Case Reports: 2019 Vol: 25 Issue: 1

Exploring Uncontested Markets With Blue Ocean Strategy in Convenience Food Business-a Case of ID Fresh Food

Reena Shyam, Indian Academy School of Management Studies

Geevarathna, Acharya Bangalore B School

Case Description

The market for Ready-to-Cook (RTC) food products in India has witnessed an unprecedented growth over the last few years on account of busier lifestyles and rising income levels of consumers. The attractive profits and potential growth opportunities in this sector has triggered the entry of multiple players, making the RTC sector extremely competitive and a red ocean. Therefore to set itself apart from competitors in this sector, any new entrant has to offer a unique value innovation. Branded idli/dosa batter in India had no competition as existing products available in this category were unbranded with no assurance of quality. By offering branded batter, focusing on research and development leading to innovations like the Vada maker and positioning itself as a personal assistant to the Indian home maker, iD has attempted not to compete in the Red ocean and instead explore the Blue Ocean by discovering a new uncontested space in the food sector. In this context the present study attempts to explore the growth strategy of iD Fresh Food based on the principles of Blue Ocean Strategy (BOS) evolved by Chan and Renée. Since its inception in 2005 iD Fresh Food, the Bengaluru-based company has experienced remarkable success in a very short span of time despite aggressive competition from both domestic and international brands in the convenience food sector. This study uses the case analysis approach which is aimed at tracing the company’s attempt to make competition irrelevant by creating an uncontested market space using Four Actions Framework. The results indicate that iD has become a game changer in the batter segment by pursuing both differentiation and low cost simultaneously thereby adopting innovation and securing competitive advantage.

Key Words

RTC, Strategy, BOS, Innovation, Competitive advantage.

Case Synopsis

The economic reforms in India has not only stimulated strong economic growth, but also resulted in fast paced urban lifestyles, rising disposable incomes, increase in the number of working women in the country also a significant change in its traditional social system. The upswing in the Ready-to-Cook (RTC) food business of India seems to be an important indication of changing economic and social lifestyles in India .The fast paced urban life styles often make the Indian cooking seem intimidating as it involves preparing homemade masalas and batters which some time ago was completely prepared in the kitchen to ensure quality and authentic taste. However in recent times with increase in dual income families for who work life balance is a major challenge, convenience food is a popular alternative. The Indian food market is the world’s 6th largest and accounts for approximately 31% of India’s consumption basket; (Maerschand, 2016). In the food category the RTC segment has emerged as the next best alternative to home cooked meal. The total processed foods market in India stands at Rs.1500 crore out of which the RTC segment share is 600-700 crores (barring noodles) and is expected to grow around 20-25 per cent over the next five years (Indian Brand Equity Foundation, 2017).

Innovation the Only Way to Stay Ahead–The RTC Sector and Strategic Moves of Id Fresh

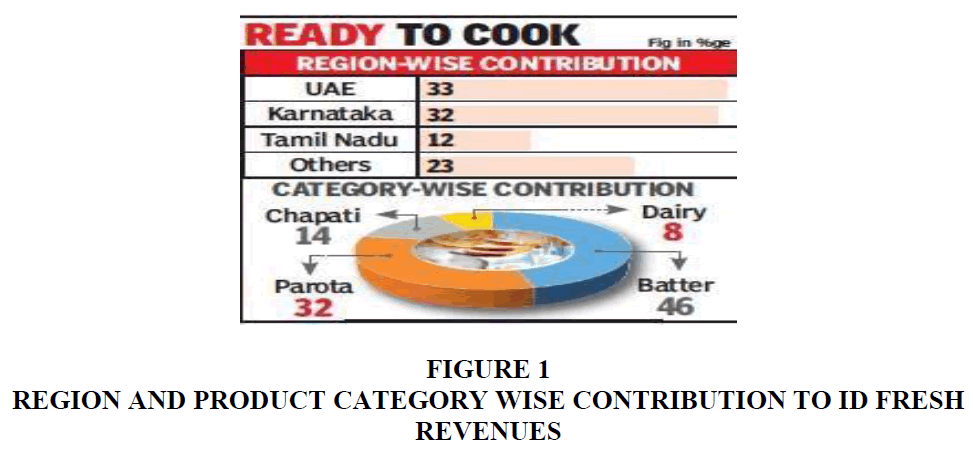

The Indian convenience food business includes both packaged Ready to Eat (RTE) and Ready to Cook (RTC) food. An RTE meal needs to be heated before eating while RTC meal means food that has been seasoned and prepared but still needs to be cooked. Some of the choices in the RTE category range from gravies, dals, biryanis, sweets and desserts while the RTC group includes breakfast-mixes, idli and dosa batter, masala mixes and dessert mixes. (Chandran, 2016).The established players in the Indian RTC market include MTR Foods (Bengaluru), ITC Limited (Kolkata), Desai Brothers Ltd (Pune) and Gits Food Products Pvt Ltd (Pune). ABT Foods Limited (Coimbatore) is one of the emerging brands in the RTC food market. These popular brands have always gained attention from the consumers, mainly because they keep involving innovations in their product line (Food and Beverage News.Com, 2018). With the market showing signs of high growth potential, players like iD have left no stone unturned in responding to the expanding demand for its food products. Although iD started with batters, the company has expanded its product range of RTC products by adding parota, chapati, paneer, curd and a healthier option of ragi batter. iD has a total network of 20,000 stores spread across Karnataka, Tamil Nadu and other states. The revenue generation for iD has been highest from its outlets in UAE market. The company has been successful in attracting funding from Helion Ventures which invested around 23 crores and also raised 150 crores from Premjiinvest, the private investment office of Azim Premji for an equity stake of 25% in the company. The funding would be used for up gradation of its existing manufacturing facilities, establishing new distribution networks and R&D that would in turn help iD expand into international markets such as US, UK and Singapore (Balasubramanyam, 2017). The company, which test-marketed the coffee decoction products in the last three months of 2018, expects the business to generate about 2.5 crores in revenue in February itself. This, along with geographical expansion and related lines of diversification such as diet batter is expected to help the startup’s revenue to grow 45% in 2019-2020 (Figure 1).

Over a span of 3 years the company’s endeavors to constantly innovate has paid off with the new product development-vada maker, which promises "perfectly shaped vadas with a hole in the middle".

It allows users to squeeze vadas directly into hot oil and avoid the messy, time-consuming process of shaping them by hand. The vada maker has a unique umbrella nozzle for creating the round fluffy sphere with a cutter to ensure even sizes and a hole. The company has filed a patent for the vada maker in India and 140 countries under the PCT Patent Cooperation Treaty.

iD’s entry and growth strategy in the food sector provides it the first mover advantage of entering the dosa/idli batter segment. Rather than competing in the highly crowded space such as fast food chains and ready to eat products, iD has chosen to enter an undeveloped market which is idli and dosa batter. Although, dosa batter did exist in the market, it was offered by local manufacturers without brand name or assurance of quality and hygiene. iD has responded to the market opportunity for RTC products by positioning the brand as a professional assistant to a home maker by replacing the cumbersome backend job of preparing food for the family thereby entering into an untapped space in the market. What makes iD brand unique is while the rest of the players in this segment try to increase the shelf life of their products, iD is working to reduce shelf life of its products. It achieves this by following a 0 inventory business model. Since they deal with perishable products, daily distribution to outlets and ensuring quality is restored throughout the supply chain is the secret sauce for the success of iD Fresh Food. Appropriate demand planning is done to ensure that regulation of production according to the market demand and use of mobile app to integrate it into its Enterprise Resource Processing system also helps in tracking everyday sales. As iD promises consumers who are strapped for time an option for easier food options, the company will tread on new innovations that will continue its phase of profitability in the competitive food business.

Theoretical Background Of The Study

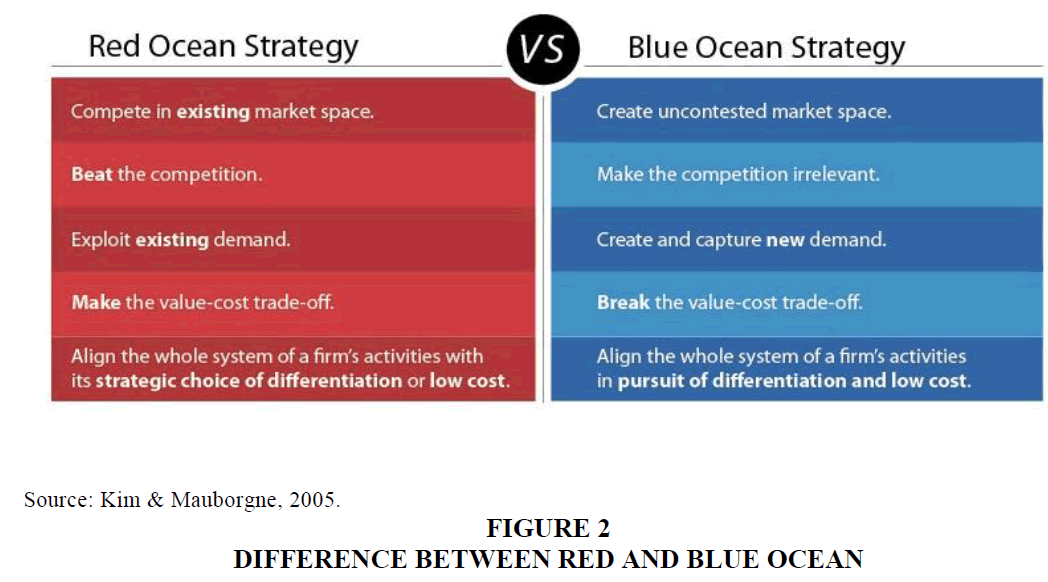

Kim & Mauborgne (2005), Professors of strategy at INSEAD, based on their study over the last 15 years, analyzed 150 strategic moves, spanning 120 years of business across 30 industries, proposed a new perspective to strategy formulation and execution called the “Blue Ocean”. As companies face stiff competition irrespective of which sector they operate in, differentiating themselves from rivals has become a major challenge. It is in this context that companies can discover a blue ocean and apply the strategy to establish a clear lead in business. In the Blue ocean approach the goal is not to beat competition, but to redraw industry boundaries and operate within a new space, making competition irrelevant. Therefore the main aim of “Blue Ocean” strategy is for organizations to find and develop “Blue Oceans” uncontested, untapped market space outside traditional market boundaries and avoid “Red Oceans” (overdeveloped, saturated markets) as shown in Figure 2.

The corner stone of Blue Ocean strategy is Value Innovation which is simultaneous pursuit of differentiation and low cost which result in value enhancement for the customer and company. Several analytical tools such as ERRC Grid having 4 factors: Eliminate, Reduce, Raise and Create which was developed by Kim and Mauborgne that can be used d by any business to create new market spaces leading to blue oceans of uncontested market space. Blue Ocean can be extremely rewarding as the company has high probability of success, face fewer risks and enjoy increased profits in a blue ocean market.

Literature Review

Since this research is probably the first of its kind in trying to look at the application of BOS principles in RTC segment in India, literature related to it has yet to be documented in very few journals or other sources. Kim et al. (2005) in their research for fifteen years feel competition matters most. Not Competing but making the competition irrelevant by creating a new market space where there are no competitors, calling it as “Blue Ocean”. Kim et al. (2006) have explored in their case study of a Third-Party Logistics (3PL) provider CJ-Global Logistics Service (CJ-GLS) in South Korea. CJ-GLS have pioneered into an uncontested market through innovative information technology (i.e., RFID-radio frequency identification), which has enabled it to create an uncontested market space, electronic logistics business.

Methodology

Secondary research included an exhaustive search of relevant publications like company websites, relevant articles in newspapers and journals. This study has major focus on the Eliminate-Reduce-Raise-Create (ERRC) Grid developed by Chan and Renée as a tool that has enabled iD Fresh to focus simultaneously on eliminating and reducing, as well as raising and creating while unlocking a new blue ocean. This was the major source of secondary data for this case study. After an overview of the main dynamics of competition present in the RTC industry, the present research adopts a case-study approach centered on iD Foods with respect to BOS.

Findings

The present study attempted to trace how iD actualized the Blue Ocean Strategy in creating value for its customers in a crowded RTC food sector by changing its approach to competition. The strategy followed by iD to break the trade-off between differentiation and low cost and to create a new value curve in the Convenience Food Sector has been explained below as the ERRC Grid. The findings reveal how iD fresh has explored a blue ocean by making competition irrelevant and creating an uncontested market space using Four Actions Framework developed by Kim and Mauborgne.

ERRC Grid with Respect to iD Fresh Food:

1. Eliminate: Which factors that the industry has long competed on should be eliminated?

a. Idli Batter business has long been a part of unorganized sector in India. iDs foray into branded batter has eliminated consumer dependence on unbranded options.

b. Breakthrough in the company’s R&D has led to the creation of the iD “Vada Maker”. This innovation has eliminated the mess and tedious process involved in the making of one of the most popular Indian breakfast “Vada”. iD has converted the art of Vada making into a science. The iD Vada maker has a unique umbrella nozzle for creating the round fluffy sphere with a cutter to ensure even sizes and a hole to make vadas. It is user friendly and allows users to squeeze vadas directly into hot oil and avoid the messy, time-consuming process of shaping them by hand.

2. Raise: What factors should be raised well above the industry's standard?

a. The traditional mindset of Indian consumer is that anything which is packed is not healthy. iD has raised the quality of its products like idli batter above industry standards assuring the consumers that the product is "fresh and 100% natural" with no preservatives, soda or flavors. By providing consumers with hygienic, branded, yet home-like taste, iD has reinforced consumer belief that packaged food could also provide healthier options.

3. Reduce: Which factors should be reduced well below the industry's standard?

a. When the rest of the market is busy trying to increase the shelf life of their products, iD is working to reduce shelf life as it strongly advocates that food tastes better when it is natural and fresh. iD achieves this by following a 0 inventory business model. Since they deal with perishable products, daily distribution to outlets and ensuring quality is restored throughout the supply chain is the secret sauce for the success of iD Fresh Food. Appropriate demand planning is done to ensure that regulation of production according to the market demand and adequately meet the requirement of suppliers so consumer need for the product is met at all times.

b. Solving the perishable foods puzzle-Uses a mobile app to track everyday sales and integrates it into its Enterprise Resource Processing system. This enables it to gauge demand live and improve delivery.

4. Create: Which factors should be created that the industry has never offered?

a. iD has been successful in creating a professional assistant to the home maker who can use smart food tools that allow convenient, faster, better and cheaper meal preparation without taking away the credit from the home maker of preparing delicious food for family. It has created a market for Ready to Cook food products (RTC) and a space to enter households that never buy batter and still continue to prefer preparing the batter through conventional, time consuming process.

Conclusion

Blue ocean strategy enhances the ability of a firm to create new market spaces and make the competition irrelevant. Intense competition is a common phenomenon across manufacturing and service sectors. The successful applicability of Blue Ocean Strategy in the convenience food sector in India with special reference to iD foods proves that the only way entrepreneurs can sustain their business in the long run is focusing create, raise, reduce and eliminate variables respectively. iD’s success in the food business reaffirms that companies which pursue uncontested markets could overcome the challenges of intense competition. iD has effectively identified he key factors of competition among current or potential competitors in the RTC segment namely customer need for branded, hygienic and convenient food solutions which is critically important in creating a successful Blue Ocean strategy.

Future Research

The study is limited to applicability of BOS in the convenience food market in India with special reference to only one player namely iD Fresh Food. Future research can delve into the experiences of international brands that operate in the food or related sectors that attempt to explore uncontested waters. This could bring in a global perspective to the study of BOS with respect to convenience food.

References

- Balasubramanyam, K.R. (2017). With Rs 150 crore from PremjiInvest, iD Fresh Food to enter US, UK and Singapore. Economic Times Rise.

- Batter Opportunity: Despite MBA from IIM Bangalore, he decided to sell idli-dosa batter. (2017). India Today.

- Chandran, P. (2016). Venture-funded, hot idlis in your kitchen. The Hindu.

- Chitra, R. (2018). ID fresh food’s vada maker looks to be a game-changer. Times of India.

- Food and Beverage News (2018). Retrieved from.Com: http://www.fnbnews.com/Top-News/indias-rtc-food-mkt-estimated-to-reach-38206-million-by-end-of-2017-41000

- iD Fresh Food. (2005). Retrieved from https://www. idfreshfood.com/about-us/

- iD Fresh Food. (2018). The iD time line. Retrieved from: https://www.idfreshfood.com/about-us/

- India Brand Equity Foundation. (2017). Retrieved from www.ibef.org

- Indian Food Industry Poised for Huge Growth: FICCI. (2017). Business Standard.

- Kim, W.C., & Mauborgne, R. (2005). The business model study on Red Collar group: Based on the perspective of Blue Ocean strategy. Chinese Studies, 6(2), 12-25.

- Kim, W.C., & Mauborgne, R. (2005). Value innovation: A leap into the blue ocean. Journal of Business Strategy, 26(4), 22-28.

- Kim, W.C., & Mauborgne, R. (2014) Interview with Kim & Mauborgne. Retrieved from moodle.technion.ac.il

- Kim, W.C., Yang, K.H., & Kim, J. (2006). A strategy for third-party logistics systems: A case analysis using the blue ocean strategy. Omega, 36(4), 522-534.

- Maerschand, J. (2016). Growing opportunities in the Indian food market. Flanders Investment & Trade.

- Singh, N. (2014). Home deliveries bite instant foods. Times of India .

- This Farmers Son Wants to be the iD of Rava Idli-iD Fresh Food. (2017). Economic Times.

- This Market is New Poised for Exponentail Growth. (2015). Food and Beverages News.