Research Article: 2017 Vol: 21 Issue: 3

Female Leadership in Banking and Bank Risk

Bing Yu, Meredith College

Mary Jane Lenard, Meredith College

E. Anne York, Meredith College

Shengxiong Wu, Texas Wesleyan University

Keywords

Gender Diversity, Leadership, Bank Risk.

Introduction

Does gender matter in banking? In a 2014 article in American Banker magazine, Editor in Chief Heather Landy lamented the decline in female CEOs of banks with assets of more than $10 billion. Of the nearly 100 bank holding companies of this size, there were only five female CEOs in 2011 and the article projected that this number would decline to two female CEOs by the end of 2014. Data from Catalyst, a non-profit organization dedicated to expanding opportunities for women and business, shows that the percentage of female directors and female executive officers in the finance and insurance industry among the Fortune 500 companies has recently decreased after initially increasing in the aftermath of the financial crisis. The percentage of female directors increased from 16.1% in 2007 to 19% in 2012and then decreased to 17.9% in 2013. The percentage of female executive officers increased from 16.6% in 2007 to 19.1% in 2010and then decreased to 17.6% by 2013. Data from the Bureau of Labour Statistics show that the percentage of women employed in the banking industry has fallen from 68.4% in 2004 to 61.9% in 2015.

The purpose of this research is to examine the impact that female bank executives and female board members have on bank risk, as measured by the variability of the bank’s monthly stock return. On the one hand, shareholders want managers to maximize the value of their equity. On the other hand, managers are given incentives and hence have motivation to take risks. However, committees of all publicly-traded companies are required to follow strict regulations as a result of the Sarbanes-Oxley Act (SOX) of 2002 (U.S. House of Representatives 2002). The SOX legislation includes specific requirements for corporate governance, such as the independence of board members and financial expertise on the audit committee. As a result, high quality boards are tasked with constraining excessive risk-taking that benefits management at the expense of shareholders (Sun and Liu 2014). In the aftermath of the global financial crisis, there were calls for greater representation of women in the upper echelons of banking and finance since it is perceived that women would not have made the risky gambles that led to the crisis (Sunderland 2009).

Given the reported challenges of women leaders in the banking industry and the possibility of their untapped potential in managing bank risk, we need to examine the impact of women leaders on the banking industry as it moves forward. Our study analyses the impact of gender in executive and board positions over the time period 2003 to 2011. We selected this time period because any specific committee memberships would reflect the rules defined under the Sarbanes-Oxley legislation and also to be able to consider the effect of the global financial crisis. If the board committees have an important role in monitoring firm performance in order to reduce risk, especially after the SOX legislation, then how do women contribute to the management of risk?

Our research makes two major contributions to the literature on women and bank risk. First, we examine women’s roles in executive and board positions separately. Our findings provide empirical evidence that highlights contradictions on women’s risk aversion in prior studies (Byrnes et al. 1999, Croson and Gneezy 2009and Adams and Funk 2012). Specifically, we look at the percentage of women leaders, in executive positions and as board members and the percentage of women directors on the audit and the corporate governance committees for our sample of banks during this time period. We chose to examine the audit and corporate governance committees because they are key committees for boards to have and because they have a monitoring role over bank risk. Second, we examine the impact of female directors who are members of the board of directors during the financial crisis.

The remainder of the paper proceeds as follows. Section 2 provides a literature review and hypotheses. Section 3 describes our data and descriptive statistics. Section 4 discusses our research results and section 5 is our conclusion.

Literature Review and Hypotheses

Risk-taking by managers is a strategic component of effective management because managers need to take risks in order to improve their competitive advantage and company performance. Hoskisson et al. (2017) address several theories and develop a framework to examine managerial risk-taking. The theories that Hoskisson et al. (2017) study include agency theory, behavioural theory of the firm, prospect theory, the behavioural agency model and upper echelons theory. Agency theory examines the conflict between managers and owners of the firms and proposes that top managers should be compensated or monitored to achieve better outcomes. The behavioural theory of the firm and prospect theory, concentrate on risk-taking preferences – that the managers will be risk-seeking if their performance is below a particular target or aspiration and risk-averse above it. The behavioural agency model assumes that executives are loss averse and that their compensation plans can be structured to determine their risk-taking preferences. Upper echelons theory proposes that a manager’s orientations toward risk are formed through a combination of psychological characteristics and observable experiences.

All of these theories describe different motivations for managers’ risk-taking behaviour and help evaluate why such behaviour may or may not benefit the firm. Several risks that are prominent for banks include credit risk, market risk, liquidity risk and operations risk (banktel.com 2015). While these are risks faced by any company, credit risk and liquidity risk are critical to bank performance because lending and expecting customers to repay what is loaned to them, is a main business of banks. Liquidity risk must be managed so that not too much money is loaned out. Stulz (2014) notes that there are good risks and bad risks that banks must manage. He states that a well-governed bank takes the amount of risk that maximizes shareholder wealth.

The risk-return relationship is a fundamental relationship that is described as “the first law of finance.” Volatility of stock return is widely used in literature as a risk measure (Anderson et al., 2009; Merton, 1973; Leon et al., 2007; Pathan and Faff, 2013; Ant and Peterson, 1985). Empirically, standard deviation of monthly stock return is a variable that grasps volatility of return (Guo and Whitelaw, 2006; Merton, 1973). Consistent with the literature, we use standard deviation of monthly stock return to measure bank risk.

Then, risk-adjusted stock return can also be used as a measure of performance (Gompers et al., 2003). Corporate governance can be evaluated in terms of how well a firm manages risk, as evidenced by the variability of corporate performance. Allayannis and Weston (2001) find that firms which are able to effectively manage their hedging activities and reduce the volatility of their financial results are valued more highly than firms that cannot do so. Jones and Wilson (2004) perform an analysis and note that the relative change in the volatility of stocks and bonds over the past 50 years has increased the importance of stocks in asset allocation.

To manage risks for the bank, management needs to mitigate bad risks, while reaching a level of risk that is appropriate given applicable laws and regulations (Stulz 2014). Those laws currently include the Dodd-Frank Act (U.S. House of Representatives 2010), which was created in response to the recent financial crisis in order to limit bank risk-taking. The Dodd-Frank Act established the financial stability council “to identify risks to the financial stability of the U.S. that could arise from the material financial distress or failure…” of large, inter-connected bank holding companies (Dodd-Frank Act, p. 19). The Act makes recommendations to the Board of Governors concerning the “establishment of heightened prudential standards” for risk-based bank activities (Dodd-Frank Act, p. 20). The Act curtails a financial institution’s ability to employ risky trading techniques when also serving as a depository. Specifically, it provided for a moratorium after Nov. 23, 2009 on approval of applications for deposit insurance “for an industrial bank, a credit card bank or a trust bank that is directly or indirectly owned or controlled by a commercial firm” (Dodd-Frank Act, p. 222).

The Dodd-Frank legislation is structured in such a way to limit bank risk-taking. Yet, as noted by the various theories of managerial risk-taking, some amount of risk-taking is necessary to survive in a competitive environment. The questions we ask are whether gender diversity among the executives or board members has an impact on the variability of bank performance.

Women Leaders and Risk-Taking

Research on women and risk generally concludes that women tend to be more risk averse than men (Croson and Gneezy, 2009; Faccio et al., 2014; Francis et al., 2015). However there have been some contradictory findings. Maxfield et al. (2010) examine the risk propensity and decision making skills of female managers. Their survey finds that the “motivators for women’s risk taking are the same as those identified in research as general, gender-blind motivators” (p. 597). Further, Iqbal et al. (2006) examine risk attitudes of male and female executives in terms of their response in stock option awards. Their findings show that the male executive’s selling behaviour exhibited more risk aversion than what was exhibited by the female executives. Adams and Funk (2012) find evidence that female board members are more risk loving than their male counterparts.

Alternatively, when women are members of the board of directors, research indicates that they take their monitoring role very seriously. Lenard et al. (2014) study boards of directors at all firms except in the financial sector and find that a higher percentage of women on the board is associated with lower variability of stock market return. Robinson and Dechant (1997) note that women directors are perceived to be more hard-working, with better communication skills, which contributes to better problem-solving ability of the entire board. Eagly and Carli (2003) propose that women have to demonstrate additional competencies to reach directorship positions, which implies that women are quite diligent as directors.

In the financial field, Bliss and Potter (2002) find no difference in risk taking between male and female mutual fund managers. Atkinson et al. (2003) find that male and female fixed-income mutual fund managers do not differ significantly in terms of performance or risk. Sapienza et al. (2009) show evidence of a biological basis for choosing a career in finance. They test a sample of University of Chicago MBA students and find that women with higher levels of circulating testosterone were associated with lower risk aversion. Individuals in the study who had high testosterone and low risk aversion were more likely to pursue a career in finance, even after controlling for gender. In addition, agency theory suggests that a manager has incentive to take risks because his or her compensation is tied to company performance. Berger et al. (2014) study executive board composition in the banking industry and find that board changes that lead to a higher percentage of female members increases their two measures of portfolio risk.

These findings lead us to propose our first two hypotheses. Given the contradictory evidence of the risk propensity of women leaders in banking, more gender diversity could be either positively or negatively related to bank risk, which we measure as the variability of the bank’s stock return. We develop the following non-directional hypotheses:

H1: Gender diversity on the executive team is significantly associated with the variability of bank performance.

H2: Gender diversity on the board of directors is significantly associated with the variability of bank performance.

Women Directors and Board Committee Membership

Thiruvadi and Huang (2011) investigate whether gender diversity on the audit committee impacts the firm’s earnings management. They find that the presence of a female director on the audit committee reduces earnings management by increasing negative (income-decreasing) discretionary accruals.

In studies specific to the banking industry, Sun and Liu (2014) conclude that having more women on the bank’s audit committee is one of the factors that lead to more effective risk management. In a study by Adams and Ragunathan (2015), the authors find that more female directors on bank boards did not lead to less risky activity. Yet they find that a higher proportion of female than male directors sit on committees, particularly being more likely to serve on monitoring committees and among those who do serve, women are on more committees than the male directors. They find that male directors have better attendance when there are female directors on their board and that female directors are less likely to depart from a board when a bank is under greater stress. Kesner (1988) has noted that that even though executives and board members may have the same risk preferences, a board consists of both insiders and outsiders. Outside members are valued because of their breadth of experience – they have contact with different companies and industries. As a result, she finds that there are disproportionately more outsiders than insiders on major board committees. In fact, Sarbanes-Oxley requires that the audit committee be composed entirely of outside members of the board (U.S. House of Representatives 2002).

We therefore choose to examine the presence of female directors on the two committees generally considered as monitoring committees–the audit and corporate governance committees. Even though the women on the board may have the same risk preferences as women executives, we believe that when women are members of these committees, they will exhibit less risky behaviour. Therefore our third hypothesis is:

H3: Gender diversity on monitoring committees of the board is negatively associated with the variability of bank performance.

Women Directors and the Financial Crisis

The global financial crisis highlighted the importance of effective corporate governance in managing bank risk (Peni and Vahama, 2012; Pathan and Faff, 2013). Francis et al. (2015), note that the role of boards would be more important and thus more visible in terms of bank performance. In a study of banks with female CEOs, Palvia et al. (2015) provide evidence that for smaller banks, those with female CEOs and female board chairs were less likely to fail during the financial crisis. We therefore formulate our next two hypotheses as follows:

H4: Gender diversity on the executive team during the financial crisis is negatively associated with the variability of bank performance.

H5: Gender diversity on the board of directors during the financial crisis is negatively associated with the variability of bank performance.

Research Method

Data and Variables

Our sample consists of companies in the financial industry (SIC codes between 6000 and 6500) from the RiskMetrics database from 2003 to 2011. This database contains information on corporate boards of directors. Financial variables are collected from the Compustat database and CRSP database for the same years. We use multiple years of financial information in order to have a more accurate measure of financial performance. We exclude companies whose financial statement information is incomplete or unavailable on Compustat or CRSP. Our final sample consists of 616 firm-year observations, which represents 101 banks.

Our dependent variable, SD_RETi,t, is the standard deviation of monthly stock return in each year. This variable measures the volatility of stock return, which we use as a proxy for bank risk. We use monthly stock return to eliminate daily stock price fluctuation and therefore standard deviation is a better risk measure (Cheng 2008). We include the following control variables to control for firm-specific factors such as operation efficiency, management effectiveness and corporate governance quality.

Our control variables are total debt ratio (LEVERAGE), return on assets (ROA), firm size that is measured by log of total assets (LN_TA) and Tobin’s_Q. We would expect that bigger, older, more diversified firms are likely to observe less variable performance (Cheng 2008). We would also expect that firms with higher LEVERAGE and lower profitability, as measured by ROA, would have higher variability of performance. We include Tobin’s_Q as a proxy for growth, computed as the sum of the market value of equity plus the book value of liabilities, divided by the book value of total assets (Pathan and Faff, 2013). It is expected to be negatively associated with market variability.

Our board variables are either board size (B_SIZE) or a CEO who is also the chairman of the board (CEO_CHAIR). We use the CEO_CHAIR variable when applying the model that analyses the effect of female executives on the bank’s stock variability and we use the variable B_SIZE when we are examining the influence of board members on stock variability. In the model examining the women on the various board committees, we follow Cheng (2008) and examine whether the board size is an indicator of performance variability. Our variable, B_SIZE, is the log of the number of board members. Wang (2012) found that small boards give CEOs larger incentives and force them to bear more risk than larger boards, which means a smaller board would imply more volatility or variability. However, other authors have found the opposite result (Jensen, 1993; Goodstein et al., 1994). Therefore we have no prediction about the sign of the B_SIZE variable. When we examine the percentage of women executives at the bank, we expect someone who is both CEO and Chairman of the Board (CEO_CHAIR) will exercise more power in decision-making. Cheng (2008) uses this variable in order to distinguish agency problems of a powerful CEO from board size. According to Cheng, when CEOs become more powerful, firm performance may become more variable or less variable. Haleblian and Finkelstein (1993) suggest that dominant CEOs may “nullify the effects” of the other board members. They find that the association between team size, CEO dominance and firm performance is significant in an environment that allows top management high discretion in making strategic choices, but is not significant in a low discretion environment. Eisenhardt and Bourgeois (1988) suggest that in situations where the CEO is less dominant, there is greater sharing of information, which would conceivably result in less risky decision making. From the perspective of agency theory, Demsetz and Lehn (1985) argue that when uncertainty increases, there may be more constraint on agent’s behaviour. This outcome would indicate a negative relationship between CEO power and performance variability. Adams et al. (2005) study powerful CEOs and their impact on firm performance. When the absolute value of stock returns is the dependent variable, they find a positive (insignificant) effect of CEO duality on firm performance. Given these contradictory findings in the literature, we make no prediction about the sign of the CEO_CHAIR variable.

To measure the impact of women in leadership positions during the financial crisis, we use a dummy variable, FCRS, to represent the time period of the financial crisis, 2007-2009. FCRS is equal to one if the year is between 2007 and 2009, otherwise zero. We expect that there will be more variability of financial performance during this time. To examine female directors’ role in bank risk during the financial crisis period, we add an interaction term FCRS*F_DIR which is the FCRS dummy variable multiplied by the female dummy, F_DIR, which is equal to one if there is a female director on a board, otherwise zero. To examine female executives’ role in bank risk during the financial crisis period, the interaction term is FCRS*F_EXE, which is the FCRS dummy variable multiplied by the female dummy, F_EXE, which is equal to one if there is a female in an executive position, otherwise zero.

We have several variables that measure female governance. Our first test variable, PCT_F_EXE represents the role of female executives. According to the RiskMetrics dataset, we count the following eight positions - CEO, CFO, Chairman, COO, Executive VP, President, Senior VP and Treasurer, as executive positions. PCT_F_EXE is the number of females in the above positions at a bank divided by eight. Although, if a bank does not have all above eight positions or one person serves for more than one position, PCT_F_EXE is the number of females in the above positions at the bank divided by number of executive positions available in that bank. We then measure the various board positions. We measure the percentage of women on the committees that comprise a monitoring role and could significantly affect bank risk. Upadhyay et al. (2014) study committee memberships and find that firms use committees to mitigate costs associated with large boards. They focus on the most common committees that have uniform responsibilities across firms. The committees in our sample are the audit and corporate governance committees because of their monitoring role. Our variables are represented as the percentage of female members of the audit committee (PCT_F_AUD) and percentage of female members of the corporate governance committee (PCT_F_CG).

To address endogeneity and heterogeneity issues, we run all models using the two-stage system GMM approach, following Arellano and Bover (1995). This two-stage system GMM model treats all explanatory variables as endogenous and orthogonally uses lagged values as instruments. To correct the unobserved heterogeneity and omitted variable bias, we generate a match equation of the first differences of all variables and use the lagged value of independent variables to estimate models via GMM. Doing so treats all explanatory variables except firm size (LN_TA) and the financial crisis dummy (FCRS) as endogenous (Wintoki et al. 2012). We conduct the F-test and Hansen’s J-test to check the reliability of estimation and validity of the instrument.

Descriptive Statistics

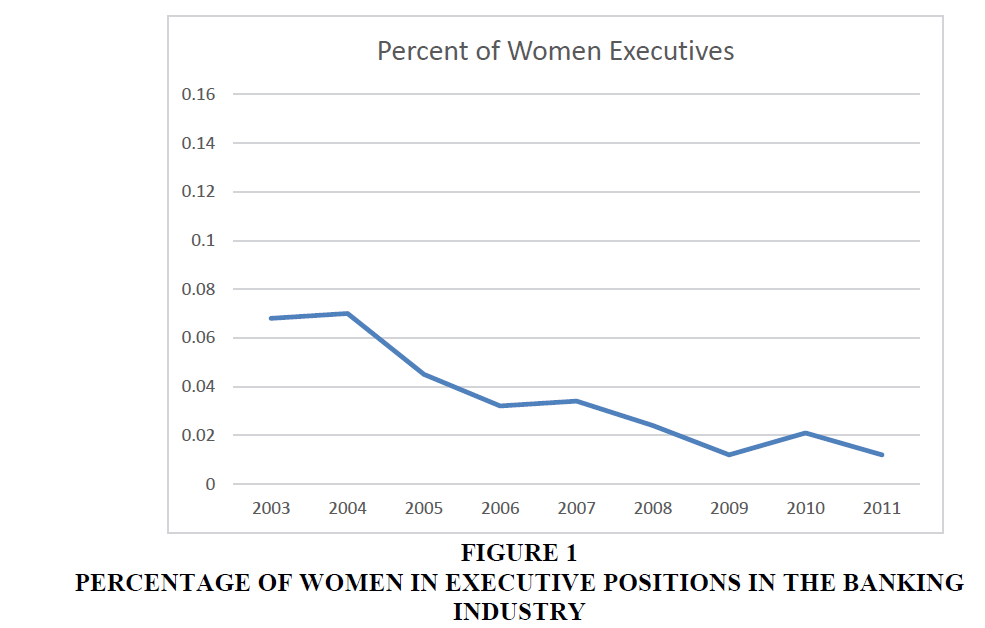

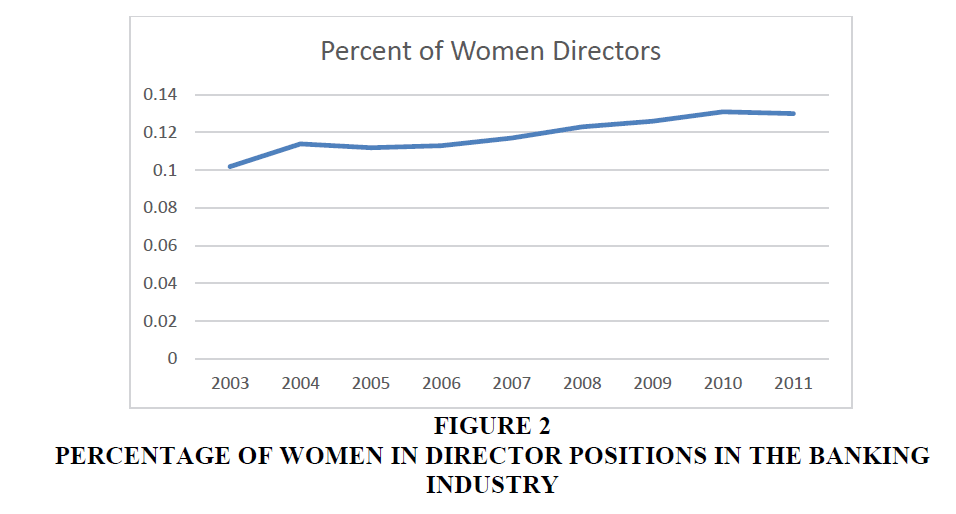

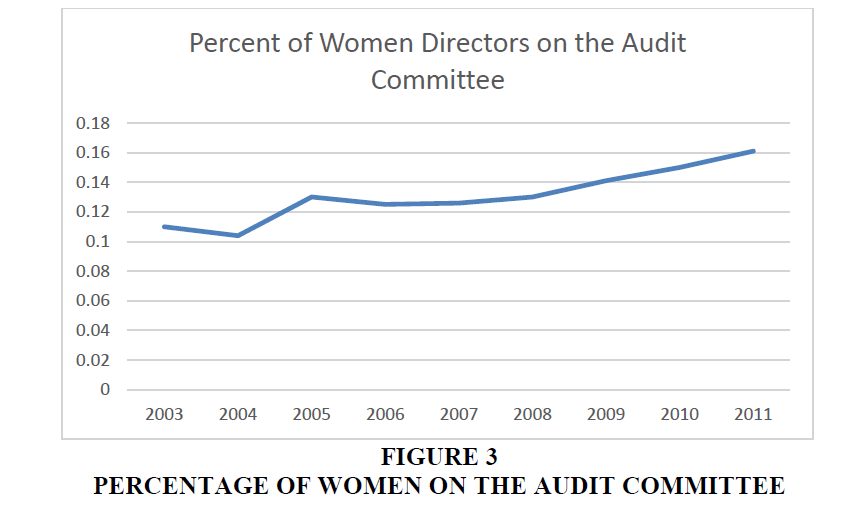

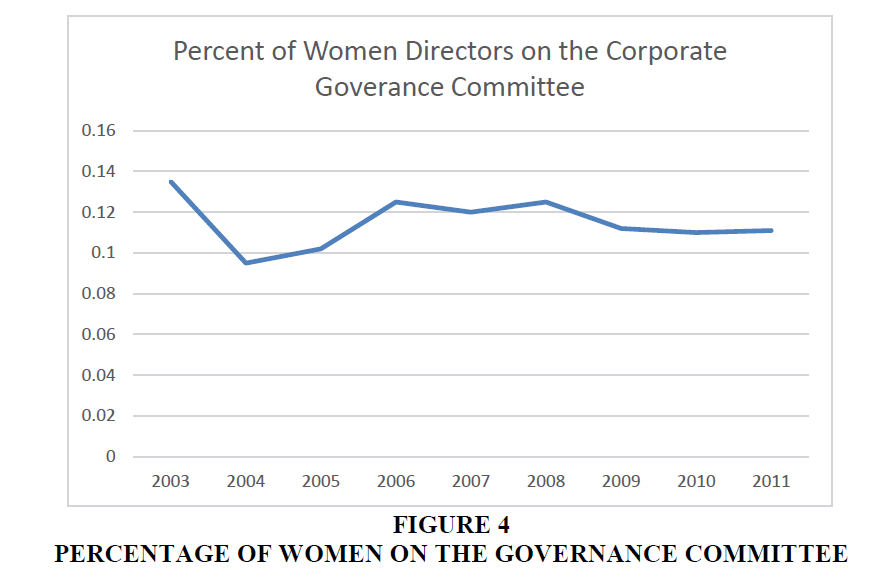

Our test variables represent the percentage of women in executive and director positions in the banking industry. Figures 1 through 4 represent the average percentage of women in executive and director positions in the banking industry over the time period of our sample. Figure 1 shows that the average percentage of female executives dropped from 7 percent in 2004 to less than 2 percent by 2011. Figure 2 illustrates that the percentage of women directors increased over the same time period, from less than 11 percent to 13 percent. Figure 3 indicates that the percentage of women on the audit committee increased after 2004, moving from slightly more than 10 percent to more than 16 percent. Figure 4 shows that the percentage of women on the corporate governance committee has fluctuated, with the most recent average at 11 percent in 2011.

Table 1, Panel A shows the descriptive statistics for our sample of banks. The minimum size of a board is 5 directors, while the maximum is 26 directors, with a median of 12 directors. The mean percentage of women on the board of directors is 12.1%, with a minimum of 0, a median of 11.1%and a maximum of 46.2%. When we examine the percentage of women on the audit committee, there is a maximum of 66.7% of women on such a committee, with an average of 13.7%. The average percentage of women on the corporate governance committee is 11.5%, with a maximum of 66.7%. In contrast, the average percentage of women executives is 4.4%. Our statistics also show that the average percentage of women who serve on more than one committee of the board (“busy” women) is 0.3%, with a maximum of 13.2%. When compared to men on the board, the average percentage of men who serve on more than one committee (“busy” men) is 1.8%, with a maximum of 30.8%. For the CEO_CHAIR variable (not shown in the table), there are 264 firm-years in which CEO_CHAIR equals one. This means that the CEO is also the board chair in those observations.

| Table 1: Descriptive Statistics | ||||||

| Panel A. Board Structure of Banks | ||||||

| Mean | SD | Min | Median | Max | N | |

|---|---|---|---|---|---|---|

| Number of Directors | 12.609 | 2.978 | 5 | 12 | 26 | 616 |

| Percent of Women Directors | 0.121 | 0.079 | 0 | 0.111 | 0.462 | 616 |

| Percent of Women on Audit Comm* | 0.137 | 0.159 | 0 | 0 | 0.667 | 616 |

| Percent of Women on CG Comm | 0.115 | 0.152 | 0 | 0 | 0.667 | 616 |

| Percent of Women Executives | 0.044 | 0.076 | 0 | 0 | 0.375 | 616 |

| Percent of Busy Women Directors | 0.003 | 0.014 | 0 | 0 | 0.132 | 616 |

| Percent of Busy Men Directors | 0.018 | 0.042 | 0 | 0 | 0.308 | 616 |

| Table 1: Panel B. Financial Characteristics of Bank | ||||||

| Mean | SD | Min | Median | Max | N | |

| SD_RET | 0.092 | 0.063 | 0.019 | 0.073 | 0.449 | 616 |

| LEVERAGE | 0.087 | 0.070 | 0.000 | 0.077 | 0.558 | 616 |

| ROA | 0.006 | 0.014 | -0.162 | 0.009 | 0.037 | 616 |

| Q | 1.052 | 0.076 | 0.892 | 1.046 | 1.314 | 616 |

| LN_TA | 9.786 | 1.556 | 7.435 | 9.386 | 14.633 | 616 |

SD_RET: Standard Deviation of Monthly Stock Return; LEVERAGE: Long-Term Debt/Total assets; ROA: Return on Assets; Q: Tobins_Q = (mkt value of equity + book value of liabilities)/book value of Total assets; LN_TA: log of Total Assets.

The descriptive statistics in Table 1, Panel B cover the financial variables in our model. The average standard deviation of stock return (SD_RET) is 9.2%. The leverage (LEVERAGE) has a mean (median) of 8.7% (7.7%). The mean (median) ROA for the time period of our sample is 0.6% (0.9%) and the mean (median) of Tobin’s_Q is 1.052 (1.046). Size, measured as the log of total assets (LN_TA), has a mean (median) of 9.79 (9.39).

Table 2 shows the Pearson pair-wise sample correlations between variables. The correlation between the percentage of women on the audit and corporate governance committees (PCT_F_AUD and PCT_F_CG) is positive and significant. The correlation between the percentage of female executives and the percentage of women on the board committees is negative and significant for the audit committee. The correlation between the percentage of female executives and the percentage of women on the corporate governance committee is insignificant. SD_RET is negatively correlated with ROA, Tobin’s_Q and B_SIZE, indicating that banks with smaller boards, lower ROA and Tobin’s_Q reflect higher risk.

| Table 2: Sample Corrections | ||||||

| F_AUD | F_CG | F_EXE | SD_RET | LEV | ROA | |

|---|---|---|---|---|---|---|

| F_AUD | 1 | |||||

| F_CG | 0.149* | 1 | ||||

| F_EXE | 0.121* | 0.013 | 1 | |||

| SD_RET | -0.058 | -0.011 | -0.097* | 1 | ||

| LEV | -0.034 | -0.024 | 0.005 | 0.015 | 1 | |

| ROA | -0.019 | -0.001 | 0.096* | -0.594* | -0.016 | 1 |

| Q | -0.009 | 0.021 | 0.112* | -0.572* | -0.120* | 0.502* |

| LN_TA | 0.193* | 0.212* | 0.161* | -0.055 | 0.192* | 0.065 |

| B_SIZE | 0.152* | 0.212* | 0.06 | -0.113* | 0.007 | 0.085* |

| CEO_CHAIR | 0.067 | 0.037 | 0.302* | -0.203* | 0.129* | 0.143* |

| Q | LN_TA | B_SIZE | CEO_CHAIR | |||

| Q | 1 | |||||

| LN_TA | -0.127* | 1 | ||||

| B_SIZE | 0.009 | 0.387* | 1 | |||

| CEO_CHAIR | 0.211* | 0.567* | 0.352* | 1 | ||

* significant at 5%. F_AUD=PCT_F_AUD; F_CG=PCT_F_CG; F_EXE=PCT_F_EXE; LEV=LEVERAGE, for brevity purposes

Pct_F_Aud: Percentage of female directors on the audit committee; Pct_F_CG: Percentage of female directors on the corporate governance committee; PCT_F_EXE: Percentage of female executives on the executive positions, including CEO, CFO, Chairman, COO, Executive VP, President, Senior VP and Treasurer

SD_RET: Standard Deviation of Monthly Stock Return; LEVERAGE=Long-Term Debt/Total Assets; ROA: Return on Assets; Tobins_Q=(Mkt value of equity + book value of liabilities)/book value of Total assets; LN_TA: log of Total Assets; B_SIZE: Log of Number Of Directors; CEO_CHAIR: 1 if someone is the CEO and Chairman of the Board, 0 otherwise.

Table 2 also shows that all of the director variables (B_SIZE, CEO_CHAIR, F_AUD, F_CG, F_EXE) are positively correlated with bank size (LN_TA). This makes sense, as a larger bank would have a larger board and more directors serving on multiple committees.

Regression Results

Women Executives and Bank Risk

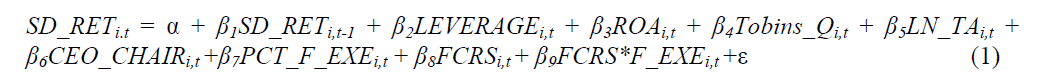

To test our first hypothesis of the effect of female executives on bank risk, we estimate the model:

| Table 3:Women Executives and Bank Risk | |

| Dependent Var | SD_RET |

|---|---|

| SD_RETt-1 | 0.259*** |

| LEVERAGE | 0.082*** |

| ROA | -2.821*** |

| Q | -0.287*** |

| LN_TA | -0.007*** |

| CEO_CHAIR | 0.008*** |

| PCT_F_EXE | 0.042** |

| FCRS | 0.033*** |

| FCRS*F_EXE | -0.203*** |

| CONSTANT | 0.430*** |

| Year Dummy | Yes |

| F-Stat | 182.11*** |

| Hansen J-Stat | 34.54(0.22) |

| N | 616 |

* significant at 10%; ** significant at 5%; *** significant at 1%

SD_RETi.t = a + ß1SD_RETi,t-1 + ß2LEVERAGEi,t + ß3ROAi,t + ß4Tobins_Qi,t + ß5LN_TAi,t + ß6CEO_CHAIRi,t + ß7PCT_F_EXEi,t + ß8FCRSi,t + ß9FCRS*F_EXEi,t +e

SD_RET: Standard Deviation of Monthly Stock Return; LEVERAGE=Long-Term Debt/Total Assets; ROA: Return on Assets; Tobins_Q=(Mkt value of equity + book value of liabilities)/book value of Total assets; LN_TA: log of Total Assets; CEO_CHAIR: 1 if someone is the CEO and Chairman of the Board, 0 otherwise. PCT_F_EXE: Percentage of female executives on the executive positions, including CEO, CFO, Chairman, COO, Executive VP, President, Senior VP and Treasurer. FCRS is a dummy variable indicating the time period of the financial crisis, 2007-2009. FCRS*F_EXE is an interaction term between FCRS and a dummy F_EXE that equals one if there is at least one female in an executive position, otherwise zero

Table 3 shows the results of the model representing women executives and bank risk. Consistent with the literature, ROA, Tobin’s Q and firm size (LN_TA) are negatively associated with bank risk. LEVERAGE and CEO_CHAIR are positively related to variability of bank stock return. Further, we find that the percent of women executives (PCT_F_EXE) is positively associated with the variability of bank performance. For every ten percentage point increase in the percent of female executives, the variability of return increases by 0.42 percent, all else held constant. This result supports our Hypothesis 1 that gender diversity on the executive team is significantly associated with the variability of bank performance and we give support to the literature that finds that women exhibit more risk-taking behaviour. The significant F-test shows that the model is well fitted and the insignificant Hansen J-statistic suggests that the instruments are valid in the two-stage system GMM model. The FCRS variable indicates that bank risk was higher during the financial crisis. However, the negative and significant interaction between FCRS and female executives (F_EXE) indicates that during the financial crisis, banks with at least one female executive had lower risk, which supports our Hypothesis 4.

Women Directors and Bank Risk

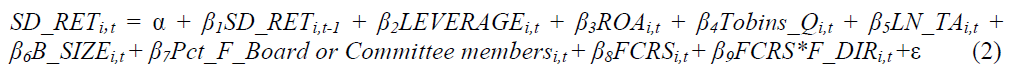

To test our hypotheses of the impact of women directors on the variability of bank performance, we estimate the following model:

| Table 4: Women Directors and Bank Risk | |||

| Dependent Var | SD_RET | SD_RET | SD_RET |

|---|---|---|---|

| SD_RETt-1 | 0.128*** | 0.354*** | 0.365*** |

| LEVERAGE | 0.146*** | 0.017* | -0.01 |

| ROA | -3.533*** | -2.772*** | -2.524*** |

| Q | -0.296*** | -0.165*** | -0.184*** |

| LN_TA | -0.004*** | -0.003*** | 0 |

| B_SIZE | 0.026*** | 0.041*** | 0.026*** |

| PCT_F_DIRECTORS | 0.049*** | ||

| PCT_F_AUD | -0.017*** | ||

| PCT_F_CG | -0.065*** | ||

| FCRS | 0.019*** | 0.047*** | 0.048*** |

| FCRS*F_DIR | -0.032*** | -0.023*** | -0.020*** |

| CONSTANT | 0.373*** | 0.161*** | 0.200*** |

| F-Stat | 1631*** | 4563*** | 8212*** |

| Hansen J-Stat | 37.12(0.56) | 76.92(0.26) | 73.83(0.29) |

| N | 616 | 616 | 616 |

* significant at 10%; ** significant at 5%; *** significant at 1%

SD_RETi,t = a + ß1SD_RETi,t-1 + ß2LEVERAGEi,t + ß3ROAi,t + ß4Tobins_Qi,t + ß5LN_TAi,t + ß6B_SIZEi,t + ß7Pct_F_Board or Committee membersi,t + ß8FCRSi,t + ß9FCRS*F_DIRi,t +e

SD_RET: Standard Deviation of Monthly Stock Return; LEVERAGE=Long-Term Debt/Total Assets; ROA: Return on Assets, Tobins_Q=(mkt value of equity + book value of liabilities)/book value of Total assets; LN_TA: Log of Total Assets; B_SIZE: Log of Number of Directors; Pct_F_Board or Committee members is as follows: Pct_F_Directors: Percentage of female board members; Pct_F_Aud: Percentage of female directors on the audit committee; Pct_F_CG: Percentage of female directors on the corporate governance committee. FCRS is a dummy variable indicating the time period of the financial crisis, 2007-2009. FCRS*F_DIR is an interaction term between FCRS and a dummy F_DIR that equals one if there is at least one female director on the board, otherwise zero.

We report the results of our tests for the relation between women directors and bank risk in Table 4. While all controlling variables are consistent with the literature, we find that board size (B_SIZE) is positively associated with the variability of bank stock return. This finding is in line with previous studies that assert large boards have lower function efficiency (Jensen, 1993; Evans and Dion, 1991; Goodstein et al., 1994). Further, our results show that the percentage of women directors has a significant association with bank risk, as proposed in Hypothesis 2. The percentage of women directors is positively related to bank risk, which is consistent with our finding above, indicating that in general, women in the banking industry exhibit more risk-taking behaviour. However, in support of Hypothesis 3, the percentage of women on the audit committee (PCT_F_AUD) and percentage of women on the corporate governance committee (PCT_F_CG) are negatively related to bank risk. These results are consistent with the literature that indicates that women take their monitoring role on the board very seriously. For every ten percentage point increase in the percent of female directors on the audit (corporate governance) committee, the variability of stock return decreases by 0.17 (0.65) percent, respectively, all else held constant. The audit and corporate governance committees play roles in monitoring and overseeing risk management directly. According to the Blue Ribbon Committee, audit committees are supposed to inquire of management about significant risks or exposures and assess risk management procedures in addition to their responsibility for monitoring financial reporting.

While the positively significant FCRS dummy indicates that bank risks are higher during the financial crisis, the negatively significant interaction term FCRS*F_DIR shows that female directors’ role in risk reduction is more pronounced during the financial crisis period, consistent with Hypothesis 5. We previously described our sample results (shown in Figure 2) indicating that the percentage of women on the audit committee increased steadily from 2007 to 2009, during the time of the financial crisis. Based on the fact that there are more women on the audit committee during this time period, our results support the literature which shows that women have lower risk tolerance (Steffensmeier et al., 2013; Byrnes et al., 1999)and that more diverse teams are more diligent in their duties (Ittonen and Peni, 2012; Schwartz-Ziv, 2013). It also supports findings by Adams and Ferreira (2009) that women are more likely to join monitoring committees and as such, gender diverse boards devote more effort to monitoring.

Robustness Tests

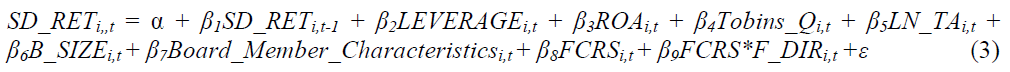

We run some additional tests to further examine board characteristics and the robustness of our models. Results for our study of board service characteristics between men and women directors are shown in Table 5. Our model for these robustness tests is as follows:

| Table 5: Comparison Of Board Service Characteristics Between Men And Women Directors | |||

| Dependent Variable | SD_RET | SD_RET | SD_RET |

|---|---|---|---|

| SD_RETt-1 | 0.160*** | 0.181*** | 0.143*** |

| LEVERAGE | 0.084*** | 0.146*** | 0.058*** |

| ROA | -2.777*** | -3.250*** | -2.885*** |

| Q | -0.409*** | -0.255*** | -0.288*** |

| LN_TA | -0.004*** | -0.002*** | -0.003*** |

| B_SIZE | 0.041*** | 0.048*** | 0.042*** |

| FCRS | 0.014*** | 0.022*** | 0.035*** |

| FCRS*F_DIR | -0.028*** | -0.022*** | -0.039*** |

| W_TENURE | 0.002*** | ||

| M_TENURE | 0.001*** | ||

| PCT_BUSY_W_DIR | -0.018*** | ||

| PCT_BUSY_M_DIR | -0.122*** | ||

| W_AGE | 0 | ||

| M_AGE | 0.001 | ||

| CONSTANT | 0.431*** | 0.258*** | 0.258*** |

| F-Stat | 3878*** | 14413*** | 6465*** |

| Hansen J-Stat | 68.37(0.98) | 65.43(0.99) | 66.82(0.99) |

* significant at 10%; ** significant at 5%; *** significant at 1%

SD_RETi,t = α + β1SD_RETi,t-1 + β2LEVERAGEi,t + β3ROAi,t + β4Tobins_Qi,t + β5LN_TAi,t + β6B_SIZEi,t + β7Board_Member_Characteristicsi,t + β8FCRSi,t + β9FCRS*Fi,t +ε

SD_RET: Standard Deviation of Monthly Stock Return; LEVERAGE=Long-Term Debt/Total Assets; ROA: Return on Assets; Tobins_Q=(mkt value of equity + book value of liabilities)/book value of Total assets; LN_TA: Log of Total Assets; B_SIZE: Log of Number of Directors; FCRS is a dummy variable indicating the time period of the financial crisis, 2007-2009. FCRS*F_DIR is an interaction term between FCRS and a dummy F_DIR that equals one if there is at least one female director on the board, otherwise zero. Board Member Characteristics is as follows: W_TENURE: Number of years a woman director is on the board; M_TENURE: Number of years a man director is on the board; PCT_BUSY_W_DIR: Percentage of women directors who serve on more than one committee; PCT_BUSY_M_DIR: Percentage of male directors who serve on more than one committee; W_AGE: Woman director’s age; M_AGE: Man director’s age.

First, we study the tenure of board members – specifically, the tenure of female directors and the tenure of male directors on the board. Anderson et al. (2004) study board tenure and the effect on the firm’s cost of debt. They posit alternative theories on board tenure. On the one hand, board directors may be more effective in monitoring corporate performance because their skill increases with tenure. On the other hand, as board tenure increases, managers may be better able to influence or sway director opinion, so there is an inverse relationship to the oversight of the financial reporting process (Anderson et al. 2004). In their study, they find a positive relationship between board tenure and the cost of debt financing, indicating that as director tenure increases, managers are potentially more able to influence board opinion. In our study, we measure the number of years a woman director has been on the board (W_TENURE) and the number of years a man director has been on the board (M_TENURE). We find a significant and positive relationship for both men’s and women’s board tenure, indicating that there is higher bank risk the longer these directors have been on the board.

An additional impact of board members on bank risk would come through their appointment to multiple committees. In studies of multiple board memberships and board busyness, there are conflicting results. Fich and Shivdasani (2006) suggest a “busyness” hypothesis and find that firms in which a majority of outside directors hold three or more directorships are associated with weak corporate governance and weaker profitability. Cooper and Uzun (2012) study busy directors and bank risk and find that bank risk increases with multiple board appointments of bank directors, supporting the “busyness” hypothesis. Sharma and Iselin (2012) study the association between multiple-directorships and tenure of audit committee members and financial misstatements. They find a significant positive association between financial misstatements and both tenure and multiple-directorships in the post-SOX time period. They reason that independent audit committee members serving on multiple boards may be stretched too thinly to effectively perform their monitoring responsibilities. Chandar et al. (2012) study what happens when there is overlap on the audit and compensation committees. They find that the effect is a non-linear relationship and that when the overlapping percentage is 47 percent, the abnormal accruals are the lowest, implying the highest financial reporting quality at that point. Sun and Liu (2014) study audit committee effectiveness and find that banks with long board tenure audit committees have lower risk, while banks with busy directors on their audit committees have higher risk.

On the other hand, Fama and Jensen (1983) report results that support the “reputation hypothesis,” where the number of committee memberships signals director reputation. This hypothesis reasons that directors on multiple committees offer better advice and better monitoring than directors on only one committee. Jiraporn et al. (2009) study not only multiple-directorships but also multiple board committee memberships. They find that busier directors often serve on a higher number of board committees because they are more competent (supporting the “reputation” hypothesis). The authors also find that directors of regulated firms serve on a larger number of committees and that woman and ethnic minority directors hold a larger number of board committee memberships. Xie et al. (2003) examine the relationship between the audit committee and financial reporting quality and determine that board and audit committee members with corporate or financial backgrounds are associated with firms that had lower discretionary accruals. Their result is the same when the board and audit committee meet more frequently. Following Chandar et al. (2012) and Fama and Jensen (1983), we believe our results will support the “reputation hypothesis”, where the number of committee memberships will signal director reputation.

We examine whether there is a difference in the effect of director busyness if the busy directors are women or men. We evaluate the effect on bank risk of the percentage of women directors who serve on more than one committee (PCT_BUSY_W_DIR) and the effect on bank risk of the percentage of men directors who serve on more than one committee (PCT_BUSY_M_DIR). Our results show that for both women and men directors, there is lower bank risk when there is a higher percentage of busy directors. This supports the “reputation” hypothesis described above. In the case of both men and women directors, they are busy because of their reputation as an effective board member.

Our third test of board service characteristics measures the age of female (W_AGE) and male (M_AGE) board members and the effect on bank risk. Anderson et al. (2004) describe age as a proxy for business experience. They find no significant relationship between director age and the cost of debt financing. In age comparisons of non-business related (personal choice) tasks, Byrnes et al. (1999) find no particular pattern of age trends that is true for all types of content. They note that the gender gap for individuals over age 21 is significantly smaller than for younger individuals. Our results show that there is no significant effect of men directors’ age or women directors’ age on bank risk.

Conclusion

The objective of our study is to examine the role of gender diversity on the variability of bank performance, both in the executive suite and in the boardroom. We examine a sample of banks from the time period of 2003-2011 and measure bank risk as the variability of stock market return. This time period includes the enactment of the SOX legislation and the global financial crisis. Our findings support the assertion that not all women have the same risk preferences in every situation. As the percentage of women executives increases, the variability of bank performance increases. Similarly, as the percentage of women on the board of directors increases, the variability of bank performance increases. Yet when the percentage of women on the audit committee and corporate governance committee increases, the variability of bank performance decreases. Further, for women in all the positions, bank risk decreases during the financial crisis. Our findings also support the “reputation hypothesis” regarding board busyness (Chandar et al., 2012; Fama and Jensen, 1983). As the percentage of both women and men on multiple committees in our sample increases, the variability of bank performance decreases.

Our findings contribute to the growing literature on women and risk by showing that women play an important but diverse role in the risk management of the banking industry. The stereotype of women being more risk averse does not always hold among women who pursue high-level careers in banking. So does gender matter in banking? Conceivably so, because we demonstrate that there are statistically significant differences in risk preferences between male and female executives and directors in specific situations and these differences impact bank risk. Especially during the financial crisis, women in leadership positions contributed to more effective monitoring of their bank’s exposure to risk. As Schubert (2006) describes, women have a comparative advantage with respect to diversification and communication tasks. She asserts that a well-established cooperation of men and women at the senior management level appears to have advantages in risk management. Banks should embrace public calls for greater female representation and actively pursue these qualified women for board and executive positions in order to enhance bank monitoring and performance.

References

- Adams, R.D., Almeida, H. & Ferreira, D. (2005). Powerful CEOs and their impact on firm performance. The Review of Financial Studies, 18, 1403-1432.

- Adams, R.B. & Ferreira, D. (2009). Women in the boardroom and their impact on governance and performance. Journal of Financial Economics, 94(2), 291-309.

- Adams, R.B. & Funk, P. (2012). Beyond the glass ceiling: Does gender matter? Management Science, 58, 219-235.

- Adams, R.B. & Ragunathan, V. (2015). Lehman sisters. Working paper, Available at SSRN: http://ssrn.com/abstract=2380036

- Allayannis, G. & Weston, J.P. (2003). Earnings volatility, cash flow volatility and firm value. Working paper, University of Virginia, Charlottesville, VA and Rice University, Houston, TX.

- Arellano, M. & Bover, O. (1995). Another look at the instrumental variables estimation of error-components models. Journal of Econometrics, 68, 29-51.

- Anderson, E.W. Ghyhels, E. & Juergens, J.L. (2009) The impact of risk and uncertainty on expected returns. Journal of Financial Economics, 94, 233-263.

- Anderson, R.C., Mansi, S.A. & Reeb, D.M. (2004). Board characteristics, accounting report integrity and the cost of debt. Journal of Accounting & Economics, 37, 315-342.

- Atkinson, S.M., Baird, S.B. & Frye, M.B. (2003). Do female mutual fund managers manage differently? The Journal of Financial Research, 26(1), 1-18.

- Bankrate.com (2015). 4 biggest risks for today?s banks and how to manage them. http://banktel.com/4-biggest-risks-for-todays-banks-and-how-to-manage-them. Accessed 9 March 2017.

- Berger, A.N., Kick, T. & Schaeck, K. (2014) Executive board composition and bank risk taking. Journal of Corporate Finance, 28, 48-65.

- Bliss, R.T. & Potter, M.E. (2002). Mutual fund manager: Does gender matter? Journal of Business and Economic Studies, 8, 1-15.

- Byrnes, J.P., Miller, D.C. & Schafer, W.D. (1999). Gender differences in risk taking: A meta-analysis, Psychological Bulletin, 125(3), 367-383.

- Catalyst. (2007). Appendix 7: Average number and percentage of women board directors and women corporate officers by industry. In: 2007 Catalyst census: Fortune 500. http://www.catalyst.org/knowledge/2007-catalyst-census-fortune-500-average-number-and-percentage-women-board-directors-and-1. Accessed 30 November 2014

- Catalyst. (2010). Appendix 8: Women?s representation by NAICS industry. In: 2010 Catalyst census: Fortune 500. http://www.catalyst.org/knowledge/2010-catalyst-census-fortune-500-womens-representation-naics-industry. Accessed 30 November 2014

- Catalyst. (2012). Appendix 8: Women?s representation by NAICS industry. In: 2012 Catalyst census: Fortune 500. http://www.catalyst.org/knowledge/2012-catalyst-census-fortune-500-appendix-8%E2%80%94womens-representation-naics-industry. Accessed 30 November 2014

- Catalyst. (2013). Appendix 8: Women?s representation by NAICS industry. In: 2013 Catalyst census: Fortune 500. http://www.catalyst.org/knowledge/2013-catalyst-census-fortune-500-appendix-8-womens-representation-naics-industry Accessed 1 December 2014

- Chandar, N., Chang, H. & Zheng, X. (2012). Does overlapping membership on audit and compensation committees improve a firm?s financial reporting quality? Review of Accounting and Finance, 11, 141-165.

- Cheng, S. (2008). Board size and the variability of corporate performance. Journal of Financial Economics, 87(1), 157-176.

- Cooper, E. & Uzun, H. (2012). Directors with a full plate: the impact of busy directors on bank risk. Managerial Finance, 38(6), 571-586.

- Croson, R. & Gneezy, U. (2009). Gender differences in preferences. Journal of Economic Literature, 47(2), 448-474.

- Demsetz, H. & Lehn, K. (1985). The structure of corporate ownership: Causes and consequences. Journal of Political Economy, 93, 1155-1177.

- Eagly, A. & Carli, L. (2003). The female leadership advantage: An evaluation of the evidence. The Leadership Quarterly, 14, 807-834.

- Eisenhardt, K. & Bourgeois, L. (1988). Politics of strategic decision-making in high velocity environments: Toward a mid-range theory. Academy of Management Journal, 31, 737-770.

- Evans, C.R. & Dion, K.L. (1991). Group cohesion and performance: A meta-analysis. Small Group Research, 22, 175-186.

- Faccio, M., Marchica, M. & Mura, R. (2014). CEO gender and corporate risk-taking. Working paper, Available at SSRN: http://ssrn.com/abstract=2021136

- Fama, E. & Jensen, M. (1983). The separation of ownership and control, Journal of Law & Economics, 26, 301-25.

- Fich, E.M. & Shivdasani, A. (2006). Are busy boards effective monitors? The Journal of Finance, 41, 689-723.

- Francis, B., Hasan, I., Park, J.C. & Wu, Q. (2014). Gender differences in financial reporting decision-making: Evidence from accounting conservatism. Contemporary Accounting Research, forthcoming.

- Gompers, P.A., Ishii, J.L. & Metrick, A. (2003). Corporate governance and equity prices. Quarterly Journal of Economics, 118(1), 107-155.

- Goodstein, J., Gautam, K. & Boeker, W. (1994). The effects of board size and diversity on strategic change. Strategic Management Journal, 15, 241-250.

- Haleblian, J. & Finkelstein, S. (1993). Top management team size, CEO dominance and firm performance: The moderating roles of environmental turbulence and discretion. Academy of Management Journal, 36, 844-863.

- Hoskisson, R.E., Chirico, F., Zyung, J. & Gambeta, E. (2017). Managerial risk taking: A multi-theoretical review and future research agenda. Journal of Management, 43(1), 137-169.

- Hui G. & Whitelaw, R. (2006) Uncovering the risk-return relation in the stock market. The Journal of Finance, 61(3), 1433-1463.

- Iqbal, Z., Sewon, O. & Baek, H.Y. (2006). Are female executives more risk-averse than male executives? Atlantic Economic Journal, 34, 63-74.

- Ittonen, K. & Peni, E. (2012). Auditor?s gender and audit fees. International Journal of Auditing, 16, 1-18.

- James S. & Peterson, D. (1985) Return, risk and yield: evidence from Ex Ante data. The Journal of Finance, 40(2), 537-548.

- Jensen, M.C. (1993). The modern industrial revolution, exit and the failure of internal control systems. Journal of Finance, 48, 831-880.

- Jiraporn, P., Singh, M. & Lee, C.I. (2009). Ineffective corporate governance: Director Business and board committee memberships. Journal of Banking & Finance, 33, 819-828.

- Jones, C.P. & Wilson, J.W. (2004). The changing nature of stock and bond volatility. Financial Analysts Journal, 60(1), 100-113.

- Kesner, I.F. (1988). Director?s characteristics and committee membership: An investigation of type, occupation, tenure and gender. Academy of Management Journal, 31(1), 66-84.

- Landy, H. (2014). The incredible shrinking statistic: Female bank CEOs. American Banker, http://www.americanbanker.com/bankthink/the-incredible-shrinking-statistic-female-bank-ceos-1068188-1.html?wib. Accessed 1 September 2014.

- Lenard, M.J., Yu, B., York, E.A. & Wu, S. (2014). Impact of board gender diversity on firm risk. Managerial Finance, 40(8), 787-803.

- Leon, A., Nave, J.M. & Rubio, G. (2007). The relationship between risk and expected return return in Europe. Journal of Banking and Finance, 31(2), 493-512.

- Maxfield, S., Shapiro, M., Gupta, V. & Hass, S. (2010). Gender and risk: Women, risk taking and risk aversion. Gender in Management: An International Journal, 25(7), 586-604.

- Merton, R.C. (1973) An inter-temporal capital asset pricing model. Econometrica, 41, 867-887.

- Pathan, S. & Faff, R. (2013). Does board structure in banks really affect their performance? Journal of Banking & Finance, 37, 1573-1589.

- Palvia, A., Vahamma, E. & Vahamma, S. (2015). Are female CEOs and chairwomen more conservative and risk averse? Evidence from the banking industry during the financial crisis. Journal of Business Ethics, 131, 577-594.

- Peni, E. & Vahamaa, S. (2012). Did good corporate governance improve bank performance during the financial crisis? Journal of Financial Services Research, 41, 19-35.

- Robinson, G. & Dechant, K. (1997). Buidling a business case for diversity. Academy of Management Executive, 11, 21-30.

- Sapienza, P., Zingales, L. & Maestripieri, D. (2009). Gender differences in financial risk aversion and career choice are affected by testosterone. Proceedings of the National Academy of Sciences of the United States, 106, 15268-15273.

- Schubert, R. (2006). Analyzing and managing risks ? on the importance of gender difference in risk attitudes. Managerial Finance, 32, 706-715.

- Schwartz-Ziv, M. (2013). Does the gender of directors matter? SSRN Working Paper Series, Edmond J Safra Center for Ethics, Harvard University. http://ssrn.com/abstract=1868033. Accessed 1 April 2013

- Sharma, V.D. & Iselin, E.R. (2012). The association between audit committee multiple-directorships, tenure and financial misstatements. Auditing: A Journal of Practice & Theory, 31, 149-175.

- Steffensmeier, D.J., Schwartz, J. & Roche, M. (2013). Gender and twenty-first-century corporate crime: Female involvement and the gender gap in Enron-era corporate frauds. American Sociological Review, 78, 448-476.

- Stulz, R.M. (2014). Governance, risk management and risk-taking in banks. https://www.fdic.gov/bank/analytical/cfr/bank_research_conference/annual_14th/STULZ DAY1_AM.pdf Accessed 9 March 2017.

- Sun, J. & Liu, G. (2014). Audit committee?s oversight of bank risk-taking. Journal of Banking & Finance, 40, 376-387.

- Sunderland, R. (2009). The real victims of this credit crunch? Women. The Guardian/The Observer. http://www.theguardian.com/lifeandstyle/2009/jan/18/women-credit-crunch-ruth-sunderland Accessed 1 December 2014.

- http://www.bls.gov/cps/wlf-table14-2005.pdf. Accessed 14 August 2014.

- http://www.bls.gov/cps/cpsaat18.htm. Accessed 13 March 2016.

- Thiruvadi, S. & Huang, H. (2011). Audit committee gender differences and earnings management. Gender in Management: An International Journal, 26, 483-498.

- U.S. House of Representatives. (2002). The Sarbanes-Oxley Act of 2002, Public Law 107-204 [H.R. 3763]. Government Printing Office, Washington, D.C.

- U.S. House of Representatives. (2010). The Dodd-Frank Wall Street Reform and Consumer Protection Act, Public Law 111-203 [H.R. 4173]. Government Printing Office, Washington, D.C.

- Upadhyay, A.D., Bhargava, R. & Faircloth, S.D. (2014). Board structure and role of monitoring committees, Journal of Business Research, 67, 1486-1492.

- Wang, C.J. (2012). Board size and firm risk-taking. Review of Quantitative Finance and Accounting, 38(4), 519-542.

- Wintoki, M.B., Linck, J.S. & Netter, J.M. (2012). Endogeneity and the dynamics of corporate governance. Journal of Financial Economics, 105, 581-606.

- Xie, B., Davidson, W.N.III. & DaDalt, P.J. (2003). Earnings management and corporate governance: The role of the board and the audit committee. Journal of Corporate Finance, 9, 295-316.