Research Article: 2019 Vol: 18 Issue: 5

Factors of Strategic Management of the Tax Potential of the Region

Murzina Elena Aleksandrovna, Volga State University of Technology

Yalyalieva Tatiana Valerievna, Volga State University of Technology

Shemyakina Marina Sergeevna, Volga State University of Technology

Abstract

The article is devoted to the problem of strategic management of the tax potential of the region. The paper presents the author's grouping of factors affecting the tax potential: technological, natural-environmental, social, values, political, legal, economic, their structure is detailed. Refined and supplemented by separate groups of factors: economic factors supplemented factor processes of globalization in the world economy. The political factors include the level of government, ideology, political situation, tax competition, corruption, tax policy. Suggested division of strategic management factors depending on their impact on the quantitative and qualitative assessment of tax capacity. The first group of factors influences the parameters reflecting the quantitative certainty of the degree of impact on. A dynamically developing aggregate of taxable resources of a territory. These include economic, legal and political. The second group of factors influences the parameters that can not be quantified but have a certain impact on the formation of taxable resources in the region: natural, ecological, social, value systems.

Keywords

Strategic Management, Taxes, Tax Potential, Taxpayer, Management.

Introduction

The need for an objective and comprehensive assessment of the tax potential determines the definition and systematization of the factors influencing its formation. Under the factor, we understand the condition, cause or parameter that determines the process of forming the tax potential. At the same time, tax revenues of the budget are formed as the result of the financial and economic activities of taxpayers, taking into account the influence on this activity of various factors. Despite the many criteria used to classify the factors influencing the formation of the tax potential, we can single out the main ones: the division of factors into external and internal, exogenous and endogenous, subjective and objective, historical and acquired, and others. At present, the question of directly assessing this effect remains practically undeveloped. In this connection, there is a need to develop a classification of the studied factors. In our opinion, finding a solution to this problem is a key tool for building an effective assessment model, planning and strategic management of a company's tax potential. Taking into account all the factors affecting him, you can get the exact data needed to plan the costs of the company.

Review Of Literature

The scientific literature has paid detailed attention to the influence of external and internal factors on the strategic management of the tax potential of the region. Of particular importance is given to the strategy of the taxpayer company in choosing a business development plan.

For example, the geographical location also determines the extent of natural disasters. The impact of natural disasters on economic growth and income is determined by the reduction of Gross Domestic Product per capita from 0.5 to 1 percent. Modern researchers emphasize that, depending on the type of state (developed or developing), this effect may be reversed. This is due to country differences in fiscal policy: an increase in spending and tax cuts for some countries and a decrease in spending and an increase in income for others (Noy & Nualsri, 2011). Also, as a factor, the interrelation of political changes and their influence on the forecasting of state revenues is distinguished (Bretschneider, 1989).

It is possible to agree with the assertion that good governance is correlated to the tax revenues. However, according to the authors, this effect is achieved through a combination of regional government, tax administration and macroeconomic policy. It should be noted that this indicator is formed not only due to the listed factors, but also under the influence of the qualitative level of tax administration in each territory (Ajaz & Ahmad, 2010).

For many studies, the inclusion of factors such as “corruption” in this group is also relevant. Theoretically, we single out this factor as having an impact on the tax potential, but we believe that in the conditions of the Russian reality in the field of taxation, it does not have a significant impact on the tax revenues of the budget (Imam & Jacobs, 2007; Tanzi, 1999; Gupta & Abed, 2002).

Methodology

Among the existing methods for the development of the classification of factors, a facet method was chosen, which is understood as the parallel division of a set of objects into independent classification groups. As the result of its use, the following groups of factors influencing the formation of the tax potential are highlighted: technological, natural-ecological, social, value system, political, legal and economic. Consider each of the groups of factors in more detail. Technological factors are divided into two groups: extensive and intensive. The first group includes the results; the second group is influenced by research and new technology policies. It should be noted that innovation plays an important role in the development of not only taxpayer companies, but also ensures the competitiveness of the regional and state economies. Natural and environmental factors influencing the formation of the tax potential include: geographical location; the presence of mineral deposits; climatic, soil conditions; natural disasters (Aseri, 2018). A special role in terms of effective territory is played by the first factor. In Russia, only 5.5 million square kilometers (1/3 of the country) are territories without extreme conditions for people's lives, and the creation of production facilities for them requires less expenditure per unit of production. The “value system” as a group of factors influencing the formation of the tax potential consists of non-economic elements to which we include: tax culture, spiritual climate, civilization code and the media as an information source of cultural transformation.

Consider a group of political factors affecting the tax potential, including: political stability, corruption, tax competition, level of government, ideology and tax policy.

One of the main factors affecting the profitability of budgets in general, and, in particular, on their tax part, is political stability in the country. Imbalance and instability in the implementation of state policy hinders or slows down the process of long-term tax reforms, which negatively affects possible tax revenues.

Tax competition as a factor influencing the formation of tax potential, we consider in two aspects: external and internal. On the one hand, this is competition between the regions in terms of establishing tax privileges and various preferences for taxpayers, which theoretically affects the level of tax revenues of an individual territory; however, the tax potential of the state remains unchanged. On the other hand, tax competition should be viewed in the context of globalization as an interstate phenomenon (Keen & Konrad, 2012).

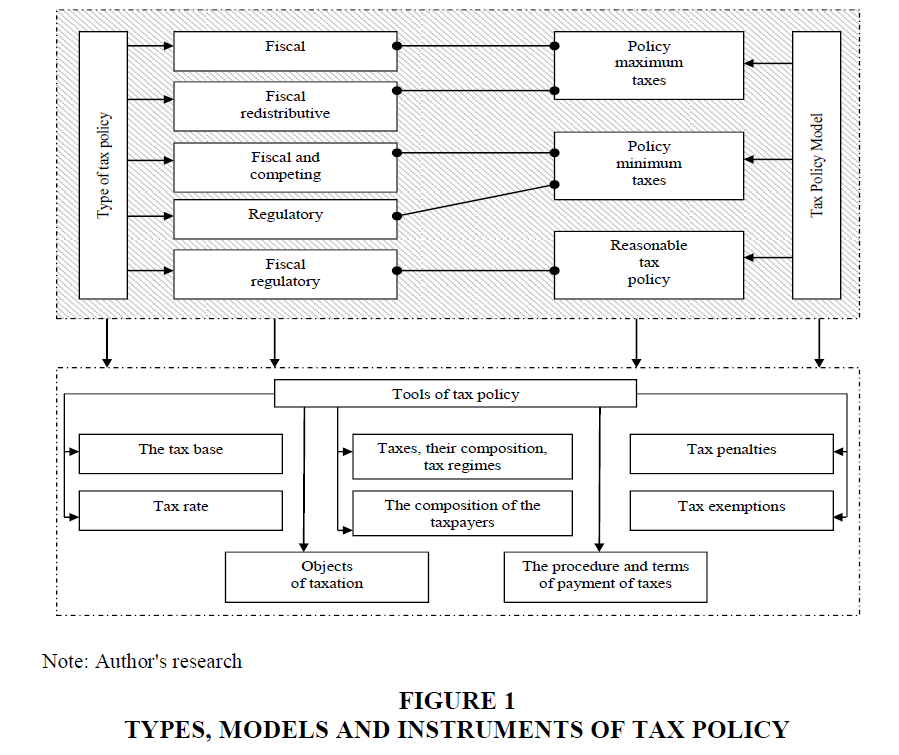

Tax policy is a set of measures in the field of taxation, carried out to ensure the fiscal interests of the state and to develop the economy through the redistribution of resources. Possible types, models and instruments of tax policy are presented in Figure 1.

Legal factors include two components: a change in tax legislation and a system of sanctions. The impact of changes in tax legislation is quite difficult to quantify. In this regard, it is impossible not to agree with the opinion on the division of the studied factor into groups: endogenous and exogenous (Romer & Romer, 2007).

The “Social Factors” group consists of demographic features, population, migration, level of infrastructure development (industrial, social, credit and financial, institutional). The last factor is directly related to the quality of life, and the level of its development is reflected in the migration process of individuals between the subjects of the Russian Federation.

Globalization processes in the global economy, as well as their impact on the tax potential of the territory, are of particular relevance at the present time, due to the difficult foreign economic policy that Western countries are pursuing in relation to Russia. An analysis of Russia's involvement in global processes shows that by the degree of integration into the international economy in 2018, the state occupied 56th place (KOF Index of Globalization, 2019).

In our opinion, the net effect of sanctions on the economy, including on the tax potential of the territory, is difficult to estimate, but based on the direct dependence of the gross domestic product and the parameter under study, taking into account changes in tax legislation, it is possible to predict a change in tax revenues, especially in regions with a larger share of exported goods.

The impact of inflation on fiscal revenues was also studied by economists. In his study, the author showed how the inflation factor influences tax revenues (Tanzi, 1999). The feedback between these categories is explained by the fact that the real value of tax revenues changes under the influence of inflation, since there is a period between the date of payment and the moment of effective collection of these tax revenues. This negative effect in economic theory is referred to as the Oliver-Tanzi effect.

Results

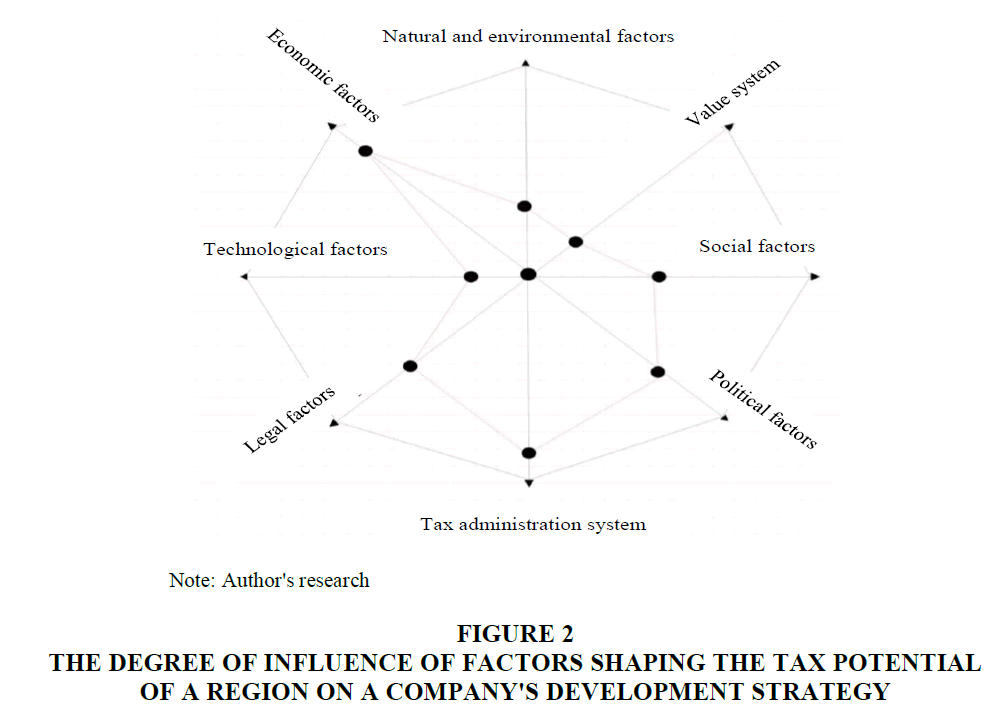

The previously described groups of factors should be assessed according to the degree of their influence on the formation of tax potential. The estimation was made by the method of pairwise comparisons, as the result of which the normalized priorities are calculated, the graphical interpretation of the obtained values is presented in Figure 2. Groups that have received a high rating should be given special attention.

Figure 2.The Degree Of Influence Of Factors Shaping The Tax Potential Of A Region On A Company's Development Strategy.

The analysis of the presented factors determined their division depending on the possibility of quantitative assessment. In this connection, the classification of factors highlighted the quantitative and qualitative. By quantitative factors influencing the tax potential of a region, we understand the parameters reflecting the quantitative certainty of the degree of influence of a factor on a dynamically developing aggregate of tax resources of a region. These include economic, legal and political (Burkov & Murzina, 2016). Qualitative factors are defined as parameters that cannot be quantified but have a certain impact on the formation of taxable resources in the region: natural, environmental, social, “value systems”. Summarizing what has been said, we note that to identify the degree of influence of the first group (quantitative factors) we used the use of econometric methods to identify the dependence and build the corresponding models. For the second group, we used integral assessment, since this method is essentially an effective expert assessment.

Conclusion

The content of the tax potential as a theoretical concept should be revealed in close connection with external and especially internal factors of tax potential formation. Ignoring or incorrect assessment of these factors in practice can lead to an incorrect determination of the tax potential, that is, a significant deviation in the amount of the strategic and actual tax potential and, as a consequence, to the budget deficit and problems with the fulfillment of the social and economic obligations of the state. The focus should, in the authors' opinion, be on such internal factors as intergovernmental relations.

Acknowledgements

The reported study was funded by RFBR, project number 19-010-00620

References

- Ajaz, T., & Ahmad, E. (2010). The effect of corruption and governance on tax revenues. The Pakistan Development Review, 405-417.

- Aseri, A.M. (2018). Organizational Factors Affecting the Implementation of Green Supply Chain Management. Academy of Strategic Management Journal, 5(17).

- Bretschneider, S.I., Gorr, W.L., Grizzle, G., Klay, E. & Bretschneider, S.I. (1989). Political and organizational influences on the accuracy of forecasting state government revenues. International Journal of Forecasting, 3, 307-319.

- Burkov, A.V. & Murzina, E.A. (2016). Analysis method of structural equation modeling. Advances in Systems Science and Applications, 4(16), 1-12.

- Gupta, M.S., & Abed, M.G.T. (2002).Governance, corruption, and economic performance. International Monetary Fund.

- Imam, P.A. & Jacobs, D.F. (2007). Effect of Corruption on Tax Revenues in the Middle East. IMF Working Paper, 07(270) , 36-35.

- Keen, M., & Konrad, K.A. (2013). The theory of international tax competition and coordination. InHandbook of public economics. Elsevier.

- Noy, I., & Nualsri, A. (2011). Fiscal storms: public spending and revenues in the aftermath of natural disasters.Environment and Development Economics,16(1), 113-128.

- Romer, C.D. & Romer, D.H. (2010). The macroeconomic effects of tax changes: estimates based on a new measure of fiscal shocks. American Economic Review. 100(3), 763-801.

- Tanzi, V. (1999). Governance, corruption, and public finance: An overview.Governance, corruption, and public financial management. Manila, Philippines: Asian Development Bank, 1-20.