Research Article: 2022 Vol: 26 Issue: 1

Evaluating the Accounting and Financial Performance of Banks by Internal Audit in Implementation of Corporate Governance

Sohad Sabih Alsaffar, Middle Technical University, Baghdad, Iraq

Citation Information: Alsaffar, S.S. (2022). Evaluating the accounting and financial performance of banks by internal audit in implementation of corporate governance. Academy of Accounting and Financial Studies Journal, 26(1), 1-12.

Abstract

This paper aims to shed light on some important concepts of governance principles that require the development of an area in which it is integrated with a widely accepted approach to performance appraisal, which is the balanced score card. it has been identified and applied analytical techniques to enhance governance in the research sample (Credit Bank of Iraq). The research reached a set of conclusions that can be summarized as follows: (1) There is a symmetry between the tasks of internal auditing under international auditing standards and principles related to the implementation of governance by emphasizing effective control procedures and controls. This achieves a sustainable improvement in the effectiveness, efficiency and adequacy of control controls in response to the risks of governance, operations and information systems (2). Indicators from the balanced scorecard can be used to implement the tasks presented in the previous conclusion. The indicators are selected according to the nature of the activities of the economic unit, the business sector operating in it, and the risks to which it is exposed within this sector. (3) The creation of sustainable value for the bank's shareholders can be considered. It is reached through the growth of the bank's revenues and the performance of activities with less material and human resources, which is expected to positively reflect on the dividend and share price in the market. A strategic goal for the research sample bank (the Credit Bank of Iraq) that management should strive to achieve.

Keywords

Evaluating, Performance, Accounting, Finance, Internal Audit, Corporate Governance.

Introduction

Recent years have witnessed a growing interest in governance. Governance can be viewed as a comprehensive set of relationships for any economic unit with a wide range of stakeholders. This range includes parties linked to each other by a set of relationships, and among these parties it is possible to mention the shareholders, creditors, customers of the unit, individuals working within the unit, and governmental organizations.

Internal corporate governance (ICG) is a small but significant part of corporate governance that focuses on an internal organization and its structure, which is influenced by current rules. The "agent problem" that occurs between the regulator, who wants financial guarantee for each firm and a less risk, and shareholders, who want to increase the return of their investments, may arise as a result of ICG alignment to banking regulatory standards (Jensen & Meckling, 1976; Laeven & Levine, 2009; Alzabari et al., 2019). Given the importance of banks in the effective running of economic activity, significant emphasis is paid to guaranteeing the financial system's stability. Corporative governance (CG) plays a significant role in safeguarding bank stability. Internal corporate governance flaws occurred by mistaken application of current norms, according to the European Banking Authority (EBA), were not a primarily cause of the recession, though were an important element supporting it. several researchers have looked at the impact of corporate governance (CG) on bank outcomes (BP) to have a better understanding and improving it, as well as the role of weak corporate governance in bank insolvency (The Basel Committee on Banking Supervision - BCBS, 2010, p.5). The current research explores the impact of (ICG) on (BP) and gives guidance for evaluating possible CG flaws in the Romanian financial sector (Maseer & Flayyih, 2021).

Problems Statement

There are many problems with the tools available to internal auditing under its standards. This is in application of the principles of governance of economic units in general, particularly in banks. These problems revolve around the integration of theoretical concepts with practical application for the purposes of follow-up and evaluation. The problem of the research is that the lack of interest in knowing the scope of the integration of the principles of banking governance with an effective tool for strategic evaluation and It is represented by the balanced score card. It can reduce the ability of internal audit to apply internal audit standards in evaluating the performance of these resources. Which makes it more vulnerable to the risks of financial crises and affects the performance of its activities and the achievement of its objectives.The research problem can be expressed in the form of questions as follows:

1. Is it possible to enhance the benefit of the balanced scorecard as an effective tool for strategic evaluation, by identifying areas of application in which it is integrated with the principles of bank governance?

2. How can the ability of internal auditing to apply internal audit standards in evaluating the performance of banks and making them less vulnerable to the risks of financial crises be enhanced?

The Importance of Research

The importance of the research stems from its quest to provide an approach that guides internal auditing to implement the principles of bank governance. Which contributes to enhancing the ability of internal audit to follow up and evaluate the performance of banks, by employing the balanced scorecard within an integrated framework (Coles et al., 2008).

Research Objectives

The research seeks to achieve the following objectives:

1. Knowing areas in which the tasks that the internal audit must perform can correspond to the principles of bank governance by identifying and meeting the requirements of those principles.

2. Defining and employing indicators within the axes of the balanced scorecard to transform the bank’s strategic objectives into common areas of work that can be used to achieve the bank’s governance requirements.

3. Develop a method to benefit from the balanced scorecard perspectives in performing internal audit tasks considering internal audit standards in application of related areas of governance for an Iraqi bank.

Research Hypothesis

The research starts from a basic hypothesis as follows:

The capabilities of internal auditing are enhanced to adhere to international auditing standards, in implementation of the principles of bank governance through the integration of the indicators of the axes of the balanced scorecard with the principles of governance, which contributes to reducing the face of risks, raising the value of these banks and supporting their competitive position. The key mechanisms of an effective ICG involve: corporate structural framework (CSO), the management and system for risks and internal control, specialized committees (Risk, Remuneration and Audit committees, RC, AC and RMC committees), and firm accountability, as noted by the EBA rules on internal governance (Kühn et al., 2011; Al-Taie et al., 2017). An index of internal corporate governance is constructed to analyze the impact of those factors on BP (ICGI). In terms of CSO, bank personnel, particularly management, should understand the importance of having explicitly declared guide and accountabilities, avoiding risks comes from self-complication, and guaranteeing individuality among work routines. In terms of managing risks and the internal control framework that exists among shareholder interests and external governance. A small capital required, stated by Laeven & Levine (2009), have a favorable connection with taking risks, whereas some capital rules and working limitations get a negatively correlation result with taking risks, widely different with owners focuses and attempting to participate for the utility loss by taking higher risks. For managing risks practices at a level required by banks, a system of internal control must be formed to identify risk possibilities and evaluating activities in accordance with legal provisions, and evaluation of the processional and sufficient of internal control. Regarding the rules of the Romanian managing an account framework within the setting of the financial development, accessibility of capital for financing, counting the streams of the outside capital deposited by foreigners, beside the unwinding of their financial situations and presence of the extra money to hide the exposures, permitted the increment of lending money, short benefits and possible dangers come along side. From the other side, despite the abundance of the recession, which necessitates extra credits, the implementation of a risk-based rules and improved internal control are bound to get rid of a portion of the cumulative risks. Committees’ presence, as well as the individuality of participants, is supposed to better managing the risks and watching corporations. Adams & Mehran (2012) discovered a negative impact of the number of committees on the Tobin-Q factor, calculated as the ratio, in previous studies. Aebi et al. (2012) discovered a similar relationship between RC and ROE. We believe that educating members of committees to individually evaluate the remuneration rules based on activities outcomes and associated risks in the perspective of the Romanian banking system have had side-effects on risk reduction and bank performance. As market discipline will indeed reduce the financing of reckless financial institutions, transparency may be required to avoid additional risks. According to Barth et al. (2004), policies demanding precise data to strengthen the private banking sector authority and help private agencies to exercise corporate power, thus also encouraging bank steadiness and efficiency. Based on the standards of the Romanian financial system, we believe that the need of transparency in terms of risk management systems, risk profiles and remuneration policies has impeded risk-based investments, resulting in increased investment uncertainty and suspicion in the system. The number of individuals of the MB (BS) is essential for achieving a higher CG which has been shown by many research findings. Adams & Mehran (2012) and Aebi et al. (2012) discovered a positive relationship between BS and Tobin-Q, respectively ROE, assuming that board size rising causes additional expenses due to the increasing banks complexity, allowing for carefully watching and guiding managers. Cooper (2008) discovered a good relation noted on ROA as well. Nevertheless, expanding the number of representatives may cause flexibility control and issues for making decision methodology. Based on Andres and Vallelado (2008), an inverted U- shaped relationship exists between BS and Tobin Q, thus there is a point at which the performance of these variables begins to decline. Pathan (2009) discovered a positive impact on Z-score. Hoare et al. (2011) found no significant relationship between BS, ROA and ROE in financial system in Romania. We anticipate a positive relationship with BP with respect to the individual customers of MB (BI), i.e. those participants who does not have any linkage with the lending banks. Cornett et al. (2009) found that BI had a good influence on ROA cause by increasing management oversight, whereas Aebi et al. (2012) discovered that BI had a bad influence on ROE during recessions, claiming financial institutions had impacted by employees to achieve maximum stock-holders wealth prior to the downturn and risks possibility that might have been known to increase profit, it though turned out inadequately when the financial meltdown hit. People of non-Romanian nationality MB (PRV) had a negative influence on ROA, according to Hoare et al. (2011), that might clearly show that risk affected ability to adapt to local organizational structure and business atmosphere, with implementation of a new risk management culture verifying ineffective. Another component of MB that contributes to the development of collective management skills is gender diversity (GEN). Previous research showed that both Hoare et al. (2011) and McKinsey et al. (2011) have a positive effect on the financial performance (2007). In terms of those members of Board who are encounter in the financial groups involving schools of economic (DwFB), specially during the recession, a negative impact on BP was noticed (Aebi et al. 2012) and a positive impact was also observed on taking risks (Minton et al., 2010). Adams and Mehran (2012), on the other hand, found no significant impact on the Tobin Q variable. During the credit collapse, a positive impact on risk- taking and investment returns was discovered (Pathan, 2009). Cornett et al. (2009) discovered that individuals who owned stock, which is (DwHS), had positively impacted ROA, whereas Grobman et al. (2007) discovered that they enhanced ROE and the Z-score. The authors truly think by focusing on increasing financial advantages from pay rates and dividends when decision-making on investment dynamics is supported, they failed to make a proper assessment of the fact that failure to honor borrowers' obligations, combined with ability to lure sources to obtain the maturity difference in assets, could cause to reduce rewareds and capital reduction. Having a better performance strategy that are primarily focused on profit growth may result to an easy fulfillment of those standards in the context of economic growth by adding up recent risks and ignoring long-term steadiness goal. Continuous practice, on the other hand, gives good entity outcomes, though may outcome in daily basis and new adaptability that changes workplace environment. We truly think that continuity in function (DUR) has a negative impact on ROA in the context of rising banking activity.

Research Methodology

Employing the internal audit of the balanced score card indicators in the governance of the Iraqi Credit Bank. This section of the research presents a method for employing internal auditing, indicators of the balanced scorecard in the Follow up on the governance of the Iraqi Credit Bank with the approval of the bank's financial reports for the years (2014-2019).

Introduction to the Credit Bank of Iraq

The bank was established and opened its doors to banking in 1998 with a capital of 200 million Iraqi dinars. The bank's ownership structure changed later in 2005 with the participation of the National Bank of Kuwait by 75%, the International Finance Corporation by 10%, and Iraqi individual shareholders by 15%. The contribution of the National Bank of Kuwait increased in 2014 to reach 84.3%, compared to a decrease in the percentage of the contribution of the International Finance Corporation to 6.7%. The bank's capital was increased in 2013 to 150 billion Iraqi dinars. Later, and in implementation of the instructions of the Central Bank of Iraq, the capital of the bank was increased in 2014 to 250 billion Iraqi dinars. The Bank exercises its activities under the supervision and control of the Central Bank of Iraq under its Law No. 56 of 2004, Banking Law 94 of 2004 and their instructions, and Companies Law 21 of 1997.

1. The bank seeks to achieve the highest possible profitability through credit interests on credit facilities and commissions for services provided. As well as the returns of remittances, foreign currency and investment returns, and by improving the cost structure and performance of the bank’s activities with less material and human resources, in a way that achieves sustainable value for the bank’s shareholders.

2. The Bank is keen to provide the highest possible degree of safety by avoiding uncalculated risks, providing liquidity to depositors and fulfilling obligations towards them easily and easily.

3. The Bank works on the sustainable development of the skills and competencies of its employees.

Governance Applied in the Bank, Research Sample

In application of governance and in implementation of the provisions of banking laws and instructions and the approval of the general assembly, the bank has an audit committee that includes three members of the board of directors, and it exercises its functions in coordination with the bank’s auditor (the external auditor). As well as the monthly comparison tables sent to the committee for the balances of trial balances. As well as the schedules of expenditures and revenues sent to the Central Bank. Monthly and quarterly reports prepared by the internal audit and compliance observer, auditing the financial statements of the bank, the report of the board of directors in accordance with the legislation in force and in accordance with the approved audit procedures.

The role of internal audit in evaluating the bank’s performance using the indicators of the balanced scorecard

The Central Bank of Iraq has defined the functions of the internal audit under the supervisory work manual as follows.

Article one: Establishing an internal audit department

Banks should establish an internal audit department that has powers. An appropriate position in the organizational structure, independence, and adequate financial and human resources, with access to the Board of Directors and its audit committee. Having independent, competent, qualified and honest internal auditors is vital to sound corporate governance. Article Two: Duties and Duties of the Internal Audit Department.

Paragraph 10: The internal audit department should do the following:

1. Prepare an independent risk-based assessment report for the effectiveness and efficiency of internal control, risk management, and governance systems and processes established by business units and supporting activities.

2. Providing guarantees regarding these systems and processes.

Paragraph 13: The Bank's internal auditors shall communicate regularly with the Central Bank's auditors to:

Results and Discussion

1. Discuss the risks identified by the two parties.

2. Determining the risk mitigation measures taken by the bank.

3. Identifying identified weaknesses and following up on the bank's response to address these points.

For the purpose of the internal audit performing its tasks in application of the principles of governance in the bank in the field of research, the balanced score card can be used by selecting indicators that relate it, These indicators were determined based on digital formulas for values and performance indicators extracted from several paragraphs of records and financial statements for the years (2014-2019) as shown in Table 1.

| Table 1 Values of Items Included in the Financial Reports of the Credit Bank of Iraq for the years 2014-2017 (Amounts in Millions of Dinars) | ||||||

| Items | 2014 | 2015 | 2016 | 2017 | 8102 | 8102 |

| total assets | 625,187 | 612,858 | 513,382 | 476,638 | 496,794 | 255,227 |

| Property rights | 290,171 | 301,809 | 306,815 | 315,457 | 292,493 | 596,957 |

| Total revenue from banking operations | 8,646 | 21,636 | 15,855 | 14,700 | 94,591 | 4,346 |

| Total expenses of banking operations | 2,834 | 7,722 | 9,473 | 6,650 | 6,444 | 9,973 |

| Surplus after tax (net profit) | 16,016 | 11,638 | 4,976 | 6,707 | 2,296 | )2,959( |

| total deposit | 304,975 | 157,787 | 179,282 | 144,170 | 975,277 | 513,223 |

| Investments (financial assets) | 408,620 | 306,540 | 421,680 | 308,092 | 31,443 | 23,611 |

| Current accounts | 126,804 | 118,373 | 147,915 | 116,510 | 922,599 | 932,952 |

| Saving accounts | 51,723 | 38,165 | 28,990 | 24,291 | 52,329 | 52,643 |

| Loans and advances | 1,227 | 68 | 2 | 309 | 31 | 29 |

| Preparing the staff (employee) | 579 | 267 | 183 | 176 | 935 | 995 |

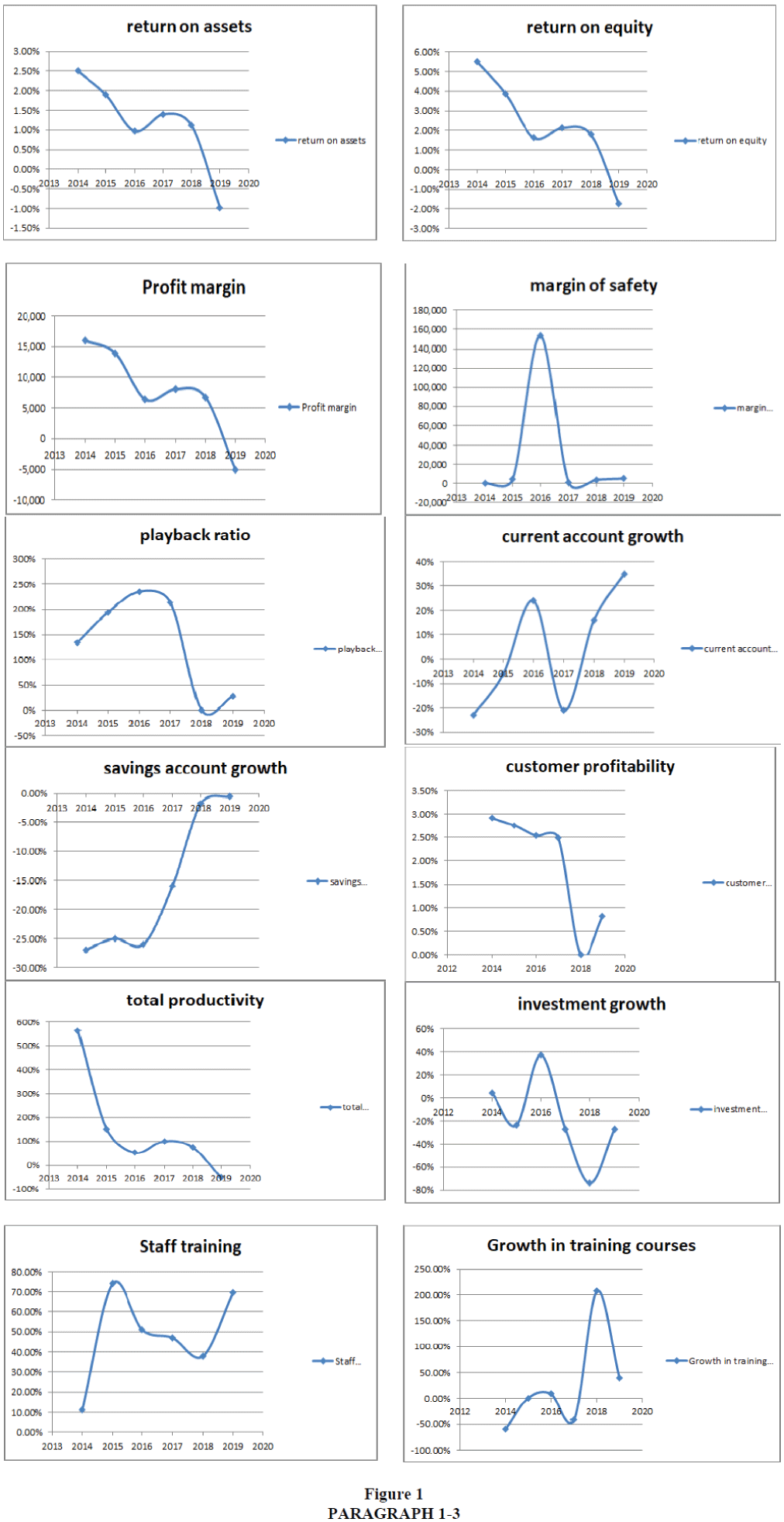

Table 2 shows the values of the extracted indicators. The indicators were identified and extracted after taking into account their correspondence with each of the research objectives mentioned in paragraph 1-3. The strategic objectives are defined by the bank with the indicators displayed graphically in Figure 1 with its branches A-L. In addition to focusing on the following:

| Table 2 Extracted KPI Values | |||||||||

| Balanced Score Card Sections Indicators Tools for implementing internal audit tasks in application of governance | |||||||||

| Calend ar | The objectives of the bank in question |

5199 | 5193 | 5196 | 5197 | 5192 | 5194 | Indicators | Sections |

| × | Achieving the highest returns and profits for our shareholde rs | %1993- | %9995 | %994 | %1996 | %9939 | %592 | return on assets | Financia l |

| × | %9965- | %99637 | %59957 | %9975 | 2932 | %292 | return on equity | ||

| × | 2,959 - | 7,672 | 3,121 | 7,235 | 92,994 | 2,395 | Profit margin | ||

| 212,712 % |

299,362 % |

915,191 % |

92,241,621 % |

442,326 % |

52,749 % |

margin of safety |

|||

| × | Providing the best banking services to customers | %1939 | %592 | %5949 | %5922 | %5967 | %5999 | customer profitabili ty |

Clients |

| × | %53 | %21 | %594 | %522 | %994 | %924 | Operation ratio | ||

| %22 | %97 | %59- | %54 | %7- | %52- | Current account growth |

|||

| %1946- | %996- | %97- | %57- | %52- | %56- | savings account growth |

|||

| × | Optimizin g the cost structure (Reducing the cost of services) | %29- | %62 | %911 | %25 | %921 | %272 | total productivi ty |

internal operatio ns |

| %56- | %64- | %56 - | %26 | %54 - | %4 | investmen t growth | |||

| %61 | %41 | %46 | %29 | %64 | %99 | Staff | |||

| and overheads | training | ||||||||

| × | Develop employee skills |

%41 | %516 | %49- | %9 | %9 | %71 - | Growth in training courses |

growth and learning |

1. Attention to the value of the supposed benefit to the customer contributes to the growth of the bank's revenues.

2. Paying attention to the perspective of operations contributes to the performance of the bank's activities with fewer material and human resources.

3. Attention to the perspective of learning and growth contributes to the development of the bank's operations.

It is noticed when looking at the values of the indicators for evaluating the performance of the bank and their graphic representation in Figure (2) with the branches of the axes of the balanced score card (A - L) to judge the ability of the bank to achieve its goals. They mostly show a deterioration in performance for reasons related to the contraction and weak performance of the bank's owners. In addition, it fluctuates between slight improvement and deterioration. The reasons for this can be explained through the following:

1. Most of the main financial axis indicators decreased for the year 2019 as follows:

1. The surplus after tax (net profit), amounted to 10718 million dinars (-5,121 - 5,597) million dinars, with a corresponding decrease in the profit margin by 11,886 (-5121 - 6,765). When analyzing this decline, it is noted that the total revenues of banking operations decreased by 9363 million dinars (4,847 - 1,4210) million dinars. There was a corresponding rise in the total expenses of banking operations by 2524 million dinars (9,968 - 7,444) million dinars.

2. The return on assets decreased by 2.1% (-0.98% - 1.12%) because of the decrease in the after-tax surplus mentioned in (a) above, with a corresponding increase in total assets by 24,842 million dinars (522,536 - 497,694) million dinars.

3. The return on equity decreased by 3.506% (-1.72% - 1.786%), because of the decrease in the after-tax surplus mentioned in (1) above accompanied by a corresponding decrease in equity by 16,372 million dinars (297,126 - 313,498) million dinars.

4. In the same financial axis, it is noted that the safety margin increased by 111.730% (503,603% - 391,873%), and this can be explained by the decrease in loans and advances. This enhances the security of depositors' funds, but at the cost of falling indicators in the previous paragraph (1). As it is known, an important amount of profitability is achieved through credit interests on credit facilities.

All these declines mean the failure of the bank's management to achieve the objectives of the financial axis by achieving the highest returns and profits for its shareholders as a result of the inability to increase or even maintain the same level of revenues. What increased the amount of the loss, the higher the expenses of banking operations. In this regard, the role of internal audit in controlling and explaining the high expenses of banking operations in return for the decrease in the revenues of banking operations. Whether this is the result of waste, abuse, waste and manipulation, with the need to inform the Audit Committee and the Board of Directors according to reports submitted to them (Brown & Maloney, 1999).

As for the customers axis, the operating ratio decreased by 22% (28% - 50%), and the customer profitability rate decreased by 1.49 (0.81% - 2.3%). On the other hand, the growth rate of each of the current accounts slightly increased by 19% (35% - 16%). and savings accounts by 1.23% [- 0.47% - (1.7%)].

For the internal operations axis:

1. Total productivity decreased by 126% (-51% - 75%). As a result of the decrease in the after-tax surplus, it is accompanied by an increase in the expenses of banking operations mentioned in (1) above.

2. The growth in investments increased by 47% (-27% - (-74)) while continuing to remain in the negative territory.

The numbers of these indicators correspond to the analysis of the indicators of the financial axis, which confirms the failure of the bank's management, whether in improving the cost structure or performing activities with fewer material and human resources.

In relation to the growth and learning axis:

1. The growth in employee training increased by 30% (70% - 40%). As a result of the increase in the number of employees registered in training courses.

2. It is noticed with the increase in the number of trained workers. Decreased growth rate in training courses by 167%. Which means dispensing with several training courses.

3. Considering the values, indicators and graphs of the analysis, the following can be reached. Considering the results of the analysis, it can be said that the research hypothesis that states: m “The capabilities of internal auditing to adhere to international auditing standards in application of the principles of bank governance are enhanced through the integration of indicators for the axes of the balanced score card. This is in line with the principles of governance and in a way that contributes to reducing facing risks, raising the value of these banks, and supporting their competitive position.”

Conclusion and Recommendations

Conclusion

The research findings and recommendations can be identified as follows:

1. There is a symmetry between the internal audit functions in light of international auditing standards and principles related to the implementation of governance by emphasizing effective control procedures and controls that achieve a sustainable improvement in effectiveness and efficiency. As well as the adequacy of control controls in response to the risks of governance, operations and information systems, as the research identified this analogy as follows:

2. When looking closely at the conceptual description presented within the research on both governance and the balanced scorecard. It is noticeable that there is symmetry and convergence of goals and areas of interest between the two, which makes them complement each other in their quest to implement and abide by the principles of governance.

3. Indicators from the balanced scorecard can be used to carry out the tasks presented in the previous conclusion. The indicators are selected according to the nature of the activities of the economic unit, the business sector operating in it, and the risks to which it is exposed within this sector.

4. Within the context of this research, 12 indicators were selected whose values were distributed on the axes of the balanced score card for the purpose of evaluating the performance of the Iraqi Credit Bank in implementation of governance.

5. It was revealed by evaluating the indicators of the balanced scorecard that the performance of the credit bank was weak and that the indicators of the return on assets and the return on equity were high. The profit margin, safety margin, savings account growth, and overall productivity are considered temporary and inconclusive in terms of improving performance.

6. The formation of a sustainable value for the bank's shareholders can be considered to be reached through the development of the bank's revenues and the performance of activities with less material and human resources, which is expected to reflect positively on the dividend and share price in the market. As well as a strategic goal for the research sample bank (the Iraqi Credit Bank) that the administration must strive to achieve.

7. Expanding the internal audit activity to include evaluation and improvement of risk management, control and governance. The scope of internal audit functions has been extended to include advisory services in addition to assurance services that provide an independent assessment of risk management, assessment and examination in a way that supports the corporate governance system.

8. There are many areas that have been clarified within the research, for the integration between the internal audit tasks in light of international auditing standards and the strategic objectives within the perspectives of the balanced scorecard in the Iraqi Credit Bank.

9. It was revealed through the quantitative analysis of the results of the bank’s performance that the management failed to achieve the bank’s strategic goals, which calls for alerting the internal audit to the governance parties to this as one of the tasks entrusted to it.

Recommendations

1. Develop the internal audit staff to enable it to perform the tasks assigned to it in accordance with the established international auditing standards, especially the performance standards 2110, 2120, and the control standard 2130. For the purpose of providing an independent assessment of risk management, assessment and examination. In a manner that supports the governance system and provides useful information to the governance parties represented by the bank’s board of directors, its audit committee and stakeholders. As well as developing an efficient reporting system that ensures the delivery of evaluation results by the internal audit to the parties to the governance of the bank's activities.

2. Attention to identifying and following-up the areas where internal audit functions correspond in light of international auditing standards with the principles of governance implementation and awareness of their importance by emphasizing effective control procedures that sustainably improve control procedures in response to governance risks, operations and information systems.

3. Adopting the approach contained in the research for the purpose of knowing and determining the areas of integration of governance mechanisms with strategic objectives within the financial perspective of the balanced scorecard in the Iraqi Credit Bank.

4. As well as following the method applied in the research to analyze the results of the bank's performance quantitatively from an integrative strategic perspective.

5. Continuing the research in expanding the areas of integration and the mechanisms for its achievement so that it extends to the rest of the balanced score card perspectives.

6. The necessity of directing the Audit Committee and the Compliance Controller to pay attention to the areas of integration of the principle of governance, which includes ratification and supervision of the implementation of strategic objectives and adherence to the established values. With the financial perspective of the strategic objectives in the balanced scorecard on increasing the value of the bank's shareholders by improving productivity and performance of activities with fewer material and human resources.

7. The researcher recommends the bank in question (the Credit Bank of Iraq) to adopt comprehensive monitoring to achieve the goal of creating a sustainable value for the bank's shareholders. This is achieved by developing the bank's revenues and performing activities with fewer human and material resources.

References

Alzabari, S. A. H., Talab, H. R., & Flayyih, H. H. (2019). The Effect of Internal Training and Auditing of Auditors on Supply Chain Management: An Empirical Study in Listed Companies of Iraqi Stock Exchange for the Period 2012-2015. International Journal of Supply Chain Management, 8(5), 1070.

Barth, J., Schumacher, M., & Herrmann-Lingen, C. (2004). Depression as a risk factor for mortality in patients with coronary heart disease: a meta-analysis. Psychosomatic Medicine, 66(6), 802-813.

Cooper, M. (2008). Essential research findings in counselling and psychotherapy: The facts are friendly. Sage.

Fama, E. F., & Jensen, M. C. (1983). Agency problems and residual claims. The journal of law and Economics, 26(2), 327-349.

Grobman, W. A., Lai, Y., Landon, M. B., Spong, C. Y., Leveno, K. J., Rouse, D. J., ... & Mercer, B. M. (2007). Development of a nomogram for prediction of vaginal birth after cesarean delivery. Obstetrics & Gynecology, 109(4), 806-812.

Maseer, R. W., & Flayyih, H. H. (2021). Use a decision tree to rationalize the decision of accounting information users under the risk and uncertainty: A Suggested Approach.

Rost, B. (2010). Basel committee on banking supervision. In Handbook of Transnational Economic Governance Regimes (pp. 319-328). Brill Nijhoff.

Solovic, I., Sester, M., Gomez-Reino, J. J., Rieder, H. L., Ehlers, S., Milburn, H. J., ... & Lange, C. (2010). The risk of tuberculosis related to tumour necrosis factor antagonist therapies: a TBNET consensus statement.