Research Article: 2025 Vol: 29 Issue: 4S

Evaluating Customer Satisfaction through Omnichannel Banking Integration Quality: A Moderated Mediation Mechanism

Tina Seth, Banaras Hindu University

Nidhi Keshari, Banaras Hindu University

Soummya Chowdhury, GITAM Deemed to be University, Hyderabad

Shankar Nath Jha, Banaras Hindu University

Citation Information: Seth, T., Keshari, N., Chowdhury, S., & Nath Jha, S. (2025). Evaluating customer satisfaction through omnichannel banking integration quality: a moderated mediation mechanism. Academy of Marketing Studies Journal, 29(S2), 1-16.

Abstract

This research evaluates the relationship that contributes to customer satisfaction in the omnichannel banking environment with SOR framework. Through a robust analysis of 651 participants, using SEM the study reveals a significant and positive connection between the omnichannel integration quality and customer satisfaction. Furthermore, it sheds light on mediation role of perceived value and moderated mediation role of technological anxiety. The findings reveal the positive impact of omnichannel integration quality on perceived value, and subsequently, the influence of perceived value on overall customer satisfaction. A noteworthy contribution of this study is the identification of a partial mediating effect, highlighting the significant role of perceived value in shaping the ultimate satisfaction of omnichannel banking customers. Moreover, researchers also found that technology anxiety negatively moderates the relationship of omnichannel integration quality and customer satisfaction. These findings not only contribute to academic knowledge but also offer valuable insights for financial institutions and industry practitioners aiming to enhance customer satisfaction through effective omnichannel strategies. Additionally, this research informs strategic decision-making in the banking sector, guiding efforts to surpass customer expectations and cultivate enduring customer satisfaction in the ever-evolving landscape of omnichannel banking.

Keywords

Omnichannel Banking, Omnichannel Integration Quality, Perceived Value, Customer Satisfaction, Technology Anxiety.

Introduction

The rapid advancement of technology has led to the emergence of various interaction channels, providing consumers with multiple opportunities to engage throughout their consumption journey (Tran Xuan et al., 2023). The 21st century has witnessed transformative technological advancements reshaping the landscape of business operations and influencing consumer behaviour (Hamouda, 2019). In this era, consumers are not confined to a single purchasing channel; instead, they have a myriad of channels at their disposal to meet their needs. This paradigm shift has extended its impact to the banking sector as well, where consumers now navigate through various channels encountering a diverse array of products and services. Modern customers no longer limit their transactions to a specific channel; instead, they prefer to engage through multiple channels, including ATMs, physical branches, mobile apps, or websites (Tran Xuan et al., 2023; Y Lee et al., 2019). The complexity inherent in the banking sector is further compounded by the nuanced nature of financial products, necessitating innovative marketing strategies to establish and maintain competitive advantages. This shift has given rise to the concept of omnichannel, Omnichannel retailing, introduced by Lemon and Verhoef in 2016, it was designed to supersede the well-established concepts of multi-channel and cross-channel retailing (Nguyen, 2021) which providing customers with a seamless experience across various channels. The omnichannel approach enables consumers to engage with a brand by encountering uniform merchandise and promotions across all retail channels, offering a cohesive brand experience. This advantage allows consumers to enjoy consistent experiences across platforms, meeting their demands based on a central and common database encompassing products, offers, prices, and more. Omnichannel service empowers customers to utilize not just a single available channel but multiple channels simultaneously. This interaction across integrated channels results in a seamless and enhanced experience for customers (Tran Xuan et al., 2023). 76% of the business leaders surveyed identified the omnichannel strategy as their top business priority, and omnichannel management ranked as the third most crucial topic in service research (Shen et al., 2018).

Omnichannel banking centres around the principles of consistency, optimization, and seamlessness, striving to enhance the customer experience and ensure maximum satisfaction (Komulainen & Makkonen, 2018). The idea of integration quality (IQ), which was initially emphasized in the multi-channel context, has gained even more significance in the omnichannel setting. It is considered a crucial factor for achieving a unified omnichannel experience and can contribute to improved overall performance for the firm (Hamouda, 2019; Nguyen, 2021). Shen et al., (2018) highlighted channel integration as a key factor for success in omnichannel business. They argued that without effectively bringing together separate channels, the business may face challenges in achieving comprehensive success. Channel integration quality is characterized by the capability to deliver customers a smooth and cohesive service experience consistently across various channels (Shen et al., 2018). Its aim is to optimize each channel's strengths, reduce competition, foster synergy, and ultimately boost firm performance. Channel integration involves improving interaction and cooperation between channels, with well-integrated retailers coordinating operations and management across various channels (Zhang et al., 2018). Channel convergence strives to provide customers with a seamless, interconnected ecosystem, delivering a comprehensive banking experience where service quality is coordinated and consistent across all channels (S, 2024)

Ensuring a seamless experience and actively engaging customers across diverse channels are primary objectives in the development of an omnichannel business because, service providers may encounter challenges in fostering increased client engagement within a multichannel environment, such as the banking sector (Tran Xuan et al., 2023; Y Lee et al., 2019).

Therefore, the researchers have framed following objectives:

1. To investigate the influence of Omnichannel Integration Quality on customer satisfaction within the banking sector in India.

2. To assess whether the perceived value mediates the relationship between Omnichannel integration quality and Customer Satisfaction in banking sector in India.

3. To analyse the conditional effect of technological anxiety on the relationship of omnichannel Integration Quality and Customer satisfaction mediated by perceived value in banking sector in India.

Based on the above research objectives the researchers have identified the research gap that there is a scarcity of empirical research studies exploring the correlation between channel integration quality, customer satisfaction, and the mediating role of perceived value in the context of omnichannel banking in India. Furthermore, this research also offers new insights into technology anxiety as a moderated mediation between the relationship of omnichannel integration quality, perceived value and customer satisfaction as earlier studies focus technological anxiety in the context of use behaviour (Budhathoki et al., 2024; Li et al., 2020) this will offer insights into how anxiety related with new technologies can affect omnichannel integration quality, perceived value of the customers and satisfaction of the customers. Hence, the author aims not only to enhance the existing limited research in omnichannel literature by offering an overview of the outcomes of this phenomenon from a customer standpoint but also to provide insights to professionals in the retail banking sector in India to enhance customer satisfaction in the banking industry.

Theoretical Framework

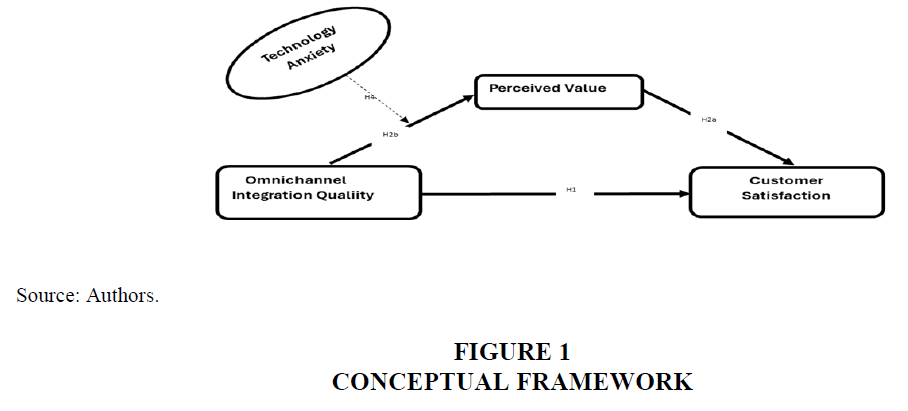

The Stimulus-Organism-Response (SOR) Theory, originally proposed by Mehrabian and Russell (Khoa & Huynh, 2023) and later extended to marketing by Belk (Chen et al., 2022), is widely used in retail research to understand how environmental cues shape consumer reactions (Vieira, 2013). As suggested by Pereira et al., (2023) SOR framework has identified various types of Stimuli (S), such as content attractiveness, store ambiance, omnichannel capabilities, channel integration. Organism (O) component includes responses like emotional reactions, utilitarian and hedonic perceptions, consumer empowerment, brand value, and both cognitive and affective responses and Response (R) outcome covers consumer behaviors like brand loyalty, purchase intention, and satisfaction hence, based on premises of SOR theory this research omnichannel integration quality as the stimulus, perceived value as the organism’s , and customer satisfaction as the final outcome, response. Additionally, the researchers also take insights from Value-Percept Theory which suggests that satisfaction arises as an emotional response following a cognitive evaluation, where customers assess how well their experience aligns with their values, needs, and expectations.

Review of Literature and Hypothesis Development

Omnichannel Banking

The banking sector was one of the first sectors to adopt an omnichannel strategy by enhancing both its physical and electronic channels and shifting to digital platforms (Hamouda, 2019; Liu et al., 2017).Omnichannel focuses on integrating various channels to function seamlessly as a single entity for the customer, enhancing accessibility. For example, a purchase can begin on one channel and be completed on another, or an online purchase can be returned at a physical store (Lorenzo-Romero et al., 2020). (Chauhan & Sarabhai, 2019) in their paper stated that consumers don’t rely on just one channel to interact with their financial institutions. Instead, they use a mix of physical and digital channels, depending on the specific task or service they need." Hence with the help of omnichannel banking customers can easily access a wide range of financial services, regardless of whether they are using a personal computer, mobile device, ATM, or visiting a branch (Liu et al., 2017).

Omnichannel Integration Quality and Customer Satisfaction

Customer satisfaction in omnichannel retailing relies on a business’s ability to ensure a smooth and consistent experience across all its channels (Asare et al., 2022). Channel integration facilitates the seamless transition of consumers to alternative companies' channels to access the information disseminated through a variety of channels (Zhang et al., 2018). An omnichannel environment ensures that customers receive consistent and standardised services across all available channels (Zhang et al., 2018). It was observed that customers seek to utilize channels based on their convenience, expecting a heightened level of coordination among retailer omni-channels. A consistent interface that delivers uniform information across channels contributes to a seamless experience, prompting customers to positively evaluate the retailer omni-channel system and deem it valuable. This perspective aligns with the insights provided by (Hamouda, 2019). (Riaz et al., 2022) in their paper states that that omnichannel retailing influence consumer behaviour subsequently, (Hamouda, 2019) in their paper stated that there exists a positive relationship between omnichannel banking integration quality and customer satisfaction. Hence, hypothesis proposes in this paper is:

H1: The relationship between omni-channel Integration Quality and customer satisfaction in banking sector is significant.

Perceived Value and Customer Satisfaction

Customer perceived value (CPV) is a fundamental concept in marketing literature, holding significant importance in both academic studies and practical management. It is characterized as the balance between the benefits a customer gains from an offering and the sacrifices they perceive (Blut et al., 2023). Moreover, as per customer value frameworks, the ultimate measure of customer satisfaction is determined by how consumers perceive the value they obtain (Woodruff, 1997). (Kusumawati & Rahayu, 2020) has claimed that customer perceived value has a significant impact on customer satisfaction . Customers tend to assess whether or not a service or product has performed above their expectations (Mansouri et al., 2022). As a result, the subsequent hypothesis is formulated.

H2a: The relationship between Perceived value and customer satisfaction in banking sector is significant.

Omnichannel Integration Quality and Perceived Value

It is essential to deliver a unified consumer experience across multiple channels—including websites, social media, physical locations, sales routes, and agents—without separating them (Asare et al., 2022). Channel integration quality refers to the capability to deliver a smooth and cohesive service experience for customers across various channels (Shen et al., 2018). In a multichannel context, perceived value is defined as "the overall evaluation by consumers of the benefits they gain from utilizing multiple channels to meet their needs, considering the associated costs and potential drawbacks of these channel structures (Asare et al., 2022)." The use of many channels is motivated by the benefits it brings, such as cost, time, and effort savings (Hsiao et al., 2012). Perceived quality has a positive correlation with PV (Zeithaml, 1988), and other research indicates that perceived channel quality has an impact on perceived value (Yu et al., 2011) multi-channel integration, which ensures a smooth customer experience, enhances the customer's usage of the multi-channel system (Gentile et al., 2007). The outcome is widely recognised in the field of multi-channel banking (Kabadayi et al., 2017). Hence, the following hypothesis is postulated:

H2b: The relationship between Omnichannel Integration Quality and Perceived value in banking sector is significant.

Perceived Value as Mediator

The concept of perceived value has been extensively studied in marketing literature as a prominent factor in understanding consumer behavioural intentions. It is considered both a direct influence and a mediating predictor variable (Ma & Kaplanidou, 2020). The assessment of value as seen by customers is a crucial and consistent determinant in forecasting consumer behaviour (Uzir et al., 2021). Hence in this study researchers tried to check the mediating role of perceived value between omnichannel banking integration quality and customer satisfaction and the hypothesis proposed is:

H3: Perceived Value mediates the relationship between omnichannel integration quality (IQ) and consumer satisfaction in banking sector.

Technology Anxiety as Moderator

With the advancement in technologies, it is very significant to analyse the capacity of customers to use the new technologies (Meuter et al., 2003). Failing to do so may lead to low adoption rates among customers. In the context of omnichannel retail, studies show that businesses strive diligently to create and deliver value to customers through omnichannel systems (Khoa & Huynh, 2023). However, the apprehensions of consumers can act as a detrimental disincentive that inhibits or dissuades them from engaging in online purchases, despite the numerous benefits and value propositions offered by sellers (Khoa & Huynh, 2023). Moreover, anxiety can lead consumers to abandon omnichannel purchases and, if it continues across various channels, may decrease their loyalty. Negative emotions can weaken long-term relationships between businesses and customers, as increased anxiety tends to lower the frequency of online shopping, thereby diminishing engagement with digital platforms (Khoa & Huynh, 2023). Previous studies have defined technology anxiety as a fear or difficulty in using new technologies (Li et al., 2020; Meuter et al., 2003). Recent studies have shown that technology anxiety—whether due to discomfort with technology or a lack of readiness—negatively impacts users' adoption and continued use of various technologies, including e-learning, mobile health, and self-service platforms (S. C. Chen et al., 2013; Deng et al., 2014; Kotrlik & Redmann, 2009; Li et al., 2020). This study attempts to examine if, in the case of omnichannel banking integration quality, technology anxiety works similar to or different from the context of using other types of conventional technologies. Hence, the hypothesis proposed is that:

H4: The mediating effect of perceived value on the association among omnichannel banking integration quality and the customer satisfaction is significantly moderated by technological anxiety.

To understand the study with the stated objective a conceptual model has been developed and present in Figure 1

Research Methodology

The study sought to evaluate customer satisfaction in the context of omnichannel banking, investigating the mediating influence of perceived value. This study applied a purposive sampling with causal research design process for collecting the data of target populations. A detailed and structured questionnaire, consisting of 25 statements, was utilized for result analysis and organized into two sections. The first segment consists of 7 statements, which collected demographic and socio-economic information, while the second section consist of 18 statements featured questions on omnichannel integration quality, perceived value (as a mediator), customer satisfaction, Technological anxiety (moderator). Responses were measured on a 5-point Likert scale, ranging from 'strongly disagree' to 'strongly agree.' The sample size was obtained using G*Power, (Faul et al., 2007) which recommended 262 participants, however for better results 651 sample size has taken for the study. To operationalize the constructs in the proposed model, existing scales from the literature were adapted to fit the study's setting. The final section provides details on the items and their sources of adoption.

Demographic Profile of Respondents

The responses collected for conducting the study holds differentiated demographic characteristics pertaining to the age, gender, educational qualification, and occupation. Moreover the study also asked the qualifier questions from the respondents regarding the awareness of omnichannel and those who are not aware of the omnichannel banking has excluded from the study. The details of the demographic properties have been provided in Table 1. These findings highlight potential challenges in participant engagement and knowledge levels. Among the 651 participants, 368 (approx. 56.6%) were females, and 283 (43.4%) were males. Notably, a significant majority fell within the 18-30 age group, constituting approximately 63.82% of the study. This suggests the active participation of Gen Z and millennials in omnichannel banking activities. Table 1 presents the complete demographic details of respondents.

| Table 1 Demographic Profile | |||

| Variable | Category | Number of Responses | Percentage |

| Gender | Female | 368 | 56.6% |

| Male | 283 | 43.4% | |

| Age Group | 18-30 | 415 | 63.75% |

| 31-40 | 158 | 24.27% | |

| 41-50 | 56 | 8.60% | |

| 50+ | 22 | 3.38% | |

| Educational Qualification | Secondary Education | 26 | 3.99% |

| Senior Secondary | 102 | 15.67% | |

| Graduation | 292 | 44.85% | |

| Post Graduation | 201 | 30.87% | |

| Others | 30 | 4.61% | |

| Occupation | Un-employed | 26 | 3.99% |

| Student | 201 | 49.31% | |

| Salaried | 321 | 49.34% | |

| Self employed | 103 | 15.82% | |

Results

Partial Least Square Structural Equation Modeling (PLS-SEM) was utilized for data analysis using SmartPLS 4.1. The PLS-SEM approach was chosen because it effectively supports both measurement model and structural model (Hair et al., 2011).

Measurement Model

To assess the validity of the measurement model, tests for construct validity and discriminant validity were carried out. Utilizing Smart PLS, internal consistency, reliability, as well as convergent and discriminant validity were examined. Table 2 illustrates the use of Cronbach's alpha and composite reliability for assessing internal consistency and reliability (Hair et al., 2020). The values exceeded the threshold of 0.736, indicating strong internal consistency. It's noteworthy that all Cronbach's alpha and composite values for the items were above 0.7 but below 0.95, which is appropriate, as values exceeding 0.95 suggest that indicators measure the same concept, potentially lacking the necessary diversity for multi-item construct validity (Hair et al., 2020).

| Table 2 Construct Measurement and Convergent Validity Evaluation | |||||||

| Construct | Item | Factor Loadings | Cronbach’s alpha | Rho A | Composite Relaibility | AVE | Contribution |

| Omnichannel Integration Quality | OI1 | 0.858 | 0.855 | 0.862 | 0.896 | 0.634 | (Hamouda, 2019; Kabadayi et al. 2017), |

| OI2 | 0.772 | ||||||

| OI3 | 0.784 | ||||||

| OI4 | 0.752 | ||||||

| OI5 | 0.812 | ||||||

| Perceived value | PV1 | 0.785 | 0.819 | 0.830 | 0.872 | 0.577 | (Hamouda, 2019; Kabadayi et al. (2017) |

| PV2 | 0.784 | ||||||

| PV3 | 0.813 | ||||||

| PV4 | 0.707 | ||||||

| PV5 | 0.701 | ||||||

| Customer Satisfaction | CS1 | 0.884 | 0.807 | 0.807 | 0.887 | 0.723 | (Cronin et al., 2000; Hamouda, 2019) |

| CS2 | 0.861 | ||||||

| CS3 | 0.803 | ||||||

| Technology Anxiety | T1 | 0.747 | (Gunasinghe & Nanayakkara, 2021) | ||||

| T2 | 0.777 | 0.860 | 0.873 | 0.899 | 0.641 | ||

| T3 | 0.810 | ||||||

| T4 | 0.805 | ||||||

| T5 | 0.860 | ||||||

Next, the average variance extracted (AVE) scores were examined to ascertain convergent validity, with all scores surpassing the threshold limit of 0.538 (Hair et al., 2020). The values for both convergent validity and internal reliability are detailed in table 2. Table 2 provides the summary of factors loadings, Cronbach alpha, AVE, Rho A and Composite reliability along with authors contribution.

Cross Loadings

Table 3 presents cross-loading, demonstrating that items were strongly associated with their respective constructs. This analysis also indicates that items from their respective constructs exhibited lower associations with other constructs, confirming item-level discriminant validity.

| Table 3 Cross Loading Between Constructs | ||||

| Items | CS | OI | PV | T |

| CS1 | 0.884 | 0.284 | 0.300 | 0.473 |

| CS2 | 0.861 | 0.281 | 0.319 | 0.457 |

| CS3 | 0.803 | 0.287 | 0.324 | 0.301 |

| OI1 | 0.349 | 0.858 | 0.462 | 0.429 |

| OI2 | 0.218 | 0.772 | 0.437 | 0.310 |

| OI3 | 0.257 | 0.784 | 0.394 | 0.367 |

| OI4 | 0.220 | 0.752 | 0.388 | 0.322 |

| OI5 | 0.272 | 0.812 | 0.405 | 0.374 |

| PV1 | 0.293 | 0.486 | 0.785 | 0.244 |

| PV2 | 0.347 | 0.461 | 0.784 | 0.270 |

| PV3 | 0.306 | 0.354 | 0.813 | 0.339 |

| PV4 | 0.231 | 0.359 | 0.707 | 0.226 |

| PV5 | 0.201 | 0.295 | 0.701 | 0.255 |

| T1 | 0.218 | 0.400 | 0.260 | 0.747 |

| T2 | 0.323 | 0.381 | 0.252 | 0.777 |

| T3 | 0.405 | 0.369 | 0.281 | 0.810 |

| T4 | 0.396 | 0.292 | 0.250 | 0.805 |

| T5 | 0.541 | 0.380 | 0.345 | 0.860 |

Source: Authors.

The Bold Figures Signify the Factor Loading of Items Representing their Respective Constructs, Highlighting the Distinctiveness of these Constructs at the Individual Item Level

Discriminant Validity

Following the confirmation of convergent validity and construct reliability, the study proceeded to establish discriminant validity. To achieve this, the paper employed both Fornell and Larcker's criterion and the HTMT criteria. Fornell and Larcker's criterion entails comparing the square root of the Average Variance Extracted (AVE) diagonally with the correlation values between constructs (Fornell & Bookstein, 1982). The purpose is to ascertain whether AVE values surpass the correlations between constructs. Table 4 confirms that all constructs in the study exhibit discriminant validity according to Fornell and Lacker’s criterion.

| Table 4 Fornell And Lacker’s | ||||

| Constructs | CS | OI | PV | T |

| CS | 0.850 | |||

| OI | 0.335 | 0.796 | ||

| PV | 0.371 | 0.525 | 0.760 | |

| T | 0.482 | 0.455 | 0.351 | 0.801 |

Source: Authors.

The Bold Figures Represent the Square Root of AVE Values for the Constructs and Must Exceed Inter-Construct Correlations to Signify Discriminant Validity at the Construct Level

However, recent studies have raised concerns about the efficacy of the Fornell-Larcker criterion in certain situations, indicating a potential limitation in its widespread use for assessing discriminant validity. To address this concern, an alternative method known as the heterotrait-monotrait ratio of correlations (HTMT) has been introduced as a novel approach for evaluating discriminant validity in variance-based Structural Equation Modeling (SEM) (Henseler et al., 2015). Henseler's criteria stipulate that all values should remain below 0.85, as an HTMT value exceeding 0.85 is more likely to suggest insufficient discriminant validity. Therefore, if the discriminant validity is below 0.85, it meets the established threshold, as indicated in the table 5 (Henseler et al., 2015) Table 5 confirm that all constructs in the study exhibit discriminant validity according to Discriminant validity criterion.

| Table 5 Discriminant Validity | |||

| Constructs | CS | OI | PV |

| CS | |||

| OI | 0.398 | ||

| PV | 0.444 | 0.613 | |

| T | 0.566 | 0.528 | 0.412 |

Source: Authors

VIF Values

Subsequently, the study employed the Variance Inflation Factor (VIF) to assess multicollinearity among predictors, with all VIF values registering below 3 Hair et al. (2011) Table 6 represents the results of VIF values.

| Table 6 VIF Values | |||

| Items | VIF | Items | Values |

| CS1 | 2.289 | PV1 | 1.911 |

| CS2 | 2.081 | PV2 | 1.912 |

| CS3 | 1.473 | PV3 | 1.943 |

| OI1 | 2.301 | PV4 | 1.891 |

| OI2 | 1.755 | PV5 | 1.969 |

| OI3 | 1.983 | T1 | 1.626 |

| OI4 | 1.793 | T2 | 1.852 |

| OI5 | 2.081 | T3 | 2.010 |

| T4 | 2.025 | ||

| T5 | 2.287 | ||

Source: Authors.

Structural Models Assessments

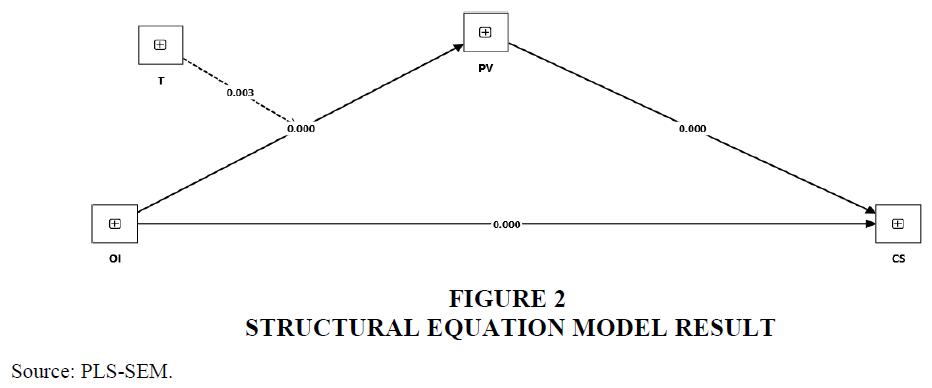

In the evaluation of the structural model, the researcher initially employed bootstrapping through 10,000 iterations to derive p-values for the hypotheses (Hair et al., 2017). The results of the SEM model are shown in below Figure 2.

The results shows that the relationships between OI and CS (t= 3.902, β = 0.225, p < .05), OI and PV (t = 6.430, β = 0.829, p < .05), and PV and CS (t= 5.025, β = 0.288, p < .05), were significant. Thus, Hypothesis H1, H2, and H3 were significant. Table 7 provides the summary of hypothesis derived from the SEM results.

| Table 7 Hypothesis Testing | ||||||||

| Hypothesis | Original sample (O) | Sample mean (M) | SD | T Value | P values | Confidence Interval 2.5% 97.5% |

Supported | |

| OI -> CS | 0.225 | 0.226 | 0.058 | 3.902 | 0.000 | 0.117 | 0.340 | Yes |

| OI -> PV | 0.829 | 0.830 | 0.129 | 6.430 | 0.000 | 0.564 | 1.072 | Yes |

| PV -> CS | 0.288 | 0.287 | 0.057 | 5.025 | 0.000 | 0.178 | 0.402 | Yes |

| T x OI -> PV | -0.126 | -0.126 | 0.042 | 2.970 | 0.003 | -0.206 | -0.040 | Yes |

Source: Authors

The researcher calculated the Structural Model Fit Index (SRMR), revealing a value of 0.07, which falls below the accepted threshold of 0.08 according to (Hu & Bentler, 1998). This suggests that the model possesses substantial explanatory power.

Mediation Analysis

After the Structural model assessment for mediation analysis mediating effect of Perceived Value has been assessed between Omnichannel Integration and Customer Satisfaction. The findings of the paper revealed that total effect between omnichannel integration and Customer satisfaction is significant as the P value is less than 0.005 with direct and indirect effect. Hence, the VAF value is calculated to conclude the mediation type which is calculated using formula indirect effect-to-total effect which comes at 51.61%. As a rule of thumb, if the VAF is lower than 20%, it is feasible to assume that no mediation takes place. A typical partial mediation might be described as having a VAF greater than 20% and less than 80%, while a VAF higher than 80% denotes a full mediation, according to (Hair et al., 2019) research. We can therefore draw the conclusion that partial mediation is present in the present study. Table 8 show the mediation effects of the perceived Value between omnichannel Integration Quality and Customer Satisfaction.

| Table 8 Hypothesised Mediating Effects | |||||

| Type of Effect | Effect | Path Coefficient | T statistics | Remark | P value |

| Total Effect | OI -> CS | 0.463 | 7.270 | Sig Total Effect | 0.000 |

| Indirect Effect | OI -> PV -> CS | 0.239 | 0.059 | Sig Indirect Effect | 0.000 |

| Direct Effect | OI -> CS | 0.225 | 3.902 | Sig Direct Effect | 0.000 |

| VAF | IE/TE | 51.61% | |||

| Conclusion | Moderately Strong Partial Mediation b/w OI And CS Exists | ||||

Source: Authors.

Moderated Mediation Results

The results indicate that the index value of the technology anxiety for moderated mediation effect is significant [index = -0.036, SE = 0.069, 95% CI = (-0.070, -0.011)]. The results revealed that at higher level of T the indirect effect of Omnichannel integration quality on Customer Satisfaction through perceived value (path = 0.066, t = 2.389,) is lower in comparison to the indirect effect at low T (Path = 0.132, t = 5.174). This shows that with increase in T, the indirect effect of Omnichannel integration quality on customer satisfaction through T is reduced. Therefore, the moderated mediation is supported and shown in table 9.

| Table 9 Moderated Mediation Results | ||||

| Moderating Indirect relationship | Direct Effect | Indirect Effect | Confidence Interval (Low/High) | P value |

| OI -> PV -> CS | 0.225 | 0.239 | 0.139/0.369 | 0 |

| Probing Moderated Indirect Relationship | ||||

| Low Level of T | 0.132 | 0.086/0.187 | 0 | |

| High Level of T | 0.066 | 0.019/0.130 | 0.017 | |

| Mean Level of T | 0.099 | 0.002/0.060 | 0 | |

| Index Level of T | -0.036 | -0.070/-0.011 | 0.013 | |

Source: Authors.

Discussions

This research aimed to enhance our understanding of how omni-channel banking impacts consumer satisfaction from the consumer's viewpoint. An empirical investigation focused on bank customers was conducted to examine the interplay among omni-channel integration quality (IQ), customer satisfaction, and the mediating role of perceived value with SOR framework. Consistent with prior studies by (Asare et al., 2022; Hamouda, 2019; Kanwal et al., 2022), researchers reaffirm the positive correlation between omni-channel integration quality and customer satisfaction hence, H1 was accepted.

Moreover, this research has brought a light on substantial partial mediating effect associated with perceived value. As defined by Kotler, perceived value is the balance between the benefits and costs of a product or service compared to the other choices (Rico et al., 2019). Simply, when channel integration quality delivers substantial benefits, it elevates the overall perceived value. Consequently, this heightened perceived value becomes a key factor in increasing customer satisfaction. This dynamic relationship underscores the pivotal role of perceived value in connecting both omnichannel integration quality and customer satisfaction, creating positive feedback. In line with the findings of (Kanwal et al., 2022) researchers established that high-quality omni-channel banking integration significantly influences perceived value i.e. H2b was accepted. Importantly, perceived value, in turn, has a noteworthy impact on customer satisfaction H2a was accepted as supported by (Kanwal et al., 2022). Also, the results of mediation between omnichannel integration quality and customer satisfaction were significant and H3 was accepted. Thus, this study substantiates the notion that superior omni-channel banking integration elevates the perceived value of the omni-channel for customers, as highlighted by (Hamouda, 2019).

The paper also offers technology anxiety as a moderated mediation approach which confirms that technology anxiety will weaken the relationship between omnichannel banking integration quality and customer satisfaction as previous studies has stated that technology anxiety negatively moderates the relationships between key antecedents and the adoption of technological devices (Li et al., 2020).

Implications

The coordinated approach of omnichannel banking enables customers to interact seamlessly with the bank, transitioning effortlessly between channels based on their convenience. This highlights the integrated and unified nature of omnichannel banking. Customers also have the flexibility to access and manage their accounts as they desire, including updating and transferring funds between different accounts. Encouraging customers to switch channels after transactions enhances the perception of coordination and consistent experiences. Furthermore, the paper underscores the role of perceived value in increasing customer satisfaction, emphasizing that banks should focus not only on channel integration, but also on providing maximum value to customers for increased satisfaction and loyalty. Moreover, this paper also provides evidences that how technology anxiety can prevent people to use new technologies hence it suggests banks to run campaign or awareness program for customers so that they can easily use new technologies without any fear. Additionally, the paper provides implications for banks, employees, and managers to utilize omnichannel strategies, positioning themselves competitively in the market and ensuring customer satisfaction and loyalty. Anjani Kumar,(2018) states that omnichannel banking is a future of banking, as it is crucial for banks as it provides significant business advantages, driving both revenue growth and profitability. While investing in omnichannel banking may involve short-term costs, it yields substantial long-term financial benefits. Overall, this paper makes a significant contribution to existing literature and theory by introducing a new dimension to the S-O-R (Stimulus-Organism-Response) framework through its integration into the context of omnichannel quality in the banking sector. This approach not only extends the applicability of the S-O-R framework but also offers fresh insights into how omnichannel integration enhances satisfaction in banking, thereby advancing our understanding of consumer behavior in digital banking environments.

Conclusion

This research has delved into the intricate dynamics of omnichannel integration (OI), customer satisfaction (CS), the mediating influence of perceived value (PV), and moderated mediation approach of technological anxiety with SOR framework in the context of banking sector. The findings of this study contribute valuable insights to our understanding of how these elements interconnect in shaping the customer satisfaction.

The results revealed a significant relationship between omnichannel integration quality and customer satisfaction. Notably, the examination of the mediating role of perceived value reveals a moderately strong partial mediation. This implies that while omnichannel integration directly influences customer satisfaction, a significant portion of this effect is channelled through the lens of perceived value. This nuanced interplay underscores the importance of considering not only the seamless integration of channels but also the perceived value that customers derive from such integration. The identification of perceived value as a mediator adds depth to our comprehension of the mechanisms at play in influencing customer satisfaction. Businesses aiming to enhance customer satisfaction through omnichannel strategies should prioritize not only the integration itself but also strategies that enhance the perceived value experienced by the customers throughout their omnichannel journey. Furthermore, technology anxiety negatively impacts the relationship between omnichannel integration quality and customer satisfaction. Therefore, banks aiming to enhance customer satisfaction through omnichannel integration should prioritize reducing technology anxiety by offering user-friendly interfaces, ensuring robust customer support, and maintaining transparent communication regarding security measures. Additionally, this paper suggests that banks should conduct campaigns or awareness programs to help customers engage with new technologies confidently and without fear. In conclusion, this study emphasizes the importance of adopting a holistic approach to omnichannel strategies that takes into account both integration, perceived value, and technological anxiety fostering heightened customer satisfaction in the continually evolving landscape of contemporary commerce.

Limitations and Future Scope of Study

This study has some limitations that can be used for future research directions. Due to constraints in time and budget, the study relies on a small sample size, employs a cross-sectional design, and utilizes purposive sampling. This approach may hinder the generalizability of the results, as a larger sample size and a longitudinal data collection process would offer more robust insights. A future study with a broader participant pool, including a variety of banks, and incorporating employee perspectives could contribute to a more comprehensive understanding. Additionally, exploring additional factors that may influence or interact with the relationships studied could provide a deeper insight into the dynamics shaping customer satisfaction in the digital era.

References

Anjani Kumar. (2018). Omnichannel Banking: A Win Win Proposition.

Asare, C., Majeed, M., & Cole, N. A. (2022). Omnichannel Integration Quality, Perceived Value, and Brand Loyalty in the Consumer Electronics Market: The Mediating Effect of Consumer Personality. Lecture Notes in Networks and Systems, 392, 29–45.

Blut, M., Chaney, D., Lunardo, R., Mencarelli, R., & Grewal, D. (2023). Customer Perceived Value: A Comprehensive Meta-analysis. Journal of Service Research.

Budhathoki, T., Zirar, A., Njoya, E. T., & Timsina, A. (2024). ChatGPT adoption and anxiety: a cross-country analysis utilising the unified theory of acceptance and use of technology (UTAUT). Studies in Higher Education.

Chauhan, P., & Sarabhai, S. (2019). Customer experience quality in omni-channel banking: identifying the factors affecting customer experience in the Indian context. International Journal of Management Concepts and Philosophy, 12(2), 222.

Indexed at, Google Scholar, Cross Ref

Chen, S. C., Liu, M. L., & Lin, C. P. (2013). Integrating technology readiness into the expectation-confirmation model: An empirical study of mobile services. Cyberpsychology, Behavior, and Social Networking, 16(8), 604–612. https://doi.org/10.1089/cyber.2012.0606

Chen, X., Su, X., Li, Z., Wu, J., Zheng, M., & Xu, A. (2022). The impact of omni-channel collaborative marketing on customer loyalty to fresh retailers: the mediating effect of the omni-channel shopping experience. In Operations Management Research (Vol. 15, Issues 3–4, pp. 983–997). Springer.

Cronin, J. J., Brady, M. K., Tomas, G., & Hult, M. (2000). Assessing the Effects of Quality, Value, and Customer Satisfaction on Consumer Behavioral Intentions in Service Environments. Journal of Retailing, 76(2), 193–218.

Deng, Z., Mo, X., & Liu, S. (2014). Comparison of the middle-aged and older users’ adoption of mobile health services in China. International Journal of Medical Informatics, 83(3), 210–224.

Faul, F., Erdfelder, E., Lang, A. G., & Buchner, A. (2007). G* Power 3: A flexible statistical power analysis program for the social, behavioral, and biomedical sciences. Behavior Research Methods, 39(2), 175–191.

Fornell, C., & Bookstein, F. L. (1982). Two Structural Equation Models: LISREL and PLS Applied to Consumer Exit-Voice Theory. In Source: Journal of Marketing Research (Vol. 19, Issue 4).

Gentile, C., Spiller, N., & Noci, G. (2007). How to Sustain the Customer Experience:. An Overview of Experience Components that Co-create Value With the Customer. European Management Journal, 25(5), 395–410.

Indexed at, Google Scholar, Cross Ref

Gunasinghe, A., & Nanayakkara, S. (2021). Role of technology anxiety within UTAUT in understanding non-user adoption intentions to virtual learning environments: the state university lecturers’ perspective. International Journal of Technology Enhanced Learning, 13(3), 284.

Hair, J. F., Howard, M. C., & Nitzl, C. (2020). Assessing measurement model quality in PLS-SEM using confirmatory composite analysis. Journal of Business Research, 109, 101–110.

Hair, J. F., Hult, G. T. M., Ringle, C. M., & Sarstedt, Marko. (2017). A primer on partial least squares structural equation modeling (PLS-SEM).

Hair, J. F., Ringle, C. M., & Sarstedt, M. (2011). PLS-SEM: Indeed a silver bullet. Journal of Marketing Theory and Practice, 19(2), 139–152.

Hair, J. F., Risher, J. J., Sarstedt, M., & Ringle, C. M. (2019). When to use and how to report the results of PLS-SEM. In European Business Review (Vol. 31, Issue 1, pp. 2–24). Emerald Group Publishing Ltd.

Hamouda, M. (2019). Omni-channel banking integration quality and perceived value as drivers of consumers’ satisfaction and loyalty. Journal of Enterprise Information Management, 32(4), 608–625.

Indexed at, Google Scholar, Cross Ref

Henseler, J., Ringle, C. M., & Sarstedt, M. (2015). A new criterion for assessing discriminant validity in variance-based structural equation modeling. Journal of the Academy of Marketing Science, 43(1), 115–135.

Hsiao, C. C., Yen, H. J. R., & Li, E. Y. (2012). Exploring consumer value of multi-channel shopping: A perspective of means-end theory. Internet Research, 22(3), 318–339.

Hu, L.-T., & Bentler, P. M. (1998). Fit Indices in Covariance Structure Modeling: Sensitivity to Underparameterized Model Misspecification. In Psychological Methods (Vol. 3, Issue 4).

Kabadayi, S., Loureiro, Y. K., & Carnevale, M. (2017). Customer Value Creation in Multichannel Systems: The Interactive Effect of Integration Quality and Multichannel Complexity. Journal of Creating Value, 3(1), 1–18.

Kanwal, M., Arshad, M. R., Shahid, M., & Gul, R. (2022). The Framework of Loyalty and Customer Satisfaction with Perceived value and Omni-channel Integration Quality as Drivers in Banking Sector of Pakistan. Pakistan Journal of Humanities and Social Sciences, 10(4).

Khoa, B. T., & Huynh, T. T. (2023). How Does Anxiety Affect the Relationship between the Customer and the Omnichannel Systems? Journal of Theoretical and Applied Electronic Commerce Research, 18(1), 130–149.

Indexed at, Google Scholar, Cross Ref

Komulainen, H., & Makkonen, H. (2018). Customer experience in omni-channel banking services. Journal of Financial Services Marketing, 23(3–4), 190–199.

Kotrlik, J. W., & Redmann, D. H. (2009). A Trend Study: Technology Adoption in the Teaching-Learning Process by Secondary Agriscience Teachers-2002 and 2007. Journal of Agricultural Education, 50(2), 62–74.

Kusumawati, A., & Rahayu, K. S. (2020). The effect of experience quality on customer perceived value and customer satisfaction and its impact on customer loyalty. TQM Journal, 32(6), 1525–1540.

Li, L., Lee, K. Y., Emokpae, E., & Yang, S.-B. (2020). What makes you continuously use chatbot services? Evidence from chinese online travel agencies.

Liu, J., Abhishek, V., Li, B., John Heinz, H., Fienberg, S. E., Geng, D., Kauffman, R. J., Li, Z.-O., Lin, M., Ma, D., Montgomery, A., Ondrus, J., & Tang, Q. (2017). The impact of mobile channel adoption on customer omni-channel banking behavior.

Lorenzo-Romero, C., Andrés-Martínez, M. E., & Mondéjar-Jiménez, J. A. (2020). Omnichannel in the fashion industry: A qualitative analysis from a supply-side perspective. Heliyon, 6(6).

Indexed at, Google Scholar, Cross Ref

Ma, S. C., & Kaplanidou, K. (2020). Service quality, perceived value and behavioral intentions among highly and lowly identified baseball consumers across nations. International Journal of Sports Marketing and Sponsorship, 21(1), 46–69.

Mansouri, H., Sadeghi Boroujerdi, S., & Md Husin, M. (2022). The influence of sellers’ ethical behaviour on customer’s loyalty, satisfaction and trust. Spanish Journal of Marketing - ESIC, 26(2), 267–283.

Meuter, M. L., Ostrom, A. L., Bitner, M. J., & Roundtree, R. (2003). The influence of technology anxiety on consumer use and experiences with self-service technologies. Journal of Business Research, 56(11), 899–906.

Indexed at, Google Scholar, Cross Ref

Nguyen, H. N. (2021). Channel Integration Quality, Customer Experience and Patronage in Omnichannel Retailing. Journal of Distribution Science, 19(12), 23–32.

Pereira, M. L., de La Martinière Petroll, M., Soares, J. C., Matos, C. A. de, & Hernani-Merino, M. (2023). Impulse buying behaviour in omnichannel retail: an approach through the stimulus-organism-response theory. International Journal of Retail and Distribution Management, 51(1), 39–58.

Riaz, H., Baig, U., Meidute-Kavaliauskiene, I., & Ahmed, H. (2022). Factors Effecting Omnichannel Customer Experience: Evidence from Fashion Retail. Information (Switzerland), 13(1).

Rico., Tecoalu, M., Wahyoedi, S., & Purnama, E. D. (2019). The Effects of Trust, Service Quality and Perceived Value on Satisfaction and Their Impact on Loyalty. 325–330.

S, S. (2024). Integrated banking channel service quality (IBCSQ): Role of IBCSQ for building consumers’ relationship quality and brand equity. Journal of Retailing and Consumer Services, 76.

Indexed at, Google Scholar, Cross Ref

Shen, X. L., Li, Y. J., Sun, Y., & Wang, N. (2018). Channel integration quality, perceived fluency and omnichannel service usage: The moderating roles of internal and external usage experience. Decision Support Systems, 109, 61–73.

Tran Xuan, Q., Truong, H. T. H., & Vo Quang, T. (2023). Omnichannel retailing with brand engagement, trust and loyalty in banking: the moderating role of personal innovativeness. International Journal of Bank Marketing, 41(3), 663–694.

Uzir, M. U. H., Al Halbusi, H., Thurasamy, R., Thiam Hock, R.L., Aljaberi, M. A., Hasan, N., & Hamid, M. (2021). The effects of service quality, perceived value and trust in home delivery service personnel on customer satisfaction: Evidence from a developing country. Journal of Retailing and Consumer Services, 63.

Vieira, V. A. (2013). Stimuli-organism-response framework: A meta-analytic review in the store environment. Journal of Business Research, 66(9), 1420–1426.

Woodruff, R. B. (1997). MARKETING IN THE 21ST CENTURY Customer Value: The Next Source for Competitive Advantage. In Journal of the Academy of Marketing Science (Vol. 25, Issue 2).

Y Lee, Z. W., H Chan, T. K., Yee-Loong Chong, A., & Thadani, D. R. (2019). Customer engagement through omnichannel retailing: The effects of channel integration quality.

Indexed at, Google Scholar, Cross Ref

Yu, U. J., Niehm, L. S., & Russell, D. W. (2011). Exploring perceived channel price, quality, and value as antecedents of channel choice and usage in multichannel shopping. Journal of Marketing Channels, 18(2), 79–102.

Indexed at, Google Scholar, Cross Ref

Zeithaml, V. A. (1988). Consumer Perceptions of Price, Quality, and Value: A Means-End Model and Synthesis of Evidence. In Source: Journal of Marketing (Vol. 52, Issue 3).

Indexed at, Google Scholar, Cross Ref

Zhang, M., Ren, C., Wang, G. A., & He, Z. (2018). The impact of channel integration on consumer responses in omni-channel retailing: The mediating effect of consumer empowerment. Electronic Commerce Research and Applications, 28, 181–193.

Indexed at, Google Scholar, Cross Ref

Received: 19-Mar-2025, Manuscript No. AMSJ-25-15774; Editor assigned: 20-Mar-2025, PreQC No. AMSJ-25-15774(PQ); Reviewed: 20-Mar-2025, QC No. AMSJ-25-15774; Revised: 16-Apr-2025, Manuscript No. AMSJ-25-15774(R); Published: 30-Apr-2025