Research Article: 2021 Vol: 25 Issue: 6

Event Study Analysis Before and After Covid-19 In Indonesia

Deannes Isynuwardhana, Telkom University

Meisya Luthfia Putri, Telkom University

Citation Information: Isynuwardhana, D., & Putri, M.L. (2021). Event Study Analysis Before and After Covid-19 In Indonesia. Academy of Accounting and Financial Studies Journal, 25(6), 1-11.

Abstract

This study aims to determine whether there are significant differences in abnormal returns, trading volume activity, and bid-ask spread before and after announcement of Covid-19 in Indonesia. This study uses a case study method using secondary data in form of closing index prices, number of shares circulated, number of shares outstanding, bid and ask prices. The population in this study were companies included in SRI-KEHATI index. The sampling technique used saturated sampling technique, namely as many as 25 companies. The results of the test using the Wilcoxon signed-rank test, shows that there is no significant difference in abnormal returns, trading volume activity, and bid-ask spread before and after announcement of Covid-19 in Indonesia.

Keywords

Abnormal Return, Bid-Ask Spread, COVID-19, Event Study, Trading Volume Activity.

Introduction

Doing business in the capital market, investors will consider all forms of information then used to consider the decision, whether to invest or not. According to (Saraswati & Mustanda, 2018) states that the Efficient Market Hypothesis is a theory that discusses about the relation between information or events with stock price movements. In general, the capital market will react quickly when an event occurs. Therefore, investors should be consider the situations and conditions that occur to make his decisions. This needs to be done by the investors in order to avoid or minimize the risks that will be obtained in the future.

Corona virus or Covid-19 first appeared in Wuhan, China at the end of 2019. Since this case was discovered in Indonesia on March 2, 2020, causing chaos and a big impact in many aspects, which one is the Indonesian capital market. On that day, the closing price of the JCI on the capital market occupied 1.76% points at the level of 5,361. On March 9, 2020, the JCI was closed to reach 6.5% at the level of 5,136. Decreasing of the Composite Stock Price Index (JCI) during the Covid-19 pandemic, was due to market concerns about the large impact that will be felt in the future on the global and domestic economy (Sugianto, 2020).

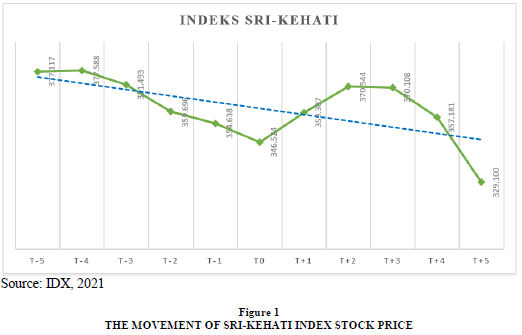

Before and after Covid-19 incident in Indonesia, SRI-KEHATI index's stock price fluctuations were quite extreme. The following is the movement of SRI-KEHATI index stock during the 11 days of the study period, that is 5 days before the event, during the event, and 5 days after the event:

Figure 1 is shows the movement of SRI-KEHATI index shares for 5 days before the event, during the event, and 5 days after the event, namely 24 February 2020 - 9 March 2020. We can see that the movement of SRI-KEHATI index stock price has fluctuated quite drastically. On the t-5 period The SRI-KEHATI index is 377,117 and experienced a steady increase to 377,588 in the next period (t-4). Passing the t-4 period, SRI-KEHATI index continued to decline from t-3 until t0 period. On t-3 period SRI-KEHATI index stock price is 371,493. On the next period (t-2) SRI-KEHATI index obtain 359.696. At t-1 period, SRI-KEHATI index get to 354,638 and back down to 346,524 on t0 period. After Covid-19 incident in Indonesia, on the t + 1 and t + 2 periods SRI-KEHATI index increased to 359,307 and 370,544. Furthermore, on t + 3 to t + 5 periods, SRI-KEHATI index continues to experience a drastic decline. At t + 3 period SRI-KEHATI index obtained to 370,108. Then, on t + 4 period the SRI-KEHATI index gained 357.181 and it occurred a very drastic reduction on the t + 5 period to 329,100. This means that many investors who remove their ownership of the shares and are not interested in buying shares so it makes stock market movements weakened.

To determine the market reaction to an event, the rate of return can be used as a tools to measure the value of the price changed by using abnormal returns, and also, investor needs to assess the quality of information on the level of stock liquidity. The more liquid the shares, the easier and quicker the shares will be to trade or cash back. The higher transaction rate of a share, the higher the liquidity of the shares. To find out the level of stock liquidity, it can be seen through the trading volume of shares, by using trading volume activity and bid-ask spread. The smaller bid-ask spread value obtained, the higher level of stock liquidity.

Therefore, with this research, the researcher aims to analyze the differences of significance in abnormal returns, trading volume activity, and bid-ask spread before and after announcement of Covid-19 in Indonesia, on SRI-KEHATI index group.

Literature Review

Investment

In general, investment is an activity in investing funds in a certain period hope that the user of these funds can generate profits and increase the value of the investment. According to Hartono (2016) says that investment is a delay current consumption which are included in productive assets for a certain period (p. 5). Investment is divided into two types, that is direct investment, which is those who invest directly in buying a company's financial assets either through intermediaries or in other ways. Furthermore, indirect investment is those who make investments that are not directly involved, but instead buy financial assets in the form of stocks or bonds (Fahmi & Hadi, 2011, p. 7).

Capital Market

In capital market, there are many trading activities that can be done. That can be stock of shares, equity, bonds, debt instruments, and other important documents issued by the government or a company with an intermediary. In UUD no. 8 at 1995 explains the meaning of the capital market, which is an activity related to securities trading activities and a public offerings. Public companies that affected or impact of their securities issuance also institutions and professions that related to securities. The capital market is a vehicle for meeting those who have excess funds with those who need these funds. The capital market is a market for various financial-related instruments that can be traded, it can be form of debt, stocks, derivative instruments, or other instruments (Tandelilin, 2010). From that, it can be concluded that the capital market is a tools that given to connect the owner of funds (investors) with companies or institutions that need funds.

Stock

Stocks are a type of securities that are traded because they can provide a level of return for investors. Shares are defined as an ownership of funds or capital of a company, which is clearly stated in the nominal value, name of the company, along with the rights and responsibility of each holder. With the meaning of that when someone has bought shares in a company, that person already has part of the ownership rights to the assets and income of the company (Safira & Simon, 2016). There are two types of shares is the most common about capital market, namely common stock, is a certificate that serves as proof of ownership of a company with various important aspects contained in the company. The certificate owner will have the right to receive profits in dividends. A person who owns ordinary shares has the right to control the company or can attend the GMS (General Meeting of Shareholders) and EGMS (Extraordinary General Meeting of Shareholders) and has the right to decide to buy a right issue (sale of limited shares or not). Last one is preferred stock, is a shares which have more rights than the owners of common stock types. Preferred shareholders will be prioritized in distribution of dividends and have rights for voting more than common stockholders, for example, selection for new directors (Fahmi & Hadi, 2011, p. 68).

Market Efficiency

According to Hartono (2016) market efficiency is defined as the relationship between stock prices and information. In general, an capital Market can be defined as efficient market if the price of securities can be reflects all accurate and relevant information. The faster the information is reflected in the price of securities, the more efficient the capital market will be (p. 585). There are forms of market efficiency, namely the informationally efficient market is an efficient market from an information point of view, and a decisionally efficient market is an efficient market seen from the point of view of the sophistication of market players in making decisions based on available information (Hartono, 2016, p. 586).

There are three main forms of market efficiency, namely weak form market efficiency, which is a market where the price of the security reflects all information in the past, then semi-strong form market efficiency is a market where the price of the security reflects all the information in circulation. Lastly, strong form market efficiency is a market where the price of the securities reflects all information, public and private. If an announcement or event contains information, the market will receive the information and will react to the announcement of the information. This market reaction can be seen with changes in the price of securities in the market.

Event Study

Event study is a study that studies about market reactions to an event. This study is analyze the reaction that results from an information or announcement that is widely published to the general public (Hartono, 2016, p. 623). These events can be found from internal or external of the company and the consequences can be widely felt by the company itself and other companies.

Return

Return is the result or profit obtained by investors after carrying out investment activities or an amount received on investment in a company. According to Tandelilin (2010) said that return on investment is one of the factors that motivates investors to invest, a reward of the investment and courage for taking the risk. Investing is known as 'high risk, high return', which means that the higher risk that we get, the higher return we will get too.

According to Hartono (2016) there are two elements of return, that is yield and capital gain (loss). Yield can be interpreted as the percentage of cash obtained by investors in investment. Meanwhile, capital gain is the profit that will be obtained from the difference between the current period investment value and the investment value that has been made at the price of the previous period. However, if there is a decrease in investment value that will cause investors to lose (capital loss) (p. 264).

There are two types of returns, it’s acrual return and expected returns. Acrual return is a return that has occurred. Acrual return is calculated using historical data which is used as a measure of the performance of a company. Furthermore, expected return is the return expected by investors in the future, which has not yet happened.

Abnormal Return

Abnormal return is the difference between the actual rate of return and the expected return. Abnormal returns can be used as a basis for testing market reactions. It can be said that if an event contains information, it will give an abnormal return to the market. According to Hartono (2016) a simple way to calculate abnormal returns is to find the difference between actual return and expected return (p. 647). Actual return is the level of realization of return that has been obtained or that has occurred, while the expected return is the rate of return that investors expect or will obtain in the future, by using the formula:

RTNi.t = Ri.t – E[Ri.t]........(1)

To get the expected return, there are several calculation methods that can be use:

Mean-adjusted Model

According to this average fit model, the expected return has constant value with the previous realized return during the estimated period. The estimated period is the period that occurs before the event period or it can be referred to as the event window.

Market Model

This model can be done in two stages, namely by using the data realization during the estimation period for the expectation model and estimating the expected return in the window period. The expected model can be obtained using Ordinary Least Square regression with the formula:

Ri.j = αi + βi . Rm.j + ei.j .......(3)

Market-djusted Model

This model is also called the model according to market. Hartono (2016) said this model is considered the best estimate for calculating the return of a stock's security using the market return index at that time. By applying this model, it does not require an estimation period to form an estimation model, because the security return with the market index return is estimated to be the same. This can be done with the formula:

ARi,t = Ri,t – Rm..........(4)

Trading Volume Activity

Trading volume activity can be used as a parameter for the stock market's reaction to an event. Trading volume is a comparison between the number of company shares traded in a certain period with the number of company shares outstanding at a certain period (Listiani & Lestariningsih, 2018). If the value of the stock's trading volume is high, then the stock is in great demand by investors, or it can be said that the stock is more liquid. Trading volume activity is directly proportional to stock liquidity, so the higher value of trading volume activity, the more liquid the stock is, if the value of trading volume activity is low, the less liquid it will be. The following is the formula for calculating trading volume activity (Widiatmoko & Paramita, 2017):

Bid-Ask Spread

The bid and ask spread is the difference between bid price and ask price. According to Hartono (2016) says that bid price is a condition when the buyer is willing to buy shares at the highest price and ask price or offer price is a condition when the seller is willing to sell the shares at the lowest price (p. 67). The bid-ask spread is inversely related to stock liquidity. The smaller bid-ask spread value, the more liquid the stock is, and the higher bid-ask spread value obtained, the less liquid the stock will be (Listiani & Lestariningsih, 2018). To calculate the bid-ask spread, it can be use:

Methodology

The population and sample in this study are companies that are included in the SRI-KEHATI index group by using a sampling technique, namely saturated sampling which is a sampling technique when the entire population is used as a sample. This is often done when the population is small (less than 30), or the researcher wants to make generalizations with a very small error rate.

SRI-KEHATI Index is the result of a collaboration between Indonesia Stock Exchange and the Keanekaragaman Hayati Indonesia Foundation (KEHATI). SRIKEHATI index applies the principles of Sustainability and Responsible Investment (SRI) or Sustainable and Responsible Investment, and principles of Environmental, Social and Governance (ESG), as the standard for selecting companies. There are 25 companies included in the SRI-KEHATI index group during the study period.

This research was conducted using event study method, it’s reactions of market before and after Covid-19 in Indonesia. This study utilizes daily data on SRI-KEHATI index, daily stock price of SRI-KEHATI index company, the number of shares issued and circulating by the company and the bid-ask spread during the study period. This research uses the observation period for 11 days, 5 days before, during the event, and 5 days after the incident occurred in order to minimize the occurrence confounding effect or changes in stock prices due to other factors outside of research events (Suganda, 2018, p. 23).

After the data is collected, the data is processed and analyzed using SPSS software. The first thing to do is to calculate the abnormal return, trading volume activity, and bid-ask spread according to a predetermined formula. In this study, the calculation of expected return uses market-adjusted model. This model is considered the best estimate for calculating the return of a stock's security using the market return index at that time. By applying this model, it does not require an estimation period to form an estimation model, because the security return with the market index return is estimated to be the same. After that is analyze descriptive. Descriptive analysis is used to describe the research data that has been collected by presenting a table containing the minimum, maximum values, as well as the calculation of the distribution of data through the calculation of mean and standard deviation. After doing descriptive analysis, the next step is test normality data to find out whether the data that has been collected is normally distributed or not, which would determine the type of test to be carried out next, it is difference test. In different tests, there are two tests that can be done. If the data is normally distributed, the test is parametric test using the Paired Sample T-Test. Meanwhile, for data that are not normally distributed it is recommended to use a non-parametric test, using the Wilcoxon Signed Ranks Test.

Results and Discussion

Descriptive Analysis

Table 1 is the results of descriptive analysis tests on the abnormal return, trading volume activity, and bid-ask spread before and after announcement of Covid-19 in Indonesia. The abnormal return before announcement of Covid-19 in Indonesia, the minimum and maximum values is -0.02744 and 0.01536. The average value is -0.00413 with a standard deviation is 0.00997. Furthermore, the abnormal return after announcement has a minimum and maximum value is -0.02612 and 0.01387. The average value is -0.00335 with a standard deviation is 0.01129.

| Table 1 Descriptive Analysis Data of Abnormal Return, Trading Volume Activity, and Bid-Ask Spread Before and After Announcement of Covid-19 in Indonesia | |||||

| N | Minimum | Maximum | Mean | Std. Deviation | |

| AR-Before | 25 | -,02744 | ,01536 | -,0041388 | ,00997279 |

| AR-After | 25 | -,02612 | ,01387 | -,0033592 | ,01129397 |

| TVA-Before | 25 | ,00001 | ,00377 | ,0013384 | ,00087826 |

| TVA-After | 25 | ,00000 | ,00387 | ,0013116 | ,00094058 |

| BAS-Before | 25 | ,00171 | 1,20792 | ,0530680 | ,24061563 |

| BAS-After | 25 | ,00159 | ,41576 | ,0213064 | ,08220679 |

| Valid N (listwise) | 25 | ||||

The trading volume activity before announcement of Covid-19 in Indonesia obtained minimum and maximum values is 0.00001 and 0.00377. The average value is 0.00133 with a standard deviation is 0.00087. Furthermore, the trading volume activity after announcement has a minimum and maximum value is 0.00000 and 0.00387. The average value is 0.00131 with a standard deviation value is 0.00094 (table 1).

The bid-ask spread before announcement of Covid-19 in Indonesia obtained minimum and maximum values of 0.00171 and 1.20792. The average value is 0.05306 with a standard deviation is 0.24061. Furthermore, the bid-ask spread after announcement obtained minimum and maximum values is 0.00159 and 0.41576. The average value is 0.02130 with a standard deviation is 0.08220 (table 1).

Normality Test

Table 2 is the result of normality test for abnormal return, trading volume activity, bid-ask spread before and after announcement of Covid-19 in Indonesia. Based on the results, the normality test for abnormal return by using Kolmogorov-Smirnov test, some data are not normally distributed. On the abnormal return before announcement, a significance value is 0.027 < 0.05, then the data of abnormal return before announcement are not normally distributed. While the abnormal return after announcement, a significance value is 0.200 > 0.05, then the abnormal return after announcement are normally distributed.

| Table 2 Normality Test of Abnormal Return, Trading Volume Activity, and Bid-Ask Spread Before and after Announcement of Covid-19 in Indonesia | ||||||

| AR-Before | AR-After | TVA-Before | TVA-After | BAS-Before | BAS-After | |

| Asymp. Sig. | 0,027 | 0,200 | 0,067 | 0,0001 | 0,000 | 0,000 |

The results of trading volume activity test, some of data are not normally distributed. Before announcement, a significance value is 0.067 > 0.05 (table 2), then the data of trading volume activity before announcement are normally distributed. Meanwhile, trading volume activity after announcement a significance value is 0.001 < 0.05, then the trading volume activity after announcement are not normally distributed.

The results of the bid-ask spread data normality test before and after announcement are not normally distributed, where the significance value on the bid-ask spread before and after announcement is 0.000 < 0.05 (table 2).

Wilcoxon Signed Ranks Test

Based on the results of data normality test (table 2), for different tests on abnormal return, trading volume activity, and bid-ask spread will use a non-parametric test, that is Wilcoxon signed ranks test. It is because the data that obtained are not normally distributed.

Table 3 shows the results of the Wilcoxon Signed-Ranks test for abnormal return trading volume activity, and bid-ask spread. For abnormal return, obtained Z value is -0.336 with a probability value is 0.737. It shows that the probability value is bigger than the predetermined significance value (0.737 > 0.05), it can be concluded that there is no significant difference in abnormal return of shares for SRI-KEHATI index before and after announcement of Covid-19 in Indonesia. This indicates that the announcement of Covid-19 in Indonesia on March 2, 2020 does not contain information that can affect market price movements. Even though the period before and after announcement gives a reaction to the market which can be indicated by the fluctuation of the stock price, this is not enough to influence a significant change in the abnormal return before and after announcement. there is no significant difference it also can be due to the fact that there is information leakage among investors which causes investors not to be surprised about the announcement of Covid-19 entering Indonesia.

| Table 3 Based on Negative Ranks Wilcoxon Signed Ranks Test Result of Abnormal Return, Trading Volume Activity, and Bid-Ask Spread Before and after Announcement of Covid-19 in Indonesia | |||||||||

| AR-Before and After | TVA-Before and After | BAS-Before and After | |||||||

| N | Mean Rank | Sum of Ranks | N | Mean Rank | Sum of Ranks | N | Mean Rank | Sum of Ranks | |

| Negative Ranks | 12a | 12,50 | 150,00 | 12a | 13,88 | 166,50 | 9a | 16,83 | 151,50 |

| Positive Ranks | 13b | 13,46 | 175,00 | 13b | 12,19 | 158,50 | 16b | 10,84 | 173,50 |

| Ties | 0c | 0c | 0c | ||||||

| Total | 25 | 25 | 25 | ||||||

| Z | -0,336d | -0,108d | -0,296e | ||||||

| Asymp. Sig. (2-tailed) | 0,737 | 0,914 | 0,767 | ||||||

a. After < Before

b. After > Before

c. After = Before

d. Based on Positive Ranks

Before announcement of Covid-19 in Indonesia, the average abnormal return value is -0.00413 and increase from to -0.00335 (table 2). This indicates that during the research period, the market responded positively or investors considered the announcement to be quite good information because it could affect the average value obtained on abnormal returns after announcement became negative greater than the average value of abnormal returns before announcement. Investors think that the announcement of Covid-19 in Indonesia is enough to influence the movement of a company's stock price.

The results of the Wilcoxon Signed-Ranks test for trading volume activity, the Z value is -0.108 with a probability value is 0.914 (tabel 3). It shows that the probability value is bigger than the predetermined significance value (0.914 > 0.05). it can be concluded that there is no significant difference in trading volume of shares for SRI-KEHATI index before and after announcement of Covid-19 in Indonesia. The absence of a significant difference in trading volume activity can indicate that the announcement of Covid-19 in Indonesia on March 2, 2020, investors think that this information is not sufficient to affect the value of share that they have in a company. This can be due to the fact that the actual return (acrual return) given by the company has a smaller value than the expected return rate by investors. Then, many investors made long-term investments, so they did not respond to the announcement information to make short-term investments.

Before the announcement of Covid-19 in Indonesia, the average value in trading volume activity is 0.00133 and decreased to 0.00131 (tabel 2). Decreasing the value of average trading volume activity before and after announcement shows that the liquidity value of shares in SRI-KEHATI index after announcement had decreased. Decreasing of the average trading volume activity after announcement could be caused by the fact that investors are not sure about prospects of the company in the future, so investors is more cautious or reduce their investing activity in a company.

The results of the Wilcoxon Signed-Ranks test for bid-ask spread, the Z value is -0.296 with a probability value is 0.767 (tabel 3). It shows that the probability value is bigger than the predetermined significance value (0.767 > 0.05). It can concluded that there is no significant difference in the bid-ask spread of shares for SRI-KEHATI index before and after announcement of Covid -19 in Indonesia. This could be due to the fact that the buying and selling prices of companies in the SRI-KEHATI index during the study period tended to be constant. Investors consider that the announcement is not able to provide information that can help to reduce the level of risk or value of the spread that will be obtained on their investment.

Before announcement of Covid-19 in Indonesia, the average value in bid-ask spread is 0.05306 and decreased to 0.02130 (table 2). This can indicate that the announcement of Covid-19 in Indonesia increased the level of stock liquidity in a company with a decrease in the average value of the bid-ask spread after announcement. Decreasing the value of average bid-ask spread after announcement, shows that the information circulating and absorbed by investors is information that has a positive impact (good news), because it is said that the smaller value of bid-ask spread is or closer to zero (0) then the company's shares are getting more liquid.

Conclusion

Based on the results of the testing and discussion previously described, it can be concluded that there is no significant difference in abnormal returns before and after announcement of Covid-19 in Indonesia in SRI-KEHATI Index by obtaining a significance value is bigger than the α value (0.05), which is 0.737. This is also supported by increase the average abnormal return before and after announcement of Covid-19 in Indonesia by 0.00078 or 0.078%, from -0.00413 to -0.00335.

There is no significant difference in trading volume activity before and after announcement of Covid-19 in Indonesia in SRI-KEHATI Index by obtaining a significance value is bigger than the α value (0.05), which is 0.914. This is also supported by decrease the average trading volume before and after announcement by 0.00002 or 0.002%, from 0.00133 to 0.00131.

There was no significant difference in bid-ask spread before and after announcement of Covid-19 in Indonesia in SRI-KEHATI Index by obtaining a significance value is bigger than the α value (0.05), which is 0.767. This was also supported by a decrease the average bid-ask spread before and after announcement by 0.03176 or 3.176%, from 0.05306 to 0.02130.

References

- Alexander, M., Manajemen, M. K.J., & 2018, U. (2018). Analisis Abnormal Return dan Trading Volume Activity Sebelum dan Sesudah Stock Split Pada Perusahaan yang Terdaftar di Bursa Efek Indonesia. Jurnal Manajemen,10(1), 1–6.

- CRMS. (2021). Mengenal Indeks Keberlanjutan Perusahaan dari SRI-KEHATI. https://crmsindonesia.org/publications/mengenal-indeks-keberlanjutan-perusahaan-dari-sri-kehati/

- Diantriasih, N.K., Purnamawati, I.G.A., & Wahyuni, M.A. (2018). Analisis Komparatif Abnormal Return, Security Return Variability dan Trading Volume Activity Sebelum dan Setelah Pilkada Serentak Tahun 2018. Jurnal Ilmiah Mahasiswa Akuntansi) Universitas Pendidikan Ganesha, 9(2), 2614–1930. http://dx.doi.org/10.23887/jimat.v10i1.20529

- Fahmi, I., & Hadi, Y.L. (2011). Teori Portofolio dan Analisis Investasi: Teori dan Soal Jawab. ALFABETA.

- Firli, A., & Rahadian, D. (2020). Analysis of The Impact of Terrorist Bombing Acts on Abnormal Return and Trading Volume Activity: Study of Terrorist Bombings Worldwide (2008–2017). Advanced Issues in the Economics of Emerging Markets (International Symposia in Economic Theory and Econometrics, 27, 13–26. https://doi.org/10.1108/S1571-038620200000027002

- Firmansyah, A.D., & Agustin, S. (2016). Analisis Perbandingan Trading Volume Activity dan Abnormal Return Sebelum Sesudah Stock Split. Jurnal Ilmu Dan Riset Manajemen, 5(5).

- Hartono, J. (2016). Teori Portofolio dan Analisis Investasi. BPFE.

- IDX. (2020a). Indeks Saham. https://www.idx.co.id/produk/indeks/ [Diakses pada tanggal 29 Januari 2021]

- IDX. (2020b). Pengantar Pasar Modal. https://www.idx.co.id/investor/pengantar-pasar-modal/ [Diakses pada tanggal 4 Oktober 2020]

- Indrawati. (2015). Metode Penelitian Manajemen dan Bisnis: Konvergensi Teknologi Komunikasi dan Informasi. Refika Aditama.

- Kusnandar, D.L., & Bintari, V.I. (2020). Perbandingan Abnormal Return Saham Sebelum dan Sesudah Perubahan Waktu Perdagangan Selama Pandemi Covid-19. Jurnal Pasar Modal Dan Bisnis, 2(2), 195–202. https://doi.org/10.37194/jpmb.v2i2.49

- Listiani, D.A., & Lestariningsih, M. (2018). Analisis Perbedaan Trading Volume Activity dan Bid-Ask Spread Sebelum dan Sesudah Stock Split Tahun 2013-2016. Jurnal Ilmu Dan Riset Manajemen, 7(7).

- Mahaputra, I.M.D., & Purbawangsa, I.B.A. (2015). Pengaruh Peristiwa Pemilu Legislatif 2014 Terhadap Perolehan Abnormal Return Saham LQ45 di Bursa Efek Indonesia. E-Jurnal Manajemen Unud, 4(5), 1406–1421.

- Manik, S., Sondakh, J.J., & Rondonuwu, S. (2017). Analisis Reaksi Harga Saham Sebelum dan Sesudah Tax Amnesty Periode Pertama (Studi Kasus Saham Sektor Properti yang Tercatat di Bursa Efek Indonesia). Jurnal Riset Ekonomi, Manajemen, Bisnis Dan Akuntansi, 5(2), 762–772. https://doi.org/10.35794/emba.v5i2.15989

- Ramesh, S., & Rajumesh, S. (2015). Stock Market Reaction to Political Events: A Study of Listed Companies in Colombo Stock Exchange of Sri Lanka. Journal of Economics and Sustainable Development, 6(3).

- Safira, T.H., & Simon, F. (2016). Uji Komparasi Abnormal Return, Trading Volume, Trading Frequency, Dan Bid-Ask Spread Sebelum Dan Sesudah Share Split (Studi Pada Perusahaan yang terdaftar di BEI Periode 2008-2015). Ultima Accounting: Jurnal Ilmu Akuntansi, 8(2), 24–45. https://doi.org/10.31937/akuntansi.v8i2.580

- Santoso, S. (2018). Menguasai SPSS Versi 25. Elex Media Komputindo.

- Saraswati, N.M.A.W., & Mustanda, I.K. (2018). Reaksi Pasar Modal Indonesia Terhadap Peristiwa Pengumuman Hasil Penghitungan Suara Pemilihan Umum dan Pelantikan Presiden Amerika Serikat. E-Jurnal Manajemen Unud, 7(6), 2971–2998. https://doi.org/10.24843/EJMUNUD.2018.v07.i06.p05

- Sekaran, U., & Bougie, R. (2017). Metode Penelitian untuk Bisnis: Pendekatan Pengembangan-Keahlian, Edisi 6 Buku 1. Salemba Empat.

- Suganda, T.R. (2018). Event Study, Teori Dan Pembahasan Reaksi Pasar Modal Indonesia (Edisi Pertama). CV. Seribu Bintang.

- Sugianto, D. (2020). Perjalanan IHSG Sejak RI Positif Virus Corona. https://finance.detik.com/bursa-dan-valas/d-4972595/perjalanan-ihsg-sejak-ri-positif-virus-corona.

- Sugiyono. (2017). Metode Penelitian Pendidikan Pendekatan Kuantitatif , Kualitatif, dan R&D. ALFABETA.

- Sugiyono. (2019). Metode Penelitian Kuantitatif, Kualitatif, dan R&D. ALFABETA.

- Suryanto. (2015). Analysis of Abnormal Return Before and After The Announcement of Investment Grade Indonesia. International Journal of Business and Management Review, 3(1), 11–23.

- Tandelilin, E. (2010). Portofolio dan Investasi: Teori dan Aplikasi. Kanisius.

- Umar, H. (2008). Metode Penelitian untuk Skripsi dan Tesis Bisnis. RajaGrafindo Persada.

- Utami, D.P., & Asandimitra, N. (2017). Analysis of Abnormal Return, Trading Volume, And Bid-Ask Spread At the Period of Stock Split Announcement. IOSR Journal of Economics and Finance, 08(04), 83–93. https://doi.org/10.9790/5933-0804018393

- Widiatmoko, A., & Paramita, V.S. (2017). Analisis Perbedaan Return Saham, Trading Volume Activity dan Bid-Ask Spread Sebelum dan Sesudah Stock Split (Studi Kasus Pada Perusahaan yang Terdaftar di Bursa Efek Indonesia Tahun 2010-2014). Jurnal Manajemen, 14(1), 17–32. https://doi.org/10.25170/jm.v14i1

- Wijanarko, S.W., & Bachruddin, B. (2015). Effects of The Japan Disaster 2011 on the Stock Return and Trading Volume in Indonesia Stock Exchange. Al Tijarah, 1(1), 19. http://dx.doi.org/10.21111/tijarah.v1i1.377

- Zakiyah, A., & Nurweni, H. (2018). Analisis Perbandingan Trading Volume Activity, Bid-Ask Spread dan Abnormal Return Sebelum dan Sesudah Adanya Pengumuman Stock Split pada Perusahaan yang Terdaftar di Bursa Efek Indonesia Periode Januari 2015-Oktober 2018. Telaah Bisnis, 19(2), 95–104. http://dx.doi.org/10.35917/tb.v19i2.172