longer tenure of maturity. The Treasury bill rate was found to be the main interest rate determining the behavior of investors with equity and money market instruments holdings in Nigeria. For the Bonds holding, the interbank call rate is the dominant influencer of its holding. Most of the responses of foreign portfolio investments and components were marginal, signifying that the monetary policy authority could reduce interest rates without losing substantial capital flight.

Conclusion

The analysis of foreign portfolio investment and its components has serious policy implications to a monetary policy decision. This justifies why the study of this nature is very important as findings from it could guide policy. In the analysis of the aforementioned subject, the Toda-Yamamoto augmented VAR model was adopted. The method is very relevant in handling multivariate analysis given its power in taking into cognisance the data generating process that includes the order of integration and cointegration. The study found the non-existence of causality from any of the monetary policy tools innovations to aggregate FPI. However, a unidirectional causality was found running the FPI to MPR and CRR. Following this finding, the study concluded that monetary policy is reactive, as developments in the foreign portfolio markets influence it. It also means that portfolio investment in Nigeria does not respond to monetary policy, rather, it is the monetary policy that responds to foreign portfolio investment. Therefore, the decision to tweak the monetary policy rate to influence portfolio investment may not be plausible in Nigeria. The results also showed that each key component response to monetary policy instruments with varying levels of magnitudes. This development might imply that the general monetary policy decision could not be effective in influencing foreign investors’ decisions.

The study also examined the impulse routes of FPI and its components to monetary policy innovations. The conclusion from the impulse response function was variations in monetary policy could only influence the behavior of FPI with marginal impact. This conclusion was corroborated by the finding of the forecast error variance decomposition.

Recommendations

The study, therefore, recommends the following policies.

- The reduction of the interest rate. This is because of the finding that the response of FPI to Monetary policy is minimal implying that the CBN can reduce the policy rate without losing significant capital flight.

- Given the finding of different components responding differently to monetary policy decisions and different decision tools, the study recommends component-specific policy prescription.

- The monetary authority should target the money market instruments when it wants to influence foreign portfolio investment. This can be done by putting in place measures to monitor and ensure that changes in money market instruments are not caused, largely, by speculations.

References

Alade S. (2015). Determination of optimal threshold for the Central Bank of Nigeria monetary policy rate. CBN Working Paper Series. CBN Working Paper Series.

Ammera, J., Claessensb, S., Tabovaa, A., & Wroblewskia, C. (2018). Home country interest rates and International Investment in U.S. Bond. S. Fed: International Finance Discussion Papers.

Ayodele, A.E., Afolabi, B., & Olaoye, A.C. (2017). Impact of interest rate on portfolio management in Nigeria. Asian Journal of Economics, Business, and Accounting, 1-10.

Bandholz, H., Clostermann, J., & Seitz, F. (2009). Explaining the US bond yield conundrum. Applied Financial Economics, 19(7), 539?50.

Beltran, D., Kretchmer, M., Marquez, J., & Thomas, C. (2013). Foreign Holdings of U.S. Treasuries and U.S. Treasury Yields. Journal of International Money and Finance, 32, 1120?1143.

Bertaut, C., DeMarco, L.P., Kamin, S., & Tryon, R. (2012). ABS in?ows to the United States and the global ?nancial crisis. Journal of International Economics, 88(2), 219?34.

Bredin, D., Hyde, S., Nitzsche, D., & O?Reilly, G. (2009). European monetary policy surprises: the aggregate and sectoral stock market response. International Journal of Finance and Economics, 14, 156-171.

Can, N. (2003). The impact of small business on the economic development of Kazakhstan.Journal of Academic Research,17, 31-48.

Can, N., & Tursunbadalov, S. (2019). Performance Analysis of Nigerian? Global Innovation Index (GII), IJSS, 3(17), 119-132.

Carvalho, D., & Fidora, M. (2015). Capital inflows and euro area Long Term Interest Rates. European Central Bank Working Paper Series.

(2014). Effects of monetary policy on the real economy of Nigeria: A disaggregated analysis. A ?Festschrift? In Honour Of Mr. B.S. Adebusuyi, Occasional Paper No 54.

Chiawa, M.M., Torruam, J.T., & Abur, C.C. (2012). Cointergration and causality analysis of government expenditure and economic growth in Nigeria.International Journal of Scientific and Technology Research, 1(8), 165-174

Conover, C.M., Jensen, G.R., Johnson, R.R., & Mercer, J.M. (2005). Is fed policy still relevant for investors?Financial Analysts Journal, 70-79.

Demirbas, E., Can, N., & Arabaci., A. (2022). Impact of Boko Haram-led Conflict on capital flows in Nigeria: evidence from time series data. Academy of Accounting and Financial Studies Journal, 26(4), 1-1

Fanelli, S. (2017). Monetary policy, capital controls, and international portfolios. MIT Job Market Paper.

Flageollet, A., & Bahaji, H. (2016). Monetary policy and risk-based asset allocation. Open Economies Review, 27(5), 851-870.

Fratzscher, M., Saborowski, C., & Straub, R. (2009).Monetary policy shocks and portfolio choice. European Central Bank Working Paper Serie

Crossref, Google Scholar, Indexed at

Frankel, J.A. (1992). Measuring international capital mobility: A review. American Economic Review, 82(2), 197-202.

Golit, P.D., Adamu, Y., & Belonwu, M.C. (2018). Interest rates and investment in Nigeria: Is the monetary policy rate a signaling instrument for portfolio investors?Economic and Financial Review, 56(4).

Jelilov, G., Celik, B., & Adamu, Y. (2020). Foreign portfolio investment response to monetary policy decisions in Nigeria: A Toda-Yamamoto Approach.International Business Research, 13(3).

Crossref, Google Scholar, Indexed at

Karaman, S.C., & Can, N., (2014). The effects of world financial integration on financing current account deficits: the case for Turkey. International Journal of Academic Research in Business and Social Sciences, 4(10), 144-157.

Crossref, Google Scholar, Indexed at

Khan, M.S. (2011). The design and effects of monetary policy in sub-Saharan African countries. Journal of African Economies, 20, ii6-ii35.

Obstfeld, M., Shambaugh, J.C., & Taylor, A.M. (2005). The trilemma in history: Tradeoffs among exchange rates, monetary policies, and capital mobility.Review of Economics and Statistics, 87(3), 423-438.

Okpanachi, U. (2012). An assessment of monetary policy response to capital flows in Nigeria. CBN Journal of Applied Statistics.

Orphanides, A. (2010). Taylor rules. In S. N. Durlaf and L. E. Blume (Eds.), Monetary Economics, 362-369. England: Palgrave Macmillan.

Rauf, A., Qayum, A., & Zaman, K. (2012). Relationship between public expenditure and national income: An empirical investigation of Wagner?s law in case of Pakistan. Academic Research International, 2(2), 533-538.

Siddiqui, H.A., & Aumeboonsuke, V. (2014). Role of interest in attracting FDI: Study on Asian 5 Economy.International Journal of Technical Research and Applications, 59-70.

Taylor, J.B. (1995). The monetary transmission mechanism: An empirical framework.Journal of Economic Perspectives, 9(4), 11-26.

Taylor, J.B. (2000). Using monetary policy rules in emerging market economies.

Taylor, J.B. (2001). The role of the exchange rate in monetary-policy rules.American Economic Review, 91(2), 263-267.

Vayanos, D., & Vila, J.L. (2005). A preferred-habitat model of the term structure of interest rates.National Bureau of Economic Research, Inc NBER Working Papers 15487.

Waqasa, Y., Hashmia, S.H., & Nazirb, M.I. (2015). Macroeconomic factors and foreign portfolio investment volatility: A Case of South East Asian Countries. Future Business Journal, 65-74.

Warnock, F.E., & Warnock, V.C. (2009). International capital ?ows and U.S. interest rates. Journal of International Money and Finance, 28, 903?19.

Ziramba, E. (2008). Wagner?s Law: An Econometric Test for South Africa, 1960-2006. South African Journal of Economics, 76(4), 596-606.

Crossref, Google Scholar, Indexed at

Received: 28-Mar-2022, Manuscript No. AEJ-22-11470; Editor assigned: 30-Mar-2022, PreQC No. AEJ-21-11470(PQ); Reviewed: 14-Apr-2022, QC No. AEJ-21-11470; Revised: 21-Apr-2022, Manuscript No. AEJ-21-11470(R); Published: 28-Apr-2022