Research Article: 2025 Vol: 29 Issue: 3

E-Wallet's Attributes & Its Impact on Stimulating Consumer Impulse Purchase

Nidhi Jhawar, Institute of Business Management and Research, Indore, M.P.

Tarika Nandedkar, Institute of Business Management and Research, Indore, M.P.

Citation Information: Jhawar, N., & Nandedkar. T. (2025). E-Wallet’s attributes & its impact on stimulating consumer impulse purchase. Academy of Marketing Studies Journal, 29(3), 1-13.

Abstract

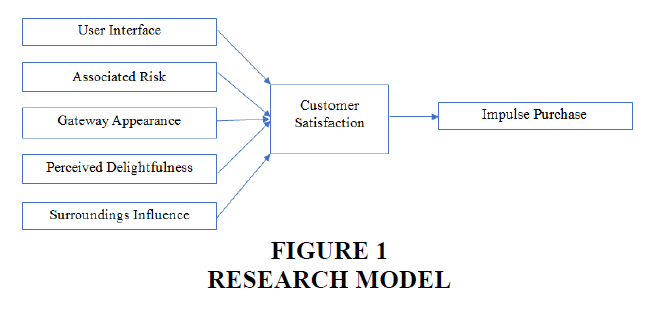

Purpose: Impulse buying significantly boosts business revenue, which is commonly observed in retail where product placement entices customers. This study investigates the attributes that contribute to customer satisfaction with e-wallets and their impact on impulsive purchases, highlighting the influence of digital payment systems on the Indian economy and citizen payment behavior. Factors such as the user interface, perceived risk, gateway appearance, perceived delightfulness, and social influence on e-wallet usage and customer satisfaction are examined. Additionally, it analyses how customer satisfaction affects impulsive purchases. Methodology: A descriptive research design is used to target e-wall customers in this study. A 5-point Likert scale questionnaire was used to collect data from 417 respondents, analyzed using SEM and Smart PLS 4.1.0.8. Findings: This research on e-wallet attributes reveals several key factors influencing customer satisfaction and impulse buying behavior. User interface, gateway appearance, perceived delightfulness, and social influence positively impact customer satisfaction, while associated risk has a negative effect. The user interface emerged as the strongest predictor of satisfaction, followed by gateway appearance and perceived delightfulness. Customer satisfaction, in turn, significantly influences impulse buying behavior. The study found that gateway appearance, perceived delightfulness, and user interface indirectly affect impulse buying through customer satisfaction. These findings suggest that e-wallet providers should prioritize improving user interface, gateway appearance, and perceived delightfulness to enhance customer satisfaction and potentially increase impulse purchases. Additionally, reducing perceived risks is crucial for boosting satisfaction. These insights offer valuable guidance for businesses looking to leverage e-wallets effectively in their operations. Research Implications: These findings can help e-wallet platforms increase traffic and promote impulsive buying, thereby boosting business revenue. Originality and Value: The study examines e-wallets in Indian digital retail, focusing on customer satisfaction and impulse buying behavior. It aims to identify influential factors, establish relationships between variables, quantify impacts, and uncover indirect effects. Using structural equation modeling, the research contributes to technology adoption theories and provides practical insights for e-wallet providers and businesses. This comprehensive approach offers a clear understanding of e-wallet usage in the Indian context, with potential implications for both theory and practice in the digital retail sector.

Keywords

Customer Satisfaction, E-wallet, Digital Payment, Impulsive Purchase.

Introduction

Unified Payment Interface (UPI) is a significant contributor and has amplified the adoption rate of digital payments. UPI innovation in the banking sector has powered multiple bank accounts into one mobile application considering numerous banking features, Finance Minister of India highlighted that India is adopting digital payment platforms not only in urban areas but also in rural areas. The country has recorded about 83.7 crore UPI transactions worth ₹139 trillion in FY 2023 and 131 billion UPI transactions with a total value of ₹200 trillion in FY2024 according to data from the National Payments Corporation of India (NPCI), which runs UPI. Currently, India is experiencing substantial growth as a developing nation. In addition, an outburst of COVID-19 fuelled heights in online payments as social distancing was the new norm; vendors favored contactless payments (George & Sunny, 2023).

Electronic purse also known as an electronic wallet (e-wallet), is one of the latest technological innovations in financial products, and has significantly contributed to the economy in both developing and developed countries. Technological advancements have changed how people pay for purchases (Abdul-Halim et al., 2022)(ABdul-Halim et al., 2022). Over the past few years, the rise and development of the Internet have increased the number of payment options and instruments. E-commerce has generated financial e-commerce, and traditional payment methods are unable to fulfill these needs effectively (Sahi et al., 2022). With the advancement of platforms and e-commerce, the pocket-friendly prices of smartphones and low-rate data plans have paved the way for mobile wallet revolution (Shetu et al., 2022). Digital India, an Indian Government initiative, has contributed to the growth of digital payment. Government initiatives bound businesses to go digital, and currently, small, medium, or large businesses have both modes of working: offline and online (Aldaas, 2021). The emergence of information and communication technology (ICT) and digital initiatives in almost every field has affected people's lives and contributed to the evolutionary holistic development of business (Slozko & Pello, 2015).

Digital payment systems are safer burglaries because retailers have less cash and more online payments that move directly to their bank accounts or digital platforms simultaneously, they have the advantage of having various ways to pay (George and Sunny, 2021). Mobile wallet integration methods for digital payments have made online markets more sustainable and more rapid. With the launch of the UPI, it is easy to transfer the received payments directly to bank accounts instead of keeping them on mobile wallets.

Digitalization has been a significant contributing factor to changes in consumer behavior as consumers have adopted new ways of living backed by digital infrastructure. Digital infrastructure support has helped online platforms flourish because online payments make online purchases easy, swift, and trustworthy (Li et al., 2020).

The online business horizon is now beyond geographical boundaries, and this has become possible only because of the rise of the Internet and digitalization (Salzabella et al., 2021). The world has become a market and manual transactions are almost at the bottom of the pyramid. Inadvertently, the dependency on digital payments has increased. This contemporary system is advantageous over the manual mode in many aspects, such as cash handling risk, country miles or remote transactions, complete visibility, and transparency (Alsamman et al., 2022).

Access to digital payments allows users to recharge their e-wallets from linked bank accounts at any given time. The adoption of e-wallets has increased at the same time that they have made buying and selling much easier with smartphone applications (Shaqman etal., 2022). These payment applications allow the shopping experience to be hassle-free and quick. However, along with these benefits, the use of e-wallets has security risks, the mandatory use of smartphones, UPI, and e-wallet applications, and easy access leads to unplanned purchases.

Research Objectives

This study examines the attributes of e-wallets and their impact on user satisfaction. This study further investigates whether user satisfaction leads to impulse purchases. Many studies have been conducted to understand technology adoption and impulsive purchases; however, few studies have correlated impulsive purchases with e-wallet attributes. Therefore, this study attempted to identify the impact of the facilitating variables of e-wallets on customer satisfaction and impulsive purchases. This study sheds light on the existing literature and aims to understand how satisfaction derived from using an e-wallet may influence spontaneous or impulse buying behavior, particularly in digital retail environments, with the research objectives outlined below.

RQ 1: Investigate the theoretical perspectives of previous research on e-wallet adoption and impulse purchasebehavior.

RQ 2: Analyze the factors of customer satisfaction in e-wallet adoption and their impact on impulsive purchases.

RQ 3: Suggest scope for future research.

Further, to analyze the outlined objectives, the following sections discuss the background of the topic and previous research to develop the framework and hypothesis for this study.

Key Concepts, Theories, and Studies

The development of technology in the financial sector has emerged as an e-commerce activity, and one of the most accepted innovations is digital payment systems (Sivathanu 2019). The rapid increase in acceptance of digital payments has been influenced by the available infrastructure, which has increased the transaction rate between the involved parties. Several attributes of the offered technology influence the adoption of e-wallets (Chaveesuk et al. 2022).

Easy access to technology has increased consumers’ dependency on e-wallets because they are the easy, handy, and faster mode in today’s business environment, and reward points, and cashback influence consumer usage (Nag et al., 2019). Several factors contribute to the use of e-wallets, and their increased use further intensifies spontaneous or unplanned purchases.

The rapid advancement of technology and at the same time acceptance of these developments have become an area of interest for research in the 21st century. to an increasing extent, our lives are now influenced by technology and various theories have been developed to understand the acceptance and adoption of these technologies. Some of them are the Technology Acceptance Model (TAM) by Davis (1989), the Theory of Planned Behavior (TPB) by Ajzen (1991), and the Unified Theory of Acceptance and Use of Technology (UTAUT) by Venkatesh et al. (2003). After understanding the prevailing theories, UTAUT is one of the most acknowledged models on the grounds of considering all the key determinants of user acceptance and usage behavior in the context of acceptance and adoption of technology.

The key constructs of the UTAUT model are performance expectancy, effort expectancy, social influence, and facilitating conditions The effect of predictors was moderated by age, sex, experience, and voluntariness of use. The model demonstrated that key constructs account for 70 percent of the variance in the intention to adopt technology(Marikyan and Papagiannidis 2023). The UTAUT model helps explain and predict the acceptance of technology in an organizational setting. However, other researchers have later added other contributing factors to technology adoption such as satisfaction and continuous intention to use (Maillet et al., 2015).

Few researchers have extended it to culture, ethnicity, religion, employment, language, income, education, geographical location, and so on (Marikyan & Papagiannidis 2023). Understanding the findings of other research and aiming to achieve generalizability by addressing individual behavior towards technology acceptance and adoption along with organizational context, the UTAUT2 model has been introduced, underpinning three additional key constructs hedonic motive, cost/perceived value and habit, moderated by age, gender, and experience (Venkatesh et al., 2012). Research on technology acceptance and behavioral intentions for technology has indicated that performance expectancy (PE) and effort expectancy (EE) have important influences on individuals’ behavior and intention toward technology usage. Further studies are also discussed to understand technological attributes and their impact on impulse purchases.

User interface refers to the technical aspects and functions of a particular application, and the level at which the user understands any mobile application as a medium for communication or other relevant purposes (Bozkurt et al., 2021). User interface is the degree to which a customer understands a mobile app as a mechanism for interacting and communicating with others to gain relevant information (Zhang & Du, 2020). A strong user interface with technology increases its usage, ease of access, quick response time, and other features of e-wallets added to the customer experience (Shen et al., 2020). The user interfaces offered by different applications provide customers with a high level of personal experience and autonomy when operating mobile applications. Therefore, e-wallets offering comfortable user interfaces tend to gain confidence in customers and, increase usage rates, and are believed to be effective. The quality of the information provided and easy navigation cause customer satisfaction, further contributing to spontaneous purchases.

It has been concluded that interactive applications lead to customer satisfaction and tend to increase traffic for e-wallet applications. Thus, this study hypothesizes the following

H01: User interface has no significant impact on customer satisfaction.

H11: The user interface has a significant impact on customer satisfaction.

The use of any technology is associated with the risk, uncertainty, and seriousness of an outcome. The risk associated with an e-wallet reflects customer behavior toward uncertainty regarding the possible negative impact of technology use (Nguyen & Huynh, 2018). Perceived risk has also been referred to in several previous studies, as it is related to the adoption of any technology, and its significance increases as soon as monetary transactions are involved. Security issues related to personal information and, fraud, such as bank details being disclosed and payment failure alter the user’s perception. E-wallet providers collaborate with banks to offer their applications, since these applications are used for online transactions the perceived risk of transaction failure does exist. Consumers’ trust in e-wallet services as reliable and authentic increases in usage percentage over time and may completely replace traditional payment methods (Chaveesuk et al., 2021). However, perceived risk has become an obstacle in the implementation of e-wallets. When implementing innovation, two aspects stand out: expected or associated risk, and trust. Perceived risk is an important element that negatively affects user satisfaction (Abrar et al., 2017). Thus, this study hypothesizes the following:

H02: Perceived risk has no significant impact on customer satisfaction.

H12: Perceived risk has a significant effect on customer satisfaction.

In the context of consumer acceptance of technology, hedonic motivation is also been observed to be an important determinant. It is defined as enjoyment or delightfulness derived from using a technology; hence, it is a predictive factor for identifying consumers’ intentions to adopt any technology (Venkatesh et al., 2012). Perceived enjoyment, as a hedonic motivation, describes the emotional state of use in terms of enjoyment and entertainment (Rouibah et al., 2021).

E-wallets offer convenience, speed, ease of use, offers, and coupons, eliminate the need to carry physical money, etc., and these attributes serve as hedonic motivation and increase the intent to use this platform. The presence of six hedonic attributes adventure, social, gratification, ideas, roles, and value shopping positively affects impulse buying (Gültekin, 2012). Another study found that different hedonic factors such as fun, social interaction, newness, and outside appreciation, contributing to customer engagement and satisfaction (Dey & Srivastava, 2017). Thus, this study hypothesizes the following,

H03: Gateway Appearance has no significant impact on customer satisfaction.

H13: Gateway Appearance has a significant effect on customer satisfaction.

Perceived enjoyment, satisfaction, and pleasure from technology are strongly associated with visual aesthetics and are considered key determinants of human interaction with technology (Jordan, 1998). Perceived visual attractiveness is the latest construct that defines the degree to which a user believes that technology is aesthetically pleasing to the eye. How does a digital platform consider or present itself as playing a significant role in its adoption? The visual appearance of a digital platform critically affects other attributes of human-computer interaction such as perceived usability, satisfaction, and pleasure. Therefore, in light of these findings, it can be hypothesized that visually appealing e-wallet platforms will certainly contribute to user satisfaction. Thus, this study hypothesizes the following,

H04: Perceived Delightfulness has no significant impact on customer satisfaction.

H14: Perceived Delightfulness has a significant effect on customer satisfaction.

Social influence is the influence of surroundings, such as family, friends, and peers, on our decision-making process (Nisa & Solekah, 2022). Social influence projects the extent to which an individual’s perception may be influenced or modified when believing in or accepting any new system or technology (Buabeng-Andoh, 2018).

The decision to adopt any technology in today’s virtual world is significantly dependent on social opinion and it is no longer a choice of an individual. It is an important element that may provide new routes for influential dimensions of attitudes and even behaviors. Young and dynamic consumers are easily influenced by positive recommendations from their peers and social surroundings regarding e-wallet applications (Nur and Panggabean, 2021). Thus, this study hypothesizes the following

H05: Social influence has no significant impact on customer satisfaction.

H15: SI has a significant impact of social influence on customer satisfaction.

Customer satisfaction is understood as a set of customers out of the crowd who have a satisfying experience with a product, service, or technology (Fungai, 2017). Satisfaction is a psychological state that arises when there is no gap between the accepted and actual performance of an information system, repurchasing or retaining the same technology (Fernandes & Barfknecht, 2020). Satisfaction with a particular technology significantly influences the intention to adopt online mobile shopping (Natarajan et al., 2018). The presence of other attributes such as trust, ease of use, appearance, service quality, and enjoyment influences customer satisfaction. Customers who are highly satisfied with satisfaction with an e-wallet platform will eventually continue to use it (Shang and Wu 2017). Impulse purchases are frequently defined as unplanned expenditures. This refers to the immature purchase of certain products that customers do not want to buy in the present situation (Sari et al., 2021). Impulse buying occurs due to several reasons, such as easy shopping, visual merchandising, promotional activities, EMI options, and comfortable payment methods (Karbasivar and Hasti, 2011).

Unplanned purchases and impulse buying are interchangeable terms that indicate shoppers' mindsets when purchasing unplanned products. The author focused on nine variables that significantly contributed to impulse purchases: low price, marginal need for an item, mass distribution, self-service, mass advertising, prominent store display, short product life, small size, lightweight, and ease of storage. Without identifying a thorough need, the product being purchased falls under the impulse-buying category.

At the same time, online impulse buying “is stimulated by a sudden, often powerful, and persistent urge to buy something spontaneously, unreflectively, immediately, and kinetically”. Offers, such as discounts, cashbacks, and coupons, influence rapid decision-making and urge for immediate possession (Ku & Chen, 2020). Online shopping and digital payment platforms have attracted customers to shop online. This has also encouraged frequent purchases and expenditures, and impulsive buying behavior contributes to business sales turnover. An impulsive purchase is an individual attempt to spend money on a product that is not part of the shopping list and marketing activities, such as promotional efforts, contribute to this (Aji & Adawiyah, 2022). Thus, in triggering impulse purchases, customer satisfaction is an important element, because derived satisfaction tends to increase the usage of the application or the intention to repurchase a product. Accordingly, the hypothetical link is defined as:

H06: Customer satisfaction has no significant impact on impulse buying behavior.

H16: Customer satisfaction has a significant impact on impulse buying behavior.

In light of the above literature review, this study identifies customer satisfaction factors establishes a relationship between customer satisfaction and impulse purchases, and focuses on the combined impact of all measures on customer satisfaction, and the combined impact of all measures of customer satisfaction on customers’ impulse buying behavior. Thus, this study hypothesizes the following.

H07: There is no significant combined effect of any measure on customer satisfaction.

H17: All measures have a significant combined impact on customer satisfaction.

H08: There is no significant combined impact of any measures of customer satisfaction on impulse buying behavior.

H18: All measures of customer satisfaction have a significant combined impact on customers’ impulse buying behavior.

The review of various studies on technological adoption and impulse buying has helped to design the current research roadmap and hypotheses. Several attributes provoke consumers to make unplanned online and offline purchases. Previous studies have concluded that perceived interaction, perceived risk, aesthetic factors, the influence of surroundings, and perceived delightfulness are the major factors that influence unplanned or impulsive buying. If mobile apps, online shopping platforms, and e-wallets focus on these characteristics, they may increase consumers’ usage and impulse purchases. Many studies have been conducted to understand technology adoption and impulsive purchases; however, few studies have correlated impulsive purchases with e-wallet attributes.

Methods

A descriptive research design is used to attain the study's objectives, focusing on analyzing the customer satisfaction attributes of e-wallets and their impact on impulsive purchases. This study analyzes the individual and combined effects of customer satisfaction attributes on impulse purchase behavior. The study population consisted of e-wallet users, and a convenience random sampling method was used to collect data. A questionnaire on 5-point Likert scale was circulated among the 500 users of E-Wallet, and 417 responses were considered for the data analysis. The data were further analyzed using Smart PLS software.

The components considered for the Use of E-wallet measures are

1. User Interface,

2. Associated Risk,

3. Gateway Appearance

4. Perceived Delightfulness

5. Influence of Surroundings

With the help of previous studies, these latent variables were measured and items were included, such as User Interface and Perceived Delightfulness includes a total of three items; associated risk includes four items; Gateway Appearance includes two items; and Surrounding Influence, Satisfaction, and Impulse Buying were measured with the help of 5,3,4 items Figure 1. Further, the impact of all latent variables of the e-wallet on customer satisfaction was measured using SEM. The study also analyzed the impact of satisfaction on Impulse Buying behavior. Hence, the model can be expressed as follows:

Results

Sample Characteristics

The research questionnaire included the demographic profile of the respondents, including age, gender income level, and occupation. The descriptive analysis showed that 50.1% of the participants were female and 49.9% were male.

The age groups considered for the study were 18-25, 25-35, 35–45, and 45 and above, and the responses were from the age group 18-25 (30%), 25-35 (24.9%), 45 and above (23.3%) and 35-45 (21.8%). Most of the respondents belonged to the 18 -25 age group.

Further analyzing the income group 24.5% belonged to the income group 20000- 30000 Rs., 18% belonged to 30000-40000 Rs., 19.7% belonged to 40000-50000, 18.7% belonged to 50000-60000 and 19.2% belonged to 60000 Rs. and above. 30.5 respondents were students, 41.2% were in a service class, and 28.3% were self-employed. 20.9 Of the respondents, 20.9% used Rupay as an e-wallet, 21.1% used Paytm, 23.7% used Phonepe, 17.5 were Airtel Money, and 1 used other options.

Reliability and Validity of the Data

The reliability and validity of the data were measured using Composite reliability and Cronbach's alpha, respectively. Composite reliability shows average internal consistency, with a value greater than 0.7 is considered a good measure of reliability and validity (Ketchen, 2013). The Cronbach’s alpha values obtained for the data fulfilled this criterion (lies between 0.67 to 0.85), thus showing the reliability of the obtained data.

Hypothesis Testing

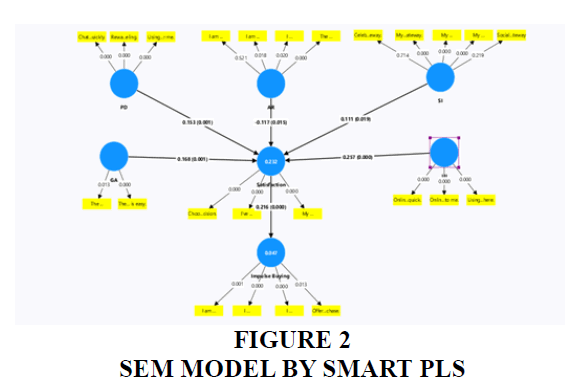

Smart PLS 4.1.0.8. software was used to analyze the data. SEM is often used to analyze multivariate data in marketing research. SEM visualizes the relationship between variables and the impact of the independent variables on the dependent variables. The indicators considered were reflective; therefore, a measurement scale was used to assess the relationships between the variables. The model measures the direct relationship between the variables User Interface, associated risk, perceived delightfulness, gateway appearance Figure 2, and social influence on customer satisfaction. In addition, the model measures the direct relationship between customer satisfaction and impulse buying behaviour Table 1. The model constructed from the data is as follows:

| Table 1 Path Coefficients: Mean, Stdev, T-Values, P-Values | ||||||

| Original Sample (O) | Sample Mean (M) | Standard Deviation (STDEV) | T- Statistics | P-values | Hypothesis | |

| UI -> Satisfaction | 0.257 | 0.256 | 0.046 | 5.574 | 0 | H01 Rejected |

| AR -> Satisfaction | -0.117 | -0.133 | 0.048 | 2.439 | 0.015 | H02 Rejected |

| GA -> Satisfaction | 0.168 | 0.171 | 0.053 | 3.189 | 0.001 | H03 Rejected |

| PD -> Satisfaction | 0.153 | 0.158 | 0.045 | 3.415 | 0.001 | H04 Rejected |

| SI -> Satisfaction | 0.111 | 0.13 | 0.047 | 2.34 | 0.019 | H05 Rejected |

| Satisfaction -> Impulse Buying | 0.216 | 0.233 | 0.048 | 4.482 | 0 | H06 Rejected |

The constructed model provides the path coefficients, p-value, and T- statistics by analyzing the data. All the p-values obtained here are less than 0.05 and the values of T - T-statistics> 1.96 show the significant impact of variables Perceived Risk, Gateway Appearance, Perceived Delightfulness, and Social Influence on Customer Satisfaction hence rejecting the null hypothesis H01, H02, H03, H04, and H05. It is also found that the p-value for checking the impact of satisfaction on impulse buying behavior is 0.000 with T- statistics of 4.482 (>1.96); suggesting the rejection of null hypothesis H06. Hence there is also a significant impact of customer satisfaction towards impulse buying behaviour.

The constructed model also provided the path coefficient for Associated Risk to Satisfaction is -0.117 (Fig. II) with the p-value 0.015 (<0.05) which shows an 11.7% significant negative impact of Associated Risk to Satisfaction, implies that if the associated risk with the use of e-wallet increases, the satisfaction level of customer decreases. The Gateway Appearance has a 16.8% (Fig. II) significant impact on satisfaction with a p-value of 0.001(<0.05), Perceived Delightfulness has a significant impact of 15.3% (Fig. II) with a p-value of 0.001(<0.05), Social Influence has an impact of 11.1% (Fig. II) with p-value 0.019 (<0.05), The obtained impact of User Interface on satisfaction is 25.7 (Fig. II) with p-value is 0.000 (<0.05). The impact of satisfaction on Impulse buying behavior is 21.6% with a p-value of 0.000 (<0.05) Tables 2 & 3.

| Table 2 Total Indirect Effect: Mean, Stdev, T-Values, P-Values | |||||

| Original Sample (O) | Sample Mean (M) | Standard Deviation (STDEV) | T-statistics (|O/STDEV|) | P-values | |

| AR -> Impulse Buying | -0.025 | -0.031 | 0.013 | 1.941 | 0.052 |

| GA -> Impulse Buying | 0.036 | 0.04 | 0.015 | 2.428 | 0.015 |

| PD -> Impulse Buying | 0.033 | 0.037 | 0.014 | 2.383 | 0.017 |

| SI -> Impulse Buying | 0.024 | 0.03 | 0.012 | 1.917 | 0.055 |

| UI -> Impulse Buying | 0.055 | 0.06 | 0.017 | 3.222 | 0.001 |

| Table 3 Specific Indirect Effect: Mean, Stdev, T-Values, P-Values | |||||

| Original Sample (O) | Sample Mean (M) | Standard Deviation (STDEV) | T-statistics (|O/STDEV|) | P-values | |

| SI -> Satisfaction -> Impulse Buying | 0.024 | 0.03 | 0.012 | 1.917 | 0.055 |

| UI -> Satisfaction -> Impulse Buying | 0.055 | 0.06 | 0.017 | 3.222 | 0.001 |

| AR -> Satisfaction -> Impulse Buying | -0.025 | -0.031 | 0.013 | 1.941 | 0.052 |

| GA -> Satisfaction -> Impulse Buying | 0.036 | 0.04 | 0.015 | 2.428 | 0.015 |

| PD -> Satisfaction -> Impulse Buying | 0.033 | 0.037 | 0.014 | 2.383 | 0.017 |

It is clear that the model also measures the total indirect impact of individual variables (measures of customer satisfaction) on Impulse Buying Behaviour. It has been found that the t-value obtained for Associated Risk and Social Influence is < 1.96 and the p-value is also greater than 0.05 which resulted in no significant direct or indirect impact of Associated Risk and Social Surroundings on Impulse buying behavior; however, they significantly impact customer satisfaction.

On the other hand, the direct or indirect impact of variables Gateway Appearance, Perceived Delightfulness, and User Interface on Impulse buying behavior is found significant as the p-values for these are <0.05, with a t-value >1.96 Table 4.

| Table 4 Quality Criteria: R-Square: Mean, Stdev, T Values, P Values | |||||

| Original Sample (O) | Sample Mean (M) | Standard Deviation (STDEV) | T-statistics (|O/STDEV|) | P-values | |

| Impulse Buying | 0.047 | 0.057 | 0.023 | 2.063 | 0.039 |

| Satisfaction | 0.232 | 0.258 | 0.037 | 6.342 | 0 |

The model also measured the combined impact of all measures of Customer Satisfaction, that is User Interface, Associated Risk, Perceived Delightfulness, Surrounding Influence, and Gateway Appearance on Impulse Buying Behavior. Table 4 explains the R-square value (0.047) and establishes that there is a combined impact of all latent variables of customer satisfaction on impulse buying behavior, found to be 4.7%, with a p-value of 0.039 (<0.05) and a t-value of 2.063 (> 1.96). Although this impact was not very high, however, it is significantly impacting. Based on these values the null hypothesis H08, which states that there is no significant combined impact of all measures of customer satisfaction on the Impulse Buying Behavior of Customers, is rejected, and the alternative hypothesis H18, which states that there is a significant combined impact of all measures of customer satisfaction on the Impulse Buying Behavior of Customers, is accepted.

The obtained R square value for Customer Satisfaction is 0.232, with a p-value of 0.000 (<0.05) and a t-value of 6.342 (>1.96) (Table 4), showing a significant combined effect of 23.2% of all latent variables on Customer Satisfaction, thus rejecting Hypothesis H07; that is, there is no significant combined effect of any of the measures on customer satisfaction.

Discussion and Conclusion

This study attempts to identify the impact of e-wallet use on customer satisfaction and impulse buying behavior. This study underscores the significantly positive relationship between the use of e-wallets and customer satisfaction. It also revealed how customer satisfaction afterward resulted in impulse buying behavior. This study suggests that factors such as the convenience of the user interface, the gateway appearance, perceived delightfulness, surrounding influence, and security offered by e-wallets play an important role in building customer trust and generating customer satisfaction. These factors also affect the purchase decisions of customers. When a customer perceives an e-wallet as a reliable and efficient payment source, impulse purchases will probably be increased. The study also revealed that the integration of technological advancement in digital payment solutions in the form of e-wallets and customer satisfaction creates a positive environment that lowers barriers and makes purchase decisions quick. This rationalized process encourages customers to buy impulsively. This study’s insights promote businesses’ use of e-wallets to foster an atmosphere that is conducive to impulse buying. This approach not only improves customer satisfaction with their shopping experience but, also results in revenue growth as a consequence of more impulse purchases.

Limitations

This study has certain limitations that show directions for future research. First of all, due to the convenience random sampling method employed in the study, it is not the case to generalize the results of this research to all e-wallet users, or the global market. While the sample size was significant, respondents were mainly of specific income groups and occupations that may not give an exhaustive representation of the e-wallet user population. Secondly, the research narrows the analysis to certain variables only which include user interface, associated risk, perceived delightfulness, gateway appearance and social influence and more factors determinants of customer satisfaction and impulse buying behavior were not taken into consideration.

Scope of Future Research

Future research could address these limitations by using more varied and stratified sampling methods to enhance the generalizability of the findings. Longitudinal studies might be useful in examining how customer satisfaction and impulse buying behavior change over time as e-wallet technologies develop. Additionally, broadening the range of variables to include factors like customer loyalty, privacy concerns, and cultural differences could lead to a deeper understanding of the relationship between e-wallet usage and consumer behavior. Moreover, conducting comparative studies across different regions or between e-wallets with distinct features could provide valuable insights into regional preferences and technological adaptability, helping businesses tailor their digital payment solutions more effectively.

References

Abdul-Halim, N. A., Vafaei-Zadeh, A., Hanifah, H., Teoh, A. P., & Nawaser, K. (2022). Understanding the determinants of e-wallet continuance usage intention in Malaysia. Quality & quantity, 56(5), 3413-3439.

Abrar, K., Naveed, M., & Ramay, M. I. (2017). Impact of perceived risk on online impulse buying tendency: An empirical study in the consumer market of Pakistan. Journal of Accounting & Marketing, 6(3), 246.

Indexed at, Google Scholar, Cross Ref

Aji, H. M., & Adawiyah, W. R. (2022). How e-wallets encourage excessive spending behavior among young adult consumers?.Journal of Asia Business Studies, 16(6), 868-884.

Indexed at, Google Scholar, Cross Ref

Ajzen, I. (1991). The Theory of planned behavior. Organizational Behavior and Human Decision Processes.

Aldaas, A. (2021). A study on electronic payments and economic growth: Global evidences. Accounting, 7(2), 409-414.

Indexed at, Google Scholar, Cross Ref

Alsamman, T. A., Alshaher, A. A., & Alsamman, A. T. A. (2022). An Investigation the Factors Affecting Towards Adoption of Digital Wallets in Iraq. In Digital Economy, Business Analytics, and Big Data Analytics Applications (pp. 237-256). Cham: Springer International Publishing.

Indexed at, Google Scholar, Cross Ref

Bozkurt, S., Gligor, D. M., & Babin, B. J. (2021). The role of perceived firm social media interactivity in facilitating customer engagement behaviors. European Journal of Marketing, 55(4), 995-1022.

Indexed at, Google Scholar, Cross Ref

Buabeng-Andoh, C. (2018). Predicting students’ intention to adopt mobile learning: A combination of theory of reasoned action and technology acceptance model. Journal of Research in Innovative Teaching & Learning, 11(2), 178-191.

Indexed at, Google Scholar, Cross Ref

Chaveesuk, S., Khalid, B., & Chaiyasoonthorn, W. (2021). Digital payment system innovations: A marketing perspective on intention and actual use in the retail sector. Innovative Marketing, 17(3), 109.

Indexed at, Google Scholar, Cross Ref

Chaveesuk, S., Khalid, B., & Chaiyasoonthorn, W. (2022). Continuance intention to use digital payments in mitigating the spread of COVID-19 virus. International Journal of Data and Network Science, 6(2), 527-536.

Indexed at, Google Scholar, Cross Ref

Corsini, F., Rizzi, F., & Frey, M. (2018). Institutional legitimacy of non-profit innovation facilitators: Strategic postures in regulated environments. Technology in Society, 53, 69-78.

Davis, F. D. (1989). Technology acceptance model: TAM. Al-Suqri, MN, Al-Aufi, AS: Information Seeking Behavior and Technology Adoption, 205, 219.

Dey, D. K., & Srivastava, A. (2017). Impulse buying intentions of young consumers from a hedonic shopping perspective. Journal of Indian business research, 9(4), 266-282.

Fernandes, N., & Barfknecht, C. (2020). Keep customers coming back: Enhancing value and satisfaction in a mobile shopping application context. Cogent Business & Management, 7(1), 1788874.

Fungai, M. (2017). Factors influencing customer repurchase intention in the fast food industry: a case study of Innscor-Mutare, Zimbabwe. Business & Social Sciences Journal, 2(1), 113-133.

Gültekin, B. (2012). The influence of hedonic motives and browsing on impulse buying. Journal of Economics and Behavioral Studies, 4(3), 180-189.

George, A., & Sunny, P. (2021). Developing a research model for mobile wallet adoption and usage. IIM Kozhikode Society & Management Review, 10(1), 82-98.

George, A., & Sunny, P. (2022). Why do people continue using mobile wallets? An empirical analysis amid COVID-19 pandemic. Journal of Financial Services Marketing, 1.

Jordan, P. W. (1998). Human factors for pleasure in product use. Applied ergonomics, 29(1), 25-33.

Karbasivar, A., & Yarahmadi, H. (2011). Evaluating effective factors on consumer impulse buying behavior. Asian Journal of Business Management Studies, 2(4), 174-181.

Ketchen, D. J. (2013). A primer on partial least squares structural equation modeling.

Ku, E. C., & Chen, C. D. (2020). Flying on the clouds: how mobile applications enhance impulsive buying of low cost carriers. Service Business, 14(1), 23-45.

Maillet, É., Mathieu, L., & Sicotte, C. (2015). Modeling factors explaining the acceptance, actual use and satisfaction of nurses using an Electronic Patient Record in acute care settings: An extension of the UTAUT. International journal of medical informatics, 84(1), 36-47.

Marikyan, M., & Papagiannidis, P. (2021). Unified theory of acceptance and use of technology. TheoryHub book.

Nag, A. K., & Gilitwala, B. (2019). E-Wallet-factors affecting its intention to use. International Journal of Recent Technology and Engineering, 8(4), 3411-3415.

Nguyen, T. D., & Huynh, P. A. (2018). The roles of perceived risk and trust on e–payment adoption. In Econometrics for financial applications (pp. 926-940). Springer International Publishing.

Nisa, U. K., & Solekah, N. A. (2022). The influence of TAM, social influence, security relationship toward intention to use E wallet through attitude and Trust. Iqtishoduna: Jurnal Ekonomi dan Bisnis Islam, 18(1), 35-50.

Nur, T., & Panggabean, R. R. (2021). Factors influencing the adoption of mobile payment method among generation Z: the extended UTAUT approach. Nur, T. and Panggabean, RR, 14-28.

Rouibah, K., Al-Qirim, N., Hwang, Y., & Pouri, S. G. (2021). The determinants of eWoM in social commerce: The role of perceived value, perceived enjoyment, trust, risks, and satisfaction. Journal of Global Information Management (JGIM), 29(3), 75-102.

Sahi, A. M., Khalid, H., Abbas, A. F., Zedan, K., Khatib, S. F., & Al Amosh, H. (2022). The research trend of security and privacy in digital payment. In Informatics (Vol. 9, No. 2, p. 32). MDPI.

Salzabella, S., Sumarwan, U., & Yuliati, L. N. (2021). Analysis of factors influencing consumers in using the e-wallet application. International Journal of Research and Review, 8(6), 45-58.

Sari, R. K., Utama, S. P., & Zairina, A. (2021). The effect of online shopping and E-wallet on consumer impulse buying. APMBA (Asia Pacific Management and Business Application), 9(3), 231-242.

Shang, D., & Wu, W. (2017). Understanding mobile shopping consumers’ continuance intention. Industrial Management & Data Systems, 117(1), 213-227.

Shaqman, N., Hashim, N. H., & Yahya, W. K. (2022). Influence of utilitarian shopping value, personal innovativeness and electronic word of mouth on Mobile shopping: Indexed at, Google Scholar, Cross Ref a conceptual framework. Asian Journal of Research in Business and Management, 4(1), 52-63.

Shen, H., Wu, L., Yi, S., & Xue, L. (2020). The effect of online interaction and trust on consumers’ value co-creation behavior in the online travel community. Journal of Travel & Tourism Marketing, 37(4), 418-428.

Shetu, S. N., Islam, M. M., & Promi, S. I. (2022). An empirical investigation of the continued usage intention of digital wallets: The moderating role of perceived technological innovativeness. Future Business Journal, 8(1), 43.

Sivathanu, B. (2019). Adoption of digital payment systems in the era of demonetization in India: An empirical study. Journal of Science and Technology Policy Management, 10(1), 143-171.

Indexed at, Google Scholar, Cross Ref

Slozko, O., & Pelo, A. (2015). Problems and risks of digital technologies introduction into e-payments. Transformations in Business & Economics, 14(1).

Venkatesh, V., Morris, M. G., Davis, G. B., & Davis, F. D. (2003). User acceptance of information technology: Toward a unified view. MIS quarterly, 425-478.

Venkatesh, V., Thong, J. Y., & Xu, X. (2012). Consumer acceptance and use of information technology: extending the unified theory of acceptance and use of technology. MIS quarterly, 157-178.

Zhang, J., & Du, M. (2020). Utilization and effectiveness of social media message strategy: how B2B brands differ from B2C brands. Journal of Business & Industrial Marketing, 35(4), 721-740.

Received: 07-Jan-2025, Manuscript No. AMSJ-25-15597; Editor assigned: 08-Jan-2025, PreQC No. AMSJ-25-15597(PQ); Reviewed: 28- Jan-2025, QC No. AMSJ-25-15597; Revised: 20-Feb-2025, Manuscript No. AMSJ-25-15597(R); Published: 11-Mar-2025