Research Article: 2021 Vol: 25 Issue: 5S

Financial and Integrated Reporting of Ukraine Energy Holdings in the Categories of Sustainable Development and Marketing Innovations

??tiana Kosova*, National Aviation University

Serhii Smerichevskyi, National Aviation University

Lidiia Kostyrko, V. Dahl East Ukrainian National University

Ruslan Kostyrko, SHEI University of Banking

Hanna Radchenko, National Aviation University

Olha Bondarenko, National Aviation University

Citation: Kosova, T., Smerichevskyi, S., Kostyrko, L., Kostyrko, R., Radchenko, H., & Bondarenko, O. (2021). Financial and integrated reporting of ukraine energy holdings in the categories of sustainable development and marketing innovations. Academy of Accounting and Financial Studies Journal, 25(S5), 1-16.

Abstract

The relevance of the topic of this article is determined by the important role that energy companies of the world play in the process of the sustainable development of the society under conditions of global challenges. Their timeliness for Ukraine determines the formation of a new model of the energy market under conditions of European integration, the risks of losing the transit potential, low power efficiency, considerable negative environmental influence of the activity of energy holdings. The purpose of the paper is to diagnose the state of the implementation of the ESG – energy strategies of the Ukrainian holdings, using the data of financial and integrated reporting, to design the guidelines on their improvement based on innovation marketing, digital transformation, socially responsible investment and energy saving. The theoretical aspects of the research rest on the evaluation of the information capacity of financial and non-financial reporting of Ukraine energy holdings as the source for analysis of their sustainable development and innovation marketing. The object of the research is three leading energy holdings of Ukraine: Naftogaz Group, DTEK, SE “NNEGC “Energoatom”. In was shown that among these business structures, DTEK is based on private capital, while the other two are controlled by the government. Results of the paper include the conclusion that the following contributes to the implementation of the models of corporate social responsibility into practice of the activity of Ukrainian energy holdings under conditions of European integration: unification of the forms of social non-financial reporting; implementation of legislative acts aimed at the creation of competitive energy trading market; involvement of energy investments based on the agreements on cooperation with the European Community; fulfilment of national responsibilities in the area of nuclear security according to the European standards.

Keywords

Financial and Integrated Reporting, Ukraine Energy Holdings, Sustainable Development, Marketing Innovation.

Introduction

To ensure sustainable development of the society is the main task of our time and the key to the further existence and prosperity of civilization. Energy companies in the world play an important role in this process in the face of global challenges associated with the following factors: the transition of the world economy into a recession phase, increased volatility in world prices for raw materials, an outbreak and the spread of the COVID-19 pandemic. The development of Ukraine's energy sector is complicated by internal problems caused by a number of factors, including: loss of the base of raw materials, coal resources and energy capacities due to the military-political conflict in the east of the country; reducing the volume of transportation of gas from the Russian Federation to Europe, which currently account for 40% of the Russian Federation's supplies; low energy efficiency and structural imbalance of the national economy; the lag in economic development from European countries. The risks of losing the transit potential are associated with the commissioning of the “North Stream-2” pipeline, which will lead to a decrease in the volume of gas transportation from the Russian Federation to Europe through Ukraine almost by two times. At the same time, one should estimate positively the progress of Ukraine in implementing European legislation, which is an obligation that follows from our country’s accession to the Treaty on the Establishment of the Energy Community. The separation of the gas transmission system operator was a significant step towards further integration of Ukraine into the European gas market and strengthened our country’s position in negotiations on the continuation of transit of Russian gas in 2020, and Naftogaz Group gained advantages in the arbitration process against Gazprom in terms of revising the transit tariff in 2018-2019 in accordance with EU regulatory norms implemented in Ukrainian legislation. The program of Ukraine’s cooperation with the IMF, focused on overcoming corruption, carrying out sectoral reforms, including those in the energy sector, is aimed at mitigation of a negative impact of the internal and external environment. The systemic solution of the outlined problems and the achievement of the goals of sustainable development of the UN Global Compact involves the development of ESG (Environmental, Social, Governance) strategies by super-state, state, municipal institutions, business entities, etc. and making commitments to progress.

Literature Review

The historical experience proves that the volume of using energy resources and their specific consumption, on the one hand, and the level of development of the society, economic system, human capital, on the other hand, are closely connected (Arto et al., 2016). However, the indicators of measuring the general energy needs of countries change over time: the information value of the indicator of generation and consumption of secondary energy, rather than the general demand for primary energy is growing.

The activities of energy enterprises have important social and environmental consequences and the key to its effectiveness is proper corporate management and introduction of innovations. It should be borne in mind that the latter can be not only progressive in nature, contributing to the sustainable development of society, but also have a destructive nature, causing instability, due to the following factors: markets and business models, rules and policies, as well as entities and networks (Kivimaa et al., 2021). One of the manifestations of the effect of innovations on the break in the transition to sustainability is their unfavorable environmental consequences. That is why the implementation of the new approaches to ensuring ecological management is one of the most important directions of the European integration processes in Ukraine as a whole (Gulac et al., 2019). One of the global innovative problems of our time in the energy sector is ecologically safe burning of new types of composite fuels, the purity of waste disposal and disinfection, etc. (Suvorova et al., 2018). A positive example of progressive innovations is the MOVBIO project of energy recovery of residual biomass, which is effective both from the economic and technical point of view and is intended for agricultural enterprises, thermal energy consumers, farmers and local governing bodies (Carvalho et al., 2018).

Green energy resources are becoming an increasingly popular object of market research due to exhaustible mined hydrocarbon resources as well as to fighting greenhouse gas exhausts. Biofuel has a number of advantages that include their environmental friendliness, possibility of being transported in the liquid form (Alalwan et al., 2019). It is represented by four generations, depending on the type of raw materials used: the first – edible biomass (there were contradictions with the solution of the food problem in the world), the second – non-edible biomass (problems associated with scaling production to the commercial level), the third – microorganisms, the fourth – genetic modification of these microorganisms. Therefore, the priority direction of development is to focus on the third and fourth generations of biofuels, in particular, on the genetic engineering of algae.

Scientists pay considerable attention to estimation of alternative technologies of energy generation, in particular, to its renewable sources, for which the cost of capital differs significantly in various countries and technologies (Steffen, 2020). In ranging of technology, it grows from solar photoelectric power to wind power (land and sea), in ranging of countries – from developed countries to developing countries. The implementation of the models of corporate social responsibility (?SR) in the practice of activities of energy enterprises will contribute to enhancing the social well-being and decreasing the environmental damage, excluding the monopoly market where the exhaust tax is low (Fukuda & Ouchida, 2020). ?SR is the result of the social dialogue between power and business which resulted in reaching the agreement on passing a number of state functions to business structures. Despite certain achievements in the implementation of social partnership projects, its development is hampered by the contradiction of the interests of public administration bodies and business entities, the lack of unified forms of social non-financial reporting, as well as non-systemic participation of enterprises in the development of the territory (Chyzh & Sakhno, 2020).

In the majority of countries of the world, wholesale electricity markets are subject to state regulation. At the same time, the object of influence is marginal costs, average variable costs, etc. Market regulation under the single price agreement provides for its restrictions to reduce the highest level and mitigate volatility (Khezr & Nepal, 2021). Unlike other regions of the world, the EU has consistently carried out energy reform based on liberalization, when energy markets open up for competition; there is an expansion of the vertical separation of electricity transmission and distribution at all stages – from production and retail trade; and the operation of an independent regulator is introduced (Zogolli, 2015).

Energy security is an important subsystem of national security of a country, the guarantee of which requires the development and implementation of strategies for the development of the energy sector in accordance with the obligations adopted by Ukraine under the Association Agreement with the EU and other EU acts (Shulga et al., 2019). To ensure the integration of the national energy market into the energy markets of the Member States of the European Union, Ukraine needs to implement a number of measures, including: firstly, the implementation of legislative acts aimed at creating a competitive electricity trading market; secondly, the development of infrastructure and electricity networks to ensure electricity flows; thirdly, joining the strategy for the development of the trans-European network in the sectors of electricity, natural gas, oil, etc.; fourthly, attracting energy investments based on cooperation agreements with the Energy Community (Semkou et al., 2019). In the context of European integration, Ukraine’s nuclear energy sector faces new challenges related to the fulfillment of national obligations in the field of nuclear safety in accordance with European standards in terms of ensuring the functioning of nuclear facilities, physical protection of nuclear materials and setups, as well as radioactive waste management. The issue of unification of legal norms in the field of nuclear safety regulation in Ukraine and EU member states is on the agenda (Dubchak et al., 2020).

Assessing the activities of energy holdings of Ukraine, it is necessary to take into account their dependence on the trajectory of previous development. The national energy market, as well as the markets of other post-Soviet countries, were formed as a result of privatization. The overall positive effects of the reforms were: improvement of the conditions of electricity supply, an increase in production volumes and employment. The negative sides are associated with an increase in inequality of income of certain energy market entities, which differ, depending on the business cycle, macroeconomic distribution proportions, etc. (Blagrave & Furceri, 2021). The state plays an important role in the energy market of Ukraine by taking part in the statutory capitals of energy holdings creates in the course of corporatization and represented by the National Joint Stock Company (NJSC) “NaftogazofUkraine”, which are part of Naftogaz Group, and State Enterprise (SE) National Nuclear Energy Generating Company (NNEGC) “Energoatom”. The above fact has to be taken into consideration when designing the methodology of analysis of financial and integrated reporting of Ukraine energy holdings in the categories of sustainable development and marketing innovation.

The purpose of the paper is to diagnose the state of implementation of the ESG – strategies of energy holdings of Ukraine using the data of financial and integrated reporting, designing the recommendations on their improvement based on innovation marketing, digital transformation, socially responsible investment and energy saving.

Methodology

The object of the research is three leading energy holdings of Ukraine: Naftogaz Group, DTEK, SE “NNEGC “Energoatom”. Among these business structures, DTEK is based on private capital, the other two are controlled by the state.

The organizational management structure of Naftogaz Group is based on the divisional principle. The main divisions include the following: «Integrated Gas Business Delivery Unit», «Oil Midstream and Downstream Business Delivery Unit», «Natural gas transmission», «Gas Storage Business Delivery Unit», «Technical Business Enabling Unit», «New Energy Business Unit», «New Businesses». Division «New Energy Business Unit» is the innovative and in represented by the creation and operation of objects: of renewable energy facilities; of highly shunting power plants; of electricity facilities for electricity storage.

The information source for analysis of the strategies of Ukraine energy holdings are financial and integrated reporting. The characteristics of non-financial reporting of the studied holdings are shown in Table 1.

| ??ble 1 InformationCapacityofNon-FinancialReportingofUkraineEnergyHoldingsas a Source of Analysis of their Sustainable Development and Marketing Innovations |

||

| Name of holding and non-financial reporting | Structure of non-financial reporting (section number, name) | Results of achieving the indicators of sustainable development and marketing innovations for sections |

|---|---|---|

| Naftogaz Group. Annual report - 2019. On to new heights. | 1. Market and Reforms 2. Strategy and Operations 3. Corporate Governance 4. Environmental and Social Responsibility 5. Financial Overview and Statements 6. Additional Information |

1.2. Natural gas market 1.3. Global oil market 1.4. Unbundling of GTS 1.5. Operator Natural gas transit 4.5. Investments in energy efficiency 4.7. Procurement Management |

| DTEK. Integrated Report 2019. Financial and non-financial results. | 1. About DTEK 2. Our Business 3. Sustainability 4. To Investors & Partners 5. Media Center |

3.4. Innovations and Digital Transformation 3.5. Impact Investment 3.6. Sustainability Reporting |

| SE “NNEGC “Energoatom” (2020). Clean Energy for Sustainable Future. Non-Financial Report – 2019. | 1. Address by Energoatom Acting President 2. Practicing Effective Governance 3. Improving Safety Culture 4. Opening up new Opportunities 5. Ensuring Sustainable Development 6. Caring for the Environment 7. Investing in People 8. Annexes |

2.2.Energoatom Development Strategy 2.5. Procurement Management 4.2. Overview of Our Investment Activities 4.3. Construction of the Central Spent 4.4. Fuel Storage Facility 4.5. Developing South-Ukraine Electric Power producing Complex 5.3. Prioritising UN Sustainable Development Goals 5.4. Achieving UN Sustainable Development Goals 6.5. Energy Management |

Source: DTEK 2020, Naftogaz Group 2020, SE “NNEGC “Energoatom” 2020.

In contrast to the integrated reporting, financial reporting is unified, which made it possible to construct a summary table to analyze the financial results of Ukraine’s energy holdings based on income and net profit, as well as to determine their rankings according to the scope of activity. Fundamental differences in the sources of information and the used approaches to the analysis led to separation of two subsections in section “4. Data collection", the objects of which are the indicators of financial and integrated reporting.

Data Collection

Analysis of indicators of financial reporting

Financial results of the activity of energy holdings of Ukraine were analyzed based on the data of the four-year period in 2016-2019 Table 2.

| ??ble 2 FinancialResultsofActivityofEnergyHoldingsofUkrainein 2016-2019 |

||||||||||||||||||

| Energy holding | Income | Net profit | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2016 | 2017 | 2018 | 2019 | 2016 | 2017 | 2018 | 2019 | |||||||||||

| UAH, billion | UAH, billion | |||||||||||||||||

| Naftogaz Group | 161,2 | 188,4 | 184,9 | 149,8 | 26,5 | 40,1 | 11,5 | 63,3 | ||||||||||

| DTEK | 131,8 | 145,1 | 157,6 | 137,7 | -1,2 | 4,6 | 12,4 | 12,6 | ||||||||||

| SE “NNEGC “Energoatom” | 36 | 38,5 | 46,7 | 53,8 | 0,2 | 2,8 | 4,6 | 3,8 | ||||||||||

| Basis indices, % | Basis indices, % | |||||||||||||||||

| Naftogaz Group | 100 | 117 | 115 | 93 | 100 | 151 | 43 | 239 | ||||||||||

| DTEK | 100 | 110 | 120 | 104 | 100 | -383 | -1033 | -1050 | ||||||||||

| SE “NNEGC “Energoatom” | 100 | 107 | 130 | 149 | 100 | 1400 | 2300 | 1900 | ||||||||||

Source: DTEK 2020, Naftogaz Group 2020, SE “NNEGC “Energoatom” 2020.

By the volume of financial results, Naftogaz Group is the largest energy holding of Ukraine. Within 2016-2019, its income decreased from 161.2 to 149.8 UAH billion, or by 7%. However, in 2017-2018, the income reaches its maximum value, which, accordingly, were by 17% and by 15% more that the basic level of 2016. The volume of net profit of the analyzed period increased from 26.5 to 63.3 UAH billion, or by 2.39 times. However, the increasing trend was not steady and in 2018 the value of net profit was the lowest and made up only 43 % of the volume of 2016.

DTEK by the volume of its activity is the second energy holding of Ukraine, the revenues of which within 2016-2018 increased from 131.8 to 157.6 UAH billion, or by 20 %, in 2019, they decreased to 137.7 UAH billion, but all the same it is 4 % higher that the basic level. The net profit of the holding demonstrated the steady trend of growing from the negative value of (-1,2) to 12.6 UAH billion, or by 10.5 times by module.

SE “NNEGC “Energoatom” is the smallest one from the analyzed energy holdings of Ukraine by the criterion of financial results, however, is keeps on developing rapidly, within 2016-2019 the volume of income increased from 36 to 53.8 UAH billion, or almost by 1.5 times, the volume of net profit – from 0.2 to 3.8 UAH billion, or by 19 times. The financial results of this holding are lower compared to Naftogaz Group and DTEK by income volume – respectively, by 2.8 and by 2,.6 times, and by net profit – by 16.7 and 3.3 times.

Thus, the common features of the activities of all studied energy holdings in Ukraine are their profitability, the prevailing tendency to increase the volume of activity and net profit. The differences include differentiation of activity volumes and a decrease in the amount of income of Naftogaz Group and DTEK in 2019.

Analysis of Indicators of Integrated Reporting

Integrated reporting of the analyzed energy holdings for 2019 has different information capacity in the part of quantitative estimates of their activity and shifting the emphasis to different components of the ESG – strategies. The non-financial report of Naftogaz Group is the most informative Table 3.

| Table 3 Quantitative Indicators of Naftogaz Group Activity as of December 31, 2019 |

|||||||||

| No. by order | Indicator | Measurement unit | Value | Structure, % | No. by order | Indicator | Measurement unit | Value | Structure, % |

|---|---|---|---|---|---|---|---|---|---|

| 1 | Human resources management | 5 | Social benefits, including | UAH mln | 2358,9 | 100 | |||

| 1.1 | full-time employees | persons | 55078 | 100 | 5.1 | financial assistance stipulated by collective agreements | UAH mln | 685,5 | 29,1 |

| 1.2 | Managers | persons | 6631 | 12,0 | 5.2 | other social benefits and payments | UAH mln | 658,6 | 27,9 |

| 1.3 | Professionals | persons | 11155 | 20,3 | 5.3 | maintenance of social infrastructure | UAH mln | 321,6 | 13,6 |

| 1.4 | technical staff | persons | 252 | 0,5 | 5.4 | rehabilitation and recreation of employees and their family members, including children | UAH mln | 164,9 | 7,0 |

| 1.5 | Workers | persons | 37040 | 67,3 | 5.5 | medical services for employee | UAH mln | 45,1 | 1,9 |

| 2 | Gender structure | 5.6 | providing housing and loans | UAH mln | 40,0 | 1,7 | |||

| 2.1 | - men | persons | 42251 | 76,7 | 6 | Occupational safety | |||

| 2.2 | - women | persons | 12827 | 23,3 | 6.1 | - on-site fire workshops, including | units | 2216 | |

| 3 | Age structure | 6.1.2 | - training sessions together with units of the State Emergency Service of Ukraine | units | 132 | ||||

| 3.1 | - under 30 | persons | 5563 | 10,1 | 6.2 | - expenses on fire safety measures | UAH mln | 31,6 | |

| 3.2 | - between 30 and 50 | persons | 33052 | 60,0 | 7 | Cooperation with local communities | |||

| 3.3 | - between 50 and 60 | persons | 14523 | 26,4 | 7.1 | - the total amount of rent payments | UAH billion | 23,3 | |

| 3.4 | - over 60 | persons | 1940 | 3,5 | 7.2 | - social development of local communities | UAH mln | 11,0 | |

| 4 | Qualification increase | 7.3 | - social projects and charitable assistance in the areas of its activity | 5,3 | |||||

| 4.1 | - number of employees who were trained and retrained | persons | 29200 | 7.4 | - the purchase of medical equipment and supplies for the military | 11,3 | |||

| 4.2 | - total number of training hours provided to employees of group enterprises | hours | 361766 | 7.5 | - charitable transfers for the development of children with disabilities | UAH thsd | 261,7 | ||

| 4.3 | - average duration of training | hours / person |

12,4 | ||||||

Source: Naftogaz Group 2020

Integrated reporting of two other holdings gives general reference points of the number of employees: more than 60 thousand employees in D??? (its enterprises were recognized as the best employers of Ukraine by the ratings of the international audit company Ernst & Young and business editions of Ukraine), 34736 employees in SE “NNEGC “Energoatom”. The total recorded number of staff in Naftogaz Group (55078 persons) is lower compared to D??? approximately by 8 % and by 1.6 times higher compared to SE “NNEGC “Energoatom”.

Within Naftogaz Group in 2019, the number of recorded staff decreased by 13308 people, or by 19.5%. It is related to the successful restructuring on transfer of the function of technical operation of gas transportation system and transferring 10386 employees from the structural subdivision of Naftogaz Group («Urktransgas» JSC) to LLC «Operator of GTS of Ukraine». A considerable number of scientists including doctors of sciences - 17, professors - 10, candidates of sciences - 205, associate professors - 27, senior researchers – 9 were involved in the activity of the Naftogaz Group. The non-financial reporting of Naftogaz Group gives the idea about the staff structure: job category (managers – 12.0%, professionals – 20.3%, technical staff – 0.5%, workers – 67.3%), gender structure (men – 76.7%, women – 23.3%), age structure (under 30 – 10.1%, between 30 and 50 - 60,0%, between 50 and 60 - 26,4%, over 60 – 3.5%). 29200 employees upgraded their qualification, which makes up 53% of the Naftogaz Group staff, the average duration of training is 12,4 hours /person. Social benefits made up 2358,9 UAH mln. Their major part was directed to financial assistance stipulated by collective agreements and other social benefits and payments – respectively, 29.1% and 27.9%. 13.6 % and 7.0% respectively, were allocated for maintenance of social infrastructure and rehabilitation and recreation of employees and their family members, including children. The important direction of Naftogaz Group activity is occupational safety: 2216 - on-site fire workshops were conducted, including 132 - training sessions together with units of the State Emergency Service of Ukraine. Expenses on fire safety measures made up 3.,6 UAH mln. Within ?ooperation with local communities, the total amount of rent payments made up 23.3 UAH billion.

Within the SE “NNEGC “Energoatom”, the share of women in the structure of full-time employees in 2019 made up 33.4%, which is by 10.1 percentage point higher, than within Naftogaz Group. 96833 man-courses were conducted for staff training, 611 students took internships and industrial placements Table 4.

| Table 4 Quantitative Indicators of Se “Nnegc “Energoatom” Activity as of December 31, 2019 |

|||

| No. by order | Indicator | Measurement units | Value |

|---|---|---|---|

| 1 | Full-time employees, including | persons | 34736 |

| 1.1 | - men | % | 66,6 |

| 1.2 | - women | % | 33,4 |

| 2 | Inclusive and equitable quality education and lifelong learning opportunities | ||

| 2.1 | - were conducted for staff training | man-courses | 96833 |

| 2.2 | - took internships and industrial placements | students | 611 |

| 3 | Occupational safety | ||

| 3.1 | - training in the system of fire and technical minimum | employees | 4410 |

| 3.2 | - special training on fire safety | employees | 1541 |

| 3.3 | - fire workshops | units | 2428 |

| 3.4 | - expenses on fire safety measures | UAH mln | 533,3 |

| 3.5 | - occupational diseases, accidents, group accidents or fatalities | cases | 0 |

| 4 | Socio-economic indicators | ||

| 4.1 | - investments in social development | UAH mln | 687,0 |

| 4.2 | - expenses on social and economic compensation duty | UAH mln | 473,4 |

| 4.3 | - taxes to the national and local budgets | UAH mln | 19392,2 |

| 4.4 | - payroll | UAH mln | 11024,2 |

| 4.5 | - one-time retirement allowances | UAH mln | 140,6 |

| 4.6 | employees | 653 | |

| 5 | Healthy life and well-being | ||

| 5.1 | - health treatment and disease prevention services | employees | 18077 |

| 5.2 | - improved their health in resorts | children of employees | 7170 |

| 5.3 | - investments in Health & Safety measures and equipment | UAH mln | 464 |

| 6 | Investment activity | ||

| 6.1 | - invested into projects | UAH billion | 14,67 |

| 6.2 | - key investment projects under implementation | units | 12 |

| 6.3 | - estimated value of 12 key investment projects | UAH billion | 165 |

Source: SE “NNEGC “Energoatom” 2020.

The number of fire workshops made up 2428 units, which meets the level of Naftogaz Group, however, investments in social development (687.0 UAH mln) are by 3.4 times lower. The amount of taxes to the national and local budgets made up 19392.2 UAH mln, ? payroll made up 11024.2 UAH mln, which characterizes the holding as a socially responsible taxpayer and employer. SE “NNEGC “Energoatom” takes care of healthy life and well-being of its employees: 18077 employees received health treatment and disease prevention services, 7170 children of employees improved their health in resorts, investments in Health & Safety measures and equipment reached 464 UAH mln. The analyzed holding is involved in investment activity: investments into projects made up 14.67 UAH billion, estimated value of 12 key investment projects reached 165 UAH billion.

D??? investments in power energy and sustainable development since the moment it was created in 2005 have made up 19.5 UAH billion Table 5, including: environmental protection, excluding environmental tax - 49,6%, labor protection and industrial safety - 25,6%, maintenance of social facilities - 18,1%, social partnerships - 4,5%, employee training - 2,3%.

| Table 5 Quantitative Indicators of Dtek Activity in 2005-2019 |

||||

| No. by order | Indicators | Measurement unit | Value | Structure, % |

|---|---|---|---|---|

| 1 | Environmental protection, excluding environmental tax | UAH mln | 9670,6 | 49,6 |

| 2 | Labor protection and industrial safety | UAH mln | 4989,3 | 25,6 |

| 3 | Maintenance of social facilities | UAH mln | 3534,4 | 18,1 |

| 4 | Social partnerships | UAH mln | 868,8 | 4,5 |

| 5 | Employee training | UAH mln | 451,4 | 2,3 |

| Total | 19514,5 | 100,0 | ||

| 6 | Environmental | UAH mln | ||

| 3 | - reduction of CO2 emissions into the atmosphere since 2017 | % | -22 | |

| 3.1 | - reduction of water consumption by DTEK enterprises since 2017 | % | -23 | |

| 3.2 | - trees planted | thousand | 910 | |

| 3.3 | - white stork nests moved from power lines to special artificial platforms between 2013-2019 | units | 157 | |

| 4 | Social | |||

| 4.1 | - invested on creating a safe working environment for employees | UAH billion | 4,9 | |

| 4.2 | - territories where DTEK implements social partnership programs | units | 56 | |

| 4.3 | - invested in social partnership programs for community development | UAH billion | 1,3 | |

| 5 | Key Indicators for 2019 | |||

| 5.1 | - coal production | Mt | 22.4 | |

| 5.2 | - natural gas production | bcm | 1,7 | |

| 5.3 | - electricity generation | bn kWh | 28,4 | |

| 5.4 | - electricity distribution | bn kWh | 43,7 | |

| 5.5 | - electricity supply to the domestic market | bn kWh | 38,6 | |

| 5.6 | - electricity supply to foreign market | bn kWh | 5,8 | |

Source: DTEK 2020

The investments resulted in an increase in mining natural gas and gas coal, respectively, by 3.3 and 2 times, construction of 1 GW facility of “green” power industry, implementation of 2310 projects on the Programs of social partnership; upgrading 16 power units of Thermal Power Plant (TPP) of the total capacity of 4.1 GW. Within DTEK, the corporate university Academy DTEK is the base of training employees, innovative educational business platform open for the representatives of business, the state sector and citizens.

Generalization of the indicators of financial and integrated reporting of the studied energy holdings makes it possible to proceed to the results presented by innovation marketing, digital transformation, socially responsible investment and innovations in energy management.

Results

Innovation Marketing and Digital Transformation

Specific features of innovation marketing of state-influenced energy holdings are the implementation under conditions of public procurement based on the principles of information transparency and openness. Naftogaz Group and SE "NNEGC "Energoatom" approved of internal standards for procurement, which determine: the requirements for preparation of procurement documentation, qualification criteria and requirements for procurement participants; response measures in case of violations during procurement, compliance with environmental criteria. The ProZorro system calculates savings as the difference between the expected cost of purchase and the price of the most cost-effective offer of the participant according to the indicators of procedures in statuses: qualification of the winner; proposals considered; completed. In 2019, the number of purchases made through the ProZorro system amounted to: Naftogaz Group – 5611, SE "NNEGC "Energoatom" – 5055, and their cost was respectively 33152.3 and 18287.3 UAH mln.

Innovation marketing and digital transformation of the procurement process involves increasing efficiency through the purposeful implementation of software systems that increase the speed and accuracy of business processes implementation, while minimizing erroneous actions and decisions arising from the human factor. The principles of marketing activities of energy holdings are: non-discrimination of participants; fair competition among participants; objective and impartial evaluation of bids; openness and transparency at all stages of procurement; maximum economy and efficiency; prevention of corruption and abuse.

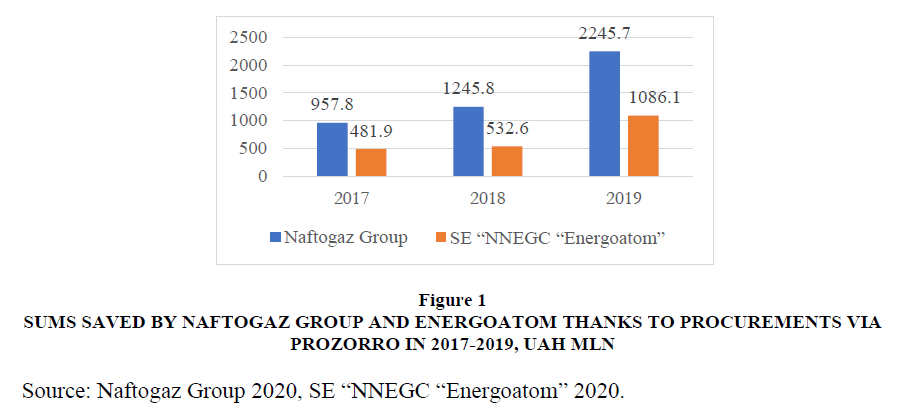

Within 2017-2019, the sums saved thanks to procurements via ProZorro increased Figure 1: for Naftogaz Group – from 957.8 to 2245.7 UAH mln, for Energoatom – from 481.9 to 1086.1 UAH mln.

Figure 1: Sums Saved by Naftogaz Group and Energoatom Thanks to Procurements Via Prozorro in 2017-2019, UAH MLN

Source: Naftogaz Group 2020, SE “NNEGC “Energoatom” 2020.

These savings are the result of systemic work of energy holdings aimed at attracting to bid as wide a range of potential suppliers as possible. At the end of 2019, Energoatom joined the Electric Power Research Institute (EPRI, USA) on engineering support of the NPP operation. The goal of the program is to introduce the best world practices and state-of-the-art methods of engineering support for nuclear power plants, which will further increase NPP safety and efficiency and reduce operating costs and maintenance costs. Within the framework of the EPRI Program for Engineering Support of NPP Operation, NNEGC Energoatom will have access to research results and recommendations on the following issues: assessment of technical condition, development and implementation of reliability programs, evaluation and continuation of the resource, long-term planning and optimization of assets, diagnostic methods, approaches to mitigation of degradation effects, methods of repair and replacement of equipment, development of professional skills and advanced training. The expenses of SE “NNEGC “Energoatom” for the program implementation will make up 434.7 USD thousand per year. Within 2020-2021 ?????, the holding, together with the European Instrument for Nuclear Safety, has been implementing the national project “Increasingthelevel of operation safety at the NPP of Ukraine” in the framework of the Program of technical cooperation with International Atomic Energy Agency (IAEA).

To create clean, efficient, customer-oriented power industry, DTEK introduces new solutions and technologies. For this purpose, in 2019, a special structural unit Innovation DTEK was created, which aims to find innovative solutions to improve the level of safety, business efficiency and environmental friendliness of production. DTEK creates its own innovative ecosystem, pursues an open innovation policy that allows attracting external resources to ensure technological progress based on a platform, through which anyone from anywhere in the world can put forward an innovative idea. Innovation DTEK is looking for the best solutions that meet the innovative needs of the holding and contribute to the achievement of global goals determined within the framework of the ESG – strategy of the company. The Expert center for digital technologies in the DTEK MODUS Group implements the digital business transformation program that covers production and administrative processes of all business areas and combines the following modules: digital mining, digital TPP, digital logistics, digital networks, digital deposit, digital procurement, digital office, digital HR, digital RES (Renewable energy sources), and digital client.

Socially Responsible Investment and Innovations in Energy Management

One of the key aspects of ESG – strategies of energy holdings is an increase in the level of energy efficiency of production processes and the careful use of fuel and energy resources. They have internal program documents based on the international standard ISO 50001. In August 2019, an external assessment of the current management system was carried out to establish if it meets the requirements of international standards, including ?SO 50001:2018 «Energy Management».

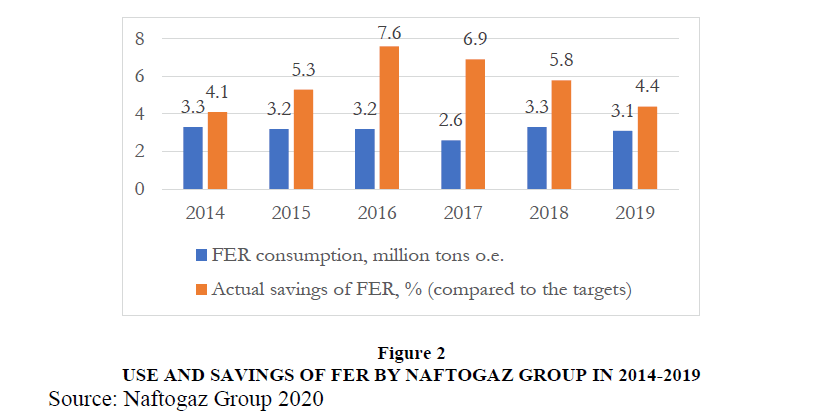

In 2014-2019 Figure 2, the volume of FER consumption in Naftogaz Group fluctuated within the interval from 2,6 million tons o.e. (2017) to 3,3 million tons o.e. (2014, 2018).

In 2019, energy resources used Table 6 made up 3,1 million tons o.e., including: natural gas - 3,2 bcm, heat - 597,3 thousand Gcal, electricity - 1,1 billion kWh, oil (gas condensate) - 76,5 thousand tons, other FER (boiler and furnace fuels) - 203,7 ktoe. Due to the implementation of energy saving programs, fuel and energy resources were saved (FER - 140,7 ktoe). Within 2014-2016, actual savings of FER (compared to the targets) increased from 4.1% to 7.6%, but by the end of the analyzed period (2019) they decreased by 4.4%, however, this indicator is by 0.3% higher, compared to the beginning of the analyzed period (2014).

| Table 6 Indicators of Socially Responsible Investment and Energy Consumption of Naftogaz Group in 2019 |

||

| Indicators | Measurement unit | Value |

|---|---|---|

| Energy resources used, including: | million tons o.e. | 3,1 |

| natural gas | bcm | 3,2 |

| Heat | thousand Gcal | 597,3 |

| Electricity | billion kWh | 1,1 |

| oil (gas condensate) | thousand tons | 76,5 |

| other FER (boiler and furnace fuels) | ktoe | 203,7 |

| Saved fuel and energy resources (FER) | ktoe | 140,7 |

| The total cost of fuel and energy resources saved | UAH million (including VAT) | 1273,7 |

| Expenditures on Environmental Protection, including: | UAH mln | 178,9 |

| - current | UAH mln | 171,7 |

| - capital investments | UAH mln | 7,2 |

Source: Naftogaz Group 2020

Acting as a socially responsible entity, Naftogaz Group in 2019 spent on Environmental Protection 178,9 UAH mln, including: current expenditures - 171,7 UAH mln, capital investments - 7,2 UAH mln.

The basic principles of DTEK operation are: production efficiency, investment efficiency, and management efficiency. As a socially responsible corporation, it cooperates with local communities in the framework of social partnership programs. Within 2013-2019, their expenses amounted to 731.1 UAH mln Table 7.

| Table 7 D??? Investments in Social Partnership Programs, UAH mln |

|||||||||

| Program | Years | Total | Structure, % | ||||||

|---|---|---|---|---|---|---|---|---|---|

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | |||

| Socially significant infrastructure | 34,2 | 34,4 | 13,9 | 10,9 | 40,9 | 63,6 | 38,1 | 236 | 32,3 |

| Increasing local community activity | 5,5 | 3,8 | 3,3 | 9,2 | 39,8 | 58,8 | 40,8 | 161,2 | 22,0 |

| Energy efficiency in the utility sector | 45,9 | 25,7 | 12,7 | 23,1 | 86,6 | 38,5 | 11,4 | 243,9 | 33,4 |

| Health care | 32,3 | 11,1 | 10,1 | 1,5 | 3,3 | 6,4 | 4,2 | 68,9 | 9,4 |

| Business environment development | 12,8 | 2,6 | 0,9 | 0,8 | 2,0 | 2,1 | 0 | 21,2 | 2,9 |

| Total | 130,8 | 77,6 | 40,9 | 45,5 | 172,6 | 169,3 | 94,4 | 731,1 | 100,0 |

Source: DTEK 2020

More than a third of volumes of funding (33.4%) is implemented in the program «Energy efficiency in the utility sector», almost a third (32,3%) – in the program «Socially significant infrastructure». Program «Increasing local community activity» ranks third by the volume of expenses (22.0 %). Specific weight of two other programs is considerably lower: «Health care» - 9,4%, «Business environment development» - 2,9%. The highest volume of funding for all programs was in 2017 (172.6 UAH mln), the lowest – in 2015 (40.9 UAH mln).

Nuclear power plants in Ukraine are the largest source of low-carbon electricity among the basic types of energy generation. Electricity production at NPPs does not lead to an increase in CO2 emissions and ensures uninterrupted power supply, taking into account the continuation of operation of 10 NPP units. The mission of SE "NNEGC "Energoatom" is safe production of low-carbon electricity in order to ensure sustainable development of Ukraine’s economy. The activity of Energoatom makes it possible to avoid more than 3 billion tons of CO2 emissions into the environment. In order to implement international standards ISO 50001:2018, the corporate program "Responsibility Energy", designed to increase the culture of energy consumption and energy efficiency, is implemented.

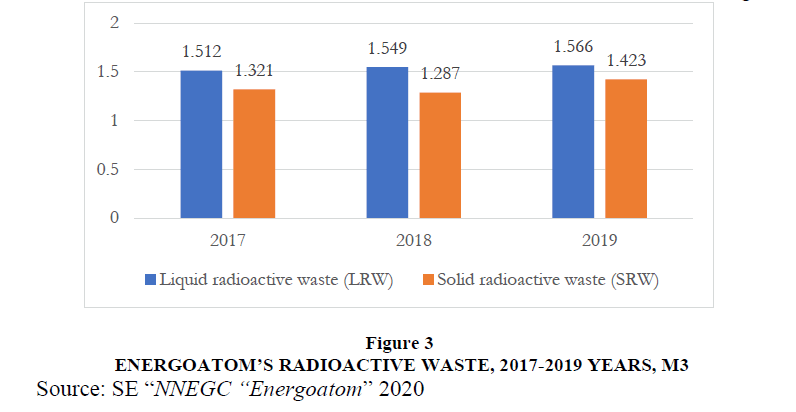

Within 2017-2019, the amount of LRW, generated by Energoatom, increased from 1.512 to 1.566 cubic metres, and that of SRW – from 1.321 to 1.423 cubic metres Figure 3.

That is why the priorities of socially responsible investment of Energoatom are: the creation of new nuclear capacities; modernization of production processes on the basis of the latest technologies; infrastructure development; accident-free long-term operation of NPP power units and obsolescence management; continuity and reliability of functioning of the system of physical protection of operations with nuclear fuel and its waste, ionizing radiation; improvement of LRW and SRW storage and utilization system aimed at safety improvement; enhancement of the working conditions and safety of personnel.

Energoatom allocates considerable funds to decrease a negative impact of the NPP operation on the environment, protection of humans and environment from the potential radioactive contamination. In 2017-2019, environmental expenses increased from 489.9 to 515 UAH mln with the maximum value of 763.7 UAH mln in 2018 Table 8.

| Table 8 Energoatom’s Environmental Expenses and Tax Paid, 2017-2019Years |

||||||||

| expenditure / tax | 2017 | 2018 | 2019 | |||||

|---|---|---|---|---|---|---|---|---|

| UAH mln | Structure, % | UAH mln | Structure, % | UAH mln | Structure, % | |||

| Environmental expenses | ||||||||

| Current environmental expenses | 226,1 | 46,2 | 272,3 | 35,7 | 312,3 | 60,6 | ||

| Capital investments | 263,9 | 53,9 | 491,4 | 64,3 | 202,7 | 39,4 | ||

| Total | 489,9 | 100,0 | 763,7 | 100,0 | 515 | 100,0 | ||

| Environmental tax | ||||||||

| Emissions, discharges of pollutants, and waste disposal | 2,21 | 0,2 | 2,96 | 0,3 | 2,58 | 0,2 | ||

| Radioactive waste management | 975,81 | 99,8 | 1024,52 | 99,7 | 1072,22 | 99,8 | ||

| Total | 978,02 | 100,0 | 1027,48 | 100,0 | 1074,8 | 100,0 | ||

Source: SE “NNEGC “Energoatom” 2020.

The maximum specific weight of current environmental expenses was observed in 2019 (60.6%), and that of capital investments – in 2018 (64.3%). The steady growth of environmental tax from 978.02 UAH mln in 2017 to 1074.8 UAH mln in 2019 was observed. Their major part that exceeds 99.7 % is «Radioactive waste management», which made it possible to enhance the state of production and safety culture at NPP.

Conclusion

Generalization of historical experience convincingly shows that the shift of emphasis from the informativeness of the demand for primary energy sources in favor of secondary energy is associated with the introduction of marketing innovations and the needs of ecological protection of the environment and humanity. The activities of Ukraine's energy holdings have important social and environmental consequences, and the key to their effectiveness is proper corporate management and the introduction of financial and marketing innovations, among which green energy resources, primarily biofuels, are becoming an increasingly popular object. The priority of Ukrainian energy holdings is the use of renewable sources of energy generation: from solar photovoltaic energy to wind energy (land and sea).

The voluntary nature of reporting and the low level of unification leads to significant differences in the integrated reporting of Ukraine energy holdings. The number of sections ranges from five in DTEK to eight in SE "NNEGC "Energoatom". The presentation of the results of achieving indicators of sustainable development and marketing innovations for the sections is arbitrary, which makes it impossible to construct summary tables, which display the data on all three holdings in an end-to-end way. That is why the results of achieving indicators of sustainable development, the introduction of marketing innovations, digital transformation, socially responsible investment and innovations in energy management were assessed on an individual basis using quantitative and qualitative indicators.

Unification of financial reporting of energy holdings of Ukraine allowed constructing a summary table and establishing that Naftogaz Group is the largest energy holding in Ukraine by the volume of financial results. DTEK is the second largest energy holding in Ukraine. SE "NNEGC “Energoatom” is the smallest from the analyzed energy holdings of Ukraine according to the criterion of financial results, but it is developing rapidly. The common features of all the studied energy holdings in Ukraine are profitable activities, the prevailing tendency to increase the volume of activity and net profit. The differences include differentiation of the volume of activity and a decrease in the amount of income of Naftogaz Group and DTEK in 2019.

The implementation of the models of corporate social responsibility in the practice of Ukrainian energy holdings in the context of European integration will be facilitated by: the fullest use of the advantages of the information capacity of financial reporting and the unification of forms of social non-financial reporting; implementation of legislative acts aimed at creating a competitive market of electricity trading; development of infrastructure and electrical networks to ensure electricity flows; joining the strategy of the development of the trans-European network in the sectors of power industry, natural gas, oil, etc.; attraction of energy investments based on agreements on cooperation with the Energy Community; fulfillment of national obligations in the field of nuclear safety in accordance with European standards.

References

- Alalwan, ?.H., Alminshid, H.A., & Aljaafari, S.A. (2019). Promising evolution of biofuel generations. Subject review. Renewable Energy Focus, 28, 127-139. https://doi.org/10.1016/j.ref.2018.12.006.

- Arto, I., Capellán-Pérez, I., Lago, R., Bueno, G., & Bermejo, R. (2016). The energy requirements of a developed world. Energy for Sustainable Development, 33, 1-13.

- Blagrave, P., & Furceri, D. (2021). The macroeconomic effects of electricity-sector privatization. Energy Economics, 1, 105245. https://doi.org/10.1016/j.eneco.2021.105245. Accessed 07/05/2021.

- Carvalho, J., Mota, A., Ribeiro, A., Soares, M., Araújo, J., & Vilarinho, C. (2018). MOVBIO - Mobilization of Biomass for Energy Recovery Towards a Sustainable Development. European Journal of Sustainable Development, 7(4), 483-488. https://doi.org/10.14207/ejsd.2018.v7n4p483.

- Chyzh, V., & Sakhno, T. (2020). Corporate Social Responsibility in the Development of Territorial Communities of Ukraine. European Journal of Sustainable Development, 9(3), 39-50. https://doi.org/10.14207/ejsd.2020.v9n3p39.

- DTEK (2020). Integrated Report 2019. Financial and non-financial results. https://dtek.com/en/investors_and_partners/reports/. Accessed 05/05/2021.

- Dubchak, S., Goshovska, V., Goshovskyi, V., Svetlychny, O., & Gulac O. (2020). Legal Regulation of Ensuring Nuclear Safety and Security in Ukraine on the Way to European Integration. European Journal of Sustainable Development, 9(1), 406-422. https://doi.org/10.14207/ejsd.2020.v9n1p406.

- Fukuda, K., & Ouchida, Y. (2020). Corporate social responsibility (CSR) and the environment: Does CSR increase emissions? Energy Economics, 92, 104933. https://doi.org/10.1016/j.eneco.2020.104933. Accessed 04/05/2021.

- Gulac, O., Goshovska, V., Goshovskyi, V., & Dubchak, L. (2019). New Approaches to Providing of Environmental Management in Ukraine on the Way to Euro Integration. European Journal of Sustainable Development, 8(2), 45-56. https://doi.org/10.14207/ejsd.2019.v8n2p45.

- Khezr, P., & Nepal, R. (2021). On the viability of energy-capacity markets under decreasing marginal costs. Energy Economics, 96, 105157. https://doi.org/10.1016/j.eneco.2021.105157. Accessed 06/05/2021.

- Kivimaa, P., Laakso, S., Lonkila, A., & Kaljonen, M. (2021). Moving beyond disruptive innovation: A review of disruption in sustainability transitions. Environmental Innovation and Societal Transitions, 38, 110-126. https://doi.org/10.1016/j.eist.2020.12.001.

- Naftogaz Group (2020). Annual report - 2019. On to new heights. https://www.naftogaz.com/files/Zvity/Naftogaz_2019_EN.pdf. Accessed 06/05/2021.

- SE “NNEGC “Energoatom” (2020). Clean Energy for Sustainable Future. Non-Financial Report – 2019. http://nfr2019.energoatom.kiev.ua/en/index.php. Accessed 07/05/2021.

- Semkou, A., Kolovos, E., Andreadis, I., & Konstantinidou, A. (2019). Integrating Energy Markets in the Wider Europe: The Eastern Dimension. European Journal of Sustainable Development, 8(4), 101-113.

- Shulga, I., Kurylo, V., Gyrenko, I., & Savych, S. (2019). Legal Regulation of Energy Safety in Ukraine and the European Union: Problems and Perspective. European Journal of Sustainable Development, 8(3), 439-447. https://doi.org/10.14207/ejsd.2019.v8n3p439.

- Steffen, B. (2020). Estimating the cost of capital for renewable energy projects. Energy Economics, 88, 104783. https://doi.org/10.1016/j.eneco.2020.104783. Accessed 05/05/2021.

- Suvorova, I., Kravchenko, O., Baranov, I., & Goman, V. (2018). Innovative Technologies for Utilization and Disinfection of Waste to Ensure Sustainable Development of Civilization. European Journal of Sustainable Development, 7(4), 423-434. https://doi.org/10.14207/ejsd.2018.v7n4p423.

- Zogolli, H. (2015). Market Monitoring and Analysis: Electricity Sector. European Journal of Sustainable Development, 4(3), 73-86. https://doi.org/10.14207/ejsd.2015.v4n3p73.