Research Article: 2021 Vol: 20 Issue: 6S

Enhancing Database Strategies for Management Information System (MIS) and Bank Sustainability under Macro Effects - A Case Study in Vietnam Listed Banks

Phan Anh, Banking Academy

Dinh Tran Ngoc Huy, Banking University HCMC

Dao Minh Phuc, Banking Academy

Abstract

During industry 4.0 with effects from US-China commerce war, in bank sector in emerging markets such as Vietnam, we need to enhance better database for bank risk and bank sustainable development. This is one goal of this study, esp. under applications of IoTs and internet data. Currently there are about 7 big banks in Vietnam listed on stock exchange and have enough data in period 211-200 for us to present a study case or an example of risk database modeling. Banks in Vietnam has gained big achievements and play a major roles in providing loans and financial services to socio-economy and contribute to community activities over years. But there are certain weaknesses in risk database modeling. This study mainly use combination of quantitative methods (statistics, calculation formulas) and qualitative methods including synthesis, inductive and explanatory methods. The research findings tell us that Organizing better Risk management information system with support of software and showing in forms of charts, figures and tables will provide data for management to analyze, and for establish suitable risk policies: For instance, because CPI has negative higher effects on market risks of banks, Ministry of Finance, State bank of Vietnam and relevant agencies need to control inflation (not decreasing so much) for managing risk. Besides, this study also give out recommendations for enhancing risk an sustainability database of banks in digital era.

Keywords

Risk Database, Sustainability, Vietnam Banks, Beta CAPM, MIS, Macro Effects

JEL Classifications

M21, G30, G32, G38

Abbreviation

G: GDP Growth, CPI: Inflation, RF: Risk Free Rate, R: Lending Rate, IM: Industrial Manufacturing, RMIS: Risk Management Information System, MIS: Management Information System

Introduction

First, we recognize the importance of digital technology in banking also increase to a new level in digital era, as well as the increasing meanings of organizing better risk management information system for commercial banks.

In the context of digital transformation, information is considered vital for businesses. People focus a lot of energy and intelligence to have fast and accurate information. Whoever has the information wins. Therefore, information has become the hunted target of those who want to get ahead, and at the same time something that everyone tries to keep. In fact, in order to protect their information, businesses need to computerize to ensure information security. Thus, the protection of information is the building of a database management system for all that information. This is also the work that businesses need to do to conduct digital transformation in the context of the industrial revolution 4.0.

Next, We emphasize that the role of reliable internet data increasing in recent years. There is evidence in banking sector showing that internet data serving better for building information system for better bank management.

In this paper we mainly focus on using reliable internet data in proposing suitable and better database organized for risk modeling and for bank sustainable development assessment.

All internet data such as stock price, exchange rate, inflation, GDP growth, risk free rate we take from reliable internet data sources, esp. from website of State Bank of Vietnam, Bureau of Statistics, Ministry of Finance, banks, etc.

Research Question

Question 1: What are recommendations for building better risk database in bank sector and for better organization of MIS and Risk management information system (RMIS) in banks? What are macro factors affecting bank market risk measured by beta CAPM?

Question 2: What are suggestions for building database for bank sustainable development? What are factors affecting bank net profit?

Literature Review

First, Trivelas & Satouridis (2013) stated that in Greece a) the externally focused Management Information System (MIS) effectiveness archetypes (OS, RM) reflecting innovation, creativity, goal setting and planning enhance task productivity b) the Internal Process (IP) model of MIS effectiveness influences negatively task productivity.

Arasu, et al., (2014) found the Internet has revolutionized services across institutions. The Banking sector has registered significant change in the quality of service owing to the bandwidth of information flow ensuring greater customer-satisfaction. This has also brought into perspective the security environment within which information flow takes place.

Balasubramanian, et al., (2014) specified that the banking sector has always been in the vanguard of technology in order to add value to its products, services and efficiency. The Internet has galvanized business by increasing customer base, reducing transaction costs, and enabling sale of products globally. Khrais (2019) mentioned Business information systems are interconnected structures or procedures within a business entity that uses Information and Communication Technology (ICT) to support decision making by generating, processing and providing useful information for the entity. Business information systems have five key components. These are the people using the system, the hardware, software, database and network. Good business information systems are flexible such that they can be able to anticipate and adapt to changes in the information needs of the business. They are also must efficient, meet the demands of the business, and are designed according to the financial and human resource capacity of the business entity. Furthermore, good businesses are cost effective.

Moreover, Gupta (2019) specified that Information System (IS) is important in almost all the functional areas of any bank i.e., HR, Marketing, Finance, etc. It also helps in risk management and cash management along with maintaining long run customer relationship.

And last but not least, Sibanda, et al., (2020) mentioned digital technology has transformed banking from classical model to innovative Fintech collaborative model.

Then, We summarize previous studies as follows (Table 1):

| Table 1 Summary of Previous Studies |

||

|---|---|---|

| Authors | Year | Contents, results |

| Karim, A.J | 2011 | Management Information Systems (MIS) is the key factor to facilitate and attain efficient decision making in an organization. |

| Avegrou, C. | 2008 | Information system (IS) in emerging markets research has expanded the IS research agenda and developed new understanding of IS innovation phenomena, mainly through its attention to social context and strategic concerns associated with socio-economic development. As it encounters questions on policy and practice of development, it is confronted with critical issues associated with the role of Information and Communication Technology (ICT) in the transformation of social relations and macro-level institutions. |

| Huy, D.T.N | 2015 | We need to enhance risk management system and MIS in banks |

| Giebe et al | 2019 | a progressive tool for providing customer-oriented services and products, in the banking sector, is currently defined as “Big Data & Analytics”. |

| Feitosa et al | 2019 | Disruptive technologies are triggers that transform the nature of work, leading to profound changes in organizational structure, labor relations, employee skills, customer relationship and communications. |

Methodology

Method and Data

This study mainly uses combination of quantitative methods and qualitative methods including synthesis, inductive and explanatory methods. And it emphasizes again important roles of internet data in sustainable modern bank management

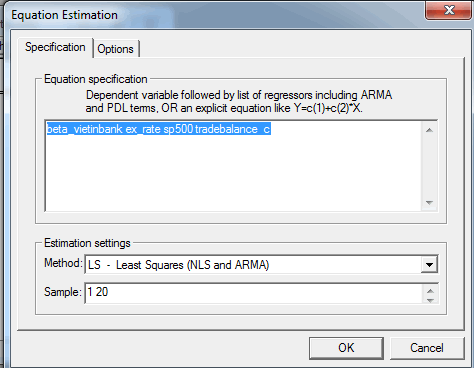

For quantitative analysis, the study is supported with OLS regression.

The formula to calculate weighted beta CAPM expressed as follows:

Beta (at time t) weighted = ∑n Beta (bank i at time t) × Market value

of stocks (bank I at time t) / Market value of stocks of banks

Market value of stocks of banks

In which beta bank i at time t is estimated in traditional formula of beta CAPM.

Data is collected from reliable internet sources and websites.

Main Results

Process of Modeling of Analysis Steps of Risk Database and Bank Sustainable Development

First we collect data from reliable websites as follows (Table 2):

| Table 2 Variables - Data Description |

|||

|---|---|---|---|

| Variable name | Sign | Data source | Reference source |

| Dependent variable | |||

| Market risk (BetaCAPM) | BetaCAPM | HOSE and HNX | Jack Treynor (1961, 1962),William F. Sharpe (1964), John Lintner (1964) và Jan Mossin (1966) |

| Independent variables | |||

| GDP growth | g | Bureau statistics | Dinh Tran Ngoc Huy (2021, Springer Verlag book chapter) “Impacts of Internal and External Macro Factors on Firm Stock Price in An Econometric Model – A Case In Viet Nam Real Estate Industry” |

| VNIndex | VNindex | HOSE and HNX | Dinh Tran Ngoc Huy “Econometric model for ACB bank stock price 2008-2011, Sai Gon university journal, No.22, 2015” |

| Risk free rate | Rf | Ministry of Finance (MOF) | Dinh Tran Ngoc Huy “Econometric model for ACB bank stock price 2008-2011, Sai Gon university journal, No.22, 2015” |

| Lending rate | r | Commercial bank | Dinh Tran Ngoc Huy (2021, Springer Verlag book chapter) “Impacts of Internal and External Macro Factors on Firm Stock Price in An Econometric Model – A Case In Viet Nam Real Estate Industry” |

| Exchange erate | Ex_rate | Commercial bank | Dinh Tran Ngoc Huy (2021, Springer Verlag book chapter) “Impacts of Internal and External Macro Factors on Firm Stock Price in An Econometric Model – A Case In Viet Nam Real Estate Industry” |

| S&P500 | SP500 | NYSE | Dinh Tran Ngoc Huy “Econometric model for ACB bank stock price 2008-2011, Sai Gon university journal, No.22, 2015” |

| BOT(trade balance) | BOT | Bureau statistics | Author synthesis |

| IM (Industrial manufacturing index) | IM | Bureau statistics | Author synthesis |

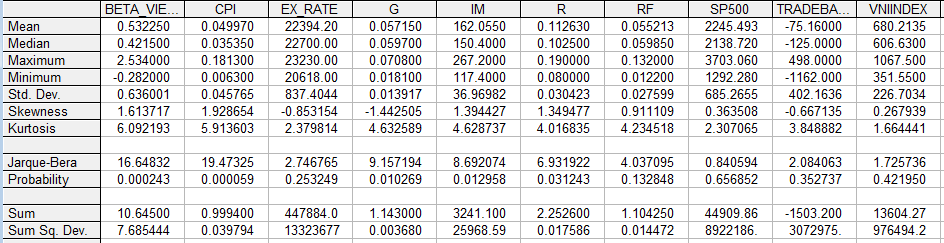

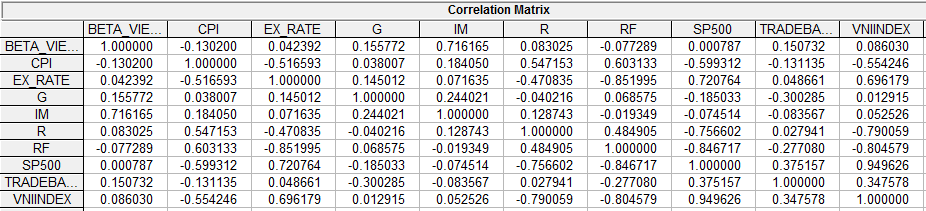

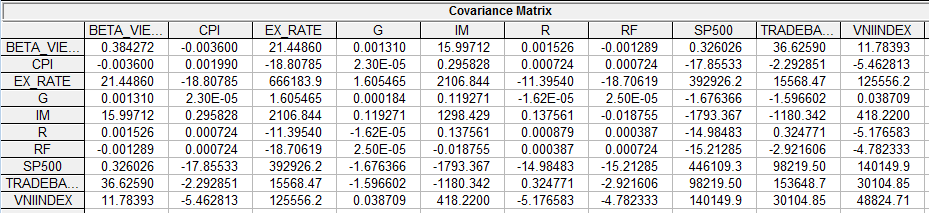

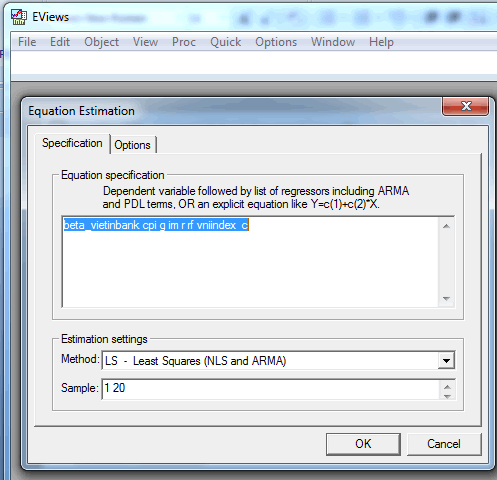

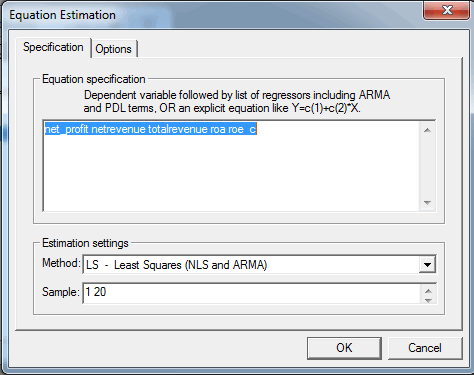

Then we use statistics softwares (such as Eviews, Stata, SPSS,...) to run correlation and descriptive statistics as follows:

Step 1:

Step 2:

Step 3:

From above figures we can see that standard deviation of each variables (figure 1) and correlation between variables (figure 2).

Step 4:

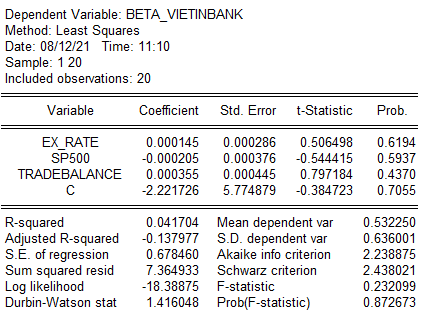

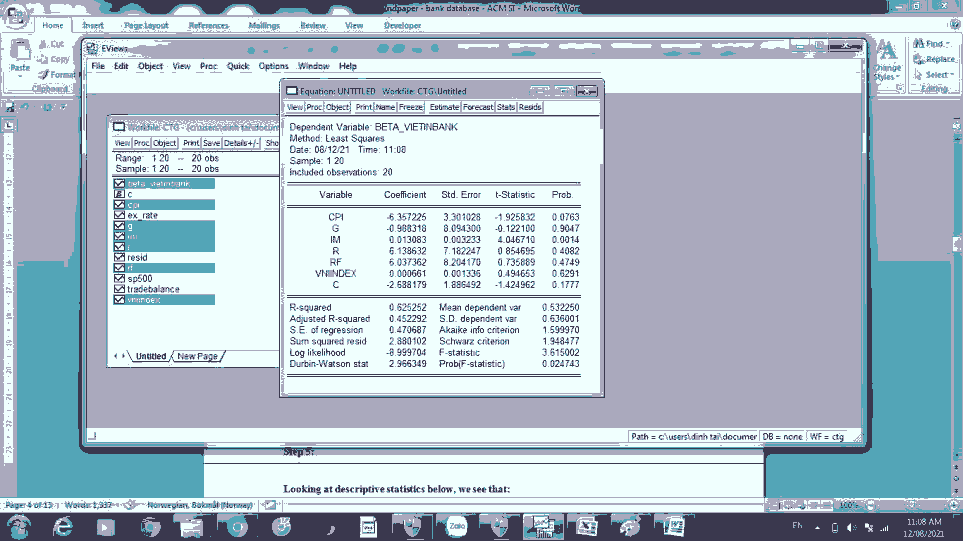

Step 5:

Step 6:

Step 7:

Step 8:

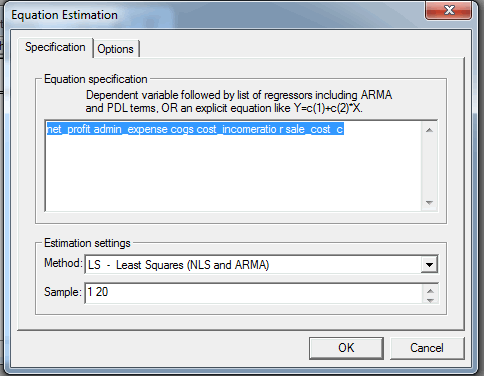

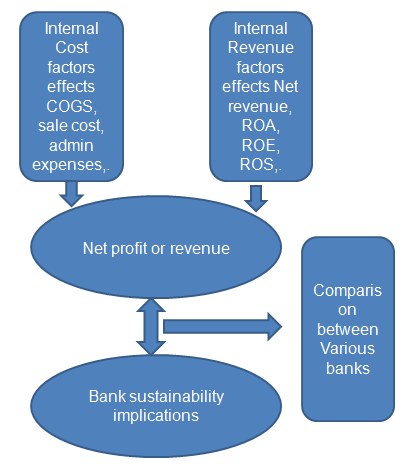

Figure 8: For Bank Sustainability We Can Regression for Internal Cost Factors

(source: made by author)

Step 9:

Figure 9: For Bank Sustainability We Can Regression For Internal Revenue Factors

(Source: Made by author)

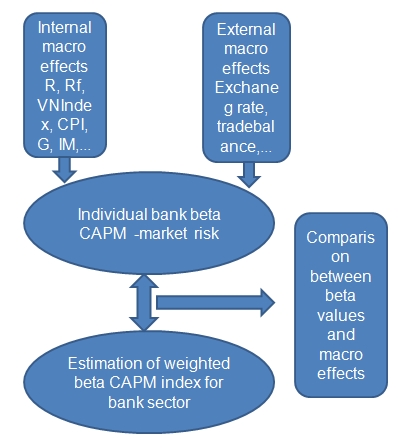

From above steps we see that with support of software statistic, we can get results of regression of risk determinants, in which there are internal macro factors and external macro factors.

Modeling Determinants of Bank Risk Database and Bank Sustainable Development Database

This section we will show two database modeling: risk modeling and bank sustainability modeling.

Determinants of Bank Risk Database

Determinants of bank Sustainable Development Database

Management Implications from Analysis of Bank Risk Data

Then we can organize and present bank risk determinants in below tables3,4:

| Table 3 Example of Risk Volatility and Weighted Beta Estimation In Bank Sector |

|||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Bet a CT G | MV (Cf G) | Bet a EI B | MV (ElB) | Bet a SH B | MV (SH B) | Bet a NV B | MV (NV B) | Bet a AC B | MV (AC B) | Bet a ST B | MV (ST B) | Bet aVC B | MV(VC B) | Weighte d Beta CAPM | |

| Jun-15 | 0.58 | 49148.94 | 1.08 | 23605.11 | 0.97 | 7679.60 | 0.05 | 253.92 | 0.7I | 18821.75 | 0.94 | 20679.46 | 1.64 | I 19126.41 | 1.20 |

| Dec-15 | 0.85 | 40957.45 | 1.34 | 22252.74 | 0.69 | 5783.40 | 0.07 | 1815.78 | 0.97 | 17208.46 | 0.84 | 2 1I02.75 | 1.76 | I 13263.36 | 1.36 |

| Jun-16 | 0.43 | 42446.8I | I.I4 | 20531.53 | 0.84 | 5783.40 | I.I5 | 1666.95 | 0.49 | 17208.46 | 0.85 | 20381.28 | 0.87 | 124722.95 | 0.78 |

| Dec-16 | 0.55 | 33510.64 | 0.58 | 18502.97 | I.I3 | 5148.29 | -0.36 | 1428.81 | 0.40 | 15774.42 | 0.56 | 17044.52 | 2.10 | 126641.45 | 1.45 |

| Jun-17 | 2.53 | 53989.37 | 2.50 | 24896.02 | -1.46 | 8393.95 | 3.54 | 2589.73 | 3.37 | 25732.02 | 2.65 | 256I I.88 | 0.79 | 138514.09 | 1.65 |

| Dec-17 | 1.29 | 59946.8I | 2.00 | 29752.28 | 0.66 | 10408.49 | 0.63 | 2145.60 | 0.75 | 36379.76 | I.II | 23176.95 | I.II | 195358.83 | 1.16 |

| Jun-18 | 0.4I | 53989.37 | 1.5I | 29813.75 | 1.07 | 9865.58 | 0.6I | 2264.80 | 1.04 | 38607.9I | I.I2 | 20832.20 | 1.35 | 208670.58 | 1.17 |

| Dec-18 | 0.37 | 52313.83 | 1.59 | 23728.06 | 1.0I | 8662.46 | 0.8I | 2831.00 | 1.09 | 36916.09 | 1.43 | 21553.66 | 1.06 | 192469.92 | 1.02 |

| Jun-19 | -0.28 | 70000.0I | 1.68 | 23973.94 | 0 69 | 8181.22 | 0.42 | 2384.00 | 0.86 | 36043.07 | 1.05 | 20471.47 | 0.59 | 261475.86 | 0.55 |

| Dec-19 | 0.65 | 62925.54 | 1.38 | 25387.79 | 0.96 | 7699.97 | 0.6I | 3825.80 | 0.60 | 37602.90 | 0.89 | 18307.08 | 1.39 | 335653.41 | 1.20 |

| Jun-20 | 0.13 | 66090.43 | 0.39 | 5410 48830.24 | 0.18 | 2457472 | - 0.0I | 350 0.20 | 0.52 | 392 40.60 | 0.85 | 203 81.28 | 0.60 | 308949.49 | 0.39 |

| Dec-20 | 0.36 | 71117.0 | 1.47 | 42661.32 | 0.89 | 30542.8 | 0.26 | 3744.40 | 1.08 | 60415.5 | 1.2I | 30571. | 1.04 | 361986. | 0.99 |

| Table 4 Example of Market Risk Determinants In Bank Sector (Macro) Under Internal And External Effects |

||||||

|---|---|---|---|---|---|---|

| VCB - Coefficient | ACB - Coefficient | STB- Coefficient | ||||

| Internal | External | Internal | External | Internal | External | |

| CPI | -3.14 | -3.1 | -5.2 | |||

| G | -46.4 | -13.5 | -45 | |||

| IM | 0.006 | 0.009 | 0.004 | |||

| R | 9.8 | 6.4 | -33.5 | |||

| Rf | -2.3 | 4.8 | 43.2 | |||

| VNIndex | 0.005 | 0.003 | 0.005 | |||

| Ex_rate | 4.11E | -9.77E | 0.0001 | |||

| SP500 | 0.001 | 0.0007 | -0.001 | |||

| Trade balance | 0.0009 | 0.0005 | -0.0004 | |||

| R-squared | 0.67 | 0.53 | 0.53 | 0.53 | 0.22 | 0.22 |

| Akaike info criteria | 1.9 | 1.75 | 1.4 | 0.84 | 3.68 | 2.6 |

Discussion

Digital transformation is an inevitable trend of businesses when switching to new ways of doing business in the 4.0 digital era. Digital transformation is an opportunity for businesses to create a competitive advantage in the market. The way to implement digital transformation starts with small steps, with a well-defined strategic plan. The first key toa successful digital transformation business is technology. To successfully implement digital transformation, businesses need to choose the right IT partner. One of the criteria used to choose the right IT partner is based on reputation, capacity and customer experience. The first thing that businesses need to do to implement digital transformation is to design a process, each person in the enterprise's apparatus must be knowledgeable about digital transformation. If a business has not applied modeling, automation and continuous improvement in its operating processes, it should not start other digital transformation technologies. In addition, businesses need to choose tools and methods to perform digital transformation accordingly. Process management software is an optimal solution that businesses should use to improve the efficiency of their business processes.

Digital transformation can be done at all businesses, as long as businesses really want to transform when user behavior is changing in a complex direction. Technology is an Important basis for businesses to better understand human behavior.

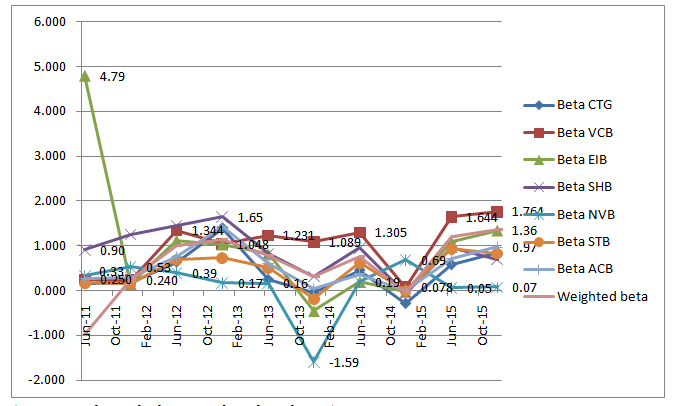

From figure 6, we see that we can estimate weighted beta CAPM index from estimations of beta CAPM of single bank.

Then, from above table, we find out that: risk determinants of banks can be classified into internal and external macro elements, for instance, CPI will have negative correlation with beta of all 3 banks. And for external factors, trade balance will have higher effects on beta (see table 3).

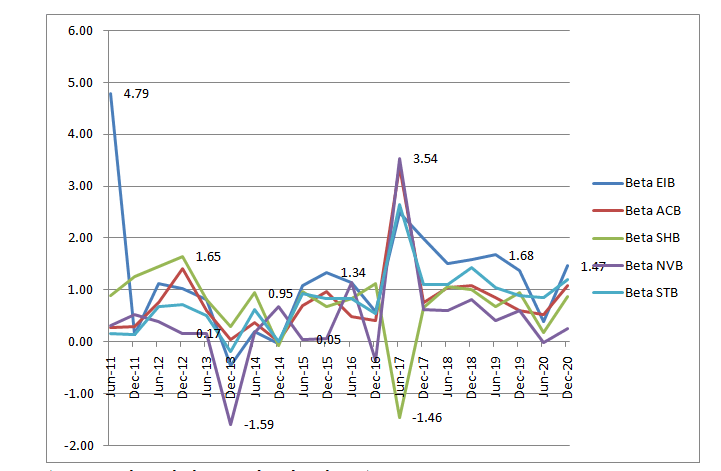

And next, we also can present risk data in the form of line figures as in below:

Figure 12: Movement of Weighted Beta Index And Betas Of Bank Sector

(source: author calculation and stock exchange)

Figure 13: Fluctuation of Beta of Vietnam Banks Period 2011-2020

(Source: Author calculation and stock exchange)

Conclusion

For bank sector, attention must be paid to the management of information and data to ensure information security and convenient storage. Therefore, the collection, processing and storage of information are extremely necessary to help businesses effectively manage information sources in the context of digital transformation. In the process of information management, there are often many incidents as well as the loss and change of information. To perform information management, digital enterprises need to build an information system with basic functions: System functions: assigning access rights, different priority levels for user members…

Organizing better Risk management information system and MIS with support of software and showing in forms of charts, figures and tables will provide data for management to analyze, and for establish suitable risk policies:

For instance, because CPI has negative higher effects on market risks of banks, Ministry of Finance, State bank of Vietnam and relevant agencies need to control inflation (not decreasing so much) for managing risk.

Mukhamadeev, et al., (2019) stated that the role of information systems for entrepreneurship education in developing countries on the example of the Azerbaijan education system and Internet banking. The information systems role in entrepreneurship education was determined with the help of online questionnaire. As a result of the study, it was found out that about 29% of higher entrepreneurship education institutions use IT technologies and e-learning principles in the learning process.

Limitation of Research

We can expand our research model for other industries and other markets.

Acknowledgement

Aracil, E., Sanchez, J.J.N., & Forcadel, F.J. (2021). Sustainable banking: A literature review and integrative framework. Finance Research Letters, 1.

Arasu, B.S. (2014). Information systems success in the context of internet banking: Scale development. Journal of Internet Banking and Commerce, 19(3), 1-15.

Balasub, S.A., Jagannathan, V., & Natarajan, T. (2014). Information systems success in the context of internet banking: Scale development. Journal of Internet Banking and Commerce, 2.

References

- Aracil, E., Sanchez, J.J.N., & Forcadel, F.J. (2021). Sustainable banking: A literature review and integrative framework. Finance Research Letters, 1.

- Arasu, B.S. (2014). Information systems success in the context of internet banking: Scale development. Journal of Internet Banking and Commerce, 19(3), 1-15.

- Balasub, S.A., Jagannathan, V., & Natarajan, T. (2014). Information systems success in the context of internet banking: Scale development. Journal of Internet Banking and Commerce, 2.

- Blanco, B. (2012). The use of CAPM and Fama and French Three Factor Model: Portfolios selection. Public and Municipal Finance, 1(2).

- Burja, C. (2011). Factors influencing the companies‘ profitability. Annales Universitatis Apulensis Series Oeconomica, 13(2).

- Das, N.M., & Rout, B.S. (2020). Impact of COVID-19 on market risk: Appraisal with Value-at-risk Models. The Indian economic journal, 1.

- Dimitrov, V., & Jain, P.C. (2006). The value relevance of changes in financial leverage, SSRN Working Paper.

- Emilios, A. (2015). Bank leverage ratios and financial stability: A Micro-and Macro prudential Perspective & Working Paper No.849, Levy Economics Institute.

- Eugene, F.F., & French, K.R. (2004). The capital asset pricing model: Theory and evidence. Journal of Economic Perspectives, 18(3).

- Grabowska, A.M., & Orlowski, L.T. (2020). Financial market risk and macroeconomic stability variables: dynamic interactions and feedback effects. Journal of Economics and Finance volume 44, 655–669.

- Gunaratha V. (2013). The Degree of financial leverage as a determinant of financial risk: An empirical study of colombo stock exchange in Sri Lanka. 2nd International Conference on Management and EconomicsPaper.

- Hac, L.D., Huy, D.T.N., Thach, N.N., Chuyen, B.M., Nhung, P.T.H., Thang,T.D., …& Anh, T.T. (2021). Enhancing risk management culture for sustainable growth of Asia commercial bank -ACB in Vietnam under mixed effects of macro factors. Entrepreneurship and Sustainability Issues, 8(3).

- Hang, T.T.B., Nhung, D.T.H., Hung, N.M., Huy, D.T.N., & Dat, P.M. (2020).Where Beta is going–case of Viet Nam hotel, airlines and tourism company groups after the low inflation period. Entrepreneurship and Sustainability Issues, 7(3).

- Hung, J.H., & Liu, Y.C. (2005). An examination of factors influencing airline beta values. Journal of Air Transport Management, 11(4), 291-296.

- Huy D.T.N., Nhan V.K., Bich N.T.N., Hong N.T.P., Chung N.T., & Huy P.Q. (2021). Impacts of internal and external macroeconomic factors on firm stock price in an expansion econometric model—A Case in Vietnam Real Estate Industry, Data Science for Financial Econometrics-Studies in Computational Intelligence, 898, Springer.

- Huy, D.T.N. (2012). Estimating Beta of Viet Nam listed construction companies groups during the crisis. Journal of Integration and Development, 15(1), 57-71.

- Huy, D.T.N. (2015). The critical analysis of limited south Asian corporate governance standards after financial crisis, International Journal for Quality Research, 9(4), 741-764.

- Huy, D.T.N., An, T.T.B., Anh, T.T.K., & Nhung, P.T.H. (2021). Banking sustainability for economic growth and socio-economic development – case in Vietnam. Turkish Journal of Computer and Mathematics Education, 12(2), 2544–2553

- Huy, D.T.N., Dat, P.M., & và Anh, P.T. (2020). Building and econometric model of selected factors’ impact on stock price: A case study. Journal of Security and Sustainability Issues, 9(M), 77-93.

- Huy, D.T.N., Loan, B.T., & Anh, P.T. (2020). Impact of selected factors on stock price: A case study of Vietcom bank in Vietnam, Entrepreneurship and Sustainability Issues, 7(4), 2715-2730.

- Krishna, R.C. (2015). Macroeconomic variables impact on Stock Prices in aBRIC Stock Markets: An Empirical Analysis. Journal of Stock & Forex Trading, 4(2).

- Kulathunga, K. (2015). Macroeconomic factors and stock market development: With special reference to Colombo stock exchange. International Journal of Scientific and Research Publications, 5(8), 1-7.

- Mariano, G., Juan, N., & Gonzalo, R. (2018). Macro economic determinants of stock market betas & quot; Journal of Empirical Finance, Elsevier, 45(C), 26-44.

- Melicher, R.W. (1974). Financial factors which influence beta variations within an homogeneous industry environment. The Journal of Financial and Quantitative Analysis, 9(2), 231-241.

- Minh Dat, P., Duy Mau, N., Thu Loan, B., & Tran Ngoc Huy, D. (2020). Comparative China corporate governance standards after financialcrisis, corporate scandals and manipulation. Journal of security &sustainability issues, 9(3).

- Nguyen, T.P.L., Tran, N.M., Doan, X.H., & Nguyen, V.H. (2019). The impact of knowledge sharing on innovative work behavior of Vietnam telecommunications enterprises employees. Management Science Letters, 10, 53-62.

- Park, J.C., Ali, F.D., & Mbanga, C. (2019). Investor sentiment and aggregate stock returns: The role of investor attention, Review ofQuantitative Finance and Accounting, 53(2), 397 - 428.

- Perkovic, A. (2011). Research of Beta As Adequate Risk Measure - Is BetaStill Alive? Croatian Operational Research Review (CRORR), 2, 102-111.

- Puspitaningtyas, Z. (2017). Estimating systematic risk for the best investment decisions on manufacturing company in Indonesia, Investment Management and Financial Innovations, 14(1).

- Thi Hang, N., & Tran Ngoc Huy, D. (2021). Better risk management of banks and sustainability-A Case Study in Vietnam. Revista geintec InovacaoE Tecnologias, 11(2).

- Thi Hien, D., Tran Ngoc Huy, D., & Thi Hoa, N. (2021). Ho Chi Minh view points about Marxism moral human resource for state management level in Vietnam. Psychology and education, 58(5).

- Thi Hoa, N., Thi Hang, N., Giang, N., & Tran NgocHuy, D. (2021). Human resource for schools of politics and for international relation during globalization and EVFTA. Elementary education online, 20(4).

- Thi Tinh, D., Thu Thuy, N., & Ngoc Huy, D. (2021). Doing business research and teaching methodology for undergraduate, postgraduate and doctoral students-Case in Various Markets Including Vietnam. Elementary education online, 20(1).

- Tran My Hanh, P., Thi Hang, N., Tran Ngoc Huy, D., & NgocNuong, L. (2021). Enhancing roles of banks and the comparison of market risk and risk policy implications in group of listed Vietnam BanksDuring 2 Stages: Pre and Post-Low Inflation Period. Revista geintec-gestao Inovacao e Tecnologias, 11(2).

- Tran Ngoc Huy, D. (2021). Banking sustainability for economic growth and socio-economic development–case in Vietnam. Turkish Journal of computer and mathematics education, 12(2).

- Tran Ngoc Huy, D., & Thi Hang, N. (2021). Factors that affect stock price and Beta CAPM of Vietnam Banks and Enhancing Management infomation system - Case of Asia Commercial Bank. Revista geintec InovacaoE Tecnologias, 11(2).

- Tran Ngoc Huy, D., Van, P., & Thi Thu Ha, N. (2021). Education and computer skill enhancing for Vietnam laborers underindustry 4.0 and evfta agreement. Elementary education online, 20(4).

- Trivellas, P.G., & Santouridis, I. (2013). The impact of management information systems’ effectiveness on task productivity the case of the Greek banking sector, International Journal of computer theory and engineering, 5(1), 170-173.

- Van Hong, P., Xuan Nguyen, H., Ngoc Huy, VietNga, L., Thi Ngoc Lan, N., Ngoc Thach, N., … & Thanh Hanh, H. (2021). Sustainable bank management via evaluating impacts of internal and external macro factors on lending interest rates in Vietnam, Linguistica Antverpiensia, 76-87.