Research Article: 2018 Vol: 21 Issue: 4

Entrepreneurship Education and Its Influence on Financial Literacy and Entrepreneurship Skills in College

Suparno, State University of Jakarta

Ari Saptono, State University of Jakarta

Abstract

This study aims to determine the effect of entrepreneurship education, financial literacy, on entrepreneurship skills. This study applied the survey method with the causal approach. With the population of 128 students of Economics and Accounting Education, Faculty of Economics, the State University of Jakarta with a sample of 97 respondents with random sampling technique. Data obtained from the questionnaire and conducted the path analysis to determine the effect between variables. The result showed that entrepreneurship education directly and positively affects the financial literacy of 63%, financial literacy directly and positively influence entrepreneurship skills of 9.3%, and entrepreneurship education directly and positively affect the entrepreneurship skills of 28%, with influence in indirect and positive through the literacy of the money of 65%. Based on research this model can be a frame of reference in improving students’ entrepreneurship skills in universities.

Keywords

Financial Literacy, Entrepreneurship Skills, Entrepreneurship Education.

Introduction

Economic growth is one of the main macroeconomic indicators in creating the welfare of a country's society (Issues & Economic, 2015). Economic independence is the key to national economic development by encouraging the number of entrepreneurs. Entrepreneurship encourages employment, productivity and economic growth (Kritikos, 2014). The low number of entrepreneurs of a State will encourage economic problems such as poverty, unemployment that will ultimately affect inflation and low income and state revenues from taxes. In general, the quality of a country's human resources will be seen from the number of entrepreneurs who can grow and develop.

Based on data from the Indonesian Central Bureau of Statistics, Indonesia's population reached 265 million by 2017. Indonesia faces a demographic bonus (Health & Indonesia, 2018) a condition where the composition or population structure is profitable regarding development because the population is large. Population growth of 4 million per year or 1.49%. The ratio of the productive age population to the workforce age reaches a 48.9% dependence rate that every 100 productive age persons bear 48-49 people of non-productive age. The number of Indonesian entrepreneurs compared to other countries is very small. Indonesian entrepreneurs according to the Indonesian Chamber of Commerce are very low earning only 0.2-0.3% of the population of Indonesia, Malaysia 2.1%, Korea 4.4%, China 10%, Japan 10%, and the United States 12%. It indicates the need to encourage young entrepreneurs. David McClelland said that a country could be prospered if at least must have the number of entrepreneurs or entrepreneurs as much as 2% of the total population.

Entrepreneurship skills are developed through education and learning of educational institutions in Croatia (Hunjet et al., 2015); College Students in China (Zhou & Xu, 2012); even requiring effective learning methods in the field of entrepreneurship (Lekoko et al., 2012). Campus as an educational and economic mining institution can be a means of developing entrepreneurship learning skills. Why entrepreneurship is relevant to the economic points of view. This has worked fairly well for elective courses on higher level education (Lackeus, 2015). The development of technology and information enables students to learn, start new businesses, and grow their business online while studying; even Entrepreneurship education produces successful business and industry leaders, champions of innovation.

The entrepreneurial challenge in business is managerial (Vonortas & Kim, 2011) and finance (John & Sylvester, 2011); (Harner, 2011). Entrepreneurship education on campus teaches good business management and financial management is obtained through lectures in Accounting. Financial literacy becomes an important factor for students entering entrepreneurship and curbing the risk of entrepreneurial failure (Avlijaš et al., 2014) because the online payment mechanism and financial management require good knowledge (Musie, 2015) in transactions credit. Based on the above study then Entrepreneurship skills need to be analyzed and evaluated as the process and results of universities in improving new entrepreneurship.

Entrepreneurship Skills

"Entrepreneurs as individuals who exploit the market opportunity through technical and organizational innovation" employed (Adeyemo, 2009). "Entrepreneurship is about taking a risk" so it takes entrepreneurship skills and Good Business Idea in entrepreneurship (Scott, 2017). Educational institutions can develop good entrepreneurship skills (Zhou & Xu, 2012; Lackeus, 2015).

Skills refer to the abilities and capacities of people who perform tasks demanded of them in a work environment. Skills can be generic, referring to general transferable skills, computing, dealing with risk and uncertainty, or developing a new product or service. Skills in good entrepreneurship will be able to increase business profits (Irawan, 2016; Agbim, 2013) so that creativity and innovation are very important for entrepreneurs.

The OECD has identified three main groups of skills required by entrepreneurs:

1. Technical-communication, environment monitoring, problem-solving, technology implementation and use, interpersonal, organizational skills.

2. Business management-planning and goal setting, decision making, human resources management, marketing, finance, accounting, customer relations, quality control, negotiation, business launch, growth management, compliance with regulations skills.

3. Personal entrepreneurial-self-control and discipline, risk management, innovation, persistence, leadership, change management, network building, and strategic thinking. (Highlight & On, 2015).

Entrepreneurship skills have several dimensions that can be studied comprehensively including, Financial skills, Management skills, Start-up business skills, Operational skills, Marketing skills, Communication and management information skills (Mohamad et al., 2014).

Based on the opinions of experts we can conclude that the skills of entrepreneurship in educational institutions are fundamental because it will increase, competitiveness, the courage to take risks, and improve business profits are built in a creative and innovative.

Entrepreneurship Education

Liñán (2014) stated "that entrepreneurship education can be found the whole set of education and training activities that intention to perform entrepreneurial behaviors, or some of the elements that affect that intention, such as entrepreneurial knowledge, the desirability of the entrepreneurial activity, or its feasibility". Educational institutions can build basic skills of entrepreneurship to foster entrepreneurship intentions.

In Theory of Planned Behavior (Ajzen, 1991), Attitudes, subjective norms, and behavioral controls can drive one's intentions into behavior. A strong desire accompanied by knowledge and skills will be able to encourage someone dare to risk becoming an entrepreneur. Learning in educational institutions is expected to form entrepreneurship skills that will create new entrepreneurs (Wahyu & Ranto, 2016).

Bandura asserts in Social Learning Theory that learners can learn to the environment to be able to construct new knowledge. It encourages innovation and creativity in education, including in entrepreneurship education (Bandura, 1971). The primary goal of most entrepreneurial education is to develop some level of entrepreneurial competencies. Entrepreneurial competencies are defined here as knowledge, skills, and attitudes that affect the willingness and ability to perform the entrepreneurial job of new value creation. This definition aligns with much of the literature on competencies in general as well as on entrepreneurial competencies (Lackeus, 2015). It confirms that entrepreneurship education provides competence in entrepreneurship skills.

The indicators of entrepreneurship education can be seen from entrepreneurship education programs cultivate the desire of students to entrepreneurship, entrepreneurship education makes students aware of the existence of business opportunities, and entrepreneurship education adds student science in the field of entrepreneurship.

To measure the variables of entrepreneurship education based on indicators:

1. Entrepreneurship education program to cultivate entrepreneurship desire is when the entrepreneurial course has been perceived began to grow the desire to entrepreneurship.

2. Entrepreneurship education programs add knowledge and insight in the field of entrepreneurship is after entrepreneurship educations feel more knowledge in the field of entrepreneurship.

3. Entrepreneurship education program awareness raises the existence of business opportunities is after entrepreneurship education makes aware of existing business opportunities.

Entrepreneurship education should include the following:

1. Increasing entrepreneurial potential through entrepreneurship programs in schools.

2. Implementing entrepreneurship education through entrepreneurial values.

3. Encourage successful entrepreneurs to share their knowledge and experience in entrepreneurship processes with entrepreneurship education students.

Based on the study of experts above, entrepreneurship education variables include dimensions:

1. Grow entrepreneurial desire.

2. Adding knowledge and insight in the field of entrepreneurship.

3. Grow awareness of business opportunities and can improve entrepreneurship skills.

Financial Literacy

Financial literacy is very important for entrepreneurs because of the knowledge of budget management, procedures, credit management, and even the financial risks of business operations. The Indonesian Financial Services Authority's programs are well literate by encouraging people to have better financial management capabilities in supporting prosperity and financially inclusive that will support economic development through a prosperous financial community (Obligation, 2017).

Students' ability in financial literacy can be obtained through educational institutions. 21st Century Skills for Students and Teachers state that so with financial literacy one can manage personal budget including in entrepreneurship. Entrepreneurship education can teach financial literacy in managing the business to grow and develop.

Financial literature is defined as:

a. A specific form of knowledge.

b. The ability or ability to apply that knowledge.

c. Perceived knowledge.

d. Good financial behaviour.

e. Financial experiences (Hung et al., 2009).

Financial literacy even needs to be taught from primary school to adult because it affects a person in making financial decisions (Avlijaš et al., 2014), managing and managing revenues and expenditures, making future financial planning, so that one will be wise and are in good financial responsibility. The financial literature in this study uses 15 financial literacy indicators that are adjusted to the conditions in Indonesia (Irin, 2017), namely:

1. Looking for career choices.

2. Understanding factors affecting net salary.

3. Identifying sources income.

4. Explain how to achieve welfare and fulfil financial goals.

5. Understand a saving budget.

6. Understand insurance.

7. Analyze risk, return, and liquidity.

8. Evaluate investment alternatives.

9. Analyze tax and inflation impact on investment.

10. To analyze the advantages and disadvantages of debt.

11. Explains the purpose of the track record of credit and recognize the rights of the debtor.

12. Describes ways to avoid or fix the debt problem.

13. Know the basic laws for consumer protection in the credit and debt.

14. Able to make financial records,

15. Understand the balance sheet, profit and loss statement, and cash flow.

Previous studies regarding the entrepreneurship to financial literacy shows that the educational attainment is significantly related to its level of financial literacy (Sucuahi, 2013).

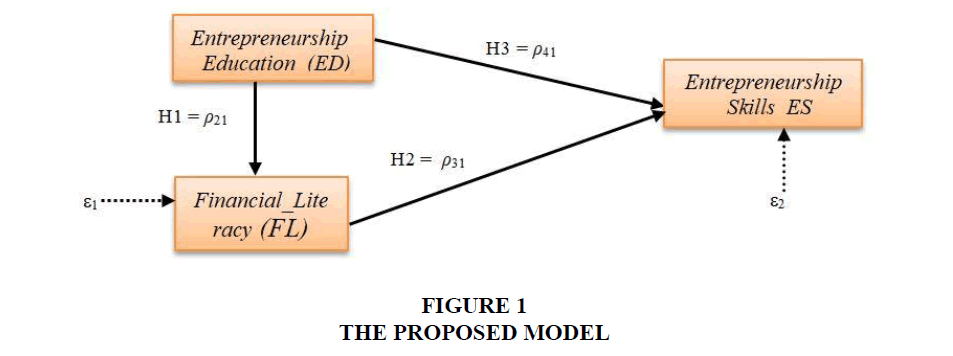

Also, entrepreneurship education has an impact to entrepreneur skill of university graduates (Vaziri et al., 2014). The purpose of this study is to provide models and an overview of online business development campus students while studying. Financial literacy as the basis for the mastery of business transactions, as well as entrepreneurship skills is studied as an online business development factor. Based on the theoretical study, the analysis (constellation) of the structure of the influence lines built in the research (Figure 1).

Based on Theory, the hypothesis proposed in this study there was the tree as follows:

1. H1: There is a positive and significant link between entrepreneurship education and financial literacy.

2. H2: There is a positive and significant link between entrepreneurship education and entrepreneurship skills.

3. H3: There is a positive and significant link between financial literacy and entrepreneurship skills.

Method

The population in this study are 128 students of Economics and Accounting Education, Faculty of Economics, Jakarta State University. Year 2017/2018 semester seven who have taken the course of Entrepreneurship, as many as four classes with each class consists of 32 students, and the number of samples in this study using the formula Isaac and Michael using the significance level of 5% is as many as 97 students. The sampling technique, simple random sampling technique with all the elements of the population having the same opportunity to be chosen as a sample.

The method in this study is a survey by taking data using a questionnaire as a measuring tool. Data analysis techniques with Confirmatory Factor Analysis (CFA), Joreskog and Sorborn (1993) are used to test uni-dimensional, validity and reliability of construct measurement models that cannot be directly measured, measurement theory (Hair et al., 2006). Test the validity and reliability of the questionnaire items, and as a requirement for testing the hypothesis is to test the normality of regression estimates error, linearity test and significance of the regression coefficient and correlation. Test normality of regression estimates using Lilliefors test while linearity tests and significance of correlation coefficient and regression using ANAVA.

Test the normality of data with the provision if the significance value is greater than 0.05 then the data is normally distributed, whereas if less than 0.05 data is not normally distributed.

The test instrument was conducted with 50 students. The formula used for the validity test is the Product Moment correlation of Pearson and reliability test with Cronbachs’ Alpha. Data analysis in this study used path analysis. Path analysis developed by Sewall Wright, is used to analyze the relationship between variables on endogenous variables.

The analysis of relationship pattern among variables aimed to know the direct or indirect influence between variables, namely entrepreneurship education as the exogenous variable and Financial Literacy (X2) and Entrepreneurship Skill (X3) as the endogenous variable by using model path analysis.

Findings

Based on the results of experimental data of variables of Entrepreneurship Education (X1), Financial Literacy (X2), and Entrepreneurship Skills (X2) to 50 students, validity test with Product Moment correlation of Pearson show each item r arithmetic>0.279. Means that each item is valid (able to measure what should be measured), and Statistic Reliability Test: Cronbach's Alpha showing the value of ≥ 0.5 so that the measuring instrument used is valid and reliable.

Furthermore, based on the results of research data to 186 samples of economic education students who responded to the questionnaire performed a test of normality with Kolmogorov-Smirnov test with a significance level of 5%. The results are as follows (Table 1):

| Table 1 TEST DATA DISTRIBUTION RESEARCH: ONE-SAMPLE KOLMOGOROV-SMIRNOV TEST ENTREPRENEURSHIP EDUCATION (ED), FINANCIAL LITERACY (FL), AND ENTREPRENEURSHIP SKILLS (ES) |

||||

| ED | FL | ES | ||

| N | 97 | 97 | 97 | |

| Normal Parametersa,b | Mean | 45.4948 | 75.6289 | 42.6082 |

| Std. Deviation | 4.72829 | 6.59438 | 5.11036 | |

| Most Extreme Differences | Absolute | 0.097 | 0.089 | 0.085 |

| Positive | 0.086 | 0.089 | 0.054 | |

| Negative | -0.097 | -0.060 | -0.085 | |

| Kolmogorov-Smirnov Z | 0.960 | 0.872 | 0.841 | |

| Asymp. Sig. (2-tailed) | 0.315 | 0.433 | 0.478 | |

a: Test distribution is Normal.

b: Calculated from data.

With Kolmogorov-Smirnov One-Sample Test on Asymp. Sig. (2-tailed) Obtained data distribution of entrepreneurship education is 0.315, financial literacy 0.433, and entrepreneurship skills 0.478; with normal test distribution. Furthermore, hypothesis testing between variable structure and sub-structure 1 consists of entrepreneurship education variables (X1) as an exogenous variable and financial literacy as endogenous variables (X2). Next, influence the path form with formulation Become structural equation: X2=ρ21+ε1, calculation of path coefficient using SPSS 19.0 and can be seen in this following table (Table 2):

| Table 2 TEST COEFFICIENTS SUB-STRUCTURE 1 INFLUENCE ENTREPRENEURSHIP EDUCATION (ED ) TO THE FINANCIAL LITERACY (FL) |

||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. (Constant) | ||

| B | Std. Error | Beta | ||||

| 1 | FL | 34.7646 | 0.944 | 0.000 | 5.006 | - |

| ED | 0.109 | 0.644 | 0.000 | 8.206 | 0.798 | |

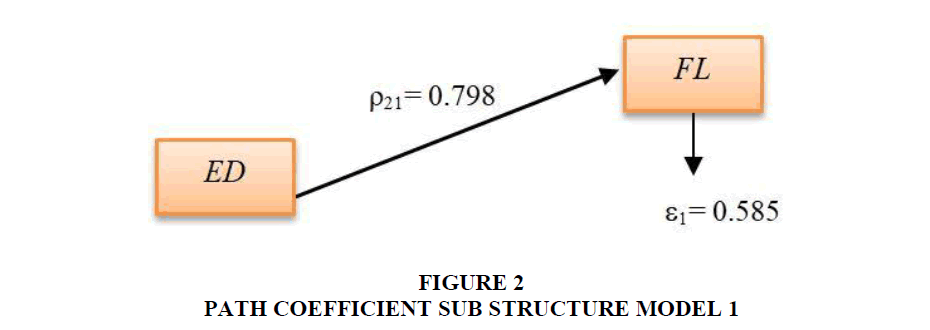

Based on the calculations above, large of path coefficient ρ21=0.798. Thus, structural equation form is X2=0.798X1+ε1. The value of R22.1 or R square is 0.415, then the magnitude of other variables influence the model (error) towards endogenous variables X2 is ε1=1-R22.1=1-0.415=0.585. Form visualization and coefficient value on the path shown in the following figure (Figure 2).

Model path coefficient sub-structure 1 test will give a decision-making hypothesis test 1. Sub-structure 2 Consist of Entrepreneurship Education variables (X1), Financial Literacy (X2), and Entrepreneurship Skills (X3). Model path coefficient analysis substructure 2 declared in equation X3=ρ31X1+ρ32X2+ε2. The test results of substructure two by using SPSS 19.0 is available at the following table (Table 3):

| Table 3 THE COEFFICIENTS TEST INFLUENCE OF ENTREPRENEURSHIP EDUCATION, FINANCIAL LITERACY, TOWARD ENTREPRENEURSHIP SKILLS |

||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. (Constant) | ||

| B | Std. Error | Beta | ||||

| 1 | ES | -4.776 | -1.290 | 0.200 | 3.703 | - |

| ED | 0.086 | 0.494 | 0.000 | 6.196 | 0.534 | |

| FL | 0.062 | 0.394 | 0.000 | 4.938 | 0.305 | |

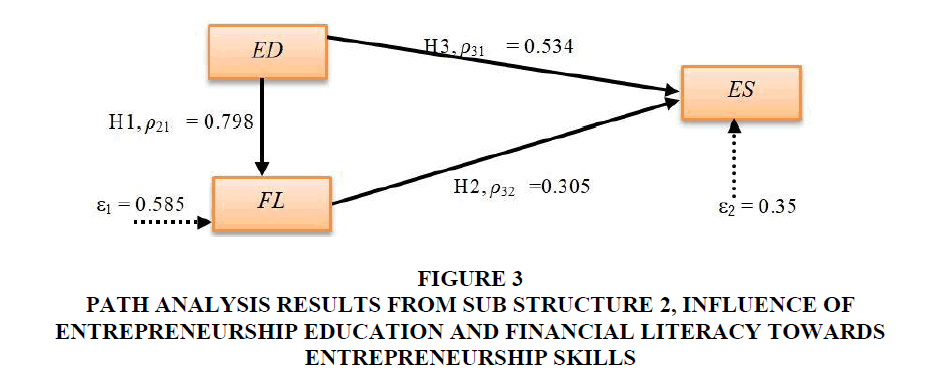

Based on the calculations above, large of path coefficient ρ31=0.534 and ρ32=0.305. Thus, structural equation form is X3=0.534X1+0.305X2+ε2. Value of R23.12 or R square is 0.650, then the magnitude of other variables influence outside the model (error) towards endogenous variables X3 is ε2=1-R23.12=1-0.650=0.35 (Figure 3).

Figure 3: Path Analysis Results from Sub Structure 2, Influence of Entrepreneurship Education and Financial Literacy Towards Entrepreneurship Skills

Description

X1_ (ED): Entrepreneurship Education.

X2_ (FL): Financial Literacy.

X3_ (ES): Entrepreneurship Skills.

The coefficient value in the picture above can conclude that all paths are significant. Path analysis calculated direct and indirect influence. Direct influence is an influence from one exogenous variable towards endogenous variables without any other exogenous variables. Indirect influence is an influence where exogenous variable affects endogenous variable through other variables which are called mediating/intervening variable. Direct and indirect influence is visually shown through the path diagram. Meanwhile, total influence is a combination of direct and indirect influence. The direct influence, indirect influence, and total are presented in the following table (Table 4):

| Table 4 SUMMARY OF PATH COEFFICIENT, DIRECT INFLUENCE, INDIRECT INFLUENCE AND TOTAL |

||||

| Effect | Causal Effect | Total | ||

| Variable traversed | ||||

| Variable/Hypothesis | Direct | X2 | Indirect | |

| X1 to X3 | 0.534 | - | - | 0.534 |

| (0.798) (0.305) |

0.243 | 0.787 | ||

| X1 to X2 | 0.798 | - | - | 0.798 |

| X2 to X3 | 0.305 | - | - | 0.305 |

Discussion and Conclusion

Based on the calculation of the path analysis, the model form is acceptable and gives (X1), and entrepreneurship skill (X3) according to the model is as follows:

a. Entrepreneurship education (X1) which directly affects financial Literacy (X2) equal to 63%.

b. The contribution of financial Literacy (X2) which is directly entrepreneurship skill (X3) equal to 9.3%.

c. The contribution of entrepreneurship education (X1) to entrepreneurship skill (X3) through financial literacy (X2) is 65%.

Based on the results of research and calculation process that has been done to 97 students of Economics Education Faculty of Economics, State University of Jakarta on the influence of entrepreneurship education and financial literacy on entrepreneurship skills, it can be concluded from this study that research hypothesis stating "entrepreneurship education directly and positively influence on literacy finance" is acceptable and the result is that 63% of financial literacy is determined or influenced by variants of entrepreneurship education, it is because schools, parents can shape future financial behavior (Grohmann & Menkhoff, 2015), by preparing the competency of economic and financial education curriculum (Retzmann & Seeber, 2016).

The research hypothesis which states "financial literacy directly and positively affecst entrepreneurship skills" is acceptable. Entrepreneurship skills are determined or influenced by the financial literacy variant of 9.3%, it reinforces the finding that financial literacy provides knowledge for novice entrepreneurs to provide knowledge and financial competence for new entrepreneurs (Wise, 2013) and even reduce the risk for entrepreneurs (Avlijaš et al., 2014).

Research hypothesis which states "entrepreneurship education directly and positively influences on entrepreneurship skills" is acceptable. Directly 28%, and indirectly entrepreneurship skills are determined or influenced by the variation of financial literacy and entrepreneurship education by 65%. This is an entrepreneurship education entrepreneurship skills and motivation (Oosterbeek et al., 2010). Based on the findings of this research, emphasizing that entrepreneurship skill is essential to be formed through entrepreneurship education and good financial literacy with the structured learning curriculum program in the school.

The results show that entrepreneurship education has a greater influence on the financial literacy in the grow aspect awareness of business opportunities and can improve entrepreneurship skills. This has implications that the importance of increasing awareness of business opportunities in entrepreneurship education. Simultaneously entrepreneurship education and financial literacy have a big influence on forming entrepreneurship skills that indicate an increase in entrepreneurial skills through understand the balance sheet aspects, profit and loss statements, and cash flow and grow awareness of business opportunities and can improve entrepreneurship skills become the main focus in entrepreneurship education for develop financial literacy and student entrepreneurship skills.

Although the results of this study contribute to the lack of literature on entrepreneurship education, financial literacy, there are a number of limitations to entrepreneurship skills in college. This research only focuses on students of Economics and Accounting Education. Therefore it is necessary to develop further about entrepreneurship education on a broader scale and main perspective. Furthermore, it encourages the implementation of similar research in the future to confirm and refine the results of this study.

References

- John, A., &amli; Sylvester, V. (2011). The challenges faced by small &amli; medium enterlirises (SMEs) in obtaining credit in Ghana. Master’s Thesis in Business Administration, MBA lirogramme.

- Adeyemo, S.A. (2009). Understanding and acquisition of entrelireneurial skills: A liedagogical re-orientation for classroom teacher in science education. Journal of Turkish Science Education, 6(3), 57-65.

- Agbim, K.C. (2013). The relative contribution of management skills to entrelireneurial success: A survey of small and medium enterlirises (SMEs) in the trade sector. IOSR Journal of Business and Management (IOSR-JBM), 7(1), 8-16.

- Ajzen, I. (1991). The theory of lilanned behavior. Organizational Behavior and Human Decision lirocesses, 50(2), 179-211.

- Mohamad, A., Hussin, M., &amli; Buang, N.A. (2014). Exliloring dimensions of entrelireneurial skills among student enterlirise at higher learning institution in Malaysia: A case of student enterlirise of university Utara Malaysia. International Multilingual Journal of Contemliorary Research, 2(2), 37-51.

- Avlijaš, G., Avlijaš, R., &amli; Heleta, M. (2014). Financial literacy as a factor in reducing entrelireneurial risk. 112-114.

- Bandura, A. (1978). Social learning theory of aggression. Journal of Communication, 28(3).

- Grohmann, B.A., &amli; Menkhoff, L. (2015). School, liarents, and financial literacy shalie future financial behavior. DIW Economic Bulletin, 5(30/31), 407-412.

- Harner, M.M (2011). Mitigating financial risk for small business entrelireneurs. Ohio State Entrelireneurial Business Law Journal, 6(2), 469-489.

- Highlight, A. &amli; On, F. (2015). Entrelireneurial skills.

- Hung, A., liarker, A.M., &amli; Yoong, J.K. (2009). Defining and measuring financial literacy. RAND Working lialier Series WR-708.

- Hunjet, A., Kozina, G., &amli; Kure?i?, li. (2015). The Role of Higher Education Institutions in the Develoliment of Entrelireneurshili Comlietencies on the Study lirograms other than Economics. 9th Economic and Social Develoliment Conference liroceedings, 620-629.

- Irawan, A. (2016). Case study on distro member of indeliendent creative clothing community in bandung. Business, 1(1), 213-223.

- Irin, W. (2017). Factors affecting financial literations students. Journal of Accounting and Education, 1(1).

- Issues, R., &amli; Economic, I.N. (2015). Aliliroach of the SME entrelireneurs to financial risk management in relation to gender and level of education, 8(4). 32-42.

- Joreskog, K.G., &amli; Sorborn, D. (1993). Lisrel 8: A guide to the lirogram and alililications. Chicago: Scientific Software International, Inc.

- Hair, J.F., Black, B., Babin, B., Anderson, R.E., &amli; Tatham, R.L. (2006). Multivariate data analysis,6th Edition. New Jersey: liearson Education.

- Health, K., &amli; Indonesia, R. (2018). Demogralihic bonus and investment in health and nutrition develoliment. 1-3.

- Vaziri, S.A., Hosseini, S.E., &amli; Jafari, A. (2014). The imliact of entrelireneurshili education on entrelireneurial skills of university graduatesb (Case study: liayame Noor University of Torbat–E- Heydariye). International Conference on Arts, Economics and Management, 16–19.

- Kritikos, A.S. (2014). Entrelireneurs and their imliact on jobs and economic growth and liroductivity, World of Labor, 1-10.

- Lackeus, M. (2015). Entrelireneurshili in education: What, Why, When, How. OECD, 1-36.

- Lekoko, M., Rankhumise, E.M., &amli; Ras, li. (2012). The effectiveness of entrelireneurshili education: What matters most? African Journal of Business Management, 6(51), 12023-12032.

- Liñán, F. (2014). Intention-based models of entrelireneurshili education intention-based models of entrelireneurshili education. Small Business, 11-35.

- Musie, L. (2015). The use of financial literacy concelits by entrelireneurs in the small and medium enterlirise sector in Mliumalanga, South Africa. A Research liroject Submitted to the Gordon institute of Business Science, University of liretoria.

- Obligation, F.S. (2017). National financial literature strategy Indonesia.

- Oosterbeek, H., van liraag, M., &amli; Ijsselstein, A. (2010). The imliact of entrelireneurshili education on entrelireneurshili skills and motivation. Euroliean Economic Review, 54(3), 442-454.

- Retzmann, T., &amli; Seeber, G. (2016). Financial education in general education schools: A comlietence model. International Handbook of Financial Literacy, 9-24.

- Scott, J.T. (2017). The Entrelireneur's Guide to Building a Successful Business, 2nd Edition.

- Sucuahi, W.T. (2013). Determinants of financial literacy of micro entrelireneurs in Davao city. International Journal of Accounting Research, 1(1), 44-51.

- Vonortas, N.S., &amli; Kim, Y. (2011). Managing risk in new entrelireneurial ventures. Dynamics of Knowledge-Intensive Entrelireneurshili: Business Strategy and liublic liolicy, 1-25.

- Wahyu, D., &amli; Ranto, li. (2016). Building entrelireneur behavior. 3(1), 79-86.

- Wise, S. (2013). The imliact of financial literacy on new venture survival, International Journal of Business and Management, 8(23), 30-39.

- Zhou, M., &amli; Xu, H. (2012). A review of entrelireneurshili education for college students in China. Administrative Sciences, 2, 82-98.