Research Article: 2022 Vol: 27 Issue: 2S

Factors Affecting the Interest in Using E-Wallet among Indonesian Millenials

Nawang Kalbuana, Politeknik Penerbangan Indonesia Curug

Pribadi Asih, Politeknik Penerbangan Indonesia Curug

Indah Ayu Johanda Putri, Politeknik Pelayaran Surabaya

Catra Indra Cahyadi, Politeknik Penerbangan Palembang

Nunuk Praptiningsih, Politeknik Penerbangan Indonesia Curug

Kadarusman, STIE Malangkucecwara

Sahala Purba, Universitas Methodist Indonesia

Lina Ayu Safitri, Universitas Bina Sarana Informatika

Yohana, Universitas Pramita Indonesia

Dwi Jayanti, Universitas Pramita Indonesia

Rusdiyanto, Universitas Gresik and Universitas Airlangga

Citation Information: Kalbuana, N., Asih, P., Putri, I.A.J., Cahyadi, C.I., Praptiningsih, N., Kadarusman, et al., (2022). Factors affecting the interest in using E-wallet among Indonesian Millenials. Academy of Entrepreneurship Journal, 28(S2), 1-10.Keywords:

E-Wallet, Accounting Information System, Covid-19 Pandemic, Financial Technology (Fintech)

Abstract

Objective: In the era of the Covid-19 pandemic coupled with the industrial revolution 4.0, it requires us to be able to adapt by making payments through E-Wallet. Accounting Information System is expected to be able to provide compensation, especially in the creation of proof of transaction and preparation of financial statements in E-Wallet. The research aims to analysis the factors that affect the interest of the younger generation/millennials to use E-Wallet.

Design/methodology/approach: This research will use qualitative methodology by collecting primary data from 50 respondents, especially Millennials in Indonesia. The study uses qualitative analysis with classical assumption tests, validity tests, correlation coefficients, multiple linear regressions and is processed using SPSS applications.

Findings: The results showed perceived usefulness has no impact on e-wallet interests whereas perceived easy usage variables and experience have an effect on e-wallet interests.

Implications: The study's results are expected to be able to provide more accurate input so that it can provide an overview and information to Financial Technology (Fintech) investors to continue to develop E-Wallet in accordance with the wishes of its users.

Originality: The sample used in the study was millennials, as this generation is considered more of a potential buyer and they are interested in using e-wallets.

Introduction

Technological advances in today's modern era, causing the use of technology to develop rapidly to meet human needs in various aspects of life. This is because by using technology everything is considered more effective and efficient in its use. With the use of technology, people are greatly helped to get a service. Similarly, in the field of finance or finance also experienced significant development. The development of technology has a big impact on the business world, one of which is the development of a new type of business, namely Financial Technology (Fintech) (Agarwal & Chua, 2020; Ali, Raza, Khamis, Puah & Amin, 2021; Chen, 2018; Izzo, Tomnyuk & Lombardo, 2021; Knewtson & Rosenbaum, 2020; Miskam, Yaacob & Rosman, 2019; Oladapo, Hamoudah, Alam, Olaopa & Muda, 2021; Sangwan, Harshita, Prakash & Singh, 2019; Troise, Matricano, Candelo & Sorrentino, 2021; Xu, Bao, Zhang & Zhang, 2021). Its presence in Indonesia, fintech is felt enough to create jobs and improve the nation's economy. Fintech is digital information and communication technology for business transactions in order to establish, redefine and change new relationships between buyers and sellers. E-commerce allows buying and selling transactions to be done online, so that trade activities allow cross-country transactions (Luh, Yolandari, Made & Kusumadewi, 2018). The use of technology, society is greatly helped in getting a service. Based on data from Bank Indonesia in 2019, there are 38 digital wallets or e-wallets that have official licenses.

The Covid pandemic greatly affected the world economy (Devi, Devi, Warasniasih, Masdiantini & Musmini, 2020; Gibson & Olivia, 2020; Iacus, Natale, Santamaria, Spyratos & Vespe, 2020; Jyoti, 2021; Olivia, Gibson & Nasrudin, 2020; Sparrow, Dartanto & Hartwig, 2020; Suryahadi, Al Izzati & Suryadarma, 2020; Vinod 2021). As a result of this pandemic, there has been an unexpected increase in E-wallet usage (Alam, Awawdeh & Muhamad, 2021; Loh, Lee, Tan, Ooi & Dwivedi, 2020; Undale, Kulkarni & Patil, 2020). In Indonesia popular e-wallets such as OVO, GoPay, DANA, LinkAja each have their own mass user base. Using e-wallet has become a lifestyle, especially for millennials. According to the Indonesian Internet Service Association (APJII), internet usage in Indonesia continues to grow. In 2017, there were 143,26 million internet users in Indonesia. With the increasing use of the internet is very rapid, this greatly encourages the online market will be even bigger. With the emergence of marketplaces that dominate the Indonesian market today such as Lazada, Tokopedia, Bukalapak, OLX, Shopee, and others. That's why the role of e-wallets will be increasingly important in this day and age. E-wallets will help people in the payment of transactions online. This is very suitable for the behavior of today's society wants its wants and needs to be met quickly and efficiently (Prakosa & Wintaka, 2020).

According to (Priambodo & Prabawani, 2016; Utami & Kusumawati, 2017) research, perceived ease of use influences users' interest in using electronic money services. This is because the ease of being easy to learn and understand, electronic money services are also easy to use when transacting in various merchants (merchants or stores) that have supported electronic money transactions, as well as the ease of refilling or top-up on electronic money.

Based on the phenomenon that occurs in the community, although many e-wallet services are available in Indonesia, not many people know deeply about their usefulness and benefits. Indonesians still rely on payment systems with physical cash. In the use of e-wallets, they just get to know, look for cashback discounts and do not want to explore the wider range of e-wallets to then leave the cash completely. In addition, there is still a lack of socialization and communication from fintech companies making e-wallet services still not in demand by the public for everyday transactions. Another problem is in top-uping the balance to fill the e-wallet. The existence of administrative fees from banks, and not all consumers using mobile banking is considered quite troublesome if users have to conventionally go to an ATM to fill the balance (Prakosa & Wintaka, 2020).

It is anticipated that the findings of this study will provide more accurate input so as to provide an overview and input to Financial Technology (Fintech) investors to continue to develop E-Wallet in accordance with the wishes of its users (user friendly), and this research was carried out during the pandemic of Covid-19. Covid-19 pandemic conditions make respondents prefer Mager (lazy to move) rather than doing other activities so that online transactions with E-wallet become the main choice. The sample used in the study was millennials, as this generation is considered more than potential buyers and they are interested in using e-wallets.

Literature Review

E-Wallet

E-Wallet is the digital card available for online shopping with a smartphone/computer. It has the same usefulness as a debit or credit card. In order to make payments, an E-wallet must be linked to the bank account of the person making the payment (The Economic Times, 2021).

E-wallet has mainly two components, information and software. The information component includes a user database of information, including name, amount payable, shipping address, debit or credit card information, method of payment, etc. The software component stores personal data and provides data security and encryption.

Usage Interests

In this study, interest in the use of e-wallet (Y) is used as a dependent variable according to (Fay, 2017). The desire to use an e-wallet is to use e-wallet facilities for payment purposes. Here are the interest indicators using an e-wallet:

a. Desire to use, Interest in e-wallet so that there is curiosity and curiosity to use it.

b. Always try to use the effort made to continue using the e-wallet.

c. Continue in the future the desire to continue using e-wallet for a longer period of time.

Perceived Usefulness

According to (Syahputra & Putra, 2020) perceived usefulness means that with an application can improve performance and results are better, faster, and satisfactory compared to not using the application. That the individual will use information technology if the person knows the benefits or usefulness (usefulness) positive for its use. People who can easily use the internet will find it much easier to take advantage of the technology. Benefit variables can be measured by indicators: Increases productivity, Improves job performance, Enhances Effectiveness and System is useful.

Perceived Ease of Use

Ease of use is the belief that a person can easily use and understand the use of technology. Attitudes towards the use of the Technology Acceptance Model are defined by Livianto (2018); Rithmaya (2016) as positive or negative feelings of a person if they have to perform the behavior to be determined. Individual attitudes that support the use of information system technology will automatically encourage the utilization and use of information system technology. Ease variables can be measured by indicators:

a. E-wallet is easy to learn,

b. E-wallet works easily in accordance with what the user wants,

c. E-wallet is easy to improve user skills,

d. E-wallets are easy to operate.

Experience

(Suandana, Rahyuda & Yasa, 2016) say that a positive experience will create a satisfaction that will have an impact on buybacks. Experience is used to estimate the interest in reusing a service. When consuming a product or service can arise as a result of the consumer experience in the past. Research conducted (Adytia & Yuniawati, 2016) suggests that the better the consumer experience in the past, the greater the possibility of repurchase in the future. In line with the results of Yolandari & Kusumadewi (Luh et al., 2018) research that experience has an influence on buying back interest. Therefore, a third hypothesis can be drawn up.

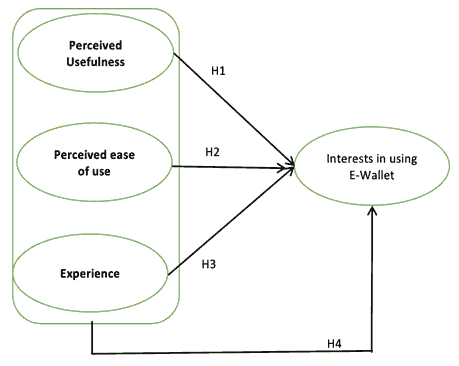

Hypothesis

H1: Perceived usefulness affects the interests in using e-wallets.

H2: Perceived ease of use affects the interests in using e-wallets.

H3: Experience affects the interests in using e-wallets.

H4: Perceived usefulness, perceived ease of use and experience affect the interests in e-wallets simultaneously

As shows in Figure 1.

Methodologies of Research

Types of Research Approach

The type of this research is called the scientific method because it has complied with scientific principles including concrete, empirical, objective, measurable, rational and systematic. While this research approach uses quantitative research because the data is taken and analyzed with numbers using statistical analysis (Abadi, 2021; Aliyyah & Prasetyo, 2021; Aliyyah & Siswomihardjo, 2021; Endarto, 2021; Endarto, 2021; Hastomo, 2021; Indrawati, Utari, Prasetyo, Rusdiyanto & Kalbuana, 2021; Jannah, 2020; Kalbuana & Prasetyo, 2021; Kalbuana & Suryati, 2021; Luwihono, 2021; Prasetio, 2021; Prasetyo, Aliyyah, Rusdiyanto, Kalbuana & Rochman, 2021; Prasetyo, 2021, 2021, 2021; Nartasari, 2021a, 2021b; Susanto, 2021; Wahyudin, Sari, Ardiansari, Raharja & Kalbuana, 2021).

Population and Sample

Indonesian millennials who used E-Wallets were studied in this study, and the selected sample was 50 people. Millennials are rated as potential buyers and they are more interested in using e-wallets. The technique of sampling used here is non-probability sampling by purposeful sampling.

Data Collection Technique

Data collection techniques by conducting a direct review of the research location with the aim of obtaining primary data by distributing questionnaires and literature studies (Syakur et al., 2021).

Variables Operational Definition

The following three independent variables (X) are included in this study: Perceived Usefulness, Perceived Ease of Use and Experience. Also included is a dependent variable (Y) Interests in Using E-Wallet.

Analysis and Discussion

Validity Test

Validity tests are useful for knowing the validity or suitability of questionnaires that researchers use in measuring respondent data. The number of respondents to this study was 50 with a significant rate of 5%, so obtained R table=0.279. as shows in Table 1.

| Table 1 Validity Test |

|||

|---|---|---|---|

| R-Count | R-table | Information | |

| Interests in Using E-Wallet (Y) | 0.727 | 0.279 | Valid |

| Perceived Usefulness (X1) | 0.607 | 0.279 | Valid |

| Perceived Ease Of Use (X2) | 0.672 | 0.279 | Valid |

| Experience (X3) | 1.000 | 0.279 | Valid |

From the table above it can be concluded that the data used is valid. On the dependent variable interest in using an e-wallet with r calculated>r table=0.727>0.279. And what is an independent variable is perceived ease of use, perceived usefulness, experience with each nominal 0.607, 0.672, 1,000>0.279 then the data used by valid researchers.

Multiple Linear Test Regression

The table 2 below shows multiple linear regression tests:

| Table 2 Multiple Linear Test Regression |

||||||||

|---|---|---|---|---|---|---|---|---|

| Coefficientsa | ||||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | Collinearity Statistics | |||

| B | Std. Error | Beta | Tolerance | VIF | ||||

| 1 | (Constant) | -137 | 2.716 | -0.050 | 0.960 | |||

| Perceived Usefulness (X1) | -079 | 0.175 | -0.060 | -0.453 | 0.652 | 0.511 | 1.958 | |

| Perceived Ease Of Use (X2) | 0.431 | 0.180 | 0.342 | 2.400 | 0.021 | 0.444 | 2.253 | |

| Experience (X3) | 0.576 | 0.145 | 0.534 | 3.983 | 0.000 | 0.502 | 1.990 | |

| Dependent Variable: Interests in Using E-Wallet (Y) | ||||||||

As shown in the table 2, the formulation of multiple linear regressions can be written as follows:

Y= a +b1X1+b2X2+b3X3

Y= -0.137+-0.079 X1+0.431 X2+0.576 X3

As shown in the table 2, it is known that based on the value of the regression coefficient which is positive, namely the perceived ease of use (X2) variable and the experience variable (X3) has a value of 0.431 and 0.576, while the regression coefficient of perceived usefulness (X1) variable has a negative value of -0.079.

In the statistic collinearity column shows the tolerance result of the three variables above 0.1, namely: X1=0.511, X2=0.444, X3=0.502. The Variation Factor (VIF) column shows that the three variables are no more than 10, namely: X1=1,958, X2=2,253, X3=1,990. So the study is free of multicollinerity problems and all three independent variables are worth using in multiple regression testing.

Perceived Usefulness Affects the Interests in Using E-Wallets (H1)

Table 2 shows a coefficient of determination of -0.079 fo perceived usefulness, which is negative, which means that under Perceived Usefulness have a negative influence on the interests in E-wallet use. While the significant level of 0.652 is>from 0.05 which means that Perceived Usefulness have a negative effect on interests in reusing E-wallets. According to (Livianto, 2018) In other words, people believe that technology will enable them to perform better in their current jobs.

Perceived Ease of Use Affects the Interests in Using E-Wallets (H2)

In the table it can be seen that the Perceived Ease of Use variable has a regression coefficient of 0.431 which is positive, which means perceived ease of use influences interest in using E-wallets. While the significant level of 0.021 is<from 0.05 which means that the perceived ease of the use does have a significant impact on the benefit of the use of e-wallets

Experience Affects the Interests in Using E-Wallets (H3)

The table shows that the experience variable has a regression coefficient of 0.576 which is positive, which means that the experience has a positive influence on the interests of using E-wallets. While the significant level of 0.000 is<from 0.05 which means that the experience has a significant effect on the interests in using E-wallets.

Perceived Usefulness, Perceived Ease of Use, and Experience Simultaneously Affect the Interests in Using E-Wallets (H4)

According to Imam Ghozali (Ghozali, 2016) if sig value.<0.05 means that independent variables (X) simultaneously affect dependent variables (Y). as shows in Table 3.

| Table3 F-Test |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Model Summaryb | ||||||||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate | Change Statistics | |||||

| R Square Change | F Change | df1 | df2 | Sig.F Change | Durbin- Watson | |||||

| 1 | 0.765 | 0.585 | 0.558 | 2.133 | 0.585 | 21.593 | 3 | 46 | 0.000 | 1.842 |

b. Dependent Variable: Interests E-Wallet (Y)

Judging from the table above, with a significance value of 0.000<0.05 and according (Wiratna, 2015), If Fcount>Ftabel, then the independent variable (X) affects the dependent variable (Y). The formula for Ftabel=(k; n - k)=(3; 50 – 3)=(3; 47)=2.80. Fcount>Ftabel=21,593>2.80 it was concluded that perceived usefulness, experience, and perceived ease of use variables simultaneously affect the interest in using e-wallet (Y).

Discussion

Perceived Usefulness

In this research, the perceived usefulness of variables had no positive impact on the value of e-wallets. Not in line with research (Yuliani, 2020). This shows that the benefits that exist on e-wallets have not been fully felt by users of the service. Such as using an e-wallet has not fully improved effectiveness, productivity, and performance in making transactions.

In variable Perceived Usefulness, it is shown to respondents who feel the speed of transactions when using an e-wallet and accuracy for payments up to the smallest nominal so that no more refunds are needed. The interesting thing about other e-wallets is that it can be used to pay for electricity, buy credit, pay payments and others. This is one of the reasons respondents to make decisions on the use of e-wallets. However, this is not felt by many respondents who doubt this transaction. Such as the lack of response from the E-Wallet service when consumers have transaction failures or balances have not entered when top-up and so on

Perceived Ease of Use

E-wallet interest is positively affected by the perceived ease of use, this is consistent with research carried out by (Widiyanti, 2020; Pratama & Suputra, 2019). This shows that if respondents use the technology will feel and get the convenience not to spend more energy in doing a job in question. The proof is enough through a smart phone installed student e-wallet account; they can make transactions quickly and easily. The easier the e-wallet application is to use transactions, the more often the use of the e-wallet.

In variable Perceived ease of use, it is shown with respondents who feel that the way e-wallets are used is very flexible and efficient. In fact, respondents feel helped by the existence of an e-wallet can be an alternative to cash so that there is no need to carry cash if going to travel, just by scanning the application then the transaction can run. The e-wallet network is also very extensive, both in the e-commerce sector, offline stores, culinary stores and transportation. This is one of the reasons respondents in making decisions on the use of e-wallets.

Experience

This study's findings are consistent with those of (Prabandari & Yasa, 2018) and (Prakosa & Wintaka, 2020) which showed that experience significantly affects the intention of using E-wallets. Positive experience as a basis for the emergence of use intentions because the behavior of consuming a product or service arises as a result of consuming behavior in the past.

On the experience variable, shown with respondents who feel more effective and flexible using this application such as a safe place to save money without carrying a wallet everywhere, often get cashback when buying food using QR payment, easy when transferring balances to fellow E-Wallet users, can invest through E-Wallet invest and much more. This encourages people to use E-Wallet for longer.

Conclusion

Partially, Perceived Usefulness (X1) has no effect on E-wallet (Y) Usage Interests. The significance value of Perceived Usefulness (X1) is 0.652>0.05. Perceived Ease of Use (X2) impact the interest in using e-wallets (Y), as the value of perceived ease of use (X2) is 0.021<0.05. Experience (X3) affects the interest in using e-wallets (Y). Because the significance value of experience (Y) is 0.000<0.05. Simultaneously or together the Perceived Usefulness, Ease of Use and Experience variables simultaneously impact the Interest in E-wallet Use. With a significance value of 0.000<0.05.

Although e-wallet has many advantages, it turns out that e-wallet has several disadvantages, including users should always have a data plan when transacting because the e-wallet application is connected to the internet, and also another complaint from users is the frequent e-wallet application to update. Another thing that does not make users comfortable is when top up through a certain bank is charged an admin fee. Of course, this can make the consideration of e-wallet application providers to continue to innovate and improve services.

Acknowledgment

The research was funded by all authors, and there was no conflict of interest. Correspondent author: Nawang Kalbuana, E-mail address: nawang.kalbuana@ppicurug.ac.id

References

Abadi, S., Endarto, B., Taufiqurrahman, Aji, R.B., Kurniawan, W., Daim, N.A., & Kalbuana, N. (2021). Indonesian desirious finality of the community in regard. Journal of Legal, Ethical and Regulatory Issues, 24(1), 1–10.

Adytia, C.A., & Yuniawati, Y. (2016). The influence of customer experience on revisit intention at the trans luxury hotel bandung. THE Journal : Tourism and Hospitality Essentials Journal.

Agarwal, S., & Chua, Y.H. (2020). FinTech and household finance: A review of the empirical literature. China Finance Review International, 10(4), 361–376.

Alam, M.M., Awawdeh, A.E., & Muhamad, A.I. Bin. (2021). Using e-wallet for business process development: challenges and prospects in Malaysia. Business Process Management Journal, 27(4), 1142–1162.

Ali, M., Raza, S.A., Khamis, B., Puah, C.H., & Amin, H. (2021). How perceived risk, benefit and trust determine user Fintech adoption: A new dimension for Islamic finance. Foresight, 23(4), 403–420.

Aliyyah, N., Prasetyo, I., Rusdiyanto, R., Endarti, E.W., Mardiana, F., Winarko, R., & Tjaraka, H. (2021). What affects employee performance through work motivation ?Journal of Management Information and Decision Sciences, 24(1), 1–14.

Aliyyah, N., Siswomihardjo, S.W., Prasetyo, I., Rusdiyanto, I., Rochman, A.S., & Kalbuana, N. (2021). The effect of types of family support on startup activities in Indonesia with family cohesiveness as moderation. Journal of Management Information and Decision Sciences, 24(S1), 1–15.

Chen, K. (2018). Financial innovation and technology firms: A smart new world with machines. International Symposia in Economic Theory and Econometrics, 25, 279–292.

Endarto, B. (2021). Global perspective on capital market law development in Indonesia. Journal of Management Information and Decision Sciences, 24, 1–8.

Endarto, B., Taufiqurrahman, S.S., Setyadji, S., Abadi, S., Aji, R.B., & Kalbuana, N. (2021). The obligations of legal consultants in the independent legal diligence of the capital market supporting proportion of legal prepparement. Journal of Legal, Ethical and Regulatory Issues, 24(1), 1–8.

Fay, D.L. (2017). Influence of Ease of Use, benefits, risks, and trust on the interest in using e-wallets on the millennial generation of Semarang. Applied Chemistry International Edition, 6(11), 951–952.

Ghozali, I. (2016). Multivariate analysis application with SPSS program. Semarang: UNDIP Publishing Agency. Multivariate Analysis with SPSS Program.

Gibson, J., & Olivia, S. (2020). Direct and indirect effects of covid-19 on life expectancy and poverty in Indonesia. 56(3), 325–344.

Hastomo, W., Karno, A.S.B., Kalbuana, N., Meiriki, A., & Sutarno (2021). Characteristic parameters of epoch deep learning to predict covid-19 data in Indonesia. Journal of Physics: Conference Series, 1933(1), 12050.

Iacus, S.M., Natale, F., Santamaria, C., Spyratos, S., & Vespe, M. (2020). Estimating and projecting air passenger traffic during the COVID-19 coronavirus outbreak and its socio-economic impact. Safety Science, 129, 104791.

Indrawati, M., Utari, W., Prasetyo, I., Rusdiyanto, & Kalbuana, N. (2021). Household business strategy during the covid 19 pandemic. Journal of Management Information and Decision Sciences, 24(1), 1–12.

Izzo, F., Tomnyuk, V., & Lombardo, R. (2021). 4.0 digital transition and human capital: Evidence from the Italian Fintech market. International Journal of Manpower.

Jannah, M., Fahlevi, M., Paulina, J., Nugroho, B.S., Purwanto, A., Subarkah, M.A., & Cahyono, Y. (2020). Effect of ISO 9001, ISO 45001 and ISO 14000 toward financial performance of Indonesian manufacturing. Systematic Reviews in Pharmacy, 11(10), 894–902.

Jyoti, G.B. (2021). Article ID: IJM_12_03_052 Cite this Article: Bidyut Jyoti Gogoi, Brand Performance in the COVID-19 Period. International Journal of Management (IJM), 12(3), 550–561.

Kalbuana, N., Prasetyo, B., Asih, P., Arnas, Y., Simbolon, S.L., Abdusshomad, A., & Mahdi, F.M. (2021). Earnings management is affected by firm size, leverage and roa: Evidence from Indonesia. Academy of Strategic Management Journal, 20(2), 1–12.

Kalbuana, N., Suryati, A., Rusdiyanto, A.R.Y., & Hidayat, W. (2021). Interpretation of Sharia accounting practices in Indonesia. Journal of Legal, Ethical and Regulatory Issues, 24(1), 1–12.

Knewtson, H.S., & Rosenbaum, Z.A. (2020). Toward understanding FinTech and its industry. Managerial Finance, 46(8), 1043–1060.

Livianto, F.P. (2018). The influence of perceived usefulness and perceived ease of use on the desire of individual taxpayers to use tax e-billing version 2. Journal of Business Accounting.

Loh, X.M., Lee, V.H., Tan, G.W.H., Ooi, K.B., & Dwivedi, Y.K. (2020). Switching from cash to mobile payment: What’s the hold-up?Internet Research, 31(1), 376–399.

Luh, N., Yolandari, D., Made, N., & Kusumadewi, W. (2018). The effect of customer experience and trust on online repurchase intentions through customer satisfaction (Study on the Berrybenka.com Online Site). Management E-Journal, 7(10), 5343–5378.

Luwihono, A., Suherman, B., Sembiring, D., Rasyid, S., Kalbuana, N., Saputro, R., & Rusdiyanto. (2021). Macroeconomic effect on stock price: Evidence from Indonesia. Accounting, 7(5), 1189–1202.

Miskam, S., Yaacob, A.M., & Rosman, R. (2019). Fintech and its impact on Islamic fund management in Malaysia: A legal viewpoint. Emerging Issues in Islamic Finance Law and Practice in Malaysia, 223–246.

Oladapo, I.A., Hamoudah, M.M., Alam, M.M., Olaopa, O.R., & Muda, R. (2021). Customers’ perceptions of FinTech adaptability in the Islamic banking sector: comparative study on Malaysia and Saudi Arabia. Journal of Modelling in Management.

Olivia, S., Gibson, J., & Nasrudin, R. (2020). Indonesia in the time of Covid-19. Bulletin of Indonesian Economic Studies, 56(2), 143–174.

Prabandari, K.D., & Yasa, N.N.K. (2018). The Role of Trust Mediates the Effect of Experience on Intention to Reuse JNE Services in Denpasar City. E-Journal of Management.

Prasetio, J.E., Sabihaini, Bintarto, B., Susanto, A.A., Rahmanda, G.A., Rusdiyanto, & Kalbuana, N. (2021). Corporate social responsibility community development and empowerment program in Indonesia. Journal of Management Information and Decision Sciences, 24(S1), 1–10.

Prasetyo, I., Aliyyah, N., Rusdiyanto, Kalbuana, N., & Rochman, A.S. (2021). Corporate social responsibility practices in Islamic studies in Indonesian. Journal of Legal, Ethical and Regulatory Issues, 24(1), 1–15.

Prasetyo, I., Aliyyah, N., Rusdiyanto, Nartasari, D.R., Nugroho, S., Rahmawati, Y., & Rochman, A.S. (2021a). Impact financial performance to stock prices: Evidence from Indonesia. Journal of Legal, Ethical and Regulatory Issues, 24(1), 1–11.

Prasetyo, I., Aliyyah, N., Rusdiyanto, R., Nartasari, D.R., Nugroho, S., Rahmawati, Y., & Rochman, A.S. (2021b). What affects audit delay in Indonesia?Academy of Entrepreneurship Journal, 27, 1–15.

Prasetyo, I., Aliyyah, N., Rusdiyanto, Suprapti, S., Kartika, C., Winarko, R., & Al-asqolaini, M.Z. (2021). Performance is affected by leadership and work culture: A case study from Indonesia. Academy of Strategic Management Journal, 20(2), 1–15.

Prasetyo, I., Aliyyah, N., Rusdiyanto, T.H., Kalbuana, N., & Rochman, A.S. (2021). Vocational training has an influence on employee career development: A case study Indonesia. Academy of Strategic Management Journal, 20(2), 1–14.

Prasetyo, I., Aliyyah, N., Rusdiyanto, Utari, W., Suprapti, S., Kartika, C., & Kalbuana, N. (2021). Effects of organizational communication climate and employee retention toward employee performance. Journal of Legal, Ethical and Regulatory Issues, 24(1), 1–11.

Pratama, A.B., & Suputra, I.D.G.D. (2019). The effect of perceived benefits, perceived ease of use, and level of trust on interest in using electronic money. E-Journal of Accounting.

Priambodo, S., & Prabawani, B. (2016). The influence of perceived benefits, perceived ease of use, and perceived risk on interest in using electronic money services. Journal of Business Administration Science.

Rithmaya, C.L. (2016). The influence of ease of use, benefit, attitude, risk and service features on bank BCA customers' re-interest in using internet banking. Journal of Economic Research and Management.

Sangwan, V., Harshita, Prakash, P., & Singh, S. (2019). Financial technology: A review of extant literature. Studies in Economics and Finance, 37(1), 71–88.

Suryahadi, A., Al Izzati, R., & Suryadarma, D. (2020). Estimating the Impact of Covid-19 on Poverty in Indonesia.

Susanto, H., Prasetyo, I., Indrawati, T., Aliyyah, N., Rusdiyanto, Tjaraka, H., & Zainurrafiqi. (2021). The impacts of earnings volatility, net income and comprehensive income on share price: evidence from Indonesia stock exchange. Accounting, 7(5), 1009–1016.

The Economic Times. (2021). Definition of “E-wallets.

Troise, C., Matricano, D., Candelo, E., & Sorrentino, M. (2021). Entrepreneurship and fintech development: comparing reward and equity crowd funding. Measuring Business Excellence.

Undale, S., Kulkarni, A., & Patil, H. (2020). Perceived eWallet security: Impact of COVID-19 pandemic. Vilakshan - XIMB Journal of Management, 18(1), 89–104.

Utami, S.S., & Kusumawati, B. (2017). Factors influencing interest in using e-money. Balance.

Vinod, B. (2021). Airline revenue planning and the COVID-19 pandemic. Journal of Tourism Futures.

Wahyudin, A., Sari, M.P., Ardiansari, A., Raharja, S., & Kalbuana, N. (2021). Instrument design of small industry performance measurement in Semarang city with balanced scorecard concept. Academy of Accounting and Financial Studies Journal, 25(3), 1–9.

Widiyanti, W. (2020). The influence of usefulness, ease of use and promotion on decisions to use OVO E-wallet in Depok. Monetary. Journal of Accounting and Finance.

Xu, Y., Bao, H., Zhang, W., & Zhang, S. (2021). Which financial earmarking policy is more effective in promoting FinTech innovation and regulation? Industrial Management & Data Systems, ahead-of-print (ahead-of-print).

Yuliani, D.R.R.Y. (2020). The influence of perceived benefits, perceptions of ease, and perception of security on decisions to use E-Wallet on students of stie bank Bpd Central Java Yuliani. The influence of perceived benefits, perceptions of ease, and perception of security on decisions to Use E-W. STIE Bank BPD Central Java.

Received: 25-Nov-2021, Manuscript No. AEJ-21-8588; Editor assigned: 27-Nov-2021, PreQC No. AEJ-21-8588 (PQ); Reviewed: 13-Dec-2021, QC No. AEJ-21-8588; Revised: 18-Dec-2021, Manuscript No. AEJ-21-8588 (R); Published: 04-Jan-2022.