Research Article: 2025 Vol: 29 Issue: 2

FDI Inflow and Economic Growth in India

Amit Hedau, NICMAR University of Construction Studies, India

Sarbesh Mishra, NICMAR University of Construction Studies, India

Citation Information: Hedau, A., & Mishra, S. (2025). FDI inflow and economic growth in India. Academy of Marketing Studies Journal, 29(2), 1-9.

Abstract

Economic growth is determined by foreign direct investment (FDI) in conjunction with other macroeconomic factors in the country where it takes place. FDI is a key driver of India's economic growth, and this research looks at how financial development and macroeconomic factors affect FDI inflows. The study analyses panel data for the year’s 2001 to 2022 using moderated regression. The annual GDP growth rate is analysed in relation to a set of independent variables through regression analysis. Two indices, "financial development" and "macroeconomic indicator", are constructed using the weighted average approach. The interactive relationship between FDI and the two indices is then examined. The significance of financial growth in attracting FDI inflows is shown by the findings. The study's findings may help organizations and investors navigate the tangled web of relationships between FDI and economic development. The findings can provide important insights to policy makers in formulating the country's FDI policy.

Keywords

FDI, Economic Growth, India.

JEL

C13, C35, F21, F43.

Introduction

Every nation prioritises economic prosperity. Investments in or acquisitions of foreign technology and expertise may be a powerful driver of economic development, a phenomenon known as foreign direct investment (FDI). FDI boosts the host country's resources. This present era of globalization is characterized by fast urbanization and economic expansion, both of which are fueled in large part by the influx of FDI. Additionally, it encourages local enterprises to acquire cash, which in turn allows them to adopt more advanced technology. Theoretically, FDI may help open up new export markets by transferring technical know-how and boosting productivity. FDI flows tend to follow economic expansions. However, GDP may take a serious hit if FDI discourages investment at home and local businesses struggle to compete with their international counterparts.

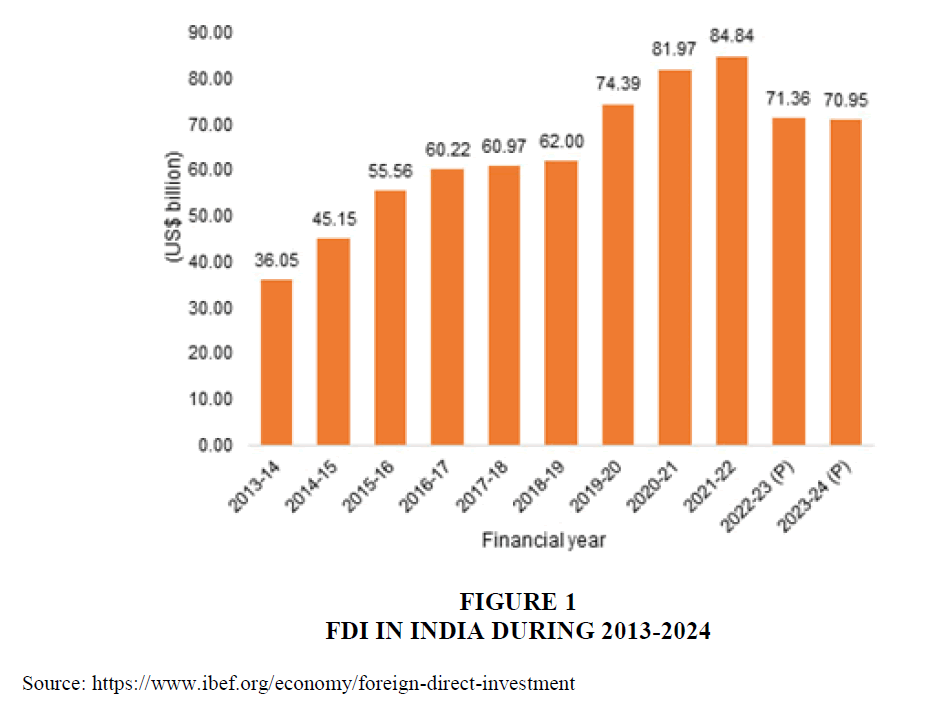

India's economy is valued at US$4.11 trillion and accounts for around 80% of the total South Asian economy. In terms of nominal value and adjusted buying power, it is the third most valuable country in the world. Since the liberalization of economic policy in the early 1990s, India's economy has risen at a remarkable pace, positioning it among the world's fastest-growing countries. Subsequently, India's economy experienced a consistent average annual growth rate of around 7% from 1992 to 2010. FDI in India surged throughout the same time period. When it comes to inflow of FDI, India was one of the developing nations that had the greatest growth from 2001 to 2010. During this period, the average annual FDI inflow was US$18.5 billion, more than six times the amount received between 1995 and 2000. The surge in FDI inflow coming into India has undoubtedly sparked a gripping analysis of how it affects India's economic growth? The total FDI in India in last decade is shown in Figure 1.

Figure 1 FDI in India During 2013-2024

Source: https://www.ibef.org/economy/foreign-direct-investment

According to studies, the overall macroeconomic circumstances in the host nation are the primary factors that determine the beneficial effect of FDI on economic development. These conditions include factors such as export orientation, human capital, political stability, institutional quality, inflation, exchange rate, government consumption and the degree of complementarity between foreign and domestic investment. The results suggest that changes in monetary policy, an improved business environment and privatisation efforts in India have led to a progressive increase in per capita GDP. The Global Financial Crisis (GFC) of 2008, however, drastically halted the country's advancement. A decrease in FDI inflows and a decrease in local savings and investment eventually stifled India's economic progress. After the 2008 global financial crisis, India's economy needed a boost, thus the country aggressively sought more FDI.

A lot of studies have looked at how FDI affects GDP growth. There has been insufficient focus on understanding how financial development and macroeconomic indicators can contribute to the progress of a country like India. This study adds to the ongoing collection of knowledge on Asian economies and fills a research gap by incorporating variables such as inflation, foreign exchange, liquid liabilities, stock market liquidity and other pertinent elements. This research uses a weighted average approach to combine financial development and macroeconomic indicators, resulting in overall indices that prevent the comparison of partially related indices. The research results reveal that FDI actually boosts and contributes significantly to the growth process. The research has significant policy consequences.

Review of Literature

Some of the past research works that compare the FDI flows with the GDP development of the developing nations are (Alam & Shah, 2013; Metwally, 2004; Mohamed & Hammami, 2017; Zhang, 2001; Tripathi et al., 2012). Actually, there is common belief that FDI is a positive factor in the economic development. The accelerated urbanisation and economic expansion in the recent wave of globalisation can largely be attributed to the inflow of FDI (Patra, 2019). In order to identify the research gap, studies conducted in India over the last 20 years are referred to. The current empirical evidence is inconclusive.

The effect of FDI on India's GDP growth is investigated by (Pradhan, 2002) via the use of production function analysis. The study's findings imply that foreign direct investment (FDI) does not considerably boost growth. Positive correlation between the aspects of economic development and FDI in India was established by (Chakraborty & Basu, 2002) employing the method of structural cointegration with vector error correction. Agrawal (2005) confirms what Pradhan (2002) found: they hold the perception that FDI is not of significant influence in the development of the economy of India. (Sahoo & Mathiyazhagan, 2003) also found out that exchange rates were relatively exerted a lesser impact on India’s development than FDI. However, it was seen that FDI and the macroeconomic variables were significantly related excluding the currency rate as concluded by (Tripathi et al., 2012). The research conclusions carry significant ramifications for policymakers and foreign investors. The authors suggested that policy makers should actively promote a reform agenda in the local market in order to attract greater FDI into the Indian economy. Greater investor confidence in the home market acts as an incentive for attracting FDI inflows, given the positive connection between FDI and stock returns.

Chakraborty & Nunnenkamp (2008) examine the dynamic relationship between FDI and economic growth using a panel cointegration technique. They find that FDI inflows have a positive impact on the economic growth of the Indian economy. They conclude that FDI boosts India's GDP development. Agrawal & Khan (2011) compare China and India, looking at China's incredible success in obtaining foreign direct investment and offering advice on how India might make better use of FDI. FDI boosts GDP growth, according to (Dash & Parida, 2013). Using a different set of variables, Sarode (2012) shows that FDI benefits the capital account while hurting the current account. Among other things, (Bagli & Adhikary, 2014) used secondary time series data to do an econometric analysis that looked at how the rise in FDI affected India's GDP growth. Their findings demonstrate that increasing domestic capital production significantly and favorably affects GDP growth. As a whole, economic development is impeded by population expansion. When it comes to India's economic development, however, openness levels and FDI influx increases don't matter much. FDI inflows into India have a favorable influence on Total Factor Productivity (TFP) development owing to positive spillover effects, according to (Choi & Baek, 2017). (Dash & Parida, 2013; Pradhan, 2002; Agarwal; 2005; Chakraborty & Nunnenkamp, 2008; Bagli & Adhikary, 2014; Choi & Baek, 2017) have recorded the contradicting results. Using secondary data spanning 1979–2012, (Patra, 2019) examines the relationship and causality among urbanization, GDP, and FDI in India and China. According to her research, there is a strong and positive relationship between urbanization and FDI flows into India and China. The findings suggest that the expansion of both urban populations and GDP per capita significantly affect the growth of foreign direct investment. The variables impacting FDI into India and China were investigated by (Neharkar &Vishnu, 2020). They wanted to know what factors, if any, government policies or incentive packages had a role in luring and retaining FDI, and why China does it better than India. According to the study's findings, FDI into China is negatively affected by the exchange rate. However, FDI flows are affected by a number of variables, including trade openness, anti-corruption initiatives, and investor trust in the current legal system. Trade openness, political stability, and anti-corruption initiatives have a favorable and substantial impact on FDI inflows to India. According to their findings, out of all the policy indicators considered, institutional traits—including government performance, rule of law, corruption control, and political elements including political stability—are the most crucial in determining China's capacity to entice FDI. (Pal, 2023) tested the hypothesis that FDI and India's growth rate are positively correlated over the long term. A variety of statistical methods were used in the research, including cointegration, VECM, IRF, VDC, and pairwise Granger causality analysis. The Granger causality test verifies that FDI has a one-way effect on India's GDP growth. A negative sign for the Error Correction Term (ECT) in the VECM model indicates that 41% of the imbalance is recovered after a year. The results are consistent with the research conducted by (de Mello, 1997) & (Huang, 2004), which examined the influence of foreign direct investment (FDI) on Chinese firms in developing countries. (Jha, 2005) contends that raising investment is more crucial than raising the FDI component of such investment and observes that the quality of FDI is more significant than its amount in his comparative study of China and India's FDI. He goes on to propose measures to boost the effectiveness and quantity of this kind of FDI. In a study that aimed to shed light on the locational factors that influence FDI from China and India, (Duanmu & Guney, 2009) compared the two nations' FDI growth rates and discovered that distance and OCED membership work against Chinese FDI.

Various critical global events happening across the globe such as the COVID 19 outbreak, the trade war between the United States of America and China, and the Russia & Ukraine war have impacted and shifted the global business environment to a significant extent. Many organizations are reconsidering their stances on FDI. In this light, the purpose of this research is to determine what aspects of India's economy are most likely to entice FDI, with the ultimate goal of boosting GDP growth. As things stand, India's national profile suggests that it might overtake China as the biggest economy in the world. The last decade has also seen a meteoric rise in FDI into India. This study aims to stimulate further discussion and encourage more research in the Indian context, taking into account India's historical growth patterns and prospects for future expansion.

Research Methodology

Research Variables and Source of Data

The panel data used in this research spans the years 2001–2022. Here, economic growth as measured by real GDP growth rates on a yearly basis serves as the dependent variable. Prior research by (Aziz, 2020); (Borensztein et al., 1998) & (Azman Saini et al., 2010) lend credence to this. Foreign direct investment (FDI) flows are determined by financial development and macroeconomic factors. Financial development includes the Reserve Bank of India's (RBI) liquid liabilities, bank size, stock market size, liquidity, and bank credit. Inflation, exchange rate, government spending, and trade openness are all examples of macroeconomic indicators. The data source for each variable is given in Annexure Table 1.

| Annexure Table 1 Data Source for Financial Development | ||

| GDP growth | Annual real GDP growth rate in % | World Bank, World Development Indicators |

| FDI inflows | Natural Logarithm of annual net inflows in US$. | World Bank, World Development Indicators |

| Human capital | Annual percentage growth rate of population | World Bank, World Development Indicators |

| Exchange rate | Official exchange rate (INR per US$, period average). | World Bank, World Development Indicators |

| Inflation | Annual percentage rate of change in CPI. | World Bank, World Development Indicators |

| Government Consumption | General government final consumption as % of GDP | World Bank, World Development Indicators |

| Liquid liabilities (M2) | Average annual growth rate in money and quasi money. | Reserve Bank of India |

| Bank size | The growth rate of total bank deposits. | Reserve Bank of India |

| Bank credit | Domestic credit to private sector by banks as percentage of GDP | Reserve Bank of India |

| Stock market size | Stock market capitalization of listed companies as percentage of GDP. | World Bank, World Development Indicators |

| Stock market Liquidity | Total value of shares traded divided by the average market capitalization (percentage). | World Bank, World Development Indicators |

| FDI inflows × Fin Deve. Index | Interaction term between FDI inflows and Fin Deve. Index | Author's own calculations based on the two variables |

| FDI inflows × Macroecon. Index | Interaction term between FDI inflows and Macroeconomic Index | Author's own calculations based on the two variables |

Financial development and macroeconomic activity are quantified by a variety of indicators. This study uses the weighted average method to construct two indices: the financial development index and the macroeconomic index. Higher index values have a larger effect on FDI inflows (Vadlamannati &Tamazian, 2009). Two interaction terms are produced by the research: one of the two figures can be related to FDI and the financial development index and the other one being the relation between FDI and a macroeconomic variable. The use of these interaction terms is to determine how much weight to give to macroeconomic indicators and financial development when trying to forecast how FDI would affect growth. When the interaction term is positive, it means that the net impact of FDI on growth is conditional on the degree of development.

Methods of Data Analysis

The initial model presented for the study is based on the research variables found in the literature review.

EGRWO = β + β1FDI + β2HC + β3GEX + e (1)

In the second stage, two interaction terms are used to examine the interaction effects. Two regression models are developed in this stage.

EGROW = β + β1FDI + β2HC + β3GEX + β4FDI*FINDEVE + e (2)

EGROW = β + β1FDI + β2HC + β3GEX + β4FDI*MACROINDI + e (3)

Where,

EGROW stands for Annual growth rate of GDP of Korea

Net FDI inflow is represented by FDI, HC is for Human Capital, GEX is government spending.

FINDEVE and MACROINDI is the financial development index and macroeconomic indicator index developed by the author and e is error term.

Multiple linear regressions is first used to analyse the linear relationship. Regression analysis relies on several key assumptions, including the presence of outliers, multicollinearity and standardised residuals. These assumptions can be assessed using statistical techniques such as Cook's Distance, Variance Inflation Factor (VIF) and the histogram of standardised residuals. By centering the means, the coefficients easier to understand and lessen the impact of multicollinearity.

Empirical Results

The findings of regression analysis are reported in Table 1. Based on the data shown here, FDI does, in fact, contribute to GDP growth, although only little. Current research has shown conflicting findings on the direct beneficial influence of FDI on economic development, which is in line with findings by (Carkovic & Levine, 2005) & (Li & Liu, 2005). A situation called "crowding out" occurs when local investment is replaced by foreign investment, which generally implies that the beneficial impacts of FDI might be substantially diminished. A number of studies have shown signs of crowding out as a result of things like heightened competitiveness. On the other hand, some academics contend that FDI may stimulate more investment at home. Examples of these researchers include (Jude, 2018; Makki & Somwaru, 2004). Even in cases where crowding-out occurs, the overall impact can still be positive, especially since substitution typically allows limited domestic funds to be allocated to alternative investment objectives.

| Table 1 Regression Coefficients | ||||

| Determinants | ||||

| GDP Growth | 0.0087 (0.047) | 0.0077 (0.845) | 0.521* (0.000) | -0.299 (0.158) |

| FDI Inflow | 0.120* (0.004) | 0.078* (0.005) | 0.047* (0.000) | 0.018* (0.041) |

| Human Capital | 0.0458 (0.199) | 0.0378 (0.321) | 0.0245 (0.139) | 0.055 (0.121) |

| Govt. Expenditure | 1.895*** (0.076) | 1.958*** (0.083) | 1.563* (0.002) | 1.498 (0.589) |

| Financial Development | 0.575*** (0.078) | 0.504** (0.019) | ||

| Macroeconomic Indicator | 1.011*** (0.066) | 1.0210*** (0.079) | ||

| FDI inflow x Financial Development | 1.125*** (0.069) | |||

| FDI Inflow x Macroeconomic Indicator | 1.459** 0.055 | |||

| Observations | 22 | 22 | 22 | 22 |

This research found only a slight correlation between higher levels of human capital and higher levels of foreign direct investment. Similarly, increases in FDI inflows do not lead to improvements in human capital. The main determinants influencing the distribution of FDI across states are the size of the market as indicated by the state's gross domestic product (GDP), the availability of affordable labour. The results thus suggest that while it is important for both national and sub-national governments to allocate resources to human capital development, equal emphasis should be placed on improving labour market conditions, physical infrastructure and the overall scope of economic activities. The author agrees with (Demissie , 2015) for concluding that the level of human capital in the receiving country depicts the pattern of FDI growth rate. Hence, it is the conclusion that for FDI and its prospective development impact to be effectively utilized, human capital of a specific minimum level is required.

There is a favorable correlation between government spending and FDI influx over the long run, according to this research. Foreign direct investment (FDI) flows are positively affected by the long-run coefficient of government spending, which is statistically significant at the 1% level. Findings from the study highlight the importance of government expenditure in luring more foreign direct investment (FDI) over the long term. Furthermore, the results back up the idea that tax revenue should mostly go toward productive economic endeavors. This is due to the fact that substantial foreign direct investment (FDI) would pour into India as a result of the country's eventual economic stimulation brought about by greater growth. In theory, developing nations may attract more foreign direct investment (FDI) by increasing their government expenditure on infrastructure, fostering a favorable business climate, and establishing strong institutions (Panigrahi & Panda, 2012).

A statistically significant interaction was found between FDI and financial development in relation to economic development. The coefficient (b) for this interaction was 1.125 and the p-value was 0.069. It was found that an increase in the value of the interaction term correlates with a higher level of economic prosperity in India. The existence of a substantial and positive financial development variable suggests that business regulation has a notable impact on economic growth. The relationship between the financial development index and FDI inflows has a positive and significant effect on growth. Countries with favourable business policies can efficiently absorb the beneficial effects of FDI inflows. The Indian economy benefits from FDI inflows due to its stringent regulations that ensure higher quality standards. This finding confirms the idea that improved business strategies are essential to promote the diffusion of FDI inflows. As a result, economic growth brings benefits that can be experienced both directly and indirectly.

The moderating relationship between FDI and the macroeconomic indicator also shows a statistically significant positive impact (β = 1.459, p = 0.055). Greater economic freedom has a significant positive impact on economic performance by encouraging more and more efficient investment. Moreover, the correlation between the macroeconomic index and FDI inflows has a robust and significant effect on growth. Banking plays a crucial role in macroeconomic factors. Empirical evidence has confirmed that macroeconomic indicators show the positive influence of banks, which generate fresh money through lending, thereby obviating the need for prior savings for investment and expansion. This suggests that the stronger a country's macroeconomic indicators are, the greater the impact of FDI inflows on economic growth. This result is consistent with the findings of (Azman-Saini et al., 2010; Vadlamannati & Tamazian, 2009) & (Shah, 2013).

Conclusion, Limitations and Future Scope

This research looks at how foreign direct investment (FDI) comes into India and how financial development and macroeconomic indicators relate to it. From 2001–2022, the researcher use a panel data estimation method to conduct the study. The analysis of empirical data revealed that growth crucially depends on the variables which influence macroeconomic policy. Significant policy ramifications stem from the study's findings. Economic development is facilitated by both a stable business climate and the absorption of FDI spillovers, provided that institutions are of high quality. India needs to undertake substantial reforms to improve its financial development. Possible reforms include improving the efficiency of the courts, strengthening adherence to legal principles, promoting fair competition, and increasing transparency. The proposed reforms should facilitate market entry for businesses, streamline licensing procedures, and minimise cumbersome regulations and bureaucratic procedures. To effectively promote global economic integration and reduce trade barriers, the Indian government should strengthen its trade links and increase the number of free trade agreements. Furthermore, by implementing its trade and investment reforms within a multilateral framework such as the WTO, India can guarantee unrestricted access to global markets, thereby enhancing their credibility.

The current study has some drawbacks. The author has selected and studied only one country. The generalisation of the study's findings is subjective. In addition, the author rely on the literature to obtain the variables, resulting in a comprehensive identification of the variables. The validity of the study's findings depends on the reliability of the secondary data used to substantiate them. In addition, the study does not take into account many variables that affect economic growth, mostly due to their absence in the database. Nevertheless, the study provides opportunities for further research. It is hoped that initiatives such as this will add to the discourse on the subject and provide grounds for further research in this area, especially in the context of India.

References

Agrawal, G., & Khan, M. A. (2011). Impact of FDI on GDP: A comparative study of China and India. International Journal of Business and Management, 6(10), 71.

Indexed at, Google Scholar, Cross Ref

Agrawal, P. (2005). Foreign direct investment in South Asia: Impact on economic growth and local investment. In Multinationals and foreign investment in economic development (pp. 94-118). London: Palgrave Macmillan UK.

Indexed at, Google Scholar, Cross Ref

Alam, A., & Zulfiqar Ali Shah, S. (2013). Determinants of foreign direct investment in OECD member countries. Journal of Economic Studies, 40(4), 515-527.

Indexed at, Google Scholar, Cross Ref

Aziz, O. G. (2022). FDI inflows and economic growth in Arab region: The institutional quality channel. International Journal of Finance & Economics, 27(1), 1009-1024.

Azman-Saini, W. N. W., Baharumshah, A. Z., & Law, S. H. (2010). Foreign direct investment, economic freedom and economic growth: International evidence. Economic modelling, 27(5), 1079-1089.

Bagli, S., & Adhikary, M. (2014). FDI inflow and economic growth in India an empirical analysis. Economic Affairs, 59(1), 23-33.

Borensztein, E., De Gregorio, J., & Lee, J. W. (1998). How does foreign direct investment affect economic growth?. Journal of international Economics, 45(1), 115-135.

Indexed at, Google Scholar, Cross Ref

Carkovic, M. (2005). Does Foreign Direct Investment Accelerate Economic Growth. Does Foreign Investment Promote Development.

Chakraborty, C., & Basu, P. (2002). Foreign direct investment and growth in India: A cointegration approach. Applied economics, 34(9), 1061-1073.

Indexed at, Google Scholar, Cross Ref

Chakraborty, C., & Nunnenkamp, P. (2008). Economic reforms, FDI, and economic growth in India: a sector level analysis. World development, 36(7), 1192-1212.

Choi, Y. J., & Baek, J. (2017). Does FDI really matter to economic growth in India?. Economies, 5(2), 20.

Dash, R. K., & Parida, P. C. (2013). FDI, services trade and economic growth in India: empirical evidence on causal links. Empirical Economics, 45, 217-238.

De Mello Jr, L. R. (1997). Foreign direct investment in developing countries and growth: A selective survey. The journal of development studies, 34(1), 1-34.

Demissie, M. (2015). FDI, human capital and economic growth: a panel data analysis of developing countries.

Duanmu, J. L., & Guney, Y. (2009). A panel data analysis of locational determinants of Chinese and Indian outward foreign direct investment. Journal of Asia business studies, 3(2), 1-15.

Huang, J. T. (2004). Spillovers from Taiwan, Hong Kong, and Macau investment and from other foreign investment in Chinese industries. Contemporary Economic Policy, 22(1), 13-25.

Jha, R. (2003). Recent trends in FDI flows and prospects for India. In Economic Growth, Economic Performance and Welfare in South Asia (pp. 305-322). London: Palgrave Macmillan UK.

Jude, C. (2019). Does FDI crowd out domestic investment in transition countries?. Economics of Transition and Institutional Change, 27(1), 163-200.

Makki, S. S., & Somwaru, A. (2004). Impact of foreign direct investment and trade on economic growth: Evidence from developing countries. American journal of agricultural economics, 86(3), 795-801.

Metwally, M. M. (2004). Impact of EU FDI on economic growth in Middle Eastern countries. European Business Review, 16(4), 381-389.

Neharkar, P., & Vishnu, K. (2020). Does FDI intensify economic growth? Evidence from China and India. In The Rise of India and China (pp. 46-70). Routledge India.

Pal, M. (2023). FDI-Growth Nexus in India: Cointegration and Causality. In Foreign Capital and Economic Growth in India: Time Series Estimation (pp. 61-83). Singapore: Springer Nature Singapore.

Panigrahi, T. R., & Panda, B. D. (2012). Factors influencing FDI inflow to India, China and Malaysia: An empirical analysis. Asia-Pacific Journal of Management Research and Innovation, 8(2), 89-100.

Patra, S. (2019). FDI, urbanization, and economic growth linkages in India and China. In Socio-Economic Development: Concepts, Methodologies, Tools, and Applications (pp. 313-327). IGI Global.

Pradhan, J. P. (2002). Foreign direct investment and economic growth in India: A production function analysis. Indian Journal of Economics, 82, 581-586.

Sahoo, D., & Mathiyazhagan, M. K. (2003). Economic growth in India:" does foreign direct investment inflow matter?". The Singapore Economic Review, 48(02), 151-171.

Sarode, S. (2012). Effects of FDI on capital account and GDP: empirical evidence from India. International Journal of Business and Management, 7(8), 102.

Tripathi, V., Seth, R., & Bhandari, V. (2015). Foreign direct investment and macroeconomic factors: Evidence from the Indian economy. Asia-Pacific Journal of Management Research and Innovation, 11(1), 46-56.

Vadlamannati, K. C., & Tamazian, A. (2009). Growth effects of FDI in 80 developing economies: the role of policy reforms and institutional constraints. Journal of Economic Policy Reform, 12(4), 299-322.

Zhang, K. H., & Song, S. (2001). Promoting exports: the role of inward FDI in China. China economic review, 11(4), 385-396.

Received: 14-Oct-2024, Manuscript No. AMSJ-24-15140; Editor assigned: 15-Oct-2024, PreQC No. AMSJ-24-15140(PQ); Reviewed: 26- Nov-2024, QC No. AMSJ-24-15140; Revised: 06-Dec-2024, Manuscript No. AMSJ-24-15140(R); Published: 03-Jan-2025