Research Article: 2021 Vol: 20 Issue: 3

Factors Affecting Corporate Income Tax Compliance: A Case Study of Small and Medium Enterprises in Vietnam

Dao Le Trung, University of Finance – Marketing (UFM)

Nga Phan Thi Hang, University of Finance – Marketing (UFM)

Thi Thuy Hang Le, University of Finance – Marketing (UFM)

Abstract

Corporate income tax is a tax that plays an essential role in the legal tax system of Vietnam, but to effectively promote the part of corporate income tax, we need to consider it in many ways. Aspects, including the handling experience of foreign countries. Corporate income tax is also one of the crucial tools of the State in performing the function of regulating socio-economic activities in each specific period of economic development. Besides, over the past years, Vietnamese small and medium enterprises (SMEs) have played an important role in socio-economic development, contributing significantly to GDP, creating jobs, and stabilizing the economy. Besides, SMEs still have many limitations in terms of scale and contribution levels and have not yet fully brought into play their full potentials. Therefore, the article determines factors affecting corporate income tax compliance. The study surveyed 600 accounting and tax managers at 600 SMEs and answered 23 questions, but 557 samples were processed. The data was collected from May 2020 to November 2020 in Vietnam. The authors applied a simple random sampling technique, tested Cronbach's Alpha and confirmatory factor analysis (CFA), and model testing with Structural Equation Model (SEM) analysis. Five factors are affecting SMEs' corporate income tax compliance in Vietnam with a significance level of 0.01. Finally, this article recommended policies for improving corporate income tax compliance.

Keywords

Income, Tax, Compliance, SMEs, Enterprises, UFM.

Introduction

Allingham & Sandmo (2017) studied the SME sector plays an important role. Over the years, The Government has been working to remove barriers to promote this SME sector's development. The Government focuses on policies to support specific content: Promoting and improving SMEs' efficiency, innovative enterprises. Support for technology innovation, creation, and modernization, and develop human resources capable of participating in regional and global production networks and value chains; strongly reform administrative procedures, creating favorable conditions for the developing private economy. The Government helped promote the national start-up movement and began good conditions for households and individuals to voluntarily cooperate to form businesses or other forms of cooperation. The Government also issued many preferential tax and credit policies for businesses, especially for SMEs, creating capital sources and production and business premises, providing market information and trade promotion, improving corporate governance capacity, vocational training for workers.

In Vietnam, in 2015-2020, the enterprise sector contributes 12.4% to the state budget per year. SMEs account for 98.1% of total operating enterprises, contribute about 45% of GDP, 31% of total state budget revenue, and create jobs for more than 5 million workers. In 2015-2020, on average, the number of SMEs increased by 8.8%, higher than the average growth rate of large enterprises of 5.4%. Corporate income tax is an essential tool for the State to redistribute income and ensure social justice. In the context of the market economy in our country, all economic sectors has the right to freedom of business and equality based on the law. Enterprises improved with a highly skilled labor force and solid financial capacity. It will have advantages and opportunities to receive high income. In contrast, enterprises with limited economic power and labor force will receive low income, even no income. To limit that drawback, the State uses corporate income tax as a tool to regulate the payment of high-income subjects, ensuring that the requirements of business entities' contributions to the State budget are covered relatively and reasonable. Therefore, this paper determines factors affecting corporate income tax compliance of small and medium enterprises in Vietnam.

Literature Review

Tax compliance (TAX)

Tax compliance is reporting all income, paying all tax liability by complying with a law, ordinance, or court judgment provisions. Whereas under Anderson & Gerbing (2016), tax compliance is defined as the taxpayer filing the tax return at the appropriate time and fulfilling its tax obligations following the tax laws, the court decisions. The definition of tax compliance is the complete, voluntary, and timely compliance with the taxpayer's tax obligations for the law. The time factor included a voluntary compliance criterion when considering tax compliance. Therefore, considering the scope of this study, the concept of tax compliance is defined as the taxpayer's correct, complete and timely implementation of the tax obligations specified in the current tax law by Thau & Teung (2019).

Business characteristics (Char)

Reriksen & Fallan (2016) showed that business characteristics affect corporate tax compliance. Business characteristics are represented by attributes such as the complexity of the business organization structure, type of business; enterprise size; operating time of the company, business performance. Mandall (2019) studied that business characteristics are a general economic sector related to many different aspects of social life (social activities, economy, culture, politics, international exchange...). This factor comes from the diverse and diverse needs of visitors; at the same time, it also comes from the safety and efficiency of businesses by Devereux & Freeman (1985). Therefore, the service business often includes many different industries. The authors have hypothesis following:

H1 Business characteristics (Char) positively impact SMEs' corporate income tax compliance in Vietnam.

Business type (Type)

The business's industry-specific factors affect corporate tax compliance. The following criteria measure the business industry factor: profit margin, competition, revenue control difficulty, and difficulty controlling costs. A popular type of business today, Joint venture business by Hosseini & Tajpour (2021); Tajpour, & Hosseini (2021). Enterprises with 100% foreign investment capital by Wamm (2015). One-member limited liability company, partnerships, private enterprise, and cooperative. The business model of an enterprise is a simple representation of its business logic. The Site & Gill (2015) described what a business offers to its customers, how it finds and establishes relationships with customers, what sources, what activities and partners to get there, ultimately, how it does business make a profit. The authors have hypothesis following:

H2 Business type (Type) positively impacts SMEs' corporate income tax compliance in Vietnam.

Quality of public management (Man)

Milliron (2016) studied the research on the effects of public governance on tax compliance. Macsky (2011) confirmed that public administration's quality is essential for a fair tax system and a proper tax system. Clausing (2017) studied a vital element for achieving quality public governance, so the public authority can positively or negatively affect taxpayers' tax compliance attitude. Besides, Ranaf (2014) demonstrated a positive relationship between the quality of public governance and taxpayers' tax compliance. The quality of general management is understood as the synthesis of management activities to define the criteria, standards, content, methods by Dzwigol (2020). And it is responsible for implementing specified criteria and standards by appropriate means, ensuring and improving quality according to the framework and standards set out previously by Salil & Mustapha (2011). The authors have hypothesis following:

H3 Quality of public management (Man) positively impacts SMEs' corporate income tax compliance in Vietnam.

Standards of society (Soc)

The justice is in the taxation of the tax system. Richard (2018) pointed out that if taxpayers are in a social community, intangible social pressures and attitudes influence tax compliance decisions and comply with their tax. Qitsema & Ferrier (2013) studied social norms to measure the social norms; fairness in the transaction or the benefit received per tax currency; fairness in tax payable compared to other taxpayers. Social norms are explicit or implicit rules that define what kind of behavior is acceptable in a society or group. The socio-psychological term further defined as the rules a group uses for appropriate and inappropriate values, beliefs, attitudes, and behaviors by Targler (2017). The authors have hypothesis following:

H4 Standards of society (Soc) positively impacts SMEs' corporate income tax compliance in Vietnam.

Tax system structure (Stru)

Tax system structure is an essential factor influencing taxpayers' tax compliance. According to the authors, the tax system structure is measured by tax rate indicators, the tax system's fairness, the tax system's complexity, and the level of technology application in tax declaration. The reality shows that there are always differences between countries in tax law systems design. Some countries provide all taxes in one standard tax code, called the internal revenue code by Hosseini et al. (2020). In this law, the lawmakers stipulate the specific content of taxes in the tax system, regulate the order, collect procedures and tax administration mechanisms, handle violations and settlement, and resolve tax disputes by Marti (2010). In contrast, some countries choose to design each tax enacted by a different law, independent from each other but still ensuring compatibility while separating the regulations on tax administration by a separate direction from tax laws Runshola (2013). The authors have hypothesis following:

H5 Tax system structure (Stru) positively impacts SMEs' corporate income tax compliance in Vietnam.

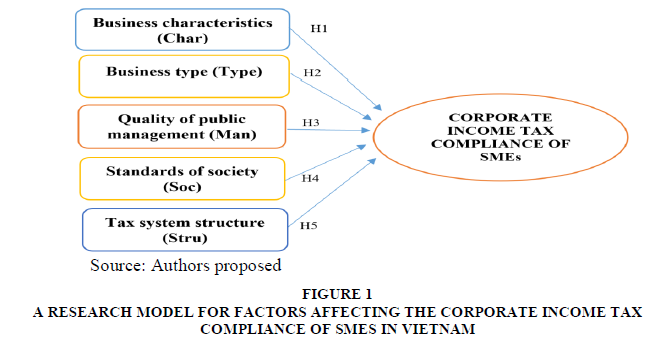

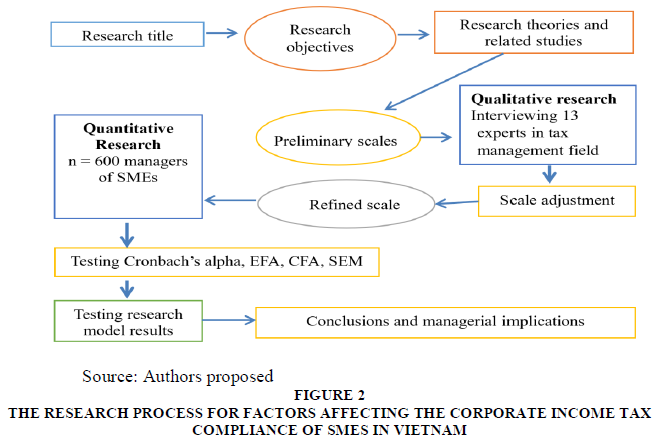

A research model for factors affecting the corporate income tax compliance of SMEs in Vietnam following Figures 1 & 2:

Figure 1 A Research Model for Factors Affecting the Corporate Income Tax Compliance of SMEs in Vietnam

Figure 2 The Research Process for Factors Affecting the Corporate Income Tax Compliance of SMEs in Vietnam

Methods of Research

This study presents the research methods and processes used. Research methods are in the paper, including a combination of qualitative and quantitative methods.

The authors used a mixture of qualitative and quantitative methods in the article.

Qualitative techniques: In Vietnam, the writers interviewed 13 experts in the tax management field. According to the study's findings, all of the factors affecting SMEs' corporate income tax enforcement in Vietnam are positive. Quantitative methods: The writers polled 600 accounting and tax managers at 600 SMEs about tax administration. SEM analysis requires a large sample to obtain a reliable estimate based on the large sample distribution theory. Meanwhile, the question of how large a model should not have been wholly solved by Hair et al. (2010) depends on the statistical methods used. However, Hair et al. (2010) recommends a sample size-to-number ratio of at least 5:1 when using SEM. This sample is also consistent with the total number of questions 23 times 5=115. Thus, the collection of 600 is appropriate and satisfactory. They looked at over 800.000 SMEs and answered 23 questions, but out of the 557 samples processed, 43 samples were missing details by Hair et al. (2010).

From May to November 2020 in Vietnam, the authors gathered primary data sources. The writers were conducting a survey that was published in hard copy. All of the information obtained from the questionnaire is coded and analyzed by SPSS 20.0 and Amos. The authors used Cronbach's alpha coefficient to assess scale reliability and exploratory factor analyses (EFA).

The author helps to explain the purpose of confirmatory factor analysis (CFA): (1) unilaterality, (2) scale reliability, (3) convergence value, and (4) difference value. If Chi-square testing is P-value > 5 percent, a study model is considered important to the data; CMIN/df < 2.0, in some cases CMIN/df may be <3.0 or<5.0; GFI, TLI, CFI>0.90. However, according to recent authors' views, GFI is still acceptable when it is more relevant than 0.8; RMSEA<0.08. In addition to the above parameters, synthetic reliability>0.6 is guaranteed by the test results; the mean-variance derived must be greater than 0.5.

Research Results

Testing Cronbach's alpha for factors affecting the corporate income tax compliance of SMEs in Vietnam following:

| Table 1 Cronbach's Alpha of the Business Characteristics (Char) of SMEs | |||

| Code | Contents | References | Cronbach's Alpha |

| Char1 | SMEs has a suitable organizational structure | Shahrodi (2010) | 0.905 |

| Char2 | SMEs has some owners and labors | Smatrak (2016) | 0.940 |

| Char3 | SMEs has operation scale is good | Deichen (2017) | 0.933 |

| Char4 | SMEs has a flexible operation time | Yaobin (2017) | 0.906 |

| Cronbach’s Alpha is 0.940 | |||

Table 1 showed that Cronbach's alpha of SMEs' business characteristics (Char) is 0.940 > 0.6.

| Table 2 Cronbach's Alpha of the Business Type (Type) | |||

| Code | Contents | References | Cronbach’s Alpha |

| Type1 | SMEs has an industry's rate of return that is good | Remotin (2017) | 0.917 |

| Type2 | SMEs has the competitiveness with others | Gonder (2015) | 0.942 |

| Type4 | SMEs has reasonable cost control | Anderson & Gerbing (2016) | 0.915 |

| Cronbach’s Alpha is 0.944 | |||

Table 2 showed that Cronbach's alpha of the business type (Type) at SMEs is 0.944 > 0.6.

| Table 3 Cronbach's Alpha of the Quality of Public Management (Man) | |||

| Code | Contents | References | Cronbach's Alpha |

| Man2 | SMEs has benefited from government spending | Thau & Teung (2019) | 0.839 |

| Man3 | SMEs has tax inspection density that is suitable | Reriksen & Fallan (2016) | 0.882 |

| Cronbach’s Alpha is 0.910 | |||

Table 3 showed that Cronbach's alpha of public management quality (Man) at SMEs is 0.910 > 0.6.

| Table 4 Cronbach's Alpha of the Standards of Society (Soc) | |||

| Code | Contents | References | Cronbach’s Alpha |

| Soc1 | SMEs has equity concerning tax obligations that is good | Mandall (2019) | 0.805 |

| Soc3 | SMEs has the criticism of society | Wamm (2015) | 0.841 |

| Soc4 | SMEs has tax administration system | Milliron (2016) | 0.801 |

| Cronbach’s Alpha is 0.855 | |||

Table 4 showed that Cronbach's alpha of society's standards (Soc) at SMEs is 0.855 > 0.6.

| Table 5 Cronbach's Alpha of the Tax System Structure (Stru) | |||

| Code | Contents | References | Cronbach’s Alpha |

| Stru1 | The State has tax rates that businesses must pay that is flexible | Macsky (2011) | 0.910 |

| Stru2 | The State has tax administrative procedures | Ranaf (2014) | 0.939 |

| Stru3 | The State has the complexity of the tax system | Richard (2018) | 0.926 |

| Stru4 | The State has technology application level in the tax return |

Targler (2017) | 0.905 |

| Cronbach's Alpha is 0.939 | |||

Table 5 showed that Cronbach's alpha of the tax system structure (Stru) at SMEs is 0.939 > 0.6.

| Table 6 Cronbach's Alpha of the Tax Compliance (Tax) | |||

| Code | Contents | References | Cronbach's Alpha |

| Tax3 | SMEs comply with tax obligations on time | Marti (2010) | 0.842 |

| Tax4 | SMEs comply with tax regulations | Runshola (2013) | 0.801 |

| Cronbach’s Alpha is 0.851 | |||

Table 6 showed that Cronbach's alpha of the tax compliance (Tax) at SMEs is 0.851 > 0.6.

| Table 7 Testing of the Confirmatory Factor Analysis (CFA) | ||||||

| Component | Initial Eigenvalues | Extraction Sums of Squared Loadings | ||||

| Total | % of Variance | Cumulative % | Total | % of Variance | Cumulative % | |

| 1 | 5.900 | 25.651 | 25.651 | 5.900 | 25.651 | 25.651 |

| 2 | 3.502 | 15.226 | 40.878 | 3.502 | 15.226 | 40.878 |

| 3 | 3.435 | 14.934 | 55.812 | 3.435 | 14.934 | 55.812 |

| 4 | 2.611 | 11.353 | 67.165 | 2.611 | 11.353 | 67.165 |

| 5 | 1.688 | 7.339 | 74.504 | 1.688 | 7.339 | 74.504 |

| 6 | 1.338 | 5.819 | 80.323 | 1.338 | 5.819 | 80.323 |

| 7 | 0.683 | 2.968 | 83.291 | |||

| … | … | … | … | |||

| 22 | 0.100 | 0.434 | 99.828 | |||

| 23 | 0.040 | 0.172 | 100.000 | |||

| KMO and Bartlett's Test is 0.821; Sig is 0.00 and cumulative % is 80.323 (> 60%) | ||||||

Table 7 showed that the testing of the confirmatory factor analysis (CFA) at SMEs with KMO is 0.821 > 0.6; Sig is 0.00 (<0.01). Table 7 showed there are six components.

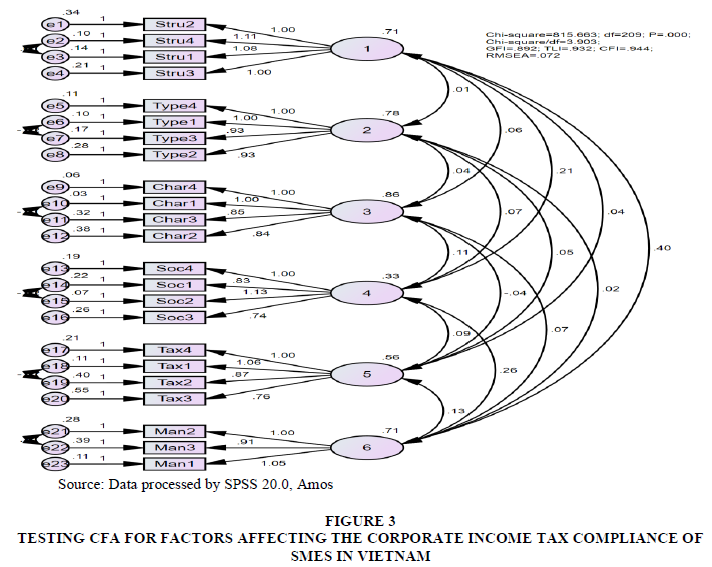

Figure 3 had the Chi-square = 815.663; df = 209; p = 0.000; Chi-square/df = 3.903; GFI = 0.890; TLI = 0.932; CFI = 0.944; RMSEA = 0.072.

| Table 8 Factors Affecting the Corporate Income Tax Compliance Of SMEs in Vietnam | |||||||

| Relationships | Estimate | Standardized Estimate | S.E. | C.R. | P | ||

| Tax | <--- | Type | 0.056 | 0.109 | 0.020 | 2.750 | 0.006 |

| Tax | <--- | Soc | 0.069 | 0.128 | 0.022 | 3.118 | 0.002 |

| Tax | <--- | Char | 0.073 | 0.150 | 0.019 | 3.846 | *** |

| Tax | <--- | Stru | 0.121 | 0.231 | 0.025 | 4.813 | *** |

| Tax | <--- | Man | 0.199 | 0.362 | 0.029 | 6.852 | *** |

Table 8 showed that column "P" < 0.01 with significance level 0.01. This result indicated that five factors affected SMEs' corporate income tax compliance in Vietnam with a significance level of 0.01.

| Table 9 Testing Bootstrap with N=20.000 Samples | |||||||

| Parameter | SE | SE-SE | Mean | Bias | SE-Bias | ||

| Tax | <--- | Type | 0.023 | 0.000 | 0.053 | -0.003 | 0.001 |

| Tax | <--- | Soc | 0.021 | 0.000 | 0.065 | -0.004 | 0.000 |

| Tax | <--- | Char | 0.027 | 0.000 | 0.066 | -0.007 | 0.001 |

| Tax | <--- | Stru | 0.029 | 0.000 | 0.118 | -0.002 | 0.001 |

| Tax | <--- | Man | 0.034 | 0.001 | 0.202 | 0.003 | 0.001 |

Table 9 showed that column "Bias" < 0.01. This result indicated that five factors affected SMEs' corporate income tax compliance in Vietnam with a significance level of 0.01.

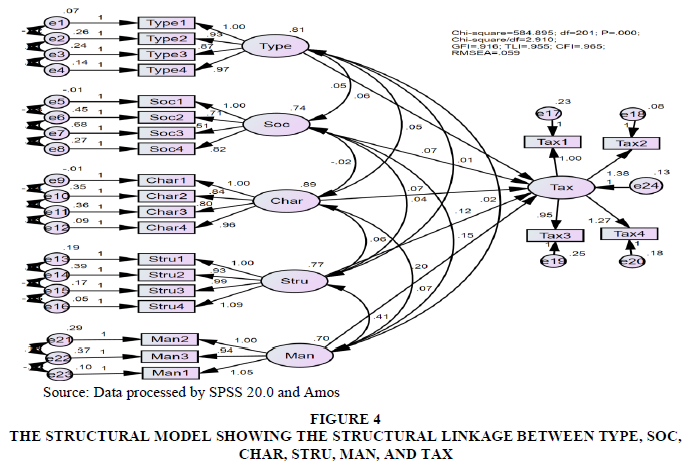

Figure 4 The Structural Model Showing the Structural Linkage Between Type, Soc, Char, Stru, Man, And Tax

Figure 4 had the Chi-square=584.895; df=201; p=0.000; Chi-square/df=2.910; GFI=0.916; TLI=0.955; CFI=0.965; RMSEA=0.059.

Conclusion

Vietnam currently has over 800 thousand enterprises operating, with small and medium enterprises account for about 98%. Over the past years, Vietnamese SMEs have played an important role in socio-economic development, contributing to GDP, creating jobs, stabilizing the economy, and expanding export markets. Based on the review of the previous studies and the processing of the survey data, it is possible to summarize the study's main findings: (1) The results showed that the five factors affected SMEs' corporate income tax compliance in Vietnam with a significance level of 0.01. Five elements sorted from high to low based on the normalized beta coefficient: (1) quality of public management (0.362), (2) tax system structure (0.231), (3) business characteristics (0.150), (4) standards of society (0.128), and (5) business type (0.109). These main findings helped tax authorities better understand the factors affecting SMEs' tax compliance and each factor's impact. Managers continue promoting SMEs' role, overcoming difficulties and problems in the current competitive and integration environment; it is necessary to pay attention to critical managerial implications.

Managerial Implications

Based on the findings, the authors made the following recommendations to strengthen SMEs' tax enforcement actions in Vietnam. Creating conditions for the private economy to invest in and developing production and trade in sectors, fields, and areas that are not prohibited by law strategy, socio-economic development in each period.

(1) Managerial implications for improving quality of public management (0.362). The Government creates an investment and business environment conducive to SMEs' development to maintain confidence and increase investment. Accordingly, it is necessary to ensure macroeconomic stability, control inflation, and speed up economic restructuring associated with growth model innovation. Besides, the Government should strengthen mechanisms and policies to encourage businesses' establishment, narrowing conditional business fields. Similarly, the Government should support the automatic connection of information with related parties such as the Ministry of Planning and Investment, the General Department of Customs, State Treasury, State Bank, Ministry of Natural Resources and Environment, building a national database on taxpayers. The Government continues to promote and innovate tax law and policy propaganda methods. Diversify contents and forms of propaganda; classify objects to choose an effective and approachable way to improve consensus and understanding knowledge of taxpayers. Besides, the department of taxation is consensus on sharing responsibilities of sectors, organizations, and society, especially services to support organizations and individuals of taxpayers to improve understanding and voluntarily comply with tax obligations. The Government should strengthen information exchange and information linkage with the international community. Actual research shows that: in Vietnam, SMEs have a high risk of tax compliance. Previous studies have also shown that: Multinational corporations tend to transfer prices from places with high tax rates to areas with low tax rates to reduce the amount of tax payable. So, the inspection work on Transfer pricing for economic groups is becoming increasingly important in tax administration. However, to analyze the tax compliance risks of multinational corporations, domestic data is not enough. Therefore, constructing a database on taxpayers should also aim to connect and exchange information between countries worldwide.

(2) Managerial implications for improving tax system structure (0.231). The Government continues to have SMEs support policies in line with the actual requirements of businesses and the business environment. Accordingly, the State's support for SMEs is based on legal foundations, national laws, and international commitments in multilateral and bilateral agreements that Vietnam is a member of the organization. The reliance on this principle will ensure no legal barriers or discrimination between businesses. Besides, the Government support SMEs to invest in advanced technology research and development, application and transfer activities, perfecting and ensuring effective implementation of the law on intellectual property; develop technology innovation and application support funds. The Government has the application of tax policies, financial support, access to preferential capital sources suitable to technology research, innovation, and modernization activities; connect businesses, start-up ideas, innovate with investors, investment funds. Finally, the State Bank is responsible for building and developing a national e-commerce payment system. And electronic payment integration utilities apply for wide use for e-commerce models. The State Bank establishes a mechanism to manage and supervise payment transactions to support tax administration for cross-border service provision in e-commerce. The commercial banking system is responsible for withholding and paying on behalf of the payable tax obligations following the tax laws of overseas organizations and individuals conducting e-commerce business and generating incomes from Vietnam. Besides, The Government continues coordinating with functional sectors to organize training for the accounting team of enterprises with solid knowledge of the accounting profession; understanding tax laws and policies will improve legal compliance. Tax law of taxpayers violates the law, causing damage to the interests of taxpayers according to the provisions of the law on tax administration. To publicize at the tax authority's offices all kinds of papers, forms, and the process of settling tax procedures so that taxpayers know and ensure favorable conditions for implementation supervision. Coordinating with functional sectors is to organize training for the accounting team of enterprises with solid knowledge of the accounting profession. Understanding tax laws and policies will improve taxpayers' legal compliance—tax law. Department of taxation promotes propaganda and disseminating new tax policies and tax administration to taxpayers, especially the contents of administrative procedure reform, support to remove difficulties for businesses and create favorable conditions for taxpayers. Taxpayers strengthen the management of tax declaration and accounting and strictly control the VAT refund; Strengthening inspection and examination to prevent loss of revenue to ensure a healthy business environment and improve taxpayers' compliance with the law. Improve quality, corporate governance, risk management, and financial management; actively participating in business associations to access information about SMEs support policies and programs of the Government, the State, and credit institutions.

(3) Managerial implications for improving business characteristics (0.150). SMEs need to increase investment and application of technology in accounting books, electronic tax declaration, and customs, internet banking transactions to reduce transaction costs, connect and share information. Financial information with credit institutions to gradually make financial information transparent, creating confidence in the market. Complete production processes and improve product quality to meet major partners' requirements, especially in the global supply chain. Besides, the Government should have a new set of risk assessment criteria that have been developed in the stage of tax refund, inspection planning, inspection, and invoice management. This set of standards is generally applied to all taxpayers. Meanwhile, Law on Tax Administration No. 38/2019 stipulates the application of compliance risk management in all stages of tax administration. In addition, SMEs are specific, so using a standard set of criteria for all businesses is not enough to assess the compliance risks of SMEs. Therefore, it is necessary to develop and complete a set of risk assessment criteria for all stages in tax administration in general and a bunch of risk assessment criteria for SMEs.

(4) Managerial implications for improving standards of society (0.128). The banks need to increase the search and access to cheap capital sources from preferential programs and domestic and foreign organizations' projects to finance SMEs' specific business fields. This recommendation is focused on development by the Government and the State. According to each industry group, they design particular loan products suitable for SME customers to have flexible solutions to customer requirements. Simultaneously, improve and simplify the lending process, request practical information, and provide detailed advice and instructions for SMEs to quickly grasp and implement. Besides, the Ministry of Finance strictly controls, prevents, and promptly detects the illegal transportation of goods across the border. To closely coordinate with functional forces in the customs area according to their functions. There are tasks and competence; improve the efficiency of collecting, exchanging, and processing information with foreign organizations and individuals, especially information on cases and violations of specific subjects, shipments, information about smuggling drugs, banned goods, goods infringing intellectual property rights. To effectively manage taxes on e-commerce business activities, it is necessary to have strong support from relevant ministries and branches. Accordingly, the Tax Administration Law 2019 stipulates departments, organizations, and units related to e-commerce business in tax administration.

(5) Managerial implications for improving business type (0.109). The Government promotes the development of the capital market. It is necessary to encourage the development of the capital market to create conditions for businesses to raise capital through bonds, stocks, and investment funds and reduce excessive dependence on banks' loans. In particular, it is necessary to promote credit rating services to support the stock market and bond market, improve transparency, encourage mobilization capital through the stock market, protect investors' rights and interests. Continue to promote administrative procedure reform in the tax and customs sector: (i) The Government encourages the reform of tax managerial procedures through the issuance of risk management regimes for enterprises that are subject to tax inspection/examination; continue to amend regulations on tax refund dossiers and automatic reporting support software; online submission of tax refund documents; to build a tax refund management database and make it public so that tax refunds can know information about the status of tax refund dossiers processing; (ii) The Government has to implement synchronously and widely the application of information technology in tax declaration, payment, tax refund, mobile tax payment, internet payment; (iii) The Government completes the legal framework to ensure the full implementation of the electronic customs clearance system.

References

- Allingham, M.G., & Sandmo, A. (1972). Income tax evasion: A theoretical analysis. Taxation: Critical Perspectives on the World Economy, 3, 323-338.

- Anderson, J.C., & Gerbing, D.W. (1988). Structural equation modeling in practice: A review and recommended two-step approach. Psychological bulletin, 103(3), 411.

- Clausing, G.H. (2017). Corporate tax policy and incorporation in Thailand. International Tax and Public Finance, 5(4), 78-98.

- Deichen, A.J. (2017). Survey on small and medium-sized enterprises' taxation: draft report on the questionnaire responses. Journal of Accounting and Taxation, 5(7), 35-45.

- Devereux, M.P., & Freeman, H. (1995). The impact of tax on foreign direct investment: empirical evidence and the implications for tax integration schemes. International Tax and Public Finance, 2(1), 85-106.

- Dzwigol, H. (2020). Methodological and empirical platform of triangulation in strategic management. Academy of Strategic Management Journal, 19(4), 1-8.

- Gonder, M.B. (2015). Investigation of the influential factors in tax efficiency. International Journal of Business Research, 18(12), 102-116.

- Hair, J.F., Black, W.C., Babin, B.J., Anderson, R.E., & Tatham, R. (2006). Multivariate data analysis. Uppersaddle River.

- Hosseini, E., & Tajpour, M. (2020). The impact of entrepreneurial skills on manager’s job performance.

- Hosseini, E., Tajpour, M., & Lashkarbooluki, M. (2020). The impact of entrepreneurial skills on manager's job performance. International Journal of Human Capital in Urban Management, 5(4), 361-372.

- Macsky, B.G. (2011). Tax compliance within gain and loss situations, expected and current asset position, and profession. Journal of Economic Psychology, 2(7), 173-194.

- Mandall, R.N. (2019). Linking business tax reform with governance: How to measure success, Working paper, Investment Climate Department. National Tax Journal, 3(5), 34-45.

- Marti, L.O. (2010). Taxpayers' attitudes and tax compliance behavior in Kenya. African Journal of Business and Management, 1(5), 112-122.

- Milliron, V.J. (2016). Tax preparers-government agents or client advocates. Journal of Accountancy, 7(5), 7-16.

- Qitsema, C.G., & Ferrier, G.D. (2013). Economic and behavioral determinants of tax compliance: Evidence from the Arkansas tax penalty amnesty program. Journal of Accountancy, 2(1), 17-26.

- Ranaf, N.A. (2014). Land tax administrations and compliance attitudes in Malaysia. National Tax Journal, 12(5), 138-143.

- Remotin, A.M. (2017). Tax policy for small and medium enterprises in Thailand. Journal of Australian Taxation, 14(11), 73-97.

- Reriksen, K.S., & Fallan, L.K. (2016). Tax knowledge and attitudes towards taxation; A report on a quasi-experiment. Journal of Economic Psychology, 7(3), 13-22.

- Richard, G.S. (2018). The impact of tax fairness dimensions on tax compliance behaviors in an Asian jurisdiction: Hong Kong's case. The International Tax Journal, 2 (1), 129-142.

- Runshola, J.A. (2013). Problems and prospects of small and medium scale industries in Nigeria. Journal of Accounting and Taxation, 2(5), 142-155.

- Salil, M.R., & Mustapha, A.H. (2011). Determinants of tax compliance in Asia: A case of Malaysia. European Journal of Social Sciences, 4(1), 17-32.

- Shahrodi, S.M.M. (2010). Investigation of the influential factors in the efficiency of the tax system. Journal of Accounting and Taxation, 2(3), 42-45.

- Site, P.U., & Gill, G.H. (2015). An examination of taxpayer preference for aggressive tax advice, National Tax Journal, 2(5), 38-43.

- Smatrak, G.F. (2016). Tax policy for small and medium enterprises. Journal of Accounting and Taxation, 12(13), 142-145.

- Tajpour, M., & Hosseini, E. (2021). Entrepreneurial intention and the performance of digital startups: The mediating role of social media. Journal of Content, Community Communication, 13(2), 2-15.

- Tandreoni, J.E., & Feinstein, J.F. (2015). Tax compliance. Journal of Economic Literature, 3(6), 18-29.

- Targler, B.N. (2017). Tax compliance and tax morale: a theoretical and empirical analysis, Journal of Accountancy, 5(2), 27-36.

- Thau, K.G., & Teung, P.F. (2019). A critical review of Fischer tax compliance model: A research synthesis. Journal of Accounting and Taxation, 1(2), 34-40.

- Tope, J., & Jabbar, H.R. (2018). Tax compliance costs of small and medium enterprises in Malaysia: Policy implications. Journal of Business and Management, 6(3), 19-32.

- Wamm, J.G. (2015). Income level and tax rate as determinants of taxpayer compliance: an experimental examination. Journal of Accounting and Taxation, 11(12), 134-140.

- Yaobin, S.K. (2017). Tax, small business, growth: effect of taxation on investment and cross-border trade. Journal of Economic Psychology, 3(4), 29-38.