Research Article: 2023 Vol: 27 Issue: 1S

FinTech: Concept, Opportunities and Challenges, and Egypt′s FinTech Landscape

Hajar Mohammad Alhosseiny, Misr University for Science and Technology

Citation Information: Alhosseiny, H.M. (2023). Fintech: Concept, Opportunities and Challenges, and Egypt’s Fintech Landscape. Journal of Organizational Culture Communications and Conflict, 27(S1), 1-18.

Abstract

Fintech innovations, or advancements made by suppliers of financial services using digital technology, are widely thought to have a disruptive impact on the financial services sector. New technologies have undergone substantial transformation as a result of the fintech industry's digital revolution, with significant ramifications for financial markets and financial services. The goal of this study is to clarify and explain the meaning of fintech, as well as how the fintech sector has altered conventional beliefs and perceptions of the financial sector in the context of the current, technologically sophisticated environment.

Keywords

FinTech, Blockchain, Crypto currency, Peer-to-peer lending.

Research Questions

Q1: What is FinTech and FinTech ecosystem according to the literature?

Q2: Who are the relevant stakeholders in the FinTech ecosystem and what challenges are faced by FinTech in the financial ecosystem?

Q3: What are the main FinTech business models?

Q4: What about the Egyptian FinTech Landscape?

Research Objectives

1. Explaining and clarifying the meaning of FinTech Concept.

2. Identifying FinTech-related industries, Ecosystem, and business models.

3. Discussing the possible opportunities and challenges in the FinTech sector.

4. Reviewing the Egyptian reality in this field.

Research Design/Methodology

This study is a qualitative secondary study depends on collecting existing data from different resources.

Introduction

Financial technology (FinTech) is rapidly transforming the financial sector. Numerous changes-many of which were unimaginable even a decade ago-are occurring at an unprecedented rate in nearly every element of the world's financial industry because to digital technology (Huaa & Huang, 2020).

Many people base many aspects of their everyday lives-from scheduling doctor appointments to buying airline tickets, from paying for electricity to investing in financial products-on the digital payment-centered ecosystems (Huaa & Huang, 2020).

Fintech refers to financial technology. A fintech company is any business that uses technology to modify, expand, or automate financial services for clients. Fintech makes financial transactions for individuals and businesses less complicated, increasing their accessibility and affordability without the use of a middleman. Fintech has had a significant influence since it has created innovations that promise to make it simple and accessible to obtain financial services (Shah, et al.,, 2022).

In other words, FinTech refers to financial services for markets & institutions that are facilitated by technology. The FinTech industry is the fusion of financial services and technological applications that adds value to society by cutting costs and time commitments while maximizing potential (Mostafa, 2021).

FinTech has a long history and evolved across three distinct eras. FinTech 1.0, which lasted from 1866 to 1987, was the first period of financial globalization supported by technology infrastructure like transatlantic transmission wires. This was followed by FinTech 2.0, which took place between 1987 and 2008 and saw financial services organizations gradually digitize their operations. Since 2008, the FinTech industry has undergone significant change in both developed and developing nations (Mostafa, 2021).

Due to the rapid innovation and disruption of the global financial system brought about by fintech, new business models, business earnings, and investment opportunities have emerged. Cryptocurrencies, blockchain, peer-to-peer (P2P) lending, artificial intelligence platforms, Insurtech, crowd funding, and mobile payment systems are just a few examples of the various Fintech categories. Global investment in the fintech sector reached US$135.7 billion in 2019, more than doubling the US$50.8 billion invested in the sector in 2017. There will be 2,953 new fintech businesses globally in 2020 (Arslan et al., 2021).

The increase in Fintech businesses and investment is seen as a response to the 2008 global financial crisis (GFC), which led to a decline in confidence in the banking system. Following the GFC, more stringent regulations, low interest rates, a surplus of global capital flows pursuing yield, shifting consumer expectations, the widespread use of smartphones, and less expensive data processing are all factors that have contributed to the emergence of fintech. A cost-effective infrastructure has been developed to support Fintech innovation as a result of the rising use of blockchain, artificial intelligence, cloud computing, and big data.

By opening up options for the roughly 1.7 billion individuals who are "unbanked," fintech has had an impact on both developed and emerging countries. Additionally, it aims to close the more than $2 trillion USD finance gap facing SMEs in emerging nations. Fintech has the ability to lessen information asymmetry, minimize risk, and more effectively allocate resources. According to Das (2019), Fintech is characterized by technology advancement in three areas: (a) capital raising, (b) capital allocation, and (c) capital transfer. Most successful Fintech ideas exhibit the LASIC principle (or low profit margin, asset light, scalable, innovative and compliance).

Mobile payment technology, including the banking system, has proven to be most successful in nations with brittle institutional structures and efficiently transfers capital. It has expanded financial inclusion, lowered cross-border fund-transfer costs, and added millions of new consumers in India, China, and Africa.

In this study, we will clarify and explain the meaning of FinTech concept, have a look over the FinTech-related industries, clarify the FinTech ecosystem and business models, discuss the possible opportunities and challenges, and lastly have a look over the Egyptian reality in this field Figure 1.

Literature Review

Overview

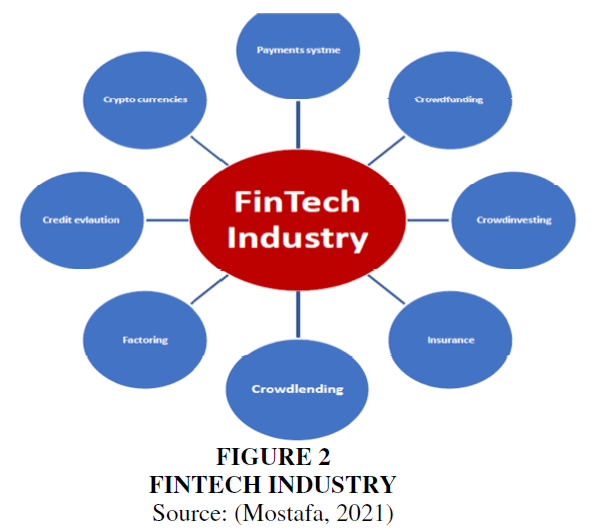

The term "fintech" is a combination of the terms financial and technology. It's a catch-all term for any technology or software advancement in the market for financial services and goods. The following list of fintech-related industries Figure 2.

Figure 2 Fintech Industry

Source: (Mostafa, 2021)

Mobile Banking

With the use of an app, customers of banks and other financial institutions can undertake a variety of transactions through mobile banking. Customers can access and manage their accounts through the app from anywhere. With mobile banking, you may create a new account, check your balance, transfer money, and pay invoices. Consumers are increasingly looking for easy digital access to their bank accounts, especially on mobile devices. An American study from November 2016 found that 72% of those who utilize financial services do so by opening checking accounts online (Shah et al., 2022).

Digital payments

A digital payment is when funds are transmitted from one account to another via a digital device, such as a smartphone. A type of digital payment system is the Unified Payments Interface (UPI). This definition covers payments made with credit, debit, and prepaid cards as well as bank transfers, mobile money, and other payment methods (Shah et al., 2022).

Blockchain

A distributed digital ledger that can record transactions across multiple computers and is unchangeable is referred to as a "blockchain" in this context. It is kept in the form of blocks that are connected to one another in a chain. Blockchain is a platform for decentralized digital assets that can be accessed online. Blockchain transactions usually involve the digital currency bitcoin, whose use is growing in popularity as more individuals use fintech (Shah et al., 2022).

Insurtech

The application of financial technology to the insurance sector is known as insurtech. Nowadays, it is possible to obtain insurance without ever leaving the house because many insurance companies are embracing technology. Online claims can also be made by individuals (Shah et al., 2022).

Crowd Funding

The financial industry of crowdfunding is expanding quickly. Crowdfunding is a way to raise money by enlisting the support of close friends, family, customers, and individual investors. Through the use of social media and crowd-funding websites, a significant number of people are recruited for this strategy, and it makes use of their networks to increase reach and exposure. Crowd funding has been progressively increasing as a result of the development of fintech (Shah et al., 2022).

Peer-to-Peer Lending

Peer-to-peer lending occurs when regular people help others in need without the use of a financial institution acting as a middleman. Potential borrowers and lenders are connected through a peer-to-peer (p2p) platform. The method makes getting credit easy, quick, and convenient. P2P lending enables customers to purchase something now and pay for it later, even in small instalments. This business model has become more and more common (Shah, et al., 2022).

Personal Finance Management

Fintech developments have made personal financial management simple for everyone. Consumers may successfully manage their funds and obtain insight into their spending habits.

Robo-advisors

Robo-advisors are software programs that use algorithms to help people make wise financial decisions. Robo-advisors are becoming more and more popular in the financial industry, particularly in portfolio management and stock markets where they simplify, make trading more accessible, and allow trading on the go.

Cryptocurrencies

While many rising markets, including Australia, Canada, Denmark, Japan, and Switzerland, as well as the US, UK, and Europe, have flourished, cryptocurrency is one application of block chain that has seen success. Companies offering financial services are increasingly entering new markets. On the other hand, there is mounting evidence that these crypto currencies undermine users, financial markets, economic activity, and the global financial system (Mostafa, 2021).

Unlike traditional currencies, which are frequently backed by gold and silver, cryptocurrency is built on distributed computing. Distributed computer networks are "mining" cryptocurrency, as opposed to central banks, which produce traditional currencies. It is a form of money designed to serve as a medium of exchange. These forms of money govern the generation of new units of a certain crypto currency and utilize cryptography to protect and verify transactions. Cryptocurrencies are essentially restricted records in a database that nobody can transfer until certain requirements are satisfied (Mostafa, 2021).

Explanation of the Concept of “FinTech”

Fintech describes cutting-edge financial services or solutions that are offered through technology. The financial technology sector (fintech) is defined as "the area at the intersection of the financial services and technology sectors where technology-focused start-ups and new market entrants innovate the products and services currently offered by the traditional financial services industry." Fintech is a movement toward the digitization, decentralization, and disintermediation of economic transactions, powered by information technologies such as peerto- peer networking, big data analytics, machine learning, blockchain technology, and open APIs, which captures its multifaceted nature (Feyen, Frost, Gambacorta, Natarajan, & Saal, 2021).

The Fintech sector has developed from a physical media presence (1500–1860) to analog technology (1860–1960) to increasingly digital technologies. (1960s onwards). As the fintech industry develops, it is influenced by new market players and fundamental technologies that offer reasonable customer acquisition costs. Similar to this, research has shown that advancements in Fintech are represented by technical change in the banking sector and investment (Arslan et al., 2021).

FinTech uses technology, including the internet and automated information processing, to offer financial solutions. This financial industry rejuvenation has improved company processes by lowering costs and fostering high efficiency, innovation, and speed.

FinTech also incorporates advancements in retail banking, crypto currency, investments, financial literacy, and financial education.

As most services are automated, business models have changed to offer consumers individualized services without regard to geography or time zones. Additionally, FinTech has given online platforms for trading, lending (crowd funding and peer-to-peer, P2P), and asset management, such as robo-advising, as well as assisted in disintermediation.

The banking sector benefits from Fintech's lower cost of intermediation and more financial inclusion, according to Vives's 2017 investigation on the effects of FinTech on efficiency, banking market structures, and financial stability. Financial exclusion can be caused by a lack of cash, old banking practices, unmet demand by traditional banks, remote bank branch locations from homes, and other factors (Arslan et al., 2021).

There is an agreement in the literature on mobile banking that the demand for smartphones in both developed and developing economies continues to have a significant impact on mobile banking services. According to Frost (2020), new fintech companies have made a significant impact on mobile payments, particularly for retail clients. For instance, mobile payments, Quick Response (QR), and SMS technology are all made possible by mobile money (Arslan et al., 2021).

67% of the world's population or 5.2 billion people were mobile service subscribers in 2019. In addition, the economic value of mobile service technology reached $4.1 trillion, or 4.7% of the global GDP. Shorter customer lines and wait times have resulted from the banking industry's development from local branches to online banking (or location centric) and mobile banking (or equipment centric) methods. Disruptive technologies have changed businesses and industries, leading to greater comfort and lower prices (Arslan et al., 2021).

FinTech stakeholders and Ecosystem

The FinTech ecosystem refers to the intricate web of relationships between FinTech firms, regulators, investors, the government, and creative institutions that have a collective concern in the ecosystem of FinTech startups. There was no clear definition of the FinTech ecosystem to be found in the literature. However, a number of stakeholders were found in scholarly studies.

Due to the extensive rules placed on this industry, banks and other financial institutions are subject to restrictions. The financial institutions include banks, credit grantors, insurance companies, and exchanges (Siddiqui & Rivera, 2022).

Additionally, FinTech gives its customers automated platforms so they can manage their assets on their own. These services operate using Robo-advisors and rely on certain algorithms. These have taken the place of wealth and asset managers and are automatic. Bankers, on the other hand, are particularly interested in fintech since they might view partnering with it strategically as a potential strategic path.

Consumer interest in using the services provided by fintech is rising, which encourages the industry's development. One reason for this is that there are currently fewer rules than there are for the dominant, banking business. Both individuals and corporations or merchants are among these customers.

The services offered by FinTech are in partnerships with mobile network operators, software and technology suppliers, mobile device makers, and IT developers, with little control from the government and regulators. On the other hand, Regulators, government organizations, and public sector institutions monitor sales practices, create regulations, and assess the quality of innovations (Siddiqui & Rivera, 2022).

FinTech's rise has aided companies in lowering costs and increasing profitability, which has helped them draw media attention and investors. These investors are intrigued not only by the profitability but also by the positive social impact. To elaborate, FinTech has given underprivileged communities other alternatives when people, for instance, do not have bank accounts (Siddiqui & Rivera, 2022).

For instance, individuals who are unable to obtain home mortgage loans from conventional banks turn to shadow banks and FinTech shadow banks, which frequently provide loans to such individuals without the need for a bank account. On the other hand, these loans have higher interest rate, which draws in a particular group of investors.

Additionally, philanthropic investors are interested in FinTechs as well. The reason for this is that, regardless of their economic level, FinTech makes it simple to undertake charitable work at the convenience and low cost. Due to the creative and enticing solutions offered to the general public, this new and inventive industry has also attracted the media's attention.

Previously done by big data firms and cloud technology companies, fintech now leverages big data analytics to better understand consumer behavior, wants, and demands to develop the best solutions.

At the end of the day, FinTech has impacted the broader public as a whole, not just consumers or small and medium-sized businesses (SMEs). It was essential for paying to nongovernmental organizations (NGOs) and charities since it is quick, effective, and has cheap transaction costs because it is not connected to a bank account (Siddiqui & Rivera, 2022).

Despite all the advantages listed, it is claimed that FinTech encourages criminal operations using bitcoins. According to estimates, 46% of bitcoin transactions are connected to illegal activity. Additionally, as additional cryptocurrencies appear, it becomes easier to make payments for nefarious acts. To limit the aforementioned actions, stringent oversight and controls are therefore necessary (Siddiqui & Rivera, 2022).

FinTech business models

The FinTech business model that appears to be the most well-liked is lending. The technology gathers the information and generates the credit scoring automatically. As was also previously mentioned, FinTech gives consumers ownership over solutions for payment services, i.e., payments based on blockchain technology, customer interaction, i.e., personal financial management, for funding, i.e., P2P funding or crowdsourcing (Siddiqui & Rivera, 2022).

Additionally, FinTech has created robo-advisors that employ algorithms and recommend a combination of assets depending on the traits and interests of their clients. Another significant model is the capital market business model, which enables customers to manage their portfolios independently and engage in trading of derivatives, equities, and foreign exchange. Moreover, FinTech use big data analytics to assess risk and behavior before providing its clients with the most individualized and effective solutions (Siddiqui & Rivera, 2022).

Mobile payments sometimes referred to as m-payments or mobile payments are another method of payment that allows for payment without providing credit card information. The application programming interface (API) is also used by FinTech for verification needs. Last but not least, banks have developed virtual money (Siddiqui & Rivera, 2022).

Impact of FinTech

Traditional financial institutions as well as the rest of the globe have been greatly impacted by the fintech revolution. The financial landscape is drastically altering as a result of the new generation of fintech companies' offerings, which include simple digital banking, peer to peer lending, and the use of digital payments. Mobile phones can be used to swiftly and easily make payments online. Making payments online is currently one of the most significant benefits of online shopping. For a lower transaction cost and with less chance of fraud, money can also be transferred straight from one bank account to another (Shah et al., 2022).

The application of blockchain technology in the finance industry, which creates a myriad of new opportunities and prospects. Traditional financial institutions have long offered financial services like deposits and credit facilities. However, by dint of the fintech sector, significant strides in financial inclusion have been accomplished. Thanks to technical improvements in the fintech sector, banking has become a hassle-free operation, whether for payments or money transfers. The banking industry is transitioning from a branch-specific process to a range of digital platforms, including the internet, social media, and smartphones (Shah et al., 2022).

Traditional remittances were once a source of annoyance because they were costly, challenging, and time-consuming. Fintech companies could assist in streamlining, accelerating, and simplifying these internal and external activities. Additionally, the bank is less dependent on its physical locations to conduct business.

As a result, several banks are using multichannel banking to reduce the number of their branches. Digital banks include neo banks. The enormous growth of e-wallets is another indicator of the development of Fintech financial services. Among the most well-known Ewallets in the world are PayPal and Apple Pay. These wallets allow for P2P payments, top-up and utility bill payments, international transfers, ticket booking, and a variety of additional uses (Shah et al., 2022).

Many financial institutions are now acknowledging its significance and recognizing ewallets as a cooperative action to accept technology improvements as a result of their enormous success.

Fintech has been a turning point for entrepreneurs and small company owners. It might be difficult for most startups to get a loan from a conventional bank. On the other side, fintech has had an impact. Fintech makes it possible for SMEs to process payments and get loans. One of the main sectors where Fintech has had the biggest influence in terms of reforming and developing is small enterprises, which were once thought to be high-risk (Shah et al., 2022).

Fintech Opportunities and Challenges

First: FinTech/Financial Inclusion Opportunities

FinTech Opportunities in Africa

Africa is another extremely fertile environment that is ready for the adoption of FinTech solutions, with its high percentage of unbanked individuals and its high level of mobile phone penetration.

A 2017 paper titled “Finnovating for Africa: Exploring the African Fintech Ecosystem Report 2017” states that there are already more than 300 active FinTech businesses in Africa, with a total funding of $92 million USD, many of which have only been operating for two years. According to the survey, South Africa is the region with the most active FinTech startups, accounting for 31.2% of all companies in this industry. Nigeria and Kenya are the next two most active regions, respectively. Fascinatingly, the survey also states that 41.5% of the market is occupied by FinTech solutions for payments and remittances (FinTech for Social Good Industry: Landscape Overview, 2018).

In order to keep up with and match the cutting-edge solutions provided by FinTech companies, the rise of FinTech in Africa is also putting pressure on the continent's traditional banking and financial services organizations to adopt FinTech solutions as well. Banks and other financial institutions are actively looking to buy, invest in, or work with FinTech businesses.

With over 30% of the $195 million in VC funding going to FinTech startups, the sector is also one of the biggest sources of investment for the continent (FinTech for Social Good Industry: Landscape Overview, 2018).

FinTech Opportunities in Asia-Pacific

The Asia-Pacific area is well-positioned for the adoption of FinTech banking solutions thanks to recent increases in mobile phone penetration and digital usage, as well as the region's high rate of unbanked people.

Asian regulators have made significant strides toward creating an environment that is conducive to the development of regional FinTech industries. According to a 2017 analysis by Frost & Sullivan, the Asia-Pacific Fintech market is predicted to develop at a CAGR of 72.5% from 2015 to 2020 and reach US$72 billion (FinTech for Social Good Industry: Landscape Overview, 2018).

Malaysia: Through the implementation of a regulatory sandbox (where FinTech innovations can be tested in controlled environments) and the advancement of FinTech-relevant guidelines for cryptocurrencies and e-KYC procedures, the Malaysian government and associated organizations are working to create a more flexible regulatory landscape for FinTech innovation.

Singapore: The Singaporean government has attempted to advance a bigger attention on job development related to FinTech and public-private collaboration. The Monetary Authority of Singapore has also taken moves to begin a regulatory sandbox.

Vietnam: In order to "advise on ways to build a suitable ecosystem, including a regulatory framework to enable the development of FinTech enterprises in Vietnam, the State Bank of Vietnam and National Payment Corporation of Vietnam established a Steering Committee on FinTech in 2017”. In accordance with the government's direction and guidelines, the committee will formulate and submit a yearly action plan to the SBV Governor, counseling the Governor on solutions to build a proper ecosystem, including a legal framework to ease the development of FinTech companies in Vietnam (FinTech for Social Good Industry: Landscape Overview, 2018).

FinTech Opportunities in Latin America

A region where micro, small, and medium-sized firms make up 99% of the private sector faced severe hurdles two years ago when more than half of the population had access to banking and even more lacked access to credit.

Approximately 50% of Latin Americans now own a mobile phone, enabling financial institutions in the region to provide digital banking, digital identity authentication, blockchainenabled smart contracts, and electronic invoicing to the region's unbanked population.

Latin America's FinTech business has steadily grown in size and diversity over the past few years, with 2016 serving as a turning point for FinTech investments in the region.

Cross-border payments and processing historically dominated the Latin American FinTech environment, allowing remittances worth $74 billion to enter the area.

The region's FinTech ecosystem has made significant progress toward diversification over the last five years, with businesses now providing smart contracts, electronic payments, and online loans. As a result, there is healthy regional competition, which has led to economic progress (FinTech for Social Good Industry: Landscape Overview, 2018).

Second: FinTech/Financial Inclusion Challenges/Obstacles

Economic Problems in the Developing Countries

Corruption, political unrest, lax intellectual property protections, and a lack of trained labor are just a few of the factors that contribute to economic problems in emerging countries.

Agriculture continues to be a major driver of economic activity and GDP in the 47 nations classified as Least Developed Countries (LDCs). Climate change, however, is having an influence on agriculture. Because agriculture is one of their main sources of revenue, this directly affects the people of developing countries (FinTech for Social Good Industry: Landscape Overview, 2018).

Challenges Faced by Africa

The World Happiness Report 2017 found that 44 nations' residents believed that weak governance was the main cause of the continent's problems with healthcare, security, political stability, and development initiatives. Every aspect of life has been affected by corruption, from the small things like getting access to jobs, schools, and medical care to the big things like contracting out work and using public funds. The result has been significant disparities in access to government services as well as investment prospects, forcing many domestic and international businesses to shut down (FinTech for Social Good Industry: Landscape Overview, 2018).

The lack of adequate infrastructure in Africa is holding back the continent's economic growth, but foreign investment is filling in some of the gaps.

When travelling, it is clear how poorly developed Africa's infrastructure is since abandoned wagons are frequently seen and the train makes a number of baffling pauses. The bulk of sub-Saharan African nations still regularly face power interruptions, which naturally lowers productivity at many businesses. The World Bank and France's development agency released a report in 2010 that identified power as the continent's biggest infrastructure weakness, with up to 30 countries experiencing frequent power outages. The productivity rates of African businesses have been reduced by as much as 40% as a result of high energy costs mixed with other infrastructural deficiencies, such as rail and road issues.

Infrastructure needs to be upgraded urgently in developing nations. Numerous firms struggle due to a lack of consistent power for industrial operations or because they are unable to get their products to market. Public-Private Partnerships (PPPs) must be widely adopted in order to improve Africa's infrastructure and speed up construction. PPPs in Sub-Saharan Africa, however, continue to have a very small market, with most of the projects being centered in South Africa, Nigeria, Kenya, and Uganda. Together, they represent 48% of the 335 PPP infrastructure projects that have been completed in the region during the past 25 years. PPP infrastructure projects in the region over the past five years have mostly focused on the energy sector (78%)- mostly renewables-followed by transportation (22%) and water and sanitation (0.5%). (FinTech for Social Good Industry: Landscape Overview, 2018).

Challenges Faced by Asian Pacific region

For their economies to expand, the majority of Asian nations must invest a significant amount of money in infrastructure. Asia must have the ability to generate enough electricity, have access to clean water, have efficient utility networks, and upgrade its transportation infrastructure urgently. Without these essential components, economies stall. Without constant, wise investment in the region's infrastructure, its potential is unlikely to be realized.

According to the research "Developing Infrastructure in Asia Pacific: Outlook, Challenges and Solutions," there is enough money in the market to finance the projects that are currently being contracted throughout the area. The available stock and debt liquidity is ample for the current purchases, but not enough to cover investments between US$10 trillion and US$20 trillion. The infrastructure that fuels economic growth-roads, railways, power, and wateris invested in at a much smaller percentage.

Large and sophisticated infrastructure projects must be procured, but this has never been done before. Technical, legal, and financial expertise are necessary for public sector employees, and these competencies must be backed by rigorous procurement procedures that enable decisions, findings, and recommendations to be confronted.

The infrastructure gap that has grown over time must be quickly addressed in both mature and emerging economies; whereas mature countries must renovate and update outdated, inefficient infrastructure, growing markets require new infrastructure. To fulfil the promise of infrastructure, funding from the public and private sectors is required. Governments should, at the most basic level, establish strict procurement procedures that are transparent. Pipeline management should concentrate on prioritizing and developing projects successfully utilizing precedents from prior transactions, but then be modified for local restrictions. When the demand for infrastructure is taken into account, there are several opportunities throughout the Asia Pacific region. The transportation networks that link economic activity within a nation and those that enable efficient trade between nations all need to be developed in order to increase the strength and utility of rising market economies (FinTech for Social Good Industry: Landscape Overview, 2018).

Challenges Faced by Women

Mobile phones and other technologies are less accessible to women. In low- and middleincome nations, 200 million fewer women than males own mobile phones, according to estimates from the GSMA. Women are 36% less likely than men to own a cell phone, even in India, a nation actively promoting the adoption of digital money.

The role of gender disparities in business and employment possibilities is equally significant. According to estimates by Cuberes and Teignier, gender disparities cause an average income loss of 38% in the Middle East and North Africa, 25% in South Asia, and 17.3% in Latin America and the Caribbean.

Social customs may restrict women's demand for access to financial services. Women are frequently not expected to pursue financial independence or encouraged to do so. Women, Business and Law lists 17 nations where husbands are legally permitted to limit their wives' freedom to leave the home.

Because the margins are less and women typically conduct fewer transactions than men, financial service companies are less motivated to sell to them.

Women who experience employment disparities find it more challenging to connect with them through the typical marketing channels geared for men, such as wage and remittance channels.

In Eastern Europe and Central Asia, only 18% of women say that their paychecks are sent directly into their accounts. Men in South Asia are twice as likely as women to have sent domestic remittances in the previous year. Men and women are equally likely to have received government pension payments, according to Findex data. Statistics on topics like income are supported by data on education, employment, and entrepreneurship (FinTech for Social Good Industry: Landscape Overview, 2018).

Challenges to Financial Inclusion in South Africa

According to the World Economic Forum, South African banks use fee structures that are up to four times higher than those used in other nations. This is partly because of the country's high operating costs and the prevalence of cybercrime (for example, $450 million was lost by South African businesses to cybercrime in 2015, leading banks to spend up to three times as much on security measures against it as other non-financial institutions of comparable size). Despite this, just 25% of adults who have transaction accounts make more than three transactions per month. Instead, people frequently transact in cash (up to 60% of buying, for instance).

Low-income individuals have a deep-rooted mistrust of formal financial institutions, which resulted in more widespread worries of exploitation brought on by historical abuses. And there is a good explanation for this. Banks have acted in deceptive and forceful ways before. As an illustration, South Africa recently started transferring social payments into bank accounts, which encouraged banks to attempt and market burial insurance and microloans to the recipients of these grants. Payment for these goods and services was taken directly out of the bank accounts of the individuals, leaving many of them with very little to live on. Public indignation over this led to a government study into the legitimacy of such practices (FinTech for Social Good Industry: Landscape Overview, 2018).

According to the National Stokvel Association of South Africa, more than 40% of South African households use trust-based models like stokvels (a type of savings or investment society in which members regularly contribute a fixed sum that is divided equally among them in accordance with rules established by the society's members). These societies offer more than just a way to save money to many of their members; they also serve as an emergency safety net and a method of social engagement for advice and enjoyment.

Unfortunately, there are far too many impediments to using services like loans because of the formal banking sector. Paystubs and bank statements are required by institutions, and approval timeframes might be lengthy. Low-income individuals frequently lack the necessary paperwork, and they frequently need loans sooner than the processing timeframes permit.

Low-income individuals have a deep-rooted mistrust of formal financial institutions, which is itself founded in more widespread worries of exploitation brought on by historical abuses. And there is a good explanation for this. Banks have acted in deceptive and forceful ways before.

For instance, South Africa recently started transferring social grants into bank accounts directly, which encouraged banks to attempt and offer burial insurance and microloans to the recipients of these grants. When these goods and services were purchased, the money was taken immediately out of the customers' bank accounts, leaving many of them very little to live on. Public indignation over this led to a government study into the legitimacy of such practices (FinTech for Social Good Industry: Landscape Overview, 2018).

In addition, the main reason why individuals prefer to deal with cash in the industrialized world, according to the World Economic Forum, is people's fear of ATM and mobile/internet banking-related fraud. In addition, they discovered that consumers strongly preferred doing business in person due to concerns of trust and because it provides a better setting for dispute resolution. A small percentage of respondents to the study expressed concern about low-income populations' lack of experience with mobile and online banking (FinTech for Social Good Industry: Landscape Overview, 2018).

Moreover, more than 1.5 million people, according to South Africa statistics, operate small, unauthorized companies there. Banks frequently require official business registration in order to create accounts and qualify for loans, even when the registration costs are too high for small enterprises. Such businesses do not meet the statutory requirements to be deemed a legal entity of the financial sector.

Egypt’s FinTech Landscape

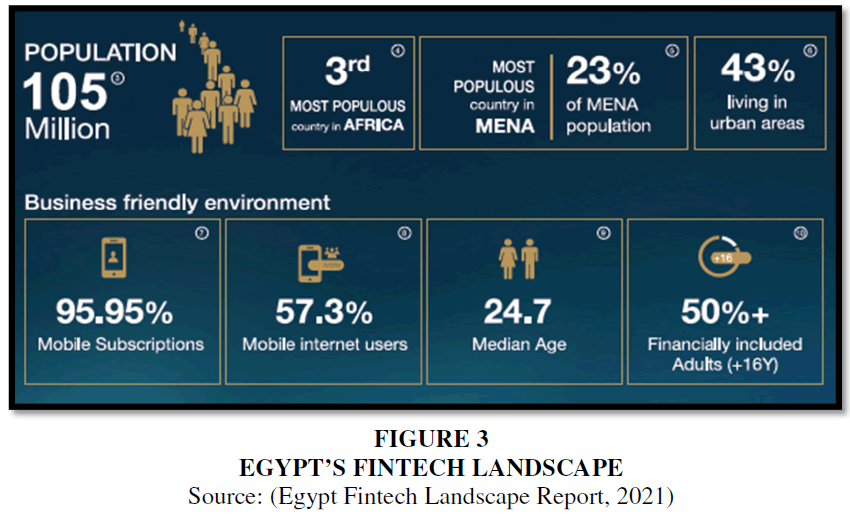

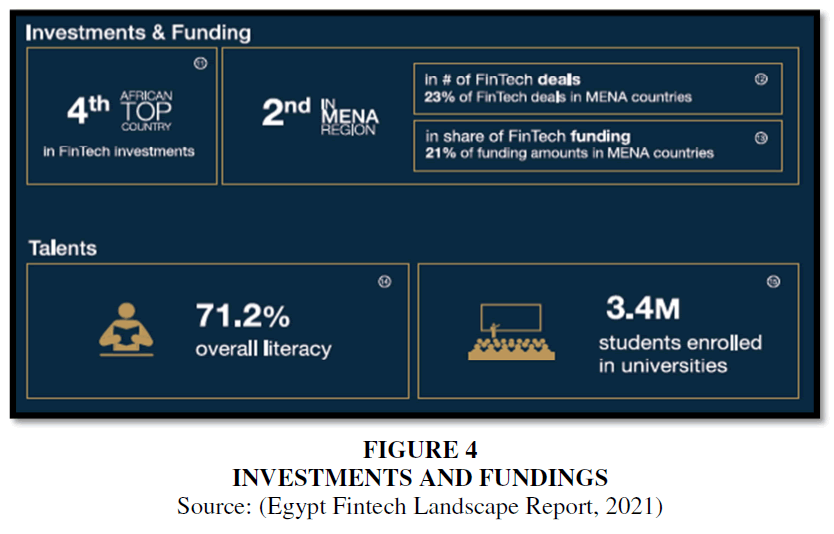

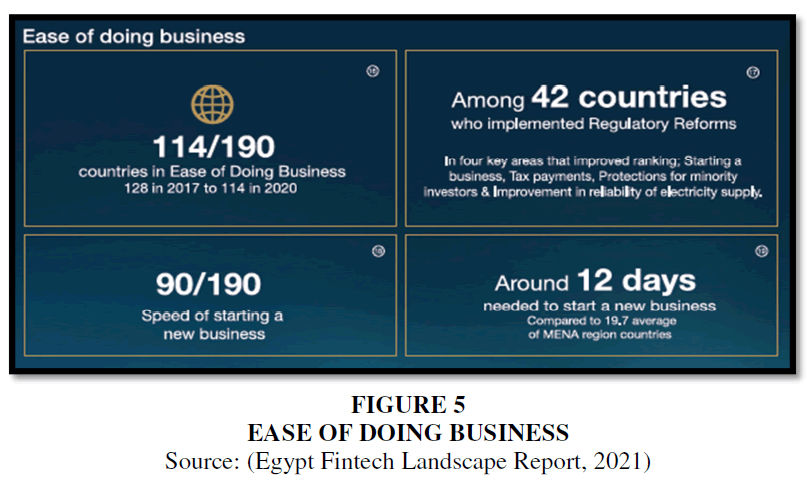

Egypt is regarded as the third-biggest country in Africa and the largest country in the Middle East and Africa (MEA) area in terms of population. Like other FinTech markets throughout the world, Egypt's is susceptible to disruption, Figures 3, Figure 4, Figure 5.

Figure 3 Egypt’s Fintech Landscape

Source: (Egypt Fintech Landscape Report, 2021)

Figure 4 Investments and Fundings

Source: (Egypt Fintech Landscape Report, 2021)

Figure 5 Ease of Doing Business

Source: (Egypt Fintech Landscape Report, 2021)

With 23% of the MENA region's population and the third-largest market in Africa, Egypt has the potential to develop into a thriving local FinTech ecosystem and a regional FinTech leader. Egypt is a huge market with a nearly 50% unbanked population, insufficient technological know-how, 57.3% of the population using mobile internet, and low levels of trust in digital financial services. These factors continue to prevent FinTech adoption in Egypt. However, FinTech in Egypt today plays a crucial role in addressing national issues for MSME's (Micro, Small, and Medium Enterprises) and retail consumers across a variety of segments, offering customized solutions to keep up with the dynamics of the Egyptian market, making digital financial services more accessible to the Egyptian community than ever before. Here are some facts about Egypt’s FinTech sector:

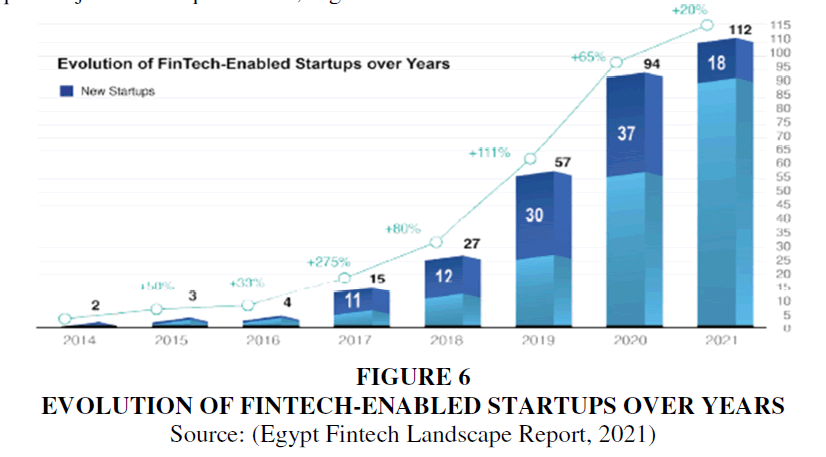

A. Evolution of FinTech-enabled Startups over years: When it comes to the concentration of FinTech companies on the continent, Egypt is one of the top 4 most active African nations in the sector. This can be attributed to the fintech sector's rapid expansion over the previous seven years, which saw 112 Egyptian fintech and fintech-enabled firms launched by 2021, up from just 2 startups in 2014, Figure 6.

Figure 6 Evolution of Fintech-Enabled Startups Over Years

Source: (Egypt Fintech Landscape Report, 2021)

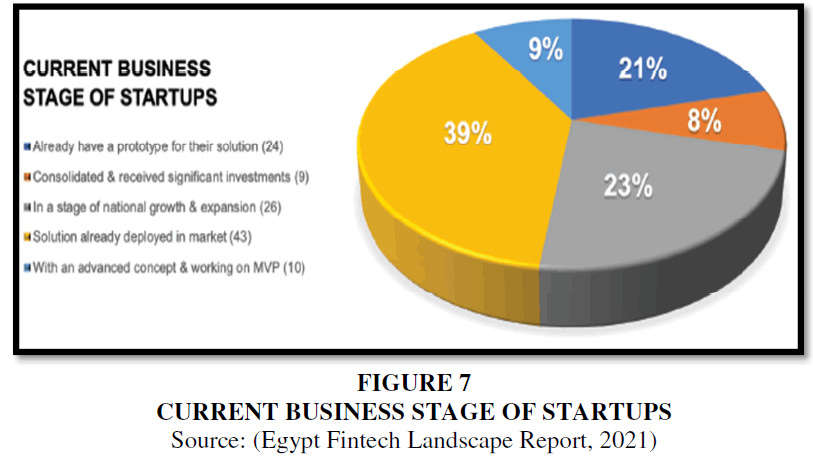

B. Business Stage of Startups: Since there have been so many new businesses over the past few years, around 70% of Egypt's FinTech/FinTech-enabled startups are in a stage where their product has already been released to the market. Around 30% of all startups in the Egyptian fintech industry are in the pipeline, including those with a developed concept who are working on their MVP (Minimum Viable Product) as well as those who have a prototype ready. This implies that further funding and investments are required for the Egyptian FinTech sector to develop more smoothly, Figure (7).

Figure 7 Current Business Stage of Startups

Source: (Egypt Fintech Landscape Report, 2021)

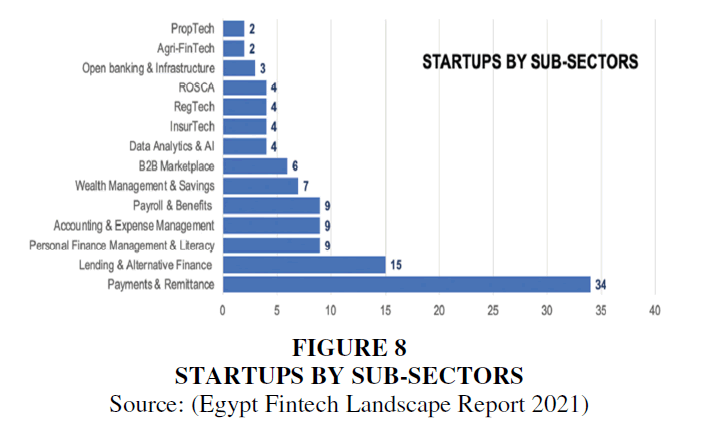

C. Breakdown of Startups by sub-sectors: Payments & Remittance, represented by 34 startups (30%), is the most important FinTech subsector in the Egyptian market, followed by Lending & Alternative Finance, with 15 startups (13%). The remaining FinTech trends are relatively diverse, which complements the best objective to meet the various financial service needs of the Egyptian population. However, it is apparent that a number of prospective subsectors, including Blockchain, Chatbots, Digital Investment Platforms, Supply Chain Digitization Platforms, Big Data & AI, and Digital Banking, are expanding globally and require the talents of Egyptians, Figure 8.

Figure 8 Startups by Sub-Sectors

Source: (Egypt Fintech Landscape Report 2021)

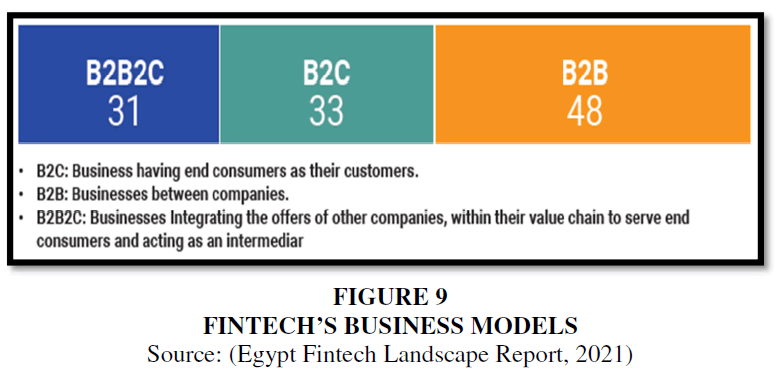

D. Prevalence of types of FinTechs’ business models: Egyptian FinTechs offer a wide range of services and goods as well as a variety of business models, the most majority of which are B2B models (48 companies), including B2B marketplaces, regulatory technology, data analytics, artificial intelligence, accounting, and expense management, among others. Due to Egypt's large population of MSMEs, which makes up approximately 99% of its new venture population, there is a big range of prospects in the B2B FinTech industry. As a result of the Covid-19 pandemic, which has accelerated the acceptance of e-payments and the expansion of local FinTech solutions, MSME's are becoming more conscious of the value that financial technology brings to the table. As a result, MSMEs gain from those FinTech B2B solutions in the areas of payments, microlending, cash management, insurance, and supply chain. As for the remaining startups, they fall into two categories: B2C model (33 startups), which includes ROSCA (Rotating Savings and Credit Association), Wealth Management & Savings, and others, and B2B2C model (31 startups), which acts as an intermediary, Figure 9.

Figure 9 Fintech’s Business Models

Source: (Egypt Fintech Landscape Report, 2021)

E. Customers served by FinTech & FinTech-enabled Startups: According to 75 Firms, around 9 million Egyptians are being served by those FinTech and FinTech-enabled startups, despite the fact that another 26 early-stage startups do not have any clients and 11 startups did not declare their consumers.

Customer gender diversity: According to 53 companies, the average percentage of female customers is 28%, while 7 startups claim having no female clients and 27 report having no sex-disaggregated or shared data.

Out of the 112 startups, only 13 (12%) have a customer base that is at least 50% female. Startups must therefore place a greater emphasis on sex-disaggregated data in order to accurately identify female financial requirements and customize their products and marketing strategies to meet unmet demand. This has strong international support because, according to Financial Alliance for Women, 64% of global FinTechs with sex-disaggregated data discovered that female clients have equivalent or higher utilization rates than men.

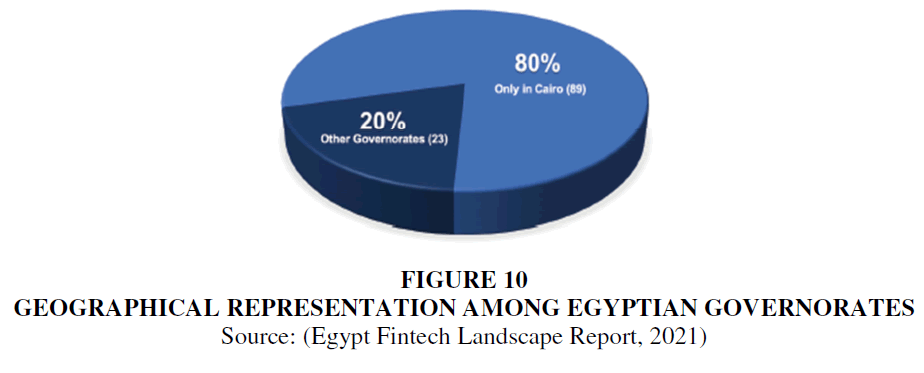

F. Startups' reach different geographic areas: Twenty-three percent (23 startups) of Egypt's 112 startups operate directly in governorates other than Cairo, with a greater focus on Lower Egypt's (Dakheila, Monofia, Sharkia, Giza, and Ismailia), Upper Egypt's (Minya, Qalyobia), and then Urban Governorates (Alexandria), Figure 10. It's also important to note that the majority of FinTech businesses have access to the national market via a website or mobile app.

Figure 10 Geographical Representation Among Egyptian Governorates

Source: (Egypt Fintech Landscape Report, 2021)

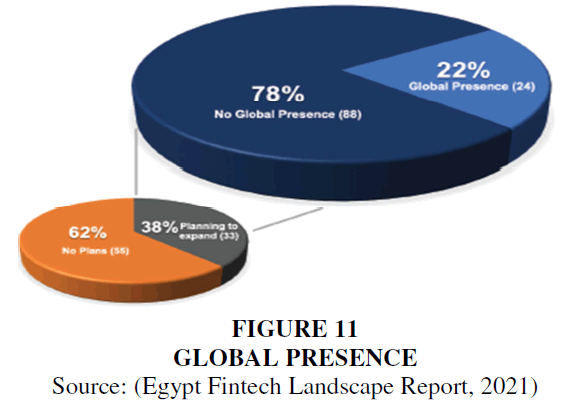

G. Global Presence: Of the Egyptian FinTech businesses surveyed, 24 have grown regionally and internationally. They now have presence in the MENA region, the GCC region, and Europe. It is also important to note that, of the 88 startups, about 33 are expecting to grow over the next 12 months, with a particular focus on the MENA and Africa regions, Figure 11.

Figure 11 Global Presence

Source: (Egypt Fintech Landscape Report, 2021)

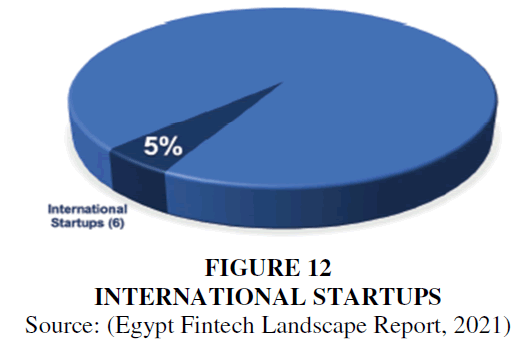

However, there were only six international new businesses have increased their activities in Egypt, But there is a tactical alternative. The desire to entice international talent to market in Egypt in the near future given the resources and extensive possibilities are plentiful in the Egyptian market, Figure 12.

Figure 12 International Startups

Source: (Egypt Fintech Landscape Report, 2021)

Conclusion

The innovative concepts in FinTech are bringing us one step closer to a cashless society. As a result of technical improvements, the entire financial services, financial goods, and financial operations company has radically changed and improved in just a few decades. Significant modifications have been made to the methods and modes of operation used by financial institutions. Traditional banking, investment, and trading operations have changed as a result of collaboration between technology and financial services. Fintech has altered how people manage their finances and carry out daily activities. It is claimed that fintech industry will be one of the industries that has a bright future.

Declaration of Conflicting Interests

The Author declares that there is no conflict of interest.

References

Arslan, A., Buchanan, B., Kamara, S., & Nabulsi, N.A. (2021). Fintech, Base of the Pyramid Entrepreneurs and Social Value Creation. Journal of Small Business & Enterprise Development, 1-29.

Indexed at, Google Scholar, Cross Ref

Egypt Fintech Landscape Report (2021). Fintech Eypt.

Feyen, E., Frost, J., Gambacorta, L., Natarajan, H., & Saal, M. (2021). Fintech and the digital transformation of financial services: implications for market structure and public policy. BIS Papers.

FinTech For Social Good Industry: Landscape Overview 2018. Deep Knowledge Analytics.

Huaa, X., & Huang, Y. (2020). Understanding China’s Fintech Sector: Development, Impacts and Risks. European Journal of Finance, 27(10), 1-13.

Indexed at, Google Scholar, Cross Ref

Mostafa, A.S. (2021). Obstacles of FinTech in Egyptian Bank Sector under Social Distancing. Scientific Journal for Financial and Commercial Studies and Researches (SJFCSR), 2(1), 425-454.

Shah, Z., Ranashing, O., Shaikh, H., Hajare, P., & Shirode, A. (2022). Study on The Impact And Social Implications of Fintech. International Research Journal of Engineering and Technology (IRJET), 9(4), 1324-1327.

Siddiqui, Z., & Rivera, C.A. (2022). Fintech and fintech ecosystem: a review of literature. Risk Governance and Control: Financial Markets & Institutions, 12(1), 63-73.

Received: 01-Feb-2023, Manuscript No. JOCCC-23- 13218; Editor assigned: 03-Feb-2023, Pre QC No. JOCCC-23- 13218(PQ); Reviewed: 17-Feb-2023, QC No. JOCCC-23- 13218; Revised: 24-Feb-2023, Manuscript No. JOCCC-23- 13218(R); Published: 28-Feb-2023