Research Article: 2023 Vol: 27 Issue: 3S

Exploratory review of ESG factor attribution to the Portfolio Return in Fama-French Factor Model Framework

Sumit Kumar, Indian Institute of Management, Kozhikode

Citation Information: Kumar, S. (2023). Exploratory review of esg factor attribution to the portfolio return in fama-french factor model framework. Academy of Marketing Studies Journal, 27(S3), 1-20.

Abstract

Integrating ESG (Environment, Social and Governance) factors into the investment portfolio has become increasingly important in asset allocation and portfolio construction. We wanted to understand if the ESG factor integration positively contributes to the portfolio Alpha. We did a systematic review of more than 30 distinct & relevant literature which have used Fama-French factor model to validate the attribution of Portfolio Alpha to the ESG factors. Primary objective of this review paper is using the Fama-French Model Framework, determine the influence of ESG factor exposure on the Alpha of the equity investment portfolio. Examine the existence of cross-sectional bias and the possibility of modifying the Fama-French Model to account for any cross-sectional influence. Analysis of ESG factor attribution over a temporal axis using pre-UNSDG and post-UNSDG resolutions. We found that the alpha of a globally and regionally diversified portfolio cannot be linked to ESG factors or sustainable qualities. No relevant relationship exists between Portfolio Alpha and ESG Factor for a globally diversified portfolio. There is a positive link between Portfolio Alpha and ESG component, and this relationship holds for a regional portfolio whose asset allocation weight is mostly determined by the Developed Market portfolio. The risk-adjusted performance of a portfolio allocated to the Developed Market is positively benefited by the inclusion of ESG or sustainability factors. Regional bias in portfolio responses is typical and has been noted by previous investigations.

Keywords

ESG, Sustainability, Fama-French, Factor Model.

Introduction

In recent years, the number of global securities authorities and trading exchanges that recognize the importance of ESG (environmental, social, and governance) factors in investment has increased significantly. It is claimed that the environment, social responsibility, and governance are the three pillars of ESG. The following is an illustrative list (Table 1) of the items contained in the different pillars.

| Table 1

Three Pillars Of Esg With Indicative Components |

||

|---|---|---|

| E (Environment) | S (Social) | G (Governance) |

| Climate Change | Human Rights | Board Independence |

| Carbon Emission | Labour Standards | Board Diversity |

| Pollution | Poverty | Transparency |

| Resource Erosion | Equal Health Opportunities | Share Holder’s Participation |

| Biodiversity | Equal Education Opportunities | Employee Wellness |

| Green Coverage | Social Security | Equal Opportunity |

Eurosif (2014) defines ESG integration as the "explicit incorporation by asset managers of ESG risks and opportunities in traditional financial analysis and investment choices based on a systematic methodology and relevant research source." In recent years, there has been an increase in the evaluation and measurement of businesses based on their environmental (E), social (S), and governance (G) issues. Accepted in 2015, the Paris Climate Agreement and the United Nations Sustainable Development Goals (SDGs) have served as drivers for the adoption and monitoring of more sustainable company practices. There have been campaigns to increase corporate knowledge of ESG policies and issues, with the objective of having firms perceive these policies and issues as part of risk management, distinct from corporate social responsibility or CSR activities (UNPRI, 2018). Launched in 2007, the United Nations Principles for Responsible Investment (UN PRI) is an example of this program.

According to the World Bank (2018), ESG investing activities are defined as:

1. For the environmental (E) aspect, the common issues involve climate change, resource efficiency, pollution, biodiversity, and carbon emissions.

2. For the social (S) aspect, the key elements are related to health and safety, health and education, labor standards, community relations, human rights, and diversity policies.

3. For the governance (G) aspect, the key issues are law, transparency, corruption, institutional strength, and corporate governance.

There is empirical evidence that integrating ESG factors into a portfolio of assets results in a more stable return, less volatile stock performance, and a considerably greater risk-adjusted return on investment overall. Sustainable development was defined by the World Commission on Environment and Development in 1987. It was characterized as progress towards the future without sacrificing future generations' ability to fulfill their own needs.

ESG (Environment, Social and Governance) factors integration in investment portfolio is an essential market practice now. Environment concerns, social justice and inequality, governance concerns have become a risk in the financial decision making and it is practice factoring in, these risk in the portfolio construction.

The Fama-French Three-factor Model extends the Capital Asset Pricing Model (CAPM). The Fama-French model seeks to characterize stock returns based on three factors: (1) market risk, (2) outperformance of small-cap businesses relative to large-cap companies, and (3) outperformance of high book-to-market value companies vs low book-to-market value companies. The concept is based on the fact that high-value and small-cap firms consistently beat the general market. Despite its shortcomings, CAPM (Fama & French, 2004) has been widely utilized by practitioners to calculate needed rate of return. Fama French (Fama & French 1996, 2013) introduced their three-factor approach to overcome the constraints of the CAPM model. Sattar (2017) examines the practical implications and efficacy of the Fama French model vs the CAPM model in explaining excess return on the Dhaka Stock Exchange by evaluating five publicly traded cement manufacturers from 2004 to 2014. DGEN is used as a market index representative from 2004 to 2013, and afterwards DSEX is used. Simple and multiple linear regression analysis were used to the daily market return and the return of the different firms. After conducting cross sectional regression on the observed panel data, the results demonstrate that the adjusted R square of the Fama French model is greater than the adjusted R square of the CAPM model. It indicates that the Fama French model predicts variance in excess return above Rf better than the CAPM model for all five cement businesses over a ten-year period. The presence of a low p value indicates that the coefficients are statistically significant. Nonetheless, this article suggests that organizations who wish to utilize the Fama French model instead of CAPM should consider the time and effort necessary to employ the model before replacing CAPM with the multi factor model for stock return analysis.

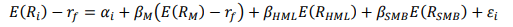

Three Factor

In a 1996 model, Eugene Fama and Kenneth French demonstrated that the return of a stock can be described by three factors: market return, firm size, and market to book value (MBR). The model equation is as follows:

Where E (RHML) is the difference between the returns of the high and low companies (high minus low), E (RSMB) is the difference between the returns of the small and big companies (Small minus big) and εi is the specific risk of ith firm.

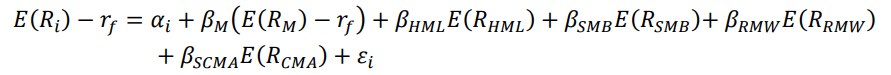

Five Factor Model

Two more parameters were added in November 2013 to the model Fama & French developed in 1996: profitability and investments.

Where RRMW is the difference between the returns of the companies with high and low profitability (Robust minus weak) and RCMA is the difference between the returns of the companies with big and small investments (Conservative minus Aggressive).

Table 2 (Claudia-Alina, 2015) summarize the explanation of portfolio variance by various models. As one notice the R-Squared is maximum with 5 factor FF (Fama and French) Model.

| Table 2

Summary Of The Findings |

|||||

|---|---|---|---|---|---|

| Reference | Year | Fama-French Factor | Analysis Framework | Alpha Attribution | Comment |

| Naffa & Fain | 2022 | 5 | ESG Vs. PPF Portfolio | Neutral | |

| Naff & Fain | 2020 | 5 | Mega-Trend Exposure | Neutral | |

| Pollard, Sherwood, and Klobus | 2018 | 3 | Cross-sectional Exposure | Positve | Regional & Geographical Dependence |

| Landi & Sciarelli | 2019 | 5 | CSR Performance | Neutral | |

| Maiti | 2019 | 3 | Risk Adjusted Return (Sharpe Ratio) | Positve | Regional & Geographical Dependence |

| Kumar | 2019 | 3 | Marginal Return over CAMP variables | Neutral | |

| Kumar | 2019 | 5 | Marginal Return over CAMP variables | Positve | Regional & Geographical Dependence |

| Shanaev & Ghimire | 2022 | 5 | Sustainability Factor Premium | Neutral | |

| Zahir & Aybars | 2020 | 3 | ESG Sectoral exposure | Neutral | |

| Diaz, Ibrushi, and Zhou | 2021 | 5 | Best vs. Worst of ESG Factor Exposure | Positve | Regional & Geographical Dependence |

| Chen & Yang | 2020 | 5 | ESG Momentum Analysis | Positve | Investment Horizon dependent |

| Ciciretti, Dalo, & Dam | 2019 | 3 | ESG risk factor Return | Negative | Sample set is not clear |

| Madhavan, Sobczyk and Ang | 2020 | 5 | ESG Factor Return | Positve | Regional & Geographical Dependence |

| Garcia-Amate et al. | 2022 | 3 | DJSI (Dow-Johns Sustainability Index) | Positive | Regional & Geographical Dependence |

| Quiros, Quiros, & Nogueira | 2020 | 5 | SRI Index sensitivity to the portfolio return | Positive | Regional & Geographical Dependence |

| Xiao et al | 2020 | 5 | Sustainability Factor Premium | Neutral | |

| Yue et al. | 2020 | 5 | Sharpe Ratio (Risk Adjusted Return) | Positve | |

| Lee, Faff, and Recker | 2020 | 5 | CSP (Corporate Social Performance) | Neutral | |

| Oberndorfer et al. | 2013 | 3 | ESG Risk factor Return | Negative | |

| Li & Wu | 2017 | 3 | Climate Friendly Stock Inclusion | Negative | |

| Gregory, Stead & Stead | 2020 | 5 | Sustainability performance and Cost of Capital | Positive | Regional & Geographical Dependence |

| Azevedo, Santos & Campos | 2016 | 5 | Sustainability factor return | Negative | |

| Lockwood and Probutr | 2010 | 3 | Sustainability factor exposure | Negative | |

| Lelassi & Rossolini | 2019 | 5 | Risk Adjusted Performance in SRI thematic Investments | Positive | Regional & Geographical Dependence |

| Herzel et al | 2011 | 3 | Sustainability constrained portfolio Return | Negative | |

| Mariani et al. | 2018 | 5 | ESG portfolio sensitivity | Positve | Regional & Geographical Dependence |

| Yang, Chen, and Xie | 2021 | 5 | Portfolio ESG factor Return | Neutral | |

| Fiskerstrand et al. | 2019 | 5 | Portfolio ESG factor Return | Neutral | |

| Huble and Scholz | 2020 | 5 | ESG Risk Variable attribution | Neutral | |

| Afrin and Shimada | 2020 | 5 | SRI factor investment | Positive | Event Based (Pre & Post Brexit) |

Applicability of Fama-French Model in ESG Factor Attribution

Investment portfolios are increasingly required to incorporate ESG elements (Environment, Social and Governance). It is now common practice to incorporate environmental, social, and governance risks into portfolio creation, since these issues have become a risk in financial decision-making. It has been increasingly essential to understand the portfolio Alpha attribution to the ESG factor exposure. There is an attempt to add a factor say RGMB which signifies the return due to difference between Good ESG stock vs. Bad ESG (Good minus Bad from ESG perspective).

The Fama-French five-factor model has been applied to assess the factor return on ESG integration in an investment portfolio in some fairly recent work and literature accessible. A growing interest in ESG-related investments has led to an academic and industry focus on the accurate attribution of ESG strategies' returns. Investors have started seeking for low-volatility and stable equities as a result of recent volatility and risk increases. Contrary to popular belief, including environmental, social, and governance (ESG) considerations into investing decisions has been shown to improve returns while reducing risk. There hasn't been enough research on how ESG issues affect the overall return on an investing portfolio.

Initial work

Ethics and morality were taken into account while assessing the financial performance of the investment portfolio by Barnett and Salomon (2006). However, the results of Becchetti et al. (2015) and Bello (2005) were not clear proof of the ESG factored return to the portfolio's overall returns.

The relative success of SRI vs conventional investments was studied by Hamilton (1993), who came up with three theories. The first hypothesis is that the risk-adjusted performance of SRI and traditional investing is identical. That an investment's socially responsible component is not valued by the market is implied by this statement. The second is that SRI investments have a lower expected return than conventional ones. Because investors typically underestimate the impact of unfavorable public information on firms that are not socially responsible, the third hypothesis states that SRI's projected return is higher than that of traditional investments.

ESG portfolios cannot be described by conventional characteristics such as market return, size, value, profitability, and investment, according to a recent Bloomberg (2020). They sought to ascribe the results of their ESG portfolios to the Fama French five-factor model. There are five characteristics that may be used to estimate the average stock return: profitability, value, size, and investing habits.

However, the factor model was not applied to portfolio allocations in the studies by Nagy et al. (2016) and Davis et al. (2017), who both utilized it to explain how ESG inclusion boosts portfolio returns.

Therefore, in this research we wanted to explore the literature which specifically applies the Factor Models as suggested by Fama and French (1996, 2013) to understand the explanatory capacity of Portfolio Alpha by inclusion of the ESG factor.

1. Objective

Objective of this review paper is to understand following:

1. Understand the ESG factor exposure’s impact to the Alpha of the equity investment portfolio using the Fama-French Model Framework.

2. Examine if there exists any cross-sectional bias and possible improvement in the Fama-French Model to incorporate any cross-sectional impact.

3. Study of ESG factor attribution on a time axis with pre- UNSDG and post-UNSDG resolutions.

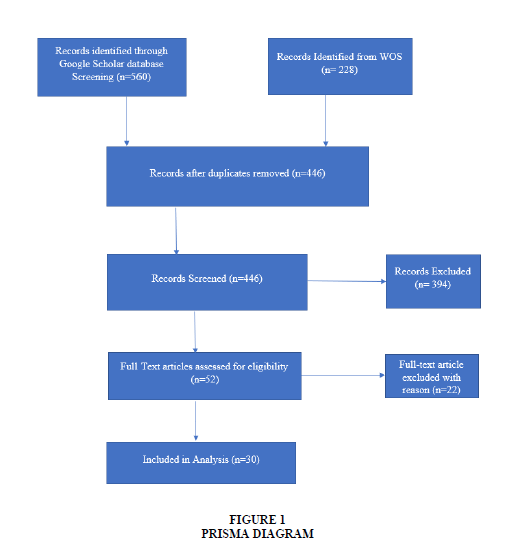

PRISMA Statement: A total of 788 research papers were initially screened. 560 of them from google scholar and 228 were sampled from Web of Science. 446 records were then screened in. Out of those 446 records, 394 were excluded based on the relevance score of the papers to the topic. 52 of them were further analyzed and again 22 of them were excluded for various reasons. Finally, a set of 30 research papers were selected for further review and analysis of the topic.

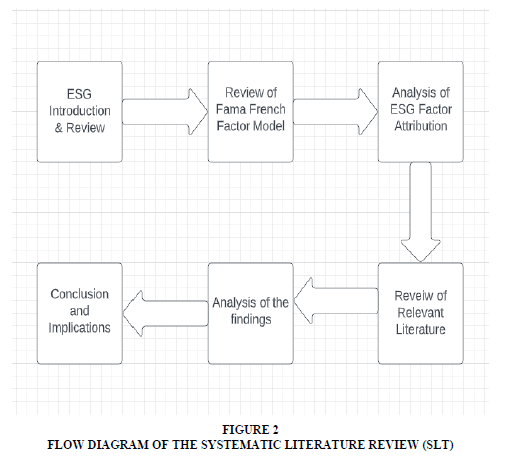

Flow of the analysis: We have done a systematic literature review (SLT) starting with conceptual introduction to ESG, followed by a review of the Fama-French Model framework which is our basic factor-based framework of analysis. We reviewed the ESG factors relevant for the analysis and based on these factors we collected relevant literature. A PRISMA statement of the literature is provided in Figure 1. The whole review process is depicted in figure 2 below.

Literature Review

In one of the works (Naffa & Fain, 2022) the performance of global ESG equities investments is measured using a factor methodology. They use Fama-MacBeth to build ESG pure factor portfolios (PFP), then use Fama-French (FF) spanning regressions to examine performance and the validity of adding new ESG factors to the FF 5-factor model. They utilize a GMM-IV estimator to deal with endogeneity. During the period 2015-2019, our ESG portfolios did not yield substantial alphas, confirming the literature's neutrality claim. ESG factors do not appear to be an adequate complement to Fama French 5 factor model. PFPs, on the other hand, might be used as ESG indices to quantify investment portfolio sustainability risks through ESG factor tilt performance attribution.

The study (Naff & Fain, 2020) examines the risk-adjusted financial performance of ESG-themed megatrend investing strategies in global stock markets. The analysis includes nine themes for 2015–2019. Environmental megatrends including energy efficiency, food security, and water scarcity; social megatrends encompassing aging, millennials, and urbanization; and governance megatrends encompassing cybersecurity, disruptive technologies, and robotics. They develop a unique metric for stock megatrend exposure (MTE) based on relative fund flows into themed ETFs. Fama-French factor returns are computed using an approach based on pure factor portfolios and restricted WLS cross-sectional regressions. Time-series regression is based on the generalized method of moments estimator (GMM) that employs robust distance instruments. In the framework of the Fama-French 5-factor model, this outperformance becomes statistically irrelevant. Importantly, the majority of megatrend factor portfolios generated large non-negative alphas, which confirms their hypothesis that the megatrend investment method advances SDGs without losing returns, even when transaction costs of up to 50bps per annum are accounted for. Higher transaction costs, as is the case with some of these ETFs with expense ratios approaching 80 to 100 bps, may be indicative of two things: ESG-themed megatrend investors were ready to forego around 30 to 50 basis points of yearly return to remain aligned with sustainability objectives, or this expense ratio is likely to fall in the future.

Another key study (Pollard, Sherwood, and Klobus, 2018) offers statistically substantial support for the empirical identification of Environmental, Social, and Governance (ESG) as a risk premium factor when included into an equity portfolio. This study aims to demonstrate that the conceptual development, adoption, and implementation of ESG research-based strategies are leading to the recording and acceptance of ESG risk premium as an intuitively and quantitatively independent risk premium. This study has proved empirically, through a cross-sectional examination of ESG studies that ESG premia regionally and longitudinally yield extra returns. In addition, this analysis demonstrates the potential for ESG premia to join other well-documented risk premia such as momentum, volatility, carry, size, value, and liquidity across asset classes.

In a related study (Landi & Sciarelli, 2019), the authors argue that the environmental, social, and governance (ESG) paradigm, which is intended to measure corporate social performance by rating issuance, can influence the abnormal returns of Italian firms listed on the Financial Times Stock Exchange Milano Indices di Borsa (FTSE MIB) Index from 2007 to 2015. To test the influence of an ESG Rating on a company's anomalous return, the authors created a panel data study using a Fixed Effects Model. They determined anomalous returns using the Fama–French method and calculated an annual Jensen's Performance Index for each business under consideration. The empirical findings indicate a rising interest in corporate social responsibility (CSR) and sustainability among managers in Italy over the past decade, as well as an improvement in the quality of ESG evaluations due to trustworthy corporate disclosure. Thus, despite the fact that investors have been employing ESG factors in their stock-selection processes, the authors discovered no positive and statistically significant impact in terms of market premium when they engaged in socially responsible investing (SRI).

One research on ESG investment (Maiti, 2019) covers three questions: first, if ESG is the next risk factor? Second, evaluate the importance of each ESG factor in investing decisions. Third is to establish a new, more comprehensive asset pricing model that incorporates ESG. This study demonstrates that three-factor models including market, size, and ESG aspects outperform the Fama–French model. Higher Sharpe ratios for ESG, environment, social, and governance variables suggest that portfolios based on these aspects outperform traditional size- and value-based portfolios in all circumstances. The fundamental conclusion of the study is that ESG, or ecological, social, and governance aspects, have a significant impact in forecasting returns and should therefore not be neglected when making investment decisions.

The paper (Kumar, 2019) explores the information content of Environment, Social, and Governance (ESG) from the standpoint of factor exposure. Using four wider MSCI USA ESG indexes, the author employs an ESG integration strategy in portfolio creation. Since the beginning of each of the four ESG indexes, assessments have been conducted using risk-return, CAPM, Fama-French three-factor, Fama-French-Carhart four-factor, Fama-French five-factor, and Fama-French-Carhart six-factor asset pricing models. The author shows that the CAPM market component explains the majority of the returns of these four indices, and that distinct asset pricing variables are highly related with the returns of these ESG indices. The results demonstrate that there is no information content in the total ESG score when developing a portfolio; instead, asset managers should use important elements comprising the overall ESG score when constructing portfolios. Institutional investors should fulfill their responsibility to assist low-scoring firms in modifying their structural framework in order to increase their overall ESG ratings and therefore obtain ESG momentum.

Related research (Shanaev & Ghimire, 2022) added a sustainability element to the Fama-French Model's five-factor model, in addition to the momentum factor. In addition, they augmented the earlier models by basing ours on the microeconomic principles of value maximization and the macroeconomic concepts of ecological economics. They calculated the sustainability factor premium and associated factor loadings and found that adopting sustainable strategic management methods lowered the cost of equity by between 1.6% and 2.9% per year worldwide. This means that sustainable strategic management methods enhanced global GDP by between $1.3 and $2.3 trillion in 2018. Our findings complement earlier studies indicating a negative correlation between sustainability performance and the cost of financing.

One more study (Zahir & Aybars, 2020), look at the performance of portfolios made up of stocks in Europe and Turkey and based on environmental, social, and governance (ESG) scores. To make the portfolios, all of the stocks are first ranked by their ESG (environmental, social, and governance) scores in descending order. Then, 10% of the stocks with the highest scores are put in the "Top" portfolio, and 10% of the stocks with the lowest scores are put in the "Bottom" portfolio. The performance of all eight portfolios is then looked at. Lastly, the capital asset pricing model (CAPM) and the Fama-French three-factor model are used as measuring sticks for performance. CAPM regression shows that two portfolios that use ESG-based scores do worse than the market index. Based on the results of the three-factor model, the Bottom ESG and Bottom GOV portfolios do better than the market by 0.57 percent and 0.53 percent, respectively. Overall, this paper's results show that there is no link between socially responsible investing (SRI) and how well a portfolio does. The efficient market hypothesis says that all information is reflected in prices, so these results are in line with that.

A related study (Diaz, et al. 2021) looks at how Environmental, Social, and Governance (ESG) ratings explain the different returns of different industries during the Covid-19 window. They use the difference in returns between companies in the top ESG quartile and those in the bottom ESG quartile to make our ESG factor. Along with the Fama-French factors, the ESG factor helps explain industry returns in a big way. They also look at the parts of ESG that have to do with the environment, society, and government. The main things that make the ESG impact on different industries are the environmental and social dimensions.

Integrating ESG issues into the investment process has evolved from a niche to a widespread practice. The study (Chen & Yang, 2020) extended the Fama-French Model to demonstrate that investors routinely overstate corporate ESG information, resulting in ESG momentum effects in financial markets. Specifically, investors respond positively to positive news about firms with higher ESG ratings, but negatively to negative news about companies with lower ESG scores. Consistent with the overreaction hypothesis, the empirical findings indicate that an ESG momentum approach can result in considerable short-term profits and long-term losses. In addition, this study demonstrates that investors overreact to environmental variables more than social or governance ones.

Low-scoring environmental, social and governance (ESG) factors are associated with greater projected returns. This negative ESG premium may be attributable to the increased risk associated with low ESG ratings, or it may indicate investors' preference for companies with strong ESG scores. The first driver suggests a systematic, underlying ESG risk factor, such that the betas of ESG risk factors explain variances in projected returns. The second driver suggests that ESG-specific corporate features are responsible for the ESG premium. To identify the separate contributions of ESG betas and ESG characteristics for explaining variation in expected returns, a study (Ciciretti, et al. 2019) employs two global data sets from 2004 to 2018 and extends the FF Model, which reveals that ESG characteristics explain variation in expected returns the most. A fall of one standard deviation in ESG ratings is related with a 13-basis-point rise in monthly projected returns.

Madhavan, Sobczyk and Ang (2020) studied the relationship between bottom-up, holdings-based environmental, social, and governance (ESG) ratings and funds' active returns, style factor loadings, and alphas using data on 1,312 active US equities mutual funds with $3.9 trillion in assets under management. We discovered that funds with high ESG ratings had factor loading profiles that differ from those of funds with poor ESG scores. Specifically, funds with high environmental ratings are characterized by strong quality and momentum factor loadings. After separating the ESG scores into factor-related and idiosyncratic components, we discovered large positive correlations between fund alphas and factor ESG ratings.

Garcia-Amate et al. (2022) investigate the allure of the regional Dow Jones Sustainability Indexes (DJSI) and other renewable energy indexes from December 31, 2010 to December 31, 2019. This study employs a risk-reward analysis and a number of explanatory variables. This study concludes with a comparison of these indices to traditional indexes. Regional DJSIs have generated returns both above and below traditional indexes, as seen by the data. In contrast, renewable energy indices were undesirable to investors due to their large betas and negative returns.

An intriguing study (Quiros, Quiros, & Nogueira, 2020) focuses on assets related to Sustainable Development Goals (SDGs), which are the most recent component of the Socially Responsible Investment framework and have attracted investors' attention due to their investment opportunities and the global challenges that can be met. Even when transaction expenses are considered, the profitability of designing an investing strategy is determined by the value of the alphas produced from the estimation of the Fama-French five-factor model as compared to an equally weighted portfolio.

Similar research (Xiao et al., 2020) is conducted to empirically evaluate if business sustainability has a "global price." This is evaluated using traditional asset pricing models, specifically by determining if a risk premium attaches to a sustainability component after adjusting for Fama–French variables. Formulation and application of both time-series and cross-sectional tests. The results indicate that (1) global Fama–French variables have a high ability to explain global equity returns and (2) sustainability investments have no appreciable effect on global equity returns. The absence of a significant relationship between sustainability and returns suggests that large institutional investors are free to implement sustainability mandates without fear of breaching their fiduciary responsibilities by realizing negative returns as a result of incorporating a sustainability investment process.

A quantitative investigation was conducted (Yue et al., 2020) to determine the potential benefits and advantages of sustainable investing. Without considering the social benefits of investing in sustainable funds, this study compares the performance and financial returns of sustainable and conventional funds. Comparing samples of 30 sustainable funds with 30 typical funds, the study was conducted in two phases. Initial calculations and analyses included yearly returns, standard deviations, Sharpe ratios, skewness, and kurtosis. Diverse market portfolios were valued by the Capital Asset Pricing Model (CAPM), Fama–French three-factor model, and Carhart four-factor model. This study indicates that sustainable funds are less hazardous than conventional funds. Nonetheless, we want to emphasize the need to consider the duration of our study and to keep in mind that a growing demand for socially responsible investments also raises associated risks. However, there was no conclusive proof that sustainable funds may offer greater returns than standard piers or the benchmark index. In addition, the study demonstrates that the Fama–French three-factor model was the best acceptable for describing the results of traditional and sustainable funds after examining various methodologies.

A second study (Lee, et al. 2020) examines whether portfolios of high ranked corporate social performance (CSP) businesses outperform or underperform portfolios of low ranked CSP firms. The authors utilized a U.S. sample spanning the years 1998 to 2007. The results are consistent with the "no linkage" hypothesis, which contends that there should be no substantial difference in the risk adjusted performance of high and low ranked CSP formed portfolios. In addition, there was no indication that high or low ranked CSP formed portfolios, regardless of portfolio formation technique, consistently differ in performance, size, book to market or momentum aspects.

In order to get accurate estimation results, one study (Oberndorfer et al., 2013) used a (short-term) event study technique based on both a modern asset pricing model, notably the three-factor model according to Fama and French, and a t-GARCH (1,1) model. Our empirical findings imply that the inclusion of a company in sustainability stock indexes may incur a penalty on the stock market. This result is mostly influenced by the inclusion in the DJSI World, which has a very unfavorable impact. In contrast, we find no significant average cumulative anomalous returns for DJSI S&P 500 components. This indicates that inclusion in a more prominent sustainability stock index may have greater negative consequences.

Researchers, practitioners, and the government must be aware of environmental sustainability's benefits and drawbacks. In a similar study (Li & Wu, 2017), researchers assess the effect of Chinese industrial, wholesale, and retail companies' ecologically friendly claims on their stock market success. Initially, there are enormous and statistically significant negative market reactions. Second, the responses of the stock market differ by industry and company. Third, the responses of the stock market differ from year to year. The Fama–French three-factor model is utilized to restrict firm size and book-to-market ratio. The conclusion is pretty consistent with what the basic market model predicted.

Gregory, Stead & Stead (2020) establish an enhanced asset evaluation model known as the environmental, social, and governance (ESG) model, which incorporates a sustainability component to account for the value of ecological and natural capital. The Fama-French Five-Element Asset Pricing Model is modified to include a sustainability factor. They advance prior models by basing their own on the microeconomic principles of value maximization and the macroeconomic concepts of ecological economics. They evaluate the sustainability factor premium and associated factor loadings and show that adopting sustainable strategic management techniques reduces the cost of equity by between 1.6% and 2.9% annually throughout the globe. This indicates that sustainable strategic management methods enhanced global GDP by between $1.3 and $2.3 trillion in 2018. According to their findings, there is a negative correlation between sustainability performance and the cost of capital.

Another research (Gupta & Benson, 2011) aims to address a gap in the current literature by examining whether sustainable enterprises can effectively compete in terms of financial performance and investor appeal. Their sample is comprised of companies that feature in the Innovest "Global 100" rankings, which are published yearly at the World Economic Forum in Davos, Switzerland. Their empirical findings reveal that sustainable firms do not underperform the stock market as a whole and are regarded as highly competitive within their respective industries. By integrating standard corporate strategy and competitive advantage theories to the performance of sustainable firms, they give a theoretical foundation for these outcomes.

Another study (Azevedo, Santos & Campos, 2016) examines the effect of business sustainability on asset values. To this end, they design a unique corporate sustainability factor and examine the extent to which this factor is priced in an enhanced four-factor version of Fama and French's (1993) standard asset pricing model. The corporate sustainability factor is based on a portfolio that is long companies with high sustainability and short stocks with poor sustainability. They utilize Brazilian stock market data to evaluate alternative model specifications with various combinations of four explanatory variables: the corporate sustainability premium, the market risk premium, the size premium, and the book-to-market premium. Our findings imply that business sustainability is priced, which helps to explain the cross-sectional heterogeneity of predicted stock returns.

Lockwood and Probutr (2010) investigate the relationship between sustainable growth and stock returns between 1964 and 2007. High sustainable development enterprises have a low default risk, low book-to-market ratios, and poor subsequent returns, according to the findings. They also utilized the Fama-French 3 factor model and concluded that, among the four components of sustainable growth, the net profit margin is the most influential in determining future returns. After adjusting for asset growth and capital expenditure growth, the results continue. Additional experiments demonstrate that the sustainable growth impact is due to risk and not price error.

Lelassi & Rossolini (2019) attempted to compare the risk-adjusted performance of sustainability-themed funds with other categories of mutual funds: sustainable and responsible mutual funds that implement different portfolio selection and management strategies, and thematic funds not committed to responsible investments. The study analyzes a sample of around 1000 European open-end mutual funds, of which 302 are sustainability-themed, 358 are responsible, and 341 are other themes. Risk-adjusted performance for the period 2007–2017 is studied using three distinct methodologies: a Capital Asset Pricing Model (CAPM) with a single component, a Fama and French 3-factor model, and a Fama and French 5-factor model. Their primary findings indicate that the risk-adjusted performance of ST funds is more strongly correlated with their responsible nature than with their thematic approach. Long-term performance study confirms that sustainability-themed mutual funds are more similar to other socially responsible funds than to other thematic funds. In addition, they are superior to other themed funds in their ability to weather financial turmoil and now benefit from SRI regulation and disclosure.

One research (Herzel et al., 2011) examined the impact of including sustainability-related constraints in optimal portfolio decision-making. Our analysis covered an investment set containing the components of the S&P500 index from 1993 to 2008. Optimizations were performed according to the classic mean–variance approach, while sustainability constraints were introduced by eliminating, from the investment pool, those assets that do not comply with the given social responsibility criteria (screening). We compared the efficient frontiers with and without screening. The analysis focused on the three main dimensions of sustainability, namely the environmental, social and governance ones. We found that socially responsible screening gives rise to a small loss in terms of the Sharpe ratio even though it has a great impact on the market capitalization of the optimal portfolio. The spanning test showed that the ex-post differences between the two frontiers, when short selling is not allowed, are significant only in the case of environmental screening.

The purpose of the research conducted by Mariani et al. (2018) is to establish the degree of association between the implementation of sustainable policies and financial performance. The Fama-French Five Factor Model has been utilized for this purpose. This study is focused on confirming the notion that sustainable and environmentally friendly components favorably impact the performance of investment portfolios, with a particular emphasis on the European property management sector. Therefore, the ambitious goal of this study is to fill the vacuum in the present literature on REITs, which focuses mostly on the U.S. market. Relation is found to be positive.

This research by Yang, Chen, and Xie (2021) comprises two distinct investigations. The first research is devoted to examining the persistence impact by analyzing the performance of portfolios ranked according to their prior performance under various factor models. The result indicates that the predictability increases with decreasing holding duration and that the multifactor model has the greatest explanatory power for the excess return with respect to the underlying components. The second research investigates the impact of sustainable investment on alpha by adding a new sustainable factor that reflects the premium resulting from exposure to sin industries. The results of the analysis indicate that there is no substantial alpha associated with sustainable investing and no meaningful return differential between funds with high and low exposure to the sustainable factor.

Fiskerstrand et al. (2019) examine the correlation between environmental, social, and corporate governance (ESG) ratings and financial success on the Norwegian stock exchange. Using the Dow Jones Sustainability Nordic Index and Norwegian stock data from 2009 to 2018, they ranked firms in terms of their sensitivity and exposure (beta) to ESG criteria. A portfolio strategy and cross-sectional regression are utilized by the econometric framework. The created ESG portfolios do not exhibit a substantial difference in return based on a high-low approach that is resilient for market sensitivity, investment style, and industry bias. Regarding the ESG factor's explanatory power and price, they find no supportive data. Their findings do not reveal a correlation between ESG and stock market performance in Norway.

Huble and Scholz (2020) investigated three ESG risk variables (Environmental, Social, and Governance) to measure firms' ESG risk exposures. When these aspects are taken into account, standard asset pricing models become significantly more understandable. They show that portfolios with notable ESG risk exposures have much higher risks, but investors may build portfolios with lower ESG risk exposures and still achieve risk-adjusted performance. Furthermore, investors may easily regulate ESG risks for equities without qualitative ESG information by measuring the ESG risk exposures of all firms in their portfolios using simple stock returns. Strategically managing ESG risks may result in potential advantages for investors. Afrin and Shimada (2020) analyze the performance and resilience of socially responsible and conventional funds listed in the Japan Investment Trust Association (JITA) amid two economic shocks in 2016 (the United States election and Brexit). An event study with a market model using ordinary least squares (OLS), an event study with a market model using exponential generalized autoregressive heteroscedasticity (EGARCH), and an event study with a Fama–French multi-factor model was used to avoid common features of return data such as non-normality, heteroscedasticity, and cross-correlation. The recent U.S. election had a substantial positive influence, but the Brexit referendum event had a big negative shock on fund returns in Japan around the event window, according to this analysis. According to the empirical data, socially responsible funds were more robust to uncertainties surrounding the recent U.S. presidential election, but conventional funds were more sensitive during the Brexit referendum. These findings have substantial implications for the best strategies of institutional or individual investors who have direct or indirect exposure to fund volatility risk in Japan.

Results and Analysis

We have analyzed 30 research papers to understand the relationship of Portfolio Alpha to the ESG factor exposure of the portfolio. Table 2 provides a summary of the result. We put the results into following three categories based on how the Portfolio ESG exposures impact the Alpha of the portfolio.

1. Neutral: There is no linkage between ESG factor exposure and the portfolio Alpha suing the Fama-French Model framework.

2. Positive: ESG factor inclusion positively influences the portfolio, Alpha.

3. Negative: There is an inverse relationship between ESG factors to the portfolio Alpha

Out of the 30 papers analyzed, we found the 6 of them found a negative relationship between Alpha of the portfolio to the ESG factor exposure, while 13 research supported a positive influence of ESG factor exposure to the portfolio Alpha. 11 papers do find any significant relationship between portfolio Alpha and the ESG/ Sustainability exposure of the portfolio. Table 3 depicts the breakdown of the findings.

| Table 3 Alpha To Esg Factor Relationship |

|

|---|---|

| Alpha to ESG Factor | Instances |

| Negative | 6 |

| Neutral | 11 |

| Positive | 13 |

| Grand Total | 30 |

Positively related Alpha with ESG: One story that we have consistently noted in our review is that wherever there is a positive relationship noted between Portfolio Alpha and the portfolio’s ESG factor exposure, the data was primarily taken by developed market. Portfolio allocation this case was heavily skewed towards the developed market entity so there was a regional and geographical bias in the asset allocation in that portfolio. Table 4 depict some of that research.

| Table 4

Positively Related Alpha With Esg |

|||||

|---|---|---|---|---|---|

| Reference | Year | Fama-French Factor | Analysis Framework | Alpha Attribution | Comment |

| Pollard, Sherwood, and Klobus | 2018 | 3 | Cross-sectional Exposure | Positive | Regional & Geographical Dependence |

| Maiti | 2019 | 3 | Risk Adjusted Return (Sharpe Ratio ) | Positive | Regional & Geographical Dependence |

| Kumar | 2019 | 5 | Marginal Return over CAMP variables | Positive | Regional & Geographical Dependence |

| Diaz, Ibrushi, and Zhou | 2021 | 5 | Best vs. Worst of ESG Factor Exposure | Positive | Regional & Geographical Dependence |

| Chen & Yang | 2020 | 5 | ESG Momentum Analysis | Positive | Investment Horizon dependent |

| Madhavan, Sobczyk and Ang | 2020 | 5 | ESG Factor Return | Positive | Regional & Geographical Dependence |

| Garcia-Amate et al. | 2022 | 3 | DJSI (Dow-Johns Sustainability Index) | Positive | Regional & Geographical Dependence |

| Quiros, Quiros, & Nogueira | 2020 | 5 | SRI Index sensitivity to the portfolio return | Positive | Regional & Geographical Dependence |

Alpha with No linkage to ESG Factors: A majority of the research papers analyzed didn’t show any significant relationship. Most of the portfolio this case was a balanced portfolio. Some of those benchmark research results have been summarized in Table 5 below.

| Table 5 Alpha With No Linkage To Esg Factors |

|||||

|---|---|---|---|---|---|

| Reference | Year | Fama-French Factor | Analysis Framework | Alpha Attribution | Comment |

| Naffa & Fain | 2022 | 5 | ESG Vs. PPF Portfolio | Neutral | |

| Naff & Fain | 2020 | 5 | Mega-Trend Exposure | Neutral | |

| Landi & Sciarelli | 2019 | 5 | CSR Performance | Neutral | |

| Kumar | 2019 | 3 | Marginal Return over CAMP variables | Neutral | |

| Shanaev & Ghimire | 2022 | 5 | Sustainability Factor Premium | Neutral | |

| Zahir & Aybars | 2020 | 3 | ESG Sectoral exposure | Neutral | |

| Xiao et al | 2020 | 5 | Sustainability Factor Premium | Neutral | |

| Lee, Faff, and Recker | 2020 | 5 | CSP (Corporate Social Performance) | Neutral | |

| Yang, Chen, and Xie | 2021 | 5 | Portfolio ESG factor Return | Neutral | |

| Fiskerstrand et al. | 2019 | 5 | Portfolio ESG factor Return | Neutral | |

| Huble and Scholz | 2020 | 5 | ESG Risk Variable attribution | Neutral | |

Alpha negatively impacted by ESG factors: There are few (6 out of 30) research papers which has also reported negative relationship between portfolio Alpha and the ESG exposure of the portfolio. Table 6 provides a summarized view of some of the leading research which reported negative relationship.

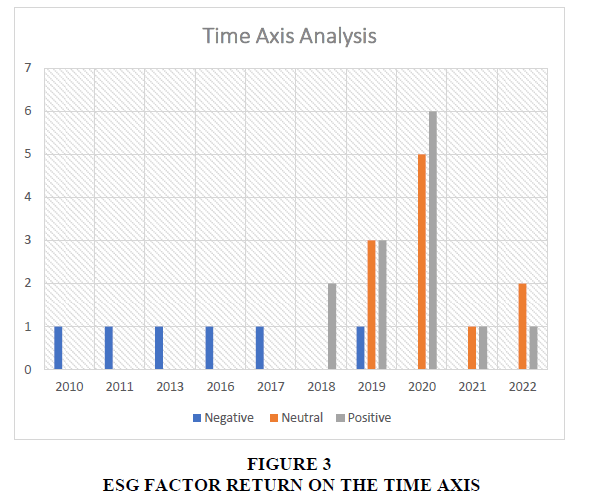

Time Axis analysis: One important aspect of the analysis is to put the research findings on the time axis. It is interesting to note that most of the research in this topic done before 2018 actually reported a negative relationship between portfolio Alpha and the ESG factor exposure. It is possible that this is due to the fact that the awareness around ESG integration in the investment portfolio got a traction among the Portfolio managers/ Fund Managers recently.

Table 6

|

|||||

|---|---|---|---|---|---|

| Reference | Year | Fama-French Factor | Analysis Framework | Alpha Attribution | Comment |

| Ciciretti, Dalo, & Dam | 2019 | 3 | ESG risk factor Return | Negative | Sample set is not clear |

| Oberndorfer et al. | 2013 | 3 | ESG Risk factor Return | Negative | |

| Li & Wu | 2017 | 3 | Climate Friendly Stock Inclusion | Negative | |

| Azevedo, Santos & Campos | 2016 | 5 | Sustainability factor return | Negative | |

| Lockwood and Probutr | 2010 | 3 | Sustainability factor exposure | Negative | |

| Herzel et al | 2011 | 3 | Sustainability constrained portfolio Return | Negative | |

The formal push to integrate ESG into investment portfolio came with UNSDG (United Nation Sustainability Development Goals). Though there were evidence of thematic investment around environment, but these portfolios didn’t report a positive gain perhaps because the general acceptance of the ESG Integration is a later phenomenon Figure 3.

Conclusion

The alpha of a global & regionally well diversified portfolio allocation cannot be attributed to environmental, social, or governance (ESG) variables or sustainable characteristics. There is no meaningful connection between Portfolio Alpha and ESG Factor at all for a globally diversified portfolio. There is a positive association between Portfolio Alpha and ESG component, and this relationship holds true for a regional portfolio in which the asset allocation weight is predominantly driven by the Developed Market portfolio. When considering a portfolio that is allocated to the Developed Market, the risk-adjusted return is favorably impacted when ESG or sustainability Factors are included in. Regional bias in the portfolio response is normal and it has been observed by other researchers. They attribute this regional impact to the social & cultural set up of the region. For example, in some of the emerging market countries, the equity from Marijuana, Adult Entertainment and other stocks are not categorized as sin stocks and they are generally included in the investment portfolio they give higher returns.

The negative results as concluded above, are also consistent with some of the previous findings though there were not intended to compute the ESG factor return.

Trinks and Scholtens (2017) show that sin stock exhibits high returns during 1991–2012 in several international markets. Individual stock levels are selected instead of excluding industries, and sin is broadly defined, having as much as 14 various issues, which contraceptives and meat are part of. A large sample was used for this data, covering 94 countries and 1,634 stocks. Fabozzi et al. (2008) show that sin stock exhibits high returns in 1970–2007 in several international markets. They analyze the returns of approximately 267 stocks in the industries of alcohol, tobacco, biotech, defense, and adult entertainment in 21 countries. A study by Hoepner and Schopohl (2016) revealed that the return generated by excluded companies, relative to the benchmark index of the funds, is abnormal.

References

Afrin, S., & Shimada, K. (2020). Performance and Resilience of Socially Responsible Investing (SRI) and Conventional Funds during Different Shocks in 2016: Evidence from Japan. Sustainability, 12(2), 540.

Indexed at, Google Scholar, Cross Ref

Ananth Madhavan, Aleksander Sobczyk & Andrew Ang (2021). Toward ESG Alpha: Analyzing ESG Exposures through a Factor Lens, Financial Analysts Journal, 77:1, 69-88.

Indexed at, Google Scholar, Cross Ref

Barnett, M. L. & Salomon, R. M. (2006). Beyond dichotomy: The curvilinear relationship between social responsibility and financial performance", Strategic Management Journal, 27(1), 1101-1122.

Indexed at, Google Scholar, Cross Ref

Becchetti et al. (2015), Socially responsible and Conventional Investment funds: Performance comparison and the global financial Crisis. Applied Economics, 47 (25).

Indexed at, Google Scholar, Cross Ref

Bloomberg. (2020). Seeking Signals from ESG Data.

Ciciretti, Rocco and Dalò, Ambrogio and Dam, Lammertjan (2019). The Contributions of Betas versus Characteristics to the ESG Premium, CEIS Working Paper No. 413.

Indexed at, Google Scholar, Cross Ref

Claudia-Alina (2015). The evaluation of CAPM, Fama-French and APT models on the Romanian capital market.

Davis, B., Balkissoon, K., & Heaps, T. (2017). Performance and impact: Can ESG equity portfolios generate healthier financial returns? Journal of Environmental Investing, 8(1), pp. 252-272.

Eurosif (2014), Eurosif Report 2014, Eurosif Report 2014 - EUROSIF

Eugene F. Fama and Kenneth R. French (2004), The Capital Asset Pricing Model: Theory and Evidence, Journal of Economic Perspectives, 18 (3), 25-46.

Indexed at, Google Scholar, Cross Ref

Eugene F. Fama and Kenneth R. French (2013), A Five-Factor Asset Pricing Model (Draft), Unpublished.

Indexed at, Google Scholar, Cross Ref

Eugene, F. F., & French, K. R. (1996). Multifactor explanations of asset pricing anomalies. The journal of finance, 51(1), 55-84.

Indexed at, Google Scholar, Cross Ref

Fabozzi, F. J., Ma, K. C., & Oliphant, B. J. (2008). Sin stock returns. The Journal of Portfolio Management, 35(1), 82‐94.

Garcia-Amate, A., Ramírez-Orellana, A. and Rojo Ramirez, A.A. (2022), "Is it attractive to invest in alternative energy? Evidence from a five-factor Fama-French model for regional DJSI and renewable stock indexes", Sustainability Accounting, Management and Policy Journal, Vol. 13 No. 1, pp. 273-296.

Indexed at, Google Scholar, Cross Ref

Gupta, Neeraj and Benson, Christina C., Sustainability and Competitive Advantage: An Empirical Study of Value Creation (November 30, 2011). Competition Forum, Vol. 9, No. 1, 2011.

Hamilton, S., Jo, H. & Statman, M. (1993), Doing well while doing good? The investment performance of socially responsible mutual funds. Financial Analysts Journal, 49(6), pp. 62-66.

Indexed at, Google Scholar, Cross Ref

Hübel, B., Scholz, H. Integrating sustainability risks in asset management: the role of ESG exposures and ESG ratings. (2020), Journal of Asset Management, Vol. 21, PP 52–69.

Indexed at, Google Scholar, Cross Ref

Miralles-Quirós, J. L., Miralles-Quirós, M. M., & Nogueira, J. M. (2020). Sustainable development goals and investment strategies: The profitability of using five-factor Fama-French alphas. Sustainability, 12(5), 1842.

Indexed at, Google Scholar, Cross Ref

Larry Lockwood & Wikrom Prombutr (2010), Sustainable Growth and Stock Return, The Journal of Financial Research, Vol. 33, Issue A, PP 519-538.

Indexed at, Google Scholar, Cross Ref

Lee, D.D., Faff, R.W. and Rekker, S.A.C. (2013), "Do high and low‐ranked sustainability stocks perform differently?", International Journal of Accounting & Information Management, Vol. 21 No. 2, pp. 116-132.

Indexed at, Google Scholar, Cross Ref

Lelasi, F., & Rossolini, M. (2019). Responsible or Thematic? The True Nature of Sustainability-Themed Mutual Funds. Sustainability, 11(12), 3304.

Indexed at, Google Scholar, Cross Ref

Li, B., & Wu, K. (2017). The Price of Environmental Sustainability: Empirical Evidence from Stock Market Performance in China. Sustainability, 9(8), 1452.

Indexed at, Google Scholar, Cross Ref

Violeta Díaz, Denada Ibrushi & Jialin Zhao (2021), Reconsidering systematic factors during the Covid-19 pandemic – The rising importance of ESG, Finance Research Letters, 38.

Indexed at, Google Scholar, Cross Ref

Helena Naffa, Máté Fain (2022), A factor approach to the performance of ESG leaders and laggards, Finance Research Letters, Volume 44.

Indexed at, Google Scholar, Cross Ref

Hong-Yi Chen & Sharon S. Yang (2020), Do Investors exaggerate corporate ESG information? Evidence of the ESG momentum effect in the Taiwanese market, Pacific-Basin Finance Journal, Vol. 63.

Indexed at, Google Scholar, Cross Ref

Hoepner, A. G. & Schopohl, L. (2016). On the price of morals in markets: An empirical study of the Swedish AP‐Funds and the Norwegian Government Pension Fund. Journal of Business Ethics, 151, pp.665-692.

Indexed at, Google Scholar, Cross Ref

Naffa, H., & Fain, M. (2020). Performance measurement of ESG-themed megatrend investments in global equity markets using pure factor portfolios methodology. PloS one, 15(12), e0244225.

Indexed at, Google Scholar, Cross Ref

Julia L. Pollard, Matthew W. Sherwood and Ryan Grad Klobus (2018), Establishing ESG as Risk Premia, Journal of Investment Management, Vol. 16, No. 1, pp 1-12.

Giovanni Landi & Mauro Sciarelli (2019), Towards a more ethical market: the impact of ESG on Corporate Financial Performance, Social Responsibility Journal, Vol. 15, No.1

Indexed at, Google Scholar, Cross Ref

Massimo Mariani, Paola Amoruso, Alessandra Caragnano & Marianna Zito (2018), Green Real Estate: Does It Create Value? Financial and Sustainability Analysis on European Green REITs, International Journal of Business and Management; Vol. 13, No. 7

Indexed at, Google Scholar, Cross Ref

Moinak Maiti (2021). Is ESG the succeeding risk factor?, Journal of Sustainable Finance & Investment, 11:3, 199-213.

Indexed at, Google Scholar, Cross Ref

Nagy, Z., Kassam, A., & Lee, L. (2016). Can ESG add alpha? An analysis of ESG tilt and momentum strategies. The Journal of Investing, 25(2), pp. 113-124.

Indexed at, Google Scholar, Cross Ref

Kumar, R. (2019). ESG: Alpha or Duty?. The Journal of Index Investing, 9(4), 58-66.

Indexed at, Google Scholar, Cross Ref

Richard P. Gregory, Jean Garner Stead & Edward Stead (2021) The global pricing of environmental, social, and governance (ESG) criteria, Journal of Sustainable Finance & Investment, 11:4, 310-329.

Indexed at, Google Scholar, Cross Ref

Savva Shanaev & Binam Ghimire (2022), When ESG meets AAA: The effect of ESG rating changes on stock returns, Finance Research Letters, Volume 46, Part A.

Indexed at, Google Scholar, Cross Ref

Sondre R. Fiskerstrand, Susanne Fjeldavli, Thomas Leirvik, Yevheniia Antoniuk & Oleg Nenadić (2020) Sustainable investments in the Norwegian stock market, Journal of Sustainable Finance & Investment, 10:3, 294-10.

Indexed at, Google Scholar, Cross Ref

Stefano Herzel, Marco Nicolosi & Cătălin Stărică (2012) The cost of sustainability in optimal portfolio decisions, The European Journal of Finance, 18:3-4, 333-349.

Indexed at, Google Scholar, Cross Ref

Trinks, P. J. & Scholtens, B. (2015). The opportunity cost of negative screening in socially responsible investing. Journal of Business Ethics, pp.1‐16.

Indexed at, Google Scholar, Cross Ref

Ulrich Oberndorfer, Peter Schmidt, Marcus Wagner &Andreas Ziegle (2013), Does the stock market value the inclusion in a sustainability stock index? An event study analysis for German firms, Journal of Environmental Economics and Management, Volume 66, Issue 3, PP 497-509.

Indexed at, Google Scholar, Cross Ref

UNPRI (2018), Principals of Responsible Investment, Annual Report 2018.

Vitor, A. G. D., Santos, A. A. P., & Campos, L. M. D. S. (2016). Corporate sustainability and asset pricing models: empirical evidence for the Brazilian stock market. Production, 26, 516-526.

Indexed at, Google Scholar, Cross Ref

Yue, X.-G., Han, Y., Teresiene, D., Merkyte, J., & Liu, W. (2020). Sustainable Funds’ Performance Evaluation. Sustainability, 12(19), 8034.

Indexed at, Google Scholar, Cross Ref

Zehir, E. and Aybars, A. (2020), "Is there any effect of ESG scores on portfolio performance? Evidence from Europe and Turkey", Journal of Capital Markets Studies, Vol. 4 No. 2, pp. 129-143.

Indexed at, Google Scholar, Cross Ref

Xiao, Y., Faff, R., Gharghori, P. et al. An Empirical Study of the World Price of Sustainability. J Bus Ethics 114, 297–310 (2013).

Indexed at, Google Scholar, Cross Ref

Xiaoshuang Yang, Xingyu Chen & Jiaxin Xie (2021), Factor Investment: Evaluating Persistence Effect for Investment Performance and Sustainability Exposure, International Journal of Economics and Finance; Vol. 13, No. 6.

Indexed at, Google Scholar, Cross Ref

Zakri Y. Bello (2005), Socially Responsible Investing and Portfolio diversification, The Journal of Financial Research, Vol. 28, Issue 1.

Indexed at, Google Scholar, Cross Ref

Received: 30-Nov-2022, Manuscript No. AMSJ-22-12940; Editor assigned: 05-Dec-2022, PreQC No. AMSJ-22-12940(PQ); Reviewed: 23-Dec-2022, QC No. AMSJ-22-12940; Revised: 28-Jan-2023, Manuscript No. AMSJ-22-12940(R); Published: 06-Feb-2023