Research Article: 2022 Vol: 28 Issue: 2

Fintech in Investment Management for Modern Entrepreneurs

R.K Tailor, Manipal University Jaipur

Sofia Khan, Manipal University Jaipur

Citation Information: Tailor, R.K., & Khan, S. (2022). Fintech in investment management for modern entrepreneurs. Academy of Entrepreneurship Journal, 28(2), 1-8.

Abstract

Present world is full of technologies. Each human being is associated and affected with the technology. The role of information technology is not limited to business but, it applied everywhere. It is very important in finance and accounting. The financial technology is known as ‘fintech’ which means application of information technology in finance for better management and control. The fintech is very helpful in entrepreneurship management as it gives freedom to work with full safety and security in the entire probable business environment. This article is explaining the concept of Fintech in Investment Management in entrepreneurship.

Keywords

Artificial Intelligence, Machine Learning, Models.

Introduction of Fintech

As per CFA Institute of USA, Fintech refers to technological innovation in the design and delivery of financial services and products.

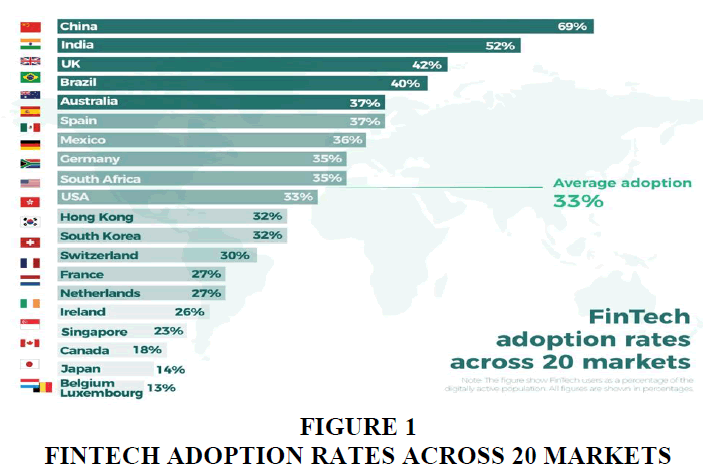

Fintech can also be used in new, or startup companies for developing applications, business sectors and new technologies. In simple words, if business uses technologies to provide financial services to society and to automate the process it is called fintech. It is a rapidly growing industry that enhances both business and society. E.g., PayPal an online payment processor, it has interlinked financial services with technologies which makes it a largest online payment processor. Using PayPal, it makes it easy, safe, and faster to make payments or receive payments throughout the world also can set up merchant account shows in Figure 1.

As of present time, highest usages of Fintech are China (69%) and India (52%). China, India, and other emerging markets are more open to new solutions as they never had time to develop Western levels of physical banking infrastructure. China has penetrated the fintech in well above the average global adoption (33%) and average adoption across emerging markets (46%) (Advantages (and Disadvantages) of Fintech-Focused IoT).

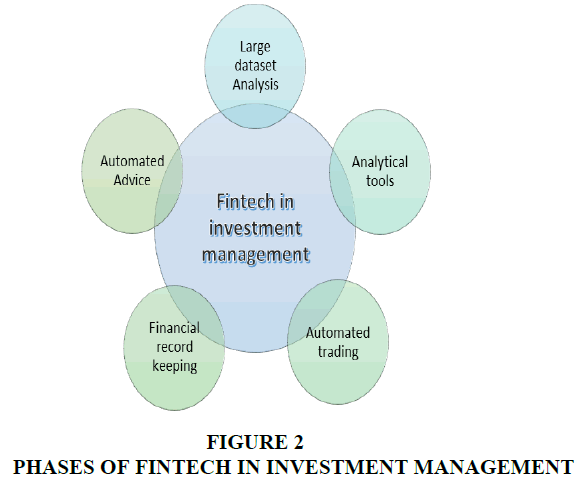

Banks are providing funding to fintech start-ups, to deliver the products they depend on insurance, banks. To improve and enhance and upgrade the operations of the new technology banks have acquired and invested in fintech start-ups (Jason Martell J, 2018) shows in Figure 2.

Phases of Fintech in Investment Management

Large Dataset Analysis

Information generated from traditional data like financial statement of corporate, security prices, economic indicators. Sensor network, social media are the alternative data generated from non-traditional data, all these can be combined with the decision-making process of investment of portfolio manager which reduces losses and ultimately generate alpha. This is how large amount of dataset can be analysed by using fintech (Wigmore, 2021).

Analytical Tools

For extremely large datasets, tools, and techniques like artificial intelligence (AI) may be more useful. Compared to traditional quantitative and statistical method, to identify complex, non-linear relationship, previously for performing the tasks which required human intelligence now require AI like computer systems capable, will more be suitable. Data analysis approaches can be differently enabled by using advances of AI techniques. E.g., analysts are using artificial intelligence to sort large dataset of company, annual reports of company can be analysed, earning calls can be determined through AI to help uncover trends and generate insights relating to human sentiment and behaviour (Gaur, 2020).

Automated Trading

Through Artificial Intelligence (AI) trading can be done automatically with ease and greater efficiency. Investment decisions can be executed using computer algorithm and automated trading applications which results in better investment decision, better market accessibility and market liquidity, anonymity, lower transaction cost, which ultimately provide a lot of benefits to investors (What is Fintech (Financial Technology).

Automated Advice

Best example of automated advice is Robo-advisers; they are the robots which help in giving automated investment decision advice or automated personal wealth management services to large number of retail investors for investing in particular stocks at lower cost compared to traditional adviser models (What is Big Data?).

Financial Record Keeping

New technology, such as DLT, may provide secure ways to track ownership of financial assets on a peer- to- peer (P2P) basis. By allowing P2P interactions in which individuals or firms transact directly with each other without mediation by a third party, DLT reduces the need for financial intermediaries. Thus, keeping large number of financial records become easier by using AI-based techniques than traditional techniques (Barbara et al., 2018) shows in Figure 3.

Following are the Advantages of Fintech:

a. Real time data collection: With the help of fintech, an entrepreneur can get real time data base of various plan and policies. Accordingly, they may set their goals and develop strategies for their business.

b. Better customer services: To authenticate identity of customers and to manage the service requests, a company can on site install sensors that connect with fintech apps. To personalize the experience of customer Internet of Things (IoT) based solutions can be used. Services pace can be increased, better security and quick decision making can be done using both IoT and fintech.

c. Easier payments: By using fintech apps payment are made easier as payment can be done contactless compared to checkout line and pay and can be done with ease from anywhere in world through key fobs, NFC-equipped devices over a point-of-sale reader, smartphones and laptops, cards.

d. Time saves: Compared to human intellect, using AI robot it become easy and faster to perform the work and large amount of data can be processed at less cost and time.

e. Quick Decisions: Robo-advisers can be used for processing the investment decision faster and efficiently. Model can be fitted in robots they can work in same way as humans but with less time and effectively. Human requires time to think and make decisions compared to robots. It enhances transparency in the process shows in Figure 4.

Disadvantages of Fintech

Following are the Disadvantages of Fintech:

a. Lack of security: In IoT, there are different level of security that utilize unique software, in communication between connected devices. There is no uniformity and hackers can exploit it. Across the whole network personal information may be at risk if security system is weak within one IoT equipped. Implementation is way difficult.

b. No uniform standards: Different companies develop IoT software, and all the programs are not compatible equally. Some devices are not capable of communicating with some apps which can be problematic for consumers.

c. Complex network: Complex networks are difficult to maintain. Maintenance is not easy and if avoided can cause to different new issues difficult to handle.

d. Unemployment: Work of human is reduced as increasing the use of technology. Nowadays companies are installing more of Artificial Intelligence (AI) and appointing fewer personnel, creating more unemployment.

e. Increase dependency: People are more dependent on Artificial Intelligence (AI) then themselves which is increasing the dependency of one on machines.

f. High Cost: Maintaining and installing devices and robots is not of less cost but requires a lot of cost involvement and ultimately reduce profit up to some extent. If small business wants to use latest technology, it involves large costs.

Big Data

As per CFA Institute of USA, Big Data refers to the vast amount of data being generated by industry, governments, individuals, and electronic devices. Big Data includes data generated from traditional sources such as stock exchanges, companies, and governments as well as non-traditional data types, also known as alternative data, arising from the use of electronic devices, social media, sensor networks, and company exhaust i.e., data generated in the normal course of doing business.

Sources of tradition data can be corporate data such as corporate report, company filings, regulatory filings, conference calls, earning figures, sales. Traditional data also include data like trade prices and volume which are generated in financial market. There are some non-traditional data or alternative data such as posts on social media, emails, websites visiting, corporate exhaust like bank records, retail scanner, Internet of Things (IoT), online reviews etc.

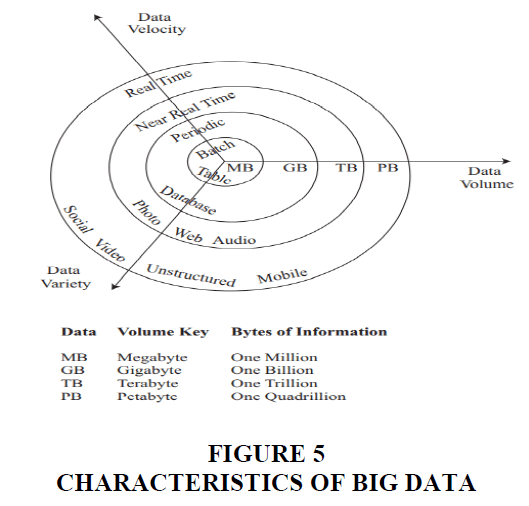

Big data is large, complex, and voluminous datasets gathered from new sources of data that are difficult to manage with traditional data processing software. It helps to tackle with business problems related to large dataset which is difficult to tackle shows in Figure 5.

Characteristics of Big Data

Volume: files, records, and tables are used to collect the amount of data that is very large, showing millions, or billions, of data points. The measurable units of data have increased from megabyte to gigabyte to terabyte to petabytes through this large amount of data can be captured, generated, and stored. On the basis of real- time or near- real- time more traditional and nontraditional data are available.

Velocity: Speed or velocity with which data can be communicated. Data have high latency when it has a lag or it is periodically communicated and low latency when the data is Real- time or near- real- time data.

Variety: There are different sources from which data can be collected i.e., variety of sources are there which includes structured data like spreadsheets, SQL tables; semi-structured (have attributes of both structured and unstructured) data like photo, webpage, and HTML code; and unstructured data like video messages shows in Figure 6.

Benefits of Big Data are as Follows:

• One can get large amount of data or say can access variety of dataset.

• As the information is large one can get more solutions or answers for more dataset.

• As the answers are large there can be more confidence in the data.

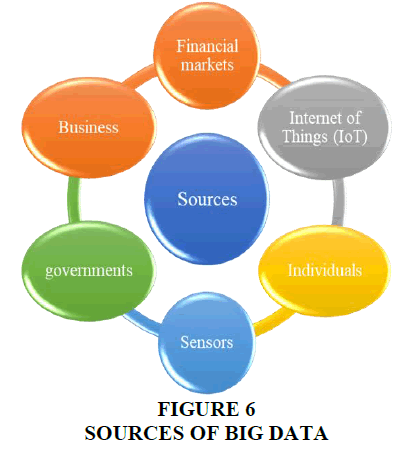

Sources of Big Data

Big Data Can Be Generated From:

1. Financial markets like from equities, fixed income, futures, options, and alternative investments.

2. Businesses like financials of companies, commercial transactions, and credit card purchases.

3. Governments like trade, economic, employment, and payroll data.

4. Individuals like credit card purchases, product reviews, news, internet search logs, and social media posts.

5. Sensors like satellite imagery, shipping cargo information, and traffic patterns.

6. Internet of Things (IoT) like data generated by smart buildings, where climate control, security, energy consumption information and operational details are provided shows in Figure 7.

Big data is to generate a large amount of data from different sources and combine or integrate it.

Data generated must be managed by storing it in clouds; data can be stored in any form

a. Integrate: with the help of big data, all the applications with traditional program are maintaining through cloud. This is a tool by which the automated software’s are integrated with basic data tools through cloud and provides a good platform of managing through automated software’s.

b. Manage: A business organisation can resolve their business problems through big data and manage their operational tasks. The users can manage their future requirements based on past data available. The latest software’s are helpful in managing all the operational activities using big data and its variants.

Challenges of Big Data

a. Management of large, complex datasets and modern technologies needs to be done by skilled professionals like data analytics, data scientists, and engineers. There is a gap as there is lack of skilled personnel. Thus, companies face a lot of challenge in appointing these professionals who can effectively operate big data. Tools of Big Data can be used even by people who have basic knowledge and are not expert of data science just by giving training to staff and knowledge analytical solutions by Artificial Intelligence can be bought, this helps in cost saving of the companies. Workshops, webinars, and seminars should be organized for the staff to gain knowledge about it.

b. It is challenging to manage the growth of data; more and more data is growing so the storage also ultimately resulting in increase in database of companies. To manage large datasets companies, use techniques like they compress the data and reduce the size of it, also they removed the unwanted duplicate data, data tiering can also be done by storing the data in different storage tiers like public and private clouds.

c. In Big Data as the data generated are very large it becomes challenging to select the tools to analyze and store the datasets, through which essential resources like money, time, hard work will be of no use or say will get wasted.

d. To make reports, data from various sources like mails, financials, presentations, must be combined or integrated together which is a challenging task to do, it’s a lengthy and complex process but important for analysis and reporting.

e. Data security of Big Data is also essential and challenging part as securing huge amount of data is not easy, it requires security tools and techniques to do it. Installing cybersecurity is important to secure the data or cybersecurity professionals may be appointed for it. To protect the data, it should be encrypted and segregated shows in Figure 8.

Application of Fintech in Investment Management

Text Analytics and Natural Language Processing

a. Robo- Advisory Services

b. Risk Analysis

c. Algorithmic Trading

Many more are there like:

a. Crowdfunding

b. Mobile Payments

c. Insure-tech

d. Reg-tech

Fintech is combination of finance and technology which provide or deliver solutions or financial services to society through Artificial Intelligence or Machine Learning (technology) with technological innovation. It is beneficial for the society as it helps in automated advice like Robo advisors they provide investment decisions to clients without any human interventions or with human interventions, automated trading and financial record keeping, analytical techniques. It is beneficial for both society and businesses. It helps businesses to take loans and services directly through phones. It also helps in transferring money through internet throughout the world like Pay-pal. Business-to-Business (B2B) and Business-to-Consumer (B2C) are fintech users. Fintech provide facility of borrowing, financial planning. People who cannot use will have access to online transactions through use of fintech.

References

Advantages (and Disadvantages) of Fintech-Focused IoT. Retrieved from https://medium.com/@jasonmartell/advantages-and-disadvantages-of-fintech-focused-iot-85aa72a7bd68

Barbara, J., Mack., & Kissell, R. (2018). Fintech in Investment Management. Reading 43, 477.

Gaur, C. (2020) Top 6 Big Data Challenges and Solutions to Overcome. Enterprise Data Management, December.

What is Fintech (Financial Technology)? Retrieved from https://corporatefinanceinstitute.com/resources/knowledge/finance/fintech-financial-technology/

Jason Martell J. (2018). Advantages (and Disadvantages) of Fintech-Focused IoT. Retrived from https://medium.com/@jasonmartell/advantages-and-disadvantages-of-fintech-focused-iot-85aa72a7bd68

Wigmore, I. (2021). 3Vs (volume, variety and velocity). Retrieved from http://whatis.techtarget.com/definition/3Vs

What is Big Data? Retrieved from https://www.oracle.com/in/big-data/what-is-big-data/https://www.e-zigurat.com/innovation-school/blog/evolution-of-fintech/