Research Article: 2020 Vol: 24 Issue: 6

Examining the Impact of Environmental Management Accounting on Achieving Sustainable Competitive Advantages

Abdul Aziz Abdul Rahman, Kingdom University

Abdelrhman Meero, Kingdom University

Hasan Mansur, Szent Istvan University

Abstract

This study aims to examine the impact of environmental management accounting (EMA) on achieving sustainable competitive advantages which are sustainable cost leader advantage, sustainable differentiation advantage and sustainable market segmentation advantage. A questionnaire based on five-point Likert scale was designed and developed to collect the data. The study population consists of the manufacturing sector and the sample covered employees from different levels of the hierarchy. The number of responses received is 148. The SPSS has been used to analyze the data and give judgment on the hypotheses. The results show a strong statistically significant impact of EMA on sustainable cost leader advantage, sustainable differentiation advantage and sustainable market segmentation advantage. The sample of study consists of the employees of the largest six manufacturing companies in Bahrain. The results of the study indicate that the use of environmental management accounting increases the sustainable competitive advantages of industrial companies with high pollution rate in Bahrain.

Keywords

EMA, Competitive advantages, Decision making, Leadership, Bahrain.

JEL Classifications

M41, Q56, L41.

Introduction

Recent decades have witnessed a great interest in environmental issues (Al-Mawali et al.,2018) as a result of the risks that accompanied the great industrial development and which threaten the environment and society (Le et al., 2019). These developments have led to the necessity of finding mechanisms and procedures capable of identifying these risks and determining their causes. Thus, the possibility of controlling them and limiting their effects. In the light of the deficiency of traditional management accounting information (Gibassier and Alcouffe, 2018), environmental management accounting (EMA) has emerged as a tool to assist business organizations in measuring and disclosing accounting for environmental costs and benefits, as well as identifying environmental performance in a manner that reduces the environmental impacts of business organizations (Jamil et al., 2015). Kingdom of Bahrain has been taking strict measures to protect the environment and limit the environmental impacts of industrial companies located on its land, which has resulted in the environmental dimension becoming an integral part of the companies’ success and sustainable growth. This study will examine the impact of environmental management accounting (EMA) on achieving sustainable competitive advantages of manufacturing companies in Bahrain.

Problem Statement and Question

The problem of this study has emerged at a time when the environmental risks of industrial companies increased. This issue led to the necessity of existence tools capable of controlling the environmental information and determining the environmental performance of the mentioned companies in a manner that contributes to reduce these risks and its negative impacts on environment which will contribute to strengthen the sustainable competitive position of these companies, especially in light of Bahrain's endeavor to support this trend. Based on the above, the study problem can be formulated in the following question: “Do EMA impact on the sustainable competitive advantages in industrial companies in Bahrain?”.

Importance of the study

Because of the increasing importance of EMA in the current era, this study will provide a better understanding of the impact of EMA on achieving sustainable competitive advantages of manufacturing companies in Bahrain, which will help to better achieve the companies’ goals regarding its sustainable competitive advantages. The results of this study will also provide a useful guide for the industrial companies in Bahrain to make important decisions under the study results.

Objective of the study

This study aims to examine the impact of EMA on achieving sustainable competitive advantages of manufacturing companies in Bahrain. Accordingly, the objective of this study will be divided into the following purposes:

1. Examining the impact of EMA on achieving sustainable cost leadership advantage.

2. Examining the impact of EMA on achieving sustainable differentiation advantage.

3. Examining the impact of EMA on achieving sustainable market segmentation advantage.

Literature Review

Le, et al. (2019) aimed to investigate the factors that affect the application of EMA as well as to study the relationship between the application of EMA and the performance efficiency in the financial and environmental sectors. The results of the research indicated that there are six factors that positively affect the application of EMAP. On the other hand, the results indicated also that the application of EMAP positively affects financial and environmental efficiency.

Falope, et al. (2019) aimed to study the effect of pollution control cost on return on assets of listed construction companies in Nigeria. The results showed an effect for the environmental pollution prevention cost, environment protecting cost, and environmental recycling disclosure on return on assets of construction companies listed in Nigeria.

Study of Le and Nguyen (2018) aimed to provide a clear picture of the application of environmental cost management accounting (ECMA) in Vietnamese brick manufacturers. The results showed that the brick industry adopted a low level of ECMA and provided some suggestions for strengthening companies that implement ECMA.

One more study for Al-Mawali et al. (2018) aimed to study the relationship between environmental strategy and EMA. It also aimed to study the impact of EMA on organizational performance. The results indicated a direct impact of environmental strategy on EMA. Also, there was a positive relationship between EMA and organizational performance.

Also, Sana et al. (2018) aimed to understand the relationship between uncertainty contingent factors in environment, like environmental strategy, regulatory pressure, organizational size, and top management commitment which effected the EMA and environmental performance among manufacturing companies in Malaysia.

Jinadu, et al. (2015) examined the current practices of accounting in managing environmental costs and find out elements to improve EMA sustainability in Nigerian. The results indicated a strong influence of EMAP on current accounting and future sustainability in Nigeria.

Another study for Jamil et al. (2015) aimed to identify the factors that affect the practice of EMA. The results indicated that most of the budgets of the companies under study include amounts related to environmental activities and the practice of EMA.

Larojana and Thevarubanb (2014) examined the impact of en EMAP on financial performance in the industrial companies listed in Sri Lanka Bourse. The results showed a positive and statistically significant relationship between EMAP and the financial performance of the mentioned companies. The results also indicated the necessity for the government to work to establish a legal and regulatory framework for environmental issues.

L´opez-Gamero et al. (2009) employed the Competitive advantage as an intermediary variable to examine the association between the performance and the environmental variables. The results showed that the decisions related to the selection of proactive environmental management are influenced by the level of investment in environmental protection aspects. furthermore, the same study showed also that the competitive advantage has a significant relationship with the costs which shall affect positively the financial performance of the firms in the legal section, moreover, the related impact in the hotel area occurs by a competitive advantage through the strategy of differentiation.

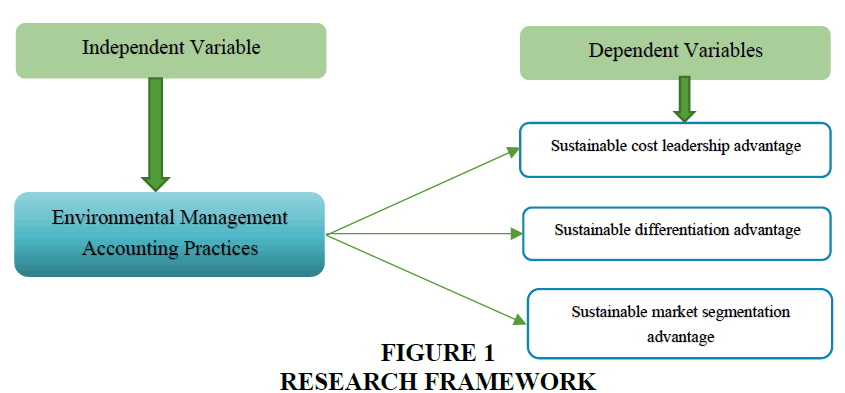

From previous studies, it can be noted that most studies focus on studying the relationship between EMA and organizational, environmental, financial performance or sustainability and adopting EMAP. We note from the above that studies related to study the impact of EMA on achieving competitive advantages are very scarce and almost non-existent. This study, as a distinguished study in this field, will focus on examining the impact of EMAP on achieving sustainable competitive advantages of manufacturing companies in Bahrain, especially in light of Bahrain 2030 vision which encourage leadership and innovation to ensure sustainability, increase competitiveness in addition to preserve the environment. The previous literature review allowed us to adopt the following variables for the study: the environmental management accounting (EMA) as independent variable, and three dependent variables which are sustainable cost leadership advantage, sustainable differentiation advantage, and Sustainable market segmentation advantage.

Environmental Management Accounting (EMA)

EMA can be defined as the process of producing and analyzing environmental information that assists management in monitoring the environmental performance of a company. EMA is more comprehensive than traditional management accounting (Le, et al., 2019). Environmental management accounting covers both monetary and physical units. The procedures that use physical units are called physical EMA, while the procedures that use monetary units are called monetary EMA. Physical EMA refers to procedures for the use, flow, and final disposal of materials and energy. That is, it expresses the company's impact on the environment in the form of physical units of measurement (kilograms, cubic meters, etc.), and monetary EMA is concerned with procedures related to the quantitative measurement of costs, savings, and revenues related to activities with a potential environmental impact. It focuses on the environmental aspects of the company's activities that are expressed in monetary units (Jamil et al., 2015; Le, et al., 2019).

EMAP refers to the company's actions to control the use of materials, energy, and environmental costs to assist in environmental protection decision-making (Schaltegger et al., 2008; Henri et al., 2016; Russell et al., 2017). Some argue that EMAP include life-cycle cost, fullcost accounting, benefit assessment and strategic planning for environmental management (Mohamed and Jamil, 2018). Other researchers argue that EMAP has the following dimensions: customer focus, environmental cost, environmental safety, management commitment, and environmental regulation. However, EMAP will be considered as a single independent variable for data collection and statistical analysis purposes in this study.

Sustainable Competitive Advantages

The competitive advantage is investigated by comparing a company’s performance with the performance of other companies in the same sector. A company that achieves superior performance in comparison to other companies in the same industry has a competitive advantage (Porter, 1998; Rothaermel, 2017; Gamble et al., 2019). several companies have achieved a competitive advantage in history. For example, Apple has achieved a competitive advantage over Google, Samsung, Nokia and BlackBerry in the quality of the smartphone industry. The company’s long-term retention of this competitive advantage means that this company has a sustainable competitive advantage (Porter, 1998; Rothaermel, 2017; Gamble et al., 2019).

To obtain a competitive advantage, the company needs to provide goods or services that meet the customers’ expectations at a lowest cost and highest possible quality in comparison to rivals. Excellence in creating superior value for customers and capturing them for a long time requires the company to continuously improve the quality of the product or the service while controlling costs simultaneously, which is reflected in maximizing profitability and market share. Consequently, the greater the difference between value and cost creation, the greater the company's economic contribution and the more likely it will obtain a competitive advantage (Porter, 1998; Rothaermel, 2017).

Many competitive advantages have been created in different references (Rothaermel, 2017; Gamble et al., 2019) such as pricing, quality, customer focus, operational efficiency, product or service differentiation, authority, brand, technology and others. In this study, the researchers determined three factors to be considered sustainable competitive advantages and dependent variables at the same time which are: sustainable cost leadership advantage, sustainable differentiation advantage and sustainable market segmentation advantage. These three factors have been chosen as the most effective competitive advantages according to many authors. On the other hand, their close association with manufacturing processes (Porter, 1998; Rothaermel, 2017 and Gamble et al., 2019).

Sustainable Cost Leadership Advantage

It focuses on producing products at the same quality as the rivals' products and a lower price. Cost leadership can be achieved through continuous improvement of operational efficiency using more efficient workers or external expertise to improve the operational efficiency as well as a company’s ability to create economies of scale (Porter, 1998; Tanwar, 2013).

Sustainable Differentiation Advantage

It indicates the company's ability to produce a product with unique specifications that exceed those of competitors' products. These specifications will enable the company to create a strong image of its brand, allowing it to sell its products at a higher price (Porter, 1998; Tanwar, 2013).

Sustainable Market Segmentation Advantage

It depends on choosing a competitive advantage that focuses on a narrow sector within the industry, then a strategy is formulated to serve that competitive advantage. This strategy depends on two variables, the first includes focusing on cost by gaining cost advantage in the target sector, and the second one is focusing on differentiation in the target sector. Both variables focus on the differences between the target segments and other sectors of the industry (Porter, 1985; Porter, 1998; Tanwar, 2013).

Several studies examine the relationship between EMA and financial performance, organizational performance or environmental performance in different countries (Sayedeh and Saudah 2014; Le, et al., 2019; Jinadu, et al., 2015; Larojana and Thevarubanb, 2014; Al-Mawali et al., 2018, Sayedeh and Saudah, 2014). These studies indicate the application of EMA helps to improve the financial, organizational and environmental performance of companies. Based on these results we can say that the application of EMA undoubtedly reduces environmental costs and thus the total costs of production. Reducing the total costs will allow companies to improve product quality and thereby gain many sustainable competitive advantages over rivals. In this study, the researcher will examine the impact of EMA on achieving sustainable competitive advantages of manufacturing companies in Bahrain. Based on the above information, a research framework to reflect the impact of EMA on achieving sustainable competitive advantages of manufacturing companies in Bahrain can be presented in the following figure 1.

Research Hypotheses

Based on the above research framework, three hypotheses can be formulated to reflect the impact of the independent variable (EMA) on the mentioned three dependent variables (sustainable cost leadership advantage, sustainable differentiation advantage and sustainable market segmentation advantage) of manufacturing companies in Bahrain as follows:

H01: EMA has no impact on achieving sustainable cost leadership advantage.

H02: EMA has no impact on achieving sustainable differentiation advantage.

H03: EMA has no impact on achieving sustainable market segmentation advantage.

Methodology

Study Community and Sample

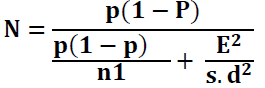

The study community consists of the manufacturing sector in the field of oil, aluminum and steel in Bahrain. This sector includes six huge companies and is considered to have a significant negative impact on the environment in Bahrain. The respondents were chosen from different levels such as senior managers, factory managers, quality managers, heads of accounting and environmental control departments, and all workers in financial and accounting affairs, estimated at 240 people, which reflects the population of this study. The researchers distribute 148 questionnaires as s sample based on the following statistical formula (Hassan, 2002).

Where: N: Sample, n1: population size, E: permissible error percentage %5, s.d2: standard score 95%, P: maximum percentage of available properties to be studied in any population 0.50

Data Collection

Data were collected using the questionnaire tool, which consists of three sections, the first section is devoted to demographic information, the second section is for the independent variable statements, and the third section is devoted to the three dependent variables. To gather data, a questionnaire was designed based on five-point Likert scale with the following classification: Strongly Disagree (1), Disagree (2), Neutral (3), Agree (4), Strongly Agree (5). means’ responses were categorized into three levels, high (3.67–5), medium (2.34-3.66), and low (1--2.33). SPSS 26.0 was used for data analysis purposes.

Data Analysis and Findings

Reliability Analysis

The acceptable value of the internal consistency test by using alpha Cronbach in social sciences research recommended by Cronbach (1970), Nunnally (1978), and Robinson et al., (2013) is 70%, while Sekaran (2000) and Amir & Sonderpandian (2002) recommend a value of Alpha Cronbach greater than 60%. The Alpha Cronbach reliability test for the research variables led to values ranged between (0.753 – 9.25), and for the whole questionnaire reached 0.966, which indicating a high level of stability for the measuring instrument, so statistically, whenever the value of this factor is directed towards the one value, the result obtained through the questions in the form is consistent and coherent (Table 1).

| Table 1 Reliability Analysis | |||

| No. | Variables | Cronbach's Alpha | N of Items |

| 1 | Environmental Management Accounting | 0.925 | 8 |

| 2 | Sustainable cost leadership advantage | 0.753 | 4 |

| 3 | Sustainable differentiation advantage | 0.825 | 4 |

| 4 | Sustainable market segmentation advantage | 0.918 | 4 |

| 5 | Total | 0.966 | 20 |

Results and Analysis

General Information

The results indicate that 74% of the respondents are male, and 26% are female. The results also indicate that 48% of the respondents were between (30 – 40) years old, and only 26% of them were less than 30 years old. The results also indicate that 30% of the respondents have a master’s degree, 32% of them have a bachelor’s degree, and only 9% of the respondents have a PhD degree. As for the practical experience of the respondents, 44% of them have more than 15 years of experience and 22% have between (10-15) years of experience. The results of the study also indicate that 34% of the respondents occupy administrative positions and 56% of them occupy different positions.

The Independent Variable

Table 2 shows descriptive statistics related to the independent variable “Environmental management accounting principles”.

| Table 2 Descriptive Statistics of Responses for Independent Variable (EMA) | ||||

| No. | Statement | Mean | Standard deviation | Relative importance |

| 1 | Company complies to the declared environmental regulations | 4.48 | 0.947 | 0.896 |

| 2 | Employees are fully aware of environmental regulations | 3.96 | 0.878 | 0.792 |

| 3 | Environmental costs are measured periodically and regularly | 4.48 | 0.79 | 0.896 |

| 4 | Environmental costs are allocated to products | 4.13 | 0.968 | 0.826 |

| 5 | Environmental costs are continuously controlled | 4.26 | 0.81 | 0.852 |

| 6 | Company regularly measures environmental gains | 4.04 | 1.065 | 0.808 |

| 7 | Company issues periodic reports about the environmental performance | 4.43 | 0.728 | 0.886 |

| 8 | Environmental performance reports help reduce environmental costs | 4.43 | 0.843 | 0.886 |

| Average | 4.28 | 0.879 | 0.855 | |

The results of the statistical analysis shown in Table 2 indicate that the highest relative importance is for the two questions “Company complies to the declared environmental regulations” and “Environmental costs are measured periodically and regularly”. The researchers justified this result by presenting that the compliance with environmental regulations has become a binding matter in all countries. Therefore, they work to monitor and reduce environmental costs has become a requirement for companies to reduce their costs and thus reduce prices and improve their competitive position. Likewise, the question which has the least relative importance is “Employees are fully aware of environmental regulations”. This is due to that adherence to environmental regulations still requires more awareness by workers in companies with large environmental emissions.

The Dependent Variables

Table 3 shows descriptive statistics related to the dependent variables: sustainable cost leadership advantage, sustainable differentiation advantage and sustainable market segmentation advantage.

| Table 3 Descriptive Statistics of Responses for Dependent Variables (Sustainable Competitive Advantages) | ||||

| No. | Statement | Mean | Standard deviation | Relative importance |

| a. | Sustainable cost leadership advantage | |||

| 1 | Periodic environmental performance reports help reduce environmental costs | 4.3 | 1.105 | 0.86 |

| 2 | Reducing environmental costs helps reduce production costs | 3.87 | 1.14 | 0.77 |

| 3 | Controlling environmental costs improve process efficiency | 4.13 | 1.058 | 0.83 |

| 4 | Reducing costs and improving efficiency allows products to be offered at competitive prices | 4.13 | 0.815 | 0.83 |

| Average | 4.11 | 1.03 | 0.821 | |

| b. | Sustainable differentiation advantage | |||

| 1 | Company’s interest in environmental protection ensures providing environment-friendly products | 4.7 | 0.559 | 0.94 |

| 2 | Managing environmental costs allow to provide high quality products | 4.43 | 0.896 | 0.87 |

| 3 | Company's interest in environmental protection enhances its reputation | 4.7 | 0.635 | 0.94 |

| 4 | Company's interest in environmental protection enhances its competitiveness | 4.57 | 0.788 | 0.91 |

| Average | 4.6 | 0.72 | 0.92 | |

| c. | Sustainable market segmentation advantage | |||

| 1 | Providing environment-friendly products increase sales volume | 4.04 | 0.825 | 0.81 |

| 2 | Providing environment-friendly products increase market share | 4.17 | 1.029 | 0.83 |

| 3 | Company's compliance to environmental laws allows it to enter new markets | 4.26 | 1.054 | 0.85 |

| 4 | Company's contribution to reducing environmental pollution increases customer loyalty | 4.48 | 0.947 | 0.9 |

| Average | 4.24 | 0.964 | 0.85 | |

The results of the statistical analysis shown in table (3) related to the first dependent variable “sustainable cost leadership advantage” indicate that the highest relative importance is for the question “periodic environmental performance reports help reduce environmental costs”. This can be explained by the fact that preparing periodic environmental performance reports can help companies identifying and limiting the causes of environmental costs. Likewise, the question has the least relative importance is “reducing environmental costs helps reduce production costs”. This can be explained by the fact that the companies can reduce its total costs by reducing the environmental costs. Regarding the second dependent variable “sustainable differentiation advantage”, the highest relative importance is for the question “company's interest in environmental protection enhances its reputation”, which indicates an increase in companies' interest in environmental factors. Likewise, the question with the lowest relative importance is “managing environmental costs allow to provide high quality products”, which indicates that reducing environmental costs has a reasonable impact on improving product quality, according to the respondents. For the third dependent variable “Sustainable market segmentation advantage”, the highest relative importance if for the question “company's contribution to reducing environmental pollution increases customer loyalty”, which indicates that the adhering to environmental factors is very important in gaining customer loyalty. Likewise, the lowest relative importance is for the question “providing environment-friendly products increase sales volume” which means that customers are highly interested in environmentally friendly products.

Discussion and Hypotheses Testing

The First Hypothesis

Table 4 shows the results of the regression analysis of the first hypothesis that measures the effect between the independent variable “EMA” and the dependent variable sustainable cost leadership advantage.

| Table 4 The Impact of EMA on Achieving Sustainable Cost Leadership Advantage | |||||||

| Model | Coefficients | T | Sig. | F | Sig. | R | |

| Constant | 0.117 | 0.214 | 0.832 | 55.178 | 0.000 | 0.851 | 0.724 |

| Strategic planning | 0.933 | 7.428 | 0.000 | ||||

Table 4 shows that the correlation coefficient value reached 0.851, which is a strong correlation coefficient between the independent variable “EMA” and dependent variable “sustainable cost leadership advantage. The value of the coefficient of determination was 0.724, which means that about 72% of changes of the dependent variable “sustainable cost leadership advantage” are caused by the independent variable “EMA”, and the rest is due to other factors. As for the Sig. value, it was 0,000, which is significant, and it means that the pattern is significant. Also, the significance of the regression coefficient was less than 5%, which means that there is a significant effect of independent variable “EMA” on the dependent variable “sustainable cost leadership advantage”. The result of this hypothesis is supported by Le, et al. (2019) who showed a positive impact of EMA on financial and environmental efficiency.

The Second Hypothesis

Table 5 shows the results of the regression analysis of the first hypothesis that measures the effect between the independent variable “EMA” and the dependent variable sustainable differentiation advantage.

| Table 5 The Impact of EMA on Achieving Sustainable Differentiation Advantage | |||||||

| Model | Coefficients | T | Sig. | F | Sig. | R | |

| Constant | 1.454 | 4.079 | 0.001 | 79.876 | 0.000 | 0.890 | 0.792 |

| Strategic planning | 0.735 | 8.937 | 0.000 | ||||

Table 5 shows that the correlation coefficient value reached 0.890, which is a strong correlation coefficient between the independent variable “EMA” and dependent variable “sustainable differentiation advantage”. The value of the coefficient of determination was 0.792, which means that about 79% of changes of the dependent variable “sustainable differentiation advantage” are caused by the independent variable “EMA”, and the rest is due to other factors. As for the Sig. value, it was 0,000, which is significant, and it means that the pattern is significant. Also, the significance of the regression coefficient was less than 5%, which means that there is a significant effect of independent variable “EMA” on the dependent variable “sustainable differentiation advantage”. The result of this hypothesis is supported by the research of L´opez- Gamero et al. (2009) which demonstrated that the decisions related to the selection of proactive environmental management are influenced by the level of investment in environmental protection aspects. furthermore. The same study showed also that the competitive advantage has a significant relationship with the costs which shall affect positively the financial performance of the firms in the legal section, moreover, the related impact in the hotel area occurs by a competitive advantage through the strategy of differentiation.

The Third Hypothesis

Table 6 shows the results of the regression analysis of the first hypothesis that measures the effect between the independent variable “EMA” and the dependent variable sustainable market segmentation advantage.

| Table 6 The Impact of EMA on Achieving Sustainable Market Segmentation Advantage | |||||||

| Model | Coefficients | T | Sig. | F | Sig. | R | |

| Constant | -0.691 | -1.986 | 0.060 | 206.115 | 0.000 | 0.953 | 0.908 |

| Strategic planning | 1.153 | 14.357 | 0.000 | ||||

Table 6 shows that the correlation coefficient value reached 0.953, which is a strong correlation coefficient between the independent variable “EMA” and dependent variable “sustainable market segmentation advantage”. The value of the coefficient of determination was 0.908, which means that about 90% of changes of the dependent variable “sustainable market segmentation advantage” are caused by the independent variable “EMA”, and the rest is due to other factors. As for the Sig. value, it was 0,000, which is significant, and it means that the pattern is significant. Also, the significance of the regression coefficient was less than 5%, which means that there is a significant effect of independent variable “EMA” on the dependent variable “sustainable market segmentation advantage”. The result of this hypothesis is supported by Al- Mawali H. et al. (2018) who indicated that EMA improved the traditional management accounting system and generate helpful information to organizations in order to manage and enhance the performance and bring about sustainable growth.

Conclusion and Recommendations

This study concludes that the application of environmental management accounting clearly affects the achievement of sustainable competitive advantages for industrial companies with high pollution in Bahrain. The industrial companies under study adhere to a strong policy regarding adherence to environmental regulations as well as working to provide environmentally friendly products, which helps in achieving sustainable competitive advantages that helps achieve the goals of these companies in the short and long term. The results of this study show a strong impact of environmental management accounting on all dependent variables respectively. The results of this study will help those companies to take advantage of the opportunities provided by the positive aspects of the research.

The results of this study will also help to better understand environmental management accounting and their role in achieving sustainable competitive advantages for those companies, especially those related to cost leadership, differentiation and market segmentation. The empirical results of this research should be considered in light of some limitations, for example, this research was restricted to companies with a large emission of pollution only in Kingdom of Bahrain. The survey has been conducted during COVID 19 epidemic which could affect the responses of the sample. These limitations don’t prevent other researchers from using the results of this paper for similar attempts trying to assist decision-makers in enhancing companies' competitive advantages. As for future research, we recommend that more companies be included in the sample. Additional variables in future studies could lead to more understanding and benefit in the field of environmental management accounting and its role in achieving other competitive advantages.

1. Cost advantage: Similar product at lower cost

2. Differentiation advantage: Price premium for unique product

3. Cost advantage: Similar product at lower cost

4. Differentiation advantage: Price premium for unique product

References

- Al-Mawali H., Al Sharif, A., Abu Rumman, G., & Kerzan, F. (2018). Environmental strategy, environmental management accounting and organizational performance: Evidence from the united arab emirates market, journal of environmental accounting and management. Journal of Environmental Accounting and Management 6(2), 105-114.

- Also, Sana, O.T., Hengb, T.B., Selleyc, S., & Magsi, H. (2018), The Relationship between Contingent Factors that Influence the Environmental Management Accounting and Environmental Performance among Manufacturing Companies in Klang Valley, Malaysia. Int. Journal of Economics and Management 12 (1), 205-232.

- Amir, D., & Sonderpandian, J. (2002). Complete Business Statistics, New York: McGraw – Hill.

- Cronbach, L. (1970). Essentials of Psychological Testing, New York: Harper & Row Publishers, Inc .

- Falope, F.J., Offor, N.T., & Ofurum, D.I. (2019). Environmental cost disclosure and corporate performance of quoted construction firms in Nigeria. International Journal of Advanced Academic Research - Social and Management Sciences, 5( 8), 17 – 31.

- Gamble J.E., Peteraf, M.A., & Thompson, A.A. (2019). Essential of Strategic Management, 6th ed., USA: McGraw-Hill.

- Gibassier, D., & Alcouffe, S. (2018), Environmental Management Accounting: The Missing Link to Sustainability. Social and environmental accountability journal, 38(1), 1–18.

- Hassan, I.M. (2002). Principles of Statistics, Alexandria University. Alexandria: Faculty of Commerce Printing Press.

- Henri, J., Boiral, O., & Roy, M. (2016), Strategic cost management and performance: the case of environmental costs. The British Accounting Review, 48(2), 269–282.

- Jamil, C.Z.M., Mohamed, R., Muhammad, F., & Ali, A. (2015). Environmental management accounting practices in small medium manufacturing firms. Procedia - Social and Behavioral Sciences, 172, 619 – 626.

- Jinadu, O., Agbeyangi, B.A., & Mamidu, I.A. (2015), Impact of Environmental Management Accounting on Current Practices and Future Sustainability in South-West Nigerian Polytechnics. International journal of economics, Commerce and Management, 3(10), 586–603.

- L´opez-Gamero, M.D., Molina-Azor´?n, J.F., & Claver-Cort´es, E. (2009). The whole relationship between environmental variables and firm performance: Competitive advantage and firm resources as mediator variables. Journal of Environmental Management, 90 (10), 3110-3121.

- Larojana, C., & Thevarubanb, J.S. (2014). Impact of Environmental Management Accounting Practices on Financial Performance of Listed Manufacturing Companies in Sri Lanka, Reshaping Management and Economic Thinking through Integrating Eco-Friendly and Ethical Practices. Proceedings of the 3rd International Conference on Management and Economics, pp. 239-246.

- Le T.T., Nguyen T.M.A., & Phan, T.T.H. (2019). Environmental management accounting and performance e_ciency in the vietnamese construction material industry: A managerial implication for sustainable development. Sustainability, 11, 5152, 1 – 32.

- Le, T.T., & Nguyen, T.M.A. (2018), Practice environmental cost management accounting: The case of Vietnamese brick production companies. Manag. Sci. Lett. 9, 105–120.

- Mohamed, R., & Jamil, C.Z.M. (2018). Barriers to implementing environmental management accounting practices in small medium manufacturing companies in Malaysia. International Journal of Engineering & Technology, 7 (3.35), 149-151.

- Nunnally, J.C. (1978). Psychometric Theory, 2nd ed. New York: McGraw – Hill .

- Porter, M.E. (1985). Competitive Advantage. USA: Free Press.

- Porter. M.E. (1998). Competitive advantage Creating and Sustaining Superior Performance. USA: Free Press.

- Robinson, J.P., Shaver, P.R., & Wrightsman, L.S. (2013). Measures of personality and social psychological attitudes: Measures of social psychological attitudes (Vol. 1). Academic Press.

- Rothaermel, F.T. (2017). Strategic Management, 3rd ed. USA: McGraw-Hill.

- Russell, S., Milne, M.J., & Dey, C. (2017). Accounts of nature and the nature of accounts: Critical reflections on environmental accounting and propositions for ecologically informed accounting. Accounting, Auditing & Accountability Journal, 30(7), 1426–1458.

- Sayedeh, S., & Saudah, S. (2014). A proposed model of the relationship between environmental management accounting and firm performance. International Journal of Information Processing and Management, 5(3).

- Schaltegger, S., Bennett, M., Burritt, R., & Jasch, C. (2008). An empirical examination of the role of environmental accounting information in environmental investment decision making. Environmental Management Accounting for Cleaner Production, 24, 457–475.

- Sekaran, U. (2000). Research Methods for Business. New York: John Wiley & sons, Inc

- Tanwar, R. (2013), Porter’s Generic Competitive Strategies. Journal of Business and Management, 15(1), 11-17.