Research Article: 2025 Vol: 29 Issue: 3S

Factors Affecting Investors' Inclination towards Sustainable Investment: A Comparative Study based on Gender

Souvik Banerjee, Management Development Institute Murshidabad, Murshidabad

Prantik Ray, XLRI Jamshedpur

Vilas G Waikar, Agnel Institute of Technology & Design, Goa

Sohom Banerjee, Jaipuria Institute of Management, Noida

Citation Information: Banerjee, S., Ray, P., Waikar, V.G., & Banerje,, S. (2025). Factors affecting investors' inclination towards sustainable investment: a comparative study based on gender. Academy of Marketing Studies Journal, 29(S3), 1-9.

Abstract

This study emphasizes the significance of considering the gender dimension in investment decision-making processes. Traditional gender roles and societal norms have influenced distinct investment patterns based on gender. Historically, women have been less represented in investment-related sectors and have encountered societal obstacles that can affect their investment decisions. This work attempts to examine the factors that influence the preferences of investors towards sustainable investment strategies and how financial trade-offs play a role in shaping these preferences. Making investment decisions can be challenging for investors, particularly in today's dynamic market with numerous alternatives. Most investors seek investments that offer substantial returns quickly while minimizing the risk of losing their principal. Many are searching for excellent investment opportunities that promise to triple their money in a few months or years with minimal risk. A sample of 291 was collected from investors. The factors that affect investors' inclination towards sustainable investment are Financial Performance, Risk Management, Social and Cultural Factors, and Technological Advancement.

Keywords

Gender Factor, Risk-Tolerance, Investment Decisions, Investor’s Perception.

Introduction

In recent years, there has been increased focus on understanding how gender influences various societal domains, including finance and investing. Traditional gender roles and stereotypes have often shaped societal expectations, resulting in disparities in economic opportunities and decision-making. As the world moves towards greater gender equality, it is essential to explore the role of gender in investment decisions and its potential impact on financial outcomes.

Investment decisions are complex and difficult processes involving risk assessment, opportunities evaluation, and resource allocation. Such decisions have significant implications for individuals, households, and the broader economy. Understanding how gender influences investment choices and outcomes can reveal the underlying dynamics and contribute to more inclusive and equitable financial systems.

Study suggests that gender significantly shapes up investment decisions, with distinct patterns emerging between male and female investors. Women typically adopt a more risk-averse approach, prioritizing long-term stability and diversification in their investment portfolios. In contrast, men tend to have a higher risk-taking tendency and a greater inclination towards aggressive investment strategies. Furthermore, gender biases and stereotypes continue to remain within the investment industry, making an impact on women's access to information, opportunities, and financial resources.

These findings highlight the importance of promoting gender equality in finance, fostering inclusivity, and addressing structural barriers to empower all individuals to participate equitably in investment activities (Shah, 2023).

The main objective of investors is to create wealth. Many investment options are available in the market, including bank deposits, bonds, life insurance, modest savings plans, stocks, corporate deposits, and mutual fund products. These options offer different features like return, risk, safety, and ease, all competing for the investor's attention. Investors must decide carefully how to build their portfolio of financial assets and consider the allocation of assets. Therefore, investment is not only an interesting pursuit but also an extremely complicated and challenging one (Tiwari & Tiwari, 2022).

Investment decisions should be made considering the financial goals an individual wants to achieve, the level of risk that an individual can tolerate, and the investment duration. The main goal of investing is to earn higher returns with minimal risk. Risk preference varies from individual to individual and is influenced by various factors. Some individuals may choose high-risk investments to achieve greater returns, while others may prefer low-risk investments with more modest returns (Mahalakshmi & Anuradha, 2018). There is a need to boost saving and investment in the country through effective policies that consider the effectiveness of potential determinants. Job-holder women are increasingly aware of investing in shares, mutual funds, insurance, and fixed deposits, while older women tend to prefer real estate investments.

Therefore, the government, bankers, and financial institutions should introduce investment schemes segmented by age and marital status to attract more funds (Bhabha & Qureshi, 2014). Sustainable investment is defined as investment that takes into account environmental, social, and governance considerations. Since its inception, sustainable investment has been one of the fastest-growing techniques in the financial market. According to the study, investors' perceptions of risk and return on sustainable investments are influenced by demographic factors such as age, educational qualifications, and investment experience. It was also found that the main reason to choose sustainable investments is the security that they offer, with energy conservation being an important criterion to consider before making an investment (Nabeel & Sumathy, 2023).

Literature Review

Francis and Lokhande (2023) stated that sustainable investing ensures that businesses are evaluated for their financial returns and contributions to society. For investors, it is important to consider various social, political, and environmental factors. Sustainable investing includes a range of practices through which an investor can seek financial returns while promoting long-term environmental or social value. With sustainable investing, businesses are assessed based on their overall contributions to humanity rather than just their immediate financial success. Investors must carefully consider the potential impacts of their decisions on social, political, and environmental spheres.

In India, creating new financial instruments and sponsoring clean technology initiatives further support sustainable investment. The country's cleantech and green initiative market has experienced substantial growth. Patidar, et al. (2022) revealed that investment preferences vary from person to person and are highly individualized, influenced by future financial goals, current and projected income, risk tolerance, immediate financial needs, and more.

As investors move through different life stages and their financial objectives evolve, their investor profile becomes unique. While most investors are familiar with various investment options, their choices are tailored to their specific circumstances and goals. Investors typically diversify their investments across multiple avenues rather than focusing on one. Among these, shares, mutual funds, and debentures are popular choices for many investors. Their personal preferences and recommendations from friends and relatives influence their investment decisions. Most investors allocate a good share of their annual income towards investments. The main factor driving investment decisions is the potential returns they can expect from their investments. Popat and Pandya (2019) found that decision-making is a critical challenge in various situations, including investment choices. People carefully consider numerous factors before making decisions. Like other issues, investment decisions pose a significant challenge for many investors.

Individuals often struggle to identify their key decision-making criteria. The challenge lies in examining the association between savings, age, the number of earners in a household, and income concerning investment decisions, as well as understanding how different features affect the risk-taking capacity of rural and urban investors. Investors are placing greater emphasis on the number of earners in the family when determining their investment plan rather than solely focusing on the family's income. This shift reflects a sensitive concern for the stability of future family income. The perception of investors varies across different variables when deciding on an investment plan. The importance attached to different attributes differs between rural and urban investors yet remains consistent within each group of investors.

Tomo and Landi (2017) studied how information irregularities in financial markets are frequently worsened by disparities between investors' limited expertise and understanding of financial matters and companies' inadequate disclosure of credentials. As companies adopt good simulation mechanisms, investors can expand and diversify their sustainable investment portfolios even further. Lestari and Wiryono (2023) studied that sustainable investments offer competitive returns, which are favourable compared to traditional investments. Furthermore, the government provides incentives for various sustainable investment products. There is an urgent need for collaboration between financial services authorities and fund managers to ensure that sustainable investment products meet the requirements of this generation. The findings support several key conclusions, with positive performance being the most significant variable in sustainable investment.

Millennials and Generation Z show increased awareness about sustainability, although the full implementation of sustainable investment is still underway. The favourable performance of sustainable investment, influenced by its impact on returns and risk aversion, should be sustained to foster the development of the capital market. Sharma, et al. (2021) revealed that sustainable investment is vital in supporting investors in reducing carbon emissions from their returns and supporting investments in environmentally sustainable companies. Sustainable investment allows investors to align their values and ethics with their investment choices while earning a financial return. There has been a growing interest in sustainable investment in the past few decades.

However, investors sometimes hesitate to pursue sustainable investment opportunities due to perceptions of higher costs or risks than conventional investments.

Aich et al. (2021) stated that although there is considerable interest, private investors are found to be uninvolved in sustainable investing. Amongst global pandemic and economic downturn, even major multinational corporations are adopting a comprehensive sustainable approach ensuring long-term feasibility and flexibility against uncertainties. Thus, sustainable investment not just produces substantial financial returns but also impacts society positively as well as environment. Being able to identify the elements that influence a market value of company and evaluate the accuracy level of that valuation is vital for successful investing.

El Oubani (2024) found that sustainability has appeared as central concern. Stock markets can play a crucial role in advancing sustainability and supporting the achievement of sustainable development goals. This includes the creation of sustainability indices that include companies meeting specific environmental, social, and governance (ESG) criteria.

It is crucial to carefully analyze the spillover effect between investor sentiment and sustainability indices. Study suggests that fluctuations in ESG index returns cause investors to concentrate more on discussions about sustainable investment on social media and the Internet. This heightened attention can influence sentiment and subsequently attract more investors to sustainable investment, leading to significant shifts in returns. Hector & Saxunova (2021) studied that sustainable investment has progressed from being primarily investor-driven to attaining significant attention in the political domain. In recent years, policymakers have shown a growing commitment to address issues related to sustainability. The implementation of the “Sustainable Finance Disclosure Regulation” by participants of the financial market in March 2021 marks a significant advancement towards enhancing transparency about the sustainability of investments. The Taxonomy Regulation will play a vital role in the next phase to ensure constant and comparable information. The purpose is to empower investors with tools to manage their investments actively and prioritize those that align with specified sustainability goals.

Armin, et al. (2021) revealed that numerous private and institutional investors express interest in financing sustainable investments but sometimes lack a clear understanding of the sustainability concept and its link with investment performance. Growing concerns about climate change and adverse environmental impacts are encouraging a shift towards sustainable investments. Investors are highly directing their attention towards options with positive environmental and social benefits. Investors can influence corporate practices and channel capital towards sustainable companies and projects through their actions.

Objective

For identifying “Factors affecting investors' inclination towards sustainable investment”

Study’s Methodology

291 respondents were considered for this study, which was collected from investors. Random sampling method was used to collect data and examined by “Explanatory Factor Analysis” for results Tables 1-7.

| Table 1 Details of Participants | ||

| Variable | Participants | % age |

| Gender of Participants | ||

| Male | 167 | 57.39% |

| Female | 124 | 42.61% |

| Total | 291 | 100 |

| Age in years | ||

| 30 to 35 | 89 | 30.58% |

| 35 to 40 | 111 | 38.14% |

| Above 45 | 91 | 31.28% |

| Total | 291 | 100 |

| Income level | ||

| Less than 5 lacs | 103 | 35.40% |

| 5 lacs – 10 lacs | 97 | 33.33% |

| More than 10 lacs | 91 | 31.27% |

| Total | 291 | 100 |

| Table 2 KMO and Bartlett's Test | ||

| “Kaiser-Meyer-Olkin Measure of Sampling Adequacy” | .784 | |

| “Bartlett's Test of Sphericity” | “Approx. Chi-Square” | 4445.000 |

| df | 91 | |

| Significance | .000 | |

| Table 3 Total Variance Explained | ||||||

| “Component” | “Initial Eigenvalues” | “Rotation Sums of Squared Loadings” | ||||

| “Total” | “% Of Variance” | “Cumulative %” | “Total” | “% Of Variance” | “Cumulative %” | |

| 1. | 5.818 | 41.559 | 41.559 | 3.698 | 26.412 | 26.412 |

| 2. | 2.695 | 19.249 | 60.808 | 3.609 | 25.777 | 52.189 |

| 3. | 2.145 | 15.321 | 76.129 | 2.392 | 17.083 | 69.273 |

| 4. | 1.408 | 10.055 | 86.184 | 2.368 | 16.911 | 86.184 |

| 5. | .475 | 3.396 | 89.580 | |||

| 6. | .388 | 2.771 | 92.351 | |||

| 7. | .267 | 1.904 | 94.255 | |||

| 8. | .222 | 1.589 | 95.843 | |||

| 9. | .182 | 1.301 | 97.145 | |||

| 10. | .145 | 1.034 | 98.178 | |||

| 11. | .092 | .661 | 98.839 | |||

| 12. | .076 | .542 | 99.381 | |||

| 13. | .056 | .402 | 99.783 | |||

| 14. | .030 | .217 | 100.000 | |||

| Table 4 Rotated Component Matrix | |||

| S. No. | Statements | Factor Loading | Factor Reliability |

| Financial Performance | .970 | ||

| 1. | Sustainable investments can yield competitive financial returns | .950 | |

| 2. | Financial returns are a significant driver to towards sustainable investment | .947 | |

| 3. | Sustainable investment can be chosen for attractive financial gains | .926 | |

| 4. | Impact on returns and risk aversion of sustainable investment attracts investors | .918 | |

| Risk Management | .953 | ||

| 1. | Strong environmental, social, and governance practices are considered less risky | .952 | |

| 2. | Investment opportunities that best align with their risk tolerance | .907 | |

| 3. | Risk-conscious investors favor such sustainable investment | .891 | |

| 4. | Investors prefer option that align with their risk tolerance | .889 | |

| Social and Cultural Factors | .874 | ||

| 1. | Personal values, social responsibility, and ethical considerations play a significant role | .887 | |

| 2. | Social norms and peer behavior can influence individual investors | .845 | |

| 3. | It offers a chance to align their values and ethics with their investment choices | .817 | |

| Technological Advancement | .846 | ||

| 1. | Technology advancement provide better tools to evaluate performance and make informed decisions | .916 | |

| 2. | New financial products, such as green bonds or sustainability-linked loans | .892 | |

| 3. | Clean technology initiatives further support sustainable investment | .756 | |

| Table 5 Reliability Statistics | |

| “Cronbach's Alpha” | “Number of Items” |

| .883 | 14 |

| Table 6 Comparison of Investors' Inclination Towards Sustainable Investment Based on Gender | |||

| S. No. | Customer engagement level | Gender | |

| Male | Female | ||

| 1. | Financial Performance | 4.59 | 4.27 |

| 2. | Risk Management | 4.34 | 4.03 |

| 3. | Social and Cultural Factors | 4.27 | 4.05 |

| 4. | Technological Advancement | 4.21 | 3.93 |

| Table 7 Independent Samples Test | ||||||

| Sustainable Investment | Levene's Test for Equality of Variances | t-test for Equality of Means | ||||

| F | Sig. | t | df | Sig. (2-tailed) | ||

| Financial Performance | EVA | .257 | .612 | 4.856 | 289 | .000 |

| EVNA | 4.802 | 253.686 | .000 | |||

| Risk Management | EVA | 11.680 | .001 | 4.239 | 289 | .000 |

| EVNA | 4.270 | 271.904 | .000 | |||

| Social and Cultural Factors | EVA | 5.094 | .025 | 3.553 | 289 | .000 |

| EVNA | 3.595 | 275.514 | .000 | |||

| Technological Advancement | EVA | 4.574 | .033 | 4.039 | 289 | .000 |

| EVNA | 4.054 | 268.611 | .000 | |||

Findings of the Study

The table below shows demographic details of participants: 57.39% are male, and 42.61% are female. Regarding the age of the respondents, 30.58% are between 30 and 35 years, 38.14% are 35 to 40 years, and 31.28% are above 40 years of age. Regarding the income level of investors, 35.40% are less than 5 lacs, 33.33% are 5 lacs—10 lacs, and 31.27% are More than 10 lacs.

“Factor Analysis”

“KMO and Bartlett's Test”, value of KMO is .784

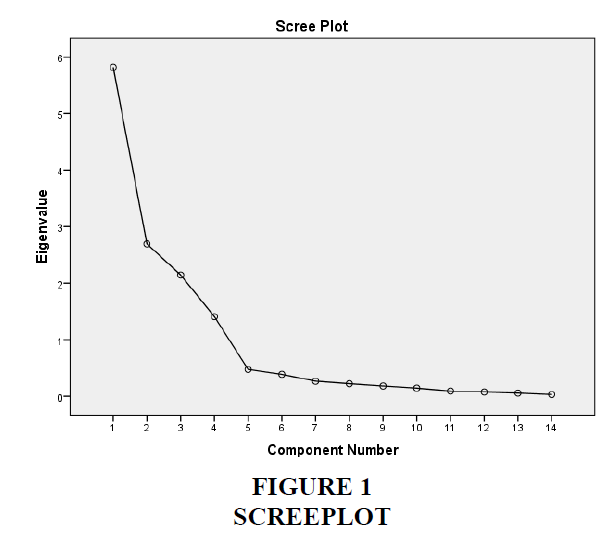

All the four factors are making contribution in explaining total 86.184% of variance. The variance explained by Financial Performance is 26.412%, Risk Management is 25.777%, Social and Cultural Factors is 17.083%, and Technological Advancement is 16.911% Figure 1.

Factors and the Associated Variables

The first factor of the study is Financial Performance; it includes variables like Sustainable investments can yield competitive financial returns, Long-duration a fixed income is a significant driver towards sustainable investment, sustainable investment can be chosen for attractive financial gains, and the Impact on returns and risk aversion of sustainable investment attracts investors.

The second factor is Risk Management. The variables it includes are Strong environmental, social, and governance practices that are considered less risky, investment opportunities that best align with their risk tolerance, risk-conscious investors favour such sustainable investment, and Investor preferred options that align with their risk tolerance. Social and cultural factors are the third factor, and the variables included are personal values, social responsibility, and ethical considerations, which play a significant role. Social norms and peer behaviour can influence individual investors and offer a chance to align their values and ethics with their investment choices.

The fourth and last factor is Technological Advancement. The variables under this factor are Technology advancement, which provides better tools to evaluate performance and make informed decisions; new financial products, such as green bonds or sustainability-linked loans; and clean technology initiatives, which further support sustainable investment.

Total reliability of 14 items that includes variables for Factors affecting investors' inclination towards sustainable investment is 0.883

Above table shows the Comparison of investors' inclination towards sustainable investment based on Gender, which shows higher mean value for all the factors like Financial Performance (male – 4.59 and female – 4.27), Risk Management (male – 4.34 and female – 4.03), Social and Cultural Factors (male – 4.27 and female – 4.05), and Technological Advancement (male – 4.21 and female – 3.93).

Above table shows the result of Independent Sample Test to know the investor’s inclination towards sustainable investment based on gender. The table shows the significant value for all statements under significant column for Financial Performance, Risk Management, Social and Cultural Factors and Technological Advancement.

Conclusion

Sustainable investments can offer comparable, if not superior, returns to traditional investments while mitigating long-term risks associated with climate change, social issues, and corporate governance. The most substantial factors that explain the attitude towards sustainable investment are the understanding about how sustainable finance instruments can be used for diversification of risk, the performance of investment, the impact of social and cultural elements, and the advancement of technology.

A key promise of sustainable investing is that it pressures companies to become more sustainable, and thereby creates a positive impact on the environment and society. Sustainable investing denotes to a variety of practices under which an investor intends to gain financial returns by endorsing long-term environmental or social value. Over time, sustainable investment will help investors become more robust, lower risks, and take advantage of opportunities. It will also help them build their brand and draw in additional investors. The factors that affect investors' inclination towards sustainable investment are Financial Performance, Risk Management, Social and Cultural Factors, and Technological Advancement.

References

Aich, S., Thakur, A., Nanda, D., Tripathy, S., & Kim, H.C. (2021). Factors Affecting ESG towards Impact on Investment: A Structural Approach, Sustainability, 13.

Indexed at, Google Scholar, Cross Ref

Armin, V., Katharina, R., & Sabrina, H. (2021). Sustainable Financial Literacy and Preferences for Sustainable Investments among Young Adults, Duncker & Humblot, 90(4), 43-69.

Indexed at, Google Scholar, Cross Ref

Bhabha, J.I., & Qureshi, Q.A. (2014). Factors Affecting the Attitude of Working-Women towards Saving-Investment in Developing Countries, Journal of Economics and Sustainable Development, 5(11), 36-41.

El Oubani, A. (2024). Investor sentiment and sustainable investment: evidence from North African stock markets, Future Business Journal.

Indexed at, Google Scholar, Cross Ref

Francis, G., & Lokhande, M. (2023). Sustainable Investing in India - Challenges and Opportunities, International Journal for Multidisciplinary Research, 5(6), 1-9.

Hector, H., & Saxunova, D. (2021). Understanding and development of sustainability investing in the recent history, Humanum, 41(2), 33-39.

Lestari, D., & Wiryono, S.K. (2023). The Perception Reality of Sustainable Investment in Millennial and Generation Z, International Research Journal of Business Studies, 16(2), 123-138.

Indexed at, Google Scholar, Cross Ref

Mahalakshmi, T.N., & Anuradha, N. (2018). A Gender Based Study on the Impact of Culture in Investment Decision Making, An International Journal of Management Studies, 8(1), 53-56.

Nabeel, M., & Sumathy, M. (2023). Investor’s Perception: Sustainable Development Through Investment Avenues in India, NIDA Development Journal, 63(1), 161-174.

Patidar, R., Tripathi, V., & Derashri, P. (2022). Behavioral factor affecting investment decision among the investor, International Journal of Creative Research Thoughts, 10(3), 633-645.

Popat, D.A., & Pandya, H.B. (2019). Identifying the Factors Affecting Investment Behaviour of Investors from Gandhinagar District, International Journal of Science and Research, 8(3), 144-148.

Shah, P. (2023). The Role of Gender Factor in Investment Decisions, International Journal of Creative Research Thoughts, 11(6), 667-670.

Sharma, G.D., Tiwari, A.K., Talan, G., & Jain, M. (2021). Revisiting the sustainable versus conventional investment dilemma in COVID-19 times, Energy Policy, 156, 1-11.

Indexed at, Google Scholar, Cross Ref

Tiwari, I., & Tiwari, S.B. (2022). A Review Paper on Factors Affecting Investor’s Investment Decisions, ENVISION – International Journal of Commerce and Management, 16, 90-99.

Tomo, A., & Landi, G. (2017). Behavioral Issues for Sustainable Investment Decision-Making: A Literature Review, International Journal of Business and Management, 12(1), 1-10.

Indexed at, Google Scholar, Cross Ref

Received: 16-Jan-2025, Manuscript No. AMSJ-25-15620; Editor assigned: 17-Jan-2025, PreQC No. AMSJ-25-15620(PQ); Reviewed: 16- Feb-2025, QC No. AMSJ-25-15620; Revised: 20-Feb-2025, Manuscript No. AMSJ-25-15620R); Published: 10-Apr-2025