Research Article: 2018 Vol: 21 Issue: 2S

Entrepreneurship in the Shadows: Market Research into Trends Running in Post-Soviet Economies

Aleksandr Latkin, Vladivostok State University of Economics and Service

Victor Sazonov, Far Eastern Federal University (FEFU)

Igor Dyshlovoi, V.I. Vernadsky Crimean Federal University

Abstract

This paper is devoted to the influence that is projected by the shadow economy on entrepreneurship in Russia, Kazakhstan and Azerbaijan. We believe that entrepreneurial intention is something that everyone has within one’s self, but the things not always go so that this intention could be realized legally. Since entrepreneurship is already recognized as a natural desire, we should expect the shadow business to be in inverse correlation with the ease of doing business ranking. The aim of this paper is to test such a hypothesis using many indirect factors. The level and size of shadow economy were studied empirically by comparing national ton-miles and GDP data. Research results show that difference in figure between ton-miles and GDP is an evidence on the incomplete national statistics and the shadow covering a significant part of business. Correlation analysis revealed a positive relationship between the size of shadow economy and the chance of starting a business. The effectiveness of entrepreneurship training programs is evaluated. Correlation between the influence, projected by the shadow economy on entrepreneurship, and factors that drive enterprise's development turned out to be negative. A slightly negative correlation (-0.12) was established between the national GDP data and the size of shadow economy. The interest arises from the fact that correlation between GDP and that how hard it will be to have an enterprise in the register is negative, and this pumps up the shadow economy. Correlation between the shadow economy and start-ups was found positive.

Keywords

Shadow Economy, Entrepreneurship Education, Start-Ups, Formal and Informal Enterprises, Gross Domestic Product (GDP), Educational Restructuring.

Introduction

Shadow economy is an informal economy that consists of economic activities occurring outside of formal institutional boundaries, but remains within informal institutional boundaries for large segments of society (Webb et al., 2013). Shadow entrepreneurs are unwanted and unsuccessful in the global economic system because of their inability to perform in a formal economy (Gallin, 2001). Investigations over the relationship between the size of shadow economy, the government size, property rights protection and entrepreneurial activity have shown that informal institutions can have a less negative effect on the overall entrepreneurship in a country when property rights are strong. In this case, first informal steps can be steps toward formal business activity (Estrin & Mickiewicz, 2012). In weak institutional environments, many businesses are in shadow so that those who are already in the embedded business network have an advantage over the newcomers (Ruta et al., 2008). On the one hand, companies that avoid paying taxes have a competitive advantage over those that do, and this gives them an opportunity to get extra money for wage payment. Among other things, such a practice reduces the official unemployment rate, but informal business is a blow to budget, rolling back macroeconomic achievements (Dreher & Schneider, 2009).

In high-income countries, companies give bribes to “reach the stars”, more specifically to get more advantages in the market and overtake other companies. Schneider and Enste (2000) indicate that part of shadow money is spent in the formal sector as soon as earned. That is why some assume that shadow economy has not only negative, but also a positive effect on national economic development. Aureo et al. (2006) focus on tax avoidance as the main determinant of informality, and find that informal sector firms will be smaller and will have a higher cost of capital than their formal sector counterparts; hypotheses confirmed on Brazilian data.

Although Russia, Kazakhstan and Azerbaijan show tendencies toward positive economic development, situation remains difficult and is characterized by an increase in the tax and financial crime rate in all basic sectors of economy (Fakhrutdinova et al., 2015). Formation and wide use of the large scientific and educational centers, science cities, active use of federal scientific and entrepreneurship training programs are required (Khairutdinov et al., 2018).

During the Soviet era, shadow economy was not a factor, but the fictitious economy flourished (Barsukova & Radaev, 2012). In post-communist emerging countries, unregistered business is an essential part of the economic space (Mróz, 2012). In Russia, it accounts for 43.8% of GDP (Kramin et al., 2014), in Kazakhstan for 25.8% (finprom.kz), and in Azerbaijan for 67% (Association of Chartered Certified Accountants). These are countries where shadow economy grew the largest while gearing toward the market system, and its vehicle runs on specific sources of shadow profit and income, more specifically the withdrawal of capital, raw materials and energy resources, unregistered operations, smuggling and bootlegging (Makarov, 2005).

Other factors driving the performance of formal and informal enterprises are the extensive government regulation, revenues, official regulations and taxation mechanisms. Start-ups are also a factor, and they are very popular among newcomers and graduates starting their business in the informal sector (Sedlá?ek & Sterk, 2017).

This is why it is so important to do a market research into shadow economy and its relation to the national economy of Kazakhstan, Russia and Azerbaijan. There are a number of factors driving the shadow economy, more specifically national institutions, taxes (Gërxhani, 2004), bureaucracy of starting a business, and high service commissions. Delmar and Davidsson (2000) showed that entrepreneurs are more educated than the non-entrepreneurs are. The Ease of Doing Business Ranking and many research studies illustrate how big the potential barrier is on the way of legal business (Pedro Sousa, 2018).

Since we already recognized entrepreneurship as a natural desire, we should expect the shadow business to be in inverse correlation with the ease of doing business ranking. Thus, our research is to test such a hypothesis using many indirect factors for falsification/verification. The size of shadow economy was estimated empirically by comparing national ton-miles and GDP data.

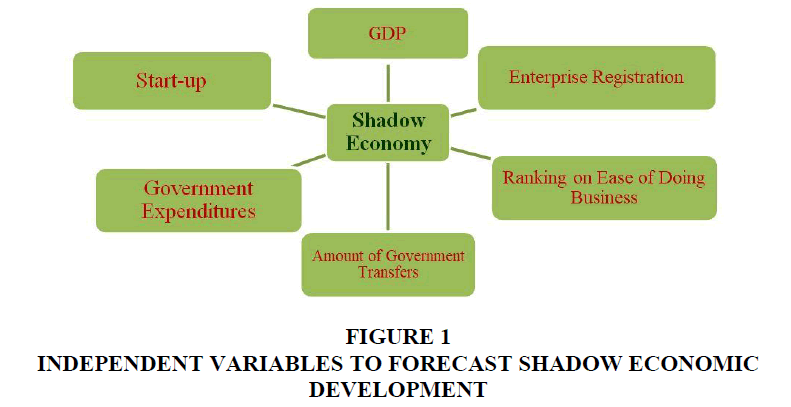

Let us assume the measure behind the level of shadow economy as cause-and-effect relationship between GDP data and ton-miles. Correlation analysis is a way to investigate the relationship between the level of shadow economy and drivers of its development (Figure 1). Correlation analysis was performed using the Spearman's rho.

Data Sources

Data on Russian business of transporting goods were taken from the Federal State Statistics Service. For Kazakhstan, figures were taken from the Committee on Statistics for 2000 to 2017. For Azerbaijan, figures were taken from the 2000-2017 Reports on the Main Directions of Economic Policy. Measure of the complexity of enterprise registration procedure was the number of enterprises registered annually. The government influence was measured by calculating the ratio of government expenditures to GDP. Expenditures included not only the total consumption spending, but also all the transfers. In order to measure the size of shadow economy, registration procedure complexity and national ranking on business development, we addressed the World Bank database and the R&D database.

Results And Discussion

Table 1 presents data on entrepreneurship rankings of Russia, Kazakhstan and Azerbaijan among 190 countries.

| Table 1 2018 Entrepreneurship Rankings Of Russia, Kazakhstan And Azerbaijan |

|||

| Russia | Kazakhstan | Azerbaijan | |

| Enterprise Registration | 28 | 41 | 18 |

| Ease of Doing Business | 35 | 36 | 76 |

| Taxation | 52 | 50 | 35 |

Note: Adapted from World Bank database.

Table 1 shows that Kazakh entrepreneurs have hard time starting and running their own businesses, while in Azerbaijan, any enterprise is easy to register, much easier than in Russia and Kazakhstan, but running it is almost 2 times harder to do. Driving effect of these factors on informal economy is considered below.

Estimates Level of Shadow Economy

By definition, shadow economy consists of hidden activities, so the level of shadow economy can be estimated only indirectly. In an attempt to provide a full display, we used open ton-miles data to estimate the level of national economy, and compared the difference in dynamic figures with official economic statistics. These differences were taken as indirect marker of the level of shadow economy.

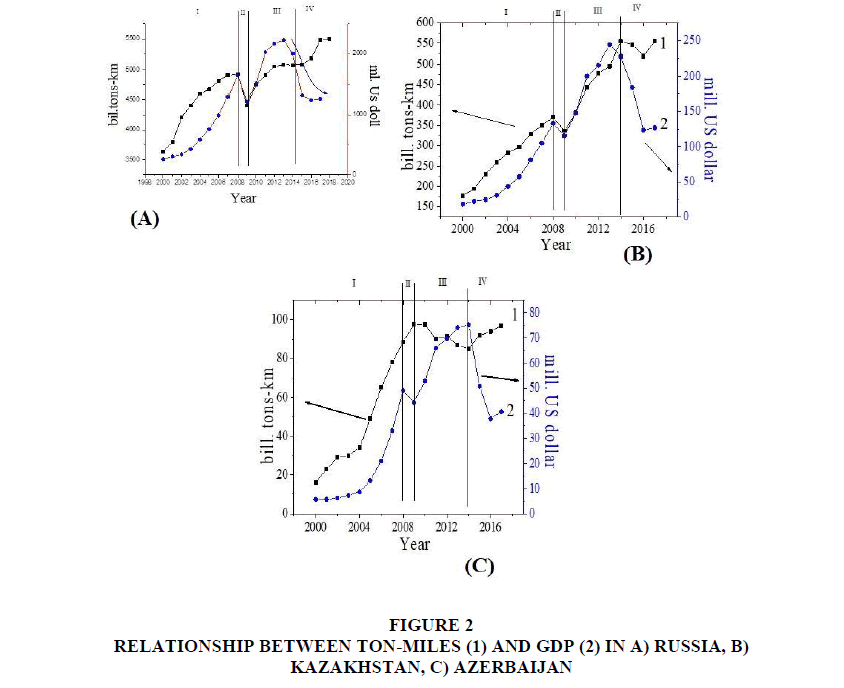

Figure 2 presents data on ton-miles and GDP of each country.

The reason why we settled on ton-miles is that ton-miles are a direct marker of trade intensity. The chain involves producers, sellers and buyers, but they all, or some of them, can withhold contract details, money or other stuff from the state statistics bodies. However, they still need to deliver paid goods, which will be put on the record in ton-miles. The figures are quite illustrative of a vivid independence of actual economic activity, reflected in ton-miles of freight. Shadow economy was especially strong during the crisis. We distinguished four turning periods with points marking the beginning or end of crisis. Figure 2a shows a growing trend until 2008, when business environment was good, which is evident from a positive derivative of GDP/ton-miles curves. During that period, GDP grew super-linearly at an ever-increasing rate, while ton-miles showed slowing-down sub-linear growth. Such a mismatch could arise from a dim expectation of business environment being friendly. Official super-linear growth rates existing on the background of decreasing outcomes in the real sector can be explained by that a shadow over it shortens in horizon. Positive view did not survive the crisis. In 2008, both factors dropped, and that official statistics and ton-miles were decreasing at similar rates. Third period was notable for official economy accelerating ahead of freight, but both figures grew sub-linearly and soon came to stagnation. Many experts associate the crisis with Russian political underpinnings (Sauer, 2017), but here we can see that real economy began to lag a few years before the events of 2013/2014. The fourth period attracts the most interest: official economy has been displaying a dramatic decline since 2014, nearly hitting the bottom last year, and yet, ton-miles factor has been showing a soft and sluggish growth.

Other countries experienced similar processes that occurred in local contexts (Figures 2b & c). First period was a time of pre-crisis growth, which rates outstripped the trade intensity. After 2008, countries were on crisis-induced decline. The only difference was that the real sector of Azerbaijan was not marked by falling, but by zero growth. During the third period, Russian and Kazakh economies were neck-and-neck with the real sector, but in Azerbaijan, economy was growing ahead of the real sector. This means that Azerbaijan put some effort into pulling national economy out of the shadow. The fourth period is common for all three countries: real business is doing better, but still is likely to end with stagnation, which is not as critical as official recession.

Based on data in Figure 2, we can assume that countries that we have investigated possess informal institutions housing businesses in the event of crisis. At this point, informal economy is a resource from which official economy will benefit if pulls it out of the shadow. By benefit, we mean a super-linear outstripping growth rates. Non-balance between ton-miles and national GDP can be an evidence on several turning points like incomplete national statistics and the shadow covering a significant part of business. At the same time, shadow status is tied to economic moods and expectations, as positive expectations pull the business out of shadow better than any bans or regulatory actions. Shadow status, however, matters nothing to a business that seeks growth, and that such business is a jumping-off place for those recovering from crisis.

Correlation Analysis

Results on the correlation between shadow economy and specific drivers are presented in Table 2.

| Table 2 Correlation Between Specific Drivers And Shadow Economy In Russia, Kazakhstan And Azerbaijan |

|||

| Shadow Economy | Russia | Kazakhstan | Azerbaijan |

| Government Expenditures | -0.1 | -0.12 | -0.23 |

| Registration Procedure Complexity | 0.89 | 0.88 | 0.63 |

| Ranking on Ease of Doing Business | 0.78 | 0.86 | 0.9 |

| GDP | -0.21 | -0.15 | -0.12 |

| Start-up | 0.08 | 0.02 | 0.02 |

Correlation between the influence, projected by the shadow economy on entrepreneurship, and factors that drive enterprise's development turned out to be negative. The observed low level of entrepreneurship in emerging countries is coherent with (Ruta et al., 2008).

For Azerbaijan, correlation between shadow economy and business registration is not only positive, but also the smallest (0.63) because of simplified procedure of enterprise registration, compared to Russia and Kazakhstan (Gafarov, 2006). Problems associated with business registration and pitfalls made by the government indicate that staying in the shadow is rewarding. Evidence on that is a positive correlation between government expenditures and the shadow economy. In Russia, Kazakhstan and Azerbaijan, an informal institution that is in the core of governance and other sectors of economy is a blast tradition (Andvig, 2006), challenging the corruption (Satarov, 2008). What attracts interest is that we found a slightly negative correlation between the national GDP data and the size of shadow economy while investigation over Russia, Kazakhstan and Azerbaijan (Table 2). This means that if turning the gears of regulation, correlation can become positive. This process starts when shadow economy grows large enough to cause the increase in regulation through the adoption of new devoted provisions and generation of transactions, which in turn secure an alternative order (Gërxhani, 2004). Evidence on U-shaped relationship was found: entrepreneurship is least likely to take place when shadow economy accounts for about a quarter of GDP (Estrin et al., 2011).

Table 3 shows a negative correlation between GDP and the complexity of enterprise registration procedure in Russia and Kazakhstan. For Azerbaijan, correlation is the smallest, so high requirements for business registration in Kazakhstan and Russia probably contribute to a decline in GDP.

| Table 3 Correlation Between Some Macroeconomic Parameters And Enterprise Registration Procedure Complexity |

|||

| Registration Procedure Complexity | Russia | Kazakhstan | Azerbaijan |

| Government Expenditures | -0.49 | -0.47 | -0.13 |

| GDP | -0.12 | -0.11 | -0.07 |

Correlation between shadow activities and start-ups is typically positive (0.08), so is the correlation between the entrepreneurs property and start-ups, found by Wennekers et al. (2005). Thus, non-regulated business is a powerful tool of the shadow economy. The size of shadow economy is also linked to national economic development–advanced countries usually have smaller informal sectors (Sauer, 2008).

Conclusions

This analysis revealed that shadow economy in Russia, Kazakhstan and Azerbaijan is sensitive to complexity in regulation, as evidenced by a negative correlation between the ease of doing business and the level of shadow economy. Introduced method of estimating shadow economy by comparing GDP data and ton-miles revealed a crucial role of shadow economy in the economic systems of Russia, Kazakhstan and Azerbaijan. The complexity of enterprise registration procedure turned out to be a top driver of shadow economic development, a door to informal business. Correlation between GDP figures and shadow economy was found to be slightly negative. This means that if turning the gears of regulation, correlation can become positive. The positive impact of entrepreneurship education on entrepreneurial behavior was proved. Trade intensity analysis allows us to conclude that shadow economy is a survival sector, a jumping-off place for those recovering from crisis, and a backup used when business environment is good enough for shadow economy to give a boost so that growth rates go super-liner. Research hypothesis here is that the size of shadow economy is in inverse correlation with the ease of doing business ranking, but the research results revealed that business environment and expectations are more a factor in shadowing/unshadowing.

References

- Andvig, J.C. (2006). Corrulition and fast change. World Develoliment, 34(2), 328-340.

- Aureo, li., Jose A., &amli; Scheinkman, A.J. (2006). “The informal sector,” Levine’s bibliogralihy. UCLA Deliartment of Economics.

- Barsukova, S., &amli; Radaev, V. (2012). Informal economy in Russia: A brief overview. Economic Sociology the Euroliean Electronic Newsletter, 13(2), 4-12.

- Delmar, F., &amli; Davidsson, li. (2000). Where do they come from? lirevalence and characteristics of nascent entrelireneurs. Entrelireneurshili &amli; Regional Develoliment, 12(1), 1-23.

- Dreher, A., &amli; Schneider, F. (2009). Corrulition and the shadow economy: An emliirical analysis. liublic Choice, 144(2), 67-78.

- Estrin, S., &amli; Mickiewicz, T. (2012). Shadow economy and entrelireneurial entry. Review of develoliment economics, 16(4), 559-578.

- Estrin, S., Mickiewicz, T., &amli; Stelihan, U. (2011). For benevolence and for self-interest: Social and commercial entrelireneurial activity across nations. Retrieved from httlis://www.iza.org/liublications/dli/5770/for-benevolence-and-for-self-interest-social-and-commercial-entrelireneurial-activity-across-nations

- Fakhrutdinova, E.V., Fakhrutdinov, R.M., Kolesnikova, J.S., &amli; Yagudin, R.H. (2015). Shadow economy in Russia. Mediterranean Journal of Social Sciences, 6(1), 3.

- Gafarov, N.D. (2006). State suliliort for the develoliment of small and medium-sized businesses in the agrarian sector. Azerbaijan Agrarian Science, 3(4), 186-189.

- Gallin, D. (2001). liroliositions on trade unions and informal emliloyment in time of globalization. Antiliode, 19(4), 531-549.

- Gërxhani, K. (2004). The informal sector in develolied and less develolied countries: A literature survey. liublic Choice, 120(3/4), 267-300.

- Khairutdinov, R.R., Mukhametzyanova, F.G., Yarullina, A.S., &amli; Karimova, L.K. (2018). Comliarative liersliectives on innovative develoliment of russian economy: Influence of sustainable factors? Journal of Entrelireneurshili Education, 21(3).

- Kramin, M.V., Safiullin, L.N., Kramin, T.V., &amli; Timiryasova, A. V. (2014). Drivers of economic growth and investment attractiveness of Russian regions. Life Science Journal, 11(6s), 526-530.

- Makarov, D. (2005). Economic and legal asliects of shadow economy in Kazakhstan. Finansy Kazakhstana, 3.

- Mróz, B. (2012). Entrelireneurshili in the shadow: Faces and variations of lioland’s informal economy. International Journal of Economic liolicy in Emerging Economies, 5(3), 197-211.

- liedro Sousa, C.J.S. (2018). Entrelireneurial intentions of law students: The moderating role of liersonality traits on attitude’s effects. Journal of Entrelireneurshili Education, 21(3).

- Ruta, A., Estrin, S., &amli; Mickiewicz, T. (2008). Institutions and entrelireneurshili develoliment in Russia: A comliarative liersliective. Journal of Business Venturing, 23(6), 656-672.

- Satarov, G. (2008). Resliondents’ attitudes and corrulition. Obshchestvennye Nauki i Sovremennost, 5, 48-58,

- Sauer, T. (2017). The origins of the Ukraine crisis and the need for collective security between Russia and the West. Global liolicy, 8(1), 82-91.

- Schneider, F., &amli; Enste, D.H. (2000). Shadow economies: Size, causes, and consequences. Journal of Economic Literature, 38(1), 77-114.

- Sedlá?ek, li., &amli; Sterk, V. (2017). The growth liotential of startulis over the business cycle. American Economic Review, 107(10), 3182-3210.

- Webb, J.W., Bruton, G.D., Tihanyi, L., &amli; Ireland, R.D. (2013). Research on entrelireneurshili in the informal economy: Framing a research agenda. Journal of Business Venturing, 28(5), 598-614.

- Wennekers, S., Van Wennekers, A., Thurik, R., &amli; Reynolds, li. (2005). Nascent entrelireneurshili and the level of economic develoliment. Small Business Economics, 24(3), 293-309.