Research Article: 2019 Vol: 23 Issue: 3

Examining the Framework of Entrepreneurial Ecosystems: A Case Study on the United Arab Emirates

Bushra Alyas Yahya, Khalifa University

Bashayer Mohamed Almarzooqi, Khalifa University

Toufic Mezher, Khalifa University

Abstract

The United Arab Emirates (UAE) commitment to building a sustainable and diversified economy includes the announcement of multiple strategies such as the UAE’s National Innovation Strategy and Abu Dhabi Economic Vision 2030. Many institutions and key players have been taking an active role in these strategies by their involvement in the entrepreneurial ecosystem and supporting startups is lacking. This paper aims to examine the UAE’s current entrepreneurial ecosystem model, its gaps and opportunities and its impact on startups. Moreover, this research paper aims to explore the domains of the ecosystem that startups find pivotal to their growth and success. The data collection methodology taken in this research is to conduct qualitative research through interviews with key ecosystem players to understand their role in the ecosystem as well as quantitative research through surveys to quantify the availability and importance of key ecosystem support elements. The analysis is conducted to support the results of the collected data. The ecosystem is then modeled based on the Triple Helix perspective of National Innovation Systems and the relationships between its three key players (i.e., government, industry and academia). The outcome of this research is summarized in an entrepreneurial ecosystem framework design that is ideal and unique to the UAE. In addition, this paper provides recommendations to close the gaps leverage the opportunities and overall enhance the entrepreneurial ecosystem in the UAE.

Keywords

Entrepreneurial Ecosystem Model, National Innovation System, Start-up, UAE.

Introduction

With the advent of technological revolutions, the world has seen breakthroughs in different areas such as governance, business, transportation, etc. Historically, technological disruptions and innovations have been created in established companies and research centers. In recent years, start-ups have entered the technology and innovation arena and have made a significant impact on the world’s economy. Start-ups are young, growth-oriented, and organically-structured companies that aim to solve challenges, typically through technological disruptors (Kenton, 2018). Start-ups are the main drivers of the entrepreneurial ecosystem, which is defined as a system of coalescing actors, organizations, institutions and processes that govern the entrepreneurship scene in a specific geographical setting (Mason & Brown, 2013). A successful entrepreneurial ecosystem plays a key role in the economic growth and innovation index of the UAE. Moreover, in this region, policy plays a key role in the success of the entrepreneurial ecosystem where it can be both a growth accelerator and inhibitor. This research is motivated by the UAE’s National Innovation Strategy which aims to make the UAE one of the most innovative nations in the world by 2021 (National Innovation Strategy). It is also motivated by the UAE’s Centennial Plan which aims to make the UAE the best country in the world by 2071 (Mohammed Bin Rashid). Finally, this research intends to add value in the academic research field as we see a lack of supporting literature in the field of entrepreneurship in the UAE. At the time of writing this paper, there exists no literature including a holistic framework of the UAE’s entrepreneurial ecosystem. The objective of the paper is to look at both the national innovation system (NIS) and entrepreneurial ecosystem in UAE, to determine existing gaps, and to recommend best strategies to close these gaps in order to drive technology development in UAE.

Literature Review

Economy diversification is a long-term economic vision that was mandated by H.H. Sheikh Khalifa bin Zayed Al Nahyan, President of the UAE, Ruler of Abu Dhabi back in 2006 (Abu Dhabi, 2008). The UAE has set Vision 2021 to be among the most innovative nations in the world (UAE National Innovation Strategy). To comply with this vision, the UAE aims to build a sustainable economy that encourages innovation through entrepreneurship and fostering the small and medium businesses (SMEs) growth as well as enhance competitiveness by focusing on new industries and internationally traded services (Abu Dhabi, 2008). For example, renewable energy and desalination have attracted many investment in recent years (Mondal et al., 2016; Hawila et al., 2014; Saif et al., 2014).

Overview of the UAE’s National Innovation System (NIS)

Most of the start-up companies are born from an idea, and the idea grows to reach the level of success. One way to explore the health of the entrepreneurial ecosystem is by looking into the Global Entrepreneurship Index (GEI) (Ács et al., 2018). This index measures the quality and the extent of supporting the entrepreneurial ecosystem. The UAE is ranked 26 out of 137 countries accumulating the score of 53.5.

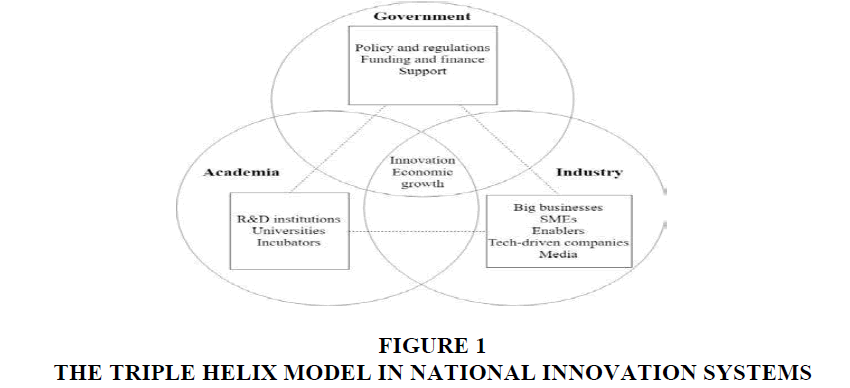

The index is primarily a result of the Triple Helix Model, which explains the interactions and flows between the three key players in the NIS; government, industry, and academia as shown in Figure 1 (Mezher et al., 2008; Acs et al., 2018).

This model plays a significant role in the economic and technological development of the UAE. The government is the primary source of funding and regulations. It contributes to the science and technology system. It also plays a significant role in setting policies, regulating social and economic mechanisms, and driving both the academia and the industry through funding and other support mechanisms (Rangaa & Etzkowitz, 2013). The main focus of the industry is profit and R&D commercialization, which is it is an essential player in national economic growth as it drives the market and GDP (Mezher et al., 2018). Academia is the hub of research and development as well as the catalyst to developing human capital. The quality of academia and the educational system is significant in the NIS. Thus, a robust educational system can lead to an effective entrepreneurial system. Moreover, Figure 1 illustrates the linkages between the three key players in the NIS, which represent many factors such as financial, human, knowledge, etc. (Al-Abd & Mezher, 2014).

A clear understanding of this helix can help identify the gaps and opportunities in the entrepreneurial ecosystem in specific and the economy at large (OECD, 1997). It helps to determine the different players, their roles and their performance and thus pinpointing where the gaps lie. Moreover, the helix promotes hybridization of elements from academia, industry, and government to reproduce new frameworks, institutions and formats (Ranga & Etzkowitz, 2013).

Entrepreneurial Ecosystem Models

This section addresses three different models. The models are chosen based on their popularity and applicability in the UAE. In addition, the content of the models is going to be the foundation of the UAE framework that is going to be established later in this research paper.

World Economic Forum Ecosystem Model

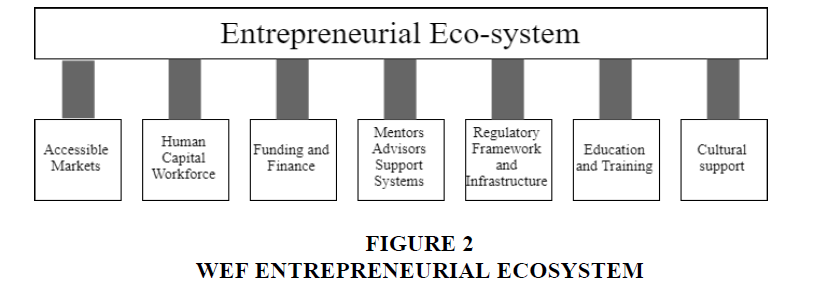

The key findings of the Annual Meeting of the New Champions during the 2013 World Economic Forum (WEF) focus on the entrepreneurial ecosystems. The ecosystem described in the report is modeled around what the entrepreneur view as important elements to their success as shown in Figure 2 (Annual Meeting of the New Champions, 2013).

The model is designed after evaluating responses from individuals with experience in early- stage companies as well as responses entrepreneurs and seniors from early-stage companies. This methodology of design gives this model its strength as it is based on realistic views of entrepreneurs from around the globe. The report indicates that the three most crucial domains for entrepreneurs are accessible markets, human capital and funding & finance (Annual Meeting of the New Champions, 2013).

Babson Entrepreneurship Ecosystem Project (BEEP)

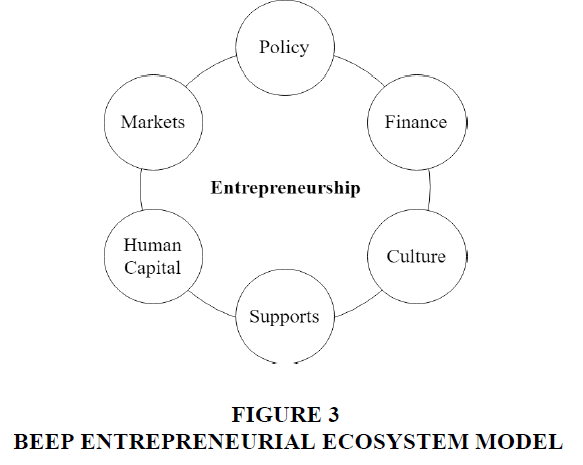

BEEP is a popular ecosystem model is proposed by Daniel Isenberg, the founding executive director of the Babson Entrepreneurship Ecosystem Project (BEEP). This model consists of six domains: policy, finance, markets, human capital, support and culture as shown in Figure 3 (Isenberg, 2011).

As shown in the Figure 3, there are no arrows indicating a cause-effect relation between the different domains which emphasizes that in entrepreneurship, an element’s political standing is determined by a large number of variables interacting in a highly complex manner. The BEEP models demonstrate the different domains and elements from the entrepreneurs’ perspective and how they impact their success. Moreover, Isenberg’s model implicates that there exist no two similar ecosystems; for example, Silicon Valley cannot be replicated because it consists of different processes, actors and organizations (Isenberg, 2011). As presented, Isenberg’s model is strong and popular for its simplicity, directness, and lack of hierarchy and authority. Also, the model is designed around the entrepreneur and what they view as important. The BEEP model almost represents an ideal national ecosystem structure where if the seven domains are satisfied, the entrepreneurship index in a particular location will be high/ideal. Unlike the WEF ecosystem model presented in the previous section, this model assumes all domains have equal importance.

Spigel and Stam’s Relational Approach to Entrepreneurial Ecosystems

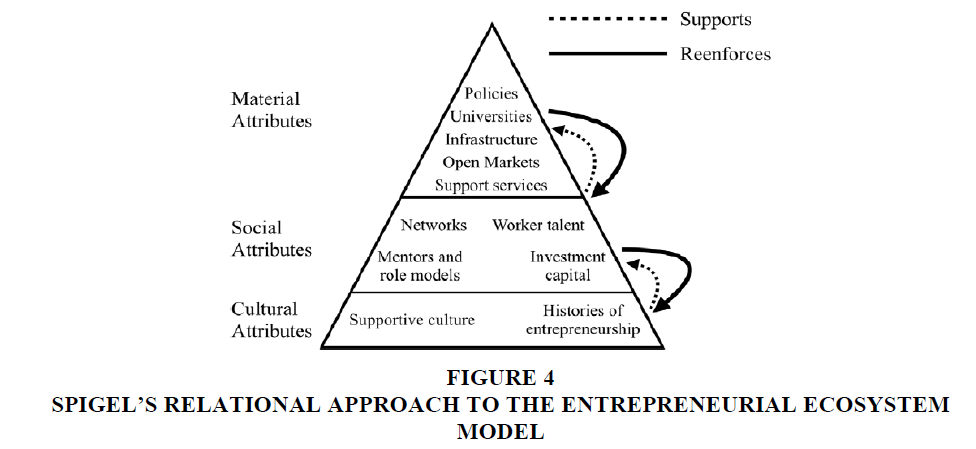

While the models containing domains and attributes presented in the previous sections have many strengths, they do not present the relations between the different domains. In his paper (Spigel, 2015), Spigel notes the importance of recognizing the relationships between the attributes. Spigel’s relational approach suggests that the entrepreneurial ecosystem is dynamic and can have multiple configurations depending on the relations between the attributes (Spigel, 2015). It can also be noticed that many of the attributes overlap and dividing them into many domains can be limiting. In their paper (Stam & Spigel, 2016), Spigel and Stam discuss attributes and shortcomings of different entrepreneurial ecosystem approaches including the BEEP and proposed a new model enforced by the relational approach. Since leadership provides top-down direction, leaders tend to become role models and mentors to the entrepreneur. Since this element is top-down, it controls whether the ecosystem is healthy or not. This is evident in countries with corrupted leadership where innovation levels are low and entrepreneurship is discouraged.

This model presents the highest level of strength (Figure 4) among the three as it provides a solid understanding of both the elements of an entrepreneurial ecosystem and their relationships. A summary of the strengths and weaknesses of each model is shown in Table 1.

| Table 1: Strengths And Weaknesses Of The Different Ecosystem Models | ||

| Model | Strengths | Weakness |

|---|---|---|

| WEF | Provides the level of importance for each ecosystem element based on global surveys | Does not consider the relations between the elements |

| Provides sub-elements | ||

| BEEP | Simple | Assumes all ecosystem elements are of equal importance |

| Direct | Does not consider the relations between the elements | |

| Provides sub-elements | ||

| Spigel and Stam | Considers the relations between the element categories | Assumes all ecosystem elements are of equal importance |

We use these three models in our design where we take a relational approach using the national innovation helix as well as consider the level of importance of each element in the UAE.

Methodology

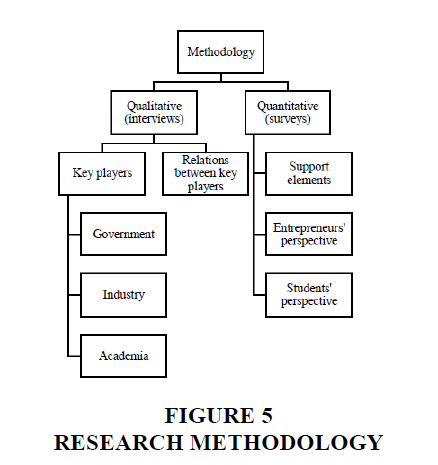

This research of the UAE’s ecosystem is based on existing models as provided in Section 2. Both qualitative and quantitative methods are used in this paper as shown in Figure 5.

Qualitative Research

The scope of work included a one-hour interview is conducted to understand and analyze the role of each of the three key players of the national innovation helix (government, industry, and academia). The key players are categorized based on their role and services as shown in Figure 6. The interview questions also explored the relations between the key players presented above. The interviews were conducted with managers, directors and founders in their respective institutions as follows: one from academia, two from the government, three from the private sector, two start-ups, and two SMEs.

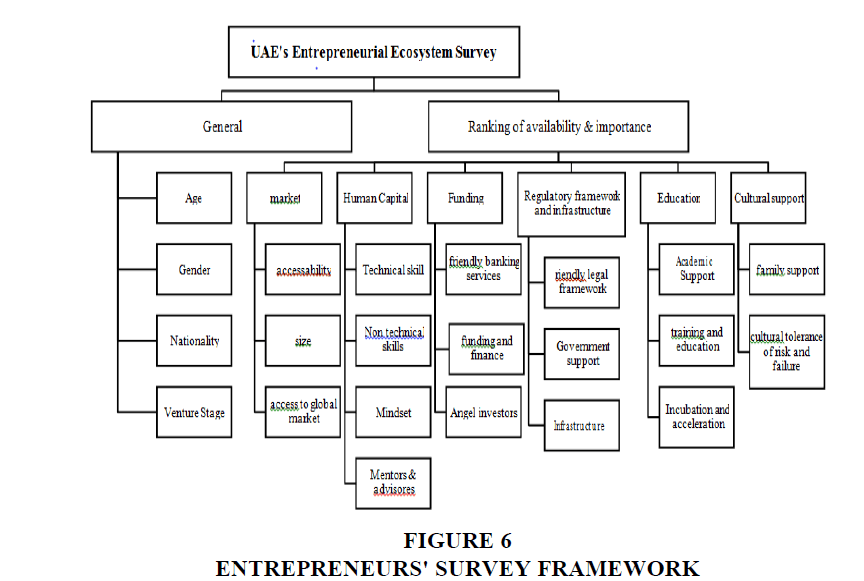

Quantitative Research

The Quantitative research covers a survey which has been conducted on two different samples groups and different sizes, the entrepreneurs and students. To study the entrepreneurs’ perspective on the ecosystem and analyze the different ecosystem elements role in accelerating their success. The list is collected through networking with different ecosystem incubators. This survey explores the availability and importance of the different support elements from the entrepreneurs’ perspective. The framework of the survey is shown in Figure 6.

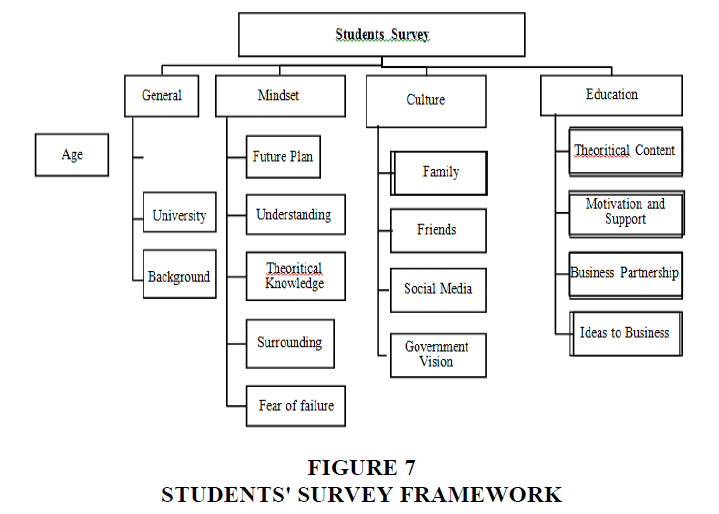

To study student perspective on entrepreneurship and analyze the culture, mindset and academia’s role in encouraging them. The list is collected through networking with different universities. The student’s survey targets university students to understand their perspective on specific support elements (i.e., mindset, culture, and education), and key players (i.e., Academia). The framework of the survey is shown in Figure 7.

The support elements used for analysis are derived from the WEF model, BEEP model, and Spigel and Stam’s model.

Analysis of Data

This section includes the data collected from the methodology and the analysis section. The analysis is separated into two categories, qualitative analysis where the three key players are analyzed and quantitative analysis, which covers both entrepreneur and student surveys.

Qualitative Data Analysis

Government entities that impose policies and laws

The UAE cabinet approved a 10-year visa for international investors, high-skilled workers in medical, science and research as well as entrepreneurs and innovators [18]. Additionally, the regular student visa is extended after graduation to give an opportunity to expat student to start their business or advance their career in the UAE. These policies are either pending execution or just recently executed; therefore, we cannot analyze their impact yet. However, during the interviews, foreign entrepreneurs expressed their concern about the difficulty of acquiring a visa to set up a business in the UAE. The new UAE bankruptcy law promotes a debtor-friendly rescue culture where companies going bankrupt do not need to be imprisoned or go through criminal prosecution. This initiative encourages entrepreneurs to take the risk and not worry about going bankrupt. Entrepreneurs expressed their concern for high setup costs, where it costs a minimum of AED 10,000 to legally set up a business in the UAE (whether in mainland or free zone). Moreover, the startups are obliged to set up an office to ensure full commitment. We explain the high setup costs by the following:

1. The government has faced cases where entrepreneurs flee the country as soon as they go bankrupt. The law needs to ensure that entrepreneurs are committed to starting their companies and not flee the country as soon as they go bankrupt, leaving the government to pay for their debt.

2. The taxation framework in the UAE does not levy taxes on companies and startups. Therefore, the high setup cost is a way to compensate for the tax-free framework.

Startups with threatening operations are usually regulated to ensure national security. For example, drone startups threaten aviation operations, cryptocurrency startups as they threaten banking services, etc. According to Partnerships and Strategy Manager at Sheraa, the government is making an effort in studying the consequences of these technologies and is working on constructing a positive legal framework to benefit from these technologies without threatening safety and security.

Government entities whose sole purpose is to grow entrepreneurship

The Dubai Future Accelerators (DFA) is a mandatory program that pairs start-ups with different government entities to solve global and local challenges. Will Fan, co-founder of QLC and a DFA graduate, expressed his satisfaction with this initiative. He states that this initiative was like a testbed where his startup can do experiments and then scale up their offerings in the Middle East and globally. This initiative offers them free space and zero setup costs. Sheraa is Sharjah’s official entrepreneurship center which connects startups with the three players in the innovation helix as well as incubates them and accelerates their growth. Startups based in Sheraa can set up their business in a free zone at a lower cost. Sheraa startups expressed their satisfaction with the program where they get advantages by being associated with Sheraa as it gives them credibility when approaching possible customers, partners and investors. Other than Sheraa, Sharjah’s Higher Committee for Digital Transformation led by Sheikh Fahim Al Qassimi allocates 10% of their procurement to be purchased from startups to encourage them.

A government entity that has an assigned department for innovation and entrepreneurship

The Department of Innovation and the Future in DEWA works closely with energy and water startups to bring in the latest technologies to DEWA as well as incubators and accelerators such as DFA and Free Electrons. An associate in the Department states that the department supports startups by accepting their offerings and products without going through the long tendering process that DEWA vendors usually go through. Additionally, they sign MOUs with global startups to share knowledge and transfer technologies. However, he expressed his concern on government employees lacking deep technical expertise and therefore cannot challenge the startups’ offerings and IPs. Instead, they accept whatever the startup has to offer.

Private entities with an initiative to promote entrepreneurship

The Abu Dhabi Financial Group (ADFG) entity has established Krypto Labs, a startup incubator that supports and invests in startups in the UAE. According to Anas Zeineddine, Director of Krypto Labs, the incubator works with the UAE Space Agency, a government entity, to incubate startups on their behalf. Moreover, they focus on corporate innovation where they collaborate with corporates and provide them with technology-related education. Similarly, Emaar’s Chairman, Mohamed Alabbar launched the e25 initiative to encourage its teams to come up with technological ideas and venture out as independent startups. Hamza Khan, Letswork co-founder, states that Emaar supports and invests in their startup. Moreover, they receive credibility by being associating with Emaar. In summary, some private entities are supporting startups by incubating them, giving them credibility and investing in them. However, the number of such initiatives is low when considering the number of private entities.

Private philanthropic funds

Sandooq Alwatan is a fund launched by the UAE’s top Emirati businesses men. This fund established programs such as researcher.ae where they fund R&D, Khalifa Innovation Center (KIC) where they incubate startups. Mohammed Alqadhi, Director General of Sandooq Alwatan, states that this fund is unique globally, where it is supported by high net worth donors and only focuses on funding local high-technology research and talents. The donors are motivated by their corporate social responsibility (CSR) and improving their public relations (PR). We have analyzed the outcomes of this fund, where most of the projects funded are unique to the UAE including a Fitbit for camels and research done on UAE’s population to identify a genetic marker to create medicine that is unique to the Middle-Eastern population.

A university with a dedicated entrepreneurship-related department Intellectual property (IP)

We notice that academia does not focus on making those research discoveries commercially viable. However, this can be possible if the university has a dedicated arm to turn research discoveries into start-ups, usually through a Technology Transfer Department. According to the Interim Director of Technology Management and Innovation at Khalifa University, universities focus on technology development and progressing IPs which can then be commercialized by having the right partnerships with the industry (See Appendix A). Dr. Bashir is concerned about the IP ecosystem in the UAE, where universities pay high fees to file for patents similar to industrial companies. He suggests that if fees are reduced for universities and start-ups, more IPs will be filed and therefore more research can be commercialized and eventually turns into start-ups.

Education

From an outside point of view, ecosystem enablers expressed their concerns with the education system’s ability to teach modern-day skills needed to start a business (e.g. risk taking, negotiations, etc.), where it focuses on knowledge retention and not agile enough to catch up with the industry trends and future jobs. Also, it does not establish entrepreneurship as a valid career option for graduating students. Thus, leaving the students with a fixed mindset, confused and dependent on the system to learn new skills and information. In efforts to solve this, the UAE has appointed a Minister of State for Higher Education and Advanced Skills, however, the outcomes of such an initiative can only be seen in 10 to 20 years from now. Moreover, the government mandated that entrepreneurship courses must be taught in universities by training the UAE universities’ faculty in Stanford University. This initiative is expected to introduce the faculty to new and relevant teaching skills to teach and train the students.

On-campus incubation

In efforts to improve the entrepreneurial culture in universities, Sheraa established its HQ in University City in Sharjah, & Sandooq Alwatan established KIC in Khalifa University campus. Both incubators are entirely funded/supported by the government and private sector, respectively, to recruit talents and support them to start their own business. This indicates that the incubation support is not initiated by the academic sector, but by other players.

Quantitative Analysis

Entrepreneurs’ Perspective on the Ecosystem

The dataset consists of responses from around 40 entrepreneurs. The demographics of the dataset reveals that the number of males exceeds the number of females by 70%. Moreover, almost 80% of entrepreneurs are under the age of 35, which indicate that the survey inputs are based on a young age perspective. Finally, the three highest percentages of venture stage are early stage (42%), seed capital (30%) and SMEs (17%). That is a good indicator that the entrepreneurs are already working towards economic diversification.

In the survey, entrepreneurs rank the ecosystem elements based on availability and importance of six different support element categories which are market, human capital, funding, regulatory framework and infrastructure, education and cultural support. The distribution of the results is examined in terms skewness to reach a meaningful conclusion.

Importance

The outcome of the survey indicated that entrepreneurs view all elements as important since they all determine the success of their ventures. Funding is the most important element. Around 43% of the sample favoured personal funding (e.g. friends, family, personal, etc.), while 37% favoured having start-up friendly banking services (e.g. loans, etc.). The results are expected since having capital is the first challenge entrepreneur’s face when starting a new venture. On the other hand, education-related support elements were the least important factors. This can be explained by the fact that entrepreneurs utilize the method of self-learning where they do not depend on institutions to learn the know-hows of entrepreneurship.

Availability

The market and human capital support elements ranked highest in terms of availability with scores of 35%, 27% respectively. Meanwhile, the funding category ranked the lowest in terms of availability, indicating that it is not readily available in the UAE. This can be explained by the fact that the entrepreneurial ecosystem in the UAE is still nascent and investors tend to be risk-averse. This gap can be closed when the investment culture starts to tolerate risk and the mind-set of investor’s shifts. Moreover, the investment community tends to follow each other; once a portion of investors become risk-takers, it will inspire the rest to take more risks with entrepreneurs.

Students’ perspective on entrepreneurship

The dataset consists of 173 students. Around 80% of the sample is above the age of 23 years, which indicates that the majority of survey takers have recently graduated and had the full academic experience. Thus, answers can be considered very accurate. Survey takers are students from around ten universities. Approximately 52% of the survey takers major in the science and engineering fields, whereas students majoring in the business and finance fields are around 30% of the sample. It can be noted that this survey outcomes are biased towards those two major groups.

Mind-set

Around 80% of the sample chose to be either employed in a company only or to be employed in a company and own a business at the same time. This result indicates that the culture is risk-averse and have the traditional mind-set of having a secured job. Even 3 out of 4 students are aware of the entrepreneurship opportunities and incubators, many of them are not encouraged to participate in these programs and opportunities.

Culture

Around 74% of the participants know a relative, a friend or a mentor who is an entrepreneur. This is a good indicator as the interaction between them might lead to motivating them to start this journey. In reference to the social media effect on the culture and the exposure it offers, around 82% of the participants find that the social media entrepreneurial content is informative and motivating. Other motivation factors are analyzed from the two main players in society: family and friends. Around 40% of survey takers indicate that their families de- motivate them to start a business, whereas 30% of them find friends de-motivating. Family tends to pressure their children to choose a secure and non-risky career path. This can be explained by the fact that many parents lived in destitution prior to oil discovery and do not want their children to experience that when there is an option not to. Finally, about 76% of the sample indicates that they are fully aware of the government’s direction towards entrepreneurship and innovation to diversify the economy which is a positive indicator.

Academia

Higher education institutions play a crucial role in an entrepreneurial ecosystem and a more important role in developing economies. However, it is clear that there is a gap between university offerings and the real market, particularly in entrepreneurship. About 60% of the participants indicate that entrepreneurship courses are offered at their universities but the percentage could be biased towards business and finance students. The survey indicated that students are not getting the support and the motivation in universities to start a business after graduation. This shows that universities condition students to look for employment. Moreover, the survey results indicate that more than half of the students believe that the university does not support them in transforming their ideas and class projects to businesses and startups. On the other hand, results do indicate that universities motivate the students to intern for small businesses. This is a positive indicator as working with startups and small businesses offer a wide range of skills that are needed in the market. In contrast to these results, more than half of the students are not aware of the collaborations their universities have with industry partners.

Results and Discussion

Strengths and weaknesses of the ecosystem

The data collected from interviews and surveys indicate that governments are a successful key player in enabling entrepreneurship and support. A strengths and weaknesses analysis of the government involvement in the entrepreneurial ecosystem can be shown in Table 2.

| Table 2: Strengths And Weaknesses Of The Government's Model | |

| Strengths | Weaknesses |

| Supportive leadership | High legal setup costs |

| Ownership law | Monopoly and exclusivity (on some activities) |

| No corporate taxation | Human capital lack deep technical expertise |

| Entrepreneur visa | Difficulty in breaking into the system without networks in the government |

| Availability of funds | Unclear business setup framework |

| Launchpad and testing environment | |

| Startup friendly free zones | |

| Government incubation initiatives | |

| Power of association credibility | |

On the other hand, industry is starting to make an effort to enhance the ecosystem mainly through investing in startups in return for equity. The effort is mainly encouraged by the government through mandates and support or CSR. A strengths and weaknesses analysis of the industry involvement in the entrepreneurial ecosystem can be shown in Table 3.

| Table 3: Strengths And Weaknesses Of The Industry’s Model | |

| Strengths | Weaknesses |

| Awareness and initiative | Weak relations with academia |

| High net venture capital venture capital arms dedicated to startups | Low number of entrepreneurial initiatives from private entities |

| CSR | Conservative procurement systems |

| Dominance of big industry players | |

It can be also being argued that academia is not active in supporting students entrepreneurially, however, external support is present by either government mandates or philanthropic private initiatives. Moreover, the IP ecosystem does not encourage academic R&D and eventually commercialize it by strengthening the relationship between academia and industry. A strengths and weaknesses analysis of the academia’s involvement in the entrepreneurial ecosystem can be shown in Table 4.

| Table 4: Strengths And Weaknesses Of The Academia's Model | |

| Strengths | Weaknesses |

| Pool of talent | Lack of entrepreneurship training |

| Establishment of Entrepreneurship Dept. | Lack of entrepreneurship culture |

| Focus on technology | Lack of teaching relevant and modern-day skills |

| Universities with top ranks regionally | Weak relations with the industry |

| High costs of IP filing fees | |

| Focus on knowledge retention | |

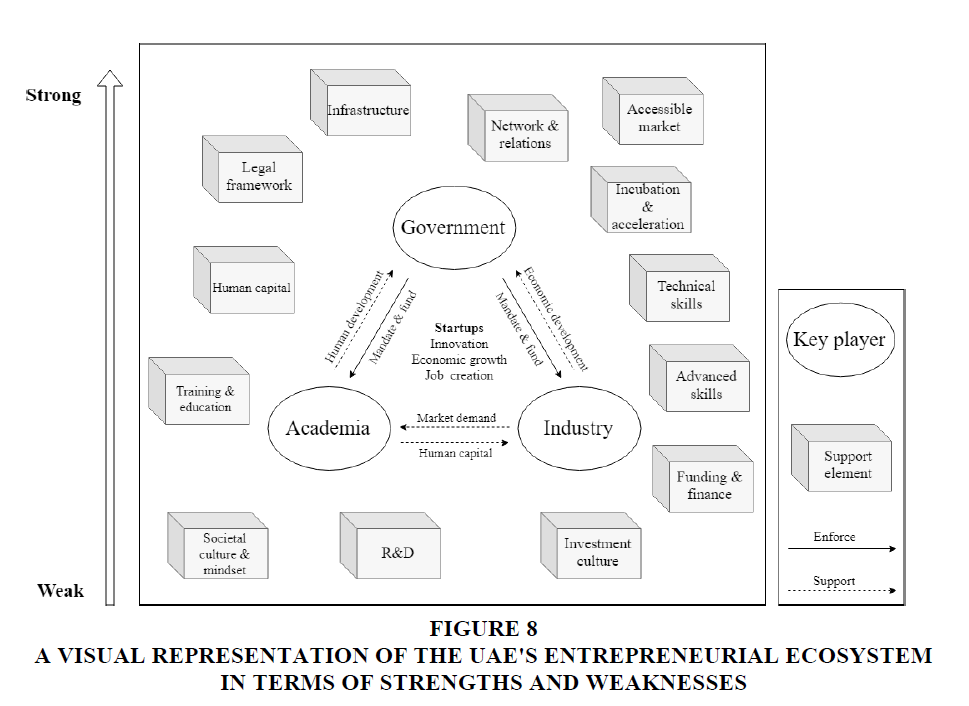

This research aimed to analyze the UAE’s entrepreneurial ecosystem to eventually map a visual representation of the UAE’s ecosystem and position in the entrepreneurship global map as shown in Figure 8.

Figure 8:A Visual Representation Of The Uae's Entrepreneurial Ecosystem In Terms Of Strengths And Weaknesses.

Government-Academia Relation

The government mandates and funds academia to encourage entrepreneurship in their curriculum, in return, academia develops human capital with advanced skills relevant to today’s economy and innovation. A large portion of this developed capital become entrepreneurs and create new jobs rather than consume them.

Government-Industry Relation

The government mandates and sometimes funds the industry to collaborate with start-ups and support them. Moreover, the government mandates the industry to strengthen their relationship with academia through R&D. The government can also incentivize the mandates (e.g. funds, lab facilities, etc.). In return, the industry grows the economy and diversifies it.

Academia-Industry Relation

The industry provides academia with data on relevant market demands and future trends as well as connect students to startups for internship programs. In return, academia develops human capital to join the industry as well as IPs that can be commercialized.

Support Elements

The support elements shown in this framework are the results of the surveys. Thus, they are specific and essential to the UAE’s ecosystem. It is predicted that once the ecosystem grows, it will start to decentralize and become autonomous, where it does not rely on mandates and incentives any longer. Once a large batch of entrepreneurs succeeds, it will create enough competition to drive the industry to innovate and collaborate with academia. Moreover, successful entrepreneurs will then become investors and motivators to encourage the younger batches to follow the same path. This will also make a paradigm shift in the culture and mindset to become more tolerant of risk and acceptant of failure.

Recommendations to improve the UAE’s entrepreneurial ecosystem

A list of recommendations is generated based on the results to improve the entrepreneurial ecosystem and strengthen the relations between the ecosystem players.

1. Government can incentivize the industry to work with academia by building non-profit shared labs, where academic IPs can be used by the industry in those labs

2. Government can incentivize industry if they allocate a percentage of their procurement to be purchased from start-ups

3. Government can reduce the IP filing fees for universities and start-ups

4. Government can reduce legal setup costs for start-ups with innovative services.

5. Academia can promote entrepreneurship by connecting students to start-ups for internship

6. Academia can promote entrepreneurship by establishing permanent acceleration programs for senior design projects to encourage the students to continue working on their ideas after graduation and start their own business

7. Government can mandate that every university establishes its own incubator

8. Establish more technology equity funds, which are funds solely dedicated to invest in specific technologies (e.g. ICT fund by TRA)

Conclusion

In conclusion, this paper discusses the current ecosystem in the UAE and the relationships between its three key players (i.e. government, industry and academia). This research paper addresses the importance of having a framework for the UAE ecosystem. The literature review provides a better understanding of what is currently available and useful for the ecosystem such as the NIS, Triple Helix Model, and the different ecosystem models. In addition, different methodologies were used to gain a better insight on the strengths and weaknesses of the ecosystem. The results show that the government is the strongest key player and the driver of the current entrepreneurial movement. The government mandates strategies to the private sector and industry, which creates a kind of reliance on the government to initiate the growth in the ecosystem. This is the fastest and most efficient approach to enhance the ecosystem which is to use a top-down approach where the government uses incentives to encourage the other players to collaborate and support each other. Moreover, it is concluded the weakest relation in the ecosystem is between industry and academia as this relationship is not well incentivized. Finally, the results show that each city’s government has a different philosophy to grow their economy through entrepreneurship. For example, Sharjah focuses on growing startups in-house for long term economic growth, while Dubai focuses on outsourcing global talent for accelerated growth. Both cities’ philosophies add value to diversify the UAE’s overall economy.

Acknowledgment

The authors would like to acknowledge the support of Khalifa University.

References

- Acs, Z.J., Laszlo, S., & Ainsley, L. (2008). The global entrepreneurship index. Washington, D.C., USA.

- Al-Abd, Y., & Mezher, T. (2014). Toward building a national innovation system in UAE. Masdar Institute of Science and Technology, Abu Dhabi, 2014.

- Hawila, D., Kennedy, S., Mondal, A., & Mezher, T. (2014). Renewable Energy Readiness Assessment for North

- African Countries. Renewable and Sustainable Energy Reviews, 33, 128-140,

- Isenberg, D. (2011). The entrepreneurship ecosystem strategy as a new paradigm for economis policy: Principles for cultivating entrepreneurship. Babson Global.

- Kenton, W. (2018). Startup Investopedia, March 2018. Available: https://www.investopedia.com/terms/s/startup.asp.

- Mason, C., & Brown, R. (2013). Entrepreneurial ecosystems and growth oriented entrepreneurship. OECD, Netherlands.

- Mezher, T., El-Saouda, R., Nasrallah, W., & Al-Ajam, M. (2008). Entrepreneurship in lebanon: A model for

- successes. International Journal of Arab Culture, Management and Sustainable Development, 1(1), 34-52.

- Mohammed Bin Rashid, (2017). He Launches Five-Decade Government Plan 'UAE Centennial 2071'," The United Arab Emirates Cabinet.

- Mondal A., Kennedy, S., Hawila, D., & Mezher, T. (2016). The GCC countries re-readiness: strengths and gaps

- for development of renewable energy technologies. Renewable and Sustainable Energy Reviews, 54, 114-128.

- National Innovation Strategy, (2013). The government of the united arab emirates. Available: https://government.ae/en/about-the-uae/strategies-initiatives-and- awards/federal-governments-strategies-and-plans/national-innovation-strategy.

- Rangaa, M., & Etzkowitz, H. (2013). Triple helix systems: An analytical framework for innovation policy and practice in the knowledge society. Human Sciences and Technology Advanced Research Institute, Stanford CA.

- Ranga, M., & Etzkowitz, H. (2013). Triple helix systems: An analytical framework forinnovation policy andpractice in the Knowledge Society. Industry and Higher Education, 27(3), 237-262.

- Saif, O, Mezher, T., Arafat, H. (2014). Water security in the GCC countries: Challenges and Opportunities. Journal of Environmental Studies and Sciences,4, 329-346.

- Spigel, B. (2015). The Relational Organization of Entrepreneurial Ecosystems. Entrepreneurship Theory and Practice, 41(1), 1-24.

- Stam, E., & Spigel, B. (2016). Entrepreneurial ecosystems in discussion per series 16-13.