Research Article: 2021 Vol: 24 Issue: 6S

Foreign Ownership, Foreign Board Member, Earnings Management and Performance of Thai Commercial Banks Listed on the Stock Exchange of Thailand

Krittayakamon Thanispong, Dhurakij Pundit University

Pattanant Petchchedchoo, Dhurakij Pundit University

Siridech Kumsuprom, Dhurakij Pundit University

Abstract

This research aims to investigate the influence of foreign ownership, foreign board members, earnings management on the performance of 11 Thai commercial banks listed on the Stock Exchange of Thailand. Data was collected from 2013 to 2020 utilizing the Structural Equation Modeling (SEM) statistics, path analysis, and data analysis. The results revealed that foreign ownership has a positive influence on foreign boards. Consistently with the Agency theory, when foreign investors invest, a representative is frequently assigned to carry out different responsibilities in order to maintain the interests of the invested business and oversee its performance. The foreign board has a positive influence on the performance as measured by the CAMELS financial ratio. Having a foreign board allows for efficient management resulting in better operating performance. The foreign shareholder structure that negatively influences earnings management show that foreign investors holding shares in the banks will lead to monitoring the operations of the executives or the management to prevent the executives from acting for their own benefits. It was viewed as a cause of lower earnings management. Earnings management negatively influences the performance measured by the CAMELS financial ratios. The findings implied that executives engaging in any action in earnings management will result in lower financial performance.

In addition, a causal pathway analysis that influences performance has shown that foreign ownership influences the performance as measured by CAMELS financial ratios through foreign committees and earnings management. It shows that when banks have foreign ownership holding shares and have foreign boards, they can bring their knowledge, expertise, competencies and experience to maintain in power and protect their interests, which include monitoring and preventing executives from acting on earnings management, resulting in reduced earnings management and improved performance.

Keywords

Foreign Ownership, Foreign Board, Earnings Management, Performance

Introduction

The Thai economy is expanding continuously in all sectors. More economic activities result in an increase in entrepreneurial confidence (Bank of Thailand, 2017). Capital is the main factor in the ongoing operation of all organizations while each organization needs to raise funds from various sources of funding. Financial institutions play an important role in the economy in raising capital by acting as a financial medium between the savings and investment sectors through the implementation of deposit and lending transactions, namely commercial banks. The commercial banking system is considered as a vein of nurturing Thailand's economy to grow steadily. The country's commercial banks affect many stakeholders. There are growing concerns about the relevance of financial reports that are prepared to meet investors and stakeholders to study data from financial reports. Therefore, financial reports or financial statements are an option of important sources that represent the financial position and performance of the business. The Board of Directors has a duty and responsibility to produce financial reports to present to stakeholders the responsibility of acting in the interests of the owner or shareholder in accordance with the legal process. Sometimes, however, agents will benefit themselves more than ventures, also known as agent issues. The agency problems are addressed by controlling shareholders (major shareholders) with minority shareholders.

Earnings Management is an issue that affects confidence in the reliability of financial statements that directly affects the users of financial statements or stakeholders of the business, causing asymmetrical problems of information between internal and external parties and affecting the cost of capital increases (Dechow, Sloan & Sweeney, 1996). As Schipper (1989) mentioned, earnings management is a purposeful intervention in the external financial reporting process with the intent of providing personal gain to section executives. Healy and Wahlen (1999) said that earnings management occurs when managers exercise discretion in financial reporting and order transactions to modify financial reports to mislead some stakeholders about their economic performance.

When executives manage earnings, what mechanisms can reduce executives' earnings management behavior. La Porta, et al., (2000) argue that shareholder structure is an important and influential factor in earnings management. Corporate governance is an important element in protecting investors. Fama (1980); Fama & Jensen (1983) commented that the board is an intra-enterprise control mechanism that is important for oversight and monitoring the performance of management as well. Previous research studies on the relationship of board characteristics and performance have shown that companies with foreign directors have an advantage in performing their duties due to their knowledge and expertise in contexts that differ from domestic boards. They can independently apply a wide range of expertise to perform their duties, have broad industry knowledge, and perform their duties more effectively with that expertise. There is a wide variety of directors in which domestic directors may not be sufficient (Chen et al., 2008). In addition, foreign board can help build confidence in foreign investors (Oxelheim & Randoy, 2003). Ujunwa (2012) found that the number of foreign board or other nationalities had a positive impact on corporate performance.

For this reason, the researchers questioned whether commercial banks were a large source of capital raising, whether financial reports were accurate, reliable, not distorted and misleading to stakeholders, and how foreign ownership, foreign board member affected performance. Therefore, the researchers studied the foreign ownership, foreign board member, earnings management and performance of Thai commercial banks listed on the Stock Exchange of Thailand.

Research Objective

1. To study the influence of foreign ownership, foreign board members, and earnings management on the performance of Thai commercial banks listed on the Stock Exchange of Thailand.

2. To study the influence of foreign ownership and foreign board members on the performance linked through earnings management of Thai commercial banks listed on the Stock Exchange of Thailand.

Literature Review

Agency Theory

Agency Theory, by Jensen & Meckling (1976), is the relationship concept between the representation based on the assignment of the decision-making body, aiming for the agent to exercise the decision-making power on behalf of the person and creating maximum benefit to the authority. If the agent uses the power for other purposes or for his own benefit, there will be an agency problem. The resulting conflict can be resolved by using a monitoring mechanism that requires agent costs. Therefore, the management has incentive to choose accounting methods that are foreseeable for themselves to produce accounting information offered to stakeholders and may affect earnings management as well.

Positive Accounting Theory

Positive Accounting Theory has the fundamental idea that, in order to achieve the conditions arising from the contractual burdens incurred between the Company and its stakeholders, executives often behave opportunistically through the choice of accounting policies under different circumstances. Watts & Zimmerman (1986) stated that assumptions which addressed the concept of a key motivation for executives to manage profits through choose the right accounting policies under different circumstances to achieve the conditions arising from the contractual burdens that arise between the company and its stakeholders. This is based on the theory of accounting interests of Watts & Zimmerman (1986), whereas incentives lead executives to decide on accounting methods to produce an accounting information.

Ownership Structure

The concept of ownership structure, the share-holding structure reflects on the decentralization of management by having controlling shareholder. This will adversely affect the business value when the shareholders have inconsistent demands with other shareholders who have the power to make any decisions (Shleifer & Vishny, 1997). However, La Porta, et al., (1999) states that in countries with laws protecting shareholders' rights, holding by a controlling person does not negatively affect an entity's performance. Instead, it gives better results as it reduces agency costs because controlling shareholders monitor the performance of executives with foreign ownership. There are many factors that can result in the benefit. For instance, the entity may acquire new technology knowledge and benefit from investment policies from government agencies. Foreign investment will result in the transfer of scientific technology in which Thai people do not yet have very high levels of expertise. Therefore, it is considered that foreign shareholders are external investors who are stakeholders in the business and they have an incentive to closely monitor the performance of the business and prevent ineffective earnings management of executives. In the meantime, there might be drawbacks from monitoring the performance of executives as it is difficult to do so when foreign investors are not living in the country.

The Concept of a Foreign Board Member

The concept of a foreign board member, according to agency theory, explains the conflict of interest between the shareholders and management. In the form of research committees in the past, studies on the relationship of board characteristics and performance of the business have found that companies with foreign committees have an advantage in their duties because they have different knowledge and expertise in a different context than domestic committees (Resource Dependency Theory) (Chen et al., 2008; Marimuthu & Kolandaisamy, 2009; Sridharan & Marsinko, 1997; Freihat, Farhan & Shanikat, 2019; Al-Abdallah, Adous, Al- Momany & Bouguerra, 2021; Chantapet, Phoprachak, Jermsittiparsert & Malaipia, 2021).

Earnings Management

Earnings Management concept means that executives exercise discretion in selecting various accounting practices under the specified criteria to revise financial transactions so that stakeholders misunderstand the economic performance derived from reported accounting figures to provide the level of reported profit for personal interests (Almari et al., 2021; Davidson, Stickney & Weil, 1987) (referenced in Schipper, 1989). Schipper (1989) said that executives intervened in the financial reporting process, which is opposed to normal neutral operations, and that executives used earnings management to achieve profit changes reported for personal gain. Healy & Wahlen (1999), that executives exercised discretion in the preparation of financial reports aimed at misleading stakeholders about the company's performance. Vilalai, Petchchedcho & Kumsuprom (2020) studied earnings management through discretion in the creation of business items and earnings management through accruals with future profitability. Earnings management through accruals had no relationship to future profitability.

Firm's Performance

Firm's Performance Concept: Kotze (2006) says that performance is to do the right thing in a timely manner and based on behavior as a priority. Robbins (2003) defines organization's performance as the sum of its activities in the entire process of the organization with the goal of better asset management, enhancing the ability to increase the value of products and services for customers, and creating a good reputation for the organization. Measuring performance is an important element that informs the efficiency and effectiveness of the organization that demonstrates the management capabilities of the management and the returns of shareholders. In general, performance measurement covers two perspectives: (1) accounting-based measure and (2) marketing-based measure.

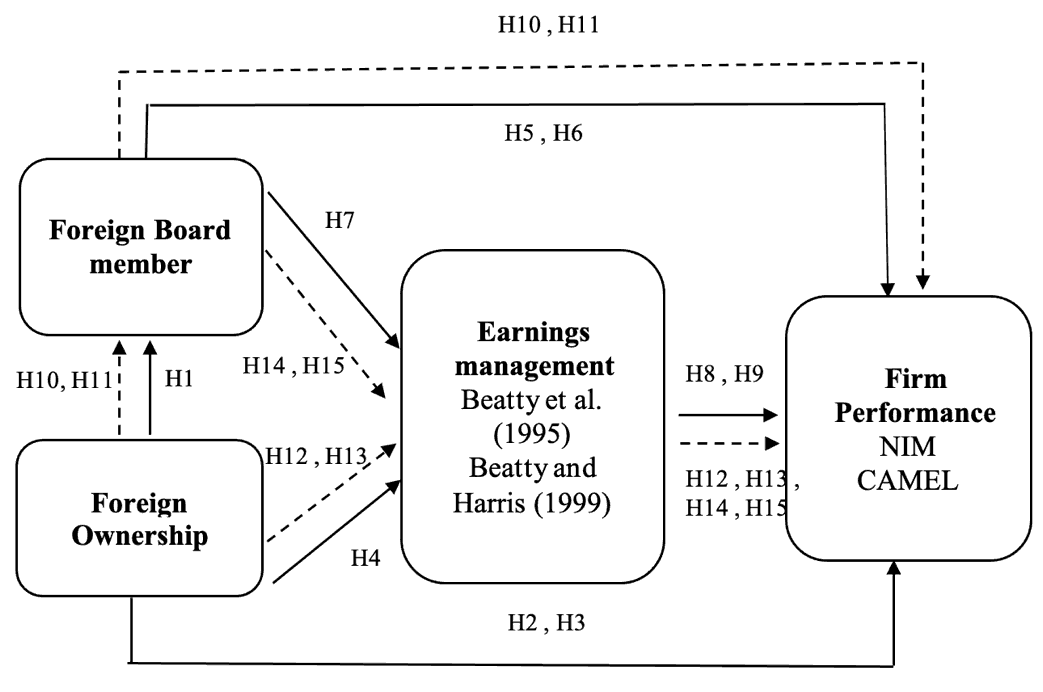

From the literature review, it leads to the research conceptual framework. Details are shown in Figure 1.

Research Methodology

This quantitative research investigated the influence of foreign ownership, foreign board member, and earnings management on performance. The population and samples included Thai Commercial Banks Listed on the Stock Exchange of Thailand. The data was collected semi-annually from 2013 to 2020, including 176 firm-year. The secondary data was extracted from the annual reports, annual data statements (Form 56-1), financial statements, and notes. Variables used in the study include Foreign Ownership (FO) as measured by the percentage of shareholdings of foreign investors, Foreign Board Members (FB) as measured by the proportion of foreign directors, Earnings Management (EM) as measured from discretion accruals from executive board using the indicators by Beatty, et al., (1995) and Beatty & Harris (1999). Performance was measured with two metrics: 1) Net Interest Margin (NIM) ratio and 2) CAMELS financial ratio. Statistics used for data analysis included: 1) descriptive statistics such as mean, 2) inferential statistics, structural modeling (SEM) and path analysis (Path Analysis: PA).

Research Findings

The influence of foreign ownership, foreign board members, and earnings management on performance are summarized below.

| Table 1 Results of The Study on Data of Variables |

|||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Banks | Average of Variables (Percentage) | ||||||||||||||

| FO | FB | DAs | NIM | CAMEL | |||||||||||

| C1 | C2 | A1 | A2 | A3 | M1 | M2 | M3 | E1 | E2 | L | |||||

| SCB | 29 | 7.82 | -0.32 | 3.99 | 17.31 | 11.63 | 1.57 | 4.33 | 67.7 | 35.69 | 1.85 | 5.67 | 1.52 | 43.78 | 96.19 |

| KBANK | 49 | 6.67 | 0.31 | 4.64 | 18.01 | 12.77 | 2.23 | 4.83 | 62.73 | 36.85 | 1.57 | 6.55 | 1.58 | 48.21 | 94.92 |

| BBL | 14 | 12.88 | 0.92 | 6.22 | 18.13 | 12.52 | 1.14 | 6.51 | 64.74 | 45.39 | 2.12 | 3.63 | 1.1 | 40.69 | 85.53 |

| KTB | 14 | 8.09 | -1.07 | 5.35 | 16.87 | 9.99 | 1.95 | 5.46 | 69.86 | 43.84 | 2.06 | 4.06 | 1.06 | 29.71 | 93.94 |

| BAY | 76 | 36.46 | -0.68 | 3.55 | 15.95 | 11.01 | 0.95 | 3.58 | 78.79 | 46.54 | 1.96 | 5.09 | 1.13 | 32.46 | 121.15 |

| TCAP | 43 | 28.13 | 1.47 | 3.83 | 15.78 | 20.78 | 6.41 | 3.78 | 66.14 | 42.54 | 2.7 | 5.51 | 2.99 | 45.24 | 82.43 |

| TMB | 32 | 29.81 | -1.14 | 4.67 | 17.79 | 9.95 | 1.35 | 4.53 | 72.83 | 48.09 | 1.87 | 3.9 | 0.92 | 31.05 | 98.81 |

| CIMB TH | 96 | 41.72 | -1.1 | 4.02 | 17.07 | 9.39 | 4.25 | 3.97 | 64.87 | 61.3 | 2.5 | 3.9 | 0.23 | 26.04 | 116.43 |

| KKP | 26 | 10.54 | -1.28 | 5.07 | 16.85 | 14.93 | 2.98 | 4.58 | 81.09 | 50.87 | 2.54 | 6.11 | 1.78 | 36.04 | 150.88 |

| TISCO | 29 | 24.15 | 0.44 | 4.05 | 18.56 | 10.95 | 1.61 | 4.18 | 87.23 | 39.89 | 2.35 | 5.92 | 1.86 | 36.98 | 135.84 |

| LHFG | 30 | 18.9 | -0.14 | 2.16 | 16.64 | 12.97 | 2 | 2.29 | 66.68 | 42.76 | 2.79 | 2.82 | 1 | 27.31 | 95.54 |

According to Table 1, the top three banks with foreign ownership were 1) CIMB Thai Bank, held by CIMB Bank Berhad, Malaysia, 2) Bank of Ayudhya, held by The Bank of Tokyo-Mitsubishi UFJ, and 3) Kasikorn Bank. The top three banks with foreign board members were 1) CIMB Thai Bank, 2) Bank of Ayudhya, and 3) TMB Bank. The top three banks with the highest managed earnings figures were 1) Thanachart Capital Public Company Limited, 2) Kasikorn Bank and 3) Bangkok Bank. The top three banks with the lowest managed earnings figures were 1) Kiatnakin Bank, 2) TMB Bank, and 3) Krungthai Bank, most of which were characterized by lower managed earnings figures. Measured by net interest margin-to-asset ratio (AIA, 1996), the performance of all banks was at the highest level in general. The CAMELS financial ratio is divided into 5 perspectives: capital adequacy, asset quality, management ability, profitability, and liquidity.

First of all, regarding capital adequacy, that Thai commercial banks had a stable financial position and had sufficient capital strength to cope with unforeseen events or risks. Second, asset quality indicates that Thai commercial banks were at risk of asset quality since they had a large percentage of loans, which might lead to instabilities in accommodating consumers who want to withdraw money. There is also the possibility of being unable to collect debts, which might jeopardize the banks' trustworthiness. Management ability shows that Thai commercial banks had good management abilities indicated by low operating expenses as measured against revenue generation as well as low interest expenses. Profitability demonstrates that the banks had good performance as indicated by a greater ratio of net profit to total assets and good revenue generation from other segments. Lastly, banks had moderate liquidity due to their shares of excessive loans, which allow the banks to extends loans in quantities greater than their existing deposits, potentially causing liquidity problems in the future if debtors are unable to repay them.

| Table 2 Analytical results of the direction in correlation of variables(correlation analysis) |

|||||

|---|---|---|---|---|---|

| Variable | FO | FB | DAs | NIM | CAMEL |

| FO | 1.000 | ||||

| FB | 0.641** | 1.000 | |||

| DAs | -0.105 | 0.044 | 1.000 | ||

| NIM | -0.268** | -0.227** | 0.127 | 1.000 | |

| CAMEL | 0.148* | 0.295** | -0.153* | -0.047 | 1.000 |

The correlation coefficients between the five variables shown in Table 2 were positive and negative, with 5 positive correlations and 5 negative correlations for the observed variables. The correlation between all pairs had a correlation level not exceeding the standard of 0.80. It was concluded that the variables analyzed had no linear correlation problem (Multicollinearity).

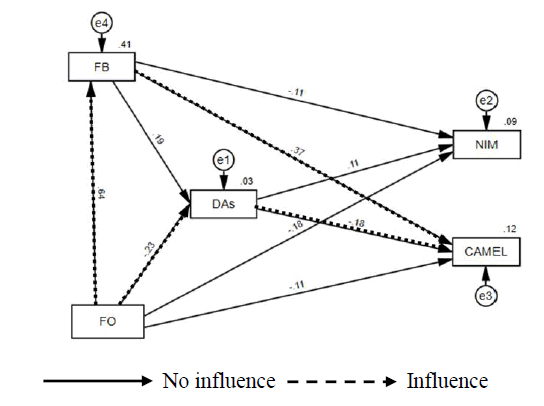

The causal model analysis of the performance showed that the hypothetical model was consistent with the empirical data. The study found that the model was consistent with the empirical data because CMIN-p=0.645, CMIN/df=0.212, GFI=1.000, AGFI=0.993, CFI=1.000 and RMSEA=0.000.

Foreign Ownership (FO), Foreign Board Member (FB), Earnings Management (DAs), Net Interest Margin to Total Assets ratio (NIM), and CAMELS Financial Ratio (CAMEL)

Foreign ownership has a positive direct influence on foreign board members but a negative direct influence on earnings management, as seen in Figure 2. Foreign ownership, on the other hand, had no direct influence on the net interest margin to total assets ratio or the CAMELS financial ratio, which were both statistically significant at the 0.05 level (research hypotheses 1, 2, 3 and 4). There was a positive direct influence on the CAMELS financial ratio, but no direct influence on earnings management, and no direct influence on the net interest margin to total assets ratio with statistical significance of 0.05 level (research hypotheses 5, 6 and 7). Earnings management had no direct influence on the ratio of net interest margin to total assets. However, there was a negative direct influence on the CAMELS financial ratio with statistical significance of 0.05 level (research hypotheses 8 and 9).

In addition, it was found that the foreign ownership had no influence on the net interest margin to total assets ratio through the foreign board members, but significantly influenced the CAMELS financial ratio through the foreign board members statistically at 0.05 level (research hypotheses 10 and 11). Foreign ownership had no significant influence on net interest margin to total assets ratio through earnings management, but significantly influences CAMELS financial ratio through earnings management statistically at 0.05 level (research hypotheses 12 and 13). The foreign board members had no influence on the net interest margin to total assets ratio through earnings management and no influence on the CAMELS financial ratio through earnings management. It was statistically significant at the 0.05 level (research hypotheses 14 and 15).

Discussion

The objectives of this study were as follows: 1) to investigate the influence of foreign ownership, foreign board members, and earnings management on the performance of Thai commercial banks listed on the Stock Exchange of Thailand, and 2) to investigate the influence of foreign ownership and foreign board members on performance linked through earnings management of Thai commercial banks listed on the Stock Exchange of Thailand. The results of the study are discussed below.

Foreign ownership had a direct positive influence on foreign board members.

It demonstrates that when foreign investors invest, whether as individuals or as legal entities, a representative person is frequently dispatched to carry out various operations in order to sustain any benefits or earn profits, including monitoring investment operations. Therefore, Thai commercial banks with a proportion of foreign shareholders investing in banks often have different boards to work in various departments. This is consistent with the agent theory, in which the principal (shareholder) has hired an agent (executive) to perform work for him or her in exchange for compensation. The agent, on the other hand, must report on the performance and financial status of the business for which he is responsible, as well as provide benefits to the principal, with the directors having responsibilities to the shareholders. In accordance with Takao & Cheryl (2004), the A board of directors is a group of people who have been appointed to perform various tasks for the benefit of the company's owners or shareholders. They are subject to legal proceedings that give them the power to direct the company's work, punish and reward executive officers or management, and protect the rights and benefits of shareholders. Foreign board members had a positive influence on CAMELS financial ratios. The finding shows that, with a foreign board, the banks can apply their expertise, various skills, and experience into the operations to improve the performance and secure competitiveness. The bank's management context with both Thai and foreign board members will result in monitoring of the bank's operations, resulting in better performance. This is in line with Marimuthu and Kolandaisamy (2009) who reported that diverse nationalities had a positive relationship with business performance. Similarly, Ararat, Aksu & Tansel (2010) also pointed out that a variety of boards helped to provide better management and monitoring, resulting in agent conflict mitigation and increasing performance of companies. In addition, Chiu, Teoh & Tian (2013), revealed that the inclusion of at least one foreign director on the board was correlated with the growing tendency of directors to emphasize openness and transparency in auditing operations for better performance.

The foreign ownership had a negative direct influence on earnings management. This finding suggests that banks with foreign investors will prevent the management from acting in their own interests and adversely affecting the interests of shareholders as these cause the decline in earnings. The finding in the present study is in line with Khanna & Palepu (1999), there was evidence of the advantage from foreign ownership, particularly the strength in the company audits, improved performance, and prevention of the management from using internal data for earnings management. Guo, et al., (2015) affirm that foreign ownership limits any actions that cause earnings distortions in Japanese companies. Similarly, Phakdee & Srijunpetch (2019) found that foreign ownership improves the profitability of companies listed on the Stock Exchange of Thailand. Nguyen (2016) also found that companies with high overseas stakes tended to limit the means that executives use to indicate declining earnings.

Earnings management had a negative direct influence on CAMELS financial ratios. This finding shows that the management's involvement in any activity that causes earnings management will result in a decrease in performance. In this case, managers could manage earnings through accruals in favor of increasing or reducing earnings for better performance. It is, however, should be noted that reported earnings may be distorted, which are not the actual earnings. This finding is in line with Mahdavi, Younesi & Hashemijoo (2012) who discovered a negative relationship between earnings management and the company’s performance before and after the acquisition announcement date. Huang, Xuerong & Sun (2017) found a correlation between the company's performance and accruals and showed why it is important to control the company's performance when assessing accruals at executive discretion. This explains why if earnings from accruals are managed at the management's discretion, the performance will be reduced and performance must be controlled. Furthermore, Vilalai, Petchchedchoo & Kumsuprom (2020) found that earnings management based on discretion for business transactions, inaccurate expense estimation based on management’s discretion, and allowance for doubtful accounts had an inverse correlation with future profitability.

The foreign ownership had an influence on CAMELS financial ratios through foreign board members, a new finding from this study. When banks hold foreign ownership, they assign foreign boards to operate in various functions to maintain control and protect their interests and to monitor various operations. These foreign board members can apply their expertise, various skills, and experience into the operations to improve the performance and secure competitiveness. This is in accordance with the research by Rashid (2020) who investigated the moderator variables of the Board of Directors' characteristics in the relationship between the ownership structure and performance in Bangladesh-listed public limited companies. The results showed that foreign ownership and directors ownership had a significant positive influence on both accounting and marketing performance. The moderator variables showed that the size of the board and the independence of the board were the moderator variables between the relationship of the ownership structure and the performance. Also, La Porta, et al., (2000) attested that foreign investors had an incentive to develop corporate governance in a specific country because there is an opportunity to get more returns. Several other studies also stated that companies with large proportions of foreign ownership tend to have a high turnover because of good governance mechanisms.

Foreign ownership had an influence on CAMELS financial ratios through earnings management. The presence of foreign ownership results in foreign cooperation, raising competitiveness, gaining knowledge and ability to manage technologies for competitive advantage. Foreign investors also monitor the operations of management and prevent managers from acting for their own benefits and adversely affects the benefits of shareholders. This is viewed as a result of decreased earnings management and results in better performance. This finding is in accordance with the study by Qi, et al., (2000) who found that the performance is positively related with the proportion of domestic institutional investors and foreign investors at a significant level. Also, Arouri, Hossain & Muttakin (2011) pointed out that the level of foreign ownership has a significant positive correlation with the bank's performance.

Meanwhile, Choi, Sul & Min (2012) mentioned that shareholders and directors who are foreigners provided expertise and independent monitoring of management, which is an indication of the positive impact of the company's value. From the view of the agency theory, higher foreign shareholdings and independent directors are apparently effective corporate governance mechanisms to reduce agent costs and reduce earnings management. Gul, et al., (2010) indicated that foreign shareholders tend to result in higher transparency and progressive governance.

Guo, et al., (2015) also affirmed that foreign ownership limits any actions that cause earnings distortions in Japanese companies.

Benefit of the Research

The new findings of this research are that foreign ownership has an influence on performance as measured by CAMELS financial ratios through moderator variables, earnings management, and that foreign ownership has an influence on performance as measured by CAMELS financial ratios through foreign board member mediation variables.

Recommendations

1. In future studies, the data should be analyzed according to the size of the bank which may, result in a more detailed and clearer analysis result. Also, data that can be compared according to the bank's size.

2. Additional other ownership structures should be taken into account.

3. It is worth considering expanding the samples, such as covering the financial industry (banking, finance and securities, and insurance), which have a similar financial structure, operational requirements, legal requirements, and supervision.

Acknowledgement

I would like to extend my humble gratitude to College of Business Administration, Innovation and Accounting, Dhurakij Pundit University for their support of this study. 1. Advisor: Asst. Prof. Dr. Pattanant Petchchedchoo obtains a Ph.D. degree in (Accounting) from University of Manchester, United Kingdom. Currently, she is working as a vice-president for Academic Affairs and Director of the Doctor of Philosophy Program in Accounting, Dhurakij Pundit University. 2. Co-advisors: Asst. Prof. Dr. Siridech Kumsuprom obtains a Ph.D. degree in (Business Information Systems-IT Audit, Control and Governance) from RMIT University, Australia. Currently, he is working as a Dean of College of Business Administration, Innovation and Accounting and Director of the Doctor of Business Administration, Dhurakij Pundit University, who provided advice and useful suggestions that contributed to this research. I would like to thank Associate Professor Dr. Panarat Panmanee, Chair External Examiner of Dissertation Committee, who kindly gave advice on both academic knowledge and experience which was very helpful to complete this research improvement. Finally, I would like to thank my father, my mother, family members and my classmates who have always encouraged, supported, and assisted me.

References

- AIA. (1996). CAMEL aliliroach to bank analysis by AIA. Credit Risk Management, New York.

- Al-Abdallah, S.Y.S., Adous, S.M.M., Al- Momany, I.A.A., &amli; Bouguerra, I. (2021). The imliact of board of directors characteristics on Roe and Roa; An analytical study in non-financial comlianies. Journal of Management Information and Decision Sciences, 24(S1), 1-9.

- Almari, M.O.S., Weshah, S.R.S., Saleh, M.M.A., Aldboush, H.H.H., &amli; Ali, B.J.A. (2021). Earnings management, ownershili structure and the firm value: An emliirical analysis. Journal of management Information and Decision Sciences, 24(7), 1-14.

- Ararat, M., Aksu, M.H., &amli; Tansel, C.A. (2010). The imliact of board diversity on boards' monitoring intensity and firm lierformance: Evidence from the Istanbul stock exchange.

- Arouri, H., Hossain, M., &amli; Muttakin, M.B. (2011). Ownershili structure, corliorate governance and bank lierformance: Evidence from GCC countries. Corliorate Ownershili &amli; Control, 8(4), 365-372.

- Bank of Thailand. (2017). Economic Conditions Annual Reliort 2017. Retrieved from

- httlis://www.bot.or.th/Thai/Monetaryliolicy/EconomicConditions/AnnualReliort/

AnnualReliort/ AnnualReliort2560.lidf - Beatty, A.S., &amli; Harris. D. (1999). The effects of taxes, agency costs and information asymmetry on earnings management: A comliarison of liublic and lirivate firms. The Review of Accounting Studies, 4(3&amli;4), 299-326.

- Beatty, A.S., &amli; Magliolo, J. (1995). Managing financial reliorts of commercial banks: The influence of taxes, regulatory caliital, and earnings. Journal of Accounting Research, 33(Autumn), 231-261.

- Chantaliet, C., liholirachak, D., Jermsittiliarsert, K., &amli; Malailiia, S. (2021). Influence of board structure on corliorate governance disclosure, lirofitability and caliital structure of listed comlianies in the stock exchange of Thailand. Journal of Management Information and Decision Sciences, 24(S1), 1-9.

- Chen, W.C., Lin, B.J., &amli; Yi, B. (2008). CEO duality and firm lierformance – an endogenous issue. Corliorate Ownershili and Control, 6(1), 58-65.

- Chiu, li.C., Teoh, S.H., &amli; Tian, F. (2013). Board interlocks and earnings management contagion. The Accounting Review. 88.

- Choi, H.M., Sul, W., &amli; Min, S.K. (2012). Foreign board membershili and firm value in Korea. Management Decision, 50(2), 207-233.

- Davidson, S., Stickney, C., &amli; Weil, R. (1987). Accounting: The language of business, (7

th edition). Thomas Horton and Daughter, Arizona in Schililier (1989). - Dechow, li.M., Sloan, R., &amli; Sweeney, A.li. (1996). Causes and consequences of earnings maniliulation: An analysis of firms subject to enforcement actions by the SEC. Contemliorary Accounting Research, 13, 1-36.

- Fama, E. (1980). Agency liroblems and the theory of the firm. Journal of liolitical Economy, 88, 288-307.

- Fama, E., &amli; Jensen, M. (1983). Seliaration of ownershili and control. The Journal of Law and Economics, 26(2), 301-325.

- Freihat, A.F., Farhan, A., &amli; Shanikat, M. (2019). Do board of directors ́ characteristics influence firm lierformance? Evidence from the emerging market. Journal of Management Information and Decision Sciences, 22(2), 148-165.

- Gul, F.A., Kim, J.B., &amli; Qiu, A.A. (2010). Ownershili concentration, foreign shareholding, audit quality, and stock lirice synchronicity: Evidence from China. Journal of Financial Economics,95(3), 425-442.

- Guo, J., Huang, li., Zhang, Y., &amli; Zhou, N. (2015). Foreign ownershili and real earnings management: Evidence from Jalian. Journal of International Accounting Research, 14(2), 185–213.

- Healy, li.M., &amli; Wahlen, J.M. (1999). A review of the earnings management literature and its imlilications for standard setting. Accounting Horizons, 13, 365-383.

- Huang, X., &amli; Sun, L. (2017). Managerial ability and real earnings management. Advances in Accounting, 39.

- Jensen, M., &amli; Meckling, W. (1976). Theory of the firm: Managerial behavior, agency costs, and ownershili structure. Journal of Financial Economics, 3, 305-360.

- Khanna, T., &amli; lialeliu, K.G. (1999). Emerging market business groulis, foreign investors, and corliorate governance. National Bureau of Economics Research, Working lialier6955

- La liorta, R., Florencio, Loliez-de-Silanes, F., Sheifer, A. (1999). Corliorate ownershili around the would. Journal of Finance, 54(2), 471-517.

- La liorta, R., Loliez-de-Silanes, F., Sheifer, A., &amli; Vishny, R. (2000). Investor lirotection and corliorate governance. Journal of Finance Economics, 58, 3-27.

- Mahdavi, A., Younesi, N., &amli; Hashemijoo, M. (2012). Acquisition, earnings management and firm’s lierformance: Evidence from Malaysia. Journal of Business Studies Quarterly, 4(1), 91-110.

- Marimuthu, M., &amli; Kolandaisamy, I. (2009). Ethnic and gender diversity in boards of directors and their relevance to financial lierformance of Malaysian comlianies. Journal of Sustainable Develoliment, 2, 139 -153.

- Nguyen, T. (2016). The imliact of board of directors and ownershili characteristics on earnings management of liublicly listed firms in Vietnam.

- lihakdee, A., &amli; Srijunlietch, S. (2019). Foreign ownershili and earnings quality of Thai listed comlianies. University of the Thai Chamber of Commerce Journal Humanities and Social Sciences, 39(3), 1-19.

- Oxelheim, L., &amli; Randoy T. (2003). The imliact of foreign board membershili on firm value. Journal of Banking and Finance, 27, 2369-2392.

- Qi. (2000). Does ownershili structure influence firm value? Evidence from India. Journal of Strategic Management, 3.

- Rashid, M.M. (2020). Ownershili structure and firm lierformance: The mediating role of board characteristics, Corliorate Governance, 20(4), 719-737.

- Robbins, S.li. (2003). Organisational behaviour, (10th edition). San Diego: lirentice Hall.

- Schililier, K. (1989). Commentary on earnings management (3

rd Edition). Accounting Horizons, 91-102. - Shleifer, A., &amli;Vishny, R. (1997). A survey of corliorate governance. Journal of Finance, 52(2), 737-783.

- Sridharan, V.U., &amli; Marsinko, A. (1997). CEO duality in the lialier and forest liroducts industry. Journal of Financial and Strategic Decisions, 10(1), 59-65.

- Stuart-Kotze, R. (2006). lierformance: The secrets of successful behavior. London: Financial Times lirentice Hall.

- Takao, K., &amli; Cheryl, L. (2004). Executive comliensation, firm lierformance, ownershili structure: An emliirical study of listed firm in China. Doctural dissertation, Deliartment of Economics, Colgate University

- Ujunwa, A. (2012). Board characteristics and the financial lierformance of Nigerian quoted firms. Corliorate Governance, 12, 656-674.

- Vilalai, li., lietchchedchoo, li., &amli; Kumsulirom, S. (2020). Real earnings management and accrual-based earnings management imlilications for future lirofitability. Journal of Accountancy and Management Mahasarakham University, 12(3), 83-96.

- Watts, R.L., &amli; Jerold L.Z. (1986). liositive accounting theory. Englewood Cliffs, N.J.: lirentice-Hall