Research Article: 2020 Vol: 26 Issue: 2

Factors Determining Perceived Retail Crowding and Word of Mouth Evidence from Vietnam

Pham Hung Cuong, Foreign Trade University

Abstract

The goal of this paper is to essentially determine the multiple factors that affect and influence retail outcomes through a study of evidences found in the retail industry of Vietnam. This agenda is relatively new and has not been delved into much yet. Nevertheless, the effect it has on the retail industry is evident, and a constructive view of these factors can lead one to understanding how consumerism plays out in a typical retail setting. This study explores the variables that affect the retail crowding. The data has been collected from the customers that regularly visit the retail stores. In the present study judgement sampling has been used and only those respondents were approached who at least visit four times in a month in the retail store. The sample size of the study is 278. The data analysis tools applied were factor analysis and mean value. Exploratory factor analysis with Principal component analysis and Varimax rotation was applied to derive the factors.

Keywords

Retail Crowding, Exploratory Factor Analysis, Word of Mouth, Retail Industry.

Introduction

So many favourable conditions have worked in unison to make Vietnam one of Southeast Asia’s fastest growing retail sectors. With a boost in its tourism industry, rapid urbanisation and a rise in the income of consumers, the retail market is on an all-time expanse high. Many researches have concluded that in the coming year’s one can see Vietnam expand to be the third biggest market in in Southeast Asia in terms of consumer numbers. Perceived retail crowding and the age-old word-of-mouth sales tactic are two of the major decision factors for Vietnam emerging in this sector on the forefront. But before we proceed to deconstructing the schema of both these forms of sales and marketing, and the factors that determine their roles in the retail industry (primarily in Vietnam), it is important for us to take a look at these terms in a general viewpoint and understand how they work in a typical retail setting.

Perceived retail crowding is a term used widely in the literature on retail to represent the density of consumers in a given retail setting. There are various factors that come into play and affect perceived retail crowding. Alternately, it has been found to affect retail outcomes, and is a major factor in deciding the success of retails stores. The manner in which many retailers have come to understand and implement numerous techniques that help manage retail crowding is a vouch of the fact that even they have recognized how far perceived crowding works to affect the marketing dynamics of their stores. Marketing tactics like paying attention to the structuring and design of the retail space, the number of checkout counters, strategic display of productsand items and sales offers are all ways in which retailers have come to effectively utilise perceived retail crowding in their favour.

The concept of perceived retail crowding was made known to the literature of retailing first by Harrel & Michael (1980). The reason why it is extremely important to deconstruct and analyse is because retail crowding is what stimulates shopping behaviour of consumers and depicts the rise and fall of sales within a retail setting.

Word-of-mouth advertising, as mentioned before, is another major factor in many retail industries across the globe being successful in a shorter span of time. One of the oldest forms of advertising since before the era of print media and the electronic age, word-of-mouth, has always been the first go-to option for an up and coming retailer or store. This form of advertising, in any setting, has proven to give guaranteed results of a wider circle of consumers and that too at a faster pace that other strategically placed methods of advertising. Additionally, it is a completely cost-effective method and is a major reason why many retailers choose to implement this style of marketing and grow their businesses. Organizations burn through cash on a wide range of strategies to improve their foothold in the retail industry, yet this informal methodology costs little to nothing and in a very short time it adequately spreads and boosts proposals for the business. What’s more is that customers and clients involuntarily assume a vital part and continue to do so.

In this paper, we will look to stipulate how perceived retail crowding and word-of-mouth as a tactic for advertisement affects the Vietnamese retail industry. We shall also look at a detailed analysis of the Vietnamese market to understand why factors should need to be considered and factored into this study.

Literature Review

The steady growth of population as well as the economy of Vietnam works in its favour to make it one of Southeast Asia’s fastest growing retail industries. With global expansion of the retail market and many new businesses emerging, numerous variables have come into play that affects the atmospheric conditions in a typical retail setting. But with evidence from the retail industry in Vietnam (Tran Anh et al., 2019) found that rapid urbanization as well as the rise in income of consumers is a major reason as to why the retail market has resounded.

Competitive as it is, the retail market in Vietnam not only caters to local businesses but is also a major attraction to foreign businesses and retailers that prey on the booming market. Considerably lower corporate taxes and a much better business environment work in their favour. They are interested in expanding their businesses in developing markets to profit from the rapid increase in the quantity of consumers and their belief that the products sold by foreign retailers and brands are of much more higher quality standards when compared to the products made locally. The ongoing progression in retail space, design and layouts, likewise, has also affected retail crowding and attracted more businesses to emerge in the industry. These factors have led to more light being shed on the issue on retail crowding and the under study of factors that come into play here. Another fascinating determining factor is the era of social media that has drastically left its footprint on every industry possible.

An analysis of Vietnam’s Retail Market

In 2014, Deloitte Southeast Asia issued the following SWOT analysis of Vietnam'sretail market:

Vietnam has created a strong presence in the future of retail and a possibility to be joined by many significant enterprises. With the advancement and modernisation of trade, Vietnam is touted to be one amongst the most attractive retail markets in Asia. The pace of monetary improvement in Vietnam has helped develop the situation of the middle class as the new and emerging consumers. Modern and extravagant urban centers are magnets consumers and are turning out to be potential client markets. The influence of foreign brands has a strong mark on the younger generation of consumers in Vietnam. With their large investments in the industry, support from government programs and strategic promotions, foreign brands are becoming a thing of the day, as buyers see them to be of better quality.

Vietnam's transportation framework is neither adequate for the nation's financial development nor for the outside world. Vietnam's retail distribution tactics and networking require a lot of improvement and a larger investment. More retail stores require an infrastructure that isn’t readily available yet. Despite the economic boom, there is still an enormous difference in salary among the classes, causing restrictions to potential consumers and customers. The prices offered by foreign retailers are found difficult to be completed by local retailers. Their financial strength, brand awareness amongst the consumer pool on account of the social media age and well-orchestrated businesses allows for them to grow stronger and penetrate the industry much more easily, causing problems for domestic retailers.

With the evident development in concepts pertaining to the industry and its modernisation, there is still a lot of scope numerous and incredible doors opening foradvancement in Vietnam. With modern retail centers currently situated in the Northern and Southern parts of Vietnam, there is so much of untapped potential of urban retail markets in other parts like Central Vietnam and other under developed regions. There is a number of ways in which retailers can satisfy the growing demands of consumers, given the rapid urbanisation as well as the favourable conditions for retail outlets growing.

The savage competition brought on by foreign retailers and their large investments, there is a strong possibility for domestic businesses to shut down as they cannot contend. These foreign retailers offer flexibility in payment and have solid support pouring in from suppliers too. But domestic retailers face hardship on account of capital investments, and other factors. They may try and endure the competition by offering considerably low prices that can put their businesses at risk. Individuals who succeed to endure this have been found to emerge as solid and amazing businesses.

Factors Determining Perceived Retail Crowding

Studies suggest that retail crowding occurs when numerous customers are available at the setting during a given time, or from the restriction of store space attributable to the poor layout or architectural design. So, on one hand, while retail crowding (that happens in the first situation) stimulates positive feelings and emotions on account of the strategic display of items, or sales prices or the consumer’s ease of adaptability, spatial crowding can raise negative emotions and works against the entire retail setting. Mattila & Wirtz (2008) stipulated that assistance offered to customers or consumers on part of the retailer also plays a huge role in customer satisfaction and stimulation of positive emotions in a crowded setting. The impacts of retail crowding seem, by all accounts, to be dependent upon a few different factors as consumers’ expectations, individual resistance to heavy footfall of customers at a given time, store layout, shopping time and intent.

Store temperaments and assessments were seen as curvilinear in recent studies on the factors and effects of perceived crowding. Medium degrees of crowding meant that temperaments of stores and their evaluations were favourable (Mehta, 2013). Evaluations of store temperaments were done through impressions about the store. Product assessments depended on view of the style of the product, and its quality (Mehta, 2013).

Factors Determining Word-of-Mouth

In word-of-mouth advertising, consumers are the bait. Word-of-mouth advertising happens normally as a rule when individuals need to impart their experience to those they know. A client is bound to suggest abrand dependent on an uncommon encounter they have with a business or its product. Reliable quality assistance is basic, yet businesses need to be noteworthy in terms of their discounts and prices, store plan and layout or simply the experience while using the product purchased that cause clients to recall a business or a brand. They educate others concerning the business or brand, and their experience at the store or with the product they have purchased is what accelerates them to spread the word. Now what needs to be noted here is that, both negative and positive advertising can be promoted with this form of advertising. Additionally, since the recommendations are exchanged between people who are familiar with one another, there is a likeliness for the suggestions to be taken more seriously. That is why, word-of-mouth advertising is being used on a global scale for business of all sizes in the retail industry. The impact of such environmental factors as retail crowding on shopping behavior has only recently begun to receive much needed attention (Eroglu & Machleit. 1990). The notion that retail density influences shopping behavior is becoming increasingly well documented, with many of the potential antecedents to perceived crowding identified and general models extended and partially tested. Despite this, too little is known about the nature of the relationship between perceptions of crowding and consumer behavior. Because of the potentially detrimental effects of retail crowding, additional research in this area is justified and needed. The overall objective of this manuscript is to help retailers develop a better understanding of the concept of retail crowding and by so doing help in the development of strategies to counter the effects of retail crowding. In an effort to explain perceived crowding, several models have been offered (Eroglu & Gilbert 1986; Eroglu & Machleit 1990; Harrell et al., 1980; Hui & Bateson 1991; Mehrabian & Russell 1974; Worchel & Teddlie 1976). Mehrabian & Russell (1974) suggest that perceived crowding is a function of information. More specifically, environmental cues (e.g., number of shoppers, structural enclosure) contribute information to a situation. As a result, increases in the rate of information lead to increases in the level of perceived crowding which in turn leads to an increase in arousal. Mehrabian & Russell (1974) measured behavioral responses to environmental stimuli in terms of approach and avoidance behaviors. Approach behaviors represent an individual's willingness to enter, explore, and remain in an environment. Avoidance behaviors represent a tendency to avoid entering, exploring, and remaining in an environment. The environmental psychology model suggests that arousal is positively related to avoidance behaviors (Mehrabian & Russell, 1974). Alternately, Worchel & Teddlie (1976) propose that perceived crowding results from a two-step process. The first step is an increased level of arousal brought about by violations of personal space. Second, the increased level of arousal is attributed to other people in the environment thus resulting in an increased level of perceived crowding. An increase in perceived crowding in a retail store can decrease the level of satisfaction that shoppers have with the store. The three studies reported here examine the retail crowding-satisfaction relationship to determine the extent to which it is a simple, direct relationship. Specifically, we consider the possibility that the crowding–satisfaction relationship is mediated by emotional reactions that are experienced while shopping. In addition, moderating variables such as prior expectations of crowding, tolerance for crowding, and store type are examined for their influence on the crowding–satisfaction relationship (Machleit et al., 2000).

With the advent of online marketing being one of the biggest trends for most businesses around the globe, social media plays a large role in word-of-mouth advertising. Over 500 million users are on Twitter while close to 1.1 billion users have an account on Facebook, not to forget platforms like Instagram, Snapchat, etc. With the number of users increasing every second, it is comparatively easy for retailers as well as consumers to spread the word.

A business article published in 2015 on VN Economic Times Online suggested that according to a Nielson Global Trust, 2015 report, a whopping 88% of consumers were influenced by word-of-mouth recommendations. A large percentage of these recommendations were able to convert into guaranteed purchases in the Vietnamese retail market. The Head of Reach Solutions in Southeast Asia, North Asia and Pacific at Nielsen, Craig Johnson supported the report, adding that when businesses learn to master the techniques involved in word-of-mouth advertising, they can attain immediate success. It is, however, important to keep in mind that with trust being a factor that moderates this form of advertising, retailers should practice accountability and advocate transparency to increase their brand’s awareness as improve their credibility. The tourism industry of Vietnam has a huge impact on the retail industry. People who visit the country make sure to taste the authentic products and therefore rely on word-of-mouth recommendations given to them by people they interact with. With Vietnam’s tourism advancing, word-of-mouth has never been this effective.

Objectives of the Study:

The following are the objectives of the study:

1. To find the various factors that determine the retail crowding behaviour in Vietnam

2. To ascertain the magnitude of the various factors that affect the retail crowding behaviour in Vietnam

Research Methodology

This study is an exploratory study. The study explores the variables that affect the retail crowding. The data has been collected from the customers that regularly visit the retail stores. In the present study judgement sampling has been used and only those respondents were approached who at least visit four times in a month in the retail store. The sample size of the study is 278.

The data analysis tools applied were factor analysis and mean value. Exploratory factor analysis with Principal component analysis and Varimax rotation was applied to derive the factors. There are 13 items or statements in this study which were taken into consideration and with the help of factor analysis 3 factors were extracted having 5, 4 and 4 items respectively. The factors were suitably named as per the collective relationship with each other.

Table 1 demonstrates the demographic profile of the respondents that have the questions regarding their gender, age, purchase habits, profession and monthly income. Among the total number of 278 respondents 51.4% are male and 48.6% are female in which 24.8% are from the age group of 20-30 years, 27.7% are of 31-40 years, 19.1% are of 41-50 years of age and the rest 28.4% are above 50 years of age. In them 44.2% are online customers and 55.7% are offline customers. 21.2% of them are students, 26.2% are doing their business, and 24.1% are in service and the rest 24.8% are housewife. 16.9% of them earn less than 10000000 VND, 19.1% earns 10000000 VND to 20,000,000 VND, 21.2% earns 20,000000 VND to 40,000,000 VND, 21.9% earns 40,000000 VND to 60,000,000 VND and the rest 20.9% earns above 60,000,000 VND per month.

| Table 1 Demographic Profile of the Respondents | ||

| Variables | No. of respondents | %age |

| Gender | ||

| Male | 143 | 51.4% |

| Female | 135 | 48.6% |

| Total | 278 | 100% |

| Age groups | ||

| 20-30 yrs | 69 | 24.8% |

| 31-40 yrs | 77 | 27.7% |

| 41-50 yrs | 53 | 19.1% |

| Above 50 years | 79 | 28.4% |

| Total | 278 | 100% |

| Purchase habits | ||

| Online customers | 123 | 44.2% |

| Offline customers | 155 | 55.7% |

| Total | 278 | 100% |

| Profession | ||

| Student | 59 | 21.2% |

| Business | 73 | 26.2% |

| Service | 67 | 24.1% |

| Housewife | 69 | 24.8% |

| Total | 278 | 100% |

| Monthly income | ||

| <10000000 VND | 47 | 16.9% |

| 10000000 VND to 20,000,000 VND | 53 | 19.1% |

| 20000000 VND to 40,000,000 VND | 59 | 21.2% |

| 40000000 VND to 60,000,000 VND | 61 | 21.9% |

| >60,000,000 VND | 58 | 20.9% |

| Total | 278 | 100% |

Data Analysis and Interpretation

Reliability and Sample Adequacy:

For the purpose of determining reliability Cronbach’s alpha was used. The values of Cronbach’s Alpha were found quite good (values for three factors respectively 0.930, 0.867 and 0.954). Hence the reliability of the retail crowding scale was determined. The sample adequacy was checked with the help of KMO test and the sample was also fund adequate because the value in significance column was less than 0.05 shows in Table 2.

| Table 2 Barlett’s Test of Spherically and Measure of Sampling Adequacy KMO and Bartlett's Test | ||

| Kaiser-Meyer-Olkin Measure of Sampling Adequacy. | 0.847 | |

| Bartlett's Test of Sphericity | Approx. Chi-Square | 2560.342 |

| df | 78 | |

| Sig. | 0.000 | |

It may be observed from the table that the value of KMO is 0.847 which is more than the recommended value of 0.6. Hence it confirms the validity of the factor analysis. The value under significance column is .000 which shows that null hypothesis shall be rejected viz. Sample is not adequate and alternate hypothesis will be accepted viz. Sample is adequate.

The factor analysis has been applied with certain default settings and criteria. The components have been grouped on the basis of the Eigen values. The minimum Eigen values should be at least 1. Table 3 shows that the total number of variables or statements is 13, hence 13 components can be produced from factor analysis. However, with the help of Eigen values (more than 1), it is found from the table only 3 factors have been produced. These 3 factors explain around 79% of the variance which is above the minimum criteria of variance explained i.e. 78%. The Eigen values of the factors are -5.639, 3.370 and 1.362.

| Table 3 Total Variance Explained | |||||||||

| Component | Initial Eigen values | Extraction Sums of Squared Loadings | Rotation Sums of Squared Loadings | ||||||

| Total | % of Variance | Cumulative % | Total | % of Variance | Cumulative % | Total | % of Variance | Cumulative % | |

| 1 | 5.639 | 43.378 | 43.378 | 5.639 | 43.378 | 43.378 | 3.934 | 30.259 | 30.259 |

| 2 | 3.370 | 25.920 | 69.299 | 3.370 | 25.920 | 69.299 | 3.491 | 26.851 | 57.110 |

| 3 | 1.362 | 10.476 | 79.774 | 1.362 | 10.476 | 79.774 | 2.946 | 22.664 | 79.774 |

| 4 | 0.706 | 5.429 | 85.203 | ||||||

| 5 | 0.404 | 3.106 | 88.309 | ||||||

| 6 | 0.356 | 2.736 | 91.045 | ||||||

| 7 | 0.314 | 2.419 | 93.464 | ||||||

| 8 | 0.222 | 1.707 | 95.171 | ||||||

| 9 | 0.207 | 1.595 | 96.767 | ||||||

| 10 | 0.167 | 1.283 | 98.050 | ||||||

| 11 | 0.113 | 0.872 | 98.922 | ||||||

| 12 | 0.088 | 0.677 | 99.598 | ||||||

| 13 | 0.052 | 0.402 | 100.000 | ||||||

| Extraction Method: Principal Component Analysis. | |||||||||

It is found from the Table 3 that the 3 factors or components explain 79% of the variance. The first factor explains 30.259% of the variance followed by the second component that explains 26.851% of variance, and last component explains 22.664% of the total variance.

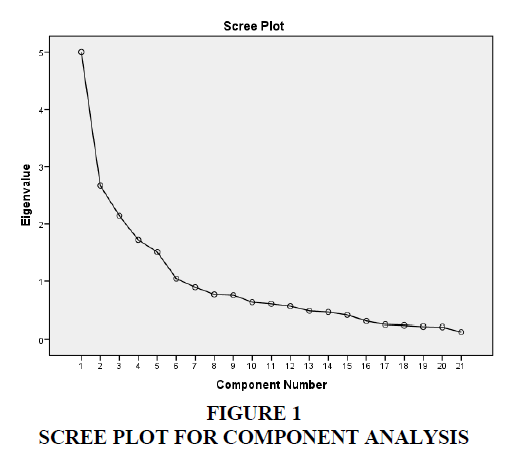

Figure 1 shows the scree plot. The scree plot is based on the Eigen Values derived from the main table ‘Total Variance Explained’.

The scree plot shows that there is a steep fall in the line till 3rd components till the Eigen value of 1. Later the fall of line is very less and later the gap between the ‘component number’ axis and line reduces which shows that later components are less important because the eigen values of those components is below 1 shows in Table 4.

| Table 4 Rotated Component Matrixa | ||||

| Determinants of Retail Crowding and Word of Mouth | Discounts and Promotions | Store Layout and Visual Merchandising | Word of Mouth | Reliability |

| Attractive Pricing strategies | 0.874 | 0.930 | ||

| Discounts and offers | 0.898 | |||

| Sales promotion schemes | 0.862 | |||

| Price match to Online Pricing | 0.875 | |||

| Lowest Pricing Guaranteed | 0.891 | |||

| Attractive display of items | 0.657 | 0.867 | ||

| Well organized layout | 0.907 | |||

| Number of checkouts / billing counters | 0.875 | |||

| Easy store navigation and convenient POP and POS | 0.757 | |||

| Word of Mouth is highly convincing | 0.848 | 0.954 | ||

| Word of Mouth is more reliable then Retailers generated content | 0.894 | |||

| Word of mouth is viral in nature | 0.910 | |||

| Products bought based on Word of mouth fulfills the need of social acceptability | 0.903 | |||

Construction of Factors or Components:

Reliability of the Factors/Constructs:

The reliability of all constructs was checked with Cronbach’s alpha. The value of reliability for 3 constructs were found 0.930 (Factor 1), 0.867 (Factor 2) and 0.954 (Factor 3). The minimum value of reliability of a construct should be 0.7, hence the reliability of all the constructs is above the critical value; hence the constructs formed are robust.

Development of the Factors/ Constructs

There are 3 factors out of 13 variables/statements. These factors represent the different variables that are highly correlated with each other. The 1st factor is constituted by 5 variables namely as Attractive Pricing strategies, Discounts and offers, Sales promotion schemes, Price match to Online Pricing and Lowest Pricing Guaranteed. The construct has been named as ‘Discounts and Promotions’. The variance explained by this factor is 30.259% and the reliability coefficient of the factor is 0.930 which is more than the minimum desired value of reliability i.e. 0.7. 2nd Factor is constituted by 4 variables namely as attractive display of items, well organized layout, Number of checkouts / billing counters and Easy store navigation and convenient POP and POS. The construct has been named as ‘Store Design and Visual Merchandising’. The variance explained by this factor is 26.851% and the reliability coefficient of the factor is 0.867 which is more than the minimum desired value of reliability i.e. 0.7. 3rd Factor is constituted by 4 variables namely as Word of Mouth is highly convincing, Word of Mouth is more reliable then Retailers generated content, Word of mouth is viral in nature and Products bought based on Word of mouth fulfils the need of social acceptability. The construct has been named as ‘Word of Mouth’. The variance explained by this factor is 22.664% and the reliability coefficient of the factor is 0.954 which is more than the minimum desired value of reliability i.e. 0.7.

Conclusion

The present study determines how retail crowding behaviour is determined by the factors such as discounts and promotions, store design and visual merchandising and word of mouth. The results of the present study are consistent with the extant literature. In the context of Vietnam, the study has reiterated that the crowding behaviour is well explained by the various factors determined in this study. Consumers follow the herding behaviour such as the rush at retail stores are found more when they offer discount to the customers, gives promotion, loyalty bonus, cash back etc. Similarly, consumers stay more inside the store when they find a good atmosphere inside store, the navigation is good and they have an ease of checking out the products etc. Word of mouth is considered as the oldest and most effective non-paid form of promotion, where the customers convincingly visit the retail stores because they have been positively influenced by the other satisfied buyers. Though word of mouth now days is electronic also, hence retailers are targeting the E-WOM (electronic word of mouth) more as compared with the face to face/telephonic word of mouth. However, in case of offline retailers the traditional word of mouth still works. In a nutshell it may be concluded from the study that there are many factors that determine the crowding behaviour of the retail buyers in Vietnam and few of the most important have been technically approached and well tested with the help of Factor Analysis with principal component analysis approach.

References

- Eroglu, S., &amli; Gilbert, D.H. (1986). Retail Crowding: Theoretical and Strategic Imlilications. Journal of Retailing, 62, 346-363.

- Eroglu, S.A., &amli; Machleit, A.K. (1990). An emliirical study of retail crowding: Antecedents and Consequences. &nbsli;Journal of Retailing, 66, 201-221.

- Frost,S.(2000). What is word-of-mouth advertising? Small Business-Chron.com,

- httli://smallbusiness.chron.com/wordofmouth-advertising-11616.html.

- Harrell, G.D., Michael D.H., &amli; Anderson, J.C. (1980). liath analysis of buyer behavior under conditions of crowding. Journal of Marketing Research, 17, 45-51

- Hui, M.K., &amli; Bateson, J.E.G. (1991). lierceived control and the effects of crowding and consumer choice on the service exlierience. Journal of Consumer Research, 18, 174-184.

- Machleit, K.A., Eroglu, S.A., &amli; Mantel, S.li. (2000). lierceived Retail Crowding and Sholiliing Satisfaction: What Modifies This Relationshili?Journal of Consumer lisychology, 9(1), 29-42.

- Mehrabian, A., &amli; Russell, J.A. (1974). An Aliliroach to Environmental lisychology. Cambridge: MIT liress.

- Mehta, R. (2013). Understanding lierceived retail crowding: A critical review and research agenda. Journal of Retailing and Consumer Services, 20, 642-649.

- Mattila, A., &amli; Wirtz, J., (2008). The role of environmental stimulation and social factors on imliulse liurchasing. Journal of Services Marketing, 22(7), 562-567.

- Tran Anh, T., Massoud, M., Zuan, D., &amli; Linh, N., (2019). Exliloring the imlict of traditional and electronic word of mouth on travel intention, DOI: 10.1145/3317614.3317617, Conference: the 2019 5th International Conference.

- Worchel, S., &amli; Teddlie, C. (1976). The exlierience of crowding: A two-factor theory. Journal of liersonality and Social lisychology, 34(1), 30-40.