Research Article: 2025 Vol: 29 Issue: 1

Factors impacting Financial Wellness: Investigating the Effects of Income level, Retirement Status, and Job Sector on Financial Wellness

Anupama Sharma, School of Management & Commerce, Poornima University, India

Gaurav Malpani, School of Management & Commerce, Poornima University, India

Citation Information: Sharma, A., & Malpani, G. (2025). Factors Impacting Financial Wellness: Investigating the Effects of Income Level, Retirement Status, and Job Sector on Financial Wellness. Academy of Marketing Studies Journal, 29(1), 1-15.

Abstract

The research aimed to explore the effect of level of the income, retirement status, and sector of the job on an individual’s overall financial wellness. Total 162 participants completed our online survey that measured financial wellness. Results indicated that income level was the strongest predictor of financial wellness followed by retirement status, and then job sector. We observed that financial wellness kept increasing as the salary increased and was highest in the highest salary group, but the level of propensity to plan was the least although a little minority of high earners showed great potential of propensity to plan. The results indicate that people of different age, Job sector, and retirement status require specific targeted financial education programs because their perceived financial wellness changes as the level of income, and sector of job changes. Also, workplace financial education plays a critical role in improving an employee’s financial wellness and dependency.

Keywords

Financial Wellness, Financial Literacy, Income Level, Propensity to Plan, Retirement Status.

JEL Classifications

D14, G53, J26, J32.

Introduction

Financial wellness is relevant more than ever before where financial hardships are constantly increasing. It includes handling finances, making plans for future requirements, and maintaining stability in times of emergency like the Covid-19. Key factors such as job sector, Income Level, propensity to plan along with retirement status significantly influence financial wellness. Achieving financial wellness requires myriad of tasks to be taken care of such as handling daily finances, budgeting for short term goals, preparing long term goals, and making plans for unexpected events such as medical emergencies. Identifying these crucial elements facilitates tailored strategy development in order to improve financial wellness and reduce economic inequalities.

Employment status or income level is the most essential component that determines financial health. Higher income levels are normally an indicator of improved financial position that includes improved capacity to save, better investment decisions and better coping mechanism in a situation of financial shock. Comparative research demonstrates that the financially secure people with higher income levels are more likely to meet their financial objectives (Lusardi & Mitchell, 2014; Collins & Urban, 2021). However, income alone does not promise financial wellness. Therefore, operating budgets, financial planning, and personal financial literacy are critical for transforming income into financial wellness and security (Lusardi, 2019). Thus, while having money or higher income ensures one’s financial health, how one spends such money is also relevant.

Retirement status is also closely linked to financial health. As individuals get close to retirement, or if they are retired, then their income decreases and cost of living increases, this necessitates careful fund management. Seniors with low income concentrate on financial planning (Lee et al., 2020), this highlights the importance of financial literacy tools and programs (Kim, 2004).

Another mediating factor is the employment sector that also affects the financial health, saving and planning patterns among individuals. Employees working in private organizations have less job security and restricted guaranteed benefits as compared to their counterparts in the public organizations; they therefore invest a lot of time in monetary planning (Baarspul & Wilderom, 2011). Whereas organisational employees especially from the public sector have their pension and health care costs taken care of thus they are not constrained by the same urgent need for financial planning (Malamardi et al., 2015). These differences demonstrate disparities in levels of financial preparedness in categories of employment, influencing how employees in different job sectors approach financial planning and financial wellness.

Although income, retirement status, and employment sector stand as notable contributors to financial wellness, but their combines effects are less studied. Most research pay attention to one factor at a time. This study will thus seek to close this gap in an effort to understand the diverse impacts that income level, retirement status, and employment sector has on financial wellness and FPs. Prior studies lay the groundwork for understanding the standalone impact of these factors. In (Lusardi & Mitchell, 2014) proved the significance of financial literacy in economic sense, and its impact on individuals’ financial decisions. The researchers established that participants who had a good level of financial literacy have better-shaped financial capabilities and hence better financial health. Likewise, (Collins & Urban, 2021) mentioned about the relationship between income and financial health that concluded income is directly proportional to one’s financial position; that means people who earn more money are inclined to have a better financial outcome.

According to the study by (Lee et al., 2020), the correlation between financial planning and retirement satisfaction was explored in the context of retirement. They indicated that as compared to higher earners, retirees in the lower income bracket are more likely to engage in financial planning since they have less funds to work with. This research highlights the importance of targeted financial literacy programs and financial planning tools to deliver financial education to the lower income retired populace to meet their financial objective of wellness. It is also worth stating that workplace financial education programs are equally crucial in enhancing the financial literacy of employees, use of appropriate financial behaviours, and thereby employees’ financial wellness as highlighted by (Kim, 2004).

In (Baarspul & Wilderom, 2011) carried out research for investigating the discrepancies concerning financial planning behaviours among the public and private sector employees. From the analysis, they found out that literature relating to behaviors of the employee in the public and private sector organizations expose the fact that, private sector employees are pro-active in the financial planning as compared to their counterpart in the public sector because they know that; they are less secured in their employment, and there are lesser benefits in terms of monetary and otherwise. In (Malamardi et al., 2015) also affirmed this by showing that the employees public sector employees are always under the coverage of stable pensions and healthcare, that reduces their need for extra and further financial planning.

Based on these insights, our objectives for this research are as follows:

1) To analyse the effect of household income on an individual’s financial wellness.

2) To examine whether lower-income retirees give more attention to financial planning than their higher-income counterparts.

3) To compare financial planning practices between public and private sector employees.

Literature Review

Financial Wellness Conceptual Framework

Financial security or financial health is the state of a person and his/her capacity to control and plan the flow of money and the overall financial stability in the given period and existing economic environment. It includes having control over the daily expenditures, being financially ready for any disaster and being financially ready to fulfill long term monetary goals (Collins & Urban, 2021). It is important to establish what factors have an impact on people’s financial situation and hence design effective strategies with an aim of enhancing positive aspects of financial health and reduce economic inequalities.

Level of Income and Financial Wellness

Income level is one of the primary drivers that determine the ability of an individual to manage his or her financial affairs. Increased income levels make it possible for persons to set as well as allocate cash towards saving, reinvestment needs, and contingencies. In (Lusardi & Mitchell, 2014) affirm that people with high income generally have better financial outcomes such as enhanced saving and investment. These findings show the association between income level and financial health, implying that better income hedges and assists one in creating effective financial strategies (Boisclair et al., 2017).

However, income alone is not enough to lead to financial wellness; therefore, managing money is a significant component of attaining it. Practical measures like budgeting, planning, and managing of funds are some of the financial management features that are vital in converting income into firm and strong financial stability. According to (Lusardi, 2019), financial literacy is vital for empowering people so that they can make optimal financial decisions. Thus, if one does not have the basic monetary understanding and good financial knowledge, they will not be able to handle, and struggle in effectively managing their finances even if they are earning a good amount of money (Collins & Urban, 2021). Hence, on one hand, income is related to financial wellness, on the other hand, financial literacy is also a key component of the general relationship.

Retirement Status and Financial Wellness

Retirement is a certain phase which characterizes the majority of people by the change of their financial status, in which the income is likely to decline, and the financial planning becomes much more critical. Reports show that it is the low-income retirees who pay much attention to the aspect of savings and investment as do the high-income retirees. In (Lee et al., 2020) was also found out that because the retirees have low income, they placed priority on financial planning because their resources are scarce and require monitoring. Hence, the increased preoccupancy with planning among lower-income retirees underlines the need for microfinance and other financial-literacy and fundamental money management tools and resources within this population group (Kim, 2004).

Financial well-being has close relations with the retirement plans that are laid down meticulously. According to (Lusardi & Mitchell, 2014), the appearance of well-developed retirement plans adds to improving people’s economic situations and lessen money related issues. In (Salignac et al., 2020) found that the retiree with proper financial planning perceived adequate preparedness of the retiree in case of an emergency. Therefore, it can be suggested that retirement status explains financial wellness only partly and is moderated by the investment and efficiency of financial planning.

Employment Sector and Financial Health

The employment sector too has an impact on financial health, as stability and favourable benefits differ in public and private organizations. Again, private sector employees are less protected and have fewer and limited rights as compared to those in the public service. Due to this instability, the private sector employees have been noticed to be more involved in financial planning. A survey by (Baarspul & Wilderom, 2011) illustrates the above claim; from the literature that they review about the employees’ behaviors, they conclude that, due to less job security and benefits offered, the private sector employees are more financially planning oriented.

On the other hand, the employees working for the public organizations are used to the fact that they will get pensions and/or health care benefits and they may not feel the need to plan financially for the short term (Malamardi et al., 2015). From these comparisons, one gets to see the level of the financial preparedness status of employees across employment areas or sectors and thereby their preparedness towards financial wellness. In (Koch & Steers, 1978) pointed out that public sector organization’s employees do not have the same need to think about the future financial planning as people in the private sector since their jobs are secure and they receive benefits.

Financial Literacy and its Impact, and the Role of Financial Planning

Financial literacy is an essential aspect of financial health, which has to do with the understanding of economic situations and the ability to make sound choices that will promote a healthy financial status. Based on the works of (Lusardi & Mitchell, 2014), it is clear that financial literacy has a direct impact on the economic choices made, hence the call for enhanced effective financial literacy. In other research, it was established that persons who had increased financial literacy were in a better position to budget their finances, save and plan for the future hence enhancing their financial health (Philippas & Avdoulas, 2021).

In (Lusardi & Messy, 2023) also having qualified the importance of financial literacy in given individuals, ability to take up the challenges that come with; pensions mortgages, and other financial instruments that may shape their financial future. They posit that financial knowledge may help prevent people from being taken advantage of by worse financial situations, whether as defined by debt or saving discrepancies, within higher-risk population subgroups including women and low-income earners. Also, their research focuses on the level of financial literacy in developed nations, explaining that people’s financial knowledge is still rather low (Lusardi & Messy, 2023).

Consequently, (Asiah et al., 2024) investigated financial literacy, in the context of students, as one of the determinants of financial health. They justify their findings with perception data which reveal that financial literacy coupled with parents’ financial education has influence over money management and the overall improvement of student financial choices. This goes to support the argument that it is not only the adults who require the knowledge in the management of their financial wellbeing but also the young people who are setting some of these financial trends for the rest of their lives.

In (Kamakia et al., 2017), indicated in their study that that only financial literacy alone is not sufficient for financial wellness. Although it is essential, but to be able to put that financial knowledge to use, along with the financial habits always mediates the relationship between financial wellness and financial literacy. Hence, appropriate financial attitudes and actions are also necessary. According to this research, it is visible that financial literacy positively promotes financial health, but it has to be succeeded by proper financial behaviour such as making short term budgets, and long-term financial goals, saving while having, and avoiding unnecessary expenses. That’s why, we should consider financial literacy as a program designed to enhance individuals’ financial knowledge and at the same time, a tool to develop right financial behaviour, attitudes, and as a means of inculcating right financial habits (Lusardi, 2019).

In order to maintain one’s financial health, personal financial planning is essential because it helps people to understand how to use their resources properly and save money for their anticipated future financial requirements. According to (Lee & Kim, 2016), The impact of making proper financial strategies, for retirement savings, and asset accumulation on an individual’s financial wellness is very positive and critical. The research proves that people who are always proactive to plan their finances and make regular plans, are usually in a better financial position when compared to the people who do not. This emphasizes the proper use of effective financial planning and forecasting, and using tools and resources to make strong financial strategies (Xiao & O’Neill, 2017).

On the other hand, Financial behavior, attitudes, and habits vary across people in different demographic groups. For an example, (Niu et al., 2020) found out that there was a difference in financial planning behavior of Chinese people living in rural and urban areas. People living in urban areas were better in financial planning than their rural counterparts due to the fact that urban areas has better financial inclusion and they had it easier to get access to better financial services and information. Hence, people in urban areas planned more for their finances then people in rural areas. In (Boisclair et al., 2017), also suggested that, it is more likely to positively influence an individual’s financial wellness through the utilization of the financial planning tools and resources.

Gender and Financial Wellness and Cultural - Regional Differences

Another factor that is found to be influencing an individual’s financial health is gender. It is evident in previous literature that males and females have difference attitudes, tendencies, and varied outcomes that concerns finances. In this study, (Taft et al., 2013) observed that men have better financial literacy as compared to women and this affects financial wellness. But this does not necessarily result in improved financial outcomes because financial behaviours and beliefs are also play an important role.

Moreover, social and economic factors moderate the differences between men and women in the aspect of financial health. In a recent study conducted by (Rahim et al., 2022), the results identified that the single mothers in Malaysia face unique financial challenges due to stress and materialism, which affects their financial stability. This emphasizes the importance for conducting gendered targeted financial education to meet the needs of the respective gender categories (Sabri et al., 2020).

Culture and geography greatly influence people’s financial health and spending patterns. People of different cultures and places have different ways of handling their money; that is the behaviors of finance. According to (Noviarini et al., 2021), young female citizens of New Zealand, and especially those of Maori or of Pacific Islands origin, are less financially literate than other groups. This goes further to imply that cultural factors are of paramount significance in the area of finance and its related matters in particular, such as education and wellness in general.

Additionally, also, the delivery and implementation of the financial wellness programs need to account for these cultural and regional differences to be successful. In (Collins & Urban, 2021) opine that financial education interventions need to be culturally and socio-economically sensitive. This approach ensures that the needs and characteristics of the different demographic groups are put into consideration in the delivery of the financial literacy education hence improving the effectiveness of the financial education programs (Kaiser et al., 2023).

Effectiveness of the Financial Education Programs

It is widely proven that financial education programs do have a positive impact on a person’s financial health. In (Kim, 2004) noted that the effectiveness of workplace financial education programs is enhanced mainly due to the fact that it leads to positive changes in the financial behaviours of the employees. The above plans assist the worker to adopt proper ways of handling money for maximum gains. Moreover, the results of financial education are better if the programs are oriented to particular categories of citizens. In (Eugster, 2019) suggests that there is need to customize the financial education to specific subgroups to enhance effectiveness. For example, financial literacy concerning the elderly should be directed toward preparing for retirement as well as the handling of income acquired after retirement while that relating to young adults should be on how to save and invest.

Psychological Factors in Financial Wellness

Psychological aspects are also significant in the advancement of financial health. Money worries and stress may limit a person’s financial capability in several ways. In their work, undertaken in the Indian context and more specifically in relation to the public sector bank employees, (Malamardi et al., 2015) established that occupational stress has an impact on the dimensions of financial health. This implies that the enhancement of financial wellness directly corresponds to employee satisfaction and engulfs all aspects of efficient monetary health. Also, financial behaviours depend on psychological variables including perceived self- efficacy and perceived locus of control. The study by (Sabri et al., 2020) revealed that participants who are self-efficient and those with an internal control had more positive financial behavior and financially healthy outcomes. This makes it important for financial education programs to also address the increase in financial optimism and financial self- efficacy (Mahdzan et al., 2019).

In (Bai, 2023), investigated the connection between financial literacy, mental budgeting, self-control and financial health. According to his study, financial literacy has a positive impact on individuals’ decisions as it improves discipline in individual’s expenditures. Mental budgeting was defined as a cognitive process of mentally sorting out financial expenses, as a crucial life skill that enables people adhere to their budgets and overcome the desire to make impulsive purchases.

Besides, (Bai, 2023) consider self-control as another personal characteristic that determines the ability of an individual to make adequate financial decisions especially during stressful financial periods. The above findings reflect the role of behavior in the effective and proper use of financial resources as well as the overall financial health.

Similarly, (Muat & Henry, 2023) showed that financial behaviour contributes significantly to financial health. People who are financially carefully spend their money and avoid accumulating more credit than they can handle. Their study also emphasized understanding how financial literacy moderates the effect of financial stress and religiosity on financial wellness. They realized that religiosity can act as a mediator to financial stress for financial wellness, which indicates that external values and beliefs are also relevant to finance.

In (Dare et al., 2023) paid attention to determinants of subjective financial well-being by focusing on cognitive aspects that include executive functioning and financial self-efficacy. Higher levels of executive functions or gravitation towards self-control and planning were linked to positive economic behaviors, including budgeting and saving – which is helpful in the achievement of financial wellness. Their study also found that financial self-efficacy, or the confidence to manage financial transactions play a more critical role in advocating positive financial habits. People with higher levels of financial self-efficacy are more likely to engage in financial behaviors that result in improved financial performance and saving or investment towards the achievement of a certain financial aspiration.

Financial Wellness in Different Life Stages

Welfare in terms of the financial aspect also has its differences because the person’s financial requirements and preferences can and will change depending on the stage in life. In their work, (Lusardi & Mitchell, 2014) note that as individuals gain experience and develop financial knowledge, they become monetarily literate and healthy. However, younger adults may encounter specific financially related issues, for instance, a student loan and low wages upon entering the job market. Additionally, financial wellness is affected by major life events that include marriage, childbirth, and retirement among others. In (Taft et al., 2013) concluded that financial wellness self-assessment score was higher among married participants than single, probably due to combined income and shared expenses. In the same manner, financial health is enhanced after retirement, but only if the retiree had properly prepared for it (Salignac et al., 2020).

In this respect, income level, the level of financial literacy, retirement plans, sectoral distribution of employment, and demographic characteristics feature as the main predictors of financial well-being in the literature. Financial intelligence along with higher income increases financial health; however financial intelligence has to be accompanied by financially healthy behaviour and financially wise planning. Other factors include retirement status and employment sector as the low-income retirees and private sector employees seem to be more in need of some sort of planning.

Also, financial wellness depends on gender and cultural preference, geographical locations, therefore the development of culturally sensitive, and regionally sensitive financial literacy programs. Other factors, which are known to influence the financial behaviors and financial experiences include psychological factors like financial pressure, perceived self-efficiency and the like. Lastly, one can conclude that personal finance differs during different periods of the life cycle, therefore underlining the need to implement appropriate interventions in particular developmental stages of people’s lives.

Methodology

Research Design

The research follows a quantitative cross-sectional research design, as it primarily involves the collection and analysis of numerical data to test hypotheses regarding financial wellness. In more details, it employs descriptive and correlational research approach that aims at describing the level of financial wellness among the respondents as well as the interrelationships between variables such as financial literacy, financial behaviour, income and financial stress.

Participants and Data Collection

This study uses a cross-sectional survey methodology. A total of 162 participants took part in this study and the type of sampling used was non-probability sampling method that’s convenience sampling. The sample consisted of the employed individuals working in the public and private organizations and also takes into consideration the retired employees. Participants were aged between 25 to 65 years. The survey form was distributed using google forms and it was divided into several section as mentioned ahead.

1) Demographic Information: Age, gender, income level, the employment sector, and retirement status.

2) Financial Wellness: Measured using the 10-item Financial Wellness Scale from the Consumer Financial Protection Bureau (2017).

3) Propensity to Plan: Based on (Lee et al., 2020), the 4-item propensity to plan scale was used to evaluate the level.

4) Financial Literacy: Assessed by a basic 3-item scale that measures the knowledge of stock market, interest rates, and risk diversification (Lusardi & Mitchell, 2014).

Sample Size

The sample consisted of 162 participants, and the size was determined by the Slovin’s formula. The total population selected for this research was 2000 employees that were working in public and private sector in selected geographical region of Ajmer City. Margin of error of 7.5% with a 95% confidence level was decided due to the nature of the research

Formula:

Where:

• N = Total population (2,000)

• e = Margin of error (0.075 or 7.5%)

• n = Sample size

Calculation:

We received 162 responses in given time, which falls very close to the calculated sample size.

Analysis of Data

The research data were analyzed using the IBM SPSS Statistics. Descriptive analysis was done alongside independent sample t-tests, one way ANOVA, and regression analysis to test for the hypotheses.

Hypotheses

H01: Lower-income retired individuals give more attention to financial planning than higher-income retired individuals.

Statistical Test: An independent sample t-test was used to compare the Propensity to Plan scores of lower-income and higher-income retired individuals. The participants were divided into two groups: lower-income (below $110,000) and higher-income (above $110,000).

H02: Higher household income results in higher levels of financial wellness.

Statistical Test: A one-way ANOVA was conducted to determine if there were significant differences in financial wellness scores across different income levels. The income levels were categorized into six groups: below $20,000, $20,001–$50,000, $50,001–$80,000, $80,001–$110,000, $110,001–$150,000, and above $150,000. The dependent variable was the financial wellness score.

H03: Private sector employees give more attention to financial planning than public sector employees.

Statistical Test: Independent Sample T-Test

Regression Analysis: Multiple regression analysis was conducted to examine the combined effects of income level, retirement status, and employment sector on financial wellness. financial wellness was considered the dependent variable and income level, retirement status, and employment sector as independent variables. The multiple regression model is as follows.

Financial Wellness = β0 + β1 (Income Level) + β2 (Retirement Status) + β3 (Employment Sector) + ?.

Results and Discussion

Household IL and Financial Wellness

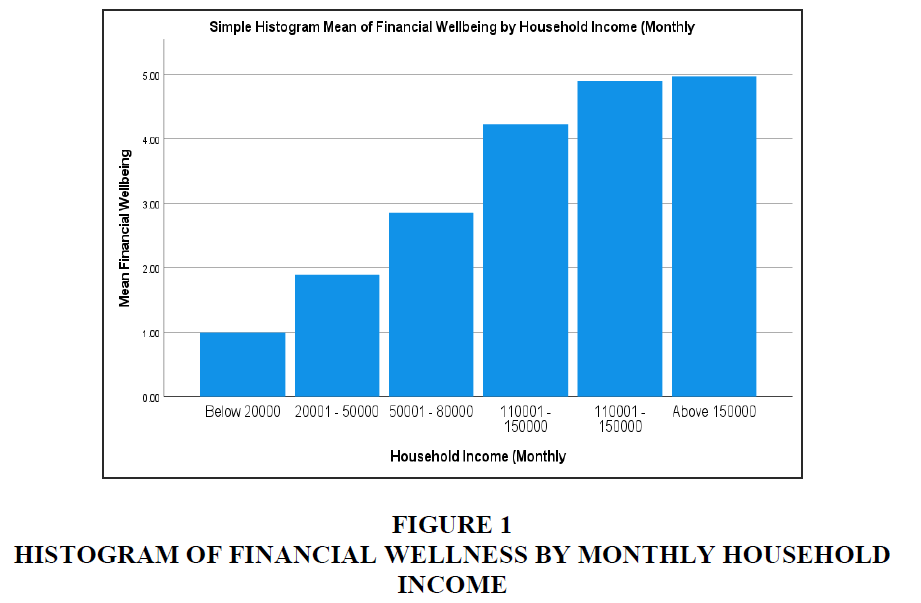

Here we test Household Income affects financial wellness. To test this, we created a histogram to visualize the relationship and descriptive Figure 1.

From the above Histogram, we can see that as the level of household income increases, the Financial Wellness score also increases. That means higher level incomes increase the Financial Wellness Table 1.

| Table 1 Descriptive Statistics of Financial Wellness by Household Income | |||

| Income Level | N | Mean Financial Wellness Score | Standard Deviation |

| Below $20,000 | 3 | 1 | 0 |

| $20,001 - $50,000 | 22 | 1.9 | 0.5 |

| $50,001 - $80,000 | 29 | 2.85 | 0.58 |

| $80,001 - $110,000 | 58 | 4.22 | 0.23 |

| $110,001 - $150,000 | 35 | 4.91 | 0.02 |

| Above $150,000 | 15 | 4.97 | 0.05 |

| Total | 162 | 3.82 | 1.17 |

Descriptive Statistics of Financial Wellness by Household Income

Explanation

Table 1 provides the descriptive statistics for financial wellness scores across different household income levels.

From table 1, it is evident that financial wellness scores tend to increase with higher income levels. Participants with higher incomes generally report better financial wellness, as indicated by higher mean scores. The standard deviations also provide insights into the consistency of financial wellness within each income bracket.

• Below $20,000: Participants in this income category have the lowest mean financial wellness score of 1.00, with no variability, indicating uniformly low financial wellness.

• $20,001 - $50,000: This group shows an increase in the mean financial wellness score to 1.90, with a standard deviation of 0.50, suggesting some variability in financial wellness.

• $50,001 - $80,000: The mean score increases to 2.85, with a standard deviation of 0.58, indicating continued improvement in financial wellness.

• $80,001 - $110,000: A further increase in the mean score to 4.22 is observed, with a lower standard deviation of 0.23, showing more consistent financial wellness.

• $110,001 - $150,000: This group has a high mean score of 4.91, with minimal variability (standard deviation of 0.02).

• Above $150,000: Participants in this highest income category have the highest mean financial wellness score of 4.97, with a standard deviation of 0.05, indicating very consistent high financial wellness.

Overall, the data in Table 1 clearly illustrates that higher income levels are associated with better financial wellness, with scores becoming more consistent as income increases Table 2.

| Table 2 Independent Sample T-Test for Financial Planning Among Retired Individuals by Income Level | ||||||

| Income Level | N | Mean Propensity To Plan Score | Standard Deviation | T-Value | Df | P-Value |

| Lower Income (<$110,000) | 48 | 3.08 | 0.37 | -2.88 | 46 | 0.01 |

| Higher Income (>$110,000) | 14 | 2.58 | 0.2 | |||

Financial Planning Among Retired Individuals by Income Level

Explanation

Table 2 presents the results of the independent sample t-test conducted to compare the propensity to plan scores between lower-income and higher-income retired individuals.

Interpretation

The results of the independent sample t-test, as presented in Table 2, reveal that lower-income retirees exhibit a significantly higher propensity to plan (mean Propensity to Plan score = 3.08) compared to their higher-income counterparts (mean Propensity to Plan score = 2.58). The t-value of -2.88 and the p-value of 0.01 indicate that this difference is statistically significant.

• Lower Income Group: Retired individuals with an income less than $110,000 have a mean Propensity to Plan score of 3.08 with a standard deviation of 0.37. This suggests that these individuals are more inclined to engage in financial planning activities, likely due to the necessity of managing limited financial resources carefully.

• Higher Income Group: Retired individuals with an income greater than $110,000 have a mean Propensity to Plan score of 2.58 with a standard deviation of 0.20. The lower mean score and reduced variability indicate that these individuals, who generally have more financial resources, may feel less urgency or need to engage in extensive financial planning.

Overall, the data supports the hypothesis that lower-income retirees give more attention to financial planning than their higher-income counterparts Table 3.

| Table 3 One-Way Anova for Financial Wellness by Household Income | |||||

| Source | Sum of Squares | df | Mean Square | F | Sig. |

| Between Groups | 203.053 | 5 | 40.611 | 357.412 | < 0.001 |

| Within Groups | 17.725 | 156 | 0.114 | ||

| Total | 220.778 | 161 | |||

One-Way ANOVA for Financial Wellness by Household Income

Explanation

Table 3 presents the results of the one-way ANOVA conducted to determine if there are significant differences in financial wellness scores across different household income levels.

Interpretation

The ANOVA results indicate a significant effect of household income on financial wellness F(5, 156) = 357.412, p < 0.001). This suggests that financial wellness scores vary significantly across different income levels.

• Between Groups: The large sum of squares and mean square values indicate substantial differences in financial wellness scores among the income groups.

• Within Groups: The relatively small sum of squares and mean square values suggest that there is less variation in financial wellness scores within each income group.

These results support the hypothesis that higher household income is associated with higher financial wellness. The significant F-value and low p-value indicate that the differences in financial wellness scores among the income groups are not due to random chance Table 4.

| Table 4 Independent Sample T-Test for Propensity to Plan between Public and Private Sector Employees | ||||||

| Employment Sector | N | Mean Propensity to plan Score | Standard Deviation | t-value | df | p-value |

| Public Sector | 82 | 3.15 | 0.45 | -3.88 | 160 | < 0.001 |

| Private Sector | 80 | 3.78 | 0.39 | |||

Independent Sample T-Test for Propensity to Plan Between Public and Private Sector Employees

Explanation

Table 4 presents the results of the independent sample t-test conducted to compare the propensity to plan scores between public sector and private sector employees.

Interpretation

The results of the independent sample t-test, as presented in Table 4, reveal that private sector employees exhibit a significantly higher propensity to plan (mean Propensity to Plan score = 3.78) compared to their public sector counterparts (mean Propensity to Plan score = 3.15). The t-value of -3.88 and the p-value of less than 0.001 indicate that this difference is statistically significant.

• Public Sector: Employees in the public sector have a mean Propensity to Plan score of 3.15 with a standard deviation of 0.45. This suggests that public sector employees, who typically enjoy more job security and stable benefits such as pensions and healthcare, may feel less urgency to engage in proactive financial planning.

• Private Sector: Employees in the private sector have a mean Propensity to Plan score of 3.78 with a standard deviation of 0.39. The higher mean score and reduced variability indicate that private sector employees, who generally face less job security and fewer guaranteed benefits, are more inclined to engage in financial planning to mitigate financial risks and uncertainties.

Overall, the data supports the hypothesis that private sector employees give more attention to financial planning than public sector employees Table 5.

| Table 5 Regression Analysis of Financial Wellness | |||||

| Predictor Variable | B | SE | Beta | t-value | p-value |

| (Constant) | 1.512 | 0.276 | 5.478 | < 0.001 | |

| Income Level | 0.524 | 0.047 | 0.632 | 11.149 | < 0.001 |

| Retirement Status | 0.178 | 0.082 | 0.157 | 2.171 | 0.032 |

| Employment Sector | 0.342 | 0.073 | 0.284 | 4.685 | < 0.001 |

Regression Analysis of Financial Wellness

Interpretation

The regression analysis results indicate that income level, retirement status, and employment sector are significant predictors of financial wellness.

• Income Level: The unstandardized coefficient (B = 0.524) and the standardized coefficient (Beta = 0.632) indicate that income level has a strong positive effect on financial wellness. The t-value (11.149) and p-value (< 0.001) confirm that this effect is statistically significant.

• Retirement Status: The unstandardized coefficient (B = 0.178) and the standardized coefficient (Beta = 0.157) suggest that retirement status has a moderate positive effect on financial wellness. The t-value (2.171) and p-value (0.032) indicate that this effect is statistically significant.

• Employment Sector: The unstandardized coefficient (B = 0.342) and the standardized coefficient (Beta = 0.284) show that working in the private sector has a positive effect on financial wellness. The t-value (4.685) and p-value (< 0.001) confirm the statistical significance of this effect Table 6.

| Table 6 Model Fit Table and Interpretation | |

| Metric | Value |

| R-squared | 0.85 |

| Adjusted R-squared | 0.84 |

| F-statistic | 150.24 |

| p-value (F-statistic) | < 0.001 |

In sum, according to the data of regression model, financial well-being has positive relationship with income level, retirement status, and the occupation of the employee. Income level is the most impacting factor, followed by employment sector and retirement status.

Conclusion

Our study shows that income level is an important factor that influences the financial wellness. ANOVA showed that individuals in high income group had significantly better financial wellness scores. This is in line with literature suggesting higher income acts as protection against financial shocks, and can be a supportive measure in the times of financial crisis.

Independent sample T-Test found out that retired individuals with low income tend to engage more in financial planning than those individuals who had higher incomes. This suggests the need for targeted financial literacy plans for low-income retirees.

Regarding employment sector, the T-Test showed that individual working in private sector were more likely to plan for their finances, than the public sector workers, this may be due to extra benefits, and strong job security in public sector jobs, that reduce the need for proactive planning.

Results from the regression confirmed income as the most important factor in financial wellness, after than employment sector and then retirement status. Overall, higher income and private sector employment positively impact the financial wellness, with retirement status also contributing, but less significantly.

The present work has practical implications for financial education. Targeted and tailored programs can address the unique needs of different demographic groups. Low income-retirees, tailor and low-cost financial literacy programs, with investment advice can be beneficial. Public sector employees can use more motivation for financial planning, despite high job security. Individuals working in private sector must be offered targeted financial education, as well better pay, and improved employment benefits in order to uplift their financial condition. Financial literacy programs should not only focus on education but also on the improvement of financial decision-making, budgeting, saving, and investing for all the income groups and employment sectors.

Declarations

Competing Interests

The authors have no relevant financial or non-financial interests to disclose

Funding Information

No funding was received to assist with the preparation of this manuscript.

Ethical Considerations

This research was in accordance with rights and privacy of the participants. Participants were fully informed about the objective and aim of the study and they had the right to withdraw or not participate at any time without penalty, this ensured voluntary participation. No sensitive or identifying data was collected, and it was ensured to safeguard their anonymity. Participation in this research implied consent, as participants were made aware that by taking part in the study, they automatically agreed to the terms. The research ensured the transparency, respected privacy and autonomy of the participants.

References

Asiah, A. N., haryono, A., & churiyah, M. (2024). Financial Wellness of Students in East Java: The Role of Parental Financial Education, Financial Status, Financial Literacy, and Financial Behavior. Jurnal ekonomi pendidikan dan kewirausahaan, 12(2), 297-326.

Baarspul, H. C., & Wilderom, C. P. (2011). Do employees behave differently in public-vs private-sector organizations? A state-of-the-art review. Public Management Review, 13(7), 967-1002.

Indexed at, Google Scholar, Cross Ref

Bai, R. (2023). Impact of financial literacy, mental budgeting and self control on financial wellbeing: Mediating impact of investment decision making. Plos one, 18(11), e0294466.

Boisclair, D., Lusardi, A., & Michaud, P. C. (2017). Financial literacy and retirement planning in Canada. Journal of pension economics & finance, 16(3), 277-296.

Collins, J. M., & Urban, C. (2021). Measuring financial well-being over the lifecourse. In Financial Literacy and Responsible Finance in the Fintech Era (pp. 45-63). Routledge.

Dare, S. E., van Dijk, W. W., van Dijk, E., van Dillen, L. F., Gallucci, M., & Simonse, O. (2023). How executive functioning and financial self-efficacy predict subjective financial well-being via positive financial behaviors. Journal of Family and Economic Issues, 44(2), 232-248.

Eugster, M. (2019). Participation in risky asset markets and propensity for financial planning: A missing link? Accounting & Finance, 59(2), 511-562.

Kaiser, T., Lusardi, A., Menkhoff, L., & Urban, C. (2022). Financial education affects financial knowledge and downstream behaviors. Journal of Financial Economics, 145(2), 255-272.

Kamakia, M. G., Mwangi, C. I., & Mwangi, M. (2017). Financial literacy and financial wellbeing of public sector employees: A critical literature review. European Scientific Journal, ESJ, 13(16), 233.

Kim, J. (2004). Impact of a workplace financial education program on financial attitude, financial behavior, financial well-being, and financial knowledge. In Proceedings of the association for Financial Counseling and Planning Education (Vol. 22, No. 1, pp. 82-89).

Koch, J. L., & Steers, R. M. (1978). Job attachment, satisfaction, and turnover among public sector employees. Journal of Vocational Behavior, 12(1), 119-128.

Lee, J. M., & Kim, K. T. (2016). The role of propensity to plan on retirement savings and asset accumulation. Family and Consumer Sciences Research Journal, 45(1), 34-48.

Lee, J. M., Lee, J., & Kim, K. T. (2020). Consumer financial well-being: Knowledge is not enough. Journal of Family and Economic Issues, 41(2), 218-228.

Lusardi, A. (2019). Financial literacy and the need for financial education: Evidence and implications. Swiss Journal of Economics and Statistics, 155(1), 1-8.

Lusardi, A., & Messy, F. A. (2023). The importance of financial literacy and its impact on financial wellbeing. Journal of Financial Literacy and Wellbeing, 1(1), 1-11.

Indexed at, Google Scholar, Cross Ref

Lusardi, A., & Mitchell, O. S. (2014). The economic importance of financial literacy: Theory and evidence. American Economic Journal: Journal of Economic Literature, 52(1), 5-44.

Mahdzan, N. S., Zainudin, R., Sukor, M. E. A., Zainir, F., & Wan Ahmad, W. M. (2019). Determinants of subjective financial well-being across three different household income groups in Malaysia. Social Indicators Research, 146(1), 699-726.

Malamardi, S. N., Kamath, R., Tiwari, R., Nair, B. V. S., Chandrasekaran, V., & Phadnis, S. (2015). Occupational stress and health-related quality of life among public sector bank employees: A cross-sectional study in Mysore, Karnataka, India. Indian Journal of Occupational and Environmental Medicine, 19(3), 134-137.

Indexed at, Google Scholar, Cross Ref

Muat, S., & Henry, K. (2023). Lecturers’ financial wellness: The role of religiosity, financial literacy, behavior, and stress with gender as the moderating variable. Journal of Accounting and Investment, 24(2), 427-449.

Indexed at, Google Scholar, Cross Ref

Niu, G., Zhou, Y., & Gan, H. (2020). Financial literacy and retirement preparation in China. Pacific-Basin Finance Journal, 59, 101262.

Noviarini, J., Coleman, A., Roberts, H., & Whiting, R. H. (2021). Financial literacy, debt, risk tolerance, and retirement preparedness: Evidence from New Zealand. Pacific-Basin Finance Journal, 68, 101598.

Indexed at, Google Scholar, Cross Ref

Philippas, N. D., & Avdoulas, C. (2021). Financial literacy and financial well-being among generation-Z university students: Evidence from Greece. In Financial Literacy and Responsible Finance in the FinTech Era (pp. 64-85).

Rahim, F. F. M., Abd Rahim, H., Osman, S., & Othman, M. A. (2022). Economic well-being among single mothers: The effects of materialism, stress, savings behaviour, and compulsive buying behaviour. Management Science Letters, 10(4), 889-900.

Sabri, M., Wijekoon, R., & Rahim, H. (2020). The influence of money attitude, financial practices, self-efficacy, and emotion coping on employees’ financial well-being. Management Science Letters, 10(4), 889-900.

Salignac, F., Hamilton, M., Noone, J., Marjolin, A., & Muir, K. (2020). Conceptualizing financial well-being: An ecological life-course approach. Journal of Happiness Studies, 21(5), 1581-1602.

Indexed at, Google Scholar, Cross Ref

Taft, M. K., Hosein, Z. Z., Mehrizi, S. M. T., & Roshan, A. (2013). The relation between financial literacy, financial well-being, and financial concerns. International Journal of Business and Management, 8(11), 63-75.

Xiao, J. J., & O'Neill, B. (2017). Propensity to plan, financial capability, and financial satisfaction. International Journal of Consumer Studies, 42(5), 501-512.

Indexed at, Google Scholar, Cross Ref

Received: 23-Sep-2024, Manuscript No. AMSJ-24-15290; Editor assigned: 24-Sep-2024, PreQC No. AMSJ-24-15290(PQ); Reviewed: 28-Sep- 2024, QC No. AMSJ-24-15290; Revised: 20-Nov-2024, Manuscript No. AMSJ-24-15290(R); Published: 24-Nov-2024