Research Article: 2024 Vol: 23 Issue: 5

FFCL - TAPING INTO THE DIGITAL BANKING POTENTIAL

Muhammad Azeem, Superior University

Citation Information: Azeem, M. (2024). FFCL – taping the digital banking potential. Academy of Strategic Management Journal, 23S(5), 1-03.

Abstract

He primary subject matter of this case concerns Often referred to as \\\"supplier finance\\\" or dealer credit facility, encourages collaboration between buyers and sellers & reduce lead time of credit sales. This counters the conflict that typically arises between two parties doing credit sales transaction, as under traditional circumstances, buyers attempt to delay payment, while sellers look to be paid as soon as possible. The case appropriate for first year graduate level.

Keywords

Dealer, Credit, Facility.

Introduction

Fauji Fertilizer Company Limited (FFC) is the largest urea manufacturer in the country. It was a joint venture between Fauji Foundation (a leading charitable trust in Pakistan) and Haldor Topsoe A/S of Denmark. It has largest fertilizer marketing network in Pakistan which markets nearly 3.5 million metric tons of fertilizer per annum.

The primary subject matter of this case concerns Often referred to as "supplier finance" or “dealer credit facility”, encourages collaboration between buyers and sellers & reduce lead time of credit sales Sulehri & Khurshid et al., This counters the conflict that typically arises between two parties doing credit sales transaction, as under traditional circumstances, buyers attempt to delay payment, while sellers look to be paid as soon as possible. The case appropriate for first year graduate level Desk, (2024).

In Year 2022, Mr. Mumtaz Hussain, Qualified Chartered Accountant having diversified professional exposure of more than 20 years in top rated multinational groups Grant Thornton International, Unilever in the fields of Financial Operations, Financial Reporting & Commercial Finance with specialty in SAP (FICO) operational and development experience, identified the problem arising in traditional credit sales channels of high lead time and slow conversions to sales, he addressed the problem by introducing Dealer credit facility (Supply chain financing) in the company, where basic model was that customer and bank has a credit agreement instead of company, bank transfer funds to company and company provides product (fertilizer) to customer. Which played a pivotal role in improving sales of company reduced lead times and capturing market share Hofmann, (2011).

Problem with Traditional Cahnnels of Credit Sales

In era of technology where modern technology is being adopted and large corporations are competing for market share, a problem was arising that Physical Bank guarantees for credit sale were taking too much time and effort to materialize into actual sales Gelsomino & Mangiaracina et al., (2016).

Bank guarantees were written physically on stamp papers and attested, then they were dispatched to finance department from customer’s city, it could take up to 5 working days to reach finance department. This practice was being used for more than a decade, it was embedded in company system properly, but the time consumed in process was too much and was resulting in in-efficiency.

Bank guarantees were properly red by a team at finance department, any discrepancies were highlighted and communicated with the sales team and customers, they were then returned for correction and the whole process could take up to 10 days. The time for creating a physical guarantee and actual sales being made was way more than desirable taking up to 15 days, process was complex and needed to be monitored carefully by team.

Implementation

Supply chain finance is a set of tech-based business and financing processes that lower costs and improve efficiency for the parties involved in a transaction, it provides short-term credit that optimizes working capital for both the buyers and the sellers.

Customer negotiate terms of credit with the Banks, and recommendation is provided by company to include customers with strong sales record. Bank transfer funds to company account and fertilizer was provided to customer. No paperwork is involved at companies end while minimum documentation is required by the Bank which reduce processing time to 24 hrs Zhan & Chen (2018).

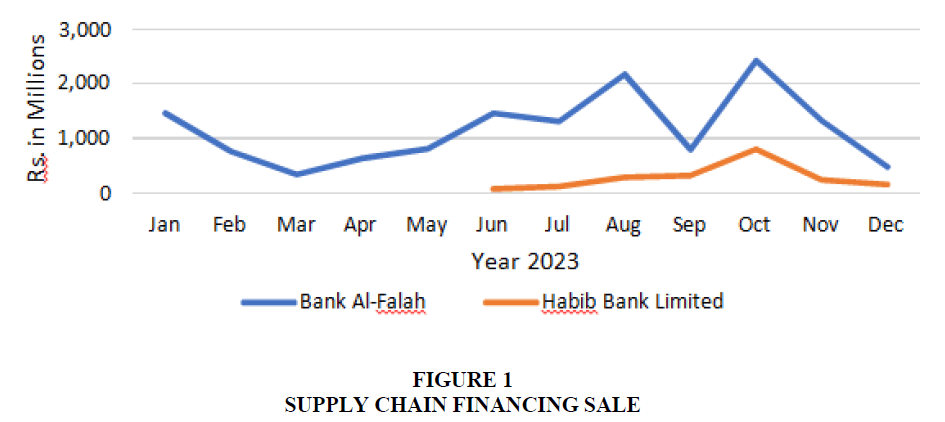

In first phase Bank Al-Falah was added to provide credit facility, few customers were selected to test the project.

As testing resulted in success more and more customers were added to the list, further other banks were also showing interest in this program, as the list grew another bank was added, now Habib Bank Limited was also part of this project. Figure 1.

Results

This resulted in less pressure on credit sales team, sales officers were eased as there was no paperwork involved. The project becomes a success and more and more customers wanted to be part of dealer credit facility.

This program was started in November 2022 and within a year Rs.17 Billion sales were made through this facility, the process of dealer’s willingness to avail the credit and sales was reduced to 2 days.

Due to adaptation of new process, time and effort was reduced. This process is far more efficient than traditional channels of credit sale, the future is for those who move with changing technology and adapt to changing environment and forgo old ways that are non-efficient. In future more, banks are willing to be added for this facility to disburse credit to customers of Fauji Fertilizer Company.

In conclusion, Fauji Fertilizer Company Limited's adoption of supply chain finance has proven instrumental in overcoming traditional credit sales challenges. Through innovative partnerships with banks and the integration of digital banking technologies, FFC successfully reduced lead times, increased sales efficiency, and enhanced overall competitiveness. This strategic initiative not only demonstrates FFC's commitment to innovation but also sets a precedent for industry-wide transformation, emphasizing the importance of embracing technology-driven solutions to drive sustainable growth in today's dynamic business environment.

References

Desk, B. W. (2024). https://www.brecorder.com/news/40294531/pakistan-imf-reach-staff-level-agreement-on-final-review-of-3bn-sba

Gelsomino, L. M., Mangiaracina, R., Perego, A., & Tumino, A. (2016). Supply chain finance: a literature review. International Journal of Physical Distribution & Logistics Management, 46(4).

Indexed at, Google Scholar, Cross Ref

Hofmann, E. (2011). Supply chain finance solutions. Springer.

Sulehri, N. A., Khurshid, A., & Saeed, A (2011). An Evolution of Fertilizer Marketing Vision.

Zhan, J., Li, S., & Chen, X. (2018). The impact of financing mechanism on supply chain sustainability and efficiency. Journal of cleaner production, 205, 407-418.

Indexed at, Google Scholar, Cross Ref

Received: 02-Jun-2024, Manuscript No. ASMJ-23-14729; Editor assigned: 04-Jun-2024, PreQC No. ASMJ-23-14729(PQ); Reviewed: 17-Jun-2024, QC No. ASMJ-23-14729; Revised: 22-Jun-2024, Manuscript No. ASMJ-23-14729(R); Published: 28-Jun-2024