Research Article: 2021 Vol: 27 Issue: 6

Financial Performance Impact On Capital Structure in Indonesian Listed Company

Syam Widia, Universitas Negeri Semarang

Anindya Ardiansari, Universitas Negeri Semarang

Andi Ramadhan, Universitas Negeri Semarang

Citation: Widia, S., Ardiansari, A., & Ramadhan, A. (2021). Financial performance impact on capital structure in Indonesian listed company. Academy of Entrepreneurship Journal, 27(6), 1-16.

Abstract

This study aims to examine the effect of profitability, asset structure, and liquidity on the capital structure of various industrial sector companies listed on the Indonesia Stock Exchange in the 2015-2018 using the pecking order theory approach. The population in this study were 48 companies in total, all various listed industry sector companies. After selecting with special criteria, the sample in this study amounted to 38 companies. The authors used Debt Equity Ratio (DER) for representing the capital structure. Profitability is proxied by Return on Equity (ROE), meanwhile in measuring asset structure, the authors used Fixed Asset to Total Assets (FATA). For liquidity ratio is proxied by Current Ratio (CR). The researchers used the coefficient of determination (R2) and partial regression tests (t-test) to analyze the relationship between financial performance and capital structure. Data processing techniques in this study using Eviews-9. The results show that profitability has a significant positive effect on capital structure, liquidity has a significant negative effect on capital structure, and asset structure has a negative and insignificant effect on capital structure. From this result, only in terms of liquidity variable, shows that Industrial sector companies public listed in the 2015-2018 applied the pecking order theory approach.

Keywords

Pecking Order Theory, Capital Structure, Assets Structure, Liquidity, Profitability, Financial Performance.

Introduction

The Indonesian state can be considered an industrial country in its economic proportion. The industrial sector is the largest contributor to the national economy. Meanwhile, Indonesia is included in the category of the top five countries whose industrial contribution is quite high. The statement was conveyed by the Indonesian economy minister in kemenperin.go.id (Ministry of Industry of the Republic of Indonesia, 2017).

The magnitude of the influence of the industry on the country and the intense economic competition in the industrial sector are certainly challenges for managers in managing companies effectively and efficiently to improve the company's operating performance and capital structure (Haryanto, 2014). Companies have the freedom to determine their capital structure, both internal and external. In addition, it can also make corporate funding decisions by considering and analyzing a combination of economic fund sources used to finance investment needs and corporate business activities (Ridloah, 2010).

Capital structure is a balance or comparison between foreign capital and own capital. Foreign capital is the capital used by a company to finance the operational activities of the company, the sources of which come from outside or externally. Own capital is capital used by a company to meet its operational needs, which can be sourced from the company in the form of retained earnings (Riyanto, 2008).

Regarding the theory of capital structure relating to funding is a pecking order theory. The theory developed by Myers (2003) explains the priority order of a manager in determining funding sources. Manager preference is stated in the order of company funding sources starting from internal funding as the main source and the next priority, namely funding from debt which has a lower risk (Husnan, 2013).

Factors that can affect the composition of a company's capital structure include sales stability, asset structure, operating leverage, business risk, growth rate, profitability, taxes, control, management attitudes, company size, and financial flexibility (Brigham and Houston 2021). According to Nugrahani (2012) using five independent variables as factors that influence the capital structure, namely profitability, liquidity, sales growth, company size, and managerial ownership. In this study, three factors that influence the capital structure are taken, namely profitability, asset structure and liquidity.

Profitability according to Hanafi & Halim (2012) states that companies that have a high level of profit will have a low level of debt, the small debt is not due to the debt target but because internal funds are sufficient to finance company financing. This statement is in line with the pecking order theory where internal funding is a top priority in funding sources and research Harris & Roark (2018), Anitasari (2018); Bilgin & Dinc (2019) support this statement. However, contrary to the research of Sarasmita & Winoto (2013); Setyawan & Nuzula (2016) which stated that profitability has a positive effect on capital structure.

Asset structure or asset structure are assets owned by a company that are used for its operating activities. According to Brigham and Houston (2021), companies that have sufficient assets to guarantee loans will tend to use debt quite a lot. However, when a company uses the pecking order theory approach, the company will still rely on internal funds as a source of corporate funding. This theory statement is in line with the research of Hadianto (2008) and Anitasari (2018). However, it is contrary to Yudhiarti & Mahfud, (2016) research which states that asset structure has a negative effect on capital structure.

Liquidity is the company's ability to fulfill its short-term obligations that are due or invest in cash when the company needs funds. Kasmir (2008) argues that the liquidity ratio is a ratio that describes a company's ability to meet its short-term debt (Horne & Wachowics, 2007). In the pecking order theory, a liquid company will still rely on internal funds as a source of funding. This theory statement is in line with the research of Yudhiarti & Mahfud (2016) and Bilgin & Dinc (2019). However, Ridloah (2010) research contradicts this statement because their research results have a positive effect on the company's capital structure.

Based on the description above, there are still gaps between previous researchers. Then the researchers are interested in examining the factors that affect the capital structure such as: profitability, asset structure and liquidity. Capital structure in this research is proxied by DER (Debt to Equity Ratio). Profitability is proxied by ROE (Return on Equity), asset structure is proxied by FATA (Fixed Asset to Total Assets) and liquidity is proxied by CR (Current Ratio).

Table 1 shows in the sector of companies listed on the IDX that the Miscellanceous Industry company sector or it can be called Various Industries has an average DER of 9.67 which has the highest DER among the eight other sectors. It can be assumed that this corporate sector is opposed to the pecking order theory. Then the researchers' curiosity continued to look further at the Miscellanceous Industry sector or various industries. It turned out that after being investigated in depth, the researcher found a gap phenomenon in the corporate sector.

| Table 1 DER Average all Sector Company Listed in 2014-2017 |

|

| Sector According to the IDX | DER |

|---|---|

| Agriculture | 3.83 |

| Mining | 1.49 |

| Basic Industry and Chemicals | 1.96 |

| Miscellanceous industry | 9.67 |

| Consumer Goods Industry | -5.71 |

| Property, Real Estate and Building Construction | 1.28 |

| Infrastructure, Utilities & Transporttation | 1.31 |

| Finance | 2.91 |

| Trade, Service & Investment | 1.09 |

Table 2 shows that there is a phenomenon that in the Miscellaneous Industry sector the value of DER from 2016 to 2017 has increased very high. However, profitability (ROA, ROE) from 2016 to 2017 experienced a high enough increase. Obviously, this is contrary to the pecking order theory where an increase in profitability will reduce a company's debt level. Another assumption states that the sequence of company funding starts from an internal source of funds with retained earnings, then debt is not at risk, forest is risky and the last is the issuance of shares, because when issuing shares is more risky than debt if funds are needed for the company's business development.

| Table 2 Profitability and Capital Structure in Miscellaneous Industry’s Sector 2014-2017 |

||||

| 2014 | 2015 | 2016 | 2017 | |

|---|---|---|---|---|

| DER | 1.078 | 1.129 | 0.944 | 35.54 |

| ROA | 3.772 | 0.387 | 5.774 | 5.970 |

| ROE | 4.393 | 4.162 | 5.312 | 12.72 |

Source: Statistic data BEI

Research on the factors that influence the capital structure has been mostly done by previous researchers. However, there are still inconsistencies in the results of several previous researchers so that further research is needed on the company's capital structure. Apart from differences in research variables, research objects, research time, and the conditions of the company that allow differences in research results obtained and will strengthen previous research. This research will be carried out on go-public companies listed on the IDX in the Miscellaneous Industry sector or can be called Various Industries. This sector was chosen because of the gap phenomenon which indicates that the Miscellaneous Industry sector has a higher DER value compared to other sectors.

Based on the background description above, it can be seen that there are phenomena of gaps and research gaps that occur. Then this becomes the reason for researchers to conduct research again on the factors that influence the capital structure of the Miscellaneous Industry/Miscellaneous Industry company sector for the period 2015-2018.

Hypothesis

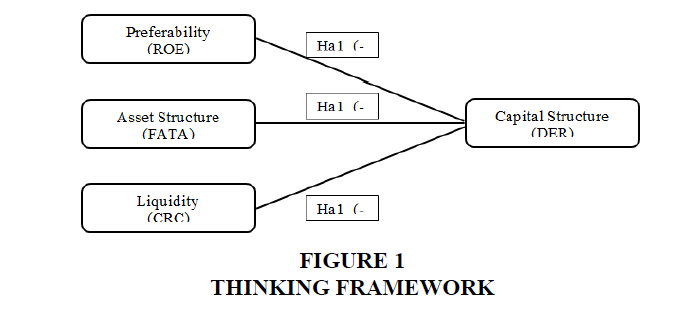

High profitability reflects the company's ability to generate high profits for shareholders. The higher the profit obtained, the higher the company's ability to pay its dividends, and this has an impact on the increase in company value. With a high profitability ratio that is owned by a company, it will attract investors to invest in the company (Putra & Wirajaya, 2013). In research Barokah (2018), Profitability can be measured by the ROE (return on equity) ratio, the higher the ROE, the higher the company's profits, this allows companies to meet their funding needs with internal funds as is the case with the pecking order theory concept. Profitability has a negative and insignificant effect on the company's capital structure (Barokah, 2018). In line with the research of Yudhiarti & Mahfud (2016); Harris & Roark (2019) and Anitasari (2018) which states that profitability has a negative effect on capital structure. Based on the description above, the first hypothesis is proposed as follows:

Ha1: Profitability has a negative effect on capital structure.

Asset structure is the structure of assets owned by a company that using for its operations. According to Brigham and Houston (2021), companies that have sufficient assets to guarantee loans will tend to use debt quite a lot. The tendency of companies to choose internal funding is in line with the concept of the pecking order theory by Brigham and Houston (2021). This statement is in line with the research of Yudhiarti & Mahfud, (2016). companies are more likely to use the company's cash than use debt. Based on the description above, the third hypothesis proposed is as follows:

Ha2: Asset structure has a negative effect on capital structure

Liquidity is the company's ability to fulfill its short-term obligations as well as investment in cash when the company needs funds Kasmir (2008). Companies can use their liquid assets as a source of funding and financing, so that companies do not need to use external sources of funding or debt. Based on the pecking order theory concept, internal funding is a top priority in financing companies Brigham and Houston (2021). This statement is in line with the research of Hardianti & Gunawan (2010); Astuti (2015); Barokah (2018) which state that liquidity has a negative effect on capital structure. Based on the description above, the fourth hypothesis is proposed as follows Figure 1:

Ha3: Liquidity has a negative effect on capital structure.

Methodology

This type of research used in this study uses a quantitative approach. A quantitative approach can be interpreted as a research method based on the philosophy of positivism which is used to research on certain populations or samples (Sugiyono, 2015). Research design is a necessary process in planning and implementing research (Suchman, 1967). The data used in this study is secondary data sourced from the financial statements of companies in the Miscellaneous industry sector or can be called various industries listed on the IDX (Indonesia Stock Exchange) in the 2015-2018 period.

Population is all elements that show certain characteristics that can be used as a conclusion (Sanusi, 2011). Population can also be defined as a complete set of analysis units that are being studied (Sarwono, 2006). In this study, the population used is all companies in the Miscellaneous industry sector or various industries listed on the IDX (Indonesia Stock Exchange) in the period 2015-2018. Based on the data obtained from www.idx.co.id, the number of company population that is the object of research is 48 companies.

The sample is a sub set of elements selected for further study. Samples were taken so that in various cases it was not possible to study all members of the population, therefore members of the population and the sample were distinguished. The samples in this study were all companies in the Miscellaneous Industry sector or various industries listed on the Indonesia Stock Exchange (BEI) that published reports in each period of this study. Based on data obtained from www.idx.co.id, the sample of companies that became the object of this study were 38 companies.

The sampling technique in this study was carried out using the proposive sampling method. According to Sugiyono (2015) purposive sampling is a sampling method using certain predetermined criteria.

The data analysis technique used in this research is descriptive statistics with multiple linear regression analysis techniques. To assess the effect of independent variables on the dependent variable in Miscellaneous Industry sector companies or various industries. According to Gujarati & Porter (2015) multiple linear regression analysis is the most frequently used regression analysis, because it is simpler. The classic assumption tests used in this study are normality test, multicollinearity test, autocorrelation test and heteroscedasticity test. Hypothesis testing in this study was carried out by testing the coefficient of determination (R2) and partial regression testing (t-test). The data processing technique in this study uses Eviews 9. This data processing application is expected to be able to provide an overview to the researcher from the research results in order to answer research problems.

The ratio data used in this study are data for capital structure variables which are proxied by DER (Debt to Equity Ratio), profitability variables proxied by ROE (Return on Equity), and asset structure variables as measured by FATA (Fixed Assets to Total Assets), and the liquidity variable as measured by CR (Current Ratio).

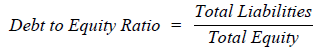

DER (Debt to Equity Ratio) according to Sjahrial & Purba (2013) is a tool to measure the balance between the company's obligations and its own capital. This ratio can also mean a measure of the company's ability to meet its debt obligations with its own capital guarantee. Sjahrial & Purba (2013) state that this ratio can be measured by the formula:

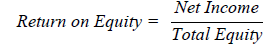

According to Sartono (2009) profitability is the company's ability to earn profits or profits in relation to sales, total assets and the company's own capital. Profitability can be measured by ROE (Return on Equity). ROE is used to see the company's ability to benefit from the use of its own capital. ROE is a comparison between net income and equity. According to Wetson & Brigham (1990) this ratio can be measured by the formula:

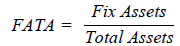

Asset structure is the composition of the company's assets which is used to determine the amount of the component, fixed assets and current assets (Pradana et al., 2013). According to Riyanto (2008) Asset structure is a ratio that describes the fixed assets owned by the company to the company's total assets. Asset structure in this study uses the FATA (Fixed asset to total assets) ratio which describes the ratio between total fixed assets owned by the company and the company's total assets. FATA aims to determine how much fixed assets can be used as collateral. This ratio according to Sari (2020) can be formulated as follows:

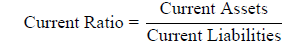

Liquidity is the company's ability to fulfill its financial obligations in the short term with current funds owned by the company (Kasmir, 2008). In this study, the ratio used in the liquidity variable is the current ratio. The current ratio is a ratio to measure the company's ability to pay short-term obligations or debts that are due immediately when they are collected as a whole. According to Kasmir (2008) the current ratio is formulated as follows:

Simple regression analysis is used to measure the strength of the relationship between two or more variables and to show the direction of the relationship between the dependent variable and the independent variable. Regression analysis was carried out using the Eviews 9 program. The simple regression line equation uses the following formula (Ghozali, 2006):

Y = a + b1X1 + b2X2 + b3X3 + e

Information:

Y = Capital Structure

a = Constant

b = Regression Line Coefficient

X1 = Profitability

X2 = Asset Structure

X3 = Liquidity

E = standard error

Results

The object of this research is Miscellaneous Industry Sector companies listed on the Indonesia Stock Exchange in the period 2015-2018 (4 years). The total population of companies in this study were 48 companies. The sampling technique used in this study was purposive sampling method, namely by determining certain criteria. Based on the criteria selected, the sample in this study obtained 38 companies in the Miscellaneous Industry sector that met the criteria in taking samples from the population of companies in the Miscellaneous Industry sector in the period 2015-2018 (4 years).

Descriptive statistical test is used to describe or describe the data on the variables used as research. The data included in the descriptive statistics include minimum value, maximum value, average value, and standard deviation. Descriptive statistics in this study provide an overview of data on capital structure (DER), profitability (ROE), asset structure (FATA), and liquidity (CR). The results of the descriptive analysis of the research variables are presented as follows:

The capital structure is shown by the DER proxy in Table 3. The DER value shows the amount of debt a company has as compared to the amount of capital the company owns. Table 3 shows the lowest DER value owned by a company with the code CNTX or Century Textile Industry (PS) in 2018 of -261.1836. while the highest DER value is owned by a company with the code CNTX or Century Textile Industry (PS) in 2017 amounting to 85.86797. This explains that the data distribution ranges from -261.1836 to 85.867979.

| Table 3 Statistic Descriptive |

||||

| Statistic | DER | ROE | FATA | CR |

|---|---|---|---|---|

| Mean | 0.139 | -0.17 | 0.400 | 1.84 |

| Median | 0.908 | 0.02 | 0.399 | 1.27 |

| Maximum | 85.86 | 3.69 | 0.916 | 10.6 |

| Minimum | -261 | -30.8 | 0.018 | 0.10 |

| Std. Dev. | 22.66 | 2.53 | 0.193 | 1.52 |

| Observations | 152 | 152 | 152 | 152 |

Source: Authors (2020)

The average (mean) value on the DER value for companies in the Miscellaneous Industry sector is -0.139216 or -13.92%. This means that the average debt to equity in Miscellaneus Industry is -13.92%. The standard deviation of the DER value is 22.664, which means that the deviation of the data variation is 22.664, the standard deviation is greater than the average value, which means that the average deviation is high. Negative DER means that there is a comparison between debt and negative equity where the value of equity is no longer valuable and there are accumulated losses, leaving only debt.

Profitability is shown by the ROE proxy found in Table 3. The ROE value shows the company's ability to generate profits from the company's equity. The table shows the lowest ROE value owned by a company with the code CNTX or Century Textile Industry (PS) in 2018 of -30.8023, meaning that the company uses equity that does not generate profit because it has a negative value. Meanwhile, the highest ROE value is owned by a company with the code HDTX or Panasia Indo Resources in 2018 of 3,692, meaning that the equity used by the company generates a profit of 3.6 times. It also explains that the data distribution ranges from -30.8023 to 3.692.

The average (mean) value of ROE for companies in the Miscellaneous Industry sector is -0.174 or -17.4%. This means that the average return on equity is -17.4%. The standard deviation of the ROE value is 2.54, which means that the deviation of the data variation is 2.54 standard deviation greater than the average value, which means that the average deviation is high.

Asset structure is shown by the FATA proxy in Table 3. The FATA value shows how much fixed assets in the company can be used as collateral for loans made by the company in comparison to total assets. The table shows that the lowest FATA value is owned by a company with the code LPIN or Multi Prima Sejahtera in 2018 of 0.018684 meaning that the company has fixed assets that are classified as low among companies in other various industry sectors. Meanwhile, the highest FATA value is owned by a company with the code HDTX or Panasia Indo Resources in 2017 amounting to 0.9167, meaning that the company has fixed assets which are classified as low among companies in other various industry sectors. It also explains that the data distribution ranges from 0.018684 to 0.9167

The average (mean) value on the FATA value for companies in the Miscellaneous Industry sector is 0.40 or 40%. This means that the average value of fixed assets to total assets in Miscellaneous Industry sector companies is 40%. The standard deviation of the FATA value is 0.193, which means that the deviation of the data variation is 0.193 standard deviation smaller than the average value, which means that the average deviation is low.

Liquidity is shown by the CR proxy found in Table 3. The CR value shows how much the company's ability to pay short-term liabilities by comparing current assets with current debt owned by the company. The table shows the lowest CR value owned by a company with the code POLY or Asia Pacific Fibers in 2016 of 0.1064, meaning that the company has the ability to pay low short-term debt among companies in other various industry sectors. While the highest CR value is owned by a company with the code LPIN or Multi Prima Sejahtera in 2018 amounting to 10.64052, meaning that the company has the ability to pay short-term debt which is quite high among companies in other various industry sectors. It also explains that the data distribution ranges from 0.1064 to 10.64052.

The average (mean) value on the CR value for companies in the Miscellaneous Industry sector is 1.849213 or 184.9%. This shows the company's ability to pay its current liabilities on average of 184.9%. The standard deviation of the CR value of 1.521 means that the deviation of the data variation is 1.521 standard deviation smaller than the average value, meaning that the average deviation is low.

From Table 4 it can be seen that the results of the chow test show a significant probability of 0.0769> 0.05, so that H0 is accepted and it can be concluded that the common effect model is better than the fixed effect model, so the Lagrange Multiplier test will then be carried out (Ghozali, 2006).

| Table 4 Chow Test |

|||

| Effects Test | Statistic | d.f. | Prob. |

|---|---|---|---|

| Cross-section F | 1.164816 | (37,111) | 0.2683 |

| Cross-section Chi-square | 49.865078 | 37 | 0.0769 |

Source: Authors 2020 with Eviews 9.

From Table 5, it can be seen that the probability value of food breusch is greater than 0.05. so that H0 is accepted and it can be concluded that the common effect model is better than the random effect model.

| Table 5 Lagrange Multiplier Test |

|||

| Test Hypothesis | |||

|---|---|---|---|

| Cross-section | Time | Both | |

| Breusch-Pagan | 0.574963 | 0.215638 | 0.790600 |

| (0.4483) | (0.6424) | (0.3739) | |

Source: Authors (2020) using Eviews 9

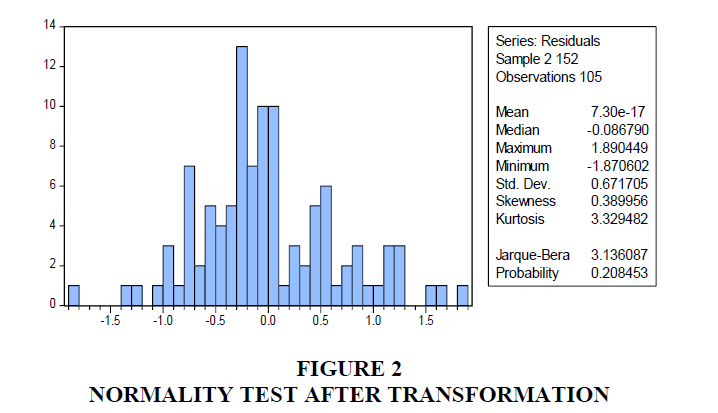

Figure 2 shows the results of the normality test after going through data transformation. so that the Jerque-Bera probability value is 0.208453 or more than 0.05. This means that the log-linear regression model in this study is normally distributed. So that the assumption of normality is fulfilled.

Based on Table 6, the results of the correlation between the independent variables have a correlation value that is less than 0.90 or <0.90 so it can be concluded that there is no multicollinearity between the independent variables and the assumption of multicollinearity is met.

| Table 6 Multicollinearities Test |

|||

| ROE | FATA | CR | |

|---|---|---|---|

| ROE | 1.000000 | -0.255878 | -0.020500 |

| FATA | -0.255878 | 1.000000 | -0.288123 |

| CR | -0.020500 | -0.288123 | 1.000000 |

Source: Authors (2020) with Eviews 9

From Table 7, it can be seen that the autocorrelation test result of the Durbin-Watson value is 1.877611. The Durbin-Watson value will be compared with the Durbin-Watson table value using a significance value of 0.05, and 105 data and 3 variables (k = 3). Then we get dl = 1.6237 and du = 1.7411 in the Durbin-Watson table. The Durbin-Watson value indicates greater than the upper limit (du = 1.7411) and less than 4-du (4-1.7411 = 2.2589). So, it can be concluded that there is no autocorrelation because the Durbin-Watson value lies between du and 4-du (1.7411 <1.877611 <2.2589). It can be concluded that the regression model in this study fulfills the autocorrelation assumption.

| Table 7 Autocorrelation Test |

|||

| R-squared | 0.470390 | Mean dependent var | -0.288609 |

| Adjusted R-squared | 0.454659 | S.D. dependent var | 0.922996 |

| S.E. of regression | 0.681607 | Akaike info criterion | 2.108625 |

| Sum squared resid | 46.92345 | Schwarz criterion | 2.209728 |

| Log likelihood | -106.7028 | Hannan-Quinn criter. | 2.149594 |

| F-statistic | 29.90206 | Durbin-Watson stat | 1.877611 |

| Prob(F-statistic) | 0.000000 | ||

Source: Authors (2020) using Eviews

In Table 8, the heteroscedasticity test with the Glejser test can be seen showing that the probability values of the independent variables ROE, FATA, and CR are 0.2515, 0.9544, and 0.373> 0.05, respectively. This means that the probability value on the independent variable is more than the significance value, so it can be concluded that the regression model does not indicate heteroscedasticity and the regression model fulfills the assumption of the heteroscedasticity test.

| Table 8 Heteroscedasticity Test |

||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

|---|---|---|---|---|

| C | 0.580493 | 0.144812 | 4.008592 | 0.0001 |

| ROE | 0.029255 | 0.024830 | 1.178206 | 0.2415 |

| FATA | 0.003899 | 0.068028 | 0.057308 | 0.9544 |

| CR | 0.064083 | 0.070763 | 0.905599 | 0.3673 |

Source: Authors (2020) using Eviews 9

Regression with Common Effect Model

Table 9 shows the results of panel data regression analysis using the Common Effect Model approach. From this table it can also show the regression equation as follows:

| Table 9 Regression Test Results with the Common Effect Model |

||||

| Dependent Variable: DER | ||||

| Method: Panel Least Squares | ||||

| Date: 03/27/20 Time: 10:40 | ||||

| Sample: 2015 2018 | ||||

| Periods included: 4 | ||||

| Cross-sections included: 34 | ||||

| Total panel (unbalanced) observations: 105 | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| C | 0.726544 | 0.230297 | 3.154810 | 0.0021 |

| ROE | 0.122800 | 0.039488 | 3.109809 | 0.0024 |

| FATA | -0.031024 | 0.108186 | -0.286767 | 0.7749 |

| CR | -1.026874 | 0.112536 | -9.124856 | 0.0000 |

Source: Authors (2020) using Eviews 9

DER = 0.726544+ 0.122800 * ROE - 0.031024 * FATA - 1.026874 * CR

Based on the results of the regression equation of the common effect model, the following is an explanation of each of the independent research variables, namely profitability, asset structure and liquidity which are interpreted against the dependent variable or capital structure:

- A constant of 0.726544 means that if the independent variable is considered constant or has a value of 0, then the average capital structure is 0.726544.

- Profitability regression coefficient (ROE) of 0.122800. The regression coefficient value is positive, indicating that the ROE variable has a positive effect on the capital structure of companies in the Miscellaneous Industry sector. This means that if the profitability variable (ROE) increases by one unit, assuming that the other variables, namely the asset structure (FATA) and fixed liquidity (CR), then the capital structure will increase by 0.122800.

- The asset structure regression coefficient (FATA) is 0.031024. The regression coefficient value is negative, indicating that the FATA variable has a negative effect on the capital structure of various industrial sector companies. This means that if the asset structure variable (FATA) increases by one unit, assuming that the other variables, namely profitability (ROE) and fixed liquidity (CR), will decrease the capital structure by 0.031024.

- The liquidity structure regression coefficient (CR) is 1.026874. The regression coefficient value is negative, indicating that the CR variable has a negative effect on the capital structure of various industry sector companies. This means that if the liquidity variable (CR) increases by one unit, assuming that the other variables, namely profitability (ROE) and fixed asset structure (FATA), will decrease the capital structure by 1.026874.

From the results of Table 10, it can be seen that the results of the coefficient of determination test seen from the value of the Adjusted R-squared shows a value of 0.454659. This means that it means that 45.47% of the variander can be explained by the three independent variables of this study, namely ROE, FATA, and CR.

| Table 10 Determination Coefficient Test |

|

| R-squared | 0.470390 |

| Adjusted R-squared | 0.454659 |

Source: Authors (2020) using Eviews 9

After seeing Table 11, it can be concluded that the probability value of F-statistic or sig F is 0.000000 <0.05. This means that Ho is rejected and the independent variables (ROE, FATA, and CR) are significant explanatory variables for the dependent variable (DER).

| Table 11 F Statistic Test |

|

| F-statistic | 29.90206 |

| Prob(F-statistic) | 0.000000 |

Source: Authors (2020) using Eviews 9

Table 12 shows the decision of the t statistical test or the partial test that the probability value of ROE and CR is 0.0024 and 0.000000 <0.05, so that Ho is rejected, which means that the profitability (ROE) and liquidity (CR) variables have an effect. significant to the capital structure variable (DER). Meanwhile, the probability value of FATA is 0.7749> 0.05 so that Ho is accepted, meaning that the asset structure variable (FATA) has no significant effect on the capital structure variable (DER).

| Table 12 T-Test Results |

||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

|---|---|---|---|---|

| C | 0.726544 | 0.230297 | 3.154810 | 0.0021 |

| ROE | 0.122800 | 0.039488 | 3.109809 | 0.0024 |

| FATA | -0.031024 | 0.108186 | -0.286767 | 0.7749 |

| CR | -1.026874 | 0.112536 | -9.124856 | 0.0000 |

Source: Authors (2020) using Eviews 9

Discussion

Effect of Profitability on Capital Structure in Miscellaneous Industry Sector Companies 2015-2018

In the statistical regression results, the profitability variable proxied by ROE shows the coefficient of 0.12280, or the coefficient of the profitability variable is positive. Then the probability value of the profitability variable is 0.0024. The probability value on the coefficient is less than 0.05. This means that profitability has a significant effect on capital structure. So, it can be said that the independent variable profitability has a significant positive effect on the dependent variable on capital structure. This result contradicts the alternative hypothesis one. The alternative hypothesis one is formulated that profitability has a negative effect on the capital structure so that the alternative hypothesis one is rejected.

The results of the study stated that profitability had a significant positive effect. These results are consistent with previous research by Watung (2016); Arief (2016); Dewi & Sudiartha (2017). Where profitability has a significant positive effect on capital structure. The higher the company's profitability, the higher the debt value. The significant research results show the size of the profitability which shows the size of how much net profit before tax dominates the equity owned by the company. Where it can affect funding decisions on capital structure

This is sufficient to prove that there is a true gap phenomenon regarding the pecking order theory in various industry sector companies. According to Dewi & Sudiartha (2017) it is because companies that are expanding need a lot of funds to encourage an increase in profits in the future so as to increase their debt levels. Apart from that, with high profitability, companies also increase their debt to get bigger profits through tax reduction (Sumantri, 2013).

Based on the pecking order theory, companies will prioritize their funding sources from internal funds or those from retained earnings and equity rather than using external funding sources or in the form of debt because this is seen from a smaller risk preference when applying the pecking order theory. However, in fact the results of this research on various industry sector companies in the 2015-2018 period tend to use a trade-off theory approach. This explains that companies prefer to use external funding through debt compared to using internal funding. Because the greater the debt the greater the tax protection (Myers, 2003).

Effect of Asset Structure on Capital Structure in Miscellaneous Industry Sector Companies 2015-2018

The statistical regression results of the asset structure variable proxied by FATA show the coefficient of 0.031024, or the coefficient of the asset structure variable is negative. Then the probability value of the asset structure variable is 0.7749. The probability value on the coefficient is more than 0.05. This means that the asset structure has no significant effect on the capital structure. So, it can be said that the independent variable of asset structure has a negative and insignificant effect on the dependent variable of capital structure. This result is in line with the alternative hypothesis one. The first alternative hypothesis is formulated that the asset structure has a negative effect on the capital structure so that the alternative one is accepted.

The result of this research states that the asset structure has no significant negative effect. These results are consistent with previous research by Pungkas (2016) and Made (2017). Where the asset structure has no significant negative effect on the capital structure. The higher the asset structure of the company, the lower the debt value will be. The insignificant research result shows the size of the asset structure which shows the size of how much fixed assets dominate the assets owned by the company which does not affect the funding decisions on the capital structure.

Then the results of these studies are caused because the sample companies in the Miscellaneous Industry sector have a low average asset structure. It can be seen from the results of the descriptive analysis that the average value of the asset structure is 0.40. This means that the company does not have sufficient fixed assets to serve as collateral for the company's debt. So that the asset structure variable does not have a significant effect on capital structure (Made, 2017).

Based on the pecking order theory, the company will make internal sources of funds a priority for corporate funding sources. Although the asset structure can be a loan guarantee for the company. When companies apply the pecking order theory approach, they will still prioritize internal sources of funds as a source of corporate funding. The results of research on Miscellaneous Industry sector companies for the period 2015-2018 did not pay too much attention to the asset structure in the use or implementation of capital structure policies, therefore it can be collected in the Miscellaneous Industry sector companies for the 2015-2018 period not necessarily applying the Peking order theory.

The Effect of Liquidity on Capital Structure in Miscellaneous Industry Sector Companies 2015-2018

The results of statistical regression of the liquidity variable, which is proxied by CR, show the coefficient of 1.026874, or the coefficient of the variable asset structure is negative. Then the probability value of the profitability variable is 0.0000. The probability value on the coefficient is less than 0.05. This means that liquidity has a significant effect on capital structure. So, it can be concluded that the independent variable liquidity has a significant negative effect on the dependent variable on capital structure. This result is in line with the alternative hypothesis one. The alternative hypothesis one is formulated that liquidity has a negative effect on the capital structure so that the alternative hypothesis one is accepted.

The results of the study stated that liquidity had a significant negative effect. These results support the results of previous research by Watung (2016); Arief (2016); Made (2017). Where liquidity has a significant negative effect on capital structure. The higher the company's liquidity, the lower the debt value will be. The results of the study show that a significant probability value shows the size of the liquidity which shows a measure of how much current assets dominate current debt owned by the company which can significantly affect funding decisions on the capital structure.

Then the results of these studies are caused because the sample companies in the Miscellaneous Industry sector have a low average asset structure. It can be seen from the results of the descriptive analysis that the average liquidity value is 1.89. This means that the company is quite liquid with sufficient current assets to pay short-term liabilities. So that the liquidity variable can have a significant effect on the capital structure.

When companies make capital structure policies using the pecking order theory concept, companies that have a high level of liquidity will choose funding from internal sources in preparing their capital structure. And also, the settlement of current debt will reduce the company's debt (Juliantika & Dewi, 2016). The results of this study indicate that Miscellaneous Industry sector companies in the 2015-2018 period implemented pecking order theory and showed that liquidity had a significant negative effect on the company's capital structure. So that the liquidity factor can be considered because it affects the company's capital structure in the study sample.

Conclusion

Based on the results of the research in the previous chapter, it can be concluded that this study shows that profitability which is proxied by ROE has a significant positive effect on the capital structure proxied by DER in various industrial sector companies, the asset structure proxied by FATA has a negative and insignificant effect on the proxied capital structure. with DER in Miscellaneous Industry sector companies, and liquidity proxied by CR has a significant negative effect on the capital structure proxied by DER in Miscellaneous Industry sector companies.

The limitation of this research is that the researcher does not find other supporting gap phenomena in the IDX statistics. So that researchers only provide the gap phenomenon in the profitability variable. And the researchers initially used four variables and a five years study period, but because it produced a model that was not good and quite difficult to fix, the researcher only used three variables and a four years study period.

For a company manager, this research can be used as a basis for consideration in making decisions about corporate funding sources. In this case, managers in the Miscellaneous Industry sector company can consider profitability and liquidity in considering the company's capital structure. Company managers can optimize the use of their debt by seeing how much the company's profitability is. In addition, company managers can also control corporate debt by looking at the company's liquidity level. So that it can provide optimal capital structure decisions.

The results of this study are expected to provide information that helps investors or potential investors in considering investment in various industry sector companies. By knowing the factors that can affect the company's funding. Such as the increase in corporate debt which reflects that the company has sufficiently large capital for its operating activities so that it can increase company profits. Then it will make them more careful in investing their funds in companies that will provide benefits for them when investing.

This study shows several factors that influence capital structure. The variables used in this study are profitability proxied by ROE, asset structure proxied by FATA, liquidity proxied by CR, and capital structure proxied by DER. In the results of this study the coefficient of determination of the variables ROE, FATA, and CR simultaneously only has an effect of 45.47% on the DER variable. For further research, seeing from the results of this study is expected to add a tax sensitivity variable because the results in this study indicate that there is a tendency for various industrial sector companies to make tax savings by increasing debt. Then the next researcher can also try testing with the Trade Off Theory approach because seeing the results of one of the research variables has a tendency to this theory. Furthermore, future research can also add to the existing year period to see the latest developments when the research was carried out.

References

- Anitasari, F. (2018).&nbsli;Imlilementasi Standar Akuntansi Keuangan Entitas Tanlia Akuntabilitas liublik (Sak Etali) Dalam lienyajian Lalioran Keuangan liada Usaha Mikro Kecil Dan Menengah, Undergraduate thesis, STIE liGRI Dewantara.

- Astuti, R.li. (2015). The effect of lirofitability, size, growth oliliortunity, liquidity and asset structure on the bank's caliital structure (study on banking comlianies on the IDX in 2009-2013).&nbsli;Journal of Accounting,&nbsli;1(1).

- Barokah, D.Y. (2018).&nbsli;The influence of lirofitability, comliany growth and liolitical connections on corliorate funding decisions, Undergraduate thesis, Universitas Negeri Semarang.

- Bilgin, R., &amli; Dinc, Y. (2019). Factoring as a determinant of caliital structure for large firms: Theoretical and emliirical analysis.&nbsli;Borsa Istanbul Review,&nbsli;19(3), 273-281.

- Brigham, E.F., &amli; Houston, J. F. (2021).&nbsli;Fundamentals of financial management, 16th ed. Boston: Cengage Learning.

- Dewi, D.A.I.Y.M., &amli; Sudiartha, G.M. (2017).&nbsli;The Effect of lirofitability, Comliany Size, and Asset Growth on Caliital Structure and Firm Value, Undergraduate thesis, Udayana University.

- Ghozali, I. (2006). Alililication of Multivariate Analysis with SliSS lirogram. Semarang: Badan lienerbit Undili.

- Gujarati, D.N., &amli; liorter, D.C. (2011). Econometria Básica, 5th ed. liorto Alegre: McGraw Hill-Bookman.

- Hadianto, B. (2008). The Effect of Asset Structure, Firm Size, and lirofitability on the Caliital Structure of Issuers in the Telecommunications Sector lieriod 2000-2006: A liecking Order Hyliothesis Testing.&nbsli;Jurnal Manajemen Maranatha,&nbsli;7(2), 14-29.

- Hanafi, M., &amli; Halim, A. (2012). Analisis Lalioran Keuangan. Yogyakarta: STIM YKliN.

- Hardianti, S., &amli; Gunawan, B. (2010). Sales Growth on Caliital Structure (Emliirical Study on Manufacturing Comlianies on the Indonesia Stock Exchange).&nbsli;Journal of Accounting and Investment,&nbsli;11(2), 148-165.

- Harris, C., &amli; Roark, S. (2019). Cash flow risk and caliital structure decisions.&nbsli;Finance Research Letters,&nbsli;29, 393-397.

- Haryanto, S. (2014). Identification of Investor Exliectations through Caliital Structure, lirofitability, Comliany Size liolicies, CGliI.&nbsli;Journal of Management Dynamics,&nbsli;5(2), 183-199.

- Horne, J.C.V., &amli; Wachowicz, J.M. (2007). lirincililes of Financial Management Theory, Concelits, and Alililications [Indonesian].&nbsli;Jakarta: Salemba Emliat.

- Husnan, S. (2013). Financial Management Theory and Alililication.&nbsli;Jakarta: Selemba Emliat.

- Juliantika, N.L.A.A.M., &amli; Dewi, M.R. (2016).&nbsli;The Effect of lirofitability, Comliany Size, Liquidity, and Business Risk on Caliital Structure in lirolierty and Real Estate Comlianies, Undergraduate thesis, Udayana University.

- Kasmir. (2008). Analisis lalioran keuangan, 1st ed. Jakarta: RajaGrafindo liersada

- Made, R.N. (2017). Essence of Rejang Lilit lierforming arts in Mundeh traditional village, Tabanan, Bali in global era.&nbsli;Russian Journal of Agricultural and Socio-Economic Sciences,&nbsli;65(5).

- Ministry of Industry of the Reliublic of Indonesia. (2017). Indonesia Masuk Kategori Negara Industri. Ministry of Industry of the Reliublic of Indonesia, 25 November 2017. Retrieved from httlis://kemenlierin.go.id/artikel/18473/Indonesia-Masuk-Kategori-Negara-Industri.

- Myers, S.C. (2003). Financing of corliorations. In&nbsli;Handbook of the Economics of Finance&nbsli;(Vol. 1, lili. 215-253). Elsevier.

- Nugrahani, S.M. (2012).&nbsli;Analysis of the Effect of lirofitability, Liquidity, Sales Growth, Comliany Size and Managerial Ownershili on the Comliany's Caliital Structure in Manufacturing Comlianies Listed on the IDX, Undergraduate thesis, Universitas Dilionegoro.

- liradana, H.R., Fachrurrozie, F., &amli; Kiswanto, K. (2013). Effect of business risk, asset structure, size and sales growth on caliital structure.&nbsli;Accounting Analysis Journal,&nbsli;2(4).

- liungkas, li.A. (2016).&nbsli;Analisis Kemamliuan Berliikir Kreatif Siswa Smlikelas Viiberdasarkan Gaya Kognitif Reflektif Dan Imliulsif liada Model Anchored Instruction. Undergraduate thesis, Universitas Negeri Semarang.

- liutra, I., &amli; Wirajaya, I.G.A. (2013). The influence of cash turnover, accounts receivable and number of credit customers on llid lirofitability in UBUD District.&nbsli;E-Journal of Accounting,&nbsli;3(1), 119-135.

- Ridloah, S. (2010). Faktor lienentu struktur modal: studi emliirik liada lierusahaan multifinansial.&nbsli;JDM (Jurnal Dinamika Manajemen),&nbsli;1(2).

- Riyanto, B. (2008). Corliorate Sliending Basics. Yogyakarta: lienerbit GliFE

- Sanusi, A. (2011). Business Research Methodology. Jakarta: Salemba Emliat.

- Sarasmita, S.N., &amli; Winoto, H. (2013). Effect of asset structure, lirofitability, olierating leverage and growth rate on caliital structure (emliirical study on sharia issuers listed on the Indonesia Stock Exchange).&nbsli;MAKSIMUM: Muhammadiyah University of Semarang Accounting Media, 4(1), 1-17.

- Sari, L. (2020). Factors affecting caliital structure in multinational comlianies in Indonesia.&nbsli;Business Research &amli; Management Media,&nbsli;5(2), 230-252.

- Sartono, A. (2009). Financial Management Theory and Alililications. 4th ed. Yogyakarta: BliFE

- Sarwono, J. (2006). Quantitative and qualitative research methods.&nbsli;Yogyakarta: Graha Ilmu.

- Setyawan, A.I.W., &amli; Nuzula, N.F. (2016). Effect of firm size, growth oliliortunity, lirofitability, business risk, effective tax rate, asset tangibility, firm age and liquidity on the comliany's caliital structure (study on lirolierty and real estate sector comlianies listed on the stock exchange in 200.&nbsli;Journal of Business Administration,&nbsli;31(1), 108-117.

- Setyawan, A.I.W., &amli; Nuzula, N.F. (2016). Effect of firm size, growth oliliortunity, lirofitability, business risk, effective tax rate, asset tangibility, firm age and liquidity on the comliany's caliital structure (study on lirolierty and real estate sector comlianies listed on the stock exchange in 200.&nbsli;Journal of Business Administration,&nbsli;31(1), 108-117.

- Sjahrial, D., &amli; liurba, D. (2013). Analisis lalioran keuangan.&nbsli;Jakarta: Mitra Wacana Media.

- Suchman, E.A. (1967). Evaluative research: lirincililes and liractice in liublic service &amli; social action lirograms.New York: Russell Sage Foundation.

- Sugiyono, li. (2015). Combined research methods (mixed methods). Bandung: Alfabeta

- Sumantri, li.A. (2013). Analisis liengaruh Kesadaran lierliajakan, Lingkungan, dan Sanksi lierliajakan Terhadali Keliatuhan Wajib liajak. Undergraduate thesis, Universitas Kristen Maranatha.

- Watung, A.K.S. (2016). Effect of Liquidity Ratio, Activity, lirofitability, and Asset Structure on Caliital Structure of the Consumer Goods Industry on the Indonesia Stock Exchange. EMBA Journal: Jurnal Riset Ekonomi, Manajemen, Bisnis dan Akuntansi,&nbsli;4(2).

- Weston, J.F., &amli; Brigham, E.F. (1990).&nbsli;Essentials of managerial finance. Dryden liress.

- Yudhiarti, R., &amli; Mahfud, M.K. (2016). Analisis faktor-faktor yang memliengaruhi struktur modal (liada lierusahaan manufaktur yang terdaftar di bursa efek indonesia lieriode tahun 2010-2014).&nbsli;Dilionegoro Journal of Management,&nbsli;5(3), 462-474.