Research Article: 2024 Vol: 27 Issue: 3

Exploring the Nexus Between Entrepreneurship Development, Credit Access, Unemployment, And Economic Growth in Nigeria

Segun Kehinde, Covenant University

Kemi Kehinde, Anchor University

Citation Information: Kehinde,S., & Kehinde, K.(2024). Exploring the nexus between entrepreneurship development, credit access, unemployment, and economic growth in nigeria. Journal of Management Information and Decision Sciences, 27(3), 1-11.

Abstract

This study delves into the intricate relationship between entrepreneurship development, credit access, unemployment, and economic growth in Nigeria. Through a comprehensive analysis, the research aims to examine the impact of entrepreneurship advancement on overall economic growth, considering factors such as innovation, job creation, and market expansion. Additionally, it investigates the effect of credit accessibility on entrepreneurship capacity utilization and its subsequent influence on economic growth within the Nigerian context. By assessing the extent to which entrepreneurs can leverage credit facilities to enhance their business operations, this study provides insights into the importance of financial support for entrepreneurial endeavors. Furthermore, the research explores the moderating role of entrepreneurship development in mitigating the adverse effects of unemployment on economic growth. By evaluating how a robust entrepreneurial ecosystem can buffer the negative impact of unemployment on economic productivity and stability, this study highlights the significance of fostering entrepreneurship as a means of addressing socio-economic challenges and driving sustainable growth. Overall, the findings contribute to a deeper understanding of the dynamics between entrepreneurship, credit access, unemployment, and economic growth in Nigeria, offering valuable insights for policymakers, practitioners, and stakeholders to inform strategic interventions and policy decisions aimed at fostering entrepreneurship-led economic development

Keywords

Entrepreneurship Development, Economic Growth, Financial Inclusion, Nigeria.

Introduction

The production of goods and services efficiently stands as a cornerstone for the growth, development, and sustainability of global economies. Integral to achieving high levels of productivity is a robust industrial sector, which operates across both large and small scales in both public and private domains (Akinola, 2013). Particularly, small and medium-scale enterprises (SMEs) play a pivotal role in driving economic growth, innovation, and job creation (Henrekson & Johanson, 2010). These innovative firms serve as engines for output expansion, employment generation, and indigenous technology promotion, bolstering industrial linkages and strengthening the economic landscape (ABD, 2012).

However, SMEs in Nigeria face significant challenges in financing their ventures, hindering their growth and development Yusuf and Dansu, 2013. Limited access to conventional bank loans poses a considerable obstacle to seizing new business opportunities and implementing innovative strategies (Suberu et al., 2011). Consequently, the growth trajectory of existing businesses heavily relies on adequate funding to drive research and innovation initiatives (Akinola, 2013). Despite Nigeria's efforts to foster entrepreneurial endeavors, many private firms remain small-scale in terms of capital, employment, and revenues. Moreover, the lack of government support and interest in micro and small enterprises exacerbates the challenges faced by entrepreneurs. Additionally, infrastructural deficiencies, bureaucratic hurdles, multiple taxes, and unreliable power supply further impede entrepreneurship and SME development in Nigeria (Berger et al., 2001).

Furthermore, the mismanagement of Nigeria's abundant oil wealth has hindered economic growth and failed to translate into communal benefits, exacerbating socio-economic disparities (Jonathan, 2015). Consequently, this study seeks to investigate the barriers to entrepreneurial development in Nigeria and their repercussions on economic growth. While previous research has explored various aspects of entrepreneurship in Nigeria, empirical studies on the relationship between entrepreneurship development and economic growth remain limited (Akinola, 2013; Duru, 2011; Vanacker & Manigart, 2010). Therefore, this study aims to fill this gap by examining the impact of entrepreneurship development on economic growth in Nigeria, contributing to the existing body of research on this critical topic (Oloyede, 2008).

Literature Review

Entrepreneurship, a concept spanning multiple disciplines including economics, sociology, psychology, and management, defies a singular definition. One seminal definition by Schumpeter portrays entrepreneurship as a catalyst for economic development, characterized by risk-taking innovation and "creative destruction" to replace obsolete technologies and ideas with new ones (Lucas, 2000). Ronstadt echoes this perspective, describing entrepreneurship as the dynamic process of creating incremental wealth through risk assumption and value infusion (Imafidon, 2014). From a management standpoint, entrepreneurship involves introducing change, innovation, or a new order. Drucker (1985) emphasizes the entrepreneur's role in identifying and exploiting opportunities for change rather than merely being agents of change. Psychologists view entrepreneurs as individuals driven by specific goals, a need for achievement, or a desire for autonomy (Ikem et al., 2012).

Essentially, an entrepreneur identifies business opportunities and efficiently allocates resources to exploit them profitably. This entails bearing non-insurable risks and directing resources to achieve economic, social, and financial goals. According to Akanwa and Agu, individuals who establish, nurture, innovate, or inherit businesses qualify as entrepreneurs Agu & Evoh, 2011).

Duru (2011) delved into entrepreneurship opportunities and challenges in Nigeria, defining entrepreneurship as the process of creating something new with value while bearing financial and social risks (Rusu et al., 2012). The study identified creating a vision, leveraging strengths, and understanding market needs as key factors facilitating entrepreneurship in Nigeria. It underscores the importance of changing mindsets towards embracing self-employment for sustained economic growth, particularly among Nigerian youths (Evbuomwan et al., 2013).

Egwu explores the challenges hindering government efforts in entrepreneurship development by identifying weaknesses in major government programs (Robinson, 2002).The paper argues that treating all small businesses as entrepreneurial constrains entrepreneurship development in Nigeria and other developing economies. It advocates for distinct categorization to differentiate entrepreneurial firms from non-entrepreneurial small businesses, recommending tailored policies and strategies for each class. The study also highlights environmental hazards, infrastructural inadequacies, insecurity, and corruption as challenges affecting small business development.

Somoye (2013) investigates the impact of finance on entrepreneurship growth in Nigeria using an endogenous growth framework. Findings indicate significant relationships between finance, interest rates, real GDP, unemployment, industrial productivity, and entrepreneurship. Access to finance is shown to have a significant relationship with economic growth, emphasizing its importance for entrepreneurship development (Dansu, 2013).

Asogwa & Arinze examine the effects of entrepreneurship development on the economic growth of Enugu State. Their survey-based study reveals that entrepreneurial activities positively impact job creation and the standard of living in Enugu State. They recommend government intervention to enhance existing programs like Microfinance Banks and the Bank of Industry to bolster entrepreneurial activities and spur economic development. Idam (2014) underscores the economic challenges faced by nascent enterprises in Nigeria, including high incorporation costs, legal fees, permits, licenses, and multiple taxation. These challenges, coupled with limited access to credit and high interest rates, impede the growth of small businesses, both entrepreneurial and non-entrepreneurial (Man, 2001). Ogundele, Olajide, and Ashamu emphasize the crucial role of entrepreneurship in driving economic growth but stress the importance of conducive opportunities for its development. They argue that government policies should create an enabling environment to harness the potential of entrepreneurs effectively.

Theoretical Framework

Theories of entrepreneurship encompass a diverse array of perspectives, often classified into four main categories: personality-based theories, socio-cultural theories, economic theories, and social-network theories. These classifications offer frameworks for understanding the multifaceted nature of entrepreneurship and the various factors that influence entrepreneurial behavior and outcomes (Ebiringa, 2011).

Supply-Side Theory of Entrepreneurship: A crucial prerequisite for entrepreneurial activity is the presence of individuals willing and capable of seizing opportunities. Research examining factors influencing individual occupational choices reveals a myriad of empirical literature. On an aggregate level, the prevalence of entrepreneurship is explored through multidisciplinary approaches such as the 'eclectic' framework by (Verheul et al., 2022). The rate of entrepreneurship is explained by both supply and demand side factors. On the supply side, country-specific characteristics shaped by demographic factors (population growth, age structure, urbanization, income levels) and cultural dimensions (values, beliefs) play a significant role (Man, 2001).

Personality-based Theory of Entrepreneurship: These theories posit that specific personal traits confer advantages in entrepreneurial activities. Traits such as internal locus of control, low risk aversion, aggressiveness, ambition, marginality, and a high need for achievement are considered. However, research using comparison groups has revealed inconsistent and weak relationships between personality characteristics and entrepreneurial behavior.

Socio-cultural Theory of Entrepreneurship: This group of theories challenges individualistic approaches and emphasizes national origins, culture, and religion. Certain groups are believed to possess predispositions for business success based on their beliefs, values, and traditions. However, this approach faces criticism for being deterministic and over-socialized, assuming stereotypical standards for entire groups (Uma et al., 2015).

Economic Theories: Economic theories view entrepreneurs as rational, isolated decision-makers who, with a clear vision and all necessary information, can make decisions to start their own businesses. Critics argue that these models do not align with empirical research on cognition and decision-making, and a person behaving as described by economic models would be considered a social pathology (Baum & Amburgey, 2017).

Economic Growth Theories: Economic growth involves the steady increase in the productive capacity of the economy, comprising capital accumulation, population growth, and technological progress. Capital accumulation involves saving and investing personal income to augment future output, while population growth is traditionally seen as a positive factor in stimulating economic growth. Technological progress results from new and improved ways of accomplishing tasks, ranging from neutral to labor-saving and capital-saving innovations (Usman, 2011).

Methodology

This study employed a purposive or judgmental sampling technique to select its sample, drawing from the entire spectrum of entrepreneurship businesses in Nigeria. Purposive sampling involves the researcher's subjective judgment in selecting a sample that represents the population adequately for the study's objectives. The data utilized for empirical analysis were of a secondary nature, sourced from the annual Statistical Bulletin of the Central Bank of Nigeria. These data encompassed various metrics, including real gross domestic product (as a measure of economic growth), agricultural production, entrepreneurship capacity utilization, and unemployment rate, serving as indicators for entrepreneurship development in Nigeria (Fritsch, 2017).

Data Analysis

The model for this study is represented below:

RGDP = α0 + α1API +α2CUI + α3UNR + Ut

Where: RGDP= Real Gross Domestic Product; API= Agricultural Production Index; CUI= Capacity Utilization Index and UNR= Unemployment Rate. The scope of the analysis trend across 1980 to 2015 Table 1.

| Table 1 Data on the Relationship between Entrepreneurship and Economic Growth | ||||

| YEAR | RGDP | AGP | CUI | UNR |

| 1980 | 49,632.30 | 26186.6 | 32.3 | 5.3 |

| 1981 | 47.619.7 | 29374.4 | 34.3 | 4.8 |

| 1982 | 185600 | 30202.5 | 34.1 | 5.4 |

| 1983 | 183600 | 31089.1 | 32.2 | 5.2 |

| 1984 | 201000 | 31218.5 | 34.4 | 6.2 |

| 1985 | 206000 | 32917.7 | 37.1 | 5.9 |

| 1986 | 204800 | 35699.3 | 39.6 | 5.3 |

| 1987 | 219800 | 23320.5 | 44.1 | 7 |

| 1988 | 236700 | 37753 | 42.1 | 5.3 |

| 1989 | 267500 | 22757 | 42.2 | 4.4 |

| 1990 | 265400 | 26186.6 | 44 | 3.5 |

| 1991 | 271400 | 28081 | 46.5 | 3.1 |

| 1992 | 274800 | 31021 | 48.1 | 3.4 |

| 1993 | 275500 | 34901 | 59.9 | 2.7 |

| 1994 | 281400 | 32341 | 40.1 | 2 |

| 1995 | 293700 | 38221 | 40.2 | 1.8 |

| 1996 | 302000 | 21621 | 63.4 | 3.2 |

| 1997 | 310900 | 32711 | 20.4 | 3.2 |

| 1998 | 312200 | 37001 | 20.4 | 3.2 |

| 1999 | 329200 | 39061 | 20.5 | 3 |

| 2000 | 357000 | 30133.2 | 31.5 | 4.7 |

| 2001 | 433200 | 31037.2 | 20.5 | 3.6 |

| 2002 | 477500 | 32090 | 34.6 | 2.5 |

| 2003 | 527600 | 33310 | 73.3 | 2.9 |

| 2004 | 561900 | 34740 | 87.4 | 2.8 |

| 2005 | 595800 | 36100 | 88.6 | 3.3 |

| 2006 | 634300 | 37990 | 92.1 | 3.5 |

| 2007 | 672200 | 39130 | 60.9 | 4.1 |

| 2008 | 718900 | 40610 | 54.8 | 4.3 |

| 2009 | 775500 | 42720 | 55.9 | 4.7 |

| 2010 | 718900 | 43990 | 65.5 | 4.9 |

| 2011 | 775500 | 46380 | 58.1 | 5.2 |

| 2012 | 718908 | 56345 | 76.1 | 5.05 |

| 2013 | 672200 | 39130 | 60.9 | 4.1 |

| 2014 | 718900 | 40610 | 54.8 | 4.3 |

| 2015 | 775500 | 42720 | 55.9 | 4.7 |

Presentation of Regression Result.

The result generated from the econometric estimation of the model facilitated through the use of econometric view (E-VIEW) is presented below Table 2 and Table 3.

| Table 2 Regression Result | ||||

| Variables | Coefficient | Std. Error | T-value | T-Prob |

| AGP | 16.87971 | 3.433741 | 4.915836 | 0.0000 |

| CUI | 0.454284 | 1248.715 | 3.639168 | 0.0011 |

| UNR | -0.145367 | 18265.32 | -0.795588 | 0.4327 |

| Constant | -350365.1 | 137042.8 | -2.556610 | 0.0161 |

| Table 3 Dependent Variable: RGDP | ||||

| Method: Least Squares | ||||

| Date: 22/07/15 Time: 02:37 | ||||

| Sample: 1980 2015 | ||||

| Included observations: 35 | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| AGP | 16.87971 | 30.433741 | 4.915836 | 0.0000 |

| CUI | 0.454284 | 1248.715 | 3.639168 | 0.0011 |

| UNR | -0.145367 | 18265.32 | -0.795588 | 0.4327 |

| C | -350365.1 | 137042.8 | -2.556610 | 0.0161 |

| R-squared | 0.672220 | Mean dependent var | 382981.5 | |

| Adjusted R-squared | 0.638312 | S.D. dependent var | 215444.9 | |

| S.E. of regression | 129569.6 | Akaike info criterion | 26.49504 | |

| Sum squared resid | 4.871111 | Schwarz criterion | 26.67643 | |

| Log likelihood | -433.1681 | F-statistic | 19.82469 | |

| Durbin-Watson stat | 1.108829 | Prob(F-statistic) | 0.000000 | |

RGDP = -350365.1 + 16.87971API +0.454284CUI -0.145367UNR

t* = (-2.557) (4.916) (3.639) (-0.796)

R2= 0.67

DW= 1.109

Intercept

The estimated intercept of the relationship between entrepreneurial development and economic growth, calculated at -350365.1, indicates a baseline scenario where all explanatory variables in the model are zero. This suggests that in the absence of any entrepreneurial development, there would be a negative impact on the rate of economic growth in Nigeria. Specifically, when the indices of agricultural production, capacity utilization, and unemployment rate are all zero, it implies a detrimental effect on the economy's growth rate.

Interpretation of Result

Evaluation Based on Economic Criteria

The parameters estimates are expected to conform to a priori expectations. Consequently, the table below summarizes the outcome of the model parameters on a priori ground on the expected direction of relationship between the dependent variable and each of the independent variable Table 4.

| Table 4 A Priori Expectations | |||

| Variables | Expected sign | Obtained sign | Conclusion |

| AGP | Positive (+) | Positive (+) | Conform |

| CUI | Positive (+) | Positive (+) | Conform |

| UNR | Negative (-) | Negative (-) | Conform |

The table confirms that all explanatory variables align with the expected direction based on a priori expectations. Specifically:

• The positive coefficients for agricultural production index (AGP) and capacity utilization index (CUI) indicate that increases in these variables are associated with positive impacts on economic growth in Nigeria.

• Conversely, the negative coefficient for unemployment rate (UNR) suggests that an increase in unemployment leads to a decrease in economic growth.

These results imply that entrepreneurial development has a positive influence on economic growth in Nigeria.

Furthermore, the specific coefficients reveal the magnitude of these effects:

• A one percent increase in agricultural production index is associated with approximately a 1687% increase in economic growth.

• Similarly, a one percent increase in capacity utilization index is linked to roughly a 45% increase in economic growth.

• Conversely, a one percent increase in unemployment rate corresponds to approximately a 15% decrease in economic growth.

These findings underscore the significant impact of entrepreneurial development on driving economic growth in Nigeria, emphasizing the importance of factors such as agricultural production, capacity utilization, and unemployment rate in shaping the country's economic trajectory Table 5.

| Table 5 The Summary of the Student T- Test is Presented Thus | ||||||

| Variable | T-value | Prob | Decision | Conclusion | ||

| 1% | 5% | 10% | ||||

| AGP | 4.915836 | 0 | t* 2.76 | t* 2.04 | t* 1.70 | Significant |

| CUI | 3.639168 | 0.0011 | t* 2.76 | t* 2.04 | t* 1.70 | Significant |

| UNR | -0.795588 | 0.4327 | t* 2.76 | t* 2.04 | t* 1.70 | Not Significant |

| Constant | -2.55661 | 0.0161 | t* 2.76 | t* 2.04 | t* 1.70 | Significant |

The Student T- Test

The student t- test compares the t* (calculated) to its tabulated value which defines the critical region in a two tailed table, with n-k degrees of freedom (n= sample size and k= total number of estimated parameters).

The null hypothesis:

Ho: bi=0 is tested against the alternative

H1; bi≠0

If t* > t, reject the Ho, otherwise accept Ho.

The above result shows that, agricultural production index and capacity utilization index exert a significant impact on economic growth as proxied by gross domestic product. Unemployment rate does not exert a significant impact on economic growth as proxy by gross domestic products. By and large, entrepreneurial development exerts a significant impact on economic growth as proxy by gross domestic products in Nigeria.

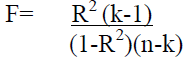

F- Test

F ratio is used to test for the joint influence of the explanatory variables on the dependent variables. It tests for the statistical significance of the entire regression plane. It is given mathematically as:

The computed F ratio, F* is compared with the theoretical F(0.05) with N1=k-1 and N2= n-k degrees of freedom.

Where: N1=degrees of freedom for numerator; N2=degrees of freedom for denominator and k= numbers of bs (including b0). If F* >0.05, reject H0 otherwise accept

H0from our regression result F* (4, 33) =2.69

Since F* =, F = 19.82469 >F0.05= 2.69

The null hypothesis that the entire regression plane is not statically significant is rejected. Therefore at 5% level of significance; the overall regression is statistically significant.

Coefficient of Multiple Determination R2

When the sample size is expanded indefinitely, the explanatory variables will still explain the variation in the behaviour of the dependent variables adequately. This is evident in the high value of adjusted R2 (0.63) which shows that when the sample size is expanded indefinitely the explanatory variables accounted for at least 63% of the variation in the pace of economic growth.

Econometric Test (second Order Test)

Test for Auto correlation.

One of the assumptions of OLS regression model is that errors are independent. In the context of time series analysis, this means that an error µt is not correlated with one or more of previous errors µt-i. The Durbin Watson d test compares the empirical d* value calculate from regression residuals with di and du is D-W tables with their transforms (4-dl) and (4-du).

Decision Rule

If d*<dl, we reject the null hypothesis of the presence of autocorrelation and accept that there is no positive auto correlation of first order.

Hence, 1.108829< 2.304

The null hypothesis is rejected that there is autocorrelation in the model. Hence, in the model there exist no autocorrelation.

Summary and Conclusion

The study reveals that agricultural production index and capacity utilization index significantly contribute to economic growth, as measured by gross domestic product, in Nigeria. Interestingly, unemployment does not demonstrate a significant impact on economic growth. These findings suggest that despite the comparatively low level of entrepreneurial support programs and schemes in Nigeria compared to international standards, entrepreneurial development remains productive. This productivity may stem from personal motivating factors and the imperative of individual survival, which drive entrepreneurial growth in Nigeria. The results of this study align with previous research. For instance, Bosma and Nieuwenhuijsen found a positive relationship between turbulence and total factor productivity growth in the service sector, while Reynolds observed a correlation between turbulence and economic growth in American regions. Similarly, Acs and Armington discovered a strong positive correlation between entrepreneurial activity and economic growth in the U.S., even after accounting for establishment size and agglomeration effects.

Additionally, the findings support the conclusions of Audretsch and Thurik, who found that an increase in the number of entrepreneurs leads to a reduction in the unemployment rate. These consistencies across studies reinforce the notion that entrepreneurship plays a vital role in driving economic growth and reducing unemployment, highlighting its importance for overall economic development.

Recommendations

Based on the findings of the investigation, the study offers the following recommendations:

1. Government Support for Farmers: The government should create an enabling environment for farmers by providing them with increased access to loans. Ensuring that farmers have easy access to loans will encourage more individuals to engage in farming activities.

2. Promotion of Mechanized Farming: Emphasis should be placed on mechanized farming, and the government should facilitate access to modern farming technologies, tools, machines, and equipment. This will enhance agricultural productivity and efficiency.

3. Enabling Policy Environment for Industry: The government should prioritize the creation of a conducive policy environment to support the growth of the industrial sector. This includes implementing policies that promote industrial development and remove barriers to entry for entrepreneurs.

4. Collaboration with Research Institutions: There should be collaboration between small business entrepreneurs and research institutions to leverage research findings for technology development. This collaboration can lead to innovation and the adoption of advanced technologies in various industries.

5. Government Intervention in Providing Support: Governments at all levels should intervene by providing supportive policies to address the challenges faced by entrepreneurs. This includes supplying necessary technological and business information and advice to entrepreneurs to facilitate their growth and success.

6. Integration of Entrepreneurship Training: Entrepreneurship training should be integrated into the programs of the National Youth Service Corps (NYSC) in Nigeria. This will equip fresh graduates with the skills and knowledge needed to become self-employed entrepreneurs after completing their mandatory service year, contributing to job creation and economic development.

References

ABD, H. O. B. (2012). Evolution and theories of entrepreneurship: A critical review on the Kenyan perspective. International Journal of business and Commerce, 1(11), 81-96.

Agu, U., & Evoh, C. J. (2011). Macroeconomic policy for full and productive and decent employment for all: The case of Nigeria (No. 994672123402676). International Labour Organization.

Akinola, A. O. (2013). Entrepreneurship in Nigeria-funding and financing strategies. European Journal of Accounting Auditing and Finance Research, 1(4), 115-128.

Baum, J. A., & Amburgey, T. L. (2017). Organizational ecology. The Blackwell companion to organizations, 304-326.

Indexed at, Google Scholar, Cross Ref

Berger, A. N., Klapper, L. F., & Udell, G. F. (2001). The ability of banks to lend to informationally opaque small businesses. Journal of Banking & Finance, 25(12), 2127-2167.

Indexed at, Google Scholar, Cross Ref

Ebiringa, O. T. (2011). Entrepreneurship venturing and Nigeria’s economic development: The manufacturing sector in focus. International. Journal of Business Management & Economic Research, 2(6), 376-381.

Evbuomwan, G. O., Ikpi, A. E., Okoruwa, V. O., & Akinyosoye, V. O. (2013). Sources of finance for micro, small and medium enterprises in Nigeria. In 19th International Farm Management Congress, SGGW, Warsaw, Poland (Vol. 1, No. 1, pp. 1-17).

Fritsch, M. (2017). The theory of economic development–An inquiry into profits, capital, credit, interest, and the business cycle.

Indexed at, Google Scholar, Cross Ref

Henrekson, M., Johansson, D., & Stenkula, M. (2010). Taxation, labor market policy and high-impact entrepreneurship. Journal of Industry, Competition and Trade, 10, 275-296.

Indexed at, Google Scholar, Cross Ref

Idam, L. E. (2014). Entrepreneurship development in Nigeria: A review. Journal of Business and Management, 16(1), 01-07.

Indexed at, Google Scholar, Cross Ref

Ikem, O. C., Chidi, O. F., & Titus, I. T. (2012). Financial challenges of small and medium-sized enterprises (SMES) in Nigeria: The relevance of accounting information. Review of Public Administration and Management, 1(02).

Indexed at, Google Scholar, Cross Ref

Jonathan, O. A. (2015). Entrepreneurial Firms Andmicro Finance Funding in Southwestern Nigeria. International Journal of Research in Business Management (IMPACT: IJRBM), 3(10), 67-76.

Lucas, A. F. (2000). Leading Academic Change: Essential Roles for Department Chairs. The Jossey-Bass Higher and Adult Education Series. Jossey-Bass Publishers, 350 Sansome Street, San Francisco, CA 94104.

Man, W. Y. T. (2001). Entrepreneurial competencies and the performance of small and medium enterprises in the Hong Kong services sector. Hong Kong Polytechnic University (Hong Kong).

Oloyede, J. A. (2008). Informal financial sector, savings mobilization and rural development in Nigeria: Further evidence from Ekiti state of Nigeria. African Economic and Business Review, 6(1), 35-63.

Robinson, J. W. (2002). Commercial Bank Interest Rate Spreads in Jamaica: Measurement, Trend and Prospects. Kingston: Bank of Jamaica.

Rusu, S., Isac, F., Cureteanu, R. & Scorba, L. (2012). Entrepreneurship and entrepreneurs: Areview of literature concepts, African Journal of Business Management, 6(10), 3570-3575.

Indexed at, Google Scholar, Cross Ref

Somoye, R.O.C. (2013). The impact of finance on entrepreneurship growth in Nigeria: A cointegration framework. ACRN Journal of Entrepreneurship Perspectives, 2(2), 21-45.

Received: 29-Feb-2024, Manuscript No. jmids-24-14707; Editor assigned: 02-Mar-2024, Pre QC No. jmids-24-14707(PQ); Reviewed: 16- Mar-2024, QC No. jmids-24-14707; Published: 18-Mar-2024