Research Article: 2025 Vol: 29 Issue: 3

Evaluating the Impact of Digital Public Infrastructure on Financial Inclusion with Mediating Effect of Digital Literacy in Aspirational Districts of Uttar Pradesh

Nitu Maurya, Institute of Integrated Learning in Management University

Najul Laskar, Institute of Integrated Learning in Management University

Citation Information: Maurya, N., & Laskar, N. (2025). Evaluating the impact of digital public infrastructure on financial inclusion with mediating effect of digital literacy in aspirational districts of uttar pradesh. Academy of Marketing Studies Journal, 29(3), 1-8.

Abstract

The study investigates the impact of Digital Public Infrastructure (DPI) on Financial Inclusion (FI), mediated by Digital Literacy (DL), in the aspirational districts of Balrampur and Shravasti, Uttar Pradesh. The study constructs indices for DPI, DL, and FI to capture their multidimensional characteristics and evaluates their interrelationships based on a sample of 300 respondents. The results indicate that DPI substantially improves financial inclusion, both directly and indirectly, by digital literacy, which serves as a partial mediator. However, gaps in digital literacy and socio-economic variables, including poverty and education, engender a digital divide, constraining fair access to financial services. Regression and mediation studies highlight the revolutionary potential of DPI, while stressing the need to improve digital skills to augment its influence. Policy considerations include digital literacy initiatives, addressing the digital gap via subsidies and localised strategies, and the incorporation of financial and digital literacy programs. The study underscores the need of overcoming structural obstacles to guarantee that DPI acts as a catalyst for equitable economic development in impoverished areas.

Keywords

Financial Inclusion, Digital Public Infrastructure, Digital Literacy, Aspirational Districts.

Introduction

Financial inclusion, defined by the availability and accessibility of financial services to all societal segments, especially neglected and marginalised populations, is an essential facilitator of economic development and poverty reduction (Demirgüç-Kunt et al., 2018). In India, financial inclusion has been a national objective, with notable progress facilitated by digital public infrastructure (DPI), including the Aadhaar system, the Unified Payments Interface (UPI), and the Pradhan Mantri Jan Dhan Yojana (PMJDY) (Suri, 2020). DPI has revolutionised financial service delivery by diminishing obstacles associated with cost, distance, and documentation, hence enhancing participation in the formal economy and empowering marginalised populations (NITI Aayog, 2020; Rahman, 2024; Adelaja et al., 2024). DPI can enhance financial inclusion by offering interoperable and inclusive systems that facilitate essential services, thus allowing rural populations to effectively utilise digital wallets and other financial instruments (G20 Policy Recommendations for Advancing Financial Inclusion and Productivity Gains through Digital Public Infrastructure: Global Partnership for Financial Inclusion 2023). The growth of digital financial inclusion in Tanzania is associated with rural revitalisation, underscoring the need for improved digital infrastructure to expand service availability and quality in economically disadvantaged areas (Huang, 2023; George et al., 2024). In Pakistan, the relationship between digital wallets and infrastructure development highlights that while digital technologies may enhance financial access, their efficacy depends on the quality of the foundational infrastructure (Salman et al., 2024). Improving DPI is essential for closing the digital divide and promoting sustainable economic development in rural areas (Gu, 2021).

Despite advancements in DPI offering significant opportunities for financial inclusion, challenges such as regulatory barriers and deficiencies in digital literacy remain critical issues in rural regions and must be addressed to ensure equitable access to financial services for all demographics (Bhattacharya & Sharma, 2021). In aspirational areas such as Balrampur and Shravasti in Uttar Pradesh, where socio-economic indices fall below the national average, using DPI for financial inclusion is especially vital. The NITI Aayog has designated these districts under its Aspirational Districts Programme owing to their developmental constraints, which include restricted access to education, healthcare, and financial services (NITI Aayog, 2022). Although digital infrastructure has expanded, insufficient digital literacy might hinder people from properly using these services, thereby restricting their socio-economic advantages.

The study aims to assess the influence of DPI on financial inclusion in these two districts; by examining this relationship, the research aims to provide actionable insights into enhancing the effectiveness of DPI in achieving inclusive growth in underdeveloped regions.

Importance and Relevance of the Study

The rapid digitization of financial services in India has created unprecedented opportunities to bridge the gap between the formal financial system and underserved populations. However, the effectiveness of digital public infrastructure (DPI) in achieving financial inclusion depends significantly on the ability of individuals to access and use these services (Demirgüç-Kunt et al., 2018, Ravi, 2023). Nonetheless, restricted digital literacy and internet accessibility in rural regions may impede the efficacy of these initiatives (Joshi & Raj, 2021). This is particularly critical in aspirational districts such as Balrampur and Shravasti in Uttar Pradesh, where socio-economic vulnerabilities are pronounced (Chakraborty & Jayaraman, 2021). These districts are marked by low literacy levels, poor financial awareness, and limited access to digital resources, making them a focal point for developmental interventions (NITI Aayog, 2022).

The study is relevant in addressing the critical gap in understanding how DPI initiatives can be made more inclusive by enhancing digital literacy. It seeks to contribute to policy-making by identifying the bottlenecks that hinder financial inclusion in underdeveloped regions, despite the availability of advanced digital platforms. The findings can inform targeted interventions, ensuring that the benefits of DPI translate into tangible socio-economic improvements, thereby advancing the United Nations’ Sustainable Development Goals (SDGs) of reducing inequalities and promoting inclusive economic growth (UNDP, 2020).

Statement of the Problem

India's substantial investments in digital public infrastructure (DPI), including the Aadhaar-enabled Payment System (AePS), Pradhan Mantri Jan Dhan Yojana (PMJDY), Unified Payments Interface (UPI), and Direct Benefit Transfers (DBT), have sought to improve financial inclusion. Although these initiatives have significantly aided urban and semi-urban areas, rural and undeveloped districts, such as Balrampur and Shravasti in Uttar Pradesh, persist in encountering significant obstacles to efficiently obtaining and using financial services (Kumar & Sahu, 2022). Both districts, designated as aspirational by NITI Aayog due to elevated poverty rates and low development indices, face considerable challenges including insufficient digital literacy, restricted internet access, and inadequate banking infrastructure (Verma & Mishra, 2020; NITI Aayog, 2022). These structural shortcomings underscore a discrepancy in the capacity to embrace and use digital financial services between developed and marginalised areas.

Although DPI theoretically has the ability to enhance financial inclusion by improving service accessibility, its actual implementation and effectiveness in marginalised regions are remain inconsistent. Research indicates that digital literacy is essential for fostering trust, understanding, and efficient utilisation of digital financial platforms; nevertheless, its impact on enhancing financial outcomes in areas such as Balrampur and Shravasti remain inadequately examined (Bhattacharya & Sharma, 2021; Yadav & Gupta, 2022). Socio-economic limitations, such as poor literacy levels, elevated poverty rates, and restricted financial literacy, intensify this issue, resulting in the exclusion of vulnerable groups from the formal financial system (Singh & Patel, 2021; NITI Aayog, 2022).

In the aspirational districts of Balrampur and Shravasti, socio-economic challenges exacerbate this issue. These districts face low literacy levels, high poverty rates, and inadequate financial awareness, which collectively hinder the integration of marginalized populations into the formal financial ecosystem (NITI Aayog, 2022). Without addressing the mediating role of digital literacy, the transformative potential of DPI in achieving financial inclusion remains underutilized, creating a pressing need for systematic inquiry into this problem.

Theoretical Framework

The theoretical framework for this study is grounded in two primary theories:

Diffusion of Innovations Theory (Rogers, 2003): This theory explains how innovations, such as digital public infrastructure, are adopted by individuals within a social system over time. The study applies this framework to analyze the adoption of digital financial services in Balrampur and Shravasti, focusing on the role of digital literacy as an enabler or barrier in this process. Factors such as awareness, accessibility, and ease of use are considered critical to the adoption of DPI for financial inclusion.

Capability Approach (Sen, 1999) Amartya Sen’s capability approach provides the foundation for understanding how DPI can enhance individuals’ abilities to achieve financial inclusion. This framework emphasizes the need to develop individual capabilities—such as digital literacy—to enable people to make effective use of available resources and infrastructure. The study investigates how the intersection of digital literacy and DPI contributes to expanding financial capabilities in aspirational districts.

By integrating these theories, the study explores the interplay between technology adoption, individual empowerment, and financial inclusion, emphasizing the importance of digital literacy as a mediating variable.

Objectives of the Study

1. To evaluate the impact of digital public infrastructure (DPI) on financial inclusion in the aspirational districts of Balrampur and Shravasti, Uttar Pradesh.

2. To examine the mediating role of digital literacy in influencing the relationship between DPI usage and financial inclusion outcomes.

3. To identify the socio-economic factors affecting the adoption of DPI for financial transactions and services in underdeveloped regions.

Hypotheses

H1: Digital public infrastructure has a significant positive impact on financial inclusion in the aspirational districts of Balrampur and Shravasti.

H2: Digital literacy significantly mediates the relationship between DPI and financial inclusion.

H3: Socio-economic factors significantly influence the adoption of DPI in financial services.

Research Methodology

The study focuses on the aspirational districts of Balrampur and Shravasti in Uttar Pradesh, regions identified for their socio-economic vulnerabilities and development gaps under the NITI Aayog’s Aspirational Districts Programme. These districts are characterized by low literacy levels, inadequate digital access, and limited financial inclusion. A sample size of 300 respondents was selected using stratified random sampling to ensure representation across different socio-economic groups, including variations in income, education, and gender. To comprehensively evaluate the relationship between Digital Public Infrastructure (DPI), Digital Literacy (DL), and Financial Inclusion (FI), three indices were constructed to represent these multidimensional constructs.

The Financial Inclusion Index (FI) measures the extent of financial inclusion through three key dimensions: access, usage, and quality of financial services. Access is assessed by indicators bank account ownership, usage captures the frequency of financial transactions (digital payments), and quality reflects the availability of services like savings, credit, and insurance that meet user needs (Demirguc-Kunt, A., Klapper, L., Singer, D., Ansar, S., & Hess, J. (2018). The index aggregates these factors into a single score ranging from 0 (low inclusion) to 1 (high inclusion), providing a holistic measurement. This is justified by the multidimensional nature of financial inclusion, which requires consideration of various aspects to ensure comprehensive assessment.

The Digital Public Infrastructure Index (DPI) evaluates the adoption and usage of digital public platforms assessed by Aadhaar-enabled services, UPI transactions, and mobile banking apps or wallets. Indicators include the frequency of biometric authentications, digital payments, and access to online platforms, which are aggregated into a score on a 0 to 1 scale. This index reflects the cumulative effectiveness of multiple platforms working together to enhance digital service delivery. Measuring DPI adoption is crucial for identifying gaps in outreach and usage, ensuring that digital infrastructure achieves its intended objectives.

The Digital Literacy Index (DL) assesses individuals’ ability to engage with digital platforms across three dimensions: device literacy, service literacy, and internet literacy. Device literacy focuses on operating smartphones or other devices, service literacy examines understanding of digital financial and non-financial services, and internet literacy evaluates browsing and transacting securely online. The index provides a composite score from 0 (no literacy) to 1 (high literacy), enabling targeted interventions. Digital literacy is essential for leveraging digital public infrastructure effectively, and a comprehensive measure ensures skill gaps are identified and addressed. Together, these indices offer standardized, data-driven insights for policymakers, allowing for targeted programs to enhance financial and digital inclusion while fostering equitable access.

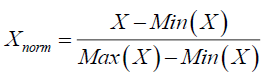

Each index was constructed using Min-Max normalization, which scales variables between 0 and 1:

Analysis and Interpretation

Descriptive Statistics (Table 1) used to summarize demographic characteristics of the sample and distribution of the index scores. It highlights the mean, standard deviation, and range for FI, DPI, and DL indices. The Financial Inclusion Index (Mean = 0.65, SD = 0.15) indicates moderate inclusion levels, with variability reflecting unequal access and usage of financial services in the districts. The Digital Public Infrastructure Index (Mean = 0.70, SD = 0.12) suggests high adoption of DPI services, reflecting the success of initiatives like UPI and Aadhaar. However, the Digital Literacy Index (Mean = 0.58, SD = 0.18) highlights a significant gap in digital skills, limiting the effective utilization of DPI. These findings align with prior research (Demirgüç-Kunt et al., 2018; Bhattacharya & Sharma, 2021) and frameworks like Sen’s (2014), which emphasize the role of individual skills and resources in achieving socio-economic outcomes.

| Table 1 Descriptive Statistics | ||||

| Index | Mean | SD | Min | Max |

| Financial Inclusion (FI) | 0.65 | 0.15 | 0.3 | 0.9 |

| Digital Public Infra (DPI) | 0.7 | 0.12 | 0.4 | 0.95 |

| Digital Literacy (DL) | 0.58 | 0.18 | 0.2 | 0.85 |

Regression analysis (Table 2) used to test the impact of DPI on FI. The regression results (B=0.52, p<0.001, R2=0.48) indicate that DPI significantly improves financial inclusion, explaining 48% of its variability. For every one-unit increase in DPI, FI improves by 0.52 units. This result demonstrates the transformative role of DPI in enhancing financial inclusion by addressing traditional barriers such as documentation and distance, consistent with Suri (2020) and Rogers’ Diffusion of Innovations Theory (2003)

| Table 2 Regression Analysis | |||||

| Model | B | SE | t | p-value | R2 |

| DPI → FI | 0.52 | 0.08 | 6.5 | <0.001 | 0.48 |

To further explore the role of Digital Literacy (DL), mediation analysis was conducted using the Baron and Kenny (1986) approach.

• Path A: DPI → DL

• Path B: DL → FI

• Path C: DPI → FI (direct effect)

• Indirect Effect: DPI → DL → FI

The analysis (Table 3) revealed that DPI significantly improves DL (B=0.60, p<0.001), and DL, in turn, significantly impacts FI (B=0.40, p<0.001). The indirect effect of DPI on FI through DL (Indirect Effect=0.24, p<0.001) suggests that DL partially mediates this relationship. While DPI directly improves FI (Direct Effect=0.30, p<0.), its total effect (Total Effect=0.54) is amplified through the mediating role of DL. This highlights the critical importance of digital literacy in maximizing the benefits of DPI, consistent with the Technology Acceptance Model (TAM, Davis, 1989), which posits that ease of use and competence enhance technology adoption.

| Table 3 Mediation Analysis (DPI → DL → FI) | ||||

| Paths | B | SE | t | p-value |

| DPI → DL (Path A) | 0.6 | 0.1 | 6 | <0.001 |

| DL → FI (Path B) | 0.4 | 0.07 | 5.71 | <0.001 |

| DPI → FI (Direct Effect) | 0.3 | 0.09 | 3.33 | <0.001 |

| DPI → DL → FI (Indirect Effect) | 0.24 | 0.06 | 4 | <0.001 |

ANOVA (Table 4) conducted to assess the influence of socio-economic factors (e.g., income) on DPI adoption. The significant results (F=4.85, p<0.001) indicate that DPI adoption differs significantly across income groups, with higher-income groups demonstrating greater adoption. This finding aligns with van Dijk (2020) and Rogers (2003), who highlight the digital divide, where higher socio-economic groups are more likely to adopt and benefit from innovations due to fewer resource constraints. The variability between groups, reflected in the high Mean Sum of Squares Between Groups (MSB = 6.13) compared to Within Groups (MSW = 0.22), further underscores the role of income in digital adoption.

| Table 4 Anova Table | |||||

| Source | SS | df | MS | F | p-value |

| Between Groups | 18.4 | 3 | 6.13 | 4.85 | <0.001 |

| Within Groups | 64.7 | 296 | 0.22 | ||

| Total | 83.1 | 299 | |||

The results provide robust evidence that DPI positively influences financial inclusion, both directly and indirectly through digital literacy. However, socio-economic disparities, particularly in digital literacy, continue to limit the equitable distribution of benefits. These findings support the need for targeted interventions to enhance digital literacy, particularly in low-income populations, and bridge the digital divide. By integrating frameworks such as the Capability Approach (Sen, 1999) and Diffusion of Innovations Theory (Rogers, 2003), the study demonstrates that empowering individuals with digital skills is essential for leveraging DPI to achieve comprehensive financial inclusion.

Conclusion and Policy Implication

The study examined the interplay among Digital Public Infrastructure (DPI), Digital Literacy (DL), and Financial Inclusion (FI) in the aspirational districts of Balrampur and Shravasti, Uttar Pradesh. The analysis indicated that the construction of indices for these multidimensional constructs reveals that DPI significantly improves financial inclusion, both directly and indirectly, via digital literacy. The findings emphasise the significant impact of DPI in mitigating traditional barriers, including distance and documentation. However, they also reveal ongoing challenges related to low digital literacy and socio-economic inequalities. The mediating role of digital literacy highlights that mere access to technology is inadequate; the capacity to utilise digital platforms effectively is also essential. The findings indicate that focused efforts to enhance digital skills can enhance the effectiveness of Digital Payment Initiatives (DPI) on financial inclusion, especially in less developed areas.

The differences in DPI adoption among socio-economic groups, as demonstrated by ANOVA, underscore the digital divide, indicating that higher-income groups are more likely to benefit from digital infrastructure. The findings correspond with theoretical frameworks, including Sen’s Capability Approach, which underscores the importance of enhancing individual capabilities, and Rogers’ Diffusion of Innovations Theory, which elucidates the influence of socio-economic and contextual factors on technology adoption. The study offers practical insights for enhancing the reach and effectiveness of DPI initiatives aimed at achieving comprehensive financial inclusion.

This study's findings highlight the necessity for specific policy interventions to optimise the effectiveness of Digital Public Infrastructure (DPI) in promoting comprehensive financial inclusion. Enhancing digital literacy, especially among marginalised groups such as women, low-income households, and individuals with limited formal education, is a key priority. Targeted digital literacy initiatives, designed for specific local contexts and implemented via community programs, can enable users to proficiently navigate digital financial platforms. Addressing the digital divide is essential, as income disparities and access to technology significantly impact DPI adoption. Policies should prioritise the provision of affordable smartphones, subsidised internet services, and the expansion of digital connectivity in rural areas to guarantee equitable access.An integrated approach that combines digital and financial literacy is essential. Individuals require both the skills to operate digital tools and the knowledge to manage savings, access loans, and utilise insurance products. Financial institutions ought to actively engage in the development of user-friendly digital financial products and promote their adoption through incentives such as cashback schemes, discounts, and low-cost services. Furthermore, localised solutions, including mobile applications in regional languages and voice-guided systems, enhance the accessibility of DPI for users with low literacy levels.

Continuous monitoring and evaluation of DPI initiatives is essential to ensure their effectiveness. The creation of a Digital Financial Inclusion Index at the district level enables policymakers to monitor progress, pinpoint deficiencies, and enhance strategies to tackle emerging challenges. Integrating these measures enables policymakers to address the gaps in digital and financial literacy, thereby ensuring that DPI initiatives are inclusive, equitable, and transformative for socio-economic development in underdeveloped regions.

References

Adelaja, N. A. O., Umeorah, N. S. C., Abikoye, N. B. E., & Nezianya, N. M. C. (2024). Advancing financial inclusion through fintech: Solutions for unbanked and underbanked populations. World Journal of Advanced Research and Reviews, 23(2), 427–438.

Indexed at, Google Scholar, Cross Ref

Bhattacharya, S., & Sharma, R. (2021). Digital literacy and financial inclusion: A case study of India. Journal of Financial Services Marketing, 26(2), 159–172.

Chakraborty, S., & Jayaraman, V. (2021). Digital infrastructure and rural financial inclusion in India: Evidence from aspirational districts. Journal of Rural Development, 40(4), 459-477.

Davis, F. D. (1989). Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Quarterly, 13(3), 319–340.

Indexed at, Google Scholar, Cross Ref

Demirgüç-Kunt, A., Klapper, L., Singer, D., Ansar, S., & Hess, J. (2018). The Global Findex Database 2017: Measuring Financial Inclusion and the Fintech Revolution. The World Bank.

Indexed at, Google Scholar, Cross Ref

G20 Policy Recommendations for Advancing Financial Inclusion and Productivity Gains through Digital Public Infrastructure: Global Partnership for Financial Inclusion 2023.

George, N.M., Ge, H., & Tang, D. (2024). Impact of Digital Financial Inclusion on Rural Revitalization in Tanzania. Journal of Economics, Management and Trade, 30(6), 88-106.

Joshi, R., & Raj, S. (2021). Assessing the digital divide in rural India: Barriers to financial inclusion in remote districts. Development Policy Review, 39(4), 639-654.

Kumar, P., & Sahu, A. (2022). Digital financial inclusion in rural India: Barriers and prospects. Journal of Financial Technology, 34(2), 123-137.

NITI Aayog. (2020). Aspirational districts programme: A progress report. Government of India. Retrieved from https://niti.gov.in/aspirational-districts.

Rahman, A. (2024). Financial Inclusion through Technological Advancements in Banking Institutions: An Analytical Review. Advances: Journal Ekonomi & Bisnis, 2(3), 163–173.

Indexed at, Google Scholar, Cross Ref

Ravi, S. (2023). The role of public digital infrastructure in financial inclusion: A case study of Uttar Pradesh. Journal of Development Economics, 58(1), 85-99.

Rogers, E. M. (2003). Diffusion of Innovations. Free Press.

Salman, M., Rauf, N., & Murtaza, Z. (2024). Unlocking financial inclusion and economic empowerment in rural Pakistan: The interplay of financial literacy and infrastructure development in the impact of digital wallets. Journal of Excellence in Management Sciences, 3(3), 141-160.

Indexed at, Google Scholar, Cross Ref

Sen, A. (1999). Development as Freedom. Oxford University Press.

Singh, D., & Patel, R. (2021). Assessing the impact of digital financial infrastructure on rural financial inclusion: Evidence from Uttar Pradesh. Rural Economy and Development, 56(1), 67-83.

Suri, T. (2020). Mobile money. Annual Review of Economics, 12(1), 515–536.

UNDP. (2020). Sustainable Development Goals: A Framework for Action. United Nations.

Verma, N., & Mishra, R. (2020). Financial exclusion and digital infrastructure in aspirational districts of India: A case study of Balrampur and Shravasti. International Journal of Rural Management, 16(2), 201-221.

Yadav, A., & Gupta, S. (2022). Digital divide and financial inclusion in rural India: A critical review. Indian Journal of Rural Development, 43(3), 375-389.

Received: 31-Dec-2024, Manuscript No. AMSJ-25-15588; Editor assigned: 01-Jan-2025, PreQC No. AMSJ-25-15588(PQ); Reviewed: 14-Jan-2025, QC No. AMSJ-25-15588; Revised: 20-Feb-2025, Manuscript No. AMSJ-25-15588(R); Published: 08-Mar-2025