Research Article: 2020 Vol: 24 Issue: 1

Factors Affecting the Export Performance of the Food and Beverage Manufacturing Firms in Zimbabwe

Reinford Khumalo, University of Lusaka

Abstract

This paper investigates factors that improve the performance of exporting firms in the food and beverages manufacturing subsectors in Zimbabwe. The research developed and tested four models on the mediating effects of the export marketing mix strategy (the 4Ps), on the association between commitment to export, experience on the international market, promotion of exports and firm export performance. A mixed sequential approach using qualitative and quantitative techniques has been used by the researchers in collecting data for the study. A Partial Least Squares Structural Equation Modelling (PLS-SEM), and content analysis were used to analyse quantitative and qualitative data respectively. The research has confirmed a positive relationship between the 4Ps, experience in international markets, commitment to exporting with export performance. Management’s commitment to export, place, product and attractiveness of foreign markets have emerged as strong precursors for improvement in exporting by firms. The validated conceptual model makes significant contribution to theory the literature for export performance. The outcomes of this research offer recommendations to exporting firms, especially, those operating in emerging economies. For Zimbabwean exporters, distribution channel, and product adaptation are significant in developing exports on a sustainable basis.

Keywords

Adaptation, Export Commitment, Export-Marketing Mix Strategy, Export Performance, Foreign Market Attractiveness, International Trade, Zimbabwe.

Introduction

Globalisation of trade has induced an ever-increasing number of firms to engage in international operations (Mühlbacher et al., 2006; Leonidou & Katsikeas, 2010; Chang & Fang, 2015; Chen et al., 2016). Exporting is strategic because for firms to internationalise and is frequently used by firms (Morgan & Katsikeas, 1997; Zhao & Zou, 2002; Katsikea et al., 2007; Sousa et al., 2008), as it gives firms high levels of flexibility and requires minimal financial, human, and resource commitments when compared to other international entry modes (Leonidou, 1995; Sousa, 2004). Furthermore, exporting allows firms to acquire market knowledge, as it often requires them to compete in diverse and less familiar environments. Knowledge acquired through exporting can be applied not only in foreign markets, but also in the domestic market, thereby rendering firms more competitive (and, thus, more successful) abroad and at home.

As a result of several benefits that exporting can bring to firms and nations, over the last six decades, a number of researchers have devoted their research efforts to the identification of the variables that affect the export performance of firms. However, and despite notable progress in the recognition of the drivers of export performance of firms, knowledge on this topic is still limited and literature on the export performance frequently yields inconsistent results (Sousa et al., 2008). In this context, researchers have investigated the impact of a large variety of factors on export performance, including industry antecedents (Ito & Pucik, 1993; Das, 1994), environmental factors (Cavusgil & Zou, 1994; Cadogan et al., 2012), and organisational antecedents (Cadogan et al., 2012; Morgan et al., 2012). Among the factors just outlined, organisational variables are the ones which have been more often examined by researchers. This is grounded on the fact that organisational predictors are more under the control of the firms. As such, organisational factors can potentially be used by firms to shape their levels of export success.

The literature on export performance generally lacks a comprehensive theory base and remains fragmented to this day. This fragmented and lack of a general theory originates in (i) numerous studies that adopt inconsistent methodological and analytical approaches (ii) substantial number of determinants of export performance, and (iii) contradicting and confusing findings on the implications of the different determinants of export performance (Sousa et al., 2008). Madsen (1987) and Chetty & Hamilton (1993) and Zou & Stan (1998) and Katsikeas et al. (2000) and Sousa et al. (2008) and Zou et al. (2009), have all contributed with noteworthy efforts to standardise the export performance literature through traditional literature reviews and hybrid approaches, which combine vote-counts with narrative reviews, to reveal discrepancies in the literature.

The performance and growth of exports, has throughout the world, been of great interest to among others, economists, entrepreneurs, managers, governments, financial institutions, and non-governmental organisations, (Baker, 1992). Globally, exports are being highly regarded for the pivotal role in promoting grassroots economic growth, and equitable sustainable development. Zimbabwean manufacturing companies have been facing and are still facing serious competition from foreign products. This cut-throat competition seems to be intensifying and fuelled by the enhanced globalisation agenda, with regional integration also proving to be the hallmark of the new global economic architecture.

A typical example is the COMESA bloc whose envisaged migration from being a Free Trade Area (FTA) to becoming a Customs Union (CU) results in duties being significantly lowered down, while other non-tariff barriers are also being abolished. Against this backdrop, the Zimbabwe manufacturing sector has struggled for quality and competitiveness. The ripple effect of this scenario has meant that the country’s exports have remained very depressed and a negative trade balance has been experienced for some time now (Reserve Bank of Zimbabwe, 2016a).

The Reserve Bank of Zimbabwe (2015) pointed out that the liquidity crunch that has been negatively affecting the Zimbabwe economy for the past decade, requires that exports be enhanced or improved, since exports remained the chief source of financial liquidity. The manufacturing sector is very critical to economic growth, prosperity and higher standard of living. Part of the reason for that is its multiplier effect. More than any other sector in the economy, manufacturing creates the most wealth (Reserve Bank of Zimbabwe, 2016a). Manufacturing pays higher wages and provides greater benefits, on average, than other industries. It performs almost two-thirds of private sector research and development, creates the highest number of jobs to support the industry while serving the surrounding communities, and contributes to around 8 percent of Zimbabwe’s total exports (Reserve Bank of Zimbabwe, 2017).

Statement of the Problem

Given the importance of exporting, an array of international research has focused on understanding the factors that determine successful performance in exports. In particular, recent years have seen increasing attention being given to the identification and assessment of international business competencies that underpin export performance of firms (Knight & Kim, 2009; Kaleka, 2012; Chang & Fang, 2015; Chen et al., 2019). However, previous studies have not comprehensively examined major factors that affect performance of exporting firms.

Moreover, the majority of prior studies in this direction have focused on Western and advanced economies, hence, an understanding of the relationship between such competencies and export performance in the developing economies’ context is still lacking (Boso et al., 2016). Considerable evidence from prior studies points to differences between advanced and developing economies in factors important for export. More importantly, exporting firms operating from developing economies have to manage multiple export market challenges, such as resource constraints (Tesfom & Lutz, 2006; Boso et al., 2016), little international experience (Gries & Naudé, 2010), lack of marketing knowledge and information (Tesfom & Lutz, 2006), complex regulatory system and underdeveloped institutions and structures supporting international operations (Bell et al., 2004; Boso et al., 2016), and significant tariff and non-tariff barriers applied to their manufactured exports (Korneliussen & Blasius, 2008). Given these differences, more studies and data are needed from the context of developing economies to broaden knowledge on the subject (Okpara, 2009; Boso et al., 2016). This study, therefore, generates a better understanding through step-by-step disentangling of the complex relationship between managerial characteristics, export marketing mix strategies and export performance in a developing economy context, such as Zimbabwe.

The manufacturing sector in Zimbabwe has over the last decade suffered from the economic downturn, which the country experienced. Its contribution to total exports has remained extremely low over the years, averaging about US$50 million per year (Reserve Bank of Zimbabwe, 2017). Despite numerous Government and Reserve Bank of Zimbabwe efforts to encourage more exports, through various export oriented policies, and export incentive schemes, the annual contribution of the manufacturing sector to total exports remained subdued at around 8%, compared to mining sector at 54%, agriculture 30%, hunting 2%, and services 6% (Reserve Bank of Zimbabwe, 2017).

Firms that export are typically more productive, more skilled labour intensive and more capital intensive (Bernard et al., 2007, 2010, 2011; Wagner, 2007, 2012) and within the set of exporters, the more productive firms export more products to more destinations and export larger volumes to each market (Bernard et al., 2010; Karedza & Govender, 2016). It follows that as these characteristics improve, exports will rise accordingly. Encouraging improvements in the productivity of Zimbabwean manufacturing firms (i.e., reductions in inefficiency or increases in technology), or the quality of inputs they use (i.e., skilled labour, services such as design sales or support, components etc.) will therefore have an effect on the overall Zimbabwe exports.

Research Objectives

1. To determine the key factors that influence the export performance of the manufacturing firms in Zimbabwe;

2. To examine interceding effects of export-marketing mix strategy on the relationship between management’s commitment to export, experience on the international markets, programmes that promote exports, and export performance;

3. To examine the regulating (moderating) effect of the attractiveness of a foreign market on the relationship between the 4Ps), and export performance; and

4. To develop and test a mediating and moderating export performance model.

In order to contextualise the research objectives, the following hypotheses were developed: -

H1: Adaptation of the 4Ps (place, product, promotion, and price) positively enhances export performance;

H2: Management’s commitment to export enhances the adaption of the 4Ps;

H3: Programmes that promote exporting enhances the adaptation of the 4Ps;

H4: Experience with international markets enhances the adaptation of the 4Ps;

H5: The 4Ps enhances the relationship between export commitment and export performance;

H6: The 4Ps) regulate the relationship between Programmes that promote exporting and export performance;

H7: The 4Ps regulate the relationship between Experience with international markets and export performance; and

H8: The more the attractiveness of the foreign market, the stronger the relationship between the 4Ps and export performance.

Literature Review

Researchers seem to agree that export performance is a multidimensional construct. In this context, two broad categories of export performance are export sales performance and export profit performance (Zou et al., 1998; Cadogan et al., 2009; Morgan et al., 2012). Assessments of export performance using profit take into account costs and range across differing outcomes. The importance of export sales performance and export profit performance as two critical categories of export performance corresponds to the notion that organisational success can be classified into outcomes that take account for costs versus outcomes that place emphasis on revenues and that do not reflect costs (Homburg et al., 2011).

Most issues associated with the literature boils down to the lack of a sound theoretical basis and disagreement across studies on the appropriate measure of export performance and determinants thereof (Leonidou, 2003; Sousa et al., 2008). The majority literature completely neglects a coherent theoretical basis and formulate hypotheses without reference to theoretical arguments, while different conceptual definitions, classifications and measures of factors that affect export performance hinder the comparability of studies. This lack of theoretical guidance and inconsistent use of determinants are among the main causes of the conflicting empirical findings that reflects the literature (Zou & Stan, 1998; Sousa et al., 2008). The first attempts to research on export performance dates back to (Madsen, 1987; Aaby & Slater, 1989; Chetty & Hamilton, 1993). Aaby & Slater (1989) developed the first framework of casual relationships in their strategic export model, where the export performance was evaluated against management influences such as firm characteristics, competences and strategy. Chetty & Hamilton (1993) extended the strategic export model in a meta-analysis in an attempt to validate the findings of Aaby & Slater, 1989), but most of the results remained inconclusive. The main point of criticism is related to the inclusion of studies that investigated conceptually broader dimensions of export performance.

Despite the fact that export performance has been at the centre of interest in the study of export-marketing, the evaluation of conceptual underpinnings of export performance and its measures has largely been ignored (Katsikeas et al., 2000; Sousa et al., 2008). Indeed, there is little agreement in the literature about a conceptual definition of export performance, as well as about its operational definition (Shoham, 1998). In fact, most of the papers on export performance in the past did not even provide a conceptual definition of export performance (Sousa, 2004) and empirical efforts to explore this area are even less developed (Lages & Montgomery, 2005; Sousa et al., 2008).

A wide range of literature has been published on measurement of export performance and such studies are summarised in Table 1.

| Table 1: Export Performance Measurements | ||

| Export Performance Measure | Type | Researchers |

|---|---|---|

| Sales Growth and Intensity of exports | Objective (Unbiased) | Alvarez, 2004; Lages & Lages, 2004; Morgan et al., 2004; Lages et al., 2008b; Hultman et al., 2011; and Morgan et al., 2012. |

| Profitability or Increase in Market Share of exports | Objective (Unbiased) | Das, 1994; Moen, 1999; Lages & Lages, 2004; Morgan et al., 2004; Wong, 2004; Katsikeas et al., 2006; Hultman et al., 2011; and Morgan et al., 2012. |

| Strategic Goals Achievement | Subjective (Biased) | Cavusgil & Zou, 1994; Das, 1994; Styles, 1998; Zou et al., 1998; Francis & Collins-Dodd 2004 and Lages & Lages, 2004. |

| Management’s understanding of Export Success | Subjective (Biased) | Cavusgil & Zou, 1994; Evangelist, 1994; Katsikeas et al., 1996; and Wilkinson & Brouthers, 2006. |

| Export Performance Satisfaction | Subjective (Biased) | Jap, 2002; Lages et al., 2008a; and Lages & Montgomery, 2004 |

| Combination of Measurements | Subjective (Biased) | Zou et al., 1998; Katsikeas et al., 2000; Shoham 2002; O’Cass & Julian 2003; Morgan et al., 2004 and Sousa & Bradley, 2008. |

Conceptual Framework And Hypotheses Development

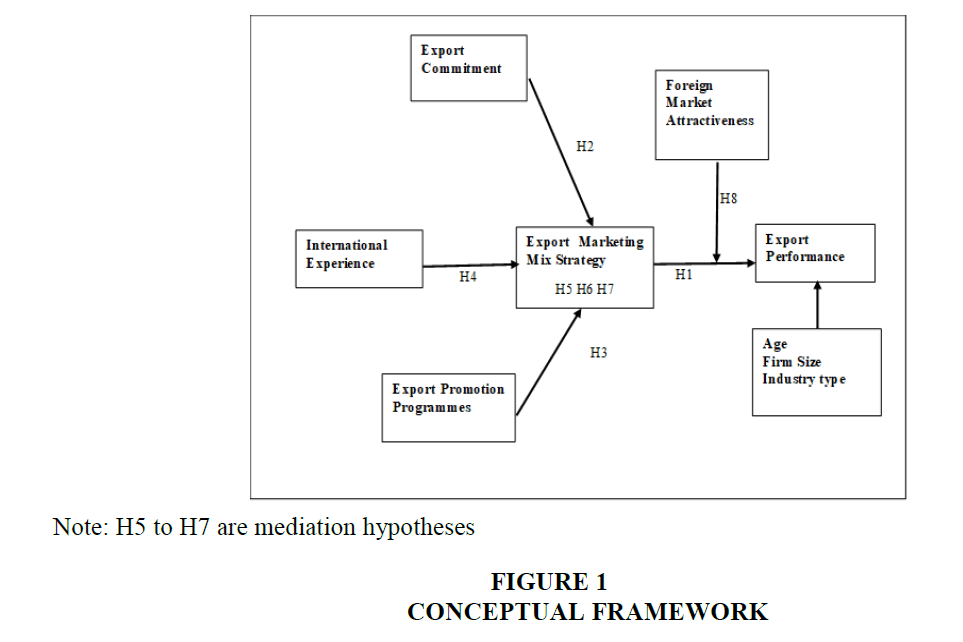

Figure 1 shows the independent, interceding, and regulating variables on the relationship with export performance (dependent variable). The controls variables are firm size, age and type of industry.

Table 2 shows expected outcomes of the hypotheses

| Table 2: Hypotheses And Export Performance | ||

| Hypothesis | Explanatory Latent Variable | Expected Outcome |

|---|---|---|

| H1: | 4Ps (place, product, promotion, and price)/export performance | (+) |

| H2: | Management’s commitment to export/adaption of the 4Ps | (+) |

| H3: | Programmes that promote exporting and adaptation of the 4Ps | (+) |

| H4: | Experience with international markets and the adaptation of the 4Ps | (+) |

| H5: | The 4Ps enhances the relationship between export commitment and export performance; | (+) |

| H6: | The 4Ps) regulate the relationship between Programmes that promote exporting and export performance; | (+) |

| H7: | The 4Ps regulate the relationship between Experience with international markets and export performance | (+) |

| H8: | The more the attractiveness of the foreign market, the stronger the relationship between the 4Ps and export performance. | (+) |

Research Methodology

An explorative sequential mixed method was used in order to determine the socio-economic factors that enhance export performance of the food and beverage manufacturing firms. For this purpose, a semi-structured interview (qualitative method) and a questionnaire (quantitative method) were used to collect data. Data has been connected in that the results of the qualitative was used to develop a measurement instrument, namely a questionnaire (quantitative method). In this way, an attempt has also been made to ensure triangulation of data.

For this study, the researchers chose key informants based on their employment positions in the 100 food and beverage manufacturing and exporting firms in the year 2018. The Reserve Bank of Zimbabwe exporter’s database has been used because the Central Bank keeps an up-to-date database of all exporters in Zimbabwe. The population for the qualitative phase comprised of chief executive officers, managing directors, general managers and owners of the firms. The population of the qualitative research study consisted of a non-probability, purposive selection of 91 exporting firms in six major cities namely; Harare, Bulawayo, Mutare, Gweru, Kwekwe and Chitunwgiza. A total of 91% of the firms are concentrated in these six major cities.

Data Collection

In order to eliminate selection bias, a web-based ‘random number generator’ has been used to select 22 key informants from the 91 food and beverage manufacturing firms.

Table 3 shows distribution of target population and samples drawn for the qualitative interviews.

| Table 3: Distribution Of Target Population Of The Key Informants | ||||||

| Location | Food Manufacturing Firms | Beverages Manufacturing Firms | ||||

|---|---|---|---|---|---|---|

| Target Population | Sample Drawn Randomly | No. of Qualitative Interviews Conducted | Target Population | Sample Drawn Randomly | No. of Qualitative Interviews Conducted | |

| Harare | 31 | 6 | 5 | 8 | 3 | 2 |

| Bulawayo | 19 | 3 | 2 | 4 | 1 | 1 |

| Gweru | 8 | 2 | 2 | 2 | 1 | 1 |

| Mutare | 7 | 1 | 1 | 2 | 1 | 1 |

| Kwekwe | 4 | 1 | 1 | 1 | 1 | 1 |

| Chitungwiza | 4 | 1 | 1 | 1 | 1 | 0 |

| 73 | 14 | 12 | 18 | 8 | 6 | |

| Chinhoyi | 2 | 0 | 0 | 0 | 0 | 0 |

| Bindura | 2 | 0 | 0 | 0 | 0 | 0 |

| Chipinge | 0 | 0 | 0 | 1 | 0 | 0 |

| Beitbridge | 1 | 0 | 0 | 1 | 0 | 0 |

| Masvingo | 1 | 0 | 0 | 1 | 0 | 0 |

| Total | 79 | 14 | 12 | 21 | 8 | 6 |

A combination of the ‘deliver and collect’ technique and the use of email services has been appropriate for primary data collection due to lack of up-to-date email directory and the spread of respondents across the major cities in Zimbabwe (Ibeh, 2004; Brock & Zhou, 2004; Crick et al., 2011).

After screening the completed questionnaires, 1 was declared unusable due to more than 15% missing values, leaving a total of 49 questionnaires for analysis (Hair et al., 2012). The study achieved a response rate of 81.7%. The sample size requirements to detect R2 values of 0.10 to 0.50 based on the number of arrows pointing to the endogenous variable in PLS-SEM analysis, was met (Hair et al., 2014a).

Findings

Table 4 shows that a greater proportion of the respondents (94.8 %) indicated that they were agreeable that the listed factors have positive effect on export performance of the firms. Only about 1.3% disagreed and 3.9% were undecided.

| Table 4: Responses On Factors That Affect The Export Performance Of The Food And Beverage Manufacturing Firms | |||||

| Factors | Number of Respondents | ||||

|---|---|---|---|---|---|

| Strongly Disagree | Disagree | Undecided | Agree | Strongly Agree | |

| Access to affordable working capital | 0 | 0 | 0 | 8 | 41 |

| Availability of efficient production technology | 0 | 0 | 1 | 3 | 45 |

| Availability of export incentives | 0 | 0 | 0 | 2 | 47 |

| Competitive pricing of goods | 0 | 1 | 2 | 10 | 36 |

| Depreciated exchange rate for the local currency | 1 | 2 | 1 | 14 | 31 |

| Ease of doing export business | 0 | 0 | 0 | 34 | 15 |

| Export committed management | 0 | 0 | 1 | 22 | 26 |

| Export marketing mix strategy | 0 | 0 | 3 | 13 | 33 |

| Foreign market attractiveness | 0 | 0 | 0 | 5 | 44 |

| Good distribution network | 0 | 3 | 1 | 7 | 38 |

| Good knowledge of the foreign market | 0 | 0 | 1 | 19 | 29 |

| High capacity utilisation | 4 | 3 | 10 | 14 | 18 |

| High demand for the products | 0 | 0 | 0 | 20 | 29 |

| High productivity | 0 | 0 | 2 | 23 | 24 |

| High quality inputs | 0 | 0 | 0 | 24 | 25 |

| High quality of goods produced | 0 | 0 | 1 | 34 | 14 |

| Large scale operation (firm size) | 0 | 1 | 11 | 20 | 17 |

| Low export market competition | 0 | 0 | 5 | 19 | 25 |

| Low production costs (competitiveness) | 0 | 0 | 1 | 22 | 26 |

| Low tariffs (by importing country) | 0 | 0 | 3 | 25 | 21 |

| Low tax regime | 0 | 0 | 1 | 17 | 31 |

| Low threats of substitutes | 0 | 0 | 5 | 33 | 11 |

| Management perception toward export | 0 | 0 | 0 | 35 | 14 |

| Mature firm (age) | 0 | 0 | 3 | 32 | 14 |

| No trade restrictions (e.g., permit requirements etc) | 0 | 0 | 2 | 20 | 27 |

| Profitable export sales | 0 | 2 | 1 | 24 | 22 |

| Reduced or no export barriers | 0 | 0 | 2 | 22 | 25 |

| Reliable supply of inputs | 0 | 0 | 0 | 23 | 26 |

| Reliable transportation system (road, air & Rail) | 0 | 0 | 0 | 20 | 29 |

| Skilled labour force | 0 | 0 | 1 | 24 | 24 |

| Stable political environment | 0 | 2 | 1 | 22 | 24 |

| Well established research and development | 0 | 1 | 2 | 27 | 19 |

| Total Number of Responses | 5 | 15 | 61 | 637 | 850 |

| Proportion (%) | 0.3 | 1.0 | 3.9 | 40.6 | 54.2 |

Analysis

Unlike other structural equations modelling techniques such as LISREL, AMOS, and EQS, Partial Least Squares (PLS) does not need to satisfy assumptions like multivariate normality and independence of observations (Chin & Newsted, 1999; Chin, 2010). PLS combines regression, path analysis and principal components analysis, and avoids the problems of factor indeterminacy and inadmissible (Fornell et al., 1990; Buchan, 2005). Other structural equations modelling techniques such as LISREL, require a minimum sample of 150 (Anderson & Gerbing, 1998; Chin & Newsted, 1999), whereas PLS requires only a minimum number of 30 cases. In line with the reasons cites above, the researcher decided to use PLS for testing the model. The two stage procedure followed by MacMillan et al. (2005) has been adopted to carry out the analysis.

Reliability and Validity

Reliability has been assessed in two different ways. Firstly, the magnitudes of the factor loadings corresponding to each construct have been examined. Fornell & Larcker (1981), recommend a loading of 0.70 for each item on the constructed factor, but 0.50 is often used in factor analysis. The convergent validity has been assessed by examining the average variance extracted (AVE) for each of the factors. The AVE is the average shared between a construct and its measure, and Fornell & Larcker (1981) suggested a minimum of 0.50. For assessment of the discriminant validity, the AVE values were plotted on the diagonal and the squares of correlations as off-diagonal items. If the amounts shown in the off-diagonals are less than the diagonals, then the measures have discriminant validity.

Testing the Structural Model

At this stage of the analysis, the R2 values were examined to assess the predictive ability of the model. For assessing the R2 values, the guidelines provided by Hair et al. (2006) have been used. Subsequently, the path coefficients are examined and their structural significance has been assessed.

Model estimation and measurement

The measurement model and significance values are shown in Table 5.

| Table 5: The Measurement Model And The Significance Values | ||||

| Latent Variable(s) | Performance Indicators | F: Loadings | Standard Error | T Statistics |

|---|---|---|---|---|

| Performance (Export) α=0.93, Pc=0.94, AVE=0.75 |

Sales volume. Export market share. Export market profitability. Return on investment. Export sales intensity. |

0.847 0.885 0.914 0.811 0.891 |

0.034 0.023 0.015 0.057 0.024 |

24.90*** 38.43*** 61.25*** 14.20*** 37.11*** |

| Place α=0.83, Pc=0.89, AVE=0.68 |

Selection criteria Transport strategy. Distribution budget. Type of middlemen. |

0.775 0.842 0.890 0.801 |

0.061 0.057 0.023 0.046 |

12.79*** 14.78*** 38.14*** 17.52*** |

| Product α=0.88, Pc=0.91, AVE=0.68 |

Product design. Variety. Product quality. Features and characteristics. Packaging. |

0.729 0.820 0.891 0.836 0.870 |

0.085 0.062 0.030 0.044 0.038 |

8.55*** 13.26*** 23.06*** 18.83*** 22.06*** |

| Promotion α=0.82, Pc=0.88, AVE=0.63 |

Channels for adverts. Promotion objectives. Budget for promotion Direct marketing. |

0.761 0.846 0.834 0.782 |

0.062 0.041 0.046 0.053 |

12.36*** 20.48*** 17.98*** 14.75*** |

| Price α=0.70, Pc=0.79, AVE=0.57 |

Determination of price strategy. Price discount policy. Price margins. |

0.586 0.813 0.843 |

0.228 0.186 0.160 |

2.70*** 4.30*** 5.30*** |

| Commitment (Export) α=0.72, Pc=0.78, AVE=0.54 |

Frequent travels to foreign markets. Adequate funds set aside to develop export markets. Exporting is priority |

0.750 0.755 0.701 |

0.071 0.061 0.138 |

10.62*** 12.46*** 5.13*** |

| Programmes for Promoting Exports α=0.91, Pc=0.93, AVE=0.75 |

Attending Seminars. Conducting Training Providing export advice Export publications. |

0.869 0.885 0.887 0.873 0.817 |

0.025 0.027 0.031 0.028 0.048 |

34.25*** 33.36*** 28.43*** 31.13*** 17.02*** |

| Management’s Experience on international markets α=0.77, Pc=0.86, AVE=0.68 |

Professional experience. Attendance of formal courses Follow up on trade deals Many foreign markets |

0.680 0.690 0.820 0.871 |

0.064 0.096 0.046 0.022 |

10.55*** 7.18*** 17.91*** 35.95*** |

| Attractiveness of Foreign Market α=0.84, Pc=0.89, AVE=0.67 |

Potential demand Education of consumers Level of industrial development. Rules and Regulations |

0.814 0.832 0.837 0.891 |

0.045 0.034 0.035 0.043 |

17.65*** 28.18*** 24.30*** 21.13*** |

Notes: ***=0.001, α = Cronbach’s alpha, Pc = Composite Reliability, AVE = Average variance extracted.

| Table 6: Discriminant Validity | ||||||||||||

| Fornell-Larcker Criterion | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Age | EPP | ExpComt | ExPerf | FMA | Fsize | Industry | InExp | Place | Price | Product | Promotion | |

| Age | 1.000 | |||||||||||

| EPP | 0.039 | 0.866 | ||||||||||

| ExpComt | 0.298 | 0.410 | 0.736 | |||||||||

| ExPerf | 0.089 | 0.284 | 0.419 | 0.870 | ||||||||

| FMA | 0.194 | 0.377 | 0.488 | 0.600 | 0.824 | |||||||

| Fsize | 0.475 | 0.069 | 0.432 | 0.262 | 0.217 | 1.000 | ||||||

| Industry | 0.110 | 0.147 | 0.102 | 0.005 | 0.018 | 0.225 | 1.000 | |||||

| InExp | 0.400 | 0.435 | 0.492 | 0.286 | 0.237 | 0.350 | 0.075 | 0.770 | ||||

| Place | 0.036 | 0.335 | 0.322 | 0.393 | 0.351 | 0.183 | 0.029 | 0.140 | 0.828 | |||

| Price | 0.244 | 0.151 | 0.228 | 0.125 | 0.157 | 0.143 | 0.238 | 0.216 | 0.297 | 0.756 | ||

| Product | 0.194 | 0.251 | 0.383 | 0.249 | 0.383 | 0.184 | 0.173 | 0.170 | 0.201 | 0.404 | 0.831 | |

| Promotion | 0.056 | 0.216 | 0.313 | 0.114 | 0.046 | 0.262 | 0.091 | 0.435 | 0.234 | 0.226 | 0.118 | 0.806 |

All item loadings are greater than 0.58 with most of them exceeding 0.708 with significance at the p<0.001 level (Haenlein & Andreas 2004; Hair et al., 2014a). There has been no collinearity issues with constructs in the structural model (Sarstedt et al., 2014). The measurement model has been confirmed to be used to assess the structural model and test path analysis in the research hypothesis (Hair et al., 2012).

Discriminant validity was assessed using the Fornell-Larker criterion which compares the squares root of the AVE values with the latent variable correlations (Martin & Méjean, 2011). The results exhibit no evidence of strong correlations between constructs.

| Table 7: Results Of The Pls-Sem Analysis | |||||||

| Hypo. | Variables | Expected Result | Place | Product | Promotion | Price | Decision |

|---|---|---|---|---|---|---|---|

| H1 | 4Ps/EP | (+) | (+)*** | (+)*** | (-) ns | (-) ns | 2 supported |

| H2 | EC/4Ps | (+) | (+)*** | (+)*** | (+)*** | (+)*** | Supported |

| H3 | EPP/4Ps | (+) | (+)*** | (+) ns | (+) ns | (+) ns | 1 supported |

| H4 | IE/4Ps | (+) | (-) ns | (-) ns | (+)*** | (-) ns | 1 supported |

| Interceding (Mediation) | |||||||

| H5 | EC→4Ps→EP | (+) | (+)** | (+)** | (+) ns | (+) ns | 2 supported |

| H6 | EPP→4Ps→EP | (+) | (+)** | (-) ns | (-) ns | (-) ns | 1 supported |

| H7 | IE→4Ps→EP | (+) | (-) ns | (-) ns | (-) ns | (-) ns | Not supported |

| Regulation (Moderation) |

|||||||

| H8 | FMA via 4Ps and EP | (+) | (+)*** | (+)*** | (+)** | (+) ns | 3 supported |

Tables 8 summarises the characteristics of exporting firms in Zimbabwe.

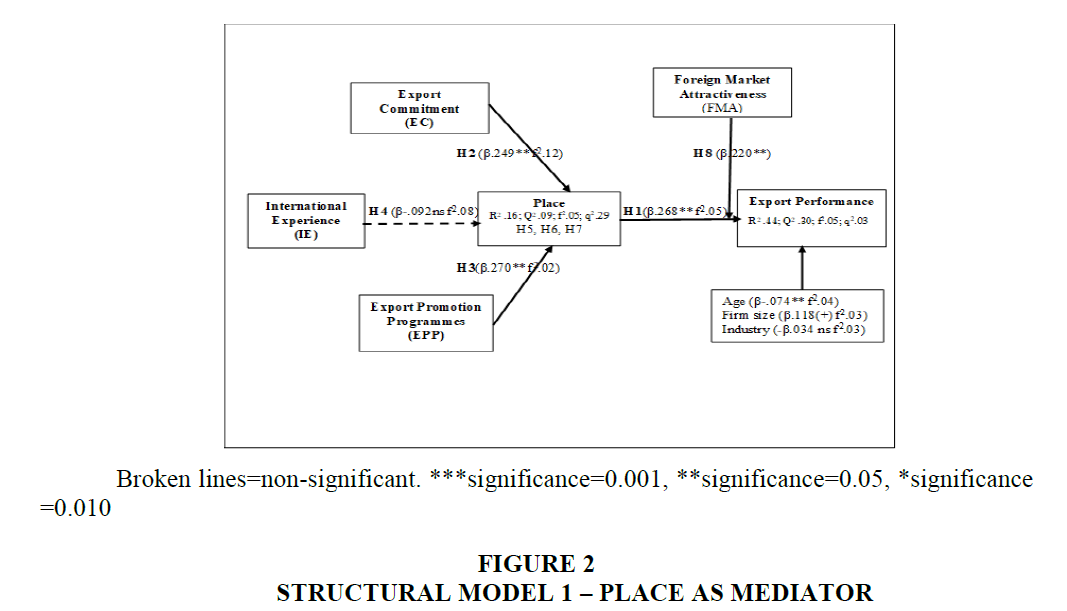

Structural Model 1 – Place as mediator

Figure 2 shows the results of the path analysis and significance level. The value of the mean average variance accounted (AVA) is 0.25 (R2) and R2 is greater than 0.10 (Falk & Miller 1992). Place explained a total of 44% of variance of Export Performance. Commitment to Export explained a total of 20% of the variance of Place and Export Performance. Programmes for Promoting Exports (EPP) explained a total of 19% of Place and Export Performance. The Q2 values range from (EC=0.08; EPP=0.14; Place=0.09; EP=0.30) which are above acceptable levels (Hair et al., 2014a). The f2 values range from 0.02 to 0.26. Place recorded an interceding effect of 0.29 on Export Performance. Place significantly affects Export Performance (EP) at (p= 0.009, t=2.60).

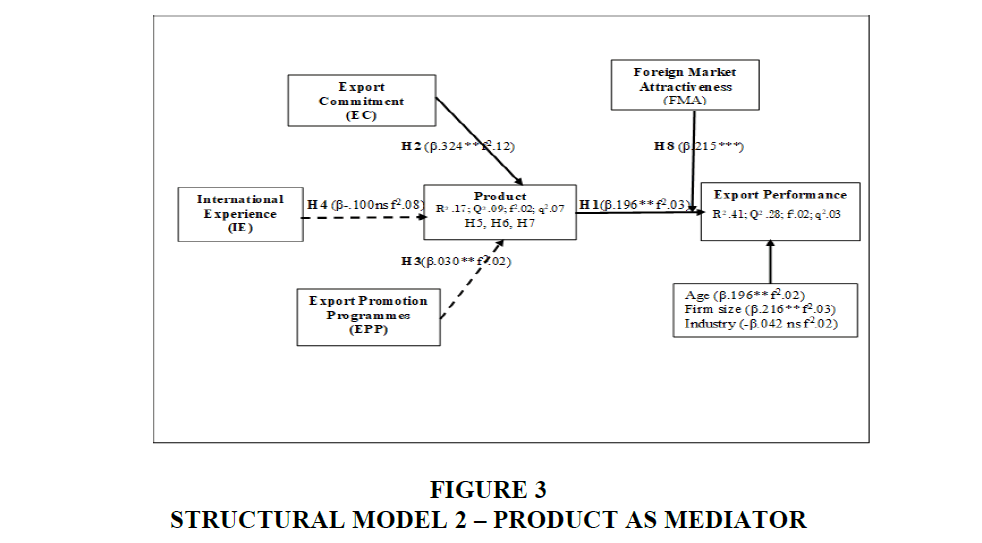

Structural Model 2 – Product as Mediator

Figure 3 shows the results of the path analysis and significance level. The value of the mean average variance accounted (AVA) is 0.25 (R2) and R2 is greater than 0.10 (Falk & Miller, 1992). The Q2 values range from (EC=0.08; EPP=0.14; EP=0.28) which are above acceptable levels (Hair et al., 2014a). The f2 values range from 0.02 to 0.26. Product recorded an interceding effect of 0.26 on Export Performance. Product significantly affects Export Performance (EP) at (p= .009, t=2.60).

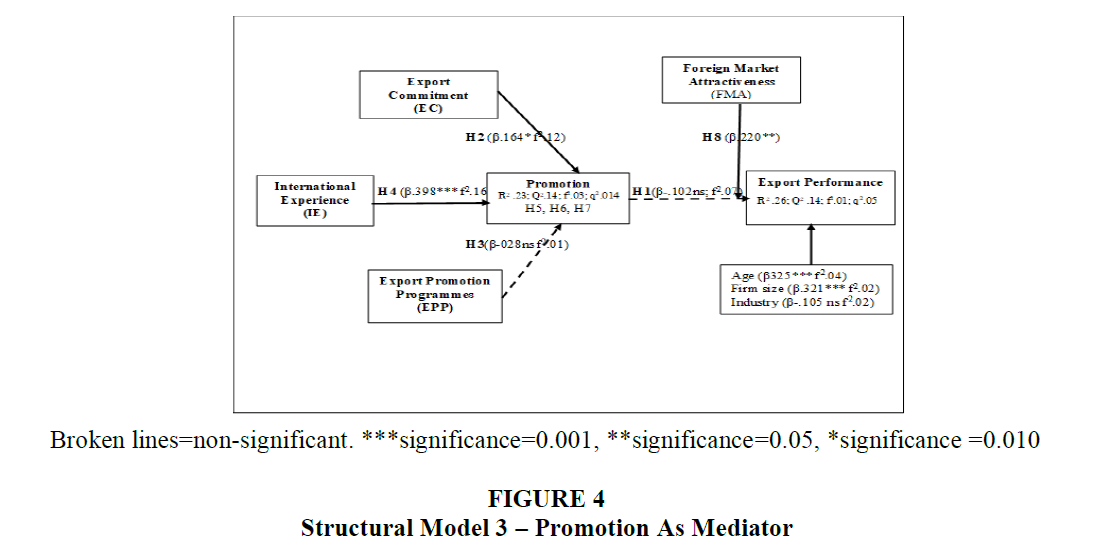

Structural Model 3 – Promotion as Mediator

Figure 4 shows the results of the path analysis and significance level. The value of the mean average variance accounted (AVA) is 0.26 (R2) and R2 is greater than 0.10 (Falk & Miller 1992). The Q2 values range from (EC=0.08; EPP=0.14; EP=0.140 which are above acceptable levels (Hair, Hult, Ringle & Sarstedt 2014a). The f2 values range from 0.02 to 0.26. Product recorded an interceding effect of 0.26 on Export Performance. Promotion insignificantly affects Export Performance (EP) at (p=0.009, t=2.60).

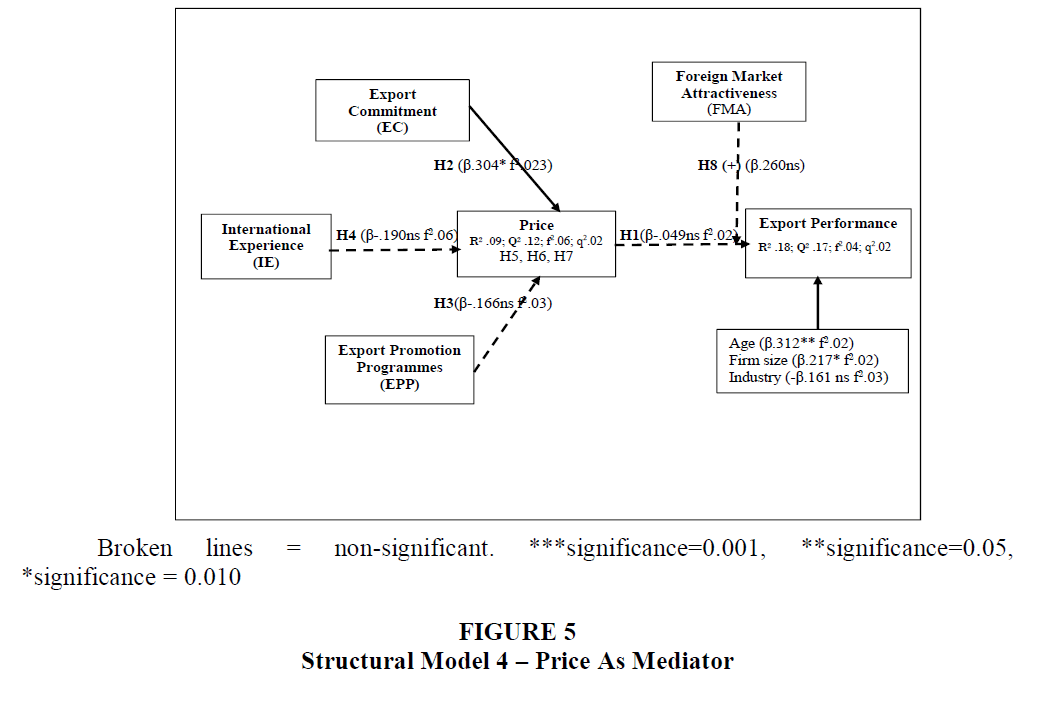

Structural Model 4 – Price as Mediator

Figure 5 shows the results of the path analysis and significance level. The value of the mean average variance accounted (AVA) is 0.09 (R2) and R2 is less than 0.10 (Falk & Miller 1992). The Q2 values range from (EC=0.31; EPP=0.17; Price=0.012; EP=0.17). The f2 values range from 0.02 to 0.26. Price recorded an interceding effect of 0.17 on Export Performance. Price insignificantly affects Export Performance (EP) at (p= 0.916, t=0.497).

Results of the PLS-SEM Analysis

As shown in Table 7 (the results of the PLS-SEM Analysis and decisions), place and product have positive and significant impact on export performance of the food and beverage manufacturing firms in Zimbabwe.

| Table 8: Characteristics Of Zimbabwean Exporting Firms | ||||

| Place Adaption | Product Adaption |

Promotion Adaption |

Price Adaption | People |

|---|---|---|---|---|

| • Poor transport infrastructure • Logistics barriers • Extensive use of Agents or middlemen as compared to direct distribution • Firms mostly located near major trunk road and rail | • Low product quality • Packaging needs to meet international standards • Less differentiated • Limited product modification, product design and style, and packaging | • Zimtrade (export promotion agency) lacks capacity • Trade shows and exhibitions not prioritised • No training and development programmes • Rely mostly on other forms of promotion such as export of samples | • Uncompetitive prices • Lack of access to affordable finance • Pricing policies not responsive to the fluctuation, price reductions. • Pricing mechanism based on cost of production | • Unsupportive business environment • High technical skills • Lack of international experience • Limited export commitment • Limited cultural adaptation • Limited export initiatives • Lack of financial resources, allocation of resources and export investment. |

Discussion

Price and Export Performance recorded non-significant results which supports the theoretical evidence of a negative relationship existing between the two variables. Of the 4Ps, place (distribution) and product are the most adapted export-marketing mix strategies by the food and beverage manufacturing firms in Zimbabwe, and promotion and price are the least adapted. The qualitative interviews have produced the same results as those of the quantitative interviews.

With regards to other factors that affect export performance, the qualitative results show that functional, marketing, and logistical barriers and lack of funding are common problems associated with exporting in Zimbabwe. The fast track land reform programme, poor quality farm produce, unnecessary bureaucracy, lack of aligned workforce, and late delivery of export orders, have been linked to functional barriers.

Control variables, namely, firm size and age of the firm have produced positive results with export performance. Type of industry has shown results in which depict non-significant relationship with the export performance. Table 9 shows quantitative and qualitative results of the study.

| Table 9: Quantitative & Qualitative Results Of The Studies | ||

| Theme | Quantitative | Qualitative |

|---|---|---|

| Export Performance Determinants | ||

| The 4 Ps | ||

| Place (Distribution) | Significant (+) | Supported |

| Product | Significant (+) | Supported |

| Promotion | Non-significant (-) | Not Supported |

| Price | Non-significant (-) | Not Supported |

| Export Commitment | Significant (+) | Supported |

| Programmes to Promote Exports | Non-significant (+) | Supported |

| International Experience | Non-significant (+) | Not Supported |

| Foreign Market Attractiveness | Significant (+) | Supported |

| Interceding (Mediation) Effect | ||

| EC→4Ps→EP | Place & Product significant (+) | not applicable |

| EPP→4Ps→EP | Place significant (+) | not applicable |

| IE→4Ps→EP | 4Ps non-significant (-) | not applicable |

| Regulation (Moderation) Effect | ||

| FMA - 4Ps and EP | Place, Product & Promotion significant (+) | not applicable |

| Other Factors | ||

| Initiation of Exports | not applicable | Supported |

| Firm location | not applicable | Supported |

| Common challenges | not applicable | Supported |

| Measurement of EP | ||

| Subjective measures | Subjective | Supported |

| Objective measures | not applicable | Not supported |

The role of Innovation and Technology on Enhancing Export Performance

The study revealed that innovation and technology play a critical role in export development, and contribute significantly to value addition of Zimbabwe exports. The results show that technology has a positive relationship with export performance. This corroborates with other studies (Sanyal, 2004; Montobbio & Rampa, 2005; Zengin, 2014) that were carried out in some developing countries.

Bi-lateral Trade Agreements and Export Performance

A limited and less significant number of respondents cited trade agreements as enhancers of exports in the manufacturing sectors. However, the respondents indicated that once technology has been improved so as to enhance product quality, trade agreements would be necessary for facilitation of trade. The study established that the share of manufactured products in total exports present a negative effect on total value of bi-lateral exports which implies that the demand for manufactured products is low due to competition or change in consumer preferences in the importing country.

The Effect of Credit and Export Performance

The results advocate that access to affordable bank financing has a positive and significant effect on the manufacturing firm’s export performance. The results suggest that access to affordable credit increases the firm’s export revenue. The capacity of the firm to increase production and increase the market reach is significantly enhanced.

Our results further provide evidence that access to finance by manufacturing firms have positive effect on the overall firm performance. An enhanced financial muscle most strongly support the entry of less well-endowed firms into foreign markets and substantially sustain exports into that market. Increased export performance by manufacturing firms has positive ripple effects on job creation, value added exports as well as productivity.

Conclusion

The study has identified a number of factors that affect the export performance of the food and beverage manufacturing firms such as firm characteristics factors (firm size, management perception toward export, firm export experience, firm strategy and commitment); firm competency factors (technology, marketing knowledge, foreign market knowledge and international performance; adequacy of infrastructure; labour cost and labour skill; economic factors (economic growth, economic policy, inflation, exchange rate); market factors (market attractiveness, market competitiveness and market structures); contextual environment factors (trade barriers, cultural differences - cultural distance); physical distance; export initiation; and location of the firm.

The commitment to export, place and product adaptation and foreign market attractiveness have emerged as key success factors for the Zimbabwean firms to enhance their exports. The research has shown that place (distribution) and products have been significantly adapted, which reiterates the relevance of adaptation strategies on enhancing export performance (Leonidou et al., 2002). Thus, research contributes to the literature by validating two of the adaptation forces (place and product) in a model focusing on emerging country context in Africa. This study reveals the reasons behind the mixed findings of the effect of the management experience of the international export markets on the export performance.

Recommendation

In order to enhance the export performance of the manufacturing firms in less economically developed countries, the following managerial and policy implications are apparent from the study:

1. Manufacturing firms should have access to affordable working capital for successful exporting endeavours;

2. The management of the manufacturing firms should have good knowledge of the foreign markets, not only in terms of the consumer preferences, but also in terms of the existing market regulations and requirements;

3. Manufacturing firms should invest in export skills development activities for their personnel, and in product research and development;

4. The Governments should actively create conducive business working environments for their nations, so as to ensure that the ease of doing export business is upgraded and sustained; and

5. The Governments should ensure that their nations have reliable transportation system (road, air, rail and/or water) so that the exporting firms become competitive and continue generating the much needed foreign exchange.

References

- Aaby, N.E., & Slater, S.F. (1989). Management influences on export performance: A review of the empirical literature 1978-88, International Marketing Review, 6(4), 7-26, viewed 9 June 2019, http://www.emeraldinsight.com/doi/abs/10.1108/EUM0000000001516.PDF.

- Alvarez, R. (2004). Sources of export in small and medium-sized enterprises: the impact of public programmes, International Business Review, 13(3), 383-400.

- Anderson, J., & Gerbing, D. (1998). Structural Equation Modeling in Practice: A review and recommended two-step approach’, Psychological Bulletin, 103(May), 411-423.

- Bell, J., Crick, D., & Young, S. (2004). Small firm internationalization and business strategy an exploratory study of ‘knowledge-intensive’ and ‘traditional’ manufacturing firms in the UK’, International Small Business Journal, 22(1), 23-56.

- Bernard, A.B., Jensen, B., & Schott, P.K. (2007). Firms in international trade, Journal of Economic Perspectives, 21(3), 105-130.

- Bernard, A.B., Jensen, B., & Schott, P.K. (2010). Multiple-product firms and product switching. American Economic Review, 100(1), 70-97.

- Bernard, A.B., Jensen, B., & Schott, P.K. (2011). Multi-product firms and trade liberalisation. Quarterly Journal of Economics, 126, 1271-1318.

- Boso, N., Oghazi, P., Cadogan, J.W., & Story, V. (2016). Entrepreneurial and market oriented activities, financial capital, environment turbulence, and export performance in an emerging economy, Journal of Small Business Strategy, 26(1), 1 - 10.

- Buchan, J. (2005). Increasing the productivity of an existing “stock” of health workers: review for DFID. London, Department of International Development.

- Cadogan, J.W., Kuivalainen, O., & Sundqvist, S. (2009). Export market oriented behaviour and export performance: Quadratic and moderating effects under differing degrees of market dynamism and internationalisation, Journal of International Marketing, 7(4), 71-89.

- Cadogan, J.W., Sundqvist, S., Puumalainen, K., Salminen, R.T. (2012). Strategic flexibilities and export performance: The moderating roles of export market-oriented behaviour and the export environment, European Journal of Marketing, 46(10), 1418-1452.

- Cavusgil, S.T., & Zou, S. (1994). Marketing strategy-performance relationship: an investigation of the empirical link in export market ventures, Journal of Marketing, 58(1) 1-21, viewed 5 June 2019, https://eduedi.dongguk.edu/files/20070519074826836.pdf.

- Chang, Y.S., & Fang, S.R. (2015). Enhancing export performance for business markets: Effects of inter-organisational relationships on export market orientation (EMO). Journal of Business-to-Business Marketing, 22(3), 211-228.

- Chen, J., Sousa, C. M., & He, X. (2016). The determinants of export performance: a review of the literature 2006-2014, International Marketing Review, 33(5), 626-670.

- Chetty, S.K., & Hamilton, R. (1993). Firm-level determinants of export performance: a meta-analysis, International Marketing Review, 10(3), 26-34, viewed 7 March 2019, http://emeraldinsight.com/doi/abs/10.1108/02651339310040643.

- Chin, W.W., & Newsted, P.R. (1999). Structural equation modelling analysis with small samples using partial least squares. In Hoyle, RH (Ed), Statistical strategies for small sample.

- Chin, W. W. (2010). How to write up and report PLS analyses. In V. Esposito Vinzi, W. W. Chin, J. Henseler, & H. Wang (Eds.), Handbook of partial least squares: concepts, methods and applications in marketing and related fields, 655-690, Berlin: Springer.

- Crick, D., Kaganda, G.E., & Matlay, H. (2011). A study into the international competitiveness of low and high-intensity Tanzanian exporting SMEs, Journal of Small Business and Enterprise Development, 18(3), 594-607.

- Das, M. (1994). Successful & unsuccessful exporters from developing countries: Some preliminary findings, European Journal of Marketing, 28(12), 19-33.

- Fornell, C., & Larcker, D.F. (1981). Evaluating structural equation models with unobservable variables and measurement error, Journal of Marketing Research, 18(1), 39-50.

- Francis, J., & Collins-Dodd, C. (2004). Impact of export promotion programmes on firm competencies, strategies and performance: the case of Canadian high-technology SMEs, International Marketing Review, 21(4), 474-495.

- Gries, T., & Naudé, W.A. (2010). Entrepreneurship and structural economic transformation, Small Business Economics Journal, 34(1), 13-29.

- Hair, J.J., Black, W., Babin, B., Anderson, R., & Tatham, R. (2006). Multivariate data analysis (6th Edn.), Uppersaddle River, NJ, Pearson Prentice Hall.

- Hair, J.J., Ringle, C.M., & Sarstedt, M. (2011). PLS-SEM: Indeed, a silver bullet, The Journal of Marketing Theory and Practice, 19(2), 139-152.

- Hair, J.J., Christian, M.R., Sarstedt, M., Ringle, C.M., & Mena, J.A. (2012). An assessment of partial least squares structural equation modelling in marketing research, Journal of Academy of Marketing Science, 40, 414-433, viewed 10 July 2019.

- Hair, J.J., Hult, G.T.M., Ringle, C.M., & Sarstedt, M. (2014a). A primer on Partial Least Squares Structural Equation Modelling (PLS-SEM). California: Sage Publication, Inc.

- Hair, J.J., Ringle, C.M., & Sarstedt, M. (2014b). Partial Least Squares Structural Equation Modelling: Rigorous applications, better results and higher acceptance, Long Planning, 46(1-2), 1-12.

- Homburg, C., Müller, M., & Klarmann, M. (2011). When should the customer really be king? on the optimum level of salesperson-customer orientation in sales encounters, Journal of Marketing, 75(March), 55-74.

- Hultman, M., Katsikeas, S.C., & Robson, M.J. (2011). Export promotion strategy and performance: the role of international experience, Journal of International Marketing, 19(4), 17-39.

- Ibeh, K. (2004). Furthering export participation in less performing developing countries, International Journal of Social Economics, 31(1/2), 94-110.

- Ito, K., & Pucik, V. (1993). R & D spending, domestic competition, and export performance of Japanese manufacturing firms, Strategic Management Journal, 14(1), 61-75.

- Kaleka, A. (2012). Studying resource and capability effect on export venture performance, Journal of World Business, 47, 93-105.

- Karedza, G., & Govender, K.K. (2019). Enhancing the export performance of the SMEs in the manufacturing sector in Zimbabwe, Academy of Marketing Studies Journal, 21(2), 1-19, viewed 18 October 2019.

- Katsikeas, S.C., Piercy, N., & Ioannidis, C. (1996). Determinants of export performance in a European context, European Journal of Marketing, 30(6), 6-36.

- Katsikeas, S.C., Leonidou, C.L., & Morgan, A.N. (2000). ‘Firm-level export performance assessment: Review evaluation and development, Journal of the Academy of Marketing Science, 28(4), 493-511, viewed 11 February 2019, http://www.jam.Sage Publicationspub.com/content/28/4/493.full.pdf.

- Katsikeas, S.C., Samiee, S., & Theodosiou, M. (2006). Strategy fit and performance consequences of international marketing standardisation, Strategic Management Journal, 27(9), 867-890, viewed 9 May 2019, http://www.iln.cite.hku.hk/com/140/users/kyleung6/21786389.pdf

- Katsikea, E.S., Theodosiou, M., & Morgan, R.E. (2007). Managerial, organisation, and external drivers of sales effectiveness in export market ventures, Journal of the Academy of Marketing Science, 35(2007), 270-283.

- Katsikeas, S.C., & Leonidou, C.L. (2010). Strategic export-marketing: achieving success in a harsh environment, International Encyclopaedia of Marketing: John Wiley & Sons, Ltd.

- Knight, G.A., & Kim, D. (2009). International business competence and the contemporary firm, Journal of International Business Studies, 40, 255-273.

- Korneliussen, T., & Blasius, J. (2008). The effects of cultural distance, Free Trade Agreements, and protectionism on perceived export barriers, Journal of Global Marketing, 21(3), 217–29.

- Lages, F., & Montgomery, D.B. (2004). Export performance as an antecedent of export commitment and marketing strategy adaptation: Evidence from small and medium-sized exporters, Journal of Marketing, 38(9/10), 186-1214.

- Lages, L.F., & Lages, C.R. (2004). The STEP scale: A measure of short term export performance improvement, Journal of International Marketing, 12(1), 36-56, viewed 9 September 2019, http://prof.fe.unl.pt/~1f/papers/STEP_JIM.pdf.

- Lages, F & Montgomery, D.B. (2005). The relationship between export assistance & performance improvement in Portuguese export ventures, European Journal of Marketing, 39(7/8), 755-784.

- Lages, F., Lages, C., & Lages, C.R. (2005). European managers’ perspective on export performance determinants, Journal of Euromarketing, 15(2), 75-92, viewed 10 February 2019, http://www.pro.fe.unl.pt/-1f/papers/Journal_EuroMarketing.pdf.

- Lages, F., Abrantes, J.L.S., & Lages, C.R. (2008a). The STRATADAPT scale: a measure of marketing strategy adaptation to international business markets, International Marketing Review, 25(5), 584-600.

- Lages, F., Jap, S.D., & Griffith, D.A. (2008b). The role of past performance in export ventures: a short-term reactive approach, Journal of International Business Studies, 39(1), 304-325.

- Lages, F., Silva, G., & Styles, C. (2009). Relationship capabilities, quality, and innovation as determinants of export performance, Journal of International Marketing, 17(4), 47-70.

- Lages, F., & Sousa, C. (2010). Export performance. Wiley International Encyclopaedia of Marketing: John Wiley & Sons Ltd.

- Leonidou, C.L. (1995). Empirical research on export barriers: review, assessment, and synthesis’, Journal of International Marketing, 3(1), 29-43, viewed 19 February 2019, https://archive.ama.org/archive/ResiurceLibrary/JournalofInternationalMarketing/documents/4451877.pdf.

- Leonidou, C.L., Katsikeas, S.C., & Samiee, S. (2002). Marketing strategy determinants of export performance: a meta-analysis, Journal of Business Research, 55(1), 51-67, viewed on 16 September 2019, http://www.course.sdu.edu.cu/G2S/eWebEditor/uploadfile/20120821212507397.pdf

- Leonidou, C.L. (2003). Overcoming the limits of exporting research using the relational paradigm, International Marketing Review, 20(2), 129-141, viewed 9 February 2019, http://www.emeraldinsight.com/0265-1335.htm.

- Leonidou, C.L., & Katsikeas, S.C. (2010). Integrative assessment of exporting research articles in business journals during the period 1960-2007, Journal of Business Research, 63(8), 879-887, viewed on 12 September 2019, http://www.sciencedirect.com/sceince/article/pii/SO148-2963(10)00022-6

- MacMillan, K., Money K., Money, A., & Downing, S. (2005). Relationship marketing in the not-for-profit sector: an extension and application of the commitment – trust theory’, Journal of Business Research, 58, 806-818, viewed 25 May 2019.

- Madsen, T.K. (1987). Empirical export performance studies: a review of conceptualisation and findings. Advances in International Marketing Ed. S. Tamer Cavusgil. Greenwich, CT: New York: JAI Press.

- Montobbio, F., & Rampa, F. (2005). The Impact of Technology & Structural Change on Export Performance in Nine Developing countries, World Development, 33(4), 527-547.

- Morgan, A.N., Kaleka, A., & Katsikeas, S.C. (2004). Antecedents of export venture performance: a theoretical model and empirical assessment, Journal of Marketing, 68(1), 90-108.

- Morgan, A.N., Katsikeas, S.C., & Vorhies, W.D. (2012). Export-marketing strategy implementation, export-marketing capabilities, and export venture performance, Journal of the Academy of Marketing Science, 40(2), 271-289, viewed 3 October 2019, https://www.researchgate.net/profile/Neil_Morgan2/publication/225441763_Export_marleting_strategy_implmentation_export_marketing_capabilities_&_export_venture_performance/links/Odeec51daf2c7eb307000000/Export-markeing-strategy-implementation-export-marketing-capabilities-&-export-venture-performance.pdf.

- Morgan, R.E. (1997). Export stimuli and export barriers: evidence from empirical research studies, European Business Review, 97(2), 68-79.

- Mühlbacher, H., Dahringer, L., & Leihs, H. (2006). International marketing: A global perspective, (3rd Edn.), London: Thomson Learning.

- O’Cass, A., & Julian, C. (2003). Examination firm and environmental influences on export-marketing mix strategy and export performance of Australian exporters’, European Journal of Marketing, 37(3/4), 366-384, viewed 5 August 2019, http://citeseerx.ist.psu/viewdoc/download?doi=10.1.1.026.2340&rep=rep1&type=pdf.

- Okpara, G.C. (2009). A synthesis of the critical factors affecting performance of the Nigerian banking system, European Journal of Economics, Finance and Administrative Sciences, 7(1), 34-44.

- Reserve Bank of Zimbabwe. (2015). January Monetary Policy Statement. Reserve Bank of Zimbabwe, Harare, Zimbabwe.

- Reserve Bank of Zimbabwe. (2016). January Monetary Policy Statement. Reserve Bank of Zimbabwe, Harare, Zimbabwe.

- Reserve Bank of Zimbabwe. (2017). Exchange Control Exports Database. Reserve Bank of Zimbabwe, Harare, Zimbabwe.

- Sanyal, P. (2004). The Role of Innovation and Opportunity in Bi-Lateral OECD Trade Performance, Review of World Economy, 140(4), 634-664.

- Sarstedt, M., Ringle, C.M., Smith, D., Reams, R., & Hair, Jr., J.F. (2014). Partial least squares structural equation modeling (PLS-SEM): A useful tool for family business researchers, Journal of Family Business Strategy, 5(1), 105-115

- Shoham, A. (1998). Export performance: a conceptualisation and empirical assessment, Journal of International Marketing, 6(3), 59-81.

- Shoham, A., Evangelista, F., & Albaum, G. (2002). Strategic firm type and export performance, International Marketing Review, 19, 236-258.

- Sousa, C.M.P. (2004). Export performance measurement: An evaluation of the empirical research, Academy of Marketing Science Review, 9(1), 1-22, viewed 8 February 2019, https://www.researchgate.net/publication/228751641_Export_perfofmance_measurement_An_evaluation_of_the_emprical_research_in_the_literature.pdf

- Sousa, C.M.P., Martinez-Lopez, F.J., & Coelho, F. (2008). The determinants of export performance: a review of the research in the literature between 1998 & 2005, International Journal of Management Review, 108(4), 343-374.

- Sousa, C.M.P., & Bradley, F. (2009). Effects of export assistance and distributor support on the performance of SMEs: the case of Portuguese export ventures, International Small Business Journal, 27(6), 681-701.

- Styles, C. (1998). Export performance measures in Australia and the United Kingdom, Journal of International Marketing, 6(3), 12-36.

- Tesfom, G., & Lutz, C. (2006). A classification of export-marketing problems of small and medium-sized manufacturing firms in developing countries’, International Journal of Emerging Markets, 1(3), 262-281.

- Wilkinson, T., & Brouthers, L.E. (2006). Trade promotion and SME export performance, International Business Review, 15(3), 233-252.

- Zengin, Y.A. (2014). The Effect of Innovation on Export Performance in Emerging Markets (In Turkish), Unpublished Ph.D. Dissertation, Ankara: Gazi University Institute of Social Science.

- Zhao, H., & Zou, S. (2002). The impact of industry concentration and firm location on export propensity and intensity: an empirical analysis of Chinese manufacturing firms, Journal of International Marketing, 10(1), 52-71, viewed 6 April 2019, http://dx.doi.org/10/1509/jimk.10.1.52.19527.

- Zou, S., & Stan, S. (1998). The determinants of export performance: a review of the empirical literature between 1987 & 1997, International Marketing Review, 15(5), 333-356, viewed 22 February 2019, https://pdfs.semanticsscolar.org/dca6/f698ae0217d43bde8fe528897c1b4f1d6cb8.pdf

- Zou, S., Taylor, C.R., & Osland, G.E. (1998). The EXPERF Scale: A cross-national generalized export performance measure, Journal of International Marketing, 6(3), 37-58, viewed on 7 October 2019, https://business.missouri.edu/cou/Resume/zou-taylor-osl&-jim98.pdf.