Research Article: 2024 Vol: 28 Issue: 5

Farmers Inclusion in Regulated Commodity Markets: Benefits and Challenges

Swamy Perumandla, Indian Institute of Management Nagpur, IIMN Campus Nagpur

Citation Information: Perumandla, S. (2024). Farmers inclusion in regulated commodity markets: Benefits and challenges. Academy of Marketing Studies Journal, 28(5), 1-13.

Abstract

The study aimed to critically evaluate the various dimensions of FPOs in generating benefits for farmers through the regulated commodity market. In particular, the study tried to identify and discuss major challenges in pursuit of farmers' inclusion in the commodity market for policy formulation. It also aimed to propose an inclusive model to help the farmers in price discovery and price risk management through regulated commodity market access. This study used a case study methodology in order to collect comprehensive data and gain a comprehensive understanding of the context and circumstances in which various organizations plan collective action, distribute collective goods, and encourage participation from small and marginal agricultural producers. Both quantitative and qualitative studies predominantly supported the benefit of farmers’ producer’s organization and their presence in the agricultural market value chain. The analysis revealed 5 major benefits and 4 challenges. The benefits classified necessarily add value to farmers’ participation in commodity market through FPOs. Benefit 1) Transaction Cost, 2) Cropping Decision and Diversification 3) Price Discovery 4) Warehouse Facility and Grading 5) Price Risk Management. The major challenges identified and discussed in pursuit of farmers' inclusion in the commodity market for policy formulation were 1) Financial constraints and Management) Warehouse and Grading: 3) Knowledge Constraints and Understanding of Future Markets: 4) Professional and Technology support. Finally, the proposed farmer-to-commodity market model may help the farmers in price discovery and price risk management through regulated commodity market access.

Key Words

Farmers Producers Organisation (FPO), Efficient Price Discovery, Small and Marginal Farmers, Marketing Value Chain, Commodity Markets, Agrarian Distress and Poverty.

Introduction

The agricultural sector in India, known as the primary sector of the economy accounted for 18.3% of Gross Value Added (GVA) in 2022-23(Ministry of Statistics & Programme Implementation (MoSPI). This sector still provides livelihood to around 58% population of the country. Agriculture is the main livelihood in the rural economy.

The majority of farmers in Indian agriculture were small and marginal farmers; of them, 66% had an area of less than one hectare, and 85% of working holdings were smaller than or equal to two hectares (Singh, 2012).

Improved the farm income level was a crucial step in reducing agrarian distress and poverty. Expanding post-harvest information symmetry, controlling price volatility, and opening more markets would all contribute to farmers' revenue development. According to Chand (2017), improved price realization, effective post-harvest management, competitive value chains, and the adoption of related activities might easily account for nearly one-third of the rise in farm revenue. In order to engage directly in the regulated markets, small and marginal farmers can now use Farmer Producer Organizations (FPOs) and cooperatives to aggregate their resources, realize higher pricing, and minimize risk by making well-informed decisions. Agricultural cooperative societies, formed under the Co-operative Credit Societies Act, 1904, enables collective action among the small and marginal farmers. The co-operatives had many limitations in their functioning and effectiveness (Single objective, Non-tradable share, Area of Operation was restricted and discretionary, Limited dividends on shares, government control was highly patronized to the extent of interference, Limited in “real world scenario”). Cooperatives have less success in India and some African nations. They frequently had little effect because of inadequate administration and structure, as well as political meddling with their operations (Holloway et al., 2000; Lalvani, 2008). Research has demonstrated that efforts that proved effective in one environment could not always translate to a comparable situation elsewhere, highlighting the complexity of collective action (Ostrom, 1998). Lately, the Government of India promoted a new form of organization among small and marginal farmers, “Farmers Interest Groups” for endowing better bargaining power and economies of scale. Farmer Producer Organizations (FPOs), another form of farmer interest groups, facilitate small and marginal farmers to access investment, technological advancements, efficient inputs and market access (Hellin et al., 2009). Farmers’ direct participation in the market enabled significant growth in agriculture and allied activities. Hence, the focus shifted from the enhancement of production to effective market connectivity (Shepherd, 2007). Farmers’ organizations such as cooperatives and FPOs encourage and enhance the income levels of farmer organizations. According to Ornberg (2003) and Bina (2010), these groups enhanced negotiating power, decreased input purchase costs, decreased transaction costs, and made formal credit available (Braverman et al., 1991). They also helped to establish chances for value-added engagement. Notably, there has been a lot of discussion lately on the possibility of reducing poverty by using existing market systems. Only retailers with specialized assets, such storage facilities, were allowed to use retail firms as marketing conduits (Reardon et al., 2009). Benefits increased mainly because of effective market access, marketable surplus, and bargaining power of producer organizations (Cherukuri and Reddy, 2014).

Farmers producer organization ranged from formal institutions to informal producer groups and village associations. Among these, a number of typologies have been created to differentiate producer groups according to their size, legal status, purpose, and geographic reach. The World Development Report (WDR, 2008) distinguished three types of functions: organizations that specialize in providing economic services, advocacy groups that represent a wide range of interests, and multipurpose organizations that provide a variety of social and economic services. Cooperatives that handle and sell the agricultural products of its members are among the businesses that offer economic services. A good example is the dairy cooperative, which processes the raw milk that is gathered from farmers and turns it into less perishable dairy products. Economic, political, and social roles are frequently combined by multipurpose organizations, especially those operating at the community level. POs operated on a local, regional, national, and even global scale. They provided farm inputs and credit to their members, process, and market their products, offer community services, and carry out advocacy activities (Bijman and Ton, 2008).

Farmer Produce to Commodity Exchange in India

The Union Finance Minister announced a goal to create 10,000 FPOs in the following five years, or by 2024, in her address on the Union Budget for FY20. For the past few years, NABARD has been establishing FPOs; to date, it has more than 3000 FPOs). NABARD would probably be primarily responsible for scaling them with 10,000 more ones. Small Farmers Agribusiness Consortium (SFAC) was an Autonomous Society promoted by the Ministry of Agriculture, Cooperation and Farmers’ Welfare, Government of India. SFAC was the pioneer in organizing small and marginal farmers as Farmers Interest Groups (FIG), Farmers Producers Organisation (FPO), and Farmers Producers Company (FPC), to attain economies of scale and to empower them with better bargaining power. According to NABARD “A Producer Organisation (PO) is a legal entity formed by primary producers, viz. farmers, milk producers, fishermen, weavers, rural artisans, craftsmen. A PO can be a producer company, a cooperative society, or any other legal form that provides for the sharing of profits/benefits among the members. In some forms like producer companies, institutions of primary producers can also become members of PO.” SFAC has initiated FPOs to collectivize farmers, especially small producers, at various levels across several states. This would foster technology penetration, improve productivity, and enable improved access to inputs and services, thereby strengthening their sustainable agriculture-based livelihoods.

As on 31-12-2023, in India under the Central Sector Scheme for Formation and, Promotion of 10,000 FPOs by SFAC, 3313 FPOs were registered and 336 FPOs were under the process of registration. The author presented the state-wise number of FPOs registered by SFAC across the country in Table 1.

| Table 1 State-Wise Details of FPOS Under Central Sector Scheme for Formation and Promotion of 10,000 FPOS by SFAC as on 31-12-2023 | ||||

| S. No. | State Name | Allocated FPOs | Registered FPOs | Under Process of Registration |

| 1 | Andhra Pradesh | 216 | 161 | 55 |

| 2 | Arunachal Pradesh | 43 | 31 | 12 |

| 3 | Assam | 170 | 143 | 27 |

| 4 | Bihar | 300 | 262 | 38 |

| 5 | Chhattisgarh | 69 | 65 | 4 |

| 6 | Gujarat | 135 | 126 | 9 |

| 7 | Haryana | 116 | 105 | 11 |

| 8 | Himachal Pradesh | 60 | 56 | 4 |

| 9 | Jammu & Kashmir | 113 | 97 | 16 |

| 10 | Jharkhand | 93 | 88 | 5 |

| 11 | Karnataka | 54 | 48 | 6 |

| 12 | Kerala | 44 | 41 | 3 |

| 13 | Madhya Pradesh | 336 | 315 | 21 |

| 14 | Maharashtra | 210 | 198 | 12 |

| 15 | Manipur | 9 | 9 | 0 |

| 16 | Meghalaya | 13 | 12 | 1 |

| 17 | Mizoram | 13 | 13 | 0 |

| 18 | Nagaland | 8 | 8 | 0 |

| 19 | Odisha | 162 | 147 | 15 |

| 20 | Punjab | 78 | 71 | 7 |

| 21 | Rajasthan | 220 | 210 | 10 |

| 22 | Tamil Nadu | 89 | 86 | 3 |

| 23 | Telangana | 117 | 105 | 12 |

| 24 | Tripura | 22 | 17 | 5 |

| 25 | Uttar Pradesh | 757 | 706 | 51 |

| 26 | Uttarakhand | 47 | 43 | 4 |

| 27 | West Bengal | 155 | 150 | 5 |

| Total | 3649 | 3313 | 336 | |

The registered FPOs could become members of the Commodity Exchange for the purpose of agriculture trading directly, or else they could sell through the exchange-approved brokers. Regulated commodity markets could provide benefits to the commodity supply chain in various aspects such as market creation, price risk management, price discovery, and price transparency (Department of Agriculture & Cooperation, 2013). Regulated markets could help in the reduction of counterpart risk and dispute-resolution procedures.

Author presented significant growth of the registered FPOs on the exchange platform from March 2016 to June 2023 in Table 2. Simultaneously the number of FPOs traded on commodity platform were also increased. The tremendous growth in traded quantity was recorded from 60 MT to 1,25,321 MT(Metric Ton). The growth of farmers’ participation in the collective organisation was evident. However, the FPO traded in commodity market were comparatively less when compared to total number of FPO registered. Thus, it was essential to encourage and create awareness among the farmers to join on commodity platforms through FPOs. Twenty commodities were traded on the exchange platform till June 2023.

| Table 2 FPOS Registered & Commodities Traded on Commodity Exchange (NCDEX) (April 2016- June 2023) | |||||

| Particulars | FY 23-24 | Apr-23 | May-23 | Jun-23 | Cumulative |

| (FY:2016-24) | |||||

| FPOs On-boarded | 15 | 6 | 6 | 3 | 515 |

| Total Farmer Base | 6,666 | 3,421 | 2,298 | 947 | 10,74,456 |

| FPOs Traded | 25 | 14 | 15 | 13 | 174 |

| Farmer Base of FPOs Traded | 18,137 | 13,515 | 7,670 | 6,333 | 4,36,998 |

| Commodities Traded | 9 | 7 | 8 | 9 | 20 |

| Quantity Traded (MT) | 5,631 | 1,395 | 1,338 | 2,898 | 1,25,321* |

| Traded Turnover (? Lakh) | 651 | 208 | 199 | 243 | 65,122 |

| Delivery Given (MT) | 95 | 35 | 0 | 60 | 13,147 |

| Delivery Taken (MT) | 0 | 0 | 0 | 0 | 525 |

| Turnover Delivery based Trade (? Lakh) | 42 | 11 | 0 | 31 | 5,281 |

Source: NCDEX Group, Connecting Farmers to Markets, June 2023-Reports.

Methodology

This paper was based on the extensive qualitative analysis based on the case study and evaluation of past empirical analysis. With the knowledge of the Farmers Producers Organisation (FPO), the author tried to understand the different dimensions of their benefit to enhance the value of agriculture products. The author employed various case studies and examples from the individual farmers focusing on their exposure to the Farmers Producer Organisation. Several case studies as evidence have been employed in past studies to understand the benefits and challenges of farmer’s participation in the collective organisation. A case study analysis was “an empirical inquiry that attempts to investigate a contemporary phenomenon within its real-life context, especially when the boundaries between phenomenon and context are not evident” (Yin, 2009).Case studies were frequently employed in research to advance theories or when a comprehensive viewpoint was required in the face of diverse data sources (Eisenhardt, 1989). This study used a case study methodology in order to collect comprehensive data and gain a comprehensive understanding of the context and circumstances in which various organizations plan collective action, distribute collective goods, and encourage participation from small and marginal agricultural producers.

Firstly, we selected those case studies, where farmers’ societies or individual farmers who are connected to the commodity market to capture their benefits and challenges on the basis of their experience. This process included enormous case studies, where multiple FPO’s have participated and gained the experience of exposure to the derivative market. Based on the past review and evaluating of the different FPOs, the present study presented the selected cases, which have a substantive focus on the scope of the study (Chatterjee et al., 2019; Bhattacharya, 2007; Bikkina et al., 2017). While the context of the study was to understand the revenue gained after the linkage of farm produce to commodity markets. Second, the author focused on the empirical and theoretical articles, national and international, to capture the benefits and challenges faced by farmers in linkage to the commodity market. A thorough investigation of the case studies and empirical articles focused on identifying and characterizing the key benefits and challenges. Five broad benefits and four major challenges were repeated during the process of a thorough literature review. The results section described each benefit and elaborated on the challenges for future in-depth empirical studies and acts as the road map for policy formulation.

Background of Case Studies

The author considered the various case studies for the analysis. The case studies have been taken from NCDEX Group, Report on Connecting Farmers to Markets. Samriddhi Mahila Crop Producers’ Co. Ltd was set up in 2011 by Savitri Gaur in the region named Srijan. Farmer-producer company–Samriddhi Mahila Crop Producers’ Co. Ltd, comprises of 2310 women farmers on the semi-arid region of India, who mainly cultivate soybean, wheat, urad, and mustard. The FPO focused on marketing the product of its members, through a tie-up with Bunge. In the year 2015, two successive crop failures due to deficient monsoons led to rising bad debts and enormous losses for the FPO. To overcome the situation, they integrated with a commodity exchange platform to mitigate the risk of volatile prices. They took a keen interest in understanding futures instruments. In September 2016, they made a pilot trade supported by Srijan, sold 10 MT of soybean in the November contract, and delivered the same on the Exchange platform. Subsequently, they hedged 40 MT of mustard seed in the April contract, while the market price dropped significantly during harvest. These pilot trades gave them confidence of the trade cycle and focus on aligning quality requirements outlined by the exchange. With the availability of this tool, the FPO members are now confident of the forthcoming marketing season. The experience has prompted the organisation to take more positions. Investments in spiral graders, training farmer members on quality testing, and sorting produce, to ensure better value for premium quality of produce are now a norm at Samriddhi. The disintermediation of the traditional output markets has made the organisation financially viable and improve income by effective participation in the commodity market.

Aranyak Agri Producer Company Limited (AAPCL), a Farmer Producer Company promoted by JEEVIKA in Bihar. Since 2014, the company has been supported by Techno Serve, which provided technical assistance and hand-holding support to create efficient maize value chains in the Purnea-Katihar zone. Presently, Aranyak Agri Producer Company Limited (AAPCL), a Farmer Producer Company FPC, comprised of close to 3000 women farmers, focused on collective aggregation and marketing of its member farmers’ produce including maize, wheat, potato, and other vegetables. With increased transaction costs and the absence of effective agriculture markets, the producer company partnered with the National Commodity and Derivatives Exchange (NCDEX) for better price realization. Further, the accredited warehouse facilities facilitated through the exchange increased opportunities among the farmers. Through these initiatives, AAPCL was able to sell 1,014 metric tons of maize in 2015 and turn a profit for the first time. The business was selling 23,599 metric tons of maize that it had purchased from 5,824 female farmers by the year 2018. There was also a huge shift in the quality consciousness among the farmers who are now aware of exchange standards and are keen to align their produce with them. Farmers can break out of the shackles of local moneylenders who would use their financial clout to squeeze extra interest on the money they lent to them.

Further, an empirical study focusing on the effect of producers on organizations in Slovakia indicated benefits to farmers in terms of supply chain and economic viability. However, newly established POs did not improve farm performance; while the established and older POs, which were supported by government funding in the past generated benefits for their members (Michalek et al., 2018). The study also noted that increase in profitability and labor productivity among farmers that belong to producer organization when compared to others. Farmers' role in collaboration or collective action measured in the eastern chard, region of Africa showed a positive support. The result suggested that farmers collectively could leverage opportunities and optimize the inputs available (Orsi et al., 2017).Bikkina et al. (2018) proposed that FPOs are more likely than cooperatives to generate advantages via successful group action. The main obstacle was, however, raising enough money to optimize the advantages. Zhuang et.al. (2015) demonstrated that the co-existence of various farmer organizations will sustain for an extended period in both China and India. The strategy of the global value chain emphasizes the significance of group efforts in transitioning from a limited value chain to a more market-oriented system of governance. Development of the agro-food processing businesses in developing nations may be aided by a greater number of small farmers joining the value chain. Additionally, FPO decreased transaction costs and market inefficiencies while boosting farmers' productivity, income growth, bargaining power, and ability to fight poverty (Barrett et al., 2006; Hulme, 2003).

However, it was also mentioned how farmer groups' dedication to food security, traceability, and quality might help increase compliance with international standards (Barham and Chitemi, 2009; Markelova et al., 2009). Trebbin and Hassler (2012) demonstrated that small and marginal farmers can empower themselves by exploring the opportunity to access contemporary market actors and enter high-value markets.

Small producers would not be able to commercialize in many developing areas because they lack the necessary infrastructure, production equipment, and managerial skills. According to Barrett et al. (2012), most farmers in rural regions stay in the semi-subsistence system, while a tiny percentage succeed in commercializing. According to Balat et al. (2009), Barrett et al. (2012), Bellemare and Barrett (2006), this semi-subsistence production system was often characterized by low productivity and little to no update of production equipment. Further, Anika Trebbin (2014) demonstrated that producer companies were a promising tool to strengthen the farmers’ position in their relationship with supermarket chains in India, but one which needed further improvement. The producers’ organization have benefitted agriculture producers, particularly the surplus generating farmers. Past empirical evidence has focused primarily on various dimensions, investigating the role of producers organisation on supply chain (Vandeplas et al., 2013); commercialization of their agriculture produce (Bernard et al., 2008); economies of scale and production efficiency (Ito et al. 2012); role of producer organisation to reduce poverty (Verhofstadt and Maertens, 2015); and access to higher value chain and market (Michalek et al. 2018). However, most of these past studies have well focused on summarizing the benefits of farm produce as a whole. There was scant in the empirical literature well focused on assessing the exposure of farmers to commodity markets.

Results

Linkage of farm produce to commodity market model protects from price risk, the actual cost-benefit ratio is high. A parallel scope of improving the new market initiatives like linking the farm produce to commodity market derivatives would act as an effective mechanism in improving rural livelihoods. The critical evaluation of the linkage between agriculture produce and capital markets would strengthen the farm income. Both quantitative and qualitative studies predominantly supported the benefit of farmers’ producer’s organization and their presence in the market chain. The present study aimed to identify and classify the benefits that have emerged in the past literature. The focus on the discussion of benefits and challenges of linking farm produce and the commodity market was limited. Therefore, the present study broadly classified five benefits and challenges, that were highly noted among past studies. The result section elucidated each benefit and challenge engaged in the participation of commodity markets. Furthermore, the author also proposed a farmer-to-commodity exchange model for the inclusion of farmers in regulated commodity markets.

Benefit 1: Transaction Cost

Transaction costs could be divided into observable and non-observable costs associated with the trading of agricultural produce. The increased transaction cost acted as a constraint for smallholders to participate in the market (Holloway et al., 2000; Makhura et al., 2001). The lack of technology, connectivity, and poor infrastructure often lead to increased transaction costs (Okoye at al., 2016). Among developing countries, small and medium-scale farmers face the steepest transaction costs. The major factors that increased the transaction cost were poor transportation, warehouse, and pricing information, a lack of access to adequate infrastructure and expertise, and limited access to financing on collateral. The inefficient agriculture market acted as a key barrier for organized retail to directly participate in the market. The necessary coordination to overcome the intermediaries and transaction costs was necessary to understand the price signal. Transaction cost could also be referred to as the main dimension that indicates market characteristics and also represents the household characteristics and their economic environment (Makhura et al., 2001). Reducing the transaction costs across the commodity value chain was a key tool to increase the farmer’s income share and improve profitability in agriculture. The trading exchanges tended to facilitate the farmers by offering low-cost services or removing the transaction barrier that existed in the traditional market supply chain. Earlier, the FPOs had to aggregate and store their produce at an intermediate storage center. Currently, FPOs could directly take their produce to an Exchange-accredited warehouse, which also could serve as a delivery point to sell the produce. This would lead to around a 3% increase in realization through cost-saving.

Benefit 2: Cropping Decision and Diversification

The major concern among the farmers was identifying the crops that have true demand. This understanding of price signals and demand will help the farmers to match the industry needs to gain better prices in the market. Farmers choose their crops based on past performance, agricultural revenue, and/or reliance on agriculture as a means of living. Furthermore, the aims, ambitions, and values of the farming households typically drove the type and scope of such decisions (Wallace and Moss, 2002). Numerous empirical studies have looked at the factors that influence crop choice decision-making processes, especially for smallholder farmers. These factors can be broadly categorized as sociocultural factors like endowment, credit constraints, and demographics, as well as economic, biophysical, psychological, technological, policy, and institutional factors (Sakane et al., 2014; Wang et al., 2017) andsociocultural elements as credit limitations, endowments, and demography (Nguyen et al., 2017). Understanding the demand and supply would enhance the capacity for additional income through diversification. Though small-scale farmers have constraints for direct exposure to the derivative market, whereas the group of farmers collectively through FPO could deal with the capital markets. The collective participation among the farmers would benefit farmers with economies of scale and also the higher bargaining power. Access to the commodity market could help to integrate with the real purchaser rather than the middleman. The exchange market not only helps to overcome the distance barrier but also helps to facilitate the farmers with new market dimensions in the broad segment. Exposure to the commodity market could encourage farmers to make cropping decisions based on the market demand. The future prices would tend to give price signals about the demand for the crops in advance. This would facilitate crop diversification among farmers for better price and income differentials. In this view, connecting farmers to FPO and commodity market could highlight the merit of crop choice and diversification strategies to maximize the farm income.

Benefit 3: Price Discovery

Small and medium-scale farmers have a constraint of economies of scale, which could result in poor returns. Typically, developing countries with improper market facilities and low bargaining power lead to differences in prices. Imperfect markets were evidenced in developing countries, where communication technologies and infrastructure were deficient. Middlemen and brokers who have better knowledge of market conditions benefit more when compared to farmers. Access to the market or pricing information for the farmers could help them to get better prices. Financial intermediaries like commodity markets provide neutral and authoritative reference prices (NCDEX, 2018). Past studies have indicated the usage of ICT tools plays a vital role in agricultural activities. This would educate the farmers to evaluate the various options based on the modern mechanism and market conditions. Commodity derivative markets could enable the farmers to understand the price variation and development in the season. This information on the prices could enable farmers to decide the optimal time to deliver the goods to market (NCDEX, 2018). The delivery-based transparent price discovery was helping improve market efficiency, which in turn was leading to better price realization by farmers. The application of communication technologies has strengthened the farmers to understand the price volatility. Mobile communication technologies could act as an opportunity to provide price signals and updates to farmers (Svenson and Yanagizawa, 2009; Aker, 2010). Thus, with collective action and participation in the commodity market could reduce the asymmetry price differences and reveal true market prices. The commodity markets have partnered with educational institutions and state agencies to create awareness and a free SMS service followed by path-breaking shows on television (NCDEX, 2018).

Benefit 4: Warehouse Facility and Grading

Fragmented warehouse facilities and lack of cold storage among developing countries end up sale of the goods to local players (middlemen or brokers). The post-harvest supply chain could play a dominant role in enhancing farm income. An inefficient and inadequate supply chain has led to the loss of Rs. 500 to Rs. 600 billion in farm produce every year. Further, with non-availability of storage and logistics infrastructure could lead to distressed sales. With the growth of commodity market, the warehousing facilities have gradually improved. Online commodity markets have provided the warehouse opportunity. These warehouse benefit farmers with a wide range of facilities such as 1 better or more ‘scientific’ storage hardware and practices to avoid wastages; 2. Increases purchaser confidence in local quality control/certification. Already 3 Value added service like credit facilities. Further, warehousing facilities not only act as the custody of goods, but also benefit for sorting, packing and grading. The sustainable term goal towards efficient marketing system needs to be achieved with focus on ware-house based trading. Where, the goods in the warehouse are exchanged or traded based on the warehouse receipts which drastically could reduce the transaction costs. Farmers connecting to the commodity market got exposure to the exchange approved warehouse. These approved warehouses provide credit financing to the farmers and also provide guarantee in terms of quality and grading of the agriculture produce. Thus, exchange approved warehouse not only help farmers to provide the save haven for their goods but also provide price appreciation based on the quality.

Benefit 5: Price Risk Management

The middle man and brokers with license in regulated agriculture market had led to monopoly (Bhattacharya, 2007). The constraint of direct marketing has hindered agriculture income due to increased marketing cost through the traditional supply chain. Further, the impact of climate change could be noticed in the agriculture due to significant drought and floods (Kalli and Jena, 2020). To overcome the threat of climate change, future price discovery would benefit the farmers to gain the potential advantage. In this case the farmers receive the price fixed by the traders without any knowledge about the market price and irrespective of demand. However, when linked to commodity market will help the farmers to overcome the intermediaries and link directly to the purchaser. The future markets could enable the farmers to undertake effective planning with better income predictability. This would further help the farmers to understand the demand and supply of the farm produce and also provide opportunity of hedging at the time or risk. Studies demonstrated that farmers were focusing to aggregate their produce and participate directly on regulated market platforms to mitigate their price risk and secure 15- 25% more earnings than the prevailing prices at the time of harvest (NCDEX, 2018). For example: Futures contracts traded on NCDEX correctly gave early signals of an increase in sugar prices prior to the 2009-10 crushing season by predicting the fall in sugar production based on lower sugarcane cultivation. Even after futures trading was suspended in May 2009 (when futures prices were ruling around Rs. 2300 per quintal), prices in physical markets touched Rs 4000 per quintal in January 2010. Furthermore, the convergence of equity and commodity markets might expand the scope of participation in commodity derivatives market in India (Swamy and Padma, 2020).

Challenges Ahead

The major risks associated with Indian agriculture are production risk, price or market risk, finance & credit risk, institutional risk, technology risk, and personal risks. While the price or market risk acts as a big constraint in the growth of the agriculture sector. Reworking some of the entry barriers for farmers and FPCs is necessary to promote farmers' involvement in the regulated markets. Since it is difficult for farmers' businesses to comprehend and comply with regulatory standards, agricultural derivatives should be made easier to enter by regulatory norms. Further, there is a need to make things simpler. Where the process should be diluted and technical terms should be replaced with easier terms that a farmer can understand easily. From the critical evaluation of past studies, author categorized the four broad challenges that act as constraints in the linkage of farmers to commodity markets. Chatterjee, et al., (2019) found that the constraints in linking farmers to FPOs and the latter to futures are-“ (1) farmers’ already existing strong relationship with middlemen and traders, (2) given the higher risk involved in output-related activities, fewer FPOs are involved in marketing, (3) lack of capacity of FPOs, (4) management related issues of FPOs, (5) lack of trust & understanding of futures market, (6) high rejection rates, (7) reluctance in pre-harvest hedging, (8) logistic related like location of delivery centers and (9) tedious documentation and entry barriers”

Financial constraints and Management: Financial constraints could act as the key constraint to participate in the commodity market. Small and medium-scale farmers are unable to form the FPO due to the lack of capital or working capital. From establishment till participation in the commodity market, a required capital is necessary, where the minimal requirement has to be supported by the government in the form of an equity grant scheme (Chatterjee et al., 2019). Further, the intervention of the political parties and failures in the decision-making act as the bottlenecks. In most scenarios, FPOs were part of the NGO or part of a large association; the primary aim of the FPO is to act based on the parent organization. This could act as a drawback in several cases like delaying the hedging process or not a timely sale of goods after procurement (Chatterjee et al., 2019).

Warehouse and Grading: India, being one of the largest agriculture producers in the world lacks basic warehouse produce. Commodity-linked markets require produce to be sorted, graded, and of standard quality, while the availability of grading facilities at the farm level was not sufficient. With the proper availability of the warehouse, a significant loss in the agricultural produce could and avoided and helps the farmers from distress sale. Estimates suggested that approximately 12 to 16 million metric tons of grains wasted each year, could meet the food demand of about one-third of India’s poor population (Nagpal and Kumar, 2012). Further, with the unavailability of storage, farmers could tend to sell the produce as soon as possible in the post-harvest to commission agents.

Knowledge Constraint and Understanding of Future Markets: Commodity markets were viewed as a black box, where participation required professional knowledge. Most of the farmers could feel the process was related to gambling and choose not to participate in the markets (Chatterjee et al. 2019). Increased participation among traders has led to mispricing and yielding losses for several agricultural products. The importance of future markets and the advantage of different call-and-put positions in the hedging process were unknown among the farmers’ community. Other reason such as lack of depth in future markets and bans on few commodities is the reason for less participation among farmers (Gulati et al., 2017). Inadequate government support regarding the transfer of knowledge on the commodity market was the backdrop for the participation. Government involvement in the increased price volatility and participation of insurance companies could also be evidenced in the Indian context.

Professional and Technology support: Participation in the exchange platform required technological support. Inadequate rural infrastructure intervention of farmers to the commodity market could act as a barrier. It was difficult to draw any conclusion in the process of hedging, farmers require the necessary training or professional support to understand the benefits of future contracts and the hedging process. Though financial markets were integrated with efficient communication technologies, adopting these technologies without knowledge was the key constraint among the farmers.

Proposed Model

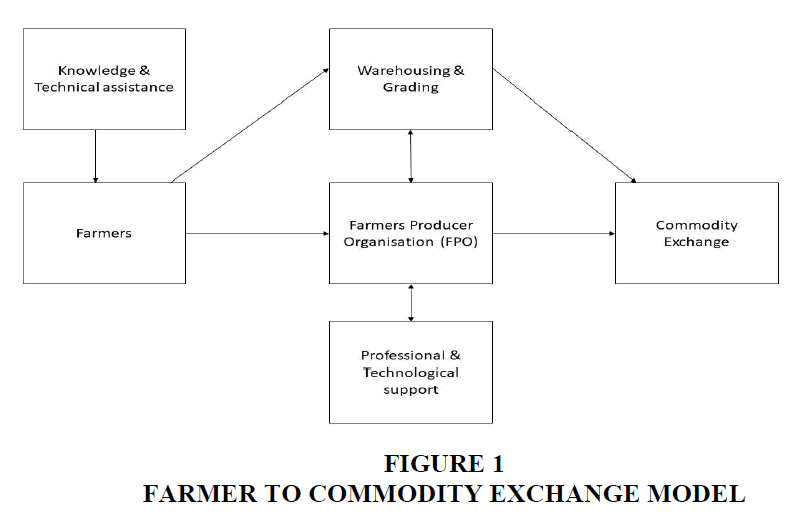

After the critical evaluation of the various dimensions of FPOs in generating benefits to farmers through the regulated commodity market, the author has proposed a model for the inclusion of farmers in regulated commodity markets. The proposed inclusive (Farmer to Commodity Exchange) model could help in price discovery and price risk management through regulated commodity market access. Farmers could avoid the steep transaction costs, payment of commission, and brokerage by implementing the proposed model in place of the conservative model. In this process, FPO, Warehousing & grading, and professional & technical factors could play a crucial role. Large-scale farmers with sound knowledge of regulated commodity markets could directly trade in commodity exchanges Figure 1.

Conclusion

Commodity market participation remains an unexplored opportunity for farmers to gain price appreciation for the farm produce. Even though significant evidence has been explored in the past, empirical evidence was lacking in the issue which attracts the researchers. Access to the market would boost the income of farmers and benefit the agrarian economy at large. A critical evaluation of FPOs and their performance in the form of empirical evaluation has to be explored. The study has made a structured attempt to identify and characterize the benefits and challenges of linking farmers to the commodity market. Farmers linked to the commodity market would be able to reap the benefits of efficient price discovery. Based on the review, the author found 5 benefits that farmers benefit from the commodity market. However, the author also identified a few challenges that have to be addressed to increase the participation of farmers in the commodity market. Addressing the first challenge, government and private partnerships have to increase the financing options for the farmers to form the farmers’ producer organization, which solely focuses on market access to farmers. Warehouse and grading facilities have to be set up through public-private partnerships to shift from mandi trading to warehouse trading. Warehouse receipts should be viewed as an important instrument in trade to reduce costs. Education on the importance of future markets and knowledge on hedging to reduce losses would act as the strength that helps the farmers to participate in the commodity market. The partnership of FPOs with organisations and brokers that have strong communication and technological support has to be encouraged to overcome the challenges. Related to collaboration among various institutions, farmer’s producers could reap a better income benefit.

References

Aker, J. C. (2010). Information from markets near and far: Mobile phones and agricultural markets in Niger. American Economic Journal: Applied Economics, 2(3), 46-59.

Balat, J., Brambilla, I., & Porto, G. (2009). Realizing the gains from trade: Export crops, marketing costs, and poverty. Journal of International Economics, 78(1), 21-31..

Barham, J., & Chitemi, C. (2009). Collective action initiatives to improve marketing performance: Lessons from farmer groups in Tanzania. Food policy, 34(1), 53-59.

Barrett, C. B., Bachke, M. E., Bellemare, M. F., Michelson, H. C., Narayanan, S., & Walker, T. F. (2012). Smallholder participation in contract farming: comparative evidence from five countries. World development, 40(4), 715-730.

Indexed at, Google Scholar, Cross Ref

Barrett, C. B., Carter, M. R., & Little, P. D. (2006). Understanding and reducing persistent poverty in Africa: Introduction to a special issue. The journal of development studies, 42(2), 167-177.

Indexed at, Google Scholar, Cross Ref

Bellemare, M. F., & Barrett, C. B. (2006). An ordered Tobit model of market participation: Evidence from Kenya and Ethiopia. American journal of agricultural economics, 88(2), 324-337.

Indexed at, Google Scholar, Cross Ref

Bernard, T., Collion, M. H., De Janvry, A., Rondot, P., & Sadoulet, E. (2008). Do village organizations make a difference in African rural development? A study for Senegal and Burkina Faso. World development, 36(11), 2188-2204.

Indexed at, Google Scholar, Cross Ref

Bhattacharya, H. (2007). Commodity derivatives market in India. Economic and Political weekly, 1151-1162.

Indexed at, Google Scholar, Cross Ref

Bijman, J., & Ton, G. (2008). Producer organisations and value chains. Capacity. org: a gateway for capacity development, 34, 4-6.

Bikkina, N., Turaga, R. M. R., & Bhamoriya, V. (2018). Farmer producer organizations as farmer collectives: A case study from India. Development Policy Review, 36(6), 669-687.

Indexed at, Google Scholar, Cross Ref

Bina Agarwal, B. A. (2010). Rethinking agricultural production collectivities. Economic and Political Weekly, 45(9), 64-78.

Braverman, A., Guasch, J. L., Huppi, M., & Pohlmeier, L. (1991). Promoting rural cooperatives in developing countries: the case of sub-Saharan Africa. World Bank discussion papers, 121.

Indexed at, Google Scholar, Cross Ref

Chand, R. (2017). Doubling Farmers' Income Rationale, Srategy, Prospects and Action Plan.

Chatterjee, T., Raghunathan, R., & Gulati, A. (2019). Linking farmers to futures market in India (No. 383). Working paper. Linking farmers to futures market in India (econstor.eu).

Cherukuri, R. R., & Reddy, A. A. (2014). Producer organisations in Indian agriculture: Their role in improving services and intermediation. South Asia Research, 34(3), 209-224.

Indexed at, Google Scholar, Cross Ref

Department of Agriculture & Cooperation (2013) 'Policy and Process Guidelines for Farmer Producer Organizations'. New Delhi: Ministry of Agriculture, Government of India.

Eisenhardt, K. M. (1989). Building theories from case study research. Academy of management review, 14(4), 532-550.

Indexed at, Google Scholar, Cross Ref

Gulati, A., Chatterjee, T., & Hussain, S. (2017). Agricultural commodity futures(No. 349). Working Paper.

Hellin, J., Lundy, M., & Meijer, M. (2009). Farmer organization, collective action and market access in Meso-America. Food policy, 34(1), 16-22.

Indexed at, Google Scholar, Cross Ref

Holloway, G., Nicholson, C., Delgado, C., Staal, S., & Ehui, S. (2000). Agroindustrialization through institutional innovation Transaction costs, cooperatives and milk?market development in the east?African highlands. Agricultural economics, 23(3), 279-288.

Indexed at, Google Scholar, Cross Ref

Ito, J., Bao, Z., & Su, Q. (2012). Distributional effects of agricultural cooperatives in China: Exclusion of smallholders and potential gains on participation. Food policy, 37(6), 700-709.

Indexed at, Google Scholar, Cross Ref

Kalli, R., & Jena, P. R. (2020). Impact of climate change on crop yields: evidence from irrigated and dry land cultivation in semi-arid region of India. Journal of Environmental Accounting and Management, 8(1), 19-30.

Lalvani, M. (2008). Sugar co-operatives in Maharashtra: A political economy perspective. The Journal of Development Studies, 44(10), 1474-1505.

Makhura, M., Kirsten, J., & Delgado, C. (2001). Transaction costs and smallholder participation in the maize market in the Northern Province of South Africa. In Integrated Approaches to Higher Maize Productivity in the New Millennium, Proceedings of the Seventh Eastern and Southern Africa Regional Maize Conference, Nairobi, Kenya, 5–11 February 2002. CIMMYT (International Maize and Wheat Improvement Center): El Batan, Mexico.

Markelova, H., Meinzen-Dick, R., Hellin, J., & Dohrn, S. (2009). Collective action for smallholder market access. Food policy, 34(1), 1-7.

Michalek, J., Ciaian, P., & Pokrivcak, J. (2018). The impact of producer organizations on farm performance: The case study of large farms from Slovakia?. Food policy, 75, 80-92.

Indexed at, Google Scholar, Cross Ref

Nagpal, M., & Kumar, A. (2012). Grain losses in India and government policies. Quality Assurance and Safety of Crops & Foods, 4(3), 143-143.

Indexed at, Google Scholar, Cross Ref

NCDEX Group (2023), Report on Connecting Farmers to Markets, June 2023

Nguyen, T. T., Nguyen, L. D., Lippe, R. S., & Grote, U. (2017). Determinants of farmers’ land use decision-making: Comparative evidence from Thailand and Vietnam. World Development, 89, 199-213.

Okoye, B. C., Abass, A., Bachwenkizi, B., Asumugha, G., Alenkhe, B., Ranaivoson, R., & Ralimanana, I. (2016). Effect of transaction costs on market participation among smallholder cassava farmers in Central Madagascar. Cogent Economics & Finance, 4(1), 1143597.

Ornberg, L. (2003). Farmers’ choice: Contract farming, agricultural change and modernisation in Northern Thailand. In 3rd International Convention of Asia Scholars (ICAS3), Singapore, August (pp. 19-22).

Orsi, L., De Noni, I., Corsi, S., & Marchisio, L. V. (2017). The role of collective action in leveraging farmers' performances: Lessons from sesame seed farmers' collaboration in eastern Chad. Journal of Rural Studies, 51, 93-104.

Ostrom, E. (2014). A Behavioural Approach to the Rational Choice Theory of Collective Action (pp. 121-66). Colchester: ECPR Press.

Reardon, T., Barrett, C. B., Berdegué, J. A., & Swinnen, J. F. (2009). Agrifood industry transformation and small farmers in developing countries. World development, 37(11), 1717-1727.

Sakane, N., van Wijk, M. T., Langensiepen, M., & Becker, M. (2014). A quantitative model for understanding and exploring land use decisions by smallholder agrowetland households in rural areas of East Africa. Agriculture, ecosystems & environment, 197, 159-173.

Indexed at, Google Scholar, Cross Ref

Shepherd, A. (2007). Approaches to linking producers to markets (Vol. 13). Food & Agriculture Org..

Singh, S. (2012). New markets for smallholders in India: Exclusion, policy and mechanisms. Economic and Political Weekly, 95-105.

Swamy, P., & Padma, K. (2020). An empirical examination of correlation dynamics between commodity and equity derivative indices: evidence from India using DCC-GARCH models. Afro-Asian Journal of Finance and Accounting, 10(2), 207-234.

Trebbin, A. (2014). Linking small farmers to modern retail through producer organizations–Experiences with producer companies in India. Food policy, 45, 35-44.

Trebbin, A., & Hassler, M. (2012). Farmers' producer companies in India: a new concept for collective action?. Environment and Planning A, 44(2), 411-427.

Vandeplas, A., Minten, B., & Swinnen, J. (2013). Multinationals vs. cooperatives: The income and efficiency effects of supply chain governance in India. Journal of Agricultural Economics, 64(1), 217-244.

Verhofstadt, E., & Maertens, M. (2014). Smallholder cooperatives and agricultural performance in Rwanda: do organizational differences matter?. Agricultural economics, 45(S1), 39-52.

Indexed at, Google Scholar, Cross Ref

Wallace, M. T., & Moss, J. E. (2002). Farmer decision?making with conflicting goals: a recursive strategic programming analysis. Journal of Agricultural Economics, 53(1), 82-100.

Indexed at, Google Scholar, Cross Ref

Wang, T., Luri, M., Janssen, L., Hennessy, D. A., Feng, H., Wimberly, M. C., & Arora, G. (2017). Determinants of motives for land use decisions at the margins of the Corn Belt. Ecological economics, 134, 227-237.

Indexed at, Google Scholar, Cross Ref

Yin, R. K. (2009). Case study research: Design and methods. Los Angeles and London: SAGE.

Zhuang, J., Vandenberg, P., & Huang, Y. (2015). Avoiding the middle-income trap: policy options and long-term outlook. In Managing the Middle-Income Transition (pp. 60-92). Edward Elgar Publishing.

Indexed at, Google Scholar, Cross Ref

Received: 01-Mar-2024, Manuscript No. AMSJ-24-14634; Editor assigned: 02-Mar-2024, PreQC No. AMSJ-24-14634(PQ); Reviewed: 30-May-2024, QC No. AMSJ-24-14634; Revised: 03-Jun-2024, Manuscript No. AMSJ-24-14634(R); Published: 29-Jul-2024