Research Article: 2025 Vol: 29 Issue: 3

Exploring Multi-bagger Opportunities through Value and Quality Investment Strategies in Small and Mid-Cap Indian stocks

Amit Bathia, SVKM's Narsee Monjee Institute of Management Studies (NMIMS) Deemed-to-be-University, Mumbai, India

Jagabandhu Padhy, SVKM's Narsee Monjee Institute of Management Studies (NMIMS) Deemed-to-be-University, Mumbai, India

Mangesh Nigudkar, SVKM's Narsee Monjee Institute of Management Studies (NMIMS) Deemed-to-be-University, Mumbai, India

Christine D’Lima, SVKM's Narsee Monjee Institute of Management Studies (NMIMS) Deemed-to-be-University

Nandip Vaidya, SVKM's Narsee Monjee Institute of Management Studies (NMIMS) Deemed-to-be-University

Harshit Banthia, SVKM's Narsee Monjee Institute of Management Studies (NMIMS) Deemed-to-be-University

Citation Information: Bathia, A., Padhy, J., Nigudkar, M., DLima, C., Vaidya, N., & Banthia, N. (2025). Exploring multi-bagger opportunities through value and quality investment strategies in small and mid-cap indian stocks. Academy of Marketing Studies Journal, 29(3), 1-16.

Abstract

We have compared the risk adjusted returns of value and quality investing strategies individually and in combination. The research is done on small and mid-cap stocks in Indian Stock Market to determine multi-bagger stocks for a portfolio. The outcome showed that when specific value and specific quality factors get combined it gives better risk adjusted returns when compared to individually providing such outcome. While the value investing provides higher returns in the greatest number of comparisons to quality factors, it needs to be combined with quality to avoid value trap stocks and achieve higher returns. All strategies beat the benchmark returns in most cases except in terms of volatility. There is a consistent underperformance of portfolios from year 2019 to 2021. The strategies even though providing marginally higher returns, the risk in those portfolios is much higher.

Keywords

Value investing, Quality investing, Multi-bagger, Portfolio management, Magic formula.

Introduction

Multibagger stocks are described as equity shares of a business that, frequently as a result of the business's excellent development potential and prudent management techniques, produce returns several times higher than the cost of acquisition. Contrarily, value investing is an approach to investing in which investors choose stocks that seem to be trading below their intrinsic or book value in an effort to find cheap stocks that the market has missed. Finding businesses with exceptional quality attributes entails quality investing. These companies are chosen based on both concrete and abstract standards, such as management credibility and balance sheet soundness.

Multibagger stocks because of their huge potential for profit but also their propensity for volatility and speculative nature, may come with greater hazards. Warren Buffett popularized value investing, which emphasizes long-term investments in cheap companies with solid fundamentals that could offer steady returns and a margin of safety. Emphasizing financial stability and profitability, quality investing may result in reliable performance and resilience during market downturns.

By combining these approaches, this study examines the risk-adjusted returns from quality and value investment and ascertains which strategy provides superior growth opportunity capitalization while mitigating market volatility. This paper suggests a hybrid investment approach that targets businesses that have both low stock prices and excellent qualities by combining the best aspects of value and quality investing. The goal of this portfolio building is to minimize risks and maximize returns. It does this by utilizing the advantages of each investment philosophy to produce a strong and diverse investment.

Literature Review

The research paper “Why Quality stocks offer higher return and lower risk” provides a thorough look at Quality investing, which involves selecting companies with strong and sustainable business performance while avoiding those that may disappoint. It shows that Quality companies consistently perform better than the overall market over time, with higher returns on equity and profit margins. This suggests that investing in Quality stocks can offer better returns, especially during difficult market conditions. The paper cites various academic studies and industry reports that support the idea that Quality companies tend to outperform others, leading to investment strategies focusing on Quality characteristics. In summary, the paper emphasizes the enduring appeal of Quality investing, which dates back to Benjamin Graham's insights in the 1930s. It suggests that targeting profitable, stable companies with lower financial risk remains relevant today. The evidence presented indicates that Quality stocks not only provide superior returns but also have lower volatility and risk compared to the broader market. This makes Quality investing an attractive and sustainable approach for long-term investors seeking consistent growth and riskmanagement. The research paper “Value Investment Strategy” looks into whether Piotroski's value investment model works well in different markets. It adds to the ongoing discussion about investment strategies and market quirks. The authors want to see if Piotroski's model can do better than regular market indexes by making above-average returns. They use ideas from well-known experts like Banz, Fama & French, and Schwert to analyze how well the model works in different market situations. They use numbers and statistics, like CAPM and the Fama & French three-factor model, to carefully study Piotroski's model. By comparing it with other investment strategies based on things like small companies and book-to-market ratios, they get a better understanding of how effective Piotroski's strategy is. The results of their research not only add to what we already know about value investing but also help investors figure out how to get the most out of their investments in changingmarkets (Jiang & Moen, 2012).

Basically, future work paper is the essay, which is designed to discuss the differences between the quality definitions commonly used in the industry and those ones used in academic research. The aim is to examine the forecasting power of these index hovers in the stocks returns and study the gap in performance between them. The study takes stable and newly emerging countries stock universe from December 1985 to December 2014. The series of industries’ conceptions include operating cash flow, capital invested on the growth, leverage, and earnings variability, whereas academic term emphasizes on gross profitability, net stock issued, and operating accruals. The research underlined the use of statistical methods, such as cross-sectional regressions and portfolio analysis, to evaluate quality definitions and how well do they predict stock returns. The analysis concludes that only quality definitions in academic literature have excessive return predicting powers compared to industry definitions. Study reveals that credit bonds of good companies favourably beat off bonds of poor-quality Company, with the academic mechanism of quality rating provides better profit in the investment grade bonds and high-quality bonds. The research draws attention to the need to take into account the substance of companies' reporting and their future particular growth prospects in the construction of such funds. On the whole, the analysis highlights the dominance of academic quality definitions and therefore provides a useful guidance for investors and practitioners in opting for investment strategiesformation.(Kyosev, Hanauer, Huij, & Lansdorp, 2016)

The research paper "How to Improve Quality Investing" is aimed at disclosing whether, incorporating additional indicators, including Economic Moat and analyst consensus, may lead to better results and increase investor's abilities to manage money. Case study is concentrated on exposing the relationship between quality metrics, the moat effect, and analysts' portfolio recommendations and the investment strategy success. This study deploys cross-sectional data analysis and Fama-MacBeth regression in order to examine quality factors namely several customary income statements, Economic Moat, and analyst recommendations, and their impact on investment performance. The authors account for unseen heterogeneity that may exist across the years, by extending the analysis to year-fixed effects. The findings of the researches show that by adding Economic Moat and analyst consensus some of the underlying quality factors might help to boost a system of investing rooted in traditional quality strategies. In addition, the association, from Quality of earnings to Economic Moat, is beneficial to specific strategies in delivering abnormal returns. What is significant, is worth mentioning that The Return on Invested Capital (ROIC) is to be one of the important quality indicators, which generates the highest excess alpha, along with gross margin. The report determines that although a firm may possess more conventional quality strategies, an understanding of its possible competitive advantages, stock revaluation based on expert opinion, and Economic Moat concept would enhance the quality of the quality strategies. Basically, the research article completes the story about the advantages of investing in a diversified way rather than a traditional way of quality metrics to achieve higher results and better performance in thestockmarket.(González, Santomil, Torre Vieito, & Reboredo, 2023)

The paper under study “Quality Investing” aims to analyse key investing strategies that are determined by a set of quality metrics compared to others. The ultimate purpose of the paper may be to find out how the quality indices serve the purpose of determining the future tendency of stock performance compared to the traditional indices such as earnings and free cash flow. The case is concentrated on the construction of quality evaluation strategies by ranking companies according to the top-7 metrics. It's built by composing value-weighted portfolios that include stocks drawing from either the top or bottom 30% of stocks ranked by fundamental quality. Then, it distinguishes between financial and non-financial firms to derive quality-weighted portfolios. And portfolios are rebalanced annually with accounts data from the previous fiscal year. Data would be obtained from CRSP and Compustat databases while comprehensive description of the data variables would be presented in the appendix. The research establishes, however, that the profitability of a firm’s operations, rather than the current free cash flow or bottom-line earnings, is the better predictor of the future share prices. Investment deliverables yield more than equally-valued outlooks in predicting the stock outcome. The research underlines the significance of irrational proxy for projected income in building investment products as well. To sum it up, this research showcases the ability of human capital approach based on various metrics to stand against more traditional evaluation methods in terms of their capacity to estimate future stockperformance.

(Davydov, Tikkanen, & Äijö, 2016) paper is aimed at a comparison of Magic Formula (MF) and augmented Magic Formula (MF-CF) performance with those of traditional methodology used in value investments in the Finnish stock market during 1991-2013. The goal is to test whether the use of MFs will help value investors to generate stock returns above the base rate and analyze capacity of the MF to benefit the investors in various non-US markets. This method is a lift-and-shift model to portfolios using distinct ratios (EV/EBIT, ROIC, CF/P, B/P, E/P and EBIT/EV) and numerous risk-adjustments. The results highlight that MF as well as MF-CF perform better than the market index, which achieved an average annual return of 19.3 %, and further 20.2% respectively, compared to 13.6% for the market index. The MF strategies are found to be robust and evidence points towards traditional value strategies yielding higher risk-adjusted returns in the Finnishstockmarket.

(Penman & Reggiani, 2018) research the principle of value versus growth investing, highlighting the concept of the "value trap." The purpose of this study is to share some of the difficulties that are faced by an investor on a value investing track together with how these face-offs also tie in with the growth investing side. Authors conduct comprehensive research into financial records and market trends aimed at identifying the mechanics underpinning the shifting roles between value and growth stocks. They rely on the basic analytical methods to figure out profitability and the characteristics of those two types of investment hedge. Penman and Reggiani’s study functions to point out the fatal danger of value investing, when the trap closes on the investor and the value of the shares drop. They underscore the significance of knowing the inherent factors stimulating in price rise and value growth stocks and using such data to form investment decisions. The conducted study is in itself a source of useful information about the finer aspects of value and growth investing in addition to its contribution to raised awareness levels of the intricate nature of these investingapproaches.

The paper “Moneyball of Quality Investing” by Kalesnik, V., & Kose, E. (2014) explains about the concept of quality investing and the benefits that investors might get if they use it. The aim of the paper is to examine how performance ratios could aid in the pinpointing of poorly appraised equities, and hence, what can be referred to as alpha portfolio generation. The authors examine various elements of quality including profitability, margins, growth metrics, debt ratios, stability of earnings, and accounting quality. On this basis, success in quality investing is built upon the quality as a framework. They perform simulations and backtest evaluations to foresee the return and risk the long-only and long-short strategies based on these metrics. The analysis of the effects of the restrictions on leverage on the investment performance is also made. The findings of the study tell that an investment methodology that emphasizes quality could result in rather high alpha yield. Through the picking a better group of stocks by the usage of mixed fundamental criteria, the investors may show the ability to have a higher rate of return in comparison to the market. The importance of considering quality factors alongside traditional value and growth metrics in investment decision-making are also highlighted bytheresearch.(Kalesnik & Kose, 2014)

Research Methodology

Objectives of Study

1. Analysing risk adjusted returns in mid cap and small cap stocks.

2. Comparing the returns through value and quality investing with traditional investing multiples.

Hypothesis

H0: There is no need to use value and quality strategies together in a portfolio.

HA: There is need to use value and quality strategies together in a portfolio.

To check for risk adjusted returns Sharpe Ratio turns out to be the best and most common indicator. The Sharpe ratio evaluates an investment's risk and return. It's a mathematical representation of the realization that excess profits over time could indicate increased risk and volatility rather than skill in investing.

In the realm of financial research, the methodology I have adopted is secondary. By integrating factors from literature reviews into the study of the Indian stock market, I have laid a foundation for empirical analysis. Utilizing databases like Bloomberg, Capitaline, and Trendlyne allows for a robust collection of historical data of relevant ratios on mid cap and small cap stocks. Mid cap stocks initially retrieved from Bloomberg were 128 securities and small cap stocks were 411 securities. The data collected was then cleaned from ETF (Exchange Traded Funds) and stocks which didn’t have any data. After cleaning the number of securities were reduced to 494 stocks.

The time frame to build a historical data portfolio is used as on 15th March, 2017. The data on all the considered factors were retrieved as on that date.

While building portfolio based on quality and value investing, ranks are used on relevant factors. Some factors are smaller and better while some are larger and better. Ranks are awarded accordingly for each factor. Number 1 rank being the best. Then these ranks are added up to obtain overall rank of the stock on those factors. The summed-up rank is then filtered on smallest to largest.

After filtering, the top 50% are taken to build a portfolio and analysed upon. The use of Python and its QuantStats library further enhances the research by providing a powerful toolkit for analyzing investment portfolio performance metrics from 2017 till 2024. The output is compared to benchmark, Nifty 500.

Value Investing strategies considered are Magic Formula and Traditional Investing multiples which are:

1. Magic Formula (MF1) - Value investing techniques described in Joel Greenblatt's book "The Little Book That Beats the Market" (2010) are referred to as the "Magic Formula" by the well-known investor and hedge fund manager. The algorithm is intended to assist investors in locating premium equities at deep discounts. The two primary indicators used to rank companies are return on capital and price to earnings. Investing in businesses that the market undervalues and have a high return on capital indicates that they are effective at making money out of their assets.

2. Magic Formula (Cash Flow or MF2) - The formula is added with Price to Cash Flow ratio. This ratio is better than price to earnings because it does not get as easily manipulated as earnings.

3. Magic Formula (EV/EBIT or MF3) - Instead of price to earnings, enterprise value by earnings before interest and taxes (EV/EBIT) is used. Although both ratios are similar, it is better to use this when companies are being compared across industries.

4. Piotroski F score- A financial analysis technique called the Piotroski F-score is used, especially in the context of value investing, to evaluate the strength of a company's financial position. The score, which runs from 0 to 9, was created by accounting Professor Joseph Piotroski. Higher scores reflect better financial health. It is predicated on a set of nine standards that assess funding, operational effectiveness, and profitability. For example, among other things, a business would receive points for having a growing gross margin, positive operating cash flow, and positive net income. In an effort to maximize profits while lowering risks, value investors frequently use the Piotroski F-score to sort through a multitude of stocks in search of those with strong fundamentals and cheap pricing.

5. Traditional Investing multiples- Financial ratios, such as price-to-book (PB), price-to-earnings (PE), enterprise value to earnings before interest and taxes (EV/EBIT), and price-to-cash flow (P/CF), are essential for evaluating a company's financial health and figuring out whether its stock is overvalued or undervalued in value investing. The PE ratio indicates how much the market is ready to pay for a company's earnings by comparing the share price to earnings per share. Value investors frequently utilize the PB ratio, which assesses a company's market value in relation to its book value, to identify possible investments. When comparing a stock's valuation to that of similar stocks and the market, the EV/EBIT ratio is utilized to take both debt and earnings levels into account. Finally, the P/CF ratio, which is helpful for appraising businesses with positive cash flow but unprofitable because of significant non-cash charges, lastly calculates the value of a stock's price in relation to its operational cash flow per share. When combined, these ratios offer a thorough understanding of a company's valuation, assisting investors in making defensible choices based on basic research.

Quality Investing Strategies is to find businesses that have steady earnings growth and sound financial standing. It entails choosing businesses with a stable profits growth pattern, minimal debt, and a profitable track record. Investors that employ this strategy frequently evaluate a company's financial health and growth prospects using measures including Return on Equity (ROE), Debt-to-Equity (D/E) ratios, and earnings unpredictability. Investing in businesses with competitive advantages, strong management, and the potential for long-term, consistent returns is the aim. Empirical evidence and economic theory have backed this approach, indicating that it can be a wise strategy for assembling a robust investment portfolio.

1. Earnings Stability- Key components of investing methods include net income, free cash flow (FCF), and sales stability. Stability is measured through standard deviation of sales, net income and free cash flow for the past 5 years from 2017. Free cash flow is especially important because it paints a more complete picture of a company's financial health than net income alone. Because free cash flow (FCF) is a measure of a company's ability to grow and sustain operations without outside funding, investors may be looking for a constant or rising trend in FCF. Furthermore, a steady cash flow is a desirable criterion for long-term investment choices since it can sustain dividend payments and other shareholder rewards.

2. Financial Constraint- Financial statistics such as the Debt-Service Coverage Ratio (DSCR), Altman Z-score, and Current Ratio are essential in evaluating a company's investment potential and overall financial health in the context of quality investing. An important measure of a company's capacity to repay loans is the debt-to-stock ratio (DSCR); a higher ratio denotes stronger financial stability. In contrast, the Altman Z-score is a useful indicator for investors looking to make high-quality investments because it predicts bankruptcy risk; a number nearer 3 denotes a lesser probability of bankruptcy. On the other hand, the current ratio is a basic indicator of liquidity; a ratio greater than two is frequently interpreted as an indication of a company's capacity to fulfil short-term obligations and, consequently, as a constituent of a superior investment plan. A financial indicator called the debt-to-equity (D/E) ratio is used to assess a firm's financial leverage. It is computed by dividing the total liabilities of the company by the equity held by its shareholders. A reduced debt-to-equity ratio can indicate that a business is using shareholder stock to support its operations instead of debt, which is generally seen as a sign of sound financial standing and a decreased default risk. The growth rate of debt to equity over the past 5 years is considered. This enables to show that over the period if company has shown become debt free or increased leverage. When combined, these ratios offer a thorough understanding of a business's financial leverage, liquidity, and operational efficiency. This helps investors make well-informed decisions that are consistent with the principles of quality investment. Investors can discover organizations with robust financial positions and long-term resilience to sustain profitability and growth by incorporating these financial criteria.

3. Growth in Profitability- The Compound Annual Growth Rate (CAGR) of different financial measures is essential for evaluating a company's performance and potential for long-term growth in the context of quality investing techniques. An important measure of profitability is return on equity (ROE), which shows how well a business can make money off of its equity foundation. A corporation is likely using its equity to grow earnings efficiently if its CAGR for ROE is high. Another important statistic is asset turnover ratio, which gauges how well a business uses its assets to produce sales. A growing CAGR in this area indicates increased operational efficiency. By displaying the growth in earnings before interest and taxes in relation to revenue, the EBIT margin CAGR gives information about a business's operating profitability. Finally, a picture of a business's operational success free from the distortion caused by non-operational elements like amortization and depreciation is provided by the EBITDA margin CAGR. When combined, these CAGRs provide a clear picture of a business's financial standing and are useful in locating premium assets with the potential to provide higher returns over time. As part of a quality investment approach that emphasizes companies with robust business models, competitive advantages, and the capacity to generate value over numerous market cycles, investors frequently look for companies with strong and consistent development in these areas.

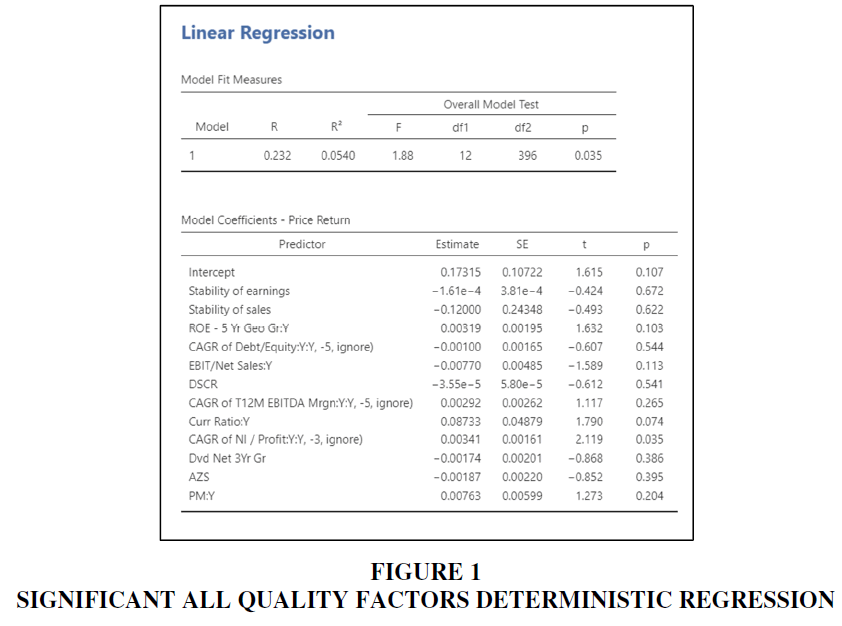

Lastly a combination of few of these ratios are taken based on linear regression to determine which variables make a significant model Figure 1. The Dependent variable is the Price return of stocks from 2010 to 2017. The following output was generated:

From the above figure, quality factors were combined to get highest R square (portraying strength of the model) and significant overall model fit. DSCR is Debt Service Coverage Ratio, PM is Profit Margin, Y:Y is Year on Year, -n is the number of previous years taken into calculation, Dvd Net is Net dividend, Gr is Growth and AZS is Altman Z score.

Performance Measures Looked at are

1. The compound annual growth rate (CAGR): It is a statistic that expresses how much an investment has grown annually over a given period of time. Better performance is typically indicated by a greater CAGR.

2. Sharpe Ratio: This ratio calculates an investment's risk-adjusted return. Better risk-adjusted returns are suggested by a higher Sharpe ratio.

3. Treynor Ratio: Using beta as the risk measure, the Treynor ratio calculates the risk-adjusted return in a manner similar to the Sharpe ratio. In comparison to the fund's beta, superior risk-adjusted returns are indicated by a higher Treynor ratio.

4. Beta- The sensitivity of a fund's returns to changes in the market is measured by its beta. When a fund has a beta of 1, it follows the market's movements. Higher volatility is indicated by a beta value larger than 1, whilst lower volatility is indicated by a beta value less than 1.

5. Value at Risk (Daily VAR): Over a certain time period, Daily VAR calculates the possible loss in value of an investment at a specific confidence level. A smaller VAR indicates a less possible danger of decline.

6. Volatility: Volatility is a metric used to quantify how much a fund's returns fluctuate over time. Reduced volatility is a sign of more consistent returns.

Chart Output Measures to Understand

1. Log scaled returns: When log-scaled, cumulative returns vs a benchmark offer a multiplicative means of comparing an investment's performance over time against a standard reference. This approach, which places more emphasis on the rate of return than the absolute value, can be very helpful for displaying performance trends over extended time periods. Additionally, the log scale aids in evaluating volatility and risk-adjusted returns by highlighting growth rate variations and making large values more comparable.

2. Rolling volatility: A rolling volatility chart over a six-month period provides a visual representation of how the price volatility of an asset has changed over time. It calculates the standard deviation of the asset's returns within a moving six-month window, which rolls over time. This type of chart can help investors identify periods of higher risk when the price movements were more unpredictable, and periods of lower risk with more stable price movements. Understanding these patterns can be crucial for making informed investment decisions, particularly for mid to long-term investment horizons.

Data Analysis and Findings

Starting with Value strategies, showcase the CAGR returns for the period taken under analysis along with Sharpe Ratio, Treynor Ratio, Beta, Daily Value at Risk (VAR) and Volatility.

The output shows:

• CAGR is a measure of past performance that is often higher. Here, "P/E" has the greatest CAGR (12.34%), closely followed by "MF 2" (12.30%) and "P/E & P/B" (12.01%).

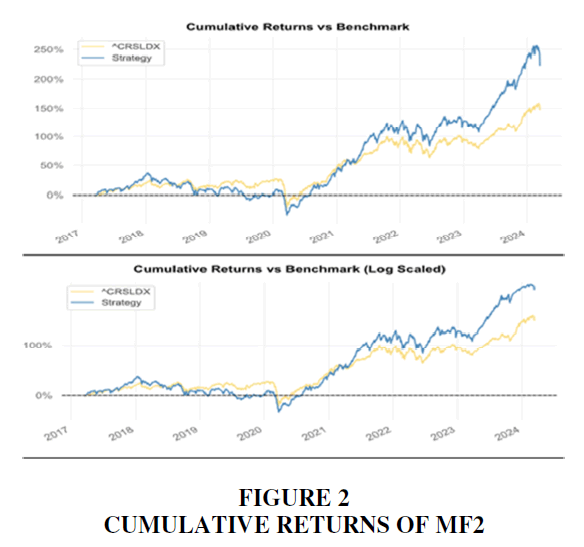

• Risk-adjusted returns are measured by the Treynor and Sharpe ratios. Better risk-adjusted performance is indicated by higher values. Out of all the funds, "MF 2" has the highest Treynor ratio (0.06) and Sharpe ratio (0.31), indicating greater risk-adjusted returns.

• Beta: The sensitivity of returns to changes in the market is measured by beta. Less volatility in relation to the market is implied by a lower beta. The two stocks with the lowest beta values, "MF 2" and "MF 1" (0.87 and 0.88, respectively), indicate lesser volatility than the market.

• Value at danger (VAR) and Volatility: Lower values of both metrics point to more consistent returns and less possible danger on the downside. With the lowest daily volatility (16.86%) and VAR (-1.67%), "MF 2" may have less downside risk and more consistent returns.

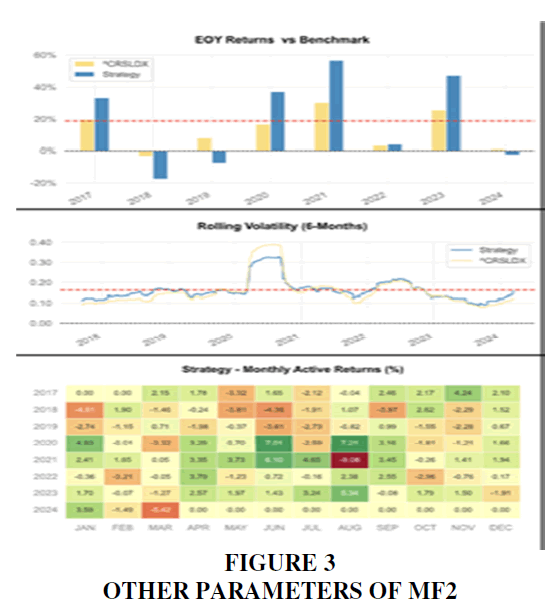

These indicators suggest that "MF 2" does well on a number of measures, including strong risk-adjusted performance, lower volatility Figure 2, and relatively high returns. It has also beaten the benchmark returns and risk adjusted returns with similar kind of risk. Further detailed output of MF2 is:

It is seen that the period between 2019 till 2021 has been underperforming for the portfolio Figure 3. This could be due to financial crisis because of IL&FS in 2018, leaving after shocks in 2019 followed by pandemic.

Similarly, while analysing Quality factors following output generated:

The strategy with the highest CAGR and Sharpe ratio is "earnings stability," which suggests strong return performance. Additionally, a high Treynor ratio indicates that it offers a respectable return on risk. On the other hand, its high volatility and VAR suggest that it may be risky.

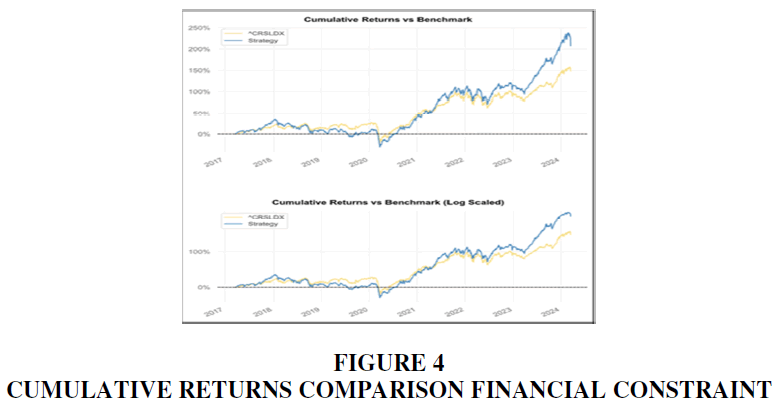

Conversely, "Financial Constraint" appears to be less risky because of it’s slightly lower return ratios, lower volatility, lower VAR, and lower beta.

Therefore, "Financial Constraint" would be a better option if you're more risk adverse. Both quality parameters have beaten benchmark returns. Earnings stability has higher risk than benchmark but it gives that much higher return. While Financial constraint portfolio gives higher return than benchmark but with lower risk.

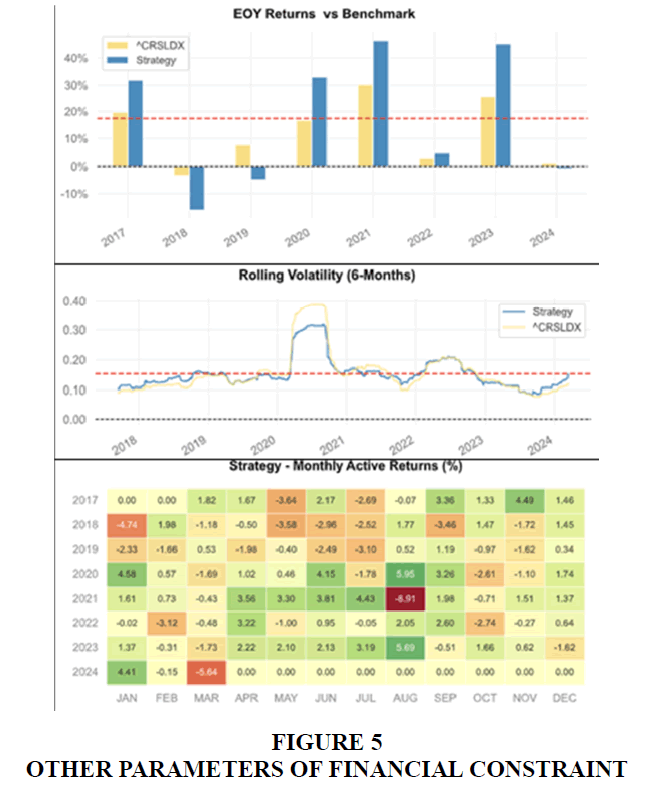

Output for Financial Constraint portfolio is

Similar underperformance phase can be seen during 2019-2021 Figure 4.

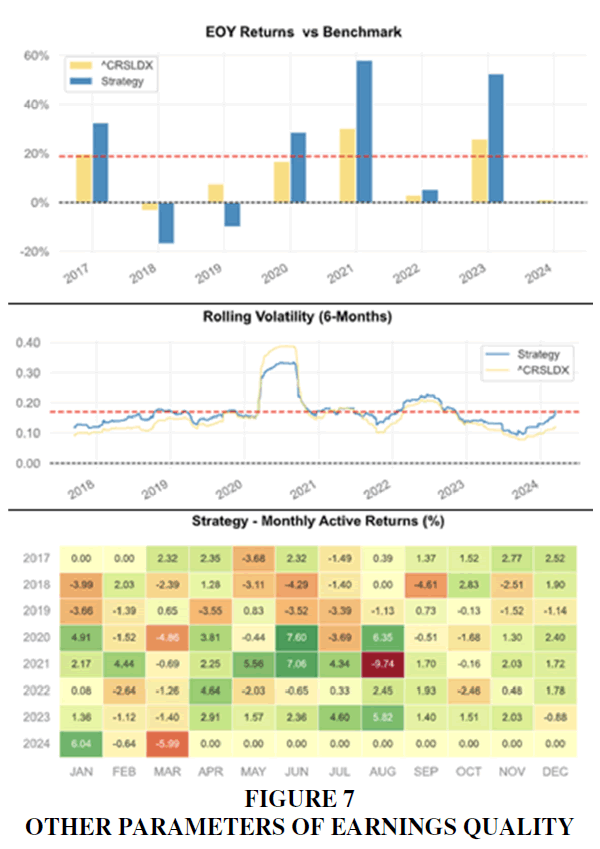

Output for Earnings Stability is Figure 5.

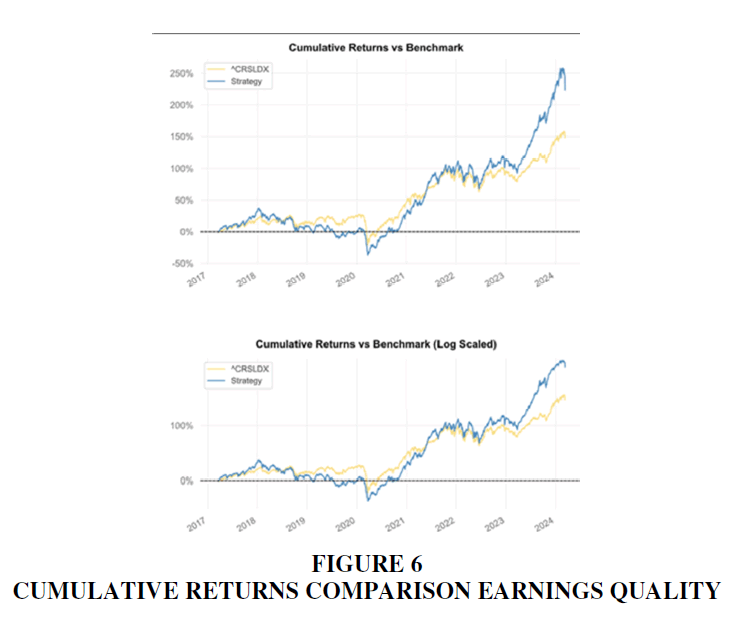

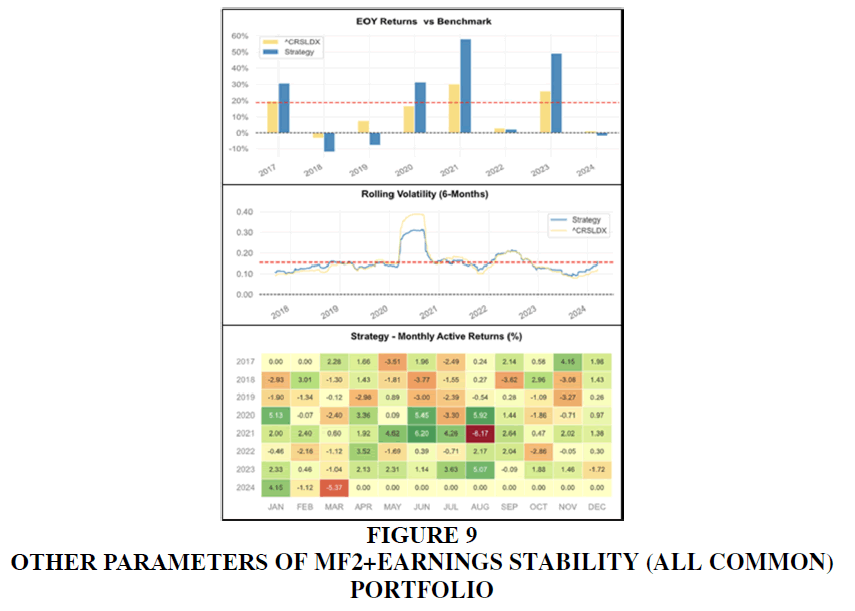

After analysing both value and quality strategies, two cases are considered to check if combining these two results in better results Figure 6, 7. One case is MF2 and Financial Constraint and second case is MF2 and Earnings Stability. Following output is obtained:

From the output following inferences can be made:

1. MF2+Financial Constraint

a) This portfolio has a CAGR of 11.76%, a Sharpe ratio of 0.30, a Treynor ratio of 0.06, a beta of 0.82, a daily VAR of -1.56%, and a volatility of 15.74% when taking into account all common names, i.e., all stocks which are common in both the portfolio.

b) The measures marginally rise when all the equities in both universes are taken into account, suggesting both more risk and maybe higher rewards.

c) The Sharpe ratio stays the same when the portfolio is balanced with 50% value and 50% quality, but the volatility rises little to 16.46%, suggesting a modest increase in risk.

2. MF2+Earnings Stability

a) This portfolio has a CAGR of 12.50%, a Sharpe ratio of 0.34, a Treynor ratio of 0.07, a beta of 0.84, a daily VAR of -1.60%, and a volatility of 16.18% when taking into account all common names.

b) The risk measures marginally rise and the CAGR slightly falls when all equities in both universes are taken into account.

c) The Sharpe ratio marginally drops to 0.31 and the volatility rises to 17.17%, signifying increased risk, when the portfolio is balanced with 50% value and 50% quality.

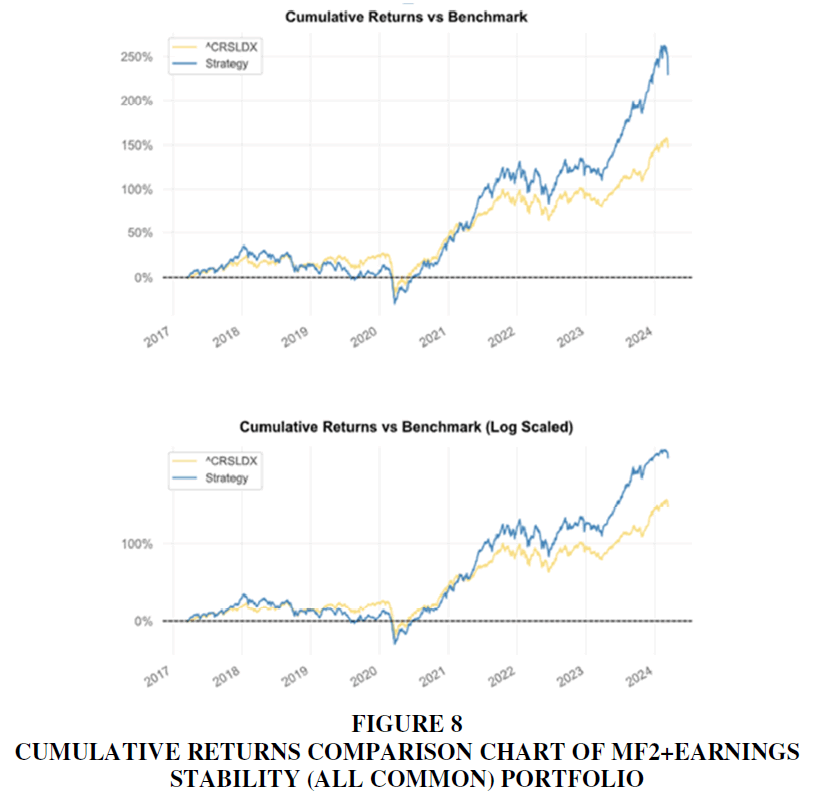

In summary Figure 8, the "MF2+Earnings Stability" portfolio, when taking into account all common names, can be a solid choice if you're looking for larger returns and are willing to take on more risk.

All portfolios have beaten the benchmark in almost every manner except volatility in few cases Figure 9.

Following output is generated for MF2+Earnings Stability (All common names)

Limitations

The study faces few limitations which are:

1. The data is collected from multiple sources which could lead to data discrepancy.

2. It takes fewer stocks compared to the universe of stocks.

3. The timeframe for calculation is limited to 7 years.

4. The analysis considers stocks on various factors but factors are more often than not for companies which are asset heavy. The model doesn’t work effectively for stocks in banking sector and has asset light model.

5. The ratios are taken as whole while it can be compared to its industry ratios to get better judgment.

Conclusion

Combining value and quality investing is similar to using the best aspects of both worlds to create a strong portfolio in the context of investment techniques. The goal of value investing is to purchase cheap equities, which, should the market rectify these pricing anomalies, can result in substantial profits. But by itself, this strategy can fail to recognize the underlying strength of the companies that support the equities. This is where value and quality investing work best together. A company's long-term survival and resilience are indicated by strong fundamentals, such as consistent cash flows, steady profits growth, and sales. These companies are the focus of quality investing. Value investing strategies that incorporate quality criteria can help investors reduce the dangers associated with value traps, which are stocks that seem inexpensive but are actually cheap for deeper reasons. Moreover, great businesses frequently have the capacity to hold onto or grow in value over time, acting as a buffer in times of market turbulence. Essentially, a dual strategy makes sure that investors are able to take advantage of the current pricing inefficiencies and that the companies in their portfolio are stable and have a track record of performance. This synergy provides a protective position against market volatility in addition to increasing the potential for better returns. As a result, combining a value and quality investment approach means that you should not just buy cheap, but cheap with a purpose, making sure that every asset in your portfolio adds to the right amount of growth and safety. To sum up, combining value and quality investing is a wise way to build a portfolio since it provides a thorough framework that, for the astute investor, combines the finest aspects of both approaches.

References

Altman, E. I. (1968). Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. The journal of finance, 23(4), 589-609.

Davydov, D., Tikkanen, J., & Äijö, J. (2016). Magic Formula vs. traditional value investment strategies in the finnish stock market.

Otero González, L., Durán Santomil, P., Vieito, J. P. D. T., & Reboredo, J. C. (2023). How to improve quality investing. BRQ Business Research Quarterly, 23409444231202810.

Greenblatt, J. (2010). The little book that still beats the market. John Wiley & Sons.

Jiang, P., & Moén, R. (2012). Value Investment Strategy: Robustness test and application of Piotroski’s model in 4 different markets.

Kalesnik, V., & Kose, E. (2014). The moneyball of quality investing. Research Affiliates, 13.

Kyosev, G., Hanauer, M. X., Huij, J., & Lansdorp, S. (2016, 6 13). Quality Investing – Industry versus Academic Definitions.

Penman, S., & Reggiani, F. (2018). Fundamentals of value versus growth investing and an explanation for the value trap. Financial Analysts Journal, 74(4), 103-119.

Indexed at, Google Scholar, Cross Ref

Sharpe, W.F. (1994) The Sharpe Ratio. The Journal of Portfolio Management, 21, 49-58.

Corresponding Author:

Christine D’Lima, SVKM's Narsee Monjee

Institute of Management Studies (NMIMS)

Deemed-to-be-University

Received: 18-Dec-2024, Manuscript No. AMSJ-24-15559; Editor assigned: 19-Dec-2024, PreQC No. AMSJ-24-15559(PQ); Reviewed: 28-Jan-2025, QC No. AMSJ-24-15559; Revised: 20-Feb-2025, Manuscript No. AMSJ-24-15559(R); Published: 07-Mar-2025