Research Article: 2018 Vol: 22 Issue: 5

FDI, FPI and Institutional Quality-evidence From African Countries

Patricia Lindelwa Rudo Makoni, University of South Africa

Abstract

The primary objective of this study was to explore the relationship between FDI, FPI and institutional quality using a panel of nine African countries, over the period 2009-2016. This period was of interest as it was immediately after the global economic crisis of 2007/2008, which resulted in international capital flight from host countries due to the flouting of many market regulations and other similar institutions. Using various econometric approaches, we found that where natural resources and developed financial markets were absent, institutional quality mattered for both FDI and FPI inflows. Further, we established a positive relationship between FDI and FPI, in line with theory and earlier empirical studies. Our study’s novelty lies in that it applies the Kuncic database of institutional quality, which is more comprehensive than other single source databases. In light of our findings, the policy recommendations put forth are that the Governments of these developing African countries formulate and implement investment policies to attract FDI and FPI by ensuring that the operating governance environment is conducive, and hindrances such as expropriation risk, poor corporate governance and political instability are absent. This will assist these countries to further grow their economies, by supplementing domestic savings and investments with international capital inflows to boost local production, increase employment, economic growth and other trade opportunities.

Keywords

FDI, FPI, Institutional Quality, Africa.

Introduction

Foreign Direct Investment (FDI) is defined as international investment made by one economy’s resident entity, in the business operations of an entity resident in a different economy, with the intention of establishing a lasting interest (International Monetary Fund [IMF], 1993). According to the UNCTAD (2006), FDI can potentially generate employment, raise productivity, transfer skills and technology, enhance exports as well as contribute to the long-term economic growth of the world´s developing nations. Although FDI is important in promoting growth and economic integration, the inflows of foreign direct investment into Africa have been significantly lower than those of other developing economies in Asia and Latin America (Makoni, 2016).

Foreign Portfolio Investment (FPI), on the other hand, is that investment made by a resident entity in one country in the equity and debt securities of an enterprise resident in another country, motivated by capital gains but not necessarily seeking to establish a significant interest or long term lasting relationship in the foreign enterprise (IMF, 1993). It comprises of investments in bonds, notes, money market instruments and financial derivatives, as well as government bonds. Sawalha et al. (2016) argued that FPI could contribute positively to economic growth, whether on its own or through its interaction with FDI inflows thus creating liquidity, and providing a source of low-cost capital. FPI-investors often demand higher transparency in corporate governance and legal protection. If these expectations are met, they result in enhanced investor confidence. According to Sawalha et al. (2016), these features make FPI a prominent driver for improvements in domestic financial infrastructure, thus paving the way for countries to attract longer term FDI inflows.

Lipsey (2004) cited in Makoni (2015) identified several macro-level determinants that influence a host country’s attractiveness to foreign investment. Key amongst these was institutional factors such as the political stability of the country. In the study by Daude and Fratzscher (2008), it was found that inward FDI flows and loans were high for countries with weaker regulatory institutional bodies and lowly developed capital markets, because foreign direct investors’ perceptions of such economies were that their investments were not secure and could be subjected to expropriation of assets such as factories and mines. Their findings further highlighted the importance of strong regulations as a prerequisite to establish and integrate domestic stock markets in line with international standards to be able to attract FPI inflows.

There has been an increasing interest amongst academics to understand the relationship between institutional quality and foreign international capital flows. This is despite there being no consensus on the appropriate proxy for institutional quality. As such, we feel the need to address this gap by examining this phenomenon in the African context.

This paper contributes to the empirical literature on the relationship between FDI, FPI and institutional quality by examining the role of institutional quality in the host countries, and FDI and FPI inflows using econometric panel data techniques that address the problem of endogeneity of some of the independent variables. Secondly, for our institutional quality proxy, we use a composite principal component analysis Kuncic (2014) constructed index.

Thus the question that we want to answer is: What influence, if any, does institutional quality have on FDI and FPI inflows to our selected African economies? The remainder of the paper is organised as follows: the next section considers a review of the existing literature on the relationships between FDI, FPI and institutional quality respectively. This is followed by the methodology in which we lay out our econometric model and steps followed. The findings are discussed thereafter, and conclusions and recommendations wind up the paper.

Literature Review

Dunning and Dilyard (1999) suggested that the theory of FPI is located within international economics, and drawn on macroeconomic financial variables, notably interest rates and exchange fluctuations. As such, it is expected that financial resources will flow from capitalrich countries to poor ones, in pursuit of the higher rate of return. Bartram and Dufey (2001) are also of the view that international financial investments are subject to not only currency and political risk, but also institutional factors such as respect for the rule of law, property rights and tax issues. In support of these views, Goldstein and Razin (2006) also reiterated the notion that FPI is motivated by yield-seeking and risk-reducing activities that are achievable through portfolio diversification.

Wilhems and Witter (1998) as cited in Makoni (2015) theorised that FDI institutional fitness is a country’s ability to attract, absorb and retain FDI. The theory attempted to explain the uneven distribution of FDI flows between countries, based on four key aspects the role of Government, market, educational and socio-cultural factors. According to Makoni (2015), a country’s institutional strength, as proxied by government fitness, advocates for the formulation and implementation of strong market regulations.

In addition, Musonera et al. (2010) empirically tested the theory of FDI institutional fitness using a three-country case study between 1995 and 2007. They found that FDI inflows to African countries were motivated by variables such as the population, size of the economy, financial market development, trade openness, infrastructure and other economic, financial and political risks, and not primarily by natural resource endowment as often perceived. The success of African economies in receiving FDI inflows has increasingly grown on the strength of the establishment of macroeconomic and political stability policies, the introduction of an efficient regulatory framework in financial markets, as well as the elimination of corruption from both the private and public sectors, thus proving an enabling environment to MNCs to invest (Makoni, 2015).

Institutional quality measures reflect the effectiveness of the rule of law, the level of corruption, enforceability of legal contracts and stability of the government in a country. Kuncic’s (2014) institutional quality measures encompass legal, political and economic institutional indicators. The relationship between FDI and institutional quality has been extensively studied. Although on the one hand, Kedir et al. (2011) and Cleeve (2012) found that political and institutional risk factors were insignificant in explaining FDI inflows to Africa; other studies have reached different conclusions.

Buchanan et al. (2012) examined the relationship between FDI and institutional quality and found that institutional quality has a positive and significant effect on FDI. Other scholars also concluded that the institutional quality of the host country has a positive impact on FDI (Bengoa & Sánchez-Robles, 2003; Cheng & Kwan, 2000). In addition, Stein and Daude (2001) examined the impact of institutional quality on FDI and found that countries whose governments are highly ranked according to various indices of the quality of institutions tend to do better in attracting FDI. Lothian (2006) adopted the Economic Freedom of the World Index in his study and concluded that countries with better institutions were able to attract increased foreign capital flows. Likewise, Papaioannou (2009) studied the relevance of institutions on a sample of countries using panel data and found that improvements in institutional quality are often complemented by a corresponding increase in inward FDI flows.

On the other contrary, poor institutional quality has been found to have a negative impact on the ability to attract FDI inflows. Authors such as Dutta and Roy (2011) and Asiedu (2002) found that poor institutional quality served to shun FDI. Similar conclusions were drawn by Levine and Zervos (1996), Rowland (1999), and De Santis and Luhrmann (2009) who also found that poor quality institutions, high taxes and transaction costs inhibit on the freedom of foreign investors to bring in the much sought-after capital from abroad.

Methodology

Data and Variables

In this paper, we examine the interrelationships between FDI, FPI and institutional quality using World Bank panel data for Botswana, Cote D’Ivoire, Egypt, Ghana, Kenya, Mauritius, Morocco, Tunisia, and South Africa from 2008 to 2016. We opted to use Kuncic’s (2014) database of institutional quality. This database groups over 30 institutional indicators derived from different sources such as the Heritage Foundation, Freedom House, Fraser Institute, ICRG, World Bank World Governance Indicators (WGI), Polity and Transparency International into three spheres of legal, political and economic institutions, with the objective of computing an index of institutional quality to capture the institutional environment (Kuncic, 2014). This made the database a more comprehensive index to apply than any of the other individual sources.

FDI is measured as the ratio of net FDI inflows to GDP, and FPI is net inflows scaled by GDP. Institutional quality is a composite index from Kuncic’s database. Our control variables FDI is measured as the ratio of net FDI inflows to GDP, and FPI is net inflows scaled by GDP. Institutional quality is a composite index from Kuncic’s database. Our control variables

Econometric Model

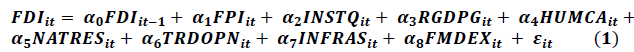

In determining the relationship between FDI, FPI and institutional quality, we estimated the following multiple regression models:

Where, i denotes country, t denotes time, α0 is a constant term, εit is a random error term and

the other variables are defined as:

FDIit=the inflow of FDI as a percentage of GDP into country i for time t.

FPIit=the inflow of FPI as a percentage of GDP into country i for time t.

INSTQit=the measure of legal, political and economic institutional quality.

HUMCAit=the gross enrolment ratio for primary education.

NATRESit=total natural resources scaled by GDP.

TRDOPNit=the openness index proxied by total trade as a % of GDP.

INFRASit=the log of fixed telephone lines per 1000 people.

RGDPGit=real GDP growth rate.

FMDEXit=composite financial market development index.

The Ordinary Least Squares (OLS) model was applied on the multiple regressions to determine the nature of the relationship between the dependent and independent variables. The next section presents the results of the regression analysis.

Results And Analysis

The objective of this study was to examine the interrelationship between FDI, FPI and institutional quality using World Bank panel data for Botswana, Cote D’Ivoire, Egypt, Ghana, Kenya, Mauritius, Morocco, Tunisia, and South Africa from 2009 to 2016.

A summary of the descriptive statistics of the variables used in the estimations for the sample of nine African countries in this study is presented in Table 1 below.

| Table 1 DESCRIPTIVE STATISTICS |

|||||

| Variable | Observations | Mean | Standard deviation | Minimum | Maximum |

| FDIGDP | 72 | 6.3788 | 26.8446 | -0.2045 | 220.0027 |

| FPIGDP | 72 | 3.1110 | 11.8588 | -0.9046 | 80.4750 |

| INSTQ | 72 | 0.3836 | 0.1479 | 0.1314 | 0.7071 |

| FMDEX | 72 | -5.6910 | 0.1002 | -0.4932 | 3.7156 |

| TRDOPN | 72 | 76.5599 | 26.2492 | 30.2000 | 121.3044 |

| RGDPG | 72 | 4.0167 | 2.8131 | -7.6522 | 10.7065 |

| HUMCA | 72 | 89.4573 | 29.1078 | 15.9148 | 117.5122 |

| NATRES | 72 | 7.4182 | 5.8322 | 0.0034 | 28.4123 |

| INFRAS | 72 | 88.6038 | 85.5671 | 1.0267 | 315.0345 |

Source: Author’s own computations

Table 1 above reflects the descriptive statistics for the sample of nine African countries for an eight-year period spanning from 2009 to 2016. It can be deduced from the data that FDI inflows to sampled African countries as a percentage of GDP were significantly low. The mean of net FDI inflows for the period under review was 6.37% of GDP, with a standard deviation of 26.84. The minimum FDI as a percentage of GDP was -0.2045%, while the maximum was 220%. The negative FDI inflow values are indicative that outflows exceeded inflows during the period under review. It therefore appears that most countries faced disinvestment of foreign direct capital flows from the relevant country’s economy during this period.

FPI inflows averaged 3.11% of GDP, with a standard deviation of 11.85. The minimum FPI as a percentage of GDP was -0.90%, while the maximum was 80.48. Similar to FDI inflows, where the FPI value is negative, there were investment outflows that occurred during that period. Poor FPI inflows are the result of equally under-developed financial (stock and bond) markets in Africa, with most multinational corporations resorting to the credit banking sector rather than the stock markets as conduits for raising capital locally.

The institutional quality of our selected African countries was measured using Kuncic’s (2014) database. The aim of Kuncic’s database is to compute an index of institutional quality to reflect the institutional environment of a country (Kuncic, 2014). The relative institutional quality values derived from Kuncic’s database range from -2 to 2, with a mean of zero (0); are calculated using factor analysis to identify the latent factor scores for every country every year, within each institutional group. We chose to adopt this database as it combines comprehensive sources of legal, political and institutional quality variables, and were hence deemed to be the most appropriate measure for our sampled African countries. Therefore, with a pooled mean score of 0.38 for institutional quality, a minimum of 0.13 and a maximum of 0.71, the sample of African countries had a medium score on the quality of institutions. Institutional quality is a proxy of the legal, economic, political and regulatory frameworks, and other such characteristics, which enhance a country’s current and future attractiveness to multinational corporations, domestic and foreign investors alike.

The relative size of the domestic financial markets as measured by a composite financial market index constructed using principal components analysis, reflected an average of -5.69%, with -0.49% for the smallest financial market to a maximum of 3.72% for the most developed financial market within our sample frame. Financial markets play a pivotal intermediation role within the economy and hence should be developed in terms of instruments offered, as well as adhering to a strong regulatory framework.

The real GDP growth rates, which served as a proxy of macroeconomic stability for the sampled African countries, averaged 4.01% for the period under review. Further, the countries surveyed appeared to have been very open to trade with an average of 76.55%, which matters for multinational corporations which bring in foreign direct investment. Trade openness was measured as the sum of the host country’s imports and exports scaled by GDP. Other variables included in this paper are infrastructure, human capital development and natural resource endowment.

In terms of infrastructural development in the sample of African countries between 2009 and 2016, there were a maximum of 315 fixed telephone lines per 1,000 people of the population, as compared to the lowest with one line per person. This confirmed that infrastructure in some African countries is unevenly developed. Human capital development remains a largely debated driver of FDI. Scholars have argued that it is not the size of the labour pool that matters, but rather the skills level of human capital, which is important for FDI inflows (Mallik & Chowdhury, 2017). This assertion is reflected in our descriptive statistics by the high average of 89.46 which is the gross enrolment ratio for primary level education, and is considered the minimum level required to undertake tasks as expected of labour by the MNCs. Lastly, natural resource endowment was measured as the total natural resources scaled by GDP. It yielded a mean of only 7.41% and a maximum of 28.41% of overall GDP. According to Asiedu (2006), countries that do not have an abundance of natural resources are able to harness inward FDI flows by improving their regulatory institutions and political environment.

Various diagnostic tests were run to test our regression model before it was estimated. To avoid spurious results of the regression analysis, the data were tested for serial correlation, multicollinearity and heteroskedasticity. A correlation matrix was employed to examine our variables for any multicollinearity amongst them. According to Table 2 below, none of the variables was correlated at the 5% level of significance. Generally, the correlation coefficient should fall between ranges of +1 to -1. The rule of thumb is that correlations between any two variables should not be above 0.8 (80%).

| Table 2 CORRELATION COEFFICIENTS |

|||||||

| FDI FPI INSTQ NATRES TRDOPN HUMCA RGDPG INFRAS FMDEX, star (0.05) | |||||||

| FDIGDP | FPIGDP | INSTQ | NATRES | TRDOPN | HUMCA | RGDPG | |

| FDIGDP | 1.0000 | ||||||

| FPIGDP | 0.1402 | 1.0000 | |||||

| INSTQ | 0.0070 | 0.3118* | 1.0000 | ||||

| NATRES | -0.2137 | -0.2756* | -0.2796* | 1.0000 | |||

| TRDOPN | 0.2783* | 0.3522* | 0.0721 | -0.6188* | 1.0000 | ||

| HUMCA | 0.1092 | 0.1294 | 0.0656* | -0.2307 | 0.2021 | 1.0000 | |

| RGDPG | -0.0244 | -0.0130 | -0.2388* | 0.1237 | -0.0605 | -0.4483* | 1.0000 |

| INFRAS | 0.4244* | 0.5898* | 0.5244* | -0.5378* | 0.6135* | 0.4899* | -0.2290 |

| FMDEX | -0.0672 | -0.0773 | 0.1550 | -0.0148 | -0.2674* | 0.2537* | -0.3004* |

| INFRAS | FMDEX | ||||||

| INFRAS | 1.0000 | ||||||

| FMDEX | 0.0418 | 1.0000 | |||||

Standard errors in parentheses

*p<0.05, **p<0.01, ***p<0.001

Source: Author’s own computations

The Hausman test was used to determine whether to adopt a fixed effects model or a random effects model. Mundlak (1978) argued that the random effects model assumes exogeneity of all the regressors, and the random individual effects. Wooldridge (2010) later added weight to this argument, stating that the random effect (or error component) model is based on the assumption that there is no correlation between the regressors (explanatory variables) and the unobserved, individual-specific effects. A fixed effects model, on the other hand, would allow the individual-specific intercept to be correlated with one of more of the regressors (Gujarati & Porter, 2009). The p-value of one for the Hausman test indicates that there is no evidence that the random effects estimates are invalid, thereby making random effects model more efficient than the fixed effects model for this study. Applying random effects would further allow the generalisation of inferences beyond just the sample in the study. Due to the failure to reject the null hypothesis, we applied the random effects estimator (Table 3).

| Table 3 REGRESSION RESULTS |

||||||

| POOLED OLS ROBUST | FIXED EFFECTS | RANDOM EFFECTS | 2-STEP GMM | GLS | LSDVC | |

| L.FDIGDP | -0.0582 | -0.0715 | -0.0582 | -1.468 | -0.0443 | 0.0686 |

| (0.195) | (0.0657) | (0.0935) | (1.561) | (0.195) | (0.281) | |

| FPIGDP | 0.791 | 1.054*** | 0.791*** | 0.624 | 0.298 | 0.947* |

| (0.620) | (0.0601) | (0.202) | (2.424) | (0.568) | (0.391) | |

| INSTQ | 91.82 | 79.08 | 91.82 | 150.0 | 15.19 | 76.96** |

| (58.77) | (80.34) | (56.98) | (144.0) | (15.11) | (26.23) | |

| NATRES | -0.480 | 0.329 | -0.480 | 5.605 | -0.0607 | 0.534 |

| (0.437) | (1.579) | (0.401) | (7.719) | (0.185) | (0.434) | |

| TRDOPN | -0.387 | -1.389 | -0.387 | -7.013 | -0.0919 | -1.328 |

| (0.269) | (1.526) | (0.257) | (6.672) | (0.0635) | (0.943) | |

| HUMCA | -0.216 | -0.121 | -0.216** | 0.103 | -0.0230 | -0.131 |

| (0.155) | (0.128) | (0.0799) | (0.271) | (0.0425) | (0.213) | |

| RGDPG | 1.235 | 0.453 | 1.235 | 6.154 | 0.604* | 0.437 |

| (1.169) | (0.814) | (1.021) | (7.021) | (0.290) | (2.205) | |

| INFRAS | 0.427 | 0.592 | 0.427** | 0.0640 | 0.146* | 0.549 |

| (0.284) | (0.650) | (0.152) | (0.422) | (0.0567) | (0.385) | |

| FMDEX | -2.849 | -4.097 | -2.849** | -75.34 | -2.652* | 0.440 |

| (2.732) | (10.24) | (0.907) | (108.2) | (1.245) | (33.03) | |

| _cons | 53.01 | 100.9 | 53.01 | 4.935 | ||

| (35.28) | (103.8) | (33.35) | (10.05) | |||

| N | 63 | 63 | 63 | 54 | 63 | 63 |

| R2 | 0.399 | 0.245 | ||||

Standard errors in parentheses

*p<0.05, **p<0.01, ***p<0.001

Source: Author’s own computations

The R2 shows that almost 40% of the variation in FDI was driven by the regressors. In this instance, we acknowledge that there are other variables, which account for inward FDI and FPI flows, other than the specific variables under study in this paper. The F-statistic on the random effects model is positive and significant at 1955.66, meaning that the model was properly specified and unbiased. Thus, the random effects estimation results are discussed in the next section (Table 4).

| Table 4 DIAGNOSTIC STATISTICS |

|||||||

| Pooled OLS robust | Fixed effects | Random effects | Diff GMM | GLS | LSDVC | ||

| Observations | 63 | 63 | 63 | 54 | 63 | 63 | |

| Groups | 9 | 9 | 9 | 9 | 9 | 9 | |

| F-stats/Wald chi2 | 36.21 | 2428.94 | 1955.66 | 4.75 | 28.73 | ||

| Prob>F/Prob>Wald chi2 | 0.0000 | 0.0000 | 0.0000 | 0.019 | 0.0007 | ||

| Hausman (chi2) | 3.1 | 3.1 | |||||

| Prob>chi2 | 0.96 | 0.96 | |||||

| R2 | |||||||

| Within | 0.2452 | 0.2058 | |||||

| Between | 0.0850 | 0.9337 | |||||

| Overall | 0.3988 | 0.1008 | 0.3988 | ||||

| Arellano-Bond AR (1) | -0.56 | ||||||

| Prob>z | 0.576 | ||||||

| Arellano-Bond AR (2) | -0.75 | ||||||

| Prob>z | 0.455 | ||||||

| Sargan test of overid | 47.14 | ||||||

| Prob>chi2 | 0.083 | ||||||

| Hansen test of overid | 0.00 | ||||||

| Prob>chi2 | 1.00 | ||||||

| Instruments | 44 | ||||||

Source: Author’s own computations

Discussion Of Findings

The results indicate that there is a positive and highly significant relationship between FDI and FPI. This was expected to be the case since investors tend to use FPI to test the waters of new destinations, prior to engaging in more permanent investments such as FDI. As such, countries that are able to harness FPI inflows would expect to see a similar pattern with regards to FDI inflows. This finding is supported by the theory of Pfeffer (2008) who assessed the relationship between FDI and FPI, and found that firms often pursue international diversification through combined investment strategies (FDI and FPI together, as opposed to FDI only or FPI only), hence making FDI and FPI key strategic complements. On the contrary, Humanicki et al. (2013) examined the long run and short run relationships between foreign direct and foreign portfolio investments in Poland using the vector error correction model. They found that FDI and FPI are in fact substitute forms of capital for one another. Further, they concluded that FDI is more prominent in economies that portray economic stability, while FPI becomes the capital source of choice when political instability is inherent in a host country’s environment.

In this study, we also found evidence that there was a positive influence between FDI, FPI and institutional quality. This finding is similar to that of Cleeve (2012) and Asiedu (2004) who concluded that for African countries, there exists a positive relationship between FDI and institutional quality. These results were also similar to studies by Wei (2000), Alfaro et al. (2008) and Buchanan et al. (2012) who found a positive relationship between international capital flows and institutions. It would appear that, in the absence of developed financial markets, good quality institutions matter for FPI.

Asiedu (2006) examined the role of natural resources, market size, government policy, institutions and political stability in African countries. She found that good quality institutions attract more FDI, although corruption and political instability hinder FDI inflows to Sub-Saharan countries. On the contrary, Mallik and Chowdhury (2017) examined the effect of institutions on FDI using panel data for 156 countries. They concluded that corruption has a negative impact on FDI inflows, while other institutions such as democracy, political stability, and the rule of law and order positively influence inward FDI.

Most studies that considered the effect of institutional quality on foreign investment used the six common variables drawn from the ICRG and the World Bank World Governance Indicators (WGI) of voice and accountability, political stability, governance effectiveness, regulatory quality, rule of law and control of corruption as individual measures. In our study however, we adopted a composite index of institutional quality, which is more comprehensive that the individual indicators. It is against this background that scholars such as Daude and Stein (2007) and Bailey (2018) argued that individually, poor institutional quality variables such as the lack of protection of property rights, expropriation risk, high levels of corruption and political instability deter inward foreign investment capital. Similarly, our study found a positive, net effect of good institutions on foreign investment inflows, that is where institutions are considered to be favourable and do not represent an additional cost to foreign investors and multinational corporations, the volumes of FDI and FPI are most likely going to increase towards developing countries. In addition, we specifically examined the pre-and post-2007 financial crisis period and found that global financial crises cast the spotlight on weak institutions, resulting in a withdrawal or volatility in foreign capital flows.

Although Africa is generally a resource-rich continent, in the presence of good quality institutions, natural resources do not seem to matter for inward FDI inflows to certain countries. Asiedu and Lien (2011) examined the effect of institutions between resource and non-resource exporting countries. They found that foreign investors preferred democratic governments when operating in non-resource exporting countries, but preferred less democratic governments when based in resource-exporting countries. This preference by foreign investors is informed by the work of Li and Resnick (2003), who found that countries that cannot guarantee property rights protection to foreign investors are expected to remedy that shortcoming with incentives such as tax holidays or exclusive rights to natural resources, which ultimately still works in favour of the FDI firm.

Insofar as the control variables are concerned, the study found a positive but insignificant association between FDI, FPI and the real GDP growth of host country. Although the economic growth rate is an indicator of macroeconomic stability as well as current and future prospects in a country, international investors are spurred by other country-specific factors. Further, the availability of good infrastructure has a positive and highly significant influence on a country’s attractiveness to foreign investors. Although previous studies by Borensztein et al. (1998) as well as Mallik and Chowdhury (2017) found that human capital development matters for FDI, our study finds evidence to the contrary. In this instance, the earlier studies are confirmation that it is not only the size of the labour pool which affects FDI inflows but also the skills level of workers, a phenomena which is not characteristic of African countries.

Conclusions And Policy Recommendations

The primary objective of this paper was to study the effect of institutional quality on FDI and FPI inflows into selected African countries using panel data. The selected period of 2009 to 2016 is significant in that it was immediately after the global financial crisis of 2007/2008 that resulted in many multinational corporations and institutional investors re-evaluating and restructuring their foreign investment portfolios. The global crisis was a wake-up call as many standards of good practice and market regulations were flouted, resulting in significant losses to investors, and capital flight of foreign investments from host countries. Examining the status quo after the financial crisis was important to assess the reaction and response of investors to global economic turbulence, which was magnified by poor institutional quality. The contribution of this paper is that it applies Kuncic’s (2014) database of institutional quality which is a more comprehensive source for the proxy as it combines over 30 institutional indicators derived from different individual sources such as the Heritage Foundation, Freedom House, Fraser Institute, ICRG, World Bank World Governance Indicators (WGI), Polity and Transparency International into three spheres of legal, political and economic institutions. Earlier studies have predominantly applied only one of the sources aforementioned.

The results of this paper show that in the absence of natural resource abundance, and developed financial markets institutional quality matters for host countries to attract inward inflows of both FDI and FPI. There is a positive relationship between FDI and FPI, supported by both theoretical and empirical literature; and a further positive relationship between FDI, FPI and institutional quality for our sample of African countries in this study, despite the market disturbances caused by the global financial crisis prior to the period under survey.

In light of these findings, the policy recommendations are that African governments continue to formulate, adopt and implement macroeconomic investment policies that will attract further flows of both FDI and FPI. These policies need to be complemented by strong quality institutions such as a respect for the rule of law, lower corruption and incidents of bribery, well as greater transparency and good corporate governance of host country financial markets. It has been proven that for those countries that does not have abundant natural resources, strong legal, political and economic institutions are a good substitute, and can enhance the attraction of foreign investment capital. International capital flows are necessary to reduce the dependence of less developed countries on foreign aid, by directing inward foreign capital flows to productive sectors of the economy, which in turn increases employment and promotes further economic growth.

Our empirical findings support the theoretical priori that better institutional quality leads to higher FDI and FPI inflows. Our results further affirm that economic policy makers should consider the overall quality of institutions in order to implement more conducive policies to encourage inward FDI and FPI flows to their respective countries. Policy makers should therefore focus on promotional resources to attract the various flows of international capital in the form of FDI and FPI. By this we mean that, the degree of FDI and FPI absorption is dependent on a range of capacities including country-specific characteristics such as natural resource endowment, infrastructural development, human capital development, trade and capital openness, as well as institutional quality–all of which should be at the core of macroeconomic policy formulation and implementation. The appropriate government policies and legislation will largely depend on the objective of attracting FDI and FPI. If the foreign investment capital is to play an effective role in filling the investment gap facing developing countries, then it is paramount to ensure that these investment priorities are reflected in the domestic policies, and supported by the requisite legislature and best practices insofar as institutions are concerned. As such, developing country governments which formulate and implement sound macroeconomic policies and regulations that permit and promote the private sector can enjoy substantial increases in FDI and FPI flows, if such policies are coupled with a high standard of institutional quality. These, and other earlier studies, assert that those developing countries which show improvements with regard to lowering corruption, ensuring efficient bureaucracy, guaranteeing institutional individual property rights, and spurring confidence in the quality of contract enforcement, can attract more foreign capital inflows, which in itself can reduce dependency on official aid.

The limitations of this study are that, although it adopted the random effects model whose underlying assumption is that findings can be generalised; this is not the case as several developing countries portray heterogeneous characteristics insofar as their governance styles are concerned. It would therefore be misleading to apply these findings to all African countries since they differ in natural resource endowment, enforcement of laws and regulations as well as financial market development, which are central to the absorption of FDI and FPI, respectively.

This study only focused on determining whether relationships between FDI, FPI and institutional quality exist. It is proposed that future studies go further and assess the direction of causality between these three key variables. It is anticipated that in some instances the presence of strong institutions would result in higher inflows of foreign investment capital, while in other cases, multinational corporations and institutional investors from abroad would force host countries to instil greater discipline in their legal, political and economic regulatory frameworks. Another avenue of future research would be to determine whether a threshold level of institutional quality needs to be attained before the positive impact of FDI and FPI can be felt by host countries. Conducting such research would improve governments’ efforts to reach a regulatory level deemed adequate for the country’s economy to be integrated with other markets in the quest to attract increased international capital flows, thus competing with many other countries worldwide.

References

- Alfaro, L., Chanda, A., Kalemli-Ozcan, S., & Sayek, S. (2004). FDI and economic growth: the role of local financial markets. Journal of International Economics, 64(1), 89-112.

- Alfaro, L., Kalemli-Ozcan, S., & Volosovych, V. (2008). Why doesn't capital flow from rich to poor countries? An empirical investigation. The Review of Economics and Statistics, 90(2), 347-368.

- Asiedu, E. (2002). On the determinants of foreign direct investment to developing countries: is Africa different?. World development, 30(1), 107-119.

- Asiedu, E. (2006). Foreign direct investment in Africa: The role of natural resources, market size, government policy, institutions and political instability. The World Economy, 29(1), 63-77.

- Asiedu, E. (2013). Foreign direct investment, natural resources and institutions. International Growth Centre, Working Paper Series.

- Asiedu, E., & Lien, D. (2011). Democracy, foreign direct investment and natural resources. Journal of International Economics, 84(1), 99-111.

- Bartram, S.M., & Dufey, G. (2001). International portfolio investment: Theory, evidence, and institutional framework. Financial Markets, Institutions & Instruments, 10(3), 85-155.

- Bengoa, M., & Sanchez-Robles, B. (2003). Foreign direct investment, economic freedom and growth: New evidence from Latin America. European Journal of Political Economy, 19(3), 529-545.

- Borensztein, E., De Gregorio, J., & Lee, J.W. (1998). How does foreign direct investment affect economic growth?. Journal of international Economics, 45(1), 115-135.

- Buchanan, B.G., Le, Q.V., & Rishi, M. (2012). Foreign direct investment and institutional quality: Some empirical evidence. International Review of Financial Analysis, 21, 81-89.

- Cheng, L.K., & Kwan, Y.K. (2000). What are the determinants of the location of foreign direct investment? The Chinese experience. Journal of International Economics, 51(2), 379-400.

- Cleeve, E. (2012). Political and institutional impediments to foreign direct investment inflows to Sub?Saharan Africa. Thunderbird International Business Review, 54(4), 469-477.

- Daude, C., & Fratzscher, M. (2008). The pecking order of cross-border investment. Journal of International Economics, 74(1), 94-119.

- De Santis, R.A., & Lührmann, M. (2009). On the determinants of net international portfolio flows: A global perspective. Journal of International Money and Finance, 28(5), 880-901.

- Dunning, J.H., & Dilyard, J.R. (1999). Towards a general paradigm of foreign direct and foreign portfolio investment. Editorial Statement, 8(1), 1.

- Dutta, N., & Roy, S. (2011). Foreign direct investment, financial development and political risks. The Journal of Developing Areas, 44(2), 303-327.

- Goldstein, I., & Razin, A. (2006). An information-based trade-off between foreign direct investment and foreign portfolio investment. Journal of International Economics, 70(1), 271-295.

- Gujarati, D.N., & Porter, D. (2009). Basic Econometrics. Mc Graw-Hill International Edition.

- Humanicki, M., Kelm, R., & Olszewski, K. (2013). Foreign Direct Investment and Foreign Portfolio Investment in the Contemporary Globalized World: Should They Be Still Treated Separately?. National Bank of Poland Working Paper No. 167.

- IMF (International Monetary Fund) (1993). International Financial Statistics Yearbook 1993 (International Monetary Fund, Washington, DC).

- Kedir, A., Ibrahim, G., Elhiraika, A., & Hamdok, A. (2011). Revisiting the determinants of foreign direct investment in Africa: The role of institutions and policy reforms. In African Economic Conference October (pp. 25-28).

- Kun?i?, A. (2014). Institutional quality dataset. Journal of Institutional Economics, 10(1), 135-161.

- Levine, R., & Zervos, S. (1996). Stock market development and long-run growth. The World Bank Economic Review, 10(2), 323-339.

- Li, Q., & Resnick, A. (2003). Reversal of fortunes: Democratic institutions and foreign direct investment inflows to developing countries. International Organization, 57(1), 175-211.

- Lipsey, R.E. (2004). Home-and host-country effects of foreign direct investment. Challenges to Globalization: Analyzing the Economics. University of Chicago Press.

- Lothian, J.R. (2006). Institutions, capital flows and financial integration. Journal of International Money and Finance, 25(3), 358-369.

- Mallik, G., & Chowdhury, M. (2017). Does Institutional Quality Affect Foreign Direct Investment? A Panel Data Analysis. In Inequality, Poverty and Development in India (31-47). Springer, Singapore.

- Makoni, P.L.R. (2016). The role of financial market development in foreign direct investment and foreign portfolio investment in selected African economies (Doctoral dissertation).

- Makoni, P.L. (2015). An extensive exploration of theories of foreign direct investment. Risk Governance & Control: Financial Markets and Institutions, 5(2), 77-83.

- Mundlak, Y. (1978). On the pooling of time series and cross section data. Econometrica, 46(1), 69-85.

- Musonera, E., Nyamulinda, I.B., & Karuranga, G.E. (2010). FDI fitness in Sub-Saharan Africa-the case of Eastern African community (EAC). Journal of International Business Research and Practice, 4, 1.

- Papaioannou, E. (2009). What drives international financial flows? Politics, institutions and other determinants. Journal of Development economics, 88(2), 269-281.

- Pfeffer, B. (2008). FDI and FPI-Strategic complements? Joint Discussion Paper Series in Economics.

- Popovici, O.C., & C?lin, A.C. (2014). FDI theories: A location-based approach. Romanian Economic Journal, 17(53), 3-24.

- Rowland, P.F. (1999). Transaction costs and international portfolio diversification. Journal of International Economics, 49(1), 145-170.

- Sawalha, N.N., Elian, M.I., & Suliman, A.H. (2016). Foreign capital inflows and economic growth in developed and emerging economies: A comparative analysis. The Journal of Developing Areas, 50(1), 237-256.

- Stein, E., & Daude, C. (2001). Institutions, integration and the location of foreign direct investment. New Horizons for Foreign Direct Investment, 101-28.

- UNCTAD (2006). World Investment Report 2006: FDI from Developing and Transition economies-Implications for Development.

- Wei, S.J. (2000). How taxing is corruption on international investors?. Review of Economics and Statistics, 82(1), 1-11.

- Wilhelms, S.K., & Witter, M.S.D. (1998). Foreign direct investment and its determinants in emerging economies. United States Agency for International Development, Bureau for Africa, USAID Office of Sustainable Development.

- Wooldridge, J.M. (2010). Econometric analysis of cross section and panel data. MIT Press.

- World Bank Group. (2016). World development indicators (WDI) 2016. World Bank Publications.