Research Article: 2024 Vol: 28 Issue: 1S

Evolution of Gas based Economy in India: A Case of Gujarat State

Kadam Sambhaji Namdeo, Rajiv Gandhi Institute of Petroleum Technology

Kavita Srivastava, Rajiv Gandhi Institute of Petroleum Technology

Citation Information: Kadam, S.N., &Srivastava, K. (2024). Evolution of gas based economy in india: a case of gujarat state. Academy of Marketing Studies Journal, 28(S1), 1-16.

Abstract

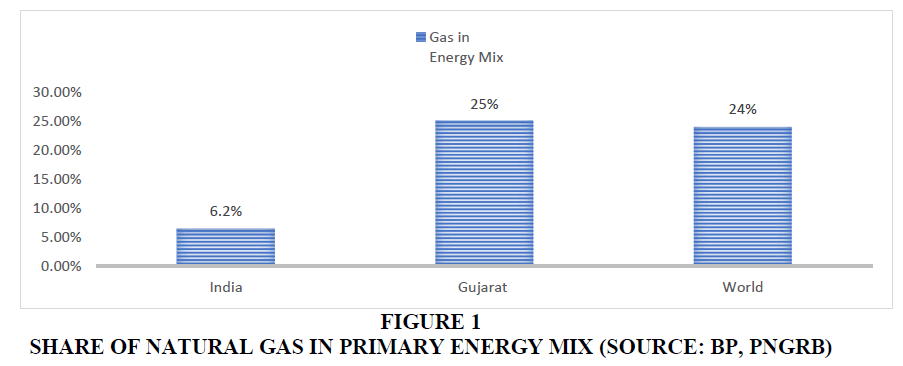

With the vision of making India a "Gas Based Economy by 2030", Government of India with notable policy initiatives is aggressively working to develop a natural gas market. Currently, natural gas holds 6.2% share in India’s energy mix against global average of 24% (BP, 2021); whereas, natural gas accounts for 25% share in Gujarat’s energy mix. To understand the Gujarat’s scenario, researcher has done the secondary research on the development of natural gas market in the state of Gujarat and also conducted the experts interview of 20 industry experts having average experience of 27+ years. Content Analysis has been done manually & by using NVIVO from the transcripts prepared from the recorded interviews. It has found that, Gujarat has led the development of natural gas market in an integrated way by focusing simultaneously on the development of integrated gas infrastructure and creating investor friendly environment for bringing gas based industry in the state. Also, Gujarat has created separate independent commercial entity GSPC for developing natural gas infrastructure in the state and given the complete freedom to take commercial decision on its own. Key lessons are focusing on infrastructure development, creating investor friendly environment, collaborative work and proactive policy.

Keywords

Energy, Gas Market, Gujarat, Gas-based Economy, Gas Infrastructure.

Introduction & Background

India is emerging as one of the fastest developing nations with sustained GDP growth and to support GDP growth, energy demand is increasing. In 2016, India became third largest energy consumer in the world & the energy sector is major contributor in the country's total greenhouse gas emissions-GHG (IEA, 2021). India is the 4th largest GHG emitter & account for 7 % of global CO2 emissions (USAEPA, 2017). Natural gas has proven to be the next-generation, cheaper and environment friendly fossil fuel globally and has the potential to replace liquid fossil fuels to make India a green economy. Globally, natural gas is considered to be top choice of ameliorating environment for promotion of sustainable development (Zhao & Guo, 2008). Government of India has set the vision to move towards a gas based economy by 2030 with increased in share of natural gas to 15% in energy mix. But securing natural gas supply is vital for the India as it depends on imported LNG for around 50% of total consumption. India is majorly dependent on Qatar & US gas LNG supply unlike Europe is predominantly depends on Norway & Russia (Hauser and Möst, 2015).

Gujarat is the pioneering state to establish itself as a gas-based economy. Gujarat is the only State in India which has 25 % share of natural gas in its energy mix which is more than global average of 24% (PNGRB, 2018). India has only around 6.2% of natural gas in the primary energy mix, the share of natural gas for World, India & Gujarat has been represented at Figure 1. First time in India, the journey of natural gas market in the state of Gujarat has begun in the year 1972 when gas distribution started by local government entity Vadodara Municipal Corporation (VMC). In the year 1979, Government of Gujarat has established Gujarat is the pioneering state to establish itself as a gas-based economy. Gujarat is the only State in India which has 25 % share of natural gas in its energy mix which is more than global average of 24% (PNGRB, 2018). India has only around 6.2% of natural gas in the primary energy mix, the share of natural gas for World, India & Gujarat has been represented at Figure 1. First time in India, the journey of natural gas market in the state of Gujarat has begun in the year 1972 when gas distribution started by local government entity Vadodara Municipal Corporation (VMC). In the year 1979, Government of Gujarat has established independent corporation (state owned entity) Gujarat State Petroleum Corporation (GSPC) to take care of Oil & Gas business in the state with special focus on Exploration & Production activities. In 1980, Government of Gujarat has established the first City Gas Distribution (CGD) Company named Gujarat Gas Company Limited in the joint venture initiatives of Gujarat Investment Corporation Limited and &Maftlal group and started natural gas distribution in Surat, Bharuch and Ankleshwar. Above local gas distribution business has helped Gujarat as a first mover’s advantage in the industry. Subsequently, in the year 1998 Gujarat has established the Gas Transmission Company named Gujarat State Petronet Limited (GSPL) under the umbrella of GSPC group.

Most important initiative and action taken by Gujarat is bringing their own “The Gujarat Gas (Regulation of Transmission, Supply and Distribution) Act 2001” way before establishment of Petroleum & Natural gas Regulatory Board (PNGRB) in 2006. Understanding the importance of developing gas-based economy, Gujarat Government has established first gas based power plant at Hazira under the newly formed company in 2002 named Gujarat State Energy Generation Ltd (GSEG) in joint venture of GSPC, GAIL & other state PSUs. Another CGD company, Sabarmati Gas Limited (SGL) was incorporated in 2006 as a joint venture company of Bharat Petroleum Corporation Limited (BPCL) and GSPC for developing gas distribution networks in Gandhinagar, Mehsana, Patan, Sabarkantha and Aravalli districts in Northern Gujarat. India’s 1st LNG Terminal has been established & operational by 2004 in the state of Gujarat at Dahej by Petronet LNG Limited with active support from Government of Gujarat and its entity Gujarat Maritime Board (GMB). Also, GSPC has formed two different entities to set-up gas based power at Hazira &Pipava in the year 2002 & 2006 respectively (GSPC Group Reports).

The Gujarat Government has taken holistic & integrated approach to develop gas based ecosystem in the state and become the first state to established itself as a gas-based economy. The factors like favourable policies, availability of gas, presence of robust gas pipeline infrastructure and LNG terminals played vital role in the successful penetration of natural gas in the state of Gujarat.

The chronology of natural gas industry and evolution of gas-based economy in the state of Gujarat has been represented in Table 1.

| Table 1 Chronology Of Natural Gas Industry In Gujarat |

|

|---|---|

| Year | Event |

| 1972 | Local Gas Distribution started by Vadodara Municipal Corporation (VMC) |

| 1979 | Formation of Gujarat State Petroleum Corporation (GSPC) |

| 1980 | 1st CGD Company formation, Gujarat Gas Company Limited (GGCL) |

| 1998 | Formation of Gujarat State Petronet Limited (GSPL) for Gas Transmission Network |

| 2000 | Construction of India’s First LNG Terminal started at Dahej by Petronet LNG Limited |

| 2001 | The Gujarat Gas (Regulation of Transmission, Supply and Distribution) Act 2001 |

| 2002 | 1st gas power company formation, Gujarat State Energy Generation Ltd (GSEG) |

| 2004 | India’s 1st LNG Terminal started operation at Dahej, Gujarat |

| 2005 | India’s 2nd LNG Terminal started operation by Shell at Hazira, Gujarat |

| 2006 | 2nd CGD Company formation, Sabarmati Gas Limited (SGL) by GSPC |

| 2006 | 2nd gas power company formation, GSPC Pipavav Power Company Limited |

| 2007 | Formation of PNGRB under “PNGRB Act 2006” by Government of India |

Methodology

To conduct the study of Gujarat’s natural gas market development and state becoming the gas-based economy well in advance to be a model state, researcher has initially carried out secondary research through literature reviews based on the public report, media reports, company annual reports, company websites and government’s policy documents. Subsequently, researcher has conducted primary research based on the data collected through One-on-One interviews of 20 experts by asking a question “Can we consider Gujarat as a model for a gas-based economy or may learn few lessons from Gujarat which could help India to move towards a gas-based economy?”. Analysis of data collected through One-On-One interview has been analysed manually for Content Analysis and also used the NVIVO software to have better understanding of key themes and code for corelating with the secondary study carried out during this case preparation.

Government Initiatives &Policy Reforms In Gujarat For Promoting Gas-Based Economy:

Gujarat Gas Act 2001 (Central’s PNGRB Act 2006)

Story of natural gas in the state of Gujarat had been started in the year 1972 itself when the leadership of one of the Municipal Corporations, i.e. Vadodara Municipal Corporation (VMC) started to supply first PNG to the domestic households in the city of Vadodara. Then in 1979, with the visionary state leadership, Government of Gujarat has formed separate corporation company, Gujarat State Petroleum Corporation (GSPC) to take the initiatives of Oil & Gas sector in the State focused on E&P. Later GSPC has been developed as an integrated gas company and currently, GSPC is the first state government compony leading the story of natural gas business in the country having strong presence across the value chain of natural gas. In 1980 state’s 1st City Gas Company, Gujarat Gas Company Limited (GGCL) has been born in Gujarat with the help of State Government & Mafatlal Group. Main reason behind the success of these companies is that, Government of Gujarat has given complete freedom for its companies to take commercial decisions & operate independently keeping arm length distance from its day-to-day activities.

Natural gas business and purchase is mostly deregulated in the western countries however, interstate transactions have additional cost to the end consumers (John, 2005). In India, natural gas is regulated one at National level hence in the year 2001 with the progressive policy reform; Gujarat Government has enacted the Gujarat Gas (Regulation of Transmission, Supply and Distribution) Act, 2001 and published in the Gujarat Government Gazette on 28 April 2001. The main objectives of an Act was to regulate transmission, supply and distribution of gas in the State and laying of natural gas transmission pipelines with moto to promote gas industry in the State and in the interests of general public (EPD, Government of Gujarat). With this act the Government of Gujarat has progressively created the integrated gas infrastructure through state owned companies like GSPL, GGCL, Petronet LNG Limited, and other private players like BG & Shell etc.

Later the Gujarat Gas Act has been challenged in supreme court for the legislative power with the state to pass laws on Gas stating Gas is falling under the central list. Same has been contended by Gujarat Government & Gujarat’s state company with representation from their lawyers senior advocate Ashok Desai & senior advocate P Chidambaram respectively stating that “any industrial activity connected to 'gas and gas works' were beneficial to the state and the state must be given power to legislate on the subject, natural gas is a subject falling exclusively under the Central list and " states have no legislative competence to enact law on natural gas, including the liquefied natural gas (LNG)” (Business Standard, 2013).

Later Act has been dropped by Gujarat subsequent to formation central regulator PNGRB under newly enacted act of central government in 2006.

Gujarat LNG Terminal Policy 2012 (PNGRB yet to be come-up with LNG Terminal Policy):

During 2012, Gujarat had two operational LNG terminals at Dahej by Petronet LNG Limited & at Hazira by Shell-Total JV with cumulative capacity of 15 MMTPA which are handling almost complete import of LNG in India. Further, Gujarat have longest coastal area of ~1600 km and Government of Gujarat wanted to leverage this geographical advantage to have more LNG import terminals in the state. Also, along with coastal benefit, Gujarat had already developed integrated gas infrastructure including regional gas transmission pipeline by GSPL, CGD network by VGL, GGCL, GSPC Gas & SGL along with private players like Adani Gas, VGL and gas based power plants in the state by GSPC & Torrent Power.

As many developers in recent years have shown keen interest in developing LNG infrastructure including port for importing LNG and then supplying in domestic market, the State Government felt it necessary to bring out our own policy t (HT, 2012).

Hence, considering above advantage and Gujarat under the leadership of Chief Minister Shri Narendra Modi has brought out their own State’s LNG Terminal Policy in October 2012 with following aims and objectives,

1. To attract private sector investment in energy sector in general and import of natural gas in particular and it's trading in Gujarat by inviting private players to set up LNG terminals and necessary infrastructure in the state.

2. To promote import of LNG, development of LNG receiving and re-gasification capacities, construction of LNG terminals and floating storage in the state.

Beyond the legislative act & policies, Gujarat Government has pushed significant uses of natural gas in industries and promoted gas based manufacturing hubs in the State including Ceramic Cluster at Morbi. Also, progressive and investor friendly industrial policies, including rationalization of tax regime, power reforms and SEZ development has helped Gujarat to attract investment in natural gas related industries.

Also, Gujarat has promoted PNG as household fuel and CNG as transport fuel across the State by facilitating the access to natural gas for end consumers and giving them confidence of supply security. This has helped Gujarat to have strong CGD consumer base even before establishment of PNGRB in 2007. Currently, Gujarat is the only large state having all 33 districts authorized by PNGRB for development of CGD.

Integrated Gas Infrastructure Development in Gujarat

Gujarat has adapted very much integrated and inclusive model for the development of natural gas infrastructure across the state with the help of progressive policies and active participation by not only their state owned gas companies including GSPC, GSPL, GSPC Gas, GGCL, SGL but also from leading players like PLL, Shell, Total, GAIL, Adani, Torrent etc. Gujarat has ensured the simultaneous development of infrastructure in all the segments of natural gas value chain starting from LNG Terminal, Gas Pipelines, CGD, gas Power plants and other associated industries like Ceramics, Petrochemicals. Gujarat have given confidence to investors, state companies and end consumers that molecule will be available for sale and consumers are ready to use at the same time. There has never be an case the gas is available and not being sold. Gujarat leadership believed in creation of demand rather than following the demand and hence they have created infrastructure and made gas available then consumer has followed the story. The segment wise infrastructure development analysis has been covered in the following section,

E&P Gas Reserves & Infrastructure in Gujarat

Gujarat has been one of the earliest oil/ gas producing states in the country with Ankleshwar and Mehsana being amongst the earliest gas field discoveries in the country. The Gujarat region is the second largest gas-producing region in the country with a share of 10% of the overall gas production in the country (GIDB, 2009). The following are the major sources of gas from Gujarat

1. ONGC & GSPC has took a lead in E&P activities in the state of Gujarat and discovered the major oil & gas fields in the sedimentary basins namely Cambay, Kutch, Saurashtra. State has total sedimentary reserves of 3090 MMT & CBM reserves of 351 BCM (Vibrant Gujarat, 2017).

2. ONGC have Onshore fields located near Ahmedabad region &Ankleshwar / Surat region and offshore (JV) fields in the Arabian Sea (Western Offshore – including PMT supplies)

3. GSPC/ Niko Resources had supply from Hazira gas fields

4. Cairn Energy supplying gas from its offshore fields -- Lakshmi and Gauri and the Cambay basin (CB-OS2 field)

LNG Terminals in Gujarat

Gujarat is the pioneering state in the history of LNG in the country, India’s first LNG terminal were successfully commissioned at Dahej, Gujarat by Petronet LNG Limited with the support of State government and Gujarat Maritime Board (GMB) in the year 2004. Subsequently, in year 2005 another LNG terminal has been commissioned at Hazira by private player Shell-Total.

If we see the history, before Gujarat one LNG terminal were considered at Ennore very, very long back and then one LNG terminal was constructed in Dabhol but they could not successfully commissioned due to many constraints. However, Gujarat has supported development of LNG terminals in Dahej& Hazira which has commissioned successfully during 2004-05. Then in 2012, Gujarat has come up with their own LNG Terminal policy to promote the LNG Terminal development and conceived third LNG terminal at Mundra (EPD, Government of Gujarat). Mundra LNG Terminal has been developed in joint venture by GSPC with Adani Port and successfully commissioned in 2020.

If we see the current picture of total operational LNG Terminals in the country as shown in the following Table 2, Gujarat holds around 70% (27.7 MMTPA) of total LNG terminal capacity. If we consider the total volume of LNG being imported in India (~25 MMTPA), Gujarat’s two terminals handle around 85-90% of volume (~22 MMTPA) with their highest level of capacity utilization, efficiency and integrated infrastructure to evacuate the LNG to domestic market.

| Table 2 India's Existing Operational Lng Import Terminals |

|||

|---|---|---|---|

| Name of Terminal | Name of Owner | Capacity (MMTPA) | State |

| Dahej LNG Terminal | Petronet LNG Ltd | 17.5 | Gujarat |

| Kochi LNG Terminal | Petronet LNG Ltd | 5 | Kerala |

| Hazira LNG Terminal | Shell Energy India | 5.2 | Gujarat |

| Dabhol LNG Terminal# | Konkan LNG Ltd (GAIL) | 2.9 | Maharashtra |

| Mundra LNG terminal | GSPC LNG Ltd | 5 | Gujarat |

| Ennore LNG Terminal | IndianOil LNG Ltd | 5 | Tamil Nadu |

| Total Regas capacity ready to use in India | 40.6 | ||

#to increase to 5 MMTPA with breakwater. Only HP stream of 2.9 MMTPA is commissioned(Source: PPAC Report October 2022)

Also, currently there are two more LNG terminals in advance stage of construction namely Chhara LNG Terminal by HPCL &Jafrabad LNG FSRU by SWAN Energy with capacity of 5 MMTPA each. These terminals are scheduled to be commissioned in 2023 and add 10 MMTPA into existing capacity of 27.7 MMTPA.

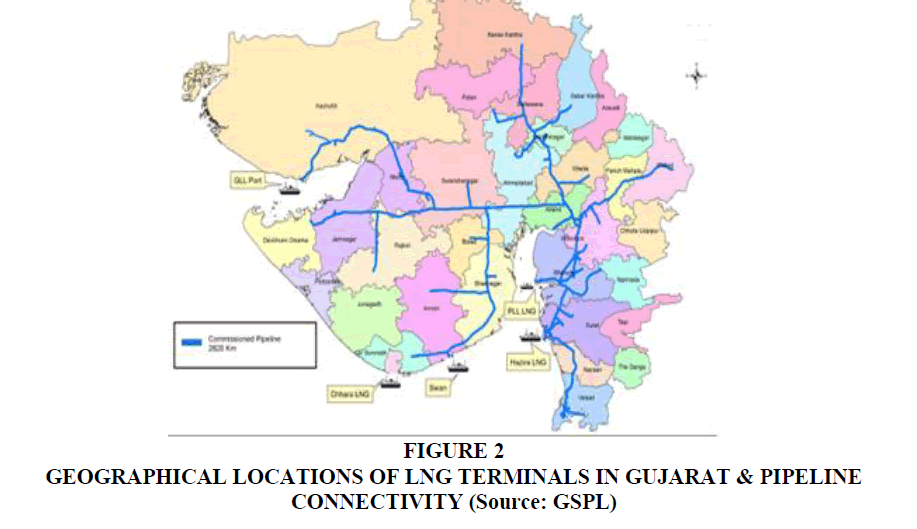

At the end of 2023, Gujarat will have 5 terminals with 33.7 MMTPA LNG Terminal capacity available for catering to Indian market and will support India to move towards a gas based economy. The important thing in case of Gujarat’s LNG Terminals is that, all terminals are well connected with the robust regional natural gas pipeline in the state of Gujarat by GSPL and further to major cross-country national gas pipelines. The Geographical location of these LNG terminals in the Gujarat has been shown in Gujarat Map as represented in the following Figure 2.

Figure 2: Geographical Locations Of Lng Terminals In Gujarat & Pipeline Connectivity (Source: Gspl).

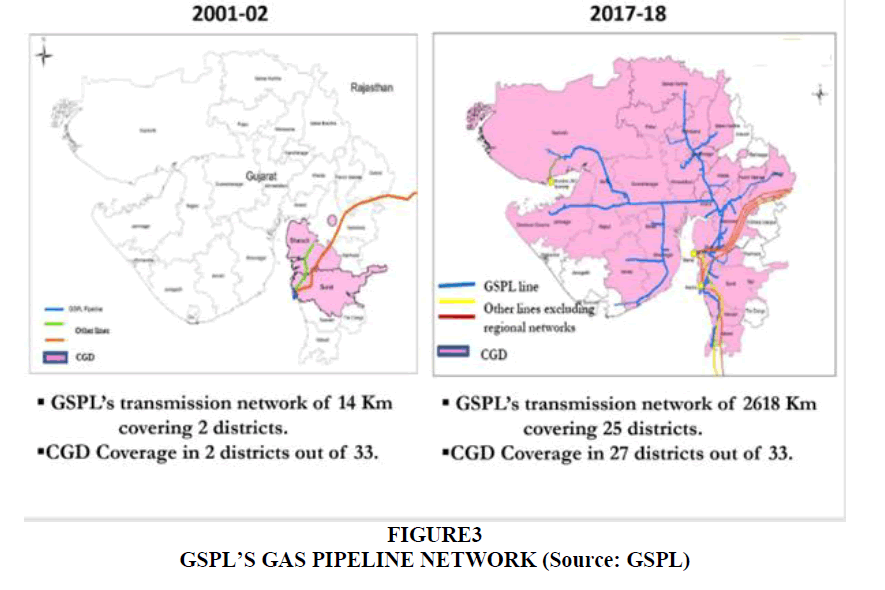

Natural Gas Transmission Pipelines in Gujarat

The gas transmission network in the Gujarat has unique developmental history in the industry where, State Government formed independent company named Gujarat State Petronet Limited (GSPL) under the umbrella of GSPC group to develop a regional transmission grid called State-Grid. With the dynamic leadership of GSPL, the gas pipeline infrastructure has increased many folds since the early 2000s in the state and has played a crucial role in increasing the share of gas in primary energy basket by providing connectivity to almost every district. The growth of gas pipeline development by GSPL in last two decades has been shown in following Figure 3.

As shown in above figure, GSPL were covering 25 Districts out of 33 districts in Gujarat and operating ~2620 kms of pipeline during FY 2017-18. Also, ‘70’ km Anjar-Mundra pipeline connecting GSPC LNG Mundra has been completed and inaugurated by Hon’ble Prime Minister of India on 30.09.2018. Further, during the period of 2018 to 2022, GSPL were under taking expansion of around 800 km regional pipeline network in different segments ranging from 10km to 200 km connecting LNG terminals and end users. Currently GSPL operate around 3000 Km pipeline and second largest gas pipeline company in the country after GAIL (GSPL, 2021).

Also, Gujarat State is home to gas pipeline network of other two major gas Transporters PIL (Formerly RGTIL) and GAIL. For the reference purpose, the overall pipeline infrastructure in India & Gujarat during year 2018 has been shown in following Table 3 where, around 28% gas pipeline where present in Gujarat itself and majority of gas pipelines in the State are operated by GSPL (PPAC Data).

| Table 3 Gas Pipeline Network In India & Gujarat In 2018 |

|

|---|---|

| Region/Geography | Length (~Km) |

| Total India | 16,475 |

| Gujarat (GSPL, GGL, GAIL, PIL) | 4,616 |

| Total India except Gujarat | 11,859 |

| % of Gujarat | 28.02% |

CGD Infrastructure in Gujarat

CGD is the another success story of Gujarat in the gas economy where India’s 1st PNG connection to household consumer has been done in Gujarat by Vadodara Municipal Corporation in the year 1972. Later in the year 1980, Gujarat has formed 1st CGD Company named Gujarat Gas Company Limited (GGCL) with the help of Government & Mafatlal Group to supply gas in Surat. Since then Gujarat leads the CGD development in terms of infrastructure and CGD consumers.

Today, Gujarat is the only largest State where all districts has been covered under CGD authorization and Gujarat Gas Limited (GGL) (2022) has evolved to become one of India’s largest players in distribution of natural gas with market share of 47% in Industrial connections, 53% in commercial connections & 35% in domestic connections (GGL, 2021-22). The CGD infrastructure and consumer base in the state of Gujarat vis-à-vis India has been shown in the following Table 4. The overall Gujarat holds 30% of CGD consumers and 20% of CNG stations in the country. However, it is significant to note that, Gujarat holds around 60% of industrial consumers in CGD sector which is the key parameters to lead the natural gas consumption by Gujarat in CGD.

| Table 4 Cgd Infrastructure & Consumer Base As On October 2022 |

|||

|---|---|---|---|

| Type of Consumer | Total | Gujarat | % Share of Gujarat |

| Domestic PNG | 1,00,63,556 | 28,35,650 | 28.18% |

| Commercial PNG | 36,106 | 21,648 | 59.96% |

| Industrial PNG | 14,348 | 5,743 | 40.03% |

| Total Consumer | 1,01,14,010 | 28,63,041 | 28.31% |

| CNG Stations | 4,853 | 966 | 19.91% |

Source: PPAC Snapshot November 2022.

Gas-Based Power Plants in Gujarat

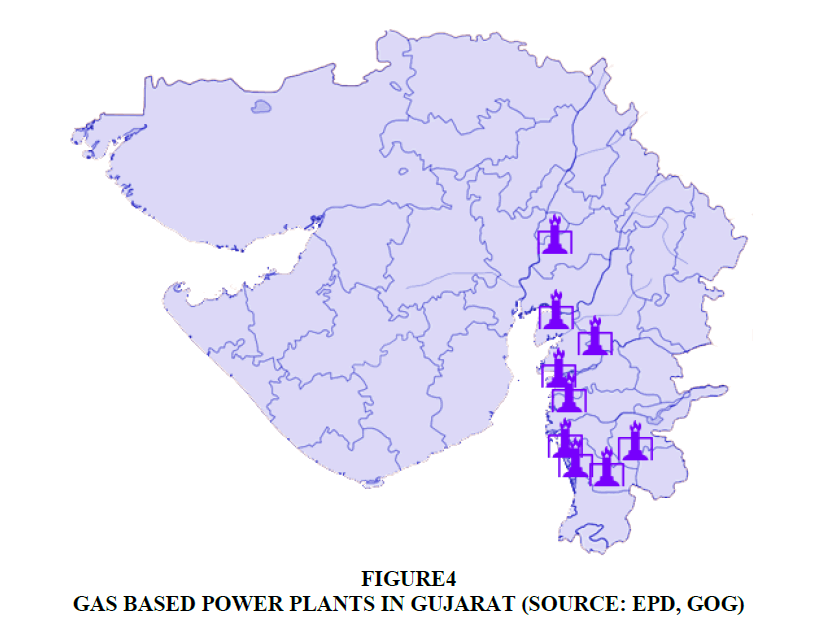

Gujarat has also focused on the development of gas-based power plants as a part of integrated gas infrastructure development by understanding the benefit of gas-based power plants in peak load demand period and grid stability. Currently Gujarat has total 10 gas-based power plants with cumulative installed capacity of 4550 MW which is around 19% of total gas-based power capacity in the country. The location of these gas-based power plants has been shown in the following Figure 4.

Natural Gas Consumption Scenario in Gujarat

Natural gas consumption in the Gujarat has been significant in terms of volume and growth over a period of time. During the period of FY 2018-19, Gujarat holds around 31% consumption of natural gas in the tune of 46 MMSCMD of total country’s consumption of 146 MMSCMD (EPD, 2019) which includes fertilizers, power, refinery, industrial and CGD.

In CGD sector, Gujarat’s CGD gas consumption accounts for around 45% of total country’s CGD gas consumption in the tune of 12 MMSCMD (PPAC, PNGRB, 2022). GSPC’s two CGD companies namely GGL & SGL supply around 10.5 MMSCMD of natural gas in Gujarat which contributes around 88% of Gujarat’s CGD consumption and 40% of total gas consumption in CGD sector in India. Other CGD players operational in Gujarat’s CGD sector are Adani Gas, Vadodara Gas and IRM Energy cumulatively contributes to the tune of balance 12% gas supply. The huge natural gas consumption in CGD within Gujarat is due to the largest number of industrial PNG which contributes around 2/3rd of total consumption and largest number of CNG stations which contributes around 20% of total consumption (SGL MD, Indian Infrastructure, 2020). The growth in total gas consumption in the state of Gujarat has been shown in Table 5.

| Table 5 Total Gas Consumption In Gujarat Vs India |

|||

|---|---|---|---|

| Unit | India | Gujarat | % Share of Guj |

| 2016-17 | 152.6 | 46 | 30% |

| 2020-21 | 166.6 | 55.57 | 33% |

| Growth in 5 Yr | 8% | 17% | |

| CGD Gas Consumption in Gujarat vs India | |||

| Unit | India | Gujarat | % Share of Guj |

| 2016-17 | 16.7 | 6.9 | 42% |

| 2020-21 | 25.3 | 13.7 | 54% |

| Growth in 5 Yr | 34% | 49% | |

GSPC Group’s Contribution in Gujarat’s Gas-based Economy

GSPC is India's only State Government-owned oil and gas Company with the Government of Gujarat holding approximately 87% equity stake. GSPC was incorporated in 1979 as a petrochemical company. GSPC was among India’s first companies to participate in the NELP bidding process & acquire exploration blocks across country.

Today GSPC has become a vertically integrated energy company which has under its umbrella twelve companies and institutions, has established itself as one of the largest E&P entities with a commanding presence across the entire hydrocarbon value chain.

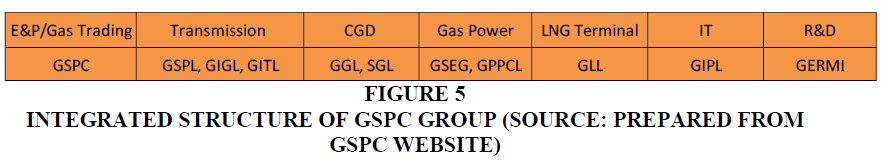

GSPC group has played vital role in establishing Gujarat as a gas-based economy with its dynamic leadership supported by Energy & Petrochemical Department (EPD) of Gujarat Government. Since last few years GSPC’s pipeline company GSPL has been mandated to expand beyond Gujarat and undertaking two cross-country pipeline. GSPL’s joint venture companies GIGL & GITL are building cross-country pipelines namely Mehsana-Bathinda, Bathinda-Jammu-Srinagar and Mallavaram-Bhilwara pipeline respectively and partially commissioned around 1600 Km of pipeline till the year 2022. Current, integrated structure of GSPC group is represented in Figure 5.

E&P and Gas Trading: Gujarat State Petroleum Corporation Limited (GSPCL) is leading players in India’s E&P sector and second largest gas trading company in the country which is having strong presence in LNG trading & domestic gas trading business.

Gas Transmission Pipeline: Gujarat State Petronet Limited (GSPL) is second largest pipeline company which operates around 3000 Kms of pipeline in Gujarat. GSPL India Gasnet Limited (GIGL) has commissioned around 1200 km pipeline out of 2000 km pipeline as a part of Mehsana-Bathinda, Bathinda-Jammu-Srinagar project. GSPL India Transco Limited (GITL) has commissioned around 365 km pipeline out of 1800 km pipeline project in the state of Andhara Pradesh & Telangana as a part of Mallavaram-Bhilwara pipeline project

City Gas Distribution: Gujarat Gas Limited (GGL) is largest CGD company in the country which handles around 8 MMSCMD gas volume sale in the Gujarat and other states and has been formed by merging two companies GSPC Gas and Gujarat gas Company Limited. Another company Sabarmati Gas Limited (SGL) active in CDG development in Gandhinagar, Banaskanta, Himatnagar and other areas.

Gas-based Power: GSPC’s two companies namely Gujarat State Energy Generation (GSEG) and GSPC Pipava Power Limited (GPPCL) have established the gas based power plants in the Gujarat.

LNG Terminal: GSPC LNG Limited (GLL) is the GSPC group company who have developed Gujarat’s 3rd LNG terminal with the capacity of 5 MMTPA LNG terminal at Mundra and successfully commissioned in the year 2020. Currently operating in the range of 20% of capacity due to pipeline constraints (PPAC,2022).

IT services to Gas companies: GSPC’s own companyGujarat Info Petro Ltd (GIPL) is providing IT & Software related services to all the group companies and other clients. GIPL has developed in-house Gas Trading Platform for conducting LNG tendering process for the GSPC.

Research & Development: Gujarat Energy Research and Management Institute (GERMI) is promoted is a centre of excellence in the energy sector, promoted by GSPC with the mandate for Research and Development, Consultancy, Training, Education.

Analysis of Expert’s View

Researcher has conducted the One-on-One interviews of 20 experts having the average industry experience of 27+ years and asked the question on “How Gujarat could be a role model for India’s gas-based economy and what key lessons we can learn from Gujarat?”.

Gujarat’s primary energy share of natural gas is higher than the word average which is close to 25% (PNGRB, 2018), whereas natural gas contributes around 6% in India’s primary energy mix. Hence, it is considered Gujarat is leading the story of India's gas-based economy. Researcher tried to understand from experts, what Gujarat exactly done to develop this market and what key lesson we can learn from Gujarat to help India to move towards gas-based economy. Whether we can consider Gujarat as a model which can be integrated across the country or at least any key lessons we can take from Gujarat and implement across the other state.

Content Analysis

Most of the experts believe that, definitely Gujarat has to be a role models for any state in the country in general and coastal states in the specific. If we talk about the gas-based economy, the numbers are there to speak for Gujarat model and definitely it has in lot of good things for being able to achieve this kind of fit and a lot of credit goes to the proactive policies of Government of Gujarat. They had a vision and they started implementing their vision 25 years back. So, what we see today is not something which has happened in last few years, it has taken 25 years for them to really had that vision and then go ahead and implement it.

There were few key natural drivers for Gujarat to achieve the lion share of India’s natural gas consumption during the initial period of gas industry’s evolution in the country. First natural landfall points of Bombay High gas was at Gujarat near Hazira, second was Gujarat were farthest from coal resources in India which was coasting them more to use coal as energy source and third was Gujarat government has negotiated well with the center to use the lion share of natural gas which has landed on their territory by encouraging the setting up of gas based industries be it gas based power, fertilizer and CGDs ahead of central government.

What really made impact in Gujarat for making it gas-based economy is the very strong interest of Gujarat Government to use gas in the state and if you look at Gujarat history, we found that the Gujarat government has always been very, very supportive of initiatives to increase the consumption of gas in the state.

Regional network development is one key lesson we can take from Gujarat because even if we develop a national gas grid completely then also the development of last mile connectivity is very, very important to grow the consumption of gas in the respective states. Because regional network will connect to city gas distribution network and also connect to the large customers within the State. So, Gujarat government actually invested in developing regional gas pipeline infrastructure.

One of the key drivers for Gujarat to drive the gas economy was creation of a state entity in the form of GSPC to promote the natural gas in the state because you require somebody in the state to drive this kind of endeavors. Gujarat had few domestic gas sources and landfall points from other state but they also ensured setting up LNG import terminals at right time to make availability of gas in the state. However other states also had similar access to gas and few states are also coastal states, but they did not create the infrastructure and they did not have a state entity to promote this thing and that makes Gujarat different than others.

One of the key example of Gujarat’s initiative in building own infrastructure for the benefit of larger society is extending East West pipeline upto Jamnagar within the Gujarat. East West pipeline was developed by Reliance which had authorization to build pipeline from Kakinada to to Jamnagar, but then Reliance terminated pipeline at Gujarat entry called Bhadbbul and from there as per the directions from Government of Gujarat, GSPL did build the remaining pipeline till the Jamnagar refinery. And it became one of the foundations for the Gujarat pipeline network and then face of GSPL completely changed in terms of regional network they have developed for the better reach of natural gas across the corners of the State.

Gujarat actually had nicely developed two things simultaneously, first is bringing industry friendly policies to develop an industrial corridor and secondly making the energy accessible to them by putting up gas infrastructure in place and that made Gujarat to bloom more on gas-based economy. So, the states need to take a decision in terms of individual states come up with an Integrated Master Plan of the consumption-based infrastructure development so that energy can reach them faster and efficiently. Find out which are the area where an industrial cluster can be developed and make the gas pipeline go through that area to penetrate gas as energy source.

Very fundamental thing what Gujarat did was that, let me not wait for the chicken and egg, let me put infrastructure and that was a huge risk, they had taken that point of time, because the market was not saying or not giving all the right direction, but they still took that plunge. And they said that look, if I connect the customer he will consume and therefore he will consume at any cost. Now that was a risky proposition that point of time, but today the same philosophy can be applied to the nation by taking away all the risk because today there is no risk. One of the key learnings from Gujarat to be taken by other states is keeping the balance between ensuring supplies and simultaneously stimulating demand by pushing industrial growth.

Gujarat did not look for extraordinarily high returns on the gas infrastructure, they just went on investing in infrastructure. And they went on doing pipeline,subsequently they went on covering city after city under distribution network, so that is the way to go for building an integrated infrastructure for ensuring the last mile connectivity to end consumers.

Obviously, a lot of things are known, like they have developed a gas distribution company called Gujarat Gas in the joint venture with the private company, which was done in very, very early 1980s. I think nobody had thought of doing it as a state, at a national level also one or two companies were thought about, Gujarat had seen that natural gas which was having landfall point in Gujarat in the Hazira region was being transported across the country. And they saw that if they can develop the gas base infrastructure, the transmission infrastructure, they will make the product available across the Gujarat.

So firstly, they had a vision, then they realised that this is something which nobody else will do because in those days, the regulations were not there. It was early days 25 years back, we did not have the experience of regional networks or VGF and all those kind of things. So, they decided to develop the gas grid through their own company, the state owned company, they took the risk and they said we will take the lead and develop the infrastructure. So they had develop the gas pipelines across the state, then they have developed LNG terminals. Before Gujarat, LNG terminals were considered to be developed at Ennore, Tamilnadu and also LNG terminal was constructed in Dabhol, which was before Gujarat. But then in the year 2002-2004 Gujarat has developed LNG terminals at Dahej& Hazira and third one got commissioned in 2020 and two more under construction. So, Gujarat has provided a right kind of environment and it has leveraged the long coastal line of 1600 Kms for LNG terminals to come and invest in Gujarat. So, it has leveraged the sourcing of gas from domestic as well as imported medium, it has leveraged the pipelines it developed for getting the city gas distribution network developed in entire state even before the PNGRB came. Around 20 districts in Gujarat had CGD even before PNGRB came into existence in the year 2007. So, they actually thought of it much ahead of time and they not only thought of it, they went head and developed and implemented. In 2001 Gujarat came out with Gujarat Gas Act and in 2004 they came out with a city gas distribution licensing policy and they invited private sector interest. Few large cities were taken up by the private sector, but the medium and semi urban rural kind of cities were not taken by these private players. Again, Gujarat Government realised that, this is not something so attractive for private players to come & invest and they asked the state company to take a rest of the area and develop the semi urban and small cities as far as CGDs is concern. So, they have actually not only vision for it, they understood the various elements of the value chain, they ensure that the infrastructure was developed in timely manner. They also ensured that they are all synchronised as the terminals were getting developed, pipelines were getting developed and CGDs also getting developed. So, there was no time lag between various elements of the value chain. And wherever they thought that private sector is willing to do it and keen, they've left it to private sector.

It is only where they realised that private sector was not very keen, or it was premature for the private sector to get in, they actually went and did it themselves. But then their all gas companies got listed, so even if those companies were government promoted, they are all listed companies. All gas companies owned by Gujarat Government have been given complete freedom to work as commercial organizations. They've been allowed to go and expand outside Gujarat and Government has kept a very big arm's length distance between the operation of those companies and ownership. So, Gujarat has followed the model which was based on light handed regulations. If you see Gujarat never had a high ended regulations on industries also, they have allowed industries to use gas or the fuel based on their economic and commercial viability. So even if the gas infrastructure & CGD was there, Gujarat government never pushed that CNG has to be used in Gujarat. It is only in Gujarat if you see, there's no high court order, there is no supreme court order, there is no Government of Gujarat’s order that say CNG has to be used, so it has been left to the market forces. It is all in their own commercial wisdom and on economics, the users whether it is industrial users or CNG, they are using gas, the most important thing they've done is they have created infrastructure make the product available and they've given confidence to users. As Gujarat state has given confidence to the users that the product is available, come what may be, the security of supply is something which is very much there in the minds of consumers. Further, as one of the expertsaid “gas is a logistic nightmare” and if you don't set it right, so if you don't get gas at someday, what do you do as a gas user, it's very difficult, you cannot store gas, that means you'll have to have alternative fuel. But in Gujarat, these initiatives have led to a situation that there is an absolute security of supply with the help of multiple players. No consumer needs to be worried about whether the gas will be available or not available, and the pricing is left to the market.

Another thing Government of Gujarat has ensured is that open access to the infrastructure, when they developed Gujarat gas grid they said it has to be an open access basis. So should they have ensured that it operates as open access on common carrier principle even before the PNGRB was conceived, even today 65 to 70% of the gas that Gujarat State Petronet (GSPL) carries is of third parties. So it's not only infrastructure was created for common use, it is also ensured that it is being made available for common use. That is how Gujarat have been able to get so many players who have invested in Gujarat’s natural gas business and that's how a market environment has got developed. It is a long story of how Gujarat has developed itself as a gas-based economy, you can have so many small-small things also identified but the above mentioned are the major reasons why it has done successfully. Based on expert’s opinion and its analysis, researcher believes that, similar things will have to be done in other states in the country where state government’s participation is very, very critical. So, if it has to be done at the pan India level, it can't be done by centre alone, the states will have to participate, their partnership will be required and they will have to play a very very important role in developing this kind of infrastructure and marketplace. If today we apply the Gujarat model by creating a national gas grid, last mile connectivity for the gas terminals, put all kinds of retail LNG outlets, put all kinds of truck loading facilities. Today the cost of that infrastructure is going to be peanuts as compared to what India is going to create history in terms of becoming gas-based economy and the golden era of gas is there to be received in India. In today’s scenario Pipeline & CGD comes under PNGRB’s regulation and hence State alone can’t do anything on these infrastructure as done by Gujarat before the PNGRB come into picture. But, State need to have policies which are in sync with the central government & PNGRB which will facilitate the early development of gas infrastructure in general and gas pipelines in specific to reach to every corners of the respective states then only it will help to increase the share of natural gas in State’s energy mix.

If we consider integrated gas infrastructure starting from LNG terminal to CGD, at least coastal states can take advantage wherever the port infrastructure are being developed and even if we do in coastal areas, we will have at least 10 Gujarat.

For example, today Odisha is one state where Dhamra LNG terminal is coming up and Odisha is considered to be a state which promotes industrial growth. So, if Odisha wants become a next Gujarat then, they will have to invest in the last mile connectivity by developing regional network. State governments will have to find a commercial solution to develop regional networks in the state similar to what has been done by Gujarat and only then they will see a significant increase in share of natural gas in State’s energy mix.

Gujarat has shown the way but then each of the other states in India they have to adopt it according to their requirements and geography because one size fits all cannot be possible for such a critical and important sector of economy.

If that is something which happens in the way things happened in the Gujarat, then researcher believes that we will see many Gujarat in the country which will help India to move towards a gas-based economy by 2030 by increasing the share of natural gas to 15% in primary energy mix.

NVIVO Results

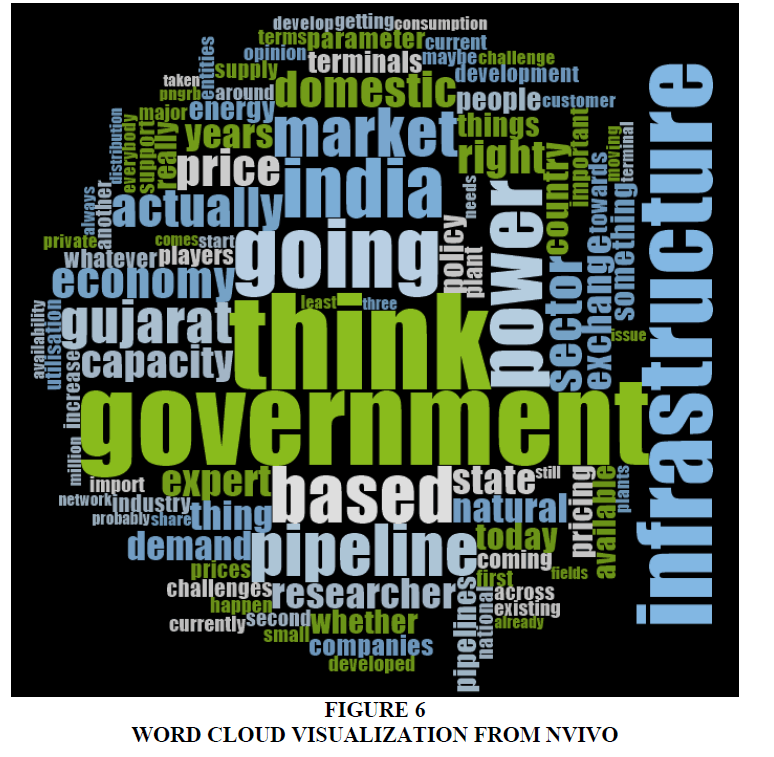

The researcher has used NVIVO software to analyse the views of expert with the help of transcripts prepared from recorded interviews of 20 experts. The output of NVIVO result in terms of Word Cloud Visualization has been shown in following Figure-XX. The Word Cloud Visualization result shows that “Infrastructure” is the most repeated word during the conversion with the experts and as per earlier content analysis done manually by researcher Infrastructure has been key back-bone of Gujarat’s evolution as a Gas-based economy Figure 6.

Conclusion and Key Lessons from Gujarat

Gujarat Government has taken proactive steps in developing natural gas industry in the State with its progressive policy, first mover advantage and geographical location having around 1600 kms of coastal line. Gujarat had not only a vision but also, they understood the various elements of the gas value chain and they have ensured that the infrastructure was developed in timely manner. Gujarat had the integrated model of development for natural gas value chain and developed the infrastructure with the help of their own state entities like GSPC, GSPL, GGL & SGL and also supported the private & central plyers like Shell, BG, Petronet LNG Limited to develop a infrastructure in the state. Gujrat have created demand by establishing integrated infrastructure and ensuring the security of gas supply to the end consumers.

Gujarat has brought out many policy & legislative initiatives like Gujarat Gas Act 2001 and LNG terminal Policy 2012 which has helped them to attract the investment and developed such a robust infrastructure. Major key element of the Gujarat’s gas-based economy is their regional robust state natural gas grid connecting to every corner of the Gujarat. Another factor was their coastal location & investor friendly policies helped them to attract the investment LNG terminal development and could have India’s 1st operational LNG Terminal in 2004 itself. They have promoted gas-based industries and clusters to come up at various locations and also gave priority to develop a CGD network in the State even before PNGRB came in to existence. Today Gujarat have largest CGD customer base in the country.

Key Lesson from Gujarat

Researcher believes that, the integrated infrastructure development is one of the key learning we can take from Gujarat and implement in other states in the country where state government’s participation is very, very critical. So, if it has to be done at the pan India level, it can't be done by central government alone, the states will have to participate and they will have to play a very important role in developing this kind of infrastructure and marketplace. If we consider integrated gas infrastructure starting from LNG terminal to CGD, at least coastal states can take advantage wherever the port infrastructure are being developed. Even if we do implement such model in coastal states only then, we will have at least 10 Gujarat. If that is something which happens then researcher believes that we will see many Gujarat in the country which will help India to move towards a gas-based economy by 2030 by increasing the share of natural gas to 15% in primary energy mix.

References

Business Standard (2013). https://www.business-standard.com/article/economy-policy/sc-quashes-gujarat-gas-act-104032601074_1.html

Energy & Petrochemical Department (EPD), Government of Gujarat. Retrieved from https://guj-epd.gujarat.gov.in/

Environmental Protection Agency. Retrieved from https://www.epa.gov/ghgemissions/global-greenhouse-gas-emissions-data

Gujarat Gas Limited (2022). Annual Report 2021-22. available at https://www.gujaratgas.com/investors/annual-reports/

Hauser, P., & Möst, D. (2015). Impact of LNG imports and shale gas on a European natural gas diversification strategy. In 2015 12th International Conference on the European Energy Market (EEM) (pp. 1-5). IEEE.

Indian Infrastructure (2020). Interview extracts of Managing Director of Sabarmati Gas Ltd.

John M. S. (2005). "Chapter 1 Natural Gas An Overview," Effectively Managing Natural Gas Costs. River Publishers.

PNGRB (2018). Booklet presentation by PNGRB for 9th City Gas Distribution Bidding Round Launched on 08th May 2018 at The Hotel Ashok, New Delhi.

Zhao, S. R., & Guo, Y. (2008). On Natural Gas price mechanism given present context of China’s natural gas industry. In 2008 International Conference on Management Science and Engineering 15th Annual Conference Proceedings (pp. 1873-1879). IEEE.