Research Article: 2022 Vol: 26 Issue: 2S

External Audit and Audit Committees Impact on Jordanian Companies Earnings

Hanan Abdelsalam Nimer Jaber, Al-Ahlyyia Amman University

Citation Information: Jaber, H.A.N. (2022). External audit and audit committees impact on Jordanian companies earnings. Academy of Accounting and Financial Studies Journal, 26(S2), 1-25.

Abstract

Investors frequently censure both audit boards and outer audit about making a terrible display on the grounds that the audited fiscal summaries have been ended up being bogus and deluding because of ongoing high-profile profit the executives’ cases on the planet. In any case, the worry about the quality and honesty of accounting data is expanding over the long haul and brought about a drop in financial backer certainty following the breakdown of certain organizations because of accounting control by supervisors. This has gained organizations need to accomplish critical headway to the corporate administration act to recover the Investors' trust in monetary announcing quality. This paper proposes a calculated system to examine the job of audit committee’ qualities and outside audit on income the executives utilizing an example of modern organizations recorded on the Amman Stock Exchange (ASE). Proof from earlier investigations proposed that Audit boards and outside auditors assume a focal part in guaranteeing the respectability of monetary detailing measure. The audit advisory group is seen as a contact between the outside auditor and the board, an audit panel connects the data deviation between them. While the outside audit is seen as a powerful outsider which mitigates data deviation and irreconcilable situation among the board and Investors.

Keywords

Audit Committee Characteristics, External Audit, Earnings Management, Jordan

Introduction

The most recent twenty years have seen a progression of ongoing corporate accounting embarrassments across the United States, Europe and East Asian (for example Enron, HealthSouth, Parmalat, Tyco, WorldCom, and Xerox). These accounting embarrassments have carried a significant attention to the requirement for an examination concerning the nature of monetary reports and for more straightforwardness and validity to secure investors and partners the same, either through authoritative or through different norms identified with exposure (Al Daoud, 2018).

The focal issue of those embarrassments place was profiting the executives (Al-Fasfus, 2019). Studies on income the executives are turning into the subject of numerous new explores in monetary financial aspects (Alkilani, Hussin & Salim, 2019).

In addition, it has been an extraordinary and steady worry among experts and controllers and has gotten significant thought in the accounting writing (Alqatamin, 2018). Organization hypothesis proposes that the checking systems should adjust interests of the two chiefs and investors and moderate the irreconcilable circumstance and any sharp conduct coming about because of it (Alshirah, Alshirah & Lutfi, 2021).

Consequently, shrewd income the executives practice delivers less solid accounting profit, which doesn’t mirror a company's actual monetary exhibition. Profit the board is probably going to diminish the nature of announced income and its convenience for venture choices through the determination of accounting techniques and medicines that serve the chiefs' advantages instead of the ones that mirror the honest monetary situation of the firm, hence lessening financial backer trust in the monetary reports and darkens realities that partners should know (Altawalbeh, 2020).

In the wake of ongoing Financial disappointments of some huge organizations coming about somewhat from accounting control has brought up difficult issues about the job of various observing gadgets dared to ensure Investors' inclinations and control administrative crafty conduct. It is generally accepted that accounting profit data gives significant and helpful data to Investors and other choice business sectors.

Consequently, as a feature of corporate administration, the audit advisory group and outside Audit have as of late happen to noticeable significance in corporate administration (Alzeaideen & Al, 2018); because of it assume significant part at regulating the nature of the financial reports, and at going about as an obstacle to the executives supersede of controls and the board misrepresentation (Alzoubi, 2019).

This paper proposes a reasonable structure to look at the relationship between audit panel attributes, outer Audit and income the executives among mechanical organizations recorded on Amman Stock Exchange (ASE). The rest of the paper is coordinated as follows: Introduces the foundation of the review. Literary works survey, the calculated system and speculation improvement introduced. Rundowns and conclusion.

Background

Jordan is an Arab Muslim nation, and it is located in southwest Asia, at the gathering point of Asia, Africa, and Europe and an entryway to the Middle East. Jordan is an agricultural nation with a unified state framework. It is exceptionally appealing for unfamiliar ventures, because of a few reasons like wellbeing, political soundness and its focal area in the Middle East notwithstanding the on-going struggles in the Middle East locale. It looks for bear the cost of a protected climate for its recorded protections simultaneously as ensuring the privileges of the Investors. Jordan has a blended economy. It comprises of a private and public areas. The financial advancement in Jordan is described by an on-going co-activity between the general population and private areas. The mechanical area today is viewed as one of the significant potential monetary areas that Jordan ought to create to accomplish better financial development (Central Bank of Jordan, 2007).

The Jordanian government commanded the foundation of audit councils in Jordanian public shareholding organizations to work with working on the nature of Jordanian Financial detailing, the audit panel comprising of three non-leader individuals from the organization's top managerial staff, two of them is free individuals in the board (see The Jordanian Corporate Governance Codes (JCGC), 2009). In addition, the improvement of Auditing calling in Jordan has obliged the advancement of the actual nation. The auditing calling in Jordan has seen huge advancement in the beyond couple of many years. This is because of various significant variables, like the social and financial advancement in Jordan, the impressive expansion in the volume of speculation, the increment in the quantity of public shareholding organizations and the increment in the quantity of qualified bookkeepers (Dakhlallh, Rashid, Abdullah & Al Shehab, 2020). Taking into account the way that, Jordan is one of the nations where clients rely upon accounting numbers expected for simply deciding, it is of huge importance to consider the region being talked about of profit the executives to shield those clients from being deluded.

Literature Review

Income the executives have been at the center of accounting research for the last over twenty years. Hamdan (2020) demonstrated that writing on income the board for the most part rotates around organization hypothesis that suggests that supervisors (specialist) would not work consistently to the greatest advantage of their investors (head). In this way, chiefs infrequently control procuring figures in Financial reports for different reasons, along these lines income the board is probably going to decrease the nature of detailed profit and its helpfulness for speculation choices, then, at that point, lessening financial backer trust in the financial reports. Particularly, the profit is a basic factor that impacts speculation choices for clients of financial reports. As is notable, one of the destinations of an organization's corporate administration framework is to guarantee the nature of that organization's financial announcing (Issaa & Siamb, 2020). The corporate controls are the primary line of protection against misquotes in the financial assertions, along these lines, as a component of corporate administration, the audit councils and outer audit are relied upon to give powerful checking of income the executives. Besides, past examinations showed that higher audit quality (outside audit) and audit council are related with higher income quality. The audit panel is seen as an observing component that can assist with lightening office issues by diminishing data imbalance between insiders (chiefs) and untouchables board individuals (Kanakriyah, 2021), since its key capacities are to survey financial data and control the executives' direct of issues.

A developing collection of writing recommends that Audit panel is as a representative body of the governing body accused of defending and propelling the interests of investors. The board generally assigns liability regarding the oversight of financial answering to the audit panel to improve the broadness of importance and dependability of the yearly report. Thusly, the audit panel has been considered as a vital observing system of corporate administration for oversight of the organization's financial announcing measure (Mohammed, 2018).

The outer audit gives one more layer of financial backer insurance by decreasing the danger of misquotes (Mohammed, 2018). The financial assertion audit is an observing system that lessens data deviation and ensure the interests of the administrators, explicitly, investors and likely investors, by giving sensible confirmation that administration's financial assertions are liberated from material errors (Oroud, 2019) and accordingly is a significant strategy for checking utilized by firms to decrease organization costs (Shatnawi, Eldaia, Marei & Aaraj, 2021). At the end of the day, investors depend upon the outside auditor to give some affirmation that the financial assertions of a firm are not deluding.

A few examinations that have exactly analyzed the connection between audit committee qualities, outer audit and income the executives; yet these investigations uncovered blended and uncertain outcomes (e.g., Klein, 2002; Gul et al., 2002; Bedard et al., 2004; Chen et al., 2005; Abdul Rahman & Ali, 2006; Siregar & Utama, 2008; Tsipouridou & Spathis, 2012; Habbash et al., 2013; Soliman & Ragab, 2014). Likewise, there has so far been pretty much nothing or absence of examination into income the executives rehearse in Jordan.

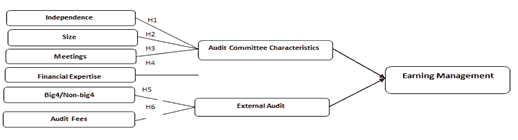

Consequently, the motivation behind this paper is to inspect the relationship between the audit committee attributes (freedom, size, gatherings, and Financial skill), outside (Audit firm size, Audit charges) and acquiring the board among mechanical organizations recorded on ASE.

Framework and Hypothesis Development

Audit Committee Attributes

Committee Independence

An audit committee fills in as a building up specialist to the freedom of inward just as outer Auditor, Audit advisory groups are relied upon to be more compelling in the oversight of financial announcing when they are autonomous (Shatnawi, Hanefah, Adaa & Eldaia, 2019) referenced that the more autonomous Audit panel is contended to give better administration contrasted with less free Audit council. In writing less Financial misquotes are related with more free Audit panels (Shbeilat & Abdel-Qader, 2018).

A few examination studies have explored the effect of having an Audit board on financial announcing quality. A typical theory is that free Audit advisory group chiefs would guarantee better financial announcing and the assumption is for the most part upheld by existing exact proof. In particular, utilizing an example of 692 public U.S. firms, (Shbeilat & Abdel-Qader, 2018) examines whether income the board is identified with Audit panel autonomy. She showed a negative relationship between profits the executives and the extent of autonomous chiefs on the Audit council.

Besides, (Siam, Idris & Al-Okdeh, 2018) research the impact of Audit committee attributes, in particular, skill, autonomy and action, on the degree of income the executives dependent on an example of 300 U.S. firms for 1996. Their discoveries uncover that forceful income the board is adversely related with completely free Audit boards of trustees.

These outcomes support the Sarbanes-Oxley Act (2002) commanding total autonomy of the audit board. (Siam, Idris & Al-Okdeh, 2018) utilizing an example of 666 firm-year perceptions for the financial years 2001, 2002 and 2003. They tracked down that more significant levels of audit council autonomy are related with diminished degrees of income the executives. Utilizing information of UK-recorded organizations in the monetary years 2000 and 2002, (Siam, Laili, Khairi & Jebreel, 2014) recommended that Audit board freedom compel the degree of income the executives.

As of late, a meta-investigation concentrated by Garcia-Meca & Sanchez-Ballesta (2009), utilizing the information of 35 experimental examinations, and Siam, Laili, Khairi & Jebreel (2014) utilizing an example included Australian public organizations recorded on the Australian Stock Exchange in 2004. The two of them upheld the idea that the autonomy of the Audit council compels income the executives. Also, (Toumeh, Yahya & Amran, 2020) inspect the relationship between the Audit council adequacy, Audit quality and income the executives practices of more dynamic 50 of Egyptian organizations recorded on the Egyptian Stock Exchange of the non-Financial area during the period 2007-2010. The outcomes showed that Audit panels autonomy have critical negative relationship with income the executives.

Interestingly, in the USA, (Zraiq & Fadzil, 2018) analyze the impact of certain attributes of the Audit board on compelling income the executives and found that Audit panel autonomy isn't altogether connected with decreased degrees of profit the executives. Abdul Rahman & Ali (2006) utilizing Malaysian recorded firms; they tracked down an immaterial connection between free Audit boards of trustees and income the executives. Al Daoud (2018) utilizing Indonesian organizations recorded on the Jakarta Stock Exchange to look at the viability of some corporate administration rehearses on profit the executives. Their example contains 144 firms and covers the periods 1995–1996, and 1999–2002. They neglected to distinguish a connection between Audit advisory groups' autonomy and profit the board.

Besides, (Al-Fasfus, 2019) tracked down an immaterial connection between autonomous Audit boards and income the executives by utilizing an example that comprises of all organizations recorded on the Saudi Stock Market and that covers the time of 2006 - 2009 (Alhababsah, 2019) use board information of 148-firm years got from the yearly reports of the 37 organizations recorded on the Nairobi Stock Exchange, the investigation discovered that freedom of the Audit council isn't fundamentally identified with profit the executives:

H1: The Audit committee freedom is adversely identified with procuring the executives among Jordanian recorded modern organizations.

Committee Size

The Blue-Ribbon Committee (BRC) report of 1999 delivered the value of having an Audit committee and suggested that a powerful Audit advisory group of recorded organizations ought to include no less than three chiefs. These proposals mirror the suspicion that size is a vital quality of the viable Audit boards and can significantly affect the checking of profit the executives (Alkilani, Hussin & Salim, 2019). Albeit the size of Audit advisory group is influenced predominantly by the size of the organization and its top managerial staff, in the event that the Audit board size is excessively little, a lacking number of chiefs to serve the council in happening and hence decline it’s the checking adequacy (Alqatamin, 2018). This maybe on the grounds that little council isn't fit for satisfying its obligations effectively as the given tasks is continually expanding. Additionally, when a council size is too enormous, the chiefs' presentation might decrease due to the coordination and interaction issues and subsequently feature one more justification for powerless checking (Alshirah, Alshirah & Lutfi, 2021).

The ideal normal of the Audit advisory group size is somewhere in the range of 3 and 4 individuals (Altawalbeh, 2020). Proof from the past proposed that the organizations with huge Audit panel are more powerful in observing the administration. (Alzeaideen & Al, 2018) tracked down that quarterly income the board is lower for the organizations that have enormous size of Audit advisory group. This might propose that having an adequate number of Audit committee individuals builds the proficiency of its observing capacity as far as financial detailing respectability.

The discoveries of earlier examinations for the impact of Audit committee size on income the executives are blended and uncertain. (Alzoubi, 2019) utilizing information from Chinese firms posting in Hong Kong 2004 to 2008, tracked down that an audit advisory group size is related with decreased degrees of income the executives. Additionally, (Dakhlallh, Rashid, Abdullah & Al Shehab, 2020) tracked down a negative relationship between audit board size and profit the executives in Australian organizations. Lin & Hwang (2010), utilizing meta-logical strategies to the information from almost 48 observational examinations, likewise tracked down a negative and exceptionally huge relationship between audit board size and income the executives, (Hamdan, 2020) tracked down no critical relationship between the quantity of chiefs on the Audit committee and income the executives by utilizing an example of 282 US firms covering the period somewhere in the range of 1992 and 1994. Similarly, (Issaa & Siamb, 2020) tracked down no huge connection between Audit advisory group size and forceful income the executives in US. (Kharashgah, Amran & Ishak, 2019) discovered no effect of Audit advisory group size on profit repetition. Moreover, in Egypt, (Mohammed, 2018) tracked down no critical connection between Audit boards of trustees size and the degree of income the executives. Also, (Oroud, 2019) tracked down a positive connection between Audit board size and income the executives (Shatnawi, Eldaia, Marei & Aaraj, 2021) contend that where there is positive connection between profit the board and Audit panel size it is credited to proficient instead of forceful income the executives. In Egypt, (Shatnawi, Hanefah, Adaa & Eldaia, 2019) found that there is a positive connection between the Audit council size and profit the executives by utilizing an example from partnerships recorded on the Egyptian Stock Exchange from the years 2008-2010.

Past examinations recommended that Audit committee size can significantly affect the observing of income the executives. As needs be, founded on the above conversation, the accompanying speculation is created:

H2: The Audit committee size is contrarily identified with procuring the board among Jordanian recorded mechanical organizations.

Committee Meetings

Viable Audit panels meet routinely to guarantee that the financial detailing measure is working appropriately, and consequently a well-working and dynamic Audit board decreases income control as well as works on firm execution since it limits chief collaboration time (Shbeilat & Abdel-Qader, 2018).

Further, (Siam, Idris & Al-Okdeh, 2018) recommends dynamic audit committees as estimated by the quantity of gatherings are emphatically connected with Audit council autonomy. A significant goal for an audit committee is to give its individuals adequate chance to play out their obligations of checking their company's financial detailing measure (Siam, Laili, Khairi & Jebreel, 2014).

Past examinations recommended that organizations with the larger number of audit committee gatherings experience are less inclined to be endorsed for misrepresentation just as forceful accounting (Toumeh, Yahya & Amran, 2020) tracked down the negative connection between meeting recurrence and the event fake financial detailing utilizing information 78 firms that were dependent upon SEC authorizations and 78 coordinated with non-extortion firms in the period 2012 to 2016 (Zraiq & Fadzil, 2018) proposed that audit councils that meet routinely during the financial year are related with compelling checking. The more incessant they meet can oblige the degrees of profit the board.

Without a doubt, the adequacy of audit panels depends, generally, upon their genuine tasks or exercises, like the recurrence, length, and content of audit committee gatherings, as of later on it has been discovered that audit panels that meet something like four times each year display a critical and negative relationship with the event of financial announcing repetitions through utilizing information 41 firms that gave deceitful reports and 88 firms which rehashed yearly outcomes in the period 1991-1999.

Moreover, (Al Daoud, 2018) analyzed the connection between acquiring the executives and action of leading group of chief and Audit board. He chose an example of US producing organizations for a very long time, 1999 and 2000; results demonstrated there is a negative connection between procuring the executives with both load up and Audit board autonomy and he records that this connection is more grounded when the Audit panel is more dynamic. (Al-Fasfus, 2019) tracked down no verifiable proof to demonstrate that regular Audit board gatherings will control misrepresentation or income rehashing. What's more, (Alhababsah, 2019) found that organizations which had more proficient Audit committee individuals and held more Audit panel gatherings recorded less income the executives rehearse for an example 561 Malaysian firms in 2001.

Alkilani, Hussin & Salim (2019) recommended that audit board meeting recurrence shows negative relationship with pay diminishing income the executives. He utilizes information of UK-recorded organizations in the monetary years 2000 and 2002. Besides, (Alzeaideen & Al, 2018) found that audit advisory group gatherings have critical negative relationship with profit the executives. In a similar institutional setting, (Alzoubi, 2019) observed to be additionally that there is a negative connection between the audit committee gatherings and the income the executives. Interestingly, (Altawalbeh, 2020) tracked down an unimportant connection between the quantity of gatherings and profit the executives. In the Australian setting, (Alshirah, Alshirah & Lutfi, 2021), the outcomes show that a more noteworthy number of audit board gatherings don't appear to diminish either income the executives or to improve profit quality measures.

Additionally, (Alshirah, Alshirah & Lutfi, 2021) found that audit panel meeting recurrence isn't related with income the board in Chinese firms.

Compelling audit boards of trustees meet routinely to guarantee that the Financial announcing measure is working appropriately, and hence a well-working and dynamic audit panel might have the option to forestall profit the executives. In like manner, in light of the above conversation, the accompanying theory is created:

H3: The audit committee meeting is adversely identified with acquiring the executives among Jordanian recorded modern organizations.

Committee Expertise

Information in accounting and money gives a decent premise to audit panel individuals to look at and investigate financial data. The instructive foundation turns into a significant trademark to guarantee audit advisory groups play out their jobs viably. Besides, audit panels that contain somewhere around one Financial master have more prominent transaction with their inward and outside auditors (Alzeaideen & Al, 2018). Many examinations contend that audit panels individuals' information/ability or experience is straightforwardly connected with powerful working of audit committees.

Alzoubi (2019) contend that the audit advisory group's financial mastery improves the probability that distinguished material errors will be conveyed to the audit committee and revised in a convenient manner. Hamdan (2020) proposed that the financial mastery of the audit committee is connected with a higher Financial detailing quality. (Issaa & Siamb, 2020) show that the presence of somewhere around one part with Financial mastery sitting on the audit committee is adversely identified with the degree of profit the executives (Susanto & Yangrico, 2020) tracked down that Financial mastery is related with a huge diminishing in income the board, where show that the presence of something like one part with Financial skill sitting on the Audit advisory group is contrarily identified with the degree of profit the executives.

What's more, (Al Sawalqa & Qtish, 2021) discovered the level of audit committee individuals having skill in accounting or financial administration is emphatically identified with the nature of financial detailing and the nature of the financial assertion improves. (Ball, Weiner, Schwartz, Altman, Binns-Calvey, Chan & Wopat, 2021) discovered proof that profit the executives is decreased with Audit panel individuals which include something like one part with a corporate or Financial foundation.

In Malaysia, (AlQudah, Azzam, Aleqab & Shakhatreh, 2019) the absolute most significant discoveries of their review are: the organizations whose individuals from audit committee are recognized for experience, financial information, polished skill, notwithstanding incessant gatherings of the panel have less acts of income the executives when contrasted with different organizations. Moreover (Nawaiseh, Bader & Nawaiseh, 2019) tracked down that Financial skill of Audit boards oblige the degree of profit the executives. Further, (Buallay, 2018) utilize a spurious variable for financial specialists if somewhere around one of the Audit board individuals have accounting experience.

Their outcomes demonstrate an imperceptibly huge negative relationship between the presence of financial specialists on the Audit council and profit the executives. (Al-Aroud, Al-Sayyed & Alawawdeh, 2021) tracked down that an Audit panel mastery is related with diminished degrees of income the executives. (Nawaiseh, Bader & Nawaiseh, 2019) tracked down a negative connection between audit board Financial aptitude and profit the executives. In Egypt, Soliman & Ragab (2014) showed that experience of audit panel individuals has huge negative relationship with profit the executives. In a similar Egyptian setting, (Alkilani, Hussin & Salim, 2019) observed to be additionally that there is a negative connection between the audit council Financial aptitude and the income the board. In various words, both the administrative worry just as the trial proof recommended that having appropriate insight and information, chiefly in accounting and auditing, is probably going to work on the presentation and judgment of the audit board. In like manner, in view of the above conversation, the accompanying speculation is created:

H4: The audit committee financial mastery is contrarily identified with acquiring the executives among Jordanian recorded mechanical organizations.

External Audit

Audit Firm Size

Bountiful examination shows higher audit quality mitigates the income the board (Becker et al., 1998; Francis et al., 1999; Zhou & Elder, 2004; Chen et al., 2005; Francis & Yu, 2009; Jordan et al., 2010). In an early examination, Becker, et al., (1998) utilizing the Jones model as intermediary for income the executives and Big6 auditors (presently Big4) as intermediary for audit quality, gathered an example of 10,379 Big6 and 2,179 non-Big6 firm years. They detailed that organizations audited by non-Big6 Audit firms have higher profit the board than organizations audited by Big6 Audit firms. (Susanto & Yangrico, 2020) has shown that Big Four auditors give a critical imperative on income the executives for public firms. What's more, (Al Sawalqa & Qtish, 2021) inspected six enormous audit firms to assess audit quality. They theorized that these organizations have high audit quality and that organizations which are not audited by these organizations are attempting to introduce more accumulations to adjust the income. In this way, it is contended that top notch auditors are relied upon to be bound to distinguish the act of income the executives.

A review by (Zraiq & Fadzil, 2018) embracing Big5 (presently Big4) audit firms and industry expert auditors for audit quality utilized an example of Taiwan IPO firms from 1996-1998. They tracked down that high audit quality assumes a significant part in obliging profit the board and that Big5 Auditors give high Audit quality prompting the limitation of income the executives. Utilizing Chinese information, (Toumeh, Yahya & Amran, 2020) in their investigation have discovered that directors are bound to incline toward more modest reviewers since they consider that little Auditors permits them to have greater adaptability revealing their income (Shbeilat & Abdel-Qader, 2018) utilizing different components for audit quality (Auditor size, industry expert auditor, Audit expenses, Auditor residency), tracked down that main Big4 auditors and industry expert auditors have a critical negative relationship with income the board. Also, in US (Oroud, 2019) focused on that the control of income is less inclined to be dealt with firms Audited by Big4 Auditors while customers with non-Big4 auditors give indications of control. (Al-Fasfus, 2019) tracked down that the viability of Big N auditors over non-Big N Auditors in obliging acquiring the executives is more noteworthy for high-case hazard customers than for low suit hazard customers, proposing that customers' high case hazard can constrain huge auditors to perform all the more adequately. (Alqatamin, 2018) utilizing an example of 90 non-Financial Iranian recorded firms from 2004 to 2009, the outcomes uncover that income the board is contrarily identified with Auditor size. Generally, this review gives proof that organizations which are audited by top notch Auditors are bound to have less income the board. In a similar setting, (Alqatamin, 2018; Altawalbeh, 2020) tracked down that Big 4 Auditors partner with less profit the executives in the organizations. To be sure, Big 4 Audit organizations are accepted to have higher Audit quality than non-Big 4, since they are less reliant upon their customers. Inaam and (Alzeaideen & Al, 2018) in the Tunisian setting and utilizing 319 firm-year perceptions during the period 2000-2010, they tracked down that Big 4 auditors related with lower levels of accumulations profit the board. Then again, different examinations report no huge connection between Big 4 audit firms and income the board. For instance, (Alzoubi, 2019) inspect the impact of Audit firm quality on profit the executives in three European nations (France, Germany and the UK). Their outcomes propose that Big 4 Audit firm don't seem to comprise an imperative on profit the board. (Dakhlallh, Rashid, Abdullah & Al Shehab, 2020) explored in the impact of different audit quality measurements on profit the executives in France. The principal finding is that the presence of a Big Five Auditor has no effect with respect to income the board exercises.

In addition, utilizing US information, (Hamdan, 2020) report an irrelevantly certain connection between Big 4 audit firms and profit the executives. (Mohammed, 2018) additionally discovered an irrelevantly certain connection between Big 5 Audit firms and profit the executives for an example of Malaysian firms. Utilizing an example of assembling industry firms recorded on Istanbul Stock Exchange (ISE) for the years 2003-2007, (Oroud, 2019) found that audit firm size as intermediary for audit quality, doesn't affect income the board. His outcomes demonstrate that there is no distinction in Audit quality between Big 4 and non-Big 4 Audit firms for limitation of profit the board in Turkey.

Under the suspicion that great Audits really fill in as an income the executive’s imperative, the accompanying theory is created:

H5: Big4 audited organizations are contrarily connected with the degree of profit the board among Jordanian recorded modern organizations.

Audit Fees

A few studies that have observationally inspected the connection between audit quality and audit expense; however, these examinations uncovered uncertain outcomes. (Shatnawi, Eldaia, Marei & Aaraj, 2021) look at the linkages between income the board and audit expenses utilizing an example of 648 Australian firms show that there is a positive relationship between profit the executives and audit charges. Likewise, (Shbeilat & Abdel-Qader, 2018) inspects the connection between profit the board and audit expenses, utilizing an enormous example of get sectional firms over the period 2000-2006 in USA. They found that there is a positive and critical relationship between profit the board and audit expenses.

Ashbaugh, et al., (2003) discovered no relationship between firms' complete expenses and profit the executives; similarly, (Siam, Idris & Al-Okdeh, 2018) discovered no relationship between a few Audit-charge measurements and their gauge of income the board.

Essentially, (Toumeh, Yahya & Amran, 2020) gives proof between auditors' expenses and profit the board in New Zealand. The outcomes show that audit expense isn't identified with income the board. (Zraiq & Fadzil, 2018) analyze whether auditor expenses are related with profit the board. They found that Audit charges are adversely connected with profit the executives markers. In a Jordanian setting, huge organizations will in general work chiefly in the banking and assembling area.

Reviewing the records of organizations that have a place with these ventures seemingly requires additional time in light of the intricacy of their tasks than that spent on organizations working in different enterprises. In an arising economy like Jordan, big organizations are additionally bound to be persistently observed by people in general and expected to bring about higher office costs. Consequently, these organizations endeavor to limit office costs by guaranteeing Investors just as lenders by utilizing a lofty audit firm that cost in excess of a common one. Moreover, big organizations can bear to utilize costly auditors. As needs be, founded on the above conversation, the accompanying theory is created:

H6: The audit expenses are adversely identified with procuring the executives among Jordanian recorded modern organizations.

Conclusion

Profit the board is of extraordinary worry to corporate partners, professionals and controllers and has gotten impressive consideration in the accounting writing. All the more as of late, high-profile outrages, financial emergencies, or institutional disappointments in East Asia, Europe and the United States have brought corporate administration issues to the front line in non-industrial nations. These embarrassments shake the uprightness of accounting data and brought about a drop in financial backer certainty. In this way, as a component of corporate administration, the audit committee and outside Audit have as of late happen to noticeable significance in corporate administration (Al-Sraheen, 2019); because of it assume significant part at directing the nature of the Financial reports, and at going about as an obstacle to the executives supersede of controls and the board extortion (Buallay & AlDhaen, 2018).

The job of audit committees and audit quality in guaranteeing the nature of corporate financial detailing has gone under extensive examination because of late high-profile profit the board cases on the planet. In particular, this paper means to explore the connection between the audit committee attributes, outer audit and profit the board among mechanical organizations recorded on the Amman Stock Exchange (ASE).

References

Al Daoud, K. (2018). The role of the audit committee and the board of director in mitigating the practice of earnings management: Evidence from Jordan. In Proceedings of Business and Management Conferences (No. 6809892). International Institute of Social and Economic Sciences.

Al-Fasfus, F.S. (2019). Effect of members of the audit committee on the quality of Jordanian Banks in Jordan. International Journal of Business and Management, 14(3).

Alhababsah, S. (2019). Ownership structure and audit quality: An empirical analysis considering ownership types in Jordan. Journal of International Accounting, Auditing and Taxation, 35, 71-84.

Alkilani, S.Z., Hussin, W.N.W., & Salim, B. (2019). The influence of audit committee characteristics on modified audit opinion in Jordan. Journal of Finance and Accounting, 7(3), 95-106.

Alqatamin, R.M. (2018). Audit committee effectiveness and company performance: Evidence from Jordan. Accounting and Finance Research, 7(2), 48.

Alshirah, M., Alshirah, A., & Lutfi, A. (2021). Audit committee?s attributes, overlapping memberships on the audit committee and corporate risk disclosure: Evidence from Jordan. Accounting, 7(2), 423-440.

Altawalbeh, M.A.F. (2020). Audit committee attributes, corporate governance and voluntary disclosure: Evidence from Jordan. Management, 10(2), 233-243.

Alzeaideen, K.A., & Al, S.Z. (2018). The effect of ownership structure and corporate debt on audit quality: Evidence from Jordan. International Journal of Economics and Financial Issues, 8(3), 51.

Alzoubi, E.S.S. (2019). Audit committee, internal audit function and earnings management: Evidence from Jordan. Meditari Accountancy Research.

Dakhlallh, M.M., Rashid, N., Abdullah, W.A.W., & Al Shehab, H.J. (2020). Audit committee and Tobin's Q as a measure of firm performance among Jordanian companies. Journal of Adv Research in Dynamical & Control Systems, 12(1).

Dakhlallh, M.M., Rashid, N., Abdullah, W.A.W., & Shehab, H.J.A. (2021). The moderate effect of audit committee independence on the board structure and real earnings management: Evidence from Jordan. Journal of Contemporary Issues in Business and Government, 27(2), 123-133.

Hamdan, A.M.M. (2020). Audit committee characteristics and earnings conservatism in banking sector: Empirical study from GCC. Afro-Asian Journal of Finance and Accounting, 10(1), 1-23.

Huang, S.L.C.L.H., & Hsiao, H.C. (2011). Study of earnings management and audit quality. African Journal of Business Management, 5(7), 2686-2699.

Issaa, G., & Siamb, Y.A. (2020). Audit committee characteristics, family ownership, and firm performance: Evidence from Jordan. Management, 14(4).

Kanakriyah, R. (2021). The impact of board of directors' characteristics on firm performance: A case study in Jordan. The Journal of Asian Finance, Economics and Business, 8(3), 341-350.

Kharashgah, K.A., Amran, N.A.B., & Ishak, R.B. (2019). The impact of audit committee characteristics on real earnings management: Evidence from Jordan. International Journal of Academic Research in Accounting, Finance and Management Sciences, 9(4), 84-97.

Mohammed, A.M. (2018). The impact of audit committee characteristics on firm performance: Evidence from Jordan. Academy of Accounting and Financial Studies Journal, 22(5), 1-7.

Mohammed, A.M. (2018). The impact of ownership structure on firm performance: Evidence from Jordan. Academy of Accounting and Financial Studies Journal, 22(5), 1-9.

Oroud, Y. (2019). The effect of audit committee characteristics on the profitability: Panel data evidence. International Journal of Economics and Finance, 11(4), 104-113.

Shatnawi, S.A., Eldaia, M., Marei, A., & Aaraj, S.A. (2021). The relationship between audit committee characteristics on accounting-based performance (roa and roe) as a measure of performance evidence from Jordan. International Journal of Business and Digital Economy, 2(2), 15-27.

Shatnawi, S., Hanefah, M., Adaa, A., & Eldaia, M. (2019). The moderating effect of enterprise risk management on the relationship between audit committee characteristics and corporate performance: A conceptual case of Jordan. International Journal of Academic Research Business and Social Sciences, 9(5).

Shbeilat, M., & Abdel-Qader, W. (2018). Independence dilemma and the reliability of the audit report: Qualitative evidence from Jordan. Australian Academy of Accounting & Finanace Review, 4(1), 22-36.

Siam, Y.A., Idris, M., & Al-Okdeh, S. (2018). The moderating role of family control on the relationship between audit committee financial expertise and earnings management. International Journal of Business and Management, 13(12), 31-37.

Siam, Y.I., Laili, N.H., Khairi, K.F., & Jebreel, M.F. (2014). Audit committee characteristics, external audit and earnings management among Jordanian listed companies: Proposing conceptual framework. In Proceedings of the Australian Academy of Business and Social Sciences Conference.

Soliman, M.M., & Ragab, A.A. (2014). Audit committee effectiveness, audit quality and earnings management: An empirical study of the listed companies in Egypt. Research journal of finance and accounting, 5(2), 155-166.

Toumeh, A.A., Yahya, S., & Amran, A. (2020). Surplus free cash flow, stock market segmentations and earnings management: The moderating role of independent audit committee. Global Business Review, 0972150920934069.

Zraiq, M., & Fadzil, F. (2018). The impact of audit committee characteristics on firm performance: Evidence from Jordan. Sch J Appl Sci Res, 1(5), 39-42.

Received: 22-Nov-2021, Manuscript No. AAFSJ-21-8369; Editor assigned: 25- Nov -2021, PreQC No. AAFSJ-21-8369 (PQ); Reviewed: 10-Dec-2021, QC No. AAFSJ-21-8369; Revised: 21-Dec-2021, Manuscript No. AAFSJ-21-8369 (R); Published: 06-Jan-2022