Research Article: 2021 Vol: 20 Issue: 6S

Features of Intermediary Activity of Banks in the Global Financial Services Market Industry

Shakizada Niyazbekova, Financial University under the Government of the Russian Federation

Zeinegul Yessymkhanova, Turan–Astana University

Marija Troyanskaya, Orenburg State University

Yuliya Tyurina, Financial University under the Government of the Russian Federation

Nataliya Annenskaya, Financial University under the Government of the Russian Federation

Botagoz Saparova, L.N. Gumilyov Eurasian National University

Abstract

Object: This article examines the global financial services industry, which is currently undergoing large– scale changes due to regulations, as well as the constant supply of digital innovations and new competitors that enter the market with them. In particular, online platforms that set standards for interaction and new rules are becoming increasingly important. As Bank customers are also increasingly versed in digital technologies.

Digital technologies are causing fundamental changes in the financial industry. Consequently, financial institutions change and respond to legal requirements and market opportunities, as well as support innovation, efficiency, customer loyalty, and decision– making.

Methods: The research was conducted using the following methods –

– General scientific dialectical method of cognition, which was chosen for the purpose of determining the essence of financial intermediation in General and determining its impact on economic development;

– a systematic approach, since the global financial industry is a set of interrelated and interdependent elements, i.e. it has signs of consistency;

– comparative legal approach, which is the main and necessary in this study for the purpose of identifying common elements of financial services.

Banks are an institution that acts as a financial intermediary in a country's economic relations. On the one hand, they accept deposits and attract depositors ' funds, and on the other hand, they provide an opportunity to borrow money at a specific percentage to other individuals (organizations, households, etc.). Therefore, it is safe to say that banks are also part of the credit system.

Thanks to the rapid growth of mobile and web applications, a huge number of customers now want to access banking services via their personal computer, smartphone or tablet. In today's fast– paced "right now" economy, customers expect instant, integrated, and seamless user experience. Suppliers who don't deliver goods here are immediately left behind.

Banks that deal with the topic of new applications often find that they need to pay as much attention to data management during implementation as to artificial intelligence itself.

In most companies, data was recorded (and is recorded) in a completely unstructured way. In banking, customer information is often distributed across multiple accounts and, consequently, across multiple «dispar».

Thus, the purpose of the financial market and financial intermediation is profitable transactions for sellers and buyers (investors and issuers) using a rational and optimal mechanism for buying and selling a special product – money and capital – using specific financial instruments (securities). The financial market as a specially organized process for the transfer of capital and money from entities that have their surplus to entities that need additional financing through the use of special financial instruments– securities.

Fintech companies and cybersecurity issues have been on the minds of regulators lately. Financial technologies are defined as technologically enabled innovations in financial services that can lead to new business models, applications, processes, or products that affect financial markets, institutions, and the provision of financial services. Fintech covers a large number of technologies (cryptography, cloud computing, data Analytics, etc.), products and services.

However, a specific current problem for banking regulators is the outsourcing of functions and processes to organizations that are not.

Keywords

Financial Intermediary, Financial Intermediation, Banking Deposit, Client's Trust, Financial Market Infrastructure, Financial Technologies

Introduction

Economic development has stabilized slightly around the world, and this has a positive impact on the social climate. Banks, insurance companies, and financial service providers generally benefit. For many consumers, financial institutions that provide financial services offer clients security in the financial market due to their competence and reliability. Many customers prefer no more than one or two Bank accounts and are relatively loyal to the business. Customers 'trust in their financial service providers is clear, and consumers' understanding of the financial sector has improved significantly. The experience of the financial crisis clearly shows that consumers know too little about their products and related financial instruments. Due to high losses, the customer tries to clearly understand the functions of their products. Thus, the power to make decisions in financial matters increases. The client becomes more critical and is more engaged in the product range of different suppliers. In addition, consumers ' understanding of the financial sector has improved significantly. Many years of experience have shown that consumers know too little about financial products and related financial instruments.

Literature Review

(Buchak, 2018; Calem, 1993) used such indicators as determining the size of financial intermediaries: the ratio of liquid liabilities to GDP, the ratio of private enterprise loans to GDP, and the ratio of commercial banks 'assets to the amount of commercial banks' assets and central banks ' assets. (Duygun-Fethi, 2010) considered the ratio of bank deposit liabilities to GDP. (Huang, 2005) once used individual indexes depending on the size object. To cover the depth of financial mediation, it includes the amount of liquid liabilities, bank overhead, and net interest margin. Instead, to assess the development of the stock market, they identified variables: stock market capitalization, total market value, and turnover ratio.

(Ferreira et al., 2019) believes that developing countries should take into account their specific characteristics when adopting international standards, such as the complexity and size of financial institutions, the level of development of financial market infrastructure, the degree of refinement and the quality of available information, as well as the potential of banking supervisory authorities.

Methods

The research was conducted using the following methods – General scientific dialectical method of cognition, which was chosen for the purpose of determining the essence of financial intermediation in General and determining its impact on economic development; a systematic approach, since the global financial industry is a set of interrelated and interdependent elements, i.e., it has signs of consistency; comparative legal approach, which is the main and necessary in this study for the purpose of identifying common elements of financial services.

Results

Banks are an institution that acts as a financial intermediary in a country's economic relations. On the one hand, they accept deposits and attract depositors ' funds, and on the other hand, they provide an opportunity to borrow money at a specific percentage to other individuals (organizations, households, etc.). Therefore, it is safe to say that banks are also part of the credit system.

Thanks to the rapid growth of mobile and web applications, a huge number of customers now want to access banking services via their personal computer, smartphone or tablet. In today's fast– paced "right now" economy, customers expect instant, integrated, and seamless user experience. Suppliers who don't deliver goods here are immediately left behind.

Banks that deal with the topic of new applications often find that they need to pay as much attention to data management during implementation as to artificial intelligence itself.

In most companies, data was recorded (and is recorded) in a completely unstructured way. In banking, customer information is often distributed across multiple accounts and, consequently, across multiple «dispar».

Discussions

Economic development has stabilized slightly around the world, and this has a positive impact on the social climate. Banks, insurance companies, and financial service providers generally benefit. For many consumers, financial institutions that provide financial services offer clients security in the financial market due to their competence and reliability. Many customers prefer no more than one or two Bank accounts and are relatively loyal to the business. Customers 'trust in their financial service providers is clear, and consumers' understanding of the financial sector has improved significantly. The experience of the financial crisis clearly shows that consumers know too little about their products and related financial instruments.

Due to high losses, the customer tries to clearly understand the functions of their products. Thus, the power to make decisions in financial matters increases. The client becomes more critical and is more engaged in the product range of different suppliers. In addition, consumers ' understanding of the financial sector has improved significantly. Many years of experience have shown that.

Many years of experience have shown that consumers know too little about financial products and related financial instruments.

For commercial banks, it is important that customers can instantly access their information from anywhere. But it also means that data must be available everywhere. To do this, you need to use a data platform that can manage widely distributed data, as well as replicate and synchronize data across all used server infrastructures, regardless of whether it works with a cloud provider, in your own data center, or a combination of both.

The amount of data, the type of data, and the speed at which it can be created are growing exponentially today. Conventional systems are often not able to handle large amounts of data and are not always adaptively configured. Therefore, modern data platforms must be able to manage data with consistent and predictable scalability.

Data platforms with built– in Analytics can help banks plan their future architecture by understanding where financial service providers need to provide flexibility and scalability. Data management is a fundamental level of technology, and companies can prepare themselves by making decisions about the structure of information technologies today.

When it comes to the global financial and information architecture, most banks and financial service providers face similar challenges: existing it systems are usually outdated and not suitable as a basis for new solutions. Since full exchange is rarely possible, new technologies and the existing it landscape must interact during the transition period. This requires intelligent solutions.

Today, commercial banks have become an important player in the market of credit and monetary relations, they are intermediaries in almost all financial transactions.

Basel III may have increased countries compliance and reporting costs, leading some countries to adopt proportional banking regulation frameworks. Some elements of Basel III, such as the introduction of liquidity requirements, can significantly increase the regulatory burden on banks, as supervisors need more data to monitor and verify these elements. Thus, some countries use or are considering proportional regimes that exempt certain banks from certain standard (Basel) regulatory requirements and establish alternative rules for qualified banks. For example, Brazil, the European Union, Japan, Switzerland, the United States, and the Hong Kong SAR, China, apply the Basel system standard to commercial banks that exceed a certain size; while Brazil and the United States only apply to banks with sufficiently large foreign operations (Castro Carvalho et al., 2017).

Over time, the definition of tier 1 capital appears to have become more lenient in some countries, emphasizing that the Basel framework leaves room for caution. BA– zel III sought to improve the quality of capital by eliminating tier 3 Capital and by increasing the percentage of tier 1 capital compared to tier 2 capital.

The Basel III guidelines allow certain financial instruments that are not ordinary capital to be considered tier 1 capital. Interestingly, over time, managers seem to have changed the way these guidelines are applied.

Now banking plays a huge role in the economy, and the state is interested in developing the economy. The role of financial intermediaries in economic development is as follows.

Self– employment program. Financial intermediaries, by providing funding for the launch of a self– employment program, allow you to get more products and income in the country. In India, after the nationalization of commercial banks, a number of programs were initiated by banks for self– employment.

The State Bank of India has made a digital transformation and is now contributing to the success of citizens in the global economy by making digital banking services available to more people in India.

Business development program. Initially, they develop local employment opportunities through a leading Bank. Later, certain specific areas were allocated by the Bank to launch various economic programs for the development of such territories (Gavrilova, 2019).

Integrated development of rural areas. Under this scheme, financial intermediaries Finance socially vulnerable segments of the population by providing loans for various types of economic activities. A third of the loan is a subsidy, and the remaining two– thirds will be carried out at a lower interest rate under the subsidy scheme.

Housing Finance: as part of home improvement, financial intermediaries provide housing loans to institutions such as housing and urban development corporations, which allowed fixed– income clients to take advantage of housing credit.

Priority sectors: according to the guidelines, commercial banks must provide a certain percentage of credit to priority sectors, which include agriculture and related activities.

The development of the district: in order to prevent regional disparities, financial intermediaries develop, the credit for the industry. The government has provided certain tax breaks for such industries, and banks have provided cheap loans so that more industries can be attracted in backward areas (Reverchuk, et al., 2020; Brodunov & Ushakov, 2015; Huang, et al., 2005).

Introduction of an electronic system: a computer is used by financial intermediaries for most of their activities, and they can link their branches through a network. Fast transfer of funds between centers helps customers to implement their checks as a matter of urgency. For this purpose, magnetic ink for character recognition is introduced.

In the financial market, mediation occurs as a result of intermediary activities in the primary markets of money and credit with the emergence of new financial instruments (Carvalho & Castro, 2017).

Financial services include investment Advice and brokerage services,

The work of multilateral trading systems. The location of the business. The conclusion of the mediation. Management of the financial portfolio. Own trade. Third– country Deposit brokers. Sale of financial instruments. Factoring. Finance lease.

The financial market is being updated with new services and tools. The functions of financial intermediaries under economic, political, and external as well as internal factors are changing, transforming, and modifying. The functions include bringing debt requirements and debt obligations in line with the needs of customers, reducing risk through diversification, reducing circulation costs through specialization in certain intermediary products, creating deposits that have high liquidity and meet all the properties of a payment instrument. In particular, there is an opinion of scientists who emphasize that financial intermediaries can include the following functions: organizational, coordination of the level of uncertainty in the economic environment, creative, based on the ability of financial intermediaries to create new financial products, integration.

You can list the following types of functions that are inherent to financial intermediaries:

1. Compliance with the requirements and obligations of clients.

2. Diversification and risk minimization.

3. Minimizing transnational costs.

4. Information function.

5. Stimulating function.

Table 1 shows the classification of the financial market.

| Table 1 Classifiaction of Financial Market |

|||

|---|---|---|---|

| By Nature of Claim | By Maturity of Claim | By Timing of Delivery | By Organisational Structure |

| Debt Market | Money Market | Cash Market | Exchange Traded Market |

| Eguity market | Capital Market | Futures Market | Over the Counter market |

There are different bases on which to classify the financial market, including by the nature of the claim, by maturity, by delivery time, or by organizational structure. But whatever the classification, the role of the financial market remains the same. It provides an environment through which potential investors ' savings flow into the economy. This will lead to capital accumulation in the country. Over the past few years, the role and functions of the financial market have changed dramatically due to a variety of factors, such as measures taken to protect investors, dispute resolution procedures, and low transaction costs.

The level of information, the level of financial culture and education, and the state of awareness of the situation in the financial markets is one of the indicators of the standard of living in the country. With sufficient awareness of the population and the level of financial literacy of the population, the market as a whole wins, and various programs aimed at implementing the development of both production and the economy as a whole are implemented with great success. The financial market includes foreign financial institutions, in particular banks, which come with innovations and new technologies and in the field of financial market services.

Table 2 shows data on access to the financial market.

| Table 2 Access Financial Institutions |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Market capitalization, excluding top 10 companies, to total market capitalization (%) | Number of economies | Average | Median | Standart deviation | Minimum | Maximum | Weighted average | |||

| World | 41 | 49.0 | 52.5 | 20.0 | 9.0 | 85.6 | 69.4 | |||

| By developed/developing economies | ||||||||||

| Developed economies | 22 | 48.4 | 54.2 | 21.2 | 9.0 | 84.7 | 69.3 | |||

| Developing economies | 19 | 49.7 | 51.9 | 19.1 | 12.6 | 85.6 | 69.5 | |||

| By income level | ||||||||||

| High income | 22 | 48.4 | 54.2 | 21.2 | 9.0 | 84.7 | 69.3 | |||

| Upper-middle income | 12 | 49.7 | 48.4 | 20.3 | 12.6 | 85.6 | 71.5 | |||

| Lower-middle income | 7 | 49.9 | 52.5 | 18.3 | 24.8 | 74.7 | 61.2 | |||

| Low income | 0 | |||||||||

| By region | ||||||||||

| High income: OECD | 12 | 53.6 | 56.1 | 21.3 | 9.0 | 84.7 | 71.3 | |||

| High income:non-OECD | 10 | 42.1 | 37.9 | 20.5 | 13.0 | 69.8 | 42.7 | |||

| East Asia and Pacific | 5 | 65.1 | 65.0 | 12.7 | 51.9 | 85.6 | 81.5 | |||

| Europe and Central Asia | 3 | 37.3 | 38.9 | 23.9 | 12.6 | 60.4 | 44.8 | |||

| Latin America and the Caribbean | 4 | 41.2 | 44.1 | 9.9 | 27.5 | 49.3 | 46.4 | |||

| Middle East and North Africa | 3 | 37.7 | 34.6 | 13.4 | 26.1 | 52.5 | 44.7 | |||

| South Asia | 2 | 68.0 | 68.0 | 9.5 | 61.3 | 74.7 | 74.2 | |||

| Sub-Sharan Africa | 2 | 46.7 | 46.7 | 30.9 | 24.8 | 68.5 | 43.6 | |||

Note: Weighted average by current GDP. OECD=Organisation for Economic Co–operation and Development

Table 2 shows the indicators account in an official financial institution (%, age 15+), by developed and developing countries, by income level, high, above– average, below– average, low, as well as by region, high income, high income: non– OECD countries. The indicators show East Asia and the Pacific, Europe and Central Asia, Latin America and the Caribbean, the middle East and North Africa, South Asia, and sub– Saharan Africa.

In the market, participants in economic relations have historically entered into various special relationships related to exchange and demands. In particular, for example, the lender had a requirement to the borrower, which for him represented an active placement of funds. As a rule, this was formed as an obligation, that is, a debt obligation, where a debtor arose as a result of the transaction. As a result of the events, debt obligations (claims) served as a certificate for the lender confirming the placement of its funds in the form of assets, and for the borrower – attracting additional funds in the form of liabilities. As a result, the duality of duty. Generated by a credit transaction is important from the point of view of equality of assets and liabilities of invested funds of subjects.

Market value of publicly traded shares:

741.7 million USD (31 December 2016 est.).

4.737 billion USD (31 December 2015 est.).

26.23 billion USD (31 December 2013 est.).

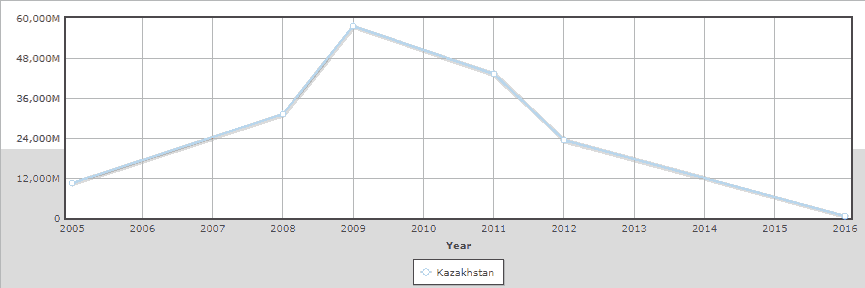

Definition: This entry gives the value of shares issued by publicly traded companies at a price determined in the national stock markets on the final day of the period indicated. It is simply the latest price per share multiplied by the total number of outstanding shares, cumulated over all companies listed on the particular exchange. Table 3 & Figure 1 shows the Market value of publicly traded shares (USD).

| Table 3 Market Value of Publicly Traded Shares (USD), 2005 – 2016 Years |

||||||

|---|---|---|---|---|---|---|

| Country | Year | |||||

| 2005 | 2008 | 2009 | 2011 | 2012 | 2016 | |

| Kazakhstan | 10,520,000,000 | 31,080,000,000 | 57,660,000,000 | 43,300,000,000 | 23,500,000,000 | 741,700,000 |

Figure 1: Market Value of Publicly Traded Shares (USD) over The 2005– 2016 Years

Sourse: https://www.indexmundi.com/

Definition of Market value of publicly traded shares (figure 2): This entry gives the value of shares issued by publicly traded companies at a price determined in the national stock markets on the final day of the period indicated. It is simply the latest price per share multiplied by the total number of outstanding shares, cumulated over all companies listed on the particular exchange.

Market value of publicly traded shares varies by country.

Table 4 shows the Market value of publicly traded shares bar chart (USD).

| Table 4 Market Value of Publicly Traded Shares Bar Chart (USD) (2016 Year) |

|

|---|---|

| Country | Market value of publicly traded shares (USD) |

| Kazakhstan | 74,16,99,968 |

| Korea, South | 13,05,00,00,17,920 |

| Taiwan | 8,51,19,99,83,616 |

| Russia | 6,35,90,00,02,304 |

| Denmark | 3,61,19,99,92,832 |

| Finland | 2,30,99,99,98,464 |

| Kuwait | 81,77,99,98,720 |

| Nigeria | 53,07,00,00,128 |

| Egypt | 27,34,99,99,616 |

| Jordan | 24,24,99,99,360 |

| Lithuania | 6,76,00,00,000 |

| Serbia | 5,06,40,00,000 |

| Slovakia | 4,56,70,00,064 |

| Macedonia | 2,07,80,00,000 |

| Nicaragua | 1,56,80,00,000 |

Definition: This entry gives the value of shares issued by publicly traded companies at a price determined in the national stock markets on the final day of the period indicated. It is simply the latest price per share multiplied by the total number of outstanding shares, cumulated over all companies listed on the particular exchange.

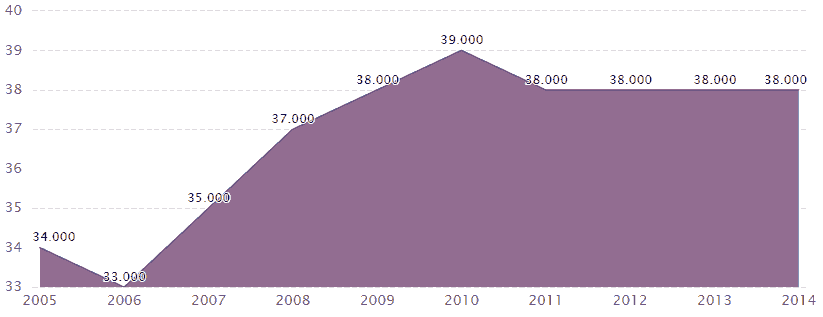

Kazakhstan’s FDI: FI: Financial Intermediation, excl Insurance and Pension Funding data was reported at 370.805 USD mn in 2016. This records a decrease from the previous number of 455.698 USD mn for 2015. Kazakhstan’s FDI: FI: Financial Intermediation, excl Insurance and Pension Funding data is updated yearly, averaging 95.463 USD mn from Dec 1993 to 2016, with 24 observations. The data reached an all– time high of 3.143 USD bn in 2007 and a record low of 3.190 USD mn in 1996. Kazakhstan’s FDI: FI: Financial Intermediation, excl Insurance and Pension Funding data remains active status in CEIC and is reported by The National Bank of the Republic of Kazakhstan. View Kazakhstan's No of Second Tier Banks from 2005 to 2014 in the chart (Figure 2).

Figure 2: Number of Kazakhstan's Second– Tier Banks from 2005 to 2014

Source: https://www.ceicdata.com/en/kazakhstan/number– of– second– tier– banks

Kazakhstan’s No of Second Tier Banks data was reported at 38 Unit in 2014. This stayed constant from the previous number of 38 Unit for 2011.

Conclusions

Thus, the purpose of the financial market and financial intermediation is profitable transactions for sellers and buyers (investors and issuers) using a rational and optimal mechanism for buying and selling a special product – money and capital – using specific financial instruments (securities). The financial market as a specially organized process for the transfer of capital and money from entities that have their surplus to entities that need additional financing through the use of special financial instruments– securities.

FinTech companies and cyber security issues have been on the minds of regulators lately. Financial technologies are defined as technologically enabled innovations in financial services that can lead to new business models, applications, processes, or products that affect financial markets, institutions, and the provision of financial services. Fintech covers a large number of technologies (cryptography, cloud computing, data Analytics, etc.), products and services.

However, a specific current problem for banking regulators is the outsourcing of functions and processes to organizations that are not subject to banking regulation and supervision. Examples include cloud computing and multiple payment system entry points (for example, mobile and Internet payment providers).

The competition situation is amplified by the emergence of competitors outside the industry, and customers tend to make more diverse demands on their financial service provider than they previously did.

Banking is a form of financing known as indirect financing (Mishkin, 1995), which consists of a commercial transfer of funds from over– leveraged individuals (families, companies, government, or the external sector) through a Bank to applicants. The process by which this transfer occurs is called financial intermediation.

To understand how financial intermediaries work, you need to understand the doctrine of Bank contracts (irregular deposits). According to Azuero (1990), banking operations are based on the receipt of an interchangeable item, when the Depositary acquires ownership of the received goods and can freely dispose of them, and their obligations to return the equivalent amount are reduced as long as there is a loan in favor of the depositor, which is required immediately or by an intermediary, depending on the type of Deposit.

References

- Buchak, G., Matvos, G., Piskorski, T., & Seru, A. (2018). Fintech, regulatory arbitrage, and the rise of shadow banks. Journal of Financial Economics, 130(3), 453–83.

- Brodunov, A.N., & Ushakov, V.Y. (2015). Justification of financial decisions in conditions of uncertainty, Bulletin of the Witte Moscow University. Series 1: Economics and management, 1(12), 30-36.

- Calem, P., & Rob, R. (1999). The impact of capital based regulation on bank risk taking. Journal of Financial Intermediation, 8, 317–52.

- DiSalvo, J., & Johnston, R. (2017). Banking trends: The rise in loan-to-deposit ratios: Is 80 the New 60? [Federal Reserve Bank of Philadelphia]. Retrieved February 23, 2018, from https://www.philadelphiafed.org/researchand-data/banking.

- Duygun-Fethi, M., & Pasiouras, F. (2010). Assessing bank efficiency and performance with operational research and artifi cial intelligence techniques: A survey. European Journal of Operational Research, 204(2), 189-198. https:// dx.doi.org/10.1016/j.ejor.2009.08.003

- Gavrilova, E.N. (2019). Investment banking as a direction of banking activity: The essence, features and problems of development. Bulletin of the Moscow State University named after S. Yu. Witte. Series 1: Economics and Management, 4(31), 81-86.

- Gavrilova, E.N., & Danaeva, K.L. (2021). The banking sector of Russia: The current state and development trends. Bulletin of the S. Yu. Witte Moscow University. Series 1: Economics and Management, 1(36), 7-14. doi: 10.21777/2587-554X-2021-1-7-14

- Fabia, A., Carvalho, & Marcos, R., Castro. (2017). Macroprudential policy transmission and interaction with fiscal and monetary policy in an emerging economy: A DSGE model for Brazil." Macroeconomics and Finance in Emerging Market Economies, Taylor & Francis Journals, 10(3), 215–259.

- Ferreira, C., Jenkinson, N., & Wilson, C. (2019). From Basel I to Basel III: Sequencing implementation in developing economies.” IMF Working Paper No. WP/19/127. International Monetary Fund, Washington, DCSantos, J. A. P. 2001. “Bank Capital Regulation in Contemporary Banking Theory: A Review of the Literature.” Financial Markets, Institutions and Instruments, 10, 41–84.

- Huang, W., & Nakamori, Y., & Wang, S. (2005). Forecasting stock market movement direction with support vector machine. Computers & OR, 32, 2513–2522.

- Reverchuk, S., Olga, V., Tetyana, Y., Lyudmyla, V., & Olesya, I. (2020). Investment activities of banks, insurance companies, and non-government pension funds in Ukraine. Investment Management and Financial Innovations, 17(2), 353-363. doi:10.21511/imfi.17(2).2020.27