Research Article: 2018 Vol: 19 Issue: 2

Features of the Task Definition In A Three Tier Economy and Its Discrete Model With Applications In the Economy of Russia and Kazakhstan

Abstract

Keywords

Inflation, Economic growth, Entrepreneurship, Efficiency, globalization, Policy of regulation.

Introduction

Sustainability of the country's economic development is ensured by the effective interaction of the three modes:

1) The technological and technological way of innovative development of the productive forces of the real sector of the economy.

2) The monetary and financial structure of innovative development of the productive forces of the financial sector of the economy.

3) Socio-political way of innovative development of the productive forces of the administrative sector of the economy.

Consequently, the social statuses of legal entities engaged in the economy of the corresponding structures differ in relation to their attitude to their professional duties, since they specifically represent the abstraction of human capital and form the basis for the creation and development of the country's productive forces:

1) Industrial-economic relations, who differ in the indicators of the real economy, connected more with the analysis of the effectiveness of interaction of human capital with natural resources or products of their processing, turning them into capital, in its form of goods.

2) Trade and production relations, which differ in the indicators of the financial economy, connected in large measure with the analysis of the effectiveness of the interaction of human capital with all sorts of resources suitable for sale and conversion into capital, in its form of money.

3) Socio-political relations, which are expressed by the indicators of the model of the inter branch balance, connected in large measure with the matrix of social accounts and the evaluation of the effectiveness of policies adopted by the managers of both sectors of the economy.

In order to verify the reality of these theoretical constructions for the analysis and suitability of the corresponding models of production relations for assessing the levels of development of the country's productive forces, it should be taken into account that the macro model of Keynesian equilibrium, which at one time became the base of Roosevelt's new course and proved its viability in the practical work of representatives real sector of the economy.

Thus, the Keynesian equilibrium model as a theoretical construction has its own mathematical expression, determined by bringing capital, in its form of commodity, into a form of capital expressed in money. And, like the laws of nature and physics, it appears to be an economic law and until today serves as a rule for practical work in the real sector of the economy.

The economic interests of financial sector entrepreneurs are realized by the macro-model of M. Fridman's quantitative theory of money, which once became the basis of D. Reagan's anti-crisis program and proved its viability.

The model of monetarism as a theoretical construction also has its mathematical expression, which is determined by bringing capital, in its form of money into the form of commodity capital, represented by physical volumes of output. It is represented by the well-known Fisher's equation of exchange and, therefore, as laws of nature and physics, is represented by the economic law and up to the present day serves as a rule for practical work in the financial sector of the economy.

Both these equilibrium models have macroeconomic roots and the principles of their construction are unified. In Keynesianism, commodity capital is reduced to money capital by commodity price indices, in the case of monetarists, money capital to commodity capital. Both models are limited to the framework of a two-fold economy associated with the development of the productive forces of its real and financial sectors.

On the contrary, the theoretical construction of the model of the three-fold economy is constructed by matching the indicators of two types, uniform inter sectoral models for measuring the costs and results. The first of them is aninter sectoral model of the Dmitriev type, constructed according to the labor theory of value. And its second type is expressed by a model of the Leontief type, which is based on the theory of marginal utility.

The mutual coordination of these models within the three-fold economy is carried out using the principle of reversibility of the indicators of the inter branch model, constructed according to the labor theory of value with indicators of the inter branch model constructed according to the theory of marginal utility and corresponding to the Kantorovich-Kupmans duality principle.

The concrete system of models for harmonizing relevant indicators by types of activity and enterprises, as well as by regions of the country, relies on a qualitative theory of money that serves as the basis for building an agent-oriented tool for assessing the levels of development of the productive forces of the managerial sector of the economy.

The question is, can the model of a quality theory of money become a reliable tool for analyzing the effectiveness of management at the level of the national economy?

Will it be able to help developing countries of the world serve as a tool for training their professional managerial staff that will be able to assess the true values of capital, in its form of money, and the true values of capital, in its form of goods, that are circulating in their economies?

Theoretical Bases Of Commensurate Costs And Final Results Of The National Economy

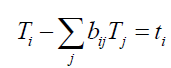

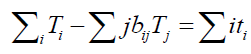

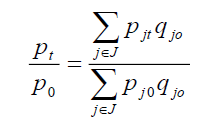

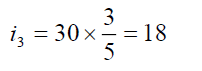

The main objective of the regulatory policy of state is to assess the costs and benefits by measuring the costs and final results of entrepreneurial activities, taking into account the feedback between the production and service industries. In this sense, the dynamics of the change in the price indices of goods and services of each type of economic activity in the labor dimension is determined in the process of the circulation of capital value in goods according to the formula:

Where i is a labor rate for the production of the ith product and services for the production of goods and services j.

In turn, the general price level of goods and services in the labor dimension is determined by the formula:

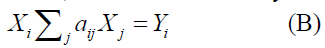

The same system of equations can be made in money terms, which is determined in the process of circulation of the capital value, in its form of money:

In this case, the general price level of goods and services in monetary terms is determined by the formula:

Both these systems of equations in the labor (A) or monetary (B) expression are subject to the duality principle associated with the names of the Nobel Prize winners Kantorovich- Koopmans, and their common matrix form of recording look like:

The principle of reversibility, defined by formula (C), allows us to assess the mutual functional relationship between the levels of payment and production prices (model B) and between direct and total labor input (model A). Judging by the book by Baye, the West used model B, led by the United States, the East led by Japan-the model A.

At the same time, based on the integration of these two systems of equations, as the initiative group of Kazakhstan has shown, it is possible to work out a new reversibility principle between indicators of economic development in labor and money terms. Due to the reversibility principle, our institute is now developing a new and effective tool for analyzing the economy which we have called a quality theory of money. This theory allows us to estimate the productivity of costs for the production of the final product, which represents the difference between hourly labor productivity and costs. It is no coincidence that all developed countries estimate the productivity of types of entrepreneurial activity by the one hour price of their workforce. Unfortunately, in Kazakhstan, instead, another instrument is still used-the monthly calculated indicator (MCI), unrelated to hourly labor productivity. Bentzel, as a member of the Royal Swedish Academy of Sciences at the Nobel Prize award ceremony to Kantorovich and Koopmans in 1975, delivered the following key phrase, uncomprehend and untapped so far in the world economic literature: “The main economic problems are the same in all societies, and a whole class of research problems of this kind can be studied in a purely scientific way, regardless of the political organization of the society in which they are researched”.

Bentzel was right, the theory of capital research, in its form of goods, and money separately have a limited application. Both these theories have not been studied in the pure scientific sense, and they should be studied in a detailed way “regardless of the political organization of society”.

This statement by Bentzel concerns both the labor theory of value and the theory of marginal utility, the unity and differences of which should be studied “in a purely scientific sense, regardless of the political organization of society” and free of ideological constraints.

The tricks here are to find a synergistic effect that is defined as the contribution of the consumed ecological and economic and other natural resources of the country to the increase in real hourly labor productivity, which is determined by the Theorem (the reversibility principle):

The multiplication of the scalar quantities of the direct labor intensity t by the production output-X=QP+WR+TR in monetary terms is equal to the multiplication of the scalar values of the sum of the income received -Y to the total labor input for its production (tX=TY).

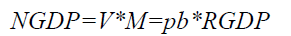

Ultimately, the cost of labor per unit of total output-X determines the price of a unit of nominal GDP (NGDP).

A Discrete Algorithm For Solving The Problem Of Coordination Of Interests Of Three Different Ways Of Economic Development

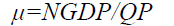

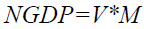

The discrete algorithm for developing a model of a quality theory of money, which determines the synergetic effect of capital, in its form of money (Y=V+M), and capital, in its commodity form (X=C+V+M) is very informative and has a simple structure that consists of several simple operators [1].

Operator 1 defines the demand function for increasing the productivity of the means of production, mineral and raw materials and other natural resources of intermediate consumption

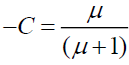

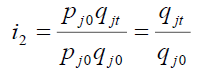

(QP) used to produce capital, in its form of money (NGDP=WR+TR)–μ:

This indicator was formulated in compliance with the P. Sraffa’s principle, according to which the production of goods is carried out through the production of goods.

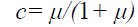

Operator 2 defines the demand function for increasing the productivity of the country’s scientific and technological potential (Х=QP+WR+TR), used to produce the same capital, in its form of money (NGDP=WR+TR)-с:

Operator 3 defines the demand function for the rate of capital growth, in its form of goods:

FGDP=c*RGDP

Operator 4 defines the demand function for the rate of economic growth of capital, in its form of money:

FGDP=pp*NGDP

Where pp the purchasing power of money in general, in this particular case, the price index of national money1:

pp=c/pb

Operator 5 defines the equilibrium function of the demand for capital, in the form of money and the supply of capital, in its form of goods and services, which determines the true value of the capital actually channeled to the consumption fund and the accumulation fund-FGDP:

Symbols:

The capital indicator, in its form of the product of labor at the level of microeconomics is represented theoretically, has the designation Х=C+V+M, practically -Х=QP+WR+TR, where Х in the system of national accounts expresses the output, the corresponding pairs C and QPintermediate consumption, V and WR-wage levels, М and TR-gross profit.

The capital indicator, in its form of goods at the level of microeconomics is represented theoretically, has the designation Y=Х–C=V+M, practically -NGDP=Х-QP=WR+TR, where Y =NGDP-nominal GDP, which serves as the basis for determining real GDP-RGDP=NGDP/pb, where pb-GDP deflator.

Conditions for the unity of the theoretical and practical approaches in defining the model of the quality theory of money–C=QP, V=WR, M=TR, Y=WR+TR, NGDP=Y.

Determination Of The Bifurcation Point As A Basis For Identifying New Investment Projects And New Opportunities For Innovative Economic Development

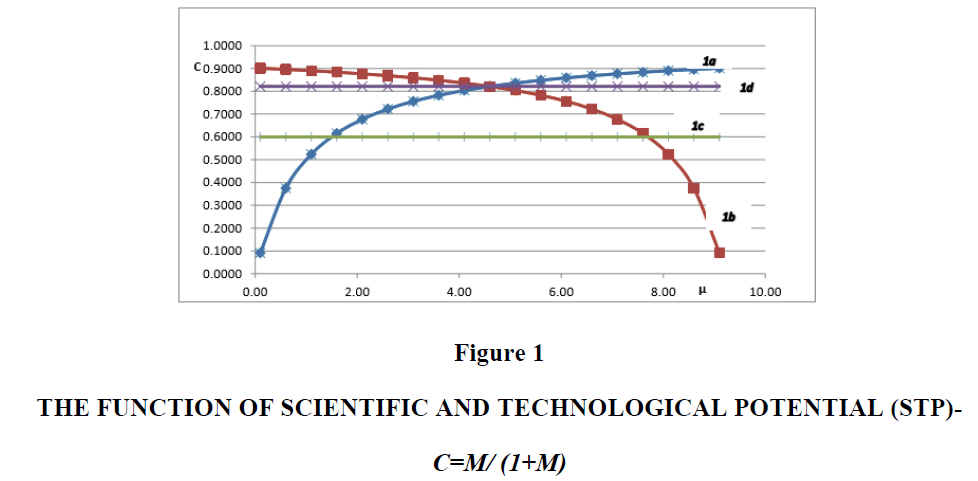

The main outcome of applying this discrete algorithm of coordinating the interests of three models (instead of two) is to determine the function of the scientific and technological potential of the country depending on the effective use of material, labor, capital and environmental resources-с=μ/(1+μ).

In the former, the STP function  as the productivity of the products of

intermediate consumption increases–μ (Figure 1; line 1a) assumes a value from 0.10 to 9.0, has

an ascending line, which at the point of μ=2.0 takes the value 0.7 and at the point of μ=8.0-0.89.

This line in Figure 1; line 1a is highlighted with rhombuses.

as the productivity of the products of

intermediate consumption increases–μ (Figure 1; line 1a) assumes a value from 0.10 to 9.0, has

an ascending line, which at the point of μ=2.0 takes the value 0.7 and at the point of μ=8.0-0.89.

This line in Figure 1; line 1a is highlighted with rhombuses.

In the second ideal case, when the STP function  as the productivity of

intermediate consumption products increases–μ (Figure 1. line 1b) assumes a value of 2.0 to 9.0,

suppose it has a descendant line, which at the point of μ= 2.0 takes value 0.89 and at the point of

μ=9.0 takes the value 0.7. This line in Figure 1; line 1b is highlighted with rectangles.

as the productivity of

intermediate consumption products increases–μ (Figure 1. line 1b) assumes a value of 2.0 to 9.0,

suppose it has a descendant line, which at the point of μ= 2.0 takes value 0.89 and at the point of

μ=9.0 takes the value 0.7. This line in Figure 1; line 1b is highlighted with rectangles.

Two other possible cases in Figure 1 are shown by straight lines parallel to the axis of productivity of intermediate consumption products-μ. The first of them defines the real situation in emerging markets with the STP coefficient being constant (Figure 1; line 1c). Thus, Figure. 1c shows a special case, with c=0.6 for any μ. The second parallel line to the productivity axis of intermediate consumption products passes through the intersections of both curves (Figure 1; line 1d). Above this line are the parameters of balanced growth of the world developed countries.

The Intention Of Michael Bay Is To Assess The Effectiveness Of The Sector Of The Managerial Economy By Macroeconomic Methods

In his book on macroeconomics, Baye gives the following task definition of managing a market economy. “At the end of the twentieth century, a member of the Japanese government argued against American workers, calling them “lazy and unproductive”. These accusations were related to the fact that, according to the data published in the Fortune magazine, the Japanese company Honda could produce a Civic vehicle, spending 10.9 h of work, while the production of an Escort vehicle of the American Ford Corporation took 16 h of work. This accusation caused serious concern among shareholders of American auto giants General Motors, Ford, Chrysler. Moreover, in the early 90s they suffered significant losses and shareholders saw one of the reasons for this situation in low labor productivity” [5, p.129]. “The managers of the American corporation succeeded to calm the shareholders, that feared inefficiencies in the American automobile industry”, Baye writes, “by pointing to an article in the Automotive News magazine documenting that the average wage rate (including all the additional benefits granted) employed in this industry, is about $16 per h, while the same rate in Japan is $18 per h” [5, p.129].

Thus, the American side believes that the outcomes of labor remuneration in monetary terms are more important in the evaluation of productivity than effectiveness in labor terms.

“Let us return now”, continues Baye, “to the question of comparing the productivity of American and Japanese workers. Thus, Honda Motor Company can make a car, having spent for it 10.9 h of work, while the American Ford corporation spends 16 h. These indicators are obtained by dividing the total duration of work at the automobile plant (labor units) by the total number of cars produced (output). Now it is understandable that the figures given are nothing else than the reciprocals of the average productivity of American and Japanese workers in relation to the automotive industry, or rather, to two companies. Performing the reverse conversion procedure, we find that the average productivity of a Japanese worker is 1/10.9=0.09, and his American colleague’s is 1/16=0.06” [5, p.190]. In my opinion, Baye, as a methodologist, reveals the essence of the methodological principles of the Japanese side, estimating the labor productivity of labor-intensive products. However, as the French experience of determining prices in the three-tier economy shows, it is also necessary to take into account the purchasing power of the national currencies themselves.

French Experience In Determining The True Prices Of Goods And Services In A Three-Tier Economy

On the need to take into account the purchasing power of national money in measuring the true level of prices of goods and services, in due time, pointed out the French economist Lionel Stoler [9, p. 25].

He notes that in order to take into account the influence of the purchasing power of money on the price level, it is not enough to consider the cost of the same product at two different time points 0 and t .

With the existing turbulence of the prices of goods and services, it is impossible to define whether the cost of oil production is increasing due to higher prices or an increase of the physical volume of output.

Therefore, constant prices are used to estimate the real growth rates of products, based on prices of the same production industry of period t or period 0. In this way, it turns out, the real volume of output, cleared from price changes. This index is called the volume index (VI).

However, the volume index of output is not an adequate criterion to judge about the real volume of consumption and accumulation in the country, the social and political development of the country. As a result, neither nominal GDP in money terms, nor the physical volume of output, without an assessment of the level of consumption and accumulation, does not always give a full picture of the economic development and business.

“To be convinced of this”, writes Stoler, “you can apply it to the production of cars for the period from 1930 to 1960. Suppose that in constant prices (1930 or 1960) the production of cars from 1930 to 1960 increased much faster than the average number of other goods. But what conclusion can we draw from this on the knowledge of the automobile sector in economic activity? No conclusion. And, in particular, it would be a substantial error to come to a conclusion on the basis of these figures that the share of the automobile sector in GDP increased by 10 times: in fact, the price of cars rose from 1930 to 1960 more slowly than the average price index. Thus, if we want to capture the evolution of the cost of production in the automotive industry during this period, then we need to operate not with constant prices, but with an average index of constant prices-with what is called constant francs (our italics-aut.)” [9. p. 25].

The average price is determined only on the basis of a comparison of direct and full labor intensity of products, as well as the level of wages per h of work of one person employed in the economy.

It should be noted that this objective economic law of measuring the indicators of real consumption and accumulation in the country by three indices in a row was discovered by the Frenchman Stoler back in 1974. It is our strong belief that such an objective economic law which extends to all countries of the world.

The relative price of goods, not only in constant francs, but also in other national currencies, produced in sectors with fast-growing productivity, leads to the even reduction in rates of real growth in constant prices, while the relative price of goods and services produced in sectors with more or less stable productivity, leads to their increase.

The essence of this economic rule is that the growth rates of the economy are measured not by two (nominal and real growth indices, as in the Keynes or Friedman models), but by three indices of the main indicators of the system of national accounts. The third index of real growth is the relative price indexes of goods in constant French francs, constant US dollars, constant Russian rubles, and constant Kazakh tenge. Stoler represents this triple of growth indices as follows [9, p. 25]:

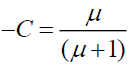

Index of nominal GDP growth- i1 at current prices for a commodity j :

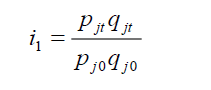

Real GDP growth index- i 2at current prices for a commodity j :

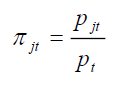

As for the GDP growth index for the end use of output for accumulation and consumption-at the purchasing power parity of national money, which is the same in constant francs, then to calculate it, one must estimate the general movement of prices for goods and services throughout the country, say, according to the input-output table.

Then we can determine the relative price  of a commodity j :

of a commodity j :

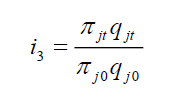

And the relative jprices index of goods represented by j in constant French francs will be as follows:

and

and  respectively, the price and quantity of goodsj in period t , and J- the

whole set of goods, which dynamics is studied from 0 to t .

respectively, the price and quantity of goodsj in period t , and J- the

whole set of goods, which dynamics is studied from 0 to t .

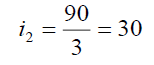

Stoler further gives a concrete example on cars, where the market value of production is increased by 90 times, the price of cars is increased by 3 times, and the general price index has increased by 5 times. Then the final results of three prices differ so much that one cannot ignore these differences and do not recognize their objectivity [9, p. 25]:

The growth index by the value of output, that is, its definition according to the quantity theory of money by M. Friedman- i1 :

The growth index for the physical volume of output, that is, its definition according to the Keynesian theory- i2 :

The growth index of goods’ prices in constant French francs at a relative value, that is, its definition of a quality theory of money:

Indeed, Stoler was right, it would be a substantial error to measure the indicators of economic development of the three models, using only two (physical and value) growth indices. However, the Keynesian model, which measures the indices of the flow of goods, and the Friedman model, which measures the indicators of cash flow, up to the present day unfairly claims to be a criterion for the development of the social and political development of the country and its enterprises. But it is the third index of balanced economic growth, which expresses the inter sectoral nature of the production industry, is the feedback carrier between the goods and money flows in the circulation of capital reproduction, in its form of goods, capital and money.

It is this third index of definition, quality, and number of goods and cash flows that are in circulation, is the main key that relieves the market economy from economic and financial shocks. Therefore, when assessing the effectiveness of business, regions and country development, it is advisable to determine the dynamics of the three indices of balanced economic growth.

As a result of the interaction of these three equitable sectors of economy, the true value of goods and services is determined. It is the third index of balanced economic growth that rid the world of measuring real growth in the economy of developing countries by two indicators: real GDP and the so-called PPP indicator, the purchasing power parity of national money. Now the purchasing power parity of national money is determined by the special methodology of international organizations. In fact, it should be determined by internal factors of the market forces development of each country and their feedback to the rest of the world.

Comparative Analysis Of The Growth Rates Of The Economies Of Kazakhstan’s Three Strategic Partners: China, Russia And The United States Among Themselves

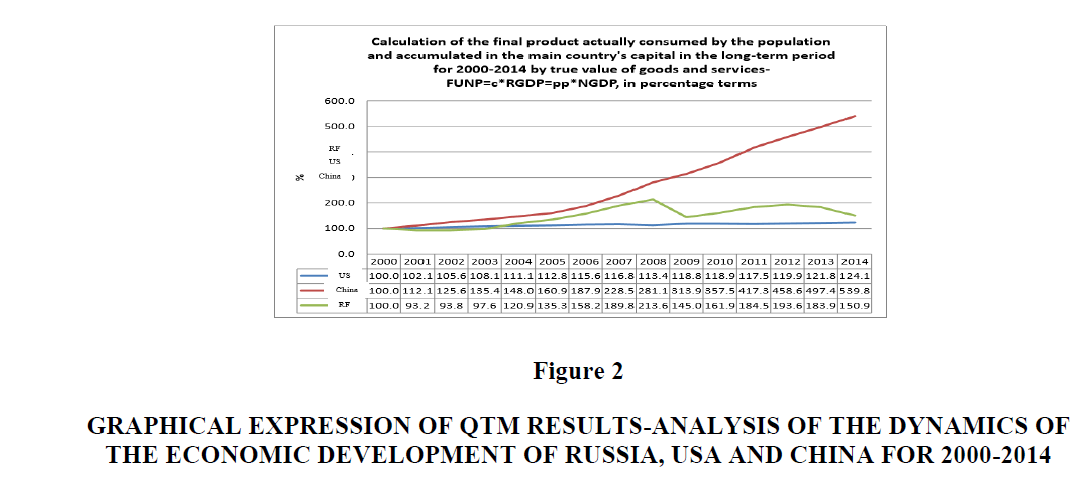

The results obtained show that the duration of the analysis period matters. Thus, in the long-term analysis Russia has the possibility to get ahead of the US in terms of economic growth (Figure 2).

Figure 2:Graphical Expression Of Qtm Results-Analysis Of The Dynamics Of The Economic Development Of Russia, Usa And China For 2000-2014.

This is an obvious fact, since the highly developed US economy is in the center of balanced equilibrium. The minimum growth rates within 1-2 percent are necessary only to maintain the growth in the number of employed people and the available scientific and technological potential of the country. As for the PRC economy, its growth rate still maintains high growth rates, in the long-term development periods (Figure 2).

However, as for Russia, the growth rate of Russia’s final product in the long-term period has been higher than in the US, whose economy, as already indicated, is on the trajectory of balanced equilibrium development. That is, by applying the models of the quality theory of money, Russia can very quickly catch up with the achieved results of the scientific and technological potential of the United States.

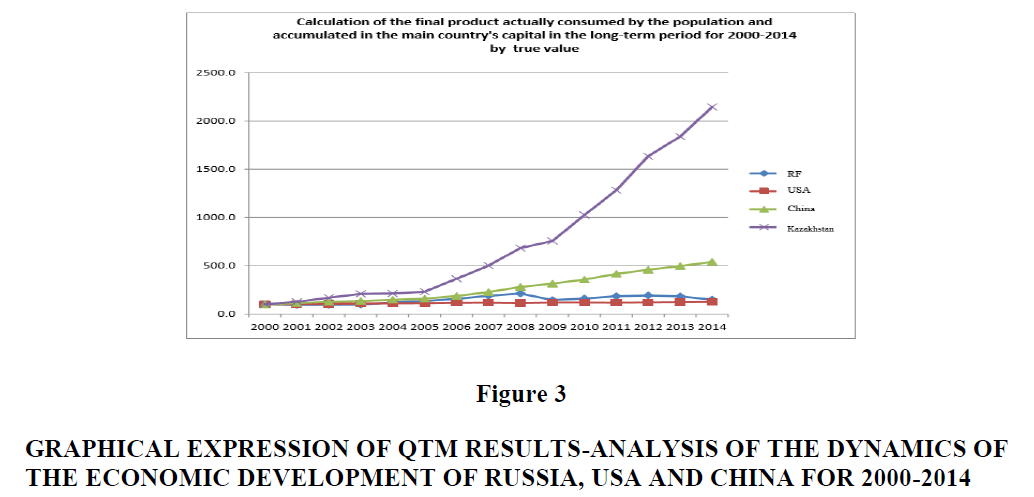

Comparison of the actual rate of growth in the economy of Kazakhstan with the corresponding growth rates of its strategic partners: China, Russia and the United States, and an assessment of Kazakhstan’s ability to be included in the list of 30 developed countries of the world in a strategic vision until 2050.

The economy of Kazakhstan continues to grow at high actual growth rates, whereas the economies of its partners including the PRC, Russia and the United States had actual compound annual growth rate shown in Figure 3.

Figure 3:Graphical Expression Of Qtm Results-Analysis Of The Dynamics Of The Economic Development Of Russia, Usa And China For 2000-2014

As shown in Figure 3, Kazakhstan’s economy which is modeled by the quality theory of money continues to grow at high rates, whereas the US economy had a real average annual growth rate of 1.3-1.4%, which serves as a development base for the rest of our strategic partners. China and Russia applying models of quality theory of money will also be able to quickly catch up with the achieved results of the scientific and technological potential of the United States.

Conclusions And Recommendations

1. The task of the three-fold economy is dynamic and reproductive. It has several advantages in comparison with the task of the two-fold economy of Keynesianism and monetarism, oriented only to solving macroeconomic problems without taking into account the microeconomic problems of innovative development and development of the country's scientific and technological potential. So, according to the theory of Keynesian theory, real GDP is reduced to nominal GDP, and by the model of the quantitative theory of money, nominal GDP is reduced to real GDP. Both these models do not take into account scientific and technological progress and its effects on macroeconomic indicators. According to the model of the qualitative theory of money, the market equilibrium is provided with the use of indicators of microeconomics and macroeconomics, and balancing between real and nominal GDP is carried out by determining their qualitative indicators.

2. One of the advantages of setting the task of a three-fold economy and its solution in the model of a qualitative theory of money allows a new interpretation of the inflation index as a catalyst for the development of a market economy and as a tool for assessing the scarcity of the money supply in circulation. Thus, the qualitative theory of money, oriented to the process of reproduction of money and commodity flows in their circular movement, allows us to give a different interpretation to the velocity of money (V), as the price of the scarcity of the money supply (M), which is in circulation:

3. Another interpretation is the multiplier, which provides a balance between nominal GDP and real GDP, with the mediation of the price of shortage of national money in circulation (M):

4. The dynamic statement of the problem of the three-fold economy is given in our work, published jointly with the American colleagues in the book, published in the publishing house Springer in 2017. But this work is just the beginning of the solution of the task of the new three-fold economy, and we are sure that the qualitative theory of money will find its researchers among economists, applied mathematicians and informatics, as well as specialists engaged in digitalization of the tasks of economic and financial management.

End Notes

1. Now we can compare the system of indicators of a quality theory with the same figures of a quantity theory of money: “If the nominal interest rate is i, the real interest rate is r, and the inflation is π, then the relationship between these three variables can be determined by the Fisher’s model: i=r+π”. Since the nominal exchange rate of the national money of the world developing countries is determined by the market relative to the dollar and is set, the real exchange rate is its product at the price level ratio over which the currencies of two countries are exchanged. “Real exchange rate = nominal exchange rate x price level ratio-Р/Р*:��=е х (Р/Р*). But change in Р/Р* as a percentage is a change in inflation levels π/π*: Changes е =Changes ��+(π*-π)=Changes ��+(i*-r*)-(i-r)” [7]. As can be seen from these quotations, Mankiw is one of the scientists who tried to derive the system of macroeconomic indicators with the indicators of microeconomics.

References

- WHO. International Agency for Research on Cancer. World Health Organization-World Cancer Report 2008. Lyon: IARC Press. In;2008.

- Schaue D, Micewicz ED, Ratikan JA, et al. Radiation and inflammation. Semin Radiat Oncol. 2015;25:4-10.

- Wang XS. Pathophysiology of cancer-related fatigue. Clin J Oncol Nurs. 2008;12:11-20.

- Berger AM, Mooney K, Alvarez-Perez A, et al. Cancer-related fatigue, version 2.2015. J Natl Compr Canc Netw. 2015;13:1012-39.

- Servaes P, Verhagen C, Bleijenberg G. Fatigue in cancer patients during and after treatment: Prevalence, correlates and interventions. Eur J cancer 2002;38:27-43.

- Begley S, Rose K, O'Connor M. The use of corticosteroids in reducing cancer-related fatigue: assessing the evidence for clinical practice. Int J Palliat Nurs. 2016;22:5-9.

- Qu D, Zhang Z, Yu X, et al. Psychotropic drugs for the management of cancer‐related fatigue: A systematic review and meta‐analysis. Eur J Cancer Care. 2016;25:970-9.

- Lopes‐Júnior L, Bomfim E, Nascimento L, et al. Non‐pharmacological interventions to manage fatigue and psychological stress in children and adolescents with cancer: An integrative review. Eur J Cancer Care. 2016;25:921-35.

- Scott K, Posmontier B. Exercise Interventions to Reduce Cancer-Related Fatigue and Improve Health-Related Quality of Life in Cancer Patients. Holist Nurs Pract. 2017;31:66-79.

- Berger AM, Wielgus K, Hertzog M, et al. Patterns of circadian activity rhythms and their relationships with fatigue and anxiety/depression in women treated with breast cancer adjuvant chemotherapy. Support Care Cancer. 2010;18:105-14.

- Schubert C, Hong S, Natarajan L, et al. The association between fatigue and inflammatory marker levels in cancer patients: a quantitative review. Brain Behav Immun. 2007;21:413-27.

- al-Majid S, McCarthy DO. Cancer-induced fatigue and skeletal muscle wasting: The role of exercise. Biol Res Nurs. 2001;2:186-97.

- Passos CS RR, Rosa TS, Neves RVP, et al. Obesity, inflammation, physical inactivity and risk for cancer. J Med Oncl Ther. 2017;2:16-9.

- Tao W, Lagergren J. Clinical management of obese patients with cancer. Nat Rev Clin Oncol. 2013;10:519-33.

- Fader AN, Frasure HE, Gil KM, et al. Quality of life in endometrial cancer survivors: What does obesity have to do with it? Obstet Gynecol Int. 2011;2011:308609.

- Dandapani SV, Zhang Y, Jennelle R, et al. Radiation-Associated Toxicities in Obese Women with Endometrial Cancer: More Than Just BMI? ScientificWorldJournal 2015;2015:483208.

- H S. Does Obesity Impact Treatment Outcome for Prostate Cancer Patients Treated with Radiotherapy: The Weighted Debate. J Cancer Prev Curr Res. 2015;2:21.

- Balkwill F, Mantovani A. Inflammation and cancer: Back to Virchow? Lancet. 2001;357:539-45.

- Schreiber RD, Old LJ, Smyth MJ. Cancer immunoediting: Integrating immunity's roles in cancer suppression and promotion. Science. 2011;331:1565-70.

- Bower JE, Ganz PA, Tao ML, et al. Inflammatory biomarkers and fatigue during radiation therapy for breast and prostate cancer. Clin Cancer Res. 2009;1:5534-40.

- Tisdale MJ. The 'cancer cachectic factor'. Support Care Cancer. 2003;11:73-8.

- Tisdale MJ. Cachexia in cancer patients. Nat Rev Cancer. 2002;2:862-71.

- Inui A. Cancer anorexia-cachexia syndrome: current issues in research and management. CA Cancer J Clin. 2002;52:72-91.

- NCCN. Cancer-Related Fatigue: In: Network N, ed. NCCN Clinical Practice Guidelines in Oncology (NCCN Guidelines); 2017.

- Pachman DR, Price KA, Carey EC. Nonpharmacologic approach to fatigue in patients with cancer. Cancer J. 2014;20:313-8.

- Given BA, Given CW, Kozachik S. Family support in advanced cancer. CA Cancer J Clin. 2001;51:213-31.

- Mansano-Schlosser TC, Ceolim MF. Qualidade de vida de pacientes com câncer no período de quimioterapia. Texto & Contexto – Enfermagem. 2012;21:600-7.

- Saad IA, Botega NJ, Toro IF. Predictors of quality-of-life improvement following pulmonary resection due to lung cancer. Sao Paulo Med J 2007;125:46-9.

- Jayadevappa R, Chhatre S, Wong YN, et al. Comparative effectiveness of prostate cancer treatments for patient-centered outcomes: A systematic review and meta-analysis (PRISMA Compliant). Medicine (Baltimore) 2017;96:6790.

- Sawada NO, Nicolussi AC, Okino L, et al. [Quality of life evaluation in cancer patients to submitted to chemotherapy]. Rev Esc Enferm USP. 2009;43:581-7.

- Sertel S, Herrmann S, Greten HJ, et al. Additional use of acupuncture to NSAID effectively reduces post-tonsillectomy pain. Eur Arch Otorhinolaryngol. 2009;266:919-25.

- Wenzel KW. Acupuncture: what is the outcome of the Gerac Studies. Dtsch Med Wochenschr 2005;130:1520.

- Oliveira AS, Filho JHAC, Oliveira OS, et al. Analgesic action of acupuncture. Unesciences. 2009;2:81-92.

- Liu S, Zhou W, Ruan X, et al. Activation of the hypothalamus characterizes the response to acupuncture stimulation in heroin addicts. Neurosci Lett. 2007;421:203-8.

- Pariente J, White P, Frackowiak RS, et al. Expectancy and belief modulate the neuronal substrates of pain treated by acupuncture. Neuroimage. 2005;25:1161-7.

- Carlsson C. Acupuncture mechanisms for clinically relevant long-term effects--reconsideration and a hypothesis. Acupunct Med. 2002;20:82-99.

- Balk J, Day R, Rosenzweig M, et al. Pilot, randomized, modified, double-blind, placebo-controlled trial of acupuncture for cancer-related fatigue. J Soc Integr Oncol. 2009;7:4-11.

- Enblom A, Johnsson A, Hammar M, et al. Acupuncture compared with placebo acupuncture in radiotherapy-induced nausea--a randomized controlled study. Ann Oncol 2012;23:1353-61.

- Meng Z, Garcia MK, Hu C, et al. Randomized controlled trial of acupuncture for prevention of radiation-induced xerostomia among patients with nasopharyngeal carcinoma. Cancer. 2012;118:3337-44.

- Pfister DG, Cassileth BR, Deng GE, et al. Acupuncture for pain and dysfunction after neck dissection: results of a randomized controlled trial. J Clin Oncol 2010;28:2565-70.

- Lu W, Wayne PM, Davis RB, et al. Acupuncture for Chemoradiation Therapy-Related Dysphagia in Head and Neck Cancer: A Pilot Randomized Sham-Controlled Trial. Oncologist. 2016;21:1522-9.

- Jeon JH, Yoon J, Cho CK, et al. Effect of acupuncture for radioactive-iodine-induced anorexia in thyroid cancer patients: a randomized, double-blinded, sham-controlled pilot study. Integr Cancer Ther. 2015;14:221-30.

- Enblom A, Steineck G, Hammar M, et al. Reduced Need for Rescue Antiemetics and Improved Capacity to Eat in Patients Receiving Acupuncture Compared to Patients Receiving Sham Acupuncture or Standard Care during Radiotherapy. Evid Based Complement Alternat Med. 2017;2017:5806351.

- Grant SJ, Smith CA, de Silva N, et al. Defining the quality of acupuncture: the case of acupuncture for cancer-related fatigue. Integr Cancer Ther. 2015;14:258-70.

- Zeng Y, Luo T, Finnegan-John J, et al. Meta-Analysis of Randomized Controlled Trials of Acupuncture for Cancer-Related Fatigue. Integr Cancer Ther. 2014;13:193-200.

- Lian WL, Pan MQ, Zhou DH, et al. Effectiveness of acupuncture for palliative care in cancer patients: A systematic review. Chin J Integr Med. 2014;20:136-47.

- Mao JJ, Palmer CS, Healy KE, et al. Complementary and alternative medicine use among cancer survivors: A population-based study. J Cancer Surviv. 2011;5:8-17.

- WHO. Definition of palliative care. In.

- Aversa Z, Costelli P, Muscaritoli M. Cancer-induced muscle wasting: latest findings in prevention and treatment. Ther Adv Med Oncol. 2017;9:369-82.

- Wurz A, Brunet J. The Effects of Physical Activity on Health and Quality of Life in Adolescent Cancer Survivors: A Systematic Review. JMIR Cancer. 2016;2:6.

- Lonkvist CK, Lønbro S, Vinther A, et al. Progressive resistance training in head and neck cancer patients during concomitant chemoradiotherapy - design of the DAHANCA 31 randomized trial. BMC Cancer. 2017;17:400.

- Neefjes ECW, van den Hurk RM, Blauwhoff-Buskermolen S, et al. Muscle mass as a target to reduce fatigue in patients with advanced cancer. J Cachexia Sarcopenia Muscle. 2017.

- Solin LJ. Breast conservation treatment with radiation: An ongoing success story. J Clin Oncol. 2010;28:709-11.

- Gami B, Harrington K, Blake P, et al. How patients manage gastrointestinal symptoms after pelvic radiotherapy. Aliment Pharmacol Ther. 2003;18:987-94.

- Noal S, Levy C, Hardouin A, et al. One-year longitudinal study of fatigue, cognitive functions, and quality of life after adjuvant radiotherapy for breast cancer. Int J Radiat Oncol Biol Phys. 2011;81:795-803.

- Bock PR, Hanisch J, Matthes H, et al. Targeting inflammation in cancer-related-fatigue: a rationale for mistletoe therapy as supportive care in colorectal cancer patients. Inflamm Allergy Drug Targets. 2014;13:105-11.

- Courtier N, Gambling T, Enright S, et al. Psychological and immunological characteristics of fatigued women undergoing radiotherapy for early-stage breast cancer. Support Care Cancer. 2013;21:173-81.

- Schmidt ME, Chang-Claude J, Seibold P, et al. Determinants of long-term fatigue in breast cancer survivors: results of a prospective patient cohort study. Psychooncology. 2015;24:40-6.

- Saligan LN, Kim HS. A systematic review of the association between immunogenomic markers and cancer-related fatigue. Brain Behav Immun. 2012;26:830-48.

- Henke M, Guttenberger R, Barke A, et al. Erythropoietin for patients undergoing radiotherapy: A pilot study. Radiother Oncol. 1999;50:185-90.

- Gutstein HB. The biologic basis of fatigue. Cancer 2001;92:1678-83.

- Monga U, Jaweed M, Kerrigan AJ, et al. Neuromuscular fatigue in prostate cancer patients undergoing radiation therapy. Arch Phys Med Rehabil. 1997;78:961-6.

- Al-Majid S, Gray DP. A biobehavioral model for the study of exercise interventions in cancer-related fatigue. Biol Res Nurs. 2009;10:381-91.

- Travier N, Velthuis MJ, Steins Bisschop CN, et al. Effects of an 18-week exercise programme started early during breast cancer treatment: a randomised controlled trial. BMC Med. 2015;13:121.

- Schmidt ME, Meynkohn A, Habermann N, et al. Resistance exercise and inflammation in breast cancer patients undergoing adjuvant radiation therapy: Mediation analysis from a randomized, controlled intervention trial. Int J Radiat Oncol Biol Phys. 2016;94:329-37.

- Peters C, Lotzerich H, Niemeier B, et al. Influence of a moderate exercise training on natural killer cytotoxicity and personality traits in cancer patients. Anticancer Res. 1994;14:1033-6.

- Hojan K, Kwiatkowska-Borowczyk E, Leporowska E, et al. Physical exercise for functional capacity, blood immune function, fatigue, and quality of life in high-risk prostate cancer patients during radiotherapy:A prospective, randomized clinical study. Eur J Phys Rehabil Med. 2016;52:489-501.

- Rahnama N, Nouri R, Rahmaninia F, et al. The effects of exercise training on maximum aerobic capacity, resting heart rate, blood pressure and anthropometric variables of postmenopausal women with breast cancer. J Res Med Sci. 2010;15:78-83.

- Lipsett A, Barrett S, Haruna F, et al. The impact of exercise during adjuvant radiotherapy for breast cancer on fatigue and quality of life: A systematic review and meta-analysis. Breast. 2017;32:144-55.

- Clauss D, Tjaden C, Hackert T, et al. Cardiorespiratory fitness and muscle strength in pancreatic cancer patients. Support Care Cancer 2017.

- Cornette T, Vincent F, Mandigout S, et al. Effects of home-based exercise training on VO2 in breast cancer patients under adjuvant or neoadjuvant chemotherapy (SAPA): A randomized controlled trial. Eur J Phys Rehabil Med. 2016;52:223-32.

- Mishra SI, Scherer RW, Snyder C, et al. Exercise interventions on health-related quality of life for people with cancer during active treatment. Cochrane Database Syst Rev. 2012:08465.

- Schmitz KH, Courneya KS, Matthews C, et al. American College of Sports Medicine roundtable on exercise guidelines for cancer survivors. Med Sci Sports Exerc. 2010;42:1409-26.

- Tian L, Lu HJ, Lin L, et al. Effects of aerobic exercise on cancer-related fatigue: A meta-analysis of randomized controlled trials. Support Care Cancer. 2016;24:969-83.