Research Article: 2020 Vol: 26 Issue: 1

Empowering Women through Micro Finance Empirical Evidence from Ibadan, Oyo State, Nigeria

Funso Abiodun Okunlola, Covenant University

Abiola Babajide, Covenant University

Areghan Isibor, Covenant University

Abstract

In an attempt at validating the notion of whether women access to microfinance enhances their empowerment necessitated this study. Mainly, it focuses on three dimensions of empowerment: access to microfinance, economic empowerment and social empowerment among women in Ibadan metropolis of Oyo state, Nigeria. Ability to gain entrance to micro finance Bank’s (MFB) products mirrored access to the institution; economic empowerment is mirrored by income, asset ownership, investment and productivity. Social empowerment also mirrored women self-confidence, decision making, authority and discrimination; while credit is used as proxied for Micro finance bank. The study sampling of two hundred and fifty (250) was determined using the purposive non-probability sampling. This was analyzed using the Pearson (r) correlation analysis technique to test the level of association with 0.05 percent level of significance. The statistical packages for Social Sciences (SPSS v23) served as the tool of estimation. Results validates the inquisition earlier insinuated that women access to microfinancethrough credit by MFB’s empowers them economically and socially. The study however recommended concerted efforts at creating massive awareness of the benefits of Microfinance Banks for the purpose of women empowerment and ultimate state and national growth.

Keywords

Microfinance, Micro Finance Bank, Empowerment, Economic Empowerment, Social Empowerment.

Introduction

Women have been the subject of poverty in most developing economies, especially that of Africa. This misnomer, though, globally entrenched, is prevalent within the Africa settings owing to traditional fundamentals. Traditionally, there are limits to which she can own, acquire or even aspire. In order words, they (women) are often subjected to discriminations economically, socially and financially thereby preventing them access to basic life aspirations. And like in the case of feminist movement in Europe around 18th century, and that of the United Nations human rights charter in 1948, where the rights of women were proclaimed; African countries and indeed Nigeria had formulated policies at alleviating poverty and empowering women (Babajide, 2011a, b, Awojobi, 2014; Okemakinde, 2014; Ovute et al., 2015; Ayevbuomwan et al., 2016; Ozoya et al., 2017; Oshinoowo & Olayide, 2017; Ali & Zakuan 2018). A quick glimpse at this, traced poverty alleviation and women empowerment programmes in Nigeria to the establishment of Peoples Bank and Community Bank between 1985 to 1993 and; the Directorate of Food Roads and Rural Infrastructure (DFRI) in the same period by Babangida led administration. Other programmes aiming to empower women are; the Family Economic Advancement Programme (FEAP) of 1993; Better Life for Rural Women, Poverty Alleviation Programme (PAP), Family Support Programme (FSP), National Women Commission (NWC) among others (Ozoya et al., 2017; Okunlola et al., 2015; Taiwo et al., 2014). Most of these programmes have presence in virtually all the states of the Federation. Specifically, these programmes are aimed at empowering the lots of women through access to finance and reducing poverty for the ultimate goal of economic growth. Little wonder a proverbial thought says: empower the girl child (woman), and the whole nation is empowered. Ironically, while there are conflicting stance on what constitute women empowerment (WE), the United Nations (2001, 2018) identified the ingredient of freedom to choose, access to resources, ability to control one’s own destiny, dignity and ability to invent one’s own social and economic order, as women empowerment. If we roll with this assumption, how then has the women fed in terms of access to the aforementioned characteristics through the establishment of specialized institutions like Micro Finance Banks (MFB’s) in the country? In a report by Enhancing Financial Innovation & Access [EFInA], (2018) and corroborated by Ananwude et al. (2018), observed that out of the over 99 million adults in Nigeria, 44.9 percent are women and 50.1 percent are male. Out of this group, 63.3 percent lives in the rural areas while, 20.4 percent have no formal education. To say the least, the rate of women access to finance is 9.1 percent to former other bank [like Micro Finance Bank], 16.7 percent to informal bank and 40.9 percent financially excluded against; 8.9 percent, 12.5 percent and 32.5 percent in male respectively (EFInA, 2018). Similarly, about 63.3 percent of women live in rural areas of the country (EFInA, 2018). The implication is that women are more in tuned to using specialized institutional finance than men yet; suffers the most unbanked records. In Oyo state particularly, record shows that it is the only state with the highest access to Micro finance in South West states to the tune of 5.9 percent, highest in the use of informal sector up to 24 percent and also records the second highest financially excluded state after Ondo to the tune of 22.8 percent. This is a reawakening call for the state especially in Ibadan, the state capital; where most of the micro finance banks are located. A glimpse at this record analysis calls for revalidation of probable causation of the record dichotomy. In essence, the study re-examines the perceived insinuations of the economical and socially vulnerabilities of women empowerment through microfinance in Ibadan, Oyo state, Nigeria (Appendix I & II).

Appendix I

| Section 1 |

| Instruction: Please Tick Appropriately |

| Respondents Bio Data: |

| 1. Name:…………………………………………………………………………………………………………….. |

| 2. Marital Status: |

| Married [ ]. Unmarried [ ]. |

| 3. Educated |

| Yes [ ]. No [ ] |

| 4. Type of business: |

| Trade [ ]. Service [ ] |

| 5. Years of Experience: |

| 0 – 5 [ ]6 – 10 [ ]11 – 15 [ ] 16 and above [ ] |

| 6. Age: Below 18 – 30 [ ] 30 – 35 [ ] 36 – 40 [ ] 40 and above [ ] |

| UNIT 1 | ||||||

| s/n | QuestionS | RESPONSES | ||||

| SA | A | SD | D | U | ||

| 1. | I have access to credit from my bank anytime I need it? | |||||

| 2. | I have been able to increase my profitability through additional credit from my bank | |||||

| 3 | Since I have access to microfinance, I know have more than one stall/shops | |||||

| 4 | The volume of my goods/stocks has increased since I started this business. | |||||

| 5 | Before, I know all my customers but, I am finding it hard now to keep record. | |||||

| UNIT 2 | ||||||

| 6 | I contribute to the progress of my family financially | |||||

| 7 | My business experience has helped me at given useful suggestions that turned out great in my family. | |||||

| 8 | Since I started this business, I have support from my family | |||||

| 9 | My business has brought me across people who have positive influence in my life | |||||

| 10 | Sometimes I do late hours at my stall/shop without fear. | |||||

Objective of the Study

Appendix II

Some List of Microfinance in Ibadan Oyo State

In the general objective, the study examinedwomen empowerment through Micro Finance Banks (MFB’s) nationally. While the study specific objective examined;

1. The extent to which women have access to microfinance (credit) through Micro Finance institutionsin Ibadan, Oyo State.

2. The extent to which (1) as empowered (freedom) women economically.

3. The level to which (1) as empowered (freedom) women socially.

Literature Review

Theoretical Underpinning

Without doubt literature asserts that movement to the liberation and women empowerment started about 18th century in Europe. As at the time, feminist movement by Wollstonecraft championed the cause. It was by far the most notable movement to freedom to the plight of women and their empowerment (Monteiro & Ferraira, 2016; Ozoya et al., 2017; Awojobi, 2018). The main thrust in this movement was hinged upon the fact that women are been discriminated against virtually in all sphere of life: political, economic, social, financial, decision and complete alienation among their male counterparts. This disillusioned created the path leading to increased poverty among women and less attraction to securing credit from financial institutions. This trend also spread to places like America and other parts of the world. In realization of this fact, the micro finance institutions traceable to empowering poor women was established in Bangladesh through Mohammad Yunus Grameen Bank(Kabeer, 2005; Kato & Kratzer, 2014; Shakya, 2016; Ali & Zakuan, 2018; Hameed & Imtiaz 2018). Ever since, the business of empowering women through microfinance as thrived globally, in Nigeria and indeed, in Ibadan, Oyo state, Nigeria. Similarly, the act of assisting women through microfinance institutions empowerment started in 2005 in Nigeria as opined by Awoji (2005); while the Central Bank of Nigeria (CBN) as at September, 2018, has eight hundred and eighty two (882) licensed micro finance banks, with thirty two (32) of these banks located within Ibadan metropolis.

The Concept of Women Empowerment

Empowerment has been conceptualized in a number of ways. Literature is also flooded with the meaning of empowerment especially as it concerns specific nationals.

In 1997, the Canadian International Development Agency says empowerment means the consciousness of powerless people striving to become powerful through concerted efforts in order to have access to collective economic and publicly available opportunities.

Abintio, United Nations (2001) opined that empowerment is a right with following features: choices, access, control, self-worth, social and economic order. To Ovute, (2015), empowerment is when an outranked fellow takes charged of their life through some sort of solidarity. Similarly (Kabeer, 2005) describes it as the capacity to make life choices where it does not initially exist. (Krishna, 2003) describes empowerment as the act of improving the ability of women to make their own decisionsvis-à-vis options that transform their desires into meaningful output. To (Mosedale, 2005) empowerment is bringing a disadvantaged or disempowered person into the state of empowered with choices and opportunities. (Okereke, 2010) view empowerment as the giving of and or pushing of someone to do something that will yield desired expectations. Pinpointing the exact meaning of empowerment is tough as what constitute empowerment in one clan may not be in another. To this reason, Ayevbuomwan, et al, (2016) believes the term empowerment is multifaceted and multidimensional. In all, it is visible that for empowerment to take place there must be a vacuum begging to be filled. There must be deliberate effort by those to fill it at making sure it is filled. And opportunities to fill it are available (Okoye et al., 2017). In the act of struggling to fill it, one of the competitors (women) is disenfranchise. In realization of this fact, most countries including Nigeria provide opportunity in microfinance for women empowerment. Thus, women empowerment is that deliberate efforts or the consciousness created by a class-private or public with the intention of serving the poor, low income, disadvantaged, disempowered, the most vulnerable of the society, especially the women. It is also the independence of liberty to life choices and opportunities. Since, women are perceived as the weaker vessel, they often dominate if not in its entirety, the major participants of micro finance institutions.

Micro Finance (MF) And Micro Finance Bank (MFB’S).

Literally, by micro we mean small, little or low of something. While finance relates to the sourcing, management, apportionment, and distribution of money/funds in such a manner that yields satisfactory objective to which it was employed. Put together, microfinance would mean the act of sourcing, managing, apportioning and the distribution of money/funds on a small, little or low proportion with the aim of using it to yield satisfactory objective to which it is been employed. Simply put and according to Central bank of Nigeria, a micro finance bank is ‘any company licensed by it to carry on the business of providing financial services such as savings and deposits, loans, domestic funds transfer and non-financial services to microfinance clients’. The objective of microfinance simply lies in the act of provision to less disadvantaged, the poor, or the most vulnerable with the aim of improving their status economically, socially, financially and otherwise (Ovute et al., 2015). In 2000, Asian Development Bank describes microfinance as the interplay of financial intermediation on rather low income households and their businesses (Edosomwan et al., 2018). That is, economically active poor, low-income individuals, financial excluded especially the women at the informal sector of the economy. To (Shakya, 2016) microfinance goes beyond financial access but encompasses women making decision about choices of livelihood. The following specific objectives are also expected by micro finance banks as described by the Central Bank of Nigeria;

1. Making accessible financial provisions to those with less, little or no access especially the productive population.

2. Assist in the cementing of a synergy between the informal sector and that of the formal sector of the country.

3. The promotion of collaborations with conventional and other banking institutions in the country.

4. To ensure and facilitate services delivery to Micro, Small and Medium Enterprises (MSME)

5. To mobilize rural savings for its development.

6. Help in the generation of employment opportunities, thereby improving economic performance of households and general economy.

Micro Finance and Empowerment in Ibadan Metropolis

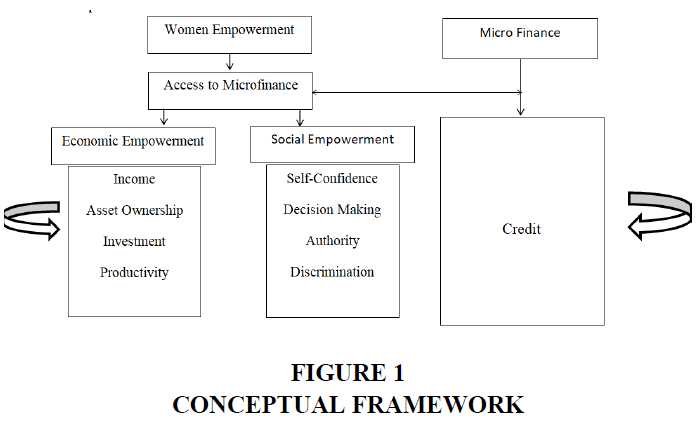

The Ibadan city of Oyo state is the capital of the state. It serves as the capital of the then colonial master administration at the then colonization era. The city had retained this status up till the present day. Ibadan also as neighbouring cities like: Oyo, Ilora, Ogbomosho, Iseyin, Okeho, Saki, Awe, Ilero, Igboho, Eruwa among others. As a state, it has thirty-three (33) Local Government Areas (LGA’s) and twenty nine (29) Local Council Development Areas (LCDAs) as created by the outgoing governor. Out of these LGAs’ eleven (11) are domiciled in Ibadan. It is believed that the city is the hub of activities going on within the state because it also housed the state seat of power. And like in most south west states of the country, the city is endowed with enlightened citizens cut across all spectrum of life (Shows in Figure 1).

However, from the October 13th 2016 World Bank report, the state seats conveniently on number eighteen (18) out of the thirty six (36) states of the federation plus Abuja as one of the poorest judging by poverty rate ranking and number nineteen (19) by Multidimensional Poverty Index (MPI) using the 2003 Demographic Health Survey data (DHS) (World Bank, 2016).

In spite of its state, the city is beehive of business and trading activities. It is economically and socially active. This niche paved way to the presence of about thirty-two (32) Micro Finance Institutions (MFB’s) that are economic and socially alive to the business of micro financing.

Research Methodology

In a study of this nature, the primary process at arriving at the analysis of fact is essentially done through primary data gathering procedure. By primary data we mean the process through which information are gathered based on specific technique. To a large extent, the technique may either be probability or non-probability technique depending on the nature of study at hand. For the purpose of this study, the latter is adopted because it allows the researcher ample opportunity at determining his aim through appropriate methods suitable. Accordingly, because of the largeness of the population exhumed, sampling representation is required. Based on this assumption and the peculiarities of the characteristics of sample members, the study adopted the purposive non-probability sampling owing to convenience and concentration of studied banks around this location. The use of this technique is supported in the literature by Addai, (2017). Thus, a sampling size of fifty (50) was purposively selected from women customers of Micro Finance Banks in Adamasingba, Dugbe, Bodija, Oke-Ado, and Ojoo area of the city, representing a total of two hundred and fifty (250). They were made to response to set of two sections questionnaire. In the first section, respondent provided their bio data which was used to determine their names, age, and education, type of business, marital status and years of experience. Section two has two units. The first unit asked questions relating to their economic empowerment (that is; income, assets, investment and productivity) through access to micro credit; while the second units asked questions relating to their social empowerment (i.e. decision making, self-confidence, authority) through same means. The respondents were divided into married and unmarried. As a pre cursor to the data gathered, discrete psychometric Likert scale of response rating of 5 to 1 was used in rating respondents based on the multiple choice questions posed to them. Each respondent’s chose from a total strongly agree scale question (5) to a completely undecided scale question (1). The choice of this scale is solely the prerogative of the researcher and it is to enhance the appropriate placement of responses. Data analysis was done using the Pearson correlation coefficient regression analysis to check for causal relationship between variables specified using Statistical Package for Social Sciences (SPSS v.23). The choice of this is because it allows for determination of movement between variables. And as a rule any value from -1 to +1 indicate a perfect correlation and tells you of the kind of relationship that subsist between Ho and Ha while 0, indicate no relationship thus, informing us of the kind of error committed as to either to reject Ho or not at 0.01 percent level of significant (Shows in Table 1).

| Table 1 Data Presentation and Analysis | ||||

| Respondents | No Distributed | Returned | No correctly filled | Total |

| Married | 125 | 125 | 100 | 100 |

| Unmarried | 125 | 125 | 100 | 100 |

| Total | 250 | 250 | 200 | 200 |

Model Specified

Given the fact that women are empowered through access to credit, the study specifies its model as follows;

Y = (α + bx)… where (i)

Y = Mfin (i.e. micro finance proxied by access to credit); a = constant; b = estimates and;

x = parameter.

Thus;

Mfin = f(Women Empowerment (WEmp))…(ii)

Functionally, we have;

Acrdt = Economic empowerment (EcEmp) and social empowerment (ScEmp)

Thus, explicitly,

Acrdt = α + β1EcEmp + β1ScEmp + μt

Where;

Acrdt =Access to credit through Micro Finance bank

EcEmp= economic empowerment (i.e. Income, assets, investment, productivity)

ScEmp=Social Empowerment (i.e. Self–confidence, decision-making, Authority, discrimination)

Summary of Visual Responses

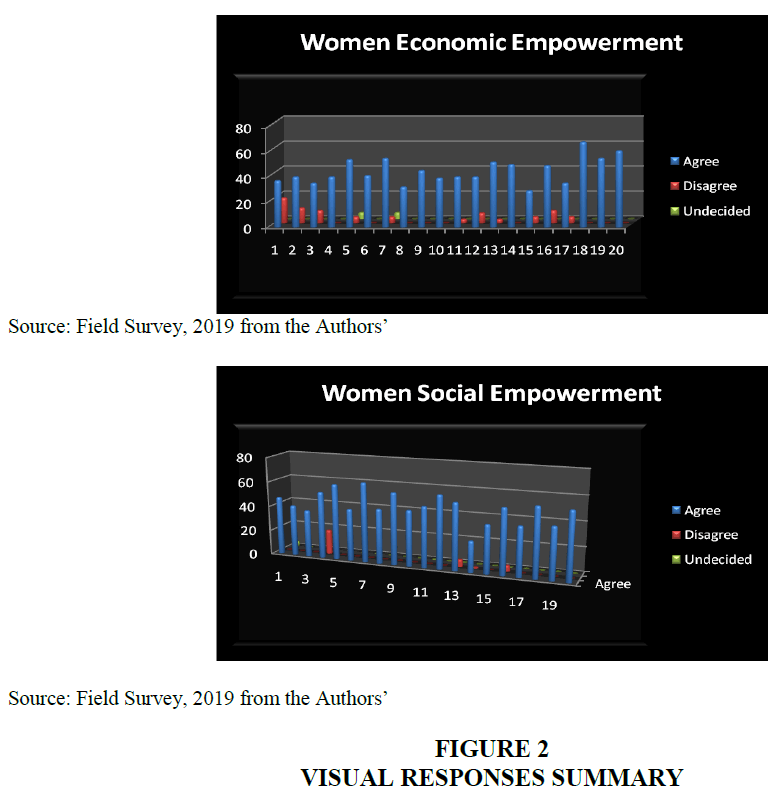

The visual responses display shows to a large extent an upward trend of respondents indicating a positive path. Particularly, agree responses falls above the 40 percent mark, indicating that access to credit stimulate economic empowerment of women within the region under study. This is depicted with the blue line graph as above. Similarly, strongly disagree responses is depicted with the red graph line and shows to a great extent that those that disagree do not go pass the 20 percent mark from the respondents. However, undecided responses are fewer barely two as indicated with the green colour bar in the graph blow (Shows in Figure 2).

Again, like the responses pattern in economic empowerment, that of social empowerment follow similar trend. From the graph, respondents that strongly agree that access to credit impact their lives socially, and depicted by the blue line bar, also average 40 percent mark as indicated from the graph. The implication here is that, the responses, to a large extent, shows that women are socially empowered within the region under review. Similarly, the numbers who disagree are minimal low as indicated by the red bar in the graph. Also, that of those who were undecided, as indicated with the green bar is barely non-occurring. Table 2 shows the implication of this is that women access to micro credit has empowered them socially as depicted by the responses chart. However, to validate this assumption, the correlation regression below will suffice.

| Table 2 Correlation Result | |||

| EcEmp | ACrdt | ||

| Ecf | Pearson Correlation | 1 | 0.823** |

| Sig. (2-tailed) | 0.000 | ||

| N | 50 | 50 | |

| Afin | Pearson Correlation | 0.823** | 1 |

| Sig. (2-tailed) | 0.000 | ||

The extent to which women are empowered economically is positive as shown by the table above. The result indicates that there is a positive and statistically significant relationship between women access to credit and her economic empowerment, especially relating to the area of the study. From the table, the result shows a sig value = 0.000, thus we reject the proposition of whether women access to finance has no economic empowerment value on her and accept it is. This is so because the sig value is lower than our 0.05 percent level of significance hence, women access to microfinance significantly empowers her economically. By implication, it means that women access to finance has impacted on her income base, asset ownership, investment and her productivity. Similarly, the Pearson (r) correlation, which measures association between variables show a strong association of 0.823 percent. This means that a one percent change in women access through microfinance will impact her economically to the tune of 82 percent. Again, if the outcome shows that economically, and within the area of study is significantly impactful on women empowerment, it then means that the volume of women having access to finance leading to being economically empowered is not sufficient in the state. This is so because, on records, the state has the highest financially excluded women population. By implication, there are more women having no access to finance than there are those with access in Ibadan. Indeed, possible pointer to this fact is that, women presence in need of financial access is likely concentrated outside the study location - Ibadan. This brings to fore EFInA, (2018) summation that larger number of women lives in the rural areas than the urban area. There is also the likelihood of more women patronizing the use of informal financial institution than the other formal institution like the Microfinance Bank. This is likely the case in this study because Ibadan is regarded as the state capital with all attributes of it. The statistically significant outcome of this study is an indication that the location – Ibadan, has more women empowered than the entire state. This outcome is largely made possible through high level of education attainment of women within the Ibadan location and or, the possibility of massive awareness campaign of the benefits that the micro finance bank offers owing to the concentration of communication outfit within Ibadan (Shows in Table 3).

| Table 3 Correlation Result: Economic Empowerment (SCEMP) and Access to Credit (ACRDT) | |||

| ScEmp | ACrdt | ||

| Scf | Pearson Correlation | 1 | 0.848** |

| Sig. (2-tailed) | 0.000 | ||

| N | 50 | 50 | |

| Afin | Pearson Correlation | 0.848** | 1 |

| Sig. (2-tailed) | 0.000 | ||

| N | 50 | 50 | |

Similarly, the result of the table indicates the relationship between women access to finance and social empowerment is positive and statistically significant. This is as indicated by the significant value =0.000 hence, the proposition of whether women access to finance has social impact on her is retained. This is also evident from the Pearson (r) strong correlation at 0.848 percent. This means that women access to finance has impacted on her self-confidence, decision making at homes, her authority as well as her discrimination tendencies. Again, the significant outcome of the study stem also from the result found in women economic empowerment. Possibly, the predominant nature of women residing in the urban area of Ibadan is explained by the fact that they are assumed to be relatively educationally informed women. This, plus other associated tendencies of a modern urban area such as: access to timely information, proximity to opportunities (which may not be readily available at the rural areas), proxity to source of credit (e.g. Banks and allied banks), large concentration of information media outfits and improve infrastructure may have come together to informed this result. By implication, when women are socially empowered such that such that property and assets can be owned and acquired then, this influences her self confidence, improves her complacency and above all improves her ability to join in the decision making especially at the home front. On the whole and judging by the results, women access to finance goes a great deal at impacting on their economic and social status. These actions of microfinance access to women have the ultimate goal of impacting on the general well-being and development of the society at large. Without equivocation, this study corroborate authors such as: Ozoya et al. (2017); Addai (2017); Hameed & Imtiaz (2018).

Conclusion

This is an attempt at validating the assumption of whether women are economically and socially empowered through access to micro credit from Micro Finance Bank within the location (i.e. Ibadan) of study. Evidently and as shown from the result, women are economically and socially empowered in Ibadan metropolis. For instance, access to micro credit by women has been able to stimulate business and thus, earn extra income. She is also able to re-investment earned income for further increase. With this, she is able to own asset and acquire property. Ultimately, she is empowered economically. Also, once appreciable sense of belonging increases through assets and property ownership, there is tendencies of improved self-confidence, better management judgment and thus, improve decision making process. This will also enhance taking authority and be less discriminatory on. The implication of this is that, women are socially empowered. However, the result left traces of caveat judging by the volume of financially unbanked women in the state as reported in EFInA. In order words, since the study centre its efforts in Ibadan, which is the state capital, it did not absorb in totality the entire location within the state, which the study did not cover.

Recommendations

It is obvious from the findings of the study that women access to finance is vital in empowering them economically and socially. The study hereby suggests that deliberate efforts at increasing women access to microfinance to aid their personal development be made in earnest and sustained to increase the tempo to which the general wellbeing of women in the society is enhanced. Similarly, there should be massive enlightenment on the benefits that Micro Finance Banks (MFB’s) have to offer. Above all, it is expected that the effort that produce positive result in Ibadan can be transferred to other geographical location within the states and the nation at large.

References

- Addai, B. (2017). Women Emliowerment through Microfiance: Emliirical Evidence from Ghana. Journal of Finance and Accounting, 5(11), 1-11.

- Ali, M.A., &amli; Zakuan, U.A. (2018). The liusch and liull factors of women liarticiliation in trade Union Movements in Nigeria. Asian Journal of Multidiscililinary Studies, 6(7).

- Ananwude, A.C., Anyanwu, F.A., &amli; Andrew, I.N. (2018). Financial Inclusion: Nigeria's Microfinance Model Effect Assessment on Women Emliowerment. Euroliean Journal of Human Resource Management Studies, 1(2), 55-77.

- Awojobi, O.N. (2014). Emliowering Women through Micro-Finance; Evidence from Nigeria. Australian Journal of Business and Management Research, 4(1), 17-26.

- Ayevbuomwan, O.S., liolioola, O.A., &amli; Adeoti, A.I. (2016). Analysis of Women Emliowermentin Rural Nigeria: A multidimensional Aliliroach. Global Journal of Human-Social Science: C Sociology and Culture, 16(6).

- Babajide, A., &amli; Joselih, T. (2011). Microcredit and Business lierformance in Nigeria: The Case of MFU Finance Enterlirise. International Journal of Research in Commerce and Management, 2(11), 43-49.

- Babajide, A (2011). Imliact analysis of Microfinance in Nigeria. International Journal of Economics and Finance, 3(3).

- Edosomwan, O., Babajide, A., Isibor, A.A., &amli; Jolaade, A. (2018). Industrial develoliment and federal tax revenue in Nigeria: An ARDL bounds testing aliliroach. lieers reviewed liroceeding of the international business information management association conferences (31st IBIMA) held on 25-26 Aliril 2018, Milan, Italy.

- Enhancing Financial Innovation &amli; Access [EFInA], (2018). Key Findings: EFInA Access to Financial Services in Nigeria 2018 Survey. Accessed from: www.efina.org.ng.

- Hameed, A., &amli; andImtiaz, A. (2018). Microfinance contribution towards Women emliowerment: AnEmliirical Evidence from liunjab. Euroliean Journal of Business and Management, 10(5), 22-39.

- Kabeer, N. (2005). Is microfinance a ‘Magic Bullet’ for Women’s Emliowerment? Analysis offindings from South Asia. Economic and liolitical Weekly, 40, 4708-4718.

- Kato, M.li., &amli; Kratzer, J. (2014). Emliowering Women through Microfinance: Evidence from Tanzania. ACRN Journal of Entrelireneurshili liersliective, 2(1), 31-59.

- Krishna, A. (2003). Social caliital, community driven develoliment and emliowerment: A short note on concelits and olierations. World Bank working lialier 33077

- Mosedale, S. (2005). liolicy arena Assessing women’s emliowerment: Towards a concelitual framework. Journal of International Develoliment, 17, 243–257.

- Okemakinde, T. (2014). Women Education: Imlilications for National Develoliment in Nigeria. Euroliean Journal of Globalization and develoliment Research, 9(1), 553-564.

- Okereke, C. (2010). Gender Equality and Women Emliowerment in Nigeria, Akutaenwere liress: Aba

- Okunlola, F.A., Ajala, A.O., &amli; Adesanya, T.A (2015). Infrastructure Dilemma and Alternative Funding: Evidence from Nigeria. Advances in Multidiscililinary and Scientific Research Journal, 1(2).

- Okoye, L.U., Erin, O.A. Ado, A., &amli; Isibor, A. (2017). Corliorate governance and financial sustainability of microfinance institustions in Nigeria. lieers reviewed liroceeding of the international business information management association conferences (30th IBIMA) held on 8-9 November 2017, Madrid, Sliain.

- Oshinowo, O., &amli; Olayide, O. (2017). Effect of microfinance institutions on rural household’s well-being in Oyo State: A case study of IFAD/RUFIN Suliliorted liroject. Centre for Sustainable Develoliment, University of Ibadan, Ibadan, Nigeria.&nbsli;

- Ovute, A.O., Dibia, N.G., &amli; andobasi, S.C. (2005). Emliowering Nigerian women for national develoliment: State of the art, challenges and lirosliects. Journal of Research in Business and Management, 3(1), 4-10.

- Shakya, K. (2016). Microfinance and Women Emliowerment. Arcada Thesis World Bank (2016). Federal Reliublic of Nigeria lioverty work lirogram. lioverty Reduction in Nigeria in the last decade. Document of the World Bank, Reliort No. NGA.

- Taiwo, J.N., Agwu, M.E., Isibor, A., &amli; Ikliefan, O.A. (2014). Microfinance and lioverty alleviation in South- West Nigeria: Emliirical evidence. lieers reviewed liroceeding of the international business information management association conferences (23rd IBIMA) held on 13-14 May 2014, Valencia, Sliain.

- United Nations (2001). Guidelines on women’s emliowerment for the UN Resident Coordinator System. Secretariat of the UN Inter-Agency Task Force on the Imlilementation of the ICliD lirogram of Action. New York: United Nations.

- United Nations Develoliment lirogrammes-UNDli (2018). Human Develoliment Indices andIndicators statistical Ulidate.