Research Article: 2024 Vol: 28 Issue: 4

Exploration of Mobile Trust, its Antecedents, and Consequences in the Context of Mobile Payment: Qualitative Study

Afef Sahli, University of Tunis El Manar

Citation Information: Sahli, A. (2024). Exploration of mobile trust, its antecedents, and consequences in the context of mobile payment: qualitative study. Academy of Marketing Studies Journal, 28(4), 1-13.

Abstract

Despite its importance in marketing research, there is still limited research on trust in the mobile payment context. The objective of this study is to understand the phenomenon of trust in mobile payment. A qualitative study was conducted with 20 individuals and analyzed using "Sphinx IQ" to reveal the main antecedents and consequences of mobile trust. Managerial recommendations are then proposed for mobile application providers and companies.

Keywords

Trust, Mobile Payment, Qualitative Study, Antecedents, Consequences.

Introduction

The literature review on trust in mobile payment reveals an abundance of concepts and theoretical models, primarily due to the diversity of explored theories and the multitude of identified conceptualization approaches (Zhang et al, 2023). The phenomenon of trust is extensively studied in various marketing application domains (Cheng et al., 2024; Habbal et al., 2024). The multitude of antecedents and manifestations of trust depends on the research object and the field of application (Zhang et al., 2024). Therefore, we aim to identify the most recurrent influencing factors in the domains of e-commerce, m-commerce, and m-banking to apply them to the context of mobile payment. While mobile payments have been adopted by many companies, the body of knowledge on user trust in mobile payments shows that trust is a major issue during its adoption and development (Almaiah et al, 2022). At this stage, we propose the following research question: What are the antecedents of trust in mobile payment and its effect on adoption intention, and what is the role of social networks, particularly mobile word-of-mouth, in this relationship?

The main objective arising from our research question is to identify the antecedents of trust in mobile payment and subsequently its impact on adoption intention, as well as the role of mobile word-of-mouth in this relationship.

The results obtained from "Sphinx IQ" version 7 of the qualitative phase were used to clarify the relevance of the preliminary model of trust in mobile payment, which was revised and expanded.

To this end, our study procedure involved a synthesis of the literature review complemented by exploratory qualitative research.

At this level, the contribution of qualitative study is justified by determining the variables involved in consumer behavior analysis (trust) as well as defining the study context (mobile payment). In this research, we will first define the conceptual framework, then detail the process of exploratory qualitative study, and finally clarify the different results that will form the backbone of our study.

Literature Review

Mobile Payment

Mobile payment is defined by Ondrus and Pigneur (2005) as "a wireless transaction of monetary value between two parties, using a mobile device capable of securely processing a financial operation over a wireless network." According to Au and Kauffman (2008), mobile payment encompasses "all payments made with a mobile device to transmit, authorize, and confirm the exchange of financial value in return for goods and services." It is also "a type of payment transaction processing in which a mobile device is used to initiate, authorize, confirm, and complete a payment" (Goeke and Pousttchi, 2010).

To make a mobile payment, an application allows the use of a bank account number and the completion of the transaction (Xu et al., 2023). Generally, authentication and security tools are introduced to ensure the contract (Flatraaker, 2009).

In conclusion, numerous commercial and financial services have emerged with the development of mobile applications such as the mobile phone, which "has become an essential tool in everyone's daily life and a true tool of belonging, identification, or social distinction, and seems to be an effective means of combining mobility and payment" (Chaix, 2014).

Trust

The evolution of ICT has deeply impacted the concept of trust, which has evolved from a traditional context to an online context and now to a mobile context (Ali et al., 2023).

Firstly, trust as a general variable in marketing is very important in consumer behavior (Saif et al., 2024; Kim et al., 2024). Therefore, understanding the concept of trust is essential for both researchers and professionals (Jarvenpaar et al., 2000). According to Chouk and Perrien (2005), "One of the fundamental bases of any human interaction or social and economic exchange is certainly trust." The concept of trust is explained in different fields such as sociology, psychology, and administration (McKnight et al., 2004; Guibert, 2009) and is defined as an expectation, belief, or behavior.

Secondly, to explain the success of online trust, it plays a key role in the realization of all online transactions (Capestro et al., 2024; Udayana et al., 2023). Indeed, trust is often considered one of the key elements for generating and maintaining relationships with online customers (Gefen et al., 2003). As a result, several marketing researchers have highlighted the major role that this variable plays in driving consumers to interact with the merchant's website and subsequently purchase a product or service (Urban et al., 2009). According to Keat and Mohan (2004), "The secret to the success of any online business operation can be summed up in one word: trust."

Research Methodology

Study Objectives

Qualitative research, like any exploratory study, has several objectives. This study is conducted to identify the antecedents of trust in mobile payment and subsequently its impact on consumer adoption intention. It aims to verify the relevance of variables derived from the literature to the objectives of the present research.

The qualitative study is structured around three main objectives:

1. Explore mobile trust and the factors that affect it.

2. Explore the trust-adoption relationship in mobile payment.

3. Determine the influence of Word of Mouth (WOM) on mobile trust and adoption intention.

Data Collection Method

In our research, we chose the semi-structured interview. This choice is justified by the fact that this type of interview allows for both in-depth exploration of the themes addressed in the literature and the emergence of new themes that may be raised by the respondents (Bardin, 2001). The interview guide was structured around 4 themes (appendix 1).

1. Mobile payment in Tunisia.

2. Antecedents of trust in mobile payment.

3. Trust and intention to adopt mobile payment.

4. WOM, trust, and intention to adopt mobile payment.

We interviewed 20 individuals who are relatively active on social networks and mobile applications to discover their opinions and understand their perceptions table 1. The analysis of this study is conducted using the "SPHINX IQ" software version 7 designed to handle a large number of variables.

| Table 1 Composition of the Study Population | ||

| Group name | Age | Number |

| Mobile payment users | ||

| Students | 20-25 years | 2 |

| Young population | 26-45 years | 5 |

| Older population | 46-55 years | 3 |

| Non-mobile payment users | ||

| Students | 20-25 years | 4 |

| Young population | 26-45 years | 3 |

| Older population | 46-55 years | 3 |

Data Analysis Methods

According to Wacheux (1996), "Data analysis consists of reducing information to categorize and relate it before arriving at a description, explanation, or configuration." We used lexical analysis and content analysis.

Lexical and Semantic Overview

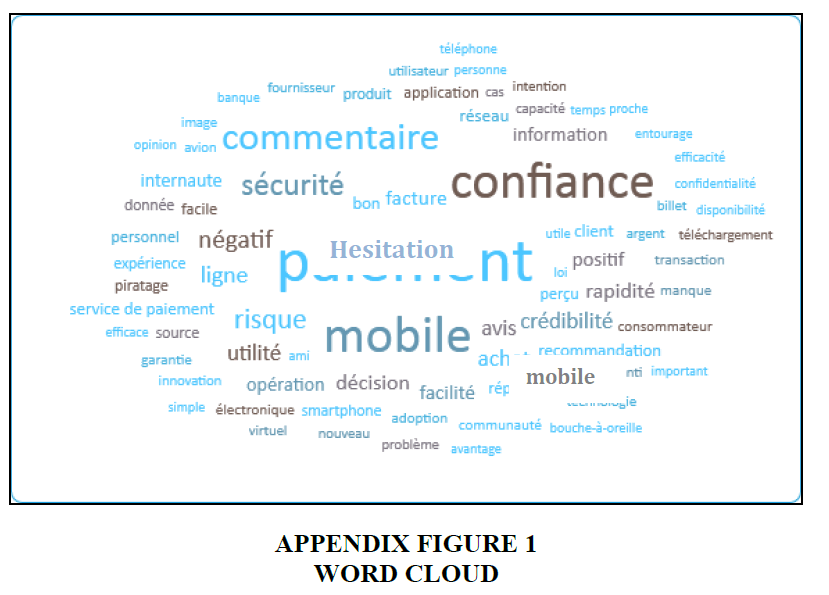

The first result presented by the software represents the word cloud. This diagram shows the main keywords mentioned by the respondents. The Sphinx software allows us to click on each word to see its occurrence and the corresponding verbatim. In this sense, the size (large and small) of each word gives us an idea of its degree of usage by the respondents and its degree of importance to the interviewers (appendix 2). We can therefore say that there are words whose proportions are relatively high compared to others, and in this case, they are displayed in the semantic field according to their spatial dimension. We can suspect that mobile payment is linked to trust. Indeed, trust dominates this diagram, indicating its importance in encouraging mobile payment. Trust could be influenced by online comments, followed by security, risk, hesitation, usefulness... These are factors related to the company, the individual, and mobility.

Thematic Distribution

The classes contribute to highlighting the themes and verbatim of the study. The word clouds depict the primary specific words of each class (proportional to the number of occurrences). The results display four different classes, namely:

1. Class 1: Mobile word-of-mouth.

2. Class 2: Mobile payment.

3. Class 3: Trust and intention to adopt mobile payment.

4. Class 4: Antecedents of trust in mobile payment.

Results and Discussion

Identification of Antecedents of Trust in Mobile Payment

This section presents the content analysis that thoroughly examines the themes identified in this study. All respondents agree on the importance of trust in exchange relationships. In the context of mobile payment, participants are divided into two groups. The first group trusts mobile payment, while the second group is skeptical and has mentioned certain conditions for them to trust this new service. Therefore, we wanted to understand the factors that can explain this trust. We were able to identify three categories of factors. The first category of factors is related to the company. The second category of factors is related to the individual, and finally, the factors related to the mobile application Table 2.

| Table 2 Content Analysis: Distribution of Antecedents of Mobile Trust | |||

| Name | Number of occurrences | Percentage | |

| Factors related to the company | 75 | 23.9% | |

| Perceived security | 38 | 12.1% | |

| Perceived risk | 31 | 9.9% | |

| Perceived reputation | 22 | 7.1% | |

| Structural assurance | 17 | 5.5% | |

| Factors related to the individual | 65 | 20.5% | |

| Propensity to trust | 34 | 10.6% | |

| Personal innovativeness | 19 | 5.7% | |

| Hesitation | 17 | 5.5% | |

| Perceived self-efficacy | 16 | 5.1% | |

| Factors related to the mobile application | 56 | 17.3% | |

| Perceived ease of use | 35 | 11.2% | |

| Perceived usefulness | 23 | 7.3% | |

| Rapidity | 22 | 7.1% | |

| Ubiquity | 16 | ||

Factors Related to the Company

Factors related to the company are the result of the company's entire past and its history. These factors provide assurance to consumers and therefore strengthen trust.

Perceived Security

This criterion is fundamental for participants (12.1%) and directly affects trust in mobile payment. Security is an essential element for consumers. The evaluation of the level of security determines their trust and therefore the decisions to adopt a service or purchase a product. According to the respondents, security is more important in electronic transactions than in traditional ones. The interviewees state that if the company assures them the protection of confidential data against threats, they are willing to trust mobile payment.

"Like everyone else, the issue of security in the virtual world seems to be a major concern, and to have trust in mobile payment, it is necessary to be secure." Individual 2

"Personally, I think security is the main element in mobile transactions, such as the security of my banking identity, payment guarantees (having a payment certificate that proves the date and amount paid...)." Individual 11.

Perceived Risk

Referring to the responses of the different participants, we can see that most people who do not trust mobile payment express a feeling of lack of security and uncertainty. Perceived risk mainly refers to security risks, performance risks, and financial risks.

• Security risk: The interviewed participants are concerned about the security and risks of virtual transactions. Thus, to carry out transactions via mobile, confidential information such as their credit card number and payment code must be provided. Additionally, other personal information must be provided to the service provider and other actors in the mobile payment system. This creates doubt in this type of service.

"As I have already mentioned, the security of my banking identity is the most important to me, and I think to everyone because the loss of data such as the code or the number of the bank card causes a lot of problems like hacking)." Individual 3

"The user's personal information and, of course, the information related to the bank card remain confidential." Individual 10

• Performance risk: The context of mobile payment is based on virtual transactions through a wireless network. That is why this service is perceived as vulnerable and prone to problems related to mobile networks and technology. This mode of transaction may not work as announced and therefore does not provide the desired benefits.

"Sometimes, I find difficulties in downloading or updating the application, sometimes I have to wait a little while for the application to start again." Individual 8

"Personally, I have sometimes had network availability problems, and it often happens that I cancel the operation to avoid the risk of paying twice or having my card hacked due to these types of connection problems." Individual 19

• Financial risk: This type refers to the risks of fraud, financial losses, and hacking of personal data encountered by consumers when using mobile payment. For the interviewees, this risk increases because they do not have a written proof of the transactions made, which implies a decrease in trust. They are afraid that their data will be hacked, and their bank accounts will be stolen. Users cannot control personal information, and it is possible that their details may be used without their knowledge and/or permission.

"The main risk is the loss, theft, and/or hacking of my banking data." Individual 5

"I think it is time for us to be reassured about the use of our personal and banking data online. We need to have a guarantee after each operation, as well as other guarantees in case of loss or theft of our banking data." Individual 17

Perceived Reputation

The study of the responses from different participants allowed us to observe that reputation is a determining factor in trust in mobile payment (for eleven participants). In the absence of experience with the company, they rely on the reputation and image of the company or product to make a decision. Therefore, if they perceive that the service provider is generally credible and benevolent and enjoys a good reputation, they have no reason to believe that the provider is not trustworthy. Among these respondents, some rely on the experiences accumulated by other people who have engaged in transactions with the company in question.

"But of course, I always look for the most honest and least risky provider." Individual 5

"As for me, if the provider has a good reputation in their field, the more trust I have in them." Individual 12

Structural Assurance

Structural assurances refer to legal laws and guarantees aimed at ensuring safe, secure, and reliable mobile payments. According to the participants, these assurances are a determinant of trust in online exchanges. Indeed, they state that they can only trust companies offering this mobile payment service if the structural assurances are respected. Improving legislative assurances helps to develop consumer trust in conducting online transactions.

"In my opinion, there is no law that protects the rights of users in any virtual transaction, so we are waiting for this law so that we can use this service." Individual 2

"The law and only the law can guarantee our rights to use mobile payment." Individual 19

Factors Related to the Individual

Individual factors are specific to each consumer, namely the disposition to trust, personal innovativeness, hesitation, and self-efficacy.

Propensity to Trust

The propensity to trust is the disposition to believe that others are trustworthy. A minority of the respondents state that they are naturally inclined to not trust easily and will be more inclined to reject this virtual payment method. Furthermore, the propensity to trust is lower among participants who have no prior experience with this payment method. The effect of propensity to trust can be significant in mobile payment, even if it is not mentioned by a large number of respondents.

"I trust mobile payment only after personal use." Individual 3

"I do not easily trust mobile payment; one must be cautious about these services." Individual 8

Personal Innovativeness

In our sample, some individuals follow technological developments and are more likely than others to quickly adopt technological innovations. By observing the responses of these individuals, we notice that the intention to try out all innovations is a manifestation of perceived usefulness and trust attributed to the mobile payment service.

"I am skilled in using online services, curious, that is, I even tried paying a small amount for an item to see how the operation goes." Individual 17

"We are in a virtual world, so it is absolutely necessary to be up to date with this radical change in our lives, it is imperative to be at the forefront of technology, in other words, connected." Individual 18

Hesitation

All respondents express their hesitation towards mobile payment services. However, the intensity of this feeling varies from individual to individual. Thus, the higher the perceived risk level, the more doubts, and perplexities the person will have. While perceived security, personal innovativeness, the existence of structural assurances, and the company's reputation reduce indecision. To overcome hesitation, some respondents rely on recommendations from their surroundings. We have noticed that the most hesitant are those who do not easily trust innovations.

"I like technological innovations and I do not hesitate to have an online experience of buying or paying online." Individual 3

"I still hesitate before using this service, and it is due to a lack of trust and guarantee." Individual 8

Perceived Self-Efficacy

In this context, perceived self-efficacy refers to an individual's judgment of their abilities and skills to master technological innovations, particularly mobile payment services. Some participants believe that the more capable they are of operating and understanding new systems, the more likely they are to have confidence in online transactions.

"Of course, using these services requires a good understanding of how they work." Individual 14

"I think that mastering the tool and having a good knowledge of the application reduces risks." Individual 15

Factors Related to the Mobile Application

Factors related to the mobile application are important explanatory variables in the formation of online trust, such as perceived ease of use, perceived usefulness, rapidity, and ubiquity.

Perceived Ease of Use

Based on the responses of the interviewed individuals, we found that most of them attach great importance to the simplicity and ease of use of mobile payment applications. For them, a system that requires a lot of time and effort to understand does not deserve their trust. Therefore, the complexity of using an innovation can be a barrier that discourages consumers from trusting and adopting an innovation.

"I trust an application that is easy to manipulate and not complicated." Individual 12

"I would like to use an application that is easy and clear, so that I don't waste a lot of time trying to understand the procedures." Individual 17

Perceived Usefulness

The interviewed individuals who have tried the mobile payment service attest to its usefulness, they emphasized that this service has facilitated certain tasks and saved them time, money, and physical effort. For those who use this service at work, it has helped them better perform their functions and improve their performance. This category trusts mobile payment. However, a minority believes that this transaction is useless and therefore does not deserve their trust. We can observe that consumers are likely to trust this payment service if they perceive an advantage in using it compared to other traditional payment methods.

"Among the advantages, I mention the time and effort saved." Individual 10

"Maybe there are advantages, maybe not." Individual 7

Rapidity

According to the participants, rapidity is necessary for this service, and it is a criterion that favors it over traditional transactions. The interviewees emphasized the ease of navigation and the speed of transactions as necessary functional factors for using mobile payment and trusting it. A minority states that speed is not a sufficient reason to trust.

"Simple navigation, guaranteed service, fast transaction, available and secure network." Individual 15

"I seek efficiency and rapidity at the same time." Individual 16

Ubiquity

Through the analysis of the responses, we have noticed the importance of conducting transactions without space and time restrictions. What encourages respondents to adopt mobile payment and trust it is the immediacy of transactions, availability, and time savings.

"It allows me to save a lot of time with minimal effort." Individual 13

"As long as I have mobile connectivity, I can carry out all my transactions smoothly without waiting for the right moments in queues." Individual 18

Trust and Intention to Adopt Mobile Payment

We present the relationship between trust and the intention to adopt mobile payment Table 3.

| Table 3 Content Analysis: Distribution of Trust Themes | ||

| Name | Frequency | % |

| Adoption of mobile payment | 45 | 13.9% |

| Use of mobile payment | 25 | 8.0% |

| Acceptance of mobile payment | 15 | 4.8% |

| Trial of mobile payment | 12 | 3.9% |

| Trust in mobile payment | 33 | 10.4% |

| lack of trust | 19 | 5.7% |

| having trust | 17 | 5.5% |

Intention of M-Payment Adoption

We have noticed that there are individuals who are more likely than others to quickly adopt m-payment and trust it. We have distinguished three categories of respondents as follows:

Individuals who have Already Adopted M-Payment

Before adopting the service, these individuals have evaluated the relative advantages and negative consequences of using this service. And they find that the relative advantages outweigh the disadvantages.

Individuals who do not adopt m-payment

These stakeholders do not perceive an interest in migrating to mobile payment when they can use direct payment. Furthermore, they believe that mobile payment involves a lot of uncertainty and risk. Generally, the risk perception among these individuals exceeds that of others. This reduces their trust in mobile services and consequently affects their intention to use m-payment.

Individuals Expressing the Intention to Adopt M-Payment

These individuals have no experience with m-payment, they face several uncertainties. Thus, they assume that the intention to adopt a new technology is determined by advantages such as perceived usefulness, ubiquity, perceived ease of use, etc. However, they perceive certain disadvantages such as the level of risk. Also, they are willing to adopt this service under certain constraints such as structural assurance, opinions of loved ones, increased security, etc.

Trust in M-Payment

The unanimity of respondents agrees on the importance of the role played by trust in the formation of evaluative judgments and in the purchase or adoption decisions of a service. Some of them think that in a virtual transaction context, building a relationship of trust is more difficult while others already trust mobile payment.

Lack of Trust

For these individuals, it is difficult to trust a virtual service without having face-to-face contact with the service provider. They perceive this service as risky and uninsured. They suggest that the service provider makes more effort to gain their trust.

Having trust

These individuals believe that the advantages of mobile payment are significantly greater than its disadvantages. We have also found that even though they perceive a risk in using m-payment, they have not changed their trust in the service.

Relationship between Trust and Intention of M-Payment Adoption

All participants emphasized that their purchase decisions are a manifestation of their trust. Likewise, the honesty of service providers and the fulfillment of promises could affect the intention to adopt m-payment.

By examining the details of the responses, we have noticed that all individuals who use m-payment have a strong trust in the service. These individuals perceive a strong utility of the service and declare that they will continue to use it in the future Appendix Table 1.

The second group of respondents consists of individuals who do not trust virtual transactions. The lack of trust prevents them from adopting mobile payment mainly because they are concerned about the uncertainties related to security and the benefits it offers Appendix Figure 1.

The third group consists of individuals who have expressed their intention to try this service. These individuals are in a situation of uncertainty. They evaluate the service by comparing the perceived advantages of the service to its disadvantages. Some of them have low trust in the service. Therefore, this group tends to verify the accuracy of their initial beliefs that are formed without any prior experience or interaction. Based on the trial of the service, they will determine to what extent future interactions will evolve. Indeed, in such a context, building a relationship of trust with consumers can be one of the mechanisms that will help overcome adoption obstacles (Gefen et al., 2003; Kasowaki and Thomas, 2024), m-commerce (Kim et al., 2009; Bargavi et al., 2024); (Malaquias, 2016; Basu et al., 2024).

Conclusion

Trust is an enabler in technological contexts such as e-commerce and m-banking. As a result, we find that the success of mobile payment services generally requires understanding and developing consumer trust.

This study examines the main findings of personal factors that influence consumer trust revealed in the qualitative phase (20 semi-structured individual interviews) studied by the software “Sphinx IQ” version 7 as well as in existing literature and current research. Furthermore, the significance of the research findings regarding mobile payment services in Tunisia is examined.

In this research, we presented on the one hand the content analysis which carefully examines the themes identified during this study. We have identified the factors that influence trust in mobile payment. We reached three categories of antecedents according to their degrees of importance (company-related factors, individual-related factors, and mobile application-related factors).

As a result, we find that the success of mobile payment services generally requires understanding and developing consumer trust. This makes it possible to suggest to managers to develop mobile commerce in Tunisia and to m-payment service providers to attract the interest of Tunisian consumers and persuade them that the expected benefits will be realized. Thus, to overcome the inadequacies of the mobile payment system such as digital piracy, content theft, lack of security, hackers, absence of authentication, absence of a monitoring system, etc., the main role of professionals then lies in coding any mobile payment transaction to be 100% secure. Likewise, the simpler, more reliable, easier to use, and quicker to download the mobile application is, the more it deserves the trust of users.

This work is not without limits. The first limitation relates to the theoretical aspect of this research. The second relates to the presence of other determinants of trust in mobile payment (Oliviera, 2016). Thus, as future perspectives, it would be interesting to complement this research with a quantitative study to validate our research model.

Appendices

| Appendix Table 1 Interview Guide |

| Interview guide 1) Do you have any applications downloaded on your Smartphone? If yes, which ones? 2) Do you use your Smartphone for mobile payments? 3) Could you give me examples of mobile payment operations that you have known or used? 4) What could encourage or discourage you from using the mobile payment service? 5) To what extent do you trust the mobile payment service? 6) In your opinion, what are the factors that influence your trust in mobile payment? 7) Do you think trust could affect the intention to adopt mobile payment? 8) Do you intend to adopt the mobile payment service in the future? |

Appendix 2

References

Ali, A., Hameed, A., Moin, M. F., & Khan, N. A. (2023). Exploring factors affecting mobile-banking app adoption: a perspective from adaptive structuration theory. Aslib Journal of Information Management, 75(4), 773-795.

Indexed at, Google Scholar, Cross Ref

Almaiah, M. A., Al-Rahmi, A., Alturise, F., Hassan, L., Lutfi, A., Alrawad, M., & Aldhyani, T. H. (2022). Investigating the Effect of Perceived Security, Perceived Trust, and Information Quality on Mobile Payment Usage through Near-Field Communication (NFC) in Saudi Arabia.Electronics, 11(23), 3926.

Indexed at, Google Scholar, Cross Ref

Au, Y. A., et Kauffman, R. J. (2008). The economics of mobile payments: Understanding stakeholder issues for an emerging financial technology application. Electronic Commerce Research and Applications, 7(2), 141-164.

Indexed at, Google Scholar, Cross Ref

Bardin, L. (2001). L'analyse de contenu (éd. 10). Paris: Presses Universitaires de France.

Bargavi, N., MONIR, M. M. S., Das, S., & Rizal, S. (2022). Consumer’s shift towards e-commerce and m-commerce: An empirical investigation. Journal of Positive School Psychology, 6(2), 703-710.

Basu, B., Sebastian, M. P., & Kar, A. K. (2024). What affects the promoting intention of mobile banking services? Insights from mining consumer reviews. Journal of Retailing and Consumer Services, 77, 103695.

Capestro, M., Rizzo, C., Kliestik, T., Peluso, A. M., & Pino, G. (2024). Enabling digital technologies adoption in industrial districts: The key role of trust and knowledge sharing. Technological Forecasting and Social Change, 198, 123003.

Indexed at, Google Scholar, Cross Ref

Chaix, L. (2014). Le paiement mobile: perspectives économiques, modèles d'affaires et enjeux concurrentiels. Université Nice Sophia Antipolis.

Cheng, W., Tian, R., & Chiu, D. K. (2024). Travel vlogs influencing tourist decisions: information preferences and gender differences. Aslib Journal of Information Management, 76(1), 86-103.

Indexed at, Google Scholar, Cross Ref

Chouk, I., & Perrien, J. (2005). La confiance du consommateur vis-à-vis d'un marchand Internet: proposition d'une échelle de mesure. Revue Française du Marketing, 205, 5.

Flatraaker, D. I. (2009). Mobile, Internet and electronic payments: the key to unlocking the full potential of the internal payments market. Journal of Payments Strategy & Systems, 3(1), 60-70.

Gefen, D., Karahanna, E., & Straub, D.W. (2003). Trust and TAM in online shopping: An integrated model. MIS quarterly, 27(1), 51-90.

Goeke, L., & Pousttchi, K. (2010). A scenario-based analysis of mobile payment acceptance. In Mobile Business and 2010 Ninth Global Mobility Roundtable (ICMB-GMR), 2010 Ninth International Conference on (pp. 371-378). IEEE.

Indexed at, Google Scholar, Cross Ref

Guibert, N. (1999). La confiance en marketing: fondements et applications. Recherche et Applications en Marketing (French Edition), 14(1), 1-19.

Habbal, A., Ali, M. K., & Abuzaraida, M. A. (2024). Artificial Intelligence Trust, Risk and Security Management (AI TRiSM): Frameworks, applications, challenges and future research directions. Expert Systems with Applications, 240, 122442.

Indexed at, Google Scholar, Cross Ref

Jarvenpaa, S. L., Tractinsky, N., & Vitale, M. (2000). Consumer trust in an Internet store.

Kasowaki, L., & Thomas, R. (2024). Secure and Swift: Unleashing the Potential of Internet Banking in the E-Commerce Landscape (No. 11808). EasyChair.

Keat, T. K., & Mohan, A. (2004). Integration of TAM based electronic commerce models for trust. Journal of American Academy of Business, 5(1/2), 404-410.

Kim, J., Jin, B., & Swinney, J. L. (2009). The role of etail quality, e-satisfaction and e-trust in online loyalty development process. Journal of retailing and Consumer services, 16(4), 239-247.

Indexed at, Google Scholar, Cross Ref

Kim, J., Kim, M., & Lee, S. M. (2024). Unlocking Trust Dynamics: An Exploration of Playfulness, Expertise, and Consumer Behavior in Virtual Influencer Marketing. International Journal of Human–Computer Interaction, 1-13.

Indexed at, Google Scholar, Cross Ref

Malaquias, R. F., & Hwang, Y. (2016). An empirical study on trust in mobile banking: A developing country perspective. Computers in Human Behavior, 54, 453-461.

Indexed at, Google Scholar, Cross Ref

McKnight, D. H., Kacmar, C. J., & Choudhury, V. (2004). Dispositional trust and distrust distinctions in predicting high-and low-risk internet expert advice site perceptions. E-Service, 3(2), 35-58.

Saif, S., Zameer, H., Wang, Y., & Ali, Q. (2024). The effect of retailer CSR and consumer environmental responsibility on green consumption behaviors: mediation of environmental concern and customer trust. Marketing Intelligence & Planning, 42(1), 149-167.

Indexed at, Google Scholar, Cross Ref

Udayana, A. A. G. B., Fatmawaty, A. S., Makbul, Y., Priowirjanto, E. S., Ani, L. S., Siswanto, E., & Andriani, S. (2023). Investigating the role of e-commerce application and digital marketing implementation on the financial and sustainability performance: An empirical study on Indonesian SMEs. International Journal of Data and Network Science, 8(24), 167-178.

Indexed at, Google Scholar, Cross Ref

Xu, Y., Ghose, A., & Xiao, B. (2023). Mobile payment adoption: An empirical investigation of Alipay. Information Systems Research.

Indexed at, Google Scholar, Cross Ref

Zhang, L., Anjum, M. A., & Wang, Y. (2023). The Impact of Trust-Building Mechanisms on Purchase Intention towards Metaverse Shopping: The Moderating Role of Age. International Journal of Human–Computer Interaction, 1-19.

Indexed at, Google Scholar, Cross Ref

Zhang, Q., Wallbridge, C. D., Jones, D. M., & Morgan, P. L. (2024). Public perception of autonomous vehicle capability determines judgment of blame and trust in road traffic accidents. Transportation research part A: policy and practice, 179, 103887.

Indexed at, Google Scholar, Cross Ref

Received: 29-Jan-2024, Manuscript No. AMSJ-24-14428; Editor assigned: 30-Jan-2024, PreQC No. AMSJ-24-14428(PQ); Reviewed: 29-Apr-2024, QC No. AMSJ-24-14428; Revised: 05-May-2024, Manuscript No. AMSJ-24-14428(R); Published: 22-May-2024