Research Article: 2021 Vol: 25 Issue: 3

Foreign direct investment (FDI) and the key sectors contributing to the Per Capita Growth Rate of India

Piyali Roy Chowdhury, Vellore Institute of Technology, VIT Business School

A. Anuradha, Vellore Institute of Technology, VIT Business School

Abstract

Economic growth is very crucial for developing economies due to their challenges in the process of development. Many less developed economies face this adversity while focusing on the strategies to promote economic growth. In this respect, the current study explores few probable factors which lead to explain the economic scenario in India. The study analyses influence of foreign exchange earnings from inbound tourism (EAR), foreign direct investment (FDI) and manufacturing sector value added output (MANU) on per capita economic growth (PCG) for a period of 1996-2018. Among all the variables taken for the study, findings of the study reveals value added output from the manufacturing sector to be a most influential factor to promote per capital economic growth. Surprisingly, the analysis explores FDI to be significantly negative impact oriented towards encouraging economic growth.

Keywords

Foreign Exchange Earnings from Inbound Tourism (EAR), Foreign Direct Investment (FDI), Manufacturing Sector Value Added Output (MANU), Per Capita Economic Growth (PCG), Multiple Regression.

Introduction

Foreign Direct Investment (FDI) is analyzed as one of the crucial factors to augment growth in any economy, (Alfaro, 2003). In addition to direct capital sourcing, FDI is required for up gradation of technology also. At recent times, the importance of FDI has been occasionally questioned. FDI generating positive spill overs in destination economies have been debated many times. Saayman & Saayman (2008) find other factors related to growth of an economy. These are income of the destination country, travel costs and relative prices that are the determinants of travel and tourism industry in South Africa. The growth of South African countries is related to expansion of hotels, firms, game reserves, etc. Travel and tourism industries are specifically required for the countries that lag growth through other sectors. The sustainable growths in these less developed economies are fully dependent on travel industries and their growth values. Apart from FDI and travel industry, manufacturing sector plays an important role in shaping the overall health in terms of growth of the economy. Bigsten, et al. (1999) finds a significant relationship between manufacturing and growth of an economy. Profits, growth of value added output, past firm borrowing, size and age of the firms are the determinants of manufacturing sector investment in less developed economies, especially in Africa.

The current analysis carried out in this study is important to discuss as it analyses the data pertaining to the period before Corona outbreak in year 2019. As tourism industry is badly affected by present Corona outbreak situation, it is essential to analyses the impact of foreign earnings from tourism on per capita growth of India, so that, while recovering from this situation, tourism industry can take measures conferring to this analysis and implement them accordingly.

In this respect, the current study is based on finding the impact of FDI, earnings from inbound tourism sector, manufacturing sector’s value addition in terms of output and employment, on per capital growth of India from 1996-2018. The arrangements of the sections and schema of the article are as follows: Section two illustrates reviews of literature. Section three explains methodology. Section four and five discuss the results. Finally, section five provides conclusion.

Review of Literature

A comprehensive review of the available literature on FDI and other sectors contributing to the economic growth is done to identify the existing gap in the study of the economic growth across the world. Balaguer & Cantavella-Jorda (2002) has proved the importance of tourism for economic growth. The study encourages tourism as it increases income. Fayissa, et al. (2008) have explored forty countries to measure the impact of tourism on economic growth with neoclassical model. The outcome of the study is based on finding the positive influence of tourism in short run on economic growth. Dritsakis (2004) has emphasized the causal relationship from international tourism earnings and economic growth in Greece. Also, the study emphasizes on the causal relationship between real exchange rate-economic growth and real exchange rate-foreign exchange rate earnings. Malik, S, et al (2010) takes a different approach to address the issue of external foreign earnings and payments in Pakistan. The study investigates the causal relationship between external debt and economic growth. It explores whether the impact of foreign debt is negative on economic growth. Ajayi & Oke, (2012) endorsed the above study conducted on Nigeria. Their result proved the negative impact of foreign debt on national income and per capita income of the country.

Discussing the effect of Foreign Direct Investment (FDI) on economic growth, Borensztein et al. (1998) explained the contribution of FDI on technology up gradation and transfer of the same in sixty-nine developing economies. The analysis concluded with a higher importance of FDI to economic growth rather than domestic investment in these economies. Carkovic & Levine, (2005) explored the contribution of FDI on economic growth in seventy-two economies. The study revealed the importance of FDI on economic growth can only be measured if two variables, as control of inflation and government sizes, are taken into consideration. Falki, (2009) explores the relationship between FDI and economic growth in Pakistan. The study showed an insignificant impact of FDI on economic growth for a period 1980-2006. Anwar & Nguyen, (2010) in Vietnam, did find a bidirectional causality between FDI and economic growth. Though regional area specific causality could not be measured, the study was able to implement an overall significance of FDI through improvement in higher education and training, expansion in financial sector and decline in technological gap in Vietnam. Berthélemy & Demurger (2000) have articulated the importance of FDI in determining higher economic growth in provincial states of China. Simultaneously, the study found a negative impact of economic growth on FDI during the same observatory period.

Analyzing the relation between manufacturing sector development and economic growth, the relevant literature examines the relationship between the two variables. Adofu, I, et al. (2015) explored and arrived at a negative and insignificant influence of manufacturing sector on economic growth of Nigeria. A study on manufacturing capacity utilization and lending rates of banks conducted by Obamuyi et al. (2012) projects significant impact of these on manufacturing sector productivity in Nigeria. Ademola (2012) proved the importance of manufacturing sector to promote growth rate in Nigeria. Lean (2008), on the other hand, explored independency in relationship between FDI and manufacturing sector growth in Malaysia. Eze & Ogiji (2014) investigated the requirement of government expenditures to promote manufacturing sector’s productivity led economic growth in Nigeria. Singh (2004) explained the influence of technology and structural changes on manufacturing output in South Korea. Seyfried (2011) investigated the association between economic growth, output gap and employment. The study indicated the positive influence of economic growth on employment at a specific period as well as for cascading periods. Klasen & Lamanna (2008, 2009) found gender gaps in education and employment predominantly reduce growth in Middle East, North Africa and South Asia. Sodipe & Ogunrinola, (2011) did a study in Nigeria, and found that employment and economic growth are positively associated with each other in contrast to the adverse relationship between employment and Gross Domestic Product (GDP) rates. Taylor, et al. (2016) examined the relationship between climate change, income distribution, employment and economic growth. The effect of climate on these variables was measured.

Flora & Agrawal (2017), did a panel co-integration analysis on FDI and Economic Growth Nexus for the major FDI recipients in Asian emerging countries and agrees to the fact that, among the most-cited reasons for Asia’s strong economic growth in the recent era has been the inflow of FDI into the region which also includes India. Mamuti & Ganic (2019) investigated on the hypothesized relationship between FDI, economic growth and unemployment rate. Sarker & Khan (2020) performed the augmented ARDL model and found a long-run relationship between FDI and GDP. Kusumawati et al. (2021) studied the impact of FDI on inclusive growth in the Badung district in Bali, as Badung is considered as an international tourism region and also foreign investment destination.

Considering the Above Literature, the Possible Gaps for the Study Is Identified

The previous studies are frequently performed on groups of economies rather than specific countries. Few specific studies are distinguishable as it is based on a specific economy of Africa. Tran H.T.T., Hoang H.T. (2019) studied the impacts of FDI, Domestic investment capital (DIC), Human resources (LB), and Trained workers (RTW) on economic growth in Vietnam. The estimated results indicated that FDI, DIC and LB have a positive effect on the level of gross domestic product, while RTW did not affect the economic growth of Vietnam. There exists no precise study for India similar to the one done by Tran H.T.T., Hoang H.T. (2019) in Vietnam. Although the individual effects of the four major macroeconomic variables- Foreign exchange earnings from inbound tourism (EAR), Foreign Direct Investment (FDI), Manufacturing sector’s value addition in terms of output (MANU), and Employment (EMP) on per capital economic growth (PCG) were extensively discussed, these four independent variables are not analyses together for a specific developing economy.

The current study, hence, substantiates the importance of the present analysis based on India for a period of 1996-2018. The objectives of the study are specified as follows:

To analyze the impact of Foreign exchange earnings from inbound tourism (EAR), Foreign Direct Investment (FDI), Manufacturing sectors value added in terms of output (MANU), and Employment (EMP) on per capital economic growth (PCG) in India for a period of 1966-2018. To find out correlations among the said variables. The hypotheses formed accordingly can be stated as:

H0A: There is no impact of Foreign exchange earnings from inbound tourism (EAR) on per capital economic growth (PCG)

H0B: There is no impact of Foreign Direct Investment (FDI) on per capital economic growth (PCG)

H0C: There is no impact of manufacturing sectors value added in terms of output (MANU) on per capital economic growth (PCG)

H0D: There is no impact of Employment (EMP) on per capital economic growth (PCG)

H0E: There is no correlation between EAR and PCG

H0F: There is no correlation between FDI and PCG

H0G: There is no correlation between MANU and PCG

H0H: There is no correlation between EMP and PCG

Methodology

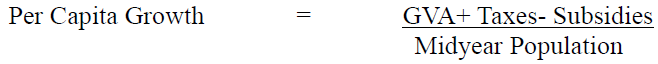

Most of the studies in the past have used spatial (or) temporal cross-sectional analysis which is often unpredictable and therefore the investigators have used the multiple regression analysis with the data. The variables used in this study are respectively Foreign exchange earnings from inbound tourism (EAR), Foreign Direct Investment (FDI), manufacturing sectors value added in terms of output (MANU) and Employment (EMP) on per capital economic growth (PCG) in India for a period of 1966-2018. All the data are taken from World Bank. EAR signifies the total expenses made by international inbound tourists. Also, any prepaid expenses in the destination country are considered for receipt for international inbound tourism. FDI is explained as summation of equity capital investment, reinvestment of earnings, and other capital in Tables 1-5. It describes a strong control and a substantial impact on a company that resides in host country. MANU is considered as total manufacturing output minus intermediate inputs in a territory. EMP refers to the labors at their working age with payments or profits producing for mining and quarrying, manufacturing, construction, and public utilities. PCG explains the growth rate of Gross Domestic Product (GDP) measured in local currency unit. PCG is calculated as Gross Value Added (GVA) by all resident producers in the economy plus any product taxes and minus any subsidies divided by Midyear population.

| Table 1 Descriptive Statistics | |||

| Mean | Std. Deviation | N | |

| ln (DPCG) | -1.2022 | 0.21177 | 23 |

| ln (DEAR) | 2.7962 | 0.27368 | 23 |

| ln (DFDI) | 2.2534 | 0.33514 | 23 |

| ln (DMANU) | 9.3423 | 0.12402 | 23 |

| ln (EMP) | 1.3026 | 0. 07505 | 23 |

| Table 2 Correlations | |||||

| Factors | ln (DPCG) | ln (DEAR) | ln (DFDI) | ln (DMANU) | ln (EMP) |

| ln (DPCG) | 1.000 | (0.453) | (0.524) | (0.330) | (0.451) |

| ln (DEAR) | (0.453)* (0.015) |

1.000 | 0.613 | 0.659 | 0.682 |

| ln (DFDI) | (0.524)* (0.005) | 0.613 | 1.000 | 0.918 | 0.855 |

| ln (DMANU) | (0.330)* (0.062) | 0.659 | 0.918 | 1.000 | 0.918 |

| ln EMP) | (0.451)* (0.015) |

0.682 | 0.855 | 0.918 | 1.000 |

| Table 3 Model Summary | |||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate | Durbin-Watson |

| 1 | 0.762 | 0.580 | 0.487 | 0.15169 | 2.137 |

| Table 4 ANOVA | |||||

| Model | Sum of Squares | df | Mean Square | F | Sig. |

| Regression | 0.572 | 4 | 0.143 | 6.219 | 0.003b |

| Residual | 0.414 | 18 | 0.023 | ||

| Total | 0.987 | 22 | |||

| Table 5 Coefficients | ||||

| Model | Unstandardized Coefficients | Standardized Coefficients | Sig. | |

| Std. Error | T | |||

| (Constant) | (23.784) | 6.853 | (3.4) | (0.003) |

| ln (DEAR) | (0.235) | 0.163 | (1.44) | (0.165) |

| ln (DFDI) | (0.846)* | .0244 | (3.46) | (0.003) |

| ln (DMANU) | 2.965* | 0.866 | 3.42 | (0.003) |

| ln (EMP) | (1.958) | 1.130 | (1.73) | (0.100) |

The variables, after combining, are deflated through GDP deflator taken from World Bank database. The data, taken together are run through multiple regressions by SPSS. The descriptive statistics, correlations and results of regressions of these variables are discussed in the following section.

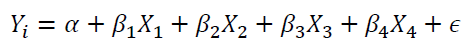

The following multiple regression equation (Equation 1) has been considered:

…………..Equation (1)

…………..Equation (1)

Yi=ln (DPCG): Logarithmic value of deflated per capita growth

X1=ln (DEAR): Logarithmic value of deflated foreign exchange earnings from inbound tourism

X2=ln (DFDI): Logarithmic value of deflated Foreign Direct Investment

X3=ln (DMANU): Logarithmic value of deflated Manufacturing sector value added output

X4=ln (EMP): Logarithmic value of employment

Discussion

The results show that there is a significant negative correlation with (PCG and DEAR), with (PCG and DFDI), (PCG and MANU) and finally (PCG and EMP). This implies acceptance of H1E, H1F, H1G and H1H. The outcomes of the regression results are showing that impact of FDI on PCG is negative. The analysis supports (Alfaro 2003). The possible outcome according to this study is the spillover effect that is ambiguous in nature. This may be the possible reason for a negative effect generating in this study. The effect of manufacturing sector value added output on per capita growth is positive. This explains the utmost requirement of manufacturing sector and its value addition in terms of output to promote the per capita growth of India. The surprising fact is FDI demotivates the per capita growth. The study needs to be decomposed through long run and short run analysis to look through the proper trends in it. Apart from the spillover effect, the study also needs to be analyzed from other aspects to sort different reasons for this negative impact of FDI. Thus, in the analysis, alternative hypotheses, H1B and H1C are accepted. This implies that there is an impact of Foreign Direct Investment (FDI) on per capital economic growth (PCG). Also, there remains an impact of manufacturing sector’s value addition in terms of output (MANU) on per capital economic growth (PCG).

Conclusion

The results of the study confer that manufacturing sector value added outputs is the crucial factor that played a major role during the period 1996-2018 to enhance per capita growth of India. As the current study has produced a negligible impact of foreign earnings from inbound tourism, it is advised to put more stress on manufacturing sector’s growth from the perspective of current Covid-19 situation. As tourism industry is severely affected by Corona outbreak, it is always essential to give more importance on the major productivity of India from sectors that have proven positive results in normal economic scenario. On the other hand, the analysis concludes FDI to be one of the least impacting factors to promote per capita growth although the decomposition effect of FDI considering long run and short run framework has not been analyzed. It may provide significant results once the effect of FDI on PCG is broken down to check for long run co integration and short run error corrections into it. Further, the scope of the study can be broadened if analysis of sub sectors of manufacturing industry is undertaken

References

- Ademola, I.S. (2012). Government expenditure in the manufacturing sector and economic growth in Nigeria 1981–2010. International Journal of Scientific & Engineering Research, 3(11), 1-6.

- Adofu, I., Taiga, U.U., & Tijani, Y. (2015). Manufacturing sector and economic growth in Nigeria (1990-2013). Donnish Journal of Economics and International Finance, 1(1), 001-006.

- Ajayi, L.B., & Oke, M.O. (2012). Effect of external debt on economic growth and development of Nigeria. International Journal of Business and Social Science, 3(12), 297-304.

- Alfaro, L. (2003). Foreign direct investment and growth: Does the sector matter. Harvard Business School, 2003, 1-31.

- Anwar, S., & Nguyen, L.P. (2010). Foreign direct investment and economic growth in Vietnam. Asia Pacific Business Review, 16(1-2), 183-202.

- Balaguer, J., & Cantavella-Jorda, M. (2002). Tourism as a long-run economic growth factor: the Spanish case. Applied Economics, 34(7), 877-884.

- Berthélemy, J.C., & Demurger, S. (2000). Foreign direct investment and economic growth: theory and application to China. Review of Development Economics, 4(2), 140-155.

- Bigsten, A., Collier, P., Dercon, S., Gauthier, B., Gunning, J.W., Isaksson, A., ... & Zeufack, A. (1999). Investment in Africa's manufacturing sector: a four country panel data analysis. Oxford Bulletin of Economics and Statistics, 61(4), 489-512.

- Borensztein, E., De Gregorio, J., & Lee, J.W. (1998). How does foreign direct investment affect economic growth?. Journal of International Economics, 45(1), 115-135.

- Carkovic, M., & Levine, R. (2005). Does foreign direct investment accelerate economic growth. Does foreign Direct Investment Promote Development, 195.

- Dritsakis, N. (2004). Tourism as a long-run economic growth factor: an empirical investigation for Greece using causality analysis. Tourism Economics, 10(3), 305-316.

- Eze, O.R., & Ogiji, F. (2014). Impact of fiscal policy on the manufacturing sector output in Nigeria: An error correction analysis. British Journal of Business and Management Research, 1(2), 31-54.

- Falki, N. (2009). Impact of foreign direct investment on economic growth in Pakistan. International Review of Business Research Papers, 5(5), 110-120.

- Fayissa, B., Nsiah, C., & Tadasse, B. (2008). Impact of tourism on economic growth and development in Africa. Tourism Economics, 14(4), 807-818.

- Flora, P., & Agrawal, G. (2017). FDI and economic growth nexus for the largest FDI recipients in Asian emerging economies: a panel co-integration analysis. In International Business Strategy (pp. 261-275). Palgrave Macmillan, London.

- Klasen, S., & Lamanna, F. (2008). The impact of gender inequality in education and employment on economic growth in developing countries: Updates and extensions (No. 175). IAI Discussion Papers.

- Klasen, S., & Lamanna, F. (2009). The impact of gender inequality in education and employment on economic growth: new evidence for a panel of countries. Feminist Economics, 15(3), 91-132.

- Kusumawati, P.N.L., Herman, J., & Holzhacker, R.L. (2021). Foreign Direct Investment (FDI), Inclusive Growth, and Institutions: A Case Study of Tourism Sector in Badung District. In Challenges of Governance (pp. 227-245). Springer, Cham.

- Lean, H.H. (2008). The impact of foreign direct investment on the growth of the manufacturing sector in Malaysia. International Applied Economics and Management Letters, 1(1), 41-45.

- Malik, S., Hayat, M.K., & Hayat, M.U. (2010). External debt and economic growth: Empirical evidence from Pakistan. International Research Journal of Finance and Economics, 44(44), 1450-2887.

- Mamuti, A., & Ganic, M. (2019). Impact of FDI on GDP and Unemployment in Macedonia Compared to Albania and Bosnia and Herzegovina. In Creative Business and Social Innovations for a Sustainable Future (pp. 167-173). Springer, Cham.

- Obamuyi, T.M., Edun, A.T., & Kayode, O.F. (2012). Bank lending, economic growth and the performance of the manufacturing sector in Nigeria. European Scientific Journal, 8(3), 19-36.

- Saayman, A., & Saayman, M. (2008). Determinants of inbound tourism to South Africa. Tourism economics, 14(1), 81-96.

- Sarker, B., & Khan, F. (2020). Nexus between foreign direct investment and economic growth in Bangladesh: an augmented autoregressive distributed lag bounds testing approach. Financial Innovation, 6(1), 10.

- Seyfried, W. (2011). Examining the relationship between employment and economic growth in the ten largest states. Southwestern Economic Review, 32, 13-24.

- Singh, L. (2004). Technological progress, structural change and productivity growth in the manufacturing sector of South Korea. World Review of Science, Technology and Sustainable Development, 1(1), 37-49.

- Sodipe, O.A., & Ogunrinola, I.O. (2011). Employment and economic growth nexus in Nigeria. International Journal of Business and Social Science, 2(11).

- Taylor, L., Rezai, A., & Foley, D.K. (2016). An integrated approach to climate change, income distribution, employment, and economic growth. Ecological Economics, 121, 196-205.

- Tran, H.T.T., & Hoang, H.T. (2019). An Investigation into the Impacts of FDI, Domestic Investment Capital, Human Resources, and Trained Workers on Economic Growth in Vietnam. In International Econometric Conference of Vietnam, 940-951.