Research Article: 2021 Vol: 24 Issue: 1S

Factors Affecting Investment Decision Making: Evidence from Investment Firms, Group of Investors, Non-Profit Organizations and Individual Investors in Pakistan

Naveed Jan, Business School Shandong Normal University Jinan China

Xiyu Liu, Business School Shandong Normal University Jinan China

Fakhr Ullah, Business School Shandong Normal University Jinan China

Waleed, Business School Shandong Normal University Jinan China

Abstract

Traditional finance theories presume that investors act rationally in the stock market but investors in behavioural finance behave irrational when making their investment choices. Behavioural finance clarifies the effect of investor psychology on their investment decision making. The research aims to examine the behavioural variables such as mental accounting, overconfidence, organizational structure and management or leadership styles on investment decision making. This study uses to collect primary data from Pakistan's stock exchanges from individuals, investment companies, a community of investors, and nonprofit organization through a questionnaire technique. The study collected 120 questionnaires from individuals, investment companies, investor community, non-profit organizations, to accomplish the objective the study use correlation analysis and regression analysis techniques. The results of the study determines that mental accounting, over-confidence, organizational structure and management or types of leadership have a positive and important effect on investment decisions.. The findings of the study can be used by stock exchanges and other regulatory authorities to explain shareholders about behavioural elements in stock market. The findings of the study are useful to enhance shareholder confidence in stock market.

Keywords

Behavioral Elements, Investment Decision Making, Organization Structure, Management Level, Individual Investors

Introduction

Investment decision making is a difficult practice for shareholders especially with multidimensional alternatives in a dynamic environment. Depending on personal resources and dynamic models investment decisions cannot be made in a vacuum to achieve their preferred goals, shareholders need to be diligent and up to date. Behavioural finance is an emerging area that can help you to choose better investment tools for investment and avoid repeating mistakes in the future. Behavioural finance describes the influence of investor psychology on investment decision making. Behavioural finance focuses on the irrational behaviour of investors that affects their investment decisions.

Kim & Nofsinger (2008) show how investors operate and how their shares affect the financial markets. According to the conventional theories of financial markets which states that market participants are rational. Financial markets are now becoming more volatile the volatility of the financial markets increases with the risk which associated with investments. Effective market theories make it clear that stock prices show all the available information in stock market. Shiller (1998) describes an effective market theory based on the idea that investors act rationally to process all available information and maximize expected profit or return. Even the existence of efficient market theory, investors' perceptions change regarding the gains and losses on their investments. Maditinos & Evans (2006) shows that investors use irrational role models on a regular basis that deviate them from their desire level of satisfaction, this variance raises the risk of investment and causes stock unpredictability in the equity markets, while in the banking sector, these developments are an exception in terms of the stock market. Several studies have explored the effects of risk aversion and different behavioural factors in decision-making on investment but have not explored the impact of corporate governance on decision-making at the corporate level. Therefore, the stock markets become unpredictable and stock prices fluctuate regularly. Fluctuations in the share price cannot be judged using conventional financial instruments. The key issue is that investors do not follow EMHs which make them deviate from the conventional decision models for their investment decisions. Investors are not concerned about the impact of behavioural influences on their investment decisions. Therefore all of these circumstances need to be addressed while minimizing systemic errors and making investment decisions.

Literature Review

Behavioural Factors Influencing the Making of Investment Decisions

The security investment decision is a very demanding job that affects behavioural factors. Kannadhasan (2010) states that investors should continue to upgrade in multidimensional areas to achieve their intended business goal. According to economic and financial theories individuals act sensibly and care about all available knowledge about formulating risk policies. However behavioural finance assumes that investors behave irrationally in the stock market. Pavabutr (2002) behavioural bias and emotions of investor lead to a systemic flaw in the way they interpreted the information. Waweru & Uliana (2008) describe that investor decisions are determined by physiological, emotional and psychological variables. Chen, et al., (2005) their empirical findings show that investors usually make bad investment decisions due to different market biases. Simon & Ricciardi (2000) described several behavioural factors that influence investment decision making. Waweru, et al., (2008) described that investor investment decision is more influence by heuristic biases rather than prospects factors. Mental accounting refers to the "process by which people think and calculate their financial transactions. Ritter (2003) state that mental accounting is a concept through which investors can organize their portfolios in multiple accounts. The effect of overconfidence and risk aversion problem was studied by Dittrich, et al., (2005). The results showed that as the investor becomes overconfident so the deviation from ideal options also increases. Lewellen (2006) calculated volatility, debt costs and their impact on financial decisions the results indicate that volatility in Ho Chi Minh City, Vietnam influenced the financial decision. Ngoc (2013) examined the effect of behavioural bias on investor preference the results show that these biases control investors about their different investment perspectives. Lakshman, et al., (2013) examined herding behaviour in the Indian capital market and identified the effects of volatility and yields on the herding behaviour of institutional investors. The results showed that variables investment behaviour continues in the Indian capital market. Chen & Pelger (2013) conducted a study to identify the influence of compensation for variables investment behaviour attracted by the Black-Scholes model. The results of the study shows that investor variables investment behaviour herding was driven by herding, risk aversion and the related reward given by the manager. There are mainly six fundamental components of the organizational structure. This includes labour specialities, sanctification, domination and regionalization, departmentalization, control time, chain of command. For the current analysis the following three variables have been discussed, which can be considered to establish a relationship between organization structure and organization creativity Paul & Nijstad (2003). Centralization and decentralization define the alteration of the right to formulate policies at lower and subordinate levels. Formalization is a process in which positions within the company are standardized and reviewed. It can also be classified as the degree to which the instructions and code of conduct are absorbed by the workforce and executives. Work specialization also known as division of labour, means separating jobs into independent, operational and specialized outlets so that the work can be done with negligible excesses and full production at the development of goods and services. Traditionally there are three general types of management styles have been identified. They are Autocratic, paternalistic and democratic types Riley (2012). Supervisors have very direct control over subordinates; they like to make all decisions and are highly regulated by them. This leadership style comes from Taylor's work on work motivation. Supervisors behave like a father figure, they are rather concerned about the social needs of their subordinates; they advise staff on business matters and then make decisions based on the best interests of staff. This management style is closely associated with Maslow's social theory. Managers trust their subordinates and encourage them to make decisions. Managers who follow this management style delegate authority to their subordinates and listen to the advice given by subordinates. This style implies good two-way communication and shows that managers can cultivate subordinate leadership skills. The ultimate democratic system when real decisions are made based on the opinion of the majority of all workers.

Objective of the Study

The main objective of this paper is to analyze the influence of behavioural variables such as mental accounting, overconfidence, organization structure and management styles at the corporate level in making investment decisions. Furthermore, the central aims of this study are:

1. To find out the association between behavioural variables such as mental accounting and investment decision-making.

2. To find out the association between behavioural variables such as overconfidence and investment decision-making.

3. To find out the association between organization structure and investment decision making.

4, To find out the association between management styles and investment decision making.

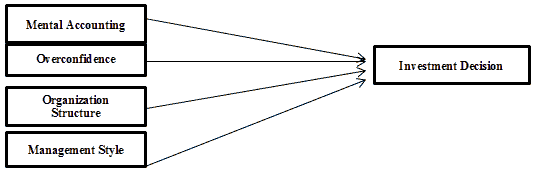

Theoretical Framework

As shows in Figure 1.

Hypothesis of the Study

H1: Mental accounting has a positive impact on investment decision making.

H2: Overconfidence has a positive impact on investment decision making.

H3: Organization structure has a positive impact on investment decision making.

H4: The management or leadership styles of have a positive effect on investment decision making.

Methodology of the Study

The research population consisted of individual investors and investment firms, the investment community and non-profit organizations of the Pakistan Stock Exchange. In this study we used the stratified random sampling methodology. The survey form method was used to collect key data from individual investors, investment firms, and investor associations, and brokerage organizations from various cities such as Peshawar, Islamabad and Lahore. The sample size of the study is 120 Indivisual investors from the above different sectors. However a total of 120 questionnaires were filled and collected from the above-mentioned sectors. Due to the homogeneity the review was carried out only in 3 segments, namely Investment Company, a pool of investors, and individual investors in Pakistani. The variable objects were calculated using a 5-point scale, where 5 represents "Strongly Agree", 4 reflect "Agree", 3 apply to "Neutral", 2 denote "Disagree" and 1 specifies "Strongly Agree" disagree ".

Results And Discussions

The data obtained via the survey questionnaire was entered and evaluated for review using the SPSS package (22.0) and the following results were obtained:

Features of Respondents

As as shows in Table 1.

| Table1 Demographics And Investment Details Of Respondents |

|||

|---|---|---|---|

| Demographics Variables | Category | No. of respondents | Percentage (%) |

| Gender | Male | 83 | 69.2% |

| Female | 37 | 30.8% | |

| Age | 20-30 | 0 | 0% |

| 31-40 | 22 | 18.2% | |

| 41-50 | 25 | 20.8% | |

| 51-60 | 73 | 60.8% | |

| Capital | RS 50,000/- | 0 | 0% |

| RS 100,000/- | 17 | 14.2% | |

| RS 150,000/- | 59 | 49.2% | |

| RS 200,000/- | 44 | 36.7% | |

| Occupation | Banker | 15 | 12.5% |

| Private organization | 35 | 29.16% | |

| Academician | 25 | 20.8% | |

| Self Employed/Business | 50 | 41.6% | |

| Retired/Any other | 5 | 4.16% | |

| Experience | 2-3 Years | 10 | 8.3% |

| 3-5 Years | 30 | 25% | |

| 5-10 Years | 40 | 33.3% | |

| Above 10 Years | 40 | 33.3% | |

Table 1 shows the demographic details of the respondents included in the sample size of the study. The male respondents are 69.2% while the female respondents are 30.8%, the proportion of women investors in Pakistan stock is lower than that of men. However, investors having age bracket between 51-60 years invest more in the stock market to secure their life after retirement, so the ratio of their investment is 60.8 % greater than as compared to investors having age bracket lies between 31-40 years showing lowest investment ratio in the group is 18.2 % respectively. Similarly, the capital investment ratio also indicates an upward trend that people want to spend more for future considerations, so investors with a capital investment of Rs150,000 showing the highest percentage of capital employed 49.2 % as compared to investors with a capital 200,000 showing the lowest percentage of capital employed 36.7 % in their respective group. The employment level of investor investment is variable in the group, self-employed and private enterprises individuals show the highest percentage of investment of 41.6% and 29.16%, as compared to academicians and bankers showing lowest ratio of investment 20.8% and 12.5 % respectively. Investor experience and investment level also show positive relationships, investors with 5-10 years and above 10 years’ of experience level shows higher percentage Investment levels which is 33.3% and higher in the group as compared to 2- 3 years and 3-5 years of experience level of investors which are 8.3% and 25% respectively. as shows in Table 2.

| Table 2 Frequencies Test |

|||||

|---|---|---|---|---|---|

| Organizations | Frequency | Percentage | Valid % | Cumulative % | |

| Investment firms | 30 | 30.0 | 30.0 | 30.0 | |

| Group of investors | 25 | 25.0 | 25.0 | 55.0 | |

| Non Profit organizations | 40 | 40.0 | 40.0 | 95.0 | |

| Individual | 25 | 25.0 | 25.0 | 120.0 | |

| Total | 100 | 100.0 | 100.0 | ||

In total, 120 results were obtained from the four main distinct groups. 30% of the respondents belonged to investment companies, 25% to Investor Group, 40% to non-profit organizations and 25% to individuals.

Reliability Test

Table 3 shows Cronbach's alpha reflecting the reliability (alpha) of the data collected from the variables. The internal stability of various objects was verified by applying Cronbach's Alpha. The data were analyzed using SPSS software in this study.

| Table 3 Cronbach’s Alpha N=120 |

|

|---|---|

| Variables | Cronbach’s Alpha Value |

| Mental Accounting | 0.735 |

| Overconfidence | 0.656 |

| Organization structure | 0.820 |

| Management Styles | 0.850 |

| Investment Decision | 0.956 |

Table 3 shows Cronbach's Alpha of Mental Accounting is 0.735, which is greater than the minimum accepted value of 0.5. Cronbach's Alpha of Overconfidence is 0.656, which is greater than the lowest accepted value of 0.5. The Cronbach's Alpha of Organization structure is 0.820, which is greater than the minimum accepted value of 0.5. The Cronbach Alpha of management styles is 0.850, which is greater than the minimum accepted value of 0.5. Cronbach's Alpha of investment decision is 0.956, which is typically greater than the normal value of 0.5.

Descriptive Statistics

Table 4 shows Descriptive statistics include quantitative synopsis of all independent or dependent variables. The measurement values of variability are (minimum, maximum and standard deviation) a measure of central tendency (mean), asymmetry and kurtosis are reported data normality.

| Table 4 Descriptive Statistics |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

| N | Range | Minimum | Maximum | Mean | Std. Deviation | Variance | Skewness | Kurtosis | |

| Mental Accounting | 120 | 4.54 | 2.49 | 6.00 | 4.8221 | .87054 | .565 | -.540 | -.288 |

| Overconfidence | 120 | 13.80 | 2.45 | 12.55 | 4.5765 | .74635 | 3.467 | 5.338 | 29.763 |

| Org. Structure | 120 | 3.00 | 3.00 | 4.00 | 4.7634 | .85432 | .763 | -.773 | -.211 |

| Mgt Style | 120 | 3.64 | 3.00 | 5.22 | 4.9875 | .68774 | .544 | -.755 | -.398 |

| Invest. Decision | 120 | 3.63 | 2.30 | 4.00 | 4.8877 | .79647 | .680 | -.563 | -.389 |

Correlation Analysis

Table No 5 shows the Correlation analysis tool that used to discover the association of binary variables. The connection matrix between mental accounting, Overconfidence, organization structure and management styles with the investment decision making process in equity Investments, the sample size was one hundred (120) Indivisual investors. The relationship between all variables is represented by this correlation matrix. This correlation matrix implies that all variables are substantial at a sig value of 0.01.

| Table 5 Correlation Analysis |

|||||

|---|---|---|---|---|---|

| Mental Accounting | Overconfidence | Org. Structure | Mgt. Style | Invest. Decision | |

| Mental Accounting | 1 | ||||

| Overconfidence | 0.541** | 1 | |||

| Org. Structure | 0.655** | 0.460** | 1 | ||

| Mgt. Style | 0.650** | 0.504** | 0.490** | 1 | |

| Invest. Decision | 0.672** | 0.446** | 0.776** | 0.665** | 1 |

The correlation at the 0.01 (2-tailed) level is significant.

By linking the Pearson coefficient values, the results in the table illustrate the correlation and the degree of importance between the dependent variables and the four independent variables. The mental accounting correlation coefficient value is 0.650, indicating a strong and meaningful relationship at 0.01 levels important for investment decision making. The overconfidence correlation coefficient value is 0.504, which is also indicating a strong and meaningful relationship with investment decision making. The organizational structure correlation coefficient value is 0.490, indicating strong and important association with investment decision making. The management styles correlation coefficient value is 0.665, also indicating strong and important association with investment decision making. The results showed that investment decision making is highly dependent on four independent variables. Since, as can be seen in the table, the relationship between the independent and dependent variables is substantially and positively correlated with each other.

Regression Analysis

Table 6 shows that the regression coefficient is the slope of the line of the regression equation. The results of investment decision making with a regression coefficient are shown below.

| Table 6 Regression Analysis |

|||||||

|---|---|---|---|---|---|---|---|

| Variable | (ß) | Std. Error | T-Value | Sig | R square | F Statistics | Durbin Watson |

| (Constant) | 0.261 | 1.673 | 0.098 | 0.778 | 50.573 | 2.010 | |

| Mental Accounting | 0.445 | 0.107 | 4.554 | 0.000 | |||

| Overconfidence | 0.155 | 0.042 | 1.044 | 0.061 | |||

| Org. Structure | 0.280 | 0.111 | 2.265 | 0.004 | |||

| Mgt. Style | 0.234 | 0.116 | 2.084 | 0.053 | |||

According to the results shown in table 6, it concludes that the model is significant because all the P values of variables are <0.05. The R square value here is 0.778, which means that all independent variables bring 77.8 % variation in the dependent variable and is best matched to 77.8 %. The F value linked to the P-value (50.573) implies that the variation in the dependent variable is moderately described by the independent variable. Durbin Watson's value is 1.033<3, which means that the regression model does not have an autocorrelation problem since the error terms are independent. The coefficient of regression of mental accounting (β) is 0.445; p-value is 0.000 and t value 4.554 reflects that mental accounting has a positive and meaningful influence on investment decision making. Waweru, N., M., E. Munyoki, E., and E. Uliana, E, 2008 research investigates the relationship and effect of mental accounting on investment decision-making. The results of these studies show that mental accounting has a positive impact on decision making, and our results are consistent with those studies. The overconfidence regression coefficient is 155, p-value 0.061 and t value 1.044, indicating that overconfidence has a positive effect on decision-making on investment. It means that overconfidence improves the investment decision-making process for investors and their ability to make decisions becomes more important. Seo and Barrett, (2007) Said Overconfidence has a positive influence on the trading behaviour of investors and their portfolio size. The organizational structure (β) value is 0.280, p-value 0.004, and t value 2.265 indicates that organisational structure has a positive and important effect on investment decision making, which demonstrates the importance of organizational structure in investment decision making. Our findings are consistent with the studies conducted by Ghazi zouari in 2011 that shows that organizational structure and investor’s decision-making is positively related to each other. Besides, the value of management level (β) is 0.234, p-value 0.053, t value 2.084 shows that the level of company management has a positive and essential impact on decision-making on investment. Our findings are consistent with studies conducted by Bruce J.Avolio James B.Avey David Quisenberry in 2010, which demonstrate that the level of management of the company has a positive or substantial influence on investment decision making. All the independent variables have a substantial effect on the dependent variable, which shows that all hypotheses H1, H2, H3 & H4 are validated in the results.

Conclusion Practical Implications & Future Directions

This research study concludes that many behavioural variables influence investor decision-making processes. The influence of these behavioural variables on decision making is also different. This paper also explores the association between investment decision making and behavioural factors mental accounting, overconfidence, organizational structure, and level of business management. The study shows that mental accounting plays an important role in the decision-making process, just as the investor is uncertain about their strategic strategy and most of the fund management has risk-related actions. Overconfidence also plays a key role in the decision-making process or influence; it is a very significant factor. The structure and level of management of the business organization are factors that contribute significantly to the decision-making process of shareholders. In this analysis we note a large divergence in actual market power due to behavioural variability so that’s why most of our study findings are consistent with former studies conducted by different scholars. This study would be useful for financial professionals, regulators, or investment managers to recognize or focus on certain behavioural factors that trigger stock market volatility. This study would help us to recognize the association and effect of the firm's structure and the degree of firm management in the decision-making process and the investor's perception of risk. The current study focuses on investment decision making, the company's organizational structure and management level of the company and three behavioural factors to better understand investor behaviour we need to conduct future research on other behavioural factors, such as optimism, halo impact, currency effect, and social factors. The respondents of our current study are non-profit organizations, group of investors and investment firms further research must be conducted that may include other respondents such as equity and real estate investors.

References

- Avolio, B.J., Avey, J.B., & Quisenberry, D. (2016). Corrigendum to “Estimating return on leadership development investment”[The Leadership Quarterly 21,(2010), 633–644]. The Leadership Quarterly, 6(27), 911.

- Barberis, N., & Huang, M. (2001). Mental accounting, loss aversion, and individual stock returns. The Journal of Finance, 56(4), 1247–1292.

- Chen, A., & Pelger, M. (2013). How relative compensation can lead to Herding Behavior. Available at SSRN 2217715.

- Chen, G.M., Kim, K.A., Nofsinger, J.R., & Rui, O.M. (2004). Behavior and performance of emerging market investors: Evidence from China. Unpublished Washington State University Working Paper (January).

- Dittrich, D.A.V., Güth, W., & Maciejovsky, B. (2005). Overconfidence in investment decisions: An experimental approach. The European Journal of Finance, 11(6), 471–491.

- Evans, D.A. (2006). Subject perceptions of confidence and predictive validity in financial information cues. The Journal of Behavioral Finance, 7(1), 12–28.

- Lakshmi, P., Visalakshmi, S., Thamaraiselvan, N., & Senthilarasu, B. (2013). Assessing the linkage of behavioural traits and investment decisions using SEM approach. International Journal of Economics & Management, 7(2).

- Lewellen, K. (2006). Financing decisions when managers are risk averse. Journal of Financial Economics, 82(3), 551–589.

- Maditinos, D.I., Loukas, A., ?eljko Ševic, S.J.D., & Theriou, N.G. (2006). Users’ perceptions and the use of fundamental and technical analyses in the athens stock exchange. AFFI06, June, 1–25.

- Ngoc, L.T.B. (2014). Behavior pattern of individual investors in stock market. International Journal of Business and Management, 9(1), 1.

- Ardaiz Villanueva, O., Nicuesa Chacón, X., Brene Artazcoz, O., Sanz de Acedo Lizarraga, M.L., & Sanz de Acedo Baquedano, M.T. (2009). Ideation2. 0 project: Web2. 0 tools to support brainstorming networks and innovation teams. Proceedings of the Seventh ACM Conference on Creativity and Cognition, 349–350.

- Pavabutr, P. (2002). Investor behavior and asset prices. Sangvien Conference.

- Ricciardi, V., & Simon, H.K. (2000). What is behavioral finance? Business, education & technology journal, 2(2), 1-9.

- Annan, C.Y., Sibanyoni, J.J., & Tabit, F.T. (2019). The socio-cultural diversity of hotel employees and their perception of the management styles in hotels of Gauteng province, South Africa.

- Ritter, J.R. (2003). Behavioral finance. Pacific-Basin Finance Journal, 11(4), 429–437.

- Seo, M.G., & Barrett, L.F. (2007). Being emotional during decision making—good or bad? An empirical investigation. Academy of Management Journal, 50(4), 923–940.

- Shiller, R.J. (1998). Indexed units of account: Theory and assessment of historical experience. National bureau of economic research.

- Waweru, N.M., Munyoki, E., & Uliana, E. (2008). The effects of behavioural factors in investment decision-making: A survey of institutional investors operating at the Nairobi Stock Exchange. International Journal of Business and Emerging Markets, 1(1), 24–41.

- Zouari, G. (2011). The corporate investment decision process and control systems. International Journal of Economic Policy in Emerging Economies, 4(1), 20–53.