Research Article: 2021 Vol: 27 Issue: 2

Exploring the Nexus between Governance, Domestic Investment and Economic Growth in the Maghreb Region.

Saoussen Ouhibi, University of Sfax

Abstract

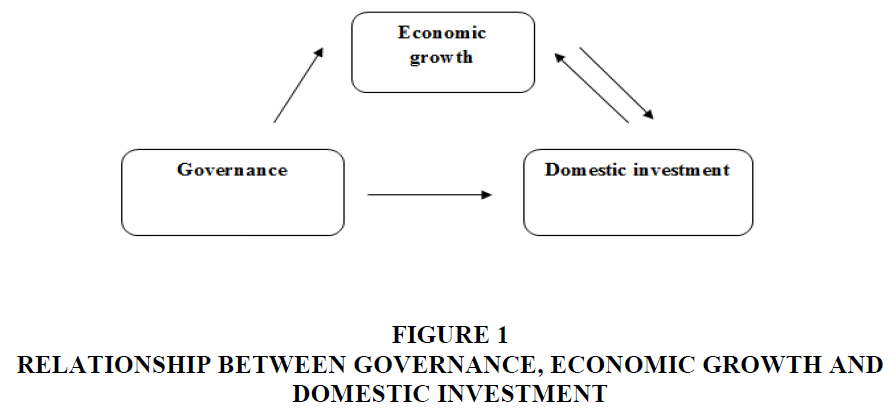

The objective of this study is to investigate the interrelationship between governance, domestic investment and economic growth in Maghreb region by using a simultaneous equation model estimated by Generalized Method of Moments (GMM). In fact, the findings support a bidirectional relationship between economic growth and domestic investment, a unidirectional causal relationship between governance and economic growth, as well as between governance and domestic investment.

Keywords

Governance, Domestic Investment, Economic Growth, Maghreb Region.

Introduction

In fact, the globalization of the economy and its integration into the world market has reduced the isolation of the Maghreb economies from the developed ones. However, the developing economies are increasingly exposed to either positive or negative externalities from the European economies in a context of growing international trade, trade openness, foreign direct investment and domestic investment linked to political, economic, financial and monetary shocks. The global integration of the Maghreb countries into these exchanges has made it possible for these countries to absorb these global shocks, such as the increase of oil prices in 2004, and therefore reduce their negative effects on these countries economic growth thanks to an increase of productivity and technology transfers, which improved their competitiveness of the international markets. In fact, economic growth is affected by many socio-economic factors such as foreign direct investment, governance, trade openness, domestic investment, corruption free society and good governance and policy, etc. Literature suggests that some of these factors, such as non performing loans, domestic investment, population and trade openness play a controversial role in economic growth.

Moreover, the Maghreb economies have been characterized by more or less periodic fluctuations. As they went through booms and busts caused by the existence of common factors that lead to a globalized business cycle, among which we can cite, for example, the volatility of the currency exchange rates, the fluctuation of both the interest rates and the prices of raw materials, mainly those of the energy products (Algeria), and the effects of the political instability (Tunisia).

Moreover, these economic problems have been aggravated in Tunisia by the immediate negative impact of the 2011 revolution, which was characterized by a long period of uncertainty and instability. In fact, during this period, Tunisia became the epicenter of a wave of political, social and economic transitions in the region. As a result, the country went through a period of profound transformations that created new challenges and opportunities, especially for the Tunisian economy. As a consequence, the revolution and the political transition that followed had a political impact and posed some significant challenges for the country, such that economic shocks had a significant impact on trade, foreign direct investment, domestic investment, governance and hence, on economic growth.

Nowadays, the nexus between domestic investment, governance and economic growth is at the heart of the research debate. In fact, this study deals with three major axes. First, it shows the impact of domestic investment and governance on the gross domestic product (GDP) then, it explores the impact of governance and gross domestic product on the domestic investment and finally, it looks into the impact of gross domestic product and domestic investment on governance. Moreover, the direct links between gross domestic product, governance and domestic investment is the subject of a current debate, as various authors emphasized the importance of domestic investment and economic. In fact, this study is the first to have analyzed the relationship between governance, domestic investment and economic growth.

Therefore, the main objective of this article is to examine the relationship between governance, domestic investment and economic growth for the Maghreb region. For this reason, an econometric approach of the Generalized Method of Moments (GMM) dynamic panel must be considered, which helps resolve the problems of simultaneity bias, measurement errors, and the risk of the omitted variables. Moreover, this method enables us to control for both individual and time-specific effects and bearing through the endogeneity of the variables, especially when there is one or more lags of the dependent variable included as an explanatory one. To the best of our knowledge, none of the previous studies has dealt with the problems of the Maghreb region context through the use of the GMM model.

This study contribute that the empirical differs from the extant literature in several aspects. First, earlier empirical research on the relationship between economic growth and domestic investment for example, Adhikary (2011) focus on analysis African countries and the relationship between governance and economic growth for example, Adzima and Baita (2009) on the developed countries. To the best of our knowledge, none of the previous studies has dealt with the question of the nexus between governance, domestic investment and economic growth in the Maghreb region.

Therefore, this analysis is performed to fill the gap in the research literature about the Maghreb region. Second, in contrast to what was reported by several studies, a GMM relationship between governance, domestic investment and economic growth is assumed. In fact, the remaining part of this paper is organized as follows. Section one presents a literature review, then two section discusses the data and methodology, finally, section three reports and discusses the empirical results and concludes the paper.

Literature Review

The Relationship between Governance and Economic Growth

Researchers in this domain have shown that non-economic determinants also play an important role in economic growth through the environment in which the factors of production, the labor and capital can operate. In fact, these non-economic factors play a crucial role in the performance of the labor and capital over time in any country. However, before 1990, studies focused on the effects of poor governance on political instability and corruption as well as on the sources of growth rather than on its direct impact on economic growth in the emerging countries. In this context, Owens (1987); Sen (1999) argued that economic and political freedoms are necessary conditions for economic growth and the development of nations.

In fact, in the Sub-Saharan African countries, investigated the role of governance in explaining the sub-optimal economic growth performance over the 1990/2004 period. Using fixed and random effects, and Arellano-Bond models, they found that the role of governance in economic growth depends on the level of income that good governance contributes to the differences in growth of African countries. The relationship between governance and economic growth using a sample of Sub-Saharan Africa countries. They concluded that effective governance and the rule of law positively and significantly promote economic growth. This implies that a one- unit increase of governance effectiveness reduces the GDP per capita by about 0.23 percentage point per year.

Recently, evaluated the participation of governance in economic growth for three panels (European Union, North American, Middle Eastern and North African countries). The author stated that in the European Union and North American countries, the economic growth rate is significantly lower than in all the other regions, excepting the Middle East and North Africa. Based on the pooled ordinary least square method (Pooled OLS), the impact of governance on economic growth was found to be greater than that of the other determinants, such as foreign direct investment, gross capital formation, government expenditure and international trade.

On the other hand, a case study undertaken by Alfada (2019) about Andonesia revealed that the impact of corruption reduces economic growth for the provinces with corruption levels below the threshold of 1.765 point, while for the provinces with a corruption level above the threshold, the reduction of economic growth is very sharp. In fact, the study used a threshold model developed, while for the endogeneity issue, it is addressed using the instrumental variable two-stage least squares (2SLS) estimator over the 2004-2015 period.

As for Mo (2001), they stated that if the corruption level increases by one percent, the economic growth rate drops by 0.72 point per year. Moreover, the authors showed that the most important channel through which corruption affects economic growth is political instability, which accounts for about 53% of the total effect. On the other hand, based on a sample of 170 countries, Kaufmann and Kraay (2003) found that the correlation between governance and economic growth is positive. Therefore, they proposed six indicators of corporate governance, namely political stability, government effectiveness, regulation quality, control corruption, and voice and accountability. Each indicator is itself a combination of several quantitative and qualitative indicators reflecting government’s behavior towards the freedom of expression, law enforcement, vulnerability of the institutional system, violence, security and perception of corruption.

The Relationship between Governance and Domestic Investment

In fact, the link between economic growth and governance has been widely studied. Nathaniel and Iheonu (2019) used a panel of 16 African countries for the period 2002-2015 to study the effects governance on domestic investment. Besides, employing unbundled and bundled governance indicators, they found that all the employed indicators of governance have a positive and statistically significant effect on domestic investment in Africa, excepting governments effectiveness, which has a positive but insignificant effect on the outcome variable. The same results were also revealed by the study of Kurul and Yalta (2017) where they found that the corporate governance system could actually be a major driver for both domestic investment and economic growth provided that the government plays an appropriate role.

On the other hand, Yaok and Drama (2019) analyzed the link between corporate governance, foreign direct investment and domestic investment in West African Economies and the Monetary Union (WAEMU) on a sample over the 2002-2015 periods. Their results showed that governance institutions are insignificantly correlated with domestic investment. Moreover, the authors gave more importance to foreign direct investment. It should be noted at this level that in the context of intensively competitive sector, an influx of foreign companies may increase investment opportunities previously open only to domestic investors. For his part, Ngov (2008) also found a positive impact of good governance on both economic growth and private domestic investment. However, in a study about 33 African countries over the period 1982-2001, Baliamoune-Lutz and Ndikumana (2008) found a negative impact of corruption on domestic investment.

Another study of 38 African Sub-Saharan countries was conducted by Ouedraogo and Kouaman (2014) to analyze the factors that affect private domestic investment and economic growth. The authors argued that the business environment (construction permits, registering property, getting credit, paying taxes, resolving insolvency and trading across borders) is the most important factor affecting the intensity of the domestic investment. The result showed that when implementing actions to foster the effect of good business practices, corruption should be tackled to reduce the gap between rules and practices.

Similarly, Akanbi (2010) used the Johansen estimation techniques to examine the relationship between governance and domestic investment in Nigeria during the period 1970-2006. The empirical results found a long run nexus between domestic investment and political environment. However, the findings showed the importance role played by the political environment in explaining long-term domestic investment in Nigeria. On the other hand, in a study of 46 developing countries from 1996-2009, Morrissey and Udomkerdmongkol (2012) showed that total investment (foreign direct and private investment) increases with a good corporate governance. For their part, Aysan et al. (2006) investigated the impact of corporate governance on private domestic investment, using a three stage least square (3SLS) estimation. It was found that administrative quality (in the form of control of corruption, bureaucratic quality, investment-friendly profile of administration, and law and order, as well as political stability) plays significant roles in explaining private investment decisions.

The Relationship between Economic Growth and Domestic Investment

In fact, the effect of domestic investment on economic growth is a key element for trade policy. Some past studies have used theoretical models to explain the effect of trade openness on economic growth. For his part, Adams (2009) used a panel data to examine the relationship between foreign direct investment, domestic investment and economic growth in Sub Saharan Africa during the period 1990-2003. This empirical results showed that DI is positive and significantly correlated with economic growth in both the OLS and fixed effects estimation, while, FDI is positive and significant only in the OLS estimation. Besides, Adams showed that FDI has an initial negative effect on DI and subsequent positive effect in later periods for the panel of the studied countries. As for, Bakari (2017) analyzed the link between domestic investment and long-term economic growth for the sample period of 1969-2015. His results showed that domestic investment is significantly and positively correlated with economic growth in the short run whereas in the long run, domestic investment has a negative effect on economic growth.

On the other hand, in a study about Kazakhstan, using a co-integration method and Granger causality tests showed that there is a strong positive link between domestic investment and economic growth. In another study used Johansen Co-integration test and Error Correction Model (ECM) to investigate the existence of a long-term relationship between exports, labor force, domestic investment and economic growth. They found that exports positively affect economic growth. While, domestic investment and labor force negatively affect economic growth. In another case study about Rwanda, Ruranga et al. (2014) concluded that the increase of domestic investment can increase economic growth in the long-run.

On the other hand, Rabnawaz and Sohail (2015) studied the relationship between public investment and gross domestic product using Granger causality test over the period of 1980-2009. The study concluded that public and private investments are the main cause of economic growth.

Moreover, in another study about Nigeria, tackled the effect of domestic investment and other macro-economic indicators on economic growth. Their results showed a positive impact of domestic investment and economic growth. Similarly, used the time series method to examine the relationship between domestic investment, FDI, trade openness, capital formation and economic growth in Bangladesh during the period 1986-2008. The empirical results showed that domestic investment has a significantly positive impact on economic growth both in the long and short run. On the other hand, to identify the presence of a bi-causal relationship between domestic investment and GDP, Granger causality test was employed. For his part, Ahmad Ghazali (2010) evaluated the impact of investment on economic growth in Pakistan during the period of 1981-2008. The same results were also revealed by the study of Kandenge (2010) where it was found that domestic investment could actually be a major driver of economic growth which in turn plays an important role in investment.

As for, who studied the causal link between economic growth and Domestic investment in Rwanda between 1970 and 2011, they showed the existence of a unidirectional relationship going from GDP to domestic investment. In their study, the authors used the Granger causality test and the vector auto regression (VAR) model. In the same vein, Naqvi (2002) used a co integration analysis of the Vector Error Correction Model about Pakistan to examine the relationship between foreign investment, domestic capital and economic growth. The equation of the long-term relationship shows that economic growth has a positive effect on economic growth.

Materials and Methods

In this paper, we examine the three-way linkages between governance, domestic investment and economic growth for three Maghreb countries, namely Tunisia, Algeria and Morocco over the 1980-2018 periods. The data are obtained from the World Development Indicators produced by the World Bank. The choice of countries and time series data rests on the availability of data. The governance, domestic investment, and economic growth are in fact endogenous. As mentioned earlier, most existing literature supposes that economic growth is likely to lead to changes domestic investment and governance. It also establishes that these two variables are often key determinants of economic growth. Hence, the interrelationship between GDP, governance and domestic investment should be considered simultaneous in a modeling framework. Using panel data estimation technique we use production function Cobb, Douglas (1928) of the following form:

(1)

(1)

Where, Y is output, GOV and DI is, respectively governance and Domestic investment, the subscript i=1…, N denotes the country and t=1… T denotes the time period and ε is the error term assumed N (iid).

After logarithmic transformation Eq. (1) is written as follows:

(2)

(2)

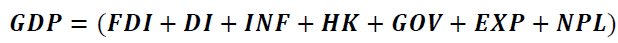

We then transform the production function Equation (2), into regression equations to derive the empirical models to simultaneously examine the interactions between GDP, public debt and foreign direct investment. These simultaneous equations are constructed on the basis of theoretical and empirical insights of the recent literature. Econometric modeling with several equations combines three models. These models are:

The economic growth model includes economic factors (foreign direct investment, domestic investment, inflation, human capital) and non-economic factors (governance). We can notice that internal and external physical factors and intangible factors as vehicles for growth.

(3)

(3)

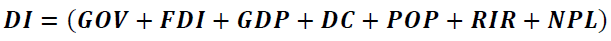

The domestic investment model includes internal financial factors, political factors and FDI flows. Indeed, this model states that economic growth and other variables, namely, unemployment rate and population can determine domestic investment.

(4)

(4)

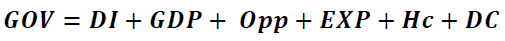

The governance model enables to examine the impact of domestic investment and economic growth on governance. Despite the ongoing debate on the importance of the relationship between governance and economic growth, there are no empirical studies that have examined the effect of economic growth and domestic investment on governance. In fact, an increase of trade openness and levels of economic development is likely to increase the level of governance (Fahim Al-Marhubi, 2004).

(5)

(5)

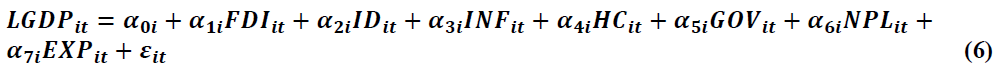

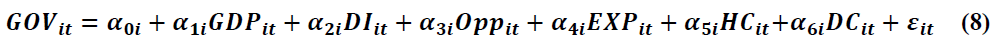

The three-way linkage between these variable is presented in the following three equations:

(6)

(6)

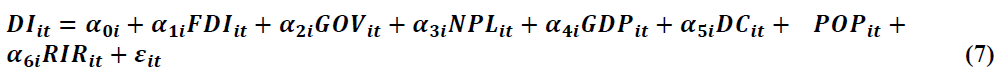

(7)

(7)

(8)

(8)

We define the variables as follows:

GDP: real GDP per capita, proxy for economic growth of a country.

DI: Gross Domestic investment (Annual% Growth)

GOV: Aggregate and individual governance indicators for six dimensions of governance suggested by the World Bank and other global institutions.

FDI: Foreign direct Investment.

HC: Human Capital.

POP: Population.

INF: inflation.

OPN: Trade openness.

EXP: Exportations.

DC: Domestic credit

NPL: Nonperforming loans to total gross loans (%)

RIR: Real Interest Rate

The criteria of selecting these variables that empirically exist in the review found positive or negative influence of these variables and availability of data shows in Table 1.

| Table 1 Expected Sign | |||

| Explanatory variables | LGDP | DI | GOV |

| GDP | ***** | +/- | + |

| DI | + | ***** | + |

| GOV | ***** | ***** | ***** |

| FDI | + | ***** | ***** |

| HC | + | + | + |

| POP | ***** | + | ***** |

| INF | - | - | ***** |

| OPP | + | + | + |

| RIR | ***** | ***** | ***** |

| EXP | + | ***** | + |

| NPL | - | - | ***** |

| DC | + | + | ***** |

Empirical Results and Analysis

Unit Root Test Results

To test the stationarity of the variables used in the estimates, we used the stationarity tests, which are Im, Pesaran and Shin W-stat (2003) and ADF-Fisher Chi-square (1979) are presented in Appendix 1A. The results show that the all variables are stationary at the first difference with 1% and 5%significance level.

Descriptive Statistics

Table 2 indicates a clear idea about the nature and characteristics of different variables (dependent and independent). It presents an essential element that can give a sense, an expression for the required information on the average level of the mean , the standard deviation (Std. Dev.), the minimum (Min) and maximum (Max) of the of these variables for each country.

| Table 2 Descriptive Statistics | ||||

| Variables | Mean | Standard Deviation | Minimum | Maximum |

| GDP | 0,8921743 | 1.7900234 | 0.0214569 | 12.8732147 |

| DI | 22.34906 | 5.19814 | 0.059126 | 89.841 |

| GOV | 62.9012 | 8.86753 | 1.32189 | 84.9143 |

| FDI | 75.5216 | 23.18529 | 0.07812 | 1485.321 |

| HC | 23.495 | 20.1693 | 12.9031 | 76.0154 |

| POP | 5.87210 | 4.21484 | 2.9981 | 9.1238 |

| INF | 7.2173 | 5.821 | 4.947 | 12.941 |

| OPP | 44.6901 | 12.624 | 19.817 | 89.8515 |

| RIR | 2.9182 | 3.3841 | 1.9182 | 11.891 |

| EXP | 2.15327 | 22.95314 | 35.8514 | 91.9613 |

| NPL | 0.2254 | 2.6312 | 2.7321 | 31.941 |

| DC | 12.5709 | 3.0172 | 8.313 | 23.512 |

In fact, the domestic investment is on average equal to 22.34% in the Maghreb region. A high margin of dispersion indicates the variations and fluctuations of this determinant from one country to another. In addition, the gross domestic investment (Annual% Growth) has minimum and maximum values therefore, we can say that the volume of this variable in each country significantly varies and depends on a number of factors. Similarly, the GDP, which measures economic growth, has a mean of 0.892% and a low standard-type of 1.790%. In this table, it appears that the mean values (=75.521, SD=23.18) of foreign direct investment are the best determinants since they have the highest mean values compared to other determinants. In addition, we can see that the non-performing loans have the lowest mean values among all the variables with 0.2254% and a standard deviation of 2.63%.

Correlation Test

In order to detect a possible relationship between the variables, we will present the various correlation coefficients in the following table to test the correlation between these variables shows in Table 3.

| Table 3 Matrix of Correlation | ||||||||||||

| Vrbs | GDP | DI | GOV | FDI | HC | POP | INF | OPP | RIR | EXP | NPL | DC |

| GDP | 1.000 | |||||||||||

| DI | 0.012* | 1.000 | ||||||||||

| GOV | 0.7591 | 0.881 | 1.000 | |||||||||

| FDI | 0.189* | 0.343* | 0.723* | 1.000 | ||||||||

| HC | 0.081** | 0.487 | 0.834* | 0.0721 | 1.000 | |||||||

| POP | 0.973 | 0.726 | 0.0165 | 0.975* | 0.052 | 1.000 | ||||||

| INF | -0.001* | 0.092 | 0.973 | -0.421 | 0.965 | 0.218 | 1.000 | |||||

| OPP | 0.718* | -0.128 | 0.983 | 0.084 | 0.965 | 0.743 | 0.097* | 1.000 | ||||

| RIR | 0.098 | 0.0061* | 0.532 | -0.83** | 0.021 | 0.876 | 0.178* | 0.965 | 1.000 | |||

| EXP | 0.578 | 0.561 | 0.143 | 0.906 | 0.976 | 0.008 | 0.987 | 0.267 | 0.512 | 1.000 | ||

| NPL | -0.412* | 0.0832 | 0.092 | 0.087* | 0.043 | 0.127 | 0.213 | 0.532 | 0.398* | 0.96 | 1.000 | |

| DC | -0.765 | 0.179 | 0.0117 | 0.732 | 0.091 | 0.886 | 0.009* | 0.901 | 0.081 | 0.08 | 0.932 | 1.00 |

According to the correlation matrix table, governance is positively correlated with economic growth, which implies that countries with better governance and a higher political stability will go a long way in promoting economic growth in the region. This is also consistent with the findings of Diaz-Cayeros (2013); Kraay et al. (2009). Similarly, the correlation between the percentage of foreign direct investment, domestic investment and economic growth is strong and significant at 1%. Thus, it is argued that domestic investment is a fundamental vector for the creation and stimulation of economic growth. On the other hand, the Human capital is positively correlated with economic growth, which implies that the policies that encourage tertiary education will go a long way in promoting economic growth in the Maghreb region, which is consistent with the findings of Kiran et al. (2009). Accordingly, trade openness and financial development are positively correlated with economic growth, which implies the importance of globalization and trade liberalization in the valuation of economic growth by contrast, inflation is negatively linked to economic growth. In addition, all the correlation coefficients between the independent variables are relatively low, which helps to eliminate the possibility of co-linearity between these variables. On the other hand, multi-collinearity can falsely identify the estimation of the regression coefficients at low fluctuations of the data, which makes it unstable and difficult to interpret.

Results of the GMM Estimates

In fact, to estimate the three way linkage between economic growth, domestic investment and governance in the Maghreb region during the 1980-2018 periods, we use Arellano and Bond’s (1991) GMM. This model is the most commonly used method with panel data. However, the choice of the method is made because it is accurate and efficient. Therefore, we will apply the method of generalized moments (GMM) on these three equations together as it gives its relevance compared to the other estimation methods (MCO, 2MCO and 3MCO). Moreover, our choice of this method is based on two criteria. First, it can deal with the potential endogeneity arising from the inclusion of the lagged dependent variables and other potentially endogenous variables. Second, it enables us to take into account the unobserved time-invariant bilateral specific effects. On the other hand, the p-values for AR (2) are higher than 0.10, which implies that, the null hypothesis cannot be rejected and that the empirical model is consistent and characterized by a good specification of instruments. In addition, using Hansen J-statistic tests to check the validity of the instruments, we notice that the p-values in the tests are greater than 0.1, indicating that over identifying restrictions are valid.

Table 4 presents the empirical methods for the assessment of the interactions between economic growth, investment domestic and governance. For this reason, GMM approach is used for all the countries. Equation (6) shows that the effect of the Domestic investment on economic growth in the Maghreb region is positive and statistically significant, which indicates that an increase of domestic investment by one percent leads to an increase of economic growth by 0.598%. Moreover, this result is consistent with what is presented in the literature. In fact, it indicates that the advanced technology and skilled labor force in the Maghreb region encouraged the private sector to continue this activity rather than venture into the investment process. On the other hand, domestic investment plays an important role in increasing economic growth. In fact, the presence and the actions of international firms lead to important changes in the domestic market, which affects the activities and the stability of the local firms. Moreover, the increase of domestic investment in the Maghreb region can be explained by the positive externalities, the borrowing by multinational companies on domestic financial markets, the infrastructures, the lack of a competitive market, the rise of the domestic demand for goods and services and the facilitation and manipulation that encourage the private sector.

| Table 4 Results of the GMM Estimate | ||||||

| Variables | Economic growth | Investment domestic | Governance | |||

| Coefficient | p-value | Coefficient | p-value | Coefficient | p-value | |

| GDP | - | - | 0,168 | 0,005* | 1.376 | 1.09 |

| ID | 0.598 | 0.000* | - | - | 1.052 | 0.876 |

| GOV | 0.211 | 0.092*** | 1.872 | 0.095*** | - | - |

| FDI | 0.934 | 1.004 | 0.917 | 1.721 | - | - |

| HK | 0.067 | 0.000* | - | - | 1,721 | 0.041** |

| POP | - | - | 2.329 | 1.521 | - | - |

| INF | -0.098 | 0.001* | - | - | - | - |

| OPP | 1.015 | 0.934 | ||||

| RIR | -0.693 | 0.047* | - | - | ||

| EXP | 1.092 | 0.931 | - | - | 1.128 | 0.291 |

| NPL | -0.832 | 0.000* | 1.726 | 1.098 | ||

| DC | 0.459 | 0.001 | 0.981 | 1.821 | ||

| Const | -0.435 | 0.000* | - | 0.632 | 0.273 | 0.000* |

| Hansen J-test | 34.687 | 0.274 | -0.562 | 0.523 | 22.732 | 0.534 |

| DWH(p-value) | 24.521 | 0.354 | -0.789 | 0.732 | -0.169 | 0.000* |

| AR2 Test | -1.24 | 0.274 | -0.872 | 0.632 | -0.221 | 0.012* |

On the other hand, governance has a positive and significant effect on economic growth, which fell by 0.092% following a 10% increase of governance. This result indicates that the effectiveness of governance and the rule of law positively and significantly promote economic growth. The political stability in the Maghreb region can influence economic growth through the level of production capacity, the investors’ confidence, local insecurity and economic activity, especially the industry and tourism. The same results were found by Kraay et al. (2010); Younis et al. (2008) who found that a stable political environment of a country increases the human and physical capital accumulation and thereby triggers the economic growth process. Moreover, human capital has a positive and significant effect on economic growth, which confirms the results showed by Dao (2012); Avom and Song (2010). Moreover, it was found that human capital can influence economic growth through the transfer of technology, knowledge and the R and D accumulation. This implies that human capital plays an important role increasing economic growth. In fact, it is an important factor in the technology transfer, as it stimulates creativity and innovation and improving business competitiveness.

On the other hand, inflation has a negative and significant effect on economic growth, high inflation associated with poor macroeconomic management causes an increase of the rate of non-performing loans, which leaves the banking system vulnerable, whereas low inflation reduces the banks nominal income, which affects their liquidity Evans et al. (2000). Moreover, a significant and rapid drop of inflation could, however, result in a lower nominal income and cash flow, which affects the liquidity and solvency of the financial institutions.

In fact, Equation (6) shows the interaction between economic growth and governance regarding domestic investment. In this context, we try to explain how domestic investment acts in the presence of GDP and GOV. This equation also shows that both GDP growth and governance have a positive and significant effect on the Maghreb region. The GDP coefficient is 0.168 indicating that an increase of inflation by 1% leads to a decrease of public debt by 0.168%. Similarly, in this equation, the governance has contributed to increasing domestic investment. A few years ago, the Maghreb region countries decided to liberalize their national policies to create a welcoming regulatory framework for domestic investment by providing attractive post-investment services to encourage the reinvestment of the existing investors. Given that these investors are satisfied with their presence in these countries, they will advertise them by encouraging new investors to establish themselves in these countries while showing them the financial or budgetary incentives that are put in place. Furthermore, governments are paying more attention to the measures that can actively facilitate the attraction of foreign direct investment. Regarding the real interest rates, there is a negative and significant effect running from interest rate to domestic investment. In fact, a high interest rate may decrease the domestic investment. For the Maghreb region, investment has become an important source of private external funding. Unlike the other major types of external private capital flows, domestic investment driven mainly by the prospect of long-term profits those investors hope to achieve in their directly managed production activities. This result is consistent with what was presented in the literature, which indicates that the interest rate has a negative effect on domestic investment Wang and Yu (2007).

The empirical findings of Equation (7) show that human capital is positive and significant. This result is consistent with what was suggested in the literature, which indicates that the reforms of the educational systems adopted in the 1980, are at the origin of the improvement of the quality of the workforce and the skills, as essential conditions for the development and effectiveness of governance in the Maghreb region. The study concluded that the effectiveness of governance and the rule of law positively and significantly promote economic growth. Moreover, over the past two decades, the Maghreb countries have pursued a policy of accompanying and supporting national businesses with the aim of absorbing the high unemployment rates. In addition, these countries have adopted a privatization strategy aimed at improving productivity and stimulating the economy.

Therefore, according to the overall results, three concluding remarks are made. First, there is a bi-directional causal relationship between economic growth and domestic investment. Second there is a uni-directional causal relationship governance and economic growth. Finally there is a uni-directional causal relationship between governance and domestic investment for the Maghreb region as a whole shows in Figure 1.

Estimate for Each Country

This table presents the results of the estimations of the three equations of our basic model shows in Table 5.

| Table 5 Estimate for Each Country | |||||||||

| Tunisia | Algeria | Morocco | |||||||

| Variables | GDP | DI | GOV | GDP | DI | GOV | GDP | DI | GOV |

| GDP | 0.948 | 0.811 | 1.093 | 0.012*** | 1.234 | 1.024 | |||

| DI | 1.084 | 1.024 | 0.012*** | 0.932 | 0.043** | 0.643 | |||

| GOV | 0.518 | 0.832 | 0 ,846 | 0.340 | 0.004* | 1.091 | |||

| FDI | 1.062 | 1.016 | -0 ,874 | 1.093 | 0.012*** | 0.481** | |||

| HK | 0,025*** | 0.042** | 0.024*** | 0.051** | 0.043** | 0.092* | |||

| POP | 1.643 | 0.893 | 1.832 | ||||||

| INF | -0,817 | -0.984 | 0.896 | ||||||

| OPP | 1.099 | 1.423 | 0.882 | ||||||

| RIR | -1.097 | 0.019*** | 1.095 | ||||||

| EXP | 0,098*** | 0.972 | 1.259 | 1.678 | 0.55** | 0.521 | |||

| NPL | 0.932 | -0.975 | 0.849 | 0.879 | 1.678 | 0.994 | |||

| DC | 1.123 | 0.051** | 0.095*** | 1.563 | 0.102*** | 0.042** | 0.652 | 1.098 | 0.083* |

| Const | 22.41*** | 1.73 | -2.34 | 23.674*** | 21.50*** | 00.734*** | 22.73*** | 21.47*** | -2.84*** |

| R2 | 0.98 | 0.83 | 0.14 | 0.88 | 0.27 | 0.66 | 0.89 | 0.63 | 0.54 |

In Tunisia, while human capital has a strong impact on economic growth, foreign direct investment and governance show an insignificant one, which makes us can deduce that economic growth in Tunisia is fueled mainly by agricultural exports and manufacturing raw materials (olive oil, phosphate, textiles, etc.). However, these products have seen an apparent decline since 2011 following the economic and political instability caused by social movements.

With regard to human capital, Tunisia has attached great importance to the education sector, which is reflected in the expenditure devoted to the establishment of universities and primary and secondary schools throughout the Tunisian territory. This strategy is intended to improve the quality of labor and competitiveness on the international market.

Regarding, domestic investment in Tunisia, it is explained by the credit provided to the private sector. This effect can be explained by the adoption of an incentive policy for domestic investors who look for financing. Indeed, Tunisia has embarked on a process of creating financial institutions capable of financing new projects in the form of small and medium-sized enterprises (SME), without forgetting the role of banking establishments as financial intermediaries, which are important for the promotion of domestic investment. On the other hand, the real interest rate (RIR), gives us a negative and insignificant sign on domestic investment which can be caused by the difficulties encountered by the banking system during the study period, especially before the application of the Structural Adjustment Programmes (SAPs) and the period of global crisis (2008).

In Algeria, economic growth was affected by human capital and domestic investment due to the concentration of this kind of investment in the energy sector, which limits the benefits of foreign direct investment in the economy. However, the oil sector remained a limited field for other industrial companies. In addition, multinational firms working in Algerian oil fields do not collaborate with their Algerian partners, which did not provide the possibility of transmitting managerial knowledge and techniques to local companies. Moreover, some types of foreign direct investment, those that are heavily dependent on natural resources and oil, are expected to have a relatively smaller contribution to economic growth. However, in an extreme case, or if there is no possibility for positive spillovers, the contribution of (FDI) to economic growth will be limited to generate income.

Moreover, we can see that, during the same period, the coefficient of foreign direct investment shows a positive but not significant sign. This result is contrary to the result found by Seddek (2009), who noted that FDI is an important factor in the accumulation of physical capital besides governance is clearly a factor that limits economic growth. The institutional system in this country remains unable to mobilize domestic and foreign resources to be at the service of production and economic growth.

In Morocco, we can see that economic growth is largely explained by human capital, foreign direct and domestic investment. Thanks to its geographical position and its historical commercial relations with Spain and the rest of the European continent, Morocco occupies an important place regarding the revival of domestic investments. In addition, it is well known that Morocco is the advantageous country in the field of agricultural exports at the Maghreb level, especially after the entry into force of the association agreement with the European Union. On the other hand, foreign direct investment was found to have a significant impact on direct investment, reflecting an inevitable indirect effect on economic growth.

We can also see that governance has a significant positive effect on economic growth, which means that Morocco is a constitutional, democratic, and social monarchy characterized by the separation, the balance and the collaboration of powers, as well as by the citizen’s participation in democracy. Moreover, Morocco is implementing and the principles of good governance and the correlation between responsibility and accountability, with an emphasis on the fact that the territorial organization of the kingdom is decentralized based on advanced regionalization.

For Morocco, human capital is positively correlated with the governance. The results obtained by some research studies showed that human capital can influence economic growth through the transfer of technology, knowledge and the R and D accumulation. This means that human capital plays an important role in increasing economic growth. In fact, it is an important mechanism for technology transfer, stimulating creativity and innovation and improving business competitiveness.

Conclusion and Policy Implications

For the last few years, the issue of causality relationship between governance, economic growth and domestic investment has been an interesting topic for economists concerning economic growth. In fact, domestic investment is an investment in production facilities, besides it is even more crucial for the developing countries not only because it increases the available capital and capital formation but it also serves as a conduit for the transfer of production technologies, skills, innovation capabilities and organizational and management practices. Moreover, it provides local facilities with access to international marketing networks. The objective of this study is then to determine the causal relationship between governance, domestic investment and economic growth in the Maghreb region. Therefore, to achieve our goal, we used annual data for 38 years from 1980-2018. Moreover, several studies have examined this relationship in these countries but no study has investigated this interaction via a simultaneous equation.

Regarding governance, the case of Tunisia is similar to that of Algeria because it was found that the coefficient associated with the governance indicator is insignificant. This result shows that the inadequacy of the institutional and organizational procedure remains insufficient to serve economic growth. On the other hand, domestic investment, as a vehicle for growth, finds its privileged place in the case of Morocco and Algeria where it has a significant positive coefficient in the growth equation, which credibly shifts the effects of domestic savings and credit to the national added value of (GDP). In fact, capital goes to territories where domestic investment is already high because it favors the fall of the transaction costs, the diffusion of technology, the intensification of the division of labor and the widening of the potential of inter-firm complementarities.

For the three Maghreb countries in our sample, human capital is positively correlated with both corporate governance and economic growth, which means that internal and imported knowledge and skills play an important role in promoting economic growth. On the other hand, it is pointed out by human capital theorists that even if higher school enrollment increases individual productivity, it requires that the human capital accumulated by elders should be preserved for the next generations in order to obtain any macroeconomic effect on economic growth. Moreover, empirical results showed that first; there is a bi-directional causal relationship between domestic investment and economic growth. Second, there is a unidirectional causal relationship from governance to economic growth. Finally, there is a unidirectional causal relationship between domestic investment and governance. Our findings present a bidirectional causal relationship domestic investment and economic growth, as a high-level of domestic investment leads to a high-level of economic growth and vice versa. This result supports the idea that domestic investment is considered very important for the development the economic growth in the Maghreb region.

As a consequence, future research should also focus on the relationship between the human capital accumulation, governance and economic growth in the Maghreb region. However, we believe that this research provides empirical results which can be useful for the understanding of this type of national economy in the region as well as in determining the most effectiveness of the economic policies in order to promote economic growth. In fact, it appears that the economic and public policies in the Maghreb region will necessarily be implemented jointly to create both economic growth and technological innovation. However, the question that remains unanswerable is if these countries can implement these public policies.

Acknowledgment

We would like to express our sincere thanks to the reviewers for their feedback and comments.

Declarations

Funding statement

This research did not receive any specific grant from funding agencies in the public, commercial, or not-for-profit sectors.

Competing Interest Statement

The authors declare no conflict of interest.

Additional Information

No additional information is available for this paper.

Appendix

| Appendix 1A Unit Root Test Results | ||||

| Im, Pesaran and Shin W-stat | ||||

| Level | First Difference | |||

| Intercept | Intercept and Trend | Intercept | Intercept and Trend | |

| GDP | 7.43212(1.000) | 2.89065(0.8894) | -3.974(0.0003)* | -2.7326(0.0000) |

| DI | 1.7631(1.98071) | 1.1672(0,9974) | -2.6549(0.0009)* | -1.984(0.0000)* |

| GOV | 0.79421(0.70091) | 1.06018(0.8665) | -2.0098(0.0000) | -2.7599(0.0000)* |

| FDI | 1.0098(0.8832) | 0.6554(1.000) | -4.2764(0.0000)* | -4.98312(0.0000)* |

| HC | 0.8416(1.000) | 0.22513(0.78211) | -1.9854(0.0000)* | -1.5643(0.0000)* |

| POP | 1.80953(0.9999) | 0.90974(0.98711) | -3.7742(0.0400)** | -2.77432(0.0500)** |

| INF | 3.67651(1.9887) | 1.90862(1.0211) | -2.8416(0.0040)* | -1.99438(0.0000)* |

| OPP | 1.55421(0.79831) | 0.98761(1.000) | -2.2732(0.0100)* | -1.7743(0.0004)* |

| RIR | 2.89367(1.0098) | 1.77331(0.7992) | -1.13951(0.0013)* | -1.0407(0.0062)* |

| EXP | 1.0093(0.91154) | 1.6653(0.89992) | -5.3610(0.0990)** | -4.5731(0.0440)** |

| NPL | 1.55632(0.79984) | 0.76269(0.86651) | -4.0170(0.0012)* | -3.984(0.0023)* |

| DC | 0.332167(0.8145) | 1.81955(0.8594) | -3.64358(0.0000)* | -2.78342(0.0000)* |

| ADF-Fisher Chi-Square | ||||

| Level | First Difference | |||

| Intercept | Intercept and Trend | Intercept | Intercept and Trend | |

| GDP | 0.5479(0.1889) | 0.7841(0.9917) | 37.3565 (0.0000)* | 30.8995 (0.0000)* |

| DI | 20.1832 (0.0182) | 17.4740 (0.8772) | 24.1832 (0.0192)* | 14.9931 (0.0000)* |

| GOV | 17.4740 (0.9002) | 15.4020 (0.9287) | 37.4740 (0.0002) ** | 17.8835 (0.0000) ** |

| FDI | 14.5384 (0.6080) | 10.355(0.7174) | 41.7084 (0.0000)* | 14.4935 (0.0174)* |

| HC | 17.9135 (0.7009) | 17. 547(0.9819) | 47.3885(0.050) ** | 46.8582 (0.0450)** |

| POP | 11.7801 (0.8131) | 10.4701 (0.8801) | 39.4701 (0.0201)* | 30.0189 (0.0001)* |

| INF | 13.4701 (0.71001) | 12.0179 (0.8154) | 37.2345 (0.0501) ** | 35.4755 (0.0491)** |

| OPP | 19.19971 (0.9818) | 15.4050 (0.4701) | 42.4701 (0.0021)* | 40.6093 (0.0031)* |

| RIR | 13.6632 (0.7201) | 10.0179 (0.7701) | 34.43326 (0.0021)* | 23.1988 (0.0011)* |

| EXP | 14.84701 (0.8301) | 13.4782 (0.8301) | 44.4766 (0.0561)** | 40.4994 (0.0871)** |

| NPL | 12.4621 (0.9312) | 12.1245 (0.9401) | 39.78771 (0.0001)* | 33.4998 (0.0001)* |

| DC | 17.4051(0.8862) | 11.7401 (0.9701) | 33.4753 (0.0031)* | 23.4789 (0.0011)* |

References

- Adams, S. (2009). Foreign direct investment, domestic investment, and economic growth in Sub-Saharan Africa. Journal of policy modeling, 31(6), 939-949.

- Adhikary, B.K. (2011). FDI, trade openness, capital formation, and economic growth in Bangladesh: a linkage analysis. International Journal of Business and Management, 6(1), 16.

- Adzima, K., & Baita, K. (2019). The impact of governance on economic growth: An empirical assessment in Sub-Saharan Africa.

- Akanbi, O.A. (2010). Role of Governance in Explaining Domestic Investment in Nigeria Working Paper Number 168. University of Pretoria.

- Alfada, A. (2019). The destructive effect of corruption on economic growth in Indonesia: A threshold model. Heliyon, 5(10), 02649.

- Al-Marhubi, F. (2004). The determinants of governance: A cross-country analysis. Contemporary Economic Policy, 22(3), 394-406.

- Avom, D., & Song, S. (2010). Institutions économiques, capital humain et croissance économique en Afrique au Sud du Sahara. Journal of Economic Literature, 6(3), 21-26.

- Aysan, A.F., Nabli, M.K., & Véganzonès-Varoudakis, M.A. (2006). Governance and private investment in the Middle East and North Africa, 3934.

- Bakari, S. (2017). The impact of domestic investment on economic growth: New policy analysis from Algeria. Munich Personal RePEc Archive, MPRA

- Baliamoune-Lutz, M., Ndikumana, L., & UNECA, A.A. (2008). Corruption and growth in African countries: Exploring the investment channel. University of Massachusetts Amherst Working Paper, 8.

- Dao, M.Q. (2012). Government expenditure and growth in developing countries. Progress in Development Studies, 12(1), 77–82.

- Diaz-Cayeros, A. (2013). In the Shadow of Violence: Politics, Economics, and the Problems of Development, chapter Entrenched Insiders: Limited Access Order in Mexico.

- Evans, N.W., Wilkinson, M.I., Guhathakurta, P., Grebel, E.K., & Vogt, S.S. (2000). Dynamical mass estimates for the halo of M31 from Keck spectroscopy. The Astrophysical Journal Letters, 540(1), L9.

- Ghazali, A. (2010). Analyzing the relationship between foreign direct investment domestic investment and economic growth for Pakistan. International Research Journal of Finance and Economics, 47(1), 123-131.

- Kandenge, F.T. (2010). Public and private investment and economic growth in Namibia (1970-2005). Botswana Journal of Economics, 7(11), 2-15.

- Kaufmann, D., & Kraay, A. (2003). Governance and growth: causality which way? Evidence for the world, in brief. World Bank, February.

- Kaufmann, D., Kraay, A. & Mastruzzi, M. (2009). Governance matters VIII: aggregate and individual governance indicators, 1996-2008. World bank policy research working paper, (4978).

- Kiran, B., Yavuz, N.C., & Güri?. B. (2009). Financial development and economic growth: A panel data analysis of emerging countries. International Research Journal of Finance and, Economics, 30(1), 87-94.

- Kaufmann, D., Kraay, A., & Mastruzzi, M. (2011). The Worldwide Governance Indicators: Methodology and Analytical Issues. Hague journal on the rule of law, 3(2), 220-246.

- Kurul, Z., & Yalta, A.Y. (2017). Relationship between institutional factors and FDI flows in developing countries: New evidence from dynamic panel estimation. Economies, 5(2), 17.

- Mo, P.H. (2001). Corruption and economic growth. Journal of comparative economics, 29(1), 66-79.

- Morrissey, O., & Udomkerdmongkol, M. (2012). Governance, private investment and foreign direct investment in developing countries. World development, 40(3), 437-445.

- Naqvi, N.H. (2002). Crowding-in or crowding-out? Modelling the relationship between public and private fixed capital formation using co-integration analysis: The case of Pakistan 1964-2000. The Pakistan Development Review, 41(3), 255-275.

- Nathaniel, S.P., & Iheonu, C.O. (2019). Carbon dioxide abatement in Africa: The role of renewable and non-renewable energy consumption. Science of the Total Environment, 679, 337-345.

- Ngov, P. (2008). Governance, Foreign Direct Investment, and Economic Growth. (36), 255-278.

- Ouedraogo, I.M., & Kouaman, P.T. (2014). Governance and private investment in Sub-Saharan Africa. International Journal of African Development, 2(1), 5-25.

- Owens, E. (1987). The future of freedom in the developing world: Economic development as political reform. Pergamon.

- Rabnawaz, A., & Sohail J.R. (2015). Impact of public investment on economic growth. South Asia Journal of Multidisciplinary Studies, 1(8), 62-75.

- Ruranga, C., Ocaya, B., & Kaberuka, W. (2014). VAR Analysis of Economic Growth, Domestic Investment, Foreign Direct Investment, Domestic Savings and Trade in Rwanda. Greener Journal of Economics and Accountancy, 3(2), 30-41.

- Sen, A. (1999). Development as freedom (1999). The globalization and development reader: Perspectives on development and global change, 525.

- Wang, D.H.M., & Yu, T.H.K. (2007). The role of interest rate in investment decisions: a fuzzy logic framework. Global Business and Economics Review, 9(4), 448-457.

- Yaok. A.P., & Drama. B.G.H. (2019). Governance, FDI and Private Domestic Investment in West African Economic and Monetary Union (WAEMU). Journal of International Business and Economics, 7(1), 1-10.

- Younis, M., Lin, X.X., Sharahili, Y., & Selvarathinam, S. (2008). Political stability and economic growth in Asia. American Journal of Applied Sciences, 5(3), 203-208.