Research Article: 2020 Vol: 24 Issue: 2

Entrepreneurial Orientation and Survival of Small and Medium Enterprises in Nigeria: An Examination of the Integrative Entrepreneurial Marketing Model

Cosmas Anayochukwu Nwankwo, University of KwaZulu-Natal

Macdonald Kanyangale, University of KwaZulu-Natal

Abstract

The challenge associated with the adoption of entrepreneurial marketing model for effective management of small and medium enterprises in Nigeria has drawn diverse views. Despite the debates, studies conducted in the past have leveraged on existing EM model which has not significantly contributed to SMEs survival in Nigeria. This paper aims at evaluating the entrepreneurial orientation (EO) of the integrated EM model to find out its contribution to SMEs survival in Nigeria. The study is a quantitative study which adopted a positivism paradigm. The study randomly selected 364 owner-managers of manufacturing SMEs in south-east geo-political zone of Nigeria. From the data obtained, EO significantly contributed to the survival of SMEs in Nigeria. Based on the result, the study recommended that integrative EM model should be adopted by both the owners and managers of SMEs as this would help reduce the rate of business failure in Nigeria.

Keywords

Entrepreneurial Orientation, Innovativeness, Proactiveness, Calculated Risk-Taking, Resources Leveraging, Integrative EM Model.

Introduction

One of the fundamental factors identified in developing and the developed economy is the adoption of a well-defined business orientation in small and medium enterprises (SMEs). SMEs are focal as the backbone of the economy of Nigeria not because it constitutes about 87 percent of all enterprises, but because, it contributes to about 61 percent of the Gross Domestic Product (GDP) (Effiom & Edet, 2018). In spite of this, it is critical for SMEs in Nigeria to effectively maintain a steady growth and survival due to persistent organisational and environmental challenges like lack of access to adequate and affordable finance, poor infrastructure, lack of basic business knowledge, skills and attitude; high operating costs, poor attitude to marketing activities, government policy, and above all, lack of entrepreneurial orientation (Arisi-Nwugballa et al., 2016). Similarly, the current trend of the global business environment has led to tight competition for SMEs and this has become unavoidable for them, despite their operations and sizes (Aroyeun et al., 2019).

Studies conducted within the last decade revealed that the sustainability of SMEs in both developed and developing nations like Nigeria could be traced to the effective implementation of entrepreneurial orientation (Brownhilder & Johan, 2017). Though SMEs sector in developing countries is relatively associated with failure due to the bad qualities possessed by owners and managers of these businesses, also many of these owners and managers do not possess the same degree of preference for innovation, proactiveness, calculated risk-taking, and resources leveraging skills (Ayeni-Agbaje & Osho, 2015). However, efforts have been made by business owners, managers and government at all levels to reduce the persistent failure of SMEs, but despite these huge efforts, there is still poor survival rate of SMEs in developing countries like Nigeria.

Given the poor survival rate and attitude of SMEs towards marketing as well as the total neglect of the sector, researches carried out in Nigeria and beyond have started to consider how the existence of SME’s can be sustained using entrepreneurial marketing (EM) models. In this pursuit, majority of the previous studies adopted Morris, Schendehutte & Laforge (2002) sevendimensional model of EM because of the amplification or elaborate way of operationalizing the key construct (Olaniyan et al. 2017). Therefore, a new and integrative EM model developed by Nwankwo & Kanyangale (2019) had adapted some basic components of Morris et al. (2002) EM model to address the many challenges that have resulted to the failure of many SMEs in developing countries, particularly in Nigeria.

This paper aims to evaluate the survivability of SMEs using EO dimensions of the new integrative EM model which could enhance the long-term survival of SMEs in developing countries, especially in Nigeria. This integrative EM model has the potential to inform SME stakeholders, especially SME owners in Nigeria and developing countries, to focus on developing competencies and build the necessary capacity to survive in a VUCA (Volatile, Uncertainty, Competitive and Ambiguous) market. The paper also adds a new EM model to the existing body of knowledge, consequently stimulating and contributing to the direction of further empirical research in developing countries.

The paper also conceptualised the core EO dimensions, before focusing on the methodology used in this paper. Subsequently, findings were presented to reflect on the state of manufacturing SMEs in Nigeria as well as limitations and recommendations.

Literature Review

Entrepreneurial Orientation

Entrepreneurial orientation (EO) is described as a firm-level tactical orientation which captures a firm's strategy-making exercise, managerial philosophies, and behaviours that are entrepreneurial (Anderson et al., 2009). Firms are said to having EO when they support and exhibit entrepreneurial behavior to become a distinctive organizational attribute and attribute (Covin & Wales, 2019). One of the similarities among past EO research is the inclusion of proactiveness, innovativeness, and calculated risk-taking as central aspects or dimensions of the orientation (Wales, 2016, 2013).

In the past, EO has largely been measured using a nine-item psychometric instrument developed by Dennis Slevin & Jeff Covin (Wales, 2015). This measurement tool captures the viewpoint of Danny Miller that EO is a ‘collective catchall’ construct which signifies what it means for a firm to be termed entrepreneurial across a broad range of contexts (Miller, 1983). A seminal quote from Miller (1983):

“In general, theorists would not call a firm entrepreneurial if it changed its technology or product line simply by directly imitating competitors while refusing to take any risks. Some proactiveness would be essential as well. By the same token, risk-taking firms that are highly leveraged financially are not necessarily entrepreneurial. They must also engage in the product market or technological innovation."

Therefore, reviews of extant EO research shows that most of the previous studies have adopted Miller's viewpoint of EO as the combination of proactiveness, innovativeness, and calculated risk-taking (Zhai et al., 2018). Research on the individual dimensions of calculated risk-taking, proactiveness, innovativeness, and resources leveraging have found that the dimensions can be linked in different ways to form configurations (Linton & Kask, 2017, 2016). As a strategic orientation of business, EO improves a firm’s performance as well as overall variance. Wales (2015) added that EO as an essential firm strategic orientation, the depth, and breadth of research on EO continues to grow as the concept is adopted to understand the effects of being entrepreneurial across all facets (Wales, 2015). The dimensions of EO in the integrative EM model are discussed below:

Proactiveness

Proactiveness has been described in many ways and different context. Therefore, being proactive as drawn from Merriam-Webster's dictionary implies "controlling a situation by making things happen or by preparing for possible future problems" (Merriam-Webster, 2015). In the case of entrepreneurial marketers, it is intrinsic to proactively act with customers and the market (Holmes & Jorlöv, 2015). Thal (2016) simply describe proactive behavior as acting in advance of future circumstances, rather than just reacting. This entails taking control and making things work rather than just adjusting to circumstances or waiting for something to work naturally. In most modern enterprises, it is not enough for the employee to respond and adjust to changes in their environment. They need to plan and prepare for potential pressure and dangers in the future by taking the bold step today (Belschak & Den-Hartog, 2010). Research by Anderson et al. (2015) revealed that engaging in proactive behaviour comes with valuable results. Though sometimes a person's proactivity may result in negative effects, such as increased stress. Olannye and Eromafuru (2016) described proactiveness is an “entrepreneurial willingness to dominate competitions through a combination of proactive and aggressive moves, e.g. introducing new products or services ahead of the competition and acting in anticipation of future demand to create change and shape the environment”. Mehran & Mortezea (2013) stated that being proactive involves discovery and satisfying the latent unarticulated needs of customers through collecting customers and competitor-based information. Proactiveness is achievementdriven, highlighting anticipating, initiatives taking, creating change, and predicting evolution towards a critical situation and early preparation before the occurrence of an impending uncertainty or risk (Olannye & Eromafuru, 2016). A proactive firm is one that places greater efforts on forward-thinking as opposed to reactive strategies to deal with challenges or to approach opportunities as they arise.

Innovativeness

The word “innovation” is derived from the Latin word innovare, which means “new” (Stenberg, 2017). The simplest definition of innovations is doing something different (Farniha, Ferreira & Gouveia, 2016). Innovation can also be described as a method and technology for new markets, new production methods and identification of new customer groups (Baskaran & Mehta, 2016). This implies that firms, irrespective of their size, need to innovate, to promptly respond to changing customer needs and market conditions and capitalize on the emerging opportunity (Baregheh et al. 2009). They further noted that the scope of the firm's innovation is broad and includes products, service, processes, operations, and people. Innovation is a core marketing task and an important means of sustaining a competitive advantage in the market (Sardana, 2016). "Entrepreneurs continually champions new approaches to market segmentation, pricing, brand management, packaging, customer relationship and communication management, service level and operational activities” (Mayasari et al., 2009). The remit of EM concept is that entrepreneurial firms should focus on innovation and development of ideas that reflect a good understanding of market needs. Innovations make little contribution to the firms unless they also offer customer benefits (Denicoló & Zanchettin, 2016). Specifically, EM helps to sustain innovation by identifying a market opportunity, generating concept, providing technical support and leveraging on the firm's resource base to support innovation (Morris et al., 2002). While few SMEs grow through breakthrough innovation, many of them through the owner-manager grow by implementing small and regular improvements to their business (Olannye & Eromafuru, 2016). Indeed, owner-manager and customers are both vital in EM to provide directions for the culture, strategy, and behaviour of business (Ionita, 2012).

Calculated Risk-Taking

The concept of risk-taking has long been applied in academic literature. Niklas Luhmann, a sociologist considers the term 'risk' as a neologism that transited from traditional to modern ideology. Allah & Nakhaie (2011) recount that in the Middle-Ages, the term residuum was used in substantially defined circumstances to describe all sort of sea trade and its resultant legal problems of damage and loss. In the 16th century, the words riezgo and rischio were used to describe “loss and damage” (Aven 2014). These words were introduced to continental Europe, through collaboration with North African Arab and Middle Eastern traders. In the English language, the word “risk” emerged only in the 17th century and appears to be introduced from continental Europe (Bijloos, 2017). However, when the term risk started gaining ground, it changes the older notion of loss, damage, and bad fortune. Risk-taking is defined as the tendency of engaging in behaviours that have the potential to be dangerous or harmful yet provides the opportunity for the outcome that can be perceived as positive and helpful (Allah & Nakhaie, 2011). Kapepa & Van Vuuren (2019) defined risk-taking “as the tendency to take bold decisions such as venturing into unknown new markets, committing a large portion of resources to ventures with uncertain outcomes and/or borrowing heavily with a chance to fail". Risk-taking is regularly used to explain the uncertainty that brought about entrepreneurial behaviour (Olaniran et al., 2016). Hosseini et al. (2018) observed that the risk-taking dimension of EO captures the degree to which the organization's processes involve and/or ignore risks. Taking risk involves engaging in manageable and calculated risks to obtain benefits, rather than taking bold risks which are disadvantageous to firm performance and survival (Morris et al., 2008). Risk-taking could be described as the willingness to commit substantial resources to opportunities having in mind a reasonable chance of costly failure and willingness to discontinue from the tried-and-true path (Bijloos, 2017).

Resource Leveraging

Resource leveraging is one of the prevalent dimensions in models of EM. This is key as SMEs have few resources available to meet numerous and various internal (e.g. employees) and external needs(e.g. customers, regulators). EM adopters are not inhibited by resources currently in their disposal as they use several ways to leverage resources. These include: stretching resources much further than competitors do; making usefully the resources others are unable to realize; using other people's resources to achieve one's own goal; combining two firms’ resources to create higher value; using certain resources to obtain other resources and recycling.

Leveraging is an operational construct both in physical and applied sciences and in the field of business. In many areas of human existence, leveraging is applied without the clear articulation of its functionality. Leverage is a business terminology that refers to how a firm obtains new assets for start-up or expansion (Idemobi, 2016). For instance, if a firm is "leveraged", it simply means that the firm has borrowed a given number of resources to support its growths. The concept of leverage in business is associated with the principle in physics which denotes that a lever can give the user a mechanical benefit of being able to lift or move objects that could not have been moved. In the same vein, firms can use leverage to propagate the firm's growth through the acquisition of resources, something that could not be done without the added benefit of additional resources. Holmes & Jorlöv (2015) describe resources leveraging as the use of a firm’s available resources creatively and effectively to achieve challenging goals. Morris, et al. (2002) is explicit that leveraging means "doing more with less". Leveraging entails that the firm capitalizes on the resources they have by linking, blending and bunding them in a creative manner that promotes efficiency, innovation, or both (Kurzhals, 2015). In leveraging, a firm can use intangible, or tangible resources or both. Otika et al. (2019) observed that the process of leveraging gives a firm a competitive advantage.

Methodology

The study adopted positivism as the research paradigm. Using a quantitative research design, stratified random sampling was employed to select owner-managers of manufacturing SMEs in the South-East geo-political zone of Nigeria. A survey was used to collect data via a structured questionnaire administered to 364 owner-managers. Cronbach’s alpha coefficients were used to test the reliability after a pilot study had been conducted. Exploratory fact analysis and confirmatory factor analysis were used to validate the findings. Structural equation modelling (SEM) was applied to test the hypotheses using IBM SPSS-AMOS version 25. To achieve this, preliminary investigation of multivariate variables was also conducted to avoid violation of the assumptions of homoscedasticity, linearity, multicollinearity and normality. The following measures were employed for the preliminary test, chi-square value was used to evaluate the general fitness of the model as well as the extent of inconsistency between the covariance matrices and sample. In this paper, the corresponding P-value and the degree of freedom were reported, and the accepted rule indicates that normed-chi-square value (CMIN/DF) must not be greater than 5.

The goodness of fit index (GFI) and the adjusted goodness of fit index (AGFI) are alternative measurement for assessing the degree of variance that originates from the estimated population covariance and the fitness of the structural model. The value for GFI and AGFI starts from 0 to 1, in which an acceptable indicator of good fit ranges from 0.8 to above 0.9. Root mean square error of approximation (RMSEA) is another important tool for measuring the fitness of a model used in this paper. The value goes from 0.05 to 0.1, where values less than 0.08 indicates a fit estimation.

The normed fit index (NFI) is the incremental fit index utilised in this paper to inspect the fitness of the model. This tool compares the chi-square values of the model and the null model. The values range from 0 to 1 which suggest that for model to be regarded as good fit, the values must be greater than 0.9. Similarly, comparative fit index (CFI) is a modified form of NFI. Nevertheless, a CFI value of greater than or equal to 0.9 shows good fit, while a CFI value of greater than or equal to 0.95 indicate a perfect fit. Other incremental fit indexes utilised to measure the fitness of models in this paper were the Incremental Fit Index (IFI) and Tucker– Lewis Index (TLI).

Data Analysis

The hypothesis rose in this paper states that owner-manager EO has no significant effect on the survival of SMEs.

However, some dimensions of EM were used as a measurement scale for EO. These dimensions include: innovativeness, proactiveness, calculated risk-taking, and resources leveraging. The psychometric scales obtained through EFA as illustrated in Table 1 below shows the factor loading and other scales.

| Table 1 Exploratory Factor Analysis on the Measurement of Entrepreneurial Orientation | ||||

| Item | Mean | SD | Factor loading | Item total correlation |

| Entrepreneurial Orientation | ||||

| Factor 1 (Innovativeness) | ||||

| Understanding the customers and their respective needs | 4.08 | 1.086 | 0.679 | 0.512 |

| Ability to identify fresh and innovative approaches to existing situations | 4.27 | 0.644 | 0.632 | 0.426 |

| SMEs owner/manager places a strong emphasis on new and innovative products/services. | 4.15 | 0.793 | 0.613 | 0.372 |

| The anticipation of change and perceive trends before it becomes apparent to others | 3.85 | 1.219 | 0.581 | 0.275 |

| The anticipation of future consequences or implications of current situations or events | 4.27 | 0.813 | 0.514 | 0.788 |

| Factor 2 (Proactiveness) | ||||

| SMEs who are entrepreneurial introduces new services/products/processes regularly | 3.18 | 1.229 | 0.768 | 0.618 |

| SMEs owner/manager always have a new strategy to create wealth | 3.97 | 1.036 | 0.733 | 0.928 |

| SMEs who are entrepreneurial are usually the first to introduce new products/services. | 3.88 | 1.08 | 0.714 | 0.646 |

| SMEs owner/manager has increased the number of services/products offered during the past two years. | 4 | 0.851 | 0.552 | 0.779 |

| SMEs owner/manager typically initiates actions that competitors respond to. | 3.82 | 1.073 | 0.538 | 0.337 |

| Factor 3 (Calculated Risk-taking) | ||||

| All relevant risk areas are considered including those coming from the services of external providers and contractors | 3.15 | 1.237 | 0.747 | 0.592 |

| The entrepreneurial business has a strong predisposition towards high-risk projects. | 3.9 | 1.062 | 0.721 | 0.662 |

| Employees in entrepreneurial business are often encouraged to take calculated risks concerning new ideas | 4.07 | 0.81 | 0.709 | 0.762 |

| SMEs owner/manager does not fear to invest money on a project whose risk has been calculated | 4.17 | 0.862 | 0.655 | 0.826 |

| SMEs owner/manager prefer low-paid employee with apparent job security | 3.87 | 1.075 | 0.653 | 0.766 |

| Factor 4 (Resources Leveraging) | ||||

| SMEs owner/manager complement one’s resources with another to create higher combined value | 3.95 | 0.978 | 0.723 | 0.532 |

| I make a decision considering our current situation and the potential benefits of this decision | 3.85 | 1.054 | 0.666 | 0.474 |

| Depending on the situation, SMEs owner/manager use sourcing and outsourcing. | 3.45 | 1.336 | 0.537 | 0.32 |

| SMEs owner/manager put profitably in use the resources others are unable to utilize | 4.43 | 0.615 | 0.523 | 0.311 |

| KMO = 0.877; X2 = 4897.741; DF= 171; P ˂0.000; Cronbach’s α = 0.926; Percentage of variance explained = 57.504%. | ||||

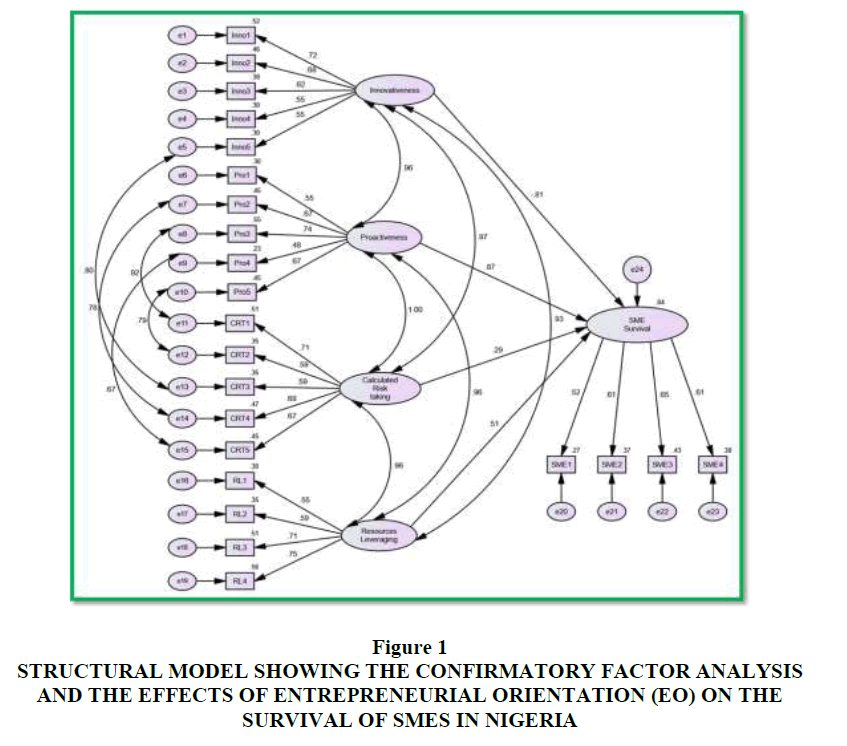

The internal consistency of factors and their respective items derived from the EFA were analysed differently using Cronbach’s alpha coefficient through IBM SPSS statistics version 25. The Cronbach’s alpha coefficients are as follows; innovativeness (0.753), proactiveness (0.780), calculated risk-taking (0.783) and resources leveraging (0.726). A factor consisting of four items measurement of the survival of manufacturing SME produced an internal consistency of 0.679. Based on the results of the EFA, part of the integrative EM model was examined via the model measurement shown in Figure 1.

Figure 1 Structural Model Showing the Confirmatory Factor Analysis and the Effects of Entrepreneurial Orientation (EO) on the Survival of Smes in Nigeria

Chi-square = 423.189, DF = 216, p-value = 0.000, CMIN/DF = 1.959, GFI = 0.908, AGFI = 0.883, NFI = 0.924, IFI = 0.962, TLI = 0.955, CFI = 0.961, RMSEA = 0.051.

The above Figure illustrates the Confirmatory Factor Analysis (CFA) and structural model of the effects of EO on the survival of manufacturing SMEs in Nigeria. The CFA of all unobserved constructs, which were examined as shown in Figure 1, produced the goodness-of-fit indexes. Statistically, all factor loadings in the measurement model were significant at p ˂ 0.001, which also confirmed the validity of the model measurement. This implies that EO has a significant effect on the survival of manufacturing SMEs in Nigeria. Mindful of the raised hypothesis, four subhypotheses were drawn from it. They are:

Ho1: Innovativeness has no significant effect on the survival of manufacturing SMEs in Nigeria.

Ho2: Proactiveness has no significant effect on the survival of manufacturing SMEs in Nigeria.

Ho3: Calculated risk-taking has no significant effect on the survival of manufacturing SMEs in Nigeria.

Ho4: Resources leveraging has no significant effect on the survival of manufacturing SMEs in Nigeria.

Having presented results on the effects EO on survival of manufacturing SMEs in Nigeria, Table 2 below depicts the results of each of the EO dimensions.

| Table 2 Selected Text Output From AMOS on Standardized Regression Weights | |||

| Estimate | |||

| SME_Survival | <--- | Proactiveness | 0.866 |

| SME_Survival | <--- | Calculated_Risk_taking | 0.29 |

| SME_Survival | <--- | Resources_Leveraging | 0.511 |

| SME_Survival | <--- | Innovativeness | -0.805 |

Effects of Innovativeness on the Survival of Manufacturing SMEs.

The results of Ho1 from the model reveal that innovativeness in the Nigerian small manufacturing sector has a significant, direct and strong negative effect on SMEs (ESC = -805, p˂0.001). On this point, Ho1 was rejected. This is based on the level of significance in the path relationship of other dimensions like the proactiveness, calculated risk-taking and resource leveraging.

Effects of Proactiveness on the Survival of Manufacturing SMEs

The results of Ho2 reveal that the path from proactiveness to SME survival (ESC = 0.866, p˂0.001) in the model was direct and depicts a weak and positive significant relationship. In contrast to innovativeness, this implies that proactiveness has a direct and positive effect on the survival of SMEs. Hence, Ho2 was thus rejected. This is based on the level of significance in the path relationship of other dimensions like innovativeness, calculated risk-taking and resource leveraging.

Effects of Calculated Risk-Taking on the Survival of Manufacturing SMEs

The results of Ho3 in the structural model reveal that the path from calculated risk-taking to SMEs’ survival (ESC = 0.290, p˂0.001) is significant. This implies that calculated risk-taking has direct and positive effects on the survival of SMEs. Hence, Ho3 was rejected. This is based on the level of significance in the path relationship of other dimensions like innovativeness, proactiveness and resource leveraging.

Effects of Resource Leveraging on the Survival of Manufacturing SMEs

The results of Ho4 in the structural model reveals that the path from resource leveraging to SMEs’ survival (ESC = 0.511, p˂0.001) is significant. This implies that resource leveraging has direct and positive effects on the survival of SMEs. For this reason, Ho4 was rejected. This is based on the level of significance in the path relationship of other dimensions like the innovativeness, proactiveness and calculated risk-taking.

Therefore, judging by the result of this study, it is interesting to know that proactiveness dimension made the largest contribution to survival of manufacturing SMEs in Nigeria (0.866) in this orientation. Followed by resources leveraging, calculated risk-taking and then innovativeness as depicted in the structural model and the standardised regression estimates or weights.

Discussion of Results

It is notable that this study has showed that owner-manager`s EO has significant, direct and positive effect on survival of manufacturing SMEs in Nigeria. This is evident in the test statistics of four EM dimensions such as innovativeness, proactiveness, calculated risk-taking and resources leveraging used in the measurement of EO. The findings of this research corroborate with and added value to the existing body of knowledge for example, Amah and Eshegheri (2017) studied EO using innovativeness and proactiveness to measure resilience of medium scale enterprises and their findings revealed that both innovativeness and proactiveness are significantly related to resilience. Consistent with this finding is the result of Nwekpa et al. (2018) which studied the relationship between EO and performance of the micro businesses within the context of a developing country. The study specifically examined how EO significantly predicts increase in sales, assets and employees’ satisfactions in the micro businesses. Their study found that EO in micro businesses would increase sales, assets and employees’ satisfaction of micro businesses.

It is established that the application of these EO dimensions in terms of its contribution to the survival of manufacturing SMEs in Nigeria has shown a relative and contradictory results, that is, proactiveness, resources leveraging, calculated risk-taking and innovativeness shows a significant contribution with innovativeness reacting negatively. Though, innovativeness is generally considered an important dimension of EO and EM as acknowledged by Etim et al. (2017). Other studies such as Duru et al. (2018); Aroyeun et al. (2019) have also identified it as a major predictor of SMEs survival both in Nigeria and beyond. This study has also found that innovativeness is important to the survival of manufacturing SMEs in Nigeria, but the manner EO dimensions are applied in business operation in Nigeria makes it depicts a negative effect to the survival and thus resulting to the failure of manufacturing SME’s in Nigeria (Gwadabe & Amirah, 2017).

Proactiveness on the other hand, is EO dimension that demonstrated a positive and significant effect on the survival of manufacturing SMEs in Nigeria as shown in this paper. According to the structural model, proactiveness portrayed a strong, direct and positive significant effect. This means that the proactiveness dimension stands to be the highest predictor of manufacturing SMEs survival in Nigeria. However, it is important to acknowledge that proactiveness have both been applied as an organizational variable (Duru et al., 2018) and individual variable (Nwankwo & Kanyangale, 2019). Again, several studies such as Amah & Eshegheri (2017); Aroyeun et al. (2019) also share in the same view with the current study, while Duru et al. (2018) findings disagreed that proactiveness dimension has a positive and insignificant relationship on SMEs performance.

Resources leveraging is another EO dimensions that demonstrates a direct, positive and significant effects on manufacturing SMEs in Nigeria. Here, resources leveraging is incorporated into the integrative EM model because it involves the use of a firm’s available resources to achieve challenging goals (Holmes & Jorlöv, 2015). Therefore, the ‘creative’ and ‘effective’ adoption and utilisation of another firm’s resources to produce new products, services or ideas draws to the fore why resources leveraging should form part of EO dimensions. From the structural model, resources leveraging shows a moderate significant contribution to the survival of manufacturing SMEs compared to calculated risk-taking, that is, owner-manager of manufacturing SMEs in Nigeria seems to have understood the needs for utilization of untapped resources, sourcing and outsourcing, understanding the current state of resources, and complementing different resources to create values, stretching resources much further than competitors do, making usefully the resources others are unable to realize, using other people's resources to achieve one's own goal; combining two firms’ resources to create higher value; using certain resources to obtain other resources and recycling (Nwankwo & Kanyangale, 2019). This supports the finding of Nwaizugbo & Anukam (2014) that resources leveraging contributes to SMEs performance.

Similarly, calculated risk-taking is also an important EO and EM dimensions as pointed out by Kapepa & Van Vuuren (2019) depicts some contributory effect of SMEs performance. Though, Duru et al. (2018) argued that the contribution of calculated risk-taking show an insignificant effect on SMEs performance. They further maintained that risk-taking is not an important variable and should not be considered as the predictor of performance. However, this study disagreed with their findings after considering a broader scope and adoption of a more sophisticated test tool, found that calculated risk-taking contributes to the survival of manufacturing SMEs in Nigeria. Hence, operating in a protected market makes it easier for the firm to predict the outcome of the decisions to be made (Kapepa & Van Vuuren, 2019). Since, firms large, small and medium, are more likely to operate in a risky environment than in an uncertain environment (Li, Zhao, Tan & Liu, 2008). It is pertinent that it is within this setting that entrepreneurial firms are more likely to take calculated risks especially when they choose to venture into new investments or markets (Kapepa & Van Vuuren, 2019).

Limitation and Recommendations

The limitation of this study was the collection of data mainly through one method, namely the self-administered questionnaire method. The use of self-administered questionnaire as the main data collection method implies that the researcher depends solely on what the SMEs owner-managers choose to divulge during data collection process due to high levels of secrecy in the private sector. Hence, SMEs owner-managers are always conscious of critical incidents when approached with issues relating to data collection. They are very skeptical because of fear that tax collector or government reinforcement agents mask themselves as researchers to obtain relevant information from them.

In a study of this kind, it is evident that EO plays a significant role in the way ownermanagers of SMEs run their businesses. Though there are some challenges occasionally faced by owner-managers. The study recommends that owner-managers of SMEs incorporate the entrepreneurial orientation dimensions of innovativeness, proactiveness, calculated risk-taking, and resource leveraging to increase the chance of SME survival. As innovativeness depicts a significant and negative effect on SME survival, the advice is that owner-managers prioritise this and thus ensure that modern technology is used.

References

- Allah, M.A., & Nakhaie, H. (2011). Entrepreneurship and risk-taking. International Conference on E-business, Management and Economics, 25, 77-79.

- Amah, E., & Eshegheri, F.K. (2017). Entrepreneurial orientation and resilience of medium scale businesses in Nigeria. European Journal of Business and Management, 3(35), 7-12.

- Anderson, B.S., Kreiser, P.M., Kuratko, D.F., Hornsby, J.S., & Eshima, Y. (2015). Reconceptualizing entrepreneurial orientation. Strategic Management Journal, 36(10), 1579-1596.

- Anderson, B., Covin, & Slevin, D. (2009). Understanding the relationship between entrepreneurial orientation and strategic learning capability: An empirical investigation. Strategic Entrepreneurship Journal, 3(3), 218-40.

- Arisi-Nwugballa, E.A., Elom, M.E., & Onyeizugbe, C.U. (2016). Evaluating the role of entrepreneurial orientation to the performance of Micro, Small and medium scale enterprises in Ebonyi State, Nigeria. International Journal of Academic Research in Accounting, Finance and Management Science, 4(2), 221-230.

- Aroyeun, T.F., Adefulu, A.D. & Asikhia, O.U. (2019). Effect of entrepreneurial orientation on performance of selected small and medium scale enterprises in Ogun State, Nigeria. International Journal of Business and Management Invention, 8(1). 16-27.

- Ayeni-Agbaje. A. R., & Osho, A., (2015). Commercial banks in financing small scale industries in Nigeria. European Jourrnal of Accounting, Auditing and Finance Research, 3(8),2053-4086.

- Aven, T. (2014). What is safety science? Safety Science, 67, 15-20.

- Baregheh, A., Rowley, J., & Sambrook, S. (2009). Towards multi-disciplinary definition of innovation. Management decisions, 47(8), 1323-1339.

- Baskaran, S. & Mehta, K. (2016). What is innovation and why? Your perspective from resource constrained environments. Technovation, 52(53), 4-17.

- Belschak, F.D., & Den Hartog, D.N. (2010). Pro-self, prosocial, and pro-organizational foci of proactive behaviour: Differential antecedents and consequences. Journal of Occupational and Organizational Psychology, 83(2), 475-798.

- Bijloos, A.D. (2017). Ethics and risk toward a responsible approach to acceptable risk impositions. Doctoral Thesis submitted to the Faculty of Arts and Social Sciences at Stellenbosch University.

- Brege, H. (2018). Exploring proactive market strategies managing the market to create value, Linköping Studies in Science and Technology, Licentiate Thesis, Department of Management and Engineering, Linköping University.

- Brownhilder, F., & Johan, A. (2017). Constraints to Entrepreneurship and investment decisions among Agri-business investors in Southeast Nigeria. European Center for Research Training and Development, 4(9), 34-56

- Covin, J.G., & Wales, W. J. (2019). Crafting high-impact entrepreneurial orientation research: Some suggested guidelines. Entrepreneurship Theory and Practice, 43(1), 3-18.

- Denicoló, V. & Zanchettin, P. (2016). Speculative profits, and growth. Economic Inquiry, 55(1), 160-174

- Duru, I.U., Ehidiamhen, P.O., & Chijioke, A.N.J. (2018). Role of entrepreneurial orientation in the performance of small and medium enterprises: Evidence from federal capital territory, Abuja, Nigeria. Asian Journal of Economics, Business and Accounting, 6(1), 1-21

- Effiom, L., & Edet, S.E. (2018). Success of small and medium enterprises in Nigeria: Do environmental factors matter? Journal of Economics and Sustainable Development, 9(4), 117-127.

- Etim, J.J., Adabu, M.U., & Ogar, C.A. (2017). Influence of entrepreneurial orientation as survival strategy for small and medium enterprises: the Nigeria experience. International Journal of Economics, Commerce and Management, 5(8), 502-518.

- Farniha, L., Ferreira, J., & Gouveia, B. (2016). Network of Innovation and Competitiveness: A triple Helix case study. Journal of the knowledge economy, 7(1), 259-275.

- Gwadabe, U.M. & Amirah, N.A. (2017). Entrepreneurial competencies: SMES performance factor in the challenging Nigerian economy. Academic Journal of Economic Studies, 3(4), 55-61.

- Holmes, C., & Jorlov, K. (2015). Entrepreneurial marketing: a descriptive study of Swedish charitable organizations. Master Thesis, Umea School of Business and Economics, Umea University, Sweden.

- Hossein, M., Dadfar, H., & Brege S. (2018). Firm-level entrepreneurship and international performance: A simultaneous examination of orientation and action. Journal of International Entrepreneurship, 16(3), 338-368.

- Idemobi, E.I., (2016). Critical skills for entrepreneurship success: how to become successful in your own business, Awka: De-Emeralds Printing & Publishing

- Ionita, D. (2012). Entrepreneurial marketing: A new approach for challenging times. Management and Marketing Challenges for the Knowledge Society, 7(1), 131-150.

- Jackson, D.L., Gillaspy Jr, J.A., & Purc-Stephenson, R. (2009). Reporting practices in confirmatory factor analysis: an overview and some recommendations. Psychological methods, 14(1), 6.

- Kapepa, O., & Van Vuuren, J., (2019). The importance of tolerance for failure and risk-taking among insurance firms in hyperinflationary Zimbabwe. Southern African Journal of Entrepreneurship and Small Business Management, 11(1), 1-15.

- Kurzhals, K. (2015). Resource recombination in firms from a dynamic capability perspective. Unpublished PhD Thesis. Coventry: Coventry University, Münster University.

- Linton, G. (2016). Entrepreneurial orientation: reflections from a contingency perspective. Örebro, Sweden: Örebro University.

- Linton, G., & Kask, J. (2017). Configurations of entrepreneurial orientation and competitive strategy for high performance. Journal of Business Research. 70, 168-176.

- Mayasari, L., Maharani, A., & Wiadi, Y. (2009). Entrepreneurial marketing for small and medium enterprises business: An exploratory study on entrepreneurial performance. Integritas - Jurnal Managemen Bisnis, 2(1), 1-12.

- Mehran, R., & Mortzea, K. (2013). Prioritization of entrepreneurial dimensions. A case of in-higher education institutions by using entropy. Journal of Contemporary Research in Business, 4(12), 297-306.

- Miller, D. (1983). The correlates of entrepreneurship in three types of firms. Management Science, 29(7), 770-791.

- Morris, M.H., Schindehutte, M., & LaForge, R.W. (2002). Entrepreneurial marketing: A construct for integrating emerging entrepreneurship and marketing perspectives. Journal of Marketing Theory and Practice, 10(4), 1-19.

- Morris, M.H., Kuratko, D.F., & Covin, J.G. (2008). Corporate entrepreneurship & innovation, 2nd ed. Mason: Thomson Higher Education.

- Morrish, S.C. (2011). Entrepreneurial marketing: a strategy for the twenty-first century? Journal of Research in Marketing and Entrepreneurship, 13(2), 110-119.

- Nwaizugbo, I.C., & Anukam, A.I (2014). Assessment of entrepreneurial marketing practices among small and medium scale enterprise in Imo State Nigeria: Prospects and challenges. Review of Contemporary Business Research, 3(1), 77-98

- Nwankwo, C.A., & Kanyangale, M.I. (2019). Deconstructing entrepreneurial marketing dimensions in small and medium-sized enterprises in Nigeria: A literature analysis. International Journal of Entrepreneurial Venturing, 5(18), 44-53.

- Nwekpa, K.C., Onwe, C., & Ezezue, B.O. (2018). Entrepreneurial orientation and business performance amongst microbusinesses in Nigeria. IOSR Journal of Business and Management, 19(7), 45-53

- Olaniyan, T., Ogbuanu, B. & Oduguwa, A., (2017). Effect of entrepreneurial marketing on SMEs development in Nigeria. International Journal of Advanced Studies in Business Strategies and Management, 5(2), 40-60

- Olannye, A.P & Eromafuru E. (2016). The dimension of entrepreneurial marketing on the performance of fast food restaurants in Asaba, Delta State, Nigeria. Journal of Emerging Trends in Economics and Management Sciences (JETEMS) 7(3), 137-146.

- Otika, U.S., Nwaizugbo, I., & Olise, C.M. (2019). Entrepreneurial marketing practices and competitive advantage of small and medium size enterprises in Nigeria. European Journal of Business and Innovation Research, 7(3), 1-30.

- Sardana, G.D. (2016). Innovation and growth. South Asian Journal of Business and Management cases, 5(1): 7-11.

- Stenberg, A. (2017). What does Innovation mean - a term without a clear definition. Unpublished paper.

- Thal, L. (2016). Three word meetings: A simple strategy to engage, inspire, and empower your team, Austin, TX. River Grove Book.

- Wales, W., Gupta, V., & Mousa, F. (2013). Empirical research on entrepreneurial orientation: An assessment and suggestions for future research. International Small Business Journal, 31(4), 357-383.

- Wales, W. (2015). Entrepreneurial orientation: a review and synthesis of promising research directions. International Small Business Journal, 34(1), 1-13.

- Wales, W.J. (2016). Entrepreneurial orientation: A review and synthesis of promising research directions. International Small Business Journal, 34, 3-15.

- Zhai, Y.M., Sun, W.Q., Tsai, S.B., Wang, Z., Zhao, Y., & Chen, Q. (2018). An empirical study on entrepreneurial orientation, absorptive capacity, and SMEs’ innovation performance: A sustainable perspective. Sustainability, 10(314), 1-14.