Research Article: 2019 Vol: 23 Issue: 3

Factors Affecting the Accuracy of Analyst's Forecasts: A Review of the Literature

Md. Jahidur Rahman, Wenzhou-Kean University

Jingxin Zhang, Wenzhou-Kean University

Siwei Dong, Wenzhou-Kean University

Abstract

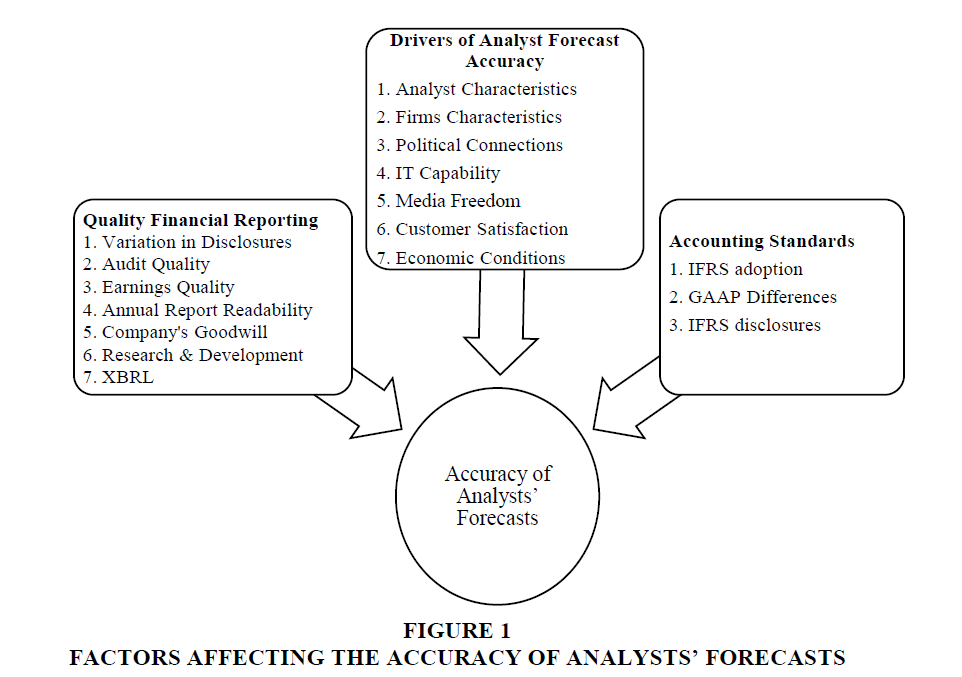

This study conducts a comprehensive review of the literature published during 1996–2017 to identify the factors that affect the accuracy of financial analysts’ forecasts. We organize our review around three main groups, namely, (a) drivers of analyst forecast accuracy, (b) quality financial reporting, and (c) accounting standards. Among the several factors found, some factors (experience of the analyst, earnings quality, audit quality, IFRS adoption, and annual report readability) have a positive relationship with the accuracy of analysts’ forecasts while others (politically connected firms, firms audited by Non-Big 4, and international GAAP differences) have a negative relationship. Our findings contribute to future research by examining the factors affecting analyst forecast accuracy from different perspectives, which will prove to be useful for academicians, regulators, investors, and financial analysts.

Keywords

Analyst Forecasts, Analyst Characteristics, Annual Report Readability, Accounting Disclosure, Forecast Accuracy.

Introduction

A listed company has many stakeholders investors, creditors, management, the public, and so on who make economic decisions on investment and management based on a few criteria. One such criterion is the analyses of financial experts or financial analysts. The role of financial analysts in capital markets is well recognized (Beaver, 1998). Financial reports are not always sufficient to forecast a firm’s earnings. Financial analysts take into account several parameters before forecasting the financial condition of a firm, which companies, investors, creditors, and others consider when making economic decisions. Therefore, the accuracy of analysts’ analysis is crucial for them.

Financial analysts collect and process public and private information to evaluate the current performance of firms. Based on the analysts’ evaluation, financial analysts make forecasts and recommendations about firms’ prospects. Impartial analysts’ Forecasts can benefit outside investors and help them make investment decisions (Kim et al., 2017). Analyst forecast accuracy is crucial for investors and the company. Investors use the analysts’ forecasts in the valuation model to decide the intrinsic value of the firm and make investment decisions (Lin & Lin, 2017).

According to Firth & Gift (1999), financial analyst’ earnings forecasts are frequently used by researchers as an important benchmark in studying finance and accounting issues. Moreover, a financial analyst’s earnings forecasts can be considered as an essential factor in the deliberation of regulators and policymakers.

The objective of this study is to conduct a comprehensive literature review to identify the factors that affect the accuracy of forecasts made by financial analysts. We perform a systematic literature review approach. We searched for articles from various resources including journal databases, library, and professional accounting websites. To find target articles, we used terms such as analyst forecast, analyst characteristics, annual report readability, accounting disclosures, and forecast accuracy. We also set some criteria to select the articles we need. For example, we review manuscripts published from 1996 to 2017. As studies in this area are abundant, several studies are found and selected for analysis. The availability of prior studies helps us choose only the factors that have a significant co-relationship with the accuracy of financial forecast analyses. We organize our review around three main groups, namely, (a) drivers of analyst forecast accuracy, (b) quality financial reporting, and (c) accounting standards.

Our study contributes to the literature in the following manner. First, we review manuscripts published during 1996-2017, thereby presenting a comprehensive review of the literature on the factors that affect analysts’ forecast accuracy. Second, we include studies conducted in various international settings, such as the United States, the European Union (EU), and Australia. Third, we summarize the studies’ findings and offer suggestions for future research from different perspectives, which will be useful for academicians, regulators, investors, and financial analysts.

The remainder of this paper is organized as follows. Section 2 consists of a comprehensive review of the literature to identify the factors affecting the accuracy of forecasts made by financial analysts. Section 3 offers suggestions for future research followed by theoretical implications of our review in Section 4 and Section 5 concludes the paper.

Factors Affecting the Accuracy of Analysts’ Forecasts

Earlier studies reveal that the extant literature on the factors affecting analyst forecast accuracy has been examined from different perspectives. Some of the studies identified several analyst characteristics that affect the accuracy of analysts’ forecasts. Some focused on the changes in accounting standards that automatically affect the accuracy of analysts’ forecasts. Others concentrated on a firm’s operating environment, political connections, information technology (IT) capability, audit quality, and customer satisfaction and how the elements of financial statements affect the forecast accuracy of financial analysts.

Drivers of Analyst Forecast Accuracy

Analyst and firm specific characteristics

In the last few years, there has been an explosion of research examining analyst forecasts. One can identify interacting analyst-specific and firm-specific factors that drive analyst accuracy. Jacob et al. (1999); Clement (1999); Barniv et al. (2005); Myring & Wrege (2009); and Athavale et al. (2013) identified several analyst characteristics that affect the accuracy of analysts’ forecasts. These attributes are forecast age, frequency of forecasts, forecast specialization, the number of companies followed by the analyst, analyst ability, analyst portfolio complexity, and the number of resources the analyst has access to.

Experience plays a vital role in the accuracy of analysts’ forecasts. According to Maines et al. (1997), the level of accuracy increases with the experience of the analyst. The study found that experienced analysts’ forecasts were much more accurate than those of less experienced Master of Business Administration students. Mikhail et al. (1997) clearly stated that an analyst’s firm-specific experience helps him/her to forecast more accurately. When an analyst knows more about a specific firm, its practices, and so on, his/her forecast is likely to be based on facts. In such cases, forecasting errors are minor and the accuracy level of the forecast increases. Brown & Mohammad (2010) suggested that earnings-forecast ability has a general aspect incremental to its firm-specific aspect (Figure 1).

Clement et al. (2007) held the opinion that both innate ability and firm-specific ability increase the accuracy of forecasts. They found a strong relationship between forecast accuracy and task-specific experience for analysts who have strong innate abilities, suggesting that these analysts can better learn from their task-specific experiences and therefore survive for longer. Barron, Byard, and Yu (2008) found that individual analysts’ private information helps them reduce errors and increase the accuracy of earnings forecasts.

Jacob et al. (1999) clearly stated that if an analyst follows a particular industry, his/her level of accuracy increases. Evidently, if an analyst follows just one industry, he/she becomes more skillful in commenting on that specific industry. The quality of his/her forecast also improves if he/she makes the forecast by maintaining a certain interval. Clement (1999) found that the accuracy of an analyst’s forecast declines if the number of firms he/she follows increases, suggesting that to increase his/her accuracy, an analyst should follow fewer firms. When an analyst follows only a few firms, he/she will be able to concentrate more, and consequently improve his/her accuracy level.

Hall & Tacon (2010) found a trend whereby an analyst who made accurate earnings forecasts in the past will continue to make accurate earnings forecasts in the following years. However, the study also mentioned that this connection cannot only be traced to the accuracy of the forecasts made in the past. Bae et al. (2008) found that the analysts residing in a country make more accurate earnings forecasts for firms operating in that country than those residing in other countries.

Political connections

The literature on international business has widely documented political power as a critical factor that confounds the strategic decisions of multinational enterprises. Chen et al. (2010) investigated the relationship between the accuracy of analysts’ forecasts and firms’ political connections. After analyzing data from 17 different sources between 1997 and 2001, it became clear that forecast accuracy is lower for firms that are politically connected than those that are not politically connected. They also observed that anti-corruption measures can decrease the negative influence of political connections on the accuracy of analysts’ forecasts.

IT capability

An organization’s ability to effectively and efficiently use IT-based resources can create sustainable competitive advantage. Wang & Alam (2007) identified a positive correlation between IT capability and the uncertainty of future earnings by measuring IT capabilities with the Information Week 500 ranking index. They argued that unrecorded IT capability increases a company’s future uncertainty, thereby decreasing the accuracy of analysts’ forecasts. Barron et al. (2002) also found that the consensus in analysts’ forecasts is negatively associated with a firm’s level of intangible assets, particularly those of R&D driven high tech manufacturers.

Media freedom

To the best of our knowledge, only one study has examined the influence of media independence on the forecast accuracy of financial analysts. Using a large international sample of 52 countries, Kim et al. (2017) investigated the influence of media freedom on the accuracy of analyst forecasts. They find that analyst forecast errors are more pronounced in countries that lack media freedom.

Customer satisfaction

By analyzing huge longitudinal data sets, Luo et al. (2010) found a very significant and positive relationship between customer satisfaction and the accuracy of analysts’ earnings forecasts. The study also found that customer satisfaction reduces the dispersion in analysts’ recommendations for the firm. The abovementioned results are more accurate when the product market is highly competitive and the financial market is highly uncertain.

Economic conditions

To make forecasts about earnings, an analyst has to consider several issues pertaining to the operating environments of firms. Chopra (1998) found that the accuracy of an analyst’s forecast increases if the economy is growing rapidly. On the contrary, forecast errors increase when the economy is not growing rapidly. Hope & Kang (2005) found macroeconomic uncertainties to be negatively associated with the accuracy of analysts’ forecasts. After analyzing the relationship between analysts’ forecasts and the global competitiveness rankings of the World Economic Forum, Black & Carnes (2006) found a positive relationship between the two. Walther & Willis (2013) found a positive relationship between financial analyst forecasts and the “fundamental” component related to underlying economic factors (FUND) and a negative relationship between financial analyst forecasts and the “sentiment” component unrelated to underlying economic factors (SENT). According to the evidence used in the study, when FUND is higher, forecast accuracy is also higher, and when SENT is higher, forecast accuracy is lower. Summary: The notion that several analyst characteristics affect analyst forecast accuracy is generally supported. These attributes include forecast age, frequency of forecasts, forecast specialization, the number of companies followed by the analyst, analyst ability, analyst portfolio complexity, and the number of resources the analyst has access to. The positive effect of both firm-specific experience and industry-specific experience is evidenced by increased forecast accuracy. Political connections impair the information asymmetry between investors and managers. Researchers find a firm that are politically connected have lower forecast accuracy; anti-corruption measures can balance the side effect of political connections on analyst forecast accuracy. An organization’s ability to effectively and efficiently use of IT-based resources can create unique and sustainable competitive advantages. IT as an intangible asset can provide incremental explanatory power for firm valuation. Thus, IT capability is positively associated with future earnings uncertainty and decreased analyst forecast accuracy. A country’s media freedom accelerates the dissemination of information about an organization. Research reveals that more media freedom would result in higher forecast accuracy.

Customer satisfaction is positively associated with forecast accuracy. Study reveals the impact of satisfaction on analyst-based outcomes and the importance of constructing customer satisfaction as a key intangible asset. Most studies conclude that worse economic conditions would decrease the forecast accuracy. Some studies find that accuracy improves when the economy is growing rapidly. Meanwhile, researchers support the notion that macroeconomic factors like inflation rate, exchange rate, and the extent countries are open to foreign trade would affect analyst forecast accuracy. What’s more, analyst forecasts are less accurate when the market reacts strongly to forecast error due to high investor expectations.

Quality of Financial Reporting

Variation in disclosure

The main job of a financial analyst is to evaluate a firm’s prospects. To do so, a financial analyst uses several information sources. Detailed financial statements such as income statements, balance sheets, and statements of cash flows can help analysts make more accurate forecasts. Holland (1998) identified that the accuracy of analyst forecasts increases if detailed information in the form of descriptions and explanation notes are available for analysis. A firm’s accounting practices also play an important role in determining the accuracy of forecasts. An analyst can make more accurate forecasts if a firm’s accounting policies are disclosed (Hope, 2003). Moreover, Lang & Lundholm (1996) argued that forecast accuracy has a positive relationship with the level of company disclosure. Kothari et al. (2009) found that when content analysis indicates favorable disclosures, analyst forecast dispersion declines significantly.

Studies reveal that apart from financial disclosure, nonfinancial data disclosure is also related to forecasts. Analyzing nonfinancial data (stand-alone corporate social responsibility reports) from 31 countries, Dan et al. (2012) concluded that the issuance of stand-alone corporate social responsibility (CSR) reports reduces the errors of financial forecast analysts. The study also identified that the abovementioned relationship is stronger in countries wherein firms are stakeholder-oriented (i.e., wherein CSR reports play a strong role in financial disclosure). Yu (2010) examined the relationship between analyst forecast accuracy, forecast dispersion, and the number of governance disclosures. The study found that financial analysts can forecast the earnings of companies more accurately if they provide more comprehensive corporate governance disclosures in annual reports. Chang et al. (2014) found a positive association between increasing disclosure with greater accuracy of analyst forecasts in firms disclosing fewer items. However, Lee et al. (2013) found that condensed equity method disclosures are negatively associated with the accuracy of financial forecasts.

Using the U.S. securities market, Kwag & Small (2007) examined the influence of regulation fair disclosure (FD) on earnings management and analyst forecast bias and concluded that the accuracy of financial analysts’ earnings forecasts reduced considerably during the postregulation FD period. Tong (2007) investigated whether recent international transparency initiatives affected information accuracy and dispersion and found that recent international transparency initiatives do not have a significant influence on the accuracy of financial forecasts.

Audit quality

Audit quality influences the quality of financial reporting. Audit quality is determined by using variables such as auditor size, Big 5 versus non-Big 5, and the auditor’s industry specialization. Behn et al. (2008) found that the accuracy of analysts’ forecasts is higher when audits are conducted by more skillful auditors such as Big 5 auditors or industry specialist non- Big 5 auditors. Xie et al. (2012) found a positive relationship between analyst forecast accuracy and financial reporting quality and the predictability of accounting earnings. They found that the forecasts are more accurate in firms that are audited by specialized national and city-level auditors.

Earnings quality

Lobo et al. (2012) concluded that when the quality of accruals decreases, financial analysts tend to depend more on private information that leads to more accurate financial forecasts. Bilinski (2014) found that a decrease in earnings quality results in a decrease in the accuracy of cash flow forecasts. This finding explains why financial analysts shy away from providing cash flow estimates when the quality of earnings is low. Coën et al. (2009) found that the type of earnings (profit and loss) and variations in earnings (increase and decrease) significantly influence the accuracy of financial analysts.

Annual report readability

Financial analysts use firms’ annual reports to arrive at their evaluations of the firms’ prospects. However, forecasting becomes complex when annual reports lack readability. To provide accurate earnings predictions, financial analysts need to put in more collective efforts for firms with less readable annual reports. Lehavy et al. (2011) investigated the effect of annual report readability on the behavior of financial analysts. They found that analyst earnings forecasts are less accurate when firms issue less readable 10-Ks. They also documented that the effort put into generating forecast reports is greater for firms with less readable annual reports.

Company’s goodwill

Chen et al. (2014) found a negative relationship between goodwill impairment charges and analysts’ forecast accuracy and a positive relationship between goodwill impairment charges and dispersion. The study reached this conclusion after analyzing data that reported periodic goodwill impairment charges during 2003-2007 and two control samples without impairment charges. The study found less accurate analysts’ forecasts and more dispersed forecasts for the impairment samples than for the control samples.

Research and development

It has been suggested that investment in research and development (R&D) is related to high forecast errors and inaccurate forecasts. This relationship was also stated in earlier studies (Amir et al. 2003; Gu & Wang, 2005), and is usually because of the uncertain future benefits of R&D and a rise in information complexity (Gu & Wang, 2005). Anagnostopoulou (2010) also examined whether the capitalization of R&D decreases the uncertain future benefits and information asymmetry. The study found that expensing R&D costs, which is the opposite of capitalization, has a negative association with increased forecast accuracy.

XBRL

Orens & Lybaert (2007) surveyed Belgian financial analysts and found that the accuracy of forecasts was higher among analysts who used more forward-looking information and more information related to internal firm structure. Notably, the investigated corporations improved the quality of their non-financial information over time. After having examined 1,430 firm-years of firms listed in the U.S. over the 2005–2010 period, Liu et al. (2013) pointed out that the adoption of extensible Business Reporting Language (XBRL) has a significant and positive relationship with the accuracy of financial forecasts.

Summary: Studies have been conducted to show the forecast accuracy is related to variations in disclosures. Accuracy increases when detailed information like explanations, descriptions and non-financial disclosures is available. And more forward-looking information and information related to the internal firm structure would also increase the forecast accuracy. Studies are also conducted to show the relationship between forecast accuracy and adoption of XBRL and FD.

Most studies find that high audit quality increases the accuracy of analysts’ forecasts. Financial reporting quality and the predictability would also increase analyst forecast accuracy. Studies show that a decrease in earning quality results in a decrease in the accuracy of forecasts. The study reveals goodwill impairment would decrease the analysts’ forecast accuracy while increasing the dispersion of the forecasts. Studies demonstrate that investment in research and development would decrease forecast accuracy. Expensing R&D has a negative relationship with forecast accuracy. Study shows that analysts make more accurate forecasts when annual report readability is higher.

Accounting standards

Prior research has shown that changes in accounting standards automatically affect the accuracy of analysts’ forecasts. These studies mostly focused on the adoption of International Financial Reporting Standards (IFRS) in the EU. Most of them found that if the adoption of a new standard increases the quality and quantity of financial disclosures, analysts’ forecast accuracy increases. Although the findings of earlier studies (Daske et al., 2008; Ashbaugh & Pincus, 2001) showed mixed results, those of subsequent studies were more consistent with the view that adopting IFRS increases forecast accuracy (Byard et al. 2011; Cotter et al., 2012). Hope (2003) also found that enforcing accounting standards reduced the uncertainty of forecasts and increased forecast accuracy.

Ernstberger et al. (2008) measured the influence of the adoption of International Accounting Standards/IFRS or U.S. Generally Accepted Accounting Principles on the accuracy of financial analysts’ forecasts in a homogenous institutional framework. The study found a higher forecast accuracy when estimates were based on IFRS or U.S. GAAP data, rather than on German GAAP data. However, forecast accuracy was found to be lower in the year that German GAAP were replaced by U.S. GAAP than in other years. Hodgdon et al. (2008) examined the relationship between earnings forecast errors of financial analysts and firms’ conformity to the disclosure requirements of IFRS. The study used a comprehensive disclosure index of selected IFRS and developed an unweighted and innovative weighted measure to measure IFRS disclosure compliance. It found a negative relationship between forecast errors and IFRS compliance. The study also found that compliance with the disclosure requirements of IFRS increases the accuracy of the forecasts of financial analysts.

According to Cotter et al. (2012), the adoption of IFRS is positively associated with the accuracy of analyst forecasts. This was evident after analyzing the data of 145 large, listed Australian firms. Demmer et al. (2015) found a positive association between the mandatory adoption of IFRS and an increase in the accuracy of financial forecasts. By applying panel data analysis to the 2001-2008 period in the Asia-Pacific region, Cheong et al. (2010) found a positive relationship between the adoption of IFRS and the accuracy of earnings forecasts. Bae et al. (2008) investigated the relationship between the differences in accounting standards across countries and the forecast accuracy of foreign analysts, and found a negative relationship between the two.

The worldwide adoption of IFRS can improve the usefulness of accounting information across countries and reduce analysts’ costs of learning a new set of accounting standards. Analysts from different countries can use the same standard to cover more companies using IFRS. Tan, Wang, and Welker (2011) stated that the mandatory adoption of IFRS attracts foreign analysts, especially those with prior IFRS-related experience or those who reside in countries that have adopted IFRS. They found that the adoption of IFRS improves the forecast accuracy of foreign analysts. Horton et al. (2013) reached a similar conclusion. They found that both the mandatory and the voluntary adoption of IFRS improves the accuracy of financial analyst forecasts and reduces forecast errors. The study also found that a reduction in forecast errors is associated with firm-specific differences between the local GAAP and IFRS.

Summary: Most of the studies agree the idea that the adoption of accounting standards would increase forecast accuracy. The worldwide adoption improves the usefulness of accounting information. Some studies find that there is a negative relationship between forecast errors and firm’s conformity to requirements of accounting standards.

Suggested Areas for Future Research

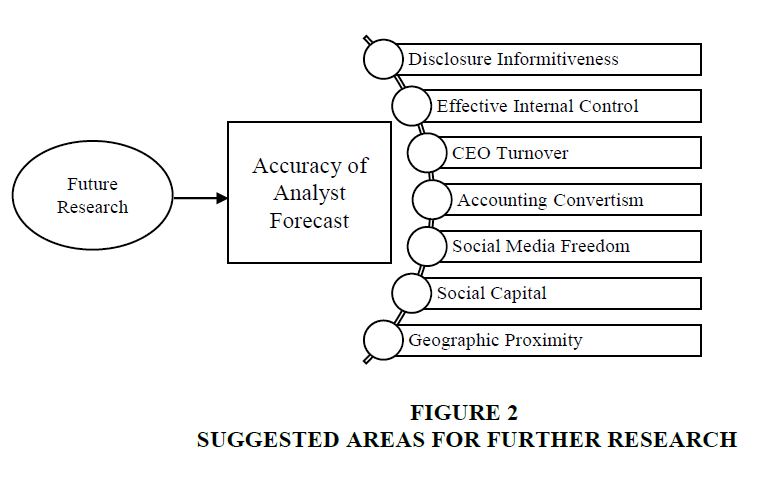

Prior literature examined the factors affecting analyst forecast accuracy from different perspectives. Some of these studies identified several analyst characteristics that affect the accuracy of analysts’ forecasts. Others focused on how changes in accounting standards automatically affect the accuracy of analysts’ forecasts. Some studies concentrated on firms’ operating environments, political connections, IT capabilities, and customer satisfaction while others investigated how the elements of financial statements affect the forecast accuracy of financial analysts. However, the present literature needs to cover other crucial areas (Figure 2).

Disclosure informativeness

The primary job of a financial analyst is to evaluate a firm’s prospects. To do so, he/she analyzes written financial disclosures issued by the firm. Thus, the accuracy of the analyst’s forecast depends on the informativeness of a firm’s written disclosure. It is assumed that financial analyst forecasts are more accurate when firms disclose more useful information. However, limited research has been conducted in this area. Therefore, future research should investigate the effect of financial disclosure informativeness on analyst forecast accuracy. Apart from financial disclosure, nonfinancial information can also be related to analysts’ forecasts. Therefore, it is essential to investigate the relationship between analyst forecast accuracy and the assurance of nonfinancial sustainability reports. It is assumed that analysts’ forecasts are more accurate for firms that publish separate general purpose and nonfinancial sustainability reports, which is required of the auditing profession.

Effective internal control systems

Further research is needed to explore effective internal control systems and analyst forecast accuracy. The Sarbanes-Oxley Act requires auditors of public companies to attest to the effectiveness of internal control of financial reporting. This evaluation increases user confidence about future financial reporting because effective internal controls decrease the probability of future misstated financial statements. It is assumed that analysts’ forecasts are more accurate for firms using effective internal control systems.

CEO turnover

There is limited evidence of how CEO turnover may affect analysts’ forecast accuracy. It is hypothesized that the probability of CEO turnover may be positively related to more accurate analyst forecasts when firms perform poorly. It is also hypothesized that analysts’ forecasts are more accurate when a firm appoints a new CEO, as he/she provides the firm with earnings management incentives.

Accounting conservatism

Our reviews suggest that only three studies have examined firms’ earnings quality and analyst forecast accuracy (Lobo et al., 2012; Coën et al., 2013; and Bilinski, 2014). However, research investigating the relationship between accounting conservatism and analyst forecast accuracy is limited. Lara, Osma, and Penalva (2016) found that conservatism improves investment efficiency and reduces overinvestment. Their findings suggest that analysts’ forecasts are more accurate for more conservative firms.

Social media freedom

Only one study has examined the influence of media independence on the forecast quality of financial analysts (Kim et al., 2017). The others have focused on a country’s state media ownership as a proxy for media freedom. However, a country’s social media can be essential to determine analyst forecast accuracy. Social and Internet media may be influential tools in breaking down information barriers. According to Stahl and Sully de Loque (2014), greater participation in social media accelerates the dissemination of information about an organization. As a result, an analyst who is engaged in forecasting for a firm may be motivated to collect data about that firm.

Social capital

Our reviews suggest that no study has examined the influence of social capital on analyst forecast accuracy. We hypothesize that an organization’s operating efficiency is positively associated with social capital. Our intuition regarding the relationship between social capital and corporate efficiency arises from the agency theory. The agency theory predicts that when trust levels are high, agency problems are fewer in number. As the level of trust in firms headquartered in countries with high social capital is higher, agency problems in these firms are fewer. Therefore, the managers of these firms do not jeopardize the interests of their firms by pursuing self-interest, which leads to higher corporate efficiency. Therefore, further research efforts are needed to explore the influence of social capital on analyst forecast accuracy.

Geographic proximity

We propose that future research should investigate whether the accuracy of a financial analyst’s forecast is related to the geographic proximity between the financial analyst and the firm. Prior studies in accounting and finance have documented the importance of geographic proximity between economic agents (e.g., Choi, Kim, Qiu & Zang, 2012; DeFond & Zhang, 2014). They have suggested that geographic proximity lowers the information asymmetry between economic agents by bringing about information flow and monitoring. Therefore, it is hypothesized that the geographic distance between financial analysts and firms plays an important role in making forecasts. The closer the listed firms to their forecasting analysts, the more accurate will their analysts’ forecasts be.

Foreign investor

Future research on the factors affecting analyst forecast accuracy should investigate the relationship between foreign investor demand and analyst forecast accuracy. It is assumed that the accuracy of analysts’ forecasts may have a strong relationship with companies in which shares are traded by foreign investors. Future research on the factors affecting analyst forecast accuracy should also investigate the relationship between stock-price reaction and analyst forecast accuracy. It is assumed that the accuracy of analysts’ forecasts largely depends on the visible stock-price influence.

Theoretical contributions

We consider 17 different factors as part of the explanation of the relationship with forecast accuracy. Among the several factors found, some factors have a positive relationship with the accuracy of analysts’ forecasts while others have a negative relationship. However, other factors have a varied relationship with the accuracy of analysts’ forecasts. We try to explain how each factor affects the analysts’ forecast accuracy and state the underlying economic and social dynamics that justify the selection of factors and the proposed causal relationships. We include studies conducted in various international settings, such as the United States, the European Union, and Australia. Using conditions related to time, place, and subject, we place limitations on the propositions generated from prior literature. Our study reviewed manuscript published during 1996-2017, presenting a comprehensive review of the literature on the factors affecting analysts’ forecast accuracy. During our theory-development process, we challenge and extend the existing knowledge by providing 8 areas which could be the future research topics such as disclosure informativeness, the effectiveness of internal control system, accounting conservatism, social media freedom, CEO turnover and so on. Financial analysts have an essential role in promoting market efficiency. By releasing their forecasts, they seek to assist investors in identifying profitable investment opportunities. Besides, investors, the accuracy of analysts’ forecasts are important to academicians, regulators, and financial analysts. The study would offer suggestions to these people.

Conclusion And Limitations

Studies pertaining to the forecasts of financial analysts have significantly increased in recent years. Researchers’ attention has been drawn to the accuracy of analysts’ forecasts because they are important to both firms and the general public for making informed stock market-related decisions. This study conducts a comprehensive review of the literature published during 1996–2017 to identify the factors that affect the accuracy of financial analysts’ forecasts. We organize our review around three main groups, namely, (a) drivers of analyst forecast accuracy, (b) quality financial reporting, and (c) accounting standards. Among the several factors found, some factors (experience of the analyst, earnings quality, audit quality, IFRS adoption, and annual report readability) have a positive relationship with the accuracy of analysts’ forecasts while others (politically connected firms, firms audited by Non-Big 4, and international GAAP differences) have a negative relationship. Moreover, as other problematic factors require attention, a careful scrutiny of these factors can guide companies and the public to make precise decisions about stock-related issues.

Based on our review, we conclude that analyst produces forecasts of accounting earnings along with other forward-looking information. We believe that analyst forecast can help the users of accounting information for more relevant and accurate decision making. Company’s financial statements usually come out two-three months later after the year close. The valuable information may come too late to utilize for a current decision. Since the analyst forecast provides an analysis as of now, users of accounting information do not have to wait for a long time. This study can help investors to understand better about the accuracy of analysts’ forecast. By using the accurate analysts’ forecast, investors can make a better investment decision. Moreover, companies can have a better understanding of the accuracy of their analysts’ forecast and understand better about their financial performance in the long run with the help of accurate analysts’ forecast.

It is important to note that the purpose of a literature review is not just to summarize what is currently known about a topic, but is also to provide a detailed justification for previous research. However, this study might not be sufficiently critical.

Appendixes

| Appendix 1: List Of Journals Covered |

|

| Period | Name of Journal |

|---|---|

| 2017 | Applied Economics Letters |

| 1999 | International Advances in Economic Research |

| 2006, 2010 | Journal of International Financial Management & Accounting |

| 2010 | Journal of International Business Studies |

| 1999, 2007, 2014, 2016 | Journal of Accounting and Economics |

| 2010 | Journal of Contemporary Accounting & Economics |

| 2008; 2010 | Journal of International Accounting, Auditing and Taxation |

| 1997, 2001, 2002, 2003, 2008, 2011 | Journal of Accounting Research |

| 2005, 2010, 2013 | Contemporary Accounting Research |

| 2007 | The International Journal of Accounting |

| 2010 | Pacific Accounting Review |

| 2007 | Journal of Information Systems |

| 1998 | Financial Analysts Journal |

| 2012, 2014 | Accounting & Finance |

| 2003 | European Accounting Review |

| 2013 | Journal of Applied Business and Economic |

| 2008 | Journal of Financial Economics |

| 1996, 2008, 2009, 2011, 2012, 2013 | The Accounting Review |

| 2005, 2014 | Journal of Business Finance & Accounting |

| 2013 | Journal of Business Ethics |

| 2014 | Accounting Horizons |

| 2012 | Auditing: A Journal of Practice & Theory |

| Appendix 2: Summary Table | |||||||

| Drivers of Analyst Forecast Accuracy | |||||||

|---|---|---|---|---|---|---|---|

| Reference | Author Number | Nature | Factor(s) | Relationship | Findings | ||

| Maines et al. (1997) | 3 | Empirical | Experience of the analyst | Positive | The experience of the analyst is positively related to the accuracy of the forecast. | ||

| Mikhail et al. (1997) | 3 | Empirical | Firm-specific experience of the analyst | Positive | The accuracy of the forecast increases with greater firm-specific experience of the analyst. | ||

| Clement (1999) | 1 | Empirical | Number of firms followed | Negative | The forecast accuracy of the analyst is negatively related to the number of firms followed. | ||

| Jacob et al. (1999) | 3 | Empirical | Particular industry; size of brokerage and duration of forecast interval | Positive | The forecast accuracy of the analyst increases if his/her analysis is limited to a particular industry and the size of brokerage. The accuracy of the forecast also increases if it is made by maintaining a certain interval. | ||

| Chopra (1998) | 1 | Empirical | Economic condition | Positive | The better the economic conditions, the more accurate is the forecast. | ||

| Hope and Kang (2005) | 2 | Empirical | Macroeconomic uncertainty | Negative | Macroeconomic uncertainty is negatively related to the accuracy of the analyst’s forecast. | ||

| Black and Carnes (2006) | 2 | Empirical | Competiveness | Positive | The forecast accuracy of the analyst is positively related to the World Economic Forum’s global competitiveness rankings. | ||

| Brown and Emad (2010) | 2 | Empirical | Firm-specific aspects | Positive | Earnings-forecast ability has a general aspect incremental to its firm-specific aspect. | ||

| Clement et al. (2007) | 3 | Empirical | Innate ability; task-specific abilities | Positive | The innate abilities and task-specific experiences of the financial analyst is positively related to the accuracy of his/her financial forecasts. | ||

| Athavale et al. (2013) | 3 | Empirical | Qualities of the analyst | Positive | Forecast accuracy of earnings is closely related to the attributes of the analyst. | ||

| Charles et al. (2010) | 3 | Empirical | Political connections | Positive | Forecasting the earnings of companies that have political connections is more difficult than doing so for those that do not have political connections. | ||

| Wang and Alam (2007) | 2 | Empirical | IT capabilities | Negative | Information technology capability decreases the analyst’s forecast accuracy. | ||

| Barron et al. (2008) | 3 | Empirical | Private information of the analyst | Positive | Individual analysts’ private information is positively associated with the accuracy of earnings forecasts. | ||

| Luo et al. (2010) | 3 | Empirical | Customer satisfaction | Positive | There is a significant and positive relationship between customer satisfaction and the accuracy of analysts’ earnings forecasts. | ||

| Quality of Financial Reporting | |||||||

| Hope (2003) | 1 | Empirical | Quantity of disclosure | Positive | The earnings forecast of the analyst is positively related to the quantity of annual report disclosure. | ||

| Lang and Lundholm (1996) | 2 | Empirical | Levels of disclosure | Positive | The forecast accuracy of the analyst is positively related to the levels of disclosure of the company. | ||

| Dan et al. (2012) | 4 | Empirical | CSR report | Positive | The issuance of stand-alone corporate social responsibility (CSR) reports improves the accuracy of financial forecast analysts. | ||

| Bruce et al. (2008) | 3 | Empirical | Auditors skills | Positive | The accuracy of the analyst’s forecast is positively related to the skills of the auditors. | ||

| Orens and Lybaert (2007) | Empirical | Non-financial information | Positive | There is a positive relationship between the accuracy of an analyst’s forecast and the use of more forward-looking and internal-structure information provided by the auditors. | |||

| Yu (2010) | 1 | Empirical | Governance disclosure | Positive | Comprehensive corporate governance disclosures in annual reports are positively related to the accuracy of analysts’ forecasts. | ||

| Kwag and Small (2007) | 2 | Empirical | Regulation fair disclosure | Positive | The accuracy of financial analysts’ earnings forecasts has reduced considerably in the post-FD period. | ||

| Hall & Tacon (2010) | 2 | Empirical | Stock recommendations | Positive | The analysts who made accurate forecasts in the past may also make more accurate forecasts in the following years. | ||

| Coën et al. (2009) | 3 | Empirical | Types and variations of earnings | Positive | The types of earnings (profit and loss) and variations in earnings (increase and decrease) significantly influence the accuracy of financial analysts. | ||

| Lobo et al. (2012) | 3 | Empirical | Accruals quality | Positive | The dependence of financial analysts on private information is positively associated with the accuracy of financial forecasts. | ||

| Liu et al. (2013) | 3 | Empirical | XBRL | Positive | The adoption of eXtensible Business Reporting Language (XBRL) has a significant and positive relationship with the accuracy of financial forecasts. | ||

| Bilinski (2014) | 1 | Empirical | Earnings quality | Negative | A decline in earnings quality decreases the accuracy of cash flow forecasts. | ||

| Walther and Willis (2013) | 2 | Empirical | Investor expectations | Positive | There is a positive relationship of financial analyst forecasts with the “fundamental” component related to underlying economic factors (FUND) and a negative relationship with economic factors (SENT). The “sentiment” component unrelated to underlying | ||

| Lee et al. (2013) | 3 | Empirical | Equity method investment | Negative | The condensed equity method disclosure is negatively associated with the accuracy of financial forecasts. | ||

| Chen et al. (2014) | 3 | Empirical | Goodwill impairment | Negative | There is a negative relationship between goodwill impairment charges and analysts’ forecast accuracy. | ||

| Chang et al. (2014) | 3 | Empirical | Investors relations disclosure | Positive | There is a positive association between increased disclosures with greater analysts’ forecasts accuracy in firms disclosing fewer items. | ||

| Xie et al. (2012) | 3 | Empirical | National and city-level auditor | Positive | There is a positive relationship between analyst forecast accuracy and financial reporting quality. | ||

| Behn et al. (2008) | 3 | Empirical | Audit quality | Positive | The accuracy of analysts’ forecasts becomes better when the audit is conducted by skillful auditors such as the Big 5 auditors or industry specialist non-Big 5 auditors | ||

| Barron et al. (2002) | 4 | Empirical | High-technology intangibles | Negative | The consensus in analysts’ forecasts is negatively associated with a firm’s level of intangible assets, particularly in R&D-driven high-tech manufacturers. | ||

| Gu and Wang (2005) | 2 | Empirical | Investment in R&D | Negative | Investment in R&D is related to greater forecast errors and inaccurate forecasts. | ||

| Anagnostopoulou (2010) | 1 | Empirical | Capitalization of R&D | Negative | Expensing R&D costs, which is the opposite of capitalization, has a negative association with increased forecast accuracy | ||

| Lehavy et al. (2011) | 3 | Empirical | Annual report readability | Positive | Analysts’ earnings forecasts are less accurate when firms issue less readable 10-Ks. | ||

| Accounting Standards | |||||||

| Byard et al. (2011); | 3 | Empirical | IFRS adoption | Positive | Forecast accuracy is affected by changes in accounting standards. | ||

| Cotter, Tarca, and Wee (2012) | 3 | Empirical | IFRS adoption | Positive | Forecast accuracy is affected by changes in accounting standards. | ||

| Bae et al. (2008) | 3 | Empirical | International GAAP differences | Negative | Differences in accounting standards across countries and the forecast accuracy of foreign analysts are negatively related. | ||

| Ernstberger et al. (2008) | 3 | Case study | Change in accounting principles | Negative | The use of IFRS or US GAAP data has a positive relationship with the accuracy of financial forecasts and the use of German GAAP data has a negative relationship with the accuracy of financial forecasts. | ||

| Hodgdon et al. (2008) | 4 | Empirical | IFRS disclosure | Negative | Forecast errors and IFRS compliance are negatively associated. | ||

| Horton et al. (2013) | 3 | Empirical | IFRS adoption | Positive | There is a positive relationship between the adoption of international financial reporting standards (IFRS) and the accuracy of earnings forecasts. | ||

| Bae et al. (2008) | 3 | Empirical | International GAAP differences | Positive | Analysts forecast firms’ financial performance more accurately if they reside in the same country. | ||

| Tong (2007) | 1 | Empirical | International transparency | Negative | Recent international transparency initiatives do not significantly influence the accuracy of financial forecasts. | ||

| Tan et al. (2011) | 3 | Empirical | IFRS adoption | Positive | Adopting IFRS improves the forecast accuracy of foreign analysts. | ||

References

- Amir, E., Lev, B., & Sougiannis, T. (2003). Do financial analysts get intangibles?European Accounting Review,12(4), 635-659.

- Anagnostopoulou, S.C. (2010). Does the capitalization of development costs improve analyst forecast accuracy? Evidence from the UK.Journal of International Financial Management & Accounting,21(1), 62-83.

- Ashbaugh, H., & Pincus, M. (2001). Domestic accounting standards, international accounting standards, and the predictability of earnings.Journal of accounting research,39(3), 417-434.

- Athavale, M., Myring, M., & Groeber, R. (2013). Analyst earnings forecasts in BRIC countries.Journal of Applied Business and Economics,14(5), 71-82.

- Bae, K.H., Stulz, R.M., & Tan, H. (2008). Do local analysts know more? A cross-country study of the performance of local analysts and foreign analysts.Journal of Financial Economics,88(3), 581-606.

- Bae, K.H., Tan, H., & Welker, M. (2008). International GAAP differences: The impact on foreign analysts.The Accounting Review,83(3), 593-628.

- Barniv, R., Myring, M.J., & Thomas, W.B. (2005). The association between the legal and financial reporting environments and forecast performance of individual analysts.Contemporary Accounting Research,22(4), 727-758.

- Barron, O.E., Byard, D., & Yu, Y. (2008). Earnings surprises that motivate analysts to reduce average forecast error.The Accounting Review,83(2), 303-325.

- Barron, O.E., Byard, D., Kile, C., & Riedl, E.J. (2002). High-technology intangibles and analysts? forecasts.Journal of Accounting Research,40(2), 289-312.

- Beaver, W.H. (1998).Financial reporting: an accounting revolution(Vol. 1). Upper Saddle River, NJ: Prentice Hall.

- Behn, B.K., Choi, J.H., & Kang, T. (2008). Audit quality and properties of analyst earnings forecasts.The Accounting Review,83(2), 327-349.

- Bilinski, P. (2014). Do analysts disclose cash flow forecasts with earnings estimates when earnings quality is low?Journal of Business Finance & Accounting,41(3-4), 401-434.

- Black, E.L., & Carnes, T.A. (2006). Analysts' forecasts in Asian-Pacific Markets: The relationship among macroeconomic factors, accounting systems, bias and accuracy.Journal of International Financial Management & Accounting,17(3), 208-227.

- Brown, L.D., & Mohammad, E. (2010). Is analyst earnings forecast ability only firm specific?Contemporary Accounting Research,27(3), 727-750.

- Brown-Liburd, H.L., Cohen, J., & Trompeter, G. (2013). Effects of earnings forecasts and heightened professional skepticism on the outcomes of client-auditor negotiation.Journal of Business Ethics,116(2), 311-325.

- Byard, D., Li, Y., & Yu, Y. (2011). The effect of mandatory IFRS adoption on financial analysts? information environment.Journal of accounting research,49(1), 69-96.

- Chang, M., Hooi, L., & Wee, M. (2014). How does investor relations disclosure affect analysts' forecasts?Accounting & Finance,54(2), 365-391.

- Chen, C.J., Ding, Y., & Kim, C.F. (2010). High-level politically connected firms, corruption, and analyst forecast accuracy around the world. Journal of International Business Studies, 41(9), 1505-1524.

- Chen, L.H., Krishnan, J., & Sami, H. (2014). Goodwill impairment charges and analyst forecast properties.Accounting Horizons,29(1), 141-169.

- Cheong, C.S., Kim, S., & Zurbruegg, R. (2010). The impact of IFRS on financial analysts' forecast accuracy in the Asia-Pacific region: The case of Australia, Hong Kong and New Zealand.Pacific accounting review,22(2), 124-146.

- Choi, J.H., Kim, J.B., Qiu, A.A., & Zang, Y. (2012). Geographic proximity between auditor and client: How does it impact audit quality?Auditing: A Journal of Practice & Theory,31(2), 43-72.

- Chopra, V.K. (1998). Why so much error in analysts' earnings forecasts?Financial Analysts Journal, 35-42.

- Clement, M.B. (1999). Analyst forecast accuracy: Do ability, resources, and portfolio complexity matter?Journal of Accounting and Economics,27(3), 285-303.

- Clement, M.B., Koonce, L., & Lopez, T.J. (2007). The roles of task-specific forecasting experience and innate ability in understanding analyst forecasting performance at https://www.sciencedirect.com

- Coën, A., Desfleurs, A., & L?Her, J.F. (2009). International evidence on the relative importance of the determinants of earnings forecast accuracy.Journal of Economics and Business,61(6), 453-471.

- Cotter, J., Tarca, A., & Wee, M. (2012). IFRS adoption and analysts? earnings forecasts: Australian evidence.Accounting & Finance,52(2), 395-419.

- Dhaliwal, D.S., Radhakrishnan, S., Tsang, A., & Yang, Y.G. (2012). Nonfinancial disclosure and analyst forecast accuracy: International evidence on corporate social responsibility disclosure. The Accounting Review, 87(3), 723-759.

- Daske, H., Hail, L., Leuz, C., & Verdi, R. (2008). Mandatory IFRS reporting around the world: Early evidence on the economic consequences.Journal of accounting research,46(5), 1085-1142.

- DeFond, M., & Zhang, J. (2014). A review of archival auditing research.Journal of Accounting and Economics,58(2-3), 275-326.

- Demmer, M., Pronobis, P., & Yohn, T.L. (2015). Financial statement-based forecasts and analyst forecasts of profitability: The effect of mandatory IFRS adoption. Retrieved from SSRN: http://ssrn.com/abstract=2544566

- Ernstberger, J., Krotter, S., & Stadler, C. (2008). Analysts? forecast accuracy in Germany: The effect of different accounting principles and changes of accounting principles.Business Research,1(1), 26-53.

- Firth, M., & Gift, M. (1999). An international comparison of analysis' earnings forecast accuracy.International Advances in Economic Research,5(1), 56-64.

- Gu, F., & Wang, W. (2005). Intangible assets, information complexity, and analysts? earnings forecasts.Journal of Business Finance & Accounting,32(9-10), 1673-1702.

- Hall, J.L., & Tacon, P.B. (2010). Forecast accuracy and stock recommendations.Journal of Contemporary Accounting & Economics,6(1), 18-33.

- Hodgdon, C., Tondkar, R.H., Harless, D.W., & Adhikari, A. (2008). Compliance with IFRS disclosure requirements and individual analysts? forecast errors.Journal of international accounting, auditing and taxation,17(1), 1-13.

- Holland, J.B. (1998). Private disclosure and financial reporting.Accounting and Business Research,28(4), 255-269.

- Hope, O.K. (2003). Disclosure practices, enforcement of accounting standards, and analysts' forecast accuracy: An international study.Journal of accounting research,41(2), 235-272.

- Hope, O.K., & Kang, T. (2005). The association between macroeconomic uncertainty and analysts' forecast accuracy.Journal of International Accounting Research,4(1), 23-38.

- Horton, J., Serafeim, G., & Serafeim, I. (2013). Does mandatory IFRS adoption improve the information environment?Contemporary accounting research,30(1), 388-423.

- Jacob, J., Lys, T.Z., & Neale, M.A. (1999). Expertise in forecasting performance of security analysts.Journal of Accounting and Economics,28(1), 51-82.

- Kim, J.B., Li, L., & Zhang, H. (2017). Analyst Forecast Accuracy and Media Independence.Financial Management,46(4), 1023-1051.

- Kothari, S.P., Li, X., & Short, J.E. (2009). The effect of disclosures by management, analysts, and business press on cost of capital, return volatility, and analyst forecasts: A study using content analysis.The Accounting Review,84(5), 1639-1670.

- Kwag, S.W.A., & Small, K. (2007). The impact of regulation fair disclosure on earnings management and analyst forecast bias.Journal of Economics and Finance,31(1), 87-98.

- Lang, M.H., & Lundholm, R.J. (1996). Corporate disclosure policy and analyst behavior.Accounting review, 467-492.

- Lara, J.M.G., Osma, B.G., & Penalva, F. (2016). Accounting conservatism and firm investment efficiency.Journal of Accounting and Economics,61(1), 221-238.

- Lee, S., Pandit, S., & Willis, R.H. (2013). Equity method investments and sell-side analysts' information environment.The Accounting Review,88(6), 2089-2115.

- Lehavy, R., Li, F., & Merkley, K. (2011). The effect of annual report readability on analyst following and the properties of their earnings forecasts.The Accounting Review,86(3), 1087-1115.

- Lin, B.X., & Lin, C.M. (2017). SEC FRR No. 48 and analyst forecast accuracy.Applied Economics Letters,24(6), 427-432.

- Liu, C., Wang, T.W., & Yao, L.J. (2013). An empirical study of XBRL's impact on analyst forecast behavior.Journal of Accounting and Public Policy. Re

- Lobo, G.J., Song, M., & Stanford, M. (2012). Accruals quality and analyst coverage.Journal of Banking & Finance,36(2), 497-508.

- Luo, X., Homburg, C., & Wieseke, J. (2010). Customer satisfaction, analyst stock recommendations, and firm value.Journal of Marketing Research,47(6), 1041-1058.

- Maines, L.A., McDaniel, L.S., & Harris, M.S. (1997). Implications of proposed segment reporting standards for financial analysts' investment judgements.Journal of Accounting Research,35, 1-24.

- Mikhail, M.B., Walther, B.R., & Willis, R.H. (1997). Do security analysts improve their performance with experience?Journal of Accounting Research,35, 131-157.

- Myring, M., & Wrege, W. (2009). Analysts? earnings forecast accuracy and activity: A time-series analysis.Journal of Business & Economics Research,7(5), 87-96.

- Orens, R., & Lybaert, N. (2007). Does the financial analysts' usage of non-financial information influence the analysts' forecast accuracy? Some evidence from the Belgian sell-side financial analyst.The International Journal of Accounting,42(3), 237-271.

- Stahl, G.K., & Sully de Luque, M. (2014). Antecedents of responsible leader behavior: A research synthesis, conceptual framework, and agenda for future research.Academy of Management Perspectives,28(3), 235-254.

- Tan, H., Wang, S., & Welker, M. (2011). Analyst following and forecast accuracy after mandated IFRS adoptions.Journal of accounting research,49(5), 1307-1357.

- Tong, H. (2007). Disclosure standards and market efficiency: Evidence from analysts' forecasts.Journal of International Economics,72(1), 222-241.

- Walther, B.R., & Willis, R.H. (2013). Do investor expectations affect sell-side analysts? forecast bias and forecast accuracy?Review of Accounting Studies,18(1), 207-227.

- Wang, L., & Alam, P. (2007). Information technology capability: firm valuation, earnings uncertainty, and forecast accuracy.Journal of Information Systems,21(2), 27-48.

- Xie,Y., Zhang,Y., & Zhou,J. (2012). National Level, City Level Auditor Industry Specialization and Analyst Forecast Properties.International Journal of Auditing,16(3), 248-267.

- Yu, M. (2010). Analyst forecast properties, analyst following and governance disclosures: A global perspective.Journal of International Accounting, Auditing and Taxation,19(1), 1-15.