Review Article: 2022 Vol: 26 Issue: 3

Factors Affecting Post Pandemic Channel Preference of Young Consumers In India

Mrinalini Shah, Institute of Management Technology

Shweta Kadam, Somaiya Institute of Management

Rituparna Basu, International Management Institute- Kolkata

Citation Information: Shah, M., Kadam, S., & Basu, R. (2022). Factors affecting post-pandemic channel preference of young consumers in india. Academy of marketing studies journal, 26(3), 1-17.

Abstract

The impact of the Covid 19 pandemic on the retail sector and its adaptive consumer behavior has been strongly felt. Researchers worldwide have studied consumers' behavioral adaptation in phases of lockdown to understand patterns and identify trends that may continue in the post-pandemic world. In order to categorize research specific to buying behavior as a response to the pandemic, the present paper carries out a bibliometric analysis to identify research trends. Further, an empirical study among young Indian shoppers is carried out to identify the factors that affect their online and offline buying decisions. The present study used exploratory factor analysis to identify factors affecting online and offline buying at the pilot study stage. Researchers proposed the models and framed the hypothesis. Dataset using a structured questionnaire was tested using structural equation modeling and path analysis. The result indicated financial impact has no mediation effect on user experience. The partial mediation effect of delivery experience for online channel preference was established. For offline channel preference, discount and in-store deals have a full mediation effect on hedonic and user experience. Indian youth preferred the online channel for utilitarian products and repeat buying whereas offline was preferred for in-store discounts.

Keywords

Covid 19, Online Buying, Offline Buying, Bibliometric Analysis, Factor Analysis, SEM.

Introduction

The seismic impact of the Covid-19 pandemic and the consequent lockdown situation has dramatically changed the retail sector and shopping habits. This unforeseen change led to faster adoption and growth in online shopping around the world, and India is no exception. On one side, the offline retailers quickly explored ways to offer products via e-commerce or mobile commerce, and on the other side, even the devout offline buyers were compelled to shop online (Roy Chaudhary, 2020), albeit only for a few products during complete lockdown period. Though the e-commerce sector also witnessed the initial shocks and chaos due to the prevailing pandemic-related constraints (Sanjanwala & Issac, 2020). On the consumption end, over-stoking of utilitarian products, health and hygiene items led to disruptions in the marketplace (Mckinsey, 2021), giving rise to adaptive consumption practices. Ministry of Home Affairs (MHA), Government of India helped e-commerce by easing guidelines permitting the delivery of essential goods, required raw materials, and intermediary products and services during the lockdown by companies operating under the e-commerce sector. E-commerce operations were readily used by consumers looking for convenience and safe shopping alternatives. Despite marked differences from the point of view of product categories purchased online being noticed during this phase, growing adoption of online buying among tier II and III city consumers in India had long-term implications for the marketers.

Almost 6-7 months of compulsory lockdowns, confined to four walls, vaccination announcements in India and many of the developed countries, and lower mortality rates in the country had a very different impact on different people for the buying and consumption pattern. Few people were always on guard and restricted their online shopping, and only consumed utilitarian products and services, whereas others started to also switch to offline buying, especially in tier II and III cities. Through the phases of intermittent easing of lockdown restriction, consumers switching to offline shopping or hybrid alternatives were seen.

However, most of the customers returned to the offline mode or switched to the hybrid mode once the market opened. Mckinsey report (2020) stated that during peak lockdown, online shopping increased, yet transactions through the online channel (both delivery and in-store pickup) were less than 30% in any country. Few media reports claimed that the offline footfall continued to be lower even after partial or complete unlocking the market during the initial phases due to pandemic fear. Still, the conversion rate was approximately 90% (Mahipal, 2020) which motivated us to study the change in channel preferences of buyers.

Interestingly, changes in consumer behaviour caused by the pandemic have received a lot of attention in research since 2020. Given the high market share of young buyers, there was a need to understand their channel preferences. This paper is an attempt to explore the factors that lead to online and offline channel preference among young Indians after the first lockdown.

In the next section of the study, a bibliometric analysis was performed to identify research gaps to complement the review of literature required for the exploratory study. A pilot study was carried out, and hypotheses and models were proposed. A subsequent confirmatory analysis was carried out to present results and insights as discussed in the concluding sections of the paper.

Bibliometric Review

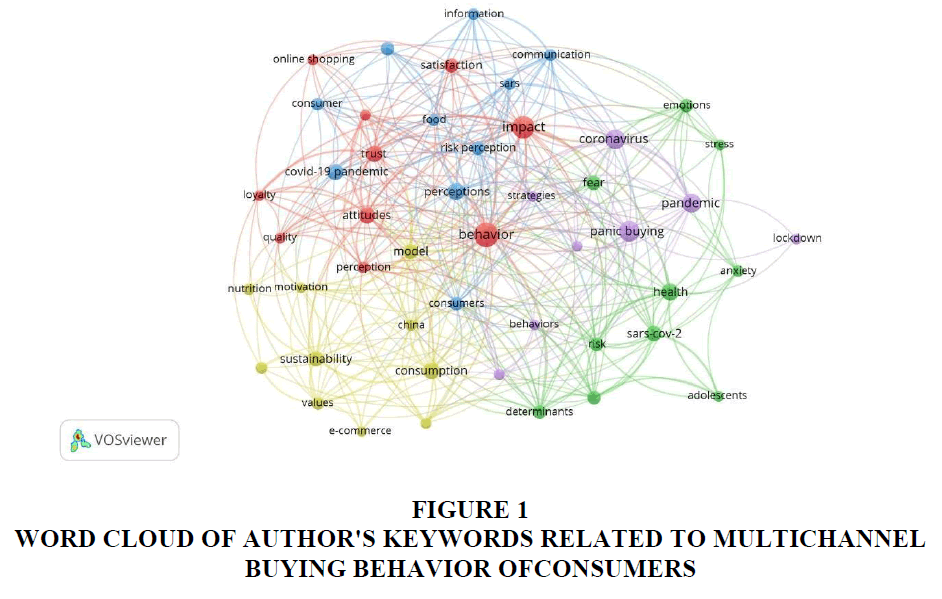

A bibliometric review of literature for keywords (Covid-19 online buying behavior + Covid 19 multichannel buying and Covid-19 consumer behavior) is done. Total 250 research papers were found using the Web of Science database out of which 169 were on consumer behavior during covid 19 for the year of the publication, including early access, 2020. After analysis of the research articles and examination of the author's keyword, a word cloud was produced. Table 1 depicts the most frequent author's keywords and their related link strength for (i) Covid 19 buying behavior and (ii) online and multichannel buying behavior. The most common words across the two tables are panic buying Figure 1.

| Table 1 Author’s Keywords | |||||

| Covid 19 Buying Behaviour | Covid 19 Online & Multichannel Buying Behaviour | ||||

| Keyword | Occurrences | Total Link Strength | Keyword | Occurrences | Total Link Strength |

| Impact | 89 | 215 | Panic buying | 17 | 60 |

| Behaviour | 21 | 73 | Communication | 11 | 51 |

| Fear | 24 | 71 | Perceptions | 3 | 33 |

| Coronavirus | 19 | 50 | Attitude | 3 | 33 |

| Consumption | 17 | 49 | Consequences | 2 | 28 |

| Panic buying | 11 | 43 | Cyberchondria | 2 | 28 |

| Perceptions | 15 | 43 | Fear Appeals | 2 | 28 |

| Attitudes | 12 | 43 | Unusual Purchasing | 2 | 28 |

| Health | 11 | 42 | Information Overload | 2 | 28 |

| Pandemic | 9 | 40 | Meta-analysis | 2 | 28 |

Panic buying, consumption, consumer behavior, attitude of people, Cyberchondria (due to fear search related to health) are discussed majorly in recent research work carried out during the last two years. Fig 1 depicts the network strength of keywords explored during bibliometric analysis. Table 2 shows the top ten countries in terms of research papers in the field of our study, its citations, and total link strength. The table is arranged in descending order of citations (Dutta & Biswas, 2009).

| Table 2 Country-Wise Data on Research and its Citations for Consumer Behavior During Covid 19 | ||||

| Id | Country | Documents | Citations | Total link strength |

| 54 | USA | 52 | 1057 | 14 |

| 23 | Italy | 16 | 500 | 4 |

| 35 | Peoples r China | 26 | 427 | 8 |

| 36 | Poland | 7 | 334 | 0 |

| 12 | England | 14 | 325 | 10 |

| 1 | Australia | 9 | 262 | 8 |

| 45 | South Africa | 6 | 260 | 4 |

| 47 | Spain | 11 | 176 | 2 |

| 18 | India | 18 | 105 | 2 |

| 15 | Germany | 7 | 86 | 5 |

Identification of Research Trends and Gaps

Almost all research studies focused on online retail/e-commerce, and no study was found on offline retail in the search results Table 1. Therefore, factors affecting offline retail preferences across the globe amidst the pandemic remained unexplored. Out of 169 papers, only 18 papers (11%) were found in the Indian context Table 2. Based on these two findings, we conducted an in-depth review of literature on consumer behavior and factors affecting online and offline channel preference (Ling & Yazdanifard, 2014; Khare & Rakesh, 2011).

Review of Literature

Consumer buying behavior has been impacted due to Covid-19 presented a framework of the consumer behavioral shifts. Off late research studies are focused mainly on online shopping in the context of a pandemic, and some have focused on the impact on specific product types or industries discussed increasing boredom among people and its impact on behavior. This rising boredom was a result of a sudden change in lifestyle due to confinement within four walls. Boredom was found to be the primary motivator and makes it more susceptible to break all barriers and indulge in the hedonic experience. Once the threat to lives reduced due to lesser cases in the country, and the hope of vaccine availability, people started looking for reducing boredom from limited activities maintaining limited safety measures like masks, etc. That led to people going for hedonic activities, products, and services which would be an expression of sensation seeking and make it interesting to study post-pandemic consumption willingness.

In general, consumers tend to explore alternatives that have been the pivotal phase in the consumer buying process. Asymmetric information (Biswas et al., 2009) and intangibility (Comegys et al., 2009) are common issues with online buying. The touch and feel of the actual product exploration is a key for offline buying (Comegys et al., 2009) which stimulates its sensory trait (Park et al., 2012). This physical examination leads to diagnostic power of the product and services.

Jena (2020) studied understanding of young Indian's shopping intentions during covid-19 and concluded that shopping intentions depend upon perceived hedonic and perceived utilitarian value and gender has a mediating effect. But Jena (2020) did not study the factors responsible for channel preference and limited his study only to online buying behaviour.

Determinants of Online and Offline Shopping Behaviour

The rise in smartphone users has also accelerated the momentum of Online buying fuelled by an external environment of lockdown and pandemic. The total number of smartphone users in India is likely to rise to nearly 83 crores by 2022 Indian Express 2020, internet users have increased to 624.0 million Digital, 2021. The median age of the Indian population is around 28 years in 2021 (Ministry of Statistics and Programme Implementation of the Government of India). Although the younger generation is more inclined toward online channel, in the past, lockdown witnessed people from all age groups purchased via online channels. However, many customers bounced back to the offline mode or converted to the hybrid mode once the market opened. Many studies have found that online commerce is likely to remain up, yet lack of social interaction and boredom will bring customers to physical stores and offline shopping post-pandemic.

The EY consumer future index 2021 found that 38% of US consumers wanted more online shopping and wanted to visit physical stores that offer great experiences. No such study was found in the Indian context. The role of the shopping experience is fundamental in building brands and channel preference. As part of the purchase process, Customers explore all possible alternatives and related benefits as per the need while selecting a channel.

Online Buying

E-commerce has witnessed growth during this pandemic, safety being a major concern. The shopping experience is believed as the key factor in building a brand of any e-commerce platform. With the rising competition even in online platforms, pricing and discount were becoming key factors in attracting customers. With many such offers, customers are now looking for many other parameters of the consumer experience cycle. Delivery deadlines, security of their payment details, and reliability of e-commerce (Sharma & Jhamb, 2020) started creating a difference in customer preference for e-commerce companies. However, it has been observed that besides discounts and offers, a customer also explores other factors like recommendations, ratings, and reviews given by firsthand customers about the perceived quality of products. Perceived ease of use of platforms, delivery experience, and service quality lead to customer satisfaction retention and develops brand loyalty eventually (Wolfinbarger & Gilly, 2003). Variety, convenience, and reviews on customer experience influence online shoppers. For avoiding coronavirus infections, maintaining social distancing was one of the primary advices from doctors. Observing that, few e-commerce sites started offering contactless delivery (no contact, stop doorbell option, leaving the parcel at the doorstep etc) and gained customers' confidence again to shop using online channels. Personal safety, diversified selection, product description, convenience, interactive websites, and time efficiency (Pera, 2020) was the primary factors for E-commerce channel preference and the other determinants discussed above.

Offline Buying

Indian traditional offline buyers were habitual exploring the market and enjoying the experience as one of the social pleasure acts as well. Customary offline user is used to weigh the alternatives (Biswas et al., 2009). Developing a personal relationship with shop owners/ managers at a retail store forms a further add-on and act of social relationships and positive impressions on these buyers. A positive experience can be considered as a specific determinant in retail performance. Traditionally, these customers are stimulated by an in-store environment that adds to their shopping experience, such as store layout and signage, pleasant environment, presence of helpful and knowledgeable staff (Park et al., 2019). Instore experience of individual judgment, feelings, and perceptions to both physical and social stimuli of individual responses and personalized discounts and deals based on bargaining adds to shopping pleasure for offline buyers. The other factors of offline channel preferences have been touch and feel during and after shopping at the base of offline/ traditional shopping along with store ambiance. Researchers and marketers coin this experience as hedonic experience and, from its perspective, play a major role in long-term relationship building (Borges et al., 2010) and fulfilling emotional needs.

In many cases, store ambiance and aroma lead to the hedonic pleasure associated with offline buying. Few traditional buyers still consider trying out the products before the actual purchase (Childers & Peck, 2010), and for a few others, immediately getting the product is a motivator for offline shopping. Retail stores that appeal to value-conscious customers (Pallant et. al., 2020) are more resilient to e-commerce as they cater and supply to the customers who want fast and convenient ways of shopping, which are discussed in the following sections.

Pilot Study, Proposed Models and Hypothesis

Online and offline susceptibility scales are developed by understanding the factors which motivate shoppers to buy online or offline. Eleven items are identified for the scale development of each buying behavior which was borrowed from a review of the literature and further modified through Exploratory Factor analysis in the pilot study. A survey questionnaire was designed using the five-point Likert scale (Meisenberg & Williams, 2008). The pilot study survey tool consisted of 40 items, including screening questions.

Pilot Study and EFA Results

Due to the study's exploratory nature, exploratory factor analysis (EFA) was executed to affirm unidimensionality. The subsequent investigation was based on the factors thus obtained. Harman's single-factor test, which includes all items in a principal component factor analysis, ruled out common method bias concerns (Chang et al., 2010). That is, no single factor stands alone in causing substantial variance in the common method. The first factor, 'User Experience', represents 22.71 % of the variance, and the total variance explained is 70.36% for online preference.

The three extracted factors accounted for 72%% of the variance for offline behavior, whereas a single factor accounted for 30.492% of the variance. These figures ruled out a common method bias. Cronbach's α coefficients were applied to examine the construct validity and reliability for each variable and the internal consistency between items for each construct. The constructs of the Cronbach's α coefficient were above 0.7.

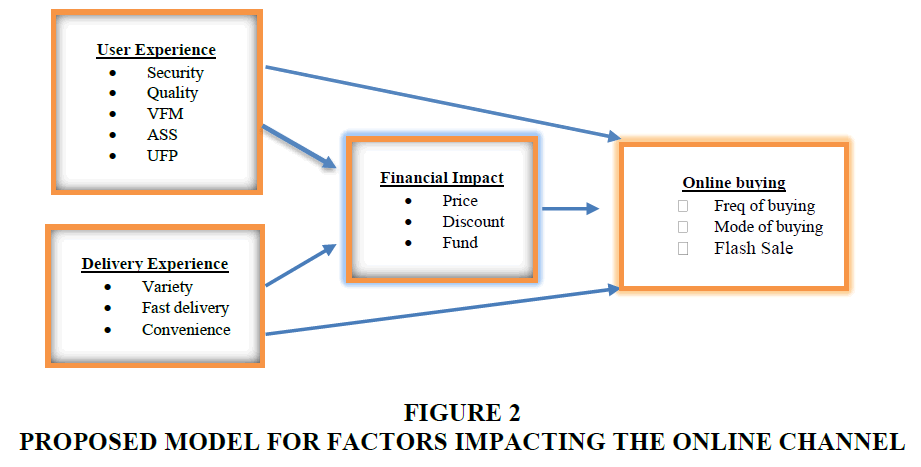

After conducting exploratory factor analysis (EFA) for online buying behavior, three items, brand image, ease of payment, and EMI were removed due to low factor loadings concerns and the EFA table 3 is designed after dropping the aforesaid variables. EFA listed three variables for online shopping buyer's behavior which we have named as: User experience, Delivery experience, and financial impact. The third variable, financial impact consists of three items: discount offers, price of the product, and fund availability. The third item is interesting and relevant, knowing the ubiquitous external situation (Basaran & Buyukyilmaz, 2015).

| Table 3 EFA for Online Buying | |||

| Variables/Items | Factors/Latent Constructs | ||

| Online | User Experience | Delivery Experience | Financial impact |

| After Sales Services (ASS) | 0.766 | ||

| Security | 0.746 | ||

| Quality of Products | 0.727 | ||

| Value for Money (VFM) | 0.676 | ||

| User Friendliness of the Platform (UFP) | 0.667 | ||

| Convenience | 0.874 | ||

| Fast Delivery | 0.858 | ||

| Variety | 0.656 | ||

| Discounts Offered | 0.881 | ||

| Price | 0.84 | ||

| Savings or Availability of Funds | 0.576 | ||

| Total variance Extracted-70.36% (KMO-0.814) | EV-22.71% | EV-22.51% | EV-20.14% |

| Rotation Method: Varimax with Kaiser normalization. a. Rotation converged in 6 iterations; EV- extracted Variance of an individual Factor |

|||

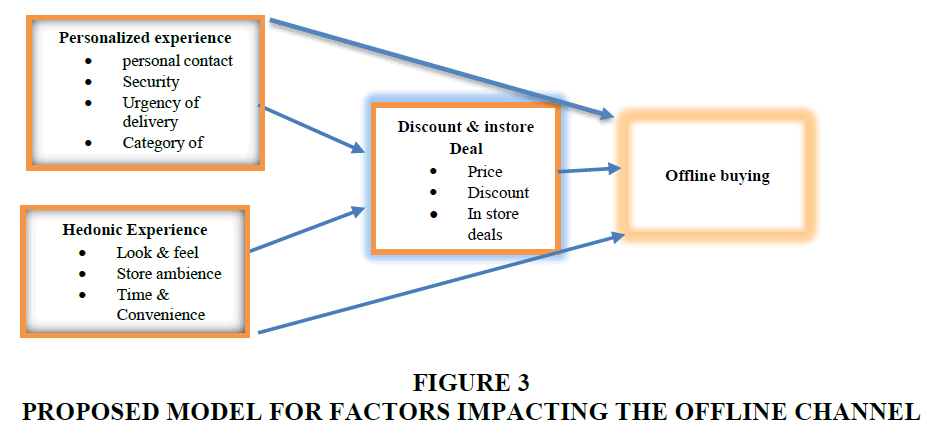

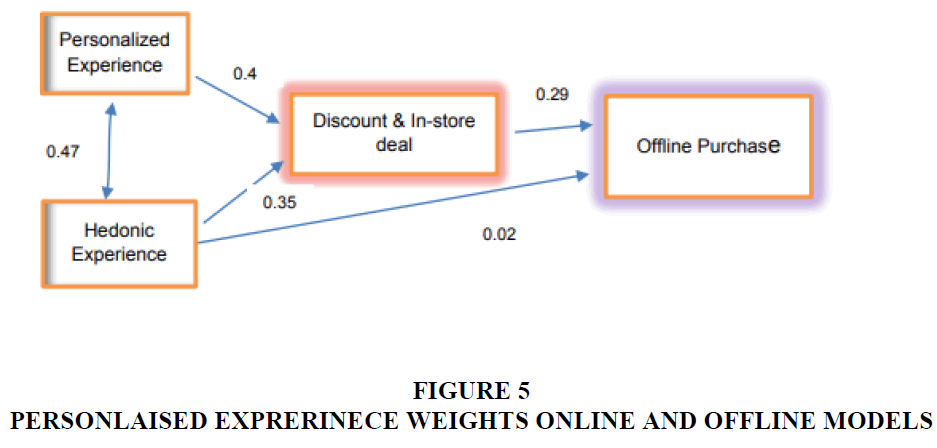

In the online buying model refer table 3, the user experience was measured using five elements/variables, while the delivery experience and the offers and discounts were measured using three elements obtained from the exploratory factor analysis (EFA) on the pilot sample of 40 respondents. Similarly, in the offline buying model, the 'Personalized Experience' was measured using five items, while the 'Discount and in-store deals offer' and 'hedonic experience' constructs were measured using three items each Table 4.

| Table 4 EFA Results for Offline Buying | |||

| Variables/Items | Factors/Latent Constructs | ||

| Offline | Personalized Experience |

Discount & instore deals |

Hedonic experience |

| Personal Contacts | 0.846 | ||

| Security | 0.813 | ||

| Personalised Attention | 0.734 | ||

| Category of Products | 0.71 | ||

| Urgency of Delivery | 0.614 | ||

| Availability of Discounts | 0.869 | ||

| Price of Products | 0.806 | ||

| In store Deals | 0.79 | ||

| Time and Convenience | 0.837 | ||

| Look and Feel of the Product | 0.811 | ||

| Store Ambience | 0.558 | ||

| Total variance extracted-72.07% (KMO- 0.82) |

EV-30.49% | EV-23.22% | EV-18.35% |

| Rotation Method: Varimax with Kaiser Normalization. a. Rotation converged in 6 iterations; EV- Extracted Variance of an individual Factor |

|||

Researchers proposed two models Figures 2 & 3 based on the EFA results to be tested for further clarity (Lăzăroiu et al., 2020).

Hypothesis

Hypothesis for online buying

H1a: User Experience has a significant impact on online buying.

H1b: Delivery Experience has a significant impact on online buying .

H1c: Discounts have a significant effect on online buying.

H1d: The delivery experience of online buying is influenced by discount offers.

H1e: User Experience of online buying is influenced by Discount offers Hypothesis for Offline buying.

H2a: Personalized experience has a significant impact on offline buying.

H2b: Hedonic Experience has a significant impact on Offline buying.

H2c: Discount & in-store deals has a significant impact on Offline buying.

H1d: Hedonic Experience of Offline buying is influenced by discount & in-store deal offers.

H1e: The personalized experience of offline buying is influenced by discounts & in-store deal offers.

Research Methodology

Cross-sectional data were collected between Jan-Mar 2021 in two phases once the market and travel were completely open post the first wave of COVID-19 in India. A partial lockdown was imposed until October 2020. Hence, that was when a hybrid mode of shopping was being observed too. After the pilot study, a refined questionnaire was administered to a new set of respondents. The data is collected to examine the proposed models obtained through a pilot study of phase 1. The main objective is to explore factors affecting channel preference of young Indian respondents.

The identified target group was from the age group 18-35 years and from the metro, tier I, and tier-II cities. Customers were experiencing multichannel service experiences across brick-and- mortar stores, online and hybrid methods. For the main study, data were collected through online and offline survey questionnaires and around 300 questionnaires were mailed as well as sent through WhatsApp using the google form. A valid sample of 174 respondents is used to analyze the buying behavior during this phase post-Covid (Wave I). An ideal sample size-to-parameter ratio of N: q would be 20:1 (1 parameter needs 20 cases), whereas less ideal would be an N: q ratio of 10:1 (1 parameter needs 10 cases) (Jackson, 2003; Byrne, 2010; Kline, 2015) where N is the number of cases and q is the number of model parameters. Our study comprises 8 latent constructs; thereby, at least 8 * 20=160 cases are needed. The N: q rule indicates that our sample size of 174 cases is acceptable.

Descriptive Analysis

SRefer to Table 4, respondents comprise 86 males (49.4 percent), and 88 females (50.6 percent), 85% reside in the metro, tier I, or II cities where online distribution and operation is well connected, making it easier to order online. 17.2% of people preferred only online mode, and 6.9% of respondents were totally into offline buying due to various reasons and, 75.9% of the buyers used a hybrid mode, which is an exciting group for this study. 43.7 % of the shoppers buy randomly depending upon a good deal.

Confirmatory Factor Analysis

Structural Equation Modelling (SEM) was employed to examine the proposed research model (Figures 2 & 3) and the hypothesized relationships. SEM has the distinctive advantage of accounting for all covariance in the data, which allows for the simultaneous examination of correlations, shared variance, path coefficients, and their significance, making it ideal for testing for main effects (Bollen, 1989); additionally, it involves an analysis of theoretical constructs that are measured by latent factors (Yuen et al., 2019; Avcilar & Özsoy, 2015)

Confirmatory factor analysis was then used to confirm the reliability and validity of the measurement model. Unidirectional path was not found between any latent variable in the measurement model, and Correlative paths among every latent variable were present. The composite reliability of the model under four constructs for both online and offline buying had the values of all indicators above the suggested criteria Table 5. Thus, the convergent validity of the measurement model is ascertained. Furthermore, the AVE (Average Variance extracted) for all constructs was above the recommended threshold of 0.5 representing good internal consistency. Discriminant validity was conducted to determine the potential overlaps among constructs, and the values of the square root were greater than the construct correlations, as presented in Table 5.

| Table 5 Descriptive Statistics | |||

| Variable | Frequency | Percentage | |

| Gender | Male | 86 | 49.4 |

| Female | 88 | 50.6 | |

| Age Group | 18-24 | 126 | 72.41 |

| 25-34 | 46 | 26.44 | |

| 35-50 | 2 | 1.15 | |

| City | Metro / Tier1 City | 98 | 56.3 |

| Tier 2 City | 50 | 28.7 | |

| Tier 3 City | 26 | 14.9 | |

| Frequency of shopping | Quarterly or less | 36 | 20.7 |

| Once a month | 40 | 23 | |

| Twice a month | 22 | 12.6 | |

| Depends upon a good deal | 76 | 43.7 | |

| Mode of Shopping | Online | 30 | 17.2 |

| Offline | 12 | 6.9 | |

| Hybrid (Online & Offline) | 132 | 75.9 | |

Table 6 represents the goodness of fit of the model under various parameters for online and offline buying and indicates a good fit of our model. For online buying RMSEA is found insignificant, but all other parameters were significant.

| Table 6 Reliability, Variance and Correlations | |||||

| Latent Variables /Constructs |

Compos ite Reliabili ty (CR) |

Average Variances | Correlation coefficients | ||

| Online buying | User Experience |

Delivery experience |

Financial Implications |

||

| User Experience (OUE) | 0.81 | 0.491 | 0.806 | ||

| Delivery Experience (ODE) |

0.69 | 0.230 | 0.489** | 0.480 | |

| Financial Implication | 0.83 | 0.548 | 0.519** | 0.443** | 0.740 |

| Online Buying | 0.75 | 0.649 | 0.059 | 0.306** | 0.220** |

| Offline Buying | Personalised Experience |

Discount & In- store deal |

Hedonic Experience |

||

| Personalised Experience | 0.86 | 0.518 | 0.720 | ||

| Discount &- In-store Deals |

0.86 | 0.324 | 0.541** | 0.569 | |

| Hedonic Experience | 0.81 | 0.452 | 0.499** | 0.539** | 0.673 |

| Offline Buying | 0.204** | 0.329** | 0.156* | ||

| **Correlation is significant at the 0.01 level (2-tailed); *Correlation is significant at the 0.05 level (2-tailed); |

|||||

| Discriminant validity- Figures in italics on diagonal in bold is the square root of AVE | |||||

For online buying RMSEA is found insignificant, but all other parameters were significant.

Hypothesis Testing

For online channel preference, all hypotheses except H1e (Users Experience of Online buying is influenced by Discount offers) are found significant. For offline channel preference, H2b (hedonic experience has a significant impact on Offline buying) was insignificant Table 7. For further probe, a mediation analysis was performed.

| Table 7 Online-Offline Buying | ||||||

| Model of Goodness of Fit |

χ2/df | RMSEA | GFI | AGFI | NFI | CFI |

| Cut-off Value | <5 | <0.08 | >0.9 | >0.8 | >0.9 | >0.9 |

| Reference | Bentler (1990) | Hu and Bentler (1999) |

Hu and Bentler (1999) |

Joreskog & Sorbom (1993) | Bentler and Bonett (1980) | Hu and Bentler (1999) |

| Online results | 4.575 | 0.144 | 0.987 | 0.871 | 0.966 | 0.973 |

| Offline results | 0.319 | 0.001 | 0.999 | 0.991 | 0.999 | 0.999 |

Mediation Analysis

Many researchers have used the Sobel-z test for mediation analysis, as suggested by Baron and Kenny. However, Zhoal et al. (2010) pointed out its inherent limitations.

Hence, according to suggested guidelines, we adopted the approach suggested by Zhao et al. (2010) to evaluate mediation effects. In order to test the significance of the indirect effects, a 10,000 subsample for bootstrapping was conducted. Four possible scenarios suggested by Zhao et al. (2010) are as follows:

1. If both the indirect and direct effects are not significant, that implies that there is no mediation.

2. If the indirect effect is significant, but direct is not significant, then it is ‘indirect only’ mediation

3. If the indirect effect is not significant, but the direct effect is significant then it is direct- only mediation

4. If both indirect and direct effects are not significant, that implies complementary, competitive, or partial mediation.

Table 8 summarizes the direct, indirect, and total effects along with their significance.

| Table 8 Testing of Hypothesis and Standardized and Unstandardized Weights | ||||

| Hypothesis | Unstandardised Coefficient | Standardised Coefficient | p- value s |

Result |

| Online buying | ||||

| H1a: User experience has a significant impact on online Buying |

NA | NA | NA | |

| H1b: Delivery experience has a significant impact on Online buying |

0.15 | 0.26 | *** | |

| H1c: Discounts have a significant effect on online buying |

0.05 | 0.11 | *** | |

| H1d: The Delivery experience of Online buying is influenced by Discount offers |

0.28 | 0.26 | *** | |

| H1e: Users Experience of Online buying is influenced by Discount offers |

0.042 | 0.029 | 0.20 2 |

Insignif icant |

| Offline Buying | ||||

| H2a: Personalized Experience has a significant impact on Offline Buying |

0 | 0.124 | *** | |

| H2b: hedonic experience has a significant impact on Offline buying |

-0.025 | 0.031 | 0.72 | Insignif icant |

| H2c: Discount Offers has a significant impact on Offline buying |

0.29 | 0.29 | *** | |

| H2d: Hedonic experience of Offline buying is influenced by discount & deal in store |

0.115 | 0.124 | *** | |

| H2e: Hedonic experience of Offline buying is influenced by discount & deal in store |

0.101 | 0.125 | *** | |

Discussion

The global pandemic and the related long lockdown have affected the market, the consumer and the way businesses were run. Consumerism and consumer behaviour is affected by these ever- changing conditions in the last two years. During 2019-20, the retail market and the way to do business changed dramatically. The following section discusses the changing retail market scenario and change in consumer behavior due to pandemic and lockdown.

Changing Retail Market

The $810 billion Indian retail market is the fourth largest worldwide and e-retail is growing rapidly. India's online shopper base is 140 million, making it the 3rd largest in the world.

Online Market

Discounts and offers have been one of the key drivers with the convenience of attracting customers to online shopping from the beginning. But during periods of pandemic, full or partial containment, online purchases were a good option. People also began to accept it as a safety measure to avoid crowds, even when few physical stores began to open for a few hours. Discounts and price took a back seat slightly. Many big retail houses became omni channel faster (Reliance opened Jiomart, Shopper's stop, to name a few), and even small local businesses started moving to e-commerce. There was a growth of D2C (Direct to customer) business last year (Bains & company, 2021). Online market base increased in terms of value, volume and customer base. Indian e-retail grew by 25% in the financial year 2020 (Business standard, 2021) with 36% in volume in the last quarter (www.IBEF.org). Due to large and growing market segments, the online marketplace started offering contactless services and safety promises instead of discounts offers.

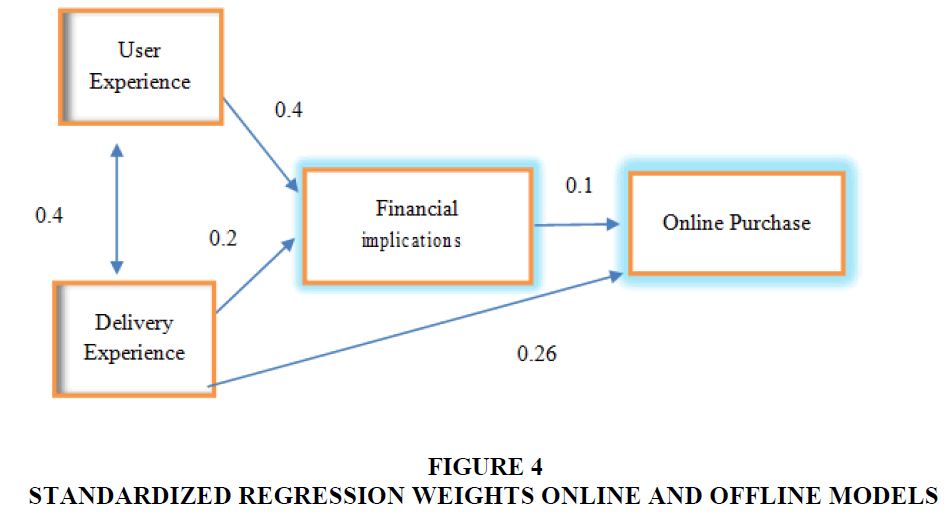

Based on the path analysis, the financial impact is not significant as either direct or indirect mediation on the user experience for the online purchase. The financial implications and delivery experience have a significant partial mediation effect on online shopping.

The research conducted prior Covid-19, referred ease of use of the platform, security, quality of products, after-sales service, returns, value for money, etc. were the motivating factors for online purchasing behavior [All these items are mentioned as the variable 'user experience' in the pilot study EFA]. User experience irrespective of discount offers had no mediation effect on Online buying. Due to compulsory lockdown and other medical or safety measures, most people were forced to buy online. One of the reasons for no mediation effect of User experience towards online buying may also be due to the age group of our respondents (18-35 years). Young urban might not have faced the technical difficulty of using an online platform. Most of the big brands for utilitarian products faced supply chain and availability issues due to the external situation and most customers compromised the brand loyalty and bought local labels (Pera, 2020; Lim et al., 2020).

The online purchase (during the investigation period) was dependent on the shipping experience with or without discount offers. This is readily explained as a security concern during the pandemic period. The products purchased online by the respondents were mostly utilitarian in nature; therefore the result explains the partial mediation effect on the path.

'DeliveryExp.→ discounts→ Online buying' refer Table 9.

| Table 8 Mediation Analysis for Online & Offline Channel Preference | |||

| (VIII a) : Online channel | Mediation | ||

| Hypothesis | Standardized Direct Effects (X1-Y) |

Standardized Indirect Effects |

Results |

| User Exp→Financial Impl→ Online Buying | 0(ns) | 0.029(ns) | No Mediation |

| Delivery Exp→ Financial Impl →Online Buying |

0.26(**) | .215(**) | Partial Mediation |

| 7) Offline Channel | |||

| Personalised Exp.→ discount &deal in store→ Offline Purchase |

0(ns) | 0.124(***) | Full Mediation |

| Hedonic experience →discount & deal I store→ Offline Purchase |

0.031 (ns) | 0.125(***) | Full Mediation |

| *** p<0.01, *p<0.05, ns "not sig" | |||

Our respondents clearly indicated the category of items preferred through online purchase. One-time surge demand for electronics products and medical equipment repeat orders for essential products like grocery items, food, medicines, hygiene, and sanitary products were observed. Due to the inherent fear among the public, they avoided luxury items, recreational activities, and sports items at least during the initial phases (questionnaire has asked about purchases in the last six months).

Offline Market

According to a joint report by C (2021), India's retail market fell 5% in 2020 despite a 25% growth in e-commerce. These data imply the enormous impact that the offline retail market faced in the country. Full and partial isolation in different phases and regions of the country has resulted in the accumulation of inventory in retail stores and warehouses. E-commerce continued to grow during the first six months of lockdown (March- October) for most utility products and services. In order to attract customers to the local market, most of the stores began attractive offers. India celebrates most of its major festivals between October and November and the wedding season (October to February). The Indian market also witnessed in-store deals and in-person bargains/ discounts, which were suddenly on the rise for all hedonic products and services. Apparel, footwear, cosmetics, artificial fashion jewelry, etc were sold at huge discounts at the store. The tourism industry has started to attract people with the option of long-stay discounts in luxury resorts, hotels and homestay options. The market was suddenly divided into two kinds: one with all essential and utilitarian products and services and one with hedonic products and services. Various types of stores behaved very differently.

The discounts & deal in the store has significant full mediation for indirect effect in both the paths (Personalized experience and hedonic experience), but were not significant as a direct effect. Personalized experience consists of personal contacts with the retailer, personal attention, quality of the product refer EFA Table 9. The personalized experience is not directly leading to Offline buying but instore discount offers/ bargaining shows full mediation effect and leads to the path:

Personalised Exp.→discounts and deal instore→Offline Purchase Table 9.

Further inquiry from the respondents suggested that local bargaining for luxury products and services was one of the catalyst and motivating factors for many to go offline shopping. Further investigation with retailers revealed that such offers were made to attract customers to purchase due to stock piled up during the lockdown period and increased credit. Although not all retailers mentioned all discount offers, the local market has a common practice of in-person rebate/local negotiation to attract customers. During the pre-covid era researchers argued hedonic pleasure, along with touch and feel, always has the antecedent of offline buying. Still, our analysis shows the full mediation effect of discount and instore deals.

Hedonic pleasure→ Instore deal→ Offline Purchase.

For utility goods, demand continued to increase or remained steady. This market only saw the shift from physical stores to online stores during the lockdown period in March until unlocking 2.0 in July-August. These companies had some supply chain issues, but the demands never diminished. So there weren't any additional offers to attract customers. In Tier II and Tier III cities, retail stores began to store and sell local brands of grocery items rather than MNCs or more recognized brands. Customers had fewer options as a result of the gap in demand-supply. For example, this has been observed for cookies, bread and numerous hygienic and sanitary products. This has led to greater profit margins or savings for many small retailers.

On the other hand, for hedonic products, luxury items, branded clothing and footwear, etc. Demand was almost negligible throughout those months (Yang, 2020). The stocks were accumulating and the money was locked in. Expenses were rising, and many businesses started laying off their supporting staff due to low business activities. With unlock 2.0, and 3.0, suddenly, the market saw festival season and marriage season (Mid October onwards) as an opportunity since the pandemic was under control in the country. These retail stores started many lucrative offers to attract customers to come to the local market and make purchases. In-store deal attracts the customer in a retail store as, over a period of time, customers have experienced that online offers are just a gimmick and the supply chain cost is also added in the price. Our respondents also confirmed this in their choices of products for offline purchase as mentioned by them.

Consumer Behaviour

A new trend of revenge shopping was seen during that time and attracted customers to also shop offline for occasions and festivals. The market is optimistic about a robust recovery once all covid-19 related restrictions are fully lifted. Large-scale vaccination programs boosted the confidence of Indian customers. Initial warning issued for old and people with comorbidities, combined with a higher recovery rate among young and low mortality rate, also played a major role in restoring and increasing customer and market confidence. Boredom combined with a large sum of savings and pent-up demand fueled by festivals and wedding seasons might increase consumer demand. China's robust recovery in consumer spending after gaining control of the COVID-19 virus is another reason for optimism for most countries ET times, Bloomberg.

In any shopping behavior, price and discount play a mediating role (Lee & Chen-Yu, 2018) and/or moderating role. People were becoming price-conscious, looking at uncertain times, which are not very surprising, looking at financial crunch too.

For online buying behaviour Figures 4 & 5 there is a significant relation between user experience and online buying, where discount offers are moderating the purchase. Delivery experience was also one of the factors in online buying. User experience was significantly associated with delivery experience and convenience.

These results are understandable during the pandemic period or therwise as well. But the study asked to list the main products that were purchased online in the last six months, and it was found that people preferred only utilitarian products. Only three respondents also bought fashion clothes due to marriage at home.

Conclusion

The pandemic impacted human connection, leaving a significant portion of the population apprehensive about socializing. Although most of the world witnessed and experienced high casualties, India in its first phase (March 2020- March 2021) experienced a very slow rate of infection and negligible human casualties.

But experiencing longer periods of work from home, school online, and partial lockdown put a strong sense of boredom too. Hence, on one side, this apprehension of socializing put the people to purchase online utilitarian products and medicines, and on the other side, the boredom of being confined to four walls made people dare to go out and re-experience offline purchasing. The offline buying was mostly for hedonic experiences and for exceptional incidents like festival shopping, marriage functions or travel-related purchases or during short pleasure trips purchases. Most of utilitarian products such as grocery and food items may continue to be purchased through E-commerce if the delivery experience and discounts are attractive. At the same time, products and services that involve high touch or close proximity to others may be permanently impacted by the pandemic. Hedonic and utilitarian products reasons for purchase post-event will allow marketers to communicate effectively with their customers and retailers should use them to determine inventory items and levels. These experiences of the last two years gradually give way to new consumer behaviors and business practices that may permanently reshape the way we do business.

The present study concluded that customers prefer online grocery items and repeat purchases of these products, but in-store deals and discounts combined with lack of socializing bring them to physical retail stores. These results also match with a recent study published.

References

Avcilar, M. Y., & Özsoy, T. (2015). Determining the effects of perceived utilitarian and hedonic value on online shopping intentions. Int. J. Mark. Stud, 7, 27-49.

Basaran, U., & Buyukyilmaz, O. (2015). The Effects of Utilitarian and Hedonic Values on Young Consumers Satisfaction and Behavioral Intentions. Eurasian Journal of Business and Economics, 8(16), 1-18.

Indexed at, Google Scholar, Cross Ref

Bollen, K. A. (1989). Structural equations with latent variables (Vol. 210). John Wiley & Sons.

Comegys, C., Hannula, M., & Váisánen, J. (2009). Effects of consumer trust and risk on online purchase decision-making: A comparison of Finnish and United States students. International Journal of Management, 26(2),295.

Dutta, S., & Biswas, A. A. (2009). Individual effects of product quality signals in the presence versus absence of other signals: differential effects across brick‐and‐mortar and online settings. Journal of Product & Brand Management.

Indexed at, Google Scholar, Cross Ref

Jackson, D. L. (2003). Revisiting sample size and number of parameter estimates: Some support for the N: q hypothesis. Structural equation modeling, 10(1), 128-141.

Indexed at, Google Scholar, Cross Ref

Jena, R. K. (2020). Understanding the determinants of young indians'shopping intention during covid-19. Academy of Marketing Studies Journal, 24(4), 1-17.

Khare, A., & Rakesh, S. (2011). Antecedents of online shopping behavior in India: An examination. Journal of Internet commerce, 10(4), 227-244.

Indexed at, Google Scholar, Cross Ref

Kline, R. B. (2015). Principles and practice of structural equation modeling. Guilford publications.

Lăzăroiu, G., Neguriţă, O., Grecu, I., Grecu, G., & Mitran, P. C. (2020). Consumers’ decision-making process on social commerce platforms: online trust, perceived risk, and purchase intentions. Frontiers in Psychology, 11, 890.

Indexed at, Google Scholar, Cross Ref

Lee, J. E., & Chen-Yu, J. H. (2018). Effects of price discount on consumers’ perceptions of savings, quality, and value for apparel products: Mediating effect of price discount affect. Fashion and Textiles, 5(1), 1-21.

Indexed at, Google Scholar, Cross Ref

Lim, W. M. (2020). An equity theory perspective of online group buying. Journal of Retailing and Consumer Services, 54, 101729.

Indexed at, Google Scholar, Cross Ref

Ling, L. P., & Yazdanifard, R. (2014). Does gender play a role in online consumer behavior. Global Journal of Management and Business Research: E Marketing, 14(7), 61-68.

Meisenberg, G., & Williams, A. (2008). Are acquiescent and extreme response styles related to low intelligence and education?. Personality and individual differences, 44(7), 1539-1550.

Indexed at, Google Scholar, Cross Ref

Pallant, J., Sands, S., & Karpen, I. (2020). Product customization: A profile of consumer demand. Journal of Retailing and Consumer Services, 54, 102030.

Indexed at, Google Scholar, Cross Ref

Park, E. J., Kim, E. Y., Funches, V. M., & Foxx, W. (2012). Apparel product attributes, web browsing, and e-impulse buying on shopping websites. Journal of Business Research, 65(11), 1583-1589.

Indexed at, Google Scholar, Cross Ref

Pera, A. (2020). Cognitive, behavioral, and emotional disorders in populations affected by the COVID-19 outbreak. Frontiers in Psychology, 2263.

Sanjanwala, P., & Issac, K. (2020). India: E-Commerce During Covid-19 & there after. Retrieved on June 30,2021,

Sharma, A., & Jhamb, D. (2020). Changing consumer behaviours towards online shopping-an impact of Covid 19. Academy of Marketing Studies Journal, 24(3), 1-10.

Wolfinbarger, M., & Gilly, M. C. (2003). eTailQ: dimensionalizing, measuring and predicting etail quality. Journal of retailing, 79(3), 183-198.

Indexed at, Google Scholar, Cross Ref

Yang, Y., Li, O., Peng, X., & Wang, L. (2020). Consumption trends during the COVID-19 crisis: How awe, coping, and social norms drive utilitarian purchases. Frontiers in psychology, 11, 2695.

Indexed at, Google Scholar, Cross Ref

Yuen, K. F., Wang, X., Ma, F., & Wong, Y. D. (2019). The determinants of customers’ intention to use smart lockers for last-mile deliveries. Journal of Retailing and Consumer Services, 49, 316-326.

Indexed at, Google Scholar, Cross Ref

Zhao, X., Lynch, J.G. Jr & Chen, Q. (2010). Reconsidering Baron & Kenny: myths & truths about mediation analysis. Journal of Consumer Research, Vol. 37 No. 2, pp. 197-206.

Received: 05-Mar-2022, Manuscript No. AMSJ-22-11462; Editor assigned: 07-Mar-2022, PreQC No. AMSJ-22-11462(PQ); Reviewed: 21-Mar-2022, QCNo. AMSJ-22-11462; Revised: 23-Mar-2022, Manuscript No. AMSJ-22-11462(R); Published: 28-Mar-2022