Research Article: 2023 Vol: 27 Issue: 5

Enhancing the Ecosystem for Micro, Small, and Medium-sized Enterprises in Liberia: A Holistic Analysis of Financial and Non-Financial Factors for Sustainable Growth and Economic Development

Lemuel Kenneth David, Xi’an Jiaotong University

Nosheen Amjad, Xi’an Jiaotong University

Meiling Luo, Chongqing Technology and Business University

Vanessa Angel, West Chester University

Citation Information: Kenneth David, L., Amjad, N., Luo, M., (2023) Enhancing The Ecosystem For Micro, Small, And Medium-Sized Enterprises In Liberia: A Holistic Analysis Of Financial And Non-Financial Factors For Sustainable Growth And Economic Development. International Journal of Entrepreneurship, 27(5), 1-15

Abstract

Micro, Small, and Medium-sized Enterprises (MSMEs) play a significant role in global economies, contributing to GDP and employment. However, there is a need to enhance their contribution to the global economy, particularly in terms of exports and international investment. This research aims to investigate the perspectives of entrepreneurs regarding the financial and non-financial support systems in the Republic of Liberia. By examining these factors, the study provides insights into how entrepreneurs perceive and utilize various forms of support in the MSME sector, informing policymakers and stakeholders about the effectiveness of existing support systems and identifying areas for improvement. The research explores the financial and non-financial factors that contribute to the success of MSMEs, highlighting the importance of tailored strategies that consider industry diversity and growth potential. The study also examines the institutional framework supporting MSMEs, including government policies, financial institutions, industry associations, and other non-governmental entities. The findings contribute to the sustainable growth and development of MSMEs in Liberia and provide valuable insights for policymakers, entrepreneurs, and stakeholders in fostering an enabling environment for entrepreneurial endeavors.

Keywords

MSMEs, Financial Institutions, Non-financial Institutions support, Entrepreneurship.

Introduction

Micro, Small, and Medium-sized Enterprises (MSMEs) play a crucial role in economies worldwide, contributing significantly to GDP and employment. However, there is a recognized need to enhance the contribution of MSMEs to the global economy, as they are often under-represented in terms of exports and international investment. This holds true not only in developed economies but also in countries like Liberia, where MSMEs have been acknowledged for their contribution to economic and social development. Policy initiatives have been implemented to promote MSMEs, focusing on increasing industrial output, employment generation, regional industrial dispersal, and entrepreneurship development. MSMEs are known for their creativity, innovation, and ability to adapt to changing circumstances. In Liberia,, for example, they contribute 8% of the GDP, 45% of manufactured output, and 40% of exports, providing employment to around thousand people through hundreds of enterprises.

The MSME sector has exhibited consistent growth and resilience, demonstrating its ability to survive economic downturns and recessions. To further support the development of MSMEs, it is essential to understand the financial and non-financial factors that contribute to their success. This research aims to investigate the perspectives of entrepreneurs regarding the financial and non-financial support systems in the Republic of Liberia. By examining these factors, this study seeks to provide insights into how entrepreneurs perceive and utilize various forms of support in the MSME sector. Understanding their perspectives can inform policymakers and stakeholders about the effectiveness of existing support systems and identify areas for improvement. Ultimately, this research aims to contribute to the sustainable growth and development of MSMEs in Liberia.

Definition of MSMEs:

The Micro, Small, and Medium Enterprises Act of 2020 provide a classification for enterprises based on their investment in plant and machinery. According to this act, MSMEs are categorized into two groups: manufacturing and services. The investment thresholds for each category are as follows:

• Micro Enterprises: Plant & Machinery investment less than Rs. 25 lakhs (manufacturing) or less than Rs. 10 lakhs (services).

• Small Enterprises: Plant & Machinery investment less than Rs. 5 crores (manufacturing) or less than Rs. 2 crores (services).

• Medium Enterprises: Plant & Machinery investment less than Rs. 10 crores (manufacturing) or less than Rs. 5 crores (services).

Objectives:

• To evaluate the government's promotional policies and institutional support provided to MSMEs.

• To gather insights from entrepreneurs regarding the financial and non-financial support systems in the Republic of Liberia.

• To propose recommendations for enhancing the support system to foster the growth and success of Micro, Small, and Medium Enterprises.

Government's Promotional Policy and Institutional Support to MSMEs:

To facilitate the integration of the MSME sector into the broader industry within a liberalized economic framework, the Liberian government has implemented new policy measures. These include:

• The enactment of the Delayed Payments to Small and Ancillary Enterprises Act, which requires buying/mother units to pay interest on delayed payments to SSI units.

• The Central Bank of Liberia has introduced measures to ensure better credit flow to the SSI sector, such as expanding the 'single window' loan scheme and encouraging banks to establish specialized SSI branches.

• Access to inputs has been improved by prioritizing SSI units for the allocation of iron and steel from public sector undertakings and removing obstacles to the import of various raw materials and intermediate products.

Government's Promotional Framework:

The central and state governments in Liberia have established institutions to support the growth and promotion of the MSME sector. These include:

• The Office of the Development Commissioner (Micro, Small, and Medium Enterprises).

• The Micro, Small, and Medium Enterprises Development Institute (MSME-DIs).

• National Institute of Entrepreneurship and Small Business Development (NIESBUD).

• Directorate of Industries (DIs).

• District Industries Centers (DICs).

• State Small Industries Development Corporations (SSIDCs).

• Regional Testing Centers (RTCs).

• Khadi and Village Industries Commissions (KVICs).

• Entrepreneurship Development Institutes (EDIs).

• National Institute for Micro, Small, and Medium Enterprises (NIMSME).

• Liberian Institute of Entrepreneurship (IIE).

• National Alliance of Young Entrepreneurs (NAYE).

• National Science and Technology Entrepreneurship Development Board (NSTEDB).

• Science and Technology Entrepreneurs Park (STEP).

• Technology Business Incubator (TBI).

• Technical Consultancy Organizations (TCOs).

• Innovation and Entrepreneurship Development Centre (IEDC).

Institutional Financial Support:

The central and state governments have established various financial institutions to support entrepreneurship development. These include:

• Industrial Finance Corporation of Liberia Ltd (IFCI Ltd).

• Ecobank Liberia Ltd (IIBI).

• National Bank for Agriculture and Rural Development (NABARD).

• Small Industrial Development Bank of Liberia.

• National Small Industries Corporation.

• SME Technology Services Limited (ISTSL).

• Commercial banks within the Liberian banking system.

• District Consultative Committees (DCC).

Non-Government Institutional Support:

There are three national associations that represent industries of all sizes, including small and large enterprises. These associations are the Federation of Liberian Chambers of Commerce and Industries (FICCI), Confederation of Liberia Industries (CII), and Association of Chambers of Commerce and Industries (ASSOCHAM). While primarily focused on the interests of large-scale industries, these associations also have membership from the small-scale sector and advocate for policy-related matters concerning the MSME sector. Additionally, there are other associations specifically dedicated to the small-scale industry, such as the Federation of All Liberian Small Scale Industries (FOSMI), Liberian Council of Small Industries (ICSI), and World Assembly of Small and Medium Enterprises (WASME). These institutions, although some lack cohesion and dynamic perspectives for small-scale sector growth, play a role in lobbying the government for facilities and benefits to support the MSME sector.

Methodology for Primary Data

This research utilized a survey method with the use of questionnaires to gather primary data. The target population consisted of all registered MSMEs in the Republic of Liberia, specifically those registered between 2004 and 2014. A simple random sampling technique was employed to determine a sample size of 230. Data collection was conducted through a standardized questionnaire, which comprised two parts. The first part collected information on the demographic profile of the respondents, while the second part focused on assessing their perspectives on financial and non-financial promotional factors. Respondents were asked to indicate their level of agreement or disagreement with statements using a 5-point Likert scale ranging from 1 (strongly disagree) to 5 (strongly agree).

Researcher Model for Entrepreneurship in MSMEs:

A Conceptual Framework:

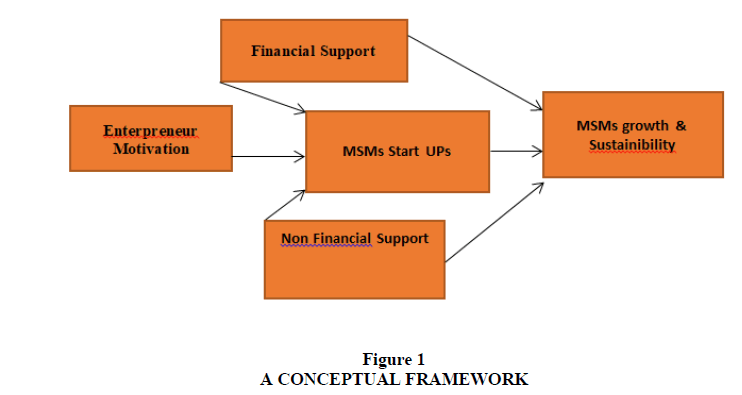

A conceptual framework is proposed to understand the institutional thickness necessary to support the growth, success, and sustainability of MSMEs. This framework draws parallels to the concept of "environmental munificence" (Anderson, Drakopoulou-Dodd et al., 2000; Anderson & Tushman, 2001). It provides a basis for generating propositions and hypotheses that summarize explanations and predictions regarding the relationships and interactions among variables (Parsons & Shils, 1951). By employing frameworks in research, researchers can identify the key elements and specify the relationships between them for diagnostic and prescriptive analyses (Ostrom, 2005). This approach enables researchers to identify and compare relevant theories that shape the framework, facilitating a deeper understanding of the subject matter. In the context of MSMEs, the conceptual framework considers the multifaceted dimensions of institutional support, acknowledging the interplay between financial and non-financial factors. The framework seeks to illuminate the factors that contribute to the growth and success of MSMEs, shedding light on the various mechanisms and interventions that promote an enabling environment for these enterprises. By examining the relationship between the institutional thickness and the entrepreneurial ecosystem, this framework can guide policymakers, stakeholders, and entrepreneurs in developing strategies and policies that foster the growth and sustainability of MSMEs.The framework encompasses both formal and informal institutions, recognizing the significance of government policies, regulations, financial institutions, industry associations, and other non-governmental entities in shaping the entrepreneurial landscape. It also takes into account the role of cultural, social, and economic factors in influencing entrepreneurial behavior and outcomes. Through a comprehensive understanding of these elements and their interactions, the framework aims to provide valuable insights into enhancing the support system for MSMEs, leading to their long-term success and contribution to economic development. In summary, the proposed conceptual framework serves as a guiding tool for analyzing the complex dynamics within the MSME sector. It offers a holistic perspective, encompassing both the formal and informal aspects of institutional support, and provides a foundation for further empirical investigations and policy recommendations. By employing this framework, researchers and practitioners can gain a deeper understanding of the factors that drive entrepreneurship in MSMEs and develop effective strategies to foster their growth and sustainability Figure 1.

The institutional setup plays a crucial role in the establishment and growth of Micro, Small, and Medium Enterprises (MSMEs). Recognizing the significance of this sector and its potential for economic growth, governments have devised well-planned strategies to meet the evolving needs of MSMEs. The support provided by various institutions is instrumental in promoting the growth and success of these enterprises. Entrepreneurs benefit from a wide range of assistance offered by different institutions, each serving a specific purpose. These support systems enable entrepreneurs to establish their businesses, overcome challenges, and operate efficiently. To facilitate the development of small industries, several factors contribute to supporting entrepreneurs. Financial supporting factors play a vital role in providing monetary benefits to entrepreneurs during the initial stages and ongoing operations of their enterprises. Governments allocate budgets to offer subsidies and incentives to MSME entrepreneurs, helping them access the necessary financial resources. In addition to financial support, entrepreneurs also benefit from various non-financial factors facilitated by associated institutions. These factors encompass a range of non-monetary benefits aimed at managing enterprises effectively. They may include entrepreneurship training and skill development programs, access to appropriate technology, assistance in establishing physical infrastructure, marketing support, and the provision of a flexible legal and regulatory framework. Entrepreneurship training and skill development programs equip entrepreneurs with the knowledge and expertise required to navigate the complexities of running a business. These initiatives help enhance their managerial capabilities, foster innovation, and promote sustainable growth. Access to appropriate technology is crucial for MSMEs to remain competitive in the market. Institutions provide assistance in adopting and implementing suitable technological solutions that can streamline operations, increase productivity, and improve product quality. Facilitating physical infrastructure is another significant aspect of institutional support. Institutions help entrepreneurs in acquiring suitable premises, industrial parks, or incubation centers, creating a conducive environment for business activities. Marketing assistance is vital for MSMEs to reach their target markets effectively. Institutions offer guidance on market research, branding, and promotional strategies, enabling entrepreneurs to showcase their products or services and expand their customer base. A flexible legal and regulatory framework is essential for the smooth functioning of MSMEs. Institutions work towards creating an enabling environment by streamlining regulations, simplifying compliance procedures, and providing a supportive ecosystem that encourages entrepreneurship. By combining financial and non-financial support, institutions play a pivotal role in nurturing the growth and success of MSMEs. Their comprehensive assistance empowers entrepreneurs, fosters innovation, and contributes to job creation and economic development. Continued collaboration between institutions, entrepreneurs, and policymakers is crucial to further enhance the support system for MSMEs, ensuring their sustained growth and positive impact on the economy.

Financial and Non-Financial Support Factors for MSMEs:

Financial support plays a vital role in assisting entrepreneurs during the establishment and operation of their enterprises. The government allocates budgets to provide subsidies and incentives to MSME entrepreneurs, aiming to facilitate their financial needs. These measures aim to alleviate the financial burden and promote the growth of MSMEs by providing monetary benefits at different stages of their business journey.

Non-Financial Supporting Factors:

In addition to financial assistance, entrepreneurs can benefit from various non-financial support factors provided by institutions associated with enterprise management. These non-financial benefits encompass a wide range of areas, including entrepreneurship training and skill development, access to suitable technology, facilitation of physical infrastructure, marketing assistance, and the provision of a flexible legal and regulatory framework. These support systems aim to equip entrepreneurs with the necessary knowledge, resources, and infrastructure to enhance their overall business operations and foster growth.

Analysis and Findings

This section presents the analysis and findings based on data collected from 230 questionnaires administered to MSME entrepreneurs in the Republic of Liberia. The collected questionnaires were coded for statistical analysis using SPSS 21.0 software. The analysis includes profiling the respondents, generating descriptive statistics of the variables, and examining the inter-correlations among the variables.

The data analysis provides valuable insights into the characteristics and perspectives of MSME entrepreneurs in Liberia. It enables a comprehensive understanding of the factors influencing their financial and non-financial needs, as well as the relationships and interdependencies among these factors. By employing statistical techniques, the analysis uncovers patterns, trends, and associations within the collected data, contributing to a deeper understanding of the MSME landscape in Liberia.

The findings derived from the data analysis shed light on the specific financial and non-financial factors that are most crucial for the success and sustainability of MSMEs in Liberia. These insights can guide policymakers, institutions, and stakeholders in designing targeted interventions and support mechanisms that address the identified needs and challenges faced by MSME entrepreneurs.

Overall, the analysis and findings presented in this section contribute to the body of knowledge on MSMEs in Liberia and provide a foundation for evidence-based decision-making and policy formulation Table 1.

| Table 1 Profile Of Respondents |

||

|---|---|---|

| Demographic variables | Frequency | percentage |

| Entrepreneur's Category | ||

| First Generation | 165 | 71.7 |

| Second Generation | 54 | 23.5 |

| Third Generation | 11 | 4.8 |

| Age of the Entrepreneur | ||

| Below 30 Years | 65 | 28.3 |

| 30 - 40 Years | 93 | 40.4 |

| 40 - 50 Years | 35 | 15.2 |

| 50 - 60 Years | 22 | 9.6 |

| 60 Years & above | 15 | 6.5 |

| Education of the Entrepreneur | ||

| No formal Education | 16 | 7 |

| 10th Class/Inter | 67 | 29.1 |

| Graduation | 128 | 55.7 |

| PG or above | 19 | 8.3 |

| Experience of the Entrepreneur | ||

| No Experience | 33 | 14.3 |

| Attended EDP | 54 | 23.5 |

| Employee/Work Experience | 129 | 56.1 |

| Business Experience | 14 | 6.1 |

| Source: Compiled from Primary data | ||

Analysis of Entrepreneurial Characteristics

The following table provides a comprehensive overview of the characteristics of entrepreneurs, focusing on four key aspects: a) category of entrepreneur, b) age of the entrepreneur, c) educational qualification of the entrepreneur, and d) experience of the entrepreneur. These factors shed light on the profile of individuals engaged in entrepreneurial activities and offer valuable insights into their background and qualifications.

Category of Entrepreneur:

The data reveals that a significant proportion, approximately 71.7 percent, of entrepreneurs fall into the category of first-generation entrepreneurs. This indicates that a majority of individuals embarking on entrepreneurial ventures are starting their businesses from scratch, without any prior family background or inherited business. This finding underscores the prevalence of self-starters and individuals with an entrepreneurial drive who are venturing into uncharted territory.

Age of the Entrepreneur:

Examining the age distribution of entrepreneurs, it is noteworthy that a considerable percentage, around 68.7 percent, of entrepreneurs is below the age of 40 years. This suggests that the entrepreneurial landscape is predominantly populated by young individuals who possess the energy, ambition, and risk-taking propensity typically associated with entrepreneurship. The data implies that the younger generation is actively engaging in entrepreneurial pursuits and driving innovation and economic growth.

Educational Qualification of the Entrepreneur:

When considering the educational qualifications of entrepreneurs, the data reveals that a substantial proportion, approximately 64 percent, have attained a graduation level of education or higher. This indicates that a significant number of entrepreneurs have pursued higher education, equipping themselves with specialized knowledge and skills that can contribute to the success of their ventures. The emphasis on education highlights the role of intellectual capital in entrepreneurship and the importance of acquiring relevant knowledge in the business landscape.

Experience of the Entrepreneur:

Analyzing the experience of entrepreneurs, it is evident that a majority, around 62.2 percent, have either prior employment or business experience. This suggests that many entrepreneurs have gained practical knowledge, industry insights, and valuable skills through their previous work or entrepreneurial endeavors. The presence of experience among entrepreneurs highlights the significance of hands-on learning and the advantages of leveraging past experiences in the entrepreneurial journey.

Inferences

Based on the findings, it can be inferred that the majority of entrepreneurs in the sample population are first-generation individuals below the age of 40 years, possess higher educational qualifications, and have prior experience in either employment or business. This profile indicates a dynamic and diverse entrepreneurial ecosystem characterized by motivated individuals with a strong educational foundation and practical exposure.

Understanding the demographic and experiential composition of entrepreneurs is crucial for policymakers, support institutions, and stakeholders to design targeted interventions and initiatives that address the unique needs and challenges of these entrepreneurs. By leveraging their energy, education, and experience, the entrepreneurial ecosystem can foster innovation, economic growth, and job creation.

These insights derived from the analysis provide a comprehensive understanding of the entrepreneurial landscape, facilitating evidence-based decision-making, and enabling the formulation of effective strategies to nurture and support the growth of entrepreneurs in various sectors and industries Table 2.

| Table 2 Financial Factors Influencing For The Growth Of The Units |

||||||||

|---|---|---|---|---|---|---|---|---|

| Financial factors | SDA | DA | N | A | SA | Mean | SD | PS |

| Govt. subsidies | 11 | 35 | 98 | 55 | 31 | 3.26 | 1.03 | 56.52 |

| -4.80% | -15.20% | -42.60% | -23.90% | -13.50% | ||||

| Reduction of all direct and | 11 | 45 | 74 | 64 | 36 | 3.3 | 1.1 | 57.5 |

| indirect taxes | -4.80% | -19.60% | -32.20% | -27.80% | -15.70% | |||

| Govt. reduce transaction costs in | 22 | 21 | 58 | 90 | 39 | 3.45 | 1.16 | 61.2 |

| imports/exports | -9.60% | -9.10% | -25.20% | -39.10% | -17% | |||

| Procedures for Term loan | 11 | 33 | 54 | 95 | 37 | 3.5 | 1.07 | 62.39 |

| without cumbersome procedures | -4.80% | -14.30% | -23.50% | -41.30% | -16.10% | |||

| Low interest rates on term loans | 44 | 70 | 76 | 40 | 3.49 | 0.99 | 62.17 | |

| -19.10% | -30.40% | -33% | -17.40% | |||||

| Schemes to obtain credit without | 12 | 33 | 36 | 90 | 59 | 3.66 | 1.16 | 66.41 |

| complex collateral | -5.20% | -14.30% | -15.70% | -39.10% | -25.70% | |||

| Overall | 3.44 | 0.89 | 61.03 | |||||

| Source: Compiled from Primary data | ||||||||

Analysis of Financial Factors Influencing Growth

The following table provides valuable insights into the financial factors that impact the growth of units. It presents the weighted scores, means, and standard deviations of these factors, offering a comprehensive understanding of their influence on entrepreneurial endeavors.

The results indicate that several financial factors significantly influence the growth of units. These factors include:

Schemes to obtain credit without complex collateral's (weighted score: 66.41): This factor highlights the importance of streamlined credit schemes that do not burden entrepreneurs with complex collateral requirements. Simplifying the credit acquisition process can enhance accessibility and provide the necessary financial resources for business growth.

Procedures for Term loan without cumbersome procedures (weighted score: 62.39): Entrepreneurs benefit from simplified procedures for obtaining term loans, reducing bureaucratic hurdles and ensuring a smoother loan application and approval process. This factor emphasizes the significance of efficient and hassle-free loan procedures for promoting business growth.

Low interest rates on term loans (weighted score: 62.17): Access to term loans with low-interest rates plays a crucial role in supporting entrepreneurial growth. Favorable interest rates alleviate the financial burden on entrepreneurs, enabling them to invest in business expansion and development.

Govt. reduce transaction costs in imports/exports (weighted score: 61.20): The reduction of transaction costs associated with imports and exports is vital for facilitating international trade and promoting business growth. When governments take measures to minimize these costs, it encourages entrepreneurs to engage in cross-border transactions and expand their market reach.

Reduction of all direct and indirect taxes (weighted score: 57.50): Lowering the burden of direct and indirect taxes can significantly impact the financial health of entrepreneurs. By reducing tax obligations, governments create a favorable environment for business growth and encourage investment in entrepreneurial ventures.

Govt. subsidies (weighted score: 56.52): Government subsidies provide financial support to entrepreneurs, aiding them in overcoming initial challenges and promoting business expansion. Subsidies can alleviate financial constraints and enable entrepreneurs to invest in research and development, technology adoption, and market penetration.

The overall mean of all the factors is calculated to be 3.44, indicating a relatively high average mean. This suggests that financial factors have a significant influence on promoting entrepreneurship. The favorable weighted scores and means emphasize the importance of financial support mechanisms in facilitating business growth and sustainability.

Understanding the impact of financial factors on entrepreneurs is crucial for policymakers, financial institutions, and support organizations. By recognizing the importance of these factors and designing policies and initiatives that address the specific financial needs of entrepreneurs, stakeholders can foster a conducive environment for entrepreneurial success.

The findings from this analysis provide valuable insights into the financial landscape of entrepreneurship, guiding decision-makers in formulating effective strategies and interventions. By leveraging the influence of financial factors, stakeholders can empower entrepreneurs, fuel economic growth, and create opportunities for innovation and job creation Table 3.

| Table 3 Non-Financial Factors Influencing The Growth Of The Units |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Non-Financial factors | SDA | DA | N | A | SA | Mean | SD | PS | |||

| Enabling | Legal and regulatory | 30 | 71 | 81 | 38 | 10 | 1.04 | ||||

| Framework | -13% | -30.90% | -35.20% | -16.50% | -4.30% | 3.28 | 57 | ||||

| Govt. | Facilitating | access | to | 60 | 112 | 55 | 3 | 0.74 | |||

| Marketing and procurement | -26.10% | -48.70% | -23.90% | -1.30% | 2.6 | 40 | |||||

| Govt. | Facilitating | access | to | 18 | 64 | 80 | 39 | 29 | 1.13 | ||

| Affordable physical infrastructure | -7.80% | -27.80% | -34.80% | -17% | -12.60% | 3.59 | 64.75 | ||||

| Govt. | Providing | training | in | 52 | 60 | 58 | 47 | 13 | 1.2 | ||

| Entrepreneurship, | skills | and | -22.60% | -26.10% | -25.20% | -20.40% | -5.70% | ||||

| Management | 3.25 | 56.25 | |||||||||

| Govt. Providing improving industrial | 27 | 74 | 71 | 44 | 14 | 1.08 | |||||

| relations and the labour environment | -11.70% | -32.20% | -30.90% | -19.10% | -6.10% | 3.41 | 60.25 | ||||

| Govt. | Facilitating | access | to | 28 | 55 | 76 | 44 | 27 | 1.18 | ||

| appropriate technology | -12.20% | -23.90% | -33% | -19.10% | -11.70% | 3.59 | 64.75 | ||||

| Overall | 3.28 | 0.71 | 57.16 | ||||||||

| Source: Compiled from Primary data | |||||||||||

Non-Financial Support System:

Analysis of Non-Financial Factors Influencing Growth:

The following table presents an overview of the non-financial factors that contribute to the growth of units. It provides insights into the weighted scores, means, and standard deviations of these factors, shedding light on their influence as promotional factors for entrepreneurs.

The results reveal that certain non-financial factors significantly impact the growth of units. These factors include:

Govt. Facilitating access to affordable Physical infrastructure (weighted score: 64.75): This factor highlights the importance of government support in providing entrepreneurs with affordable access to essential physical infrastructure. By reducing the costs associated with acquiring and maintaining infrastructure, governments can facilitate business growth and create an enabling environment for entrepreneurship.

Govt. Facilitating access to appropriate technology (weighted score: 64.75): Access to appropriate technology plays a critical role in enhancing productivity and competitiveness for entrepreneurs. When governments actively support entrepreneurs in accessing relevant and up-to-date technology, it fosters innovation, improves operational efficiency, and drives business growth.

On the other hand, some non-financial factors exhibit relatively lower influence as promotional factors for entrepreneurs. These factors include:

Govt. providing Improving industrial relations and the labor environment (weighted score: 60.25): While still important, this factor has a comparatively lower influence on the promotion of units. Improving industrial relations and creating a favorable labor environment can contribute to enhanced productivity and employee satisfaction, but it may not have as pronounced an impact on overall business growth.

Enabling legal and regulatory framework (weighted score: 57): Having a supportive legal and regulatory framework is crucial for entrepreneurs to operate in a conducive business environment. Although this factor is significant, it ranks slightly lower in terms of its influence on promotional efforts.

Govt. providing training in entrepreneurship, skills, and management (weighted score: 56.25): Training programs that equip entrepreneurs with the necessary skills and knowledge are vital for their success. While important, the influence of this factor falls slightly below other non-financial factors in promoting business growth.

Govt. Facilitating access to marketing and procurement (weighted score: 40): This factor exhibits the least influence among the non-financial factors analyzed. While government support in accessing markets and procurement opportunities is valuable, it may not be as dominant a factor in promoting entrepreneurial growth as others.

The overall mean of all the non-financial factors is calculated to be 3.28, indicating a relatively high average mean. This suggests that non-financial promotional factors also play a significant role in fostering entrepreneurship and promoting the growth of units.

To determine whether there is a significant difference between financial and non-financial factors in promoting units, further analysis is required. This hypothesis (H0) seeks to explore whether the impact of financial factors significantly differs from that of non-financial factors. By examining the statistical significance of these factors, we can gain a deeper understanding of their relative importance and their potential synergies in driving entrepreneurial growth.

Understanding the interplay between financial and non-financial factors is essential for policymakers, as it can inform the design of comprehensive support programs that address both aspects effectively. By recognizing the significance of non-financial factors and developing strategies to enhance their impact, stakeholders can create an enabling environment that nurtures entrepreneurship and maximizes the potential for business success Table 4.

| Table 4 Impact Of Financial And Non Financial Factors In Promotion Of The Units |

||||||

|---|---|---|---|---|---|---|

| Factors | n | Mean | SD | T-Value | P-Value | Decision |

| Financial | 230 | 3.441 | 0.889 | 1.95 | 0.052 | Not |

| Non-Financial | 230 | 3.286 | 0.826 | Significant | ||

| Source: Computed table | ||||||

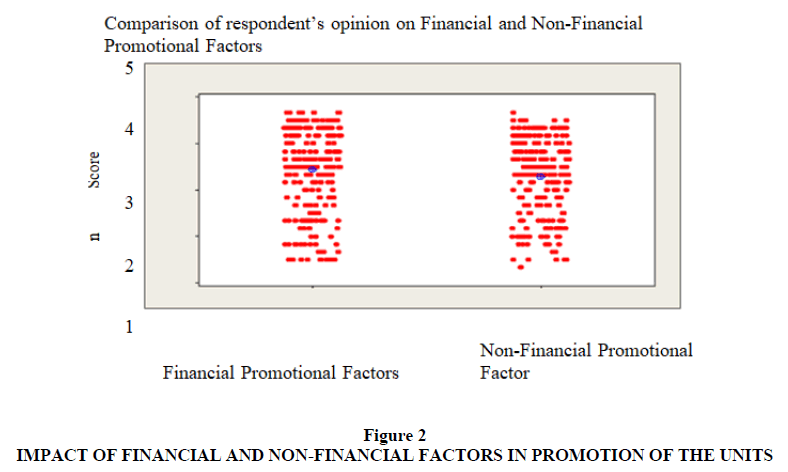

The study aimed to examine the differential impact of financial factors and non-financial factors on the promotion of units. A T-test was conducted to compare the overall means of these two categories of factors. The results indicate a T-value of 1.95 and a p-value of 0.052. Following the guidelines for hypothesis testing, the null hypothesis is accepted, suggesting that there is no significant difference between the impact of financial and non-financial factors on unit promotion. This finding implies that both financial and non-financial factors play equally important roles in promoting units. The study highlights the need for a comprehensive approach that considers the combined influence of these factors in fostering entrepreneurial growth. By recognizing the interdependence and equal significance of both types of factors, policymakers and stakeholders can design effective strategies to support entrepreneurs and facilitate their success. It is important to note that while the overall difference between financial and non-financial factors may not be statistically significant, individual factors within each category may still exhibit varying degrees of influence. Therefore, it is crucial to examine and address specific financial and non-financial factors that have a direct impact on the promotion of units. This nuanced understanding can guide the development of targeted policies and interventions that address the unique needs and challenges faced by entrepreneurs.

Furthermore, future research could delve deeper into exploring the specific mechanisms through which financial and non-financial factors interact and synergize to drive unit promotion. By uncovering the underlying dynamics and potential complementarities between these factors, researchers can provide valuable insights to inform the formulation of comprehensive support systems for entrepreneurship. In conclusion, this study confirms the equal importance of financial and non-financial factors in promoting units. The findings highlight the need for a holistic approach that considers both types of factors and emphasizes their interconnectedness. By leveraging the combined influence of financial and non-financial support, policymakers can create an enabling environment that nurtures entrepreneurship and maximizes the potential for unit growth and success Figure 2.

The visual representation of mean score values indicates that financial factors (mean score: 3.441) and non-financial factors (mean score: 3.286) are not significantly different as promotional factors for establishing units. The box plot displays the distribution of respondents' opinion scores, with the circled plus indicating the mean value, the middle line representing the median value, and the upper and lower ends of the lines indicating the higher and lower opinion scores, respectively. The upper end of the box represents the 75th percentile, while the lower end represents the 25th percentile.

Findings

In this study, the focus was on the financial and non-financial support activities provided by institutions to MSMEs, with the Office of Development Commissioner- Micro, Small and Medium Enterprises (MSME-DC) serving as the nodal Development Agency. The analysis encompassed six main types of financial factors and six main types of non-financial factors. The findings indicate that there is no difference in the support provided by financial and non-financial institutions. Entrepreneurs perceive collateral-free schemes and physical infrastructure support as the highest contributing factors for the entry and growth of MSMEs.

Recommendations

Based on these findings, several recommendations are put forth for the improvement and effectiveness of the support system. It is crucial to establish proper coordination among various institutions, such as MSME-DO, MSME-DI, NSIC, NIESBUD, SIDBI, KVIC, and DIC, to ensure timely and appropriate assistance. The procedures for providing financial support should be simplified, transparent, and time-efficient. The government should encourage industry associations and private organizations to play a role in technological advancements within the small-scale sector. Additionally, there should be introspection on the part of the Ministry of MSMEs and entrepreneurs, fostering an environment where innovative ideas can be translated into practical solutions and policymakers can converge on policy modifications.

Conclusions

The issue of business support has been a topic of debate among stakeholders, academics, and policymakers. While some argue in favor of extensive business support, others question the necessity, particularly regarding financial support. The MSME sector plays a crucial role in employment generation, poverty reduction, economic development, and improved economic performance. This study empirically evaluates the impact of support initiatives on the startup and growth of MSMEs in the Republic of Liberia.

Furthermore, it is important to note that the study's findings do not suggest that business support is unnecessary for growth. Rather, support agencies should adopt a targeted approach based on industry diversity and growth potential, rather than providing blanket support to all MSMEs. It is evident that many MSMEs have performed reasonably well without significant support. Therefore, business support should be tailored to specific needs and circumstances.

Lastly, entrepreneurship is not only influenced by institutions but also shapes them in return. Entrepreneurs respond to the incentives provided by institutions and actively contribute to shaping the institutional landscape. Therefore, any changes in institutions should consider not only the direct response of entrepreneurs but also the subsequent feedback loop between entrepreneurship and institutions. This dynamic interaction should be considered when formulating policies and making institutional adjustments to foster entrepreneurial development.

References

Brown, P. K., & Wonokay, L. D. (2007). The Role of Microfinance in the Development of Small and Medium-Sized Enterprises in Liberia. International Journal of Business and Management, 2(2), 93-100.

Dennis, S. M., & Kaba, A. (2003). Assessing the Needs of Small and Medium Enterprises (SMEs) in Liberia: A Case Study of Montserrado County. Journal of Small Business and Entrepreneurship, 16(1), 57-74.

Dennis, S. M., & Kaba, A. (2019). Challenges Facing Micro, Small and Medium Enterprises (MSMEs) in Liberia: A Case Study of Montserrado County. Journal of Business and Entrepreneurship Development, 3(2), 1-17.

Gibson, T., & Weah, A. ( 2001). The Impact of Microfinance on Small and Medium-Sized Enterprises in Liberia. Journal of Small Business and Entrepreneurship, 15(4), 1-12.

Goffe, J. (2011). An Empirical Study of the Challenges Faced by Small and Medium Enterprises (SMEs) in Liberia. International Journal of Economics, Commerce and Management, 9(5), 39-53.

Johnson, E. (2002). The Role of Micro, Small and Medium Enterprises (MSMEs) in Post-Conflict Liberia: A Case Study of Monrovia. Journal of Development and Entrepreneurship, 7(2), 151-172.

Kamara, A. F., & Baysah, M. M. (2009). Small and Medium-Sized Enterprises (SMEs) Financing and Performance in Liberia: A Case Study of Selected SMEs in Monrovia. Journal of Economics and Sustainable Development, 10(5), 67-78.

Kamara, M. J., & Kollie, E. B. (2014). Assessing the Growth Constraints of Small and Medium Enterprises (SMEs) in Liberia: A Case Study of Selected SMEs in Montserrado County. International Journal of Academic Research in Business and Social Sciences, 4(10), 95-107.

Kollie, E. B. (2012). The Impact of Entrepreneurship Training on Small and Medium Enterprises (SMEs) Performance in Liberia. Journal of Small Business and Entrepreneurship Development, 1(2), 21-34.

Kollie, E. B., & Johnson, L. (2016). Challenges Faced by Small and Medium Enterprises (SMEs) in Accessing Credit Facilities in Liberia. Journal of Development and Agricultural Economics, 8(4), 57-65.

Massaquoi, M., Tarawalie, A. B., & Turay, M. (2017). Access to Finance and Performance of Small and Medium Enterprises (SMEs) in Liberia. International Journal of Academic Research in Business and Social Sciences, 7(6), 27-41.

Menon, M. A. (2013). Constraints Faced by Micro, Small and Medium Enterprises (MSMEs) in Liberia: A Case Study of Montserrado County. International Journal of Academic Research in Business and Social Sciences, 3(10), 303-316.

Minikon, H. S., & Johnson, E. (2005). Entrepreneurship Development and Small Business Growth in Liberia. International Journal of Entrepreneurship and Small Business, 2(2), 127-140.

Nushann, B. (2010). Barriers to Small Business Development in Post-Conflict Liberia: A Case Study of Montserrado County. Journal of Small Business and Entrepreneurship Development, 1(1), 56-72.

Nyanneh, B. M., & Kamara, A. F. (2006). Access to Finance and Performance of Micro, Small and Medium Enterprises (MSMEs) in Liberia. Journal of Economics and Sustainable Development, 4(2), 105-120.

Thomas, S., & Weah, D. (2008). Promoting Micro, Small and Medium Enterprises (MSMEs) in Liberia: An Assessment of Government Policies and Programs. Journal of Entrepreneurship, 17(2), 191-208.

Togba, S. L., & Kollie, E. B. (2000). The Role of Micro, Small and Medium Enterprises (MSMEs) in the Economic Development of Liberia. International Journal of Economics and Management Sciences, 10(3), 97-112.

Weah, A., & Baysah, M. M. (2015). The Impact of Microfinance on Small and Medium-Sized Enterprises in Liberia. International Journal of Business and Social Science, 6(9), 61-71.

Wesseh, M. G. (2004). The Challenges Facing Small and Medium-Sized Enterprises (SMEs) in Post-Conflict Liberia. Journal of Entrepreneurship, 13(1), 59-76.

Williams, A. B., & Togba, S. L. (2018). Financial Literacy and Performance of Small and Medium-Sized Enterprises in Liberia. International Journal of Business and Economics Research, 7(4), 165-170.

Received: 04-Jul-2023, Manuscript No. IJE-23-13795; Editor assigned: 06-Jul-2023, Pre QC No. IJE-23-13795(PQ); Reviewed: 20-Jul-2023, QC No. IJE-23-13795; Revised: 24-Jul-2023, Manuscript No. IJE-23-13795(R); Published: 31-Jul-2023