Research Article: 2018 Vol: 17 Issue: 6

Financial Incentives: The Impact on Employee Motivation

R. Rina Novianty, University of Padjajaran Bandung

Siti Noni Evita, University of Padjajaran Bandung

Abstract

The financial incentive is a bonus given to employees as a result of employee work motivation in the company. This research use approach of research method with the approach of path analysis. Measurement of the research using questionnaires with a semantic differential scale, while the population in the study consisted of 43 employees. The result of the research shows that the dimension of the research variable is valid and the variable of financial incentives relationship has a positive effect on employee motivation.

Keywords

Financial Incentives, Employee Motivation.

Introduction

Individuals will do an action because of the encouragement from both inside and outside themselves to fulfil their needs. The role of employees who have high motivation and supported skills and knowledge in doing the work is needed. This can mean that one of the determinants of an increase in company performance is the motivation of its employees. This is supported by Weiner's (2014) assertion in his book which states that work motivation is the driving force that creates the excitement of one's work so that they will cooperate, work effectively and integrate with all their efforts to achieve satisfaction. “Several factors can affect employees’ motivation. In recent research, the relationship between job satisfaction, motivation and low burnout level between the employees have been verified (Papasotiriou et al., 2018)”. Also mentoring can positively contribute to career development and motivation, especially in the case of new employees (Ktena et al., 2018)

Incentives in the form of finance are expected to increase employee motivation because the incentives in the form of financial employees can be allocated to the needs he wants. Dessler added, Giving this incentive requires a fair and decent employee perspective. Fair has the meaning of financial incentives given the company in accordance with or commensurates with the work and achievements achieved by employees. While feasible means financial incentives given to employees can meet the needs of these employees, the feasibility can also be seen by comparing the provision of incentives made by other companies (Dessler, 2014). Distributor Company in Bandung which is divided into 3 parts, namely field employees (sales associates), administrative employees, and employees have 43 employees in one working day, and employees can work at least 10 hours of work with the possibility of additional work. In connection with the above problems, then the impact that will appear on the employee is a labour turn-over.

Several factors are related to the problems that have been stated before, and the research was conducted on distributor companies in Bandung, this is because only a number of distributor companies have decreased sales targets of companies such as consumers, production and other things due to the low motivation of employees so that the impact on incentives. This research was conducted because of the ineffectiveness of company incentives to employees, the low and work motivation of employees.

Literature Review

Variable of Financial Incentive

Financial Incentive is another form of direct compensation beyond salary which in other words is called a performance-based compensation system. According to Dessler (2014), “Financial incentives are rewards or replies in the form of the financial form given to employees whose level of production exceeds predefined standards”. Meanwhile, according to Werther & Davis (1989) also added that the incentive system connects employee compensation and work performance by paying according to the results of their work and not because of seniority or length of work. Meanwhile, according to Hasibuan (2013) argues that as a means of incentive motivation aims to direct and drive the power and potential of employees to want to work hard and enthusiastic in achieving optimal work, in order to realize the goals that have been determined. The existence of incentives that provide pay based on work performance will enhance employee motivation in the effort to achieve the goals set.

The research by Lee (2015) proves that financial incentives have a significant effect on the performance of medical personnel, which is undoubtedly the result of an increase in motivation based on given financial incentives. The research, Basu & Kiernan (2016), adds that financial incentives affect healthy lifestyle changes. The discussion raised almost identical to the subject of this study regarding motivation. Therefore, the research is also capable of being the trigger for doing this research. It can be concluded that Financial Incentive is the result of remuneration received by employees in the form of financial based on contributions and work performance that exceeds the average standard of other employees. Financial Incentive is done as a measure of investment by the company to its employees. Besides, incentives aim to motivate employees to do their work which leads to the achievement of company goals.

Variable of Work Motivation

In relation to the work environment, Robbins (2006) explains that work motivation is as follows: “Motivation is the process that accounts for individuals' intensity, direction, a persistence of effort toward attaining a goal”. From Robbins’s explanation of this motivation, it can be seen that motivation is defined as a process that participates in determining the intensity, direction and perseverance of individuals in their efforts to achieve a goal. Although general motivation is related to efforts in many directions, Robbins narrows the focus on organizational goals to show that In addition, Robbins (2006) adds an explanation related to work motivation that supports the previous definition, as follows: “The willingness to exert high level of effort toward organizational goal, conditioned by the ability to satisfy some individuals need.” Whereas, Winardi (2007) explained, “Motivation is a potential force that exists within a person that can be developed by themselves or with the help of others who can influence the results of their performance through monetary and non-monetary rewards which depend on the situation and conditions faced by the related person”.

From the definition of work, motivation can be seen that employees who are motivated will make efforts in the work that can produce optimal performance. The process of motivation is focused on the views of employees in meeting their needs simultaneously with the achievement of corporate goals. Needs are the main trigger of the employee's performance against the implications of the firm's impetus through a reward.

The Impact of Financial Incentive Variable on Employee Motivation Variable

The results of research conducted Wasito (2014) explains the influence of material incentives on motivation has a significant influence, where the higher the incentive given the company, the higher the motivation of his work. Material incentives are one of the company's financial compensations beyond the basic salary that employees receive on their performance. The Company believes that the system of compensation in general and the material incentive system, in particular, affects the motivation of employees in doing their work.

Further research conducted by (Permatasari, 2011; Handrian, 2015), resulted in similar conclusions in the influence of incentives on employee motivation. In addition to similarity in the conclusions section, the same thing is found in the dimensions of work motivation and dimensions. These dimensions and indicators are the reference materials in conducting this research: McClelland proposes the Need Theory. Besides, the phenomenon that occurs in company employees also illustrates the suitability of its needs with this theory. In the theory of needs put forward by McClelland, there are three kinds of needs, an individual with a strong need will be motivated by using appropriate behaviour to satisfy his needs. The three needs are needs for achievement. The need for power (needs of power), and the need for relationships (needs of affiliation).

Methodology

The method used in conducting research using descriptive and verification research methods. This research was conducted by census technique because the number of respondents in the study was 43 employees. The research hypothesis, Financial Incentive Variables (Variable X) with Financial Perspective Dimensions (X1.1), Financial Satisfaction Dimensions (X1.2), Dimensions of Value of Loss (X1.3) and Self-Selection Dimensions (X4) are 10 questions questionnaires given to respondents as well as work motivation variables (Y variable) with Dimensions of Need for achievement (Y1), Dimensions of Relationship Needs (Y2) and Dimensions of Needs for power (Y3), as many as 10 questions questionnaire given to respondents. The measurement scale in this study used 10 levels; respondents who gave number 1 to the statement given were very negative while respondents who gave the number 10 meant the perception of the statement submitted was very positive. The analytical tool used with the Smart Partial Least Square (PLS) method with the path analysis approach. The data analysis model in the study using Validity Test is done to measure the validity of a questionnaire, in research using the Pearson Product Moment correlation formula, Reliability Test used to test how the consistency of a questionnaire on each variable studied, while testing is done with the Cronbach alpha technique with a level (α)>60% (0.60) then the variable is said to be reliable otherwise if Cronbach alpha (α)<60% (0.60) then the variable it is said to be unreliable and hypothesis testing is used to explain the direction of the relationship between the independent variable and the dependent variable.

Results And Discussion

Partial Least Square (PLS) Analysis

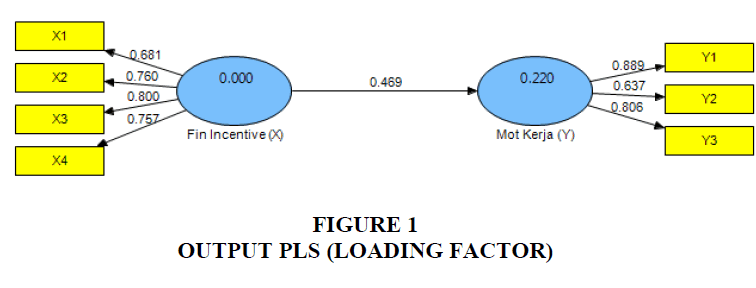

Outer models are used to specify the relationship between latent variables and indicators or manifest variables. The outer model defines how each indicator block corresponds to its latent variable. The value of loading factors for all indicators has met the requirements, which is greater than 0.5. Outer models include convergent validity (loading factors), discriminant validity, composite reliability and Cronbach alpha. Based on Figure 1, the Output PLS (Loading Factor) in Financial Incentive Variables (Variable X) with Financial perspective variable (X1.1) have a factor loading value of 0.681, the dimension of financial satisfaction (X1.2) has a factor loading value of 0.760, the value dimension of loss (X1.3) has a loading factor value of 0.800 and the Self-Selection Dimension (X4) has a factor loading value of 0.757 as well as work motivation variables (Y variable) with Dimensions of Need for achievement (Y1) has a factor loading value of 0.889, Dimension The need for relationship (Y2) has a factor loading value of 0.637 and the Dimension of Need for power (Y3) has a factor loading value of 0.86. This shows the variable dimensions in this study have a loading factor value above 0.5, which means that each variable dimension is declared valid.

Indicator variables can also be measured by evaluating the results of cross loading (discriminant validity) which shows that the dimension correlation values in variables are better than other variable dimensions. The method used to view discriminant validity is by looking at the value of the square root of Average Variance Extracted (AVE). The recommended value is above 0.5. The test results on the Average Variance Extracted (AVE) model show AVE values above 0.5, this proves that all variables in the study are declared valid. Here are the AVE values in this study (Table 1).

| Table 1 Average Variance Extracted (AVE) |

|

| AVE | |

| Financial Incentive (X) | 0.564 |

| Employee Motivation (Y) | 0.615 |

Partial Least Square Analysis.

Composite reliability (Table 2) measures internal consistency and its value must be above 0.6. Explains that this research was included in the reliable category because it was in accordance with the standard composite reliability value with a value of>0.7.

| Table 2 Composite Reliability |

|

| Composite Reliability | |

| Financial Incentive (X) | 0.837 |

| Employee Motivation (Y) | 0.825 |

In addition to being tested in the calculation of composite reliability, reliability tests can be strengthened by Cronbach alpha (Table 3) where the expected value is>0.6. Based on Cronbach Alpha Table 3, it is known that all variables have a value of Cronbach alpha that is more than 0.6 so that each variable in this study is declared reliable.

| Table 3 Cronbach Alpha |

|

| Cronbach Alpha | |

| Financial Incentive (X) | 0.743 |

| Employee Motivation (Y) | 0.726 |

Inner Model Evaluation

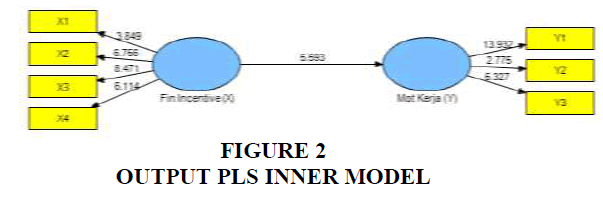

Inner models are used in specifying relationships between latent variables (structural models) that describe the relationship between latent variables based on substantive theory. Based on Figure 2 Output PLS Inner Model, shows that the large t-statistic value of financial incentive (X) on work motivation (Y) is 5.593, meaning that the inner model evaluation value that explains each variable in this study is declared valid. As follows:

1. The relationship between financial incentive and financial perspective with the T-statistic value of 3.84 and the original sample estimate value of 0.681 means that there is a positive and significant relationship. The relationship between financial incentive and financial satisfaction with a T-statistic value of 6.75 and the original sample estimate value of 0.76 means that there is a positive and significant relationship. The relationship between financial incentives with the value of the loss, with the T-statistic value of 8.47 and the original sample estimate value of 0.80, meaning that there is a positive and significant relationship. The relationship between financial incentive and self-selection, with a T-statistic value of 6.11 and an original sample estimate of 0.75, means that there is a positive and significant relationship.

2. The relationship between work motivation and the need for achievement, with a T-statistic value of 13.93 and an original sample estimate of 0.88, means that there is a positive and significant relationship. The relationship between work motivation and the need for power with a T-statistic value of 2.77 and an original sample estimate of 0.63 means that there is a positive and significant relationship. The relationship between work motivation and the need for a relationship with the T-statistic value is 2.77, and the original sample estimate is 0.63 which means there is a positive and significant relationship.

Hypothesis Test Results

Testing the hypothesis in this study by looking at the results of data processing PLS on the Path Coefficients (Table 4).

| Table 4 Path Coefficients |

|||

| Inter-variable relations | Original Sample (O) | T Statistics | H0 |

| Financial Incentive (X) → Employee Motivation (Y) | 0.469 | 5.593 | Rejected |

The results show that financial incentives influence work motivation. The table shows the T-statistic value of 5.593 more significant than the T-table amount of 2.019 (5.593>2.019), which means the value of H0 is rejected where t-value>t table and the original value of the positive sample is 0.469. This shows that financial incentive has a positive effect on employee work motivation. This is in line with research conducted by Lee (2015) which proves that financial incentives have a positive effect on the work motivation of medics. Besides, research conducted by Basu & Kiernan (2016) also proves the same thing, namely that financial incentive programs stimulate changes in motivation to change healthy lifestyles, where the motivation variables for healthy lifestyle changes can be attributed to the employee motivation variables studied.

Conclusions

Financial incentive in the perspective of financial perspective, financial satisfaction, a value of loss and self-selection is a form of finance or compensation in the form that is given to employees to motivate employees to do their jobs to increase the need for achievement, the need for work relationships and needs willpower. Giving financial incentive is as a basis so that employees can improve work performance, increase employee motivation in achieving goals, level of welfare and build work motivation that can be achieved optimally. This study aims to make employees in the company more improve personal performance and team performance so that they try to provide work morale to employees in improving employee work performance and achieving optimal work results. Besides, the company, in this case, is demanded not only in achieving employee work targets, employee motivation but must pay attention to aspects of compensation policy received from work contributions, employee resources in each division to be able to work effectively and reduce employee workload. Further research is expected that the company can pay attention to the compensation policy to employees, employee performance achievements, and position placement to employees to increase the work efficiency of employees.

References

- Basu, S., & Kiernan, M. (2016). A simulation modeling framework to optimize programs using financial incentives to motivate health behavior change. Medical Decision Making, 36(1), 48-58.

- Conrad, D.A., & Christianson, J.B. (2004). Penetrating the black box: financial incentives for enhancing the quality of physician services. Medical Care Research and Review, 61(3_suppl), 37S-68S.

- Dessler, G. (2014). Human resource management. Jakarta: Salemba Empat.

- Frederik, A., & Niels, U. (2010). SEM partial least square (PLS). Bingley, UK

- Ghozali, I. (2008). Structural equation modeling: Alternative method with partial least square (PLS). Semarang:BP Universitas Diponegoro.

- Gibson, I., & Donnely. (2003). Organization and management: Structure behavior. Jakarta: Erlangga

- Greenberg, J., & Baron, A.R. (2008). Motivation in organization. New Jersey.

- Guo, Z.Y., & Luo, Y. (2017). The effect of sales and evidence from micro data. Research in World Economy, 8(1), 37.

- Handrian, R. (2015). Influence incentives on employee motivation and performance at PT. Astra international Tbk. Regional Parts Bandung, Thesis Published.

- Hasibuan, M. (2013). Human resource management. Jakarta: Bumi Aksara.

- Ktena, Ch., Sidiropoulos, G., Chalikias, M., Ntanos, S., & Kyriakopoulos, G. (2018). The contribution of mentoring on employee's career development with non-dependent work relation: The case of the networking company LR health & beauty systems. Academy of Strategic Management Journal, 17(1).

- Lee, T.H. (2015). Financial versus non-financial incentives for improving patiences experience. Harvard Business Review, 6,1-6.

- Maslow, A. (2003). Motivation and personality. Jakarta: Midas Surya Grafindo.

- McClelland, D. (1987). Human motivation. Cambridge: Cambridge University Press.

- McShane, S., & Von, G. (2008). Organizational behavior, (5th Edition). Chicago, IL: McGraw Hill.

- Mondy, R.W., & Robert, M.N. (2006). Human resource management, (Ninth Edition). USA: Prentice Hall.

- Papasotiriou, E., Sidiropouos, G., Ntanos, S., Chalikias, M., & Skordoulis, M. (2018). The relationship between professional burnout and satisfaction: A case study for physical education teachers in a Greek urban area. Serbian Journal of Management, 13(2).

- Permatasari, W. (2011). The influence of incentives on employee motivation at PT. Mobile 8 Telecom Tbk. Bogor Branch, Unpublished Thesis.

- Prabu, M., & Anwar. (2010). Human resource management. Jakarta: Ghalia Indonesia

- Putra, F. (2012). The influence of incentives on employee motivation PT. Jamsostek (Persero) Bandung Branch, Unpublished Thesis.

- Robbins, S. (2014). Organizational behavior: Concepts, controversies, and applications. San Diego State University: Prentice Hall International Inc.

- Robbins, S.P. (2006). Organizational behavior. Hadyanan Pujaatmaka. Jakarta: PT. Prenhallindo.

- Rozalia, B. (2013). The Influence of Incentives on employee motivation at PT. Bank Rakyat Indonesia Tbk. Serdang Unit, Unpublished Thesis.

- Salamzadeh, Y., Nejati, M., & Salamzadeh, A. (2014). Agility path through work values in knowledge-based organizations: a study of virtual universities. Innovar, 24(53), 177-186.

- Schultz, D., & Sydney, E. (2013). Theories of personality. California: Brooks Publishing Company.

- Simamora, B. (2002). Management research guide. Jakarta: PT Gramedia Pustaka Utama.

- Teleki, S.S., Damberg, C.L., Pham, C., & Berry, S.H. (2006). Will financial incentives stimulate quality improvement? Reactions from frontline physicians. American Journal of Medical Quality, 21(6), 367-374.

- Veithzal, R., & Ella, J.S. (2009). Human resource management for companies: From theory to practice. Jakarta: PT Rajagrafindo Persada.

- Wasito, E. (2014). The effect of material incentives on work motivation and employee performance of STIE Ekuitas Bandung. Unpublished Thesis.

- Weiner. (2014). Handbook of psychology: Industrial and organizational psychology. New Jersey: John Willey & Sons, Inc.

- Werther, W.B., & Davis, K. (1989). Personnel management and human resources. New York: McGraw-Hil

- Winardi, J. (2007). Motivation and motivation in management. Jakarta: Raja Grafindo Persada.