Research Article: 2021 Vol: 25 Issue: 2

Factors Driving the Financial Performance of State-Owned Enterprises in an Emerging Market

Ferina Marimuthu, Durban University of Technology

Citation Information: Ferina, M. (2021). Factors driving the financial performance of state-owned enterprises in an emerging market. International Journal of Entrepreneurship, 25(7), 1-17.

Abstract

Purpose: The objective of this study was to provide a clear understanding of the combination of factors that influences the financial performance of state-owned enterprises (SOE) in South Africa. This would lay a good foundation for stakeholders to improve such performance. Furthermore, an analysis of the factors that hinder SOEs financial performance will help to alleviate the financial burden experienced by the government in funding these entities and enable policymakers to adopt strategies to strengthen their performance.

Design/methodology/approach: Based on a sample of 33 commercial SOEs in South Africa, the study employed a multiple regression model, estimated using the Two-Step System-GMM estimator. Main variables included financial performance and leverage.

Findings: The results presented indicate that leverage, measured by long-term debt has a significant negative effect on the financial performance of SOEs. Other variables that had a significant effect on financial performance include growth opportunities, liquidity and non-debt tax shield.

Originality: This study contributed new knowledge to the limited literature on capital structure and financial performance of SOEs. This study extended previous studies on capital structure and financial performance in developed and developing economies by estimating models using the two-step GMM. This addressed the issue of endogeneity in the relationship between capital structure and financial performance which was a weakness in previous studies.

Keywords

South Africa, profitability, leverage, capital structure, GMM

Introduction

Developing economies have the potential for rapid economic growth; however, their performance is impeded by volatile economic and political systems that result in common challenges. The growth of firms in these economies, especially in Africa, is often impeded by a lack of debt and equity capital. Hence, many firms seek a combination of an optimal mix of debt and equity that will minimise the weighted average cost of capital and maximise shareholders’ wealth (Yinusa, 2015), suggesting that a firm’s capital structure impacts on its value. South African state-owned entities (SOE) are plagued by structural and operational problems including financial mismanagement and ineffective corporate governance (Sixolile, 2018). According to Fourie (2001), this has resulted in irregular and unequal development of these entities and have led to poor service delivery and infrastructure provision. Fourie (2001) suggested that at the broader macroeconomic level, SOEs aim to attract foreign direct investment in order to minimise public borrowing and to enhance the economy in ways that promote financial growth and industrial competitiveness. The media is constantly publicising South African SOEs in a negative light, especially that of their poor performance resulting in their inability to meet their financial obligations and hence, calling upon government to bail them out (Marimuthu, 2020). Even though government has increased guarantees on more than one occasion to several SOEs, these entities continue to find themselves in precarious financial positions with little or no improvement to their performance and in a state of perpetual financial distress (Marimuthu, 2020). The overall status of SOEs in South Africa is thus one of underperformance and constant dependence on the government for bailouts. The higher borrowing estimates of SOEs has exceeded governments borrowing projections forcing government to borrow money in order to finance the difference between revenue and expenses and debt repayments that is due (National Treasury, 2017; 2018b). The inability of SOEs to roll over debt and achieve financial consolidation could render government liable and unable to finance the debt, placing a strain on public finances and resulting in deteriorating state balance sheets (South African Reserve Bank, 2018). For government to fund the budget deficit, it would have to borrow at unsustainable levels, and the borrowing costs would depend on lenders’ perception of its ability to repay the debt. These inefficiencies have forced government to realise that some SOEs have unsustainable business models with too much reliance on debt in their capital structures (National Treasury, 2018a). Considering that the broader public finances may be materially affected by these underperforming SOEs, there is a need to investigate the variables that could improve the performance of these SOEs to adjust their business models and prevent them from becoming a drag on economic progress. Hence, the objective of this study is to provide a clear understanding of the combination of factors that influences performance, which would lay a good foundation for key stakeholders to improve such performance. Furthermore, an analysis of the factors that hinder SOEs’ financial performance will contribute to alleviating the financial burden experienced by government in financing these entities and enable policymakers to adopt strategies to strengthen their performance.

Literature Review and Research Hypotheses

Firm Performance

Performance can be measured using non-financial and financial measures and the nature of the study determines the selection. Non-financial measures of performance include the nonfinancial aspects of the firm with a combination of operational, accounting and economic information and can be grouped into internal operational, employee orientated and customer orientated measures (Mbo, 2017). On the other hand, financial performance, a key measure of an organisation's growth based on historical accounting information, is a broad measure that includes profitability, efficiency, solvency, and liquidity. Financial measures of performance are relevant to those SOEs that have a commercial mandate, especially the measures that are returnbased as they illustrate efficiency in the employment of capital, the extent of opportunity costs and the levels of risk in pursuit of business opportunities (Mbo, 2017). Given that the current study focuses solely on commercial SOEs that are unlisted, firm performance is measured using accounting-based financial performance measures.

Theoretical Framework

Scholars have proposed various theoretical frameworks to analyse the relationship between capital structure and firm performance. As noted by Myers (2001), the theories are conditional and are dependent on the nature of the firms covered in a study; hence there is no universal theory. Theories may have to be modified to suit the environment that firms operate within. Conditions differ between developed countries and developing countries, with the latter characterised by market imperfections, imbalances in the macroeconomic environment and poor quality institutions. The agency cost theoretical model is the central theory underpinning the relationship between capital structure and financial performance. The agency theory states that the segregation of ownership and control in contemporary capitalism gives rise to the agency problem where potential conflict may arise between managers (agent) and owners (principal) of firms and further between owners and debtholders (Jensen & Meckling, 1976). This occurs when managers pursue their own goals in the form of consumption of rewards and perquisites, empirebuilding, or investment in projects that yield a negative net present value to the detriment of pursuing the firm's goals. Using debt in the capital structure controls agency problems and reduces free cash flow problems because debt payments are contractual obligations that reduce poor consumption on the part of managers. The optimal capital structure can be viewed as the point at which agency costs are minimised and firm value is maximised. This implies that the firm’s capital structure is dynamic and that firms can adjust their capital structure over time. Therefore, debt is a measure adopted by owners to ensure their wealth is maximised by mitigating agency costs and reducing opportunistic behaviour by managers (Jensen and Meckling, 1976). In the case of debt financing, managers are required to explain their investment decisions to debt holders, placing themselves under constant monitoring which they abhor. They thus prefer internal financing such as retained earnings (Frank & Goyal, 2007). From an agency perspective, debt financing disciplines managers and reduces agency costs by mitigating agency problems, which can be seen as a trade-off between the costs and benefits of debt in the trade-off theory as managers must pay off the debt to avoid bankruptcy (Jensen, 1986). To meet debt commitments, managers would also try to maximise the firm's value through improved performance; hence, the agency cost theory predicts a positive relationship between capital structure and firm performance (Yinusa, 2015). The conflicting relationship between owners and debtholders is because of risk-shifting whereby the wealth is shifted to the owner when returns are greater than the face value of debt. However, when the returns are less than the face value of debt, owners enjoy limited liability and fixed repayments and debtholders are left with a firm where the extended debt is higher than its market value (Harris & Raviv, 1991). Due to riskshifting behaviour, there is a possibility of default which may lead to debt overhang and possible bankruptcy. Hence, the agency cost theory predicts a negative relationship between capital structure and firm performance (Yinusa, 2015). This negative and positive prediction suggests a non-monotonic relationship between capital structure and firm performance. The relationship is negative at excessively high debt levels due to the increased agency costs resulting from the possibility of bankruptcy and increased distress costs. However, it is positive if the debt is used efficiently and employed moderately (Jensen & Meckling, 1976). Yinusa (2015) posited that the agency theory is more relevant for a developing economy characterised by market imperfections such as macroeconomic imbalances, underdeveloped capital markets, and poor quality institutions due to weak corporate governance practices, poor contractual enforcement, and weak protection of investors. Environments with such imperfections promote agency problems at the firm level. Given that South Africa is an emerging economy characterised by many of these market imperfections, the agency theoretical model is most relevant in analysing the relationship between the capital structure and the firm performance of SOEs.

Review of Empirical Literature

Mixed empirical findings have been reported on numerous factors and their influence on firm performance. Bhatti & Sarwet (2012) studied SOEs in Pakistan during 2001 to 2011. The study analysed the financial performance of SOEs to determine the reasons for inferior performance. The results highlighted poor financial management practices; incompetent management policies; poor management information systems (MIS); lack of key performance indicators (KPIs); political interference and corruption which was a common factor when political interference was present, along with poor salary structures. Dawar (2014) conducted a study on Indian firms during the period 2003 to 2012 using the Fixed Effects (FE) estimator. The study was underpinned by the agency theory and investigated the effect of capital structure (LTD; STD) on financial performance (ROE; ROA) based on listed firms. Control variables included size, age, asset tangibility, growth, liquidity, and advertising. The results indicated a negative relationship between the main variables, contrary to the agency theory predictions amongst developed and some developing economies. The authors suggested that the predictions of the agency theory must be viewed within the environment of a developing economy that has underdeveloped bond markets and furthermore, is dominated by banks owned by the state servicing the corporate sector. Fosu (2013) conducted a study on 257 South African Listed firms during the period 1998 to 2009. The study was based on 3 models, namely FE; Random Effects (RE) and GMM. The relationship between capital structure (lagged leverage) and competition and performance (ROA) was studied using asset tangibility, NDTS, size and growth as control variables. The effect of leverage on performance was found to be significant and positive. Saifadin (2015) conducted a study on listed firms in Iraq during 2009 to 2013 using the FE and RE models to determine the impact of capital structure (STD) on firm performance (ROA, ROE, Tobins Q). Control variables included size, age, growth, asset turnover and asset tangibility. Significant negative findings were found with ROA and ROE while Tobins Q indicated a positive effect on STD. Chang et al. (2014) investigated SOEs in Vietnam during 2007 to 2011 using the FE, RE, and Ordinary Least Squares (OLS) estimators. The study investigated the effect of leverage using STD and LTD on the performance of these SOEs. The results showed that STD negatively affects firm performance while LTD positively affects performance. Size had a positive and significant effect on performance; asset tangibility had a negative and significant effect on performance and taxation had a weak effect on performance. Nyamita (2014), studied SOEs in Kenya during 2002 to 2012 using the FE, RE, and System- GMM models. The study investigated the effect of debt (TD) on performance (ROA, ROE, ROI) among SOEs. Control variables included size, asset tangibility, growth, risk, liquidity, inflation, and age. The results indicated an inverse relationship between total debt and performance (ROA, ROI). Size, growth, and liquidity positively affected performance while risk negatively affected performance. Samour & Hassan (2016) conducted a study on American listed firms during 2008 financial crisis using the OLS method by examining the impact of leverage (LTD and STD) on financial performance (ROA). Control variables that had a significant effect included liquidity, asset tangibility, size, and growth. The findings indicated that leverage had a significant effect based on the industry. Yazdanfar & Öhman (2015) conducted a study on SMEs in Sweden during 2009 to 2012 using the 3-stage least squares and FE methods. The authors studied the effect of leverage on SMEs’ performance. Control variables included size and age. The study concluded that leverage (accounts payable, STD and LTD) had an inverse impact on performance (ROA). Vu Van & Bartolacci (2017) studied Vietnamese SMEs between 2007 and 2015 using the OLS and GMM methods. The study examined the impact that government support has on the SME performance (ROA). Age, size, leverage, and innovation were amongst the control variables. The results indicated that government support had positively impacted on performance. Khatoon & Hossain (2017) investigated the relationship between leverage (STD, LTD, TD) and performance (ROA, ROE, EPS, and net profit) of listed firms in Bangladesh between 1999 and 2011 using the FE estimator. Control variables included asset tangibility and liquidity. The effect of leverage (STD) on performance (ROA, EPS and net profit) was found to be significant and positive while LTD had a negative effect, suggesting that managers should be cautious when using LTD in their capital structure as it negatively affects performance. Assagaf and Ali (2017) investigated the factors affecting financial performance among seven SOEs in Indonesia during 2005 to 2016 using Linear Regression models. Government subsidy measured as an independent variable, negatively impacted on performance and also strengthened the relationship between debt and performance. This significant relationship was as a result of governments attempt to encourage SOEs to place less reliance on government support and rather to focus on obtaining other loans. Mbo (2017) investigated the drivers of performance among twenty-three SOEs in ten sub-Saharan African countries. The author modelled the variables using the FE estimator. With the focus on power utilities, the study found that performance was positively influenced by the presence of a stronger board as well as availability of resources. On the inverse, performance was negatively influenced by high levels of government interference. The review of previous empirical studies shows there are mixed findings on the determinants of firm performance, particularly the relationship between capital structure and firm performance. Furthermore, most scholars adopted a generic perspective that does not recognise the uniqueness of strategic government enterprises, especially South African SOEs.

Factors Affecting Financing Performance

Leverage

Debt financing strategies (financial leverage) should be designed in such a manner that they improve financial performance whereby the return generated is greater than the cost of the borrowed funds. In testing the effect of capital structure on the firm’s performance, leverage needs to be defined and the measure(s) need to be identified. Leverage is a financial measure that refers to the amount of borrowed funds used by a firm to finance its investments. Financial leverage can be referred to as the degree to which debt financing is used by a firm in its capital structure. Leverage has been measured in diverse ways in the financial literature, from using market or book values to including total debt, long-term debt (LTD) or short-term debt (STD). Scholars have advocated for the use of book leverage and/or market leverage. Those familiar with modern financial theory prefer market values as they are regarded as more relevant when computing ratios. However, Myers (1977) argued that book values are more pertinent as they are based on assets already in place while market values are based on future growth opportunities. Book leverage is also preferred because financial markets fluctuate a great deal and managers are said to believe that market leverage numbers are unreliable as a guide to corporate financial policy (Frank & Goyal, 2009). Tudose (2012); Thomas (2013) suggested that an increased debt level will reduce agency costs and result in improved financial performance until the target debt level is reached; thereafter, the debt level will decrease as financial performance improves. Tudose (2012) concluded that there is a negative relationship between financial leverage and financial performance due to more profitable firms generating higher earnings which are used for financing, therefore relying less on debt financing. Studies in developing economies have shown that these economies are characterised by higher agency costs of debt supported with findings of an inverse relationship between leverage and performance (Dawar, 2014; Nyamita, 2014)., This suggests that agency issues may have led to firms pursuing exceedingly high debt policies that resulted in lower performance. Considering the non-monotonic relationship between capital structure and firm performance, the hypothesis is stated as:

H1a: Leverage negatively influences financial performance

H1b: Leverage positively influences financial performance

Asset Tangibility

Asset tangibility refers to the resale value or ease of redeployment of a firm’s assets as the more tangible the assets, the more valuable they are because they are easier to repossess and resell. Given that fixed assets are not liquid, they hinder firms from pursuing investment opportunities, implying a negative relationship between tangible assets and firm performance (Samour & Hassan, 2016). When firms underperform or become distressed, elevated levels of asset tangibility can lead to creditors choosing asset liquidation over contract renegotiation. The impact of asset tangibility on firm performance is associated with its role of providing insiders with incentives to adopt policies that maximise the firm’s value and hence performance, resulting in a positive relationship between asset tangibility and performance (Campello, 2007). Measures of tangibility include tangible assets divided by total assets (Frank and Goyal, 2003). The combined asset base of SOEs in South Africa has been reported as being over one trillion Rand which is approximately 27% of GDP (Kikeri, 2018). However, the poor financial viability of some SOEs combined with poor asset utilisation impedes their ability to raise financing which may affect their performance. A review of the literature leads to the following hypothesis:

H2: Asset tangibility negatively influences financial performance

Board Monitoring

Proponents of the agency theory often see boards as a panacea for good firm performance (Jensen & Meckling, 1976). Board monitoring, proxied by board size, can be used as a means to strengthen the corporate governance system. A smaller board has less bureaucratic issues, a more streamlined decision making process, and enhanced cohesiveness and participation and is therefore favoured by corporate rating systems (De Andres et al., 2005). On the other hand, larger boards have a broader range of experience and more time and can therefore effectively monitor executives. De Andres et al. (2005) found an inverse relationship between board size and firm value. Hastori et al. (2015) posited that a larger board improves firm performance due to its power and effectiveness, whereas a smaller board reduces agency costs. Boards of SOEs have been linked to corruption and some are alleged to have been captured by “political rentseekers” where board members are appointed due to political affiliation and not because of their skills and expertise to manage these commercial entities. Board appointments based on political affiliation consolidate a system of patronage across SOE operations, which is a haven for corruption (Chilenga, 2016). The Companies and Intellectual Property Commission (CIPC) identifies the following issues that affect the monitoring of SOE boards: (Rabilall, 2017): the boards are not run independently as other parties exert much influence, including the Minister, among others; there is political interference; the composition may not be ideal; not all members are suitably qualified with the necessary skills and experience; and some boards are not nimble, despite their market domination and state mechanisms. These issues lead to the following hypothesis:

H3: Board monitoring negatively influences financial performance

Size

Larger firms have greater diversification, resources and capabilities than smaller firms (Frank and Goyal, 2003) and this reduces their risk of bankruptcy (Rajan & Zingales, 1995). Larger firms also benefit from economies of scale and reduced borrowing costs; hence, profitability is improved. Smaller firms experience greater information asymmetries due to shareholder and debtholder conflict, with performance negatively influenced (Saifadin, 2015). The effect of firm size on performance is likely to be positive as larger firms are also expected to use more advanced technology and be better managed (Margaritis & Psillaki, 2010). Considering the mixed empirical findings on firm size and performance, the hypothesis is stated as:

H4a: Firm size negatively influences financial performance

H4b: Firm size positively influences financial performance

Liquidity

A firm’s performance is also influenced by its liquidity (Mbo, 2017). Samour and Hassan (2016) suggested that firms with higher levels of liquidity enjoy reduced borrowing costs due to their lower risk of default and increased profitability. However, higher levels of liquidity also imply that an opportunity cost is created by the low returns in comparison to other assets, signifying a negative relationship between liquidity and performance. Karanja (2014) found that liquidity had a positive effect on firm performance and suggested that, this is a weak measure when it is computed from the firm’s financial statements. This is due to the lack of disclosure on access to capital markets that provide added liquidity, which in turn implies that the liquidity of the firm is underreported. Considering the mixed empirical findings on liquidity and performance, the hypothesis is stated as:

H5a: Liquidity negatively influences financial performance

H5b: Liquidity positively influences financial performance

Growth Opportunities

Growth opportunities can be a good signal of the firm’s expectations regarding its performance and hence its profitability (Saifadin, 2015). Increased growth opportunities result in an increase in the rate of return as more profits are generated from investments. A positive relationship between growth opportunities and firm performance has been found in studies by Margaritis & Psillaki (2010); Samour & Hassan (2016) who measured growth opportunities using the percentage change in sales, while Saifadin (2015) employed the percentage change in total assets. Considering the mixed empirical findings on growth opportunities and performance, the hypothesis is stated as:

H6a: Growth opportunities negatively influences financial performance

H6b: Growth opportunities positively influences financial performance

Non-debt Tax Shield

Gao (2016) found that non-debt tax shields can reduce tax costs, affecting firm performance as well as management’s financing behaviour by reducing the cash flow and hence the capital structure. Firms with large non-debt tax shields are less reliant on debt to provide tax shields and therefore have less debt in their capital structure. The measure used should capture tax credits other than the interest on debt payments; hence, variants of depreciation and amortisation are often used. Therefore, the hypothesis is stated as:

H7a: Non-debt tax shield negatively influences financial performance

H7b: Non-debt tax shield positively influences financial performance

Methods

The study used secondary data sourced from Bloomberg, McGregor BFA and the annual reports of the firms. Both Bloomberg and McGregor BFA provided the financial data of the firms whilst the board monitoring variable was obtained from the audited annual reports of the SOEs The population of the study comprised all state-owned entities listed under the Public Financial Management Act (PFMA), which is the main legal framework that governs SOEs in South Africa. The entities that fall under this act include national public entities, provincial public entities and municipal entities. Their legal status varies from being partially or wholly owned by government to being a listed corporation on the stock exchange, with the government as the majority stockholder (National Treasury, 2015). Only commercial entities without missing financial data and presented in a standardised format were included in the final sample of thirtythree SOEs. The period of analysis covered twenty-four (24) years from 1995 to 2018.

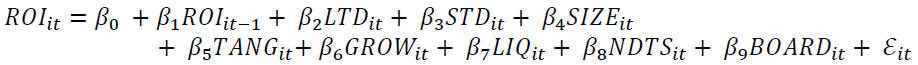

Panel data analysis was employed to estimate the parameters of the multiple regression model that was developed to examine the relationships among the variables. The model was adapted from Chadha and Sharma (2015), to include control variables as other factors besides leverage can influence financial performance.

Capital structure decisions and their effect on performance are dynamic by nature and hence should be modelled as such. Hence, the need for a dynamic panel data model, which helps to deal with endogeneity problems. To account for the impact of past performance, the lagged values of the dependent variables are also included as regressors.

An explanation of the variables is provided in Table 1.

| Table 1 Summary of Variables and Measures | |

| Variable | Variable explanation |

| LTD | Long-term debt measured by dividing long-term debt by total assets |

| STD | Short-term debt measured by dividing short-term debt by total assets |

| ROI | Financial performance is proxied using return on investment measured by dividing profit after tax by total assets |

| SIZE | Size measured as the natural logarithm of total assets |

| TANG | Asset tangibility measured by dividing tangible assets by total assets |

| GROW | Growth measured using the % change in total assets |

| LIQ | Liquidity measured by dividing current assets by current liabilities |

| NDTS | Non-debt tax shield measured by dividing depreciation by total assets |

| BOARD | Board monitoring measured as the logarithm of board members |

| Coefficients of the slope of the regression model | |

| The random error term | |

To estimate the specified model, this study employed the Two-Step System-Generalised Method of Moments (GMM) estimator. Using instrument variables that correlate with the independent variables, GMM addresses the issues of omitted variable bias, measurement errors, endogeneity of regressors and unobserved panel heterogeneity (Arellano and Bond, 1991). In addition, this estimator accommodates missing values and the survivorship bias of this study’s unbalanced panel and it is also asymptotically more efficient (Lew, 2013).

Results and Discussion

This section presents the results and discussion of the factors that influence the financial performance of South African SOEs. There are three sub-sections: firstly, the descriptive statistics are presented, followed by the correlation analysis and lastly the regression results.

Descriptive Statistics

This section presents the summarised statistics of the variables including financial performance as measured by ROI; leverage based on book values of LTD and the STD and control variables affecting the financial performance. The numerical descriptive measures including mean (average), standard deviation, minimum and maximum (range), and Jarque-Bera of the panel data across the variables, offers enhanced understanding of the nature of the data. The average debt ratio for LTD is 30% and 27% for STD which is similar to the high debt levels and mix among other developing economies such as Kenya where Nyamita (2014) reported an average 34% LTD ratio and 28% STD ratio among SOEs. The average ROI of 1% is consistent with other studies in Africa (Nyamita, 2014) and is also a signal of poor performance in the public sector. On the contrary, the private sector has reported average profitability ratios in the range of 11 to 16%, with debt ratios in the range of 40 and 50% (Jardine, 2014, Gwatidzo et al., 2016). This clearly corroborates the weaknesses of the public sector including excessive levels of debt and inadequate earnings to fund additional operations. The average liquidity ratio (LIQ) is 2 which is on par with the general norm for this ratio. The high liquidity ratio is an indication that internal debt financing is greater than external debt financing, which supports the pecking order theory (Frank & Goyal, 2008). The average growth of 10.8% is low compared to other developing countries such as the 15.65% among Kenyan SOEs reported by Nyamita (2014). This shows that it is essential for South African SOEs to finance more long-term expansion projects. The standard deviation is low for most of the variables, an indication that there is a slight deviation from the mean. The values of the mean and standard deviation of all variables are within the minimum and maximum range, indicating an elevated level of consistency. The Jarque-Bera statistics confirm that the data is normally distributed Table 2.

| Table 2 Descriptive Statistics | |||||

| Variable | Mean | Std. Dev. | Min | Max | Jarque-Bera |

| LTD | 0.300100 | 0.270392 | 0.000000 | 1.656702 | 0.000000 |

| STD | 0.270779 | 0.219648 | 0.002027 | 1.412478 | 0.000000 |

| ROI | 0.010497 | 0.130972 | -0.747000 | 0.998000 | 0.000000 |

| BOARD | 12.175080 | 4.862600 | 5 | 42 | 0.000000 |

| SIZE | 15.066100 | 1.734560 | 11.697500 | 19.133100 | 0.000000 |

| TANG | 0.991350 | 0.028610 | 0.467110 | 1.000000 | 0.000000 |

| GROW | 0.108160 | 0.180830 | -0.264910 | 1.258910 | 0.000000 |

| LIQ | 2.003840 | 1.839500 | 0.205750 | 13.005300 | 0.000000 |

Correlation Analysis

The presence of multicollinearity among the independent variables were done using both Pearson correlation coefficient and variance inflation factor (VIF). The results show that the correlation coefficients among the variables are small, which suggests that there is no problem of multicollinearity among the independent variables. It can be ascertained from Table 3 that the highest coefficient is 0.4736 which are the correlation between board monitoring and size. Apart from this, the other correlation coefficients are less than 0.40. The correlation coefficients show that there is an absence of multicollinearity among the variables because Islam (2012) suggests that collinearity exists when the correlation coefficient is more than 0.80. In addition, the VIF results confirm that there is no problem of multicollinearity among the variables because the VIF results are significantly lower than threshold value of 10 (Thompson et al., 2017).

| Table 3 Correlation Analysis | |||||||||

| RO I | LT D | ST D | SIZ E | TAN G | GRO W | LI Q | BOAR D | VI F | |

| RO I | 1 | 4.762 | |||||||

| LT D | -0.168 | 1 | 3.214 | ||||||

| ST D | -0.294 | -0.216 | 1 | 2.912 | |||||

| SIZ E | 0.014 | 0.228 | -0.194 | 1 | 2.014 | ||||

| TAN G | 0.010 | -0.354 | 0.085 | 0.033 | 1 | 1.895 | |||

| GRO W | 0.205 | -0.039 | -0.031 | 0.015 | 0.066 | 1 | 4.014 | ||

| LI Q | -0.084 | -0.176 | -0.211 | -0.081 | 0.054 | -0.071 | 1 | 3.985 | |

| BOAR D | 0.011 | 0.056 | -0.021 | 0.474 | 0.022 | -0.009 | -0.028 | 1 | 1.897 |

| ***p<0.01 significant at 1% level **p<0.05 significant at 5% level, *p<0.1 significant at 1% level | |||||||||

Table 4 presents the regression analysis results displaying the coefficients, t-statistics (in parenthesis) and the level of significance for the financial performance variables estimated using the System-GMM method. The findings indicate that the lagged performance variable is driven by past performance and captures previous performance trends on current performance levels. The coefficient of L.ROI is statistically significant and positive at the 0.01 confidence level. Furthermore, there is consistency with dynamic stability where the lagged performance coefficients are both less than one.

| Table 4 GMM Regression Results | |

| VARIABLES | ROI |

| L.ROI | 0.323*** |

| -0.106 | |

| LTD | -0.172*** |

| -0.0495 | |

| STD | -0.15 |

| -0.0962 | |

| SIZE | -0.00601 |

| -0.0189 | |

| TANG | -1.312 |

| -1.799 | |

| GROW | 0.164** |

| -0.0807 | |

| LIQ | -0.0476*** |

| -0.0206 | |

| BOARD | 0.0019 |

| -0.00597 | |

| NDTS | -3.542** |

| (0.0911 | |

| CONSTANT | 1.729 |

| -1.72 | |

| Observations | 295 |

| No. of id | 33 |

| Wald Stat | 0 |

| No. of instruments | 24 |

| AR2 | 0.245 |

| Hansen Stat | 0.983 |

| *** p<0.01, ** p<0.05, * p<0.1 | |

The optimal mix between LTD and STD is usually based on parameters, including the firm's credit rating; the portfolio of growth opportunities; the profitability of investments; the ability to fund the investments through retained earnings; the liquidation value of assets; the perceived accuracy of financial information, the size and age of the firm; and the competitive level amongst banks (AbuTawahina, 2015). As indicated in Table 2, the existing mix based on the average debt levels shows that the levels are almost equal, with LTD slightly higher. Leverage can be used to increase shareholders’ wealth; however, failure to do so will lead to the destruction of shareholder wealth (Thomas, 2013). LTD shows a negative relationship with performance (ROI). The coefficients of the LTD ratio are significant and negative at the 0.01 confidence level i.e. we are 99% confident that the current leverage measured by LTD has a significant adverse effect on the SOEs’ performance (ROI). These findings are statistically significant at the 0.01 confidence level to the extent of 0.172. This implies that an increase in the SOEs’ LTD is associated with a decrease in their performance. This is a sign that the capital structure decisions taken by South African SOEs are inefficient. This negative relationship between LTD and financial performance, implies that the poor performance may be caused by agency issues that resulted in the pursuit of extremely high debt policies. Furthermore, these negative findings could be the result of risk-shifting behaviour, where there is a possibility of default which may lead to debt overhang and bankruptcy. Hence, the agency cost theory is supported which predicts a negative relationship between capital structure and firm performance (Yinusa, 2015). Debt overhang occurs when an entity has excessively high existing debt which limits it from borrowing, even though the added debt may be to its benefit. Nyamita (2014) also found an inverse impact between LTD and performance, indicating that SOEs in Kenya are forced to increase their debt levels to finance their operations, causing reduced profitability. Reducing debt levels may contribute to an improved efficiency which will in turn improve performance (Lemmon & Zender (2010). However, this reasoning can clearly not be applied to SOEs in South Africa considering their increased debt levels and mediocre performance. The negative effect of LTD on firm performance may also be an indication that it is used to discipline managers due to the increased monitoring associated with the reduction of agency costs (Berger and Bonaccorsi di Patti, 2006).

Developing economies have higher growth opportunities and studies have shown that debt financing in such conditions causes companies to commit to future fixed repayments and thus deters investment in immediately available positive NPV projects (Iavorskyi, 2013). As a developing economy, South Africa has high growth potential which is a probable reason why an inverse relationship is found between LTD and performance. Another explanation could be the high interest rates in developing economies which increase the cost of borrow and hence the costs of financial distress that cause firms to fail. The lack of proper bond markets in capital markets is another explanation (Abata et al., 2017). The coefficients for SIZE are weak and insignificant. A positive prediction between the size of the SOE and performance would imply that larger SOEs would enjoy economies of scale that can be used to exercise influence over the product and market place. However, since the findings are insignificant, this variable does not impact on SOE performance in South African, unlike in other developing economies like Kenya and China, where the size of the SOE positively influenced their performance (Chang et al., 2014, Nyamita, 2014).

The weak negative coefficients for asset tangibility implies that an increase in asset tangibility would result in a decrease in firm performance. A positive prediction would imply that the tangible assets of SOEs provide good collateral and are easily monitored, resulting in the mitigation of agency conflicts between shareholders and bondholders. However, the finding of a negative prediction suggests that SOEs that have high levels of intangible assets have more investment opportunities in the long-term. Therefore, performance is improved in the case of lower tangible assets. Growth opportunities reveal a positive effect on the performance variable. A statistically significant positive influence, at the 0.05 confidence level suggests that SOEs can generate more profits because of increased investment opportunities. The negative effect of leverage on ROI tends to exist for high-growth SOEs as the presence of debt binds the SOE to future fixed repayments, and managers should postpone some immediately available projects with a positive NPV. Debt is used as an instrument to prevent managers from investing in projects that have a negative NPV. As a developing economy, South Africa has high growth potential and this is a probable reason why a negative relationship is found between LTD and ROI as the latter is used to finance investments and capital expenditure. Liquidity controls for factors that are firm-specific and industry-related as well as operating cycle factors, hence the reason for including liquidity as a control variable. Liquidity shows an inverse relationship with performance (ROI) and is also statistically significant at the 1% confidence level. These findings conflict with those of Dawar (2014) whose positive findings were an indication of superior working capital management. Board monitoring has a very weak, positive influence on firm profit. Hence, no significant relationship is shown with the performance of SOEs The agency theory prediction suggests that boards are a panacea for good firm performance as larger boards improve firm performance due to their power and effectiveness. However, given that the findings are insignificant, this cannot be suggested with certainty in the case of SOEs in South Africa. Non-debt tax shields, which has a statistically significant coefficient at the 0.05 confidence level, has negative influence on performance. Therefore, the Modigliani and Miller argument for the trade-off theory whereby tax savings on interest payments are generated from the maximum use of debt which in effect would improve performance, is clearly not the case in this study.

The above findings show that, after controlling for the size of SOEs, asset tangibility, growth opportunities, liquidity, board monitoring, non-debt tax shields, there is a significant finding on the relationship between capital structure and the performance of South African SOEs. The above evidence partially supports the postulates of the agency theory that has been accepted in other developing and developed economies. Studies on the public sectors of developing economies found equivalent results with some of these factors influencing performance. Nyamita (2014) found that leverage, liquidity, growth opportunities and size had a statistically significant impact on financial performance of SOEs in Kenya. Chang et al. (2014) found mixed effects with leverage and firm performance amongst Vietnamese SOEs, with size and asset tangibility having a significant effect on performance.

The study results presented in Table 4, pass the specification requirements of the regression models. In dynamic panel data analysis, it is crucial to test whether the model specification and instrumental variables are legitimate to ensure the reliability of estimations. Auto-correlation was introduced into the model when the lagged compensation variable was included as an additional regressor; hence, a first-order auto-correlation (AR (1)) was expected. The lagged-dependent variable coefficients for all models had coefficients that were below 1, which is consistent with dynamic stability. Table 4 presented the lagged values for the firm performance variables (L.ROI) to account for autocorrelation or serial correlation that is expected under system-GMM. The Arellano Bond AR1 and AR2 (Arellano and Bond, 1991) tests were also run to test for autocorrelation at first difference and second difference levels, respectively. If autocorrelation exists at first difference level, GMM would report p<0.05 at the 95% significance level. If there is autocorrelation at second difference, GMM would report p>0.05 at the 95% significance level. Autocorrelation is only expected to exist at level one (Blundell and Bond, 1998). The results of the AR (2) test for serial autocorrelation reflected nonsignificant p-values of 0.245 in Table 4. These test results indicated that auto-correlation of order 2 was absent. Hence, these results were an indication that the models passed the test. The Wald test was applied to the system-GMM results to test the reliability of the estimators in the models whereby the p(chi2) <0.05, which is a sign that the estimators are reliable at the 95% confidence level. The Hansen instruments-identification tests evaluates the ‘goodness of fitness’ of the System-GMM estimator, by testing for over-identification of the variables (Bond, 2002). The results of the Hansen test revealed that all the models were not over-identified. Higher values are a sign of the robustness of the model; hence, all models passed the over-identification of instruments test. These model specification tests are all a sign of the models’ correct specification.

Conclusion

The main objective of this study was to provide a clear understanding of the combination of factors that influence the financial performance of SOEs in South Africa, especially the effect of capital structure. The South African economy is characterised by market imperfections such as macroeconomic imbalances, underdeveloped capital markets, and inferior quality institutions due to weak corporate governance practices, poor contractual enforcement and weak protection of investors that promote agency problems. According to Yinusa (2015), the agency theory is more relevant for a developing economy characterised by market imperfections.

The agency theory proposes that debt can motivate efficiency in firms by firstly, reducing the agency costs of free cash flow whereby the cash flow available for spending on discretionary private benefits is reduced; and secondly, by motivating managers to pay back debt using the threat of failure (Jensen, 1986). This proposes that the level of debt should be increased until the marginal costs equal the benefits. This reasoning can be applied at a conceptual level to SOEs with a lower debt level in the capital structure where managers are deeply entrenched and likely to pursue personal benefits. However, a non-monotonic relationship between capital structure and firm performance occurs when the relationship is negative at excessively high debt levels due to the increased agency costs resulting from the possibility of bankruptcy and increased distress costs, and positive if the debt is used efficiently and employed moderately (Jensen and Meckling, 1976).

These results indicate that leverage measured by LTD, growth opportunities, liquidity, and non- debt tax shields are the main variables affecting performance in this study. To improve the financial performance of several underperforming SOEs in South Africa that are continuously in need of financial assistance, government should pay attention to these main variables. The agency theory also proposes that debt is used to discipline managers. This is clearly not the case in many of these SOEs due to soft budget constraints and lack of governance control. Resources drive performance; however, elevated levels of political interference, that result from governance and management structures that are politically motivated, are attracted by such resources. This impedes resolution of the agency problem in these SOEs and, indeed, exacerbates such problems. Finally, a lot is dependent on political influence if self-serving politicians have any oversight on finding a solution to the agency problem and managing the use of SOE resources (Mbo & Adjasi, 2017).

It can be concluded that, leverage does not improve firm performance as predicted by the agency theory. This implies that South African SOEs should be meticulous in choosing their optimal capital structure. Leverage is a formidable aspect of capital structure and hence further investigation is required on the part of government and other key stakeholders to determine the reasons why leverage positively affects performance in other countries. Further investigations are also necessary to determine how to use debt effectively to improve performance. One avenue could be for the SARB to consider interest rates. SOEs’ financial objectives also need to be clearly defined. Are they required to maximise their profitability ratios, namely ROA or ROE where the former requires a reduction in debt levels and the latter would require debt levels to be higher than equity? If their aim is to maximise both, an optimal mix between debt and equity is necessary to achieve optimal performance and hence maximise firm value.

The results presented can provide useful insight to government and assist in alleviating the financial burden experienced by the state. Further, key stakeholders may also benefit in their efforts to improve performance of these entities from focusing on the significant variables that influence the financial performance.

Acknowledgement

The author gratefully acknowledges the National Research Foundation of South Africa for the Research grant awarded during the study.

References

- Abata, M.A., Migiro, S.O., Akande, J.O. & Layton, R. (2017). Does Capital Structure Impact on the Performance of South African Listed Firms? Acta Universitatis Danubius. Œconomica, 13.

- Abutawahina, M. (2015). Capital Structure and Firms Financial Performance: Evidence from Palestine (Unpublished master thesis) [Online]. Islamic University–Gaza, Palestine. [Accessed].

- Arellano, M., & Bond, S. (1991). Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. The review of economic studies, 58, 277-297.

- Assagaf, A., & Ali, H. (2017). Determinants of Financial Performance of State-Owned Enterprises with Government Subsidy as Moderator. International Journal of Economics and Financial Issues, 7, 330-342.

- Berger, A.N., & Bonaccorsi Di Patti, E. (2006). Capital structure and firm performance: A new approach to testing agency theory and an application to the banking industry. Journal of Banking and Finance, 30, 1065-1102.

- BHATTI, B. & SARWET, A. 2012. Financial performance of state owned enterprises in emerging economies. Chartered Institute of management accountants, 8.

- Bond, S.R. (2002). Dynamic panel data models: a guide to micro data methods and practice. Portuguese economic journal, 1, 141-162.

- Campello, M. (2007). Asset tangibility and firm performance under external financing: Evidence from product markets. Available at SSRN 971170.

- Chadha, S. & Sharma, A.K. (2015). Capital Structure and Firm Performance: Empirical Evidence from India. Vision: The Journal of Business Perspective, 19, 295-302.

- Chang, F.M., Wang, Y., Lee, N.R., & La, D.T. (2014). Capital Structure Decisions and Firm Performance of Vietnamese Soes. Asian Economic and Financial Review, 4, 1545.

- Chilenga, A. (2016). State owned enterprises: a policy analysis of South African Airways (SAA).

- Dawar, V. (2014). Agency theory, capital structure and firm performance: some Indian evidence. Managerial Finance, 40, 1190-1206.

- De Andres, P., Azofra, V. & Lopez, F. (2005). Corporate boards in OECD countries: Size, composition, functioning and effectiveness. Corporate Governance. An International Review, 13, 197-210.

- FOSU, S. (2013). Capital structure, product market competition and firm performance: Evidence from South Africa. Quarterly Review of Economics and Finance, 53, 140-151.

- Fourie, D. (2001). The restructuring of state-owned enterprises: South African initiatives. Asian Journal of Public Administration, 23, 205-216.

- Frank, M.Z., & Goyal, V.K. (2003). Testing the pecking order theory of capital structure. Journal of Financial Economics, 67, 217-248.

- Frank, M.Z., & Goyal, V.K. (2007). Trade-off and pecking order theories of debt. Handbook of empirical corporate finance, 2, 135-202.

- Frank, M.Z., & Goyal, V.K. (2008). Trade-off and pecking order theories of debt. Handbook of empirical corporate finance. Elsevier.

- Frank, M.Z. & Goyal, V.K. (2009). Capital Structure Decisions: Which Factors Are Reliably Important? Financial Management, 38, 1-37.

- Gao, R. (2016). An Empirical Study on the Influence of Non-Debt Tax Shield on the Choice of Corporate Debt Levels----Based On the Tax Preference Policy. International Journal of Business and Social Science, 7, 201-212.

- Gwatidzo, T., Ntuli, M., & Mlilo, M. (2016). Capital structure determinants in South Africa: A quantile regression approach. Journal of Economic and Financial Sciences, 9, 275-290.

- Harris, M., & Raviv, A. (1991). The Theory of Capital Structure. The Journal of Finance, 46, 297-355.

- Iavorskyi, M. (2013). The impact of capital structure on firm performance: Evidence from Ukraine. Kyiv School of Economics, 36.

- Islam, S. (2012). Manufacturing firms’ cash holding determinants: Evidence from Bangladesh. International Journal of Business and Management, 7, 172.

- Jardine, A. (2014). Financing practices on the JSE-an empirical test of the trade-off and pecking order theories of capital structure. M.Com (Finance), University of The Witwatersrand.

- Jensen, M.C. (1986). Agency costs of free cash flow, corporate finance, and takeovers. The American economic review, 76, 323-329.

- Jensen, M.C., & Meckling, W.H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of financial economics, 3, 305-360.

- Karanja, M.G. (2014). The Effect of Capital Structure on Financial Performance of Small and Medium Enterprise in Dairy sector in Kiambu County. University of Nairobi.

- Khatoon, T., & Hossain, M. (2017). Capital Structure and Firm’s Financial Performance: Evidence from Listed Cement Companies of Dhaka Stock Exchange of Bangladesh. International Journal of Business and Statistical Analysis, 4, 29-37.

- Lemmon, M.L., & Zender, J.F. (2010). Debt capacity and tests of capital structure theories. Journal of Financial and Quantitative Analysis, 45, 1161-1187.

- Lew, S.H. (2013). An investigation of the most appropriate capital structure theory and leverage level determinants. SSRN.

- Margaritis, D., & Psillaki, M. (2010). Capital structure, equity ownership and firm performance. Journal of banking & finance, 34, 621-632.

- Marimuthu, F. (2020). Government assistance to state-owned enterprises: a hindrance to financial performance. Innovations, 17(2), pp.40-50.

- Mbo, M., & Adjasi, C. (2017). Drivers of organizational performance in state owned enterprises. International Journal of Productivity and Performance Management, 66, 405-423.

- Rajan, R.G., & Zingales, L. (1995). What do we know about capital structure? Some evidence from international data. The Journal of Finance, 50, 1421.

- Saifadin, R. (2015). The impact of capital structure on firm performance: evidence from Iraq Bahcesehir University.

- Samour, S., & HASSAN, L. (2016). Capital Structure and Firm Performance: Did the Financial Crisis Matter?: A cross-industry study [Online]. [Accessed].

- Sixolile, T. (2018). Governance in state-owned enterprises – How they are held accountable [Online]. Schoeman Law Inc. Available: https://www.polity.org.za/article/governance-in-state-owned-enterprises-how-they-are-held-accountable-2018-09-06 [Accessed].

- Thomas, A.E. (2013). Capital Structure and Financial Performance of Indian Cement Industry. BVIMR Management Edge, 6.

- Tudose, M.B. (2012). Corporate finance theories. Challenges and trajectories. Management & Marketing, 7, 277.

- Yazdanfar, D., & Öhman, P. (2015). Debt financing and firm performance: An empirical study based on Swedish data. The Journal of Risk Finance, 16, 102-118.