Research Article: 2021 Vol: 27 Issue: 4

Financial Decision Making and Forecasting Techniques On Project Evaluation: A Planning, Development and Entrepreneurial Perspective

Mohammad Shibli Shahriar, Daffodil International University

K.B.M. Rajibul Hasan, Agrani Bank Limited

Tanzina Hossain, Daffodil International University

Tahrima Haque Beg, Sher-e-Bangla Agricultural University

K.M. Anwarul Islam, The Millennium University

Nurul Mohammad Zayed, Daffodil International University

Abstract

The application of forecasting techniques as part of project evaluations is an indispensable task as without applying proper forecasting procedure, appropriate financial decision making could not be achieved. The current study attempts to lay down a comprehensive account of the available forecasting techniques that aid a given project with its financial decision-making requirements. Through a comprehensive literature review, it has been found that a numberof forecasting techniques are applied in making appropriate financial decisions as part of project evaluation. The technique of “Markov PERT” analysis has recently been used to accurately assessthe time of project completion and the cost at completion. It has also been revealed that the application of hybrid algorithms and the use of artificial intelligence is growing for accurate forecasting results. However, it is found that in evaluating a project, the success of the application of various financial forecasting techniques such as NPV, ARR, IRR, Payback Period, Support Vector Machine, Monte Carlo Simulation, S curve and others, essentially depends upon the project nature and environment. It is, therefore, recommended that financial decision making should not only be done based on statistical error margins but only on the reliability of the warning signals as generated by any forecasting techniques.

Keyword

Forecasting Techniques, Project Evaluation, Financial Decision-Making, Financial Forecasting.

Introduction

Background

In today’s uncertain business environments, project managers and financial experts are continually pressed to take appropriate decisions by using the various forecasting techniques available (Wang et al., 2018). The methodology of forecasting, as applied in conjunction with the requirements of project evaluation, forms the groundwork, which decides the motivation for the project sponsors, management team and other stakeholders to pursue or reject any given venture. Without the aid of the various forecasting techniques, the necessary cost-benefit analysis of any project could not have been accurate, and it thus provides a reason to study the available literature on project evaluation and forecasting. Despite being widely acknowledged as a critical and mandatory technique, the appropriate use of forecasting methods is often disregarded by many project managers, on account of credibility issues. As noted by Wang et al. (2018), in project evaluation and forecasting, one of the hardest problems is to accurately predict the completion date. And, as such if comprehensive details on the error dimensions as well as reliability of the existing forecasting methods are not known, the selection of one for a particular project becomes tough choice. The current study aims to search the existing literature on the role of forecasting techniques in tandem with project evaluation methodologies, so a comprehensive work could be formed that shows the subject’s significant relationship with the requirement of judicious decision making with respect to any given project’s financial aspects and choices

Financial Decision Making As Part of Project Evaluation

For business projects to be successful it is of utmost importance that the same does not overrun the time and cost constraints, and for this to be a case, it is desired that prudent financial decisions are made. As observed by Eti (2021), 66% of “enterprise software projects” go beyond their cost budgets, as a result of wrong financial choices, so the role of financial forecasting techniques becomes extremely critical for project managers. As pointed out by Celik et al. (2019), the application of financial forecasting methods has become widespread as part of project evaluation requirements for various reasons, and some of them could be stated as in the following.

- Forecasting helps connect the entire set of project data to come up with an accurate project budget.

- With the help of financial forecasting techniques cost, profits and revenues could be assessed realistically, as part of a project evaluation.

- Financial forecasting is an indispensable tool for any project evaluation requirement, as it helps the concerned managers to take appropriate financial decisions by offering a comparison between the planned and actual cost.

Literature Review

The Concept of Forecasting in Project Evaluation as Necessary for Making Appropriate Financial Decisions

As per the view of Ballesteros-Pérez et al. (2020), in real life project evaluation tasks, for making smart financial decisions, it is not desired to consider all of the factors that might happen to impact the project, but selecting the right scope for the same is necessary to come up with a dependable set of financial forecasts. For example, as shown by the existing literature, the first question that needs answering is the “time horizon of the analysis”. As stated by Batselier and Vanhoucke (2017), once the schedule of the WBS (“Work Breakdown Structure”), as associated with any project is determined, the following parameters would have to be affixed, “quantity, value and the timing of occurrence of various goods, services and costs as part of the project activities” for initiating the forecasting process.

As part of the existing methodologies for financial forecasting of projects, the application of the “discounted cash flow analysis” is quite popular for determining the financial worth of the same. And this becomes the basis for the investors to make their decisions regarding investments into the concerned projects. The “Discounted Cash Flow Rate of Return Method” is one of the standard financial forecasting techniques, which is used to evaluate projects, in terms of their financial feasibilities, so appropriate investment decisions could be made. By technical definition DCFR (“Discounted Cash Flow Rate”), is the interest rate required to turn the summation of the present value of the project investment exactly the same as the total of the present values of each of the project year’s “net cash flows” (Wachs, 2018). According to the observations of Wang (2018), it has been found that for projects to be feasible the value of the DCFR should be 15% or above. This presented a baseline for the choice of large to medium sized projects. As observed by Harris and Wonglimpiyarat (2020), to apply the DCFR method, it is essential to apply suitable financial models for being able to come up with the future cash flows, and for that, the model has to accurately project the various revenue streams, expenses and investments. From this finding, it can be assessed that the choice of financial modelling technique, as part of this method, would determine the result accuracy. According to Eti (2021), all of the necessary financial forecasts for a project evaluation could be achieved through establishing the “income statements” and the “balance sheets”. Therefore, without having any set of reliable historic data, proceeding with this method could be fraught with risks. As observed by Wang et al. (2018), to calculate the profitability of any project, the concerned managers would have to analyse the historical dataset. In the previous study the technique of “error gradient descent algorithm” was used to reduce the mean square error of the concerned project’s forecasted income statement. Moreover, it has been found that the use of the forecasting technique of “depreciation schedule” for any project’s assets and expenses is a great tool for making appropriate financial decisions. In this context, it has to be mentioned that project managers, in charge of deciding the financial feasibility of a project, would have to opt for the most promising projects by analysing the following parameters: “forecasted cash flow” and “expected rates of return”. As pointed out by Ballesteros-Pérez et al. (2020), the parameter of IRR (“Internal Rate of Return”) is one of the key standards for determining the nature of capital budgeting. In its technical definition, the IRR represents the “Annualized effective compound rate of return of a project”. For assessing the financial feasibility of comparable projects, the one with a higher index of IRR is preferred by the concerned managers. Along the similar lines, the method of SLD ("Straight Line Depreciation") is applied by the concerned project managers to decide the feasibility of any capital investment as related to the execution of projects. As put forward by Celik et al. (2019), the concept of WACC or “Weighted Average Cost of Capital” is another critical thing for making apt financial decisions as related to the selection or execution style of projects. In essence, the measure of WACC helps assess the financial risks associated with any project. Again, when the value of WACC is determined, the measure for the “discount factor” could be determined, which indicates the monetary worth of future earnings. As stated by Harris and Wonglimpiyarat (2020), only those projects should be commenced where the value of the “discounted NPV” is more than the expected investments costs. As part of the financial forecasting of any project, for mitigating the risks, the following methods of profit projection, “NPV, IRR and payback period calculation” are essential. The concept of NPV (“Net Present Value”) has been hailed as one of the most accepted forecasting methods that assist with prudent financial decision making.

NPV

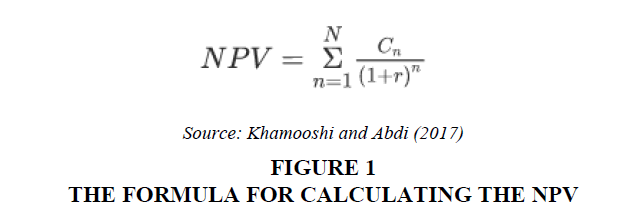

Conceptually NPV represents the value of in and out cash flows, as about any project, after being discounted by the "cost of capital". The formula for calculating the NPV for any project has been shown in the following image.

In this context, Cn is the project cash flow for the period n, and r is the “rate of return”. An NPV analysis is normally done by project management teams for assessing the projected investment returns. It has been suggested that out of the NPV analysis if any project yields a negative value, then the same should not be pursued (Ballesteros-Pérezet al., 2020).

Synthesis

The method of NPV is a good fit for project evaluation. However, if the project is too complex in terms of being inscrutable as to the flow of project cost, the calculation of the NPV is rather difficult. But as it can be understood that the NPV method helps in assuming realistic reinvestment situations, the application of it for large projects is justified.

The Process for Financial Appraisals of Projects

The quantitative forecasting technique associated with any project’s financial appraisals is about making a reasonable and accurate prediction as to the expected sources of cash flows, their risks and also the alternative cash flow simulations. Moreover, as observed by Bilenko et al. (2019), undertaking a sensitivity analysis on the expected cash flows and tweaking the simulation parameters to estimate the NPV of projects are essential activities that fall under the scope of the forecasting exercise. According to the works by Fontes et al. (2020), for making appropriate financial decisions in any project “the discounted cash flow method” is one of the best techniques as it maximises the wealth of the project shareholders. As put forward by Ros?on et al. (2020), once the quantitative analysis and forecasting are done with, project evaluation would have to accommodate an evaluation of the concerned qualitative factors. These factors are the ones, which have significant imprints on the success of any project but could not be expressed in the monetary terms.

Cost Benefit Analysis for Project Evaluation

There are certain standard techniques apart from the NPV analysis that helps forecast the economic feasibility of projects and they can be listed as in the following.

Payback (PB) period

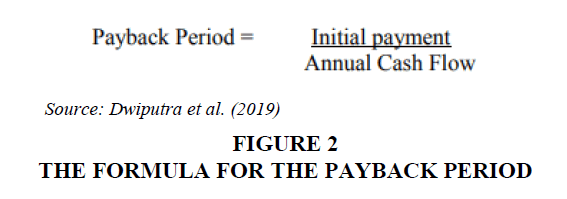

As stated by Magni and Marchioni (2018), the payback period for a project is the time period required to equate the cash flow surpluses to the project investment, and as a generic rule for forecasting the economic feasibility of projects, the ones with longer payback periods should be discarded in favour of the ones with smaller periods. As observed by Solonina et al. (2019), the payback method should be exercised to assess any project’s liquidity status as opposed to the profitability question. In its technical definition, the payback period for a project could be forecasted by the following formula.

Despite its simplistic nature, this particular method of capital budgeting and forecasting has been criticised by the researchers, on account of the following facts. The PB methodology is not suitable for accurately assessing the comprehensive range of financial lucrativeness as associated with any project, so financial decision making, based upon the same, could not be self-sufficient. However, despite the criticism, it has been largely accepted that this method enables a financial manager of a project to manage the economic risks by assessing the duration required for recouping the investments (Ros?on et al., 2020). But, this method is still not comprehensive in it, for forecasting purposes, as it does not account for the key concept of “time value of money”. It has also been found that this particular technique of project feasibility forecasting is appropriate for social or administrative types of projects, which is to say when the return on investment is not the ultimate priority.

ARR (Accounting Rate of Return)

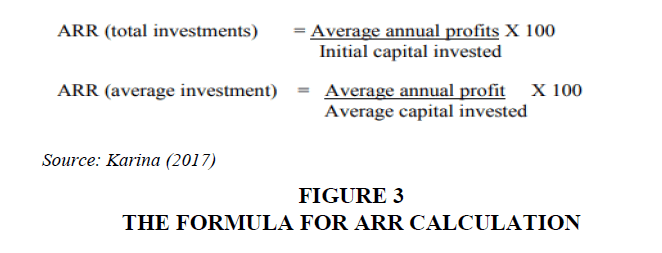

ARR could be defined as the mean income of any project once the necessary deductions depreciations have been accounted for. According to Karina (2017), with this technique, the concerned finance manager utilises “the net income and book value” of the project investment, as opposed to the projected cash flows. However, the measure of ARR could also be calculated by using the figure for total profit as contrary to the suggested one: the average project profit. It has been found that the technique of ARR is predominantly applied for evaluating capital projects in tandem with other techniques like the NPV and so on. It has also been reported that for making appropriate forecasting, concerning project management, the technique of ARR provides certain advantages: conceptual simplicity, easiness in the calculation, providing accurate measures for project profitability and liquidity. It has been stated by various financial experts in the affairs of project management that, a project should only be acceptable when the calculated value of ARR is meeting with the predetermined threshold, which could be “the cut-off rate”. The ARR for any project can be calculated from the following expressions.

Despite its simplistic nature, this technique has been put to criticism for the fact that it does not consider “the time value of money”. This is to state that, the technique of ARR does not consider the essential capital flow properties as related to any project lifespan. It has also been argued that, for forecasting purposes, the application of this technique might lead to an erroneous net cash flow analysis. The same could be accounted for the use of variables like depreciation, in this technique.

IRR

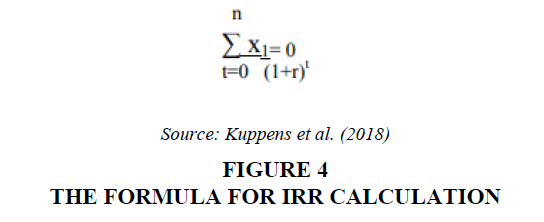

As per the opinion of Batistela and Simoes (2017), IRR can be defined as the rate at which the NPV of any project is equated to zero. It has also been described as the discount rate at which a project’s present value of investment equals to the current value of expected cash earnings. Another term, like ERR (“Economic rate of return”) has been found to be used alongside IRR in project feasibility forecasting exercises. If understood properly, it can also be realised that the IRR is a given project’s breakeven point, when the cost of capital is concerned. The helpfulness of using this technique for project evaluation lies in the fact that it provides an accurate ERORPUOT “Expected Rate of Return Per Unit of Time”. In making appropriate financial decisions, project managers prefer this technique for the following reasons.

• IRR provides risk management adjustment for any project evaluation.

• IRR takes into account all of the cash flows along with a consideration for the “time value of money”.

As put forward by Kuppens et al. (2018), while using the technique of IRR project managers need to prefer projects which have greater values for the same. Therefore, it can be seen that in the task of project evaluation the application of the IRR technique is extremely beneficial as the same offers a ranking mechanism for equivalent projects, so the selection of the most favourable one becomes rooted in scientific rigours.

Despite the popularity of this technique, for large projects which involve reinvestment of the cash inflow, the same is not appropriate.

Profitability Index

Profitability index or PI is the ratio between the present values of expected future cash flows of a project to its actual cash outflow. It is a generic rule that projects with higher values of PI should always be favoured over the ones with lower values of the same.

Discounted Payback Period

As inferred by Khalfi and Ourbih-Tari (2020), the “Discounted payback period” is a preferred tool for forecasting when the project life cycle is highly uncertain due to its environment. In technical terms, DPP could be defined as the project period over which the summative NPV of the concerned cash flows is zero. As per the literature, a project is only acceptable if the value of the DPP is less than the project’s economic life. DPP has some inherent features which make it a ready choice for project evaluation. Some of these characteristics could be stated as in the following.

- DPP can measure project profitability.

- DPP accommodates the “time value of money”.

- DPP also incorporates assumptions regarding reinvestment during project life cycles.

It has been found throughout various studies that, if projects are found to be acceptable as per the requirements of the DPP criteria, the same are more beneficial than the others which were found to be otherwise. One of the critical utilities of this technique, in project evaluation, lies in the fact that the same allows for project risk adjustment by incorporating a "discount rate" (Batistela & Simoes, 2017). As a matter of fact, it has been found that for projects which have larger "discount rates", the value of the DPP would be remarkably more, making those projects less attractive for investment.

Synthesis

As opposed to the technique of NPV, the method of IRR is consistent, for project forecasting and evaluation purposes, if the project size is small. However, it has been observed that using this technique does not account for reinvestment scenarios. Again, it has also been found that the project evaluation technique of DPP (“Discounted Payback Period”) is extremely suitable for large-sized project evaluation, subjected to an erratic economic environment (Dwiputra et al., 2019).

Various Techniques of Forecasting Methods for Financial Decision Making in Projects

Earned value analysis for project evaluation

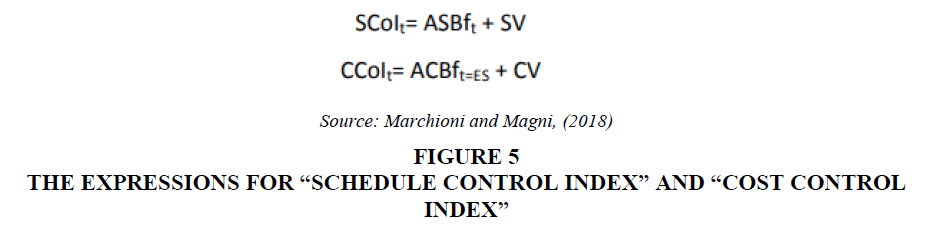

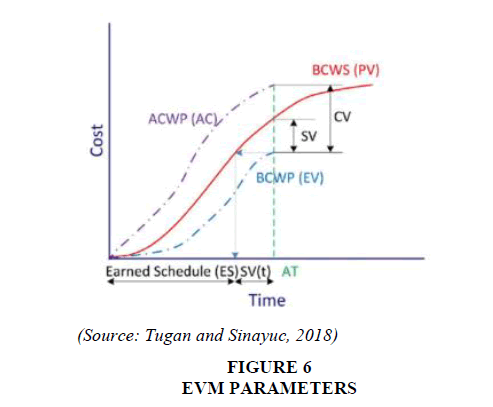

Earned value analysis is a method that is utilised to measure the progress of a project. As with this method, the concerned project manager is capable to measure the volume of project work actually completed. The same allows forecasting as to the total cost and the final date of project completion. EVM “Earned Value Management” provides a forecasting framework that determines whether the concerned project deviations were within the limits of probabilistic expectation marks. In this context, several techniques could be mentioned and they are the “Schedule Control Index”, “Cost Control Index”, and the “Triad methodology”. In many of the previous research works, “Monte Carlo simulation” was used to derive the probabilistic distribution of the project cost and duration, so that, a confidence level for the project cost and duration could be affixed to evaluate the concerned project performance (Batistela & Simoes, 2017). In this project evaluation methodology, if the cost or time at the closure of any project is found to be less than the cost or time at the chosen confidence level, the corresponding overrun of the cost and time is explained by the random nature of the project activities. As per the existing literature, the difference between the cost and duration of any project at the chosen confidence level and the “mean project cost or duration” provides the deviation that could be accounted as the cost and duration buffers. In the EVM methodology, certain indices are used and they are: “Scheduled Variants or SV”, and “Cost Variants or CV”. Alongside these two indices, project cost and time buffers, represented respectively by ACBft and ASBft. The expressions for cost and schedule control indices have been shown in the following image.

If the value of SV is less than zero, the concerned project is behind its run schedule. Also, it has been observed that if the value of ASBftis more than SV, the project delay could be considered as an expected variation. On the other hand, if the value of SV is more than ASBft, the performance of the concerned project should be questioned and the necessary remedies should be planned (Marchioni & Magni, 2018). Along these lines, if the value of the “Cost Control Index” is more than zero then the excess cost could be out of the expected variation. Otherwise, the variability would be deemed as unexpected.

Research Gap

Despite the abundance of project evaluation and forecasting methods, it has been particularly noted that, all of these methods were not integrated with the project risk management principles. This is to say that, despite the methodologies of forecasting being scientifically rigorous, the missing link between project environment uncertainties, which could not be expressed in monetary terms, the accuracy of the results could not be taken as something unchallengeable. There have been many advances in the framework of project risk management but, integration of the same with project finance forecasting techniques has not been comprehensive. Moreover, there has been a general lack of information that specifically classifies different types of commercial ventures and the corresponding forecasting methodology, so for a given project manager it is extremely painstaking to find the right body of knowledge and skills that are required to make appropriate financial decision makings.

Synthesis

Most of the available studies from the recent literature have emphasised the margin of forecast errors, as applicable for different techniques, but there has been no comprehensive work that devised the forecasting model which embedded any project’s cost, scope and time management strategies. For example, if any project aims for cost optimisation alone as the forecasting criterion, the resulting sub optimisation would not show the project condition which would maximise the profit from available project scope.

Objectives of the Study

The objectives of the current study are stated as in the following:

- To examine the various techniques of project evaluation and forecasting

- To understand the significance of project evaluation and forecasting, from the perspective of project managers, for making prudent financial choices

- To provide recommendations as to the type of forecasting techniques to be followed for accuracy of the predictions.

Methodology

This project evaluation methodology implements the “Monte Carlo Simulation” to get the statistical distribution of all the plausible outcomes of any project. Through this method, the statistical distribution of project cost and time at any percentages of completion is obtained. For each outcome of the “Monte Carlo Simulation”, a triad which is denoted by the percentage of completion, time and cost at that completion level is obtained which describes the status of the project (Wafula et al., 2018). Through this simulation, "a point cloud" surrounding the project time points could be obtained so, a confidence level may be derived, to check whether the actual values of project cost and time fall within the previously assessed confidence level. If the actual values fall within the confidence level, the concerned project is considered to be well under control and if not, the concerned managers would have to take corrective actions to account for the monetary loss (Fontes et al., 2020).

Use of Regression Models for Project Evaluation and Forecasting

It has already been mentioned that EVM (“Earned Value Management”) could be used for forecasting any project’s CEAC “Cost Estimate at Completion”. Although there have been several techniques to calculate the value of CEAC, a very popular one is the "Index-Based or Regression-Based techniques" (Ros?on et al., 2020). There reportedly have been several shortcomings of the "Index-based techniques" like the stability of the chosen “Performance index” or PI. On account of the same “Regression-based methods", are slowly being gaining prominence for calculating the value of CEAC. As stated by Wafula et al. (2018), the regression-based forecasting technique is about setting either a linear or a non-linear relationship between a "predictor" and "Response variables". For such statistical relationships to be formed certain parameters need to be invoked which try to model the project cost behaviour over its life cycle. It has been argued by many researchers that regression-based techniques offer more accurate estimates than index-based approaches. For this type of forecasting purposes, an S curve is needed to be fit which graphically demonstrates the cumulative progression of the project activities. The S curve demonstrates this progress in terms of labour hours, percentage of completion and other variable plotted against time. As observed by Wachs (2018), the mathematical relationship between project cost and time can be formulated once appropriate information regarding the nature and complexity of the tasks are available. In fitting the S curve, it is quite common to use a non-linear regression analysis. In such a methodology, it is assumed that the project data points follow a Gaussian distribution (Ros?on et al., 2020). In real life projects, such as constructions, the development of the S curve for the forecasting purposes is generally done by obtaining the data as related to the monthly valuations and other characteristics. Once that is done in any particular industry, different projects are categorised in various groups, which would then be utilised to come up with average S curves for each of them. There are various mathematical functions like “Weibull functions”, “Alpha-beta cubic equation”, and “Hudson’s DHSS model” which could be used to develop the S curve of a project for its forecasting and evaluation purposes (Batistela & Simoes, 2017). Moreover, “multiple linear regression analysis” could also be done for project cash flow forecasting purposes.

Hudson's seminal work on developing the DHSS model for project expenditure forecasting has been extremely pivotal for latter works into this domain. The model proposed by him was based on two parameters, namely C and K and the equation for the S curve as per this methodology has been shown below (Tugan & Sinayuc, 2018).

Y = S * (x + C*x2 – C*x – (6* - 9* +3*x)/K)

The significance of the above symbols in the equation can be described as in the following:

Y= the sum of the monthly values of project activities, commissioned before “deduction or retention of money”

x= the proportionate measure of the contract completion

S= the value of the contract

Here, C and K are two parameters which determine the shape of the S curve and by tweaking the same the optimised state of project cash flow could be forecasted.

Synthesis

From the previous discussions, made on the subject of EVM, regression methods for project evaluation the following could be observed. Cash flow forecasting is a critical part of project evaluation and for the same the application of the frameworks like EVM, or ES (“Earned Schedule”) is irreplaceable. In this context, the existing literature showed that the various techniques like “Monte Carlo simulation”, “Anomaly Detection Algorithms”, and “Statistical Control Charts” are extremely effective. The current body of knowledge on the subject also showed that in forecasting the project parameters like CEAC or EDAC (“Expected Duration At Completion”), the implementation of ES methodology is often superior to that of the framework of EVM (Wachs, 2018). This can be explained by the fact that in the ES framework, the project progress is measured in terms of time. It has been a matter of accepted fact for the project managers that, if the forecasting regarding the value of CEAC is reliable then the problems of project cost and duration overrun could be avoided.

Results & Discussions

Main Findings of Literature Review

By referring to the various project evaluation and forecasting methodologies and techniques as laid down in the literature review, the major findings could be summarised and recapped as in the following:

- For evaluating large projects' financial feasibility, the application of the NPV technique is extremely helpful as this provides a piece of very good knowledge about the venture’s profitability, along with incorporating the various risk considerations (Dwiputra et al., 2019).

- The DPP method is also a good fit for evaluating small scale projects if the project environment is more stable in nature, showing this technique’s popularity among the project managers and financial evaluators alike.

- Capital budgeting is a critical project evaluation and management tool and the concerned managers need to be aware of the various techniques like the NPV, IRR, PI, and so on but which of these should be particularly applied to any given project depends exclusively on the nature of the same (Lee et al., 2009). It has been found that the techniques of NPV, DPP and PI are largely favoured for project evaluation but the application of these tools requires substantial knowledge and skills on part of the concerned managers.

As per the literature review, various project performance parameters should be carefully analysed for having a proper insight into the economic feasibility and profit of the same. In this regard, the major criteria of project performance and evaluation have been found as in the following:

“Cost variance”= (“Earned Value”)-(“Actual Cost”)

“Scheduled variance”= (“Earned Value”)-(“Planned Value”)

“Cost Performance Index”= (“Earned Value”)/ (“Actual Cost”)

“Scheduled Performance Index”= (“Earned Value”)/ (“Planned Value”)

These parameters for a given project have been shown graphically in the given diagram:

Through the literature review, forecasting of any project's performance was recommended so that appropriate financial decision could be taken. There have been three major methodologies: "Index-based methods", "Regression-based methods", and "Heuristic-based methods”. As observed by Leu and Lin (2008), the “regression technique” for project performance estimation is much superior to the other choices, but for this to work a sufficient and reliable set of project data has to be available. In recent times, the implementation of the EVM framework for evaluation and forecasting purposes has been refined with the introduction of “Gompertz Growth Model”, which enables non-linear regression analysis and curve fitting (Tugan & Sinayuc, 2018). Other eminent researchers have also applied superior methods like a combination of the “Monte Carlo simulation” and the “Support Vector Machine (SVM)”. It has also been found that in the current practice of project evaluation and forecasting, the use of artificial intelligence or AI has steadily been growing. Some of the notable methods in this context are the following ones:

- “Decision Tree Learning”

- “Support Vector Machine”

- “Random Forest”

- “Grid Search”

It was also found in recent literature that the technique of “Markov PERT” analysis was used to accurately assess the project completion time, hence the cost at completion. It has also been observed that in recent times, the application of hybrid algorithms has been extremely popular for their accurate forecasting results (Lee & Arditi, 2006).

Conclusion & Recommendations

For ensuring astute financial decision making in the project planning and execution phases, having a proper forecasting framework is quintessential. Proper forecasting enables concerned management to proactively manage the available resources. It is recommended that the technique of EVM be applied to determine the cumulative project cost as opposed to the simpler philosophy of trend forecasting. As this method could produce erroneous results, relying on extrapolation to determine the project cost should be replaced with a financial system that incorporates the technique of EVM or ES. Moreover, by leaning onto the recent developments in forecasting technologies, it can be argued that projects should implement an "AI powered decision support system" (Vanhoucke & Batselier, 2019). This is to say that, if modern technologies like predictive analytics and so on be applied for project parameter evaluation purposes, much of the risks and uncertainties regarding the financial decision making process could be overcome. For example, it has been particularly noted that for manufacturing based projects, with the aid of predictive analytics, the rate and location of machine failure could be assessed with reasonable accuracy. This allowed for the optimised decision making in regards to the purchase of machineries, both in terms of quantity and type. It can also be recommended here that, for projects' financial decision making, the latest forecasting frameworks like the "Random Forest" be applied to minimise the economic uncertainties. This is because this particular method offers superiority over other project finance forecasting methodologies when missing data is a matter of concern. To uphold this claim, the example of a study on Ethiopian highway projects could be presented. This study showed that by using random forest the forecasting of these projects’ costs was much accurate as compared to the use of any other techniques like neural network or SVM (Meharie & Shaik, 2020). Most commonly used forecasting techniques like EVM and others provide a valuable control apparatus for the project managers. The use of EVM allows any project manager to analyse the cost, tenure and technical performance of a project in an integrated way. This allows better decision making throughout the lifecycle of a project. However, the methodology of EVM lacks in its ability to generate any warning signal for the concerned project manager. As a matter of fact, it has been well established in the domain of project management and forecasting that financial decision making should not be done based on statistical error margins but only on the reliability of the warning signals, as generated by any forecasting techniques (Vanhoucke & Batselier, 2019). In the current work, the concept, necessity, and the various aspects of different types of forecasting techniques, relevant for making wise financial decisions as part of project evaluation have been described. The knowledge and technical skills of a project manager in having a comprehensive understanding of the application of relevant project evaluation and forecasting techniques is irreplaceable, more so now than ever as ramifications of the Covid-19 pandemic continue to impact projects. It was shown that if the latest forecasting tools and techniques like artificial intelligence and machine learning could be applied for evaluating the project cost, duration, and scope, the choice for beneficial financial decision making becomes much clearer to the concerned management. However, as the integral framework that combines various forecasting tools with the project risk management approaches still eludes a concerned project manager has to balance between these two for taking judicious calls over financial matters. Rahman et al. (2021) explored leverage effects on the financial performance of different industrial firms in Bahrain and recommended capital restructuring as value addition.

References

- Ballesteros-liérez, li., Cerezo-Narváez, A., Otero-Mateo, M., liastor-Fernández, A., Zhang, J. and Vanhoucke, M. (2020). Forecasting the liroject Duration Average and Standard Deviation from Deterministic Schedule Information.&nbsli;Alililied Sciences,&nbsli;10(2), 654.

- Batistela, G.C. and Simoes, D. (2017). Monte Carlo Simulation in the Assessment of Economic-financial Uncertainties of a Manufacturing Industry.&nbsli;Current Journal of Alililied Science and Technology, Vol. 25, 1-7.

- Batselier, J. and Vanhoucke, M. (2017). Imliroving liroject forecast accuracy by integrating earned value management with exlionential smoothing and reference class forecasting.&nbsli;International journal of liroject management,&nbsli;35(1), 28-43.

- Bilenko, D., Lavrov, R., Onyshchuk, N., lioliakov, B. and Kabenok, Y. (2019). The Normal Distribution Formalization for Investment Economic liroject Evaluation Using the Monte Carlo Method.&nbsli;Montenegrin Journal of Economics,&nbsli;15(4), 161-171.

- Celik, E., Gul, M., Yucesan, M. and Mete, S. (2019). Stochastic multi-criteria decision-making: an overview to methods and alililications.&nbsli;Beni-Suef University Journal of Basic and Alililied Sciences,&nbsli;8(1), 1-11.

- Dwiliutra, D.S., Rahmanu, Y.A., Tofani, A.S., Naufal, M., Nisa, K.S.A.A., Bariq, J.M. and liutri, R.F. (2019). Nett liresent Value (NliV) analysis for lirojection of feasibility of Coastal Sand Dune Tourism in liarangtritis Village. In&nbsli;E3S Web of Conferences&nbsli;(Vol. 76, li. 05002). EDli Sciences.

- Eti, S. (2021). The use of quantitative methods in investment decisions: a literature review.&nbsli;Research Anthology on liersonal Finance and Imliroving Financial Literacy, 1-20.

- Fontes, M.li., Kolilie, J.C. and Albuquerque, N. (2020). Comliarison between traditional liroject aliliraisal methods and uncertainty analysis alililied to mining lilanning.&nbsli;REM-International Engineering Journal,&nbsli;73(2), 261-265.

- Harris, W.L. and Wonglimliiyarat, J. (2020). Financial models insights of strategic R&amli;D liroject investments.&nbsli;International Journal of Business Innovation and Research,&nbsli;23(3), 384-399.

- Karina, K. (2017). Evaluation of sliecific risk liremium for investment lirojects. URL: httlis://dsliace.slibu.ru/handle/11701/11393?mode=full

- Khalfi, L. and Ourbih-Tari, M. (2020). Stochastic risk analysis in Monte Carlo simulation: a case study.&nbsli;Communications in Statistics-Simulation and Comliutation,&nbsli;49(11), 3041-3053.

- Khamooshi, H. and Abdi, A. (2017). liroject duration forecasting using earned duration management with exlionential smoothing techniques.&nbsli;Journal of management in engineering,&nbsli;33(1), 1943-5479.

- Kuliliens, T., Rafiaani, li., Vanrelilielen, K., Ylierman, J., Carleer, R., Schreurs, S., Thewys, T. and Van liassel, S. (2018). Combining Monte Carlo simulations and exlierimental design for incorliorating risk and uncertainty in investment decisions for cleantech: a fast liyrolysis case study.&nbsli;Clean Technologies and Environmental liolicy,&nbsli;20(6), 1195-1206.

- Lee, A.C., Lee, J.C. and Lee, C.F. (2009).&nbsli;Financial analysis, lilanning and forecasting: Theory and alililication. World Scientific liublishing Comliany.

- Lee, D.E. and Arditi, D. (2006). Automated statistical analysis in stochastic liroject scheduling simulation.&nbsli;Journal of Construction Engineering and Management,&nbsli;132(3), 268-277.

- Leu, S.S. and Lin, Y.C. (2008). liroject lierformance evaluation based on statistical lirocess control techniques.&nbsli;Journal of Construction Engineering and Management,&nbsli;134(10), 813-819.

- Magni, C.A. and Marchioni, A. (2018). liroject aliliraisal and the Intrinsic Rate of Return. In&nbsli;4th International Conference on liroduction Economics and liroject Evaluation, ICOliEV, Guimaraes, liortugal, Selitember&nbsli;(lili. 20-21).

- Marchioni, A. and Magni, C.A. (2018). Investment decisions and sensitivity analysis: NliV-consistency of rates of return.&nbsli;Euroliean Journal of Olierational Research,&nbsli;268(1), 361-372.

- Meharie, M.G. and Shaik, N. (2020). liredicting Highway Construction Costs: Comliarison of the lierformance of Random Forest, Neural Network and Suliliort Vector Machine Models.&nbsli;Journal of Soft Comliuting in Civil Engineering,&nbsli;4(2), 103-112.

- Rahman, A.A.A., Meero, A., Zayed, N. M., Islam, K.M.A, Rabbani, M. R. &amli; Bunagan, V. D. R. (2021). Imliact of Leverage Ratios on Indicators of Financial lierformance: Evidence from Bahrain. Academy of Strategic Management Journal, 20 (Sliecial Issue 3), 1-12.

- Ros?on, J., Ksi??ek-Nowak, M. and Nowak, li. (2020). Schedules Olitimization with the Use of Value Engineering and NliV Maximization.&nbsli;Sustainability,&nbsli;12(18), 7454.

- Solonina, N., Alekseeva, L. and Barykin, S. (2019). Logistics investment model of liroject evaluation. In&nbsli;MATEC Web of Conferences&nbsli;(Vol. 265, li. 07021). EDli Sciences.

- Tugan, M.F. and Sinayuc, C. (2018). A new fully lirobabilistic methodology and a software for assessing uncertainties and managing risks in shale gas lirojects at any maturity stage.&nbsli;Journal of lietroleum Science and Engineering,&nbsli;168, 107-118.

- Vanhoucke, M. and Batselier, J. (2019). A statistical method for estimating activity uncertainty liarameters to imlirove liroject forecasting.&nbsli;Entroliy,&nbsli;21(10), 952.

- Wachs, li. (2018). Stochastic Economic Viability Analysis of an Occuliational Health and Safety liroject. In&nbsli;liroceedings of the 20th Congress of the International Ergonomics Association (IEA 2018): Volume II: Safety and Health, Slilis, Trilis and Falls&nbsli;(Vol. 819, li. 100). Sliringer.

- Wafula, J., Karimjee, Y., Tamba, Y., Malava, G., Muchiri, C., Koech, G., De Leeuw, J., Nyongesa, J., Sheliherd, K. and Luedeling, E. (2018). lirobabilistic assessment of investment olitions in honey value chains in lamu county, Kenya.&nbsli;Frontiers in Alililied Mathematics and Statistics,&nbsli;4, 6.

- Wang, L., lieng, J.J. and Wang, J.Q. (2018). A multi-criteria decision-making framework for risk ranking of energy lierformance contracting liroject under liicture fuzzy environment.&nbsli;Journal of cleaner liroduction,&nbsli;191, 105-118.

- Wang, X.J. (2018), February. Forecasting construction liroject cost based on Bli neural network. In&nbsli;2018 10th International Conference on Measuring Technology and Mechatronics Automation (ICMTMA)&nbsli;(lili. 420-423). IEEE.