Research Article: 2025 Vol: 29 Issue: 4

Exploring Millennials’ Digital Payment Adoption: The Interplay of Comfort, Security and COVID -19

Priti Aggarwal, N L Dalmia Institute of Management Studies and Research

Shailesh Kumar, Professor of Practice-Finance

Gauri Sane, Atharva Institute of Management Studies, Mumbai, India

Citation Information: Aggarwal, P., Kumar, S., & Sane, G. (2025). Exploring millennials’ digital payment adoption: the interplay of comfort, security and covid -19. Academy of Marketing Studies Journal, 29(4), 1-13.

Abstract

This empirical study investigates the impact of increased digital transaction usage during the COVID-19 pandemic on security concerns and comfort levels among Millennial users, considering demographic factors like gender and income. Using purposive sampling, 100 respondents experienced in digital transactions were surveyed, with 46 questionnaires analyzed. Both conventional p-value and robust BCa bootstrap methods were employed for analysis, with effect size reported. Findings reveal that male user’s exhibit higher security concerns than females, and middle-income individuals express greater apprehension compared to lower-income counterparts. However, the study's limitations suggest the need to explore additional demographics like age, education, occupation, and rural/urban residence, especially focusing on rural populations. Practical implications emphasize the persistent security concerns despite forced adoption, urging developers and service providers to enhance transaction security. This study's innovative multi-method approach underscores its originality and highlights the enduring importance of addressing security issues in digital transactions, particularly amidst the pandemic's influence.

Keywords

Digital Transaction, Millennials, COVID-19 pandemic, E-Finance.

Introduction

During the COVID-19 pandemic, nationwide lockdowns in India led to an increase in the use of digital payment applications as a result of preventive measures such as social distancing. Specifically, usage of digital transaction increased by 44%. Among the most popular digital payment apps in India during this period were PayTM and Google Pay (PTI, 2020). The shift from physical payments to digital payments in India during the COVID-19 pandemic was aided by the increasing number of smartphone users in the country. As of December 2019, there were 502.2 million smartphone users in India, which provided a large base of users who were able to easily adopt digital payment methods (Gadgets360, 2020). According to a report by Business Standard, mobile wallet transactions in India are projected to grow significantly in value in the coming years. The report estimates that mobile wallet transactions will increase from approximately Rs 5,500 crores in 2015-2016 to an estimated Rs 30,000 crore in 2022. This indicates a significant increase in the use and acceptance of digital payment methods in India (Umarji, 2016). While the increase in digital transactions has brought many benefits, it has also led to an increase in cyber-crime attacks. According to reports, cyber-crime attacks increased by 86% during the lockdown March and April 2020. This highlights the importance of taking measures to protect against cyber threats, such as using strong passwords and monitoring for suspicious activity on account (Desai, 2020).

Cybercrime is a growing concern in India, with a large number of cases being reported each year. According to data from the National Crime Records Bureau, a total of 44,546 cases of cybercrime were registered in India in 2019. This highlights the need for individuals and businesses to be aware of the potential risks associated with digital transactions and take appropriate precautions to protect themselves from cybercrime (National Crime Records Bureau, 2020). The number of cybercrime cases in India continues to rise. In Pune, the number of cybercrime cases registered by August 2020 had already surpassed the total number of cases registered in the calendar year of 2019. Specifically, in 8 months, 8,546 cases of cybercrime were registered in Pune, compared to 7,700 cases in 2019. This indicates a growing trend of cybercrime in India, which highlights the need for individuals and businesses to be vigilant and take steps to protect themselves from cyber-attacks (Madaan, 2020).

The rise in cybercrime cases during the COVID-19 pandemic has led to concerns about digital transaction security in India. The rapid increase in digital transaction usage during the lockdown period has highlighted the need for better security measures to protect users' information and funds. Despite the lack of official data, it is believed that the amount lost due to cybercrimes in 2020 may have exceeded the Rs 1.24tn lost in 2019. This has led to an urgent need for research to understand how comfortable people are with using digital transaction, and whether their concerns about the security of digital transaction transactions vary based on demographic factors such as age, income, and education level.

Literature Review

As the COVID-19 pandemic is an unprecedented situation, there is limited research available specifically addressing the impact of the pandemic on digital transaction usage and security? However, some studies that are relevant to this topic include research on the overall trend of digital transactions and cybercrime in India, as well as studies on consumer attitudes and behaviors related to digital transaction usage and security. Additionally, studies on the impact of previous crises or disruptions on financial technology adoption can also provide useful insights. It is important to note that the COVID-19 pandemic has had an impact on consumer behavior and adoption of digital payments and digital transaction, and thus it is recommended to conduct research on the specific topic and context of the study.

A study conducted by (Nag and Gilitwala, 2020) in Bangkok, Thailand investigated the influence of various factors on the intention to use digital transaction. The study focused on five factors: perceived usefulness, perceived ease of use, security/privacy confidence, social influence and trustworthiness. The results of the study showed a moderate positive correlation between "security" and "intention to use" digital transaction. This suggests that people's perception of the security of digital transaction is an important factor that affects their willingness to use these digital payment methods. It also highlights the importance of addressing security concerns in order to increase adoption and usage of digital transaction.

A study conducted by (LAI, 2016) found that the "intention to use" digital transaction systems is significantly influenced by factors such as security, design, perceived usefulness and perceived ease of use. The study reported that security has a positive influence on users' "intention to use" the digital transaction system. This supports the findings of the Bangkok study and other research which indicate that security is an important factor that affects people's willingness to use digital transaction and other digital payment methods. It suggests that addressing security concerns is crucial to increase users' intention to use digital transaction systems.

(Kim et al. 2010) found that "perceived security" has a positive impact on "perceived trust" and on the usage of digital transaction systems. This supports the idea that security is a crucial factor that affects users' trust in digital transaction systems, which in turn affects their willingness to use these systems. A study conducted by (Wijayanthi, 2019) reported that "perceived trust" and "perceived usefulness" influence the behavioral "intention to use" e-wallet among Indonesian young consumers. This suggests that trust and usefulness are important factors that affect users' willingness to use digital transaction, and that addressing these concerns can increase adoption and usage of digital transaction.

(Karim et al. 2020) used an extended "technology acceptance model (TAM)" to investigate the factors influencing the use of digital transaction among Malaysian youths. Their findings confirmed that "perceived usefulness, perceived ease of use, privacy and security" have a significant positive influence on "behavioral intention to use an e-wallet." This study supports the idea that users' perceptions of usefulness, ease of use, and security are key factors that influence their willingness to use digital transaction (Soodan and Rana, 2020) studied factors influencing the adoption of digital transactions. They reported that "hedonic motivation, perceived security, general privacy, facilitating conditions, performance expectancy, perceived savings and social influence and price value in this order, influence the intention to adopt e-wallets." They advocated modifying existing services to maintain the customers’ “privacy and security.” This study highlights the importance of addressing users' concerns about security and privacy in order to increase adoption of digital transaction.

The (Brahmbhatt, 2018) study surveyed customers in Ahmedabad, India and found that most were aware of digital transaction and satisfied with their service, but concerned about the security of transactions. Additionally, the study found that customers preferred using digital transaction for small transactions and for online shopping. The study also found that customers were more likely to use digital transaction if they were offered discounts and cash back. The study suggests that e-wallet providers should focus on improving the security of transactions and offering incentives to attract more customers.

(Mallat, 2007) studied the adoption of mobile payments and found that the relative advantages of mobile payments include convenience and flexibility in terms of time and place, remote payment options, and the ability to avoid lines. The study also identified barriers to adoption, such as higher costs compared to traditional payment methods, complexity, lack of widespread acceptance, and perceived risks. Mallat argues that these factors are unique to mobile payments and differ from traditional adoption theories.

(Grable, 2000) found that financial risk tolerance is associated with demographic factors such as gender, income, and education. The study found that men tend to be more risk-tolerant than women and those high-income groups tend to be more risk-tolerant than lower-income groups. (Kindberg et al. 2004) suggested that trust, security, ease of use, convenience, and social factors are all important considerations when designing e-payment technology. They argue that these factors are equally important in order to ensure the success of e-payment technology.

(Jung and Jang, 2014) emphasized the importance of security and reliability in e-wallet applications, cautioning against the vulnerabilities of the Internet of Things (IoT) environment. They proposed using a smart solid-state drive (SSD) to create a more secure and reliable e-wallet. (Urs, 2015) also stressed the importance of security in digital payments, highlighting the common threats such as worms, trojans, viruses, phishing, pharming, spoofing, man-in-the-middle, denial of service attack, transaction poisoning, and spamming. He argued that reliable and secure methods of customer authentication are necessary to reduce the inherent risks in digital payments.

(Salodkar et al. 2015) studied security concerns in e-wallet applications and proposed a new e-wallet application that they claimed would provide a secure, fast, and futuristic way of transactions. (Nachappa and Lathesh, 2018) also emphasized the importance of security in e-wallets, noting that people are increasingly concerned about the protection of personal financial information such as bank balance details and authorization details. They argued that e-wallets are best equipped to offer the necessary security for this information. (Octavian, 2012) identified security and feasibility as major concerns for e-wallet applications. He argued that security systems must effectively prevent fraud within the electronic environment, while feasibility systems must be accessible and available at all times. He also suggested that the lack of commercial success for e-wallets in the past was due to difficulties in using them.

Research Methodology

Objectives

The objective of the study is to investigate the “security” concerns and level of “comfort” in usage digital transaction during the COVID-19 pandemic. It also aimed to explore how demographic factors like gender and income may impact these concerns and comfort levels.

Hypotheses

It is possible that there may be a relationship between gender and security concerns and comfortability using digital transaction. Some studies have suggested that men may be more risk-tolerant than women, which could potentially influence their level of security concerns and comfort with using digital transaction. However, it would be important to conduct further research to verify this relationship and understand how it may vary across different contexts and populations.

Traditionally in India, men have held more financial power and have been the primary decision-makers when it comes to financial transactions. Even though more women have entered the workforce and are earning money, they still often have limited control over financial decisions and resources within their families. Despite an increase in education and access to technology, women may still face barriers to participating in financial transactions and decision-making. This is an issue that has been acknowledged by researchers such as (Kohli, 2018).

(Schubert et al. 1999) argued that men and women do not differ in risk propensities in a given context, while (Grable, 2000) reported that men tend to be more risk-tolerant than women. This research suggests that women may have higher security concerns and may not be as comfortable with digital transaction transactions as compared to male users. Therefore, it is important to consider the gender of users when assessing their concerns and comfort level with digital transactions. Thus, this study hypothesizes as:

H1. There is a significant difference in security concerns between male and female.

H2. There is a significant difference between Male and Female in their comfort using digital transactions.

It is well established that people's level of income can influence their risk propensity. People with higher incomes are more likely to take more risks than people with lower incomes (Grable, 2000). Based on this research, it can be inferred that income may influence the security concerns and comfortability of digital transactions users. People with higher incomes may have fewer security concerns and be more comfortable with digital transactions than those with lower incomes. Therefore, it is important to consider the income level of users when assessing their concerns and comfort level with digital transactions. Thus, this study hypothesizes as:

H3. Security concerns differ significantly among different income groups.

H4. Comfortability differs significantly among different income groups.

Sampling and Data Collection

This study was conducted using an empirical method, where the participants were chosen using a specific selection process. Only individuals who had previously used digital transaction were included in the survey. The survey was distributed to 75 individuals who agreed to participate, and after reviewing the responses, 46 were found to be fully filled out and were used for analysis. The response rate for the study was 61.33%. The data was analyzed using MS Excel and SPSS software.

This study used a combination of techniques to analyze the data collected from the survey. Two methods were employed: the traditional p-value method and the Bootstrap Class Interval (CI) method. Both independent sample t-test and one way ANOVA were used to evaluate the significance of the results. The Bootstrap method, known for its robustness, was chosen due to the small sample size in each demographic group. The Bias-corrected and accelerated (BCa) version of Bootstrap was used to account for the unequal sample size. The study also reported the effect size for all findings.

Reliability and Validity

The reliability of the questionnaire was established by administering it twice to a sample of 10 participants who were also included in the main survey. The test-retest method was used to calculate the reliability coefficient, which was found to be 0.80, indicating a high level of reliability. This suggests that the questionnaire is consistent and stable in measuring the concepts of security concerns and comfortability with digital transaction ushers. Overall, both validity and reliability of the questionnaire were established through a subjective approach by seeking feedback from experts and testing the questionnaire on a sample of participants.

Scope

This research focused specifically on the perceived security concerns and ease of use of digital transactions during the COVID-19 pandemic, and how these perceptions are affected by gender and income. The sample was collected from the city of Baroda, and the study sought to understand users' subjective experiences rather than technical aspects of security and usability.

Limitation

This study was restricted to a specific urban area, Baroda, and did not include rural areas in the sample. The method of selecting participants, purposive sampling, may not accurately represent the larger population. The research was also limited to the examination of security concerns and comfortability when using digital transactions, and did not consider other factors. Additionally, the impact of demographic factors other than gender and income was not studied.

Data Analysis and results

The data in the table 1 indicates that a majority of the respondents, 87%, regularly use digital transactions. Out of these, the majority, 69.8%, are comfortable with digital transactions, while a small percentage, 9.3%, are not comfortable. A relatively neutral group, 20.9%, is not particularly for or against digital transactions. However, a significant number of respondents, 44.1%, have concerns about the safety of their money when using digital transactions. Additionally, many respondents, 45.2%, are worried about the possibility of their accounts being hacked. A small percentage, 18.7%, believe that the one-time passwords (OTP) used for security cannot be cracked. Many respondents, 44.2%, think that fingerprint recognition would improve security for e-wallets, while 7% suggest using face recognition. Some other suggestions for improved security include using OTP and drawing patterns.

| Table 1 Demographics of Respondents | ||

| Variable | F | (%) |

| Gender : Male (1) Female (2) Age: 18 to 24 Years (1) 24 to 31 Years (2) 31 to 38 Years (3) Income: Below Rs. 10,000 (1) Rs. 10,000 to Rs. 50,000 (2) Rs. 50,000 and Above (3) |

35 11 24 08 11 12 13 21 |

76.1 23.9 52.2 17.4 30.4 26.1 28.3 45.7 |

| Note: n=46 | ||

The values of skewness (Sk) and kurtosis (Kr) for “security” (Sk = - 0.484, Kr = 0.021) and “comfort” (Sk = - 1.212, Kr = 1.142) (Table 2) using digital transactions were within the normal range, indicating that the data were normally distributed(Darren and Mallery, 2011). Therefore, parametric tests such as t-test and ANOVA were used to test the significance of the results. The number of cases in each class of demographic variables was not equal (Table 1), so the bootstrap robust method was used (Field, 2009). The Bias corrected and accelerated (BCa) method of bootstrap was used specifically because of the unequal sample sizes and less than 30 sample sizes. It is recommended to use 2,000 bootstrap samples, which the authors followed while analyzing the data (Chen and Peng, 2014).

| Table 2 Descriptive Statistics: Comforts and Securities | |||||

| Variable | N | Mean | SD | Skewness (Sk) | Kurtosis (Kr) |

| Comfort Security | 46 46 |

3.891 3.500 |

1.1591 1.0904 |

-1.212 -0.484 |

1.142 0.021 |

Hypothesis Testing

H1. There is a significant difference in security concerns between male and female.

The mean value of overall "security concern" is 3.500, and the standard deviation is 1.0904, as shown in Table 2. This suggests that some people have security concerns while others do not. The researchers hypothesized that the gender of users might influence security concerns. To test this, they used an independent t-test. To ensure the robustness of the findings, they also used the Bias corrected and accelerated (BCa) method of bootstrap and calculated an effect size.

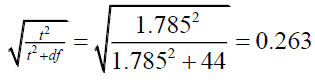

Calculation of Effect Size (r) =

It was observed that male users (M = 3.657, SD = 1.11) (Table 3) were more concerned than female users (M = 3.00, SD = 0.89) (Table 3) about digital transaction security. This difference was not significant t(44) = 1.785, p > 0.05 (Table 4) and the effect size was r = 0.263. The effect size value of 0.3 is considered as a medium effect while 0.5 is considered a large effect (Field, 2009). Therefore, effect size value 0.263 indicates that the effect size for the above test was below medium. This result was further confirmed by a robust estimate of 95% Class Intervals (CI) by BCa method of bootstrap. The bootstrapped CI (lower bound = - 0.0264 and upper bound = 1.2718 (Tables 5-7) did not include zero indicating the difference was indeed significant. The male respondents were found to be neutral on this question. This may be indicating a high-risk propensity of the younger population, as most of the respondents in this study were of young age (up to 30 years of age). The younger population is known to take a high risk (Bonsang and Dohmen, 2015; Dohmen et al., 2017).

| Table 3 Group Statistics Security by Gender | |||||||

| Variable | Gender | Measure | Statistic | Bootstrapa | |||

| Bias | Std. Error | BCa 95% CI | |||||

| Lower | Upper | ||||||

| Security | Male Female |

Mean Std. Deviation Std. Error Mean Mean Std. Deviation Std. Error Mean |

3.657 1.1099 0.1876 3.000 0.8944 0.2697 |

0.003 -0.0299 0.002 -0.0778 |

0.186 0.1534 0.277 0.2335 |

3.274 0.8220 2.583 0.4924 |

4.000 1.3182 3.461 1.1353 |

| Table 4 Independent Samples Test Security by Gender | |||||||||

| Levene’s Test for Equality of Variance | t-test for Equality of Means | ||||||||

| t | Df | Sig. (2-tailed) | Mean Diff. | Std. Error Diff. | 95% CI | ||||

| F | Sig. | Lower | Upper | ||||||

| Security Equal variance assumed Equal Variance not assumed |

1.903 | 0.175 | 1.785 2.000 |

44 20.602 |

0.081 0.059 |

0.6571 0.6571 |

0.3681 0.3285 |

-0.0846 -0.0269 |

1.3989 1.3411 |

| Table 5 Bootstrap for Independent Sample Security by Gender | ||||||

| Mean Diff. | Bootstrapa | |||||

| Bias | Std. Error | Sig. (2 Tailed) | BCa 95% CI | |||

| Lower | Upper | |||||

| Security Equal variance assumed Equal Variance not assumed |

0.6571 0.6571 |

0.0008 0.0008 |

0.3348 0.3348 |

0.057 0.077 |

-0.0264 -0.0264 |

1.2718 1.2718 |

| Table 6 Group Statistics Comfort by Gender | |||||||

| Variable | Gender | Measure | Statistic | Bootstrapa | |||

| Bias | Std. Error | BCa 95% CI | |||||

| Lower | Upper | ||||||

| Comfort | Male Female |

Mean Std. Deviation Std. Error Mean Mean Std. Deviation Std. Error Mean |

4.029 1.2482 0.2110 3.455 0.6876 0.2073 |

0.010 -0.0473 0.206 -0.545 |

0.203 0.2047 0.206 0.1712 |

3.605 0.8237 3.100 0.4216 |

4.433 1.5002 3.900 0.8433 |

| Table 7 Independent Samples Test Comfort by Gender | |||||||||

| Levene’s Test for Equality of Variance | t-test for Equality of Means | ||||||||

| t | df | Sig. (2-tailed) | Mean Diff. | Std. Error Diff. | 95% CI | ||||

| F | Sig. | Lower | Upper | ||||||

| Security Equal variance assumed Equal Variance not assumed |

0.799 | 0.376 | 1.450 1.941 |

44 31.504 |

0.154 0.061 |

0.5740 0.5740 |

0.3958 0.2958 |

-0.2237 -0.0288 |

1.3718 1/1769 |

H2. There is a significant difference between Male and Female in their comfort using digital transactions.

The data analysis indicated that gender has an influence on user comfortability with digital transactions, and an independent t-test was used to assess this difference. The mean value of 3.891 and a standard deviation of 1.1591 (Table 2) suggests that the respondents were slightly comfortable with digital transactions. To further strengthen the findings, the BCa method of bootstrapping was used to calculate the effect size.

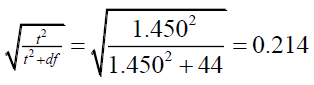

Calculation of Effect Size (r) =

“It was observed that female users (M = 3.455, SD= 0.6876) (Table 6) were less comfortable using digital transaction than male users (M = 4.029, SD = 1.2482) (Table 6). This difference was not significant t(44)= 1.450, p > 0.05 (Table 7) and the effect size was r =0.214. The effect size value of 0.1 is considered a small effect while 0.3 is considered a medium effect (Field, 2009). Therefore, effect size value 0.214 indicates that the effect size for the above test was small to medium. The result was further confirmed by a robust estimate of 95% class intervals (CI) by BCa method of bootstrap. The bootstrapped CI (lower bound = -0.0234 and upper bound = 1.1087, (Table 8) include zero indicating the difference was indeed not significant.”

| Table 8 Bootstrap for Independent Sample Comfort by Gender | |||||

| Mean Diff. | Bootstrapa | ||||

| Bias | Std. Error | BCa 95% CI | |||

| Lower | Upper | ||||

| Security Equal variance assumed Equal Variance not assumed |

0.5740 0.5740 |

0.0050 0.0050 |

0.2906 0.2906 |

-0.0234 -0.0234 |

1.1087 1.1087 |

H3. Security concerns differ significantly among different income groups.

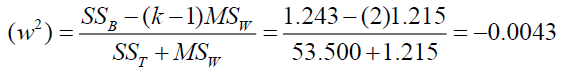

The hypothesis was that the level of income affects users' security concerns in digital transactions. To determine the difference between income groups in terms of security concern, One-way ANOVA and Welch's ANOVA were used, with the latter being a robust procedure when unequal variances were suspected (Field, 2009). The number of cases in each income group was not equal (Tables 9-11), so the BCa method of bootstrapping was applied (Chen and Peng, 2014).We also calculated the effect size:

| Table 9 Test of Homogeneity of Variance – Security by Income | |||

| Levene Statistics | Df1 | Df2 | Sig. |

| 0.494 | 2 | 43 | 0.614 |

| Table 10 Anova Security by Income | |||||

| Particular | Sum of Squares | df | Mean Square | F | Sig. |

| Between Groups Within Groups Total |

1.243 52.257 53.500 |

2 43 45 |

0.621 1.215 |

0.511 | 0.603 |

| Table 11 Anova- (Robust Test) Security by Income | ||||

| Test | Statisticsa | Df1 | Df2 | Sig. |

| Welch | 0.613 | 2 | 26.351 | 0.549 |

Calculation of Effect size

Where: SSB = sum of squares between the groups, SST = sum of squares total, MSW = mean square within the groups, K = number of levels of an independent variable.

There was no significant difference in security concerns among various income groups, F (2, 43) = 0.511, p > 0.05, = -0.0043 (Tables 10 & 11). The effect size was small as the value was close to -0.0043 (Olejnik and Algina, 2000). As the variances among different income groups were equal (Levene’s Test: p > 0.05) (Table 12), post hoc test for equal variance- LSD was used to find out which income group differs significantly from others in regard to their security concerns.

| Table 12 Post Doc Test (LSD) Security by Income Multiple Comparison | ||||||

| (I)Income | (J) Income | Mean Diff. (I-J) | Std. Error | Sig. | 95% CI | |

| Lower | Upper | |||||

| Below 10k 10k to 50k 50k and above |

10k to 50k 50k and above Below 10k 50k and above Below 10k 10k to 50k |

0.4423 0.2738 -0.4423 -0.1685 -0.2738 0.1685 |

0.4413 0.3989 0.4413 0.3890 0.3989 0.3890 |

0.322 0.496 0.322 0.667 0.496 0.667 |

-0.448 -0.531 -1.332 -0.953 -1.078 -0.616 |

1.332 1.078 0.448 0.616 0.531 0.953 |

The results showed that individuals in the middle-income group (10k to 50k) were more concerned about the security of digital transactions compared to those in the lower-income group (less than 10k). This is partially aligned with the findings of (Grable, 2000), which revealed that the middle-income group was more risk-averse and had higher security concerns regarding digital transactions than the lower-income group.

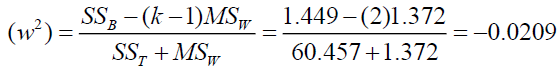

H4. Comfortability differs significantly among different income groups.

There was no significant difference in comfortability of using digital transaction among various income groups, F(2, 43) = 0.528, p > 0.05 (Tables 13-15), = -0.0209. The negative omega square value is interpreted as 0 (Tunks, 1978) and indicates no effect. The mean values of each income group were close to 5 (Tables 15 & 16) indicate that irrespective of the level of income all respondents were “slightly comfortable” (on a five-point scale 5 = highly comfortable) with the use of digital transaction.

| Table 13 Bootstrap Post Doc Test (LSD) Security by Income Multiple Comparison | ||||||

| (I)Income | (J) Income | Mean Diff. (I-J) | Bootstrapa | |||

| Bias | Std. Error | 95% CI | ||||

| Lower | Upper | |||||

| Below 10k 10k to 50k 50k and above |

10k to 50k 50k and above Below 10k 50k and above Below 10k 10k to 50k |

0.4423 0.2738 -0.4423 -0.1685 -0.2738 0.1685 |

-0.0074 -0.0073 0.0074 0.0001 0.0073 -0.0001 |

0.3880 0.3776 0.3880 0.3910 0.3776 0.3910 |

-0.2760 -0.5000 -1.2857 -1.0209 -0.9698 -0.5340 |

1.1768 1.0000 0.3523 0.6021 0.4667 0.9371 |

| Table 14 Test of Homogeneity of Variance – Comfort by Income | |||

| Levene Statistics | df1 | df2 | Sig. |

| 0.530 | 2 | 43 | 0.592 |

| Table 15 Anova Comfort by Income | |||||

| Particular | Sum of Squares | df | Mean Square | F | Sig. |

| Between Groups Within Groups Total |

1.449 59.007 60.457 |

2 43 45 |

0.725 1.372 |

0.528 | 0.592 |

| Table 16 Anova- (Robust Test) Comfort by Income | ||||

| Test | Statisticsa | Df1 | Df2 | Sig. |

| Welch | 0.692 | 2 | 26.049 | 0.510 |

Calculation of Effect size

Discussion and Conclusion

COVID-19 Pandemic forced people to use digital payment applications. There is an unprecedented surge in the usage of such applications. Not all people are comfortable and even willing to use digital transactions. However, they are compelled due to the outbreak of the CORONA virus. In this context, researcher attempted to capture the comfortability and security concerns of digital transactions users and the influence of demographic variables like gender and income on it. Researcher found that male users have more concerned about digital transactions security than female users.

This finding is although consistent with findings of (Grable, 2000) but, not in conformity with the findings of (Schubert et al. 1999), who argued that both men and women have similar risk propensity in a given context. This study showed that people from the middle-income group are more concerned about the security of digital transactions than the people from the lower-income group. This is partially consistent with the findings of the previous study of (Grable, 2000), who reported that higher income groups are more tolerant of financial risk. Our findings suggest that gender and income have no influence on comfortability in using digital transactions.

This result is inconsistent with our reasoning about the relationship between income and risk propensity. A separate detailed study needs to be carried out to investigate the relationship between demographics and comfortability using digital payment technology. This study concludes that security concerns prevailed irrespective of the forceful adoption of digital transactions due to the COVID-19 pandemic.

Research Implication

This study covered the influence of two demographic variables “gender” and “income” on security and comfort in using digital transactions. Other demographic variables such as age, education, occupation and area of residence (rural or urban) need to be investigated. This study was confined to the single city of India i.e. Baroda. Only the urban population was studied. There is a need to conduct a further study with the inclusion of the rural population. From the findings of this study, researcher argues that the middle-income group in India is more risk intolerant than the lower-income group while higher and lower-income groups are indifferent. A separate detailed study is recommended for additional support. This study used an innovative multi-method approach of analysis and use of bootstrapping. This may encourage other researchers to adopt such approaches.

References

Bonsang, E., & Dohmen, T. (2015). Risk attitude and cognitive aging. Journal of Economic Behavior & Organization, 112, 112-126.

Indexed at, Google Scholar, Cross Ref

Brahmbhatt, M. (2018), “A study on customers’ perception towards E-Wallets in Ahmedabad city”, IUJ Journal of Management, Vol. 6 No. 1.

Chen, L. and Peng, C.J. (2014), “The sensitivity of three methods to nonnormality and unequal variances in interval estimation of effect sizes”, Behavior Research Methods, Vol. 47 No. 1, pp. 107-126.

Darren, G. and Mallery, P. (2011), SPSS for Windows Step by Step: A Simple Guide and Reference, 11th ed., Pearson Education Inc.

Desai, R.D. (2020), “Cybercrime in India surges amidst coronavirus lockdown”, Retrieved May 27, 2020, from A website of Forbes, available at: www.forbes.com/sites/ronakdesai/2020/05/14/ cybercrime-in-india-surges-amidst-coronavirus-lockdown/#232e2aa2392e

Dohmen, T., Falk, A., Golsteyn, B., Huffman, D. and Sunde, U. (2017), “Risk attitudes across the life course”, The Economic Journal, Vol. 127 No. 605, pp. F95-F116

Indexed at, Google Scholar, Cross Ref

Field, A. (2009), Discovering Statistics Using SPSS, 3rd ed., SAGE Publications.

Gadgets360 (2020), “Over 500 million Indians now use smartphones, 77% of who are online: tech ARC”, Retrieved February 4, 2020, from A web site of NDTV, available at: https:// gadgets.ndtv.com/mobiles/news/over-500-million-indians-now-use-smartphones-77-percentof-who-are-online-techarc-2172219

Grable, J.E. (2000), “Financial risk tolerance and additional factors that affect risk taking in everyday money matters”, Journal of Business and Psychology, Vol. 14 No. 4, pp. 625-630.

Jung, I.Y. and Jang, G.-J. (2014),“A secure and reliable e-Wallet using a smart SSD”, Life Science Journal, Vol. 11 No. 7.

Karim, M.W., Haque, A., Ulfy, M.A., Hossain, M.A. and Anis, M.Z. (2020), “Factors influencing the use of E-wallet as a payment method among Malaysian young adults”, Journal of International Business and Management, Vol. 3 No. 2, pp. 1-11.

Kim, C., Tao, W., Shin, N. and Kim, K.S. (2010), “An empirical study of customers’ perceptions of security and trust in e-payment systems”, Electronic Commerce Research and Applications, Vol. 9 No. 1, pp. 84-95.

Kindberg, T., Sellen, A., & Geelhoed, E. (2004). Security and trust in mobile interactions: A study of users’ perceptions and reasoning. In International Conference on Ubiquitous Computing (pp. 196-213). Berlin, Heidelberg: Springer Berlin Heidelberg.

Indexed at, Google Scholar, Cross Ref

Kohli, R. (2018), “Women and banking: India’s financial inclusion suffers from a gender gap”, Financial Express. INDIA: Indian Express Group. Retrieved May 21, 2020, available at: www.financialexpress.com/opinion/women-banking-indias-financial-inclusion-suffers-froma-gender-gap/1173467/

Lai, P.C. (2016), “Design and security impact on consumers’ intention to use single platform E-payment”, Interdisciplinary Information Sciences, Vol. 22 No. 1, pp. 111-122, doi: 10.4036/iis.2016.r.05.

Madaan, N. (2020), “Pune: cybercrime complaints go past 2019 tally in 8 months”, The Times of India, Bennett, Coleman and Co. Ltd, Retrieved October 6, 2020, available at: https:// timesofindia.indiatimes.com/city/pune/cybercrime-complaints-go-past-2019-tally-in-8-mont hs/articleshow/77643486.cms

Mallat, N. (2007), “Exploring consumer adoption of mobile payments – a qualitative study”, The Journal of Strategic Information Systems, Vol. 16 No. 4, pp. 413-432.

Nachappa, M.N. and Lathesh, C.K. (2018), “Optimized e-Transaction to have a secure safe: EWallet”, IJISET - International Journal of Innovative Science, Engineering and Technology, Vol. 5 No. 9.

Nag, A. K., & Gilitwala, B. (2019). E-Wallet-factors affecting its intention to use. International Journal of Recent Technology and Engineering, 8(4), 3411-3415.

Indexed at, Google Scholar, Cross Ref

National Crime Records Bureau (2020), Crime in India 2019 (Statistics Volume I), National Crime Records Bureau, (Ministry of Home Affairs) Govt. of India, New Delhi, Retrieved October 6, 2020, available at: https://ncrb.gov.in/sites/default/files/CII%202019% 20Volume%201.pdf

Octavian, D. (2012), “E-wallet. A new technical approach”, Acta Universitatis Danubius. òconomica, Vol. 8, p. 84.

Olejnik, S. and Algina, J. (2000), “Measures of effect size for comparative studies: applications, interpretations, and limitations”, Contemporary Educational Psychology, Vol. 25 No. 3, pp. 241-286.

PTI (2020), 42% Indians have increased use of digital payments during COVID-19 lockdown: Report, Retrieved April 20, 2020, from Website of The New Indian Express, available at: www.newindianexpress.com/business/2020/apr/14/42-per-cent-indians-have-increased-useof-digital-payments-during-covid-19-lockdown-report-2130059.html

Salodkar, A., Shirbhate, M. and Morey, K. (2015), “Electronic wallet”, International Research Journal of Engineering and Technology (IRJET), Vol. 2 No. 9, pp. 975-977.

Schubert, R., Brown, M., Gysler, M., & Brachinger, H. W. (1999). Financial decision-making: are women really more risk averse?. American economic review, 89(2), 381-385.

Soodan, V., & Rana, A. (2020). Modeling customers' intention to use e-wallet in a developing nation: Extending UTAUT2 with security, privacy and savings. Journal of Electronic Commerce in Organizations (JECO), 18(1), 89-114.

Indexed at, Google Scholar, Cross Ref

Tunks, T. (1978). The use of omega squared in interpreting statistical significance. Bulletin of the Council for Research in Music Education, 28-34.

Umarji, V. (2016), “Www.business-standard.com”, Retrieved August 18, 2018, available at: www. business-standard.com/article/companies/after-iit-delhi-and-jnu-mobikwik-in-talks-with-iima-for-going-cashless-116122600866_1.html

Urs, B.A. (2015), “Security issues and solutions in e-payment systems”, Fiat Iustitia, Vol. 1, pp. 172-179.

Wijayanthi, I.M. (2019), “Behavioral intention of young consumers towards E-Wallet adoption: an empirical study among Indonesian users”, Russian Journal of Agricultural and Socio-Economic Sciences, 85(1), 79-93.

Indexed at, Google Scholar, Cross Ref

Received: 09-Jan-2025, Manuscript No. AMSJ-25-15600; Editor assigned: 10-Jan-2025, PreQC No. AMSJ-25-15600(PQ); Reviewed: 28- Mar-2025, QC No. AMSJ-25-15600; Revised: 20-Apr-2025, Manuscript No. AMSJ-25-15600(R); Published: 06-May-2025